Trump Tax Proposal to Eliminate State and Local Deductibility Harms Middle-Class NYC Taxpayers

One of the key features of the Tax Reform proposal that President Trump’s Treasury Secretary Steven Mnuchin and Economic Advisor Gary Cohn released last month was the elimination of the deductibility of State and Local taxes (SALT). Under current law, filers who itemize on their Federal income tax returns are generally eligible to take this deduction, which allows taxpayers to reduce their taxable income and tax liability.

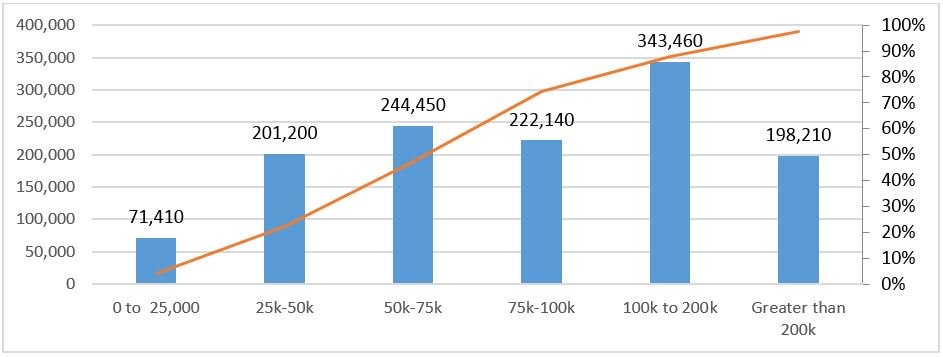

While the Administration has denounced this deduction as a loophole for the rich, analysis by the Comptroller’s office finds that:

- 740,000, or almost 60 percent of the almost 1.3 million households in the City who currently benefit from this provision, have incomes below $100,000

- Almost three out of every four NYC filers making between $75,000 and $100,000 would face higher tax bills.

- One in five of all beneficiaries have incomes below $50,000.

Many filers in New York City have come to rely on this deduction as part of their personal budgeting, to cover expenses and in particular to help defray housing costs. Its elimination would impose considerable hardship on these households, and reverse a policy that has been in place since the federal Personal Income Tax was created in 1913.

Number and Percentage of NYC Filers Impacted from the Elimination of State and Local tax Deductibility, by Income Range

Source: NYS Office of Tax Policy Analysis: 2015 Personal Income Tax Population Study data, IRS: 2014 Statistics of Income

New York City federal taxpayers deduct more than $32 billion in state and local income and property taxes annually. When the loss of these deductions is run through a tax simulation model this results in

- Over $7 billion dollars in additional taxes paid by NYC households[1]

- A median increase in taxes of $2,200 for New York City households

- A moderate income household making 75,000 would end up paying almost $1,800 more in taxes.

Contrary to the Trump administration’s assertion that the elimination of this deduction impacts primarily wealthy households, the results of our analysis show that taxpayers across all incomes would experience higher taxes and a decline in after-tax disposable income, ranging from 1.1 percent to 2.5 percent.

Median Tax Increase and Percent Loss in Disposable Income for NYC filers with S&L Tax Deductions, by Income Range

Source: NYS Office of Tax Policy Analysis: 2015 Personal Income Tax Population Study data, IRS: 2014 Statistics of Income

[1] The total loss will also depend on the interaction of the State and Local tax deductibility with other tax provisions such as the Alternative Minimum Tax and the Pease Limitation. The details of these provisions have yet to be spelled out clearly.