Popular Annual Financial Report Fiscal Year 2025

New York City Comptroller

Brad Lander

A Message from the New York City Comptroller

Dear New Yorkers,

It is my privilege to present the Popular Annual Financial Report (PAFR) for the City of New York, covering Fiscal Year 2025 (FY25), which began in July 2024 and ran through June 2025. The PAFR is a brief and concise overview of the financial health of New York City, distilling key information from the accompanying 497-page Annual Comprehensive Financial Report (ACFR) into an accessible format. That’s why we call it “Popular,” even if it makes the ACFR a little jealous.

Providing financial information in an accessible format is no laughing matter, though. This year marks the 50th anniversary of the City’s fiscal crisis, which was caused in part by the disparate and nontransparent condition of the City’s financial reporting at the time. Out of that crisis, New York enacted the Financial Emergency Act, which established stronger fiscal practices. Transparency tools like the ACFR and PAFR provide key details on the City’s finances clearly, so that the general public and stakeholders can feel confident that they have the information necessary to understand the direction the city is headed in.

Today, New York City remains on solid financial footing, and there are many reasons to be optimistic about the City’s fiscal health. Over the course of FY25, the City’s economy grew, with gains across the board in population, jobs, tourism and the real estate market. Challenges persist, of course: the potential loss in federal assistance from the Trump Administration, stubborn increases in the cost of living, and a reduction in international immigration pose challenges for New York City. However, disciplined financial management, strategic investments in City services, and effective programs to address the affordability crisis can counter this, as has been shown in the past as we recovered from the impacts of the COVID pandemic and other crises.

I am thankful for the dedicated staff of the Comptroller’s Office, and specifically our Bureau of Accountancy who compile both the ACFR and PAFR and consistently provide New Yorkers with transparent and reliable financial reporting.

Serving as New York City’s Comptroller for the past four years, as we recovered from the devastation of the COVID pandemic, welcomed hundreds of thousands of new New Yorkers, and resolved to tackle the affordability crisis, has truly been an honor and privilege. As I depart from the Comptroller’s office, I remain deeply hopeful for our city’s future.

Sincerely,

Brad Lander

Awards

Popular Annual Financial Report

The Government Finance Officers Association of the United States and Canada (GFOA) awarded The City of New York the Award for Outstanding Achievement in Popular Annual Financial Reporting for its Popular Annual Financial Report (PAFR) for the Fiscal Year ended June 30, 2024. The City of New York has received this national award for the last ten consecutive fiscal years. The award recognizes conformance with the highest standards for preparation of state and local government popular reports. In order to receive the award, a governmental unit must publish a PAFR whose contents conform to program standards of creativity, presentation, understandability, and reader appeal. The report must satisfy both generally accepted accounting principles and applicable legal requirements. We believe our PAFR continues to meet the Award for Outstanding Achievement Program’s requirements, and we are submitting it to the GFOA for consideration. The PAFR is a summary of the Annual Comprehensive Financial Report (ACFR) for the year ended June 30, 2025. The financial data in the PAFR derive from the more detailed ACFR.

Annual Financial Report

In addition to receiving the Award for Outstanding Achievement for its PAFR, The City of New York’s ACFR for the Fiscal Year ended June 30, 2024, was awarded the Certificate of Achievement for Excellence in Financial Reporting by the GFOA for the 45th consecutive year. The Certificate of Achievement is the highest form of recognition for excellence in state and local government financial reporting. In order to be awarded a Certificate of Achievement, a government unit must publish an easily readable and efficiently organized ACFR whose contents conform to program standards. We believe our ACFR continues to conform to the Certificate of Achievement program requirements, and we are submitting it to the GFOA to determine its eligibility for another certificate.

Both awards are valid for a period of one year only. The PAFR and the ACFR are consistent with generally accepted accounting principles (GAAP) and the guidelines established by the Government Accounting Standards Board (GASB), and available on the Comptroller’s Website at https://comptroller.nyc.gov.

Overview of the City’s Economy in 2025

The New York City economy continued to grow moderately during FY2025. Almost all of the net job creation accrued to the Health & Social Assistance sector. Yet, while employment in the city’s key Finance, Information, and Professional & Business Services sectors was little changed, these sectors did see fairly strong wage growth.

The office market continued to strengthen during FY2025, as indicated by gradually declining vacancy rates. This trend was also evident in rising weekday transit ridership and office attendance, though both remained below pre-pandemic levels.

The housing rental market grew increasingly tight over the course of the year, while the sales market was more sluggish. Roughly 37,000 housing units were added to the city’s housing stock in 2024 (a 1% increase, in line with job growth)—enough to prevent the housing shortage from getting worse but not enough to alleviate it. The map below shows percentage changes in the housing supply across the city’s 59 neighborhoods (Community Districts) since 2010. In general, most of the expansion in housing occurred in neighborhoods adjacent to or in Manhattan.

Percent Growth in Number of Housing Units by Neighborhood (CD): 2010-2024

What Makes Up the City’s Primary Government?

The Primary Government is made up of various City agencies and other entities established to perform the City’s core functions and duties for its citizenry. Component Units that are operationally codependent upon the primary government are in substance the same as the primary government and are included, or Blended, into the primary government. In addition to governmental activities, which account for services provided to the City residents, the primary government comprises a Component Unit distinction known as Business-Type Activities. The Business-Type Activities distinction accounts for fee-based services that the City provides to third parties.

When comparing the revenues and expenditures presented in the Governmental Funds financial statements to the revenues and expenses recorded for the primary government within the statement of activities in the ACFR, the differences that exist are due to the different methods of accounting used to prepare these statements. Financial reporting for the primary government within the statement of net position of the ACFR, is designed to provide readers with a broad, long-term, overview of the City’s finances in a manner similar to a private-sector business. The primary government’s long-term focus calls for the recording of both assets and liabilities that exceed one year. In contrast, the Governmental Fund financial statements that are contained in the ACFR are limited to reporting on near-term resources, similar to the City’s budget; its near-term focus emphasizes the recording of liabilities that are expected to be due and assets that are available to be used within the year.

The programs and functions listed are funded by two major sources:Program Revenues Program Revenues and General Revenues, including grants. Program revenues are collected and available for their respective programs and functions. General revenues are available to be used for any program or function and is mostly composed of tax revenues. Throughout this report, underlined Accounting Terms are defined later in this PAFR.

The Budget – General Fund

This Budget Roadmap is designed to help New Yorkers and others to understand the City’s budget process. The New York City budget is the place where many of the City’s policy decisions are made and where policy objectives are articulated and implemented in concrete terms. The scope of the budget includes all of the City government’s revenues and expenditures.

Budget Roadmap

Revenues: Where does the money come from?

Program and General Revenues – Primary Government

In Fiscal Year 2025, program and general revenues were approximately $120.1 billion, an increase of $4.9 billion from Fiscal Year 2024. Real estate taxes had the most revenues, totaling $34.5 billion, followed by operating grants and contributions, at $30.2 billion. The major components of the changes in governmental activities revenues were an increase in tax revenues and a decrease in operating grants and contributions. The increase in real estate taxes resulted from growth in billable assessed value during the fiscal year. The increase in sales and use taxes reflects a general increase in consumption activity. The increase in personal income taxes is driven by a robust labor market and record high Wall Street bonuses, coupled with continued strength in financial markets. The increase in other income taxes was due to strong performance among unincorporated finance and non-finance businesses. The increase in all other taxes was driven by higher hotel occupancy and increase in room rates. The decrease in operating grants and contributions was due to the decline in Federal revenues in FY 2025, primarily in Education Foundation Aid and Federal Stimulus.

Expenses: Where does the money go?

Expenses – Primary Government

Fiscal Year 2025 expenses were approximately $120.3 billion, a decrease of close to $1.8 billion from Fiscal Year 2024. The major components of the changes in governmental activities expenses were within social services and education. Social Services expenses grew due to increased spending for rental assistance costs and public assistance costs. Environmental Protection expenses increased due to increases in hiring, collective bargaining, water treatment costs, and investments in technology and cybersecurity measures. Cultural Activities and Libraries expenses increased due to the restoration of spending reductions and increased funding. Public Safety and Judicial expenses increased due to reinstatement of the Mayor’s Office of Criminal Justice department code. Transportation expenses increased due to higher costs of construction materials. A decrease in general government expenses was due to implantation of prior year savings initiatives and changes in procurement schedules.

Budget and Actual

Budget and Actual – General Fund Revenues

The General Fund is the main operating fund of the City. It is used to account for all financial resources not accounted for and reported in other funds, such as the Capital Projects Fund or the Debt Service Fund. General Fund revenues, as listed below, include tax revenues, federal and state aid (except aid for Capital Projects), and operating revenues. Revenue budgets help management set financial goals and assist management in planning for future needs and allocation of resources.

Chart 1

Budget and Actual – General Fund Expenditures

The General Fund is the main operating fund of the City. It accounts for all uses of financial resources not accounted for and reported in other funds, such as the Capital Projects Fund or the Debt Service Fund. The General Fund accounts for all expenditures in the Expense Budget that provide for the City’s day-to-day operations. The expense budget helps management set financial goals and review actual performance against these goals.

Chart 2

Discretely Presented Component Units

Component Units are legally separate organizations for which the City is financially accountable. The financial data of the following Component Units, which are supported by fees charged for goods or services, are presented separately (discretely) from the financial data of the primary government. For further details, access individual NYC Component Units Financial Statements at https://comptroller.nyc.gov/services/financial-matters/nyc-component-units-financial-statements/.

*Discretely Presented Component Units that are reported in the ACFR, but not shown above, issued financial statements with revenues less than the rounding threshold for this table. This included the New York City Land Development Corporation.

Benchmarks: How do we compare?

Benchmarks are used to put financial information into context. Below, our City is compared to Philadelphia and Chicago. “Per Capita” means that the total dollar value is divided by the population for each city. For instance, “Debt per Capita” is the total bonded indebtedness divided by the population. This makes the debt figure relative to the population size of the city.

The Importance of Bond Ratings

Good bond ratings save the City money. Bond ratings indicate the general quality of a bond, including the likelihood that investors will receive their money back when they lend it out. Bonds with higher ratings are seen as safer investments, so investors do not demand as much interest to lend money to highly-rated municipalities, such as New York City. Higher bond ratings mean lower interest rates, which save taxpayer dollars.

Borough-Wide Statistical Information

The data below provides a snapshot of the characteristics of each of New York City’s five boroughs – the Bronx, Brooklyn, Manhattan, Queens, and Staten Island.

Accounting Terms

Following are descriptions of some of the accounting terms used in this PAFR:

- Assessed Value: The value of a property for real property taxation purposes. A property’s assessed value is a percentage of its market value.

- Blended Component Units: Entities, although legally separate from the City, for which the primary government is financially accountable. These Component Units provide services exclusively to the City.

- Business-Type Activities: Component Units that were established to provide services to third parties and intended to operate with limited or no public subsidy.

- Capital Budget: The budget that is exclusively used to fund Capital Projects, such as city construction, purchases of land, buildings, or equipment.

- Capital Projects: Projects that meet the criteria of capital assets and involve the construction, reconstruction, or acquisition of Capital Assets.

- Component Units: Legally separate organizations for which the City is financially accountable.

- Discretely Presented Component Units: Component Units that are reported separately from the Primary Government. Although the City is financially accountable for them, they do not provide services exclusively to the government.

- Expense Budget: A budget that covers the day-to-day operating expenditures and is financed by city taxes and other revenues along with State and Federal aid.

- General Fund: The main operating fund of the City, which is used to finance the City’s operations.

- General Revenues: Revenues, not properly included among Program Revenues, which the City raises through taxation and other means. General Revenues are available to be used for any authorized program or function.

- Governmental Fund: For the purposes of New York City the Governmental Fund consists of: The General Fund, Capital Projects Fund, General Debt Service Fund, and Nonmajor Governmental Funds.

- Primary Government: The various City agencies and other entities established to perform the City’s core functions and duties for its citizenry.

- Program Revenues: Revenues that include charges for services such as rental revenue from operating leases on markets, ports, and terminals, and grants and contributions that are restricted to meeting the operational or capital requirements of a particular function or program. Program revenues are collected and available for their respective programs and functions.

Our Elected Officials

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The elected officials depicted above are as of the Fiscal Year ended June 30, 2025.

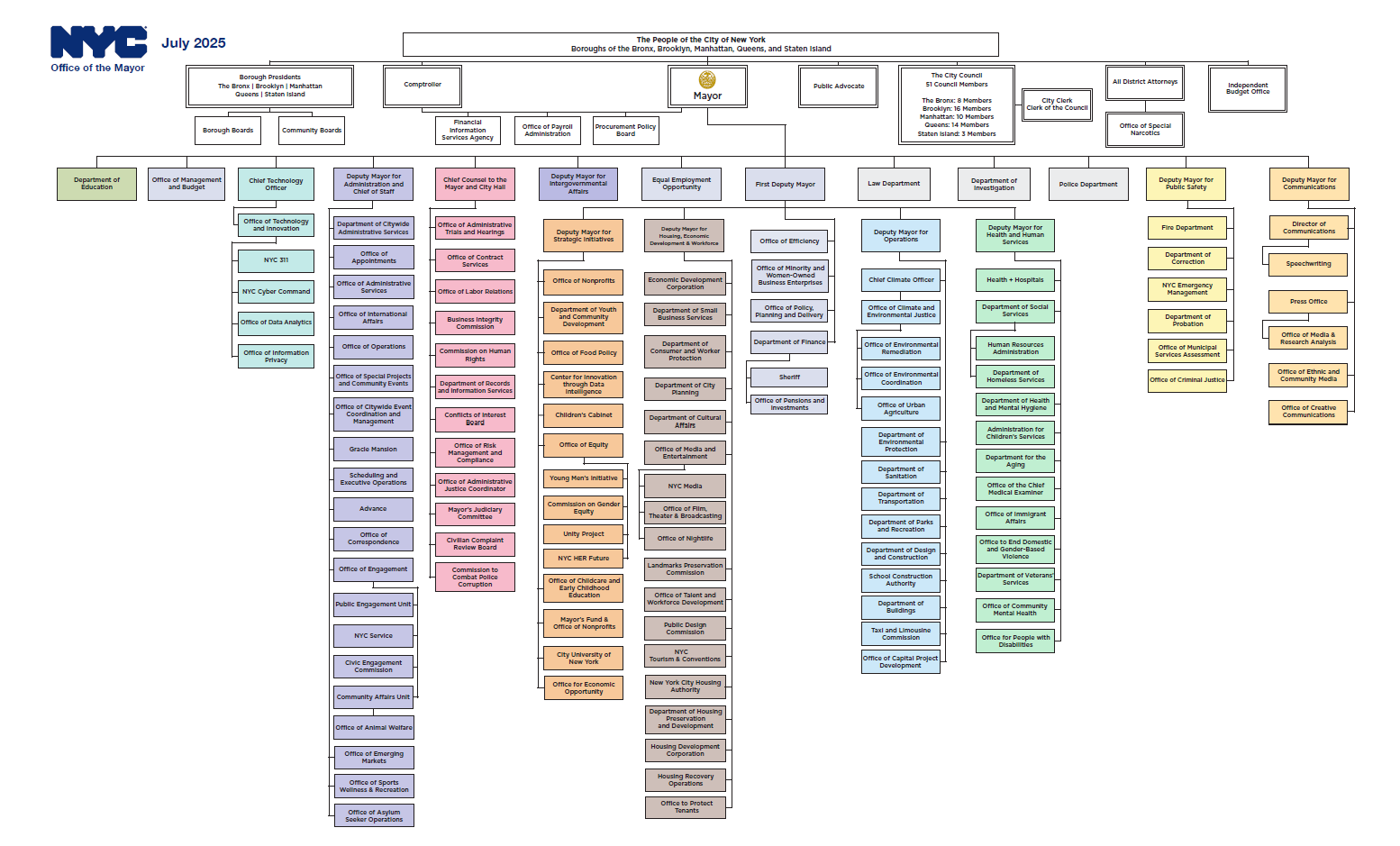

The Government of The City of New York

For a list of boards and commissions in The City of New York that fall under the Mayor’s purview, please visit the Boards & Commissions page on the Mayor’s Office of Appointments website: https://www.nyc.gov/content/appointments/pages/boards-commissions.

Acknowledgements

Brad Lander, Comptroller

Francesco Brindisi, Executive Deputy Comptroller for Budget & Finance

Popular Annual Financial Report Developed and Prepared by:

Bureau of Accountancy:

Executive Management

Jacqueline Thompson, CGFM, CIA, CFE, Deputy Comptroller for Accountancy

Katrina Stauffer, Bureau Chief

Bureau Management

Jessica Sanchez, Capital & Fixed Asset Chief

Nancy Cheung, Accounting Standards Director

Bureau Supervisors and PAFR Content Team

Grace Cheng, Capital & Fixed Asset Supervisor

Camille Arezzo, PAFR Copy Editor

Joshua Jean, PAFR Technical Writer

With Special Thanks to:

Bureau of Budget

Jason Bram, Director of Economic Research

Aliyah Sahqani, Economic Research Analyst

Stephen Corson, Senior Research Analyst

Bureau of Information Systems & Technology

Richard Lundy, Assistant Comptroller for Information Technology/CIO

Sandeep Mahale, Executive Director of Applications Development

Angela Chen, Senior Website Developer & Graphic Designer

Martina Carrington, Website Developer

Cindy Zhao, College Aide – Web Developer

Communications

Archer Hutchinson, Creative Director

Shaquana Chaneyfield, Press Secretary

Addison Magrath, Graphic Designer

Photo Credit: Shutterstock

Significant efforts were made by all staff of the Bureau of Accountancy and many others in the Office of the Comptroller and throughout the City to prepare the City’s Fiscal Year 2025 Annual Comprehensive Financial Report, from which much of the content of this report was adopted.

Comments or Suggestions

Thank you for taking the time to learn about The City of New York’s financial position. If you have comments or suggestions on how we can improve the PAFR, please contact the Technical and Professional Standards Unit:

Email: PAFR@comptroller.nyc.gov

Telephone: (212) 669-3675

X/Twitter: @NYCComptroller

Facebook: @ComptrollerNYC

Instagram: @NYCComptroller

Eric L. Adams

Eric L. Adams Jumaane Williams

Jumaane Williams Adrienne Adams

Adrienne Adams Amanda Farías

Amanda Farías Joann Ariola

Joann Ariola Vanessa L. Gibson

Vanessa L. Gibson Antonio Reynoso

Antonio Reynoso Mark Levine

Mark Levine Donovan Richards

Donovan Richards Vito Fossella

Vito Fossella Darcel D. Clark

Darcel D. Clark Eric Gonzalez

Eric Gonzalez Alvin Bragg

Alvin Bragg Melinda Katz

Melinda Katz Michael E. McMahon

Michael E. McMahon