Comptroller Stringer Releases Analysis of FY 2021 Executive Budget

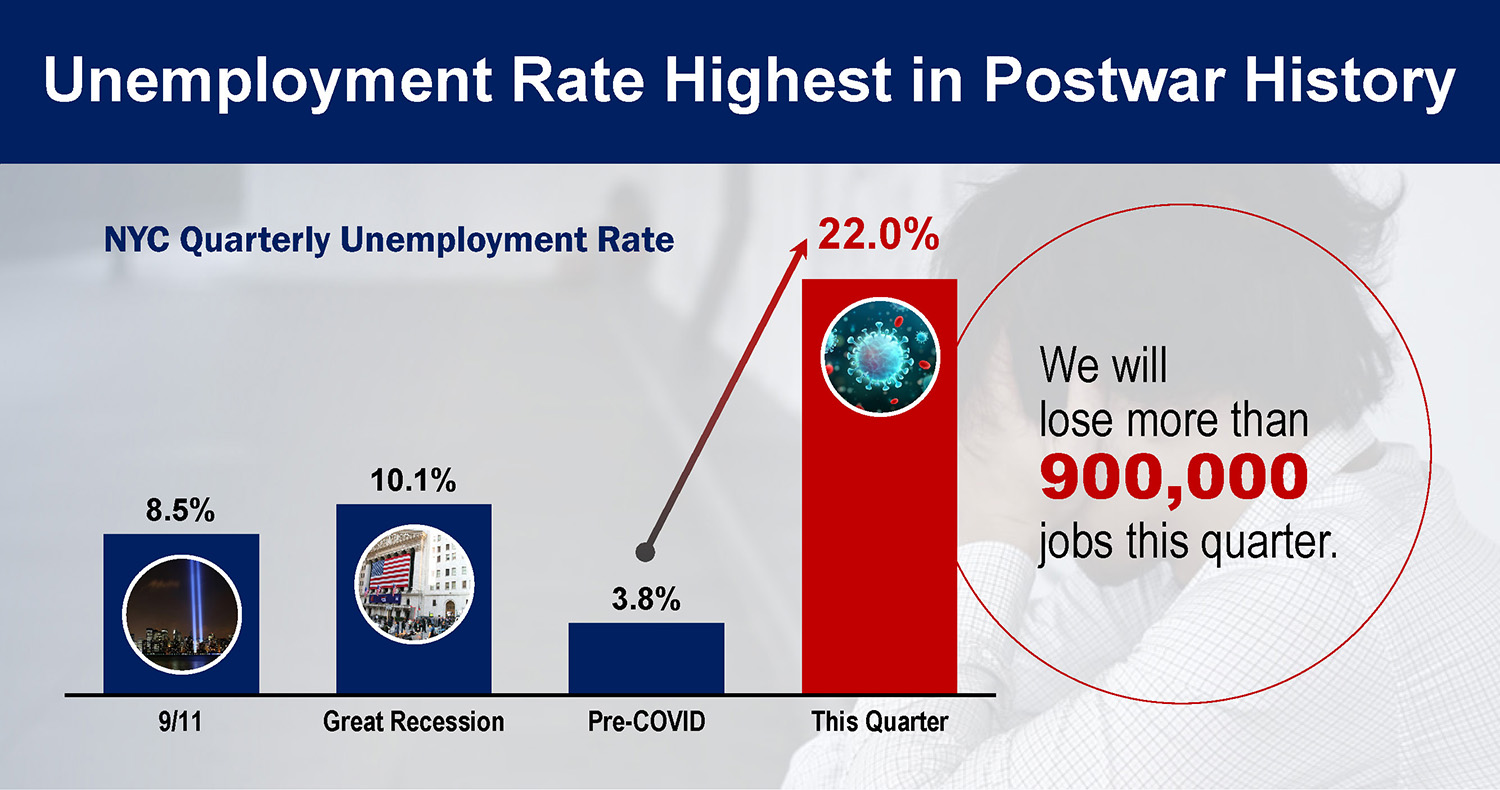

Facing $8.7 billion budget gap and 900,000 unemployed New Yorkers this quarter amid COVID-19 pandemic, with dwindling savings and inadequate federal support

New York City, with over 170,000 cases, received $8,500 per COVID case from the federal Coronavirus Relief Fund; Montana, with 457 cases, got $2.7 million per case

Stringer: In a crisis this severe, the federal government must step up and deliver relief to New York – the economic engine for the nation. Every year New York taxpayers put billions more into the federal coffers than New York receives in federal dollars, and it is unacceptable for Congress to be passing the buck – instead of passing robust local aid

(New York, NY) – Amid the COVID-19 pandemic’s devastating impact on New York City and the economy, New York City Comptroller Scott M. Stringer today released an analysis of the City’s Fiscal Year 2021 Executive Budget and outlined the state of play for the City’s finances. The new analysis of the Executive Budget spotlights the City’s overreliance on reserves and one-time savings, and Comptroller Stringer renewed his call for the federal government to pass need-based budget relief for New York and other hard-pressed state and local governments. The Comptroller also continued his push for City agencies to identify more recurring savings and efficiencies to close the budget gap, protect the social safety net, and support city workers.

“This pandemic has laid bare the deep disparities that permeate our society. We’re learning the value of a dollar, and why our taxpayer money must be accounted for andd fighting the systemic inequality that is contributing to worse health and economic outcomes for vulnerable communities,” said New York City Comptroller Scott M. Stringer. “Our analysis pulls back the curtain on our City’s budget and presents the reality of our economic outlook. We’re facing the deepest recession since the Great Depression, marked by historic and rapid job losses. In a crisis this severe, the federal government must step up and deliver relief to New York – the economic engine for the nation. Every year New York taxpayers put more into the federal coffers than New York receives in federal dollars, and it is unacceptable for Congress to be passing the buck– instead of passing robust local aid. And as a City, we need to comb through our budget for savings, because every penny counts, and every effort must be made to protect our most vulnerable. When we look back at this time, it must be said that government stood up for our city, marshaled all our resources, and did everything we could to save lives and get our economy back on track.”

Economic Outlook

- The Comptroller’s analysis of the Executive Budget accounts for recent developments driving the current, dire economic outlook.

- The national economy is facing the steepest recession of modern times– likely twice as deep as the Great Recession of 2008.

- The Comptroller’s office projects that more than 900,000 New Yorkers will lose their jobs by the end of the second quarter in June – one in five working New Yorkers.

- The unemployment rate is expected to reach 12 percent this year, higher than the Great Recession.

- Job losses will be steepest in sectors with the greatest interaction with the public, such as hotels and restaurants, and the workers in those sectors are primarily low-wage earners and already among the most vulnerable and economically insecure New Yorkers.

- The timing of the economic recovery will depend on how and when social distancing guidelines can be relaxed through a comprehensive testing regimen, and how and when people engage in social and business activity as in the past.

Executive Budget

- The Executive Budget for FY 2021 is $89.3 billion – $6 billion less than in the January Preliminary Budget. The gaps in the outyears, however, have nearly doubled compared to the preliminary budget.

- Tax revenues are projected to fall by $7.4 billion leaving a budget gap totaling $8.7 billion over the remainder of this year and FY 2021.

- The Executive Budget addresses the gap with $1.99 billion in federal aid, $2.66 billion from a savings program, and drawing down reserves for the remaining $4.03 billion.

- Subsequent to the Executive Budget, the State has proposed an additional $8.2 billion in cuts in its most recent update, which could mean more than $3 billion in additional cuts to New York City. Two-thirds of State aid to localities is for education.

More Need-based Federal Relief is Critical

- The federal Coronavirus Relief Fund, part of the CARES Act, was not allocated fairly. New York City, with over 170,000 cases, got just $8,500 per COVID case in the initial federal relief package, while Montana, with 457 cases, got $2.7 million per case.

- New York residents and businesses contribute more to the federal budget than they get back than any other state – $35.6 billion dollars more in 2019, according to the SUNY Rockefeller Institute of Government.

- Other states contribute less, and get more back. New York taxpayer dollars are funding relief efforts across the country. New York should not be left to fend for itself.

Minimal Agency Savings

- In January, Comptroller Stringer called on the Mayor to implement a PEG (Program to Eliminate the Gap) program that would task all agencies with identifying 4 percent of their budgets for recurring savings. In April, the Mayor announced that the Executive Budget would include a PEG program.

- The Executive Budget PEG program included savings totaling $2.7 billion between this year and next, with a recurring value of slightly more than $800 million in the outyears.

- Recurring Agency savings from efficiencies and program and service reductions totaled about 1.6 percent of agency spending in FY 2021, and 1.2 percent in subsequent years.

- If agencies had met the Comptroller’s benchmark of 4 percent in recurring agency efficiency savings, close to $1 billion more a year would be available to support vulnerable populations amid the COVID-19 pandemic, as well as the City’s workforce.

- Instead, the Mayor’s savings rely heavily on one-time program suspensions or delays, largely due to COVID-19 restrictions. Less than 40 percent of the savings over the life of the plan are from efficiencies or recurring program reductions.

- The Comptroller’s Office will contribute to gap-closing efforts by instituting a 4 percent PEG, reducing its FY21 City-funded expense budget by $3.5 million.

Dwindling Reserves

- The Comptroller’s analysis found that the Executive Budget relies on drawing down the City’s reserves for nearly half (46 percent) of the value of the gap-closing program.

- The Executive Budget includes just $100 million in the FY 2021 contingency reserve, a sharp drop from previous budgets’ contingency reserves of $1.25 billion.

- The Mayor has proposed using balances built up in the Retiree Health Benefit Trust — $1 billion this year and $1.6 billion next year – which would leave just $2.1 billion.

- This action leaves our finances exposed should the recovery falter or be more prolonged.

To read Comptroller Stringer’s full analysis, click here.

###