Comptroller Stringer Releases Updated “Affordability Index” with New Data Spotlighting Financial Strain of New York City’s Affordability Crisis

Rising cost of rent continues to outpace income growth, throwing New York City households into financial distress

(New York, NY) – New York City Comptroller Scott M. Stringer today released a new year of data detailing how New York City’s affordability crisis is straining households across the five boroughs. The updated “Affordability Index” tracks how the rising costs of basic necessities like housing, transportation, healthcare, and child care, are squeezing the budgets of New York City households and leaving them with dwindling savings.

“New York City’s affordability crisis impacts every New Yorker and every community – and the numbers laid out in our affordability index shine a light on this worsening crisis. Over the last decade, the lack of affordable housing and the soaring cost of everything from child care to basic everyday necessities have ravaged New Yorkers’ bank accounts, and now, these pressures are pushing people out,” said New York City Comptroller Scott M. Stringer. “This data shows exactly why we need an affordable housing plan that puts people before profits and a bold investment in quality affordable child care. We can’t allow a two-million dollar luxury condo to become the entry price to New York City. We need to meet this growing crisis with the urgency it demands and do everything in our power to keep New York City an aspirational city for our next generation.”

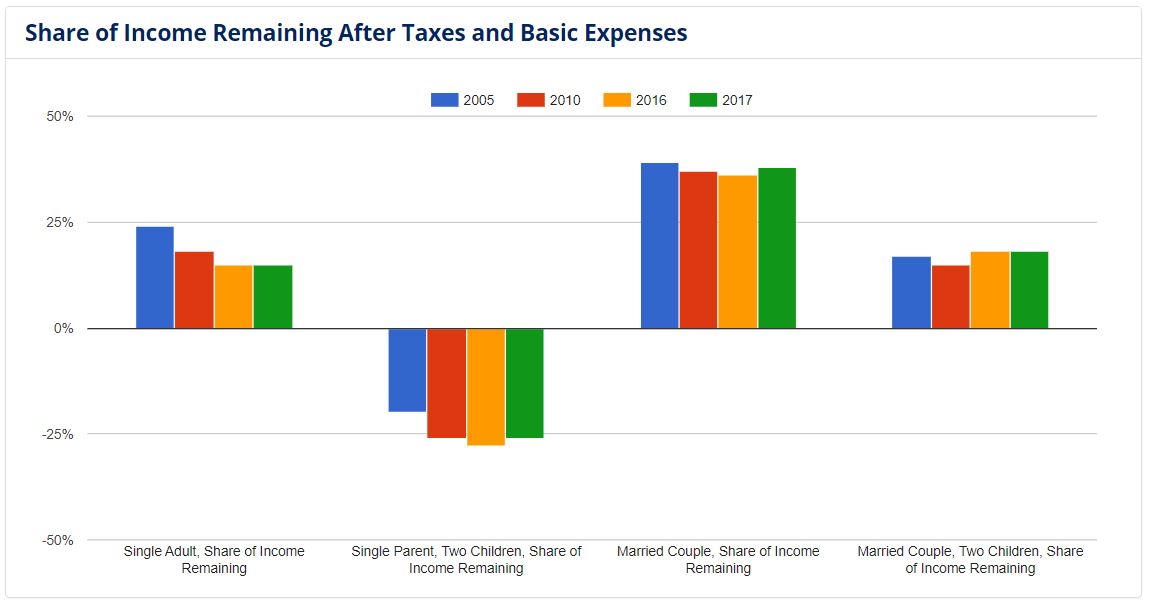

The affordability index is updated annually to monitor the economic struggles of four typical City household types: single adults, married couples with no children, single parents with two children, and married couples with two children. This year’s updated affordability index shows that between 2005 and 2017, typical household incomes increased by just 1.9 percent per year for single adult households and 3.0 percent or more for other households in the index, as the share of incoming remaining for these typical households has generally fallen.

- Single parents with two children struggle the most to afford living in New York City and have significant trouble paying for basic necessities. For these households, the costs of basic expenses actually exceeded incomes by 26 percent in 2017, meaning these New York City families are making compromises, racking up debt, or forgoing basic needs.

- In fact, the analysis shows that since 2005, single adults with children saw monthly basic expenses rise by $1,508 or 48 percent, while incomes grew just $1,079 or 42 percent over the same period.

- Single adults also saw their monthly basic expenses rise faster than incomes. The analysis notes a 41 percent jump in costs and a 26 percent rise in income, leaving those households with just $648 leftover after taxes and basic needs in 2017, down from $831 over a decade ago.

Rising Costs of Basic Necessities Outpace Income Growth

In its analysis of incomes, tax rates, household budgets, and spending on basic necessities, the affordability index shows that from 2005 to 2017:

- Median rents in New York City increased on average by 4 percent a year – resulting in $600 higher median rents for one- and two-bedroom apartments, a 61 percent and 53 percent rent hike between 2005 and 2017, respectively;

- Food costs increased by an average 2.1 percent per year;

- Transportation costs increased by an average 3.0 percent per year;

- Health care costs increased by 4-6 percent per year; and

- Child care costs increased by 2.4 percent per year.

To view the interactive “Affordability Index” webpage, click here.

###