Comptroller Stringer Report Finds Millennials Have Faced Toughest Economy Since Great Depression

Millennials earn 20 percent less than the generation before them

Job growth for next generation of New Yorkers is concentrated in low-wage industries with declining real wages

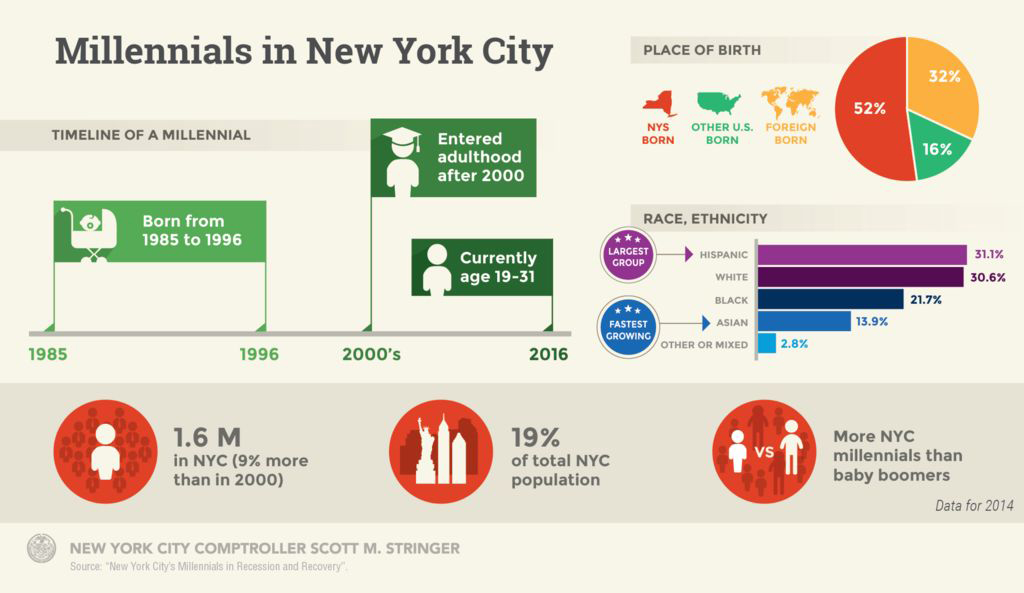

(New York, NY) – Millennials, defined as those born between 1985 and 1996, entered the workforce during the greatest economic downturn in almost a century, and faced enormous financial setbacks as a result, according to a new analysis released today by New York City Comptroller Scott M. Stringer. This group is even larger than the Baby Boomers, but Millennials have taken a back seat in our City’s economy, earning about 20 percent less than the generation before them. As Millennials advance in their careers, they may never catch up after starting off with this disadvantage.

“Millennials were applying for jobs in the most difficult economic climate since the Great Depression and as a result, a growing number are now working in low-wage industries and earning less than their predecessors,” Comptroller Stringer said. “This group of young people is confronting unique economic challenges that their parents did not have to face. Every generation is expected to do better than the last, but too many Millennials are not getting a fair chance to make it in New York City.”

The young adult population in New York City grew 9 percent between 2000 and 2014, at which point 1.6 million of them lived here. Making up 19 percent of the City’s population, they are contributing to our increasing diversity. Hispanics are the largest Millennial racial/ethnic group in New York City, while Asians are the fastest-growing young population.

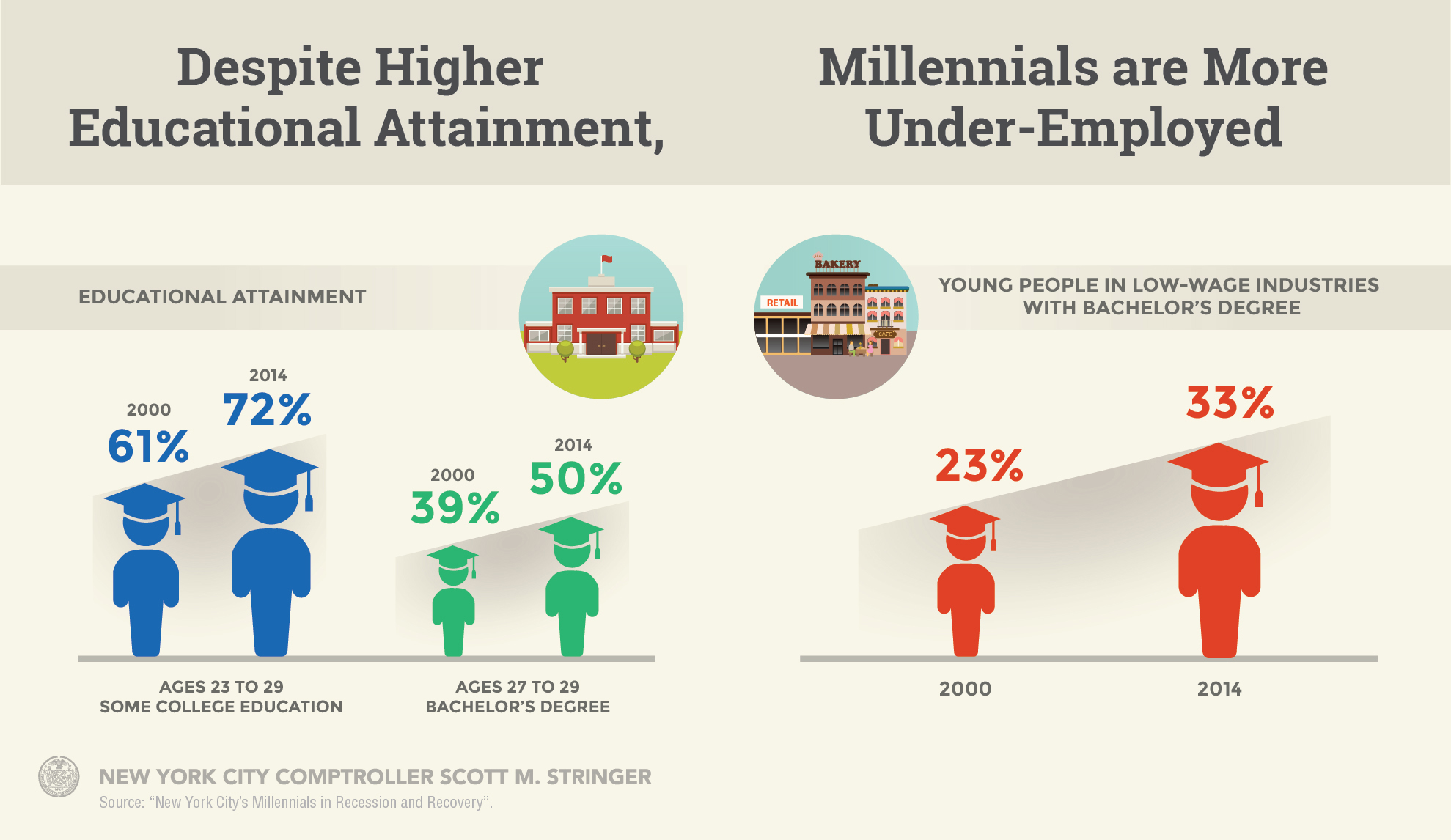

The report reveals that this generation is attending college at an increasing rate – 72 percent of all 23- to 29-year olds living in New York City had earned some college credit – but upon entering the workforce faced a devastating job market.

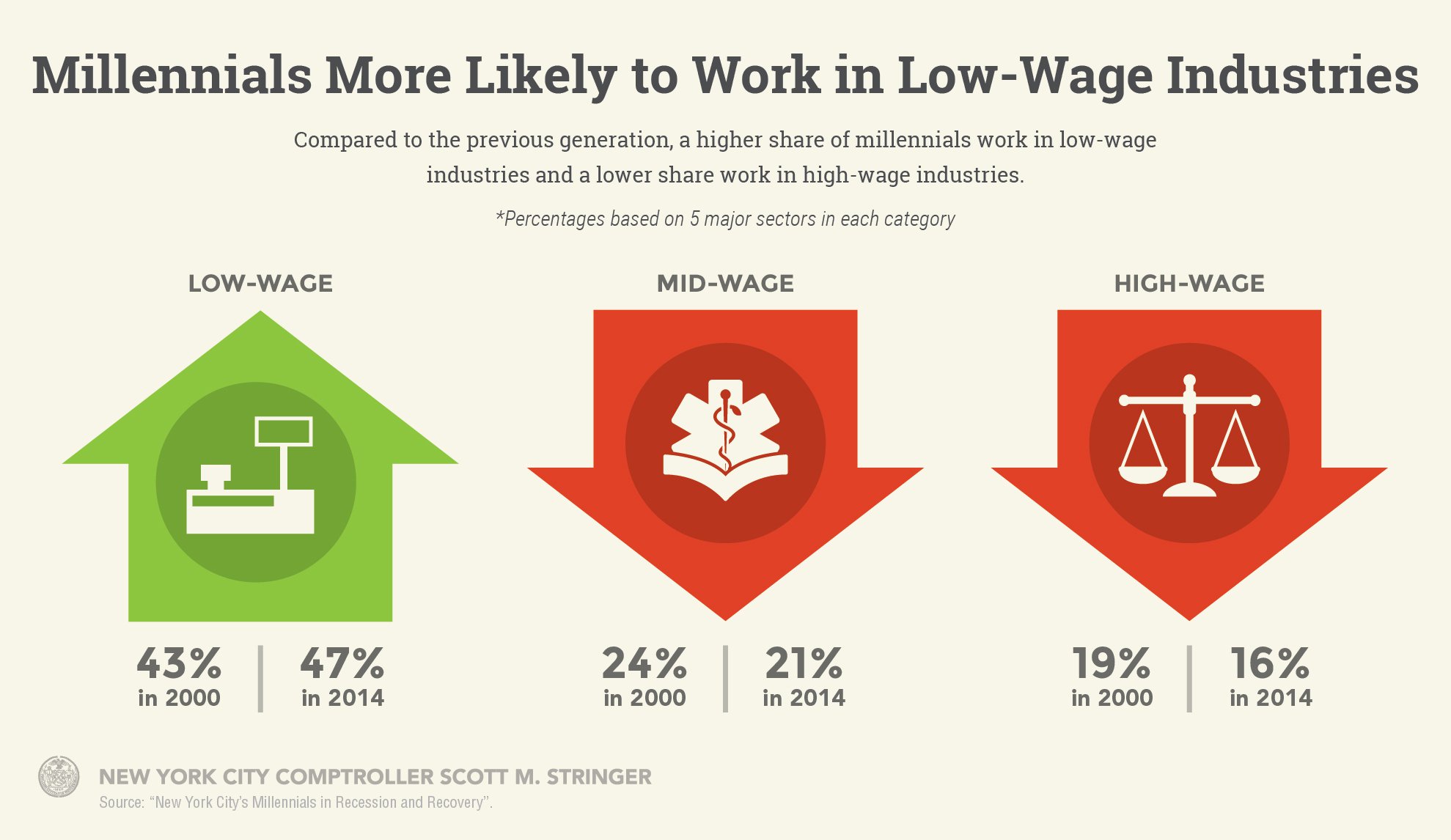

- The share of young workers employed in low-wage industries, including retail, food service, and hospitality, grew by 4 percentage points between 2000 and 2014 while the share of them working in mid- and high-wage industries each fell by 3 percentage points in the same period.

- The percentage of young adults working in low-wage industries who have a bachelor’s degree grew from 23 percent to 33 percent between 2000 and 2014.

Due to the erosion of good-paying jobs, this generation of New Yorkers earned about 20 percent less in 2014, adjusted for inflation, than their counterparts who entered the job market during the 1990s. The industries that are employing more young people are experiencing a significant decline in real wages.

- Hospitality/food service and retail produced 91,000 new jobs for young people, but real wages in both sectors fell by 16 percent from 2000 to 2014.

- The arts and entertainment sector, a mid-wage employer, added 16,000 jobs for young adults in that period, but income for them fell in that industry by 26 percent in those years.

- On the other end of the income spectrum, the number of young workers in high-wage finance jobs declined by 11,000, even as real wages for those jobs rose 14 percent.

While a large share of Millennials in New York City are working in low-wage jobs, some are not working at all, and many have high student debt burdens.

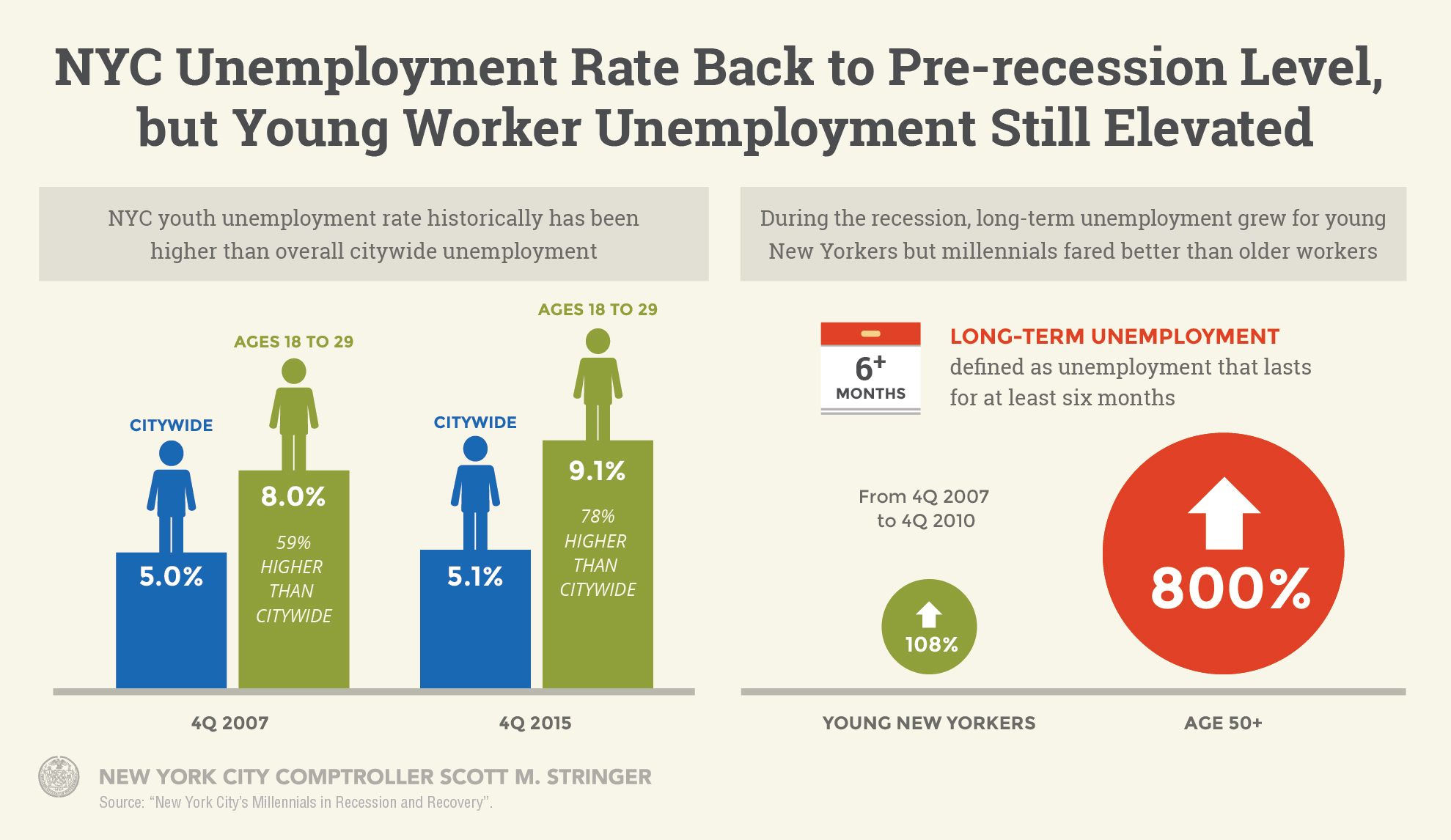

- Immediately after the Great Recession, the unemployment rate of the city’s 18- to 29-year old workforce more than doubled to over 18 percent, far higher than that of the general population. By 2015, the overall unemployment rate had returned approximately to its pre-recession level, while the rate for young workers was still 1.1 percentage points higher.

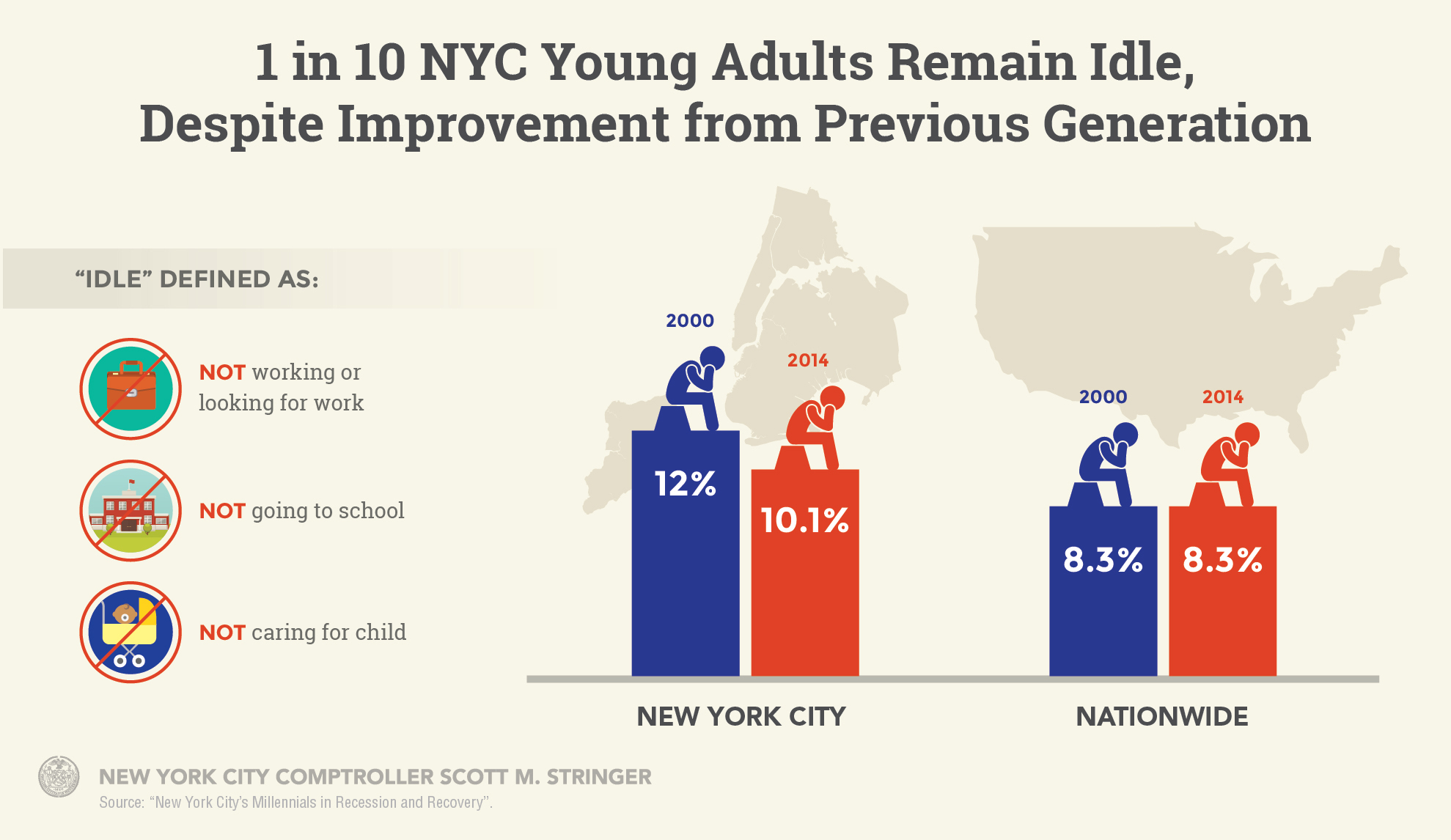

- One in ten young people in New York City are idle – not in school, not in the labor force, nor caring for a child – although the rate has improved since 2000.

- Young people in the five boroughs owe approximately $14 billion in student debt. Nationwide, total student loan balances held by all borrowers under 30 years old increased at nearly a 10 percent annual rate between 2005 and 2014, reaching $369 billion.

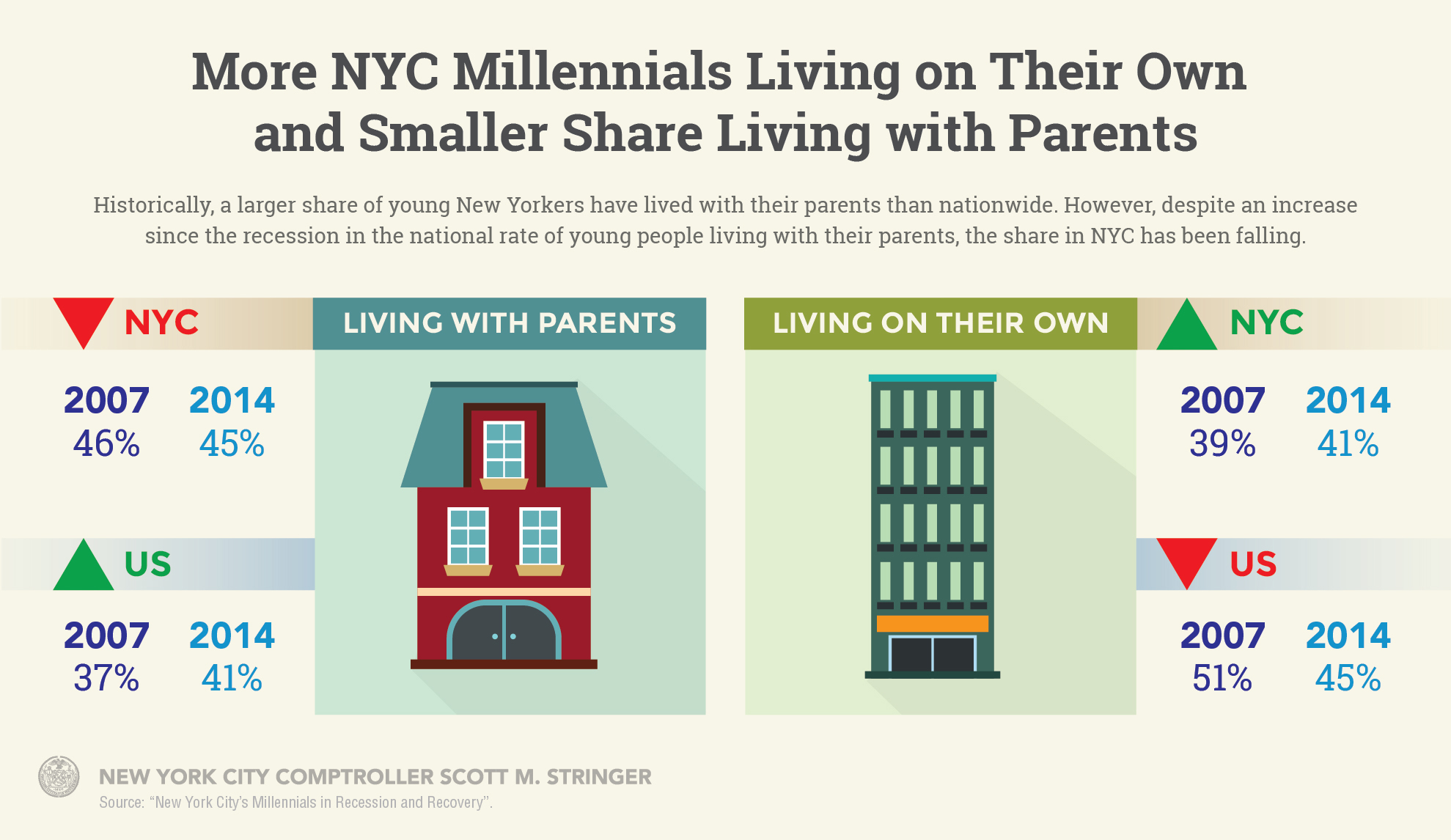

The good news is, more Millennials are moving out of their parents’ homes and living on their own.

- The share of young adults in New York City who reside independently from their parents or other relatives grew from 39 percent in 2007 to 41 percent in 2014, bucking a national trend that has seen young adult household formation fall from 51 percent to 45 percent in the same period.

“This generation is at a crossroads. They worked hard, got an education and then faced roadblocks to getting a good-paying job. It’s time for us to pay attention to the largest generation in New York City, and start to break down those barriers. We need to foster an economy here that helps young people get ahead, not one that holds them back,” Stringer said.

While macroeconomic trends will continue to have the greatest effect on the financial future of the Millennial generation, local and state governments can and should enact a series of policies that promote opportunity for young people, including:

- Raising the minimum wage;

- Expanding overtime protection;

- Supporting efforts to keep public universities affordable and reduce the burden of student debt;

- Creating more affordable housing;

- Developing more effective workforce training programs and summer employment opportunities; and

- Adopting new approaches to criminal justice and rehabilitation to help the millions of young people with criminal records.

“Millennials are doing their part for New York City – they are politically involved, culturally engaged, and highly motivated,” said Comptroller Stringer. “This generation is overcoming setbacks and changing the way we work, live and communicate. Now it’s time for the rest of us to do our part and put policies in place that will help this powerful group settle down in New York City, start their careers, and raise families here, so our economy can continue to grow.”

To read the full report, please click here.

###