A Path from Poverty: Expanding New York City’s Earned Income Tax Credit

EXECUTIVE SUMMARY

In the world’s economic capital, many New York families are struggling just to get by. Twenty percent of New York City residents and a staggering twenty-nine percent of New York children live beneath the poverty line. Even for working New Yorkers, rising rents and stagnating incomes mean that a full time job is no guarantee of economic security.

This report, by Comptroller Scott M. Stringer, offers a proposal to bolster New York City’s economy and reward hardworking families — by expanding the Earned Income Tax Credit, or the EITC. By tripling New York City’s 5 percent match of the federal EITC, the City can extend opportunity, eliminate City income taxes for thousands of New York City families, and lift thousands more out of poverty.

The EITC is a refundable tax credit for working families, designed to offset federal, state, and city taxes and provide an additional income boost for workers near or below the poverty line. While the majority of an individual’s EITC credit is derived from their federal tax return, New York State has matched a portion of the Federal EITC since 1994. Today, New York State provides a credit equal to 30 percent of the Federal EITC. In 2004, New York City began offering an additional 5 percent match of the federal credit.

Tripling the City’s portion of EITC from 5 percent to 15 percent would:

- Lift an additional 15,000 New York City families over the poverty line.

- Boost the maximum EITC credit (federal, state, and city) in New York to $9,090, an increase of $627 from today’s maximum of $8,463.

- Provide a more generous credit for over a million children and two million adult New Yorkers living near the poverty line.

- Provide an average City credit of $330 per claimant, up from $110.

- Effectively eliminate City income tax for 6,000 New Yorkers.

Enhancing the City’s EITC will increase economic security for thousands of families living on the edge by putting more food on the table, more rides on a MetroCard, more school supplies in backpacks and more savings in bank accounts.

Tripling the City’s EITC would cost approximately $210 million a year, or less than one half of one percent of the City’s total budget. The investment can be expected to pay numerous dividends, given the extensive body of research documenting the benefits of the EITC, from improved health and education outcomes, to higher lifetime earnings for children and a stronger economy. The EITC not only helps families, but lifts the economic fortunes of entire communities. EITC dollars are shown to have a strong stimulative effect, bringing more spending, jobs, and economic activity.

In the months ahead, Comptroller Stringer will work with New York City lawmakers to include a more generous EITC in the City’s 2018 budget, and urge legislative partners in Albany to authorize an increase in the City’s contribution to the EITC.

FIGHTING POVERTY AND EXPANDING OPPORTUNITY

The EITC is one of the most successful anti-poverty programs in the United States. By making work pay for low income families, the EITC has helped to reduce poverty, promote well-being, and expand opportunity for many of our City’s families.

The EITC is a refundable tax credit designed to incentivize employment by offsetting federal, state, and city taxes and by providing income support specifically to working people. Refundable tax credits are provided to eligible tax filers even if the filer’s total tax liability is zero. In that case, the filer receives a tax credit in the form of a direct payment. The size of the total credit — currently up to $8,463 annually for City residents — depends on a recipient’s income, marital status, and number of children.

The majority of an individual’s EITC credit is derived from their federal tax return. Since 1994, New York State has matched a portion of the Federal EITC, and today the State provides a credit equal to 30 percent of the Federal EITC. In 2004, New York City became one of only three municipalities in the country to offer a citywide EITC to low- and moderate-income residents. New York City’s EITC offers a refundable five percent match of the Federal EITC, helping to offset New York City’s personal income tax.[i]

THE EITC IN NYC

The EITC has proven extremely successful at helping to lift workers and children from poverty. In 2013 the EITC helped 9.4 million Americans escape poverty and put more money in the pockets of a further 22 million Americans.[i] In New York alone, the cumulative total of Federal, State, and City EITC puts approximately $2.8 billion in the hands of over 950,000 New York City families.

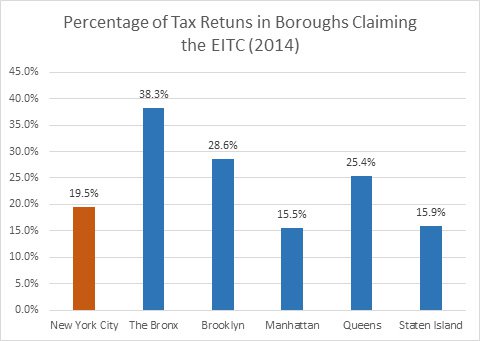

In 2014, more than one-third of all residents filing a tax return in the Bronx benefited from the EITC, along with 29.6 percent of filers in Brooklyn and 25.4 percent in Queens. Tax filers in Manhattan and Staten Island claimed the tax credit at a rate 15.5 percent and 15.9 percent respectively.[ii]

According to new estimates by the New York City Comptroller’s Office, raising the City’s match to 15 percent will lift 15,000 families above the poverty line — currently set at $31,581 for a two adult, two child family — and raise the maximum credit for families to $9,090 per year.

In addition to the 15,000 families that would be lifted above the official poverty threshold, over one million children and two million low-income adults would also see their EITC benefits increase. An expanded credit would help offset tax liability and provide more cash to New Yorkers in need of an economic boost.

Strengthening the City’s EITC will benefit both New Yorkers facing perennial hardship and New York families in temporary economic distress. Every year, 1 in 5 New York City filers claims the EITC. Nationwide, between 1989 and 2006, roughly half of all taxpayers with one or more children claimed the EITC for at least one year.[iii] Despite its wide reach, longitudinal studies show that the majority of EITC recipients only claim the EITC for periods of one or two years. [iv] This suggests that for many recipients, the EITC functions as a short-term support that helps them bridge a momentary economic challenge.

This safety net is especially critical for families living in a city where a full-time job is no guarantee of economic security. Since 2011, median rents have risen by 6.3 percent in New York, even as real wages for workers have stagnated.[v] Meanwhile, New York’s share of high-wage jobs has shrunk. During the current economic recovery, 57 percent of all new jobs created within New York City have been in low-wage industries.[vi] As a result, many New Yorkers are struggling to make ends meet.

The following chart outlines the impact of the current EITC, and how raising the City’s portion would affect filers at different income levels.

Current and Proposed Average City EITC Values 2014

| Gross Income | Number of Filers | Total Value of City Credit | Average Value of Existing City Credit per Filer | Average Value of Proposed City Credit per Filer | Average Value of Federal, State and Proposed City Credit per Filer |

| Under $5,000 | 94,216 | $2,161,611 | $23 | $69 | $665 |

| $5,000-$9,999 | 208,544 | $13,156,020 | $63 | $189 | $1,829 |

| $10,000-$14,999 | 215,461 | $26,295,254 | $122 | $366 | $3,539 |

| $15,000-$19,999 | 129,576 | $25,602,049 | $198 | $593 | $5,730 |

| $20,000-$24,999 | 93,114 | $17,765,709 | $191 | $572 | $5,533 |

| $25,000-$29,999 | 72,921 | $10,782,933 | $148 | $444 | $4,288 |

| $30,000-$51,567 | 130,331 | $9,795,311 | $75 | $225 | $2,180 |

| All Filers | 944,164 | $105,558,887 | $112 | $335 | $3,241 |

Increasing the size of the City’s credit from 5 percent to 15 percent would effectively eliminate City income tax for 6,000 more low-income New Yorkers at the cost of $210 million dollars —about one half of one percent of the City’s total annual budget — an investment that can be expected to pay large social and economic dividends in the years ahead.

REPAYING SOCIETY: HOW THE EITC HELPS FAMILIES AND LIFTS WORKERS

Since its inception in 1975, the EITC has earned the plaudits of social scientists, policy makers, and politicians from both sides of the aisle. One of the few measures of bipartisan consensus in recent years has been a shared desire by President Barack Obama and the Speaker of the House to increase the EITC allotment for childless workers.[i]

Increasing or matching the EITC at a local level amplifies the anti-poverty effect of the federal credit. According to researchers “a $1,000 policy-induced increase in the EITC lead to a 7.3 percentage point increase in employment and a 9.4 percentage point reduction in the share of families with after-tax and transfer income below 100% poverty.” [ii]

A brief review of the extensive body of research on the EITC’s many benefits explains why strengthening the credit is a good investment for the future of New York City.

Stimulating the Economy

The EITC not only benefits individual families, but can help lift the economic fortunes of entire communities. In areas like the Bronx, where 38% of all households claim the EITC each year, the infusion of capital provided by the credit can help drive increased economic activity in the community. According to a study of the EITC’s effect in Baltimore, every dollar of EITC-linked spending resulted in more than a dollar’s worth of economic activity; $71 million in total EITC expenditure in Baltimore generated over “$102 million in economic output, over 1,000 jobs, and over $30 million in wages.”[iii]

Other studies have confirmed that the EITC functions as an economic multiplier, producing additional spending and income. Analysis of the spending patterns of eligible families indicate that the vast majority of EITC dollars circulate within the local community of the EITC recipient. One analysis of the EITC’s effects in Nashville pegged the percentage of EITC disbursements spent within the local region at 87 percent.[iv]

Public Health

One of the most pronounced benefits of the EITC is in improving public health. Beginning at birth, the EITC helps improve the health and well-being of families of modest means. According to a study of New York City neighborhoods, birth weights dramatically rose after an increase in the generosity of the EITC.[v] Children with higher birth weights are typically healthier and tend to fare better in school.[vi]

The positive health effects of the EITC persist into childhood and adulthood. Families receiving the EITC report a measurable increase in the health status of children 6 to 14 years old.[vii] Studies have further shown that strengthening the EITC can have outsized impacts on boosting quality of life. For example, an innovative new study conducted by Columbia University researchers showed that supplementing the federal EITC directly increased quality of life and life expectancy.[viii] The Columbia study also asserted that dollar for dollar, the EITC provides greater benefit and value to the public health than many other public health interventions. Dr. Peter Muennig, an author of the study, contends that the “EITC might just be the bipartisan answer to both the problems of declining life expectancy and declining wages among lower income Americans.”[ix]

Education

In addition to its contributions to public health, the EITC has been found to help increase academic achievement. A series of studies have demonstrated that the EITC has a positive effect on children’s test scores.[x] These effects are particularly pronounced for minority children. Researchers at the Center for Budget and Policy Priorities estimate that a credit worth approximately “$3,000 (in 2005 dollars) during a child’s early years may boost his or her achievement by the equivalent of about two extra months of schooling.”[xi]

The credit’s effects on education are not isolated to test scores. Raising the credit also improves the likelihood of a student graduating high school or receiving a GED by age 19.[xii] The EITC also helps more students reach college. For families that qualify for the maximum EITC credit, a $1,000 increase in their EITC check can increase college enrollment rates by 10% for children graduating high school.[xiii] Studies show that these effects are even stronger in jurisdictions which offered an EITC match.

From these findings, economists have found that the EITC places children on a trajectory towards success. Improved educational outcomes directly correlate with increased future earnings, higher retirement savings rates, and increases in the quality of neighborhoods in which the student lives. According to a study of IRS data, every dollar of income provided by the EITC increases future earnings by more than one dollar, meaning that the cost of the program may be partially offset by increased economic performance in the long term.[xiv]

Encouraging Employment

The EITC is credited with substantially boosting employment rates for single mothers and female heads of households.[xv] Research suggests that even relatively small increases in the EITC can drive up employment. One analysis of the EITC in the 1990s concluded that “a $439 relative increase in the EITC [in 1990s dollars] for families with two or more children resulted in a 3.2 percentage-point increase in employment.”[xvi]

Evidence further suggests that the EITC can put families on a path out of poverty. According to research by the Congressional Budget Office and the Institute for the Study of Labor, claimants of the EITC, particularly single mothers, are more likely to find employment with potential for future earnings growth than other comparable job seekers. [xvii]

CONCLUSION

For many workers, their tax refund (including the EITC) represents the largest contribution to their bank account in the course of a year. Raising the EITC represents a chance to get ahead. Each year, the EITC allows New Yorkers to put food on the table, repay debt, build savings, invest in their homes, pay for education, and plan for their future. By tripling New York City’s match of the federal credit, the City can help lift the fortunes of more than two million adults and one million children living near the poverty line.

ACKNOWLEDGEMENTS

Comptroller Scott M. Stringer thanks Nichols Silbersack, Policy Analyst, the lead writer of this report. The Comptroller also extends thanks to Andrew McWilliam, Senior Research Economist, Zachary Schechter-Steinberg, Deputy Policy Director, and David Saltonstall, Assistant Comptroller for Policy for their work in preparing this report.

Comptroller Stringer recognizes the important contributions to this report made by:

Tim Mulligan, Deputy Comptroller for Budget; Tyrone Stevens, Press Secretary; Jack Sterne, Press Officer; Angela Chen, Senior Web Developer and Graphic Designer; and Antonnette Brumlik, Senior Web Administrator.

Cover photo credit: Phil Dolby[i]