Analysis of the Financial and Operating Practices of Business Improvement Districts, Fiscal Year 2020

IMPACT OF ANALYSIS

Summary of Conclusions

This analysis of business improvement districts (BIDs) identified four financial matters, which potentially point to increased financial risks and may decrease the availability of services to districts. The analysis highlights:

- BIDs with recurring deficits (expenses exceeded revenues);

- BIDs with low program service expenses when compared to their respective category averages;

- BIDs with high administrative expenses in comparison to their respective category averages; and

- BIDs that paid higher salaries and compensation to key employees compared to other BIDs.

As reflected in Table XVII in Appendix I, twelve BIDs were identified with more than one potential matter of concern. A BID that incurs recurring deficits or accumulates excessive reserves and expends low amounts on program services or large amounts for administrative costs may not achieve its basic goal of providing optimum services to its district. Accordingly, trustees of the twelve BIDs should consider the potential financial matters identified in this report and evaluate whether their resources could be better used.

Intended Benefits

BID operations, funding, services, needs and priorities vary greatly, making a direct comparison from one BID to another impracticable. However, analysis of similar-sized BIDs based on total revenue categories, as carried out in this report, provides a baseline for comparison. Accordingly, this analysis highlights potential risks and concerns for directors, board members, and other stakeholders of the BIDs to consider, and provides recommendations aimed at mitigating these risks in the future.

INTRODUCTION

Background

In 1981 and 1982, the State and City of New York (the City) passed legislation permitting property owners to define and self-fund BIDs.[1] The first BID established in the City was the 14th Street-Union Square Partnership in Manhattan in 1984. As of Calendar Year 2020, there were 76 BIDs operating in the City, including 25 in Manhattan, 23 in Brooklyn, 13 in Queens, 11 in the Bronx, and four on Staten Island. In Fiscal Year 2020, these BIDs invested more than $170 million and served more than 93,000 businesses in their respective districts. SBS oversees BID formation and expansion, monitors BID fiscal and organizational health, manages each BID’s contract with the City, and collects annual impact data and external audit reports for each BID. SBS also provides support, training, and best practices to the BIDs. (Exhibit A in Appendix II provides a complete list of BIDs and their FY 2020 operating parameters.)

A BID is a legally established commercial district within a defined geographical boundary made up of local stakeholders (e.g., property owners, commercial and residential tenants) formed for the purpose of promoting business development and improving the area’s quality of life. BIDs also serve as liaisons between local businesses, stakeholders, and City government. Each BID is run by a District Management Association (DMA), a not-for-profit organization composed of a board of directors that oversees the operation. Each board of directors is comprised of at least 13 members, including at least nine local stakeholders (a majority of which must be property owners), and a voting representative from the Mayor’s Office (an SBS staff member), the Comptroller’s Office, the Borough President’s Office, and a City Council member that represents the district.[2] Many BID boards also include non-voting members that may represent the local Community Boards or other local nonprofit organizations.

BIDs hire staff, contract service providers, develop budgets, and decide on the type and level of services to be provided to the districts in accordance with their respective District Plans and contracts with the City. Once formed, a BID can exist in perpetuity.[3] If a BID seeks to amend its District Plan, expand its boundaries, or increase its special assessment, it must follow the same planning, outreach, and legislative processes initially taken to form the district.

BID operations and services are funded by a special assessment billed to and paid for by each property owner in the district. Each BID’s total annual assessment is unique to the district and decided upon by the BID’s stakeholders upon formation. The assessment amount is based on a unique formula determined by each BID separately to accurately reflect the needs and character of its district. Many variables are considered in a BID’s assessment formula, including front footage, assessed value, commercial square footage, lot size, property type (commercial use, mixed use, residential) and use (parking lot, empty lot, development).

City Interest in the Operation of BIDs

The services provided by BIDs to their districts supplement existing services provided by the City, including sanitation and maintenance, public safety and hospitality, marketing and public events, capital improvements, and streetscaping and beautification. The City’s Department of Finance (DOF) bills and collects the special assessments from the property owners in each BID and in turn fully disburses the collected funds to each BID. On average, in FY 2020 approximately 75% of the BIDs’ total revenue came from special assessments, and the remaining 25% from external sources (i.e., fundraising events, advertising, concessions, grants, and private donations) to support their operations.

BIDs are required to keep accurate books and records in conformity with generally accepted accounting principles, and their financial statements must be audited annually by an independent Certified Public Accounting firm selected by its board, and copies of those statements must be provided to BID stakeholders and SBS. BIDs are also required to self-report program outputs and expenses annually to SBS. This information is compiled and published in SBS’ annual BID Trends Report. SBS allows each BID to use their own method for tracking and collecting data throughout the year. BIDs also file audited financial statements with the Comptroller’s Office; representatives of the Comptroller’s Office also sit on BID boards; and BID operations and financial activities are subject to audit and review by this office.

This report discusses the potential issues and observations resulting from the auditors’ analyses, based on the self-reported financial information published in SBS’ annual BID Trends Report for FYs 2016–2020, along with publicly available information the BIDs filed with the U.S. Department of the Treasury and the Internal Revenue Service (“Form 990: Return of Organization Exempt from Income Tax”).

In the 2020 Trends Report, the City’s 76 BIDs reported total revenue of $182.1 million, including $137.4 million in assessments. The top 28 BIDs, each with revenue of more than $1 million, accounted for nearly $163.1 million (90%) of the total revenue as shown in Table I of Appendix I. Table II of Appendix I provides a breakdown of the BIDs’ total revenue and total assessments in FY 2020 by revenue category, and Table III breaks down the BIDs’ total revenue and size category by borough.

Objective

The objective of this analysis is to provide comparative data on the overall financial activities of the 76 BIDs that received City-collected assessments during FY 2020. Discussion of the Results of the Analysis

The 12 BIDs identified with one or more financial concerns are listed in Table XVII in Appendix I.

The matters covered in this report were communicated to all 12 BIDs at the conclusion of this review. A draft was sent to SBS and the 12 BIDs, and an offer of an exit conference extended. Findings were discussed with SBS and with representatives of BIDs who requested exit conferences. All 12 BIDs submitted written responses by April 3, 2023. All responses are attached as Addenda to this report. SBS notified the auditors that it would not be submitting a response.

In their responses, most BIDs attempted to explain the causes of the conditions cited in this report; six of them also stated that the SBS Trends Report information was reported differently in their certified financial statements. Specifically, these BIDs stated that they did not allocate programmatic salaries as they did in their certified financial statements, and in one case the BID reported debt service payments to SBS in a way that overstated its expenses when compared to its audited financial statements. Some BIDs also stated that expenses were accurately reported in their certified financial statements.

This report is a compilation and comparison of publicly available information, such as the SBS Trends Report, and did not consider BIDs’ certified financial statements since they may not be readily available to the public.

It is worth noting that the information contained in the SBS Trends Report is self-reported; this information was reported to SBS by the BIDs themselves. It would be helpful if BIDs obtain clarification or guidance from SBS regarding a uniform method of reporting administrative and program expenses. This would help to ensure that publicly available information is consistent and comparable.

This report does not reach conclusions regarding the causes of the conditions identified in the report, and the auditors’ conclusions and recommendations have not been amended. The auditors continue to urge BIDs to consider their financial positions, relative to other BIDs, with a potential eye for improvement.

DETAILED ANALYSIS

Operating Surpluses or Deficits

BIDs are responsible for providing services to their respective districts while effectively managing their revenues and expenses to ensure that funds are appropriately allocated and services are optimally provided. Of the 76 BIDs operating in the City:

- 61 (80.3%) BIDs, with total revenue of $158.7 million, had combined operating surpluses (revenue exceeded expenses) of $14.4 million that ranged from $1,876 to $3.2 million.

- 14 BIDs (18.4%), with total revenue of $23.4 million, had combined operating deficits (expenses exceeded revenues) of $2.7 million that ranged from $422 to $1.83 million.

- 1 BID broke even with total revenue equaling total expenses in FY 2020.

As discussed below, analyses of the BIDs’ operating surpluses/deficits (shown in Tables IV – VI in Appendix I and Exhibit C in Appendix II) identified matters of potential concern. These should be considered and addressed.

BIDs with Recurring Annual Operating Deficits

Although BIDs may experience budget surpluses and deficits from time to time, the size and frequency of these events, especially deficits, can raise potential financial and operating concerns. Of the 61 BIDs that reported surpluses in FY 2020, 58 BIDs reported deficits in at least one year from FYs 2016 to 2020, 39 reported deficits over two to five years, with deficit amounts ranging from as little as $25 to as large as $1.6 million (highlighted in Exhibit C of the Appendix II). Only 18 BIDs (24%) reported operating without a deficit from FY 2016 to FY 2020, including three of the four new BIDs that began operations in FYs 2018, 2019, and 2020 (See Table V in Appendix I).[4]

The analysis showed that the lowest number of BIDs reported deficits in FY 2020 compared to prior fiscal years; however, the size of those deficits fluctuated from year to year, which could indicate inadequate financial controls. Compared to the 14 BIDs with reported deficits in 2020, totaling $2.7 million, in 2016, 31 BIDs had combined deficits of $6 million; in 2017, 29 BIDs had combined deficits of $4.8 million; in 2018, 29 BIDs had combined deficits of $7.2 million; and in 2019, 24 BIDs had combined deficits of $6.3 million. (See Table VI in Appendix I for details.)

Of the 14 BIDs with deficits in FY 2020, 12 reported deficits in the prior four years. Specifically, the Hudson Square BID, which reported incurring the largest operating deficit of $1.83 million in FY 2020 only reported $3.3 million in total revenue and accumulated $5.1 million in deficits from four of the five fiscal years. Similarly, the 34th Street Partnership BID reported deficits in each year from FY 2016 to FY 2020, with combined deficits of $5.4 million, and the Court-Livingston-Schermerhorn BID reported deficits in four of those years, totaling $536,869. The remaining nine BIDs are as follows:

- the Flatbush-Nostrand Junction BID had deficits in all five years from FY 2016 to FY 2020, totaling $364,103.

- the Southern Blvd BID had deficits in four of the five years, totaling $36,869.

- the Bed-Stuy Gateway, the Atlantic Ave, and the Woodhaven BIDs had deficits in three of the five years, with collective deficits of $542,315.

- the Belmont, New Dorp Lane District, Church Avenue, and Grand Street BIDs each reported deficits in two of the five years, collectively totaling $121,510.

In addition, six of the 14 BIDs (the Hudson Square, 34th Street Partnership, Court-Livingston-Schermerhorn, Southern Boulevard, Long Island City Partnership, and Grand Street BIDs) incurred deficits despite increasing assessments by a combined total of $1,969,272 during FY 2020.

While operating surpluses are preferable to deficits, BIDs must ensure that they provide adequate services to their districts. Deficits may mean a DMA did not meet the spending, fundraising, or budget goals outlined by its board of directors. Deficits can lead to higher levels of borrowing, higher interest payments, and low reinvestment rates, which in turn can result in lower revenue available to allocate to program and operating expenses in subsequent years. While an isolated operating deficit may occur from time to time, repeated deficits are of great concern as they may be the result of inadequate financial controls, unchecked overspending by BID management, and/or the under assessment of property owners in the BID.

This analysis provides a basis for comparison and highlights trends for individual BIDs to consider. It did not evaluate the operating effectiveness or assess the adequacy of services BIDs provided to their respective districts.

BID Assessments

BIDs receive most, if not all, of their revenue from the special assessments collected from district property owners by the City on their behalf. As noted earlier, the assessment for each BID is based on a formula unique to each BID. According to SBS’ BID Formation and Expansion Guide, equity is a critical factor in the formula determination, and the amount each property pays should be proportional to the benefit it will receive from the BID.

In FY 2020, overall BID assessments totaled $137.4 million of $182.1 million in total revenue (75.5%) derived from all sources (as shown in Table XVII of Appendix I). The remaining $44.7 million (24.5%) came from non-assessment sources (i.e., fundraising, donations, grants, etc.). Total BID assessments for FY 2020 increased by a net amount of $12.8 million to $137.4 million from $124.6 million in FY 2019. This increase was directly attributed to increases in the assessments for 30 BIDs, including the Throggs Neck BID that began operations in FY 2020. Increases ranged from $250 for the Bay Ridge 5th Avenue BID to $3.2 million for the Fifth Avenue BID. The Fifth Avenue Association, Garment District, and Hudson Yards/Hell’s Kitchen Alliance BIDs accounted for $6.5 million (51%) of the net assessment increases in FY 2020. The Atlantic Ave BID assessment decreased in FY 2020 by $6,600. Table VII in Appendix I lists the 31 BIDs, by total revenue category, whose assessments changed from FY 2019 to FY2020.

The auditors did not evaluate the variation in BID assessments due to the unique formulas and variables used in determining those assessments.

BID Expenses

BIDs’ primary expenditures generally fall into three categories: program services, administrative, and capital improvements. Program service expenses include supplemental sanitation, public safety, marketing and public events, streetscape and beautification, and other services.[5] Administrative expenses include administrative staff salaries, outside contractors, insurance, rent, office supplies, and other general administrative expenses.[6] Capital improvements of a district may include, for example, installation of custom street signage, security cameras, trash receptacles, lighting fixtures, etc.

In FY 2020, BIDs total spending increased by $3.5 million (2.1%), from $167 million in FY 2019 to $170.5 million. This increase was largely due to a $2.5 million increase in total administrative expenses.

As illustrated in the chart below, in both FY 2020 and FY 2019 the largest part of the 76 BIDs’ total expenditures went to program service expenses, followed by administrative expenses, and then capital improvements. Collectively, program service expenses and administrative expenses comprised approximately 97% of the BIDs’ total annual expenditures.

Program service expenses for all 76 BIDs remained consistent, increasing by just 1.1% in FY 2020 from FY 2019. Overall, program expenses represented nearly 80% of the BIDs’ total expenses in both years. In FY 2020, the BIDs’ administrative expenses increased by 8.4% and capital improvement expenses decreased by 8.6%. However, as a percentage of the BIDs’ total expenditures, both administrative and capital improvement expenses remained consistent, representing nearly the same portion of the BIDs’ total expenditures in both FY 2020 and FY 2019.

As discussed below, further analysis highlighted some areas of concern related to the level of spending by some BIDs on program services and administrative expenses.

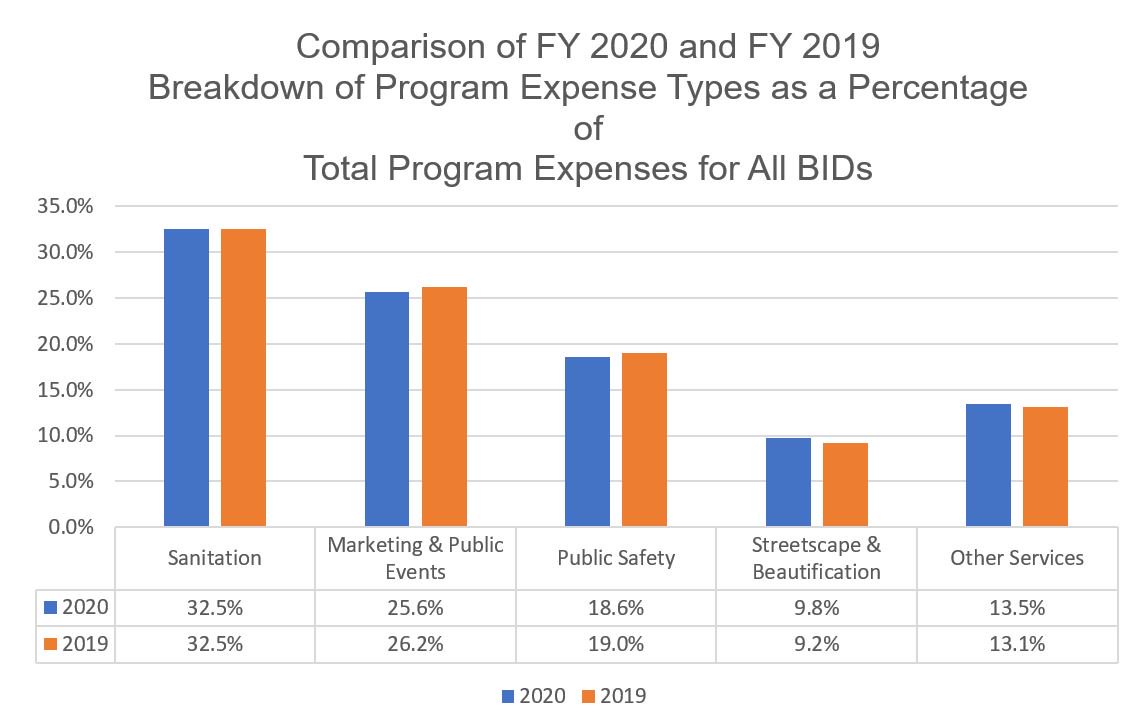

Program Service Expenses

BIDs provide a variety of program services to their districts, including supplemental sanitation, public safety, marketing, and public events, and streetscaping and beautification. In FY 2020, the 76 BIDs reported overall spending of $133.8 million on programs, up $1.3 million (1%) from $132.4 million in FY 2019. Spending included $43.5 million (32.5%) for supplemental sanitation, $24.9 million (18.6%) for public safety, $34.3 million (25.6%) for marketing and public events, $13.1 million (9.8%) on streetscaping and beautification, and $18.1 million (13.5%) for other program expenses.

As demonstrated in the chart below, proportionally, the level of spending for each of these program expense categories remained nearly the same in both FY 2020 and FY 2019.

As shown in Tables VIII – X in Appendix I, spending on program services, as a percentage of total revenue, varied by BID size (total revenue category). These percentages do not lend to the evaluation of the quality of services provided; however, they provide insight into overall trends and a benchmark for comparison and further analysis.

A more in-depth analysis of BIDs by total revenue category and each BID’s individual spending showed that the extent and level of services provided varies based on priorities and needs. Specifically, in 2020, BIDs increased their percentage of revenue spent on Streetscapes & Beautification from 9.2% in 2019 to 9.8% in 2020, reflecting an increase of 7.5% categorically. Conversely, BIDs decreased their percentage of revenue spent on Marketing & Public Events from 26.2% in 2019 and 25.6% in 2020 and in Public Safety expending 19.0% in 2019 and 18.6% in 2020, both experiencing a decrease in expense of 1.1% categorically. Exhibit D in Appendix II breaks down the amounts expended by each BID in FY 2020 on the different program services.

The percentages provide a benchmark for comparison and further analysis of program services. For example, when comparing the level of spending among the six total revenue categories (shown in Table VIII in Appendix I), there appears to be a direct relationship between revenue and spending. On average, BIDs in the highest total revenue category (more than $5 million) spent a greater portion (76.5%) of their revenue on program services than those in the lowest total revenue category (less than $250,000), which spent less than half (48.7%) of their total revenue on program expenses.

As shown in Table IX of Appendix I, this trend is explained by the different types and levels of program services provided by the BIDs. While all 76 BIDs provided marketing and promotional services and 75 BIDs provided sanitation, only 57 (75%) of the BIDs provided streetscaping, 38 (50%) provided other services (i.e., business development, debt service cost, and miscellaneous programs), and 34 (45%) provided public safety services. The quality of services provided by BIDs was not considered nor determinable as part of this analysis.

BIDs with Low Program Expense-to-Revenue Ratios

The auditors identified certain BIDs with low program expenses, which raises potential concerns about whether those BIDs provided optimal or adequate program services to their districts.

As demonstrated earlier, program services usually make up the largest portion of BID spending. To better assess each BID’s spending on program services to BIDs of similar size, the percent deviation was calculated for each BID and compared to their respective category averages.[7] Positive values represent values above the category average and negative values represent those that fell below the category average. BIDs with a negative percent deviation of 30% or more were considered to have had low program service expenses compared to BIDs in the same total revenue category.

Overall, the auditors identified 10 BIDs with low program expenses. For example, West Shore expended 21.4% of their revenue on program services as compared to their category average of 50.3%, deviating from their category by 57.5%. Similarly, the SoHo Broadway Initiative expended 33.1% of their revenue on program services as compared to their category average of 60.8%, deviating from their category by 45.5%.

BID boards and stakeholders should evaluate their budgets to determine whether their resources might be used more efficiently. A detailed breakdown of BIDs with low program expense-to-revenue ratios appears in Table XI of Appendix I.

Administrative Expenses

BIDs require full-time directors and staff to administer programs and serve as district advocates. Administrative expenses cover the costs of operating the BID, including staff salaries and benefits, payroll taxes, auditing fees, insurance, rent and office supplies, computer equipment, website fees, and similar administrative costs.

Collectively, the BIDs spent $32.7 million in FY 2020 on administrative expenses, an increase of $2.53 million (8.4%) from $30.1 million spent in FY 2019. This increase was largely due to an increase of $2.1 million or 12.7% in salaries paid to BID employees in FY 2020 over FY 2019 and a 12% increase in rent and utilities, despite a spending decline of 9.1% on supplies and equipment. As demonstrated below, of the BIDs’ total FY 2020 administrative spending, $18.9 million (58%) accounted for salaries, followed by $4.8 million (14.7%) for rents and utilities, $3.1 million (9.5%) for outside contractors, $1.9 million (5.7%) for insurance, $1.3 million (4%) for supplies and equipment, and the remaining $2.7 million (8.1%) for other expenses. (Tables XII, XIII and XIV in Appendix I and Exhibit E in Appendix II analyze the administrative expenses incurred by each BID in FY 2020.)

BIDs with High Administrative Expense-to-Revenue Ratios

The auditors identified 20 BIDs that reported substantially higher administrative expenses when compared with the category average of the similar size BIDs (shown in Table XIV of Appendix I). This trend is a potential concern for the BID boards and stakeholders to evaluate; individual BIDs should determine whether their resources could be better used.

As demonstrated earlier, administrative services generally represent a little less than 20% of BIDs’ overall spending. To better assess a BID’s spending on administrative expenses compared to other similar sized BIDs, the percent deviation was calculated for each BID and compared to the category averages for each of the six total revenue categories. In this analysis, the percent deviation measured the distance of each BID’s total administrative expenses as a percentage of total revenue from their respective category averages. Positive values represent values above the category average and negative values represent those that fell below the category average. BIDs with a positive percent deviation of 30% or more were considered to have had high program expenses compared to BIDs in the same total revenue category.

For example, in 2020, the Garment District expended $2.9 million, or 26.1%, of their revenue on administrative expenses as compared to the category average of 12.6%, representing a 106.7% deviation from the category average. Additionally, Union Square Partnership expended approximately $995,000, or 36.1%, of their revenue on administrative expenses as compared to the category average of 21%, deviating from their category average by 72%. Conversely, BIDs such as Columbus-Amsterdam expended approximately $28,000, or 6.9%, of their revenue on administrative expenses compared to their category average of 37.3%, deviating from their category average by 81.3%.

Certain BIDs Paid Higher Salaries and Compensation to Key Employees Compared to BIDs in the Same Revenue Category

Auditors highlighted BID salaries and compensation when compared to total administrative costs as a potential area of concern.

BIDs usually maintain a small staff, including a chief officer, and either a president or executive director. Based on the size and needs of the district, other key employee positions of a BID may include a vice president, a marketing director, and/or program director.[8] Organizational structure notwithstanding, the largest portion of most BIDs’ personnel costs (salaries and compensation) goes to management or key employee salaries. On average, nearly 60% of every dollar the BIDs spend on administrative expenses goes to salaries and compensation.

In FY 2020, the BIDs spent a total of $18.9 million (58%) out of $32.7 million spent on administrative costs, on salaries. Overall, total salaries and compensation expenses increased $2.1 million (12.7%) from $16.98 million in FY 2019. This 12.7% increase was more than 1.5 times the total increase of 8.4% in total administrative expenses for the same year. In fact, in just five years, the BIDs’ spending on salaries and compensation grew by $6.6 million (55%) to $18.9 million in FY 2020 from $12 million in FY 2015. Only a small portion ($305,000, or 4.6%) of this $6.6 million increase is explained by the formation of new BIDs – from 72 in 2015 to 76 in 2020. Consequently, the auditors took a closer look at salaries of key BID employees paid $100,000 or more in FY 2020.

According to the BIDs’ Form 990 filings, in FY 2020 there were 70 total BID officers or key employees whose salaries and compensation was $100,000 or more, including four individuals who received compensation from more than one BID.[9] Those 70 BID officers or key employees received salaries and compensation that ranged from $100,000 to $515,163 annually (from $46 to $369 hourly). While Grand Central BID paid the highest amount to a single individual, Bryant Park and 34th Street Partnership BIDs paid $396 and $301 per hour, respectively, to the same individual who worked an average of 25 hours per week for each BID. In cases where individuals work for more than one BID, they are receiving pay for 50 hours per week. This is a potential concern, particularly in instances where non-BID commitments that are also compensated, exist. The BIDs and SBS should ensure that compensation is based on accurate and realistically achievable time commitments.

In addition, twenty of those 70 officers or key employees also received bonuses ranging from $1,575 to $115,000 in addition to their salaries and compensation (see Table XV in Appendix I).

While renumeration for key employees is established by the BID boards, in the interest of a district’s stakeholders, the boards must be fiscally prudent and ensure that the BID provides an optimal level of services to the district at the lowest cost possible. BIDs should also consider the total hours of service provided and other outside commitments when setting compensation levels. This analysis provides a basic starting point that BIDs and SBS should consider when evaluating BIDs and assessing their overall operating costs.

Capital Improvement Expenses

BID spending on capital improvements totaled $4 million in FY 2020, a decrease of 8.6% from FY 2019. A total of eight BIDs accounted for this spending. The Hudson Square BID spent $2.3 million (56%), while seven other BIDs spent the remaining $1.7 million, ranging from $20,930 and $386,121. Overall, capital improvement expenses for the eight BIDs in FY 2020 represented 2% of BIDs total expenditures. Due to limited information available in SBS’ FY20 Trends Report on capital improvement expenses among the BIDs, further analysis of these expenses was not performed.

BIDs with More Than One Potential Concern

As discussed in earlier sections of this report, the analysis identified four potential financial issues, based on data which was self-reported by each BID. These issues included:

- Recurring deficits (expenses exceeded revenues);

- Low program service expenses when compared to their respective category averages;

- High administrative expenses in comparison to their respective category averages; and

- Higher salaries and compensation to key employees compared to other BIDs.

BIDs experiencing one or more of these matters may face an increased financial concern. For FY 2020, twelve BIDs were identified with one or more of these trends, which include the following:

Recurring Deficits

Hudson Square BID reported recurring deficits in FY 2020 and three prior years.

BID officials said that the information presented in the auditors’ report is not accurate because the BID Trends Report did not include other funding sources, such as capital reserves and the municipal bond fund, which “together ensured that [the BID] did not incur an operating deficit in any of the years analyzed in the report.”

The existence of cash reserves and a municipal bond fund may assist a BID to adjust to deficit, but it does not alter the results of the analysis. Deficits occur when expenses exceed revenue, whether reserves exist or not.

Recurring Deficits and High Administrative Expenses

Flatbush-Nostrand Junction BID reported recurring deficits in FY 2020 and four prior years, and high administrative expenses in comparison to the category average.

BID officials noted that recurring deficits occurred when SBS requested that the BID expend its reserve balance before applying for an assessment increase. With reference to the high administrative expenses, when compared to its peers, the BID’s subsequent years’ financial statements showed it only incurred approximately 26% in administrative expenses versus industry average over 40%.

Deficits are determined based on whether expenses exceed revenue. The existence of reserves is not reported in the Trends Report and was not considered in drafting this report. While the existence of reserves should assist in mitigating risk, auditors continue to recommend that the BID consider the underlying causes of the operational deficit and how best to address it.

Church Avenue BID reported recurring deficits in FY 2020 and one prior year, and high administrative expenses in comparison to the category average.

BID officials stated that the SBS Trends Report does not have accurate administrative expenses information because the BID did not allocate certain salaries to program services due to SBS’ instructions on how BIDs should submit the financial data. They also noted that, although the BID ended 2019 and 2020 in a deficit, it started each year with reserve funds and has successfully taken steps to increase revenue and decrease administrative costs.

The auditors reiterate their response to the Hudson Square BID above regarding deficits and reserves. The Church Avenue BID was asked to follow up internally on these matters.

Bed-Stuy Gateway BID reported recurring deficits in FY 2020 and two prior years, and high administrative expenses in comparison to the category average.

Officials requested that the BID not be mentioned in this report because there are no financial concerns, and attached documents to its response showing that the BID maintained a “Rainy Day Fund.”

However, the BID only provided budget reviews which showed that the BID experienced recurring deficits in 2019 and 2020.

Recurring Deficits and High Salaries

34th Street Partnership BID reported recurring deficits in FY 2020 and four prior years and paid high salaries to its key employees compared to other BIDs.

Officials said that the BID did not incur recurring deficits during FYs 2016, 2018, 2019, and 2020. The BID’s submissions of financial data in the annual reports to SBS include debt service on capital improvement bonds, as well as the depreciation of the underlying district improvements, within total expenses. Therefore, they said, total expenses under this basis of reporting are overstated.

However, the majority of the debt service payments are balance sheet items and should not be accounted for in the expenses reported to SBS. In addition, based on the categories of the general and administrative expenses in the SBS Trends Report, depreciation should be excluded from the expenditures report to SBS.

Regarding salaries, the BID stated that its directors are “actively involved in the setting of, and have approved, executive compensation of the respective entities,” and that salaries are established using comparability data, including the compensation for similar positions in large BIDs, park conservancies, and other large not-for-profit entities.

It should be noted, however, that although the BID may have reviewed the salaries of similar-sized entities when establishing compensation, its President splits his time overseeing the operations of two BIDs—34th Street Partnership and Bryant Park—while receiving salaries that are comparable to those of full-time staff at each BID. Therefore, the hourly rate is significantly higher than those with similar titles at other BIDs.

Bryant Park BID reported recurring deficits in two of the five years and paid high salaries to its key employees compared to other BIDs.

The BID said that its two years of operating deficits over a five-year period were not recurring, nor were they indicative of potential financial risk. In FYs 2020 and 2019, nearly 93% of the BID’s revenue came from sources other than BID assessments. Officials went on to state that, despite having deficits in FYs 2016 and 2018, the BID had “more than sufficient assets available to fund those deficits.”

The auditors reiterate their response regarding deficits and reserves (see Hudson Square and Church Avenue BIDs above). The Bryant Park BID was asked to follow up internally on these matters.

Regarding salaries, the BID said that its directors are “actively involved in the setting of, and have approved, executive compensation of the respective entities,” and that salaries are established using comparability data, including the compensation for similar positions in large BIDs, park conservancies, and other large not-for-profit entities.[10]

The auditors reiterate their response regarding executive salaries (see 34th Street Partnership BID above).

Times Square Alliance BID reported recurring deficits in three of the five years and paid high salaries or bonuses to its key employees compared to other BIDs.

Officials took issue with the report’s methodology but agreed that the BID had deficits in three of the five years, attributing them to increased minimum wage, healthcare costs, and the City cutting sanitation services during those years, which forced the BID to augment its own sanitation services. The BID also said that it increased public art projects and pedestrian plaza programming, in an “effort to combat negative press coverage about Times Square.”

Regarding high salaries, the BID explained that in 2020, one person’s total compensation consisted of base salary plus a bonus, and that it “benchmarks this individual’s total compensation by comparing the total compensation of the five largest BIDs and, in each case, this individual’s total compensation has always been the lowest of the five.”

High Administrative / Low Program Expenses

SoHo-Broadway Initiative BID reported high administrative expenses and low program service expenses when compared to the category averages.

Officials said that, although some BIDs allocate personnel expenses to program expense categories, this one does not. Because of this, the BID argued that “the Comptroller’s analysis draws inaccurate conclusions about the BID’s program and administrative expenses.” They went on to say that based on audited financial statements, the BID only incurred 20.7% in administrative expenses for the FY 2020.

BIDs are encouraged to seek clarification or guidance from SBS regarding a uniform method of reporting administrative and program expenses.

165th Street Mall BID reported high administrative expenses and low program service expenses when compared to the category averages.

The BID attributed its high administrative expenses and low program service expenses to the following reasons: (1) the BID’s provision of its own sanitation services, because it does not receive services from the Department of Sanitation; (2) the BID’s supplemental responsibilities of minor repairs of the sidewalk bricks; and (3) the higher-than-usual costs of general liability insurance, due to the use of bricks as paving material, which makes the BID vulnerable to lawsuits.

Jamaica Center BID reported high administrative expenses and low program service expenses when compared to the category averages.

Officials explained that the BID’s high administrative expenses and low program service expenses were due to “an outmoded contract and has been subsequently held to it by SBS,” which makes the BID responsible for supplemental sanitation and sidewalk maintenance of “32 block faces worth of sidewalk bricks it did not install.” As a result, the BID’s sanitation and insurance costs have been higher than costs borne by other BIDs (with the exception of the 165th Street Mall BID). Officials said that the BID has been required to allocate over one-third of its entire budget to pay for the general liability policy and the staff are obligated to spend more time on administration related to managing lawsuits than on program services.

Hudson Yards Hell’s Kitchen Alliance BID reported high administrative expenses and low program service expenses when compared to the category averages.

Officials disputed auditors’ claims that the BID had high administrative expenses and low program service expenses, arguing that “the report incorrectly assumes all staff costs are administrative,” and that it employs three full-time field staff whose jobs are “100% programmatic.” The BID said that these salaries were lumped under administrative costs.

Additionally, officials said the report did not take capital expenses into account and neglected to include $204,761 in capital expenses as a program expense. The report also incorrectly allocated some program expenses as administrative expenses.

Auditors reiterate that BIDs should seek clarification or guidance from SBS regarding a uniform method of reporting administrative and program expenses.

Meatpacking District BID reported high administrative expenses and low program service expenses when compared to the category averages.

Officials said that the report relies on inconsistent and inadequate data sets contained in the SBS Trends Report, and that the survey SBS sends to BIDs while compiling the report does not adequately account for staff salaries that are “programmatic,” instead lumping them under a “General & Administrative Expenses category.” This, officials said, “inadvertently made administrative expenses appear much greater than they were because programmatic salaries were incorrectly reported as administrative.”

The BID said that the FY20 SBS Trends Report includes data that was inconsistently reported across all BIDs, and that using this financial data for comparison purposes can be both inaccurate and misleading.

However, BIDs should seek clarification or guidance from SBS regarding a uniform method of reporting administrative and program expenses.

RECOMMENDATIONS

As a result of the analysis, the auditors make six recommendations—four recommendations to the Directors of the BIDs and two recommendations to SBS:

- Directors of BIDs with operating deficits should determine whether administrative costs or program services can be reduced, or additional sources of revenue can be found to ensure that deficits do not continue from year to year.

- Directors of BIDs with lower-than-average program service expenses as a percentage of total revenue should determine whether their revenue can support increased services for members.

- Directors of BIDs with higher-than-average administrative expenses as a percentage of total revenue should reduce administrative costs and determine whether the savings can be redirected to increased services for members.

- Directors of BIDs should review proposed salary and compensation increases for officers or key employees thoroughly, especially in cases where (1) the hourly compensations are already significantly higher than other BIDs in the same revenue category, and/or (2) officers or key employees receive compensation from more than one BID.

- SBS should use the information in this report to ensure at each of the relevant BIDs that BID management and Board of Directors address the conditions cited.

- SBS should implement a uniform method of reporting, such as using the audited financial statements which are in conformity with GAAP, for all BIDs when submitting their annual self-reported financial information.

SCOPE OF ANALYSIS

The purpose of this report is to provide a comparative analysis of the overall financial activities of the BIDs. This report is based upon self-reported data from FYs 2016–2020 submitted by each BID to SBS, which is published in the SBS BID Trend Reports for each of those years, along with supplemental data obtained from publicly available BID IRS 990 Forms.

This report compares certain aspects of the 76 BIDs and identifies operational norms and deviations. The report’s analyses are based on the financial activities of BIDs receiving City-collected assessments during FY 2020. To perform these analyses, auditors computed the averages for each of the six revenue categories used to group BIDs and compared each of the 76 BIDs to other BIDs of similar total revenue size as shown in the chart below. The results can then be used by BID trustees and management staff to perform their own internal analyses. (See Exhibit B in Appendix I for a list of BIDs by Revenue Category and Borough.)

Comparative Analysis: Categories of BIDs

| Category | Total Annual Revenue | # of BIDs |

| 1 | Less than $250,000 | 13 |

| 2 | $250,000 – $500,000 | 21 |

| 3 | $500,000 – $1 million | 14 |

| 4 | $1 million to $2 million | 11 |

| 5 | $2 million to $5 million | 9 |

| 6 | More than $5 million | 8 |

| Total | 76 |

This report’s tables, exhibits, and appendices can be a starting point for BID Board members to identify areas for cost reduction or other appropriate action to ensure financial solvency. No conclusions should be drawn from any single exhibit in this report. For example, even though an exhibit might show that a particular BID’s expenses exceeded its revenue, it might not be a problem if the BID has sufficient or high reserves. On the other hand, BIDs incurring high administrative costs relative to other BIDs of a similar size should review their costs carefully and reduce them whenever possible.

The auditors’ review was performed in accordance with the City Comptroller’s responsibilities under Chapter 5, §93, of the New York City Charter, and under the provisions of agreements between the City and the individual BID.

APPENDIX I

Analysis of BIDs Revenue, Assessment and Borough

Table I: BIDs with More than $1 Million in Total Revenue FY 2020

Table II: Total Revenue and Assessments of BIDs FY 2020

Table III: Total Revenue and Size of BIDs by Borough FY 2020

Analysis of Operating Surpluses and Deficits

Table IV: FY 2020 Operating Surplus (Deficit) of BIDs by Total Revenue Category

Table V: 18 BIDs with Operating Surpluses for Fiscal Years Ended 2016-2020

Table VI: 14 BIDs with FY 2020 Operating Deficits

Analysis of BID Assessments & Expenses Overall

Table VII: Change in 31 BID Assessments in FY 2020 from FY 2019

Analysis of Program Service Expenses

Table VIII: Average Amount, Percentage of Total Revenue and Percent Range Spent on Program Costs FY 2020

Table IX: Number of BIDs Providing Program Services FY 2020

Table X: BIDs Average Spending on Program Services FY 2020

Table XI: 10 BIDs with Low Program Services Expense-to-Revenue Ratios FY 2020

Analysis of Administrative Expenses

Table XII: BID Spending on Administrative Expenses FY 2020 vs FY 2019

Table XIII: Average Amount, Percentage of Total Revenue and Percent Range Spent on Administrative Costs FY 2020

Table XIV: 20 BIDs with High Administrative Expense-to-Revenue Ratios FY 2020

Table XV: Salaries and Compensation from BIDs FY 2020

Analysis of Total Revenue

Table XVI: FY 2020 Assessments, Total Revenue, Expenses, and Operating Surplus (Deficit)

Table XVII: Summary of 12 BIDs with More than One Potential Financial Matter FY 2020

Table I

BIDs with More than $1 Million in Total Revenue in Fiscal Year 2020*

| BID Name | Revenue** | Assessment |

| Downtown Alliance | $23,681,000 | $20,400,000 |

| Bryant Park Corporation | 22,262,699 | 1,600,000 |

| Times Square Alliance | 21,904,746 | 14,347,293 |

| Grand Central Partnership | 15,149,443 | 12,709,372 |

| 34th Street Partnership | 14,182,517 | 13,000,000 |

| Garment District | 11,005,256 | 10,900,000 |

| Fifth Avenue Assoc. | 6,472,751 | 6,414,000 |

| MetroTech | 5,011,621 | 4,771,553 |

| Flatiron/23rd Street | 3,858,418 | 3,000,000 |

| East Midtown Partnership | 3,500,830 | 3,500,000 |

| Lincoln Square | 3,389,881 | 2,850,000 |

| Hudson Square | 3,326,499 | 3,200,000 |

| Meatpacking District | 3,041,502 | 2,392,000 |

| Hudson Yards Hell’s Kitchen Alliance | 2,989,733 | 2,600,000 |

| Fulton Mall Improvement Assoc. | 2,756,703 | 2,701,350 |

| Union Square Partnership | 2,754,543 | 2,600,000 |

| Madison Avenue | 2,331,399 | 2,022,000 |

| Lower East Side Partnership | 1,928,595 | 1,300,000 |

| Chinatown | 1,904,464 | 1,800,000 |

| Village Alliance | 1,581,441 | 1,400,000 |

| Dumbo Improvement District | 1,448,109 | 1,150,000 |

| Court-Livingston-Schermerhorn | 1,404,754 | 1,400,000 |

| Third Avenue (Bronx) | 1,350,574 | 450,927 |

| 47th Street (Diamond District) | 1,335,608 | 900,000 |

| 125th Street | 1,279,550 | 1,240,462 |

| Jamaica Center | 1,131,381 | 1,017,500 |

| Fordham Road | 1,098,908 | 1,010,000 |

| SoHo-Broadway Initiative | 1,034,077 | 900,000 |

| Total (28 BIDs) | $163,117,002 | $121,576,457 |

| Percent of Total | 89.6% | 88.5% |

| Add: Total (48 BIDs with less than $1 Million in Revenue) | $19,019,781 | $15,861,220 |

| Percent of Total | 10% | 12% |

| Total (all 76 BIDs) | $182,136,783 | $137,437,677 |

| Percent of Total | 100% | 100% |

* This cutoff figure is arbitrary and used for descriptive purposes only.

** The difference between total revenue and assessments consists of revenue from other sources, including contributions, fundraising, grants, programs, and interest.

Table II

Total Revenue and Assessments of BIDs FY 2020

| Total Revenue Category | # of BIDs | Total Revenue | Revenue as percent of Citywide Total Revenue |

Assessments | Assessments as percent of Category Revenue |

| Less than $250,000 | 13 | $ 2,376,086 | 1.3% | $ 2,150,920 | 90.5% |

| $250,00 to $500,000 | 21 | 7,250,022 | 4.0 | 6,513,202 | 89.8 |

| $500,000 to $1 million | 14 | 9,393,673 | 5.2 | 7,197,098 | 76.6 |

| $1 million to $2 million | 11 | 15,497,461 | 8.5 | 12,568,889 | 81.1 |

| $2 million to $5 million | 9 | 27,949,508 | 15.3 | 24,865,350 | 89.0 |

| More than $5 million | 8 | 119,670,033 | 65.7 | 84,142,218 | 70.3 |

| Total All BIDs | 76 | $182,136,783 | 100.0% | $137,437,677 | 75.5% |

Table III

Total Revenue and Size of BIDs by Borough FY 2020

| Total Revenue Category | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Borough | # of BIDs |

Total Revenue | Revenue as percentage of Citywide Revenue |

Less than $250,000 | $250,000 to $500,000 | $500,000 to $1 million | $1 million to $2 million |

$2 million to $5 million |

More than $5 million |

| Manhattan | 25 | $150,987,631 | 82.9% | – | 2 | 2 | 6 | 8 | 7 |

| Brooklyn | 23 | 18,285,052 | 10.0 | 5 | 8 | 6 | 2 | 1 | 1 |

| Queens | 13 | 6,678,610 | 3.7 | 1 | 6 | 5 | 1 | – | – |

| Bronx | 11 | 5,468,593 | 3.0 | 3 | 5 | 1 | 2 | – | – |

| Staten Island | 4 | 716,897 | 0.4 | 4 | – | – | – | – | – |

| Citywide Total | 76 | $182,136,783 | 100.0% | 13 | 21 | 14 | 11 | 9 | 8 |

Table IV

Fiscal Year 2020 Operating Surplus (Deficit) of BIDs by Total Revenue Category

| Total Revenue Category | # of BIDs | Surplus | Percent of Total BIDs | Deficit | Percent of Total BIDs |

| Less than $250,000 | 13 | 9 | 69.2% | 4 | 30.8% |

| $250,00 to $500,000 | 21* | 16 | 76.2 | 4 | 19.0 |

| $500,000 to $1 million | 14 | 11 | 78.6 | 3 | 21.4 |

| $1 million to $2 million | 11 | 10 | 90.9 | 1 | 9.1 |

| $2 million to $5 million | 9 | 8 | 88.9 | 1 | 11.1 |

| More than $5 million | 8 | 7 | 87.5 | 1 | 12.5 |

| Total | 76 | 61 | 80.3% | 14 | 18.4% |

* One BID did not have surplus/deficit.

Table V

18 BIDs with Operating Surpluses for Fiscal Years Ended 2016-2020

| BID Name | Total Surplus FY 2016-FY 2020 |

FY 2020 | FY 2019 | FY 2018 | FY 2017 | FY 2016 |

| Meatpacking District | $2,663,202 | $416,970 | $635,641 | $205,671 | $440,627 | $964,293 |

| Lower East Side Partnership | 878,237 | 47,984 | 10,275 | 75,705 | 182,644 | 561,629 |

| Gateway JFK | 818,620 | 200,520 | 273,100 | 345,000 | NEW | N/A |

| Chinatown | 731,232 | 296,271 | 175,240 | 146,107 | 81,093 | 32,521 |

| Sunset Park | 504,773 | 57,574 | 21,006 | 144,584 | 100,821 | 180,788 |

| South Shore | 282,440 | 21,259 | 37,357 | 66,150 | 75,505 | 82,169 |

| Brighton Beach | 267,166 | 33,025 | 31,408 | 98,633 | 32,200 | 71,900 |

| NoHo NY | 255,860 | 89,049 | 33,378 | 39,765 | 78,958 | 14,710 |

| 125th Street | 207,791 | 16,337 | 78,096 | 12,490 | 17,422 | 83,446 |

| 161st Street | 183,423 | 71,800 | 27,913 | 44,710 | 39,000 | 0 |

| Morris Park | 169,523 | 66,205 | 103,318 | NEW | N/A | N/A |

| Fulton (FAB) | 154,298 | 77,733 | 28,770 | 20,725 | 18,540 | 8,530 |

| Bay Ridge 5th Avenue | 141,095 | 26,207 | 15,305 | 5,780 | 43,576 | 50,227 |

| Myrtle Avenue (Brooklyn) | 108,297 | 54,120 | 4,980 | 20,756 | 2,802 | 25,639 |

| Montague Street | 99,797 | 1,876 | 4,473 | 31,446 | 7,203 | 54,799 |

| 82nd Street Partnership | 90,042 | 9,072 | 16,249 | 39,298 | 12,780 | 12,643 |

| East Brooklyn | 87,294 | 23,143 | 3,902 | 172 | 1,917 | 58,160 |

| Throggs Neck (New in 2020) | 24,660 | 24,660 | NEW | N/A | N/A | N/A |

Table VI

14 BIDs with FY 2020 Operating Deficits

| 2016-2020 | ||||

|---|---|---|---|---|

| BID Name | Deficit | Total Revenue | Total Net Operating Surplus/(Deficit) | # of Deficits |

| Hudson Square | ($1,828,183) | $3,326,499 | ($5,143,181) | 4 |

| 34th Street Partnership | (621,379) | 14,182,517 | (5,442,585) | 5 |

| Bed-Stuy Gateway | (46,334) | 742,056 | (265,607) | 3 |

| Belmont | (33,050) | 608,950 | 180,202 | 2 |

| Flatbush-Nostrand Junction | (30,998) | 205,733 | (209,252) | 5 |

| Court-Livingston-Schermerhorn | (30,307) | 1,404,754 | (536,869) | 4 |

| Southern Boulevard | (22,361) | 244,076 | (27,748) | 4 |

| New Dorp Lane District | (19,929) | 170,919 | (15,897) | 2 |

| Sutphin Boulevard | (13,594) | 273,335 | 78,826 | 1 |

| Atlantic Avenue | (12,691) | 407,215 | 10,775 | 3 |

| Church Avenue | (9,206) | 221,224 | (5,375) | 2 |

| Woodhaven | (4,512) | 281,525 | 35,958 | 3 |

| Long Island City Partnership | (1,778) | 923,433 | 93,224 | 1 |

| Grand Street | (422) | 369,756 | 457 | 2 |

| Total 14 BIDs | ($2,674,744) | $23,361,992 | ($11,247,072) | |

Table VII

Change in 31 BID Assessments in FY 2020 from FY 2019

| Total Revenue Category | FY 2020 Assessments | FY 2019 Assessments | Increase/ (Decrease) |

| Less than $250,000 | |||

| Throggs Neck (New 2020) | $200,000 | $0 | $200,000 |

| Graham Avenue | 215,000 | 180,000 | 35,000 |

| Southern Boulevard | 200,000 | 190,000 | 10,000 |

| $250,000 to $500,000 | |||

| Steinway Street | 460,000 | 400,000 | 60,000 |

| North Flatbush | 200,000 | 150,000 | 50,000 |

| Grand Street | 271,752 | 226,460 | 45,292 |

| Westchester Square | 387,200 | 352,000 | 35,200 |

| Columbus Avenue | 428,800 | 398,800 | 30,000 |

| Atlantic Avenue | 390,000 | 396,600 | (6,600) |

| $500,000 to $1 Million | |||

| NoHo NY | 600,000 | 540,000 | 60,000 |

| Fulton (FAB) | 500,000 | 450,000 | 50,000 |

| Long Island City Partnership | 908,000 | 867,000 | 41,000 |

| Park Slope 5th Avenue | 475,000 | 435,000 | 40,000 |

| Bay Ridge 5th Avenue | 534,000 | 533,750 | 250 |

| $1 to $2 Million | |||

| Court-Livingston-Schermerhorn | 1,400,000 | 907,020 | 492,980 |

| Lower East Side | 1,300,000 | 974,000 | 326,000 |

| Chinatown | 1,800,000 | 1,550,000 | 250,000 |

| DUMBO Improvement District | 1,150,000 | 1,035,000 | 115,000 |

| Fordham Road | 1,010,000 | 914,250 | 95,750 |

| $2 to $5 Million | |||

| Hudson Yards/Hell’s Kitchen Alliance | 2,600,000 | 1,400,000 | 1,200,000 |

| Hudson Square | 3,200,000 | 2,500,000 | 700,000 |

| Fulton Mall Improvement Assoc. | 2,701,350 | 2,004,456 | 696,894 |

| Flatiron/23rd Street | 3,000,000 | 2,750,000 | 250,000 |

| Lincoln Square | 2,850,000 | 2,600,000 | 250,000 |

| Madison Avenue | 2,022,000 | 1,907,000 | 115,000 |

| Meatpacking | 2,392,000 | 2,300,000 | 92,000 |

| More than $5 Million | |||

| Fifth Avenue Assoc. | 6,414,000 | 3,207,000 | 3,207,000 |

| Garment District | 10,900,000 | 8,800,000 | 2,100,000 |

| MetroTech | 4,771,553 | 3,827,671 | 943,882 |

| 34th Street Partnership | 13,000,000 | 12,320,000 | 680,000 |

| Times Square Alliance | 14,347,293 | 13,669,048 | 678,245 |

| Total Net Change | $12,842,893 | ||

Table VIII

Average Amount, Percentage of Total Revenue and Percent Range Spent on Program Costs FY 2020

| Total Revenue Category | BIDs | Average Amount | Percent | Percent Range |

| Less than $250,000 | 13 | $92,020 | 48.7% | 21.4 to 72.2% |

| $250,000 to $500,000 | 21 | 185,509 | 53.2 | 37.0 to 86.7 |

| $500,000 to $1 million | 14 | 402,957 | 57.6 | 32.9 to 92.4 |

| $1 million to $2 million | 11 | 855,962 | 59.2 | 33.1 to 86.4 |

| $2 million to $5 million | 9 | 2,060,998 | 65.8 | 38.4 to 81.8 |

| More than $5 million | 8 | 11,884,073 | 76.5 | 60.4 to 94.3 |

| Overall Average 2020 | 76 | $1,760,138 | 58.0% | |

| Overall Average 2019 | 75 | $1,765,792 | 63.0% |

Table IX

Number of BIDs Providing Program Services FY 2020

| Total Revenue Category | # of BIDS | Sanitation | Marketing | Safety | Streetscape | Other |

| Less than $250,000 | 13 | 13 (100%) | 13 (100%) | 3 (23%) | 7 (54%) | 4 (31%) |

| $250,000 to $500,000 | 21 | 21 (100%) | 21 (100%) | 5 (24%) | 12 (57%) | 6 (29%) |

| $500,000 to $1 million | 14 | 14 (100%) | 14 (100%) | 5 (36%) | 13 (93%) | 5 (36%) |

| $1 million to $2 million | 11 | 11 (100%) | 11 (100%) | 6 (55%) | 8 (73%) | 9 (82%) |

| $2 million to $5 million | 9 | 8 (89%) | 9 (100%) | 7 (78%) | 9 (100%) | 7 (78%) |

| More than $5 million | 8 | 8 (100%) | 8 (100%) | 8 (100%) | 8 (100%) | 7 (88%) |

| Total | 76 | 75 (99%) | 76 (100%) | 34 (45%) | 57 (75%) | 38 (50%) |

Table X

BIDs Average Spending on Program Services FY 2020

| Total Revenue Category | Sanitation | Marketing | Safety | Streetscape | Other |

| Less than $250,000 | $52,871 | $29,660 | $9,067 | $10,173 | $6,237 |

| $250,000 to $500,000 | 106,708 | 51,291 | 19,391 | 37,285 | 5,557 |

| $500,000 to $1 million | 222,089 | 99,029 | 45,398 | 46,853 | 61,934 |

| $1 million to $2 million | 423,783 | 173,848 | 227,154 | 76,058 | 96,695 |

| $2 million to $5 million | 843,247 | 415,656 | 481,475 | 404,288 | 150,457 |

| More than $5 million | 3,254,920 | 3,221,640 | 2,474,034 | 963,506 | 2,251,398 |

| Total Expenditures | $43,484,389 | $34,275,428 | $24,876,662 | $13,082,810 | $18,051,199 |

| Average Amount* | $579,792 | $450,992 | $731,667 | $229,523 | $475,032 |

* The average was calculated by dividing the total amount spent by each BID within a revenue category by the number of BIDs that incurred that type of program expenditure. See Table XI above, for the number of BIDs within each revenue category that incurred a specific type of program expenditure.

Table XI

10 BIDs with Low Program Services Expense-to-Revenue Ratios FY 2020

| BID Name | Borough | Category Average | BID | Percentage Deviation from Category Average |

| Less than $250,000 | ||||

| West Shore | Staten Island | 50.3% | 21.4% | (57.5%) |

| White Plains Road | Bronx | 50.3 | 33.5 | (33.4) |

| $250,000 to $500,000 | ||||

| 161st Street | Bronx | 53.7 | 37.0 | (31.2) |

| 165 Street Mall | Queens | 53.7 | 37.3 | (30.6) |

| $500,000 to $1 million | ||||

| Gateway JFK | Queens | 60.1 | 32.9 | (45.3) |

| $1 million to $2 million | ||||

| SoHo-Broadway Initiative | Manhattan | 60.8 | 33.1 | (45.5) |

| Third Avenue | Bronx | 60.8 | 40.0 | (34.1) |

| Jamaica Center | Queens | 60.8 | 40.2 | (33.8) |

| $2 million to $5 million | ||||

| Hudson Yards Hell’s Kitchen Alliance | Manhattan | 66.4 | 38.4 | (42.1) |

| Meatpacking District | Manhattan | 66.4 | 45.2 | (31.9) |

Table XII

BID Spending on Administrative Expenses FY 2020 vs FY 2019

| Type of Expense | FY 2020 | Percent of Total | FY 2019 | Percent of Total | FY 2019- FY 2020 Percentage Change |

| Salaries | $18,944,380 | 58.0% | $16,802,132 | 55.8% | 12.7% |

| Rent and Utilities | 4,803,535 | 14.7 | 4,268,410 | 14.2 | 12.5 |

| Outside Contractors | 3,082,712 | 9.5 | 3,071,949 | 10.2 | 0.4 |

| Insurance | 1,851,597 | 5.7 | 1,705,055 | 5.7 | 8.6 |

| Supplies and Equipment | 1,319,244 | 4.0 | 1,451,688 | 4.8 | (9.1) |

| Other Expenses | 2,651,875 | 8.1 | 2,821,167 | 9.3 | (6.0) |

| Total | $32,653,343 | 100.0% | $30,120,401 | 100.0% | 8.4% |

Table XIII

Average Amount, Percentage of Total Revenue and Percent Range Spent on Administrative Costs FY 2020

| Total Revenue Category | BIDs | Average Amount | Percent | Percent Range |

| Less than $250,000 | 13 | $76,835 | 42.0% | 22.9 to 58.0% |

| $250,000 to $500,000 | 21 | 128,624 | 38.0 | 6.9 to 55.3 |

| $500,000 to $1 million | 14 | 231,413 | 36.1 | 7.8 to 53.7 |

| $1 million to $2 million | 11 | 427,635 | 31.7 | 10.2 to 51.7 |

| $2 million to $5 million | 9 | 652,568 | 21.6 | 9.5 to 36.1 |

| More than $5 million | 8 | 1,892,063 | 14.0 | 6.3 to 26.1 |

| Overall Average 2020 | 76 | $429,649 | 33.0% | |

| Overall Average 2019 | 75 | $401,605 | 32.1% |

Table XIV

20 BIDs with High Administrative Expense-to-Revenue Ratios FY 2020

| BID Name | Borough | Category Average |

BID | Percentage Deviation From Category Average |

| Less than $250,000 | ||||

| Church Avenue | Brooklyn | 42.0% | 58.0% | 38.1% |

| Flatbush-Nostrand Junction | Brooklyn | 42.0 | 56.8 | 35.2 |

| $250,000 to $500,000 | ||||

| 165th Street Mall | Queens | 37.3 | 55.3 | 48.3 |

| Grand Street | Brooklyn | 37.3 | 53.7 | 44.1 |

| Woodhaven | Queens | 37.3 | 52.6 | 41.2 |

| 82nd Street Partnership | Queens | 37.3 | 52.1 | 39.8 |

| Bayside Village | Queens | 37.3 | 51.0 | 37.0 |

| $500,000 to $1 million | ||||

| Bed-Stuy Gateway | Brooklyn | 34.5 | 53.7 | 55.8 |

| Washington Heights | Manhattan | 34.5 | 47.6 | 38.0 |

| Sunnyside Shines | Queens | 34.5 | 46.9 | 36.0 |

| Park Slope – 5th Avenue | Brooklyn | 34.5 | 45.2 | 31.1 |

| $1 million to $2 million | ||||

| Jamaica Center | Queens | 30.4 | 51.7 | 70.5 |

| SoHo Broadway Initiative | Manhattan | 30.4 | 48.3 | 59.2 |

| Dumbo Improvement District | Brooklyn | 30.4 | 43.5 | 43.4 |

| 125th Street | Manhattan | 30.4 | 42.2 | 39.0 |

| $2 million to $5 million | ||||

| Union Square Partnership | Manhattan | 21.0 | 36.1 | 72.0 |

| Hudson Yards Hell’s Kitchen Alliance | Manhattan | 21.0 | 32.0 | 52.4 |

| Meatpacking District | Manhattan | 21.0 | 31.8 | 51.4 |

| More than $5 million | ||||

| Garment District | Manhattan | 12.6 | 26.1 | 106.7 |

| MetroTech | Brooklyn | 12.6 | 19.2 | 51.6 |

Table XV

Salaries and Compensation* from BIDs FY 2020

Table XVII

| Total Salary & Compensation of $100,000 or More | ||||||

|---|---|---|---|---|---|---|

| Total Revenue Category | BIDs | # of Officers or Key Employees | Minimum Total | Maximum Total | Minimum Per Hour | Maximum Per Hour |

| Less than $250,000 | 13 | 0 | N/A | N/A | N/A | N/A |

| $250,000 to $500,000 | 21 | 0 | N/A | N/A | N/A | N/A |

| $500,000 – $1 million | 14 | 2 | $103,680 | $104,170 | $50 | $57 |

| $1 million – $2 million | 11 | 9 | 100,000 | 218,538 | 46 | 103 |

| $2 million – $5 million | 9 | 14 | 107,500 | 297,644 | 48 | 127 |

| More than $5 million | 8 | 45 | 108,458 | 515,163 | 47 | 369 |

| Total | 76 | 70 | ||||

* Salaries and compensation did not include compensation or other benefits that were paid by the BIDs or the related organizations.

Table XVI

FY 2020 Assessments, Total Revenue, Expenses, and Operating Surplus (Deficit)

| Total Revenue Category | BIDs | Assessments* | Total Revenue | Total Expenses | Operating Surplus (Deficit) |

| Less than $250,000 | 13 | $2,150,920 | $2,376,086 | $2,216,050 | $160,036 |

| $250,000 to $500,000 | 21 | 6,513,202 | 7,250,022 | 6,596,780 | 653,242 |

| $500,000 to $1 million | 14 | 7,197,098 | 9,393,673 | 8,881,182 | 512,491 |

| $1 million to $2 million | 11 | 12,568,889 | 15,497,461 | 14,119,566 | 1,377,895 |

| $2 million to $5 million | 9 | 24,865,350 | 27,949,508 | 27,161,922 | 787,586 |

| More than $5 million | 8 | 84,142,218 | 119,670,033 | 111,482,448 | 8,187,585 |

| Total 2020 | 76 | $137,437,677 | $182,136,783 | $170,457,948 | $11,678,835 |

| Total 2019 | 75 | $124,594,784 | $168,836,106 | $166,969,931 | $1,866,175 |

| Year-Over-Year Change | 1 | $12,842,893 | $13,300,677 | $3,488,017 | $9,812,660 |

* Assessments changed from FY 2019 to FY 2020 for 31 BIDs, with three BIDs (Fifth Avenue Assoc., Garment District, and Hudson Yards Hell’s Kitchen Alliance) accounting for a total of $6.5 million (51%) of the net increase. See Table VII earlier in this report for more details.

Table XVII

Summary of 12 BIDs with More than One Potential Financial Matter FY 2020

(Potential Problem Areas Highlighted)

| FYs 2016-2020 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| BID Name | Total Revenues | Total Expenses | FY 2020 Surplus (Deficit) | # of Deficits | Total Amt of Surpluses (Deficits) | Low Program Costs | High Admin Costs | High Salaries or Bonus to Key Employees | Increase in Assessment from FY 2019 | |

| Flatbush-Nostrand Junction | $205,733 | $236,731 | $(30,998) | 5 | $(209,252) | X | $0 | |||

| Church Avenue | 221,224 | 230,430 | (9,206) | 2 | (5,375) | X | 0 | |||

| Bed-Stuy Gateway | 742,056 | 788,390 | (46,334) | 3 | (265,607) | X | 0 | |||

| SoHo-Broadway Initiative | 1,034,077 | 842,284 | 191,793 | 2 | 319,683 | X | X | 0 | ||

| 165th Street Mall | 252,400 | 233,579 | 18,821 | 2 | (5,030)* | X | X | 0 | ||

| Hudson Square | 3,326,499 | 5,154,682 | (1,828,183) | 4 | (5,143,181) | 700,000 | ||||

| 34th Street Partnership | 14,182,517 | 14,803,896 | (621,379) | 5 | (5,442,585) | X | 680,000 | |||

| Times Square Alliance | 21,904,746 | 21,644,309 | 260,437 | 3 | (2,753,177) | X | 678,245 | |||

| Bryant Park Corporation | 22,262,699 | 21,541,915 | 720,784 | 2 | (773,188) | X | 0 | |||

| Jamaica Center | 1,131,381 | 1,040,213 | 91,168 | 1 | 49,153 | X | X | 0 | ||

| Hudson Yards Hell’s Kitchen Alliance | 2,989,733 | 2,311,963 | 677,770 | 3 | 393,228 | X | X | 1,200,000 | ||

| Meatpacking District | 3,041,502 | 2,624,532 | 416,970 | 0 | 2,663,202 | X | X | 92,000 | ||

* The operating deficit is considered immaterial; therefore, this has not been highlighted as a potential matter.

APPENDIX II – EXHIBITS

Exhibit A: Schedule Listing All 76 BIDs and Their Fiscal Year 2020 Operating Parameters

Exhibit B: Schedule of BIDs Listed by FY 2020 Revenue Category and Borough

Exhibit C: Schedule of Operating Surpluses (Deficits) FYs 2016-2020

Exhibit D: Schedule of FY 2020 Program Service Expenses

Exhibit E: Schedule of FY 2020 Administrative Expenses

Exhibit F: Schedule of Year-Over-Year Comparison of Revenue & Expenses (FY 2020 vs FY 2019)

Exhibit A: Schedule Listing All 76 BIDs and Their Fiscal Year 2020 Operating Parameters by Revenue Category (Page 1/3)

Exhibit A: Schedule Listing All 76 BIDs and Their Fiscal Year 2020 Operating Parameters by Revenue Category (Page 2/3)

Exhibit A: Schedule Listing All 76 BIDs and Their Fiscal Year 2020 Operating Parameters by Revenue Category (Page 3/3)

Exhibit B: Schedule of BIDs Listed by 2020 Revenue Category and Borough

Exhibit C: Schedule of BIDs Operating Surpluses (Deficits) By Revenue Category FYs 2016-2020 (Page 1/3)

Exhibit C: Schedule of BIDs Operating Surpluses (Deficits) By Revenue Category FYs 2016-2020 (Page 2/3)

Exhibit C: Schedule of BIDs Operating Surpluses (Deficits) By Revenue Category FYs 2016-2020 (Page 3/3)

Exhibit D: Schedule of BIDs FY 2020 Program Service Expenses by Revenue Category (Page 1/3)

Exhibit D: Schedule of BIDs FY 2020 Program Service Expenses by Revenue Category (Page 2/3)

Exhibit D: Schedule of BIDs FY 2020 Program Service Expenses by Revenue Category (Page 3/3)

Exhibit E: Schedule of FY 2020 Administrative Expenses (Page 1/3)

Exhibit E: Schedule of FY 2020 Administrative Expenses (Page 2/3)

Exhibit E: Schedule of FY 2020 Administrative Expenses (Page 3/3)

Exhibit F: Schedule of Year-Over-Year Comparison of Revenue & Expenses (FY 2020 vs FY 2019) (Page 1/3)

Exhibit F: Schedule of Year-Over-Year Comparison of Revenue & Expenses (FY 2020 vs FY 2019) (Page 2/3)

Exhibit F: Schedule of Year-Over-Year Comparison of Revenue & Expenses (FY 2020 vs FY 2019) (Pag 3/3)

Endnotes

[1] § 25-401 of the City’s Administrative Code governs the formation and expansion of BIDs in the City.

[2] BIDs are governed by their respective by-laws and contracts with the City. BIDs are also governed by New York State Consolidated Laws: §980 of the General Municipal Law and Chapter 35 “Not-for-Profit Corporations,” and Title 25, Chapter 4 of the New York City Administrative Code.

[3] § 25-415 of the City’s Administrative Code provides that a BID may be dissolved by the City Council upon request of the BID itself, or the request of owners of property in the district with 51% or more of the assessed valuation or 51% of the property owners in the district.

[4] The information contained in this report was extracted from the FY 2020 BID Trends Report, which is composed of the self-reported outputs and expenses found in each BID’s Annual Report submitted to SBS. Although this report may reflect an operating deficit for a BID, BIDs may have a legitimate explanation for why the self-reported expenditures exceed the revenue amounts.

[5] According to SBS’ Fiscal Year 2020 NYC BID Trends Report, other services may include social services, business development, debt service cost, and miscellaneous program expenses.

[6] This analysis classified expenses as they were self-reported by each BID to SBS; if an expense was reported as administrative it was analyzed as such in this report. According to SBS’ Fiscal Year 2020 NYC BID Trends Report, outside contractors are limited to general and administrative functions and may include contracted management, accountants, bookkeepers, web designers, etc.

[7] In this analysis, the percent deviation measured the distance of each BID’s total program service expense as a percentage of total revenue from their respective category average.

[8] Officers are usually the Executive Director or President of the BIDs. Key employees are other high paid managerial staff, such as Director of Operations, Controller/Chief Financial Officer, Deputy Director, and Vice Presidents.

[9] In some instances, an individual can serve as an officer, director, or other employee on more than one BID.

[10] Bryant Park BID operates under the same management structure as 34th Street Partnership, though they are separate corporate entities.