Audit Report on the Department of Citywide Administrative Services’ Compliance with Local Law 45

Audit Impact

Summary of Findings

The audit found multiple errors and discrepancies in DCAS’ reported energy usage information and identified internal control weaknesses in data collection and data integrity which indicate that all four published Local Law 45 (LL45) annual reports are unreliable. The audit found discrepancies in reported ownership status (i.e., whether a facility was City-owned or leased) for dozens of facilities. Consequently, all reported annual fossil fuel and steam usage data and trends were distorted. In addition, DCAS’ real-time meter (RTM) installation data was not always complete, and its Building Envelope Assessment and Improvement reporting was insufficient.

After the auditors shared the preliminary audit findings and subsequently met with DCAS officials, the agency informed the auditors that it had reissued FY18 and FY19 LL45 annual reports and errata for all four reports in October 2022. However, DCAS did not inform the auditors about the revised reports and corrections before the Exit Conference meeting on February 1, 2023.[1]

For this audit, the auditors did not assess the revised LL45 reports with errata released by DCAS. Consequently, the auditors are unable to express any judgment on the correctness or entirety of the modified LL45 annual reports or the revisions made.

Additionally, DCAS claimed that the errors in the LL45 reports do not reflect any errors in DCAS’ underlying data or affect the accuracy of fossil fuel data collection regardless of ownership of a facility. DCAS also stated that the data used for the LL45 reporting was/is not used for any other purposes, including GHG emissions reporting, nor does it affect DCAS policy development. However, DCAS did not furnish any proof for its assertions.

Intended Benefits

The audit identified ways DCAS can enhance its data collection, record-keeping, and reporting processes for electricity, fossil fuel, and steam usage, RTM installations status, and Building Envelope Assessment and Improvement status, provide reliable LL45 annual reports to the public, City Council, and Mayor, and assess any potential negative impacts caused by inaccurate information from past LL45 reporting.

Additionally, by improving its data management, DCAS can effectively and efficiently manage its $800 million annual energy supply budget and $2.7 billion, 10-year capital budget to reduce greenhouse gas (GHG) emissions by 80% by 2050. Finally, enhanced data accuracy and reliability will mitigate potential reputational risks for DCAS.

Introduction

Background

Local Law 45 of 2018 (LL45) arose from a 2015 New York City Comptroller’s audit report that identified deficiencies in DCAS’ implementation, tracking, and reporting of the City’s energy efficiency efforts in City-owned buildings and its oversight of the City’s goal of reducing municipal GHG emissions.[2] The law requires DCAS to report on annual electricity usage and RTM installations for City-owned and leased buildings and, for City-owned buildings, fossil fuel usage, as well as assessments of and improvements to building envelopes at covered facilities for four years, as part of the City’s efforts to address climate change.[3]

DCAS’ Division of Energy Management (DEM) leads the City’s energy conservation and sustainability efforts and administers LL45 monitoring and reporting. DEM oversees more than 10,000 utility accounts for City government agencies across 4,000 public buildings. It implements solutions to reduce energy consumption and promote energy efficiency in public buildings, and to generate clean energy on City-owned properties. DEM manages a $800 million annual energy supply budget and a $2.7 billion, 10-year capital budget to develop and implement programs to achieve the City’s mandated 80% reduction of GHG emissions by 2050.

Per LL45, DCAS was required to submit annual reports to the Speaker of the City Council and the Mayor for four consecutive years (Fiscal Years 2018–2021) and to make them publicly available on its website no later than December 31. [4] In addition to reporting on electricity and fossil fuel usage, DCAS was required to report on certain efficiency measures, including RTMs and building envelope assessments and improvements.[5]

Per DCAS, its LL45 annual report drafting process included written steps for preparing, reviewing, and revising the various sections of the annual report. These steps included developing and revising the report outline, executive summary, data analyses sections, and narrative sections. The collection of relevant data, the performance of necessary analyses and statistics, and the preparation of the reports were carried out by a DEM senior analyst. Additional checks included reviews and approvals by higher-level DCAS officials such as the Chief of Staff, Assistant Commissioners, and the DEM Deputy Commissioner.

The annual reports for each fiscal year included only those facilities that qualified as covered facilities in that reporting year. Therefore, the specific covered facilities and the total number of covered facilities vary in each annual report. According to the FY18 report, there were 680 covered facilities. There were 759 covered facilities in FY19, 677 in FY20, and 572 in FY21. Each LL45 annual report is a standalone report, and the reported five-year usage trend represents change in energy usage over the last five fiscal years or periods of time such facility was a covered facility.

Objective

The objective of this audit was to determine whether DCAS complied with Local Law 45 reporting requirements, which required reporting on electricity and fossil fuel usage, real-time metering, and assessments of and improvements made to the envelopes of covered facilities.

Discussion of Audit Results with DCAS

The matters covered in this report were discussed with DCAS officials during and at the conclusion of this audit. An Exit Conference Summary was sent to DCAS on January 18, 2023, and discussed with DCAS officials at an Exit Conference held on February 1, 2023. On March 10, 2023, we submitted a Draft Report to DCAS with a request for written comments. We received a written response from DCAS on March 28, 2023.

In its response to the Draft Report, DCAS acknowledged that the original FY18 and FY19 LL45 annual reports contained miscategorized ownership status for a small number of facilities. However, DCAS maintained that the errors do not impair the integrity of DCAS’ underlying data or analysis of GHG emissions reduction. Although the auditors acknowledge DCAS’ perspective, DCAS did not provide any evidence to support its claims. DCAS’ inconsistent reporting and changing values for the same facilities in different annual reports in addition to the miscategorized ownership statuses raise doubts about the accuracy of the underlying data. DCAS’ explanation of transcription errors does not seem credible. Moreover, contrary to DCAS’ claim that auditors used incorrect methodology and misapplied the wrong emission coefficient to calculate GHG emissions, the auditors utilized the same methodologies used by DCAS in its LL45 annual reports.

In addition, DCAS stated that the auditors did not review the corrected data prior to issuing the Draft Report to the agency. However, considering the extent of discrepancies and errors found in the four LL45 published annual reports during this audit, a separate audit would be necessary to thoroughly review and analyze the accuracy of the corrected reports.

After receipt of DCAS’ response, the auditors did review the heating fuel oil usage data for 25 facilities (shown in Appendix VIII), as reported in DCAS’ corrected FY18, corrected FY19, FY20, and FY21 reports and found that they still contain discrepancies and inconsistencies. As a result, heating fuel oil usage for these 25 facilities remains either inconsistent or underreported in all four annual reports. Consequently, the information in the corrected reports cannot be relied upon, and DCAS is still not in compliance with LL45 reporting requirements.

The auditors considered DCAS’ response to the findings but did not find any basis to modify the report’s findings. Where relevant, changes to the audit report were made.

The full text of DCAS’ response is included as an addendum to this report.

Detailed Findings

DCAS generally complied with LL45 reporting requirements in that all four annual reports generally included all required reporting areas.[6] However, the audit found multiple errors and discrepancies in the reported information and identified internal control weaknesses in data collection and integrity which indicate that, overall, all four published annual reports are unreliable.

The auditors found inaccuracies in year-to-year usage change trends; discrepancies, errors, and insufficient information in summary tables and facility-level data; and incorrectly reported performance metrics—for example, in the FY19 annual report, a decrease in usage of heating fuel oil was overstated by 20%, an increase in natural gas usage was overstated by over 12%, and an 11% decrease in steam usage was reported as a 2% increase.

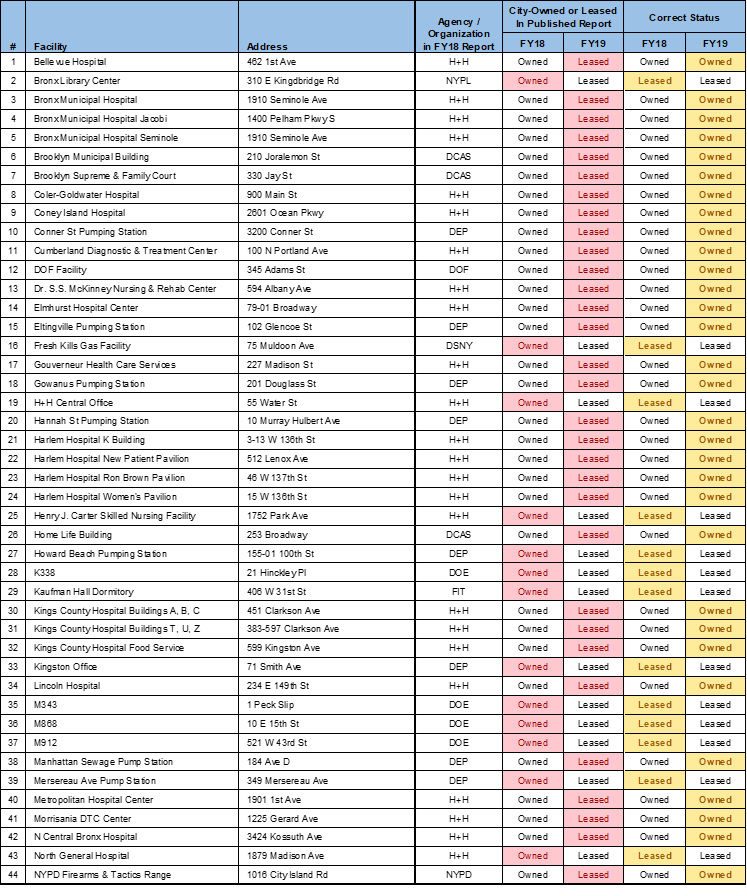

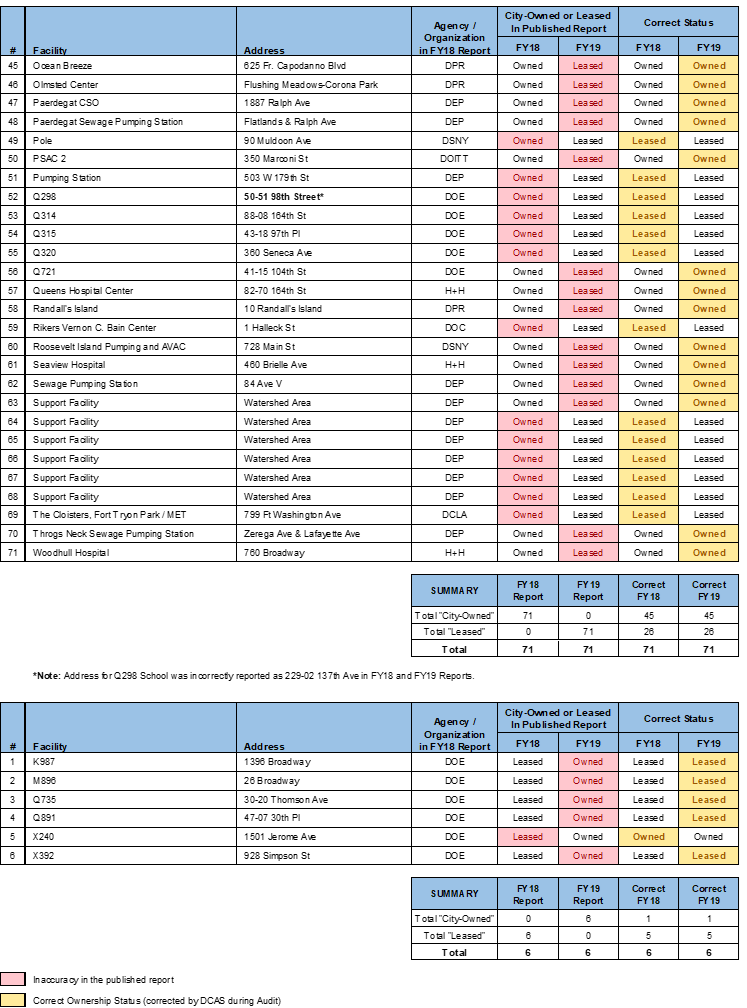

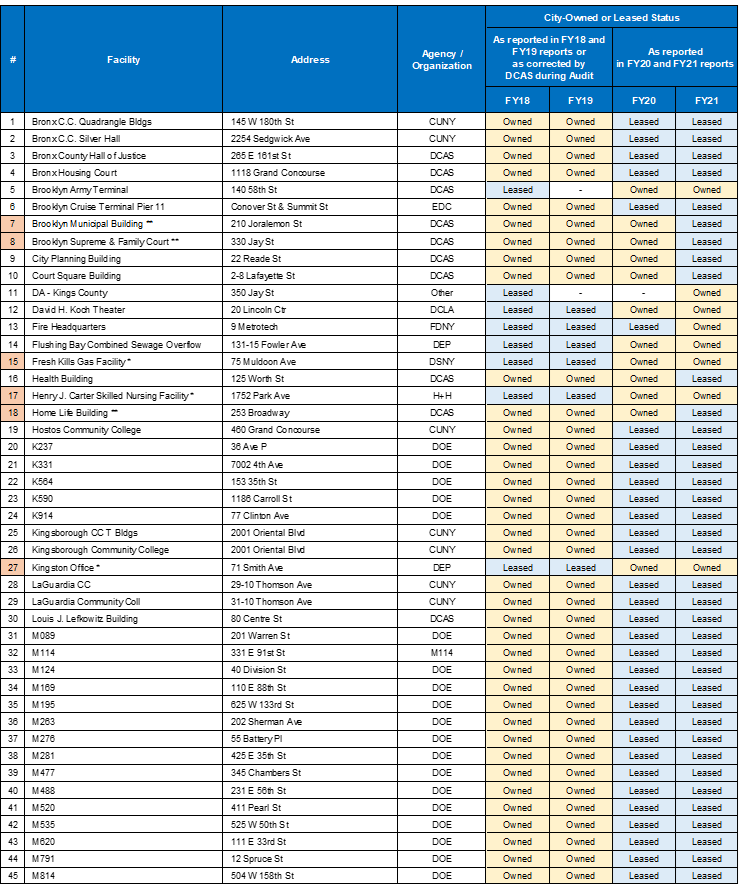

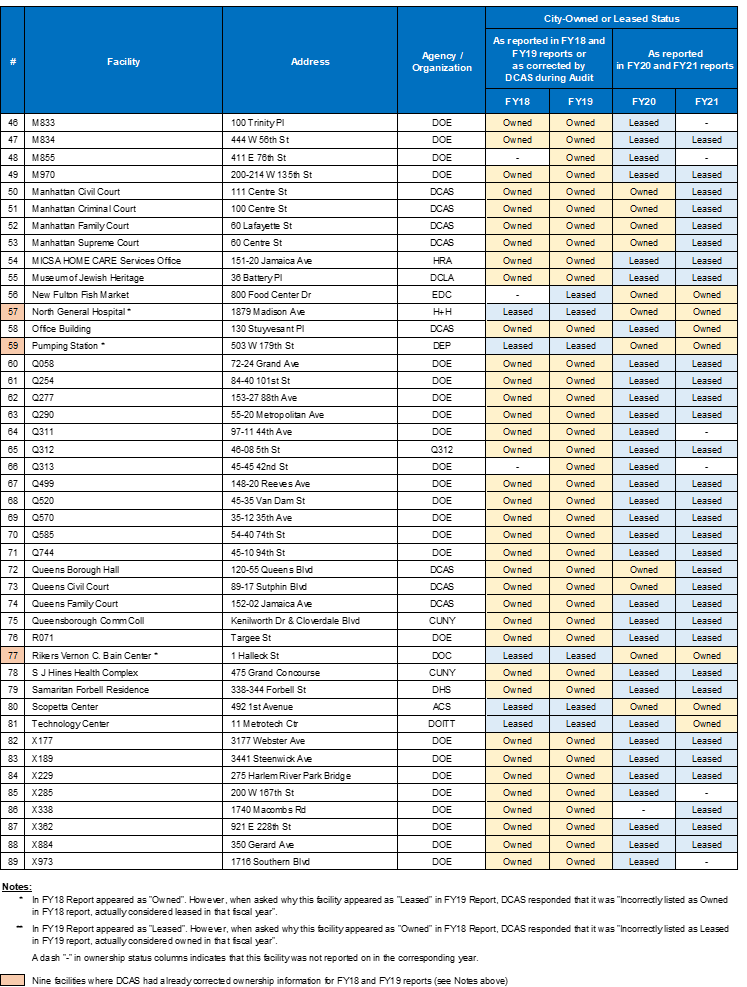

Of particular note, in the first two annual reports (FY18 and FY19), the auditors found discrepancies in reported ownership status (i.e., whether a facility was City-owned or leased) for 77 facilities. Consequently, all reported annual fossil fuel and steam usage data and trends were distorted in those two reports. In addition, the auditors’ comparisons of facility ownership data over the four reporting years showed discrepancies in ownership status for an additional 80 facilities.

Finally, the audit found that DCAS’ RTM installation data was not always complete and its Building Envelope Assessment and Improvement reporting was insufficient.[7]

These findings are detailed below in the following sections.

Unreliable Performance Data

The audit found that the annual reports included multiple errors and inconsistencies in reported trends, usages, changes, and calculations, as well as incorrect categorizations of ownership status of the facilities. These errors resulted in miscalculations of energy usage data, which was then compiled in the summary tables, and as a result, the overall picture of City energy use was distorted in the annual reports. The details of this finding are discussed below.

Distorted Usage Trends in FY18 and FY19 Annual Reports

Although it is DCAS’ responsibility to ensure the accuracy of the reports, discrepancies were found in reported electricity and fossil fuel[8] usage data , in year-to-year/five-year usage changes, and in trend calculations, all of which bring into question the reliability of the reported information.

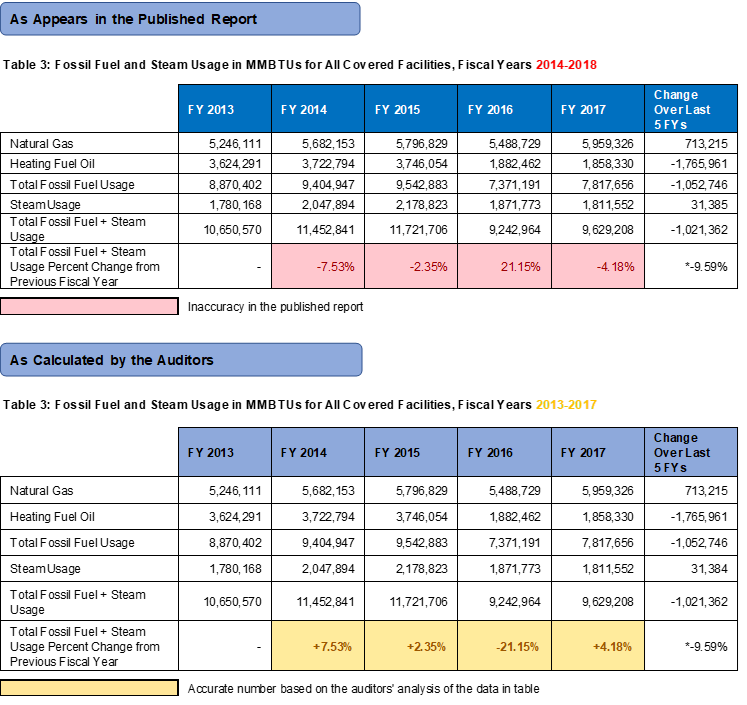

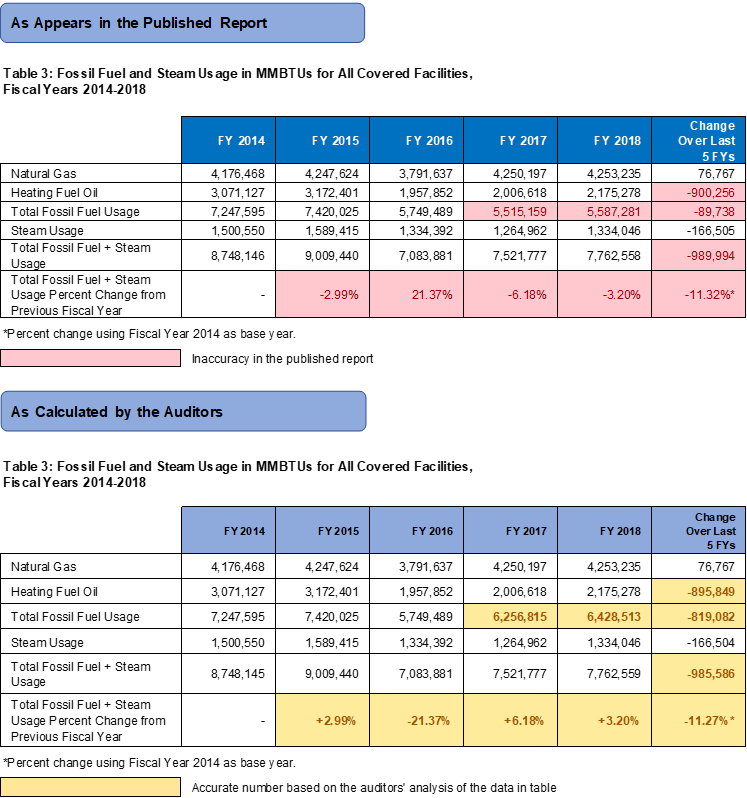

The audit found that the heating fuel oil, natural gas, and steam usage trends were incorrectly reported in the summarized data presented in Table 3: Fossil Fuel and Steam Usage in MMBTUs for All Covered Facilities of the FY18 and FY19 annual reports. Increases in fossil fuel and steam usage trends were reported as decreases and vice-versa, in both reports. In addition, there were discrepancies in the titles, reported data, and calculations to track energy usage change over five FYs in both tables. DCAS attributed these errors to typos made by its publishing office, but this explanation seems unreasonable. Maintaining data integrity using formulas in the summary tables would have helped DCAS mitigate these errors.

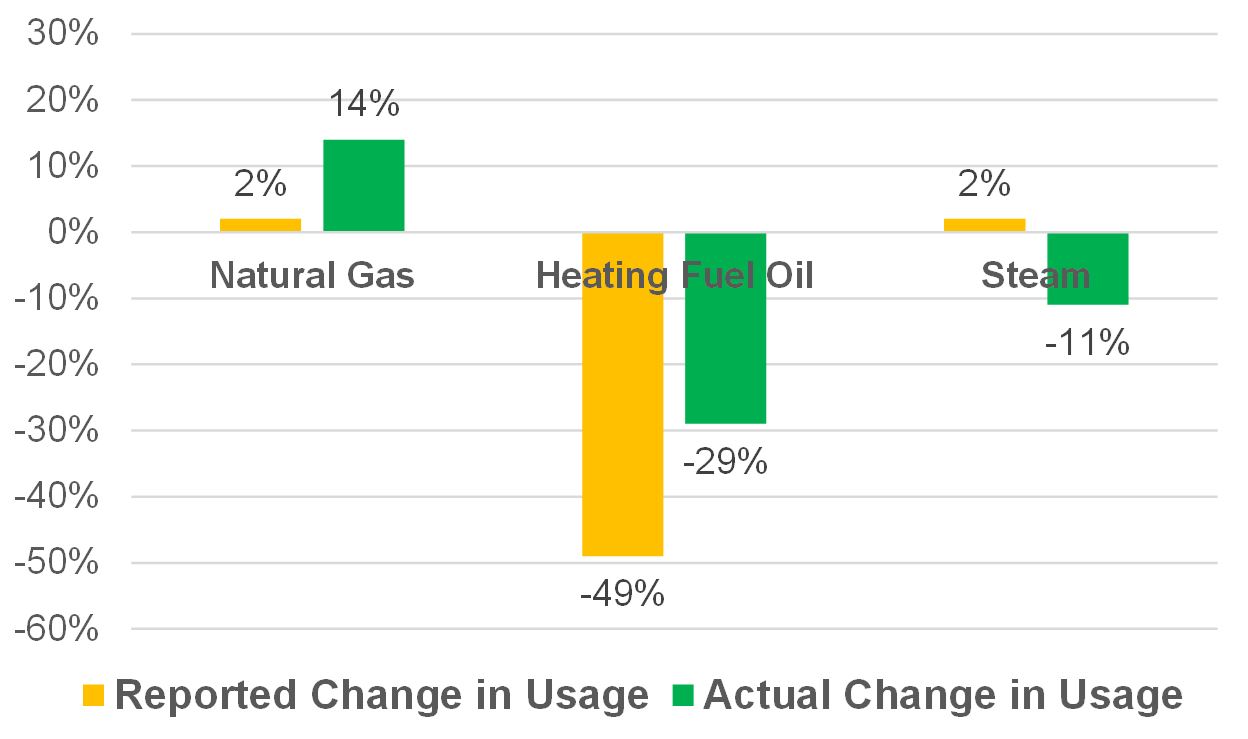

Furthermore, the FY19 report stated that heating fuel oil usage decreased by 49%, natural gas usage increased by 14%, and steam usage increased by less than 2%. However, the auditors found that heating fuel oil usage decreased by only 29% (20% less than the reported decrease), natural gas usage increased by about 2% (12% less than the reported increase), and steam usage decreased by over 13% (an 11% decrease, as opposed to the reported 2% increase). DCAS generally attributed the misstated data to transcription errors.

These findings are illustrated in the following chart:

Inaccuracies between Reported and Actual Change in Usage (in FY19 Report)

To put these inaccuracies in perspective, the heating fuel oil usage trend was overstated by 620,866 MMBTU—equivalent to seven years of the total annual energy use at the David N. Dinkins Manhattan Municipal Building; and the increase in natural gas was understated by an amount equal to five years of energy use.[9]

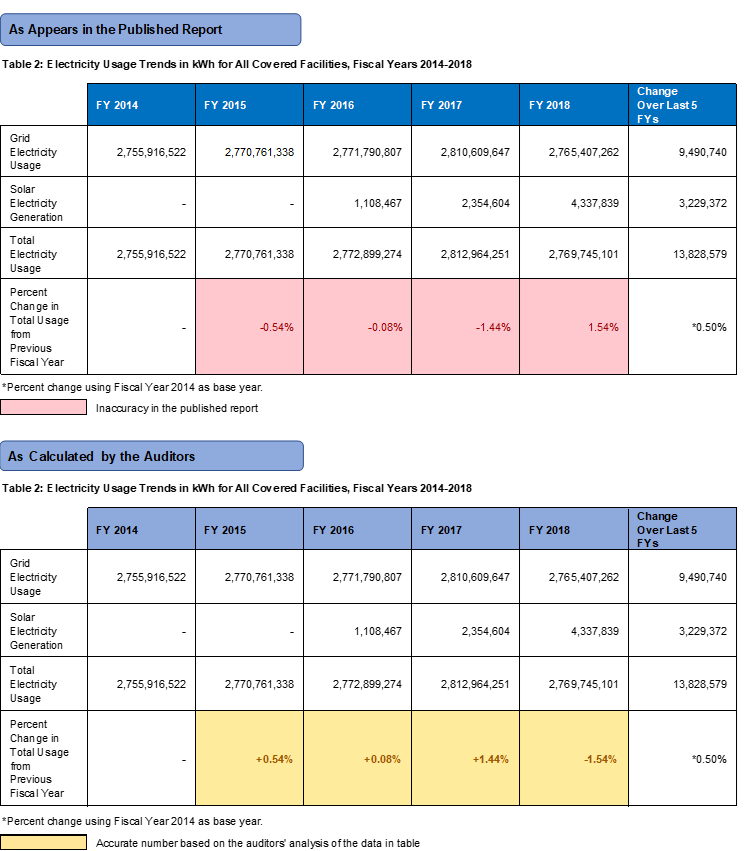

In addition, although electricity usage changes over five fiscal years appeared to be accurate in all four annual reports,[10] year-to-year usage changes were inaccurately reported in the FY18 annual report. An increase in electricity usage trend was reported as a decrease (indicated by a minus sign); likewise, a decrease was reported as an increase, in summarized data presented in the report’s Table 2: Electricity Usage Trends in kWh for All Covered Facilities, Fiscal Years 2014-2018.

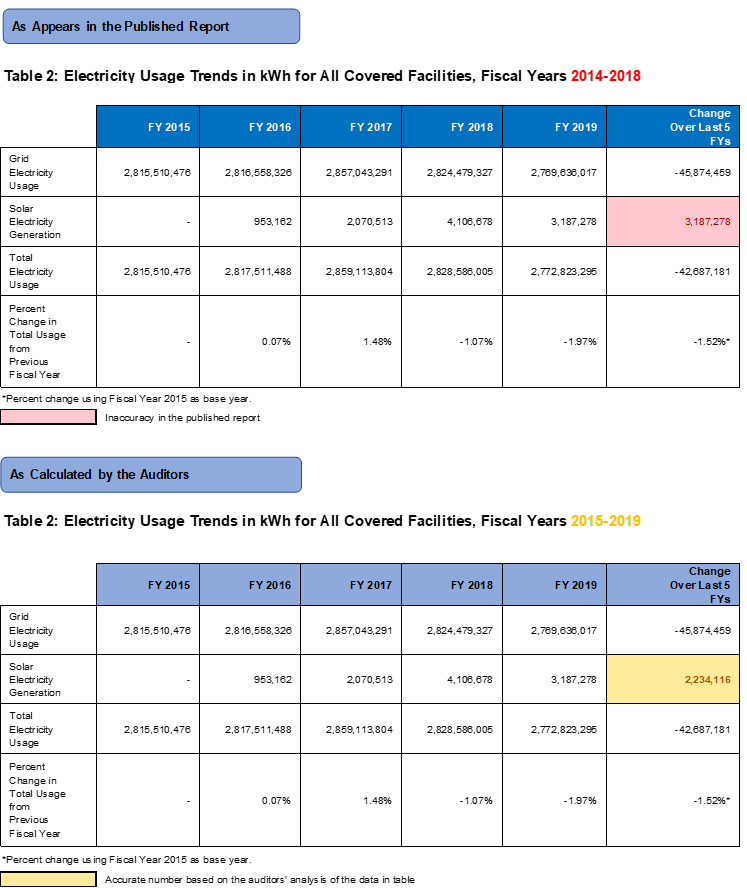

Further, in the FY19 annual report, the change in solar energy use over the last five fiscal years was calculated incorrectly. The method used by DCAS presented a larger change in solar use over the last five fiscal years, i.e., 3,187,278 kWh instead of 2,234,116 kWh. Section b.1(d) of LL45 requires difference in usage to be calculated over the last five fiscal years or the portion of such period of time that such facility was a covered facility. Accordingly, the change should have been calculated as 5th-year usage minus 2nd-year usage because no solar usage was recorded at those facilities in the first year, similar to the 5th year minus 3rd year usage calculation DCAS used to compute five-year usage differences where no solar usage was recorded for the first two years (FY18 Summary Table 2).

See Appendix I for discrepancies between reported information and corrections identified by the auditors, based on the data analyses of the summary tables and facility-level data in the LL45 report appendices.

As a result of the issues, the City Council, the Mayor, and the public cannot entirely rely upon the published annual reports.

After the auditors presented their initial findings to the agency, DCAS rejected the audit’s conclusions, pointing out that the agency had corrected and revised the previously published reports.[11] Although DCAS acknowledged the errors and inconsistencies, it maintained that inaccurate data in the LL45 reports was not utilized for any other purposes including both reporting and policy development.[12] However, DCAS did not furnish any proof to support its assertions, leaving the auditors unable to evaluate their validity.

Incomplete and Miscategorized Facility Ownership Status

LL45 required that DCAS report all facility-level information, which DCAS included in appendices in each of the annual reports . Those appendices should have included accurate, detailed data for all City-owned and leased covered facilities, designated by ownership status (categorized in Table 1 as follows). However, in several instances, the auditors found that published usage data was incomplete or showed incorrect ownership status, resulting in further discrepancies with the reported information.

Table 1

Facility-level Detailed Data Requirements per Annual Report Appendices

| Appendix A – Electricity Usage |

City-owned and Leased Facilities |

| Appendix B – RTM Status | |

| Appendix C – Fossil Fuel + Steam Usage |

City-owned Facilities |

| Appendix D – Building Envelope Assessment Status | |

| Appendix E – Building Envelope Improvement Status[13] |

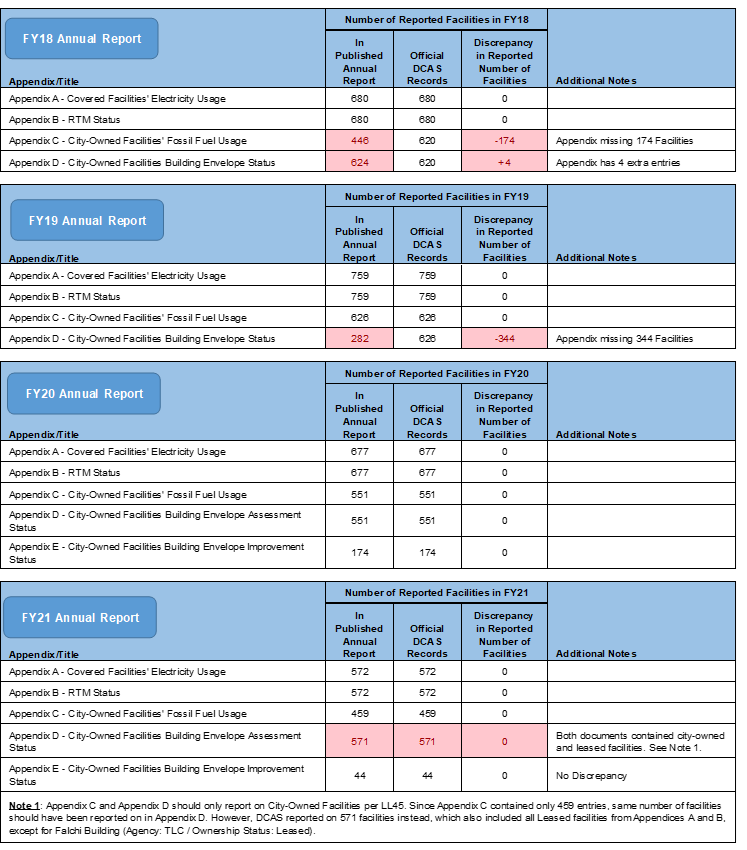

The number and type of facilities should match in all LL45-required appendix categories, as shown above. However, the auditors found that Appendix C in the FY18 report was incomplete and missing 174 facilities. Moreover, in the FY18, FY19, and FY21 reports, Appendix D was either incomplete or inaccurate. In addition, the facilities listed in the annual reports did not correlate with the Excel files that DCAS provided to the auditors.[14] See Appendix II for the results of the auditors’ analysis showing missing facilities and other discrepancies.

When asked, DCAS acknowledged the missing facilities and the omitted pages from the appendices in the FY18 and FY19 annual reports. The facilities were not numbered within individual appendices, which may have contributed to the error.

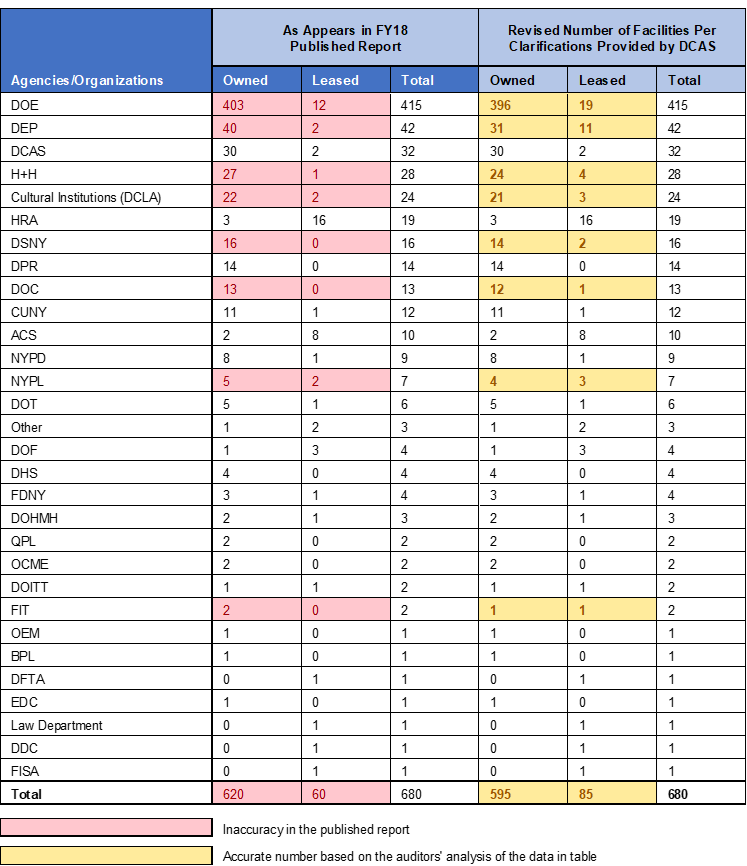

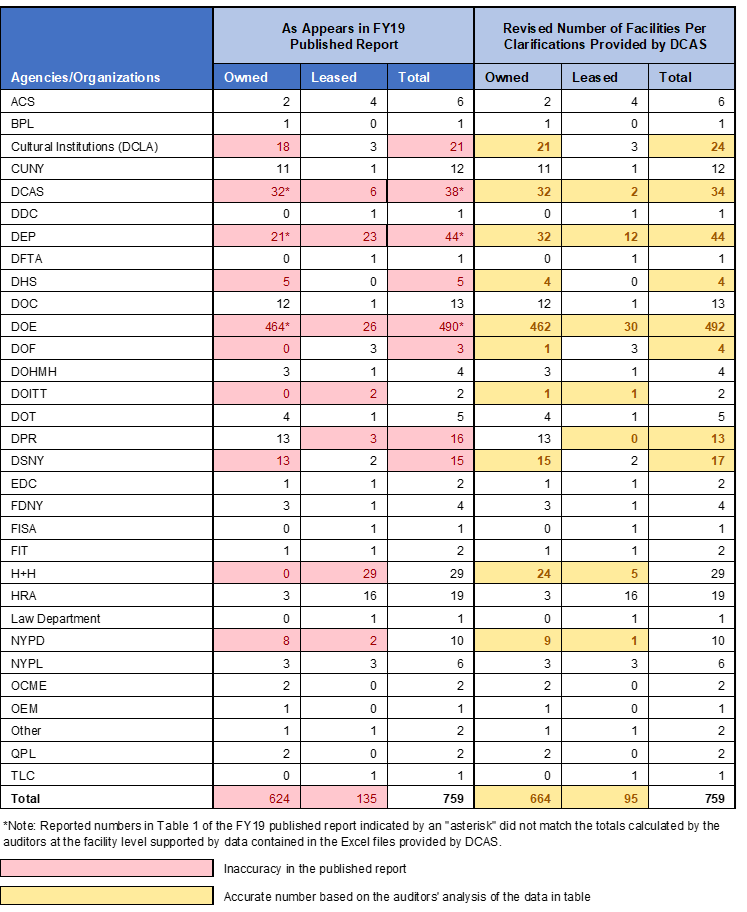

The audit also identified discrepancies between the appendices and the summary tables in the same annual report(s). Summary tables should provide overviews of the underlying data found in the respective appendices and should be verifiable and reconcilable with each other, per Comptroller’s Directive #1, Principles of Internal Control, Section 4.3, Control Activities under Standards of Control. However, the audit found that the appendices and the summary tables did not always reconcile. Specifically, the reported breakdown of all covered facilities by agency affiliation and ownership status was inaccurate in the FY18 and FY19 reports.

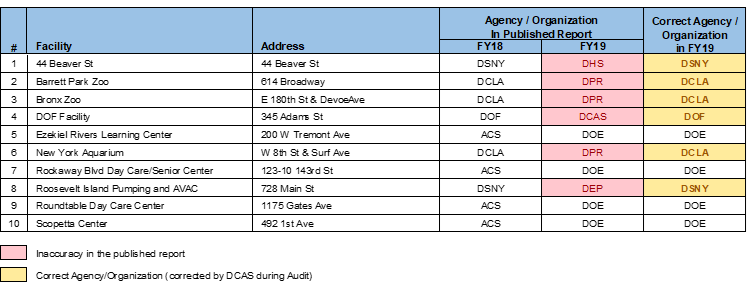

For example, Summary Table 1 in the FY19 annual report summarized facilities by agency and ownership status. As reported, the total number of facilities in the reporting year was correct based on the facility-level data in Appendix A; however, the breakdown by agency and ownership status was inaccurate—the facilities listed as owned or occupied by DCAS, the Department of Environmental Protection (DEP), and the Department of Education (DOE) did not match the underlying data in the appendices of the FY19 report. See Appendix III for discrepancies in ownership status of covered facilities by agency/organization.

The accuracy of reported ownership data was also questionable. When the auditors compared agency and ownership status in the FY19 annual report with the data recorded in the FY18 annual report for the same facility, they found that ownership designations were reported differently. Dozens of facilities were misclassified or missing altogether.[15] When questioned, DCAS acknowledged the mistakes and provided explanations or corrected ownership designations.

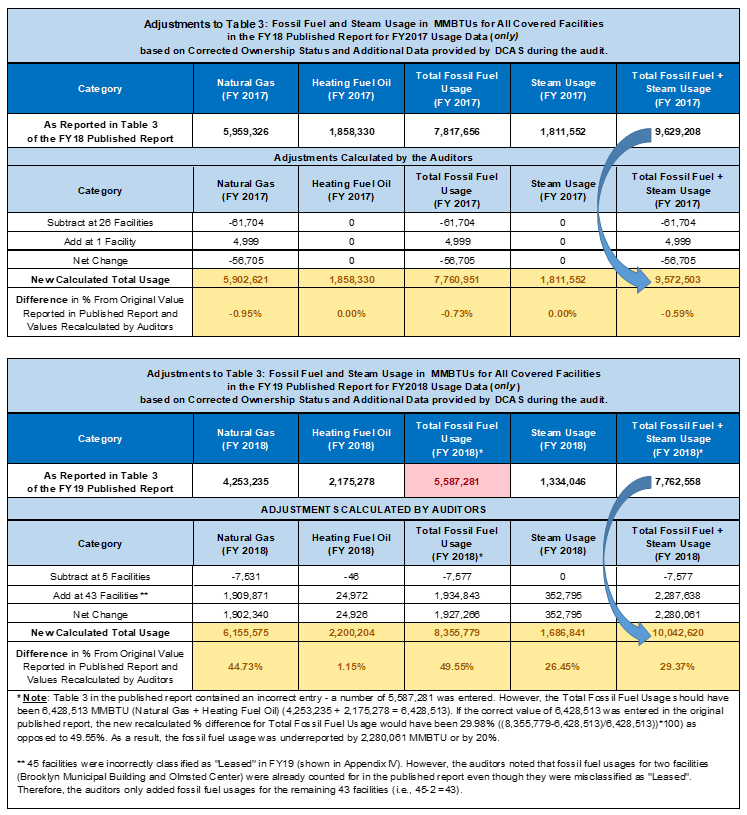

The auditors’ analysis of the potential impact of these errors on the FY19 annual report found that the total fossil fuel and steam usage for FY18 had been underreported by 29.37%.[16] Similarly, the auditors found additional discrepancies in ownership designations across all four annual reports.[17] Therefore, the reported fossil fuel usage data would have to be adjusted in all four annual reports.

See Appendix IV for discrepancies in ownership status between the FY18 and FY19 annual reports, and Appendix V for discrepancies in ownership status over the four annual reports.

See Appendix VI for analyses of fossil fuel and steam usage adjustments resulting from ownership status discrepancies, which shows corrections to one of the five-year data presented in the report summary tables, i.e., correction to FY17 data in the FY18 annual report, and correction to FY18 data in the FY19 annual report.

DCAS did not offer any further explanations during or after the Exit Conference about discrepancies in ownership status or the errors in the reported fossil fuel usage. However, DCAS emphasized that errors that occurred during the original LL45 reports for FY18 and FY19 do not reflect errors in the underlying data and that they have corrected those errors in the revised reports and issued errata.

DCAS further stated that LL45 reporting obligations are not inputs to any other analyses, including GHG emissions reporting, and that LL45 reporting represents a minority of the over 4,000 municipal facilities for which DEM pays utility bills. Therefore, according to DCAS, the identified LL45 inaccuracies do not result in any other inaccuracies in DCAS analysis or reporting, nor do they affect DCAS policy development, as DCAS does not use LL45 reports to inform policy decisions. However, the auditors cannot concur with DCAS’ statements in absence of any supporting evidence.

In its response, DCAS disagreed with the audit recommendation related to this finding (#7) and stated that the owned/leased status of the facilities does not have an impact on building benchmarking nor on HLP budget preparation, so no impact needs to be evaluated.

However, imprecise ownership status may impact the City’s accounting of energy usage and emissions of City-owned facilities, monitoring the City’s progress towards its carbon reduction goals of 40% by 2025, 50% by 2030, and 80% by 2050, and recording expenses related to energy usage and planning for the HLP budget.

Moreover, there is a risk that classifying facilities as leased instead of owned could lead to an underreporting of fossil fuel consumption for City-owned facilities. This, in turn, would result in the underreporting of emissions for the City, creating a false impression of progress towards the City’s reduction goals. As reported, the corrections in the ownership status for several facilities revealed a 29.37% underreporting of fossil fuel and steam usage for FY18 usage in the FY19 annual report, which equates to underreporting up to 125,000 metric tons of GHG.

Issues with RTM Installation Data

A real-time meter (RTM) allows electricity to be measured and reported in near real-time. LL45 required that DCAS monitor and report on RTM installation status for each City-owned and leased covered facility. The annual reports should have stated whether each facility had RTMs, and if not, whether such equipment would have been appropriate and practicable and the expected installation year.[18] Accurate reporting of RTM installation statuses provides DCAS with a real understanding of its progress and ability to monitor energy usage remotely, support energy demand response, and manage energy usage load, when necessary.

DCAS reported on the RTM installation status at all covered facilities as required. However, the auditors’ comparison of RTM Installation Status data (Appendix B, FY18 and FY19) showed discrepancies in the reporting. For example, the auditors found that the RTM installation status for five facilities changed between annual reports from “Completed” to a different status. When questioned, DCAS accounted for the discrepancy at one facility by stating that there had been a change in the utility account number, which resulted in the team changing the status from “Completed” to “To Be Determined.” For the other four facilities, DCAS indicated that there were multiple eligible accounts associated with each facility and that the “Completed” RTM status reported in FY18 reflected only one of the accounts. The status was changed due to future determination or pending installation for the other account(s) at the same facility in the FY19 annual report.

However, because RTM status is reported at the facility level and not at the account level, the statuses were noted as “Completed” when in fact, they were not “fully” completed. After the Exit Conference, DCAS disagreed with this finding and stated that DEM tracks RTMs on an account level and only consolidated RTM installation status to the facility level by address for LL45 reporting. As such, DCAS is fully aware of which facilities have and do not have RTMs and how many are installed. However, due to this recording practice, RTM status data reported in the LL45 reports was not accurate.

In its response, DCAS reiterated that the agency is fully aware of the facilities that have RTMs as they are tracked at the account level and only consolidated on a facility basis when RTMs are installed for the entire facility. However, DCAS did not provide any evidence to support its assertions.[19]

Insufficient Reporting on Building Envelope Assessment and Improvement

LL45 required DCAS to report on building envelope assessments and improvements for each City-owned covered facility. However, DCAS did not report on 344 of the 626 City-owned facilities in FY19 and mistakenly included four additional facilities that were not included in the Excel file provided by DCAS for FY18. DCAS also did not report on improvements made at those facilities in the FY18 and FY19 annual reports; however, it did report on improvements in the FY20 and FY21 annual reports. (See Appendix II for the results of the auditors’ analysis showing missing facilities and other discrepancies.) DCAS acknowledged its limitations in obtaining relevant reporting data. In its annual reports, DCAS explains that while DEM has access to a range of data sources about aspects of facilities’ envelopes, not all of them provide the kind of detailed, standardized, and quantifiable information that is useful for LL45 reporting compliance.

DCAS added a new appendix (Appendix E) to the FY20 and FY21 annual reports, which tabulates information about building envelope improvement projects. In Appendix E of the FY20 annual report, DCAS reported on the envelope improvement statuses for assessments by FY18, FY19, and FY20. However, the reported data were inadequate.[20] Moreover, although the reporting was adequate in the FY21 report, the auditors identified discrepancies in facility ownership status (see “Incomplete and Miscategorized Facility Ownership Status” above), and therefore the reported statistics are inaccurate and should be revised.[21]

After the Exit Conference, DCAS stated that it published the full inventory of facilities with building envelope improvement projects from FY18 and FY19 in the FY20 LL45 report. Appendix E also contained more information on statuses of recommended envelope improvements than required by the law.

In its response to the Draft Report, DCAS stated that LL45 does not define “envelope improvement” and noted that their Energy Management energy efficiency staff experts appropriately described the improvements and their statuses in the report within their discretion, and provided more detail than what was required by LL45.

While the auditors acknowledge that LL45 does not specifically define “envelope improvement,” LL45 is clear in its directive that DCAS must report on City-owned facilities (excluding leased facilities). As detailed in Appendix II, DCAS’ LL45 reports did not provide complete information on all City-owned facilities and therefore did not meet this directive. Additionally, the law mandates reporting only on facilities where envelope improvements were “commenced, continued or completed,” and although DCAS accurately reported on 44 facilities in the FY21 Report, it reported on 174 facilities the prior year with “No envelope improvements recommended” and “N/A” included as categories.

Reporting extraneous information adds unnecessary complexity for stakeholders and the public. Although providing additional information can at times be useful, the information that DCAS added was inconsistent with the reporting requirements and presented an inaccurate account of the number of facilities with envelope assessments and improvements.

Other Weaknesses

The auditors found issues with DCAS’ fossil fuel and steam usage data collection in that the agency did not use the fossil fuel usage data as required by LL45. The auditors also identified additional data integrity issues, further weakening the reliability of the reported information in the LL45 annual reports.

Fossil Fuel and Steam Usage Reporting Lagged by One Year

When reporting fossil fuel (heating fuel oil and natural gas) and steam usage, DCAS used two-year-old usage data, contrary to the LL45 Section b.2 requirements that it report on fossil fuel usage for the prior fiscal year and on changes in usage over the last five fiscal years for each covered facility that is City-owned. Although DCAS had natural gas and steam usage data for the previous fiscal year, for consistency it used two-year-old usage data across all fossil fuel usage reporting. Consequently, the reported usage did not reflect actual use in the annual report for that fiscal year, and all year-to-year and five-fiscal-year trends were lagging by one year in all four annual reports. DCAS attributed the one-year lag to the additional time needed to audit and process heating fuel oil usage data by DEM and other DCAS divisions.[22]

With the City in the process of converting various facilities from higher carbon output heating fuel oil to natural gas as part of the effort to reduce the City’s carbon emissions, accurate and timely information is necessary to help City regulators make appropriate policy decisions. Two-year-old fossil fuel usage data that also contains inaccuracies in the reported total fossil fuel usage due to incorrect ownership designations and data reconciliation does not accurately represent fossil fuel usage trends and is therefore unreliable.

After the Exit Conference, DCAS claimed that fossil fuel data is maintained separately from ownership data. DCAS also reiterated that fossil fuel data reporting was lagged by one year to allow for the complete reporting of available fossil fuel data sets and stated that it provides a basis for reviewing long-term trends and fully meets the intent of the law.

Data Integrity Issues

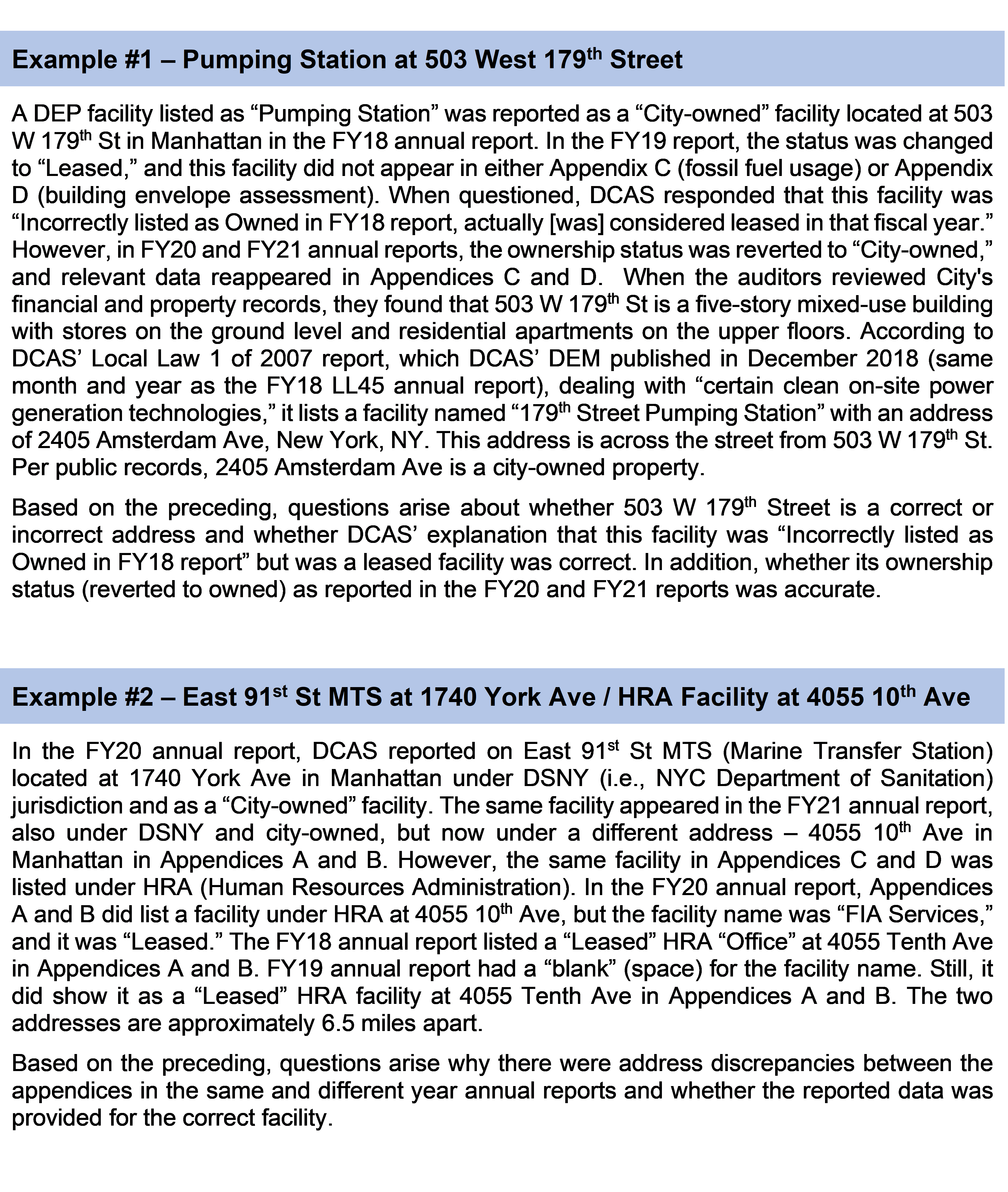

The auditors found inconsistent facility details in the reporting that varied year-to-year, potentially due to inaccurate addresses, agency affiliations, or ownership statuses. As a result, the reliability of the reports’ underlying data is in question.

In addition to the aforementioned issues with reported ownership status, the auditors identified other instances where discrepancies in data posed risks to the reliability of the reported information. As one example, the auditors found that the reported fossil fuel usage in the FY18 report at four Harlem Hospital facilities was identical at each facility in all recorded fiscal years. However, in the FY19, FY20, and FY21 annual reports, the same facilities did not show any heating fuel oil usage for the same years that were already reported on in the FY18 report. This raises the question of whether the heating fuel oil usage was erroneously reported for five consecutive fiscal years in the FY18 report.

In another example, the auditors’ reconciliations of electricity usage adjustments at 10 facilities found large discrepancies (1,544,000 kWh for Q298 and 2,017,600 kWh for X420) at two school facilities between the FY18 and FY19 annual reports which, per DCAS, were due to transcription and documentation errors. Specifically, the auditors noted that usage was accounted for in the adjusted year instead of the actual year. Per DCAS, the discrepancies noted for the other eight facilities were due to adjustments resulting from differences in reporting intervals (15 min vs. 30 min). See Appendix VII for additional examples of data integrity issues identified by the auditors. Conducting data integrity checks and quality assurance of underlying data would improve the reliability of energy usage data and other information included in DCAS’ LL45 annual reports.

After the Exit Conference, DCAS responded to the discrepancies and inconsistencies regarding heating fuel oil reporting and explained that since the data is based on delivery or external agency submissions, it is subject to revision as updated data is received each year. The auditors recognize this but found that the heating fuel oil data for certain facilities, such as Harlem Hospital, was not consistently reported in all four LL45 annual reports.

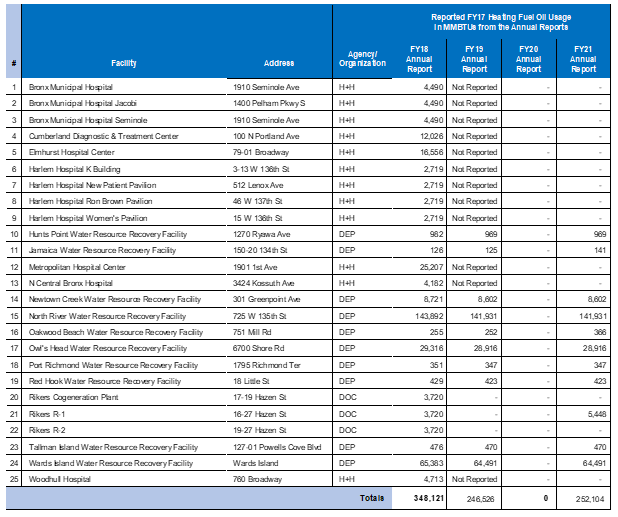

A comparison of the FY17[23] heating oil usage data across the four reports revealed that in the FY18 report, 25 facilities reported heating fuel oil usage, while roughly half of these facilities did not report any usage in the FY19 report. In the FY20 report, no usage was reported for any of the 25 facilities, but roughly half of them reported usage in the FY21 report.

See Appendix VIII for a list of discrepancies and inconsistencies found in the reported FY17 heating fuel oil usage data across the four reports for these 25 facilities.

Additionally, the auditors found that the total FY17 heating fuel oil usage for these 25 facilities was 348,121 MMBTU in the FY18 report. However, since no usage was reported for any of the 25 facilities in the FY20 report, the total reported heating oil usage for FY17 (1,663,225 MMBTU) did not include the 348,121 MMBTU of usage. The actual total usage for FY17 should have been 2,011,346 MMBTU (1,663,225 + 348,121), which means that the FY17 heating oil usage was underreported by 21% in the FY20 report.

The auditors found that the heating fuel oil usage data for the 25 facilities in question (shown in Appendix VIII), as reported in the DCAS’ corrected FY18, corrected FY19, FY20, and FY21 reports, still contain discrepancies and inconsistencies. As a result, heating fuel oil usage for these 25 facilities remains either inconsistent or underreported in all four annual reports. Consequently, the information in the corrected reports cannot be relied upon, and DCAS is still not in compliance with LL45 reporting requirements.

Recommendations

To address the abovementioned findings, the auditors propose that DCAS:

- Maintain accurate records of electricity usage, RTM installation status, fossil fuel and steam usage, and building envelope assessment and improvement status.

DCAS Response: DCAS disagreed with this recommendation. DCAS stated that it currently maintains accurate records and the inaccuracies noted in the published LL45 reports were due to transcription errors and are not reflective of inaccuracies with the underlying data collection or impact results of any other DCAS analysis and/or reporting.

Auditor Comment: DCAS’ inconsistent facility details in the reporting that varied year-to-year, inaccurate addresses, agency affiliations, or ownership statuses cannot be considered transcription errors. DCAS’ assertion that those errors were due to transcription errors does not seem credible and raise doubts about the accuracy of the underlying data.

- Evaluate and revise its data collection, analysis, and review policies and procedures to prevent perpetuating the data discrepancies and errors identified by the audit.

DCAS Response: DCAS partially agreed with this recommendation. DCAS stated that Owned/Leased statuses of buildings originally published in the LL45 reports does not demonstrate DCAS has inaccurate fossil fuel usage data, and that it collects fossil fuel data from City facilities irrespective of their owned or leased status. Regardless, DCAS corrected any discrepancies in the original LL45 reports by revising and reissuing the corrected FY18 and FY19 reports with correct building owned/leased status data.

Auditor Comment: While we acknowledge and appreciate DCAS’ efforts to rectify the inaccuracies in their reporting and correct errors in the ownership data, our evaluation of the reported usage data in the corrected reports for the 25 facilities (listed in the Appendix VIII) revealed that inconsistencies in heating oil reporting persist. We urge DCAS to fully reconsider the recommendation and revisit their corrective plan.

- Improve its report preparation and review processes to ensure that all published information is complete and free of errors and inconsistencies.

DCAS Response: DCAS partially agreed with this recommendation. DCAS stated that its DEM staff pre-emptively implemented corrective actions to their reporting process to ensure all local law reports receive secondary review of the final PDF version.

- Coordinate with all stakeholders and explore options for timely collection and verification of heating fuel oil usage information.

DCAS Response: DCAS disagreed with this recommendation but indicated that they will work with their agency partners.

- Identify sources for complete reporting on building envelope assessment and envelope improvement status.

DCAS Response: DCAS disagreed with this recommendation. DCAS stated that the law does not require it to identify sources of building envelope assessments.

Auditor Comment: This recommendation emphasizes the importance of identifying and utilizing all available sources to obtain the required information.

- Ensure data integrity of facility-level data, including ownership status and agency affiliation.

DCAS Response: DCAS partially agreed with this recommendation.

Auditor Comment: See the auditor comment to recommendation #1.

- Evaluate the impact of inaccuracies in reported ownership status on other systems (such as Emission Reporting System and EPA Benchmarking) and critical tasks (such as Heat, Light, and Power (HLP) budget preparation).

DCAS Response: DCAS disagreed with the recommendation. DCAS stated that the Owned/Leased status of the facilities does not have an impact on building benchmarking nor HLP budget preparation, so no impact needs to be evaluated.

Auditor Comment: The imprecise ownership status has a significant impact on the City’s different indicators and the accounting of its operations. If facilities are classified as leased instead of owned, it would lead to an underreporting of fossil fuel consumption for the City-owned facilities. This, in turn, may result in the underreporting of emissions for the City, creating a false impression of progress towards the City’s reduction goals.

- Post the revised and corrected LL45 annual reports so that they can be easily found on the agency website, with clear indication of the corrections, and notify all stakeholders, as appropriate.

DCAS Response: DCAS agreed with this recommendation.

Recommendations Follow-up

Follow-up will be conducted periodically to determine the implementation status of each recommendation contained in this report. Status updates are reported in the Audit Recommendations Tracker available here: https://comptroller.nyc.gov/services/for-the-public/audit/audit-recommendations-tracker/

Scope and Methodology

We conducted this performance audit in accordance with Generally Accepted Government Auditing Standards (GAGAS). GAGAS requires that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions within the context of our audit objectives. This audit was conducted in accordance with the audit responsibilities of the City Comptroller as set forth in Chapter 5, §93, of the New York City Charter.

The scope of this audit was LL45 annual reports published by DCAS for the Fiscal Years 2018 through 2021.

From DCAS’ website, the auditors obtained background information about DCAS’ and DEM’s mission to serve as the hub for energy management in City buildings. To understand DEM’s policies and procedures, the auditors obtained the following documents and reviewed them.

- Local Law 45 of 2018.

- LL45 annual reports for FY18, FY19, FY20, and FY21.

- DEM organizational charts and a list of key personnel.

- Other associated offices’ functions, including Energy Supply, Strategic Planning, and Operations, and their responsibilities and work plan explanations.

The auditors requested and obtained access to DCAS’ EC3 (Energy Cost Control and Conservation) Portal, where all electrical usage data is maintained and tracked.[24]

The auditors conducted virtual walkthroughs to understand DEM’s processes, procedures, and relevant internal controls for preparing the annual reports. They interviewed appropriate key DEM officials, including Assistant Commissioners, Senior Advisors, and the Senior Analyst responsible for preparing the annual reports. The auditors obtained and reviewed a sample building envelope assessment and conducted additional walkthroughs to understand the collection and reporting of energy usage data, including electrical usage adjustment data. The auditors asked for further information and clarifications as necessary.

The auditors reviewed LL45 and determined the stipulated reporting items. Next, the auditors reviewed the annual reports to determine whether the reports included all the reporting areas. Subsequently, the auditors compared the results of reviews of all annual reports.

The auditors requested and obtained Excel versions of all appendices included in the annual reports. The auditors conducted a data reliability analysis of the listed information in the appendices and obtained clarifications/updates.

The auditors conducted in-depth reviews of the LL45 annual reports for FY18 and FY19 and performed assessments of the FY20 and FY21 annual reports as deemed necessary. The auditors’ assessments included compliance with the LL45 requirements and accuracy, completeness, and reliability of the reported performance statements and data. The auditors tabulated the reported information and data presented in the narrative parts of the annual reports and performed validation tests on the reported information. As a part of the validation, the auditors performed various data analyses on the Excel versions of the appendices provided by DCAS to identify any discrepancies and errors in the reported information. For verification and reconciliation, as a standard, the auditors used requirements of Comptroller’s Directive #1, Principles of Internal Control, Section 4.3, Control Activities under Standards of Control.

The auditors performed various analytics[25] for comparison of the FY18 and FY19 data, as well as for the four reporting years. Furthermore, they conducted additional tests to assess accuracy and consistency of the agency affiliation and ownership status information, electrical usage adjustments, and building envelope assessment and improvement status. The auditors requested additional information, clarifications, and documents from DCAS as needed during the audit and at the end of the fieldwork to ensure that the agency submitted all necessary information and substantiating documentation.

The results of the above procedures and tests provided a reasonable basis for the auditors to evaluate DCAS’ compliance with LL45 reporting requirements and to form an opinion on DCAS’ reporting on LL45.

Appendix I

Electricity Usage ─ FY18 Annual Report Data Validation

Electricity Usage ─ FY19 Annual Report Data Validation

Fossil Fuel Usage ─ FY18 Annual Report Data Validation

Fossil Fuel Usage ─ FY19 Annual Report Data Validation

Appendix II

Summary of Discrepancies in the Number of Listed Facilities between Published Reports and Corresponding Excel Files

Appendix III

Discrepancies in Ownership Status of Covered Facilities by Agency/Organization (Table 1 – FY18 Report)

Discrepancies in Ownership Status of Covered Facilities by Agency/Organization (Table 1 – FY19 Report)

Appendix IV

Discrepancies in Ownership Status between the FY18 and FY19 Annual Reports

Discrepancies in Agency/Organization Status between the FY18 and FY19 Annual Reports

Appendix V

Discrepancies in Ownership Status between the FY18, FY19, FY20 and FY21 Annual Reports

Appendix VI

Auditors’ Calculated Adjustments to Fossil Fuel and Steam Usage Resulting from Ownership Issues in Table 3 of the FY18 and FY19 Reports

Appendix VII

Additional Examples of Data Integrity Issues Identified by the Auditors

Appendix VIII

Discrepancies and Inconsistencies in the FY17 Heating Fuel Oil Usage Reporting in the Annual Reports Identified by the Auditors

Endnotes

[1] DCAS’ public-facing Local Law Required Reports are posted on their website (https://www.nyc.gov/site/dcas/reports/Local-Law-Required-Reports.page). However, the revised LL45 annual reports are posted in an archive folder on their website (https://www.nyc.gov/site/dcas/agencies/energy-archive.page).

[2] Audit Report on the Department of Citywide Administrative Services’ Energy Conservation Efforts (7E14-120A)

[3] LL45 defines a covered facility as a City-owned or leased facility for which the City is responsible for paying electric utility bills, and where at least one electricity account exists for which demand was at least 300 kilowatts (kW) during the previous fiscal year.

[4] Under the law, DCAS is no longer required to issue any additional LL45 annual reports after the FY21 report. DCAS is still responsible for monitoring electricity and fossil fuel usage, RTM installations, and training agency personnel.

[5] An RTM (also known as telemetry equipment) allows electricity to be measured and reported in near-real time. A building envelope includes the building’s exterior walls, foundation, roof, windows, and doors that separate the indoors from the outdoors which facilitate climate controlclimate control.

[6] Per DCAS, the FY18 report was published in February 2019, the FY19 report in February 2020, the FY20 report in August 2021, and the FY21 report in January 2022. Per DCAS, it provided the annual reports to the City Council and the Mayor. The auditors found that for public access, DCAS publishes reports required under various Local Laws on its website at https://www.nyc.gov/site/dcas/reports/Local-Law-Required-Reports.page. In the past, links for the FY18 and FY19 annual reports under a reporting section titled “Energy Management Local Law 45” were present. As of January 24, 2023, a link for the LL45 FY18 report “Local Law 45 Report December 2018” is present but inactive.

[7] In addition, discrepancies and errors between title headings and underlying data made review, verification, and reconciliation difficult for the auditors.

[8] Defined by DCAS as natural gas, steam, and heating fuel oil usages. Steam is produced by the burning of fossil fuels locally.

[9] Per DCAS’ FY19 usage data for the Municipal Building, the total fuel + steam usage was 41,142 MMBTU per year and total electricity + solar usage was 13,667,200 kWh per year, which is equal to 46,634 MMBTU per year (based on 1 MMBTU = 293.07 kWh)—resulting in the total energy usage of 87,776 MMBTU per year.

[10] In the FY18 annual report, at four facilities (Port Richmond Water Resource Recovery Facility, X405 School, X475 School, and Ferry Maintenance Shop), the reported FY16 Total Electricity Usage values did not match the entries in the provided Excel file. The total electricity usage varied by over 1,000,000 kWh or 4% of the usage at those facilities in the published report compared to the usage listed in the corresponding DCAS Excel file used for the annual report.

[11] According to DCAS, the revised and corrected versions of the annual reports can be found in an archive folder on their website (https://www.nyc.gov/site/dcas/agencies/energy-archive.page). DCAS’ public-facing Local Law Required Reports webpage is in a different location on their website (https://www.nyc.gov/site/dcas/reports/Local-Law-Required-Reports.page).

[12] Also, according to DCAS, LL45 reporting represents a minority of the over 4,000 municipal facilities for which DEM pays utility bills.

[13] DCAS did not report on the envelope improvement status in the FY18 or FY19 annual reports. DCAS added Appendix E starting with the FY20 annual report.

[14] Appendix D in the FY18 published report contained four more entries than the Excel version of the same appendix provided by DCAS (the printed version contained 624 facilities, but the Excel file had only 620 facilities). Appendix D of the FY19 published report was missing 344 facilities (the printed version contained only 282 facilities; the Excel file 626 facilities). Appendix D in the FY21 report, both the published version and the provided Excel file, contained 571 facilities, a far greater number than the 459 facilities listed in Appendix C, which reported on City-owned facilities only. Appendix D should also have included the same 459 City-owned facilities. However, Appendix D in the FY21 report contained both City-owned and leased facilities. Only one facility was correctly omitted, Falchi Building (Agency: TLC / Ownership Status: Leased).

[15] At 77 facilities, the ownership status had changed from FY18 to FY19. At 71 facilities, the status changed from “City-owned” to “Leased,” and at the remaining six facilities, it changed from “Leased” to “City-owned.” When questioned, DCAS acknowledged the mistakes. Per DCAS, 26 facilities were reported as “City-owned” when in fact, they were “Leased” in the FY18 report, and 45 facilities that were reported as “Leased” were “City-owned” in the FY19. In addition, there were discrepancies in agency/organization information at 10 facilities. When questioned, DCAS acknowledged mistakes at 6 of the 10 facilities in the FY19 annual report.

[16] The auditors’ analysis reflects an adjustment in Total Fossil Fuel + Steam Usage after corrected ownership status, calculated for only one of the five years [emphasis added]. The original usage reported in Table 3 of the FY19 annual report for the FY2018 usage was 7,762,558 MMBTU. The revised usage was 10,042,620 MMBTU—a difference of 2,280,061 MMBTU or 29.37% more than the originally reported usage. It means that potentially 125,000 metric tons of GHG emissions may not have been included in the reported GHG emissions from City-owned facilities in 2018 data, as reported in the FY19 report. (This projection is based on a conversion used by DCAS in the FY19 annual report to calculate energy savings to GHG emissions avoided. DCAS reported that 67,000 MMBTU energy savings translated into approximately 3,700 metric tons of GHG emissions avoided). DCAS will need to correct the reported usages for each of the five years in each annual report, based on corrected ownership status, to compute actual corrections in the usages as well as five-year usage changes for natural gas, heating fuel oil and steam, both individually and cumulatively.

[17] The auditors’ comparison of ownership statuses across all four annual reports found that reported ownership status at an additional 80 facilities was not consistent year-to-year. In addition, ownership status discrepancies were present at nine other facilities which were part of the 77 facility ownership statuses DCAS already corrected. Furthermore, there is no way to determine potential discrepancies that may have been present in cases where an erroneous ownership status was used consistently over the four years.

[18] Additionally, for City-owned facilities only, in conjunction with the appropriate City agency, DCAS must coordinate the installation of RTMs where DCAS has determined that installation is appropriate and practicable; and following the installation, DCAS shall train agency personnel responsible for such facility in using the RTM to monitor electricity usage.

[19] In its response, DCAS also commented on its RTM installation planning and reporting on total RTM installations under its portfolio. However, the Draft Report did not make any references to these, and it is unclear why these comments were included.

[20] In many instances, the reported Envelope Improvement Recommended statuses included comments such as “no envelope improvements recommended” and “still being determined” instead of a description of a recommended improvement. Similarly, for the “Status of Recommended Improvement” section, instead of “commenced,” “in process” or “completed,” in many instances the comments included “still under consideration,” “N/A,” “will be installed,” “date TBD,” etc.

[21] For FY20 and FY21, the auditors did not analyze the reporting data in Appendix D and Appendix E due to issues found in the ownership status of the reported facilities.

[22] Per DCAS, data on natural gas and district steam usage come from monthly utility billing information. For heating fuel oil, City agencies are responsible for tracking their oil usage and reporting usage to DEM.

[23] As FY17 was a year included in all four reports, the heating fuel oil data (FY17 usage) for facilities that appear in all four reports should be consistent in Appendix C of the reports.

[24] The auditors were provided data level access. The access granted did not include the capability to run administrative reports.

[25] Consistency in the reported agency and ownership designations, accuracy and verification of facility name, address, and energy usages between different report appendices as well as between different annual reports, changes in RTM installation status between different annual reports, and adequacy of the information reported for building envelope assessments and improvements between different appendices in the same reporting year and in different annual reports were assessed by the auditors.