Comments on New York City’s Fiscal Year 2020 Adopted Budget

Executive Summary

The Fiscal Year (FY) 2020 Adopted Budget totals $92.8 billion. As adopted, FY 2020 spending is $662 million less than the final modified condition for FY 2019. But the prepayments of debt service and certain subsidies obscures actual spending trends. Adjusted for prepayments, prior-year adjustments, and for budgeted reserves, spending is set to grow by 1.6 percent, or $1.5 billion, to $95.6 billion.

The budget is funded with $68.5 billion in City funds, including $63.4 billion in tax revenues. Real property taxes total $29.8 billion, or 47 percent of total tax revenues, and personal income taxes make up another 21 percent, or $13.4 billion. Tax revenues are projected to grow by 3.4 percent over FY 2019, while non-tax City funds revenues are projected to decline.

Salaries and wages, debt service, health insurance and other (non-pension) fringe benefits are the largest drivers of spending, together growing 5.6%, or $2.6 billion in FY 2020 compared to FY 2019. Other spending components, including pensions and judgments and claims, are projected to be nearly flat, while contractual services and other non-personnel costs are projected to decline (although this will likely not be the case by year end, once additional federal categorical grants are recognized in the budget).

New spending in FY 2020 since the Executive Budget, excluding the increase to the general reserve, totals $940 million.[1] This includes $454 million in City Council initiatives, complemented by $258 million in spending by the Administration on priorities identified by the Council (including $61 million in baselined spending for libraries, parks maintenance, and youth programs). Other new spending needs total $141 million in FY 2020 and $93 million in the outyears. Approximately $109 million in unspent funds from FY 2019 was rolled over into FY 2020 ($87 million) and the outyears.

The new spending is only partially offset by additional actions in the Citywide Savings Plan of $798 million over FY 2019 – FY 2023, two-thirds of which are due to savings from bond refinancings. The rest consist of re-estimates of health insurance costs ($83 million) and savings from vacant positions ($104 million). The FY 2020 savings is estimated to be $88 million.

Other spending that will be reflected in subsequent budget modifications includes an agreement to provide pay parity for certified contract child care workers with their Department of Education counterparts, and for criminal and civil defense attorneys. The former is estimated to cost up to $29 million in FY 2020, rising to $57 million in FY 2023. In addition, the Administration, at the City Council’s behest, agreed to review and when warranted increase, on a case-by-case basis, the overhead reimbursement rate for social services contracts. The costs of an agreement with non-City attorneys and for adjustments to contract reimbursement rates are unknown at this time.

The FY 2020 budget includes a General Reserve of $1.15 billion, alongside the Capital Stabilization Reserve of $250 million. The City also deposited $100 million above the amount needed for FY 2091 retiree health benefits at the end of FY 2019 to the Retiree Health Benefits Trust, bringing its balance to $4.6 billion.

The amount of the budget surplus generated in FY 2019, however, was $355 million less than that in FY 2018: $4.221 billion, versus $4.576 billion. This led to a decline in the budget cushion – the sum of budget reserves, prepayments, and Retiree Health Benefits Trust balances — from 11.3 percent of budgeted spending at the beginning of FY 2019, to 10.7 percent at the beginning of FY 2020.

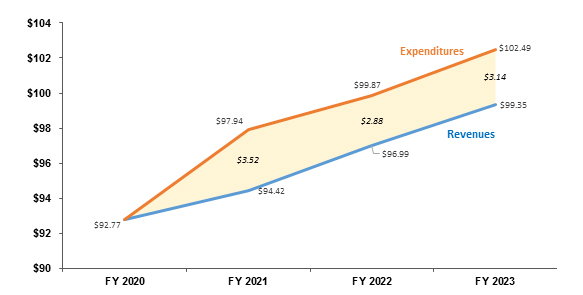

Budget gaps in the outyears of the Financial Plan are $3.52 billion in FY 2021, $2.88 billion in FY 2022, and $3.14 billion in FY 2023 — little changed from the Executive Budget plan.

The Office of the Comptroller’s estimates of revenues are above the Administration’s by $755 million in FY 2020, rising to almost $1.9 billion in FY 2023, largely due to differences in estimated real property tax revenues.

On the expenditure side, however, we identify several sources of spending risk, notably civilian overtime spending; funding for the Fair Fares program; the cost of State-mandated charter school tuition reimbursements; and spending for single adult homeless shelter operations, among others. Altogether, spending risks total $183 million in FY 2020, rising to $939 million by FY 2023. Taken together, our risks and offsets result in a projected $572 million surplus at the end of FY 2020, followed by gaps that are smaller in the outyears than those projected by the Administration by between $948 million and $1 billion.

Table 1. FY 2020 – FY 2023 Financial Plan

| ($ in millions) | FY 2020 | FY 2021 | FY 2022 | FY 2023 | Change FYs 2020 –2023 Dollar Percent |

|

| Revenues | ||||||

| Taxes: | ||||||

| General Property Tax | $29,785 | $31,089 | $32,328 | $33,286 | $3,501 | 11.8% |

| Other Taxes | 32,637 | 33,211 | 34,180 | 35,113 | 2,476 | 7.6% |

| Tax Audit Revenues | 999 | 721 | 721 | 721 | (278) | (27.8%) |

| Subtotal: Taxes | $63,421 | $65,021 | $67,229 | $69,120 | $5,699 | 9.0% |

| Miscellaneous Revenues | 6,957 | 6,909 | 6,882 | 6,876 | (81) | (1.2%) |

| Less: Intra-City Revenues | (1,820) | (1,817) | (1,815) | (1,814) | 6 | (0.3%) |

| Disallowances Against Categorical Grants | (15) | (15) | (15) | (15) | 0 | 0.0% |

| Subtotal: City-Funds | $68,543 | $70,098 | $72,281 | $74,167 | $5,624 | 8.2% |

| Other Categorical Grants | 928 | 870 | 863 | 863 | (65) | (7.0%) |

| Inter-Fund Revenues | 735 | 672 | 672 | 672 | (63) | (8.6%) |

| Federal Categorical Grants | 7,228 | 7,071 | 6,998 | 6,967 | (261) | (3.6%) |

| State Categorical Grants | 15,338 | 15,710 | 16,178 | 16,683 | 1,345 | 8.8% |

| Total Revenues | $92,772 | $94,421 | $96,992 | $99,352 | $6,580 | 7.1% |

| Expenditures | ||||||

| Personal Service | ||||||

| Salaries and Wages | $30,041 | $30,935 | $30,787 | $31,674 | $1,633 | 5.4% |

| Pensions | 9,963 | 10,130 | 10,576 | 10,632 | 669 | 6.7% |

| Fringe Benefits | 11,342 | 11,854 | 12,527 | 13,228 | 1,886 | 16.6% |

| Subtotal-PS | $51,346 | $52,919 | $53,890 | $55,534 | $4,188 | 8.2% |

| Other Than Personal Service | ||||||

| Medical Assistance | $5,915 | $5,915 | $5,915 | $5,915 | $0 | 0.0% |

| Public Assistance | 1,651 | 1,651 | 1,651 | 1,650 | (1) | (0.1%) |

| All Other | 31,272 | 30,476 | 30,787 | 31,020 | (252) | (0.8%) |

| Subtotal-OTPS | $38,838 | $38,042 | $38,353 | $38,585 | ($253) | (0.7%) |

| Debt Service | ||||||

| Principal | $3,613 | $3,726 | $3,859 | $3,967 | $354 | 9.8% |

| Interest & Offsets | 3,616 | 3,822 | 4,334 | 4,971 | 1,355 | 37.5% |

| Subtotal Debt Service | $7,229 | $7,548 | $8,193 | $8,938 | $1,709 | 23.6% |

| FY 2019 BSA and Discretionary Transfers | ($4,221) | $0 | $0 | $0 | $4,221 | (100.0%) |

| Capital Stabilization Reserve | $250 | $250 | $250 | $250 | $0 | 0.0% |

| General Reserve | $1,150 | $1,000 | $1,000 | $1,000 | ($150) | (13.0%) |

| Less: Intra-City Expenses | ($1,820) | ($1,817) | ($1,815) | ($1,814) | $6 | (0.3%) |

| Total Expenditures | $92,772 | $97,942 | $99,871 | $102,493 | $9,721 | 10.5% |

| Gap To Be Closed | $0 | ($3,521) | ($2,879) | ($3,141) | ($3,141) | NA |

Note: Numbers may not add to totals due to rounding.

Table 2. Plan-to-Plan Changes June 2019 Plan vs. April 2019 Plan

($ in millions) |

FY 2020 | FY 2021 | FY 2022 | FY 2023 |

| Revenues | ||||

| Taxes: | ||||

| General Property Tax | $74 | $0 | $0 | $0 |

| Other Taxes | 222 | 0 | 0 | 0 |

| Tax Audit Revenues | 0 | 0 | 0 | 0 |

| Subtotal: Taxes | $296 | $0 | $0 | $0 |

| Miscellaneous Revenues | 2 | (2) | (2) | ($3) |

| Less: Intra-City Revenues | (1) | 0 | 0 | $0 |

| Disallowances Against Categorical Grants | 0 | 0 | 0 | $0 |

| Subtotal: City-Funds | $297 | ($2) | ($2) | ($3) |

| Other Categorical Grants | 0 | 0 | 0 | $0 |

| Inter-Fund Revenues | 0 | 0 | 0 | $0 |

| Federal Categorical Grants | 2 | 2 | 0 | $1 |

| State Categorical Grants | 5 | (9) | (8) | ($10) |

| Total Revenues | $304 | ($9) | ($10) | ($12) |

| Expenditures | ||||

| Personal Service | ||||

| Salaries and Wages | $63 | $30 | $30 | $29 |

| Pensions | 12 | 12 | 12 | 12 |

| Fringe Benefits | (52) | 1 | 0 | 0 |

| Subtotal-PS | $23 | $43 | $42 | $41 |

| Other Than Personal Service | ||||

| Medical Assistance | $0 | $0 | $0 | $0 |

| Public Assistance | 0 | 0 | 0 | 0 |

| All Other | 846 | 65 | 69 | 62 |

| Subtotal-OTPS | $846 | $65 | $69 | $62 |

| Debt Service | ||||

| Principal | $0 | $0 | $0 | $0 |

| Interest & Offsets | (9) | (77) | (122) | (132) |

| Subtotal Debt Service | ($9) | ($77) | ($122) | ($132) |

| FY 2019 BSA and Discretionary Transfers | ($705) | $0 | $0 | $0 |

| Capital Stabilization Reserve | $0 | $0 | $0 | $0 |

| General Reserve | $150 | $0 | $0 | $0 |

| Less: Intra-City Expenses | ($1) | $0 | $0 | $0 |

| Total Expenditures | $304 | $31 | ($11) | ($29) |

| Gap To Be Closed | $0 | ($40) | $1 | $17 |

Note: Numbers may not add to totals due to rounding.

Table 3. Plan-to-Plan Changes June 2019 Plan vs. June 2018 Plan

| ($ in millions) | FY 2020 | FY 2021 | FY 2022 |

| Revenues | |||

| Taxes: | |||

| General Property Tax | $308 | $198 | $448 |

| Other Taxes | 486 | 61 | 286 |

| Tax Audit Revenues | 278 | 0 | 0 |

| Subtotal: Taxes | $1,072 | $259 | $734 |

| Miscellaneous Revenues | 226 | 172 | 166 |

| Unrestricted Intergovernmental Aid | 0 | 0 | 0 |

| Less: Intra-City Revenues | (49) | (41) | (39) |

| Disallowances Against Categorical Grants | 0 | 0 | 0 |

| Subtotal: City-Funds | $1,249 | $390 | $861 |

| Other Categorical Grants | 56 | 3 | 2 |

| Inter-Fund Revenues | 94 | 34 | 34 |

| Federal Categorical Grants | 99 | (37) | (94) |

| State Categorical Grants | 36 | (53) | (68) |

| Total Revenues | $1,534 | $337 | $735 |

| Expenditures | |||

| Personal Service | |||

| Salaries and Wages | $421 | $567 | $718 |

| Pensions | 60 | (32) | 209 |

| Fringe Benefits | (301) | (560) | (567) |

| Subtotal-PS | $180 | ($25) | $360 |

| Other Than Personal Service | |||

| Medical Assistance | $0 | $0 | $0 |

| Public Assistance | 34 | 34 | 34 |

| All Other | 2,424 | 1,309 | 1,341 |

| Subtotal-OTPS | $2,458 | $1,343 | $1,375 |

| Debt Service | |||

| Principal | ($23) | $94 | $98 |

| Interest & Offsets | (221) | (402) | (465) |

| Subtotal Debt Service | ($244) | ($308) | ($367) |

| FY 2019 BSA and Discretionary Transfers | ($4,221) | $0 | $0 |

| Capital Stabilization Reserve | $0 | $0 | $0 |

| General Reserve | $150 | $0 | $0 |

| Less: Intra-City Expenses | ($49) | ($41) | ($39) |

| Total Expenditures | ($1,726) | $970 | $1,329 |

| Gap To Be Closed | $3,260 | ($633) | ($594) |

Note: Numbers may not add to totals due to rounding.

Table 4. Risks and Offsets to the June 2019 Financial Plan

($ in millions, positive numbers decrease the gap and negative numbers increase the gap)

| FY 2020 | FY 2021 | FY 2022 | FY 2023 | |

| City Stated Gap | $0 | ($3,521) | ($2,879) | ($3,141) |

| Tax Revenues | ||||

| Property Tax | $200 | $387 | $735 | $1,085 |

| Personal Income Tax | 148 | 387 | 335 | 237 |

| Business Taxes | 78 | 111 | 148 | 178 |

| Sales Tax | 114 | 103 | 34 | (35) |

| Real Estate Transaction Taxes | 202 | 321 | 299 | 241 |

| Audit | 0 | 154 | 154 | 154 |

| Subtotal Tax Revenues | $742 | $1,463 | $1,705 | $1,860 |

| Non-Tax Revenues | ||||

| ECB Fines | $10 | $10 | $15 | $15 |

| Late Filing/No Permit Penalties | 0 | 5 | 5 | 5 |

| Other Fines | 3 | 3 | 3 | 3 |

| Subtotal Non-Tax Revenues | $13 | $18 | $23 | $23 |

| Total Revenues | $755 | $1,481 | $1,728 | $1,883 |

| Expenditures | ||||

| Overtime | ($140) | ($150) | ($150) | ($150) |

| Charter School Tuition | 0 | (150) | (334) | (562) |

| Fair Fare | 0 | (212) | (212) | (212) |

| Homeless Shelters | (74) | (74) | (74) | (74) |

| DOE Medicaid Reimbursement | (20) | (20) | (20) | (20) |

| Early Childhood Teacher Salary Parity | (29) | (26) | (55) | (57) |

| VRDB Interest Savings | 80 | 80 | 80 | 80 |

| Pension Contributions | 0 | 19 | 37 | 56 |

| Subtotal Expenditures | ($183) | ($533) | ($728) | ($939) |

| Total (Risks)/Offsets | $572 | $948 | $1,000 | $944 |

| Restated (Gap)/Surplus | $572 | ($2,573) | ($1,879) | ($2,197) |

Note: Numbers may not add to totals due to rounding.

The FY 2020 Adopted Budget

Overview

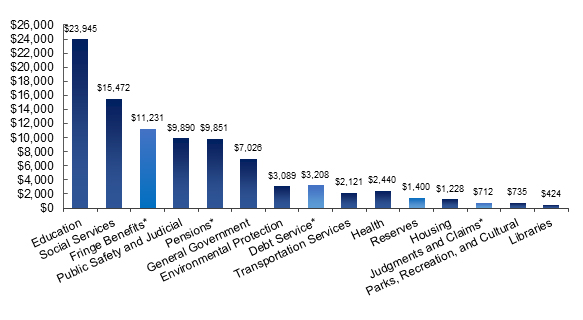

The FY 2020 Adopted Budget totals $92.77 billion. About three-quarters of the budget is allocated for education, social services, fringe benefits, public safety and judicial, and pensions, which together consume $70.4 billion of the budget. Spending on general government, including the Mayoralty Office, the Office of the Comptroller, the City Council, Department of Finance and Department of Citywide Administrative Services, accounts for about 7.5 percent of the budget. The Adopted Budget includes a General Reserve of $1.15 billion and a Capital Stabilization Reserve of $250 million. Together these reserves account for 1.5 percent of the budget. Chart 1 shows the allocation of the FY 2020 budget by service areas and centrally budgeted expenditures such as fringe benefits, debt service and pension contributions.

Chart 1. FY 2020 Budget by Service Areas and Centrally Budgeted Expenditures

($ in millions)

* Centrally Budgeted Expenditures

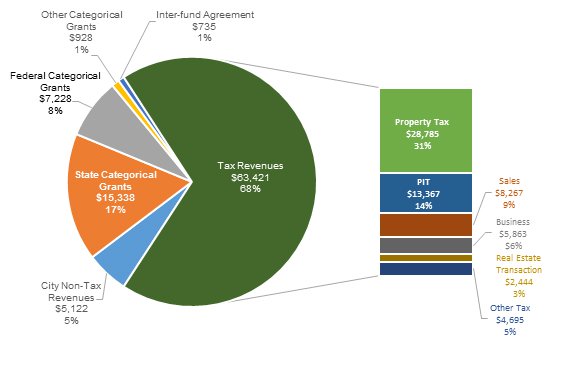

Approximately 74 percent of the budget is supported by City-generated revenues of $68.5 billion. Tax revenues, which are projected to total $63.4 billion, account for the bulk of City-generated revenues, as shown in Chart 2. Real property and personal income tax (PIT) revenues account for about two thirds of total tax revenues, with property tax revenues making up 47 percent of total tax revenues and PIT revenues constituting another 21 percent. City-generated non-tax revenues include revenues from licenses, permits and franchises; interest income; charges for services; water and sewer payments from the New York City Water Board; fines and forfeitures; and miscellaneous other non-tax revenues. Revenues from charges for services ($1.0 billion) and New York City Water Board payments ($1.5 billion) account for almost half of City-generated non-tax revenues.[2]

Chart 2. Funding Sources, FY 2020 Budget

($ in millions)

State categorical grants, which support many mandated programs, are estimated at $15.3 billion, accounting for more than 63 percent of non-City revenues. About two-thirds of State categorical grants are earmarked for education.

Federal categorical grants account for another $7.2 billion of non-City revenues. More than 45 percent of Federal grants go towards social services and account for more than one-fifth of total funding for social services. A significant portion of the budgets of the City’s social services agencies relies on Federal funding, including 38 percent of the budget for the Administration for Children’s Services (ACS), 31 percent of the budget for the Department of Homeless Services (DHS), 18 percent of the budget for the Department for the Aging (DFTA), and 15 percent of the budget for the Department of Social Services/Human Resources Administration (HRA).

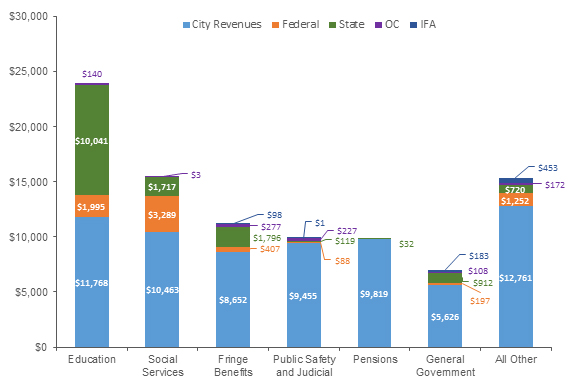

Other categorical grants and inter-fund agreement (IFA) revenues round out the remaining non-City generated revenues. Other categorical grants consist primarily of reimbursements to the Fire Department for emergency medical services; reimbursements for health benefits from Health Stabilization Fund; payments from Health +Hospitals (H + H) for fringe benefits, judgments and claims, and energy costs; interest exchange agreements, and private grants from foundations and other sources. IFA revenues are reimbursements from the Capital Fund for expense budget costs related to capital projects such as planning design and construction supervision. Chart 3 shows the funding allocation among the different service areas of the budget.

Chart 3. Funding Allocation by Service Areas and Centrally Budgeted Expenditures

($ in millions)

Changes from FY 2019

As shown in Table 5, the FY 2020 Adopted Budget is $662 million less than the modified FY 2019 budget. The decline in revenues is due to a projected $1.69 billion drop in non-City-funds revenues, offset in part by a projected increase of $1.03 billion in City-funds revenues. The drop in non-City-funds revenues is driven primarily by a reduction of $1.34 billion in Federal categorical grants. The winding down of disaster recovery Community Development Block Grants (CDBG), which is projected to drop from $469 million in FY 2019 to $50.2 million in FY 2020, accounts for $419 million of the reduction. Another $517 million decrease is due to grants that are included in FY 2019 but not in the outyears, either because they are non-recurring or because they are typically included only in budget modifications subsequent to budget adoption. Of the remaining non-City funds revenues, State and other categorical grants are projected to drop by $158 million and $284 million, respectively, while IFA revenues are projected to increase by $84 million.

The net growth in City-funds revenues result from an increase of $2.10 billion in tax revenues and a decrease of about $1.10 billion in non-tax revenues. Property tax revenues account for the bulk of the growth in tax revenues with a projected increase of $1.86 billion to $29.8 billion in FY 2020. The 6.7 percent growth in property tax revenues is consistent with the average annual growth of 6.9 percent from FY 2014 to FY 2018. Overall, tax revenues are projected to grow by 3.4 percent in FY 2020, a marginal decrease from the 3.8 percent growth estimated for FY 2019 and below the average annual growth of 5.1 percent from FY 2014 to FY 2018.

Table 5. Change FY 2019 – FY 2020

| ($ in millions) | FY 2019 | FY 2020 | $ Change | % Change |

| Revenues | ||||

| Taxes | ||||

| General Property Tax | $27,926 | $29,785 | $1,859 | 6.7% |

| Other Taxes | 32,340 | 32,637 | 297 | 0.9% |

| Tax Audit Revenues | 1,058 | 999 | (59) | (5.6%) |

| Subtotal Taxes | $61,324 | $63,421 | $2,097 | 3.4% |

| Miscellaneous Revenues | 8,157 | 6,957 | (1,200) | (14.7%) |

| Unrestricted Intergovernmental Aid | 201 | 0 | (201) | (100.0%) |

| Less: Intra-City Revenues | (2,261) | (1,820) | 441 | (19.5%) |

| Disallowances Against Categorical Grants | 91 | (15) | (106) | (116.5%) |

| Subtotal City-Funds | $67,512 | $68,543 | $1,031 | 1.5% |

| Other Categorical Grants | $1,212 | $928 | (284) | (23.4%) |

| Inter-Fund Revenues | $651 | $735 | 84 | 12.9% |

| Federal Categorical Grants | $8,563 | $7,228 | (1,335) | (15.6%) |

| State Categorical Grants | $15,496 | $15,338 | (158) | (1.0%) |

| Total Revenues | $93,434 | $92,772 | ($662) | (0.7%) |

| Expenditures | ||||

| Personal Services | ||||

| Salaries and Wages | $29,051 | $30,041 | $990 | 3.4% |

| Pensions | 9,945 | 9,963 | 18 | 0.2% |

| Fringe Benefits | 10,582 | 11,342 | 760 | 7.2% |

| Retiree Health Benefits Trust | 100 | 0 | (100) | (100.0%) |

| Subtotal PS | $49,678 | $51,346 | $1,668 | 3.4% |

| Other Than Personal Service | ||||

| Medical Assistance | $5,915 | $5,915 | $0 | 0.0% |

| Public Assistance | 1,595 | 1,651 | 56 | 3.5% |

| All Other | 32,407 | 31,272 | (1,135) | (3.5%) |

| Subtotal OTPS | $39,917 | $38,838 | ($1,079) | (2.7%) |

| Debt Service | ||||

| Principal | $3,411 | $3,613 | $202 | 5.9% |

| Interest & Offsets | 3,024 | 3,616 | 592 | 19.6% |

| Subtotal Debt Service | $6,435 | $7,229 | $794 | 12.3% |

| FY 2018 BSA & Discretionary Transfer | ($4,576) | $0 | NA | NA |

| FY 2019 BSA & Discretionary Transfer | $4,221 | ($4,221) | NA | NA |

| Capital Stabilization Reserve | $0 | $250 | NA | NA |

| General Reserve | $20 | $1,150 | NA | NA |

| Less: Intra-City Expenses | ($2,261) | ($1,820) | $441 | (19.5%) |

| Total Expenditures | $93,434 | $92,772 | ($662) | (0.7%) |

Note: Numbers may not add due to rounding

The projected $1.10 billion decrease in FY 2020 City-funds non-tax revenues reflects primarily the loss of non-recurring FY 2019 revenues. Altogether, the FY 2019 budget includes approximately $750 million of non-recurring revenues that are not projected to extend beyond the current fiscal year. These include:

- $254 million from asset sales

- $152 million in H+H reimbursements, primarily for debt service

- $35 million in recoupment for prior-year expenses

- $201 million in Federal reimbursement for prior expenses related to Medicaid, United Nations security services, and FEMA eligible expenses.

- The release of $106 million from the reserve for disallowances for categorical grants.[3]

In addition, the estimated FY 2020 revenues from restitution are about $220 million below that of FY 2019. Restitution revenues in FY 2019 were boosted by settlements with Société Générale S.A. and Standard Chartered Bank (STB) to resolve charges of transactions in violation of U.S. economic sanctions. The City’s shares of the restitutions from Société Générale and STB were $77.7 million and $141.7 million, respectively, for a total of $219.4 million.

Expenditures as presented in the FY 2020 Adopted Budget are reduced by the impact of FY 2019 prepayments. Similarly, the FY 2019 modified budget is reduced by the net impact of FY 2018 and FY 2019 prepayments. After netting out the impact from prepayments, FY 2020 expenditures before reserves total $95.59 billion, an increase of $1.52 billion or 1.6 percent from the adjusted FY 2019 expenditure, as shown in Table 6.

Table 6. FY 2020 Expenditures vs. FY 2019 Expenditures Adjusted for Prepayments

| ($ in millions) | FY 2019 | FY 2020 | $ Change | % Change |

| Salaries and Wages | $28,618 | $29,634 | $1,016 | 3.5% |

| Debt Service | $6,435 | 7,229 | $794 | 12.3% |

| Health Insurance | $6,382 | 7,032 | $650 | 10.2% |

| Other Fringe Benefits | $4,096 | 4,202 | $105 | 2.6% |

| Subtotal | $45,532 | $48,097 | $2,565 | 5.6% |

| Pensions | $9,833 | $9,851 | $18 | 0.2% |

| Medicaid | $5,915 | $5,915 | $0 | 0.0% |

| Public Assistance | $1,595 | $1,651 | $56 | 3.5% |

| Judgments and Claims | $697 | $712 | $15 | 2.1% |

| Contractual Services* | $17,835 | $17,131 | ($704) | (3.9%) |

| Other OTPS | $12,662 | $12,236 | ($426) | (3.4%) |

| Subtotal | $48,537 | $47,496 | ($1,041) | (2.1%) |

| Expenditures Before Reserves | $94,069 | $95,593 | $1,524 | 1.6% |

| RHBT Deposit | $100 | $0 | ($100) | NA |

| Prior-Year Adjustment | ($400) | $0 | $400 | NA |

| General Reserve | $20 | $1,150 | $1,130 | NA |

| Capital Stabilization Reserve | $0 | $250 | $250 | NA |

| Total | $93,789 | $96,993 | $3,204 | 3.4% |

*Excludes contractual services for debt service and Medicaid

Note: Numbers may not add due to rounding. Individual expenditure lines are net of intra-City sales, and as a result some expenditures in this table do not match the corresponding expenditures in Table 5, where intra-City expenses are net out of total expenses.

Expenditure growth in FY 2020 is driven by spending on salaries and wages, debt service, health insurance, and other (non-pension) fringe benefits. The combined spending in these areas is projected to grow by $2.57 billion. All other spending areas, excluding reserves, an RHBT deposit in excess of pay-go requirements, and prior-year adjustments, are projected to decline by $1.04 billion, driven by reductions in contractual services and other OTPS (Other than Personal Services) spending. These reductions reflect the drop in Federal funding discussed above. In total, at least $555 million and $480 million in FY 2019 Federal-funded contractual services and other OTPS spending, respectively, are not budgeted in FY 2020 and the outyears.

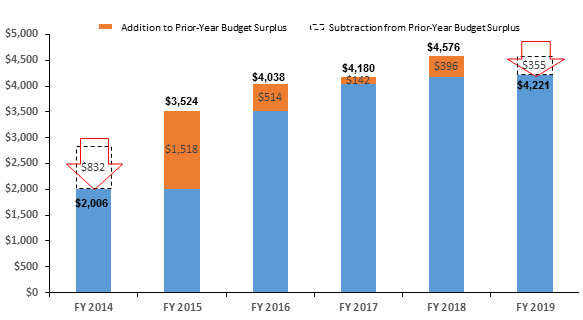

Accumulated Prior-Year Surplus and Prepayments

The FY 2020 Budget reflects prepayments of $4.02 billion of debt service and $200 million of H+H subsides. Without these prepayments, FY 2020 expenditures would be $4.22 billion higher, as discussed in “Changes from FY 2019” above. The prepayments in any given fiscal year represent the balance of the accumulated surpluses from previous fiscal years that can be rolled into future fiscal years.

In FY 2014, the City prepaid $2.06 billion of FY 2015 expenditures, a drawdown of $832 million of the accumulated surplus from prior-years, as shown in Chart 4.[4] Since then, the City has added to the accumulated surplus by increasing its prepayments in each subsequent year through FY 2018. As Chart 4 shows, in FY 2015, the City prepaid $3.524 billion of FY 2016 general fund expenses, $1.518 billion more than the prepayment of FY 2015 expenses.[5] This indicates that in addition to not needing the FY 2014 prepayment to balance FY 2015, the City was able to add to the accumulated surplus. This pattern of adding to the accumulated surplus continued through FY 2018. However, in FY 2019 the City prepaid $4.221 billion of FY 2020 expenditures, less than the prior-year’s prepayment, and balanced the budget by drawing down $355 million of the accumulated surplus.

Chart 4. Accumulation of the Year-End Surplus

($ in millions)

The drawdown of the accumulated surplus in FY 2019 is equal to almost the entire FY 2018 addition to the accumulated surplus. Additions to the accumulated surplus have been decreasing between FY 2015 and FY 2017. However, in FY 2018 the City added $396 million to the accumulated surplus, $254 million more than FY 2017 addition, aided by a boost in PIT revenues primarily from the shifting of income into FY 2018 due to the limitation on state and local tax (SALT) deductibility under the newly enacted tax provisions in the Tax Cuts and Jobs Act.

The Budget Cushion

The Comptroller’s Office measures prior-year accumulated resources and reserves — referred to as the budget cushion — to evaluate the City’s ability to weather a fiscal downturn. The FY 2019 prepayment and additional RHBT deposit, together with the $1.4 billion in the FY 2020 General Reserve and Capital Stabilization Reserve, brings the City’s budget cushion at the start of the FY 2020 to $10.2 billion — 10.7 percent of adjusted FY 2019 expenditures.[6] This is the first time the ratio has fallen below 11 percent in the last four years. The cushion is $1.2 billion shy of the lower threshold of 12 percent and $7.0 billion short of the upper threshold of 18 percent of adjusted expenditures recommended by the Comptroller’s Office.

The budget cushion is a broader measure than just cash reserves available in a given fiscal year. In FY 2020, for example, the budget reserves that could be drawn upon total $3.98 billion, which includes the $1.15 billion General Reserve, the $250 million Capital Stabilization Reserve, and payments of $2.58 billion for retiree health and welfare benefits, which could be covered by the existing balance in the Retiree Health Benefit Trust. This is equal to about 5 percent of budgeted tax revenues. It is worth recalling that in FY 2009, City tax revenues fell 7.1 percent — the equivalent of a $4.5 billion drop in FY 2020 — and did not fully recover for two years, even with increases in the real property and sales taxes. While no such decline is projected at this time during the Financial Plan period, prudent risk management dictates having as robust a hedge as possible against the unexpected.

Changes from the Executive Budget

The FY 2020 Budget as adopted is $304 million more than the Executive Budget presented in April. Revenue assumptions remain largely unchanged from the Executive Budget, with the increase due primarily to an increase of $296 million in tax revenues, driven by an increase of $222 million in PIT revenue. The increase in PIT revenue results from an upward revision of $503 million in FY 2019 PIT revenue due to stronger than expected collections, which provides a higher base for growth projection. PIT revenue is projected to grow by 1.0 percent in FY 2020, less than half the 3.3 percent growth projected in the Executive Budget. Overall, tax revenues are projected to grow by 3.4 percent, a marginal decrease from the 3.7 percent growth projected in the Executive Budget.

City-funds spending, net of prepayments, has been revised more substantially since the Executive Budget. Overall, City-funds expenditures are $1.0 billion higher than the Executive Budget. This spending increase is funded by a $705 million increase to the FY 2019 prepayments and a $297 million increase in City-funds revenues.[7] City Council initiatives account for $454 million of the City-funds expenditure increase. The Adopted Budget also added $150 million to the General Reserve, bringing it to $1.15 billion.

Additional agency expenditures total $486 million in FY 2020, including almost $198 million in one-time expenditures to address City Council budget priorities (not included as City Council “initiatives”), such as additional funding for libraries and cultural organizations, non-public school security, after-school summer programming, summer youth employment, and additional parks department maintenance staff, among others.[8] Another nearly $61 million in Council priorities, including library subsidies, parks maintenance, after-school programming and teacher classroom supplies were baselined by the Administration.[9]

The administration also funded approximately $68 million in one-time new spending needs in FY 2020, along with $56 million in spending baselined in the outyears (rising to $60 million by FY 2023), including initiatives such as senior center model budget for food, additional social workers in schools for homeless students, Vision Zero enhancements, and expansion of the speed zone camera program authorized in the State budget.

Finally, approximately $87 million of the FY 2020 agency spending increase is from the roll of FY 2019 expenses into FY 2020. New FY 2020 spending was partially offset by savings of $88 million from a new round of the Citywide Savings Program.

Citywide Savings Program

The June Plan adds another $798 million in savings over FY 2019 to FY 2023. These savings are partially offset by the restoration of $22 million in funding that was reduced in the last round of Citywide Savings Program in libraries, Department of Education (DOE), Department of Cultural Affairs (DCLA), Department of Sanitation (DOS) and Department of Small Business Savings (DSBS). The net impact of the current savings program and restoration brings the total savings over FY 2019 through FY 2023 to $5.95 billion. Savings begin at a high of $1.76 billion in FY 2019 and decline to $976 million by FY 2023. The combined savings in FY 2019 and FY 2020 total $2.86 billion, almost 50 percent of the total savings over the FY 2019 – FY 2023. Efficiency initiatives account for approximately 8% of the savings over the first two fiscal years of the Plan. The bulk of the savings are from debt service savings, re-estimates, funding-shifts, accrual savings and vacancy reductions.

Early Childhood Education Teacher Salary Parity

As part of the agreement on the FY 2020 budget, the mayor and City Council announced their intent to address salary parity between teachers in the City’s contracted early childhood program and Department of Education (DOE) as well as indigent legal providers’ staff and district attorney’s staff. After budget adoption, the Day Care Council of New York (DCCN) and Local 205, District Council 1707 of AFCME, AFL-CIO (Local 205) reached a tentative labor agreement on July 9, 2019. The schedule of salary increases in the tentative agreement provides for starting salary parity between certified early childhood education teachers represented by Local 205 working for City-contracted providers and DOE teachers by October 1, 2021. The framework of the tentative agreement provides a pattern for the remaining early childhood contracts. If implemented, the net cost of the settlement for the entire sector, including Local 205, will be $29.3 million, $26.4 million, $54.6 million and $56.6 million in FY 2020 through FY 2023, respectively.

The Outyears

While the FY 2020 budget is balanced, the June 2019 Financial Plan projects budget gaps of $3.52 billion in FY 2021, $2.88 billion in FY 2022, and $3.14 billion in FY 2023, as shown in Chart 5. Over this period, revenues are projected to grow by 7.1 percent from $92.77 billion in FY 2020 to $99.35 billion in FY 2023 while expenditures are projected to grow by 10.5 percent to $102.49 billion.

Chart 5. June Financial Plan Revenues, Expenditures and Budget Gaps

($ in billions)

As shown in Table 7, revenues are projected to grow at an average annual rate of 2.3 percent in the outyears of the Plan. Tax revenues, which account for more than two-thirds of overall revenues, contribute to 87 percent of the growth, with a projected annual average growth of 2.9 percent. With the exception of State categorical grants, which are projected to grow at an annual average rate of 2.8 percent in the outyears, all other non-City revenues are projected to decline over the Plan period.

Table 7. FY 2020 – FY 2023 Revenue Growth

| ($ in millions) | FY 2020 | FY 2021 | FY 2022 | FY 2023 | Growth FYs 20-23 | Annual Growth |

| General Property Tax | $29,785 | $31,089 | $32,328 | $33,286 | 11.8% | 3.8% |

| Non-Property Tax | 33,636 | 33,932 | 34,901 | 35,834 | 6.5% | 2.1% |

| Subtotal Tax Revenues | $63,421 | $65,021 | $67,229 | $69,120 | 9.0% | 2.9% |

| Non-Tax Revenues | 5,122 | 5,077 | 5,052 | 5,047 | (1.5%) | (0.5%) |

| Subtotal City-Funds | $68,543 | $70,098 | $72,281 | $74,167 | 8.2% | 2.7% |

| Federal Categorical Grants | $7,228 | $7,071 | $6,998 | $6,967 | (3.6%) | (1.2%) |

| State Categorical Grants | 15,338 | 15,710 | 16,178 | 16,683 | 8.8% | 2.8% |

| Other Categorical Grants | 928 | 870 | 863 | 863 | (7.0%) | (2.4%) |

| IFA Revenues | 735 | 672 | 672 | 672 | (8.6%) | (2.9%) |

| Subtotal Non-City-Funds | $24,229 | $24,323 | $24,711 | $25,185 | 3.9% | 1.3% |

| Total | $92,772 | $94,421 | $96,992 | $99,352 | 7.1% | 2.3% |

As discussed earlier in this report, FY 2019 expenditures are reduced by the prepayments of debt service and advanced subsidies to H+H. Adjusted for prepayments and advanced subsidies, expenditures in the Financial Plan are projected to grow by 5.7 percent between FY 2020 and FY 2023.

Similar to FY 2020, expenditure growth in the outyears is driven by spending on salaries and wages, debt service, health insurance, and other (non-pension) fringe benefits. Together, these expenditures are projected to grow at an average annual rate of 3.5 percent in the outyears, as shown in Table 8. All other expenditures, excluding reserves, are projected to remain relatively flat with a slight increase of 0.3 percent over the Plan period. Overall, expenditures adjusted for prepayments are projected to grow at an average rate of 1.9 percent, less than the 2.3 percent projected revenue growth.

Table 8. FY 2020 – FY 2023 Expenditure Growth Adjusted for Prepayments

| ( in millions) | FY 2020 | FY 2021 | FY 2022 | FY 2023 | Growth FYs 20-23 | Annual Growth |

| Salaries and Wages | $29,634 | $30,531 | $30,385 | $31,273 | 5.5% | 1.8% |

| Debt Service | 7,229 | 7,548 | 8,193 | 8,938 | 23.6% | 7.3% |

| Health Insurance | 7,032 | 7,454 | 8,011 | 8,591 | 22.2% | 6.9% |

| Other Fringe Benefits | 4,202 | 4,287 | 4,403 | 4,525 | 7.7% | 2.5% |

| Subtotal | $48,097 | $49,820 | $50,992 | $53,326 | 10.9% | 3.5% |

| Pensions | $9,851 | $10,018 | $10,464 | $10,519 | 6.8% | 2.2% |

| Medicaid | 5,915 | 5,915 | 5,915 | 5,915 | 0.0% | 0.0% |

| Public Assistance | 1,651 | 1,651 | 1,651 | 1,650 | (0.1%) | (0.0%) |

| Judgments and Claims | 712 | 727 | 742 | 758 | 6.5% | 2.1% |

| Contractual Services* | 17,131 | 16,483 | 16,554 | 16,591 | (3.2%) | (1.1%) |

| Other OTPS | 12,236 | 12,079 | 12,303 | 12,483 | 2.0% | 0.7% |

| Subtotal | $47,496 | $46,872 | $47,629 | $47,917 | 0.9% | 0.3% |

| Expenditures Before Reserves | $95,593 | $96,692 | $98,621 | $101,243 | 5.9% | 1.9% |

| General Reserve | $1,150 | $1,000 | $1,000 | $1,000 | (13.0%) | (4.6%) |

| Capital Stabilization Reserve | $250 | $250 | $250 | $250 | 0.0% | 0.0% |

| Total | $96,993 | $97,942 | $99,871 | $102,493 | 5.7% | 1.9% |

*Excludes contractual services for debt service and Medicaid

Risks and Offsets

The Comptroller’s Office’s analysis of the FY 2020 Adopted Budget and Financial Plan shows a budget surplus of $572 million in FY 2020 and smaller gaps of $2.57 billion, $1.88 billion, and $2.20 billion in FY 2021 through FY 2023, respectively. The FY 2020 budget surplus and smaller outyear gaps projected by the Comptroller’s Office stem from the Office’s projection of higher tax revenues, as shown in Table 9. The Comptroller’s Office projects that tax revenues will exceed the Plan’s projections by $742 million in FY 2020, $1.46 billion in FY 2021, $1.71 billion in FY 2022, and $1.86 billion in FY 2023. The Comptroller’s Office’s forecasts of non-tax revenues are also higher than the Plan projection, but at more modest margins, ranging from $13 million in FY 2020 to $23 million in FY 2023.

With the exception of a lower sales tax revenue forecast in FY 2023, the Comptroller’s forecasts for each of the major tax revenues category are above Plan projections in each year of the Plan period. The difference between the Comptroller’s Office and the Plan’s tax revenue forecast reflects the Comptroller’s Office’s more optimistic economic outlook. The Comptroller’s Office forecast Gross City Product (GCP) growth of 2.1 percent in 2020, declining each year to 1.2 percent by 2023. In comparison, the City’s GCP growth forecast begins at 1.7 percent in 2020 and falls to 0.4 percent by 2023. The Comptroller’s Office’s more optimistic economic outlook translates to higher tax revenue growth. As shown in Table 10, the Comptroller’s Office projects overall tax revenues to average 3.6 percent growth over the Plan period, compared to the City’s projection of 3.0 percent.

Table 9. Risks and Offsets to the June 2019 Financial Plan

($ in millions, positive numbers decrease the gap and negative numbers increase the gap)

| FY 2020 | FY 2021 | FY 2022 | FY 2023 | |

| City Stated Gap | $0 | ($3,521) | ($2,879) | ($3,141) |

| Tax Revenues | ||||

| Property Tax | $200 | $387 | $735 | $1,085 |

| Personal Income Tax | 148 | 387 | 335 | 237 |

| Business Taxes | 78 | 111 | 148 | 178 |

| Sales Tax | 114 | 103 | 34 | (35) |

| Real Estate Transaction Taxes | 202 | 321 | 299 | 241 |

| Audit | 0 | 154 | 154 | 154 |

| Subtotal Tax Revenues | $742 | $1,463 | $1,705 | $1,860 |

| Non-Tax Revenues | ||||

| ECB Fines | $10 | $10 | $15 | $15 |

| Late Filing/No Permit Penalties | 0 | 5 | 5 | 5 |

| Other Fines | 3 | 3 | 3 | 3 |

| Subtotal Non-Tax Revenues | $13 | $18 | $23 | $23 |

| Total Revenues | $755 | $1,481 | $1,728 | $1,883 |

| Expenditures | ||||

| Overtime | ($140) | ($150) | ($150) | ($150) |

| Charter School Tuition | 0 | (150) | (334) | (562) |

| Fair Fares | 0 | (212) | (212) | (212) |

| Homeless Shelters | (74) | (74) | (74) | (74) |

| DOE Medicaid Reimbursement | (20) | (20) | (20) | (20) |

| Early Childhood Teacher Salary Parity | (29) | (26) | (55) | (57) |

| VRDB Interest Savings | 80 | 80 | 80 | 80 |

| Pension Contributions | 0 | 19 | 37 | 56 |

| Subtotal Expenditures | ($183) | ($533) | ($728) | ($939) |

| Total (Risks)/Offsets | $572 | $948 | $1,000 | $944 |

| Restated (Gap)/Surplus | $572 | ($2,573) | ($1,879) | ($2,197) |

Table 10. Tax Revenue Forecast, Growth Rates

| FY 2020 | FY 2021 | FY 2022 | FY 2023 | Average Annual Growth | |

| Property | |||||

| Mayor | 6.7% | 4.4% | 4.0% | 3.0% | 4.5% |

| Comptroller | 7.2% | 5.0% | 5.0% | 4.0% | 5.3% |

| PIT | |||||

| Mayor | 1.0% | 0.5% | 3.2% | 3.2% | 2.0% |

| Comptroller | 2.1% | 2.2% | 2.7% | 2.4% | 2.4% |

| Business | |||||

| Mayor | (1.7%) | 2.7% | 2.0% | 1.4% | 1.1% |

| Comptroller | (1.8%) | 3.2% | 2.6% | 1.9% | 1.4% |

| Sales | |||||

| Mayor | 5.5% | 3.5% | 3.5% | 3.2% | 3.9% |

| Comptroller | 6.7% | 3.3% | 2.7% | 2.4% | 3.7% |

| Real Estate Transaction | |||||

| Mayor | (4.9%) | 1.1% | 2.5% | 2.6% | 0.3% |

| Comptroller | 1.7% | 5.6% | 1.4% | 0.3% | 2.2% |

| All Other | |||||

| Mayor | (1.5%) | 1.4% | 2.2% | 2.1% | 1.0% |

| Comptroller | (1.5%) | 1.4% | 2.2% | 2.1% | 1.0% |

| Audit Revenue | |||||

| Mayor | (5.6%) | (27.8%) | 0.0% | 0.0% | (9.1%) |

| Comptroller | (5.6%) | (12.4%) | 0.0% | 0.0% | (4.6%) |

| Total Tax with Audit | |||||

| Mayor | 3.4% | 2.5% | 3.4% | 2.8% | 3.0% |

| Comptroller | 4.3% | 3.6% | 3.7% | 3.0% | 3.6% |

With regards to expenditures, there are risks to the Plan’s assumptions on overtime, charter school tuition, funding of the Fair Fares program, homeless shelters expenditures, and Medicaid reimbursement for eligible special education transportation expenses, which has yet to be approved by the State. In addition, as discussed in “Early Childhood Education Teacher Salary Parity” above, the June Financial Plan does not include the cost of providing pay parity for early childhood teachers in contracted programs and indigent legal providers’ staff. Furthermore, the Administration has agreed to reimburse the indirect cost of health and human service providers based on the City of New York Health and Human Services Cost Policies and Procedure Manual (“Cost Manual”) released in March 2019. The manual allows providers to claim more than the City De Minimus Indirect Rate of 10 percent if they have a federally negotiated indirect cost rate (NICRA), or a letter from a CPA verifying that the Provider calculated the higher indirect cost rate according to the Cost Manual. The costs of the revision to indirect cost reimbursement and salary parity for indigent legal provider staff have yet to be determined at this time.

Overtime

The Comptroller’s Office estimates that overtime spending will exceed the Plan projections by $140 million in FY 2020 and $150 million in each of the outyears of the Plan. Risk to civilian overtime budget accounts for more than 80 percent of the overall overtime risk. Preliminary figures show that through June 2019, the City has spent $637 million on civilian overtime, $206 million more than the FY 2019 June Budget Modification estimate. While civilian overtime cost has increased at an annual rate of 10.65 percent from FY 2013 to FY 2018, the Plan assumes that civilian overtime spending will decline to $336 million in FY 2020 and average $309 million in the outyears. Although the City has implemented several initiatives to curb the growth in civilian overtime spending, the projected reductions in the Plan appear overly optimistic. The Comptroller’s Office estimates that civilian overtime could exceed the Plan projections by $115 million annually.

Charter School Tuition

While the State has approved an increased charter tuition rate, the DOE budget does not fund the increase in the outyears of the Plan. Unless the State provides additional reimbursement for charter school tuition in futures years, the DOE could face risks of $150 million in FY 2021, $334 million in FY 2022, and $562 million in FY 2023.

Fair Fares Program

The City launched a program to provide reduced transit fare to eligible low-income City residents in the second half of FY 2019, known as Fair Fares. The June Plan includes $106 million in FY 2020 to fund the program but no funding in the outyears of the Plan. The $106 million is the City’s initial estimate of the half-year cost of the program. The program is off to a slow start with only about $25 million spent in FY 2019. As such it is likely that $106 million may be sufficient for FY 2020. However, if outreach efforts are successful and the program ramps up to full participation by the end of FY 2020, the budget would face a risk of $212 million in each of the outyears of the Plan.

Homeless Shelters

City-funds spending on single adult shelter operations in the FY 2020 Adopted Budget is scheduled to decline by $74 million to $558 million and remain fairly flat at this level in the outyears. Given that no major shifts in homelessness policy that could reduce the single adult shelter population have been publicly announced, the FY 2020 budget for single adult shelter operations appears to be insufficient. The Plan should maintain the same level of funding as FY 2019 until a clear downward trend in single adult shelter population indicates otherwise.

Expenditure Offsets

The expenditure risks are somewhat tempered by anticipated savings from lower interest rates on variable rate debt bonds (VRDB) than those assumed in the Plan, and pension contributions from FY 2019 pension investment earnings. The VRDB debt service in the Financial Plan is based on a conservative estimate of variable interest rates. In an environment of low variable interest rates and no indication of a spike over the Plan period thus far, the Comptroller’s Office estimates that debt service on VRDB could be $80 million less in each of FY 2020 – FY 2023.

The City’s pension investments earned 7.24 percent in FY 2019, marginally above the actuarial interest rate (AIR) of 7 percent. Because the market value of pension assets is above the actuarial asset value, the 7.24 percent gain on market value results in a higher return on actuarial asset value. The excess earnings above the AIR on the actuarial asset value will be phased in over six years beginning in FY 2021, resulting in savings of $19 million in FY 2021, $37 million in FY 2022, and $56 million in FY 2023.

Endnotes

[1] This includes the restoration of $15 million in funding that was reduced in the last Citywide Savings Program.

[2] Payments from the New York City Water Board are used for operation and maintenance of the water and sewer system.

[3] The reserve for disallowances against categorical grants is a set-aside for potential rejections of City claims against Federal and State aid. Because the reserve is against disallowances of prior-year claims, the released funds are treated as City-funds revenues in the fiscal year they are released.

[4] A total of $2.83 billion of FY 2014 expenditures were prepaid in prior years — $2.807 billion in FY 2013 and $31 million in FY 2012.

[5] The City prepaid a total of $3.601 billion of FY 2016 expenditures in FY 2015. However, $77 million of the prepayment was for Building Aid Revenue Bond debt service which is not included in the General Fund. Thus only $3.524 billion of the FY 2015 prepayments was for General Fund expenses.

[6] The $100 million addition to the RHBT brings the balance in the RHBT to $4.6 billion.

[7] $296 million in tax revenues and $1 million in non-tax revenues.

[8] Approximately $13 million of which are restorations of fundings which were reduced in the last round of Citywide Savings Program.

[9] Approximately $2 million of which are restorations of fundings which were reduced in the last round of Citywide Savings Program.