I. Executive Summary

The City’s fiscal outlook differs significantly from that depicted in the Preliminary Budget and Financial Plan released by the NYC Office of Management and Budget (OMB) on January 12, for three main reasons.

First, on February 17 the City and DC 37 announced a tentative contract agreement. The January Financial Plan funded raises of 1.25 percent per year for four years. The DC 37 agreement includes four annual raises of 3 percent, a fifth yearly raise of 3.25 percent, and a signing bonus of $3,000. The raises do not appear to be offset by savings or productivity increases. If this were to be pattern for all other unions, it would add costs of $2.5 billion in FY 2023, $1.8 billion in FY 2024, $3.4 billion in FY 2025, $3.9 billion in FY 2026, and $4.7 billion in FY 2027 for a total of $16.3 billion.

Second, the cost for shelter and services provided to asylum seekers is escalating. The January Financial Plan assumed the annual cost to be $1 billion in FY 2023 and zero in FY 2024 and beyond, and also assumed these costs would be covered in full by Federal aid. By February 7, City Hall had projected the cumulative cost for FY 2023 and FY 2024 would be $4.2 billion. State and Federal aid are currently projected to cover only one-quarter of that.

Third, the NY State Executive Budget, while providing partial funding for the cost of sheltering asylum seekers and an increase in school funding, also includes $1 billion in cost shifts, unfunded mandates, and revenue cuts just in FY 2024. Additional, significant costs could derive from the Governor’s proposals regarding charter schools. Finally, the cost of implementing the State’s class size mandate legislation enacted in 2022, which requires the City to reduce class size in its schools over the next five years, remains unfunded.

This report also incorporates an updated forecast of economic conditions and City revenues. The forecast reflects the economic resiliency in response to tighter monetary policy shown so far, and an outlook predicated on a successful economic “soft-landing.” In this scenario, the national and New York City economies slow down but avoid a recession. The analysis also incorporates up-to-date information on the City’s property tax, which is not included in the Financial Plan. The Office of the Comptroller’s projection of City revenues exceeds OMB’s by $1.38 billion in FY 2023, $2.32 billion in FY 2024, $1.90 billion in FY 2025, $2.19 billion in FY 2026, and $3.61 billion in FY 2027.

Despite the revised revenue projection, budget gaps are estimated at $1.30 billion in FY 2023 and $1.51 billion in FY 2024. Gaps swell to $7.07 billion in FY 2025, $10.22 billion in FY 2026 and $11.66 billion in FY 2027. These gaps do not include the risk deriving from the cost of services provided to asylum seekers: $823 million in FY 2023, $2.18 billion in FY 2024, and, potentially, $2.8 billion each year thereafter. The gaps also do not incorporate the fiscal impact of the Governor’s executive budget, of the Governor’s proposals regarding charter schools, and of class size legislation.

In FY 2023, the City has access to $1.8 billion in the General Reserve and Capital Stabilization Reserve, and the Mayor’s Executive Budget later this spring will include additional savings and resources to balance the FY 2024 budget. However, the full extent of the measures needed will depend on the cost and funding for the services provided to asylum seekers, and on the enacted State budget. In the outyears, the size of the budget gaps indicates the need of structural interventions on both expenses and revenues.

The FY 2024 Preliminary Budget & January 2023 Financial Plan

The FY 2024 Preliminary Budget totals $102.66 billion, reflecting a continued drop in spending with the ramping down of COVID-19 federal grant-related spending. The budget gap of $2.89 billion in the November Plan was resolved in the Preliminary Budget through a combination of revenue increases, and a pre-payment of $1.46 billion from FY 2023 to FY 2024.

The FY 2024 Preliminary Budget reflects the culmination of both the November Plan’s and the January Plan’s Program to Eliminate the Gap (PEG), for a total of $1.95 billion of savings. These savings programs resulted in a reduction of 4,374 City-funded positions.

The Comptroller’s Office anticipates overall tax revenues and miscellaneous revenues to come in higher than the City’s projections in each year of the Financial Plan. All categories of tax revenue are forecasted to come in higher than planned in FY 2023 and FY 2024. The Comptroller’s Office forecast for Property Tax Revenue grows significantly higher than the Plan in the outyears. All other tax revenues are projected to be higher than OMB’s forecast in each year, except Business Taxes and Real Estate Transaction taxes which begin to fall below OMB’s forecast in FY 2025 and FY 2026 respectively. In total, this report projects that revenues will be higher than OMB’s projections by $1.38 billion in FY 2023, $2.23 billion in FY 2024, $1.9 billion in FY 2025, $2.19 billion in FY 2026, and $3.61 billion in FY 2027.

Offsetting these higher revenues are a number of known and unknown expenses that are not yet included in OMB’s financial plan.

If, as noted above, labor contracts with all unions follow the same pattern as the recent agreement with DC 37, the City would face additional costs of $2.5 billion in FY 2023, $1.8 billion in FY 2024, $3.4 billion in FY 2025, $3.9 billion in FY 2026, and $4.7 billion in FY 2027.

The Comptroller’s Office is also including a variety of risks within the Department of Education’s budget. In addition to risks that this office has previously included, primarily for the exhaustion of federal stimulus funds and the chronic underbudgeting for Carter cases, pupil transportation, and charter school tuition, an additional risk is included for the class size mandates imposed by the State last year. The City is estimating the cost of implementing smaller class sizes will cost $1.3 billion once fully implemented ($433 million in FY 2026 and $867 million in FY 2027).

Other risks include additional underbudgeting within the City’s ongoing support of the Metropolitan Transportation Authority (MTA) and elevated temporary and overtime expenses compared to the budget.

Overall, the Comptroller’s estimated additional expense risk is $2.68 billion in FY 2023, $3.83 billion in FY 2024, $5.81 billion in FY 2025, $7.40 billion in FY 2026, and $8.80 billion in FY 2027. Combined with the revenue offsets above, the net risk, not yet incorporated into the Financial Plan, is $1.30 billion in FY 2023, $1.51 billion in FY 2024, $3.90 billion in FY 2025, $5.21 billion in FY 2026, and $5.20 billion in FY 2027.

It is with far less certainty that we layer in the possible expense of the asylum seekers on the five years of the Financial Plan. The January 2023 Financial Plan did not alter the November Plan addition of $1 billion of expense in FY 2023, with full Federal reimbursement. OMB has since stated that they expect the FY 2023 expenses to grow to $1.4 billion at current levels of growth till the end of the year, and the FY 2024 expenses would annualize to $2.8 billion. While OMB’s estimates do not extend beyond FY 2024, it is very likely that many of these expenses will continue in the outyears and possibly at even higher levels. Expected Federal and State assistance would only provide partial support, leaving a large portion of these costs to be borne by the City.

In addition, the Governor’s Executive Budget includes a number of other items that would directly impact the City’s budget, if enacted. While record-level school aid was driven by the first ever full funding of the State’s Foundation Aid formula, the City is set to receive only 21 percent of the historic $2.73 billion increase. Other significant proposals include raising the City’s contributions to the transit system by over $500 million per year and intercepting the Enhanced Federal Medical Assistance Percentage (eFMAP), that NYC and other localities across the State use to offset their share of Medicaid costs. These cost shifts and unfunded mandates would cost the City $1 billion in FY 2024 and grow to $2.3 billion if the charter cap is removed and the full number of allowable charter schools are implemented. If enacted, these changes would significantly widen the City’s budget gap.

Capital Budget & Financing

The January 2023 Capital Commitment Plan totals $96.55 billion in all-funds authorized commitments for FY 2023 – FY 2027, a $551.2 million (0.6 percent) increase compared to the September 2022 Capital Plan over the same fiscal years. The major increases are in projects related to water pollution control, sanitation, and citywide equipment, resiliency, and energy efficiency.

The City also released its required Preliminary Ten-Year Capital Strategy, which totals $159.33 billion for FY 2024 – FY 2033. This is an increase of $25.59 billion (19.1 percent), from the last Ten-Year Capital Strategy published in April 2021. The categories with the largest changes are the Department of Transportation with an increase of $8.43 billion, housing (HPD and NYCHA) with an increase of $7.92 billion, Department of Environmental Protection, with an increase of $6.38 billion, and the Parks Department with an increase of $3.13 billion. Offsetting these increases, is a projected decrease of $4.80 billion in Education/CUNY related projects.

Total projected borrowing in the January 2023 Financial Plan for FY 2023 through FY 2027 is $62.35 billion.

Table 1. FY 2023 – FY 2027 Financial Plan

| ($ in millions) | FY 2023 | FY 2024 | FY 2025 | FY 2026 | FY 2027 | Change FYs 2023 –2027 |

|

|---|---|---|---|---|---|---|---|

| Dollar | Percent | ||||||

| Revenues | |||||||

| Taxes: | |||||||

| General Property Tax | $31,421 | $32,013 | $32,146 | $32,156 | $32,156 | $735 | 2.3% |

| Other Taxes | 36,860 | 36,154 | 37,751 | 39,161 | 40,228 | 3,368 | 9.1% |

| Tax Audit Revenues | 721 | 721 | 721 | 721 | 721 | 0 | 0.0% |

| Subtotal: Taxes | $69,002 | $68,888 | $70,618 | $72,038 | $73,105 | $4,103 | 5.9% |

| Miscellaneous Revenues | 7,983 | 7,516 | 7,381 | 7,312 | 7,289 | (694) | (8.7%) |

| Unrestricted Intergovernmental Aid | 252 | 0 | 0 | 0 | 0 | (252) | (100.0%) |

| Less: Intra-City Revenues | (2,213) | (1,902) | (1,900) | (1,896) | (1,896) | 317 | (14.3%) |

| Disallowances Against Categorical Grants | (15) | (15) | (15) | (15) | (15) | 0 | 0.0% |

| Subtotal: City-Funds | $75,009 | $74,487 | $76,084 | $77,439 | $78,483 | $3,474 | 4.6% |

| Other Categorical Grants | 1,172 | 1,060 | 1,057 | 1,055 | 1,054 | (118) | (10.1%) |

| Inter-Fund Revenues | 726 | 698 | 699 | 699 | 699 | (27) | (3.7%) |

| Federal Categorical Grants | 12,424 | 9,485 | 8,151 | 7,017 | 6,999 | (5,425) | (43.7%) |

| State Categorical Grants | 17,057 | 16,925 | 17,163 | 17,217 | 17,281 | 224 | 1.3% |

| Total Revenues | $106,388 | $102,655 | $103,154 | $103,427 | $104,516 | ($1,872) | (1.8%) |

| Expenditures | |||||||

| Personal Service | |||||||

| Salaries and Wages | $31,497 | $31,492 | $31,937 | $32,625 | $33,323 | $1,826 | 5.8% |

| Pensions | 9,414 | 9,563 | 9,783 | 9,951 | 9,799 | 385 | 4.1% |

| Fringe Benefits | 12,535 | 13,501 | 14,379 | 15,119 | 15,726 | 3,191 | 25.5% |

| Subtotal-PS | $53,446 | $54,556 | $56,099 | $57,695 | $58,848 | $5,402 | 10.1% |

| Other Than Personal Service | |||||||

| Medical Assistance | $6,564 | $6,385 | $6,385 | $6,385 | $6,535 | ($29) | (0.4%) |

| Public Assistance | 1,650 | 1,650 | 1,650 | 1,650 | 2,000 | 350 | 21.2% |

| All Other | 41,430 | 34,781 | 34,280 | 34,049 | 34,281 | (7,149) | (17.3%) |

| Subtotal-OTPS | $49,644 | $42,816 | $42,315 | $42,084 | $42,816 | ($6,828) | (13.8%) |

| Debt Service | |||||||

| Principal | $4,003 | $4,161 | $4,178 | $4,193 | $4,384 | $381 | 9.5% |

| Interest & Offsets | 3,651 | 3,740 | 4,178 | 4,912 | 5,383 | 1,731 | 47.4% |

| Subtotal Debt Service | $7,654 | $7,901 | $8,356 | $9,105 | $9,767 | $2,112 | 27.6% |

| FY 2022 BSA and Discretionary Transfers | ($6,114) | $0 | $0 | $0 |

$0 |

$6,114 | (100.0%) |

| FY 2023 BSA | $2,166 | ($2,166) | $0 | $0 | $0 | ($2,166) | (100.0%) |

| Capital Stabilization Reserve | $250 | $250 | $250 | $250 | $250 | $0 | 0.0% |

| General Reserve | $1,555 | $1,200 | $1,200 | $1,200 | $1,200 | ($355) | (22.8%) |

| Less: Intra-City Expenses | ($2,213) | ($1,902) | ($1,900) | ($1,896) | ($1,896) | $317 | (14.3%) |

| Total Expenditures | $106,388 | $102,655 | $106,320 | $108,438 | $110,985 | $4,596 | 4.3% |

| Gap to be Closed | $0 | $0 | ($3,166) | ($5,011) | ($6,469) | ($6,469) | NA |

NOTE: Numbers may not add to totals due to rounding.

Table 2. Plan-to-Plan Changes

January 2023 Plan vs. November 2022 Plan

| ($ in millions) | FY 2023 | FY 2024 | FY 2025 | FY 2026 |

| Revenues | ||||

| Taxes: | ||||

| General Property Tax | $0 | $0 | $0 | $0 |

| Other Taxes | 1,253 | 501 | 545 | 521 |

| Tax Audit Revenues | 0 | 0 | 0 | 0 |

| Subtotal: Taxes | $1,253 | $501 | $545 | $521 |

| Miscellaneous Revenues | 503 | 220 | 82 | (3) |

| Unrestricted Intergovernmental Aid | 0 | 0 | 0 | 0 |

| Less: Intra-City Revenues | (70) | 17 | 20 | 22 |

| Disallowances Against Categorical Grants | 0 | 0 | 0 | 0 |

| Subtotal: City-Funds | $1,686 | $738 | $647 | $540 |

| Other Categorical Grants | 18 | 1 | 1 | 0 |

| Inter-Fund Revenues | (15) | (38) | (37) | (37) |

| Federal Categorical Grants | 613 | 466 | 420 | (7) |

| State Categorical Grants | 83 | (6) | (7) | (6) |

| Total Revenues | $2,385 | $1,161 | $1,024 | $490 |

| Expenditures | ||||

| Personal Service | ||||

| Salaries and Wages | $74 | ($144) | ($225) | ($227) |

| Pensions | 0 | 0 | 0 | 0 |

| Fringe Benefits | (79) | (115) | (120) | (123) |

| Subtotal-PS | ($5) | ($259) | ($345) | ($350) |

| Other Than Personal Service | ||||

| Medical Assistance | $0 | $0 | $0 | $0 |

| Public Assistance | 0 | 0 | 0 | 0 |

| All Other | 1,000 | 28 | 14 | 12 |

| Subtotal-OTPS | $1,000 | $28 | $14 | $12 |

| Debt Service | ||||

| Principal | $0 | $0 | $0 | $0 |

| Interest & Offsets | (1) | (54) | (79) | (98) |

| Subtotal Debt Service | ($1) | ($54) | ($79) | ($98) |

| FY 2022 BSA and Discretionary Transfers | 0 | 0 | 0 | 0 |

| FY 2023 BSA | 1,461 | (1,461) | 0 | 0 |

| Capital Stabilization Reserve | 0 | 0 | 0 | 0 |

| General Reserve | 0 | 0 | 0 | 0 |

| Deposit to Rainy Day Fund | 0 | 0 | 0 | 0 |

| Less: Intra-City Expenses | (70) | 17 | 20 | 22 |

| Total Expenditures | $2,385 | ($1,729) | ($390) | ($414) |

| Gap to be Closed | $0 | $2,890 | $1,414 | $904 |

NOTE: Numbers may not add to totals due to rounding.

Table 3. Plan-to-Plan Changes

January 2023 Plan vs. June 2022 Plan

| ($ in millions) | FY 2023 | FY 2024 | FY 2025 | FY 2026 |

| Revenues | ||||

| Taxes: | ||||

| General Property Tax | $0 | $0 | $0 | $0 |

| Other Taxes | 1,253 | 501 | 545 | 521 |

| Tax Audit Revenues | 0 | 0 | 0 | 0 |

| Subtotal: Taxes | $1,253 | $501 | $545 | $521 |

| Miscellaneous Revenues | 672 | 261 | 119 | 29 |

| Unrestricted Intergovernmental Aid | 0 | 0 | 0 | 0 |

| Less: Intra-City Revenues | (239) | 37 | 29 | 33 |

| Disallowances Against Categorical Grants | 0 | 0 | 0 | 0 |

| Subtotal: City-Funds | $1,686 | $799 | $693 | $583 |

| Other Categorical Grants | 143 | 44 | 42 | 43 |

| Inter-Fund Revenues | (10) | (34) | (32) | (32) |

| Federal Categorical Grants | 3,140 | 809 | 193 | 43 |

| State Categorical Grants | 305 | 35 | 29 | 29 |

| Total Revenues | $5,264 | $1,653 | $925 | $666 |

| Expenditures | ||||

| Personal Service | ||||

| Salaries and Wages | ($171) | ($481) | ($516) | ($425) |

| Pensions | 0 | 861 | 1,969 | 3,018 |

| Fringe Benefits | (105) | (255) | (341) | (318) |

| Subtotal-PS | ($276) | $125 | $1,112 | $2,275 |

| Other Than Personal Service | ||||

| Medical Assistance | $0 | $0 | $0 | $0 |

| Public Assistance | 0 | 0 | 0 | 0 |

| All Other | 3,712 | (368) | (523) | (342) |

| Subtotal-OTPS | $3,712 | ($368) | ($523) | ($342) |

| Debt Service | ||||

| Principal | $9 | ($60) | $87 | $38 |

| Interest & Offsets | (108) | (125) | (328) | (307) |

| Subtotal Debt Service | ($99) | ($185) | ($241) | ($269) |

| FY 2022 BSA and Discretionary Transfers | 0 | 0 | 0 | 0 |

| FY 2023 BSA | 2,166 | (2,166) | 0 | 0 |

| Capital Stabilization Reserve | 0 | 0 | 0 | 0 |

| General Reserve | 0 | 0 | 0 | 0 |

| Deposit to Rainy Day Fund | 0 | 0 | 0 | 0 |

| Less: Intra-City Expenses | (239) | 37 | 29 | 33 |

| Total Expenditures | $5,264 | ($2,557) | $377 | $1,697 |

| Gap to be Closed | $0 | $4,210 | $548 | ($1,031) |

NOTE: Numbers may not add to totals due to rounding.

Table 4. Risks and Offsets to the January 2023 Financial Plan

$ in millions, positive numbers decrease the gap and negative numbers increase the gap

| FY 2023 | FY 2024 | FY 2025 | FY 2026 | FY 2027 | |

| City Stated Gap | $0 | $0 | ($3,166) | ($5,011) | ($6,469) |

| Tax Revenues | |||||

| Property Tax | $177 | $577 | $730 | $1,211 | $2,539 |

| Personal Income Tax | 193 | 632 | 509 | 654 | 973 |

| Business Taxes | 180 | 27 | (152) | (21) | (59) |

| Sales Tax | 202 | 525 | 390 | 133 | 26 |

| Real Estate Transaction Taxes | 60 | 305 | 126 | (105) | (195) |

| All Other | 47 | 14 | 54 | 88 | 94 |

| Audit | 579 | 179 | 179 | 179 | 179 |

| Subtotal Tax Revenues | $1,438 | $2,259 | $1,836 | $2,139 | $3,557 |

| Miscellaneous Revenues | ($55) | $63 | $68 | $53 | $53 |

| Total Revenues | $1,383 | $2,322 | $1,904 | $2,192 | $3,610 |

| Expenditures | |||||

| PS Accrual Savings | $714 | $357 | $0 | $0 | $0 |

| Temporary and Professional Services | 0 | (194) | 0 | 0 | 0 |

| Overtime | (651) | (563) | (440) | (440) | (440) |

| Collective Bargaining Agreements* | (2,500) | (1,800) | (3,400) | (3,900) | (4,700) |

| Education | (255) | (856) | (1,069) | (1,949) | (2,634) |

| Public Health Corps | 0 | 0 | (13) | (49) | (49) |

| FDNY Mental Health Response Program /

B-HEARD |

0 | (37) | (37) | (37) | (37) |

| Public Assistance | (125) | (125) | (125) | (125) | 0 |

| Rental Assistance | 0 | (237) | (237) | (237) | (237) |

| Contributions to MTA | (74) | (125) | (271) | (445) | (492) |

| Prevailing Wage for Shelter Security Guards | 0 | (64) | (64) | (64) | (64) |

| Foster Care Reimbursement Rate | (47) | (118) | (118) | (118) | (118) |

| Variable Rate Debt Service Savings | 60 | 50 | 50 | 50 | 50 |

| Court Appointed Counsel | (84) | (84) | (84) | (84) | (84) |

| Temporary eFMAP (Public Health Emergency) | 285 | 48 | 0 | 0 | 0 |

| Lynch Settlement | 0 | (82) | 0 | 0 | 0 |

| Total Expenditures | ($2,678) | ($3,829) | ($5,808) | ($7,399) | ($8,805) |

| Comptroller’s (Risks)/Offsets | ($1,295) | ($1,507) | ($3,904) | ($5,207) | ($5,195) |

| Restated (Gap)/Surplus† | ($1,295) | ($1,507) | ($7,070) | ($10,218) | ($11,664) |

| Asylum Seekers | |||||

| Federal Assistance-Asylum Seekers | ($800) | 0 | 0 | 0 | 0 |

| State Assistance-Asylum Seekers | 377 | 623 | 0 | 0 | 0 |

| Asylum Seekers Expenses | (400) | (2,800) | (2,800) | (2,800) | (2,800) |

| Subtotal Asylum Seekers | ($823) | ($2,177) | ($2,800) | ($2,800) | ($2,800) |

NOTE: Numbers may not add to totals due to rounding. *Collective bargaining risk represents the floor based on the DC 37 pattern. †Comptroller’s Restated (Gap)/Surplus does not include risks associated with Asylum Seekers.

II. The City’s Economic Outlook

Economic Forecast, 2023 – 2027[1]

The U.S. economy lingers at an important crossroads with the most disruptive impacts of the COVID-19 pandemic already in the rear-view mirror, but also the sunsetting of the unprecedented and largely successful government-led economic responses financed mainly by Federal deficits. High inflation has been the bee in the bonnet of an otherwise strong national recovery from the pandemic’s low points, and the Federal Reserve has recently taken firm steps to demonstrate that they are watching it closely and are willing and able to respond to what the latest price data tell them.

Many economic forecasters are still expecting a significant growth slowdown in 2023, despite upbeat recent data describing economic and job growth. So far unbothered by the Fed’s contractionary policy over the past year, labor markets remain very tight with U.S. unemployment at 3.4 percent, near a historic low point. Thus, markets and many forecasters took the surprisingly strong jobs report in January to be a bad piece of news—projecting that the swift pace of hiring will further widen the gap between labor demand and supply…which should drive up wages…which in turn likely increases prices…which motivates the Fed to push harder on their economic brakes.

Labor markets in NYC are arguably less tight than the U.S. nationally, with a higher unemployment rate of 5.9 percent in the city and, in New York statewide data, a recently dropping ratio of job openings to unemployed workers. Nonetheless, the city’s economy remains vulnerable to national economic trends in monetary policy, especially in the financial, technology and professional services sectors that form an important core of local income, spending, and tax bases. The technology and securities sectors in New York City are likely to experience both job and income loss in 2023 because of profit and market declines that have already occurred.

But while there may be a near-term slowdown, the forecast for the city and the nation beginning in 2024 looks brighter. The Comptroller’s forecast assumes that the Fed is relatively successful in guiding the economy through a “soft landing,” lowering inflation without creating a recession or significantly high unemployment. Most sectors in the NYC economy have already substantially caught up to their pre-pandemic levels of operation, and therefore it is likely that, after a one-year pause, most economic measures will resume patterns of growth typical of pre-pandemic years.

Table 5 summarizes the economic forecasts of the Office of the NYC Comptroller and the Mayor’s Office.

Table 5. Summary of Economic Forecasts

| 2023 | 2024 | 2025 | 2026 | 2027 | ||

|---|---|---|---|---|---|---|

| U.S. Economy | ||||||

| Real GDP (2012 $, % Change) | Comptroller | 1.3 | 2.1 | 2.7 | 2.7 | 2.4 |

| Mayor | 0.3 | 1.8 | 2.0 | 1.8 | 1.6 | |

| Payroll Jobs, (% Change) | Comptroller | 1.4 | 0.7 | 0.7 | 0.3 | 0.4 |

| Mayor | 0.6 | (0.3) | 0.5 | 0.4 | 0.3 | |

| Fed Funds Rate, (Percent) | Comptroller | 4.8 | 4.2 | 3.2 | 2.5 | 2.5 |

| Mayor | 4.8 | 4.3 | 3.0 | 2.6 | 2.6 | |

| 10-Year Treasury Notes, (Percent) | Comptroller | 4.2 | 4.0 | 3.8 | 4.0 | 4.0 |

| Mayor | 3.6 | 3.3 | 3.2 | 3.2 | 3.2 | |

| NYC Economy | ||||||

| Payroll Jobs (Change in Thousands) | Comptroller | 51.9 | 29.1 | 56.5 | 59.7 | 63.0 |

| Mayor | 68.0 | 95.5 | 103.3 | 90.1 | 80.3 | |

| Wage Earnings, (% Change) | Comptroller | 2.3 | 3.6 | 4.6 | 4.7 | 4.5 |

| Mayor | 0.0 | 5.0 | 5.4 | 5.0 | 4.9 | |

| CPI NY Area | Comptroller | 4.0 | 2.6 | 2.4 | 2.3 | 2.3 |

| Mayor | 3.1 | 1.9 | 1.7 | 1.6 | 1.6 | |

SOURCE: Office of the NYC Comptroller, NYC OMB

The National Economy

The U.S. economy’s real gross domestic product (GDP) grew by a 3.1 percent annual rate in the latter half of 2022, a moderately strong rebound after a decline of 1.1 percent in the first half of last year. This growth occurred amidst a continued contractionary monetary policy instituted by the Federal Reserve. The Fed Funds Rate began 2022 at 0.1 percent, had risen to 1.6 percent by the beginning of July and finished the year at 4.3 percent.

Meanwhile, once-hot inflation began to slow over the course of the year. Year-over-year inflation as measured by the Consumer Price Index (CPI) fell to 6.4 percent in January 2023, down from its peak of 9.1 percent in June 2022. Although the overall index has been trending down the last six months, the energy and the food indexes remain elevated, at year over year increases of 8.7 percent and 10.1 percent, respectively, in January 2023.

The deceleration in price growth can be attributed to several factors. The Fed can probably enjoy some of the credit for the slowdown—not because of its impact on the economy, which hasn’t cooled off, but by lowering future inflationary expectations that are always a major driver of price spirals. Another factor was the gradual adoption of resilience strategies by many businesses facing new supply-chain bottlenecks that initially had fueled shortage-related price hikes. In addition, energy prices declined from their spring and summer highs that were sparked by Russia’s war against Ukraine. Lastly, the effects of pandemic-response stimulus financed by Federal deficit spending began to wind down in 2022, removing a temporary fuel for additional consumer demand and a possible inhibitor of labor supply.

But it is the tight labor market that has inflation hawks worried right now. The unemployment rate was 3.4 percent in January 2023—its lowest rate since 1969. In December, the number of job openings per unemployed worker was 1.8, while the quits rate was at an elevated 2.7 percent. The Bureau of Labor Statistics reported 517,000 jobs added to U.S. payrolls in January. And while that month’s total may have been beefed-up by unseasonably warm temperatures across the country, payrolls have been consistently increasing at a good clip for the past several months. With labor markets unresponsive to monetary actions so far, the Fed will likely be watching to see if the imbalance between high labor demand and low labor supply can clear without significant wage inflation.

A key question is whether the Fed can thread the needle, lowering inflation to their target of 2 percent without pushing the economy into recession. This “soft landing” scenario probably requires that some visible signs of a loosening labor market occur soon. Debt markets appear to expect the recession option. Treasury yield curves are more sharply inverted than at any time since 1981, with 2-year rates currently more than 0.8 percent above 10-year rates. Such inversions usually reflect a strong expectation of a recession, when policy rates are almost always lowered to stimulate the economy into recovery. The Fed raised interest rates by 25 basis points early in February (0.25 percent) to a range of 4.5-4.75 percent. Recent statements by the Fed Chairman indicate that rates may rise higher than 5.0 percent in 2023 if wage growth and inflation figures do not show decelerating prices.

The Mayor’s Office of Management and Budget (OMB) has predicted a significant slowdown in U.S. economic growth in calendar year 2023 (a 0.3 percent increase in real GDP) but does not expect the economy to go all the way into a recession. Higher growth resumes in their forecast beginning in 2024, although they do not project growth above 2.0 percent any year during the Plan window (through 2027). While noting that monetary policy often works with a lag, they expect that inflation drops by 2024 all the way down to 2.3 percent, close to the Fed target. Their unemployment rate forecast peaks at 5.0 percent in 2024. Overall, their medium-term view expects that inflation will subside quickly without long-lasting economic hardships.

The Office of the NYC Comptroller’s forecast for the U.S. economy projects much less slowing in 2023, with forecast GDP growth of 1.3 percent. Our projected growth rates in years 2024-27 are also higher than OMB’s and closer to long-run average growth rates in non-recessionary years. But aside from differing GDP growth rates, our U.S. economic forecast is quite similar to OMB’s in that we forecast inflation to subside by 2024 without a recession or a significant spike in unemployment.

The New York City Economy

Employment

Private sector employment in New York City currently stands at 4.02 million, 97.9 percent of its pre-pandemic level. The city added more than 199,000 private sector jobs in 2022, a 5.2 percent annual growth rate and a pace of roughly 17,000 per month (see Table 6). The extent of recovery from pandemic job losses varies by industry sector. The sectors experiencing the most recent job growth in the city are health care and social assistance (adding 18,000 jobs in the fourth quarter of 2022) and food and hospitality (14,000). Together, these two categories accounted for roughly three-fourths of 4th-quarter growth in private payroll employment, and more than half of the growth seen throughout 2022 (See Chart 1).

Table 6. New York City Employment, Pre-pandemic vs Current

| (in thousands) | Seasonally Adjusted NYC Employment | December 2022 Change From |

Dec. ’22 % of | |||||

|---|---|---|---|---|---|---|---|---|

| Industry: | Feb. ’20 | Apr.’20 | Dec. ’21 | Dec. ’22. | Feb. ‘20 | Apr. ‘20 | Dec. ’21 | Feb. ’20 |

| Total Private | 4,108.4 | 3,161.4 | 3,821.7 | 4,021.0 | (87.4) | 859.5 | 199.3 | 97.9% |

| Financial Activities | 487.2 | 469.2 | 467.8 | 478.6 | (8.6) | 9.4 | 10.8 | 98.2% |

| Information | 229.2 | 204.1 | 233.2 | 242.3 | 13.2 | 38.2 | 9.2 | 105.7% |

| Professional and Business Services | 781.3 | 688.0 | 759.1 | 801.7 | 20.4 | 113.7 | 42.6 | 102.6% |

| Educational Services | 256.4 | 229.4 | 240.0 | 238.3 | (18.1) | 8.9 | (1.7) | 92.9% |

| Health Care and Social Assistance | 823.5 | 707.5 | 815.2 | 880.6 | 57.1 | 173.1 | 65.4 | 106.9% |

| Arts, Entertainment, and Recreation | 95.7 | 50.7 | 74.0 | 82.8 | (12.9) | 32.1 | 8.8 | 86.5% |

| Accommodation and Food Services | 374.4 | 105.8 | 288.4 | 327.6 | (46.9) | 221.8 | 39.2 | 87.5% |

| Other Services | 196.1 | 129.2 | 171.5 | 184.7 | (11.4) | 55.5 | 13.1 | 94.2% |

| Retail Trade | 346.1 | 230.2 | 301.8 | 302.0 | (44.1) | 71.8 | 0.2 | 87.3% |

| Wholesale Trade | 139.8 | 108.2 | 126.9 | 129.2 | (10.6) | 21.0 | 2.2 | 92.4% |

| Transportation and Warehousing | 135.0 | 98.8 | 132.8 | 135.7 | 0.7 | 36.9 | 2.9 | 100.5% |

| Construction | 162.6 | 87.7 | 139.5 | 143.6 | (19.0) | 55.9 | 4.1 | 88.3% |

| Manufacturing | 66.0 | 37.8 | 56.5 | 59.0 | (6.9) | 21.2 | 2.5 | 89.5% |

SOURCE: New York State Department of Labor, NYC Office of Management and Budget

Chart 1. 2022 Changes in NYC Employment by Industry (in thousands)

NOTE: Quarterly changes shown are measured by comparing seasonally adjusted payrolls from the last month of each quarter versus three months prior.

SOURCE: New York State Department of Labor, NYC Office of Management and Budget

The Health Care and Social Assistance sector is first among the several industries that have neared or surpassed their pre-pandemic levels, at 107 percent of the February 2020 count (see Chart 2). Office-based sectors, with relatively high average wages, did not cut payrolls as much as many other industries when the pandemic hit, and they have also grown since that time. At the same time, the food and hospitality sector, with lower-than-average wages, suffered the largest payroll contraction and even with strong 2022 growth job counts remain 13 percent below February 2020. The tourism portion of the food and hospitality industry may now have nearly fully recovered from the pandemic, and we project that the rate of job growth in the sector will slow down. However, it may take more than a few years for jobs in this entire sector to approach their pre-pandemic levels, as business travel to NYC is not expected to return as quickly or as completely as tourism.

Chart 2. NYC Employment Relative to Pre-Pandemic (February 2020) Levels

SOURCE: New York State Department of Labor, NYC Office of Management and Budget

Retail employment—which is also relatively low-paying on average—fell substantially in 2020 and has had more difficulty coming back in 2022, declining in the 4th quarter and still 13 percent below its pre-pandemic level. Employment in NYC retail trade was already shrinking in the years prior to the pandemic (at an annual rate of -1.7 percent in 2015-19) and the lockdowns, closures and enhanced unemployment benefits may have accelerated a trend already in motion. In addition, the now seemingly long-term reduction in the number of office workers in central business districts on weekdays will reduce the volume of retail trade in those areas—although some of this loss will presumably be offset by retail expansion in other areas. We project that the retail sector will not recover the remaining jobs it lost during the pandemic.

We anticipate near-term job losses in the securities industry, a very high-wage sector in New York City. Profits for NYC securities firms, driven down by a bear market and the erosion of interest rate spreads, declined by 60 percent in 2022 and we project a further decline in 2023. We forecast that the industry will shed close to 4,000 jobs in 2023, with an additional 3,000 in 2024 and 2025, for a cumulative total of 4 percent of that sector’s workforce. And we do not expect these jobs to rebound within the next five years. As Chart 3 demonstrates, in each of the two prior bear markets, Wall Street shed jobs and did not bring them back quickly. It can also be seen in this chart that the current down cycle, unlike the prior two, was not preceded by as large a buildup of hiring and therefore we do not expect employment to drop as dramatically as in the past.

Chart 3. History of Declines in NYC Securities Employment

SOURCE: New York State Department of Labor, New York City Office of Management and Budget, Office of the New York City Comptroller

The Comptroller’s forecast also anticipates a falloff in technology sector jobs in 2023. The sector has thus far added to its NYC payroll count over and above its pre-pandemic level. Eroding profits and share prices at many major technology companies have led many to announce layoffs and cost-cutting initiatives.[2] Our forecast calls for the sector to lose more than 9,000 jobs in 2023, approximately half of its post-COVID job gain over pre-COVID levels.[3]

OMB’s private sector employment forecast grows by over 2 percent annually, on average through 2027. In contrast, the Comptroller’s forecast expects that relatively little post-pandemic catch-up remains and assumes that—after a brief slowdown in 2023-24—overall NYC employment resumes growth at historically typical rates.

NYC Labor Market

There are indications that New York City does not have as taut a labor market as exists for the whole U.S. Unemployment in the city stood at 5.9 percent in December, compared to 3.5 percent nationally. Job openings and quits data are not available at the NYC level, but statewide rates should be heavily influenced by conditions in the city. The ratio of job openings per unemployed worker in New York State has recently fallen to 1.1, compared with 1.9 per unemployed person in the U.S. The statewide quits rate of 1.8 percent is also much smaller than the national average of 2.7 percent.[4]

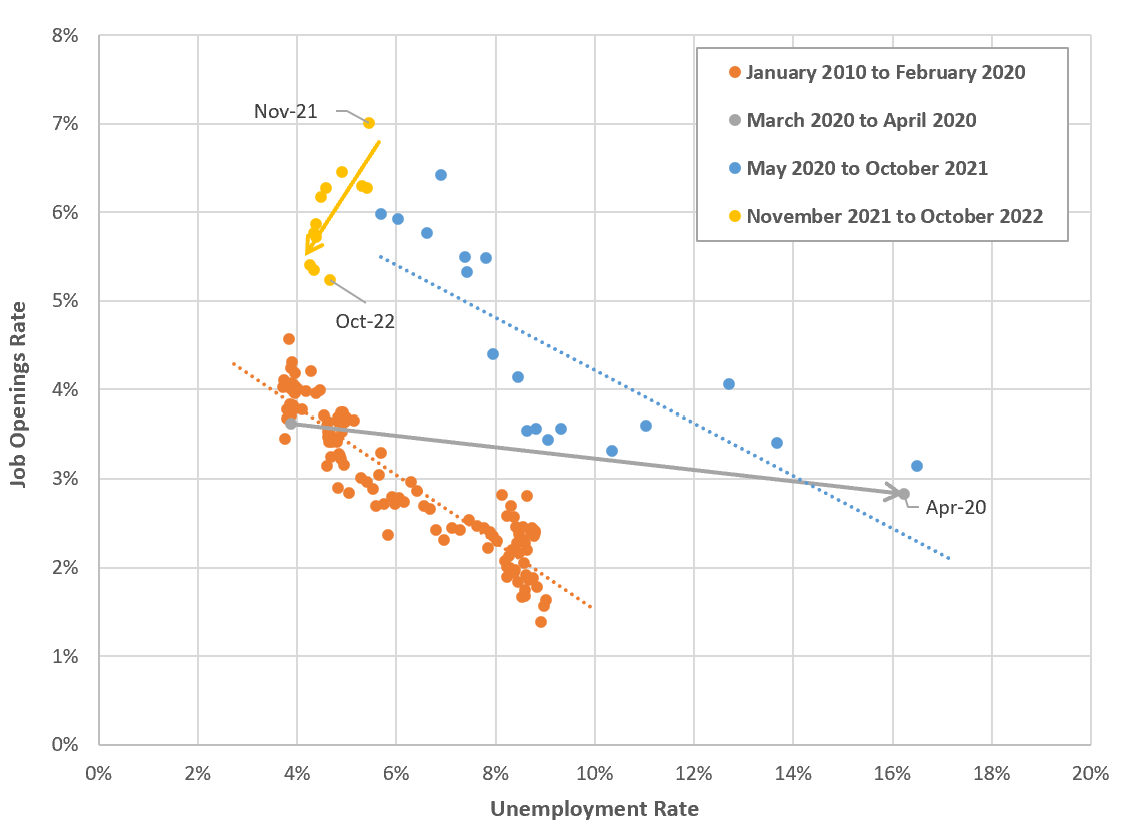

Chart 4 suggests a change in New York local labor market conditions possibly occurring in the past year. The plot shows what is known as a “Beveridge Curve” for New York State, which relates the rate of job openings to the rate of unemployment, each as a share of the labor force. While these rates are usually inversely related, the pandemic shifted this curve to the right where it has remained for most of the recovery period—indicating a higher number of job openings at every level of unemployment. This most likely reflects a sudden shock to the supply of labor—more than 300,000 people left the NYC labor force in the initial months of the pandemic and most have not returned. But in the past year, New York’s rate of job openings has been falling without unemployment rates rising—consistent with a gradual adjustment that is shifting the curve back to its longer-run level. This suggests that labor markets in NYC may no longer be so tight.

Chart 4. Beveridge Curve for New York State

SOURCE: Bureau of Labor Statistics

Inflation in the NY Area

On a 12-month basis, headline CPI in the NY area peaked at 6.7 percent in June of 2022 and was 6.0 percent in January of 2023. However, core CPI, which subtracts the more volatile food and energy components from the consumption basket, continues to increase and reached a post-pandemic high of 5.7 percent in January. This is largely because the shelter category of expenses, which represents 39.7 percent of the overall basket, jumped from a 2.1 percent increase in June 2022 to a 5.8 percent increase in January 2023 (see Chart 5).

Chart 5. NY Area CPI Inflation (12-month Percent Change)

SOURCE: Bureau of Labor Statistics

The steep increase in shelter inflation follows the well-documented large increase in market rate rents that is reflected in the CPI with a lag due to the time needed for rent contracts to reset at a higher price. Chart 6 shows year-over-year (yoy) percentage changes for the StreetEasy repeat rent index and NY shelter CPI lagged two quarters. Given the (relative) softening of market rate rent growth NY CPI shelter inflation might peak in the second quarter of 2023 and will continue to sustain core CPI inflation.

Chart 6. NY Area Shelter Inflation and Market Rent Index (Year-over-Year Percent Change)

SOURCE: Bureau of Labor Statistics, StreetEasy

Consumer Spending and Taxable Sales

As recently reported, the shift toward hybrid work schedules has disproportionately impacted spending by commuters into Manhattan’s central business districts. Manhattan resident spending also appears to be growing less than for other residents of NYC—likely a result of outmigration—according to data available from the Opportunity Insights project[5] and sourced from Affinity Solutions. Chart 7 shows the 8-week moving average of the indexes for NYC, Manhattan, and the average of Queens and Staten Island (Bronx and Brooklyn are not available). The 8-week moving average of consumer spending in NYC is 12.3 percent above pre-pandemic levels, with a large wedge between Manhattan (2.4 percent above January 2020) and the average of Queens and Staten Island (20.4 percent above January 2020).

Chart 7. Consumer Spending Indexed to January 2020

SOURCE: Opportunity Insights, Office of the NYC Comptroller

Given the differences in data sources and methodologies, the consumer spending data lines up reasonably well with data on taxable sales provided by the NYS Department of Taxation and Finance, available up to the quarter ending in November 2022.[6] Without adjusting for inflation, overall taxable sales were 14.2 percent above the level in the first quarter of 2020 and the consumer spending measure was up 12.2 percent, as shown in Chart 8 below. Consumer spending was affected relatively less than taxable sales for at least two reasons. First, consumption shifted toward non-taxable items (e.g., groceries) in the first months of the pandemic. Second the precipitous decline in tourism affected taxable sales directly but not resident spending.

Chart 8. Consumer Spending and Taxable Sales in NYC

SOURCE: NYS Department of Taxation and Finance, Opportunity Insights, Office of the NYC Comptroller

The growth of taxable sales, while still robust, is starting to moderate. Table 7 reports yearly growth rates for total sales and for its three main categories accounting for roughly two thirds of all taxable sales. Total sales grew 11.3 percent in the fourth quarter of 2022 in nominal terms, pushed by high inflation. In real terms, they have returned to 4.1 percent, within the norm of pre-pandemic quarterly growth rates. In 2022Q4 the retail category posted weak nominal growth of 2.0 percent, affected by lower sales at gasoline stations and automobile dealers, similar to national trends. Additionally, the growth rate is skewed by an unusually high amount of sales in lawn and garden equipment stores in the third quarter of 2022. Accommodation and food services expanded by 35.7 percent (28.5 percent adjusted for inflation). Utilities and information services posted another strong quarter at 10.0 percent (2.7 percent adjusted for inflation). Inflation net of shelter peaked at 9.2 percent in the third quarter (June-August) of 2022 and dropped to 7.3 percent in the fourth. As inflation continues to decline, the growth in taxable sales should continue to moderate.

Table 7. Taxable Sales Growth Rates (Year-over-Year Percent Change)

| Quarter | Total | Retail (incl. online) | Accommodation and Food Services | Utilities and Information | ||||

|---|---|---|---|---|---|---|---|---|

| Nominal | Real | Nominal | Real | Nominal | Real | Nominal | Real | |

| 2018Q4 | 6.1% | 4.1% | 3.4% | 1.4% | 3.5% | 1.5% | 3.6% | 1.7% |

| 2019Q1 | 3.8% | 2.7% | 1.7% | 0.6% | 2.3% | 1.2% | 2.5% | 1.4% |

| 2019Q2 | 4.1% | 2.9% | 4.3% | 3.2% | 4.4% | 3.2% | (2.0%) | (3.1%) |

| 2019Q3 | 6.0% | 4.6% | 2.1% | 0.7% | 3.7% | 2.3% | 8.6% | 7.3% |

| 2019Q4 | 6.0% | 4.8% | 7.7% | 6.5% | 3.3% | 2.2% | 8.8% | 7.7% |

| 2020Q1 | 7.7% | 5.3% | 11.5% | 9.2% | 4.3% | 1.9% | 6.9% | 4.6% |

| 2020Q2 | (36.1%) | (37.2%) | (31.6%) | (32.7%) | (74.0%) | (75.1%) | 4.8% | 3.8% |

| 2020Q3 | (21.7%) | (22.9%) | (3.2%) | (4.5%) | (69.0%) | (70.3%) | 1.8% | 0.5% |

| 2020Q4 | (19.8%) | (21.5%) | (4.8%) | (6.5%) | (62.3%) | (64.0%) | 1.5% | (0.2%) |

| 2021Q1 | (16.0%) | (17.7%) | (8.3%) | (10.0%) | (64.1%) | (65.9%) | 8.1% | 6.4% |

| 2021Q2 | 44.5% | 40.6% | 59.4% | 55.4% | 103.2% | 99.3% | 11.0% | 7.1% |

| 2021Q3 | 27.7% | 22.6% | 20.9% | 15.8% | 135.6% | 130.4% | 8.6% | 3.5% |

| 2021Q4 | 29.2% | 22.9% | 19.6% | 13.2% | 109.8% | 103.4% | 14.1% | 7.7% |

| 2022Q1 | 25.1% | 18.1% | 19.9% | 12.9% | 121.8% | 114.8% | 9.9% | 2.9% |

| 2022Q2 | 26.4% | 17.6% | 12.2% | 3.5% | 87.0% | 78.3% | 12.2% | 3.4% |

| 2022Q3 | 17.8% | 8.6% | 10.4% | 1.3% | 42.1% | 32.9% | 7.4% | (1.7%) |

| 2022Q4 | 11.3% | 4.1% | 2.0% | (5.3%) | 35.7% | 28.5% | 10.0% | 2.7% |

SOURCE: NYS Department of Taxation and Finance, Bureau of Labor Statistics, Office of the NYC Comptroller

NYC Real Estate Markets

Table 8. Manhattan Office Market Statistics

| Period | Vacancy Rates | Leasing (YTD, msf) |

Absorption (YTD, msf) |

Asking Rent (psf) | ||

|---|---|---|---|---|---|---|

| Direct | Sublease | Total | $2022* | |||

| Average 2010Q4 – 2019Q4 | 8.0% | 1.6% | 9.6% | 29.4 | 4.1 | $80.0 |

| 2020Q4 | 10.4% | 4.8% | 15.2% | 12.8 | (15.3) | $81.2 |

| 2021Q4 | 15.4% | 5.1% | 20.4% | 18.6 | (19.5) | $73.9 |

| 2022Q4 | 16.8% | 5.4% | 22.2% | 24.3 | (0.8) | $71.6 |

* Nominal value indexed to NY CPI-U quarterly average in 2022Q4. Average 2010Q4-2019Q4 is the average of the fourth quarters from each year.

SOURCE: Cushman & Wakefield, Bureau of Labor Statistics

The disconnect between occupancy and growth in office-using jobs continues, with the latter regaining and exceeding their previous peak in the fourth quarter of 2022. According to Kastle Systems data measuring swipes into office buildings in the NY area, attendance reached 47.8 percent of the pre-pandemic baseline in the first quarter of 2023 (data up to the week of February 9). Employers surveyed by the Partnership for NYC (PFNYC) indicated that average attendance reached 52 percent in January of 2023. Mass transit ridership also continued to increase at the start of the year, more markedly for the subway system (Table 9).

Table 9. Office-Using Jobs, Office Attendance, and Transit Indexes

| Quarter | Office-using Jobs | Kastle Systems | PFNYC Surveys | MTA Ridership (Percent of Baseline) | |||

|---|---|---|---|---|---|---|---|

| (‘000s) | Swipes as a % of Baseline | Average Weekday Attendance | Subway | LIRR | Metro North | Bridges & Tunnels | |

| 2020Q1 | 1,494 | 68.9% | N/A | 50.6% | 11.8% | 58.4% | 72.0% |

| 2020Q2 | 1,349 | 6.0% | N/A | 11.8% | 5.6% | 5.4% | 54.7% |

| 2020Q3 | 1,347 | 11.7% | 8.0% | 25.5% | 16.1% | 12.9% | 85.2% |

| 2020Q4 | 1,369 | 14.2% | 10.0% | 30.8% | 18.0% | 14.5% | 85.2% |

| 2021Q1 | 1,385 | 13.6% | 10.0% | 31.2% | 17.1% | 14.2% | 83.4% |

| 2021Q2 | 1,397 | 17.9% | 12.0% | 39.6% | 27.4% | 23.9% | 92.9% |

| 2021Q3 | 1,411 | 23.8% | 23.0% | 47.0% | 40.2% | 36.2% | 95.8% |

| 2021Q4 | 1,450 | 29.9% | 28.0% | 55.5% | 46.6% | 43.2% | 98.9% |

| 2022Q1 | 1,461 | 29.6% | N/A | 53.3% | 44.9% | 42.0% | 95.6% |

| 2022Q2 | 1,482 | 38.6% | 38.0% | 57.8% | 53.9% | 52.2% | 99.1% |

| 2022Q3 | 1,504 | 39.9% | 49.0% | 58.5% | 56.3% | 55.1% | 98.5% |

| 2022Q4 | 1,518 | 43.0% | N/A | 63.5% | 59.6% | 60.2% | 100.4% |

| 2023Q1 (to 2/9) | N/A | 47.8% | 52.0% | 66.2% | 60.7% | 61.9% | 99.2% |

NOTE: Red denotes to-date post-pandemic peak. Data matched to workdays in the Kastle data up to 2/9/2023, except PFNYC. PFNYC survey by date of publication: 8/20, 10/20, 3/21, 6/21, 8/21, 11/21, 5/22, 9/22, and 2/23. The PFNYC survey reported in 2023Q1 was conducted in January. All data are quarterly averages. Office-using jobs are the sum of FIRE, Information, and Professional and Business Services from the Current Employment Survey, seasonally adjusted by NYC OMB.

SOURCE: NYC OMB, Kastle Systems, Partnership for NYC, MTA, Office of the NYC Comptroller

Over time, PFNYC surveyed employers for both current and expected attendance, at varying horizons. As shown in Table 10, the difference between actual and expected attendance dropped dramatically in 2022 as average attendance rose toward the mid-50s. In the latest survey, PFNYC switched to asking about long-term (“new normal”) expected attendance, which was only 4 percent higher than the reported actual. The data signals that attendance may be finally stabilizing. The survey indicated that 59 percent of employees were in the office 3 or more days per week. The modal schedule was 3 days/week for 35 percent of employees. The expectations for the “new normal” pin the percentage in office for 3 or more days at 66 percent (40 percent for 3 days), with only 7 percent fully remote.

Table 10. Surveyed vs. Expected Office Attendance in NYC

| Publication Month | Average Weekly Attendance | |||

|---|---|---|---|---|

| As of Survey Period | Expectation Horizon | Expected | Difference | |

| August 2020 | 8% | July 2021 | 54% | 46% |

| October 2020 | 10% | July 2021 | 48% | 38% |

| March 2021 | 10% | September 2021 | 45% | 35% |

| June 2021 | 12% | September 2021 | 62% | 50% |

| August 2021 | 23% | January 2022 | 76% | 53% |

| November 2021 | 28% | January 2022 | 49% | 21% |

| May 2022 | 38% | September 2022 | 49% | 11% |

| September 2022 | 49% | January 2023 | 54% | 5% |

| February 2023 | 52% | “New normal” | 56% | 4% |

SOURCE: PFNYC

For any combination of hybrid schedules, the demand for space depends on peak occupancy. It is increasingly apparent that peak occupancy tends to be Tuesday through Thursday, and this is directionally confirmed by the data from Kastle Systems in Table 9. Because occupancy is not distributed uniformly through the week, any reduction in demand for office space is likely to be less than average attendance. Nonetheless, hybrid schedules imply a downward adjustment to space demanded per job. In its U.S. Real Estate Market Outlook for 2023, CBRE suggests that the reduction could be around 15 percent. In the first quarter of 2020 office space per job averaged 241 square feet. CBRE’s estimate suggests that, at current office-using jobs levels of around 1.5 million jobs (see Table 9 above), demand could be reduced by approximately 55 million square feet, other things equal.

Table 11. NY-Area Office Swipes by Day of Week

| Day of Week | Swipes as Percent of Baseline | ||

|---|---|---|---|

| 2021Q1 | 2022Q1 | 2023Q1 (to 2/9) | |

| Monday | 12.7% | 27.3% | 41.8% |

| Tuesday | 14.1% | 34.1% | 57.0% |

| Wednesday | 14.8% | 34.4% | 56.8% |

| Thursday | 14.3% | 32.2% | 53.0% |

| Friday | 11.7% | 18.8% | 25.6% |

SOURCE: Kastle Systems, Office of the NYC Comptroller

In an indication that new high-quality office space continues to be attractive, the construction pipeline for office space continues to be robust. Market reports indicate 13 million square feet (msf) under construction, including, among others, Two Manhattan West (2 msf), PENN 2 (1.6 msf), 1 Madison Avenue (1.4 msf).

The residential market remained strong in 2022 but growth in rents moderated from the blistering pace established in the first half of the year. As shown in Chart 9, median New York City asking rents held steady at $3,400 in December 2022. Rents remain up 16 percent from pre-pandemic levels and up 27 percent from the pandemic lows. Available inventory remained low and started sliding in the second half of the year. Supply averaged 28.8 thousand apartments per month in 2022, 24.8 percent less than in 2019.

Chart 9. Residential Rents and Inventory

Similar to rents, sale prices have started to moderate, with the median and mean price for condos and coops in Manhattan dropping 5.5 percent and 0.4 percent in 2022Q4 from a year ago, according to the latest Elliman report. The Case-Shiller index for condos in the NY area is also decelerating, with prices growing 5.1 percent in November 2022 over the previous 12 months. The condo index peaked in August and has declined through November. The repeat sale index produced by StreetEasy specifically for NYC also peaked in August, although this index has fluctuated less than the Case-Shiller data.

Tourism

NYC hotels capped off a strong year in December 2022 with total room demand hitting 93 percent of its December 2019 level (92 percent for the entire last quarter). For the whole year demand was 85.4 percent of 2019 levels, dragged down by the spread of COVID-19 variants at the beginning of 2022. Revenue per available room (RevPAR) was $303, 14 percent higher than December 2019 (not adjusted for inflation). With more than 11,000 rooms in the pipeline, supply growth is expected to remain robust.

Passenger volume at Port Authority’s airports increased sharply, going from 80 percent of pre-pandemic levels in December 2021 to 96 percent (or 11.4 million passengers) in December 2022. The total number of passengers in 2022 was 91 percent of 2019 levels (or 128.1 million passengers). The gain in international visitors was steeper, with December 2022 climbing to 88 percent of December 2019 levels vs. 63 percent in December 2021. The recent reopening of China to international travel could lift the outlook for tourism in 2023.

Risks to the Forecast

The U.S. economy is at a precarious moment where there is significant risk of a recession predicated by tightening monetary policy. The Fed has made its intentions clear that it will raise rates and even risk a downturn if inflation is not kept in check. Even though the “soft landing” scenario remains intact so far, a few months of wage and price growth could alter the near-term economic outlook significantly. Due to the strength of recent data on payroll jobs, consumer spending, and core services inflation, a “no landing” scenario has started to emerge, where the Fed needs to raise rates more to tighten financial conditions and slow down demand. Negotiations regarding the U.S. debt ceiling could also generate market volatility. The Congressional Budget Office estimates that the government’s ability to issue additional debt could be exhausted between July and September.

At the city level, an additional risk derives from the possibility of deeper job losses in the securities and tech sectors, and in overall office-using employment. Higher interest rates (especially long-term rates) and stagnating or declining leasing activity could be a source of real financial stress for commercial real estate. Widespread monetary tightening and supply shocks could also slow the global economy beyond projections, slowing down the recovery of international travel and tourism spending.

III. The FY 2024 Preliminary Budget

The FY 2024 Preliminary Budget totals $102.66 billion, $3.73 billion less than the modified FY 2023 budget. Excluding reserves and adjustments, the January 2023 Financial Plan reflects $108.53 billion in FY 2023 spending, decreasing to $103.37 billion in FY 2024.

The drop in spending between FY 2023 and FY 2024 primarily reflects the continued ramp down of COVID grant-related spending of $1.6 billion, as well as the $1 billion in projected expenditures for the asylum seekers included in FY 2023 only. The remaining decreases are seen in general contractual services.

Changes to the FY 2023 Modified Budget and the FY 2024 Preliminary Budget since the November Plan are depicted in Table 12.

Table 12. Changes to FY 2023 and FY 2024 City-Funds Estimates from the November 2022 Plan

| ($ in millions) | FY 2023 | FY 2024 |

| Gap to be Closed – November 2022 Plan | $0 | ($2,890) |

| Revenues | ||

| Property Tax Revenues | $0 | $0 |

| Non-Property Tax Revenues | 1,253 | 501 |

| Non-Tax Revenues | 368 | 235 |

| Revenues From PEGs | 66 | 2 |

| Total Revenue Changes | $1,687 | $738 |

| Expenditures | ||

| Agency Expenditures | $445 | $39 |

| Savings from PEGs | (144) | (285) |

| Federal Funding Swap | (75) | (390) |

| Debt Service | (1) | (54) |

| Total Expenditure Changes | $225 | ($690) |

| Gap To Be Closed Before Prepayments | $1,462 | ($1,462) |

| FY 2023 Prepayment of FY 2024 Debt Service | ($1,462) | $1,462 |

| Gap to be Closed – January 2023 Plan | $0 | $0 |

The January 2023 Financial Plan held Property Taxes and Personal Income taxes steady, but increased other taxes, including business, sales and hotel occupancy taxes, by $1.25 billion, and miscellaneous revenues by $503 million.

Expense changes were fairly limited in this Plan–the largest addition was to the Fire Department to right size personnel expenditures in FY 23 only for $140 million. $70 million was added to the Department of Small Business Services for the Early Childhood Education Stabilization Fund. $35 million was added to the Mayor’s Office of Criminal Justice for transitional housing initiatives.

As discussed directly below, the Program to Eliminate the Gap (PEG) primarily resulted from vacancy reductions across City agencies.

The resulting budget surplus forms the basis for the pre-payment of FY 2024 Debt Service, enabling both years’ budgets to balance, as required.

Program to Eliminate the Gap (PEG)

The January 2023 Financial Plan PEG totals $1.73 billion over the five years of the Financial Plan period: $210.5 million of savings in FY 2023, $340.6 million in FY 2024, $373.1 million in FY 2025, $396.0 million in FY 2026, and $413.1 million in FY 2027.

Savings were mostly concentrated in vacancy reductions as City agencies were required by the Administration to halve available vacancies (with some exceptions for public safety and essential services). The January Financial Plan proposes cutting City-funded vacancies by 3,660, resulting in a savings of $1.32 billion across the Plan in salary and fringe costs. The largest number of positions cut are in the Department of Social Services (773 positions), the Department of Education (390 non-pedagogical positions), and the Department of Health and Mental Hygiene (403 positions).

Revenue-generating initiatives total $72.1 million in savings throughout the January Plan, with $65.3 million in FY 2023. Most of these initiatives were already identified in the November 2022 Financial Plan, but FY 2023 savings were not accounted for at that time. Revenue proposals tied to new (not included in November) initiatives total $18.2 million, all in FY 2023 – with the bulk of revenue ($13.8 million) coming from the Office of Technology and Innovation (OTI, formerly known as the Department of Information & Telecommunications) mobile telecommunication franchising to offset declines in cable franchise revenues.

In a reversal from the City’s typical budget cycle, the January Plan PEG was far more technical than the November 2022 Plan PEG. The table below provides a look at savings from the PEG across the two plans. For a detailed analysis on the November 2022 Plan PEG, refer to the PEG section of the Comptroller’s latest Annual State of the City’s Economy and Finances.

Table 13. November 2022 and January 2023 Plan PEGs

| Category | FY 2023 | FY 2024 | FY 2025 | FY 2026 | FY 2027 |

|---|---|---|---|---|---|

| January 2023 Financial Plan | |||||

| Debt Service | ($616,957) | ($53,812,000) | ($79,819,057) | ($98,664,469) | ($111,802,343) |

| PS Savings | ($144,597,385) | ($285,047,311) | ($291,594,235) | ($295,592,072) | ($299,626,167) |

| Revenue | ($65,328,000) | ($1,700,000) | ($1,700,000) | ($1,700,000) | ($1,700,000) |

| January 2023 Financial Plan Total | ($210,542,342) | ($340,559,311) | ($373,113,292) | ($395,956,541) | ($413,128,510) |

| November 2022 Financial Plan | |||||

| Debt Service | ($83,297,519) | ($116,163,806) | ($147,652,118) | ($158,593,298) | ($244,103,734) |

| Expense Re-Estimate | ($126,426,331) | ($337,193,520) | ($433,520,680) | ($477,893,767) | ($484,938,396) |

| Possible Program Impact | ($61,007,001) | ($373,974,503) | ($405,132,687) | ($372,021,785) | ($370,825,074) |

| PS Savings | ($366,431,053) | ($349,123,202) | ($290,620,868) | ($263,352,741) | ($254,383,677) |

| Revenue | ($278,885,567) | ($437,631,050) | ($239,631,723) | ($226,926,474) | ($217,585,625) |

| November 2022 Financial Plan Total | ($916,047,471) | ($1,614,086,081) | ($1,516,558,076) | ($1,498,788,065) | ($1,571,836,506) |

| Total PEG Impact November 2022 and January 2023 | |||||

| ($1,126,589,813) | ($1,954,645,392) | ($1,889,671,368) | ($1,894,744,606) | ($1,984,965,016) | |

SOURCE: NYC Office of Management and Budget; Office of the NYC Comptroller

Risks and Offsets

The January 2023 Financial Plan presents stated budget gaps of $3.17 billion in FY 2025, $5.01 billion in FY 2026 and $6.47 billion in FY 2027.

The Comptroller’s Office foresees some differences, including positive offsets against the Plan, but some additional risks as well.

Table 14. Risks and Offsets to the January 2023 Financial Plan

$ in millions, positive numbers decrease the gap and negative numbers increase the gap

| FY 2023 | FY 2024 | FY 2025 | FY 2026 | FY 2027 | |

| City Stated Gap | $0 | $0 | ($3,166) | ($5,011) | ($6,469) |

| Tax Revenues | |||||

| Property Tax | $177 | $577 | $730 | $1,211 | $2,539 |

| Personal Income Tax | 193 | 632 | 509 | 654 | 973 |

| Business Taxes | 180 | 27 | (152) | (21) | (59) |

| Sales Tax | 202 | 525 | 390 | 133 | 26 |

| Real Estate Transaction Taxes | 60 | 305 | 126 | (105) | (195) |

| All Other | 47 | 14 | 54 | 88 | 94 |

| Audit | 579 | 179 | 179 | 179 | 179 |

| Subtotal Tax Revenues | $1,438 | $2,259 | $1,836 | $2,139 | $3,557 |

| Miscellaneous Revenues | ($55) | $63 | $68 | $53 | $53 |

| Total Revenues | $1,383 | $2,322 | $1,904 | $2,192 | $3,610 |

| Expenditures | |||||

| PS Accrual Savings | $714 | $357 | $0 | $0 | $0 |

| Temporary and Professional Services | 0 | (194) | 0 | 0 | 0 |

| Overtime | (651) | (563) | (440) | (440) | (440) |

| Collective Bargaining Agreements* | (2,500) | (1,800) | (3,400) | (3,900) | (4,700) |

| Education | (255) | (856) | (1,069) | (1,949) | (2,634) |

| Public Health Corps | 0 | 0 | (13) | (49) | (49) |

| FDNY Mental Health Response Program /B-HEARD | 0 | (37) | (37) | (37) | (37) |

| Public Assistance | (125) | (125) | (125) | (125) | 0 |

| Rental Assistance | 0 | (237) | (237) | (237) | (237) |

| Contributions to MTA | (74) | (125) | (271) | (445) | (492) |

| Prevailing Wage for Shelter Security Guards | 0 | (64) | (64) | (64) | (64) |

| Foster Care Reimbursement Rate | (47) | (118) | (118) | (118) | (118) |

| Variable Rate Debt Service Savings | 60 | 50 | 50 | 50 | 50 |

| Court Appointed Counsel | (84) | (84) | (84) | (84) | (84) |

| Temporary eFMAP (Public Health Emergency) | 285 | 48 | 0 | 0 | 0 |

| Lynch Settlement | 0 | (82) | 0 | 0 | 0 |

| Total Expenditures | ($2,678) | ($3,829) | ($5,808) | ($7,399) | ($8,805) |

| Comptroller’s (Risks)/Offsets | ($1,295) | ($1,507) | ($3,904) | ($5,207) | ($5,195) |

| Restated (Gap)/Surplus† | ($1,295) | ($1,507) | ($7,070) | ($10,218) | ($11,664) |

| Asylum Seekers | |||||

| Federal Assistance-Asylum Seekers | ($800) | $0 | 0 | 0 | 0 |

| State Assistance-Asylum Seekers | 377 | 623 | 0 | 0 | 0 |

| Asylum Seekers Expenses | (400) | (2,800) | (2,800) | (2,800) | (2,800) |

| Subtotal Asylum Seekers | ($823) | ($2,177) | ($2,800) | ($2,800) | ($2,800) |

NOTE: Numbers may not add to totals due to rounding. *Collective bargaining risk represents the floor based on the DC 37 pattern. †Comptroller’s Restated (Gap)/Surplus does not include risks associated with Asylum Seekers.

Revenue

The Comptroller’s Office anticipates tax and miscellaneous revenues to come in higher than the City’s projections in each year of the Plan. All categories of tax revenue are forecast to come in higher than planned in the current fiscal year and FY 2024, with Audits notably higher in FY 2023 at $579 million above Plan. The Comptroller’s Office forecast for Property Revenue grows significantly higher than the City’s Plan in the outyears. All other tax revenues are higher than planned in each year, except business taxes and real estate transaction taxes which begin to fall below OMB’s forecast in FY 2025 and FY 2026, respectively.

Miscellaneous Revenues show a slight risk in FY 2023 due to the possible non-payment from the City’s vendor for bus shelter advertising. Fines are anticipated to come in higher in all years of the Plan.

In total, revenue offsets against the Plan are $1.38 billion in FY 2023, $2.32 billion in FY 2024, $1.90 billion in FY 2025, $2.19 billion in FY 2026, and $3.61 billion in FY 2027.

Expenditures

The current Financial Plan holds a labor reserve to cover annual wage increases of 1.25 percent pertaining to collective bargaining agreements. Since the January Plan was released, the City has come to a tentative agreement with DC 37, the City’s largest union, for increases of 3 percent for the first four years of the agreement (retroactive to FY 2021) and 3.25 percent in the fifth year. The agreement also includes a one-time bonus of $3,000 upon ratification of the agreement. Typically, other unions follow the established pattern, though certain unions could negotiate higher increases. If followed, the DC 37 pattern is estimated to cost $2.5 billion in FY 2023, $1.8 billion in FY 2024, $3.4 billion in FY 2025, $3.9 billion in FY 2026, and $4.7 billion in FY 2027, based on the timing of the specific contract expirations and the respective retroactive payments associated with each contract. These amounts are above what is currently held in the labor reserve.

Other personnel expenditure variances against the four-year plan include payroll savings due to the current high vacancy rate and elevated temporary staff and overtime expenses compared to the budget.

The Comptroller’s Office is including a variety of risks within the Department of Education’s budget against the January Plan. Some of these are familiar risks that the office has previously included relating to the exhaustion of federal stimulus funds (fiscal cliffs associated with Summer Rising, Special Education Pre-K Expansion, Universal 3-K, and Community Schools), and the chronic underbudgeting for Carter cases, pupil transportation, and charter school tuition. A new risk is now included for the class size mandates imposed by the State last year. The City is estimating the cost of implementing smaller class sizes will cost $1.3 billion annually once fully implemented. Furthermore, the additional risks posed by the Governor’s Executive Budget and the removal of the charter school cap, are not included in this number but could pose significant exposure. See the Department of Education section for a further discussion of these items.

Other risks include underbudgeting within the City’s ongoing support of the Metropolitan Transportation Authority (MTA). The City is currently required to pay 50 percent of the paratransit expenses, for a risk of $48 million in FY 2023 growing to $120 million in FY 2027. The City’s budgeted amounts for the operating subsidies to the MTA Bus Company and Staten Island Railway are also underestimated; an additional risk is included for these items of $26 million in FY 2023, growing to $372 million in FY 2027. Not included in the table, but also looming within the Governor’s Executive Budget is the possibility that the City will be required to contribute over $500 million further in additional paratransit costs, student MetroCards, and an enhanced Payroll Mobility Tax. See the State Executive Budget section for additional details on these items.

The Comptroller’s Office risks include several other items that are currently not funded in the Financial Plan. Funding required to cover foster care reimbursement costs associated with a State requirement to pay 100 percent of the rates set by the State Office of Children and Family Services is estimated at $47 million in the current year and annualizing at $118 million per year. In addition, a New York State Court decision increased the hourly rate to be paid to court appointed counsel, with an estimated annual cost to the City of $84 million. In addition, New York City reached a settlement in the Lynch class action case on behalf of former detainees whose releases had been delayed for hours or days after they made bail. The Comptroller’s Office is assuming that approximately 25 percent of the 72,000 potential claimants will come forward for payments of $3,500; the settlement will be paid by the City in FY 2024. The Comptroller’s Office is also watching several other class-action cases, including Dunn et al v. NYC which concerns the Department of Correction’s alleged failure to provide constitutionally appropriate incarceration conditions to detainees at Rikers Island, and the Onaida class action concerning the City’s former policy of enforcing requests made by Immigration and Customs Enforcement to the Department of Correction.

The Comptroller’s estimated expense risk, including the impact of Collective Bargaining, but not including the unexpected and unpredictable forecast around asylum seekers noted below, is $2.68 billion in FY 2023, $3.83 billion in FY 2024, $5.81 billion in FY 2025, $7.40 billion in FY 2026, and $8.81 billion in FY 2027. Combined with the revenue offsets above, the net risk, not yet incorporated into the Financial Plan, is $1.30 billion in FY 2023, $1.51 billion in FY 2024, $3.90 billion in FY 2025, $5.21 billion in FY 2026 and $5.20 billion in FY 2027.

The Comptroller’s resulting restated budget gap for the January 2023 Plan is $1.30 billion in FY 2023, $1.51 billion in FY 2024, $7.07 billion in FY 2025, $10.22 billion in FY 2026, and $11.66 billion in FY 2027.

Asylum Seekers

The Comptroller’s Office is carrying an expense risk of $400 million in FY 2023 and $2.8 billion in FY 2024, in line with OMB’s recently stated cost estimates for providing shelter and services to the asylum seekers, who continue to come to New York City and are driving the shelter census upward. Although President Biden has recently announced a more stringent policy to stem the flow of asylum seekers at the border, there is much uncertainty in how the courts will respond, and some level of new arrivals can be expected to continue, particularly given that the underlying causes in the home countries of many of these migrants remain unresolved. Also, the lack of sufficient affordable housing within the city suggests no simple alternative to the shelter system for those who arrive in New York without a place to live. The Comptroller’s Office is maintaining a below the line risk at $2.8 billion in the outyears, though acknowledging significant uncertainty in either direction. The City budgeted $1 billion in federal aid in FY 2023 when it first introduced these expenses in November. The Comptroller’s Office anticipates some level of federal reimbursement given the $800 million allocated nationally in the Omnibus appropriations bill in December, but is assuming only 25 percent of the allocation will come to New York City. Furthermore, the Governor has proposed to cover 29 percent of the shelter expenses for the asylum seekers, yet capped the amount at $1 billion over two years.

State Executive Budget

As noted above and further outlined in the State Executive Budget section, the Governor’s proposed budget includes a variety of items that would have a potential negative impact on the City. These cost shifts and unfunded mandates would cost the City $992 million in FY 2024 and grow to approximately $2.3 billion over time if the charter cap is removed and the full number of allowable charter schools are implemented. The Comptroller’s Office will incorporate items that are in the State Budget into its assessment of Risks and Offsets once the Budget is enacted.

Revenue Analysis

Tax Revenues

The January 2023 Plan revises expected local tax revenues upward by $1.3 billion in the current fiscal year (FY 2023) compared to the November 2022 Plan. This revision primarily reflects collections that have significantly exceeded OMB’s prior expectations thus far by a similar amount.

The second column to the left in Table 15 shows the FY 2023 variance of collections through December relative to the November 2022 projections. As of December, total tax revenues grew 13.2 percent from the same period in FY 2022 and were above expectations by $1.4 billion. Non-property taxes grew by 23.6 percent. Some of the strength is temporary, particularly in PIT due to the timing of collections and expected refunds related to the Pass-Through Entity Tax (PTET) and an anomalous amount of State/City offsets received at the end of October that are expected to be more fully reversed later in the fiscal year.[7] Even after correcting for these and other timing issues, non-property taxes grew 12.4 percent over the year, as noted at the bottom of the table.

The table also reports, in the fourth column, OMB’s full-year FY 2023 expected growth rate per the January Plan, which is slightly negative (-0.9 percent) despite the large positive growth in collections observed in the fiscal year to-date. Their prediction for non-property taxes in FY 2023 is down more than 6 percent from FY 2022 despite collections running over 12 percent higher than FY 2022 so far in this fiscal year (after collections timing adjustments). The last column in Table 15 shows the implicit rate of growth (year-over-year) in OMB’s January forecast for the remainder of FY 2023. Their forecast contains significant expected declines in non-property taxes, a drop of over 20 percent from the prior year (after adjusting for technical timing issues).

Table 15. Tax Revenues FY 2023 to-Date Relative to the Mayor’s November 2022 Projections

| Collected FY to-date through Dec. 2022 ($ in mil.) |

Variance versus Mayor’s November 2022 Plan ($ in mil.) |

FY 2023 to-date growth versus prior year | January Plan forecast growth versus prior year | Implied forecast growth for remainder of FY (versus prior year) | |

| Total | 44,471 | 1,352 | 13.2% | (0.9%) | (19.1%) |

| Property tax | 24,920 | 62 | 6.3% | 6.2% | 6.1% |

| Non-Property Taxes | 19,551 | 1,229 | 23.6% | (6.1%) | (27.9%) |

| PIT | 6,850 | 382 | 17.7% | (19.7%) | (39.7%) |

| Business taxes* | 4,998 | 562 | 54.0% | 13.8% | (46.1%) |

| GCT/Bank tax | 2,496 | 305 | 0.6% | (9.0%) | (16.5%) |

| UBT | 819 | 74 | 7.3% | (8.9%) | (15.8%) |

| PTET | 1,682 | 182 | N/A | N/A | N/A |

| Sales Tax | 4,682 | 166 | 16.2% | 6.9% | (1.4%) |

| Real Estate Transaction Taxes | 1,286 | 11 | (13.6%) | (32.6%) | (48.7%) |

| RPTT | 719 | (4) | (19.3%) | (34.0%) | (51.2%) |

| MRT | 567 | 14 | (5.2%) | (30.6%) | (48.7%) |

| All Other | 1,390 | 110 | 45.4% | 12.8% | (8.0%) |

| NYC DOF Audits | 347 | 61 | 24.3% | (15.1%) | (34.3%) |

| Memo: PIT with collections adjustments (PTET and offsets) | 6,541 | 73 | 12.4% | (8.5%) | (19.6%) |

| Memo: Non-property taxes with collections adjustments | 17,460 | 820 | 12.4% | (6.1%) | (19.3%) |

* Growth rate includes PTET

SOURCE: NYC Office of Management and Budget, Office of the NYC Comptroller

Based on a much-improved economic outlook for the first half of 2023, continued strong sales tax collections and unexpectedly high audit collections, the Comptroller’s Office has revised its tax forecast upward for FY 2023. Overall, tax revenues are projected to be $70.4 billion, up approximately $1.5 billion from our previous estimate.

The difference between the Comptroller’s and OMB’s tax revenues forecasts is reported in Table 16. The Comptroller’s Office expects tax revenues will be higher than OMB’s estimates by $1.4 billion in FY 2023, $2.3 billion in FY 2024, $1.8 billion in FY 2025, $2.1 billion in FY 2026, and $3.6 billion in 2027.[8]

Table 16. Tax Revenues Risks and Offsets ($ in millions)

| FY 2023 | FY 2024 | FY 2025 | FY 2026 | FY 2027 | |

| Property Tax | $177 | $577 | $730 | $1,211 | $2,539 |

| PIT/PTET | $193 | $632 | $509 | $654 | $973 |

| Business taxes | $180 | $27 | ($152) | ($21) | ($59) |

| Sales Tax | $202 | $525 | $390 | $133 | $26 |

| Real Estate-Related | $60 | $305 | $126 | ($105) | ($195) |

| Other | $47 | $14 | $54 | $88 | $94 |

| Audits | $579 | $179 | $179 | $179 | $179 |

| Total | $1,438 | $2,259 | $1,836 | $2,139 | $3,557 |

SOURCE: Office of the NYC Comptroller

Tables 17 and 18 provide both levels and growth rates from the Comptroller’s and OMB’s forecasts. A discussion of the individual taxes follows.

Table 17. Comparison of Tax Revenue Projections: Growth Rates

| FY 2023 | FY 2024 | FY 2025 | FY 2026 | FY 2027 | FYs 2024 – 2027 Average Annual Growth |

|

|---|---|---|---|---|---|---|

| Property | ||||||

| Comptroller | 6.8% | 3.1% | 0.9% | 1.5% | 4.0% | 2.4% |

| Mayor | 6.2% | 1.9% | 0.4% | 0.0% | 0.0% | 0.6% |

| PIT/PTET | ||||||

| Comptroller | (7.3%) | 0.0% | 3.2% | 3.5% | 4.4% | 2.7% |

| Mayor | (8.5%) | (2.9%) | 4.2% | 2.6% | 2.5% | 1.6% |

| Business | ||||||

| Comptroller | (6.8%) | (6.4%) | 0.0% | 3.8% | 1.2% | (0.4%) |

| Mayor | (9.0%) | (4.5%) | 2.5% | 1.9% | 1.7% | 0.4% |

| Sales | ||||||

| Comptroller | 9.2% | 4.9% | 4.8% | 4.1% | 2.6% | 4.1% |

| Mayor | 6.9% | 1.5% | 6.5% | 6.9% | 3.7% | 4.6% |

| Real Estate- Related | ||||||

| Comptroller | (4.1%) | 6.8% | (1.1%) | (2.5%) | 1.2% | 1.0% |

| Mayor | (6.0%) | (1.1%) | 4.7% | 4.7% | 3.9% | 3.0% |

| All Other | ||||||

| Comptroller | 23.9% | (3.2%) | 5.2% | 3.3% | 1.5% | 1.7% |

| Mayor | 20.9% | (1.6%) | 3.1% | 1.7% | 1.3% | 1.1% |

| Audits | ||||||

| Comptroller | 53.1% | (30.8%) | 0.0% | 0.0% | 0.0% | (8.8%) |

| Mayor | (15.1%) | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

| Total Tax | ||||||

| Comptroller | 1.2% | 1.0% | 1.8% | 2.4% | 3.4% | 2.1% |

| Mayor | (0.9%) | (0.2%) | 2.5% | 2.0% | 1.5% | 1.5% |

SOURCE: Office of the NYC Comptroller, NYC Office of Management and Budget

Table 18. Comparison of Tax Revenue Projections: Levels

($ in millions)

| FY 2023 | FY 2024 | FY 2025 | FY 2026 | FY 2027 | ||

|---|---|---|---|---|---|---|

| Property Tax | Comptroller | 31,598 | 32,590 | 32,876 | 33,367 | 34,695 |

| Mayor | 31,421 | 32,013 | 32,146 | 32,156 | 32,156 | |

| PIT/PTET | Comptroller | 15,477 | 15,476 | 15,971 | 16,523 | 17,242 |

| Mayor | 15,284 | 14,844 | 15,462 | 15,869 | 16,269 | |

| Business Taxes | Comptroller | 7,670 | 7,181 | 7,180 | 7,453 | 7,543 |

| Mayor | 7,490 | 7,154 | 7,332 | 7,474 | 7,602 | |

| Sales Taxes | Comptroller | 9,333 | 9,791 | 10,258 | 10,682 | 10,961 |

| Mayor | 9,131 | 9,266 | 9,868 | 10,549 | 10,935 | |

| Real Estate-Related | Comptroller | 3,105 | 3,315 | 3,277 | 3,194 | 3,232 |

| Mayor | 3,045 | 3,010 | 3,151 | 3,299 | 3,427 | |

| Other | Comptroller | 1,956 | 1,894 | 1,991 | 2,058 | 2,089 |

| Mayor | 1,909 | 1,879 | 1,937 | 1,970 | 1,995 | |

| Audits

|

Comptroller | 1,300 | 900 | 900 | 900 | 900 |

| Mayor | 721 | 721 | 721 | 721 | 721 | |

| Total | Comptroller | 70,440 | 71,147 | 72,453 | 74,177 | 76,662 |

| Mayor | 69,002 | 68,888 | 70,618 | 72,038 | 73,105 |

Property Tax

The Comptroller’s forecast of real property tax (RPT) revenue for FY 2023 is $31.6 billion, an increase of 6.9 percent from FY 2022. As of December 2022, the total RPT collections is $24.9 billion. The Department of Finance (DOF) released the tentative 2024 assessment roll in January 2023 and based on these tentative property values, the Comptroller forecasts that the RPT revenue in FY 2024 would be $32.4 billion, an increase of 3.2 percent over the FY 2023 revenue forecast. The growth in the revenue for FY 2024 is primarily due to an increase in values of Class 1 and Class 4 properties. The market values of Class 1 properties are estimated using sales of mostly one, two, and three-family homes. The median sales price for a one-family home sold outside Manhattan (these properties make up most of Class 1 properties) increased by 10.2 percent from 2020 to 2021 and 7.0 percent from 2021 to 2022. The Comptroller forecasts revenue growth for FY 2025 to FY 2027 would average 2.1 percent with revenue forecasted to be $34.6 billion in 2027.