Introduction

COVID-19 has exacerbated persistent and deep inequalities impacting women and people of color. In fact, a recent national analysis of minority- and women-owned businesses estimated that between February and April 2020, 41 percent of Black-owned businesses, 32 percent of Latino- owned businesses, and 26 percent of Asian American-owned businesses closed either temporarily or permanently, while 17 percent of white-owned businesses closed.i

In New York City, the numbers are even more discouraging. According to a survey of more than 500 City-certified M/WBEs conducted by the New York City Comptroller’s Office in June 2020, 85 percent of M/WBEs believe they cannot survive for six more months. The results below highlight structural inequities and the need for urgent action.

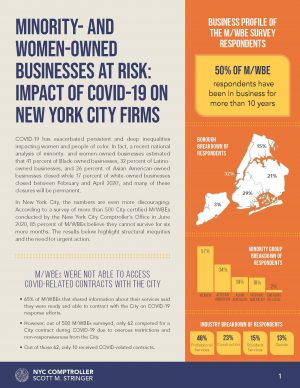

Business profile of the M/WBE survey respondents

50% of M/WBE

respondents have been in business for more than 10 years

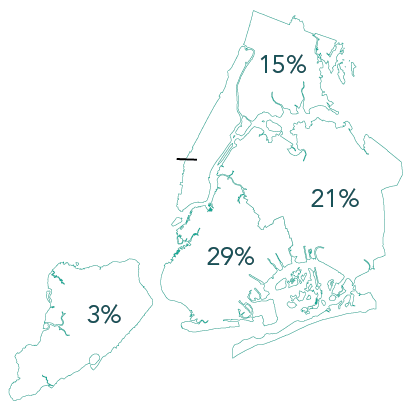

Borough Breakdown of Respondents

Minority Group Breakdown of Respondents

Chart 1

Industry Breakdown of Respondents

48%

Professional Services

23%

Construction

15%

Standard Services

13%

Goods

Did City-certified M/WBEs get relief from the federal Economic Injury Disaster Loan?

Chart 2

Did City-certified M/WBEs get relief from the federal Paycheck Protection Program?

Chart 3

Chart 4

M/WBEs Were Not Able to Access COVID-related Contracts With the City

- 65% of M/WBEs that shared information about their services said they were ready and able to contract with the City on COVID-19 response efforts.

- However, out of 500 M/WBEs surveyed, only 62 competed for a City contract during COVID-19 due to onerous restrictions and non-responsiveness from the City.

- Out of those 62, only 10 received COVID-related contracts.

M/WBEs Face Barriers to Federal, City, and Private Sector Relief

- 25% of M/WBEs did not apply for federal or City funding for the following reasons:

- Restrictive application criteria or use of funds

- M/WBEs did not want to be subject to debt or high interest rates

- Lack of outreach and awareness

- Funds were exhausted before they applied

- 20% of M/WBEs applied for federal or City funding but were not approved for the following reasons:

- Low credit score

- They did not meet application criteria

- They were still waiting approval

- They were rejected and were not told why they were ineligible

- Funds were exhausted before their application was processed

- Did M/WBEs get relief from the City of New York?

- Only 40 M/WBEs applied for the New York City Business Continuity Loan. Of the 40, only six were approved.

- Only 48 M/WBEs applied for the New York City Employee Retention Grant. Of the 48, only 15 were approved.

What M/WBEs want from the City of New York

Long Term Viability of M/WBEs in Question

30%

85%

80%

50%

35%

i National Bureau of Economic Research, https://www.nber.org/papers/w27309.pdf.