MWBE and Emerging Manager Pension Investments & MWBE Participation in the Bureau of Public Finance

Fiscal Year 2021 – 2022

A Message from Comptroller Brad Lander

Dear Reader,

As the Chief Financial Officer for the City of New York, the Comptroller has an interlocking set of responsibilities to achieve strong returns for pension beneficiaries, to secure the City’s fiscal health, and to help create a more just, equitable, and resilient city. Expanding the participation of minority- and women-owned businesses (MWBEs) in the work of investing the City’s pension funds and financing our municipal infrastructure is a critical strategy to help achieve all three of those goals.

When I took office earlier this year, I asked our team to prepare a detailed, public accounting of this work – something that had not been done in the past. Providing clear, transparent data is necessary for public trust, and an essential platform for setting goals and strengthening our performance. We are pleased today to provide the first detailed accounting of the Comptroller’s Office’s work with MWBE firms across the investment management and public finance industries.

New York City’s five pension funds serve nearly 800,000 public sector workers and retirees. The Comptroller’s Bureau of Asset Management serves as investment advisor, custodian, and fiduciary to those funds. As investors, we know that diversity is a proven strength in business that drives both value creation and economic growth. Investment firms owned by people of color and women are among the best performing managers in the industry and in our portfolio. As of June 30, 2022, the New York City Retirement Systems had $16.82 billion in investments with or committed to MWBE managers. This represents 11.65% of U.S.-based actively managed assets for the five pension funds. We are committed to growing both the amount and the percentage consistent with fiduciary duty.

The Comptroller’s Bureau of Public Finance works in partnership with the NYC Office of Management and Budget to manage all aspects of the City’s borrowing, including the sale of tax-exempt and taxable bonds to finance our extensive infrastructure needs and other public purpose capital projects. As we finance our schools, water and sewer infrastructure, climate resiliency projects, parks, roads, bridges, public transit, affordable housing, cultural institutions, and more, we know that MWBE firms deliver great value. For FY 2022, we contracted with MWBE firms for 30.4% of our bond underwriting, 41.5% of our financial and swap advising, and 22.3% of our bond counsel.

This report details allocations to MWBE asset management firms managing assets for the New York City Retirement Systems, the status of our “emerging manager” programs, the MWBDVE Brokerage Program for the Retirement Systems, and the efforts of the Bureau of Public Finance to expand our work with diverse firms.

While there are many things to be proud of in this report (I hope you’ll read some of the profiles of our managers), it is clear that we still have a long way to go. People of color – especially Blacks and Latinos – and women remain deeply underrepresented among our asset managers, and indeed among the senior staff of both bureaus.

I’m pleased to introduce Taffi Ayodele as our new Director of Diversity, Equity and Inclusion and Emerging Manager Strategy in the Bureau of Asset Management. She has already hit the ground running, bringing her extensive experience within the financial services industry to build upon the work we are doing to move the needle on diverse representation amongst our pension system managers and expand our work with our emerging investment managers.

It is my sincere hope that this transparency, and our work together over the coming year, can help move the needle forward to increase opportunities for MWBE firms, to achieve first-rate returns for our beneficiaries, and to foster a thriving, inclusive economy for all New Yorkers.

Sincerely,

Brad Lander

New York City Comptroller

A Message from Chief Investment Officer Steven Meier

The Bureau of Asset Management of the New York City Comptroller’s Office has a long-established commitment to advancing diversity, equity, and inclusion throughout its work to enhance the long-term value of the New York City pension funds’ investments. I am honored to join the Bureau of Asset Management this year to help build upon this commitment, by increasing opportunities to allocate capital to diverse and emerging managers that demonstrate the ability to generate superior risk-adjusted returns.

The Bureau of Asset Management of the New York City Comptroller’s Office has a long-established commitment to advancing diversity, equity, and inclusion throughout its work to enhance the long-term value of the New York City pension funds’ investments. I am honored to join the Bureau of Asset Management this year to help build upon this commitment, by increasing opportunities to allocate capital to diverse and emerging managers that demonstrate the ability to generate superior risk-adjusted returns.

Diversity and inclusiveness are correlated with stronger performance, better decision-making and greater resilience. Our proactive practices to invest with diverse and emerging managers ensure that we can identify the highest-performing managers, diversify our opportunities and build long-term partnerships for our success. Fostering diversity, equity and inclusion among our investment managers and assets not only benefits the performance of our investment portfolio but also contributes to much needed progress in the financial services industry. In addition, racial, gender and economic inequality are increasingly understood as systemic risks to the long-term health of the economy and markets, which affect the future of our investments and beneficiaries.

Diversity, equity and inclusion are an important component of our fiduciary duty to generate sustainable and superior returns to benefit the nearly 800,000 City employees, retirees and their families who participate in the City’s pension funds. As of June 30, 2022, the New York City Retirement Systems collectively had $16.82 billion invested in and committed to MWBE managers which represents 11.65% of U.S.-based actively managed assets. The amount invested and committed to emerging managers, many of whom are diverse-owned, was $8.59 billion. We intend to strengthen our strategies of investing with high-performing diverse and emerging managers across asset classes, including first-time funds and early-stage managers. In addition, we continue to integrate and evaluate diversity, equity and inclusion in the diligence, monitoring and engagement of all our investment managers as a fundamental competitive advantage.

I look forward to working closely with our Trustees and investment and industry partners to achieve our goals of creating more diversity, equity and inclusiveness in our investments and asset management industry in the interest of our beneficiaries.

Sincerely,

Steven Meier

Deputy Comptroller for Asset Management and Chief Investment Officer

A Message from Marjorie Henning, Deputy Comptroller for Public Finance

Dear Reader,

The Comptroller’s Bureau of Public Finance, working with our counterparts at the Mayor’s Office of Management and Budget, oversees the City’s debt program and issuance of municipal bonds for capital projects. Debt issuance funds parks, schools, bridges, sidewalks, and the rest of the City’s infrastructure throughout the five boroughs. Projects funded through the City’s capital program benefit all New Yorkers, and MWBEs are an integral part of the debt issuance process, serving as underwriters, advisers and counsel.

The Bureau of Public Finance has decades-old policies to promote MWBE participation in the capital financing process. Over the years, we have developed policies and practices in our financing programs to help ensure that MWBE underwriters have the ability expand their capital and staff over the years. By creating a pipeline and process for additional exposure, the Comptroller’s Office is helping to break the catch-22 cycle of needing experience at the City to get experience at the City. Additionally, all of the City’s major bond issuers include MWBEs as part of their financial adviser teams. And every counsel position in the debt issuance process includes MWBEs, giving these firms the opportunity to grow their size and capabilities.

Beyond reflecting the City’s population and its values of equity and inclusion, MWBEs provide valuable ideas to improve the City’s financial position and the efficiency of our financings. From additional distribution channels to reach more investors, to innovative financing ideas and alternative credit structures that improve borrowing efficiency, MWBEs are a critical part of the City’s debt program.

Lower borrowing costs means the City can provide more with less. Responsible debt management means New York City’s strength will carry forward to future generations. And MWBEs involved in every step of that process means that we’re doing it in a more equitable way.

Sincerely,

Marjorie Henning

Deputy Comptroller for Public Finance

Overview of the New York City Retirement Systems and the Bureau of Asset Management (BAM)

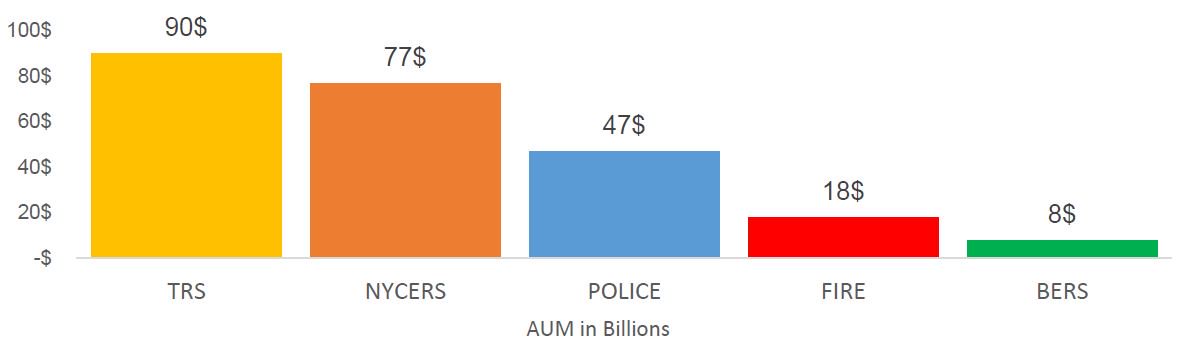

The New York City Retirement Systems, referred to hereafter as “the Systems,” are the City of New York’s five public pension funds serving nearly 800,000 members and beneficiaries.

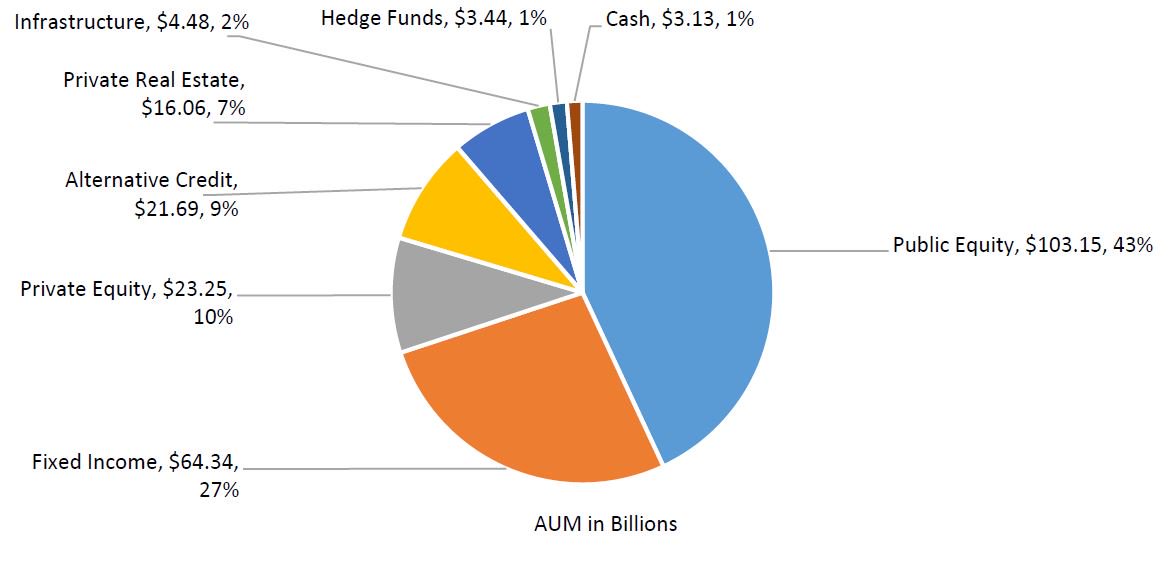

As of June 30, 2022, the Systems have approximately $240 billion in assets under management, constituting the fourth largest public pension plan in the U.S. The five pension funds comprising the Systems are the New York City Employees’ Retirement System (NYCERS), the Teachers’ Retirement System of the City of New York (TRS), the New York City Police Pension Fund (POLICE), the New York City Fire Pension Fund (FIRE), and the New York City Board of Education Retirement System (BERS).

The New York City Comptroller is by law the custodian of City-held trust funds and the assets of the New York City Retirement Systems and serves as Trustee on each of the funds. The Comptroller is also delegated to serve as investment advisor by all five pension boards. In this role, the Comptroller provides investment advice, implements Board decisions, and reports on investment performance.

The Comptroller’s Bureau of Asset Management oversees the investment portfolio for each system and related defined contribution funds and works closely with the Board of Trustees of each pension fund and their consultants on matters of asset management and allocation for each System. The Systems’ portfolios are managed predominantly by external investment managers, and are largely invested in publicly traded securities, with additional allocations to private equity, real estate, infrastructure, hedge funds, and alternative credit (opportunistic fixed and high yield) income investments.

Pension Fund Value

Net Asset Value by Asset Class

(AUM in Millions)

| Asset Class | BERS | FIRE | NYCERS | POLICE | TRS | Total |

|---|---|---|---|---|---|---|

| Public Equity | $3,581.48 | $7,259.36 | $33,034.04 | $20,011.43 | $39,260.96 | $103,147.27 |

| Fixed Income | $1,477.30 | $4,423.15 | $21,627.45 | $9,739.25 | $27,077.01 | $64,344.17 |

| Alternative Credit | $893.76 | $1,662.83 | $6,182.22 | $5,256.74 | $7,695.82 | $21,691.36 |

| Private Equity | $927.25 | $1,670.64 | $8,059.60 | $4,791.63 | $7,797.27 | $23,246.38 |

| Private Real Estate | $647.79 | $1,122.32 | $5,698.35 | $3,328.79 | $5,267.73 | $16,064.99 |

| Infrastructure | $222.70 | $275.69 | $1,426.87 | $856.25 | $1,699.64 | $4,481.15 |

| Hedge Funds | $861.76 | $1.13 | $2,574.58 | $3,437.47 | ||

| Cash | $175.29 | $269.16 | $545.75 | $477.54 | $1,661.43 | $3,129.17 |

| Total | $7,925.56 | $17,544.91 | $76,575.43 | $47,036.21 | $90,459.88 | $239,541.99 |

Overview of Diversity, Equity and Inclusion in Asset Management

MWBE and Emerging Managers

The Bureau of Asset Management and the New York City Retirement Systems have a longstanding commitment to prudently increasing their capital allocation to MWBE (minority- and women-owned) managers and Emerging Managers.

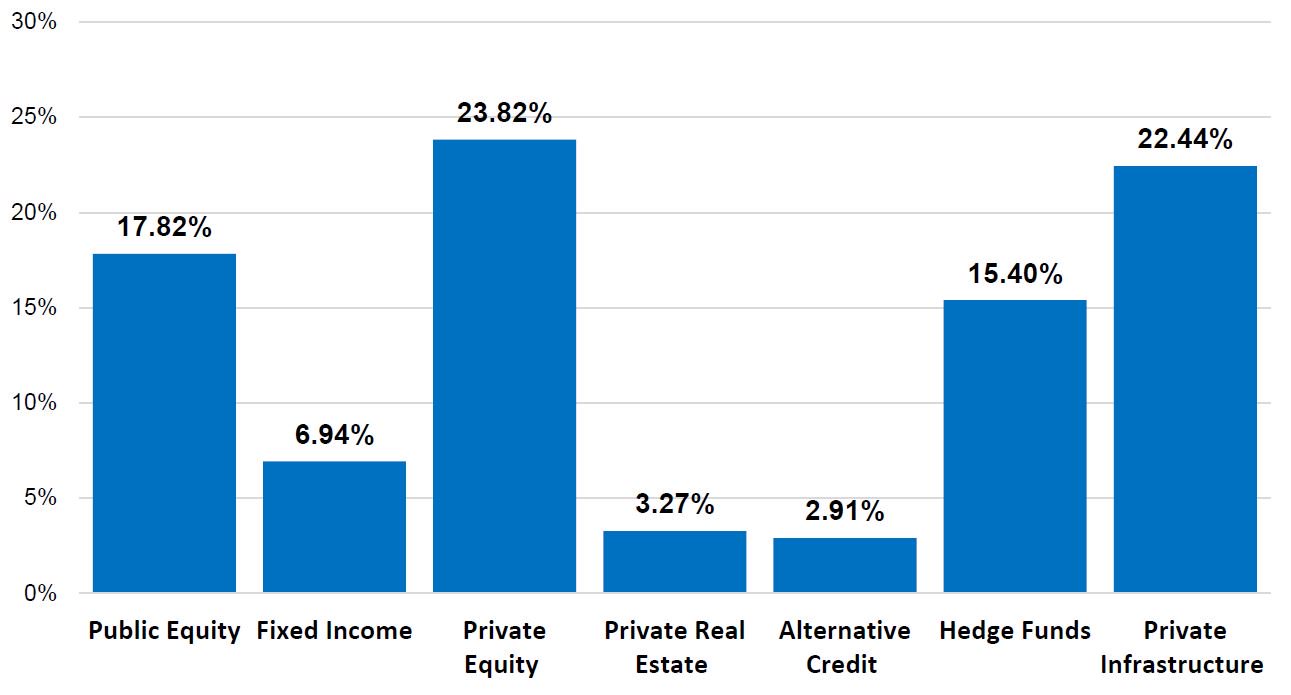

The Systems have $16.82 billion in investments with or committed to MWBE managers as of June 30, 2022. Those investments amount to 11.65% of U.S.-based actively managed assets.

BAM and the Systems also have a program of investing in Emerging Managers to seek the best performing managers, including MWBE managers, that do not typically have access to large institutional investors.

The Systems have a total of $8.59 billion in investments with or committed to Emerging Manager firms as of June 30, 2022.

MW/DVBE Broker Dealer Program

In 2008, BAM, on behalf of the Systems, established the Minority- and Women-Owned Business Enterprise (MWBE) Brokerage Program, which was expanded to include Disabled Veteran-Owned businesses in 2019 and is now the MW/DVBE Brokerage Program. The program supports opportunity for brokerage firms owned and operated by minorities, women and disabled veterans to conduct the purchase, sale or exchange of traded securities, consistent with best execution, for external investment managers in Public Equity and Public Fixed Income investing on behalf of the Systems.

Since the inception of the program BAM has maintained a MW/DVBE Brokerage Firm List (“Brokerage List”) on behalf of the Systems, which was designed to assist the Systems’ investment managers with identifying MW/DVBE brokerage firms with relevant experience, organizational stability, regulatory controls, trading capacity and certifications for potential utilization. Investment managers are encouraged to include firms from the Brokerage List in executing trades on behalf of the Systems and to make good faith efforts to achieve certain utilization goals recommended by BAM and approved by Trustees. These goals range from 5% to 30% depending on the sub-asset class and cover U.S. Equity, Non-U.S. Equity, Government & Agencies (Fixed Income), Mortgages (Fixed Income), U.S. Corporate Bonds and High Yield Fixed Income. In choosing to allocate to a manager, the Systems delegate to their investment managers full discretion to select all the brokerage firms that execute trades on their behalf. The Systems and Comptroller require all purchases and sales of securities for the Systems to be made on the basis of best execution.

BAM identifies firms for the Brokerage List by periodically soliciting expressions of interest and evaluating firms. The Brokerage List has 15 firms as of January 2022 and is intended for reference only, not as an exclusive, approved or recommended list of brokers, and does not guarantee trading activity. However, all public equity and public fixed income managers are monitored and engaged throughout the year and encourage to increase their utilization of MW/DVBE brokers.

Diversity, Equity and Inclusion in Manager Due Diligence

In 2014, BAM developed a due diligence and annual monitoring questionnaire to evaluate investment managers based on the diversity of their investment professionals and the quality of their diversity, equity and inclusion policies and practices. This policy is based on research showing that diversity improves decision-making, prevents the limitations of groupthink and is correlated with stronger financial performance and risk management. BAM asks all managers during due diligence for the race, ethnicity, gender and additional diversity characteristics of their investment professionals and other employees and addresses this in all investment memoranda.

MWBE Managers and Asset Values

Percentage of Assets Managed by MWBE Firms by Asset Class

Values denote invested and committed assets with US-based MWBEs as of June 30, 2022 as a percentage of US-based actively managed assets.

Total Assets Managed by MWBEs

Values denote invested and committed assets with US-based MWBEs as of June 30, 2022 as a percentage of US-based actively managed assets.

Public Markets: Public Equity

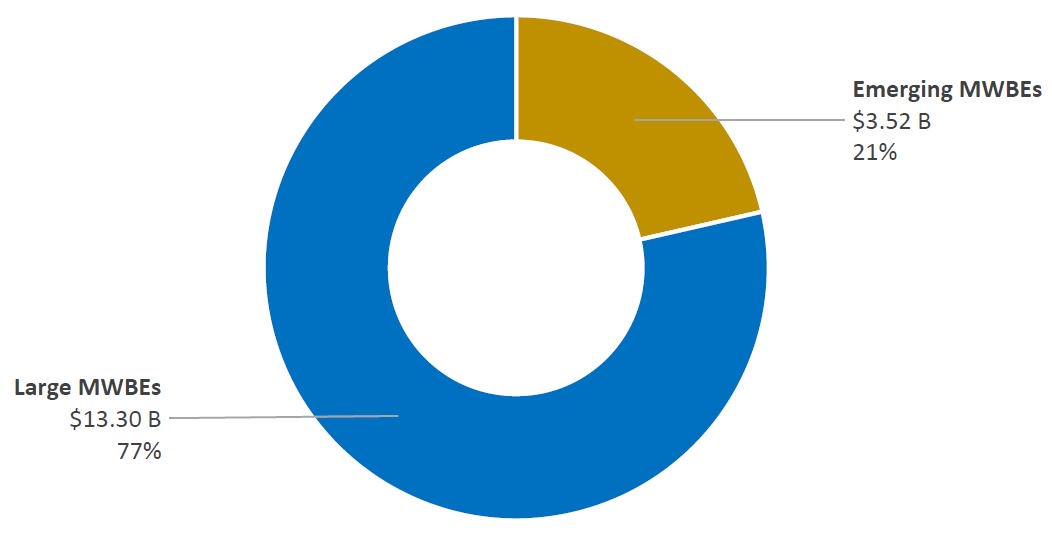

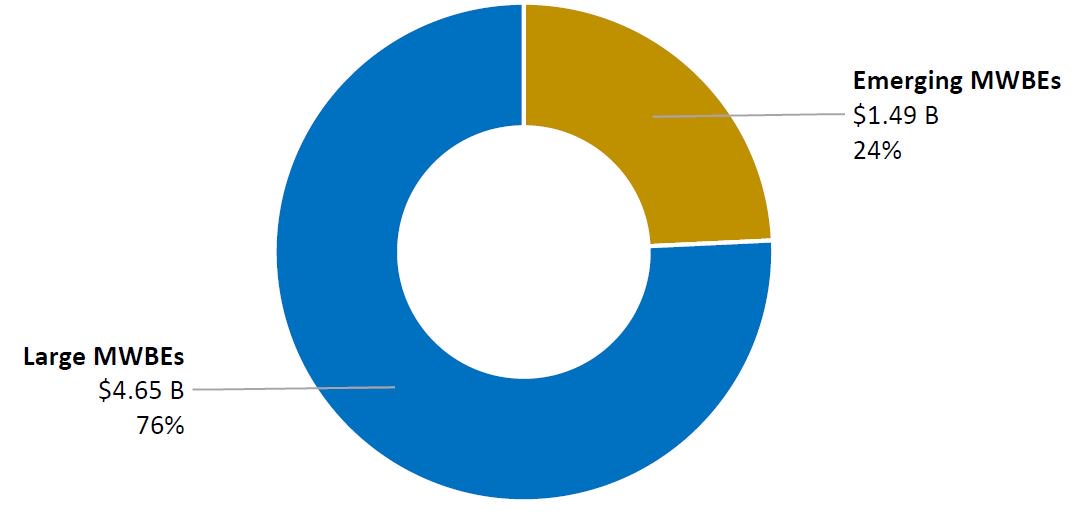

The Public Equity asset class has $5.68 billion in investments with US-based MWBEs as of the end of Fiscal Year 2022, comprised of emerging and large MWBEs as illustrated below. These assets represent 17.82% of US-based actively managed Public Equity assets.

MWBE Assets – Public Equity

Public Equity MWBE Managers and Asset Values as of June 30, 2022

| LARGE MWBE FIRMS | ||||||

|---|---|---|---|---|---|---|

| Firm Name and Investment Fund | BERS | FIRE | NYCERS | POLICE | TRS | Total |

| 269.41M | 1415.66M | 1014.16M | 1872.88M | 4572.11M | ||

| Brown Asset Management: Brown Asset Mgmt-US SCG | 52.74M | 195.58M | 413.55M | 661.87M | ||

| Causeway Capital Management: Causeway-WorldxUS LMCC | 216.67M | 1279.05M | 589.52M | 1312.97M | 3398.21M | |

| Earnest Partners: Earnest-US MCC | 136.61M | 229.06M | 146.36M | 512.03M | ||

| EMERGING MWBE FIRMS | ||||||

| Firm Name and Investment Fund | BERS | FIRE | NYCERS | POLICE | TRS | Total |

| 39.68M | 50.85M | 360.54M | 207.53M | 445.30M | 1103.91M | |

| Altravue Capital: Altravue-US SCV – Legato | 3.10M | 5.58M | 30.09M | 18.04M | 29.73M | 86.53M |

| ARGA Investment Management: ARGA-WorldxUS LCV – Bivium | 34.91M | 44.80M | 79.71M | |||

| ARGA Investment Management: ARGA-WorldxUS LMCV – Xponance | 10.81M | 12.95M | 26.43M | 21.46M | 35.24M | 106.89M |

| Ativo Capital Management: Ativo-WorldxUS ACC – Leading Edge | 29.47M | 23.39M | 36.24M | 89.10M | ||

| Blackcrane Capital: Blackcrane-WorldxUS ACC – Leading Edge | 70.54K | 52.65K | 66.01K | 189.21K | ||

| Blackcrane Capital: Blackcrane-WorldxUS SCG – Bivium | 5.57M | 7.06M | 12.63M | |||

| Foresight Global Investors: Foresight-EAFE LMCV – Xponance | 9.12M | 10.89M | 22.23M | 18.00M | 29.95M | 90.19M |

| Haven Global Partners: Haven-WorldxUS LMCV – Leading Edge | 33.28M | 26.12M | 42.94M | 102.33M | ||

| Lisanti Capital Growth: Lisanti-US SCG – Legato | 1.98M | 3.53M | 19.48M | 11.77M | 19.30M | 56.05M |

| Martin Investment Management: Martin-EAFE ACG – Xponance | 8.21M | 9.79M | 20.17M | 16.16M | 26.93M | 81.26M |

| Nicholas Investment Partners: Nicholas Investment-US SCG – Legato | 694.29K | 1.25M | 6.84M | 4.32M | 6.74M | 19.84M |

| Promethos Capital: Promethos-WorldxUS ACC – Bivium | 30.61M | 39.96M | 70.58M | |||

| Promethos Capital: Promethos-WorldxUS ACC – Leading Edge | 26.03M | 21.00M | 32.51M | 79.54M | ||

| Redwood Investments: Redwood-EAFE ACG – Xponance | 5.77M | 6.86M | 14.08M | 11.36M | 19.01M | 57.08M |

| Redwood Investments: Redwood-EM ACV – Bivium | 6.97M | 9.75M | 16.72M | |||

| Redwood Investments: Redwood-WorldxUS LMCC – Leading Edge | 28.42M | 21.45M | 33.25M | 83.11M | ||

| RVX Asset Management: RVX-EM ACV – Bivium | 8.09M | 11.46M | 19.54M | |||

| Solstein Capital: Solstein-WorldxUS ACC – Leading Edge | 17.82M | 14.41M | 20.38M | 52.61M | ||

MWBE Profile

ALTRAVUE CAPITAL, LLC

AltraVue Capital, LLC is a Bellevue Washington based, SEC-registered investment advisor that was founded in 2016 by long time partners Touk Sinantha and DeShay McCluskey. The firm is 100% employee-owned and is majority women and minority owned. AltraVue’s approach is value-oriented and seeks to generate superior long-term returns by investing in a concentrated portfolio of businesses that are under-followed, under-analyzed and undervalued by the market. The firm manages a Small Cap Value strategy and a highly concentrated, global long-only absolute return fund.

AltraVue was selected by one of the Systems’ Manager of Emerging Managers in 2017, when the firm had approximately $3 million in assets under management. The Systems’ $44 million allocation to AltraVue’s Small Cap Value strategy helped the firm to get started and encouraged other organizations to pay attention. The Small Cap Value strategy has added great value to the Systems’ portfolios since its inception.

The AltraVue Small Cap Value strategy ranks in the top 4th percentile for 3 years and in the top 6th percentile for 5 years in the eVestment US Small Cap Value Equity universe as of the fourth quarter of 2022; top quartile ranking for both time periods. Today, AltraVue manages around $900 million, and its two products and are now closed to new investments as asset capacity has been reached.

Public Markets: Public Fixed Income

The Public Fixed Income asset class has $2.45 billion in investments with US-based MWBEs as of the end of Fiscal Year 2022 as illustrated below. These assets represent 6.94% of US-based actively managed Public Fixed Income assets.

Public Fixed Income MWBE Investments as of June 30, 2022

| LARGE MWBE FIRMS | ||||||

|---|---|---|---|---|---|---|

| Firm Name and Investment Fund | BERS | FIRE | NYCERS | POLICE | TRS | Total |

| 114.38M | 77.29M | 1371.25M | 629.59M | 258.21M | 2450.71M | |

| Advent Capital Management: Advent-Convertible Bonds | 821.41M | 371.78M | 1193.19M | |||

| GIA Partners: GIA-Core Plus | 33.32M | 182.42M | 65.94M | 86.58M | 368.26M | |

| LM Capital Group: LM Capital-Core Plus | 29.64M | 320.56M | 65.94M | 116.22M | 532.36M | |

| Pugh Capital Management: Pugh-CorePlus | 114.38M | 14.33M | 46.86M | 28.26M | 55.41M | 259.25M |

| Taplin, Canida & Habacht: Taplin-Credit | 97.66M | 97.66M | ||||

Investments with emerging MWBEs in the Public Fixed Income asset class are invested through Manager of Managers after the previous Manager of Managers discontinued operations, the Boards selected Bivium for a new allocation which is expected to be funded before the end of calendar year 2022.

MWBE Profile

GIA PARTNERS, LLC

GIA Partners, LLC (GIA) is a credit-focused bond manager based in New York City. GIA was established as an independent Registered Investment Advisor in 2009. Previously, GIA was known as Global Investment Advisors, an investment firm started by Eduardo Cortes in 1998, which became a division of Reich & Tang Asset Management, where Mr. Cortes was joined by four of his former colleagues from JP Morgan Investment Management. GIA is a certified MBE (New York City, State of New York, NY & NJ Minority Supplier Development Council) (Hispanic/Asian). GIA received the Comptroller’s Diverse Practitioner Award in 2018.

GIA was initially selected by the Systems’ Manager of Managers for Fixed Income in May 2012 to manage $40 million in a core plus strategy for two of the Systems. After three years, GIA competed in a search in the Systems’ Developing Manager Program in 2015 and was awarded direct mandates, totaling $200 million, from four of the Systems. With additional funding in 2020 of about $155 million and investment returns, GIA currently manages approximately $370 million for the Systems. When GIA was first selected, its client base consisted almost entirely of corporate pension plans and foundations and endowments. Its client base and offerings have expanded. Public plans now represent over 25% of clients and assets under management, with investments in multiple strategies, including core plus, global high yield and emerging market corporate debt, through both direct allocations and Manager of Manager Programs.

Private Markets: Private Equity

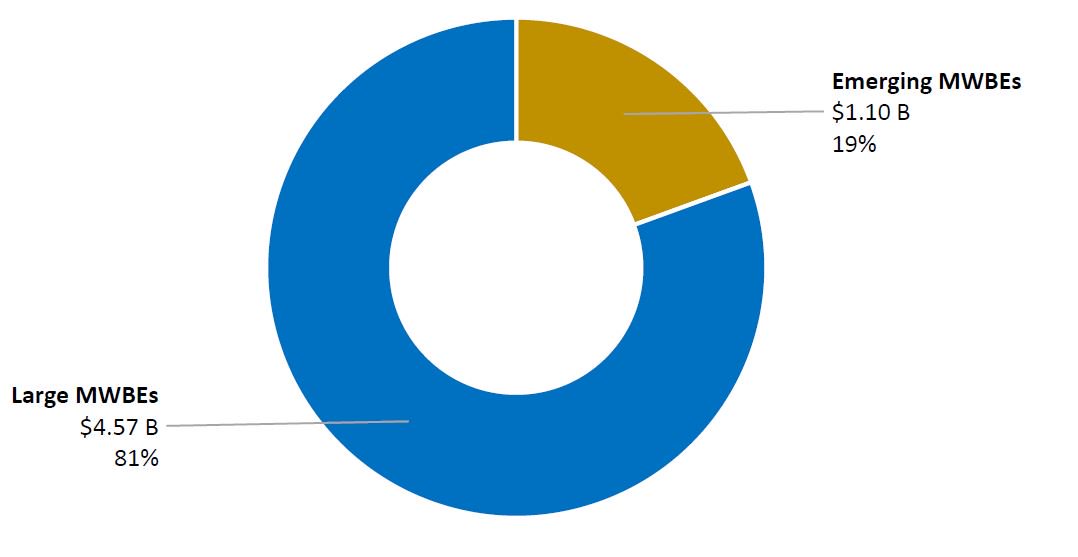

The Private Equity asset class has $6.14 billion in investments and commitments with US-based MWBEs as of the end of Fiscal Year 2022, comprised of emerging and large MWBEs as illustrated below. These assets represent 23.82% of US-based actively managed Private Equity assets.

MWBE Assets – Private Equity

Private Equity MWBE Investments and Commitments as of June 30, 2022

| LARGE MWBE FIRMS | ||||||

|---|---|---|---|---|---|---|

| Firm Name and Investment Fund | BERS | FIRE | NYCERS | POLICE | TRS | Total |

| 272.30M | 350.92M | 1506.74M | 993.21M | 1529.48M | 4652.65M | |

| Clearlake Capital Group: Clearlake Capital Partners VI | 15.08M | 16.59M | 70.88M | 45.24M | 63.34M | 211.12M |

| Clearlake Capital Group: Clearlake Capital Partners VII | 29.36M | 39.14M | 140.92M | 102.44M | 140.92M | 452.78M |

| Grain Management: Grain Communications Opportunity FD III | 2.82M | 4.70M | 19.75M | 14.11M | 19.75M | 61.14M |

| One Rock Capital Partners: One Rock Capital Partners III | 27.65M | 10.51M | 47.55M | 30.41M | 43.13M | 159.24M |

| Palladium Equity Partners: Palladium V | 11.51M | 7.67M | 38.36M | 26.85M | 30.69M | 115.09M |

| Reverence Capital Partners: Reverence Capital Partners III | 17.71M | 9.84M | 41.32M | 36.40M | 34.43M | 139.70M |

| Reverence Capital Partners: Reverence Capital Partners III Co-Invest | 6.95M | 3.97M | 14.89M | 12.90M | 12.90M | 51.61M |

| Siris Capital Group: Siris Partners III | 3.42M | 5.38M | 30.30M | 14.66M | 43.99M | 97.75M |

| Siris Capital Group: Siris Partners IV | 13.51M | 24.31M | 120.21M | 83.74M | 95.89M | 337.66M |

| Stellex Capital Management: Stellex Capital Partners II | 25.07M | 12.03M | 51.65M | 33.10M | 46.63M | 168.49M |

| The Vistria Group: Vistria Fund IV | 13.44M | 11.37M | 49.63M | 46.53M | 49.63M | 170.62M |

| Thoma Bravo: Thoma Bravo Fund XV | 3.31M | 4.90M | 20.08M | 13.71M | 19.59M | 61.57M |

| Thoma Bravo: Thoma Bravo XV Co-Invest | 1.35M | 2.00M | 8.20M | 5.60M | 8.00M | 25.15M |

| Valor Equity Partners: Valor Equity Partners V | 4.41M | 7.17M | 32.76M | 21.52M | 29.62M | 95.48M |

| Vista Equity Partners: Vista Equity Partners IV | 28.65M | 95.50M | 66.85M | 95.50M | 286.51M | |

| Vista Equity Partners: Vista Equity Partners V | 40.43M | 64.69M | 202.17M | 137.47M | 202.17M | 646.94M |

| Vista Equity Partners: Vista Equity Partners VI | 29.00M | 50.74M | 286.32M | 135.96M | 404.11M | 906.13M |

| Vista Equity Partners: Vista Equity Partners VII | 27.28M | 47.25M | 236.25M | 165.70M | 189.18M | 665.66M |

| EMERGING MWBE FIRMS | ||||||

| Firm Name and Investment Fund | BERS | FIRE | NYCERS | POLICE | TRS | Total |

| 63.90 M | 86.57 M | 600.33 M | 228.02 M | 511.21 M | 1490.04 M | |

| ACON Investments: ACON Equity Partners III | 20.62K | 226.80K | 41.24K | 144.33K | 432.99K | |

| Arrowhead Investment Management: Gleacher Mezzanine Fund II | 246.95K | 823.12K | 1.07M | |||

| Fairview Capital Partners: Fairview Emerging Managers Tranche 1 | 72.65K | 1.16M | 871.88K | 2.11M | ||

| Fairview Capital Partners: Fairview Emerging Managers Tranche 2 | 3.58M | 32.21M | 25.05M | 60.83M | ||

| Fairview Capital Partners: Fairview Ventures Fund III | 547.80K | 267.49K | 815.29K | |||

| Fairview Capital Partners: New York Fairview Private Equity Fund | 1.88M | 1.88M | ||||

| Grain Management: Grain Fund II | 13.99M | 7.53M | 45.20M | 13.99M | 48.42M | 129.13M |

| Grey Mountain Partners: Grey Mountain Partners Fund III | 259.47K | 1.45M | 493.00K | 1.69M | 3.89M | |

| ICV Partners: ICV Partners III | 1.87M | 3.74M | 13.10M | 18.72M | ||

| ICV Partners: ICV Partners IV | 3.03M | 3.03M | 18.20M | 6.07M | 20.22M | 50.55M |

| Incline Equity Partners: Incline Equity Partners III | 270.74K | 2.17M | 451.24K | 1.62M | 4.51M | |

| Levine Leichtman Capital Partners: Levine Leichtman Capital Partners IV | 1.36M | 9.54M | 2.72M | 6.81M | 20.43M | |

| Lightbay Capital: Lightbay Investment Partners II | 4.50M | 4.50M | 27.00M | 9.00M | 30.00M | 75.00M |

| Mill City Capital: Mill City Fund II | 1.45M | 1.45M | 8.44M | 2.89M | 9.89M | 24.12M |

| New Mainstream Capital: New Mainstream Capital II | 777.49K | 777.49K | 4.54M | 1.55M | 5.31M | 12.96M |

| New Mainstream Capital: NMS Fund III | 3.20M | 3.20M | 16.79M | 5.60M | 19.19M | 47.97M |

| Palladium Equity Partners: Palladium Equity Partners III | 890.08K | 3.51M | 1.83M | 2.71M | 8.95M | |

| Palladium Equity Partners: Palladium Equity Partners IV | 9.39M | 51.63M | 32.86M | 93.88M | ||

| Reverence Capital Partners: Reverence Capital Partners II | 4.10M | 4.10M | 24.57M | 8.19M | 26.05M | 67.01M |

| Reverence Capital Partners: Reverence Capital Partners II Co-Invest | 2.33M | 2.33M | 13.97M | 4.66M | 14.84M | 38.12M |

| RLJ Equity Partners: RLJ Equity Partners Fund I | 3.96M | 3.46M | 7.43M | |||

| Scale Venture Partners: Scale Venture Partners III | 1.84M | 3.67M | 5.51M | |||

| Starvest Partners: Starvest Partners II | 10.65M | 8.52M | 19.16M | |||

| Stellex Capital Management: Stellex Capital Partners | 4.29M | 4.29M | 27.34M | 9.11M | 30.02M | 75.05M |

| The Vistria Group: Vistria Fund III | 3.84M | 3.84M | 23.04M | 7.68M | 25.60M | 64.00M |

| The Yucaipa Group: Yucaipa Corporate Initiatives II | 1.13M | 10.16M | 3.39M | 7.90M | 22.58M | |

| Valor Equity Partners: Valor Equity Partners III | 2.74M | 1.17M | 7.82M | 2.34M | 8.60M | 22.66M |

| Valor Equity Partners: Valor Equity Partners IV | 10.73M | 10.73M | 64.35M | 21.45M | 71.50M | 178.76M |

| Vista Equity Partners: Vista Equity Partners Fund III | 1.26M | 5.04M | 3.36M | 4.20M | 13.86M | |

| Vista Equity Partners: Vista Foundation Fund II | 3.90M | 23.38M | 7.79M | 27.28M | 62.36M | |

| GCM Grosvenor – Fund of Funds | 4.70 M | 61.80 M | 30.20 M | 31.10 M | 127.80 M | |

| ACON Investments: ACON Equity Partners III, L.P. | 700.00 K | 9.90 M | 4.40 M | 4.90 M | 19.90 M | |

| Avante: Avante Mezzanine Partners SBIC, LP | 300.00 K | 4.60 M | 2.40 M | 2.30 M | 9.60 M | |

| Clearlake: Clearlake Capital Partners II, L.P. | 0.00 K | 800.00 K | 500.00 K | 400.00 K | 1.70 M | |

| DBL Investors: DBL Equity Fund-BAEF II, LP | 500.00 K | 6.40 M | 3.60 M | 3.30 M | 13.80 M | |

| Estancia Capital Management: Estancia Capital Partners, L.P. | 300.00 K | 4.40 M | 2.00 M | 2.20 M | 8.90 M | |

| GenNx360 Capital Partners: GenNx360 Capital Partners II L.P. | 800.00 K | 10.40 M | 4.50 M | 5.10 M | 20.80 M | |

| Grey Mountain: Grey Mountain Partners Fund II L.P. | 0.00 K | 400.00 K | 200.00 K | 200.00 K | 800.00 K | |

| Ironwood: Ironwood Mezzanine Fund III LP | 100.00 K | 800.00 K | 400.00 K | 400.00 K | 1.70 M | |

| Pharos: Pharos Capital Partners II-A, L.P. | 200.00 K | 3.20 M | 1.80 M | 1.70 M | 6.90 M | |

| Pharos: Pharos Capital Partners III, L.P. | 500.00 K | 4.90 M | 2.10 M | 2.40 M | 9.90 M | |

| Siris: Siris Partners II L.P. | 400.00 K | 5.20 M | 2.70 M | 2.70 M | 11.00 M | |

| Sycamore: Sycamore Partners, L.P. | 700.00 K | 7.90 M | 4.10 M | 4.00 M | 16.70 M | |

| Utendahl: Uni-World Capital L.P. | 0.00 K | 200.00 K | 100.00 K | 100.00 K | 400.00 K | |

| Vista | 200.00 K | 2.70 M | 1.40 M | 1.40 M | 5.70 M | |

| JP Morgan Chase Bank – Fund of Funds | 516.06 K | 27.66 M | 7.66 M | 12.62 M | 48.45 M | |

| 21st Century Group Equity Fund II, L.P. | 74.16 K | 1.05 M | 1.36 M | 733.83 K | 3.22 M | |

| 406 Ventures LP | 91.84 K | 1.31 M | 1.22 M | 1.13 M | 3.76 M | |

| Alsop Louie Capital 2 | 5.51 M | 1.80 M | 7.31 M | |||

| Altus Capital Partners II | 2.31 M | 747.03 K | 3.06 M | |||

| Greycroft Partners II | 9.96 M | 3.26 M | 13.22 M | |||

| KH Growth Equity Advisors Vicente Capital Partners Growth Equity Fund | 3.85 K | 54.94 K | 51.12 K | 47.46 K | 157.37 K | |

| Longitude Venture Partners | 47.26 K | 668.86 K | 885.49 K | 458.35 K | 2.06 M | |

| Parallel 2005 Equity Fund | 41.97 K | 599.59 K | 566.14 K | 514.25 K | 1.72 M | |

| Pharos Capital Partners II-A, LP | 174.43 K | 2.49 M | 2.32 M | 2.15 M | 7.14 M | |

| Rizvi Opportunity Equity Fund I, II | 67.09 K | 3.48 M | 967.17 K | 1.62 M | 6.13 M | |

| Scale Venture Partners II | 15.24 K | 215.64 K | 285.48 K | 147.77 K | 664.14 K | |

| Syndicated Communications Venture Partners V | 0.23 K | 3.30 K | 4.36 K | 2.26 K | 10.15 K | |

| Neuberger Berman Group – Fund of Funds | 7.06 M | 8.34 M | 73.98 M | 36.45 M | 54.21 M | 180.03 M |

| Altus Capital Partners II, L.P. | 502.44 K | 2.01 M | 2.51 M | |||

| Avance Investment Management I | 947.88 K | 947.88 K | 9.93 M | 4.21 M | 7.28 M | 23.32 M |

| Broad Sky Partners I | 1.18 M | 1.18 M | 12.36 M | 5.24 M | 9.06 M | 29.01 M |

| [Fund Name Withheld] | 302.48 K | 1.21 M | 1.51 M | |||

| Clearlake Capital Partners II, L.P. | 163.16 K | 652.64 K | 815.81 K | |||

| Ethos Capital I | 1.46 M | 1.46 M | 15.33 M | 6.49 M | 11.23 M | 35.98 M |

| FCDE II | 996.99 K | 996.99 K | 10.45 M | 4.43 M | 7.66 M | 24.53 M |

| Grey Mountain Partners Fund II L.P. | 43.86 K | 175.42 K | 219.28 K | |||

| Knox Lane Fund I | 1.23 M | 1.23 M | 12.87 M | 5.45 M | 9.43 M | 30.21 M |

| Vista Foundation Fund I L.P. | 264.59 K | 1.06 M | 1.32 M | |||

| Wavecrest Growth Partners II | 590.60 K | 590.60 K | 6.19 M | 2.62 M | 4.54 M | 14.53 M |

| WM Partners II | 653.69 K | 653.69 K | 6.85 M | 2.90 M | 5.02 M | 16.08 M |

MWBE Profile

AVANCE

Founded in 2020 and based in New York and Miami, Avance is led by Managing Partners David Perez and Luis Zaldivar, who were previously part of Palladium Equity Partners. Avance is a private equity firm focused on transformational growth opportunities in the Services, Technology, and Consumer sectors across the U.S.

Avance invests in the Lower Middle Market, targeting founder-owned companies in attractive and fragmented segments of the Business Services and Consumer sectors. In addition, the firm focuses on companies that serve the growing Hispanic market. Avance focuses on transforming companies by applying a disciplined value creation framework to accelerate growth both organically and through acquisitions. Avance works in partnership with management teams, industry executives, and functional experts with the goal of increasing the EBITDA and enterprise value of each underlying portfolio company. Avance will seek to take majority control positions, generally investing in businesses with $5-25mm of EBITDA with an enterprise value range of $50-$250mm.

Avance has raised over $900 million for its debut fund, and the Systems made a $15 million commitment to Fund I through the Neuberger Berman Early-Stage / First-Time Fund Program (“NYC-NorthBound Emerging Managers Program”).

Private Markets: Real Estate

The Real Estate asset class has $728.62 million in investments and commitments with US-based MWBEs as of the end of Fiscal Year 2022, comprised of emerging and large MWBEs as illustrated below. These assets represent 3.27% of US-based actively managed Real Estate assets.

MWBE Assets – Real Estate

Real Estate MWBE Investments and Commitments as of June 30, 2022

| LARGE MWBE FIRMS | ||||||||

|---|---|---|---|---|---|---|---|---|

| Firm Name and Investment Fund | BERS | FIRE | NYCERS | POLICE | TRS | Total | ||

| 34.71M | 9.94M | 108.58M | 37.71M | 157.16M | 348.11M | |||

| Artemis Real Estate Partners: Artemis Income & Growth | 9.94M | 9.94M | 60.65M | 17.90M | 100.42M | 198.84M | ||

| Basis Management Group: Big Real Estate Fund II | 24.77M | 47.56M | 19.82M | 56.48M | 148.63M | |||

| Capri Capital Partners: Capri Urban Investors | 372.89K | 266.42K | 639.32K | |||||

| EMERGING MWBE FIRMS | ||||||||

| Firm Name and Investment Fund | BERS | FIRE | NYCERS | POLICE | TRS | Total | ||

| 8.86 M | 13.09 M | 148.10 M | 37.98 M | 172.48 M | 380.50 M | |||

| Artemis Real Estate Partners: NYCRS Artemis Mach II Co-investment | 8.59 M | 8.59 M | 41.39 M | 27.33 M | 54.66 M | 140.57 M | ||

| Avanath Capital: Avanath Affordable Housing II | 61.63 K | 222.09 K | 138.81 K | 277.61 K | 700.14 K | |||

| Basis Management Group: BIG Real Estate Fund I | 4.10 M | 16.98 M | 9.49 M | 19.38 M | 49.95 M | |||

| American Value Partners – Fund of Funds | 337.84 K | 2.95 M | 1.01 M | 1.34 M | 5.65 M | |||

| Hudson Realty Capital Fund IV | 133.19 K | 736.85 K | 399.57 K | 334.74 K | 1.60 M | |||

| IC Hospitality Fund | 204.64 K | 2.22 M | 613.93 K | 1.01 M | 4.04 M | |||

| Franklin Templeton Institutional – Fund of Funds | 269.08 K | 269.08 K | ||||||

| Greenoak Real Estate Advisors LP | 269.08 K | 269.08 K | ||||||

| GCM Grosvenor – Fund of Funds | 86.55 M | 96.82 M | 183.37 M | |||||

| Arc Urban Investors | 7.98 M | 8.93 M | 16.92 M | |||||

| Basis BIG Equity Value-Add Fund II | 9.40 M | 10.51 M | 19.91 M | |||||

| Brasa Credit I, Credit II, Real Estate Fund II | 11.89 M | 13.30 M | 25.20 M | |||||

| Ethos GP I Venture | 10.40 M | 11.63 M | 22.03 M | |||||

| Grandview I-C, II, Windler Co-Invest | 8.35 M | 9.34 M | 17.69 M | |||||

| Hillcrest Enhanced Yield and Income Fund I | 8.81 M | 9.86 M | 18.67 M | |||||

| Locust Point Seniors Housing Debt Fund II | 7.18 M | 8.03 M | 15.21 M | |||||

| Pennybacker Credit II, | 8.59 M | 9.61 M | 18.19 M | |||||

| RailField Partners RG Value Add Fund I | 6.91 M | 7.73 M | 14.63 M | |||||

| Raith Real Estate Fund III | 7.05 M | 7.89 M | 14.94 M | |||||

MWBE Profile

BRASA CAPITAL MANAGEMENT

Brasa Capital Management is a value-add/opportunistic real estate investment manager based in Los Angeles. Brasa targets middle market commercial real estate investments in the Western US and Texas, investing across the capital stack in diversified asset types. The firm manages both commingled funds and separate accounts on behalf of institutional and high net worth investors. Brasa is minority-owned and registered as an investment adviser with the SEC.

Brasa was founded in 2018 as a spin-out from AEW Capital Management. Eric Samek, founder, previously ran West Coast. Fund I, anchored by GCM Grosvenor and a family office, closed in early 2019 with $120 million in commitments – the first vehicle raised under the Brasa name. The Systems, through the GCM Grosvenor Emerging Manager program, provided $20 million as part of a $75 million joint venture to launch Brasa’s credit practice in late 2019. The Systems, through the GCM Grosvenor program, then committed $20 million to help seed Brasa’s Equity Fund II in Q3 2021; the Fund held an oversubscribed final close at $450 million, well ahead of its initial target.

On the heels of a fully invested credit joint venture, GCM and the Systems provided another $50 million of joint venture capital in Q3 2021 to continue that strategy. Brasa now manages nearly $700 million of institutional capital commitments in under 5 years from firm launch.

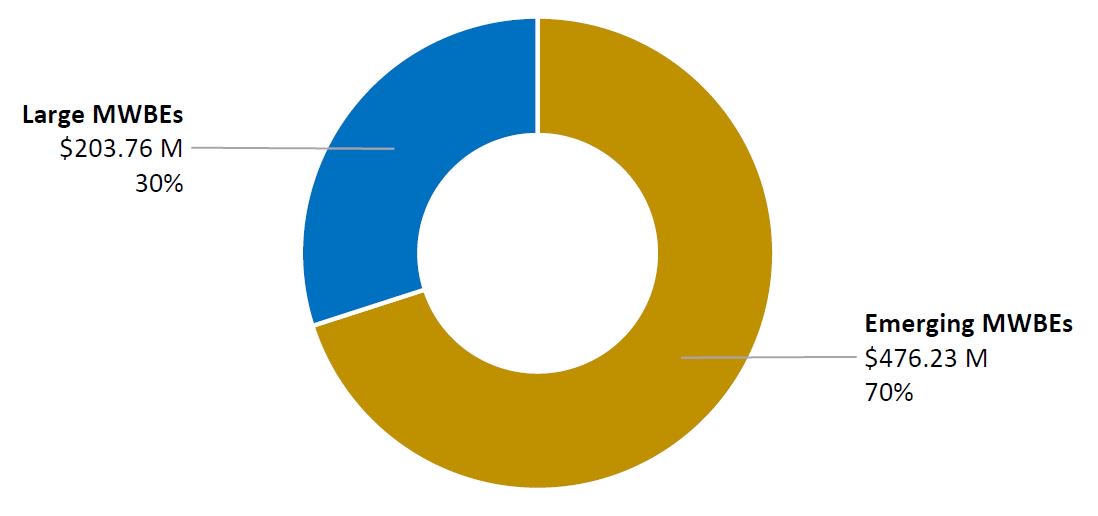

Private/Public Markets: Alternative Credit (Opportunistic Fixed Income and High Yield)

The Alternative Credit asset class has $679.99 million in investment and commitments with US-based MWBEs as of the end of Fiscal Year 2022, comprised of emerging and large MWBEs as illustrated below. These assets represent 2.91% of US-based actively managed Alternative Credit assets.

MWBE Assets – Alternative Credit

Alternative Credit MWBE Investments and Commitments as of June 30, 2022

| LARGE MWBE FIRMS | ||||||

|---|---|---|---|---|---|---|

| Firm Name and Investment Fund | BERS | FIRE | NYCERS | POLICE | TRS | Total |

| 40.75M | 55.02M | 47.88M | 60.11M | 203.76M | ||

| Brightwood Capital Advisers: Brightwood Capital Fund V | 40.75M | 55.02M | 47.88M | 60.11M | 203.76M | |

| EMERGING MWBE FIRMS | ||||||

| Firm Name and Investment Fund | BERS | FIRE | NYCERS | POLICE | TRS | Total |

| 21.18 M | 174.43 M | 94.20 M | 186.42 M | 476.23 M | ||

| Brightwood Capital Advisers: Brightwood Capital Advisors III | 3.91M | 17.11M | 10.76M | 17.11M | 48.89M | |

| Brightwood Capital Advisers: Brightwood Capital Advisors IV | 17.27M | 75.55M | 47.49M | 75.55M | 215.87M | |

| GCM Grosvenor – Fund of Funds | 81.77 M | 35.95 M | 93.75 M | 211.47 M | ||

| Altura Capital Fund III, L.P. | 3.78 M | 1.66 M | 4.33 M | 9.76 M | ||

| Comvest Special Opportunities Fund, L.P. | 12.21 M | 5.37 M | 14.00 M | 31.59 M | ||

| Crayhill Principal Strategies Fund II, L.P. | 11.39 M | 5.01 M | 13.06 M | 29.45 M | ||

| Hollis Park Value Fund LP | 10.87 M | 4.78 M | 12.46 M | 28.11 M | ||

| Paceline Equity Partners Opportunity Fund I, L.P. | 17.21 M | 7.57 M | 19.73 M | 44.51 M | ||

| Reverence Capital Partners Credit Opportunities Fund (Fund III), L.P. | 12.48 M | 5.48 M | 14.30 M | 32.26 M | ||

| TELEO Capital, L.P. | 13.84 M | 6.08 M | 15.87 M | 35.79 M | ||

MWBE Profile

BRIGHTWOOD CAPITAL ADVISORS

Brightwood Capital Advisors (Brightwood or BCA) is a New York City-based private credit manager with more than $4 billion in assets-under-management, focused on providing directly originated senior loans to US middle market borrowers. Brightwood is 100% minority owned (African-American) and nearly 70% of its 50+ employees are minority and/or women professionals. BCA was initially selected by the Systems’ Manager of Managers in 2011 to manage $2.5 million in Brightwood’s initial fund, Brightwood Capital SBIC I, LP, a Small Business Investment Company (SBIC).

Three years later, BCA competed in the Systems’ search for US private credit firms for its Alternative Credit portfolio in 2015 and won direct mandates totaling $100 million from four of the Systems to Brightwood Capital Fund III, LP. With additional fundings in Brightwood’s more recent fourth and fifth funds totaling an additional $450 million, the most recent of which was allocated last year, Brightwood now manages more than $550 million in commitments for all five Systems.

When BCA was first selected, the majority of its client base consisted high net worth, corporate pension plans, and foundations and endowments. With the Systems’ early investments as a foundation, Brightwood’s client base and offerings have expanded. Public plans now represent more than one-third of BCA’s assets under management.

Private Markets: Hedge Funds

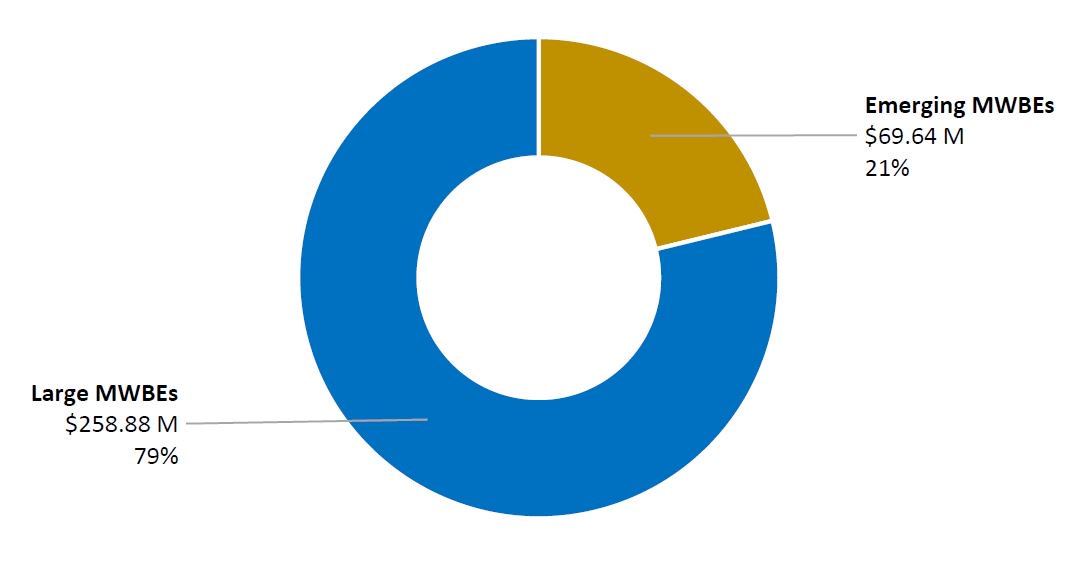

The Hedge Funds asset class has $328.52 million in investments with US-based MWBEs as of the end of Fiscal Year 2022, comprised of emerging and large MWBEs as illustrated below. These assets represent 15.40% of US-based actively managed Hedge Fund assets. The Teachers’ Retirement System; New York City Employees’ Retirement System; and Board of Education Retirement System do not have allocations to Hedge Funds as an asset class.

MWBE Assets – Hedge Funds

Hedge Funds MWBE Investments and Commitments as of June 30, 2022

| LARGE MWBE FIRMS | ||||||

|---|---|---|---|---|---|---|

| Firm Name and Investment Fund | BERS | FIRE | NYCERS | POLICE | TRS | Total |

| 62.97M | 195.90M | 258.88M | ||||

| SRS Investment Management: SRS Partners US | 62.97M | 195.90M | 258.88M | |||

| EMERGING MWBE FIRMS | ||||||

| Firm Name and Investment Fund | BERS | FIRE | NYCERS | POLICE | TRS | Total |

| 17.28 M | 52.36 M | 69.64 M | ||||

| Standard General: Standard General | 17.28M | 52.36M | 69.64M | |||

Private Markets: Infrastructure

The Infrastructure asset class has $814.28 million in investments with US-based MWBEs as of the end of Fiscal Year 2022. These assets represent 22.44% of US-based actively managed Infrastructure assets.

Infrastructure MWBE Investments and Commitments as of June 30, 2022

| LARGE MWBE FIRMS | ||||||

|---|---|---|---|---|---|---|

| Firm Name and Investment Fund | BERS | FIRE | NYCERS | POLICE | TRS | Total |

| 39.07M | 54.04M | 258.58M | 166.39M | 296.20M | 814.28M | |

| Global Infrastructure Management: Global Infra Partners IV-A/B | 23.75M | 25.96M | 123.37M | 75.76M | 118.95M | 367.79M |

| Global Infrastructure Management: Global Infrastructure Partners III | 15.32M | 28.08M | 135.22M | 90.63M | 177.25M | 446.49M |

The New York City Retirement Systems’ and Bureau of Asset Management’s Emerging Managers Program

Emerging Managers are generally defined as managers that are earlier in their lifecycles, without substantial assets under management, and can include minority-, women-owned firms. All of the Systems’ asset classes have Emerging Manager programs. These programs generally invest in Emerging Managers through (1) direct allocations and/or (2) indirect allocations. Indirect allocation programs are those where the Systems allocate to an investment manager (e.g., a Fund of Funds/Manager of Managers or in separately managed customized accounts) that has expertise and experience in selecting and allocating to Emerging Managers. Trustees and BAM have no discretion in selecting the underlying Emerging Managers or investments in indirect allocations.

The Private Market assets classes (Private Equity, Real Estate, Opportunistic Fixed Income (OFI) and Infrastructure) each have a First-Time Funds/Early-Stage Managers program (“Early-Stage Program”), an indirect allocation approach which is designed to invest in small Emerging Managers that are launching first or second time institutional funds and are even earlier in their stage of development than Emerging Managers in direct allocation programs. The Early-Stage Program has dedicated allocations in each participating asset class and a flexible investment strategy with primary fund commitments, co-investments, secondary investments and GP stakes/seeding. In addition, all asset classes, except Hedge Funds, have Transition Programs that transition successful Emerging Managers, based on certain criteria, to direct or larger allocations.

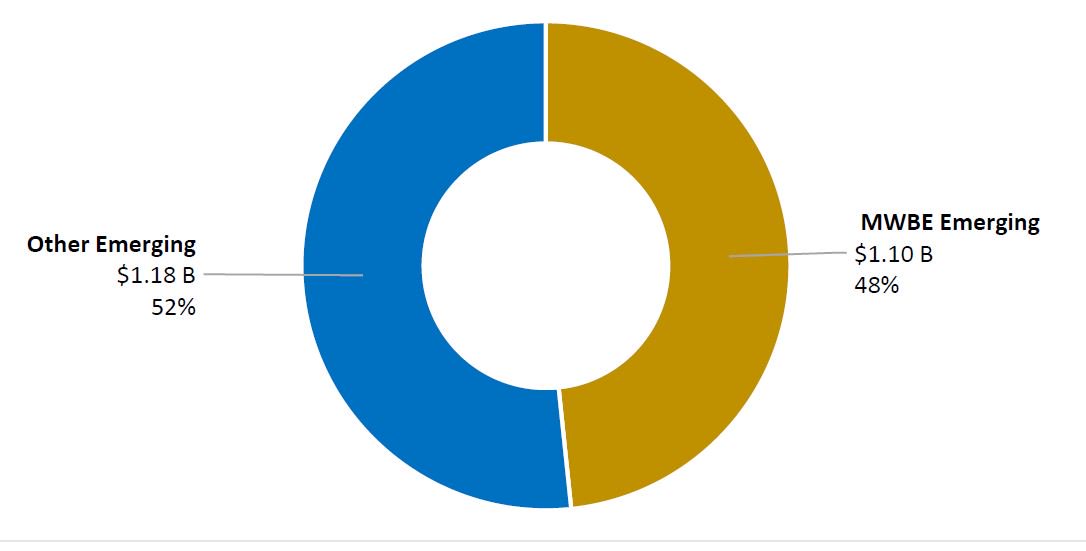

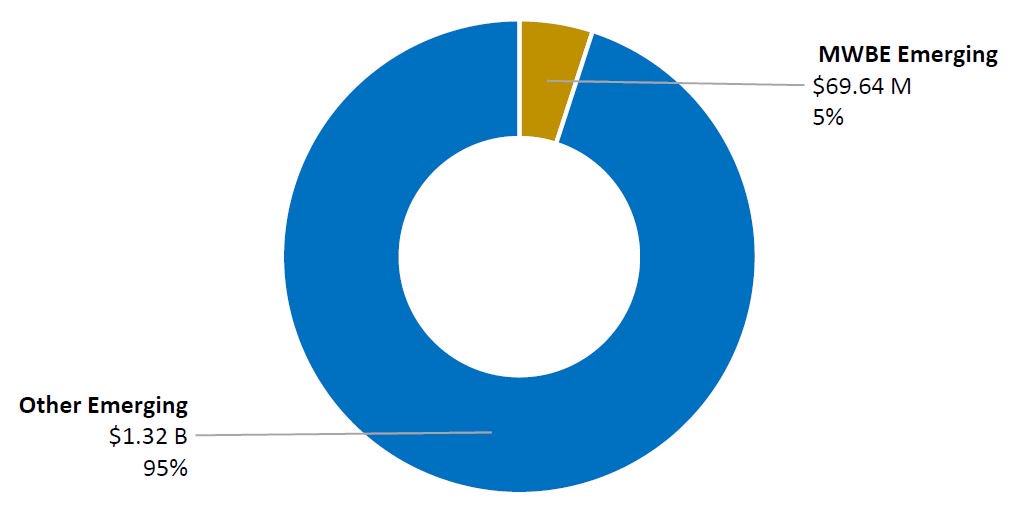

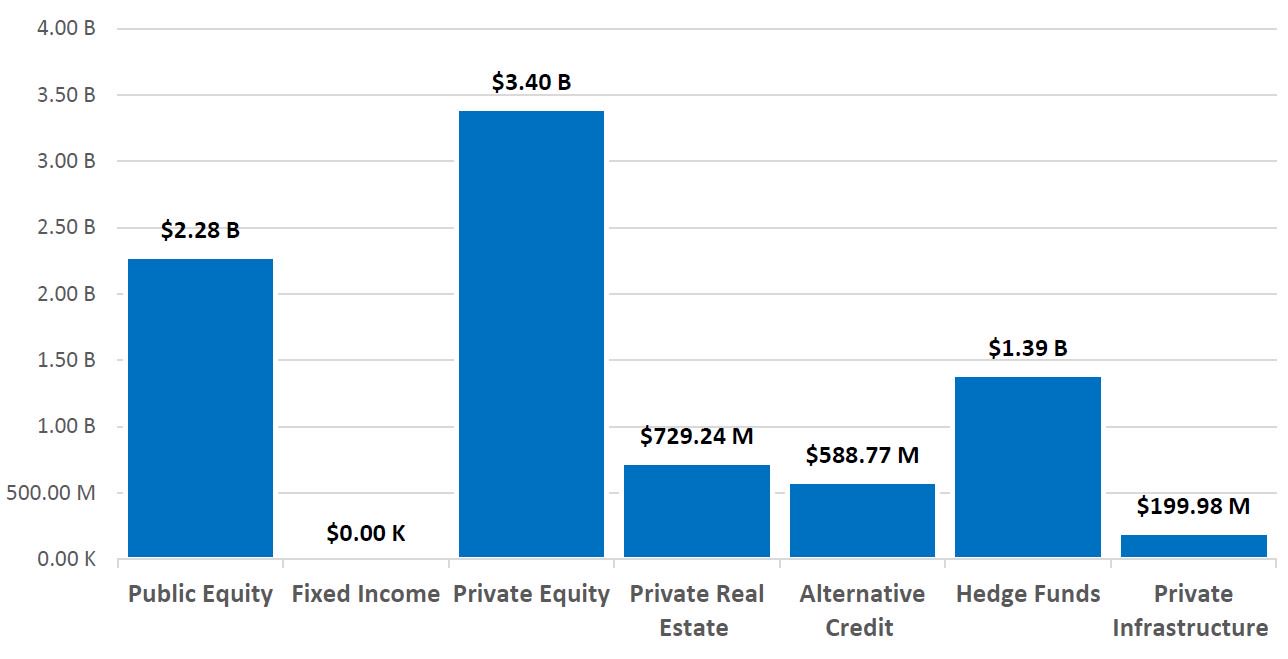

Assets Managed by Global Emerging Managers by Asset Class

Values denote invested and committed assets with global Emerging Managers as of June 30, 2022.

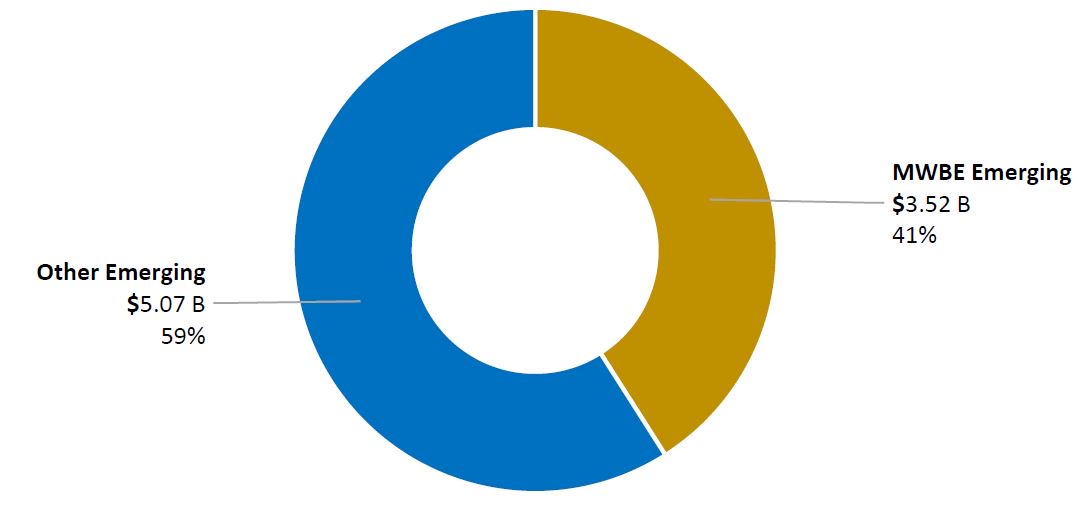

Total Assets Managed by Global Emerging Managers

Values denote invested and committed assets with US-based Emerging Manager MWBEs as of June 30, 2022 as a percentage of global Emerging Manager assets.

Emerging Manager Program Descriptions and Asset Values

Public Equity and Public Fixed Income (“Public Markets”)

The Public Markets asset classes invest with Emerging Managers through Funds of Funds/Managers of Managers. This program was initiated by NYCERS in Public Equity in 1992, Fire and BERS in 1999 and by TRS and Police in 2007. Funds of Funds select a portfolio of Emerging Managers, referred to as “sub-managers”, in the Fund of Funds portfolio.

Public Markets Transition Program

Public Equity and Public Fixed Income can utilize an expedited procedure in the Procurement Policy Board (PPB) Rules to transition successful sub-managers from Funds of Funds to direct and larger allocations.

Public Markets: Public Equity

Public Equity’s Fund of Funds managers are: Bivium, Leading Edge, Legato and Xponance. Public Equity’s Fund of Funds invest only in International Equity and U.S. Small Cap Equity. Legato invests in U.S. Small Cap Equity while the others invest in International Equity. Sub-managers must have no more than $5 billion of firm-wide assets under management at time of initial funding for International Equity and no more than $2 billion for U.S. Small Cap.

Public Equity Emerging Manager Program Investments

The Public Equity asset class first established its Emerging Manager Program in 1992. As of June 30, 2022 there is $2.28 billion of Public Equity invested with Emerging Manager firms.

Assets with Emerging Managers – Public Equity

Public Markets: Public Fixed Income

Public Fixed Income has one Fund of Funds for three Systems, Bivium, which will receive an allocation by the end of 2022. Public Fixed Income is increasing the maximum amount of assets under management for sub-managers to $10 billion at the time of initial funding for the Fund of Fund strategies. Public Fixed Income also has a Developing Managers program that allocates directly to larger Emerging Managers that have transitioned out of the Funds of Funds program or are otherwise sourced.

Private Markets: Private Equity

Private Equity Direct Emerging Manager Program

The direct Private Equity Emerging Manager program was launched in 2012 and reauthorized in 2015 and 2019 with a dedicated amount of assets to Emerging Managers. Private Equity also has an Early-Stage Program.

A brief overview of the direct Emerging Manager program and the Early-Stage Program as of December 2021 is below:

For the direct program, criteria for Emerging Managers are generally:

- Raising up to $1 Billion for Funds II, III and IV, with a broad institutional investor base

- Investing in buyout, growth equity and distress/special situations strategies in North America and Western Europe

| 2019 Direct EM Program | Early-Stage First-Time Fund Program | |

|---|---|---|

| Inception | 2012 | 2020 |

| Program Size | $600 million | $621 million |

| Est. Commitment Size | ~$50 million on average (range of $30-$75 million) | $15 million on average

(range of $10-$20 million) |

| Program Guidelines | Funds targeting up to $3.0 billion

– Potential candidates for Direct PE Program |

Funds targeting up to $750 million

– Potential candidates for Direct EM Program |

| Flexible Strategy | Primary Commitments, co-investments | Primary Commitments, co-investments, secondaries, GP-stakes/seeding |

| Manager Profile | 8-12 managers

– Expect strong representation of MWBE managers |

30-40 managers

– Expect strong representation of MWBE managers |

| Discretion | BAM PE team | Third party asset manager |

Private Equity First-Time Fund/Early-Stage Emerging Manager Program

Private Equity’s Early-Stage Program partners with Neuberger Berman to invest in early-stage / first-time funds that are generally defined as:

- Funds I and II

- Targeting $750 million or less in commitments

- Limited, but growing institutional investor base

- For co-investments, Neuberger seeks opportunities with an enterprise value smaller than $1 billion

The key terms and conditions for the Neuberger Berman program are:

- Size: $621 million in aggregate AUM

- Investment Period: The vehicle will commit new capital over 2-3 years

Private Equity Emerging Manager Program Investments

The Private Equity asset class first established its Emerging Manager Program in 2004. As of June 30, 2022 there is $3.40 billion invested or committed to Emerging Manager firms.

Assets with Emerging Managers – Private Equity

Private Markets: Real Estate

Real Estate Direct Emerging Manager Program

For the direct program, criteria for Emerging Managers are generally:

- Manage capital commitments of not more than $2 billion of institutional capital

- Raising institutional real estate funds I, II or III

- Targeting a fund size of $500 million or less

Real Estate First-Time Fund/Early-Stage Emerging Manager Program

Real Estate has an Early-Stage Program with GCM Grosvenor (“Grosvenor”) to invest in Real Estate early-stage Emerging Managers and first-time funds. The program primarily targets US-based value-add and opportunistic equity and debt, and middle-market opportunities.

The criteria for the Grosvenor program are generally:

- Size: $500 million in aggregate AUM

- Investment Period: The investment period for Grosvenor to make new commitments is 4 years (3 years + 1 year extension subject to GP with LP consent)

- Investment Types: Targeted strategies for this program are designed to accommodate the full lifecycle of managers and include JV/Seeding, Primary funds, Joint Ventures, Co-investments and Secondary investments (opportunistically)

First-time funds/early-stage managers are generally defined as:

- Raised three (3) or fewer previous commingled institutional-grade investment products with the same investment strategy and focus as the targeted Investment

- No more than $500 million in aggregate capital commitments

- Commitments of $2 billion or less of institutional capital in a commingled fund format

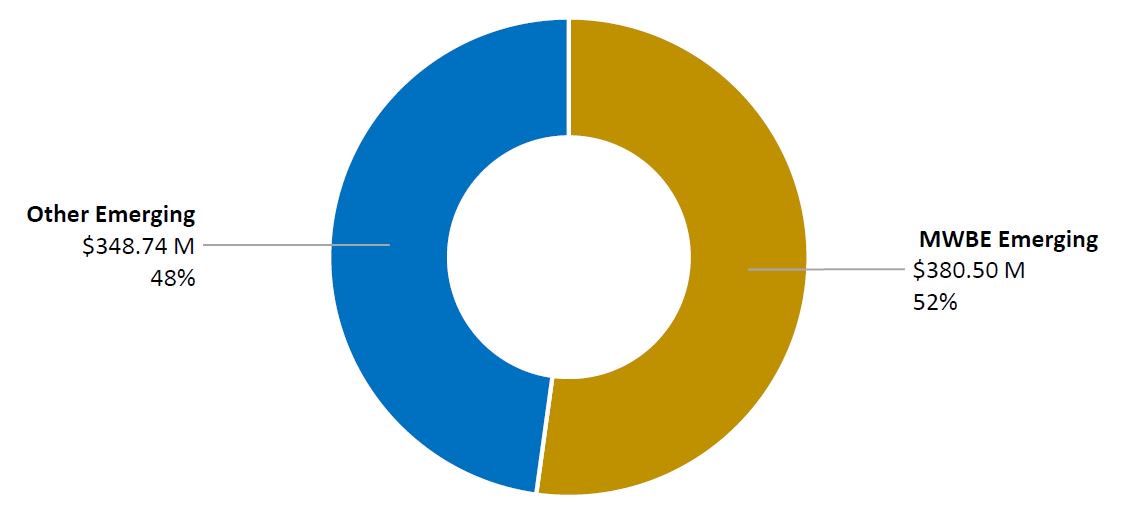

Real Estate Emerging Manager Program Investments

The Real Estate asset class began participating in the Emerging Manager Program in 2007. As of June 30, 2022 there is $729.24 million invested or committed to Emerging Manager firms.

Assets with Emerging Managers – Real Estate

Private Markets: Alternative Credit

Opportunistic Fixed Income (OFI) Direct Emerging Managers Program

For the direct program, criteria for Emerging Managers are generally:

- Firm AUM of <$2 billion

- Raising Fund II or III

OFI First-Time Fund/Early-Stage Emerging Manager Program

Alternative Credit has an Early-Stage Program with Grosvenor to invest in OFI early-stage Emerging Managers and first-time funds generally defined as:

For open-end vehicles:

- < $1 billion in AUM

- Operational track record of less than 3 years

- First open-end institutional-grade fund raised at current independent organization

For closed-end vehicles:

- No more than $1.5 billion in AUM with respect to the same investment strategy and focus;

- Operational track record of less than 6 years;

- Funds I, II and III

The key terms and conditions for the Grosvenor OFI program are generally:

- Series I: approved in 2019; began investing in April 2020; $300 million size of total commitment

- Series II: approved in 2022; began investing in July 2022; $295 million size of total commitment

- Investment Period: The investment period for Grosvenor to make new commitments is 4 years (3 years + 1 year extension subject to GP with LP consent)

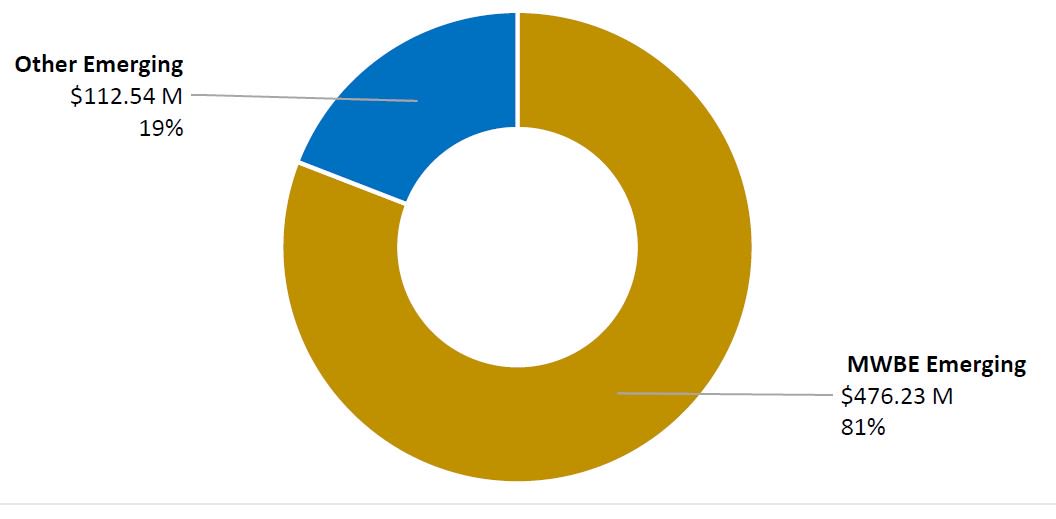

OFI Emerging Manager Program Investments

The Alternative Credit asset class established its Emerging Manager Program for OFI in 2014. As of June 30, 2022 there is $588.77 million invested or committed to Emerging Manager firms.

Assets with Emerging Managers – Alternative Credit

Private Markets: Hedge Funds

Hedge Funds directly sources and invests with Emerging Managers and does not use a Fund of Funds or indirect allocation approach.

Criteria for Hedge Funds Emerging Managers are generally:

- Manage long/short equity, event-driven, tactical trading, relative value strategies

- Firm-wide AUM between $250 million and $1 billion

- Less than a 3-year track record as an independent firm at the time the investment is made

Hedge Funds Emerging Manager Program Investments

The Hedge Funds asset class first established its Emerging Manager Program in 2014. As of June 30, 2022 there is $1.39 billion invested or committed to Emerging Manager firms.

Assets with Emerging Managers – Hedge Funds

Private Markets: Infrastructure

Infrastructure employs a Separately Managed Account (“SMA”) structure, as approved by the Systems, to execute the Systems’ Emerging Manager program. This is driven by the significant resources and differentiated expertise required to invest and to effectively manage the program. BAM committed to BlackRock Infrastructure Solutions for a customized investment targeting Infrastructure Emerging Managers and first-time funds on behalf of the Systems. The program targets primary funds and co-investment opportunities primarily in OECD countries.

The key terms and conditions for the NYCRS/Blackrock customized program are as follows:

- Size: $200 million in aggregate AUM

- Investment Period: The investment period for Blackrock to make new commitments is 3 years from inception date of 2020.

- Investment Types: Primary funds and co-investments

In the context of this mandate, the Emerging Manager investment criteria is defined as follows:

- Raising Funds I, II and III

- < $1.5 billion in aggregate capital commitments

Infrastructure Emerging Manager Program Investments

As of June 30, 2022 there is $111.4 million invested or committed (out of the $199.98 million BlackRock allocation) to Emerging Manager firms, none of which are MWBEs.

Key Definitions for MWBE Investments

The expectations for what qualifies as a minority or women-owned manager differ across asset classes. For the purposes of this report, data is presented according to the definitions in that asset class. These definitions are explained below.

- Minority and Women-Owned Investment Managers

In 2019, BAM established two definitions of this term—one for Private Markets (Private Equity, Real Estate, Infrastructure, Hedge Funds and Opportunistic Fixed Income) and another for Public Markets (Public Equity and Public Fixed Income) informed by differing prevailing standards for the two industry areas determined through industry research.

Note that a definition of minority- or women-owned investment managers is separate and independent from a definition of “Emerging Managers”.

Definition for Public Markets:

Minority and women-owned investment managers are firms that are 51 percent or more owned and operated by women or members of minority groups who also have demonstrable investment decision-making and/or executive leadership authority.

Definition for Private Markets:

Minority and women-owned investment managers are firms that are generally 25 percent or more owned and operated by women or members of minority groups who also have demonstrable investment decision-making and/or executive leadership authority.

- Large MWBE

A large MWBE manager is defined as an MWBE manager that is not an emerging manager.

- Minority Group

“Minority Group” is defined as Native American, Asian American/Pacific Islander, Black American or Hispanic American consistent with prevailing U.S. laws and policies defining “minorities”. Women and members of minority groups must be U.S. citizens or permanent residents, consistent with requirements in local, state and federal minority and women-owned business enterprise (MWBE) laws.

In addition to firms that qualify as minority and/or women-owned investment managers as defined above, BAM tracks firms that identify as owned by “Other” groups (e.g., LGBTQ+, veterans, people with disabilities, etc.).

- Investment Authority and Executive Leadership

The term “demonstrable investment-making and executive leadership authority” in the definition is intended to ensure that the minority and women-ownership is not economically passive, but active in the business operations and investment process of the firm. Executive leadership is defined as governance control over the strategy and direction of the firm, such as voting shares.

Overview of the Bureau of Public Finance

The Public Finance Bureau manages all aspects of City capital borrowing for the Comptroller, acting jointly with the Mayor’s Office of Management and Budget (“OMB”), as required under State law. In this role, it promotes New York City’s short-term and long-term financial health by establishing and enforcing fiscally responsible debt practices, monitoring the City’s portfolio of outstanding bonds, and securing the lowest risk-appropriate borrowing cost on debt of the City and its affiliated entities. In addition, the Bureau directs interactions with ratings agencies, investors, and municipal market financial services firms on behalf of the Comptroller.

The Comptroller, through the Bureau of Public Finance, and the Mayor, through the Office of Management and Budget, share the responsibility for issuing bonds through the City’s General Obligation (“GO”), Transitional Finance Authority (“TFA”) and Municipal Water Finance Authority (“NYW”) credits (collectively, the “Issuers” or the “City”), the three main vehicles for financing capital spending. New York City and its related entities are in aggregate one of the largest municipal bond issuers in the nation. In Fiscal Year 2022, the City sold more than $13 billion of debt for new capital projects or refinancing of outstanding bonds for debt service savings.

Public Finance provides leadership and support on issues that relate to debt or to City Issuers. The Deputy Comptroller and other senior staff may represent the Comptroller’s office as speakers at municipal market conferences and events and in testimony at the City Council on related topics.

The Bureau of Public Finance’s MWBE Program

The Bureau of Public Finance consistently promotes MWBE vendors’ access and growth, so that MWBE firms can capitalize on opportunities in public finance. Bond underwriting and sales represent the largest portion of the Issuers’ yearly spending, and the Public Finance Bureau contracts with MWBE firms in the financial advisor and specialized legal counsel roles as well.

Bond Underwriting

Beginning in the 1990’s, New York City began to implement measures to promote MWBE participation in its bond transactions. As part of these efforts, in 2002, the City created the “special bracket tier” for underwriters, which aims to elevate firms that are looking to serve as a lead underwriter on a NYC transaction. Firms assigned to the special bracket are those that are not generally familiar with the inner workings of a NYC bond sale. Firms in the special bracket are given an opportunity to serve as a co-senior managing underwriter on a City bond issue, giving them the experience to ultimately become a senior book manager for a smaller mid-sized deal.

The special bracket has played a key role in promoting MWBE firms and led to the City appointing its first MWBE underwriter as book-running senior manager in 2004 on a NYW transaction. At the time, the City was one of the first large issuers to rely on these smaller firms to run sizeable bonds issues. All of the City’s current MWBE book-running senior managers have been promoted from the special bracket, and since its creation the City has issued more than $35 billion of bonds underwritten by MWBE firms serving in the book-running senior manager role.

Since 2018, the City has issued more than $13.8 billion of GO and TFA bonds for which MWBE firms served in the book-running senior manager role. Between Fiscal Years 2018 and 2022, MWBE firms in the GO and TFA underwriting syndicate and selling group have earned more than $48.7 million in takedown (the primary form of compensation for underwriters), representing an average of more than 30% of total takedown paid over that period.

| Fiscal Year: | 2018 | 2019 | 2020 | 2021 | 2022 | Total |

|---|---|---|---|---|---|---|

| Total Takedown ($) | 28,343,080 | 28,048,230 | 22,529,366 | 39,985,413 | 32,898,386 | 151,804,474 |

| MWBE Takedown ($) | 6,660,311 | 11,408,107 | 6,843,065 | 13,827,961 | 9,993,627 | 48,733,070 |

| MWBE % | 23.50% | 40.67% | 30.37% | 34.58% | 30.38% | 32.10% |

Financial and Swap Advisors

The GO and TFA credits have each had a least one MWBE advisor since 2006 that provides advisory and price guidance services on every transaction, as well as general advisory services for non-transaction-related issues. Additionally, the GO and TFA credits have had a MWBE swap advisor since 2011.

Between Fiscal Years 2018 and 2022, the GO and TFA financial and swap advisors have earned more than $2.7 million in fees representing an average of more than 30% of fees paid over that period.

| Fiscal Year: | 2018 | 2019 | 2020 | 2021 | 2022 | Total |

|---|---|---|---|---|---|---|

| Total Fee ($) | 1,807,445 | 1,601,742 | 1,807,247 | 1,869,095 | 1,657,804 | 8,743,333 |

| MWBE Fees ($) | 348,934 | 411,918 | 639,078 | 710,214 | 687,944 | 2,798,087 |

| MWBE % | 19.31% | 25.72% | 35.36% | 38.00% | 41.50% | 32.00% |

Bond, Underwriter and GO Disclosure Counsel

For many years, the GO and TFA credits have had at least one MWBE firm serving in a counsel position. MWBE firms have been appointed to serve as bond counsel, underwriters’ counsel and GO Disclosure counsel.

Between Fiscal Years 2018 and 2022, MWBE counsel working on City bond transactions have earned more than $3.7 million in fees representing an average of more than 17% of fees paid over that period.

| Fiscal Year: | 2018 | 2019 | 2020 | 2021 | 2022 | Total |

|---|---|---|---|---|---|---|

| Total Fees | 3,835,000 | 3,785,000 | 4,225,000 | 5,137,800 | 4,070,700 | 21,053,500 |

| MWBE Fees | 116,000 | 680,500 | 941,250 | 1,095,800 | 932,000 | 3,765,550 |

| MWBE % | 3.02% | 17.98% | 22.28% | 21.33% | 22.90% | 17.89% |

The Bureau has been able to meaningfully increase participation by MWBE firms in the City’s financings, which benefits the MWBE firms directly through the fees they earn, as well as indirectly by increasing their ranking on industry “league tables” and ensuring their visibility in the municipal market.

The Bureau of Public Finance has an open-door policy in which any firm that wishes to discuss their capabilities and offer their services related to the issuance of bonds can meet with the Bureau of Public Finance as well as members of OMB and the Law Department. Many MWBE firms have and continue to take advantage of this long-standing policy which has provided firms with an opportunity to gain access and a better understanding of the City’s financing programs.

The RFP process is the primary avenue for any firm to be appointed to a role in one of the City’s financings. Underwriter and Financial Advisor RFPs are managed jointly by the Comptroller’s Office and OMB; Bond Counsel and Disclosure Counsel RFPs, which follow Procurement Policy Board rules, are managed by the Law Department with the participation and concurrence of the Comptroller’s Office and OMB. All RFPs and procurements are done on multi-year cycles, typically ranging from 3 to 5 years, except for selling group members, which may be added at any time by filling out a questionnaire.

Since 2009 there have been several RFPs and procurements for each of these roles, and it has been a long-standing policy goal of the Comptroller’s Office to look for ways to increase MWBE participation.

Highlights of the most recent procurements the City has undertaken are below:

- Underwriters: In August 2020, the City completed its most recent underwriter RFP, appointing nine senior managing underwriters, three of which (33%) are MWBE firms, for GO/TFA bonds and five senior managing underwriters, two of which (40%) are MWBEs, for NYW bonds. This represents an increase from the previous selection process in 2016, where 30% of GO and TFA senior managers and 33% of NYW senior managers were MWBEs. In addition, 32% and 30% of GO/TFA and NYW co-managing underwriters, respectively, are MWBE firms.In 2016 the City, TFA, and NYW changed their policies on how underwriters are compensated to provide for a “special designation” of MWBE co-managers, resulting in these firms receiving at least 10% of the total takedown (the per bond underwriting compensation representing most of the total fees paid to underwriters). As a result of this special designation policy, these MWBE firms received several million dollars in underwriting fees since the policy was implemented.The City has also promoted MWBE firms from the selling group to serve in the syndicate. Selling group members are firms that place orders for individual accounts, bank trusts, and investment advisors during the retail order period for bonds. MWBEs add value to the bond sale process by providing new distribution channels and bringing in new investors and the City tries to ensure that their orders are filled during the allotment process. Firms that are part of the senior manager pool, which also includes MWBEs, may be “designated” (i.e., compensated) for any institutional orders that they place.

- Financial and Swap Advisor: In August 2019, the City completed its most recent financial advisor and swap advisor RFP. Seven firms submitted responses for consideration to be financial advisors to the City and its related issuers. Following a competitive process, the City appointed two co-financial advisory firms to each of its three main credits (GO, TFA, and NYW). Women-owned business enterprises (WBE) make up half of the financial advisor firm pairing for each of the City’s three main credits.The City’s swap advisor prior to the 2019 RFP was a MWBE. Based on the firm’s strong performance in that role and its RFP response compared to the other submissions, the City reappointed this firm as its swap advisor.

- Bond, Underwriter and GO Disclosure Counsel: In July 2018, the City completed a procurement for outside counsel that selected Bond Counsel and established a pool of Underwriter’s Counsel for each of the Issuers, as well as Special Disclosure Counsel for the City’s GO credit.The counsel RFP resulted in an MWBE firm being appointed to a co-counsel position for each of the nine available assignments across the City’s issuers.The City has come a long way since it first adopted policies that have promoted growth of MWBE firms participating in the City’s financings and our partnership with those firms has proved to be effective over the years. New York City is not the only issuer that has taken an active role of promoting MWBE firms in their bond transactions, but it has been a leader in the adopting policies that have proven to be effective over the years, with many other large issuers adopting similar policies that have continued to provide growth opportunities for MWBE firms.

Certification and Participation Process

During the RFP process, MWBE firms are encouraged to apply and share their MWBE ownership status in their response. The City gives additional consideration to MWBEs in its RFP selection criteria across its Issuers. For NYW, the relevant jurisdiction for MWBE certification is the State of New York; for all other Issuers, the relevant jurisdiction for MWBE certification is the City. Additional information on City MWBE certification is available through the NYC Department of Small Business Services.

MWBE Profiles

Siebert Williams Shank – History With New York City and its Issuing Entities

Siebert Williams Shank (“SWS” or “Siebert”) has served as senior managing underwriter for New York City’s GO credit for 12 years, TFA credit for 6 years, and NYW credit for a total of 18 years. Since their first senior manager appointment, through the special bracket in 2004, the firm has progressively increased its role in the City’s underwriting syndicate, earning a bigger share of the overall underwriting pool.

Following the City’s 2006 RFP, Siebert was qualified by the City to serve NYW as a member of the rotating senior managed underwriting pool and was selected to serve as a senior co-manager on all GO and TFA transactions.

In 2009 Siebert was elevated by the City to serve as a member of the rotating senior managed underwriting pool for its GO credit and was selected to serve as a senior co-manager on all NYW and TFA transactions, an appointment they maintained after the next underwriter RFP in 2012.

Following the City’s 2016 Underwriter RFP, Siebert was selected as one of 10 firms to serve in the City’s combined GO/TFA senior managed underwriting pool and one of 3 firms to serve in its NYW senior managed underwriting pool. Of the selected, SWS was the only firm selected to serve in both pools.

Most recently, in 2020, Siebert was one of 9 firms to serve in the City’s combined GO/TFA senior manager underwriting pool and one of 4 firms to serve in the NYW senior manager underwriting pool. Siebert is one of just two firms selected to serve in both pools. Siebert has also been twice selected to serve as book-running senior manager in the GO and TFA refunding bracket.

In total, since SWS’ first senior managed transaction for the City in 2004, they have served in the senior manager role on more than $14 billion dollars of total par on 24 transactions.

Siebert has continued to grow and reinvest in the firm to effectively compete with bulge bracket firms while expanding their footprint both nationally and in New York City.

According to Suzzane Shank, President and CEO of the firm: “The application of the MWBE goals of the City of New York and the City Comptroller’s Office have provided significant and consistent opportunities for Siebert Williams Shank and our MWBE peers. It is a great source of pride for SWS that the City has trusted our firm to serve in a steadily growing series of senior financing roles over an eighteen-year period. That trust and the experience our firm has gained has helped SWS grow rapidly into an industry leader both in New York as well as nationally.

Additionally, SWS has been able to hold out the large and complex transactions that the City has increasingly awarded to MWBE firms as best practice examples to successfully convince numerous notable issuers across the country to afford similar opportunities to SWS and other MWBE firms.”

Ramirez & Co., Inc. – History With New York City and its Issuing Entities

Ramirez & Co., Inc. (“Ramirez”) has served as a senior managing underwriter for one of the City’s issuing entities for more than 12 years. Ramirez was first elevated to book-running senior manager for NYW following an RFP selection process 2009 and first served as sole senior manager on a $400 million transaction in January 2010.

After the City’s Underwriter RFP in 2012, Ramirez maintained its position in the NYW senior manager pool and was selected to serve as one of only two senior underwriters in the TFA’s Building Aid Revenue Bonds (“BARBs”) rotation. Ramirez served as book-running senior manager on its first TFA transaction, which totaled $750 million, in January 2015.

Ramirez was further elevated in 2016 to serve in the GO and TFA senior manager pool and most recently, as part of the 2020 RFP selection process, Ramirez maintained its position in the GO and TFA senior manager pool. Ramirez has twice been selected to serve as book-running senior manager in the GO and TFA refunding bracket, which was created to reward firms for their exceptional response to the RFP and continued coverage to City and its related issuers.

In additional to their success with GO and TFA transactions, Ramirez has also been selected to serve as joint book-running senior manager on both the Hudson Yards Infrastructure Corporation’s 2017 Series A and 2022 Series A transactions, totaling $2.6 billion.

In total, since 2010, Ramirez has served as senior manager on $13 billion of bonds, underwritten across the City’s credits.

The City‘s partnership with Ramirez has delivered a substantial amount of value and has allowed Ramirez to reinvest resources into the City as well as the firm. “New York City’s commitment to diversity and inclusion has played a critical role in our firm’s growth as one of the oldest and largest Hispanic-owned banks in the country,” said Samuel A Ramirez, the founder, President and CEO of the firm. “The City has given us the opportunity to take leading roles on complex deals, and to paraphrase the famous song, if we can make it here, we can make it anywhere. We are grateful to be given the chance to earn a reputation as a trusted partner for our hometown, and to help demonstrate that New York City’s greatest strength lies in its diversity.”

For More Information

To contact the Bureau of Public Finance, please email PublicFinance@comptroller.nyc.gov or (212) 669-4851

Acknowledgements

The Comptroller thanks the Bureau of Asset Management and the Bureau of Public Finance for their diligent efforts to grow the office’s work with diverse and emerging managers. Special thanks go to Shaquana Chaneyfield, Deputy Press Secretary, Mark Pendarvis, Senior Investment Officer, and Kate Visconti, Associate Director of Pensions, for their work to author this report and compile the data on the New York City Retirement Systems’ holdings with MWBEs and Emerging Managers. The data was provided with the assistance of Tim Martin, Assistant Comptroller for Public Finance and asset class leadership including John Merseburg, Head of Public Equity; Robert Feng, Head of Public Fixed Income; Eneasz Kadziela, Head of Private Equity; Neil Messing, Head of Hedge Funds; John Gluszak, Interim Head of Real Estate; Petya Nikolova, Head of Infrastructure; and Tina Suo, Head of Alternative Credit. Thanks are also due to Marjorie Henning, Deputy Comptroller for Public Finance; Tom Carroll, Pensions Manager; Jimmy Yan, Director of ESG; Taffi Ayodele, Director of Diversity, Equity, and Inclusion, and Emerging Manager Strategy; John Adler, Chief ESG Officer; Alison Hirsh, Assistant Comptroller for Pensions and Senior Adviser; and Steven Meier, Chief Investment Officer and Deputy Comptroller for Asset Management for their assistance and contributions to this report, and to Archer Hutchinson, Graphic Designer, who led the design of this report.