Introduction

At the beginning of his first term as Mayor, Mike Bloomberg was reported to have asked what could “literally close down” New York City. Mayoral transitions are an important moment for asking critical questions of this sort. The answer to Mayor Bloomberg’s question was a failure of the City’s water tunnels. For this reason, the City prioritized the completion of a third tunnel to provide redundancy and allow maintenance of the two existing ones.

So, what would our answer be if we were asked what could “literally close down” the City’s government? We think that a failure of the City’s payroll operations or financial infrastructure should rank high on that list. It should worry us that the City’s payroll system is more than 40 years old and its budget system has been in place for nearly 30 years.

These systems are overseen by two little-known but critical operational agencies: the Financial Information Services Agency (FISA) and the Office of Payroll Administration (OPA). Together, they provide oversight, systems management, and operational continuity for the City’s payroll, central budget and central accountancy. Since 2015, the two agencies, which are co-located and managed by the one executive team, have operated under the FISA-OPA moniker. Because they maintain an infrastructure that is of common interest for the orderly functioning of government, the governance of FISA-OPA is shared between the Mayor and the Comptroller. However, the Mayor, through its Office of Management and Budget (OMB), controls their headcount as well as operating and capital budgets.

While the agencies have been successful in providing continuity of operations and maintaining statutory compliance, many of the core systems they manage—chief among them the Payroll Management System (PMS) and the Financial Management System (FMS)—face risks due to outdated technologies and to personnel retention and recruitment challenges. PMS dates to 1984 while FMS budget was operational starting in 1999. FMS accountancy was updated in 2009 to a more modern, though now also outdated, software. Technological and personnel risks compound each other: detailed knowledge of complex legacy systems is held by workers that are eligible to retire at much higher rates than in other agencies. At the same time, FISA-OPA personnel planning has suffered in the past few years when budgeted headcount was reduced below actual and, in addition, the City implemented hiring freezes, and three- and two-separations-per-new-hire rules. This meant that FISA-OPA was effectively prevented from hiring.

This Office has consistently advocated alongside FISA-OPA for the upgrade of both PMS and FMS, and some encouraging initial steps were taken over the past few years. In 2021, OMB issued a Request For Information to conduct market research on potential IT solutions for FMS budget. In 2023, FISA-OPA issued a Request for Expression of Interest for the payroll system. FISA-OPA, OMB, DOE, the Office of Technology and Innovation (OTI), this Office, and staff from the First Deputy Mayor’s Office, engaged a number of respondents over several months, only to see the project grind to a halt due to OMB’s repeated denial to devote any resources for planning and scoping. In 2024 and 2025 FISA-OPA, OMB, and this Office explored an upgrade of FMS accountancy and budget, again only to witness a sudden and shortsighted denial to proceed to non-committal procurement steps, under the pretense of the impending mayoral transition. The denial further limited the ability to bring the proposed project to the starting line for the new administrations.

The City’s financial systems are not only old but also fragmented because the Department of Education (DOE) has its own independent, and similarly outdated, payroll and financial systems. This separation stems from the fact that DOE was not under mayoral control until relatively recently. Meanwhile, DOE was recently allowed to issue a request for proposals to replace its payroll system. Perpetuating the fragmentation of the payroll system of the largest City agency is both a missed opportunity and a baffling management choice.

IT modernization is seldom prioritized because it is hard, painstaking, expensive, risky, and not flashy. Nonetheless, the upgrade of PMS and FMS is crucial to stave off technological obsolescence, to increase productivity and operational flexibility, to protect against cyber risks, to improve financial management, to deliver pay and benefits timely to hundreds of thousands of City active and retired employees, and to make the government run.

This report provides an overview of FISA-OPA and describes its main IT portfolio. The report concludes with a series of recommendations for modernization and improved governance.

Overview of FISA-OPA

FISA-OPA is an IT service agency responsible for critical enterprise systems that provide financial, human resource, and payroll functions to City officers, employees, vendors and retirees.

FISA was created by Executive Order No. 70 of 1976 and codified in Chapter 38 (§§ 860–862) of the NYC Charter as part of the package of changes recommended by the 1989 Charter Revision Commission. The Office of Payroll Administration (OPA) was created by Executive Order No. 77 of 1984 and codified in Chapter 39 (§§ 870–872) of the NYC Charter.

Mission and Governance Structure

The Charter assigns FISA the management of the City’s “integrated financial management system”, the oversight of financial data processing, the provision of coordinated access to fiscal information for city operations (budgeting, revenues, investments, debt, and disbursements), and the provision of services to the City’s “covered organizations’’ (e.g., NYCHA, H+H, and others). All city agencies must supply the information needed to carry out these functions to FISA.

As stated in Charter, OPA is responsible for implementing and maintaining a computerized payroll system, ensuring its accuracy, creating uniform payroll procedures, managing payroll distribution and deductions, and coordinating services and information with other government entities. As seen in OPA’s website, “the mission […] is to ensure employee payrolls, pension payrolls, and direct deposit distributions are disbursed accurately, on time, every time.”

FISA is governed by three directors appointed by the Mayor, one of which upon the Comptroller’s recommendation, and one of which upon the recommendation of the other two directors. OPA is governed by two directors appointed by the Mayor, one of which upon the Comptroller’s recommendation. In practice, the same two appointees serve as both FISA and OPA directors. FISA has not had a third director since 1997. Responsibility for the day-to-day management of FISA-OPA rests with an Executive Director, which is appointed by the Mayor upon recommendation of the FISA and OPA directors.

The Mayor controls FISA-OPA’s budget and headcount. The Mayor’s appointee has traditionally been an employee of the Mayor’s Office of Management and Budget (OMB), the director or a deputy director during the rollout of the biggest initiatives. OMB’s FISA-OPA board director is separate from the OMB task force that oversees FISA-OPA’s operating and capital budgets and headcount. Spending on IT is subject to review by the Office of Technology and Innovation (OTI) and by yet another OMB task force. The Office of the First Deputy Mayor also performs oversight functions and assigns the agency tasks independently. The Comptroller’s director is an employee of the Comptroller’s Office, typically an executive or a deputy comptroller.

IT Systems Managed by FISA-OPA

The main systems managed by FISA-OPA are:

- The Payroll Management System (PMS): payroll calculation and processing for active City employees, except for the Department of Education which interfaces its own payroll system through FISA-OPA’s DOE-PMS.

- The Pension Payroll Management System (PPMS): payroll processing for retirees and their beneficiaries, which interfaces with the City’s retirement funds.

- Financial Management System for Budget (FMS/2): the legacy budget system through which agencies enter budget modifications, plan updates, and other Charter-required budget actions. The DOE uses a separate school-based budgeting and staffing system called Galaxy to operationalize budgets at the school level.

- Financial Management System for Accounting (FMS/3): the official system of record for how NYC appropriates, modifies, obligates, and pays out public funds: agencies enter or route budget actions from FMS/2, register contracts, create purchase orders, record vouchers, and issue payments. DOE uses its separate Financial Accounting Management Information System (FAMIS) for purchases and payments, and the transactions are then routed to FMS/3.

- The New York City Automated Personnel System (NYCAPS and NYCAPS-Retirees): employee self-service, central personnel management, benefits administration and retiree health benefit administration.

- CityTime: time and attendance/absence collection for active City employees.

- City Human Resource Management System (CHRMS): the centralized HR and payroll data warehouse holding core employee data (e.g., appointment and job information, pay and deductions, budget line, leave balances, and related personnel records) used for reporting.

Citywide payroll operations are supported by a more than a dozen additional FISA-OPA administered applications for more specific mandated business functions, such as workers compensation management, garnishment tracking, FICA refund management, welfare benefit annuity processing, tax file validation, union dues program administration, and others. Similarly, citywide financial operations are supported by applications with more specific business functions, such as Inter Fund Accounting (IFA) for the calculation of personnel costs of capital projects, and the Payee Information Portal (PIP) for payee self-service. These are co-dependent supporting applications for the main systems listed above.

Budget

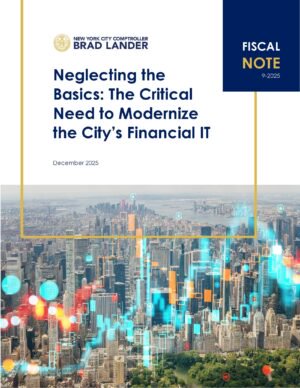

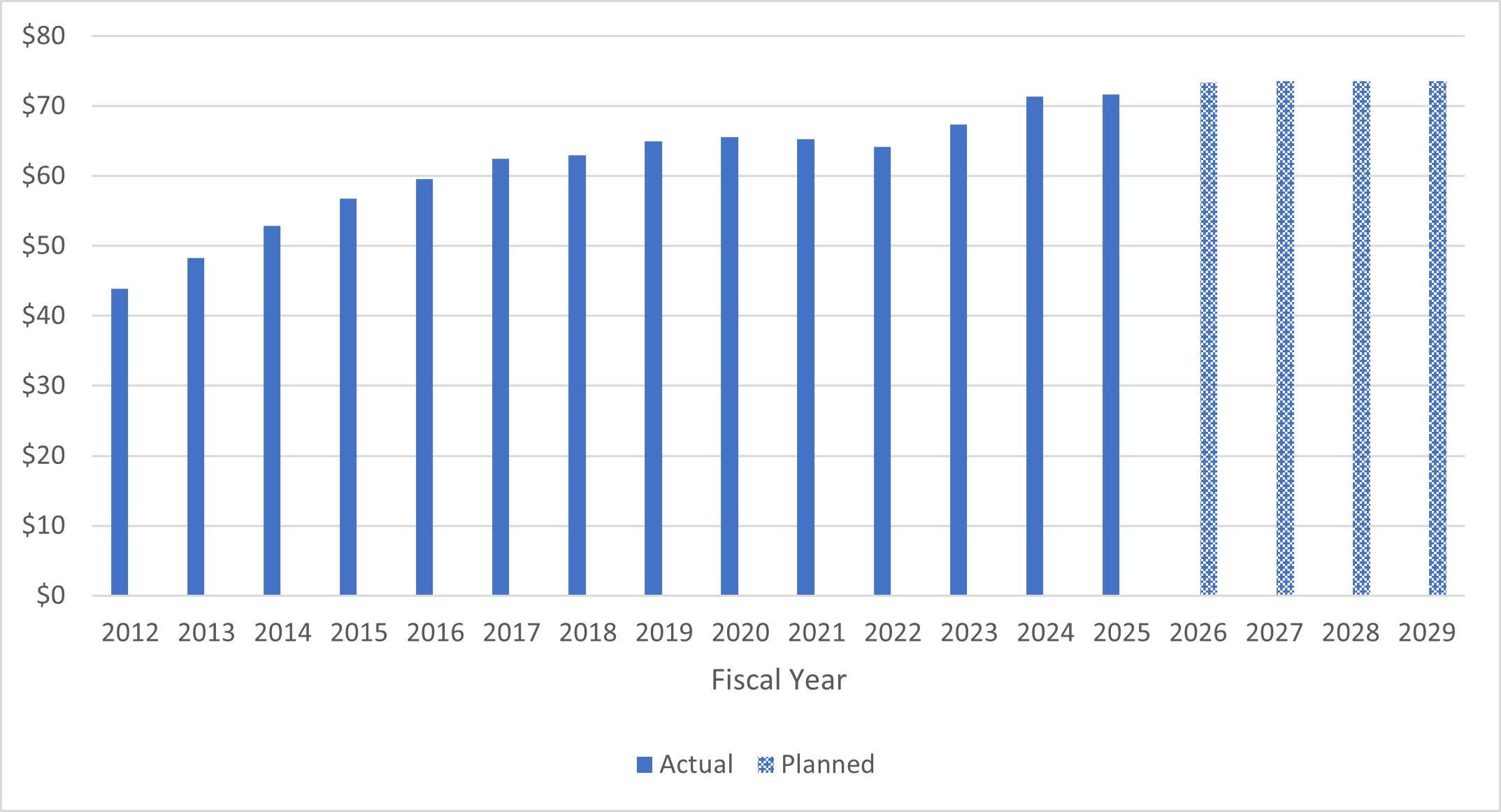

The combined personnel cost (PS) of FISA-OPA was $71.6 million in FY 2025 and is planned to remain flat in the November 2025 financial plan for FY 2026-2029. Other than personnel cost (OTPS) was of comparable size in FY 2025 ($67.9 million), declining slightly in FY 2026-2029. Nearly all OTPS costs are incurred by FISA. Charts 1 and 2 provide historical and planned spending.

Chart 1. FISA-OPA Personnel Costs ($ million)

Source: Office of the NYC Comptroller, OMB. Actual spending is before prior-year adjustments and interfund agreements, and intracity sales. These items are significant only in Fiscal Years 2012 and 2013.

Chart 2. FISA-OPA Other than Personnel Costs ($ million)

Source: Office of the NYC Comptroller, OMB. See notes to Chart 1.

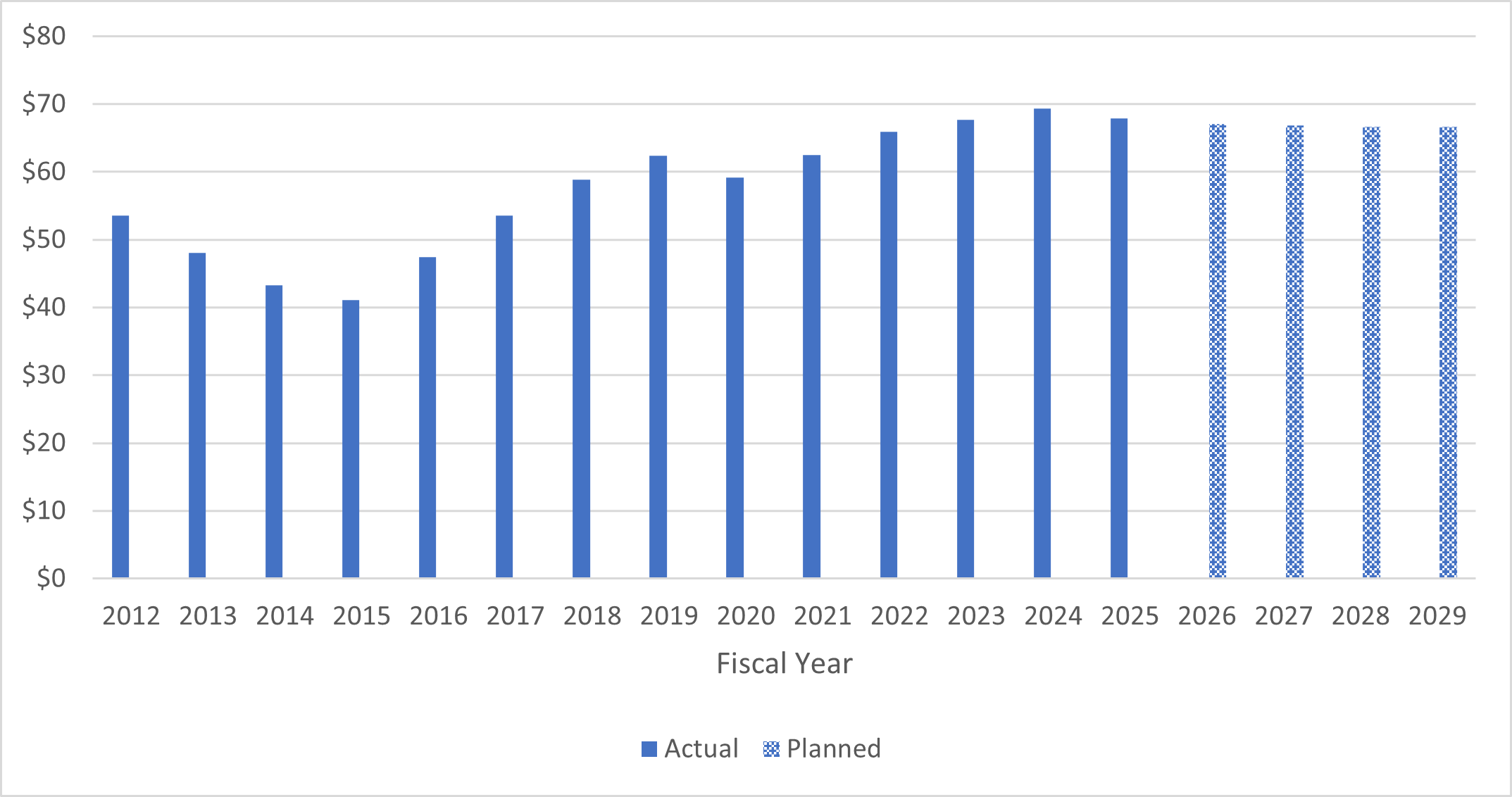

Chart 3 looks at the flow of capital commitments over the same period. Historically, commitments fluctuated between $10 million and $16 million per year, except for FY 2012 and FY 2013 when commitments supported initiatives to improve data center operational recoverability and resiliency.

Chart 3. FISA-OPA Actual and Planned Capital Commitments ($ million)

Source: Office of the NYC Comptroller, Mayor’s Office of Management and Budget.

Headcount and Retirement Eligibility

Over the course of the past decade, most City agencies experienced an increase in authorized headcount and an increase in their vacancy rate (the percentage of authorized headcount above actual).[1] Even after the reduction in authorized headcount in the Program to Eliminate the Gap (PEG) started in September 2023, many agencies remain plagued by high vacancy rates as can be seen in the NYC Agency Staffing Dashboard published by this Office.

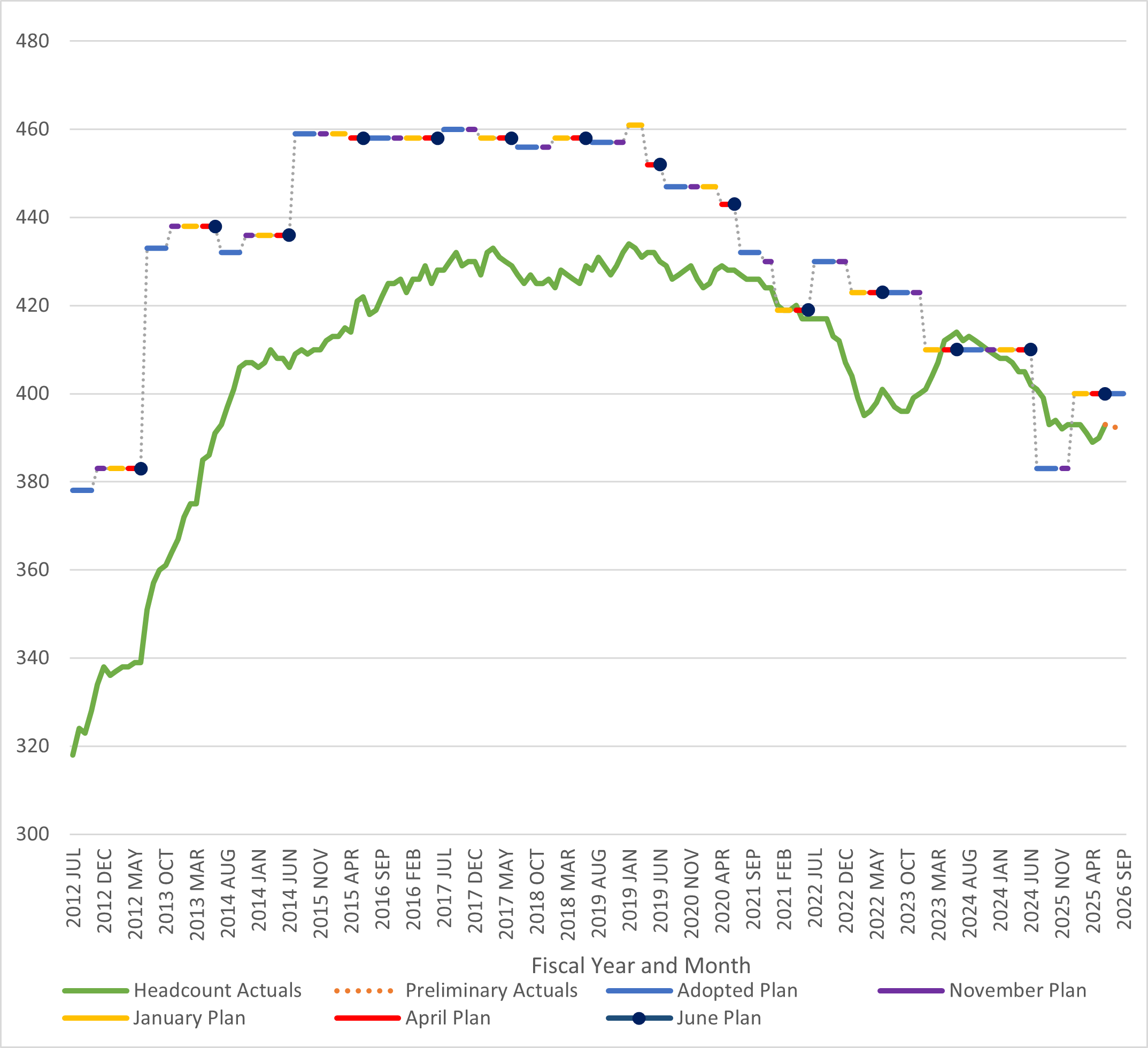

In stark contrast, FISA-OPA has seen its authorized headcount reduced starting in 2020, to the point that actual headcount has at times been above authorized.

Chart 4 shows FISA’s actual and authorized full-time headcount from the start of FY 2012 to the beginning of FY 2026. FISA’s actual headcount rose from an average of 333 in FY 2012 to a peak of 430 in FY 2017. The average vacancy rate was 13%-15% in FY 2012 and FY 2013 and settled between 6% and 7% for most fiscal years through 2019. The vacancy rate dropped to 4% in FY 2020 and to 1% in FY 2021 due to a sharp reduction in authorized headcount. A reduction in actual headcount in FY 2022 was responsible for an increase of the vacancy rate to 5%. Further cuts to the authorized headcount reduced the vacancy rate to 3% in FY 2023 and to 0% in both FY 2024 and FY 2025. Hiring was essentially precluded in the past 3 years [check] due to the combined effect of hiring freezes and turnover restrictions imposed since FY 2023, and to the cut in authorized headcount. For long stretches of time, FISA’s actual headcount was above authorized.

The headcount increases in FY 2012 and 2013 was part of an initiative to lessen City dependence on consultants and transition support functions to FISA-OPA employee staff. The transition occurred as these initiatives approached steady state operations.

Chart 4. FISA Full-Time Headcount: Actual vs. Authorized

Source: Office of the NYC Comptroller NYC Agency Staffing Dashboard, Mayor’s Office of Management and Budget.

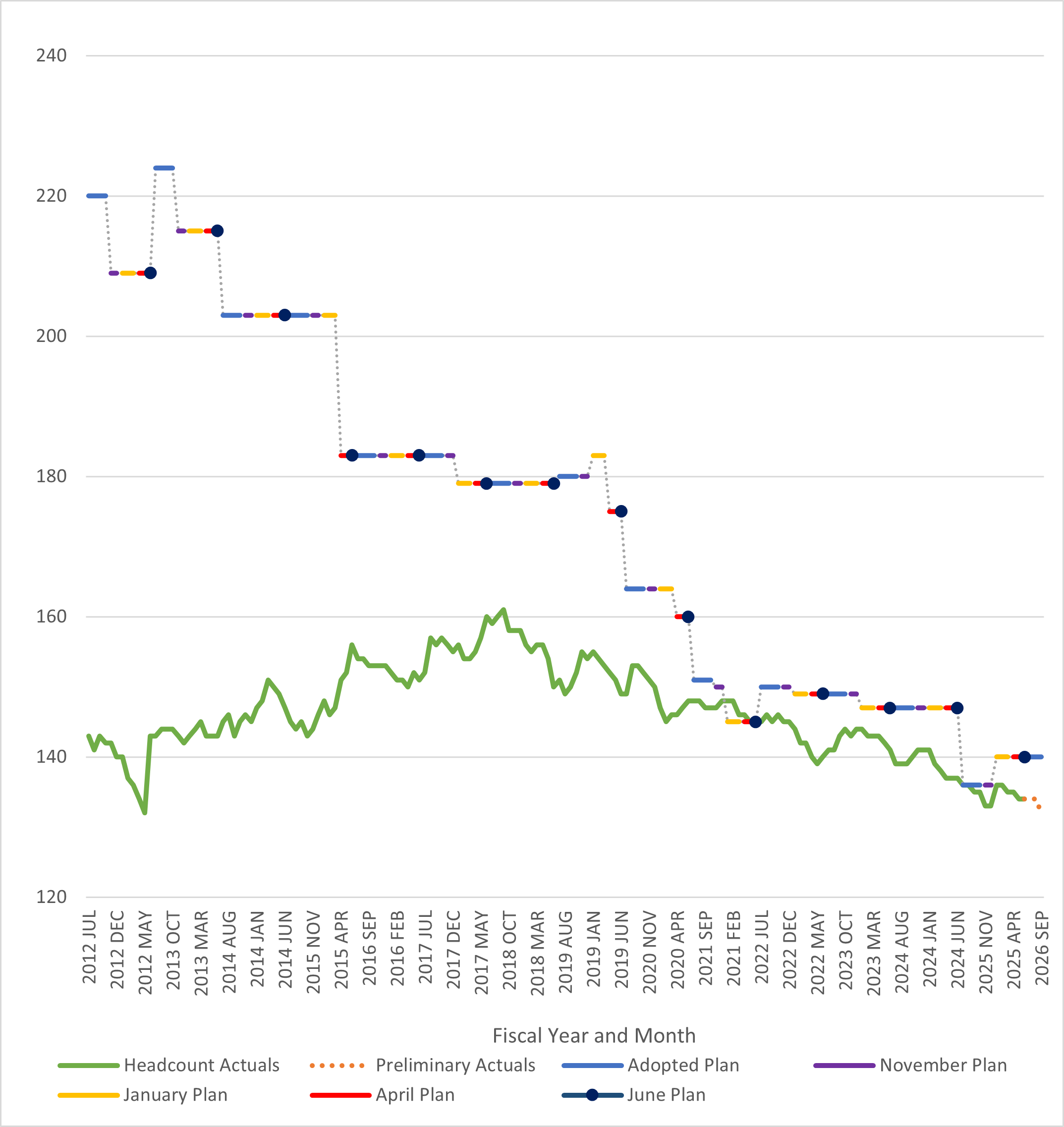

Chart 5 shows the same data for OPA. Actual headcount at OPA is both smaller and more stable than at FISA. Annual average actual headcount started at 139 in FY 2012, peaked at 157 in FY 2018, and was 135 in FY 2025. The vacancy rate at the beginning of the sample exceeded 30% and dropped gradually over time. Actual and authorized headcounts have been falling steadily since FY 2021, leaving OPA with vacancy rates between 1% and 5%, punctuated by months of zero or negative vacancy rates.

Chart 5. OPA Full-Time Headcount: Actual vs. Authorized

Source: Office of the NYC Comptroller NYC Agency Staffing Dashboard, Mayor’s Office of Management and Budget.

The lack of hiring capacity is particularly worrisome given that, at the end of 2024, nearly 40% of employees were immediately eligible to retire, about three times the Citywide percentage of 14% in FY 2024.[2] Another 3.5% of all FISA-OPA employees would be eligible for retirement within two years. Obviously, the turnover risk was particularly elevated among the executive and senior staff (52.9% immediately eligible, 5.9% eligible two years), and management (47.4% immediately eligible, 5.4% eligible within two years). However, the risk was also elevated among the Technology Operations Division’s staff, with 43.4% eligible to retire immediately, and another 2.2% eligible within 2 years.

PMS and Its Modernization Needs

The City’s payroll system operates on a scale few state governments can match, both in dollars and the number of individuals it serves. In a single year, the system pays over 458,000 employees and more than 360,000 pension recipients, generating more than 10.1 million paychecks and 4.5 million pension payments. It also processes over 1.4 million tax forms filed with federal and state authorities. The system handles more than 63 million time and leave transactions and 1.7 million personnel transactions annually.

The system’s complexity is equally striking. It accommodates over 9,600 civil service title levels, 190 collective bargaining units, and hundreds of unique labor agreements covering pay and leave. Payroll processing supports more than 1,000 payment types and 1,400 leave types, alongside 9,200 deduction plans that account for union dues, insurance, and taxes. Additionally, the system integrates payroll functions across 150 decentralized organizations, including city agencies and authorities, and coordinates with seven pension fund managers. Despite this integration, payroll operations remain divided among the City, the Department of Education, and pension systems, underscoring the system’s vast and fragmented structure.

The Executive Order that created OPA in 1984 states:

“The Mayor and Comptroller jointly have developed a computerized Payroll Management System (PMS) designed to ensure prompt and accurate payments of wages or salaries to employees and to provide City agencies with improved and modernized management and accounting payroll information.”

PMS, a major step forward in 1984, remains the City’s payroll system to this day. PMS runs on outdated programming languages such as COBOL and assembler code, and uses an old-fashioned database system from IBM. Payroll clerks and administrators often still interact with it through “green screen” terminals, a text-only interface that looks much like computers from the early 1980s. It is, in all respects, a “legacy system”: an old system that still works but is increasingly difficult to maintain and update. Adding new rules for things like remote work schedules or new benefit programs often requires workarounds. Large-scale updates, such as contractual pay increases or retroactive adjustments,[3] can be time-consuming and technically cumbersome. And while PMS can handle massive amounts of data, it is not well designed for modern needs like real-time data sharing or user-friendly reporting.

Despite its age, PMS is a highly sophisticated engine that keeps the City running. It calculates “gross pay” (the total before taxes and deductions), applies rules for overtime and leave, and then calculates “net pay” (what an employee receives). It manages more than 1,700 deduction types, covering everything from federal and state taxes to union dues, commuter benefits, pension contributions, and health insurance.

The three payroll applications (PMS, DOE-PMS, and PPMS) pay all the employees of the City of New York, the Department of Education, New York City Housing Authority and the Water Authority as well as all retirees and beneficiaries entitled to benefits from the City’s several pension programs. Citytime, NYCAPS and FMS interface with PMS. PPMS receives pension data from the five pension funds, NYCAPS (health insurance), and from third party entities (unions, life insurance carriers, etc.). The DOE payroll system is discussed further below.

The interconnectedness means that PMS is the hub for virtually all payroll activity in the City. But it also means that its limitations ripple outward. The system’s rigid structure makes it difficult to integrate more detailed financial or project-level data, limiting how the City can analyze workforce costs or adapt to new reporting demands.

The DOE Payroll System

DOE is the largest single employer in City government and the NYC economy. DOE runs its own payroll system, separate from PMS, and divided across four aging sub-systems: EIS (covering teachers and school staff), PDPS/T-Bank (covering per diem and per session staff), APRL (for administrators), and CPS (for custodial engineers). Each operates on legacy platforms and uses different rules, schedules, and timekeeping methods. Each sub-system must reconcile separately with PMS, creating extra layers of complexity. The fragmentation means that DOE payroll is riddled with duplication and inefficiency.

DOE payroll sends batch files at scheduled intervals to PMS. This means that OPA has limited real-time visibility into DOE payroll, and errors may only be discovered after payroll has already been processed. PMS is centralized but technologically obsolete, while DOE payroll is fragmented, duplicative, and disconnected. Both systems create risks and inefficiencies for the City’s workforce.

The Pension PMS (PPMS)

The Pension PMS (PPMS) solution went live in stages starting in 2005 and completing in 2007. The prior solution was subject to operational risks and was migrated into the PMS platform to benefit from the FISA-OPA support operations. As both a custom business solution for unique New York City requirements and a custom (and dated) technical framework, PPMS is vulnerable to the risks inherent in a legacy IT platform.

In a uniquely complicated model, each of the five pension funds have substantial investments in pension administration solutions, but all rely on the central PPMS solution for core pension payroll operations.[4] Annually, PPMS manages the calculation and distribution of pay to Variable Supplement Fund (VSF) processing, Medicare Part B and Income-Related Monthly Adjustment Amount (IRMAA) refunds (over 250,000 payments per year).

Each pension agency has a unique set of technical requirements to interface with PPMS. Under technical management at FISA-OPA is the NYCAPS-Retiree application – a solution which the Office of Labor Relations (OLR) uses to manage pension recipient health care enrollments and data exchanges with the health carriers. Seamless and timely setup of pension recipient health care deductions is managed through sophisticated interfaces between OLR’s NYCAPS-Retiree system and PPMS. Additional technical interfaces exist to exchange data with Federal Agencies, Labor Unions, the City Actuary, and Insurance Providers.

Why Modernization is Critical

Although the current systems continue to function, their fragility increases each year. Maintaining COBOL-based systems is costly and depends on shrinking pools of expertise. DOE’s fragmentation makes payroll more error-prone and slows the adoption of new labor rules. At the same time, the City’s workforce needs and labor agreements continue to evolve. New forms of work—such as hybrid schedules—require flexibility the system was never designed to handle. And the City’s push for greater transparency and real-time reporting puts demands on a system built in an era when payroll reports were printed and mailed.

The City should replace PMS, DOE-PMS, and PPMS with a modern payroll solution—one that is more adaptable, user-friendly, and capable of meeting the City’s needs for decades to come.

Modernizing New York City’s payroll system will require coordination well beyond FISA-OPA. Key stakeholders such as the Office of the Comptroller, OMB, the Department of Citywide Administrative Services (DCAS), and the Office of Labor Relations (OLR) must be involved. Agencies with unique payroll models—including the Department of Education (DOE), the New York City Housing Authority (NYCHA), and the City University of New York (CUNY)—will also need to participate to ensure systemwide integration.

Similarly, modernization of the pension payroll system will demand collaboration with the Office of the Comptroller, the City’s five major pension agencies, and OLR, alongside FISA-OPA. Both payroll and pension initiatives will require strong governance structures, as well as effective change and risk management strategies that engage all stakeholders and participants throughout the process.

FISA-OPA took the first steps by issuing a Request for Expression of Interest (RFEI) in 2023 for a unified payroll system and with several interested vendors that included the Office of the Comptroller, OMB, DOE, OTI, and others. However, the procurement has stalled, and a governance structure was never put in place. Furthermore, OMB repeatedly refused requests to hire an independent firm or staff at FISA-OPA to guide the modernization process by creating a clear plan and assist in choosing the right vendor. In early 2025, DOE issued a request for proposals through the U.S. General Services Administration for the modernization of its payroll systems.

FMS and Its Modernization Needs

The City’s operating budget is now $116 billion, and its capital commitment plan exceeds $100 billion. The management of the City’s funds relies on two core systems: FMS/2 and FMS/3. Together they form the backbone of the City’s financial management,[5] ensuring that funds are allocated, spent, and recorded according to law. While FMS/2 and FMS/3 have successfully supported the City for decades, both systems face challenges that make modernization necessary.

FMS/2: The Budget System

Launched in 1999, FMS/2 manages budget planning, requests, modifications, and long-term forecasts. It allows agencies to build and submit budgets, supports OMB’s reviews, and integrates City Council actions. However, FMS/2 is outdated, runs on legacy COBOL code, and is no longer supported by CGI, its developer. Much of its reporting and publishing requires manual intervention, slowing processes, reducing transparency, and reducing management flexibility and operational efficiency.

FMS/3: The Accounting System

Deployed in 2009, FMS/3 is a more modern web-based accounting system. The system serves as the official record of the City’s financial transactions, enforces appropriations, processes payments to vendors, records revenues, and interacts with payroll and procurement. FMS/3 uses CGI Advantage 3.x platform.

FMS/3 is nearing end-of-support by CGI, whose maintenance contract includes interoperability with various systems (including but not limited to FMS/2), compatibility with third-party software, software defect remediation, code management services, as well as security and cyber software patches.

Why Modernization is Critical

In 2021, OMB published a Request for Information (RFI) for the modernization of FMS/2. However, it is increasingly clear that the City would benefit from an integrated approach. Instead of maintaining a divide between budgeting and accounting, the City should pursue a coordinated modernization/upgrade of both FMS/2 and FMS/3, ideally also including DOE.[6] This would allow for real-time data flows between budget planning and accounting enforcement, reduce duplication of work, and provide agencies with more timely information. A unified data environment would improve forecasting, enhance transparency, and reduce the reliance on manual extracts and workarounds.

Integration and modernization should focus on cloud-ready, vendor-supported platforms that are user-friendly and capable of handling the City’s scale. Upgrading both systems together, with interoperability as a core principle, would ensure the City’s financial management is more resilient, transparent, and adaptable to future needs.

But time is of the essence: the maintenance for FMS/3 is being extended for two years, from the end of 2025 to the end of 2027. Without a system in place or well underway at the end of the extended maintenance contract, the City is facing a gap in interoperability which could increase operating risks exponentially. OMB’s refusal to fund the modernization and the impending transition to new Mayor and Comptroller administrations all but guarantee delaying this priority project well into 2026, at best.

Modernization of FISA-OPA’s payroll and financial systems is time-sensitive when considering both the legacy nature of the technology as well as the high percentage of retirement-eligible support staff.

The City should commit to a unified, cloud-ready modernization of FMS/2, FMS/3, and related payroll systems—prioritizing interoperability, real-time data integration, and timely execution to avoid operational risk and ensure long-term financial stability.

Relocation Initiative

FISA-OPA is located at 5 Manhattan West (450 West 33rd Street). The agency has occupied the offices since 1996, well before the redevelopment of the far West Side and the building’s renovation and rebranding. The location hosts FISA-OPA’s staff and data center. The lease expires in 2028 (with a 10-year City option to renew).

In July 2024, FISA-OPA was notified by the Citywide Space Saving Task Force at the Department of Administrative Services (DCAS) (an initiative led by then-Deputy Commissioner Jesse Hamilton) that the agency had an efficiency target of nearly 25%. In reality, DCAS, OMB, and City Hall had started planning FISA-OPA’s relocation. The initiative was still under development as of March 2025, when a walkthrough by DCAS and the real estate broker CBRE took place. A decision to relocate the agency is within the purview of the mayoral administration, not FISA-OPA’s directors, as long as it does not imperil the smooth functioning of the IT systems.

Besides the objective to optimize the City’s real estate holdings, relocating FISA-OPA requires the creation of a duplicate data center before the move can take place. A far more efficient approach would be to modernize the oldest systems (PMS and FMS/2) before the relocation, which would then be less expensive, less complex, and substantially de-risked. The relocation would require highly specialized expertise. However, it does not appear that such additional resources have yet been considered, engaged, or contracted.

The City should sequence any relocation decisions around a clear modernization plan—ensuring core systems are upgraded first, data center risks are mitigated, and the specialized expertise required for a safe transition is secured before proceeding.

OMB’s Comments on this Fiscal Note

OMB’s provided comments on this Fiscal Note recognizing the need to upgrade the financial IT systems but also expressing the critiques listed below.

- Regarding FMS: “Pushing an agreement with the existing vendor without giving the new administration the opportunity to make a thoughtful decision is, at best, inappropriate, and, at worst, irresponsible.”

It is worth noting that the meetings with the vendor took place for the better part of 2025 and were far from rushed. In addition, the proposed contractual steps would not have constrained any decision by the new administration.

- Regarding PMS: “[…] we are uncomfortable with the Comptroller’s push to use expensive consultants to `create a plan and assist in choosing the right vendor’ for PMS when this work can be done in-house by city agencies with experience in the area.” And “adding budget funding for a PMS contract that does not yet exist reduces the city’s leverage in negotiating an agreement that efficiently applies taxpayer dollars – we would be bidding against ourselves.”

The process of writing the PMS RFEI started in the Winter of 2023 and the meetings with respondents extended well into 2024. After more than one year of diligent work, OMB has neither accepted budget requests for consulting services nor it has proposed or provided any additional “in-house” resources either to FISA-OPA or from other agencies “with experience in the area.” To reiterate, the analysis in this Fiscal Note makes clear that FISA-OPA’s resources are already strained. Finally, it is hard to see how determining system requirements and the best fit for the City’s needs constitutes a negotiating misstep.

- Regarding hiring constraints: OMB put them in the context of “the need to fund a humanitarian crisis that has cost the city more than $8.6 billion to date, and that all city agencies were subject to the hiring freeze.”

The Fiscal Note shows how FISA-OPA’s authorized headcount was dramatically reduced already in 2021 and how it has faced negative vacancy rates. Because actual headcount was above authorized, FISA-OPA was not able to hire even when the City shifted from a full freeze to requiring three and, subsequently, two vacancies for each new hire.

- Finally, OMB is concerned that “suggesting that we are in imminent risk of harm that could `literally close down’ the city is an overstatement and could unnecessarily panic New Yorkers, including city employees who rely on the payroll system, our investors, and the credit rating agencies.”

This Fiscal Note provides an analysis of the critical need to update the City’s financial IT systems. Based on its factual basis, it is inaction that is worrisome, not the analogy used in the introduction.

Conclusions

The evidence assembled here underscores a simple point: modernizing the City’s financial and payroll systems is no longer optional. PMS, DOE’s payroll sub-systems, PPMS, and the FMS/2–FMS/3 environment are simultaneously mission-critical and increasingly fragile—running on aging platforms, dependent on scarce technical expertise, and misaligned with today’s reporting, transparency, and labor-relations demands. System risks are compounded by FISA-OPA’s constrained staffing and retirement-heavy workforce, creating a genuine single-point-of-failure problem for City government.

The City has already done some of the preliminary work through prior RFIs, RFEIs, and exploratory efforts to understand the market and to outline feasible paths forward. What is missing is sustained political and fiscal commitment, governance, and up-front planning resources. Relocating FISA-OPA without modernizing these systems would lock the City into duplicating outdated infrastructure. Sequencing modernization alongside or ahead of relocation, by contrast, would reduce long-run risk and cost, while improving continuity of operations and service to agencies, employees, and retirees.

Accordingly, the next phase should focus on three linked actions: 1) establishing a formal joint governance structure (Mayor, Comptroller, OMB, FISA-OPA, OTI, DOE, and the pension systems, among others); 2) funding dedicated planning, vendor selection, and change-management capacity; and 3) setting a clear timeline that aligns system modernization with FMS/3’s support horizon and FISA-OPA’s move.

This work is not a discretionary IT upgrade but rather a core matter of operational and fiscal stewardship that will ensure the orderly functioning of City government, and guarantee that payroll, payments, and pension obligations, continue to be met accurately and on time for decades to come.

Acknowledgements

This fiscal note was authored by Francesco Brindisi, Executive Deputy Comptroller for Budget and Finance, and Director of FISA-OPA. Bailey Schweitzer, Sr. Capital Budget Analyst and Kieran Persaud, Assistant Director of Budget Oversight provided research assistance. Archer Hutchinson, Creative Director, and Addison Magrath, Graphic Designer led the report design and layout. The author is thankful to Neil Matthew, Executive Director of FISA-OPA and to FISA-OPA’s executive team for their dedication and unrelenting focus serving the employees and retirees of the City of New York.

Endnotes

[1] See for instance Callahan R. (2022) Title Vacant: Addressing Critical Vacancies in NYC Government Agencies, Office of the NYC Comptroller.

[2] See NYC Department of Citywide Administrative Services FY 2024 NYC Government Workforce Profile Report.

[3] The system also supports retroactive pay processing, a critical feature for the City because new labor contracts often apply to work done months or years earlier. PMS can recalculate past pay periods going back up to six years, ensuring employees are made whole when a contract settlement or correction is applied. Similarly, it recalculates leave balances if prior time entries are changed.

[4] Core pension payroll operations include: gross-to-net calculations, deduction management, tax reporting, wage/pay distribution banking operations, annual cost of living adjustments (COLA), New York State Special Accidental Death Benefit (SADB), and others. For some pension administrators, PPMS provides payment, tax and reporting operations for non-recurring distributions (pension loans, refunds of excess contributions, death benefits, and others). For other pension administrators, PPMS provides unit-based payment calculations where the pension distribution is calculated monthly based on a share value.

[5] The City’s myriad component units (such as the Housing Authority and Health + Hospitals Corporation) tend to have separate financial management systems that interface with FMS/2 and FMS/3.

[6] As is the case for its payroll system, DOE manages and operates its own financial management system outside the purview of FISA.