Executive Summary

Venture capital, a form of investment activity for privately-held business ventures with high growth potential, has long been an important source of financing for start-ups and other companies that face challenges getting financing through traditional means, such as banks or equity capital. New York City – with many well-established industries, attracts a healthy share of global venture capital, even as the volume of venture capital investment has exploded over the last decade.

This report reveals several important facts and observations concerning the role of venture capital in New York City.

First, as venture capital has exploded globally, New York City has held its own. The number of venture capital deals, and the amounts invested, have grown commensurately with global venture capital growth, rising by 256 percent and 439 percent, respectively. New York City’s share of the global total has also increased, growing from 4.58 percent in 2008 to 6.01 percent in 2017.

At the same time, the number of companies, and the range of industries they represent, continues to show a diversity of sectors that attract venture capital in New York City – a sign of strength for the local economy. And venture capital has also played a significant role in job creation, providing backing to firms that employ some 355,000 workers.

It is significant that many of the sectors that have drawn venture capital in recent years are well-established City industries – from advertising and publishing, to financial services and real estate. Unlike venture capital in Silicon Valley, in New York it is less about creating new technology, and more about applying new technology to the transformation of existing sectors for the knowledge age.

In addition, New York City technology firms are prominent recipients of venture capital investment, indicating the sector’s growing role and strength in the City’s economy. Also, numerous other new and niche businesses are benefitting from venture capital investment in order to gain a foothold and establish themselves as part of the City’s economy.

In short, the story of recent venture capital investment in New York shows that the City has remained an attractive place for investment and growth, and continues to represent a promising bet on the future by investors.

The changing face of venture capital and other recent features of the capital markets – such as the declining role of initial public offerings – highlight questions that deserve further research and monitoring, to ensure that New York City continues to build on the success it has enjoyed to date.

Introduction

New York City has long been among the world’s leaders in venture capital activity, supporting entrepreneurs and start-up ventures in a range of industries across the five boroughs. However, the market for venture capital backing, which had been limited to a handful of U.S. cities and Silicon Valley municipalities just a decade ago, has transformed into a cross-border race among business hubs and centers of innovation in Asia, North America and Europe. This changing dynamic prompts a number of pressing questions. Has New York City kept up with its competitors in terms of venture capital investment? What New York City industry sectors have attracted venture capital? What economic benefit does the City derive from venture capital investment?

This report examines New York City’s standing in the global distribution of venture capital activity from 2008 through 2017 and identifies the emergence of industry clusters fueled by venture capital in New York and around the world. Our analysis is informed by data from Crunchbase, a comprehensive source for venture capital activity worldwide.[1]

Using Crunchbase data, the Comptroller’s Office sought to answer a number of research questions about venture capital activity in New York City:

- How has the venture capital activity of companies headquartered in New York City compared to companies headquartered in other major cities? What share of global venture capital has the city received?

- What are the leading sectors and industries for venture capital activity in New York City and its competitor cities? What industry clusters have dominated venture capital activity in New York? How does that compare with competitor cities?

- How many companies and jobs have been supported by venture capital activity in New York City and in its competitor cities?

Although this report will go into some detail about venture capital activity in major cities and regions, the purpose and scope of this report is unabashedly New York City focused – its place in the world’s venture capital ecosystem, the industry clusters that have been facilitated by venture capital activity and the jobs at New York City-based enterprises that have emerged as a result.

Definitions and Scope

Briefly defined, venture capital is a form of investment activity often sought by developing, privately-held business ventures with high growth potential that may have limited prospects of obtaining traditional bank loans or other types of financing. In addition to the dollars and cents of a venture capital deal, venture capital backing can also involve an infusion of managerial expertise into a promising new venture, and investors obtain a stake in the developing company, allowing for future returns on original investments if those businesses grow and become successful. By its nature, venture capital is a volatile, long-term, high-risk, high-reward proposition.

In this report, “venture capital activity” generally refers to an investment into a developing company by a venture capital firm and its limited partners.[2] Although modern venture capital activity and the discussion around it is often equated with technology-oriented start-up companies, venture capital recipients are not necessarily “tech companies”. In fact, household names such as Starbucks, Staples and FedEx were all one-time venture capital recipients in their early stages.

Our report is divided into two sections to address the research questions detailed earlier. The first section is comparative in nature and focuses on the race between the world’s twenty largest headquarter cities for venture capital activity. Within this first section we briefly examine venture capital activity in major metro areas using the New York Metro area vs. the San Francisco Bay area as a major area of focus. Later in our comparative section we discuss the importance of proximity to institutional investors and introduce the concept and implications of supergiant funding rounds in New York City and elsewhere. Our comparative section concludes by measuring industry clusters across the same twenty cities. The second section of this report is dedicated entirely to New York City. We analyze the City’s areas of strength, drill down on venture capital backed job creation and provide a detailed list of the industries in New York City where venture backed industry clusters have emerged over a recent five year period.

Finally, it is important to note some of the crucial venture capital related topics that this report does not examine in detail. Although comparisons of New York to other cities invites discussion on a number of important and interesting sub-topics, from cross border transactions and the recent ascendance of venture capital activity outside of the United States, to the public policies that impact venture capital investors themselves, this report generally refrains from providing in-depth analyses of these topics. For example, a goal of most entrepreneurs in soliciting venture capital funding and investing in new enterprises is the ultimate issuance of equity in the stock market. However, one critique of New York City’s venture capital ecosystem has been the inability of some of its largest funded companies to exit the venture capital stage through major acquisitions or initial public offerings.[3] Nonetheless, a company level analysis of returns on venture capital investments through acquisitions and public offerings is beyond the scope of this report.

The Global Pursuit of Venture Capital

We begin with an examination of New York City’s position in the worldwide venture capital race in order to determine how New York compares to other major venture capital recipient cities.

It is well documented that the geographic concentration of venture capital activity is unevenly distributed. A recent series of reports published by the Martin Prosperity Institute (MPI) sheds some light on the geographic areas and industries in which venture capital activity is most often concentrated. In January 2016, MPI quantified venture capital investment in 2012 across 170 metropolitan areas worldwide. Their report concluded that the top ten venture capital recipient cities attracted more than half of the world’s venture capital investment. Most of the top ten cities at that time were in the United States, with Asian cities just beginning to compete.[4]

A subsequent MPI report in 2016 examined venture capital concentrations across industries and United States zip codes and found that more than three quarters of venture capital investment was concentrated across just five key industries and in a small number of geographic clusters, largely the San Francisco Bay Area, New York City and Boston.[5] Still later, in an article published in 2017, MPI examined venture capital activity across certain industries in the United States, finding that some two thirds of venture capital investments in 2016 were limited to the San Francisco Bay Area and the “Acela Corridor” – stretching from Washington, D.C. to Boston in the Northeast.[6]

Venture capital is also growing rapidly outside of the United States. An October 2018 report co-published by the Center for American Entrepreneurship and the New York University School for Professional Studies found that, even while continuing to grow in absolute terms, the U.S. share of venture capital activity has declined from some 95 percent in the mid-1990’s to just over 50 percent now.[7]

Like many global cities, New York City’s venture capital ecosystem experienced a decade of tremendous growth between 2008 and 2017, fueled by a rebounding post-recession economy (Figure 1). In 2008, businesses headquartered in New York City closed fewer than 300 deals worth a cumulative $1.7 billion. At the peak of the City’s venture capital deal making in 2015, companies headquartered in New York City finalized over 1,440 venture capital deals for approximately $8.7 billion. Although the deal count dropped sharply in the following two years, the total amount of capital invested in New York City headquartered companies continued to rise after a pause in 2016. By 2017, deal and capital totals in New York City had risen by 256 percent and 439 percent respectively, compared to 2008 levels, in nominal terms, with nearly 1,000 deals amounting to just under $9.4 billion raised.

Figure 1 – New York City Venture Capital Activity, 2008 – 2017

Source – NYC Comptroller’s Office, Crunchbase

Headquarters Cities

Back in 2008, New York City-headquartered businesses primarily competed against domestic start-ups, mostly based in California, for venture capital backing.[8] However, a changing geographic distribution of venture capital activity has considerably altered the last decade’s dynamic, with a number of global cities outside of the U.S. rising to new positions as some of the largest venture capital recipient cities. Across the twenty cities that tallied the largest venture capital totals in 2008, only four were located outside of the United States. Ten years later, more than half of the top twenty venture capital recipient cities were located outside of the United States and only four were in California. The remarkable swell of venture capital dollars that has flowed into Beijing, Shanghai, London, Singapore, Hong Kong, Shenzhen, Paris, Berlin, Bangalore, Jakarta and Hangzhou has transformed the global venture capital arena.

Experts and commentators have pointed to a number of factors that have facilitated the recent globalization of venture capital markets. Chief among these are the establishment of new industry clusters in certain countries that have spurred innovations, which in turn have served as a catalyst for venture capital activity. Another important factor has been a reduction of central government participation in some national economies that had impeded innovation by discouraging risk taking. In some countries, newly adopted hands-off approaches have spawned entrepreneurial environments and attracted venture capital backing that may not have otherwise materialized.[9]

Companies headquartered in major Chinese cities have experienced a meteoric rise in venture capital activity over the last several years. This rise has been driven in part by the factors described above, as well as China’s ongoing transition to a cashless, mobile-internet oriented society, facilitated by platforms such as AliPay and WeChat.[10] Chinese entrepreneurs have also been adept at developing their own copycat start-ups that customize, and in some cases supplant, American innovations in areas such as social media, ridesharing and retail commerce to meet the social and cultural preferences of Chinese consumers or adhere to government imposed regulations on censorship and speech.

In Figure 2, the top twenty venture capital recipient cities in 2017 are plotted on a chart that illustrates the total amounts raised in 2008 and 2017. These twenty cities form the basis for the remainder of our analysis.

Figure 2 – Top Twenty Venture Capital Recipient Cities in 2017

Source – NYC Comptroller’s Office, Crunchbase

New York City maintained its second place position in terms of total deal counts in 2017; however, the City dropped to fifth in the race for total venture capital dollars in 2017, lagging behind Beijing’s venture capital total by $5.7 billion. Now, even Silicon Valley and San Francisco trail Beijing’s venture capital totals. Figure 3 illustrates the growth in venture capital activity across seven leading venture capital recipient cities in 2017.

Figure 3 – Growth in Venture Capital Activity in Select Headquarters Cities, 2008-2017

Source – NYC Comptroller’s Office, Crunchbase

An examination of the share of global venture capital across the start and end dates of this study uncovers a number of interesting trends. New York City’s piece of the pie has grown slightly bigger, rising from 4.58 percent in 2008 to 6.01 percent in 2017 although the headquarters cities that New York competes with, including Beijing, San Francisco and Shanghai, have increased their ratios by even larger amounts. The gains in these cities, however, contrast with a substantial decrease in the proportionate distribution of venture capital investment in Silicon Valley during this same time period. Figure 4 below illustrates these changes. Perhaps the most notable trend seen in Figure 4 is the contraction in the share of venture capital investment claimed by all other cities not included in the chart, which suggests an increasing concentration of venture capital activity in a small group of “superstar cities”, a development that may benefit New York City at the expense of its national and global counterparts.

Figure 4 – Changes in the Share of Global Venture Capital Investment in Major Cities, 2008 vs. 2017

Source – NYC Comptroller’s Office, Crunchbase

Metro Regions

Although this report primarily focuses on headquarters cities rather than regions as its geographic frame of reference, similar analyses have often used a regional context that often pits the New York metropolitan region against the San Francisco Bay Area. Therefore, we conclude this discussion with a brief comparison of these two places.

One factor that distinguishes the New York metropolitan region, and most others, from the Bay Area is the central role of a single, anchor city. In 2017, companies headquartered in New York City were responsible for 91 percent of its regional venture capital activity, leaving no question that New York is the principal city in its region. By contrast, San Francisco accounted for only 41 percent of the Bay Area’s venture capital activity in 2017, with the remainder spread across 50 other Bay Area municipalities. Companies headquartered in San Jose, the most populous city in the region and the heart of Silicon Valley, accounted for just 2.7 percent of regional venture capital activity, while those in Oakland accounted for less than 1 percent. Meanwhile, smaller municipalities in the Bay Area, including Palo Alto, Menlo Park, Mountain View and Redwood City, accounted for a combined 29 percent of the Bay Area’s venture capital activity.

Without these small Silicon Valley municipalities, San Francisco could not have risen to become one of the world’s premier venture capital recipient cities. Enabled by California’s ban on non-compete employment clauses and a strong network of science and engineering universities, talent diffused across tech start-ups throughout Silicon Valley in the 1960’s and 1970’s, allowing the world’s powerhouse tech cluster to germinate naturally.[11] As new inventions and innovations became commercially successful, businesses grew and the importance of business support workers – managers, lawyers, marketers, and the like – eventually took on a greater importance, pulling the center of gravity to nearby San Francisco, which had a pre-existing commercial infrastructure and the deepest pool of business talent in the region. San Francisco’s strength as a venture capital destination is a direct consequence of the Bay Area’s innovative prowess and it is improbable that its current success could have occurred without its proximity to the small towns and cities near its borders.

New York City, on the other hand has not had to rely on its peripheral neighbors in the same way as San Francisco.[12] With a wealth of pre-existing industry strongholds, including advertising, finance, fashion and media, the New York metropolitan region has been able to harness inventions and innovations from other parts of the world and apply them to its legacy industries. The regional culture of innovation in the Bay Area has contrasted with that of the New York metropolitan region, which has been characterized by a culture of technological adaption and reinvention. New York has used its historical strengths as a business hub as a launching point to disrupt and modernize its strongest industries on a major scale, which has in turn both attracted and been fueled by venture capital.[13] The absence of a strong network of regional innovation similar to Silicon Valley has not hindered New York City’s venture capital success in the same way that it could have in San Francisco, had the considerable technological advancements that took place in Silicon Valley happened elsewhere.

Investor Proximity

One contributing factor to New York City’s strength as a venture capital hub may be the proximity of the City’s start-up companies to venture capital investors themselves. According to a working paper published by the National Bureau of Economic Research in 2009, more than half of the world’s venture capital firms were located in either New York, Boston or San Francisco in 2005. That same analysis also found that venture capital firms have strong local biases. Among venture capital backed start-up companies based in New York City at that time, more than half were financed by venture capital firms based in New York City.[14]

A simple interpretation may be that start-ups with proximity to investors will have a greater range of venture capital options and thus a better chance of obtaining funding while venture capital investors themselves also benefit by reducing the distance between their headquarters locations and the new ventures that they have backed. If successful, venture capital-backed companies eventually spawn new spin-offs which may return to the venture capital community to seek new rounds of start-up financing. Physical proximity, therefore, creates a reinforcing cycle of venture capital activity. In this regard, New York City’s longstanding position as a global leader in the financial services industry may give local entrepreneurs a leg up in their search for venture capital backing. Similarly, start-up companies headquartered in thin venture capital markets may have fewer opportunities to engage with venture capital firms than their big-city counterparts.

Figure 5 illustrates the world’s thickest regional venture capital markets, measured by the number of institutional venture capital investors that were active as of January 2018.[15] The New York City region is second in venture capital investors only to the San Francisco Bay Area which may bring about considerable advantages for our locally based start-ups seeking venture capital backing.[16]

Figure 5 – Number of Institutional Venture Capital Investors by Region, January 2018

Source – NYC Comptroller’s Office, Crunchbase

The Rise of “Supergiant” Venture Capital Rounds

New York City’s concentration of institutional venture capital investors combined with its position as one of the world’s financial, political and cultural hubs may have also helped to facilitate the City’s strong position as a recipient of “supergiant” venture capital rounds.[17] Defined here and elsewhere as having a value of $100 million or more, supergiant rounds are a recent phenomenon and venture capitalists, entrepreneurs and others are still coming to grips with its consequences.[18] The rise of supergiant rounds is a reflection of the growing role of the largest institutional and sovereign venture capital investors in the global venture capital ecosystem with potential implications for the types of innovation that investors will support in venture capital recipient cities, especially among the smallest start-ups.

Across the twenty cities analyzed in this report, New York City attracted 52 supergiant rounds from 2008 – 2017, trailing Beijing, San Francisco, Silicon Valley and Shanghai which attracted 124, 109, 90 and 65 supergiant rounds, respectively. Boston followed New York City with a total of 23 supergiant rounds. Figure 6 illustrates the emerging prominence of supergiant rounds in each of these cities.

Figure 6 – Top Recipients of “Supergiant Rounds” from 2008 – 2017

Source – NYC Comptroller’s Office, Crunchbase

Funded Companies

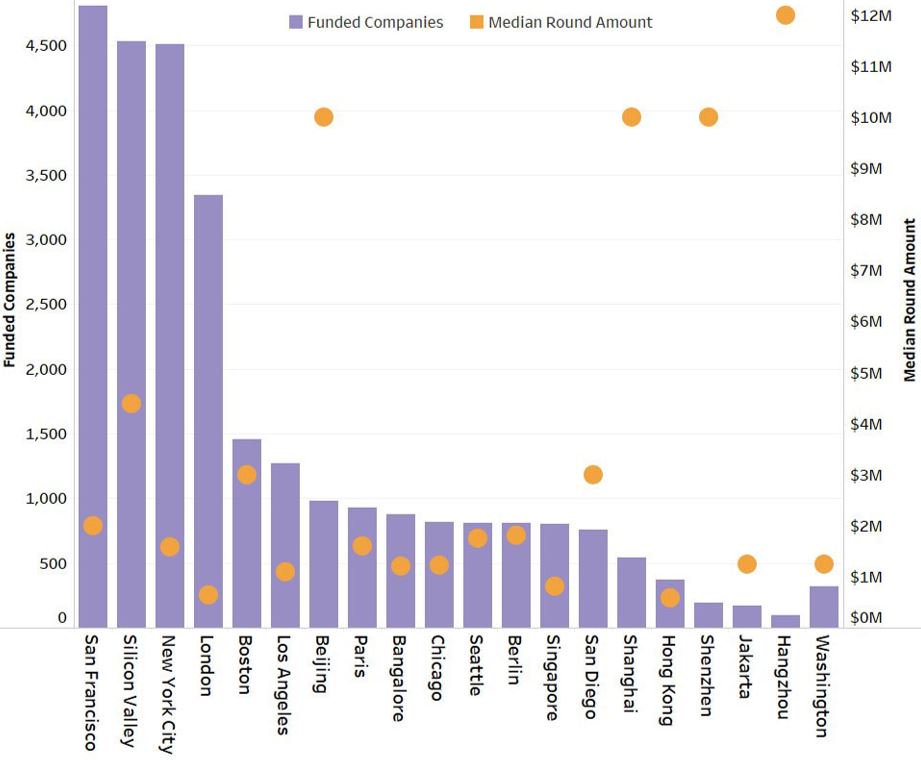

Perhaps the strongest indication of New York City’s strength as an entrepreneurial and start-up destination are the large number of companies headquartered here that have attracted venture capital backing. Overall, there were 4,449 unique New York City-headquartered companies that obtained venture capital backing from 2008 through 2017, a total that trailed only San Francisco and Silicon Valley, as illustrated by the blue bars in figure 7 below. In order to gauge the typical size of a venture capital round in key headquarters cities, we have overlaid the median funding amounts per round onto figure 7, depicting those amounts as orange dots.

Figure 7 – Funded Companies and Median Funding Amounts, 2008-2017

Source – NYC Comptroller’s Office, Crunchbase

Companies often obtain multiple rounds and differing amounts of venture capital backing over time, which prompts questions about the typical size of a venture capital round in any given headquarters city. Unsurprisingly, the typical venture capital round size in our twenty city study group varies widely, with some apparent geographic patterns. New York City placed 12th among the group of twenty with a median round value of approximately $1.6 million per company. Companies headquartered in Hong Kong recorded the lowest median round value of $587,500, while companies headquartered in mainland Chinese venture capital hotspots had the highest median round values, ranging from $10 – $12 million, concentrated in a relatively small number of companies.

One distinguishing factor between major western cities like New York and their Chinese counterparts is that, notwithstanding the recent rise of supergiant rounds, institutional venture capital investors in the United States and Europe have tended to spread smaller amounts of capital across a larger pool of start-up companies, as demonstrated in figure 7. Relatively low median funding amounts and a large number of funded companies point to a substantial breadth of venture capital activity in New York City which may ultimately serve to increase innovation and enhance economic competitiveness when start-ups exit the venture capital stage.

Jobs

One of the most important consequences of venture capital backing from the perspective of any city are the jobs that are created and the tax revenues that are generated as a result. Some emerging evidence suggests that employment at venture backed start-ups may offer superior pay to the nation’s young talent. For example, a recent study of Massachusetts Institute of Technology graduates found that the average wage paid by start-up companies that have received venture capital backing exceeds the average wage at large, established companies by 8 to 13 percent.[19]

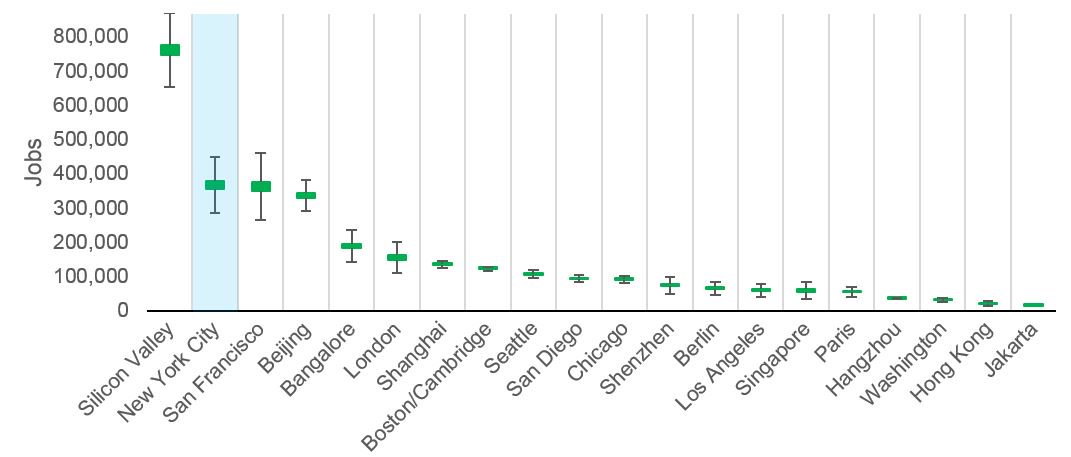

The Comptroller’s Office has used Crunchbase’s data to estimate the number of jobs that existed at venture capital backed enterprises as of 2017. Crunchbase provides an estimated employee count for each company that appears in its database, presented as a range with an estimated minimum and maximum number of workers that are currently employed by each company in the database. To estimate the number of jobs supported by venture capital activity during this report’s ten year study period, the Comptroller’s Office took the minimum and maximum employee counts for every company that raised any amount of venture capital from 2008-2017 and then aggregated these totals for each headquarters city and industry levels. Figure 8 illustrates the estimated number of jobs supported by venture capital activity in each headquarters city. The green boxes represent median values, while the lines that extend represent high and low total job estimates.

Based on median job estimates, venture capital backing from 2008-2017 supported approximately 355,400 jobs at companies headquartered in New York City, the second highest value of any city studied in this report (Figure 8). Silicon Valley handily dominates all of the other urban areas that we examine with a median estimate of more than 745,000 jobs, while the medians in San Francisco and Beijing follow closely behind New York City’s job estimate. A deeper analysis of New York City jobs supported by venture capital activity, including the industries in which they are located, is included in the next section of this report.

Figure 8 – Estimated Number of Jobs Supported by Venture Capital Activity, 2008-2017.

Source – NYC Comptroller’s Office, Crunchbase

NOTE: Green squares represent midpoint of estimates, with the range of the estimate shown by the extended line.

Industry Clusters

An industry cluster is defined here as an industry in which the share of total investment in a given city is higher than the average share of investment in that industry worldwide. A higher than average share indicates an industry where a city has a particular degree of dominance, or specialization, which in turn may result in a self-reinforcing clustering, or agglomeration effect, especially when industry clusters overlap with, or complement, one another.[20]

A high tally of industry clusters is significant for several reasons. Chief among these is that multiple industry clusters point to multiple areas of strength in a city’s economy as well as a certain degree of resilience if any one industry experiences negative shocks. Cities with a more diverse range of industries may be better equipped to weather perilous changes in the economy and pivot when economic or societal changes create or alter existing consumer demand.[21]

Additionally, clusters beget spinoffs. More clusters should yield more spinoff companies. Therefore, cities that attract more venture capital-backed clusters are likely to attract more start-up activity and more innovation in the future.[22]

Finally, venture capital activity has known stimulative effects on innovation in recipient industries. A leading study found that one dollar of venture capital is three times more effective in stimulating innovation at the industry level than one dollar of traditional corporate research and development funding.[23] Because venture capital activity has such a powerful effect on innovation in the industries that it touches, recent venture capital trends may provide insights into areas of strength and future growth in a city’s economy and could indicate the cities that have gained the most traction in terms of attracting new, cutting edge industry clusters or shoring up existing industry clusters. As such, figure 9 below serves as a rough proxy for where future innovation may be most prevalent.

The discussion of industry clusters in this section covers the five year period from 2013 – 2017 in order to hone in on recent trends. We use location quotients to measure the ratio between a city’s share of venture capital activity in a certain industry and the global share of venture capital activity in that same industry. A location quotient of 1.0 denotes a city that has an average amount of venture capital activity within the industry that is being measured. Location quotients of less than 1.0 indicate that a city has below average venture capital activity in an industry while location quotients of greater than 1.0 indicate an above average share of venture capital activity in a given industry, compared to the global average. Industry clusters with fewer than ten venture capital rounds from 2013-2017 were omitted from our location quotient calculations in order to exclude outlier industries and ensure a cluster’s maturity in any given city. A complete explanation appears in the Methodology & Limitations section at the end of this report.

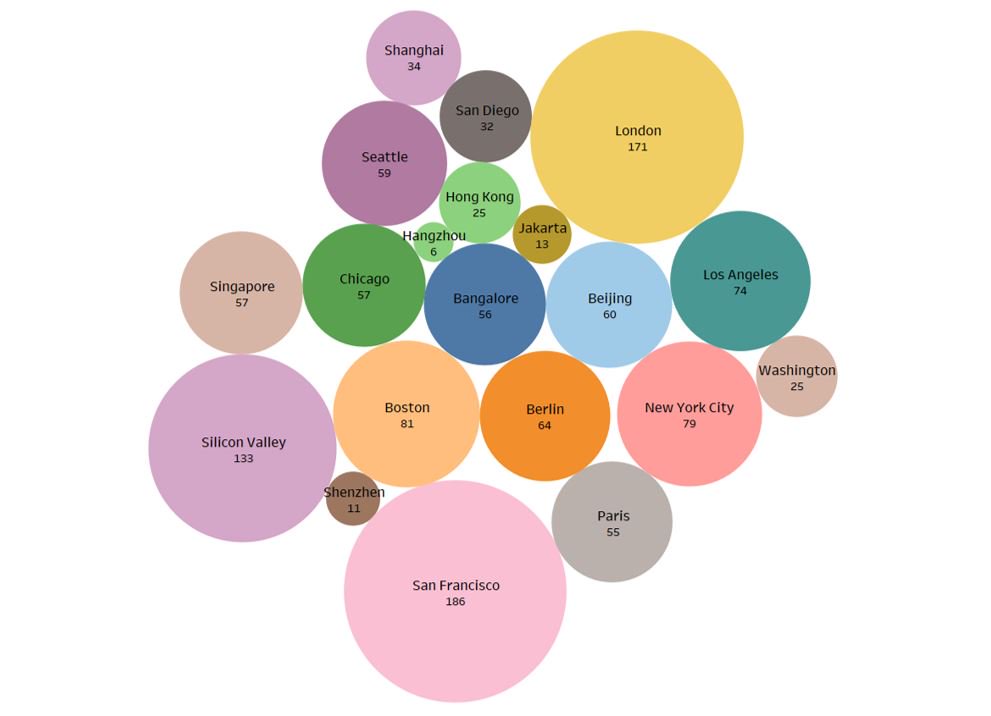

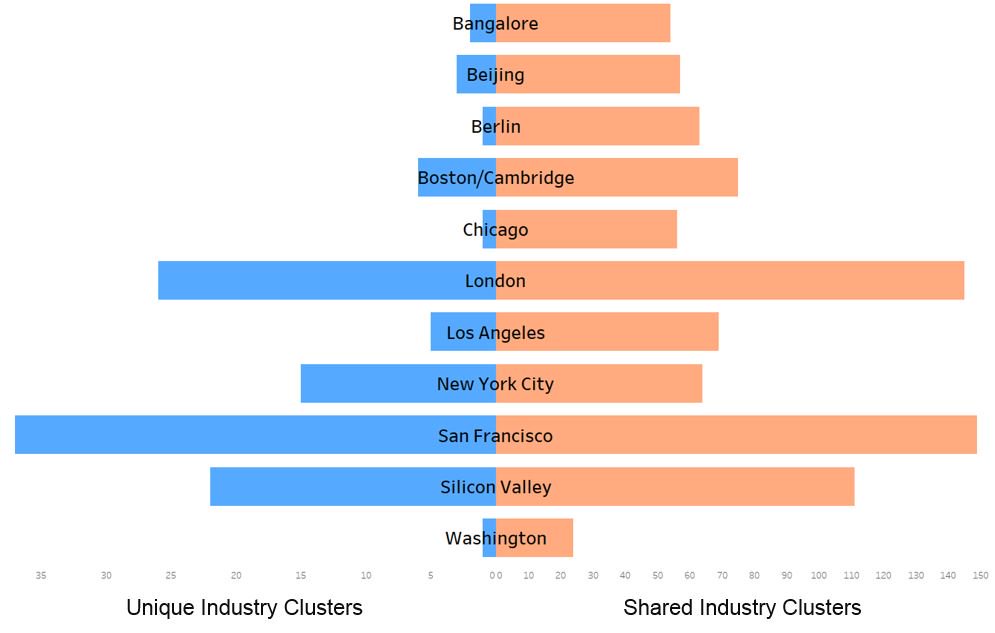

Across the twenty cities we have included in our study, we identified some 1,278 industry clusters with higher than average shares of venture capital activity. New York City registered 79 such industry clusters, ranking fifth behind San Francisco, London, Silicon Valley and Boston, as illustrated in figure 9 below.

Figure 9 – Venture Capital Supported Industry Clusters by Headquarters City.

Source – NYC Comptroller’s Office, Crunchbase

We also measured the presence and prevalence of industry clusters that are unique to one of the twenty selected cities, which shed light on the industries where New York City-based start-ups have established distinct strongholds relative to other leading cities.[24] The prevalence of unique industry clusters is also an indicator of the diversity of industry sectors that have been favored in New York City’s venture capital ecosystem.

Figure 10 illustrates the number of unique and shared industry clusters across the cities in our study group where unique industry clusters were found. A city’s tally of unique industry clusters are represented in blue and that city’s total number of shared industry clusters, meaning clusters that are found in more than one of our top twenty cities, is represented in orange. Following San Francisco, London and Silicon Valley, New York City registered the fourth highest number of unique industry clusters at 15, putting New York among the world’s most diversified big-city venture capital funding environments. The industry clusters that were found in New York City but not in any of the other nineteen cities examined in this report include: Ad Retargeting, Concerts, Contact Management, DIY (do it yourself), Fantasy Sports, Fertility, Journalism, Podcast, Product Search, Property Development, Shoes, Social CRM (customer relationship management), Stock Exchanges, Video Editing, and Weddings.

Figure 10 – Unique and Shared Industry Clusters Supported by Venture Capital Activity in Select Cities.

Source – NYC Comptroller’s Office, Crunchbase

Spotlight on New York City

In this section of the report we take a closer look at the venture capital backed sectors in New York City. To spotlight recent trends and offer a clear glimpse into the future, the discussion in this section is based on venture capital activity from 2013 – 2017.

As an organizing principle for this section of our report:

- Industries – assigned to each venture capital recipient by Crunchbase. At the time that our data was drawn from Crunchbase there were 726 different industry categories in the data.

- Sectors – defined by us based on aggregations of the distinct industries found in Crunchbase in order to facilitate broad observations and conclusions about venture capital trends. We grouped the 726 distinct industry categories into sixteen sectors, as described below.

After examining the performance of these sectors in New York City, we focus on the New York City headquartered industries that have shown particular strength, as measured by above average shares of venture capital backing. We profile the ten industry clusters in this group that have raised at least $1 billion over this five year period and we inventory the rounds, company counts, investment totals and job estimates for each of New York City’s most significant venture capital-backed industries. We complete our analysis with an examination of job estimates across the industries and sectors of New York City headquartered companies with recent venture capital backing.

Top Sectors

Our analysis in this section begins with a big-picture review of the sectors that received venture capital backing in New York City. This is followed by a more granular examination of venture capital-backed industry clusters using location quotients. The purpose of this section is to identify the strongest fields for venture capital activity in New York over the last five years.

Figure 11 depicts the top venture capital backed sectors in New York City, based on the dollar amounts of venture capital backing attributed to those sectors from 2013 to 2017. The “tech” sector is by far the largest and broadest of our sectors, comprising a 25 percent share in terms of dollars raised. Company categories that were grouped into the tech sector range from big data and cloud computing to machine learning and virtual reality. Tech’s large size as a New York City sector in this report is explained by the robust linkage and association between venture capital and new technologies.[25]

The three next largest categories are “Business Services”, “Media & Content” and “Financial Services”, capturing a wide range of industries, the most prominent of which are detailed in Table 1 at the conclusion of this report. Other major sectors include Culture and Entertainment, Advertising, Real Estate, and Health & Medical. Generally, the sectors that appear in Figure 11 include some of New York City’s established industry strongholds.[26]

Figure 11 – Top Venture Capital Backed Sectors in New York City, 2013 – 2017.

Source – NYC Comptroller’s Office, Crunchbase

Other measures of a sector’s success, including the total number of venture backed companies and the number of successful venture capital rounds achieved, yield results that closely hew to the trends illustrated in Figure 11, reinforcing the dominance of tech as New York City’s leading venture capital sector. From 2013-2017, the tech sector in New York City notched 3,537 venture capital rounds across 1,918 different companies. The Business Services sector was next with 2,242 rounds across 1,213 different companies, followed by the Media & Content sector, which recorded 912 rounds across 532 companies.

Top Industries

New York City’s top industry clusters are comprised of a mix of both well-established business types and emerging industries that are working to strengthen their place in the City’s economy. Traditional New York City industries attracted disproportionate shares of venture capital activity, including companies that specialize in commercial real estate, news and journalism, architecture, nightlife, art, and hedge funds. One hypothesis for the venture capital support attracted by some of the City’s legacy industries is that they may be adopting new technologies that will be employed in adapting those industries for the information age economy. The ongoing transition from print news to the digital consumption of journalism is one such example.

In figure 12 below, we display the ten industry clusters with companies headquartered in New York City that recorded a location quotient of at least 1.0 and attracted at least $1 billion in venture capital backing from 2013 – 2017. These industries align with many of New York’s historical strongholds – including advertising, financial services, real estate, publishing, media, culture and entertainment – many of which also attracted large shares of venture capital activity as measured by their location quotients, including industries that specialize in property development (2.67), ad retargeting (2.49), video advertising (2.21), concerts (2.20) and hedge funds (2.15). One notable element of the figure is the very low tally of round counts and funded companies in the property development industry, which ranks third in terms of total venture capital investment. This anomaly in the figure is driven by one well known New York City start-up that has benefited from the supergiant trend described earlier.

Figure 12 – Ten NYC Industry Clusters with at least $1 Billion in Venture Capital Backing, 2013-2017.

Source – NYC Comptroller’s Office, Crunchbase

A number of new or niche industries have also established strong clusters in New York City based on their venture capital support, including start-up companies dedicated to fertility, women, fantasy sports, coffee, social media management, concerts and freelance work. Some of the highest location quotients in New York City are held by these very small industries that are on the cusp of potentially substantial future growth. A prominent example of this is fertility, a market that is expected to grow by $1 billion between 2017 and 2022 in the United States according to one estimate.[27] Despite the relatively small size of the City’s fertility industry in 2017, New York City-based fertility companies pulled in a share of venture capital backing three times greater than in any other city worldwide, putting New York City in a strong position to leverage its existing biotech talent.

Other emerging and specialized industries have also established strong clusters in New York City based on their venture capital support. DIY, or “do it yourself”, is another interesting example. One recent projection estimates that the global DIY market will grow to nearly $14 billion in total value by 2021.[28] Facilitated by the expansion of sharing economies, especially in areas such as craft goods and home improvement, DIY companies headquartered in New York City registered a location quotient of 2.03.

Table 1, which appears at the conclusion of this section, details the New York City industries with location quotients of 1.0 or greater based on their venture capital backing. Table 1 also includes details on the round counts, number of funded companies and venture capital investment totals associated with each industry cluster.

Jobs

The jobs that emerge from venture backed companies are among the most consequential and immediately felt impacts that venture capital activity can have on headquarters cities. As noted earlier, we estimate that venture capital activity from 2008-2017 supported more than 355,000 total jobs at venture capital recipient companies headquartered in New York City as of 2017. In this final portion of the report, we honed in on the period from 2013-2017 to measure jobs across the sectors assigned to industries by the Comptroller’s Office and the industries assigned to companies by Crunchbase.[29]

New York City-headquartered industries grouped into the tech sector were responsible for the highest employment estimates across this report’s categories, with approximately 186,000 jobs supported by local tech companies that obtained venture capital backing over this five year period. This figure includes tech and non-tech occupations.[30] Beyond the continued and well documented expansion of New York’s burgeoning tech sector in recent years, the City’s legacy as a stronghold for business, advertising, media and culture may have been key contributing factors to the impressive job estimates found in other, non-tech sectors.

Following the tech sector, venture backed companies in the business services sector were also formidable job creators, supporting some 124,000 employees at New York City headquartered companies. New York City’s advertising sector was another strong job creator during our study period. It is estimated that venture capital activity supported some 56,000 advertising sector jobs at companies headquartered in New York City. Within the advertising sector, the 244 venture capital backed advertising companies headquartered in New York City generated the highest estimated employment and the greatest total financing amount – nearly $3.2 billion – among any of the City’s leading industries.

The City’s media and content sector saw similarly impressive job tallies across its industries. Chief among these are video, content, media and entertainment, digital media, advice, publishing and news industries where venture capital activity was responsible for supporting an estimated 63,000 jobs at recipient companies across these industries. Venture capital activity in culture and entertainment, another sector that is synonymous with New York City, raked in more than $5.3 billion in financing which helped to support an estimated 74,000 jobs at recipient companies in the sector, including in the lifestyle, fashion and beauty industries, among several others.

That so many of the sectors with impressive employment figures have historical roots in New York City suggests that local venture capital recipients likely represent new entrepreneurial efforts to disrupt well established industry norms and build something new while standing on the shoulders of strong, pre-existing industry clusters.

Table 1 below details the New York City industries that were found to have location quotients greater than 1.0. The sector subtotals only account for high location quotient industries listed in the table and do not include industries with location quotients below 1.0.

Table 1 – New York City Industry Clusters, by Sector

| Sector | Industry | VC Rounds | Companies | Total VC Investment | Location Quotient |

| Advertising | Ad Retargeting | 16 | 7 | $115,050,000 | 2.49 |

| Video Advertising | 17 | 9 | $107,787,528 | 2.21 | |

| Ad Targeting | 26 | 11 | $185,346,988 | 1.47 | |

| Ad Network | 23 | 15 | $64,839,998 | 1.40 | |

| Advertising | 354 | 244 | $3,193,747,052 | 1.19 | |

| Advertising Platforms | 92 | 52 | $517,051,973 | 1.18 | |

| Mobile Advertising | 50 | 23 | $150,033,824 | 1.13 | |

| Marketing | 142 | 111 | $1,637,875,725 | 1.06 | |

| Subtotal, Advertising | 720 | 472 | $5,971,733,088 | —— | |

| Business Services | Professional Networking | 24 | 14 | $44,010,000 | 1.40 |

| Wholesale | 18 | 10 | $180,736,510 | 1.34 | |

| Freelance | 14 | 7 | $63,200,000 | 1.31 | |

| Risk Management | 49 | 24 | $390,688,015 | 1.30 | |

| Productivity Tools | 22 | 11 | $46,750,446 | 1.29 | |

| Brand Marketing | 100 | 47 | $441,932,338 | 1.24 | |

| Product Search | 11 | 6 | $42,250,000 | 1.17 | |

| Contact Management | 10 | 9 | $11,845,000 | 1.14 | |

| B2C | 14 | 7 | $128,041,500 | 1.13 | |

| Subtotal, Business Services | 262 | 135 | $1,349,453,809 | —— | |

| Culture & Entertainment | Concerts | 19 | 8 | $232,950,620 | 2.20 |

| DIY | 15 | 4 | $34,923,000 | 2.03 | |

| Women’s | 45 | 22 | $194,241,094 | 1.96 | |

| Shoes | 20 | 9 | $162,963,502 | 1.90 | |

| Nightlife | 16 | 6 | $21,672,661 | 1.49 | |

| Wedding | 17 | 9 | $51,172,999 | 1.48 | |

| Jewelry | 27 | 15 | $87,923,785 | 1.46 | |

| Architecture | 21 | 10 | $27,611,604 | 1.35 | |

| Art | 49 | 30 | $186,558,385 | 1.35 | |

| Fashion | 270 | 167 | $1,847,700,591 | 1.33 | |

| Beauty | 66 | 41 | $296,753,000 | 1.24 | |

| Lifestyle | 134 | 114 | $1,396,484,123 | 1.15 | |

| Dating | 17 | 14 | $29,296,699 | 1.07 | |

| Subtotal, Culture & Entertainment | 716 | 449 | $4,570,252,063 | —— | |

| Education | EdTech | 121 | 73 | $574,251,130 | 1.05 |

| Language Learning | 24 | 12 | $96,021,612 | 1.02 | |

| Subtotal, Education | 145 | 85 | $670,272,742 | —— | |

| Financial Services | Hedge Funds | 12 | 7 | $26,180,000 | 2.15 |

| Impact Investing | 24 | 9 | $373,000,000 | 1.51 | |

| Wealth Management | 29 | 14 | $81,206,522 | 1.39 | |

| Personal Finance | 56 | 24 | $217,876,095 | 1.24 | |

| Insurance | 82 | 39 | $757,289,106 | 1.18 | |

| Financial Exchanges | 14 | 7 | $113,440,000 | 1.11 | |

| FinTech | 396 | 208 | $2,947,794,899 | 1.05 | |

| Stock Exchanges | 10 | 8 | $105,385,000 | 1.02 | |

| Asset Management | 11 | 9 | $214,276,000 | 1.01 | |

| Subtotal, Financial Services | 634 | 325 | $4,836,447,622 | —— | |

| Food & Beverage | Coffee | 24 | 9 | $36,200,000 | 1.63 |

| Cooking | 22 | 8 | $95,745,000 | 1.35 | |

| Restaurants | 103 | 62 | $298,595,152 | 1.12 | |

| Subtotal, Food & Beverage | 149 | 79 | $430,540,152 | —— | |

| Goods & Services | Subscription Service | 52 | 24 | $312,675,106 | 1.58 |

| Psychology | 13 | 5 | $54,528,015 | 1.42 | |

| Interior Design | 19 | 9 | $69,365,114 | 1.12 | |

| Career Planning | 25 | 21 | $66,580,000 | 1.08 | |

| Home Renovation | 17 | 7 | $138,513,917 | 1.07 | |

| Legal | 53 | 42 | $83,955,059 | 1.04 | |

| Location Based Services | 82 | 60 | $298,940,826 | 1.03 | |

| Subtotal, Goods & Services | 261 | 168 | $1,024,558,037 | —— | |

| Health & Medical | Fertility | 11 | 2 | $77,410,000 | 3.07 |

| Subtotal, Health & Medical | 11 | 2 | $77,410,000 | —— | |

| Media & Content | Podcast | 12 | 6 | $92,305,000 | 2.19 |

| Content Discovery | 31 | 19 | $296,480,748 | 1.53 | |

| News | 124 | 68 | $954,956,351 | 1.52 | |

| Video Editing | 10 | 5 | $164,126,000 | 1.48 | |

| Publishing | 128 | 77 | $1,046,701,106 | 1.46 | |

| Content Marketing | 23 | 14 | $230,390,000 | 1.38 | |

| Content | 139 | 125 | $1,259,977,720 | 1.27 | |

| Journalism | 10 | 7 | $10,810,000 | 1.25 | |

| Digital Media | 207 | 112 | $1,468,890,183 | 1.20 | |

| Content Delivery Network | 21 | 18 | $34,295,219 | 1.12 | |

| Video | 206 | 173 | $1,506,936,798 | 1.11 | |

| Media and Entertainment | 107 | 75 | $893,243,841 | 1.07 | |

| Advice | 14 | 16 | $38,666,578 | 1.05 | |

| Subtotal, Media & Content | 1,032 | 715 | $7,997,779,544 | —— | |

| Miscellaneous | Personalization | 55 | 23 | $346,863,517 | 1.41 |

| Government | 17 | 6 | $25,110,000 | 1.25 | |

| Subtotal, Miscellaneous | 72 | 29 | $371,973,517 | —— | |

| Real Estate | Property Development | 11 | 4 | $2,439,634,331 | 2.67 |

| Commercial Real Estate | 66 | 25 | $302,775,000 | 2.01 | |

| Coworking | 18 | 13 | $178,395,000 | 1.22 | |

| Real Estate Investment | 21 | 12 | $48,559,600 | 1.21 | |

| Subtotal, Real Estate | 116 | 54 | $2,969,363,931 | —— | |

| Social | Social CRM | 16 | 7 | $267,402,841 | 1.50 |

| Social Media Management | 30 | 11 | $403,564,111 | 1.28 | |

| Private Social Networking | 27 | 20 | $133,405,000 | 1.16 | |

| Messaging | 111 | 92 | $314,875,243 | 1.02 | |

| Subtotal, Social | 184 | 130 | $1,119,247,195 | —— | |

| Sports | Fantasy Sports | 15 | 8 | $427,187,750 | 1.65 |

| Subtotal, Sports | 15 | 8 | $427,187,750 | —— | |

| Tech | Meeting Software | 10 | 7 | $115,040,000 | 1.09 |

| Open Source | 44 | 20 | $776,186,505 | 1.06 | |

| Enterprise Applications | 23 | 12 | $67,623,534 | 1.04 | |

| Subtotal, Tech | 77 | 39 | $958,850,039 | —— |

Conclusion

This report reveals several important facts and observations concerning the role of venture capital in New York City.

First, as venture capital has exploded globally, New York City has held its own. The number of venture capital deals, and the amounts invested, have grown commensurately with global venture capital growth, rising by 256% and 439%, respectively. New York City’s share of the global total has also increased, growing from 4.58 percent in 2008 to 6.01 percent in 2017.

At the same time, the number of companies, and the range of industries they represent, continues to show the diversity of sectors that attract venture capital in New York City – a sign of strength for the local economy. And venture capital has also played a significant role in job creation, providing backing to firms employing some 355,000 workers.

It is also significant that many of the sectors that have drawn venture capital in recent years are well-established City industries – from advertising and publishing, to financial services and real estate. In contrast to Silicon Valley, characterized by technological invention, venture capital investment in New York has focused on the application of new technologies to the transformation of existing sectors for the knowledge age.

At the same time, New York City technology firms are prominent recipients of venture capital investment, indicating the sector’s growing role and strength in the City’s economy. And numerous other new and niche businesses are benefitting from venture capital investment in order to gain a foothold and establish themselves as part of the City’s economy.

In short, the story of recent venture capital investment in New York shows that the City has remained an attractive place for investment and growth, and continues to represent a promising bet by investors on the future.

The changing face of venture capital and other recent features of the capital markets – such as the declining role of initial public offerings – raise several questions that deserve further research and monitoring, to ensure that New York City continues to build on the success it has enjoyed to date. For example, how have venture capital-funded companies fared in surviving and scaling up compared to other places? It has been suggested that New York City-based startups struggle to exit the venture capital stage through major acquisitions or initial public offerings. How accurate is this contention in 2019 and what are the implications for the City’s entrepreneurial ecosystem? What public policy changes – such as Governor Cuomo’s proposed ban on non-compete clauses – might help boost and sustain the culture of innovation already established with the help of venture capital? Exploration of these and other questions will help determine the future direction of entrepreneurship in the city, and build on the investments made to date in transforming the city’s economy for the 21st century.

Methodology

In October 2017, the New York City Comptroller’s Office entered into a research partnership agreement with Crunchbase. Per this agreement, all of the findings in this report are presented in an aggregated format without divulging individual round-level or company-level details.

A range of venture capital activities is tracked by Crunchbase. Variables from the Crunchbase data that are utilized in this report include: company descriptions, investor descriptions, headquarters locations and company sizes as well as the dates, amounts and types of the venture capital financing rounds attributed to each company.

The data used in this report spans the period from 2008 to 2017 and was drawn from Crunchbase in two different batches. The first batch, representing venture capital activity from 2008 to 2016 was accessed on November 2, 2017. The second batch, representing venture capital activity in 2017, was accessed on January 18, 2018. In total, the analysis in this report covers 140,224 funding rounds, across 82,584 companies that met the date criteria above and the venture capital definition below, in 11,318 headquarter locations, spanning 726 different industries. Because the Crunchbase data is constantly updated, our results reflect the information that was contained in the database on the dates that our batches were drawn.

For the purpose of this report, we define a “round” as an investment from a funding entity to a privately held company. “Venture capital activity” is defined as including the following funding types found in the Crunchbase data: angel rounds, convertible notes, equity crowdfunding, initial coin offerings, product crowdfunding, seed rounds and venture funding rounds. All venture capital activity in this report is expressed in U.S. dollars.

Our definition of “institutional venture capital investor” includes the following investor classifications assigned by Crunchbase: accelerators, angel groups, corporate venture capital, incubators, micro vc, venture capital and venture debt. Only investors designated by Crunchbase as “active” are included in our analysis of institutional venture capital investors. Our definition excludes individual investors.

All of the place-based analysis in this report is tied to company headquarters locations. In some instances, Crunchbase categorizes company headquarters locations using the names of counties, boroughs, neighborhoods or subdivisions in place of city names. For example, a company headquarters location may be listed in Crunchbase as being in “Brooklyn” or “Astoria” instead of “New York City”. In these cases, headquarter locations were consolidated to reflect that company’s place in the greater city instead of a sub-area within that city. The cities appearing in this analysis that went through this consolidation process are: Bangalore, Beijing, Berlin, Boston, Hangzhou, Hong Kong, Jakarta, London, Los Angeles, New York, San Diego, Shanghai, Shenzhen, Silicon Valley and Singapore. A similar consolidation process was undertaken to measure venture capital activity in the New York Metropolitan Area, where our regional analysis grouped together entries that Crunchbase tagged as belonging to the New York City region, the Newark, NJ region and municipalities located in Fairfield County, CT. Venture capital activity in Crunchbase that did not detail a company’s headquarters location was excluded from our analysis.

Sectors and industries are identified in this study using the “company category” labels that Crunchbase assigns to each company in its database. Most companies in the Crunchbase data have more than one label assigned to them so there is some overlap and duplication across industries. To measure industry clustering, venture capital amounts and rounds were grouped into a five year block covering activity from 2013 through 2017. Location quotients were calculated based on venture capital round counts as opposed to venture capital funding totals in order to mitigate the effects of very large or very small funding round amounts on the results. Additionally, company categories with fewer than ten venture capital rounds over the five year study period were omitted from our location quotient calculations. The ten-round benchmark serves as a baseline threshold for an industry’s maturity in any given city and filters outlier industries out of the results.

Finally, one limitation in this report is our ability to localize our job estimates to geographies, sectors and industries with precision. Because of how Crunchbase organizes its data, all geographical job estimates in this report must be attributed to a company’s headquarters city. As such, our estimates may overstate the headquarters city job totals for companies with employees stationed in non-headquarters locations and understate those same totals for companies with employees in satellite offices. Similarly, as noted in the report, Crunchbase has tagged many companies in its database with more than one company category which creates some degree of duplication in the results that appear in the “Spotlight on New York” section. For example, a hypothetical company specializing in music-related podcasts may be tagged as belonging to the “music” and “podcast” industries. As a result, sector- and industry-level job estimates in that section will not sum to our estimate of approximately 355,000 venture capital supported jobs in New York City, which is an unduplicated total.

Report prepared by Stephen Corson, Senior Research Analyst

Bureau of Budget

Larry Mielnicki, Chief Economist

Preston Niblack, Deputy Comptroller for Budget

End Notes

[1] Crunchbase describes itself as a: “free database of technology companies, people, and investors that anyone can edit. Our mission is to make information about the startup world available to everyone”. https://www.crunchbase.com/

[2] A breakdown of the specific investment types that we classify as “venture capital activity” is included in the methodology section.

[3] Turck, Matt. “The NYC Tech Ecosystem: Catching up to the Hype”. July 13, 2016 (http://mattturck.com/the-nyc-tech-ecosystem-catching-up-to-the-hype).

[4] Florida, Richard and Karen M. King: “Rise of the Global Start Up City: The Geography of Venture Capital Investment in Cities and Metros Across the Globe,” The Martin Prosperity Institute, January 2016 (http://martinprosperity.org/content/rise-of-the-global-startup-city/). The top ten venture capital recipient cities identified in this report were: San Francisco, San Jose, Boston, New York, Los Angeles, San Diego, London, Washington D.C., Beijing and Seattle.

[5] Florida, Richard and Karen M. King: “Venture Capital’s Leading Industrial Clusters: The Geography of Venture Capital Investment by Industry.” The Martin Prosperity Institute. April 2016 (http://martinprosperity.org/content/venture-capitals-leading-industrial-clusters/). The five industries identified in this report were: software, biotechnology, media and entertainment, medical devices and equipment and information technology.

[6] Florida, Richard. “Venture Capital Remains Highly Concentrated in Just a Few Cities.” Citylab. October 3, 2017.

7 Florida, Richard and Ian Hathaway. “The Rise of the Global Startup City.” Center for American Entrepreneurship and NYU School of Professional Studies. October 2018. (http://startupsusa.org/global-startup-cities/report.pdf/)

[8] All of the place-based analysis in this report is tied to company headquarters locations. Additionally, while San Francisco and Silicon Valley are often thought of as one region, this report treats them as separate headquarters locations for presentational purposes.

[9] Lyasnivov, Nikolai, et. al. “Venture Capital Financing as a Mechanism for Impelling Innovation Activity”. European Research Studies Journal. 2017.; see also: Lerner, Josh, et. al. “The Globalization of Angel Investments: Evidence Across Countries”. Journal of Financial Economics. May 2017.

[10] Chan, Connie. “When One App Rules Them All: The Case of WeChat and Mobile in China”. Andreessen Horowitz. August 6, 2015.

[11] Annalee Saxenian’s seminal research in Regional Advantage, a book on the business environments in Silicon Valley vs. the Route 128 Corridor in Massachusetts drew a key conclusion that has attracted recent attention in New York State: Silicon Valley flourished in ways that its East Coast counterparts did not, in part because of California’s ban on non-compete clauses. The absence of non-compete clauses in Silicon Valley facilitated knowledge spillovers across Silicon Valley’s tech industry that nurtured innovation and increased start-up formation. Governor Andrew M. Cuomo, in his 2019 State of the State agenda, has proposed the elimination of non-compete agreements.

[12] Of course this is not to say that there is an absence of venture capital activity along New York City’s periphery. The tri-state area surrounding New York City attracted more than $7.5 billion in venture capital activity from 2008 – 2017, with companies headquartered in Newark, NJ and Fairfield County, CT accounting for over 90 percent of that total.

[13] There are decidedly different cultures on the East Coast vs. the West Coast which has seeped into the venture capital eco-systems in those regions. One recent paper measured the descriptive language used on venture capital investment firm websites in Boston and San Francisco in 2007. Although firms in both cities highlighted a commitment to innovation, those in Boston emphasized hierarchical control and status while those in San Francisco underscored entrepreneurialism, egalitarianism and creativity. See: Plaut, Victoria, et al. “The Cultural Construction of Self and Well-Being: A Tale of Two Cities”. Personality and Social Psychology Bulletin. 2012.

[14] Chen, Gompers, Kovner and Lerner. “Buy Local? The Geography of Successful and Unsuccessful Venture Capital Expansion.” NBER Working Paper No. 15102. June 2009.

[15] A breakdown of the specific investor types that we classify as an “institutional venture capital investor” is included in the methodology section.

[16] The venture capital investor footprints in Shanghai and Beijing, two cities that are prominently featured in this report, ranked 27th and 36th respectively, perhaps because of their heavy reliance on supergiant rounds, a concept that we describe on the next page.

[17] For the purpose of this report, we define a “round” as an investment from a funding entity to a privately held company.

[18] Rowley, Jason. “Inside the rise and reign of supergiant venture capital rounds”. TechCrunch. July 22, 2018; see also: Griffith, Erin. “$100 million was once big money for a start-up. Now, it’s common”. New York Times. August 14, 2018.

[19] Kim, J.D. “Is there a start-up wage premium? Evidence from MIT graduates”. Research Policy. February 1, 2018.

[20] Porter, Michael. “The Economic Performance of Regions.” Regional Studies. August/October 2003. See also: Delgado, M; Porter, M; & Stern, S. “Defining Clusters of Related Industries.” National Bureau of Economic Research. August 2014.

[21] A report published by the New York City Comptroller’s Office in 2017 found some benefits that have coincided with recent but modest increases in industry diversity in New York City, most notably smaller fluctuations in employment volatility across business cycles. “New York City’s Economy Has Become More Diversified: So What?” December 20, 2017 (https://comptroller.nyc.gov/reports/new-york-citys-economy-has-become-more-diversified-so-what/).

[22] Golman, R. & Klepper, S. “Spinoffs and Clustering.” Rand Journal of Economics. April 22, 2016.

[23] Kortum, S. & Lerner, J. “Assessing the Contribution of Venture Capital to Innovation.” Rand Journal of Economics. Winter, 2000. Despite a wide recognition of its existence, researchers have not yet reached a consensus on how this stimulatory effect works. See also: Dessi, R. & Yin, N. “The Impact of Venture Capital on Innovation.” The Oxford Handbook of Venture Capital. March, 2012.

[24] For the purpose of this report, we define a “unique industry cluster” as any industry that registers a location quotient that is greater than 1.0 in one, and only one, of the top twenty venture capital recipient cities identified earlier.

[25] Florida, Richard and Kenney, Martin. “Venture Capital, High Technology and Regional Development”. Regional Studies. 1988.

[26] The sectors grouped into the “other” category in this chart include, in descending order: social, miscellaneous, sports, education, transportation, food and beverage, and energy & environment.

[27] Crain’s New York City Business. “The Fast 50, Annual List of the New York Area’s 50 Fastest Growing Companies”. October 15, 2018. (https://www.crainsnewyork.com/awards/2018-fast-50)

[28] Inc. Magazine. “Why the Huge DIY Market is Just Getting Started”. May 19, 2017. (https://www.inc.com/joel-comm/why-the-huge-do-it-yourself-market-is-just-getting-started.html)

[29] As noted earlier, Crunchbase has tagged most companies in its database with more than one company category which creates some degree of duplication in the results that appear in the “Spotlight on New York” section. For example, a hypothetical company specializing in music-related podcasts may be tagged as belonging to the “music” and “podcast” industries. As a result, sector- and industry-level job estimates in this section will sum to more than our estimate of approximately 355,000 venture capital supported jobs in New York City, which is an unduplicated total.

[30] A report published in 2017 by the Office of the New York State Comptroller found that approximately 50 percent of jobs in the New York City tech sector are in non-tech occupations. (https://www.osc.state.ny.us/osdc/rpt4-2018.pdf)