BERS Net Zero Implementation Plan

Adopted April 18, 2023

The Board of Education Retirement System of the City of New York (“BERS”, the “System” or the “Board”) adopts this Net Zero Implementation Plan (the “Plan”) building upon BERS’ resolution in 2021 to divest from publicly-traded fossil fuel reserve owners, as part of our commitment to achieve net zero greenhouse gas (GHG) emissions by 2040 across our investment portfolio. The Plan further reflects our belief that our role as a fiduciary obligates us to mitigate the risks, take advantage of opportunities, and reduce the contributions our investments make to climate change. This Plan provides the policy of the Board and its directives to the Bureau of Asset Management (“BAM”) in the Office of the New York City Comptroller (“Comptroller”).

Net Zero by 2040 – BERS Plan Highlights

| Goals and Actions | Asset Classes |

|---|---|

| DISCLOSE Emissions and Risk | |

| Annually measure and report portfolio emissions (Scope 1, 2, 3)[1] and progress of plan | Public Markets |

| Adopt portfolio emissions reduction targets of 22% by 2025 and 49% by 2030 for Scopes 1, 2 + Set targets for Scope 3 by 2025 | Public Markets |

| Plan interim portfolio emissions reduction targets for private equity, real estate, infrastructure, and alternative credit | Private Markets |

| ENGAGE for Alignment and Action | |

| Adopt goal that by 2025 portfolio companies representing 70% of Scopes 1 & 2 portfolio emissions and by 2030 90% of Scopes 1, 2 & 3 portfolio emissions have science-based targets | Public Markets |

| Engage with high-emitting companies + collaborate with other institutional investors | Public Markets |

| Aim for all asset managers to have net zero goal or science-based targets and plan by 2025 | Public + Private |

| Integrate assessment of Just Transition in investments | Public + Private |

| INVEST in Climate Change Solutions | |

| Increase investments in climate change solutions to $400 million by 2025 and $1.8 billion by 2035 | Public + Private |

| DIVEST to De-Risk | |

| Consistent with the approved fossil-fuel divestment resolution, ask private managers to exclude investments in the production, exploration, or extraction of fossil fuels | Private Markets |

| Develop criteria to guide possible future divestment decisions consistent with fiduciary duties, should engagement efforts conclusively fail | Public + Private |

Executive Summary

The System has a fiduciary duty to evaluate and address the systemic risks that climate change poses to our investment portfolio. Building on our history of climate leadership, BERS committed in October 2021 to a goal of achieving net zero GHG emissions by 2040 through comprehensive strategies of decreasing the GHG emissions of our investments, increasing investments in climate change solutions, and contributing to the reduction of GHG emissions in the real economy.

The primary elements of the Net Zero Implementation Plan are:

Disclose Emissions and Risk

GHG Emissions Reduction Targets for Public and Private Markets

BERS commits to:

- Targets of reducing Scopes 1 and 2 portfolio emissions in public equity and corporate bonds by 22% by 2025, 49% by 2030, and 100% by 2040, using a baseline of December 31, 2019. Our primary metric is financed emissions (emissions/$million invested) with Enterprise Value Including Cash (“EVIC,” discussed below on p. 11), and we will strive for comparable progress among all metrics.

- Set interim emissions reduction targets for every five years from 2030 on and may update and revise our Scope 1, 2 and 3 targets as conditions evolve and data, methodologies and analytical tools improve. We will also seek to disaggregate measurements and set separate targets for material non-CO2 GHG emissions, such as methane, as that data becomes available.

- Develop and adopt interim portfolio emissions reduction targets in private markets and direct BAM to present recommendations as private markets emissions data improves.

- Set targets and a plan for reducing the System’s operational emissions to net zero by 2040. The targets and plan shall include BAM facilities in the Comptroller’s Office.

- Annually publish a report disclosing the status and progress of implementing this Plan, including interim emissions reduction targets, carbon footprint analysis, climate change solutions investment goals, net zero alignment and science-based target goals, asset manager alignment goals, and any additional climate-related risk analysis and targets approved for disclosure.

On behalf of BERS, BAM will:

- Conduct and report annual carbon footprint analyses of our public equity and corporate bond portfolios measuring Scopes 1, 2 and 3 financed emissions (emissions/$million invested) with Enterprise Value Including Cash (“EVIC,” discussed below on p. 19. We will also measure, evaluate and report changes in absolute emissions and weighted average carbon intensity.

- Annually measure, assess and report progress in Scope 3 emissions of our public equity and corporate bond portfolios beginning with 2022 data, with a focus on high-emitting sectors and sectors and companies where Scope 3 emissions are material. We will set interim Scope 3 emissions targets by 2025 as data quality and availability improve.

- Over the next year, evaluate the Scopes 1 and 2 emissions and science-based decarbonization pathways of specific sectors of the portfolio and set prudent interim emissions reductions targets for the most material sectors in the portfolio, taking into account the Paris Aligned Investment Initiative’s Net Zero Investment Framework and supplementary guidance (“NZIF”, discussed below on p. 12).

- Measure, assess and report Scope 3 emissions separately for high-emitting sectors including, at a minimum, energy, utilities, materials, industrials and finance.

Engage for Alignment and Action

Portfolio Companies in Public Markets: Science-Based Targets by 2030

- Corporate engagement is a central element of the Plan. This engagement will include emphasizing Scope 3 emissions reductions in sectors for which Scope 3 emissions are material.

- BERS will seek to support real economy emissions reductions by increasing the alignment of our investments with science-based pathways to limit global warming to 1.5⁰ C. Accordingly, it is the goal of the Board that by 2025 companies representing 70% of Scopes 1 and 2 financed emissions in our public equity and corporate bond portfolios, and by 2030 companies representing 90% of Scopes 1, 2 and 3 financed emissions in those portfolios will have adopted science-based targets. Such targets should be approved by the Science-Based Targets Initiative (“SBTi”, discussed below on p. 22) or otherwise independently verified with globally established science-based standards.

- To focus resources efficiently toward engagement, BERS will focus on portfolio companies in the highest emitting sectors in developed markets as well as the largest emerging markets portfolio companies in those sectors by market capitalization.

- For 2023, BERS’ shareholder engagement work will focus on banks that have adopted net zero targets, but which continue to finance or underwrite new fossil fuel supply projects, in defiance of the admonition of the International Energy Agency of the need to cease such funding to limit global temperature rise to 1.5⁰ C.

- BERS directs BAM to continue exploring data, tools, and methodologies for further assessing the net zero alignment of portfolio companies based on whether their plans and capital expenditures are aligned to achieving 1.5⁰ C.

- BERS directs BAM to monitor the recently launched Task Force on Nature-related Financial Disclosures (TNFD) and its developing framework and make recommendations on incorporating its framework in our net zero implementation.

Public and Private Asset Managers: Net Zero Plans by 2025

- BERS expects all our public and private markets asset managers to have a net zero goal or science-based targets and implementation plan covering, at a minimum, assets managed for the System, by June 30, 2025. BERS expects all managers to cover Scopes 1 and 2 emissions and material Scope 3 emissions of underlying investments in their targets and plans.

Just Transition

- BERS will integrate assessments of how our investments support a just transition to a low-carbon and net zero economy, including stakeholder engagement with local communities, workers and their union representatives, and environmental advocates, to mitigate systemic risk, adhere to human rights standards and support sustainable value creation consistent with the Board’s fiduciary duties.

Invest in Climate Change Solutions

- BERS has a goal of achieving a total of $1.8 billion in climate change solutions investments by 2035, with an interim goal of $400 million by 2025, consistent with the Board’s fiduciary duties and investment objectives. As of June 30, 2022, BERS has a total of $200.9 million in invested and unfunded commitments in climate change solutions across all asset classes.

Divest to De-Risk

- We completed divesting $113.18 million from fossil fuel reserve owners in publicly listed equity and corporate bonds in 2022.

- Consistent with the Board’s January 2021 Fossil Fuel Reserve Owner Divestment resolution, BAM shall ask all private markets managers recommended for Board approval to commit across the recommended fund to exclude investments in exploration, extraction or production of oil, gas or thermal coal or otherwise provide BERS with the ability to opt out of such investments. If a manager does not agree to either condition, BAM will report the manager’s position to the Board, which shall determine whether to approve the investment, consistent with its fiduciary duties.

- BERS prefers engagement to divestment, and BAM will make every effort to collaborate with as many portfolio companies and managers as possible. Should some companies or managers nonetheless consistently refuse to take meaningful action to reduce their GHG emissions, BAM will by 2025 recommend to BERS criteria to consider for possible divestment decisions consistent with fiduciary duty.

We recognize that our goal of achieving net zero by 2040 is ambitious, and that most economic actors, to the extent they are setting net zero goals, are targeting 2050 as their target date. We do this because we believe that bolder action is required to address the risks we face. To be clear, we seek real world decarbonization, not just portfolio decarbonization, and we will not rely on the sleight of hand of poor-quality carbon offsets to appear to lower our carbon footprint.

To achieve this ambitious goal, we will need to collaborate with like-minded investors, governments, non-governmental organizations and companies such as Climate Action 100+, Ceres, and other signatories of the Paris Aligned Investment Initiative Asset Owner’s Commitment and Net Zero Asset Owner Alliance. Toward that end, BERS joined the Net Zero Asset Owner Commitment of the Paris Aligned Investment Initiative (PAII) to work collaboratively with other asset owners on this goal. As we prepared this Plan, we reviewed the United Nations’ High Level Expert Group on the Net-Zero Commitments of Non-State Actors, which we believe outlines key considerations to avoid “greenwashing” and to adopt genuinely meaningful net-zero plans. We are eager to work ambitiously with others to achieve shared goals.

Implementation Plan

Net Zero Goal Background

In October 2021 BERS voted to commit to achieve net zero greenhouse gas emissions (GHG) emissions by 2040 across our investment portfolio. This action was designed to mitigate the systemic risks of climate change to our investments and the real economy, while taking into account the best available scientific knowledge while acting consistently with BERS’ fiduciary duties. To fulfill this commitment, BERS directed BAM to develop an implementation plan for the net zero goal that prudently considers climate change risk and opportunity as well as material environmental, social and governance (ESG) factors in our investment portfolio, along with all additional risks and investment considerations, and annually report on the plan and its progress.[2]

To support our efforts to prudently achieve this goal, BERS adopted the Net Zero Asset Owner Commitment[3] of the Paris Aligned Investment Initiative (PAII), a formal partner of the United Nations Framework Convention on Climate Change’s (UNFCCC’s) Race to Zero campaign[4], allowing us to collaborate with and learn from other large asset owners and leading practitioners. As a PAII signatory, BERS shall consider the PAII Net Zero Investment Framework and supplementary guidance (“NZIF”)[5] in implementing our net zero goal. In addition, BAM will research whether to recommend that BERS consider joining the UN-convened Net Zero Asset Owners Alliance (“NZAOA”), which provides additional resources for asset owners that have set net zero targets, or other comparable coalitions.

This document establishes BERS’ Net Zero Implementation Plan, which will be subject to annual review and updated as needed over time.

Fiduciary Duties

BERS adopts this Plan in accordance with our fiduciary duty to act solely in the best interests of our members and beneficiaries. We seek to fulfill our fiduciary duties and this Plan by achieving a competitive, risk-adjusted, market-rate return, consistent with our asset allocation, while prudently mitigating downside risks to the System’s investments, including those affecting the sustainability of our investments’ long-term returns. As a large, diversified fund with broad exposure across the economy, we have a direct economic interest in the overall strength of the financial markets and broader economy in which the System invests. As a pension fund with long-term obligations to our beneficiaries extending for decades, we are obligated to pay attention to long-term risks and opportunities. We have a fiduciary duty, therefore, to protect against downside and systemic risks and foster stable financial markets and long-term economic growth essential to the performance of the System’s investments.

Systemic Risks of Climate Change

Climate change is generating increasingly devastating effects that risk undermining the stability and health of the global economy. We regard these climate change-related risks as systemic—that is, we cannot diversify them away—and severe, as they can lead to the failure of broad segments of the market and economy. The Intergovernmental Panel on Climate Change (IPCC) confirmed, based on the best available scientific knowledge, that limiting temperature rise to 1.5⁰ C is necessary to avoid the worst climate impacts and preserve livable conditions.[6] To achieve this goal, the world must reach net zero GHG emissions by 2050. Reaching net zero by 2040 substantially improves the probability of limiting warming to 1.5⁰ C and avoiding temporary overshoots of 1.5⁰ C that would have irreparably harmful impacts.[7] The System’s goal of net zero emissions by 2040 seeks to contribute to more concerted and ambitious action in the real economy and markets toward systemic change needed to protect the interests of our beneficiaries.

A low-carbon transition of the economy in line with science and 1.5⁰ C pathways requires greatly increasing financing of climate change solutions, significantly reducing fossil fuel investments and ceasing investments in new fossil fuel supply projects in accordance with established net zero scenarios, and engaging companies, managers, and policymakers to ensure net zero alignment.

Disclose Emissions and Risks

Reporting and Risk Management

On behalf of BERS, BAM shall conduct and report annual carbon footprint analyses of our public equity and corporate bond (including investment grade, high yield and convertible bonds) portfolios measuring Scopes 1, 2 and 3 financed emissions (emissions/$million invested) with Enterprise Value Including Cash (“EVIC” defined below). BAM will also measure, evaluate and report changes in absolute emissions and weighted average carbon intensity.

BAM is exploring appropriate and prudent analytical tools for evaluating climate risks to the portfolio more comprehensively including scenario analysis and ways of assessing 1.5⁰ C pathways, net zero alignment, transition risks and physical risks.

Portfolio Greenhouse Gas Emissions Reduction Targets

BERS seeks to prudently reduce GHG emissions in our portfolio, taking into account the best available scientific knowledge, including the findings of the Intergovernmental Panel on Climate Change (IPCC), and to contribute to the reduction of real economy emissions. The UNEP Gap Report states that global GHG emissions need to decrease by 7.6% annually between 2020 and 2030 to maintain temperature increase to 1.5⁰C.[8] The Net Zero Asset Owners Alliance (NZAOA) Target Setting Protocol, which the PAII Framework endorses, recommends emissions reductions of 22% to 32% from 2020 to 2025 and 49% to 65% from 2020 to 2030 based on IPCC findings.[9]

Definitions of GHG Emissions and their Categories (Scopes 1, 2 and 3)

Scopes 1, 2 and 3 are ways of categorizing the different sources of GHG emissions from a company’s direct operations and its wider value chain.

| Scope 1 | Scope 2 | Scope 3 |

|---|---|---|

| Covers the direct emissions from sources owned or controlled by a company – for example, by running its boilers and vehicles. | Covers indirect emissions from the generation of energy a company purchases. | Covers all other indirect emissions up and down a company’s supply and value chain. For example, a petroleum company’s Scope 3 emissions include the emissions from the gasoline they produce when it is burned by a customer’s car. A bank’s Scope 3 emissions include those from extracting fossil fuels from projects they finance. It is estimated that Scope 3 emissions constitute 75% of firms’ emissions on Average.[10] |

Illustration of Scopes 1, 2 and 3 emissions

Source: Greenhouse Gas Protocol Corporate Value Chain (Scope 3) Accounting and Reporting Standard (2011)

Public Equity and Corporate Bonds Interim Scopes 1 and 2 Emissions Reduction Targets

BERS commits to targets of reducing Scopes 1 and 2 GHG emissions in our public equity and corporate bond (including investment grade, high yield and convertible bond) portfolios by 22% by 2025, 49% by 2030, and 100% by 2040 using a baseline of December 31, 2019. Our primary metric is financed emissions with EVIC, and we will strive for comparable progress among all metrics.

Over the next year, on behalf of BERS, BAM will evaluate the Scopes 1 and 2 emissions and science-based decarbonization pathways of specific sectors of the portfolio and set prudent interim emissions reductions targets for the most material sectors in the portfolio, taking into account the NZIF.

Public equity and corporate bonds make up 59.12% of our total assets as of June 30, 2022. Our adopted targets are aligned with NZAOA’s recommendations and lay a pragmatic path to achieve the System’s 2040 net zero goal. BERS’ financed emissions decreased by 16.33% during the 2.5 years between December 31, 2019, and June 30, 2022, yielding an average annual reduction of 6.53%. With the interim target of 22% for 2025, the annualized emissions reduction rate could drop to 2.27% between 2022 and 2025, and then would need to increase to 5.4% for the next 5 years to achieve 49% reduction by 2030.

BERS will seek to reduce our portfolio Scopes 1 and 2 emissions in the amounts of the target percentages relative to the Scopes 1 and 2 emissions of the System’s portfolio as of December 31, 2019. This date is recommended by NZIF as the baseline and is consistent with the Paris Agreement’s Nationally Determined Contributions (NDC) process and timeline. NZIF also recommends setting five-year interim targets consistent with the NDC process.[11]

Scope 3 emissions are addressed in the next section of this Plan.

Figure 1: BERS – Realized and projected emissions reduction targets

Figure 1: BERS – Realized and projected emissions reduction targets

| For our interim emissions reduction targets, BERS will use financed emissions (tons of emissions/$million invested) based on Enterprise Value Including Cash (EVIC) as our primary metric for emissions. We will also report, measure and evaluate changes in absolute emissions and weighted average carbon intensity and strive toward comparable progress among all metrics.

A financed emissions metric allows better comparison across asset classes, portfolios and companies as it normalizes emissions by value invested. Because financed emissions metrics can be artificially increased or decreased by market movements such as equity and bond volatility, inflation, exchange rates and interest rates without changes in real economy emissions, BAM will evaluate methodologies to adjust financed emissions metrics for factors such as these to obtain a better understanding of real economy emissions changes.[12] In addition, BAM will provide the Trustees with attribution analysis, on a disaggregated basis, of various sources of financed emissions changes[13]. EVIC is a PAII-recommended metric consistent with the Partnership for Carbon Accounting Financials (“PCAF”) standard and the recent Task Force for Climate-Related Financial Disclosures (“TCFD”) recommendations. EVIC is defined as “the sum of the market capitalization of ordinary shares at fiscal year-end, the market capitalization of preferred shares at fiscal year-end, and the book values of total debt and minorities’ interests. No deductions of cash or cash equivalents are made to avoid the possibility of negative enterprise values.”[14] EVIC allows for greater accuracy and comparability of emissions across equity and fixed income. |

The interim targets for 2025 and 2030 are informed by a combination of PAII-recommended ranges, science-based net zero emission pathways, and actual emissions trajectories of the System’s investments. As cited above, the NZAOA protocol, which NZIF endorses, finds that absolute emissions reductions for 2020 to 2025 should range between -22% to -32% and for 2020 to 2030 between -49% to -65% or more. Furthermore, IPCC scenarios for 1.5⁰ Celsius pathways demonstrate a rapid acceleration of emissions reductions earlier followed by a gradually reduced rate of emissions reduction. This pacing reflects the decarbonization needed earlier in order to avoid temporary overshoots of 1.5⁰.[15]

The following table shows BERS’ financed emissions covering Scopes 1 and 2 emissions for public equity and corporate bonds, including investment grade credit and high yield bonds, for December 31, 2019, and June 30, 2022, compared to the blended market benchmark.

Public Equity & Corporate Bond Scopes 1 and 2 Financed Emissions (tons CO2e / $M invested based on EVIC)

| NYCERS – Financed Emissions/$m (Scope 1, 2) |

Blended Benchmark* – NYCERS – Financed Emissions/$m (Scope 1,2) |

Portfolio- Benchmark ratio | |

|---|---|---|---|

| 31-Dec-19 | 83.43 | 81.01 | 1.03 |

| 30-Jun-22 | 69.81 | 61.50 | 1.14 |

| Emissions Change % | -16.33 | -24.08 |

Source: MSCI

*ACWI IMI 80%, MSCI USD IG Corporate Bond 14%, MSCI USD HY Corporate Bond Index 6%

For more details on BERS’s carbon footprint analysis, please see Appendix A.

Scope 3 Emissions

On behalf of BERS, BAM will annually measure, assess and report progress in Scope 3 emissions beginning with 2022 data, with a focus on high emitting sectors and sectors and companies where Scope 3 is material. BERS will set interim Scope 3 emissions reduction targets by 2025 as data availability and quality improve.

While measuring Scope 3 emissions presents greater challenges than Scopes 1 and 2, it is essential to track and assess this data due to the vast impact of Scope 3 emissions on real world emissions. Our Scope 3 footprint as of June 30, 2022, is as follows:

Public Equity & Corporate Bond Scope 3 Financed Emissions Tons CO2e / $M invested based on EVIC)

| BERS – Financed Emissions/$m (Scope 3) |

Blended Benchmark -BERS – Financed Emissions/$m (Scope 3) |

Portfolio-Benchmark ratio | |

|---|---|---|---|

| 30-Jun-22 | 292.94 | 383.90 | 0.76 |

BERS will also measure, report and assess Scope 3 emissions separately for high-emitting sectors including, at a minimum, energy, utilities, materials, industrials and finance.

While we do not have Scope 3 emissions data for our portfolio before 2022, we note that in 2022 our portfolio Scope 3 financed emissions are 24% lower than the blended benchmark, whereas our portfolio Scopes 1 and 2 emissions are 14% higher than the blended benchmark. While we continue to analyze possible reasons for this discrepancy, it is reasonable to assume that the divestment of the securities of fossil fuel reserve owners during 2021 and the first half of 2022 may have had a larger impact on our portfolio Scope 3 emissions than on Scopes 1 and 2, since these companies tend to have much larger Scope 3 emissions than Scopes 1 and 2. For example, in 2021 BP had Scopes 1 and 2 emissions of 35.6 MtCO2e (millions of tons of carbon dioxide emissions), while its estimated Scope 3 emissions were 304 MtCO2e, or more than eight times as high.[16]

Scope 3 emissions are estimated to constitute 75% of companies’ emissions on average.[17] For the financial services sector, Scope 3 emissions comprise an average of 99.98% of a company’s total emissions. In addition, the disclosure and quality of Scope 3 emissions data will improve and grow in importance over time, with the number of companies reporting Scope 3 emissions consistently growing each year.[18] The European Sustainable Finance Disclosure Regulation (SFDR) begins to require Scope 3 reporting in 2023. The International Sustainability Standards Board (ISSB) of the International Financing Reporting Standards Foundation (IFRS) voted to require company disclosures to include Scope 1, 2 and 3 emissions. The ISSB is a global body formed to create a unified set of sustainability disclosure standards and plans to issue these standards in early 2023.[19] The Science-Based Targets Initiative (SBTi)[20] requires companies to set Scope 3 targets if they comprise more than 40% of total Scope 1, 2 and 3 emissions, and we adopt that definition of materiality for Scope 3 emissions.

BERS will set interim emissions reduction targets for every five years from 2030 on and may update and revise our Scope 1, 2 and 3 targets as conditions evolve and data, methodologies and analytical tools improve. We will also seek to disaggregate measurements and set separate targets for material non-CO2 GHG emissions, such as methane, as that data becomes available.

Private Markets Interim Emissions Reduction Targets

BERS commits to develop and adopt interim GHG emissions reduction targets in private markets and directs BAM to present recommendations as private market emissions data improves.

BERS intends to adopt prudent interim emissions reduction targets in our private markets asset classes, including Private Equity, Real Estate, Infrastructure and Alternative Credit. BERS shall collaborate with other asset owners and asset managers to identify prudent and consistent approaches to measuring emissions in private markets asset classes and developing interim emissions reduction targets. BAM is conducting a review of ESG and climate data sources and methodologies, including the ESG Data Convergence Project (Private Equity) and GRESB (Real Assets), and will present recommendations to BERS on data sources and approaches as appropriate.

Operational Emissions

| BERS shall set targets and a plan for reducing the System’s operational emissions to net zero by 2040.The targets and plan shall include BAM facilities in the Comptroller’s Office. |

BERS seeks to meet net zero targets from our own operations by 2040. As tenants, BERS will engage with the owners and managers of our spaces to reduce emissions from those spaces. In 2023, BERS will complete a baseline assessment of annual energy use at BERS headquarters at 335 Adams Street and any other occupied spaces, including a breakdown of the percentage of energy used that is grid-purchased and that which is generated on-site through fossil fuel infrastructure. BERS will also confirm that 55 Water Street is in compliance with Local Law 97 in advance of the 2024 enforcement period. In subsequent years, BERS will create a plan to reduce energy use from fossil fuels in line with net zero emissions by 2040 alongside our building owners and managers. This plan will include interim targets. BAM will follow a similar path for its occupied space at 1 Centre Street. In 2023, BERS will also assess whether employee travel is a significant source of emissions and if so, create plans to offset those emissions.

Disclosure and Reporting

| BERS shall annually publish a report, consistent with guidance of the Task Force on Climate-Related Financial Disclosures (TCFD), disclosing the most up-to-date versions of the following:

1. Climate change solutions investment goals and amounts and progress in climate change solutions investments across the portfolio 2. Carbon footprint analysis using financed emissions / $ million invested, absolute financed emissions, and weighted average carbon intensity (WACI) for Scope 1, 2 and 3 emissions of public equity, investment grade corporate bonds, high yield corporate bonds and additional asset classes as available and determined by BERS with improvement of data quality and availability 3. Progress toward interim emissions reduction targets 4. Progress toward portfolio company science-based target and alignment goals 5. Progress toward asset manager net zero, science-based target and alignment goals 6. Any additional climate-related risk analysis and targets that BERS has reviewed and approved for disclosure 7. Any updates or amendments to the BERS Net Zero Implementation Plan |

Engage For Alignment and Action

Portfolio Companies: Science-Based Targets

It is the goal of the Board that by 2025 companies representing 70% of Scopes 1 and 2 financed emissions in our public equity and corporate bond portfolios, and by 2030 companies representing 90% of Scopes 1, 2 and 3 financed emissions in those portfolios will have adopted science-based targets, to be approved by SBTi or otherwise independently verified with globally established science-based standards.

Corporate engagement is central to our ability to achieve the goal of net zero by 2040. BERS will seek to achieve our emissions reduction targets by supporting real economy emissions reductions and increasing the alignment of our investments with science-based pathways to limit global warming to 1.5⁰ C.

Science-based targets are interim targets for emissions reduction that are in line with what the latest climate science deems necessary to meet the goals of the Paris Agreement – limiting global warming to 1.5⁰ C above pre-industrial levels. According to MSCI data, as of June 30, 2022, approximately 16% of BERS’ Scopes 1 and 2 financed emissions in BERS’ publicly traded equity and corporate bonds portfolio were attributed to companies with SBTi-approved targets, while 84% were not. NZIF recommends using SBTi for assessing companies against certain criteria that may identify companies as net zero aligned or aligning to net zero (this is further explained in Appendix B).

To focus resources efficiently toward engagement, BERS will focus on portfolio companies in the highest emitting sectors in developed markets as well as the largest emerging markets portfolio companies in those sectors by market capitalization.

For 2023, BERS’ shareholder engagement work will focus on banks which have adopted net zero targets but continue to finance or underwrite new fossil fuel supply projects, in defiance of the admonition of the International Energy Agency of the need to cease such funding to limit global temperature rise to 1.5⁰ C.

To focus resources efficiently toward engagement, BERS directs BAM to prioritize identifying and engaging high-emitting corporate portfolio companies in the Russell 1000 and the ACWI World-ex USA IMI, and the largest portfolio companies by market capitalization in the MSCI Emerging Markets indices in the highest emitting sectors. These sectors shall include, at a minimum, energy, utilities, industrials and materials, as the highest emitting sectors of portfolio Scopes 1 and 2 emissions and the financial sector, as a high source of Scope 3 emissions. This does not preclude BAM from engaging with companies outside of this universe but conveys the belief of the Board that focusing on companies in the highest emitting sectors where the System has the most potential influence will generate the greatest impact on reducing real world emissions.

These prudent efforts to enhance shareholder value, particularly in coalition with other asset owners such as our participation in Climate Action 100+, will be based on our proxy voting principles. Climate Action 100+ is an ambitious global investor collaboration through which more than 700 global investors with at least $68 trillion in assets across 33 markets encourage the world’s 166 highest emitting companies — responsible for an estimated 80 percent of global emissions — to take necessary action on climate change.

Every year we will strategize and collaborate with other investors, and report on our engagement results in our annual reports (the annual shareholder initiatives post-season report and the annual disclosure report we are committing to in this Plan). For 2023 we will focus on the following:

- We have collaborated with like-minded investors to craft a 2023 proxy season shareholder strategy at banks which have adopted net zero targets but continue to finance or underwrite new fossil fuel supply projects, in defiance of the admonition of the International Energy Agency of the need to cease such funding to achieve net zero by 2050 or sooner. This strategy includes filing shareholder resolutions at certain banks calling for the adoption of absolute (as opposed to intensity) 2030 GHG emissions reductions targets.

- We are currently leading shareholder engagement for Climate Action 100+ on Ford, GM and GE, and co-leading engagement at commercial truck manufacturer PACCAR. At Ford and GM—both of which have set science-based targets for Scopes 1, 2, & 3 emissions approved by SBTi and committed to invest more than $35 billion to produce electric vehicles—ongoing engagement will focus on advocating for the automakers to reduce emissions from internal combustion engine vehicles (in the period until all of their vehicles are electric) and to support strong fuel efficiency and medium duty vehicle emissions standards in upcoming federal rulemakings.

- In addition, we have active, ongoing, and substantive engagements on climate with three of the highest GHG emitting companies in the U.S., Duke Energy (#2), Southern Company (#3) and Dominion Energy (#14)[21], as well as Toyota.

- We are joining with other investors to urge the managed phaseout of high-emitting assets, which will require portfolio companies to move away more rapidly from processes involving the extraction and burning of fossil fuels than short-term competition from cleaner processes or renewables might prompt but that will lead to more sustainable long-term profitability.

BERS directs BAM to continue exploring data, tools, and methodologies for further assessing the net zero alignment of portfolio companies based on whether their plans and capital expenditures are aligned to achieving 1.5⁰ C.

BERS directs BAM to continue exploring data, tools, and methodologies for further assessing the net zero alignment of portfolio companies based on how well aligned their plans and capital expenditures are to achieving their science-based targets. The following are examples of frameworks to inform assessment of net zero alignment (please see Appendix B for details of each framework):

- PAII’s Net Zero Investment Framework (NZIF) recommends criteria for classifying companies as (1) achieving net zero (2) aligned to a net zero pathway (3) aligning towards a net zero pathway (4) committed to aligning or (5) not aligned.

- Climate Action 100+ has a Net Zero Company Benchmark that assesses the disclosure and alignment of a company’s actions with the Paris Agreement’s goals. This benchmark considers ten disclosure criteria and separate independently assessed alignment criteria including the company’s capital allocation, climate policy engagement and climate accounting and audit.

- The Transition Pathway Initiative is a global initiative led by asset owners and supported by asset managers that measures the management quality and carbon performance of companies and whether they are aligned with the goals of the Paris Agreement.

BERS directs BAM to monitor the recently launched Task Force on Nature-related Financial Disclosures (TNFD) and its developing framework and make recommendations on incorporating its framework in our net zero implementation plan.

BERS will also assess the role of nature in climate change, both as a vital carbon sink and as a subject of the impact of climate change. Deforestation, loss of biodiversity and ecosystem destruction are all causes and effects of global warming.

Asset Managers: Net Zero Plans by 2025

BERS cannot achieve our net zero goals unless our investment managers, in both public and private markets, actively collaborate in this effort. We shall ensure prudent consideration of climate change risk and opportunity and net zero alignment in the evaluation, due diligence, selection, monitoring and engagement of asset managers in all asset classes, consistent with our fiduciary duties.

BERS expects all our public and private markets asset managers to have a net zero goal or science-based targets and implementation plan covering, at a minimum, assets managed for the System, by June 30, 2025. BERS expects all managers to cover Scopes 1 and 2 emissions and material Scope 3 emissions of underlying investments in their targets and plans.

To help achieve this objective, BAM asks all asset managers during investment due diligence and monitoring whether they (1) measure and report GHG emissions associated with their investments and (2) have climate commitments or targets, including net zero goals and science-based targets, and to provide details on these efforts and targets. BAM presents this information to the Board in every investment memorandum.

BERS expects all managers to cover Scopes 1 and 2 emissions and material Scope 3 emissions of their underlying investments in their targets and plans. Should data be insufficient for Scope 3 emissions, managers are expected to have a plan for measuring Scope 3 emissions and setting material Scope 3 targets as soon as possible. BAM shall provide the Board with an interim report in 2023 on the number of managers across asset classes that have adopted net zero goals or science-based targets and an in-depth progress report in 2024 of all managers’ status, including details of net zero implementation plans and progress toward their targets.

- For private markets managers who invest without control over portfolio companies (e.g., certain strategies in Opportunistic Fixed Income, Private Equity growth, and Real Estate debt), BAM will consult with a representative sample of our existing managers to draft a proposal for Board consideration on how such managers may address GHG emissions in their portfolios.

- Private markets general partners that determine not to set long-term net zero goals based on the timeline of such goals exceeding their funds’ holding periods are expected to commit in the near term to have all of their controlled portfolio companies adopt science-based targets during their holding period. This approach would align with maintaining temperature increase to 1.5° C to appropriately mitigate climate risks.

BERS also directs BAM to recommend to the Board in 2025 potential actions for managers that have not adopted a net zero goal, science-based targets or accompanying implementation plan, or an acceptable alternative approach appropriate for their investment approach, consistent with our fiduciary duties.

Approximately 79% of the 99 managers for BERS that responded to the BAM annual manager questionnaire in 2022 reported that they already measure emissions and/or have adopted climate targets or plan to measure emissions or adopt targets within the next 12 to 18 months constituting the vast majority of BERS’ primary manager relationships.

BAM shall also review the proxy voting record of public markets asset managers related to climate change, including shareholder proposals and director elections; and strengthen processes for monitoring and reporting related to these issues.

Consistent with our fiduciary duties, BERS will continue to seek opportunities to engage with policy-making and regulatory entities to advance legislation, policy, regulations and programs that support achieving net zero emissions in the real economy, and appropriately engage market actors to promote alignment with net zero pathways.

Deliver a Just Transition

BERS will integrate assessments of how our investments support a just transition to a low-carbon and net zero economy, including stakeholder engagement with local communities, workers and their union representatives, and environmental advocates, to mitigate systemic risk, adhere to human rights standards and support sustainable value creation consistent with our fiduciary duties.

The principles of a just transition to a low-carbon and net zero economy to mitigate systemic risk, adhere to human rights standards and support sustainable value creation are embedded in the Boards’ approach to investments as well as global and national policies.

BERS currently incorporates these principles in our investment process in numerous ways such as in our Responsible Contractor Policy, integration of wage and labor issues and diversity, equity and inclusion in manager diligence and monitoring and proxy voting guidelines and engagement to support human capital. Our responsible contractor policy expresses our belief that a diverse, adequately compensated, and trained workforce delivers a higher quality product and service. We support paying workers fair wages and benefits, workforce training and safety and health, and a position of neutrality with regard to union organizing. In addition, the 2015 Paris Agreement states the need to account for “the imperatives of a just transition of the workforce and the creation of decent work and quality jobs in accordance with nationally defined development priorities.”[22]The United Nations’ Intergovernmental Panel on Climate Change (IPCC), an intergovernmental body delegated to assess climate science, addresses the importance of a just transition in mitigating climate change.[23] President Biden by Executive Order 14057 has required the federal government to incorporate just transition goals to advance environmental justice, expand jobs and ensure the flow of benefits from climate mitigation to historically disadvantaged communities.[24]

BERS will integrate assessments of how our investments support a just transition to a low-carbon and net zero economy to mitigate systemic risk, adhere to human rights standards and support sustainable value creation consistent with our fiduciary duties. BERS directs BAM to develop and apply prudent frameworks for such assessment in the diligence and monitoring of investment managers, shareholder engagement and other appropriate aspects of the investment process. For the purpose of developing such frameworks, BAM shall continue to assess data, methodologies, and standards for evaluating how our investments support a just transition, including but not limited to ensuring genuine stakeholder engagement with local communities, workers and their union representatives, and environmental advocates; providing tangible economic benefits to the communities in which companies operate; and hiring local workers, with a priority if applicable to displaced workers from fossil fuel-related industries.

BERS directs BAM to recommend an initial approach to supporting a just transition in the investment process, consistent with our fiduciary duties, by the fourth quarter of 2023.

Frameworks and standards for assessing investors’ and companies’ contributions to a just transition are growing. Climate Action 100+ will launch Just Transition criteria as part of its Net Zero Company Benchmark in 2023.[25] The International Energy Agency convened, in January 2021, the Global Commission on People-Centred Clean Energy Transitions to develop recommendations for how energy policy and planning can address the social and economic impacts of the energy transition, including affordability, equity and inclusion.[26] The World Benchmarking Alliance, a multidisciplinary organization with many investor and corporate members, intends to publish free and publicly available assessments of 450 companies by 2023 on their work towards a just transition.[27] The Council for Inclusive Capitalism, a global group of leaders from business, foundations and nonprofits with over $10 trillion in assets under management collectively, released The Just Energy Transition: A Framework for Company Action in November 2021 to guide companies on how to address social equity in their transition[28]. In addition, various industry frameworks are available to address business and human rights and other issues related to a just transition.

Invest In Climate Change Solutions

Climate Change Solutions Investments

BERS has a goal of investing a total of $1.8 billion in climate change solutions by 2035, with an interim goal of $400 million by 2025, consistent with our fiduciary duties and our investment objectives. As of June 30, 2022, BERS has a total of $200.9 million in invested and unfunded commitments in climate change solutions across all asset classes.

Climate change not only presents risks that must be mitigated. It also presents opportunities to achieve superior risk-adjusted returns through financing and facilitating the energy transition.

BERS shall develop and periodically assess and update climate change solutions investment goals in consultation with our investment advisors, taking into account the System’s asset allocation, pipeline and opportunity sets for each asset class, including public and private markets. Climate change solutions are investments in economic activities that contribute substantially to mitigating, remediation, adaptation and/or resilience in relation to climate change impacts.

Such activities include but are not limited to renewable energy, energy efficiency, sustainable water, and pollution prevention. BERS directs BAM to periodically review the definitions for climate change solutions investments by asset class to ensure that they accurately reflect investments that are contributing to achieving the goals of the Paris Climate Agreement to keep global warming below 1.5° C. See Appendix C for our current definitions of climate change solutions investments.

As of June 30, 2022, BERS has a total of $200.9 million of invested and unfunded commitments in climate change solutions. BAM will report semi-annually to BERS on the status of climate change solutions investments in our portfolio. A full report of our climate change solutions investments by asset class as of June 30, 2022, appears in Appendix C.

Here are some examples of climate change solutions investments in the BERS portfolio:

Climate change solutions investments in the infrastructure asset class exist within blended and diversified funds.

| The Holtwood Portfolio |

|---|

| a Brookfield Infrastructure Fund III investment in a set of hydroelectric assets in Pennsylvania, including a 252-megawatt facility on the Susquehanna River and a 40-megawatt facility on Lake Wallenpaupack. The total BERS investment in the Holtwood portfolio is $442,136. |

| Isagen, the owner and operator of renewable energy generation infrastructure in Colombia |

|---|

| also a portfolio company of Brookfield Infrastructure Fund III which owns and operates six hydroelectric plants in Colombia generating over 14,500 gigawatt hours of clean power, the equivalent of power for eight million homes and 20% of the Colombia’s annual electricity production. Since Brookfield’s acquisition, Isagen has expanded to develop and own solar and wind assets. The BERS investment in Isagen totals $788,011. |

| Nitrogen Renewables |

|---|

| a KKR Global Infrastructure Investors III company which owns and manages utility-scale clean energy projects in the United States. As of 2021, the company consisted of ten large wind and solar generation projects comprised of over 1,190 megawatts. The BERS investment in Nitrogen Renewables is $510,982. |

Climate change solutions assets in private equity are companies that generate renewable energy, provide environmental services, or manufacture and distribute products that address a climate- related challenge. Examples include:

| GFL Environmental |

|---|

| a portfolio company of BC European Capital X, L.P. that provides waste management services to businesses, communities, and households in North America. The company offers services in solid and liquid waste management and environmental cleanup (e.g., soil remediation). The total BERS investment in GFL Environmental is $2,796,990. |

| Redwood Materials, Inc. |

|---|

| Creates a closed-loop supply chain for lithium-ion batteries in the United States by recycling used lithium-ion batteries into components of future batteries. Located in Nevada, Redwood Materials is a portfolio company of Valor Equity Partners V L.P. BERS has a total investment of $51,471. |

| BERS directs our investment advisors to assess whether and how our strategic asset allocation may be constructed to prudently increase allocations to climate change solutions investments across multiple asset classes consistent with our fiduciary duties and our investment objectives. |

Divest To De-Risk

Public Markets

In 2015, BERS began excluding from our portfolio publicly-traded companies which derive at least 50% of their revenue from thermal coal production, mining and/or processing. In 2018, we voted to divest from fossil fuel owners in publicly traded equity and fixed income securities within five years; we completed that divestment of $130.56 million in 2022. We will explore further potential prudent actions in the thermal coal value chain, including coal infrastructure and coal-powered electricity generation, as part of our engagement strategy, to manage the phaseout of high-risk fossil fuel assets and expedite the transition to a clean energy economy. Such actions may include consideration of additional exclusions of the coal value chain to address the high financial and climate risk of thermal coal but would be subject to investment analysis to ensure compliance with our fiduciary duties and an assessment of Just Transition plans for workers.

Private Markets

Consistent with the Board’s January 2021 Fossil Fuel Reserve Owner Divestment resolution, BAM shall ask all private markets managers recommended for Board approval to commit across the recommended fund to exclude investments in exploration, extraction or production of oil, gas or thermal coal, or to otherwise provide BERS with the ability to opt out of such investments. If a manager does not agree to either condition, BAM will communicate the manager’s position to the Board, which shall determine whether to approve the investment, consistent with our fiduciary duties.

Exclusions

If investment managers or publicly traded companies fail to comply with the parameters to mitigate climate risk and align with science-based pathways to limit global warming to 1.5⁰ C as laid out in this Plan, we will consider excluding them from our portfolio going forward consistent with fiduciary standards.

As our Divestment and Exclusion Policy recognizes, BERS prefers engagement to divestment. This is particularly true where the subject is climate change. Robust and long-term engagement is essential to overcoming the many obstacles—financial, logistical, technological, social, and political—to reaching a net-zero future. There must be space in this conversation for good-faith disagreement about what measures are appropriate and when for the diverse sectors of the global economy.

This Plan lays out the engagement strategies that BAM will pursue on behalf of BERS. BERS directs BAM, as it pursues these strategies, to identify companies and managers that decline to take the steps requested of them, along with the explanations, if any, they provide for their decisions. BAM will report this information annually to BERS.

By 2025, BAM, with the benefit of this information, will recommend to BERS criteria that it will employ to identify companies or managers for possible divestment due to their demonstrated and implacable opposition to taking substantive steps to reduce their GHG emissions consistent with the goal of maintaining global warming to 1.5˚ C. These criteria will not be exclusive or determinative of any final decision by BERS to divest.

Any subsequent effort by BERS to pursue a divestment from a company or manager identified by BAM on the basis of these criteria will be undertaken consistent with the Divestment and Exclusion policy to ensure that the proposed divestment is prudent in all respects and consistent with fiduciary duty.

Conclusion

BERS recognizes the enormity of the challenges that climate change poses:

- to the participants and beneficiaries of the System,

- to the global economy and therefore to our investments, which depend on the health of that economy to deliver the returns that fund the benefits the System will pay out, and

- to the City of New York and its residents who are bearing the fiscal and physical risks that climate change is creating, which will only increase if we are unable to mitigate and reverse its effects.

With this Net Zero Implementation Plan, BERS strives to take a multi-faceted approach to address the investment risks and opportunities of climate change, consistent with our fiduciary duties. With our investment partners, we will carry it out to the best of our abilities, and we pledge to be transparent and accountable to our members and the public at large on our accomplishments and any shortcomings as we move forward. It is our hope that other investors will be aligned with the key elements of this plan, collaborate with us to magnify its impact, and use it as a jumping off point to go even further to address climate change and inspire us and others to redouble our own efforts and effectiveness.

Appendix A

Carbon Footprint Analysis

| BERS – Financed Emissions/$m (Scope 1, 2) |

Blended Benchmark – BERS – Financed Emissions/$m (Scope 1,2) |

Portfolio- Benchmark ratio | |

|---|---|---|---|

| 31-Dec-19 | 83.43 | 81.01 | 1.03 |

| 30-Jun-22 | 69.81 | 61.50 | 1.14 |

| Emissions Change % (2019-2022) |

-16.33 | -24.08 |

| BERS – Total Emissions (Scope1,2) |

Blended Benchmark – BERS – Total Emissions (Scope 1,2) |

|

|---|---|---|

| 31-Dec-19 | 351,857.00 | 339,056.54 |

| 30-Jun-22 | 323,849.00 | 274,940.00 |

| BERS – Financed Emissions/$m (Scope 3) |

Blended Benchmark – BERS – Financed Emissions/$m (Scope 3) |

Portfolio- Benchmark ratio | |

|---|---|---|---|

| 30-Jun-22 | 292.94 | 383.90 | 0.76 |

| BERS – Total Emissions (Scope 3) |

Blended Benchmark – BERS – Total Emissions (Scope 3) |

|

|---|---|---|

| 30-Jun-22 | 1,363,932.00 | 1,716,811.00 |

The following table shows the Weighted Average Carbon Intensity (WACI) for BERS for the years 2019 and 2022. WACI is the weighted average of financed emissions normalized by company sales

| BERS – WACI (Scope 1, 2) |

Blended Benchmark – BERS – WACI (Scope 1,2) |

|

|---|---|---|

| 31-Dec-19 | 218.18 | 187.03 |

| 30-Jun-22 | 187.85 | 179.70 |

| BERS – WACI (Scope 3) |

Blended Benchmark – BERS – WACI (Scope 3) |

|

|---|---|---|

| 30-Jun-22 | 705.61 | 817.80 |

Appendix B

PAII Net Zero Investment Framework (NZIF) for Assessing Net Zero Alignment in Public Equity and Corporate Fixed Income

For Public Equity and Corporate Fixed Income, the NZIF recommends assessing all companies in “material” sectors for net zero alignment. “Material” sectors are defined as those in NACE code categories A-H and J-L.

The NZIF provides ten criteria for assessing the net zero alignment of companies. Six of these criteria (Criteria 1-6) are core criteria to help determine whether a company has a credible, science-based net zero transition plan. Four criteria (Criteria 7-10) are complementary and contribute to a comprehensive assessment of company alignment.

The NZIF recommends “higher impact” companies to be assessed against the six core (Criteria 1-6) criteria. PAII defines “higher impact” companies as those companies on the Climate Action 100+ focus list, companies in high sectors consistent with Transition Pathway Initiative sectors14, plus banks and real estate. All other companies in material sectors are deemed “lower impact” by PAII. The PAII Framework recommends assessing “lower impact” companies using Criteria 2, 3 and 4.

The NZIF Net Zero Alignment Criteria for Public Equity and Corporate Fixed Income are:

- Ambition: Has the company adopted a goal of achieving net zero emissions by 2050 or sooner consistent with achieving global net zero emissions?

- Targets: Has the company adopted short- and medium-term emissions reduction targets for Scopes 1 and 2 emissions and material Scope 3 emissions?

- Emissions Performance: How does the company’s current emissions intensity performance (Scopes 1 and 2 and material Scope 3 emissions) compare relative to targets the company has?

- Disclosure: Does the company disclose its Scope 1 and 2 emissions and material Scope 3 emissions?

- Decarbonization Strategy: Does the company have a quantified plan setting out the measures that will be deployed to deliver GHG targets, proportions of revenues that are green and, where relevant, increases in green revenues?

- Capital Allocation Alignment: Does the company clearly demonstrate that its capital expenditures are consistent with achieving net zero by 2050 or earlier?

- Climate Policy Engagement: Does the company have a Paris-Agreement-aligned climate lobbying position and demonstrate alignment of its direct and indirect lobbying activities?

- Climate Governance: Does the company provide clear oversight of net zero transition planning and executive renumeration linked to delivering targets and transition?

- Just Transition: Does the company consider impacts from transitioning to a lower carbon business model on its workers and communities?

- Climate risk and accounts: Does the company provide disclosures on risks associated with the transition through TCFD Reporting and incorporate such risks into its financial accounts?

The NZIF recommends classifying companies as (1) achieving net zero (2) aligned to a net zero pathway (3) aligning towards a net zero pathway (4) committed to aligning or (5) not aligned and defines them as follows:

- Net Zero: a company which is already achieving the emissions intensity required by the sector and regional pathway for 2050 or earlier and whose ongoing investment plan or business model will maintain this performance.

- Aligned: companies in high impact sectors that are achieving all six core criteria; companies in other material sectors that are achieving Criteria 2, 3 and 4.

- Aligning: Companies achieving 2, 4 and some evidence (partial fulfillment) of Criteria 5.

- Committed to aligning: Companies that have met Criteria 1 – setting an ambition to achieve net zero.

NZIF recommends using SBTi for assessing companies against alignment criteria 2, 3 and 4 only. Fulfilling criteria 2, 3 and 4 would classify a non-high impact company in material sectors as net zero “aligned”. In addition, fulfilling criteria 2 and 4 and some evidence of 5 would classify all companies in material sectors as net zero “aligning”, including high impact companies.

SBTi-approved science-based targets are consistent with the NZIF criteria for net zero alignment for all material sectors with the exception of high impact sectors. The NZIF criteria for net zero alignment for material sectors include (1) a long-term 2050 goal consistent with achieving net zero; (2) short- and medium-term emissions reduction targets covering Scopes 1, 2 and material scope 3; (3) emissions performance across Scope 1, 2 and material Scope 3 consistent with the interim targets and (4) disclosure of Scope 1, 2 and material Scope 3 emissions.

For high impact sectors, the NZIF sets two additional criteria: (1) A quantified plan setting out the measures to deliver targets, proportions of revenues that are green and, where relevant, increases in green revenues; and (2) a clear demonstration that capital expenditures of the company are consistent with achieving net zero.

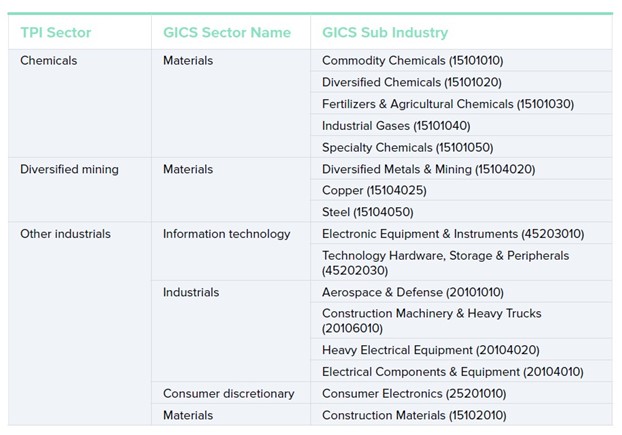

“High Impact Sectors” based on Transition Pathway Initiative (TPI) (additional “High Impact” companies as defined by NZIF are those on the Climate Action 100+ focus list and banks and real estate).

companies as defined by NZIF are those on the Climate Action 100+ focus list and banks and real estate)

Climate Action 100+ Net Zero Company Benchmark (Structure and Methodologies | Climate Action 100+)

The Net Zero Company Benchmark assesses companies’ transition to net zero emissions business models based on companies’ disclosure practices and alignment of their actions with net zero.

The disclosure criteria are: (1) net zero GHG emissions by 2050 (or sooner) ambition; (2) long-term (2036-2050) GHG reduction target(s); (3) medium-term (2026-2035) GHG reduction target(s); (4) short-term (up to 2025) GHG reduction target(s); (5) decarbonization strategy (target delivery); (6) capital allocation alignment; (7) climate policy alignment; (8) climate governance; (9) just transition; and (10) TCFD disclosure.

Alignment assessment complement the disclosure criteria. They provide independent evaluations of the alignment and adequacy of company actions with the goals of Climate Action 100+ and the Paris Agreement.

The alignment assessments come from different data providers of the Climate Action 100+ Technical Advisory Group including Carbon Tracker Initiative (CTI), the Climate Accounting and Audit Project (CAAP), The Rocky Mountain Institute (RMI) (formerly 2 Degrees Investing Initiative,2DII) and InfluenceMap. For the March and October 2022 Net Zero Company Benchmark assessments, they cover the following topics and sectors:

CAPITAL ALLOCATION ALIGNMENT (CTI)

For oil and gas focus companies, CTI’s alignment assessments analyze companies’ potential capital expenditures (CapEX) for unsanctioned upstream oil and gas carbon-emitting assets relative to a range of climate change scenarios. In addition, for electric utility focus companies, CTI’s alignment assessments analyze companies’ announced retirement schedules for their legacy coal and gas-fired power generation capacity and new planned additional carbon-emitting assets relative to a range of climate change scenarios.

CLIMATE POLICY ENGAGEMENT ALIGNMENT (INFLUENCEMAP)

InfluenceMap’s alignment assessments provide detailed analyses of corporate climate policy engagement and the alignment of company climate policy engagement actions (direct and indirect via their industry associations) with the Paris Agreement goals. Their assessments cover nearly all Climate Action 100+ focus companies.

CAPITAL ALLOCATION ALIGNMENT (RMI – FORMERLY 2DII)

For electric utility and autos focus companies, RMI’s alignment assessments analyze focus companies’ planned CapEX and production capacity relative to a range of climate change scenario pathways for the sectors. In addition, for steel, cement, and aviation focus companies, RMI’s alignment assessments analyze companies’ planned economic outputs and associated emissions intensities relative to selected climate change scenarios.

CLIMATE ACCOUNTING & AUDIT [PROVISIONAL] (CTI AND CAAP)

CTI and CAAP’s alignment assessment evaluates whether a focus company’s accounting practices and related disclosures, and the auditor’s report thereon, reflect the effects of climate risk, the global move towards a 2050 (or sooner) net zero emissions pathway, and the Paris Agreement goal of limiting global warming to no more than 1.5°C.

This assessment covers nearly all focus companies and is considered Provisional, meaning the information will be collected and publicly assessed for the March and October 2022 iterations of the Benchmark, but the framework will be subject to change in future iterations.

Transition Pathway Initiative (TPI) Management Quality and Carbon Performance Framework

(90.pdf (transitionpathwayinitiative.org)

TPI assesses companies’ progress on the low carbon transition with (1) Management Quality (companies’ carbon management practices and governance) and (2) Carbon Performance (companies’ emissions pathways compared to different climate scenarios consistent with the Paris Agreement).

TPI’s Management Quality Framework utilizes up to 19 different indicators and question to track the progress of companies through five levels: Level 0: Unaware of (or not Acknowledging) Climate Change as a Business Issue; Level 1: Acknowledging Climate Change as a Business Issue; Level 2: Building Capacity; Level 3: Integrating into Operational Decision-Making; and Level 4: Strategic Assessment.

TPI’s Carbon Performance assessment is based on the Sectoral Decarbonization Approach (SDA) comparing individual company emissions performance to sector benchmarks.

Appendix C

BERS Climate Change Solution Investments

Report

BERS Climate Change Solutions Investments (millions of $) – Dec 31, 2021, to Jun 30, 2022

| BERS (4Q 2021) | Total

Port |

Public

Eq. |

Public FI | Alt

Credit |

Private

Eq. |

Real

Est |

Infra |

|---|---|---|---|---|---|---|---|

| Total NAV | 9,050.1 | 4,521.0 | 2,102.7 | 929.0 | 832.7 | 463.7 | 200.9 |

| Climate NAV | 286.4 | 101.8 | 3.6 | 14.2 | 28.5 | 96.2 | 42.0 |

| Climate % | 3.16% | 2.25% | 0.17% | 1.53% | 3.42% | 20.75% | 20.90% |

| BERS (2Q 2022) | Total

Port |

Public

Eq. |

Public FI | Alt

Credit |

Private

Eq. |

Real

Est |

Infra |

| Total NAV | 7,847.2 | 3,573.8 | 1,652.6 | 891.5 | 925.4 | 554.6 | 249.3 |

| Climate NAV | 200.9 | 72.1 | 3.0 | 13.3 | 23.8 | 46.9 | 41.9 |

| Climate % | 2.56% | 2.02% | 0.18% | 1.49% | 2.57% | 8.45% | 16.81% |

| 4Q-21 to 2Q-22 | Total

Port |

Public

Eq. |

Public FI | Alt

Credit |

Private

Eq. |

Real

Est |

Infra |

| Total NAV –

Change |

-13.29% | -20.95% | -21.41% | -4.04% | 11.12% | 19.61% | 24.05% |

| Climate NAV –

Change |

-29.84% | -29.16% | -17.96% | -6.53% | -16.50% | -51.30% | -0.25% |

Definitions of Climate Change Solutions Investments

Public Equity: Companies that derive 50% or more of their revenue from MSCI categories of alternative energy, energy efficiency, green building, pollution prevention, or sustainable water, as analyzed by BAM Risk Management.

Public Fixed Income: Companies that derive 50% or more of their revenue from MSCI categories of alternative energy, energy efficiency, green building, pollution prevention, or sustainable water, as analyzed by BAM Risk Management. It also includes green bonds based on manager surveys conducted by Fixed Income Team. Managers were allowed discretion in defining green bonds.

Alternative Credit: Opportunistic Fixed Income (OFI) market values are based on manager surveys conducted by the Alternative Credit Team. The definition of climate change solutions used for OFI is “investments in companies that generate 50% or more revenue from clean and renewable energy technologies and assets including (1) renewable energy such as solar, wind, geothermal and hydropower; (2) energy efficiency and energy smart technologies such as power storage, fuel cells and carbon capture and storage; (3) energy efficient transport and (4) low carbon buildings.” This definition is a summary of the MSCI and Burgiss definitions as well as a reflection of a definition by Ceres.

The non-OFI Alternative Credit assets (High Yield, Bank Loans and Convertible Bonds) data are based on companies that derive 50% or more of their revenue from the MSCI categories, as analyzed by BAM Risk Management.

Private Equity: Companies generating 50% or more of their revenue from the Burgiss category of “Eco Friendly” activities, including renewable energy, biofuel and other clean tech or associated companies, as analyzed by BAM Risk Management.

Real Estate: Properties certified as Energy Star. Includes properties certified as LEED only if they are also certified as Energy Star. All data is based on manager surveys conducted by the Real Estate Team. All data is NAV. Data for 2Q 2022 is based on manager survey conducted for 4Q 2021.

Infrastructure: Climate change solutions identified by Infrastructure Consultant.

Economically Targeted Investments (ETI): ETI data is incorporated in the data for Public Fixed Income and Real Estate due to the portfolio’s investment structure.

Endnotes

[1] Please see page 8 for detailed explanation of Scopes 1, 2, and 3

[2] The Office of the New York City Comptroller serves as the delegated investment advisor and custodian of assets as well as a Trustee to all five New York City Retirement Systems. The Bureau of Asset Management of the Comptroller’s Office is responsible for fulfilling these functions, including providing investment advice, implementing Board decisions and reporting on investment performance.

[3] PAII-Net-Zero-Asset-Owner-Commitment-Statement.pdf (parisalignedinvestment.org)

[4] Race To Zero Campaign | UNFCCC

[5] Net_Zero_Investment_Framework_final.pdf (parisalignedinvestment.org); Net Zero Investment Framework Implementation Guide – IIGCC

[6] Chapter 3 — Global Warming of 1.5 ºC (ipcc.ch)

[7] Chapter 2 — Global Warming of 1.5 ºC (ipcc.ch)

[9] Target Setting Protocol Second Edition – United Nations Environment – Finance Initiative (unepfi.org)

[10] CDP-technical-note-scope-3-relevance-by-sector.pdf

[11] Article 4.9 of the Paris Agreement sets a five-year cycle of 2025, 2030, 2035, etc.

[12] “PAII aims to establish a best possible solution to reduce the impact of market volatility on these metrics and work towards a level of standardisation for EVIC normalisation across the industry, with the aim to provide additional guidance to investors in the near future. PAII will engage with PCAF to promote an industry-wide approach.” Net Zero Investment Framework: IIGCC’s Supplementary Guidance on Target Setting, IIGCC (The Institutional Investors Group on Climate Change), December 17, 2021.

[13] This attribution analysis may cover sources of emissions changes including but not limited to sectors, strategies, company carbon emissions and reallocations.

[14] Enterprise Value Including Cash – Open Risk Manual

[15] For a discussion of the impact of substantial overshoots of 1.5° C., see SR15_Chapter_1_HR.pdf (ipcc.ch), p. 60.

[16] BP Net zero from ambition to action, pp. 14-15 at bp-net-zero-report-2022.pdf

[17] CDP-technical-note-scope-3-relevance-by-sector.pdf

[18] Trends Show Companies Are Ready for Scope 3 Reporting with US Climate Disclosure Rule | World Resources Institute (wri.org)

[19] CDP-technical-note-scope-3-relevance-by-sector.pdf

[20] The SBTi is a partnership between the Carbon Disclosure Project (CDP), the United Nations Global Compact, World Resources Institute (WRI) and the World Wide Fund for Nature (WWF). Its purpose is to define and promote best practice in emissions reductions and net zero target in line with climate science. It provides technical assistance and resources to companies who set science-based targets in line with the latest climate science. About Us – Science Based Targets.

[21] Greenhouse 100 Polluters Index from the University of Massachusetts Amherst Political Economy Research Institute, 2021 Report based on 2019 data), PERI – Greenhouse 100 Polluters Index (umass.edu)

[22] The Paris Agreement references the International Labour Organization’s Guidelines for a Just Transition Toward Environmentally Sustainable Economies and Societies for All (ILO Guidelines for a just transition (2015)).

[24] Executive Order on Catalyzing Clean Energy Industries and Jobs Through Federal Sustainability | The White House

[25] Climate Action 100+ opens public consultation on Net Zero Company Benchmark for its next phase | Climate Action 100+

[26] Our Inclusive Energy Future – Programmes – IEA

[27] Just transition | World Benchmarking Alliance

[28] JET Framework Microsite Home | Council for Inclusive Capitalism