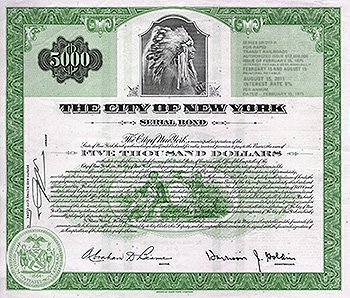

Purpose of NYC bonds

New York City sells bonds to finance the construction and repair of infrastructure projects such as roads, bridges, schools, water supply, and wastewater treatment systems. The City determines projects through the capital budgeting process. Projects must have useful lives of five years or longer to be funded by debt (three years or longer for information technology projects).

New York City also issues bonds to refinance outstanding bonds for interest savings, which saves money for taxpayers and ratepayers. Refinancing bond sales are strictly economic and do not extend the final maturity of the debt or cause increases in debt expense.

Issuance of NYC bonds

The Comptroller, through the Bureau of Public Finance, and the Mayor, through the Office of Management and Budget, share the responsibility for issuing bonds and notes backed by:

- NYC General Obligation (GO)

- NYC Transitional Finance Authority (TFA)

- NYC Municipal Water Finance Authority (NYW)

Working with the Office of Management and Budget, the Comptroller’s Office determines and approves structures, terms, and conditions for all City debt. The Comptroller also reviews and approves debt issued by:

- The Battery Park City Authority

- NYC Health + Hospitals

- The NYC Housing Development Corporation

- The Trust for Cultural Resources

- TSASC, Inc.

The Comptroller also participates in the issuance of Hudson Yards Infrastructure Corporation (HYIC) bonds, among others.

In addition to issuing debt, the Comptroller’s Office actively monitors the City’s outstanding bonds and handles debt policy and administrative matters.