Comptroller Stringer: City Economy Slows During The Second Quarter Of 2016

The City added 13,400 private-sector jobs, the second smallest increase in six years

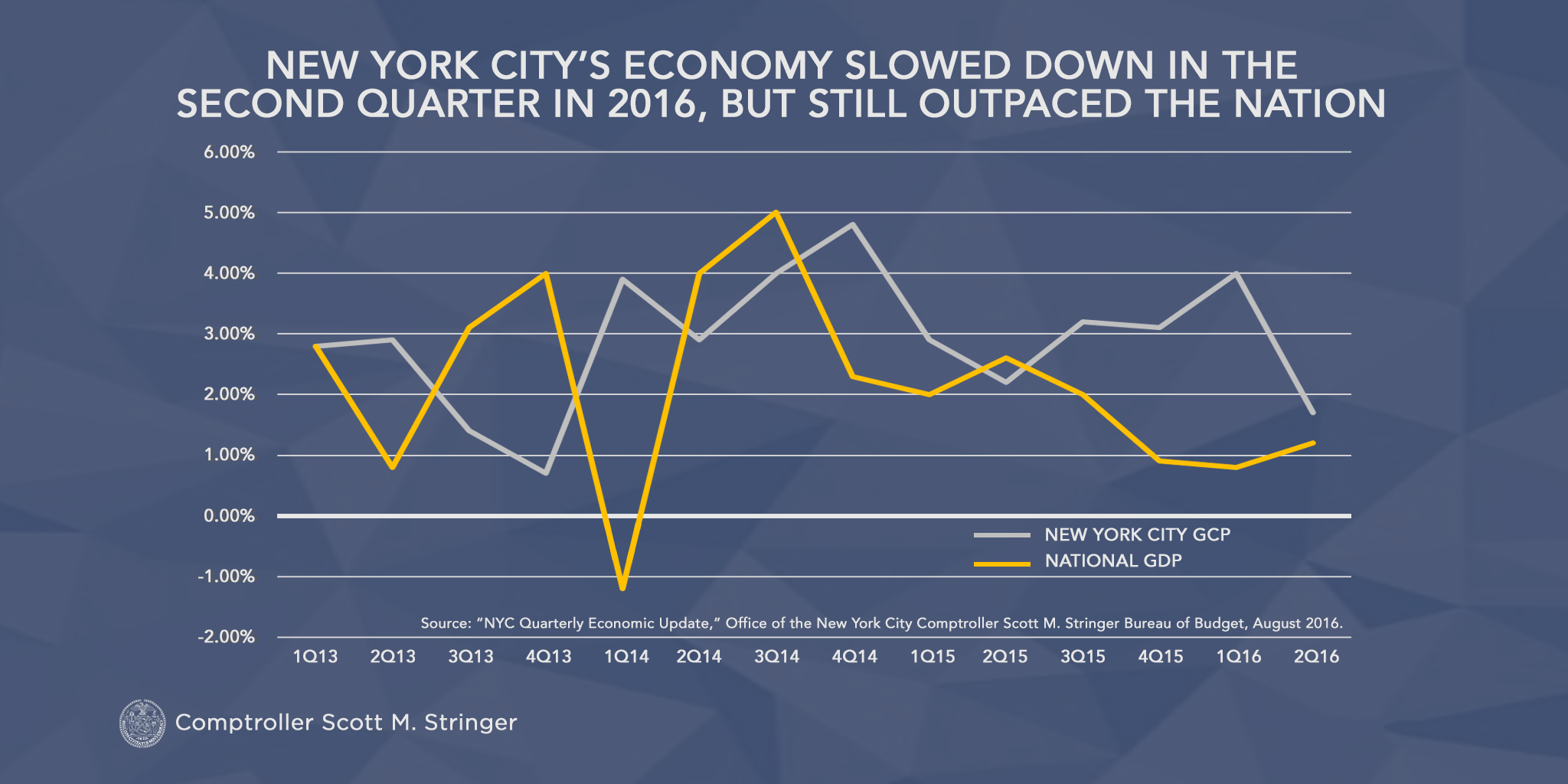

The City's economy grew 1.7%, the slowest rate in two years, but still outpaced the national economy

In 2015, average real wages grew 3.3 percent for employees in low-wage industries

(New York, NY) – Weak economic indicators such as falling venture capital investment and disappointing job growth contributed to the first tangible signs of a potential slowdown of the City’s economy during the second quarter of 2016 according to a Quarterly Economy Report released today by New York City Comptroller Scott M. Stringer. The report found that the City’s economy, while continuing to outpace the nation’s, grew an estimated 1.7 percent between April and June of this year – the slowest rate since the end of 2013.

“Our City’s economy is still growing – but in 2016 we’ve gone from a sprint to a jog,” Comptroller Stringer said. “For the first time in a number of years, several important economic indicators are pointing toward weaker growth. While the residential real estate market remains strong and the wage gap has narrowed, this report confirms that our recovery is no longer gaining steam.”

Released every quarter, the Comptroller’s Quarterly Economic Update examines a broad range of indicators that reflect the City’s current conditions in the national economic context.

Findings include:

The City’s overall economic growth slowed, but still outpaced the nation’s

- Real Gross City Product grew at an estimated annual rate of 1.7 percent in the second quarter of 2016, the slowest pace since the fourth quarter of 2013, but faster than national Gross Domestic Product growth of 1.2 percent.

- The U.S. economy was dragged down by the third consecutive quarter of contractions in business investment amid global economic uncertainties and decreased demand from businesses in the energy sector. Gross private domestic investment fell 9.7 percent, the biggest drop in seven years.

Private-sector job growth dropped significantly, but wages improved

- In the second quarter of 2016, the City added 13,400 private-sector jobs, a seasonally adjusted annualized rate of 1.4 percent – a substantial drop from growth of 4.6 percent in the first quarter. Despite recent trends, the vast majority – 85 percent – of these jobs were in medium-wage industries such as hospitals, and arts, entertainment and recreation.

- Mirroring national increases in consumer spending, local industries like education and health services and leisure and hospitality saw the greatest private-sector job gains.

Wages in low-wage industries improved in 2015

- Reversing a six-year trend, the gap between low-wage, medium-wage, and high-wage earners shrank last year. In 2015, average wages, adjusted for inflation, grew 3.3 percent for low-wage industries, 3.1 percent for mid-wage industries, and fell 0.9 percent for high-wage industries.

- However, since the end of recession in 2009 through 2015, the average wage in low-wage industries is still flat in real terms.

Slower growth in personal income

- Year-over-year, personal income tax revenues fell 5.7 percent in the second quarter of 2016. Personal income taxes withheld from paychecks rose only 0.5 percent during that same time period.

- Estimated tax payments, which reflect trends in taxpayers’ non-wage income, including interest earned, rental income, and capital gains, fell 16 percent compared to quarterly collections from last year. In June alone, estimated taxes were down about 20 percent.

- The average hourly earnings of all private New York City employees fell to $33.48 in the second quarter – the first year-over-year decline in nearly seven years. National average hourly earnings, on the other hand, grew 2.8 percent during the same period, the biggest increase in seven years.

- The slight decline in average city private-sector earnings is in part due to a loss of high-paid jobs. In the second quarter the number of private-sector city jobs in high-wage industries shrank by 4 percent, equal to the loss of 500 jobs. Professional and business services lost 1,400 jobs, and the financial sector lost 1,100 jobs.

Labor force participation declined

- In the second quarter, unemployment in New York City fell to 5.2 percent, while the U.S. unemployment rate remained unchanged at 4.9 percent.

- The decline in the City’s unemployment rate was due to a contraction of the City’s labor force by 34,200, the biggest quarterly decline on record. A shrinking labor force may signal that the City’s discouraged job seekers are leaving the labor market. However, the decline follows an unprecedented increase of 32,000 in the first quarter of this year.

Venture capital investment fell year over year

- Venture capital investment in the New York Metro Area experienced the first second quarter year-over-year decline since 2012. Investment fell to $1.4 billion from $2.4 billion in the second quarter of 2015.

- During this time period, total venture capital investment in the U.S. fell 12.2 percent as investment in Silicon Valley fell 9.6 percent.

Residential real estate remained strong, while commercial leasing showed signs of cooling

- Average housing prices continued to rise on a year-over-year basis, growing 8.4 percent in Manhattan to $2 million; 3.6 percent in Brooklyn to nearly $817,000; and 16.5 percent in Queens to $527,000.

- New commercial leasing in the second quarter of 2016 totaled seven million square feet, 15.6 percent lower than this time last year. The Manhattan office vacancy rate, however, stayed level at 8.8 percent.

“New York City’s economy continues to grow, but has begun to feel the impact of national and global uncertainty,” Stringer said. “My office will keep a close eye on the City and global economies as the year progresses.”

To read the full report, please click here.

###

###