Analysis of the Financial and Operating Practices of Union-Administered Benefit Funds with Fiscal Years Ending in Calendar Year 2017

EXECUTIVE SUMMARY

This report provides a comparative analysis of the overall financial activities of 92 union‑administered welfare and annuity funds that in 2017 received approximately $1.31 billion in City contributions for the benefit of active and retired City employees.[1] Such an analysis is prepared annually based on the independently audited financial reports and other information filed by the funds in accordance with New York City Comptroller’s Directive #12. This report aggregates the information reported by the funds and compares funds of similar type and size of City contribution in relation to the amounts spent on administration, operating surplus/deficits, benefits provided, and year-end reserves. [2]

Findings and Conclusions

In 2017, the 92 welfare and annuity funds spent nearly $111.5 million (7.74 percent on average) of their total revenue on administration as compared with $107.8 million (9.76 percent on average) in 2016.

Of the 92 funds, in 2017:

- 16 welfare funds and 8 annuity funds expended 30 percent higher-than-average amounts for administration than other funds of a similar type and size.

- 10 welfare funds, which maintained high reserves, expended 20 percent lower-than-average amounts for benefits than other funds of a similar type and size.

- 4 welfare funds had benefit expenditures that exceeded their revenues, causing each of these funds to dip into their reserves.

- 10 welfare funds incurred operating deficits totaling $2.0 million, which reduced their available reserves. The deficits ranged from $16,397 to approximately $554,241.

In summary, we identified the following financial issues in one or more of the funds that should be addressed by those funds:

- Expenses that exceeded revenues, resulting in operating deficits;

- Administrative expenses that exceeded the average for that category of fund; and

- Operating surpluses that resulted in higher-than-average reserves.

The analysis also identified other areas of concern, which include:

- 23 funds received “qualified” opinions[3] from their independent auditors.

- 28 funds did not submit their Directive #12 reports within the prescribed time frame.

- 70 funds did not use a certified public accountant (CPA) firm listed on the Comptroller’s prequalified list as recommended by Directive #12.

- One fund continues to delay benefit eligibility for new members in violation of its agreement with the City of New York.

Recommendations

As a result of our analysis, we make 11 recommendations, 8 to the trustees of individual funds and 3 to the Office of Labor Relations (OLR):

- Trustees of funds with higher-than-average administrative costs as a percentage of total revenue should reduce administrative expenses and determine whether the savings can be redirected to increased benefits for members.

- Trustees of funds with lower-than-average benefit expenses as a percentage of total revenue should determine whether their revenues can support increased benefits for members.

- Trustees of funds with low reserve levels should take steps to ensure that their funds remain solvent. To accomplish that goal, funds should seek to reduce administrative expenses. If that is not possible or does not provide sufficient funds to ensure solvency, the trustees should attempt to reduce costs associated with benefits.

- Trustees of funds that have incurred operating deficits, particularly those with low reserve levels, should ensure that anticipated benefit and administrative expenses will not exceed projected total revenue.

- Trustees of funds with higher-than-average reserve levels, particularly those whose funds spend less than average amounts of their revenue on benefits, should consider enhancing their members’ benefits.

- Trustees of funds are required to submit to the Comptroller’s Office an annual report showing the fund’s condition and affairs in accordance with Directive #12 and that submission must be filed within nine months after the close of a fund’s fiscal year-end. Trustees should ensure that those filings are timely made in accordance with Directive #12.

- Trustees of funds should consider contracting with CPAs that are listed on the Comptroller’s prequalified list.

- Trustees of the fund that delays members’ eligibility for benefits beyond their first day of employment must revise the fund’s policy to comply with its union’s welfare fund agreement with the City.

- OLR should use the information in this report to ensure that the trustees of the relevant funds correct the conditions cited in qualified opinions received from their independent accountants.

- OLR should consider withholding City contributions from all delinquent funds that failed to submit their Directive #12 reports to the Comptroller’s Office or fail to otherwise abide by the terms of that Directive and/or their welfare fund agreements with the City.

- Whenever a fund improperly delays the provision of benefits to members after their first day of City employment, OLR should recover from the fund the portion of the City’s contributions that corresponds to the number of employees whose coverage was delayed and the period of such delay.

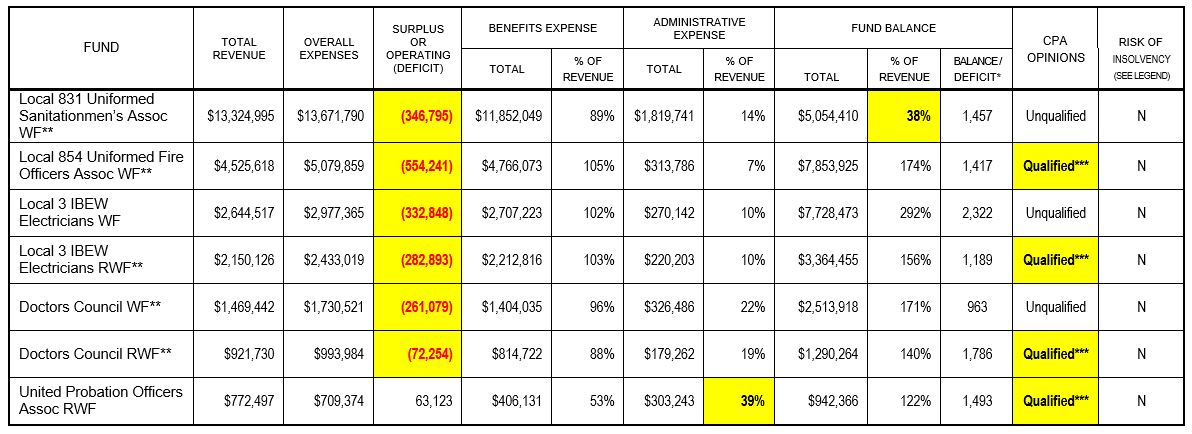

This report has identified 7 funds that as of 2017 had potential financial issues that should be addressed by fund management as shown in the chart on the following page.

Summary of the 7 Funds with Potential Financial Problems Identified in this Report

(Problem Areas Highlighted)

Legend

N – Currently Not at Risk of Insolvency

ST – Short-term Risk of Insolvency within 1 – 3 years

LT – Long-term Risk of Insolvency greater than 3 years

N/A – Not Applicable

* A ratio estimating the number of years that a fund can operate before being “in the red” if all factors remain constant.

For example, the number “101” would indicate the fund has approximately one year before becoming insolvent.

** These funds were also cited for Potential Financial Problems in 2016.

*** See Table XXI where the specific issue for each fund with a “Qualified” opinion is detailed. CPAs may render one of the following opinions:

Unqualified, Qualified, Adverse, or a Disclaimer (see page 28)

[1] For 2017, the City contributed approximately $1.34 billion to 107 union-administered funds that submitted Directive #12 filings. However, we limited the computation of category averages and other financial analyses in this report to 92 of the funds, which received $1.31 (98 percent) of $1.34 billion in total City contributions. The remaining 15 funds, 13 of which received a total of $32.72 million (2 percent) of the City’s contributions in 2017, along with 2 funds that failed to submit their required audited financial statements for 2017, were excluded from the analysis for different reasons which are detailed in the Scope of Analysis section of this report, and on page 4 of Exhibit B.

[2] The Comptroller’s Office issued Directive #12 to ensure uniform reporting and auditing requirements for union-administered benefit funds that receive contributions from the City. The Comptroller’s Directives are used to establish policies governing internal controls, accountability, and financial reporting. The Comptroller is not, however, a regulator with remedial powers charged with enforcing fiduciary obligations under a rubric of laws and regulations akin, for example, to the United States Department of Labor or the New York State Department of Financial Services.

[3] CPAs may render one of the following opinions on a Fund’s audited financial statements: Unqualified, Qualified, Adverse and Disclaimer. Descriptions of each of these CPA opinions can be found on page 28.