I. Executive Summary

The FY 2024 Executive Budget and April 2023 Financial Plan incorporates many of the expenses that the Comptroller’s Office highlighted as unaccounted for in the Preliminary Budget, thus providing a more candid view of the City’s fiscal condition. The City added nearly $16 billion to fund the cost of settling municipal labor contracts over the five years of the Plan and $4.3 billion to pay for the cost of providing shelter and services to people seeking asylum. The Comptroller’s Office identifies the growing cost of providing these services as the biggest near-term risk to the City budget, particularly as State, and to a greater extent Federal, aid remains inadequate.

In addition to accounting for increased expenditures, the Financial Plan recognizes higher revenues. The City revised its tax forecast upward in each year—bringing its projections closer in line with the Comptroller’s Office. The City continues to add jobs and is now at 99.7 percent of its pre-pandemic employment level. And while local economic growth is slowing from its fast-paced pandemic recovery, neither the Comptroller’s Office nor the City projects a recession. There are reasons for caution, however, as the economic risk remains elevated. Turmoil in the banking sector, high interest rates, and rising commercial vacancies in the City are also causes for concern.

Overall, the FY 2024 Executive Budget as presented by the Mayor totals $106.69 billion, an increase of $4.03 billion over the Preliminary Budget, but $2.22 billion less than the $108.91 billion currently planned for FY 2023; with much of the difference stemming from the drop of Federal COVID-19 aid. Higher estimates of tax collections, along with the spending down of budgeted reserves, and savings resulting from a third consecutive Program to Eliminate the Gap (PEG), increased the projected FY 2023 surplus by $868 million, which is used to close the FY 2024 gap and results in balanced budgets for both years. In the outyears, the City projects gaps of $4.20 billion in FY 2025, $5.95 billion in FY 2026, and $6.98 billion in FY 2027.

Based on its own economic forecast, the Comptroller’s Office projects higher tax revenues than the Mayor in each year. Driven by strong collections early in the year, the Comptroller’s Office expects FY 2023 tax revenues to total $72.28 billion in FY 2023, 1.7 percent higher than the Mayor’s current projections and an increase of 3.9 percent compared with FY 2022 collections. After FY 2023, the Comptroller’s Office projects that tax revenues will dip slightly in FY 2024 (by 1.0 percent) before regaining growth in the outyears (averaging 3.0 percent).

While the Executive Budget addresses several major items left outstanding in the Preliminary Budget, there are still many underfunded expenditures and risks—the greatest of which is the cost of providing services to people seeking asylum. Given the high level of unpredictability, the Comptroller’s Office, in this report, explores several scenarios of the flow of arrivals, State and Federal aid, and costs. The mid-range scenario suggests $1.15 billion more in City funds could be required in FY 2024, growing to $2.94 billion in FY 2025, and $3.65 billion in FYs 2026 and 2027, the two years when no funds for these services are budgeted.

The Comptroller’s Offices estimates that spending at the Department of Education (DOE) will exceed budgeted costs by $210 million in FY 2023 rising to $2.72 billion in FY 2027. This results from the expiration of Federal COVID aid used to fund ongoing DOE programs, the underbudgeting of special education Carter Cases, the implementation of the State mandate to reduce class sizes, and the underfunding of charter school tuition costs, including the reauthorization of 14 charter schools as required by the 2023-2024 State budget, as well as other costs.

The Comptroller’s Office’s expenditure estimates also take into account other costs included in the 2023-2024 State budget but not yet reflected in the City’s Financial Plan, such as increased payments to the MTA, growth in payroll taxes paid by the City, and the capture of Federal healthcare funds, as well as several other actions. Together these result in additional City spending of $409 million in FY 2024, growing to $511 million in FY 2025. Underbudgeting for overtime and rental assistance costs also pose significant risks in FY 2024 and forward.

Because of the uncertainty around the cost of providing services to people seeking asylum, the Comptroller’s Office presents its restated surpluses and gaps with and without its estimates of increased spending. If the City’s projection of these costs (and the level of Federal/State reimbursement) proves accurate, the Comptroller’s Office projects additional resources of $1.69 billion in FY 2023, and a FY 2024 gap of $2.14 billion, roughly in balance with the FY 2023 surplus. Projected outyear gaps are larger at $6.45 billion in FY 2025, $9.05 billion in 2026, and $10.38 billion in FY 2027 (2.0 percent of the budget in FY 2024 growing to 9.6 percent in FY 2027).

If costs to provide services to people seeking asylum grow at a faster rate than the City projects, and if Federal and State support comes in less than budgeted, gaps increase to $3.29 billion in FY 2024 (3.1 percent of the budget) and reach $14.03 billion in FY 2027 (12.9 percent of the budget).

One risk not quantified here—but critical—is the impact that the City’s cost-saving measures could have on essential services. Since November, the City has proposed multiple PEG programs. These have included measures to reduce the high number of vacant City-funded positions by a cumulative 4,496 for FY 2024, as well as cuts to CUNY, public libraries, re-entry services at Rikers, and human service providers. New Yorkers would be better served by a multi-year and strategic approach to savings that maintains critical service levels.

The release of the Executive Budget also included an updated Capital Commitment Plan and Ten-Year Capital Strategy. The Capital Commitment Plan totals $97.93 billion from FY 2023 – FY 2027, a $1.39 billion increase over the Preliminary Plan. The greatest increase is for Department of Correction (DOC) projects, largely for the Brooklyn Borough-Based Jail. The Ten-Year Capital Strategy totals $164.78 billion. Based on past experience, it is unlikely that commitments will be delivered at the pace planned, resulting in lower levels of actual spending and borrowing.

Overall, while the Comptroller’s Office projects a surplus in the current year and a manageable gap in FY 2024, there is significant pressure in the outyears. The City must not only look at cost-cutting measures, but long-term strategies to increase efficiency, achieve long-term savings without cutting core services, improve its capital process to invest in infrastructure, and bolster revenues in ways that are equitable and effective to secure the city’s thriving future. [1]

Table 1. FY 2023 – FY 2027 Financial Plan

| Change FYs 2023 –2027 |

|||||||

| ($ in millions) | FY 2023 | FY 2024 | FY 2025 | FY 2026 | FY 2027 | Dollar | Percent |

| Revenues | |||||||

| Taxes: | |||||||

| General Property Tax | $31,570 | $32,405 | $32,366 | $32,633 | $33,238 | $1,668 | 5.3% |

| Other Taxes | 38,318 | 38,013 | 39,747 | 41,118 | 42,962 | 4,644 | 12.1% |

| Tax Audit Revenues | 1,200 | 721 | 721 | 721 | 721 | (479) | (39.9%) |

| Subtotal: Taxes | $71,088 | $71,139 | $72,834 | $74,472 | $76,921 | $5,833 | 8.2% |

| Miscellaneous Revenues | 8,251 | 7,793 | 7,624 | 7,562 | 7,518 | (733) | (8.9%) |

| Unrestricted Intergovernmental Aid | 297 | 0 | 0 | 0 | 0 | (297) | (100.0%) |

| Less: Intra-City Revenues | (2,361) | (1,996) | (1,987) | (1,989) | (1,986) | 375 | (15.9%) |

| Disallowances Against Categorical Grants | (15) | (15) | (15) | (15) | (15) | 0 | 0.0% |

| Subtotal: City-Funds | $77,260 | $76,921 | $78,456 | $80,030 | $82,438 | $5,178 | 6.7% |

| Other Categorical Grants | 1,109 | 1,082 | 1,075 | 1,070 | 1,070 | (39) | (3.5%) |

| Inter-Fund Revenues | 706 | 720 | 725 | 732 | 732 | 26 | 3.7% |

| Federal Categorical Grants | 11,721 | 10,411 | 8,060 | 7,052 | 7,026 | (4,695) | (40.1%) |

| State Categorical Grants | 18,113 | 17,555 | 17,540 | 17,304 | 17,367 | (746) | (4.1%) |

| Total Revenues | $108,909 | $106,689 | $105,856 | $106,188 | $108,633 | ($276) | (0.3%) |

| Expenditures | |||||||

| Personal Service | |||||||

| Salaries and Wages | $33,461 | $32,661 | $33,793 | $35,090 | $36,297 | $2,836 | 8.5% |

| Pensions | 9,414 | 9,634 | 10,415 | 10,878 | 11,060 | 1,646 | 17.5% |

| Fringe Benefits | 12,375 | 13,300 | 14,155 | 14,913 | 15,529 | 3,154 | 25.5% |

| Subtotal-PS | $55,250 | $55,595 | $58,363 | $60,881 | $62,886 | $7,636 | 13.8% |

| Other Than Personal Service | |||||||

| Medical Assistance | $6,297 | $6,651 | $6,385 | $6,385 | $6,535 | $238 | 3.8% |

| Public Assistance | 1,970 | 1,650 | 1,650 | 1,650 | 2,000 | 30 | 1.5% |

| All Other | 43,238 | 38,559 | 35,925 | 34,729 | 35,000 | (8,238) | (19.1%) |

| Subtotal-OTPS | $51,505 | $46,860 | $43,960 | $42,764 | $43,535 | ($7,970) | (15.5%) |

| Debt Service | |||||||

| Principal | $4,003 | $4,144 | $4,165 | $4,187 | $4,371 | $368 | 9.2% |

| Interest & Offsets | 3,541 | 3,671 | 4,101 | 4,847 | 5,354 | $1,813 | 51.2% |

| Subtotal Debt Service | $7,544 | $7,815 | $8,266 | $9,034 | $9,725 | $2,181 | 28.9% |

| FY 2022 BSA and Discretionary Transfers | ($6,114) | $0 | $0 | $0 | $0 | $6,114 | (100.0%) |

| FY 2023 BSA | $3,035 | ($3,035) | $0 | $0 | $0 | ($3,035) | (100.0%) |

| Capital Stabilization Reserve | $0 | $250 | $250 | $250 | $250 | $250 | NA |

| General Reserve | $50 | $1,200 | $1,200 | $1,200 | $1,200 | $1,150 | 2,300.0% |

| Less: Intra-City Expenses | (2,361) | (1,996) | (1,987) | (1,989) | (1,986) | 375 | (15.9%) |

| Total Expenditures | $108,909 | $106,689 | $110,052 | $112,140 | $115,610 | $6,701 | 6.2% |

| Gap to be Closed | $0 | ($0) | ($4,196) | ($5,952) | ($6,977) | ($6,977) | NA |

SOURCE: Mayor’s Office of Management and Budget

NOTE: Numbers may not add to totals due to rounding.

Table 2. Plan-to-Plan Changes, April 2023 Plan vs. January 2023 Plan

| ($ in millions) | FY 2023 | FY 2024 | FY 2025 | FY 2026 | FY 2027 |

| Revenues | |||||

| Taxes: | |||||

| General Property Tax | $149 | $392 | $220 | $477 | $1,082 |

| Other Taxes | 1,458 | 1,859 | 1,996 | 1,957 | 2,734 |

| Tax Audit Revenues | 479 | 0 | 0 | 0 | 0 |

| Subtotal: Taxes | $2,086 | $2,251 | $2,216 | $2,434 | $3,816 |

| Miscellaneous Revenues | 268 | 277 | 243 | 250 | 229 |

| Unrestricted Intergovernmental Aid | 45 | 0 | 0 | 0 | 0 |

| Less: Intra-City Revenues | (148) | (94) | (87) | (93) | (90) |

| Disallowances Against Categorical Grants | 0 | 0 | 0 | 0 | 0 |

| Subtotal: City-Funds | $2,251 | $2,434 | $2,372 | $2,591 | $3,955 |

| Other Categorical Grants | (63) | 22 | 18 | 15 | 16 |

| Inter-Fund Revenues | (20) | 22 | 26 | 33 | 33 |

| Federal Categorical Grants | (703) | 926 | (91) | 35 | 27 |

| State Categorical Grants | 1,056 | 630 | 377 | 87 | 86 |

| Total Revenues | $2,521 | $4,034 | $2,702 | $2,761 | $4,117 |

| Expenditures | |||||

| Personal Service | |||||

| Salaries and Wages | $1,964 | $1,169 | $1,856 | $2,465 | $2,974 |

| Pensions | 0 | 71 | 632 | 927 | 1,261 |

| Fringe Benefits | (160) | (201) | (224) | (206) | (197) |

| Subtotal-PS | $1,804 | $1,039 | $2,264 | $3,186 | $4,038 |

| Other Than Personal Service | |||||

| Medical Assistance | ($267) | $266 | $0 | $0 | $0 |

| Public Assistance | 320 | 0 | 0 | 0 | 0 |

| All Other | 1,808 | 3,778 | 1,645 | 680 | 719 |

| Subtotal-OTPS | $1,`861 | $4,044 | $1,645 | $680 | $719 |

| Debt Service | |||||

| Principal | $0 | ($17) | ($13) | ($6) | ($13) |

| Interest & Offsets | (111) | (69) | (76) | (64) | (29) |

| Subtotal Debt Service | ($111) | ($86) | ($89) | ($70) | ($42) |

| FY 2022 BSA and Discretionary Transfers | $0 | $0 | $0 | $0 | $0 |

| FY 2023 BSA | $869 | ($869) | $0 | $0 | $0 |

| Capital Stabilization Reserve | ($250) | $0 | $0 | $0 | $0 |

| General Reserve | ($1,505) | $0 | $0 | $0 | $0 |

| Deposit to Rainy Day Fund | $0 | $0 | $0 | $0 | $0 |

| Less: Intra-City Expenses | ($148) | ($94) | ($87) | ($93) | ($90) |

| Total Expenditures | $2,520 | $4,034 | $3,733 | $3,703 | $4,625 |

| Gap to be Closed | $0 | $0 | ($1,031) | ($942) | ($508) |

SOURCE: Mayor’s Office of Management and Budget

NOTE: Numbers may not add to totals due to rounding.

Table 3. Plan-to-Plan Changes, April 2023 Plan vs. June 2022 Plan

| ($ in millions) | FY 2023 | FY 2024 | FY 2025 | FY 2026 |

| Revenues | ||||

| Taxes: | ||||

| General Property Tax | $149 | $392 | $220 | $477 |

| Other Taxes | 2,711 | 2,360 | 2,541 | 2,478 |

| Tax Audit Revenues | 479 | 0 | 0 | 0 |

| Subtotal: Taxes | $3,339 | $2,752 | $2,761 | $2,955 |

| Miscellaneous Revenues | 940 | 538 | 362 | 279 |

| Unrestricted Intergovernmental Aid | 45 | 0 | 0 | 0 |

| Less: Intra-City Revenues | (387) | (57) | (58) | (60) |

| Disallowances Against Categorical Grants | 0 | 0 | 0 | 0 |

| Subtotal: City-Funds | $3,937 | $3,233 | $3,065 | $3,174 |

| Other Categorical Grants | 80 | 66 | 60 | 58 |

| Inter-Fund Revenues | (30) | (12) | (6) | 1 |

| Federal Categorical Grants | 2,437 | 1,735 | 102 | 78 |

| State Categorical Grants | 1,361 | 665 | 406 | 116 |

| Total Revenues | $7,785 | $5,687 | $3,627 | $3,427 |

| Expenditures | ||||

| Personal Service | ||||

| Salaries and Wages | $1,793 | $688 | $1,340 | $2,040 |

| Pensions | $0 | $932 | $2,601 | $3,945 |

| Fringe Benefits | ($265) | ($456) | ($565) | ($524) |

| Subtotal-PS | $1,528 | $1,164 | $3,376 | $5,461 |

| Other Than Personal Service | ||||

| Medical Assistance | ($267) | $266 | $0 | $0 |

| Public Assistance | $320 | $0 | $0 | $0 |

| All Other | $5,520 | $3,410 | $1,122 | $338 |

| Subtotal-OTPS | $5,573 | $3,676 | $1,122 | $338 |

| Debt Service | ||||

| Principal | $9 | ($77) | $74 | $32 |

| Interest & Offsets | (218) | (194) | (405) | (372) |

| Subtotal Debt Service | ($209) | ($271) | ($331) | ($340) |

| FY 2022 BSA and Discretionary Transfers | $0 | $0 | $0 | $0 |

| FY 2023 BSA | $3,035 | ($3,035) | $0 | $0 |

| Capital Stabilization Reserve | ($250) | $0 | $0 | $0 |

| General Reserve | ($1,505) | $0 | $0 | $0 |

| Deposit to Rainy Day Fund | $0 | $0 | $0 | $0 |

| Less: Intra-City Expenses | ($387) | ($57) | ($58) | ($60) |

| Total Expenditures | $7,785 | $1,477 | $4,109 | $5,399 |

| Gap to be Closed | $0 | $4,210 | ($482) | ($1,972) |

NOTE: Numbers may not add to totals due to rounding.

SOURCE: Mayor’s Office of Management and Budget

Table 4. Risks and Offsets to the April 2023 Financial Plan

| FY 2023 | FY 2024 | FY 2025 | FY 2026 | FY 2027 | |

| City Stated Gap | $0 | $0 | ($4,196) | ($5,952) | ($6,977) |

| Tax Revenues | |||||

| Property Tax | $90 | ($24) | $513 | $663 | $1,384 |

| Personal Income Tax | 590 | 410 | 124 | 99 | (245) |

| Business Taxes | 297 | (359) | (451) | (188) | (49) |

| Sales Tax | 71 | 235 | 151 | 60 | (9) |

| Real Estate Transaction Taxes | 43 | (45) | 228 | 188 | 3 |

| All Other | (1) | (8) | 40 | 67 | 70 |

| Audit | 100 | 179 | 179 | 179 | 179 |

| Subtotal Tax Revenues | $1,191 | $388 | $784 | $1,068 | $1,333 |

| Miscellaneous Revenues | ($89) | $67 | $65 | $49 | $34 |

| Total Revenues | $1,102 | $455 | $849 | $1,117 | $1,367 |

| Expenditures | |||||

| PS Accrual Savings | $725 | $362 | $0 | $0 | $0 |

| Temporary and Professional Services | 0 | (155) | 0 | 0 | 0 |

| Overtime | (282) | (538) | (440) | (440) | (440) |

| Education | (210) | (822) | (1,069) | (1,997) | (2,720) |

| Public Health Corps | 0 | 0 | (13) | (49) | (49) |

| Public Assistance | 0 | (225) | (225) | (225) | 0 |

| Rental Assistance | 0 | (392) | (392) | (392) | (392) |

| Payroll Mobility Tax | 0 | (65) | (69) | (72) | (73) |

| Contributions to MTA | 25 | (298) | (442) | (450) | (497) |

| Prevailing Wage for Shelter Security Guards | 0 | (55) | (55) | (55) | (55) |

| Foster Care Reimbursement Rate | 0 | (118) | (118) | (118) | (118) |

| Variable Rate Debt Service Savings | 40 | 0 | 0 | 0 | 0 |

| Court Appointed Counsel | 0 | (42) | (42) | (42) | (42) |

| Minimum Wage Increase | 0 | (8) | (21) | (30) | (38) |

| State Intercept of ACA eFMAP Savings | 0 | (129) | (214) | (343) | (343) |

| PHE eFMAP Savings | 285 | 48 | 0 | 0 | 0 |

| City Settlements | 0 | (157) | 0 | 0 | 0 |

| Total Expenditures | $583 | ($2,594) | ($3,100) | ($4,214) | ($4,767) |

| Comptroller’s (Risks)/Offsets | $1,685 | ($2,138) | ($2,251) | ($3,097) | ($3,399) |

| Restated (Gap)/Surplus | $1,685 | ($2,138) | ($6,447) | ($9,049) | ($10,376) |

| Asylum-Seeker Re-estimate | |||||

| Projected Risk | $0 | ($1,150) | ($2,940) | ($3,650) | ($3,650) |

| Restated (Gap)/Surplus w/ Asylum-Seeker Re-estimate | $1,685 | ($3,288) | ($9,387) | ($12,699) | ($14,026) |

$ in millions, positive numbers decrease the gap and negative numbers increase the gap

NOTE: Numbers may not add to totals due to rounding.

SOURCE: Office of the New York City Comptroller

II. The City’s Economic Outlook

Economic Forecast, 2023 – 2027[2]

More than one year has elapsed since the Federal Reserve started to significantly increase interest rates, and their upward revisions have continued through this month—although at a more moderate pace than when they began. The Federal Funds Rate—which is essentially under the Fed’s control—currently fluctuates in the range of 5.00 to 5.25 percent, while it stood at close to zero in February 2022. Throughout this period, many economic prognosticators have predicted an impending recession or at least a deceleration to a very slow rate of economic growth. However, most current economic measures suggest that a recession is likely not imminent.

The Mayor’s Office of Management and Budget (OMB) has revised upward its own prediction of real economic growth in calendar year 2023 to 1.0 percent (from 0.3 percent previously). Their forecast growth rises to 1.5 percent in 2024 and goes no higher than 1.7 percent in any year during the Plan window through 2027.

While acknowledging that substantial risks are present and the possibility of recession remains non-negligible, the Comptroller’s Office’s forecast expects that the U.S. economy will grow in both 2023 and 2024 at 1.7 percent each year. Our projected growth rates in years 2025-27, averaging 2.6 percent per year, are also higher than OMB’s and closer to long-run average growth rates outside of recessions.

Table 5 summarizes the economic forecasts of the Office of the Comptroller and OMB.

Table 5. Summary of Economic Forecasts

| 2023 | 2024 | 2025 | 2026 | 2027 | |||

| U.S. Economy | |||||||

|---|---|---|---|---|---|---|---|

| Real GDP (2012 $, % Change) | Comptroller | 1.7 | 1.7 | 2.6 | 2.8 | 2.5 | |

| Mayor | 1.0 | 1.5 | 1.5 | 1.7 | 1.7 | ||

| Payroll Jobs, (% Change) | Comptroller | 1.9 | 0.3 | 0.6 | 0.4 | 0.4 | |

| Mayor | 1.6 | (0.4) | (0.2) | 0.1 | 0.3 | ||

| Fed Funds Rate, (Percent) | Comptroller | 4.92 | 4.27 | 3.16 | 2.50 | 2.50 | |

| Mayor | 5.05 | 4.62 | 3.20 | 2.63 | 2.63 | ||

| 10-Year Treasury Notes, (Percent) | Comptroller | 3.86 | 3.88 | 3.79 | 3.98 | 4.01 | |

| Mayor | 3.98 | 3.70 | 3.39 | 3.26 | 3.23 | ||

| NYC Economy | |||||||

| Payroll Jobs (Change in Thousands) | Comptroller | 86.8 | 28.9 | 56.7 | 54.9 | 55.7 | |

| Mayor | 92.3 | 76.7 | 74.9 | 77.3 | 70.7 | ||

| Wage Earnings, (% Change) | Comptroller | 3.2 | 5.0 | 4.2 | 4.3 | 4.1 | |

| Mayor | 0.5 | 5.1 | 4.9 | 4.5 | 4.7 | ||

| CPI NY Area, (% Change) | Comptroller | 3.9 | 2.6 | 2.3 | 2.3 | 2.3 | |

| Mayor | 3.5 | 1.9 | 1.7 | 1.6 | 1.7 | ||

SOURCE: Office of the New York City Comptroller, Mayor’s Office of Management and Budget

Current Economic Conditions

Economic Growth

Economic growth in the U.S. has remained solid since the middle of last year, despite a persistent consensus view expecting a recession or significant slowdown. The U.S. economy’s real gross domestic product (GDP) grew at a 2.9 percent annual rate in the latter half of 2022, rebounding from a decline in the first half of the year, despite the contractionary monetary policy interventions by the Federal Reserve. While advanced GDP estimates from the Bureau of Economic Analysis for the first quarter of 2023 indicated a slower growth rate of 1.1 percent, this figure includes a $138 billion drawing down of private inventories that reduced real GDP growth spending, real GDP growth in the first quarter of 2023 was 2.9 percent. This economic growth was primarily fueled by real (i.e., inflation-adjusted) personal consumption spending, which rose by a strong 3.7 percent rate. The GDPNow measure from the Atlanta Fed—a “nowcast” of the current quarter based on available data—estimates the second quarter of 2023 growing at 2.7 percent.

Significant inventory reduction is often a sign that the economy has already entered the downward part of its business cycle and the resulting lowered inventory levels will help to activate the self-correcting recovery stage. The fact that this drawdown has not coincided with a negative GDP growth rate is a positive sign for the economy’s chances to get through this year without entering a recession.

Credit and Interest Rates

On May 3rd, the Federal Reserve increased interest rates to a range between 5.0 percent and 5.25 percent. The statement accompanying the decision signaled the possibility of a pause in the hiking cycle after 10 consecutive increases dating back to March 2022.

Recent liquidity crises in the banking sector have rattled nerves in an uncertain economy. The turmoil began with the failures of Silicon Valley Bank and Signature Bank in March and was sparked again at the start of May by First Republic’s disclosure of a drop in deposits exceeding 40 percent in the first quarter. Mid-size regional lenders play a major role in originating commercial real estate loans in the U.S. and in New York City—Signature was prominent in the NYC multifamily market while First Republic specialized in high-end mortgages in the city—and it therefore remains important to monitor impacts on lending.

The evidence so far suggests that federal policymakers have ample tools to largely insulate the economy and the financial system from substantial harm from such flare-ups. The FDIC rapidly arranged First Republic’s sale to J.P. Morgan Chase, which seemingly mitigated any further spread of the crisis. These are stories of undercapitalization and mismanaged risks at selective institutions, and the government has been expanding its role as a lender of last resort and as a facilitator of private-sector correctives—both of which provide significant crisis containment.

All of this is not to say there are no real credit effects from these events. Indeed, bank credit downgrades have raised the costs of funds overall by as much as 100 basis points (1.00 percent), indirectly impacting the rates borrowers pay. This amplification of the Fed’s policy of intentionally raising rates is part of the reason the monetary authority appears ready to pause its hikes. The Fed’s Senior Loan Officer Opinion Survey on Bank Lending Practices is showing an elevated number of banks reporting tightening lending standards, although most of those banks answered “tightened somewhat” rather than “tightened considerably.” And measures of total bank credit have been turning downward. In sum, the balance sheet crises at a certain number of regional banks are having a tightening effect, but so far it appears modest, and perhaps corrective, and not a credit “crunch” such as was seen last in 2008.

It is most likely that the lasting impact of these crises will come in the next major overhaul of banking regulation—when it will be recognized that the government is now implicitly underwriting commercial banks beyond those considered systemically important.

Inflation

Although inflation is moderating in both the U.S. and the New York City area, as seen in Chart 1, and trending in the right direction in most categories of goods and services, price growth remains far above the Federal Reserve’s target of 2 percent. The April headline Consumer Price Index (CPI) 12-month growth rate fell to 4.9 percent in the U.S. and to 3.7 percent in the New York City area. Inflation peaked in June 2022 at 9.1 percent nationally and 6.7 percent in the New York City area. The Federal Reserve’s preferred gauge (the core Personal Consumption Expenditures, or PCE, price index) stood at 4.6 percent year-over-year in March. CPI grew at a slower rate in the NYC area than in the U.S. since January 2021, with the differential widening to 2.5 percentage points in the first quarter of 2022. The rates have more recently converged. In the first quarter of 2023, the differential averaged 0.3 percentage points.

Chart 1. U.S. and NYC Area CPI (12-Month Percent Change)

SOURCE: Bureau of Labor Statistics

Locally, increased housing price inflation over the past year has masked what has been a stronger deceleration in other prices. As shown in Chart 2, shelter inflation in the New York City area—which captures housing costs of all types—remained near 6 percent in the first quarter of 2023. This is in sharp contrast with all other items in the basket, for which CPI inflation dropped to 2.5 percent in March (notably, motor fuel posted a 15.3 percent decline over the year).

Chart 2. NYC Area CPI Shelter vs. All Other Items (12-Month Percent Change)

SOURCE: Bureau of Labor Statistics

Corroborating this data on housing costs, median asking rental rates for one-bedroom apartments in New York City on StreetEasy.com have increased by 20 percent over the past year, as seen in Chart 3. This rise has been accompanied by a relatively low inventory of available apartments—averaging below 30,000 over the past 12 months compared to a nearly 40,000 average from 2015 through 2019 (a 25 percent decline).

Chart 3. NYC Rental Housing Inventory and Median One-Bedroom Asking Rent

SOURCE: StreetEasy.com

Labor Markets

After fully recovering from pandemic-era declines, and a year-plus into a period of contractionary monetary policy intended to curb a spike in inflation, the U.S. job market continues to show resilience, with 253,000 jobs added in April and the unemployment rate dropping to 3.4 percent (its lowest since May 1969). Average hourly earnings in April grew 4.4 percent over the year and the March Wages and Salaries component of the Employment Cost Index came in at 5.0 percent over the year.

But despite the low unemployment rate and continued wage and job growth, there are signs suggesting that labor markets are not tight: Job openings and quitting rates have both fallen significantly in recent months without an accompanying rise in the unemployment rate. This loosening of the job market likely portends a future reduction in wage growth and gives credence to the hope that the Fed can engineer a “soft-landing” reduction of inflation without an economic recession.

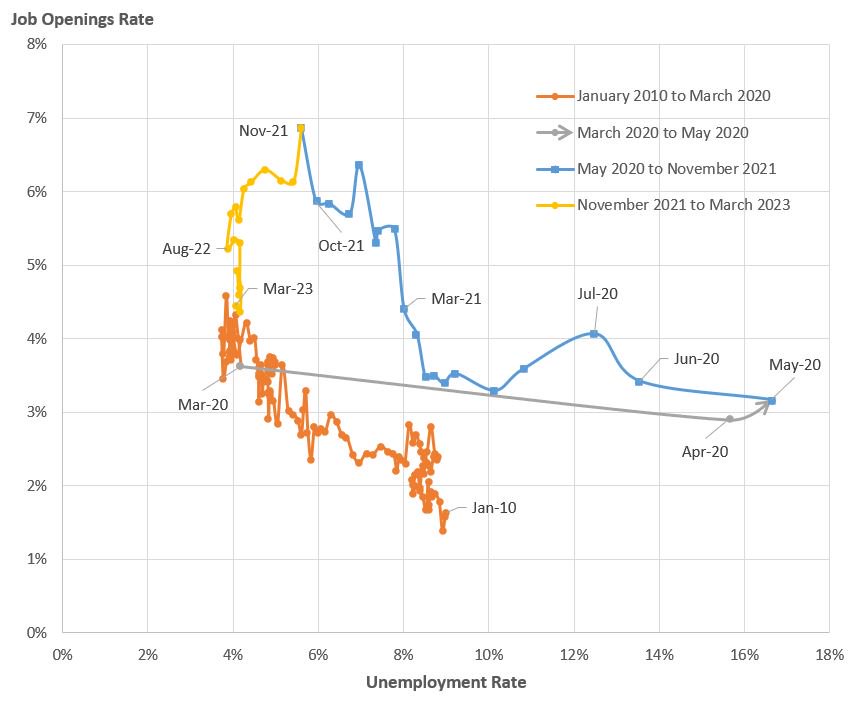

In New York State, the March job openings rate has already fallen to 4.5 percent of the labor force, a level consistent with earlier non-inflationary times (note that job openings data are not available below the state level, but New York City contains close to half of all employment statewide). Chart 4 shows the relationship between the job openings rate and the unemployment rate in New York State. Historically, downward movement in job openings rates is almost always associated with rising unemployment rates. This inverse correlation can be seen in the orange line which maps the relationship of the two rates between 2010 and early 2020. At the onset of the pandemic, in April 2020, the unemployment rate suddenly spiked (the grey line) as businesses shuttered temporarily, going far off the line that had previously prevailed. In the following year-and-a-half, unemployment fell steadily and the job openings rate rose commensurately (blue line), pushing job openings rates to unprecedented highs. These high openings rates were of great concern as they were likely to lead to rapid wage growth that, in turn, would fuel inflation. And the only way down appeared to include a rise in the unemployment rate, if this historic relationship still held. But in this unique case, the job openings rate in New York State has been falling for 15 months without any significant rise in the unemployment rate (yellow line).

Chart 4. Job Openings Versus Unemployment in New York State

SOURCE: Bureau of Labor Statistics and NYC Office of the Comptroller

One part of the unusual labor market story in New York City has been a rise in the labor force. As seen in Chart 5, the City’s labor force has grown by 0.2-0.3 percent per month over the last eight months, for a cumulative total of 2.0 percent (83,000 workers). Such a pattern is usually seen in a recovery from a recession with high unemployment, with previously discouraged workers re-entering the employment and job-seeking pools as signs of a better labor market. Unlike a labor force contraction during a typical recession, which is largely a consequence of discouraged workers, the labor force reduction following the onset of the pandemic was caused by a temporary combination of home care needs, health concerns, and new forms of financial assistance. Recent labor supply increases appear to be the partial unwinding of those developments.

Chart 5. New York Labor Force and Unemployment Rate

SOURCE: New York State Department of Labor

NYC Employment

New York City private-sector employment rose by 190,000 jobs from March 2022 to March 2023, a 5 percent gain in payrolls that has returned the count to 99.7 percent of its pre-pandemic level from February 2020 (on a seasonally adjusted basis). However, the jobs recovery has been differently experienced across the city’s industries. Certain sectors have already significantly surpassed 100 percent of their pre-pandemic level—such as health care and social assistance (110 percent of pre-pandemic), and office-based employers in finance, information, and professional and business services (all at least 101 percent of pre-pandemic). At the same time, jobs in accommodation and food service (94 percent of pre-pandemic), construction (92 percent), retail (88 percent), and arts and entertainment (86 percent) lag their earlier levels. Table 6 shows New York City employment numbers as of March 2023. April payroll counts just released by the State show a decline of 16,000 jobs in NYC on a seasonally adjusted basis, with the largest declines in transportation and warehousing (8,800) and information technology (4,500).

Table 6. New York City Employment, Pre-Pandemic vs. Current

| (in thousands) | Seasonally Adjusted NYC Employment | March 2023 Change From | Mar. ’23 as a % of | |||||

| Industry: | Feb. ’20 | Apr.’20 | Mar. ’22 | Mar. ’23. | Feb. ‘20 | Apr. ‘20 | Mar. ’22 | Feb. ’20 |

|---|---|---|---|---|---|---|---|---|

| Total Non-Farm | 4,702.6 | 3,746.0 | 4,476.6 | 4,672.0 | (30.5) | 926.0 | 195.4 | 99.4% |

| Total Private | 4,108.1 | 3,161.7 | 3,907.4 | 4,097.1 | (11.0) | 935.4 | 189.7 | 99.7% |

| Financial Activities | 487.1 | 469.1 | 477.6 | 495.8 | 8.7 | 26.7 | 18.2 | 101.8% |

| Information | 229.2 | 204.2 | 234.0 | 235.3 | 6.1 | 31.1 | 1.3 | 102.7% |

| Professional and Business Services |

781.3 | 688.1 | 764.4 | 792.0 | 10.7 | 103.9 | 27.6 | 101.4% |

| Educational Services | 256.4 | 229.4 | 255.3 | 258.7 | 2.3 | 29.3 | 3.3 | 100.9% |

| Health Care and Social Assistance |

823.5 | 707.5 | 832.1 | 907.4 | 83.9 | 199.9 | 75.3 | 110.2% |

| Arts, Entertainment, and Recreation |

95.7 | 50.7 | 74.7 | 82.6 | (13.1) | 31.9 | 7.9 | 86.3% |

| Accommodation and Food Services |

374.4 | 105.8 | 307.8 | 350.6 | (23.8) | 244.8 | 42.8 | 93.6% |

| Other Services | 196.1 | 129.2 | 176.7 | 185.3 | (10.8) | 56.1 | 8.6 | 94.5% |

| Retail Trade | 346.1 | 230.3 | 307.0 | 305.1 | (41.0) | 74.8 | (1.9) | 88.2% |

| Wholesale Trade | 139.8 | 108.3 | 129.6 | 131.4 | (8.4) | 23.1 | 1.7 | 94.0% |

| Transportation and Warehousing |

134.9 | 98.8 | 132.6 | 131.8 | (3.1) | 33.0 | (0.8) | 97.7% |

| Construction | 162.6 | 87.7 | 143.7 | 149.8 | (12.8) | 62.1 | 6.1 | 92.1% |

| Manufacturing | 66.0 | 37.8 | 57.1 | 56.9 | (9.0) | 19.1 | (0.2) | 86.3% |

SOURCE: New York State Department of Labor, Mayor’s Office of Management and Budget

The Comptroller’s Office’s economic forecast projects New York City employment slowing its growth to 1.9 percent in calendar year 2023, 0.7 percent in 2024, and 1.3 percent in 2025-2027. Our forecast contains expected 2023 declines in employment in two high-wage sectors—securities and information technology, as well as indirect job-loss effects on other sectors emanating from the changes in these two industries.

The Comptroller’s Office expects that securities firms are currently reducing or planning reductions in their New York City employment, in response to diminished profits. Many of these reductions may not yet be showing up in the most recent employment data because of severance arrangements that formally delay removal from payrolls. The Comptroller’s Office projections reduce NYC securities employment by 6,000 (3 percent) over the course of 2023.

Nationwide, the information technology sector has been announcing payroll reductions. The sector, which employed 15,000 more people in New York City in 2022 than in 2019, already shed a net of 4,000 jobs in the city this year. The Comptroller’s Office expects a cumulative decline of 7,500 by the end of 2023. April 2023 payroll counts just released show an additional monthly decline of 4,500 for the information technology industry.

OMB’s New York City total employment forecast grows by 1.7 percent annually, on average, through 2027. In contrast, the Comptroller’s Office forecasts that relatively little post-pandemic employment recovery remains and assumes that—after a brief slowdown in 2023-24—overall New York City employment resumes growing at a historically typical rate of 1.2 percent.

Consumer Spending and Taxable Sales

Newly released data on taxable sales through February 2023 allows a preliminary analysis of consumer spending in New York City three years into the COVID-19 pandemic. Chart 6 contains an index of taxable sales to equal 100 in the first quarter of 2020. In the initial quarters of the COVID-19 pandemic, taxable sales surged in the parts of the New York Metropolitan Statistical Area (MSA) outside city limits, while they remained well below pre-pandemic levels in the city itself. This is consistent with an outflow of city residents and far fewer office and other daily commuters into the city. More recently, the gap in spending between New York City and its suburbs appears to be narrowing. NYC taxable sales in the first quarter of 2023 were 14.2 percent higher than three years prior, as compared with 16.7 percent higher in the inner MSA and 20.6 percent higher in the outer MSA.

Chart 6. Taxable Sales in NYC and the MSA

SOURCE: New York State Department of Taxation and Finance, Office of the New York City Comptroller. Inner MSA includes Long Island and the Lower Hudson Valley (Putnam, Rockland, and Westchester counties). Outer MSA includes the Mid-Hudson Valley (Dutchess, Orange, Sullivan, and Ulster counties).

NYC Real Estate Markets

After two years of post-pandemic recovery, office attendance in NYC appears to have reached a tentative steady state, with pandemic-accelerated remote and hybrid work patterns now expected to continue indefinitely. Card-swipe entry data from Kastle Systems are indicating stability in the rate of utilization of NYC office space in this year to date—a rate that averages 47 percent of its pre-pandemic usage levels. Other cities around the U.S. are also showing stabilizing preferences for physically reporting to the office in the Kastle data, but at different levels—for example, the technology-oriented San Jose area has stabilized at under 40 percent office attendance while Houston, a city with a greater intensity of professional and business services, has stayed near 60 percent. Corroborating this data for NYC is a February survey of office-based employers by Partnership for New York City which indicates that current office attendance averages 52 percent, not far below the employers’ expected “new normal” of 56 percent.

Diminished utilization of offices may foreshadow lower demand for leased space in the future. Long-term leases prevalent in much of the office market may spread the effects of such reduced demand over many years. But as can be seen in Chart 7, the most recent data on volume of leasing indicate that after having only partially recovered from its pandemic low point, NYC office leasing activity has declined in the past two quarters, especially for Class A office space.

Chart 7. NYC Office Leasing Activity by Class

SOURCE: CoStar

Risks to the Forecast

Despite the Comptroller’s Office’s forecast that a recession is not very likely, it remains a possibility in an uncertain economy. The consensus among economists is that the economy will shrink starting next quarter. Significant risk arises from tightening monetary policy. Inflation remains elevated and the Fed has made its intentions clear that it will raise rates further and risk a recession if inflation is not kept in check. Even though the “soft landing” scenario remains intact thus far, an increase in wage and price growth rates could alter the near-term economic outlook significantly. Due to the strength of payroll jobs, consumer spending, and core services inflation, a “no landing” scenario has started to emerge, where the Fed needs to raise rates more to tighten financial conditions and slow down demand. However, the turmoil in the banking sector and the associated tightening of credit standards have made this scenario less likely.

Negotiations regarding the U.S. debt ceiling could also generate market volatility. The Secretary of the Treasury recently informed Congress that, because of lower tax receipts, the Federal government is projected to hit the debt limit earlier than previously thought, potentially as early as June 1. The Fed’s chair remarked that breaching the debt limit would have “highly uncertain” and “averse” consequences on the U.S. economy, which the Fed may not be able to counter.

At the New York City level, an additional risk derives from the possibility of deeper job losses in the securities and tech sectors, and in overall office-using employment. Higher interest rates (especially long-term rates) and stagnating or declining leasing activity could exacerbate financial stress for commercial real estate. Widespread monetary tightening and supply shocks at a global level could also slow down the recovery of international travel and tourism spending.

III. The FY 2024 Executive Budget and April 2023 Financial Plan

Overview: Changes to FY 2023 and FY 2024

FY 2023 Budget

The FY 2023 Budget in the April 2023 Financial Plan totals $108.91 billion, an increase of $2.52 billion from the January Plan. The increase is the result of $2.25 billion more in anticipated City-funded revenues and $1.06 billion in additional State grants, offset by a $658 million reduction in Federal funding (including unrestricted grants).

The majority of the increase in City-funded revenues comes from upward revisions for nearly all the City’s major tax sources, resulting in an increase of $2.09 billion in forecasted tax revenues compared to the January Plan. Projections for miscellaneous revenue, from things like fines and fees also increased. The largest single source of the increase in State funding ($438 million of the $1.06 billion FY 2023 increase) reflects the Enacted State Budget’s action to provide the City with funding to help cover the cost of shelter for people seeking asylum in the City. In prior plans, the City had budgeted $1 billion in Federal funds to pay for these costs. This Federal support was removed in the April Plan for FY 2023, leading to the overall drop in Federal funding. This decline was offset somewhat by smaller increases in other Federal programs.

On the City-funded expenditure side, the largest change for FY 2023 comes from the addition of $2.29 billion to the City’s labor reserve to fund contract settlements for the City’s workforce. The City also budgeted $962 million of its own funds to cover costs of services and shelter for people seeking asylum, given the rising costs and lack of Federal aid expected this year. Another $815 million was added in agency expenditures. To help cover these increased expenditures the City drew down nearly all its budgeted reserves ($1.50 billion from the General Reserve and $250 million from the Capital Stabilization Fund). This leaves a balance of $50 million in the General Reserve remaining for FY 2023. Savings from the City’s PEG program increased by $417 million.

The City also added $868 million in surplus FY 2023 resources to the Budget Stabilization Account to pre-pay FY 2024 debt service and close that year’s budget gap.

FY 2024 Budget

The FY 2024 Budget in the April Plan totals $106.69 billion, the largest Executive Budget in the City’s history. It reflects a $4.03 billion increase over the January Plan. More than half of this increase comes from revisions in City-funded revenues, which are $2.43 billion higher than planned in January. As for FY 2023, the City increased projections for all its major tax sources, except for the mortgage recording tax (no change). Non-City funding sources increased by $1.60 billion, including the addition of $926 million in Federal grants and $630 million in State grants. The increase in non-City funds is largely due to expected funding to help pay for costs of services to people seeking asylum, with $600 million budgeted to come from Washington in FY 2024 and $562 million from Albany.

City-funded expenditures for FY 2024 increased by $3.30 billion compared to the January Plan. Just over half of this increase ($1.74 billion) is budgeted to cover costs related to services for people seeking asylum in the City’s care. The increase also includes $1.68 billion for the City’s labor reserve for contract settlement costs. Other City-funded agency expenditures increased by $959 million. These increases are offset by $863 million in additional PEG savings, as well as $216 million in debt service savings and other adjustments. As mentioned above, the City has budgeted $868 million in FY 2023 resources to pre-pay FY 2024 debt service costs, closing the FY 2024 budget gap.

Table 7. Changes to FY 2023 and FY 2024 City-Funds Estimates

from the January 2023 Plan

| ($ in millions) | FY 2023 | FY 2024 |

| Gap to be Closed – January 2023 Plan | $0 | $0 |

| Revenues | ||

| Tax Revenues | $2,086 | $2,238 |

| Non- Tax Revenues | 118 | 98 |

| Unrestricted Governmental Aid | 37 | 0 |

| Revenues From PEGs | 9 | 98 |

| Total Revenue Changes | $2,250 | $2,434 |

| Expenditures | ||

| Agency Expenditures | $815 | $959 |

| Asylum Seekers | 962 | 1,738 |

| Federal Funding Adjustment | 0 | (130) |

| Labor Reserve | 2,288 | 1,684 |

| Savings from PEGs | (417) | (863) |

| Debt Service | (111) | (86) |

| General Reserve | (1,505) | 0 |

| Capital Stabilization Fund | (250) | 0 |

| Prior Payables | (400) | 0 |

| Total Expenditure Changes | $1,382 | $3,302 |

| Gap To Be Closed Before Prepayments | $868 | ($868) |

| FY 2023 Prepayment of FY 2024 Debt Service | ($868) | $868 |

| Gap to be Closed – April 2023 Plan | $0 | $0 |

Program to Eliminate the Gap (PEG)

The April 2023 Financial Plan PEG totals $4.81 billion over the five years of the Plan period: $541.1 million in FY 2023, $1.05 billion in FY 2024, $1.11 billion in FY 2025, $1.09 billion in FY 2026, and $1.02 billion in FY 2027.

A partial vacancy restoration at the Departments of Social Services, Housing Preservation and Development, and Finance offset the PEG by $4.4 million in FY 2023 and restored 393 positions.

Combined with PEG initiatives from the November and January Plans, the savings sum to $13.66 billion over the Plan period. The largest categories of savings over the budget cycle are in expense re-estimates ($4.17 billion), an area that covers spending needs below anticipated amounts, lower usage rates, efficiencies, funding re-allocations, and expense-to-capital swaps.

Savings associated with personnel – including headcount reductions, fringe funding reductions, personnel savings not requiring headcount reductions, and accruals – make up $3.75 billion of the savings over the three programs. Over a third of this amount ($1.29 billion) represents vacancy reductions, with 4,496 city-funded positions slated to be cut as a result of the Administration’s PEG actions in FY 2024. Another $581.7 million of the personnel savings impacts fringe benefits across the Plan period, including reductions tied to headcount decreases ($465 million) and funding shifts to other sources of revenue ($116.7 million).

Separately, $2.12 billion of the PEG items (including some that are associated with personnel costs) are flagged as possible program impact actions – these are items that have the potential to directly impact service delivery.

Table 8. Cumulative PEGs Across the Budget Cycle

| Category | FY 2023 | FY 2024 | FY 2025 | FY 2026 | FY 2027 |

| April 2023 Financial Plan | |||||

| Debt Service | ($110,700,499) | ($85,569,936) | ($89,330,762) | ($70,150,209) | ($41,672,966) |

| Expense Re-Estimate | ($270,806,608) | ($448,129,011) | ($504,493,868) | ($544,552,662) | ($543,294,899) |

| Possible Program Impact | ($10,000,000) | ($138,884,391) | ($131,187,324) | ($128,218,530) | ($130,218,524) |

| PS Savings | ($17,400,000) | ($234,788,372) | ($248,899,132) | ($212,838,857) | ($181,266,196) |

| Revenue | ($132,156,685) | ($139,401,032) | ($133,108,206) | ($133,164,138) | ($127,814,138) |

| April 2023 Financial Plan Total | ($541,063,792) | ($1,046,772,742) | ($1,107,019,292) | ($1,088,924,396) | ($1,024,266,723) |

| January 2023 Financial Plan | |||||

| Debt Service | ($616,957) | ($53,812,000) | ($79,819,057) | ($98,664,469) | ($111,802,343) |

| PS Savings | ($144,597,385) | ($285,047,311) | ($291,594,235) | ($295,592,072) | ($299,626,167) |

| Revenue | ($65,328,000) | ($1,700,000) | ($1,700,000) | ($1,700,000) | ($1,700,000) |

| January 2023 Financial Plan Total | ($210,542,342) | ($340,559,311) | ($373,113,292) | ($395,956,541) | ($413,128,510) |

| November 2022 Financial Plan | |||||

| Debt Service | ($83,297,519) | ($116,163,806) | ($147,652,118) | ($158,593,298) | ($244,103,734) |

| Expense Re-Estimate | ($126,426,331) | ($337,193,520) | ($433,520,680) | ($477,893,767) | ($484,938,396) |

| Possible Program Impact | ($61,007,001) | ($373,974,503) | ($405,132,687) | ($372,021,785) | ($370,825,074) |

| PS Savings | ($366,431,053) | ($349,123,202) | ($290,620,868) | ($263,352,741) | ($254,383,677) |

| Revenue | ($278,885,567) | ($437,631,050) | ($239,631,723) | ($226,926,474) | ($217,585,625) |

| November 2022 Financial Plan Total | ($916,047,471) | ($1,614,086,081) | ($1,516,558,076) | ($1,498,788,065) | ($1,571,836,506) |

| Total PEG Impact November 2022, January 2023, April 2023 | |||||

| ($1,667,653,605) | ($3,001,418,134) | ($2,996,690,660) | ($2,983,669,002) | ($3,009,231,739) | |

SOURCE: Office of the New York City Comptroller, Mayor’s Office of Management and Budget

NOTE: Does not include $4,361,500 in FY 2023 partial vacancy restorations.

The April Program to Eliminate the Gap

OMB’s request for agencies to submit PEG proposals came just weeks before the release of the April Plan. The Administration cited cost concerns associated with collective bargaining and the city’s response to the influx of people seeking asylum in the City as reasons necessitating a savings program. Most agencies were required to submit a 4 percent reduction in their FY 2024 and outyear budgets. The DOE and CUNY were required to submit reductions of 3 percent. Agencies were also instructed to avoid layoffs and, where feasible, limit cuts that may impact service delivery.

Possible Program Impact

Many of the proposed initiatives seem to indicate that agencies have begun to pass on savings to contracted providers, likely forcing them to implement reductions. The Department of Homeless Services (DHS) included a “Provider Flexibility Funding” savings of $29.1 million in FY 2024 and the outyears that calls for contracted providers to reduce their budgets by 2.5 percent, with providers given some additional flexibility on salaries and staffing rules. The Department of Social Services (DSS) also submitted a provider flexibility savings of $3 million in FY 2024 and out, as well as a larger $9 million savings associated with the in-housing of various substance use treatment services. The Department of Correction (DOC) provided a savings of $17 million in FY 2024 and the outyears for the insourcing of contracted services including programmatic contractors.

Other concerning items include stated savings from reduced spending despite evidence of increased need:

- A reduction in home delivered meals ($5 million in FY 2024 and out) and Older Adult Center meals ($7 million in FY 2024 and $5.6 million in FY 2025 and out) due to less usage than expected at the Department for the Aging. This comes despite the Administration’s latest Mayor’s Management Report (MMR) highlighting that over 2.5 times as many meals have been served during the first four months of FY 2023 compared to the same time period in FY 2022.[3]

- Budgeted declines in spending for youth workforce programs ($9.1 million in FY 2024, $8.8 million in FY 2025 and out) at the Department of Youth and Community Development, even though the MMR showed growing programmatic participation.[4]

- Expense re-estimates at the Department of Housing Preservation and Development (HPD) for supportive housing rental assistance programs ($500,000 in FY 2023, $5.2 million in FY 2024, $8.2 million in FY 2025, $6.4 million in FY 2026, and $300,000 in FY 2027) despite completing more units of supportive housing.[5]

- Less spending on “traffic studies, data collection, and materials” at the Department of Transportation (DOT) ($23.4 million in FY 2024, $19.6 million in FY 2025, $18.1 million in FY 2026, and $20.1 million in FY 2027).

The Young Men’s Initiative, a public-private partnership started in 2011 (and greatly expanded during the de Blasio Administration) to address disparities among Black and Latino men between 16 and 24 continues to be incrementally reduced in the April Plan, losing $4.2 million in funding (just over $1 million baselined from FY 2024 onwards) across five agencies. The cumulative reduction over the three PEG plans for this program is $11.5 million from FY 2023 through FY 2027 across eight agencies.

Vacancy Reductions

In total, there were 122 City-funded vacancy reductions in the April Plan (160 cuts offset by 38 adds). Agencies with the largest reductions in planned positions included the Department of Sanitation (DSNY) with 76 uniformed reductions (33 in solid waste management, 24 in precision cleaning, 19 uniformed positions in administrative roles), the Department of Health and Mental Hygiene (DoHMH) with 33 reductions across divisions, DOT shifted 17 positions to state and Federal funding sources.

Efficiency Savings

Key efficiency savings in the April Plan include planned citywide wireless savings at the Office of Technology and Innovation (OTI, previously the Department of Information Technology and Telecommunications, DoITT) resulting from the discontinued use of devices and consolidation of wireless carriers ($20.3 million in FY 2024, $20.9 million in FY 2025, and $20.8 million in both FY 2026 and FY 2027) and technology-related funding efficiencies at DSS ($1 million in FY 2024 and out). This an example of the kind of cost-saving efficiency that could be explored and expanded into other areas of the City budget.

Uniformed Agency Offsets

The current PEG continues a pattern started in November of offsetting savings in the City’s uniformed agencies with other adjustments resulting in no actual budget reduction for these items, although they are counted in the PEG totals:

- The New York Police Department’s (NYPD’s) overtime reduction savings are offset by the same amount in adjustments elsewhere in the budget every fiscal year ($4 million in FY 2024 and out). NYPD school safety division personnel savings are offset by the same amount in every fiscal year ($59.9 million across the Financial Plan period). Interestingly, vacancy reductions associated with part-time school crossing guards in the amount of $7.5 million in FY 2024 and out were not offset by any other adds.

- The Fire Department (FDNY) saw similar offsets, with training savings ($1.6 million in FY 2024 and out), a reduction in help desk spending ($838,000 in FY 2024), and increased revenue from higher Medicare ambulance rates ($4.5 million in FY 2024 and out) completely offset by other City funds.

- DOC also saw a large offset in the outyears: $30 million in uniform overtime based on the closure of Rikers Island proposed but then also reversed with other adjustments in FY 2026 and FY 2027.

- Lastly, DSNY saw its savings of $6.7 million a year from FY 2024 and out from canceling annual snow removal training offset by the same amount in other adjustments.

S(no)w Future?

DSNY included snow removal savings of $45 million for the current fiscal year due to the lack of snow this winter. The City Charter sets the snow removal budget for a given fiscal year at the average of the five preceding fiscal years. Hence, a reduction of $904,000 in FY 2024, and an $11.8 million savings in the outyears.

Revenue and Other Considerations

The largest revenue item in the April Plan’s PEG (excluding rolls of prior year revenue into FY 2023) is NYPD’s increase in parking summons revenue based on headcount, deployment, and productivity, resulting in a gain of $30 million of revenue per year from FY 2024 and onwards. Similarly, DSNY includes $7.5 million in increased revenue annually beginning in FY 2024 resulting from alternate side parking summonses. DoHMH plans to “maximize several revenue sources agencywide” to bring in $7.5 million a year beginning in FY 2024—in areas as diverse as school-based nursing, mental health, building assessment, and health administration. Shifts to either State or Federal grant funding from City funds represent $24.5 million in FY 2024, $24.8 million in FY 2025, $22.4 million in FY 2026, and $20.4 million in FY 2027.

Risks and Offsets

The April 2023 Financial Plan, as required by law, presents a balanced budget in FY 2023 and FY 2024. It projects gaps of $4.20 billion in FY 2025, $5.95 billion in FY 2026, and $6.98 billion in FY 2027.

The Comptroller’s Office restates the City’s gaps and surpluses based on its own estimates of City revenues and expenditures; projected risks increase City gaps and offsets reduce them. In FY 2023, the Comptroller’s Offices projects that the City will end the year with a surplus of $1.69 billion, based on higher than anticipated revenues and somewhat lower expenditures than those forecast by the Administration. Given the uncertainty around the costs of services and shelter to people seeking asylum, the Comptroller’s Office presents its restated gaps in FY 2024 through FY 2027 with and without its projections of increased costs for this population.

If these costs remain within the levels currently budgeted by the City and all Federal and State reimbursement for these costs comes in as expected, the Comptroller’s Office estimates that FY 2024 will end with a gap of $2.14 billion and that outyear gaps will be higher than the City’s estimates: with a $6.45 billion gap projected for FY 2025, a $9.05 billion gap in FY 2026, and $10.38 billion gap in FY 2027. These differences result from higher revenue projections by the Comptroller’s Office in each year that are outstripped by even greater expenditure risks.

If the number of people seeking asylum in shelter and average daily cost to provide shelter exceeds levels currently projected by the City—and if not all non-City reimbursement comes in as currently projected—the Comptroller’s Office estimates that the City’s overall budget gaps would grow to $3.29 billion in FY 2024, $9.39 billion in FY 2025, $12.70 billion in 2026, and $14.03 billion in FY 2027. The City has not budgeted any funds for these costs in FYs 2026 and 2027, leading to the greater than $3 billion difference between the Comptroller’s Office’s two sets of estimates of gaps in those years. (See City Services for People Seeking Asylum section of this report for the Comptroller’s Office’s estimates of the possible increased costs).

Table 9. Risks and Offsets to the April 2023 Financial Plan

$ in millions, positive numbers decrease the gap and negative numbers increase the gap

| FY 2023 | FY 2024 | FY 2025 | FY 2026 | FY 2027 | |

| City Stated Gap | $0 | $0 | ($4,196) | ($5,952) | ($6,977) |

| Tax Revenues | |||||

| Property Tax | $90 | ($24) | $513 | $663 | $1,384 |

| Personal Income Tax | 590 | 410 | 124 | 99 | (245) |

| Business Taxes | 297 | (359) | (451) | (188) | (49) |

| Sales Tax | 71 | 235 | 151 | 60 | (9) |

| Real Estate Transaction Taxes | 43 | (45) | 228 | 188 | 3 |

| All Other | (1) | (8) | 40 | 67 | 70 |

| Audit | 100 | 179 | 179 | 179 | 179 |

| Subtotal Tax Revenues | $1,191 | $388 | $784 | $1,068 | $1,333 |

| Miscellaneous Revenues | ($89) | $67 | $65 | $49 | $34 |

| Total Revenues | $1,102 | $455 | $849 | $1,117 | $1,367 |

| Expenditures | |||||

| PS Accrual Savings | $725 | $362 | $0 | $0 | $0 |

| Temporary and Professional Services | 0 | (155) | 0 | 0 | 0 |

| Overtime | (282) | (538) | (440) | (440) | (440) |

| Education | (210) | (822) | (1,069) | (1,997) | (2,720) |

| Public Health Corps | 0 | 0 | (13) | (49) | (49) |

| Public Assistance | 0 | (225) | (225) | (225) | 0 |

| Rental Assistance | 0 | (392) | (392) | (392) | (392) |

| Payroll Mobility Tax | 0 | (65) | (69) | (72) | (73) |

| Contributions to MTA | 25 | (298) | (442) | (450) | (497) |

| Prevailing Wage for Shelter Security Guards | 0 | (55) | (55) | (55) | (55) |

| Foster Care Reimbursement Rate | 0 | (118) | (118) | (118) | (118) |

| Variable Rate Debt Service Savings | 40 | 0 | 0 | 0 | 0 |

| Court Appointed Counsel | 0 | (42) | (42) | (42) | (42) |

| Minimum Wage Increase | 0 | (8) | (21) | (30) | (38) |

| State Intercept of ACA eFMAP Savings | 0 | (129) | (214) | (343) | (343) |

| PHE eFMAP Savings | 285 | 48 | 0 | 0 | 0 |

| City Settlements | 0 | (157) | 0 | 0 | 0 |

| Total Expenditures | $583 | ($2,594) | ($3,100) | ($4,214) | ($4,767) |

| Comptroller’s (Risks)/Offsets | $1,685 | ($2,138) | ($2,251) | ($3,097) | ($3,399) |

| Restated (Gap)/Surplus | $1,685 | ($2,138) | ($6,447) | ($9,049) | ($10,376) |

| Asylum-Seeker Re-estimate | |||||

| Projected Risk | $0 | ($1,150) | ($2,940) | ($3,650) | ($3,650) |

| Restated (Gap)/Surplus w/ Asylum-Seeker Re-estimate | $1,685 | ($3,288) | ($9,387) | ($12,699) | ($14,026) |

SOURCE: Office of the New York City Comptroller

NOTE: Numbers may not add to totals due to rounding.

Revenue

The Comptroller’s Office anticipates tax and miscellaneous revenues will come in higher than the City’s projections in each year of the Plan – by $1.10 billion in FY 2023, $455 million in FY 2024, $849 million in FY 2025, $1.12 billion in FY 2026, and $1.37 billion in FY 2027.

Most of this difference come from higher tax revenue forecasts in each year of the Plan. In FY 2023 the Comptroller’s Office projects $1.19 billion in additional taxes compared with the City, nearly half of which comes from higher forecast personal income tax/pass-through entity tax projections. The difference between the Comptroller’s Office’s and the City’s total tax forecast shrinks in FY 2024 to $388 million before growing to $784 million in FY 2025, $1.07 billion in FY 2026, and $1.33 billion in FY 2027.

Miscellaneous revenues show a slight risk in FY 2023 due to the possible non-payment from the City’s vendor for bus shelter advertising. In all other years of the Plan, the Comptroller’s Office estimates Miscellaneous revenues will come in higher than in OMB’s assumptions, due to higher forecasts of interest rates and fines.

Expenditures

The Comptroller’s Office estimates expenditures will be higher than those reflected in the April Plan in each year, except for FY 2023. In FY 2023, expenditures are anticipated to total $583 million less than projected by the City. In FY 2024, however, the Comptroller’s Office projects net expenditure risks of $2.59 billion, which grow to $4.77 billion in FY 2027. These risks, however, do not include the Comptroller’s estimate of greater-than-budgeted costs to provide services to people seeking asylum.

While the City has increased budgeted expenditures for services to people seeking asylum in the April Plan for FY 2023 through FY 2025, these funds may not be sufficient given both the growth in their population and the costs incurred thus far by the City to provide these services. In addition, the Comptroller’s Office anticipates that the City may not receive a substantial portion of the planned reimbursement from the Federal government ($400 million of $600 million in Federal funding budgeted in FY 2024) and the State government (all of the $290 million currently budgeted in FY 2025)—meaning those expenses would have to be paid with City funding. Lastly, the April Plan does not include funds for services to this population in FY 2026 and FY 2027. Together, these factors could lead to additional expenditure risks of $1.15 billion in FY 2024, $2.94 billion in FY 2025, and $3.65 billion in FYs 2026-2027. With these costs included, expenditure risks would total $3.29 billion in FY 2024 growing to $8.42 billion in FY 2027. (See the City Services for People Seeking Asylum section for more details on the calculation of these estimates.)

The Department of Education (DOE) poses the largest set of risks over the plan period. The Comptroller’s Office estimates DOE expenditures will be $210 million above what the City has budgeted for FY 2023, growing to $2.72 billion in FY 2027. These risks include the exhaustion of Federal COVID stimulus funding for programs that are expected to continue past their expiration (fiscal cliffs associated with Summer Rising, Special Education Pre-K Expansion, Universal 3-K, and Community Schools), as well the chronic underbudgeting for special education Carter Cases, pupil transportation, and charter schools. This includes the impact of the Enacted New York State Budget’s reauthorization of 14 “zombie” charter schools to replace those that closed or never opened. In addition, the April Plan does not include funding to address the State’s mandate to reduce class sizes, which will begin to be phased in the next school year. See the Department of Education section for a further discussion of these risks.

The City’s underbudgeting of ongoing support for the Metropolitan Transportation Authority (MTA) also poses a major risk. As part of the Enacted State Budget, the City’s contribution of MTA paratransit expenses increased from 50 percent to 80 percent for the next two years (with a limit of a $165 million increase in subsidy each year). However, the April Plan did not include enough funding to cover even the 50 percent cost. The City’s budgeted amounts for the operating subsidies to the MTA Bus Company and Staten Island Railway are also underestimated. The chronic underbudgeting for these subsidies, plus the increased cost for Paratransit due to the State budget action leads to a risk of $298 million in FY 2024, growing to $497 million in FY 2027 for the City’s contributions to the MTA. See the Metropolitan Transportation Authority section for a further discussion of these items.

Additional risks that result from changes made in the State budget, released after the April Plan, include the State intercepting Enhanced Federal Medical Assistance Percentage (eFMAP) funds historically passed on to localities to pay for services, as well as an increase in the Payroll Mobility Tax that the City must pay for its employees. See the Enacted State Budget section for a further discussion of these items.

Other risks include additional funding necessary to cover foster care reimbursement costs as mandated by the State— an $118 million ongoing cost that is only reflected in FY 2023 in the April Plan. The Comptroller includes this cost as a risk in FY 2024 through FY 2027. Similarly, while funding has been added to cover the growing cost of the City’s rental assistance programs in FY 2023, these increases have not been carried through the rest of the Plan period, resulting in risks of $392 million in FY 2024 forward. The City also continues to underbudget for overtime costs, which presents risks of $282 million in FY 2024 (of which $139 million in uniformed overtime), growing to $538 million in FY 2025 ($376 million in uniformed overtime) and $440 million in FY 2026-FY 2027 ($322 million in uniformed overtime).

In addition, the Comptroller’s Office has included estimates of settlement costs for two class action lawsuits against the Department of Correction in its risks. In 2022, the City reached a settlement in the Lynch class action case on behalf of former detainees whose releases had been delayed for hours or days after they made bail. Based on the number of claimants thus far, the Comptroller’s Office estimates a $82 million risk in FY 2024. In addition, the Comptroller’s Office includes a $75 million risk in FY 2024 for the Onaida class action case, which concerns the Department of Correction’s extended detention of inmates subject to ICE detainers beyond their scheduled release date.

One area where the Comptroller’s Office forecasts lower than City-budgeted expenditures is for non-overtime personnel costs. Due to lower-than-expected headcount, personnel costs are expected to total $725 million less than budgeted by the City in FY 2023 and $362 million in FY 2024.

Revenue Analysis

Tax Revenues

The Mayor’s April 2023 Plan revises expected local tax revenues upward by $2.1 billion in the current fiscal year (FY 2023) compared to the January 2023 Plan. This revision reflects FY 2023 collections that have significantly exceeded OMB’s prior published forecasts and include upward revisions to personal income tax (up $657 million, inclusive of PTET), sales tax ($331 million), business income taxes ($350 million), and property tax (up $155 million). Also increasing the total was a $479 million upward revision to City audits, which surged in January with a likely one-time occurrence yielding nearly $500 million in banking corporation tax.

Table 10 shows FY 2023 collections though March and compares these to the forecast full year revenues in the Mayor’s Executive Plan. Despite the large upward revision, the Mayor’s Plan still expects substantially lower revenue for the balance of this year than was collected during the same months in the prior fiscal year, down 40 percent. One significant reason for this decline is the introduction of the pass-through entity tax (PTET) for NYC during FY 2023, which is discussed below. While our estimates agree that net collections will fall during the rest of FY 2023—relative to FY 2022 and relative to the earlier part of this fiscal year—the Comptroller estimates about half as large a decline as the Mayor for remainder of the fiscal year.

Table 10. FY 2023 Projections in the Mayor’s April 2023 Plan

| Collected FY to-date through Mar. 2023 | FY 2023 to-date growth versus prior year | Forecast Full FY 2023 growth versus prior year | Forecast Remainder FY 2023 growth versus prior year | |||

|---|---|---|---|---|---|---|

| ($ in millions) | Mayor | Comptroller | Mayor | Comptroller | ||

| Total | $61,209 | 11% | 0% | 4% | (40%) | (23%) |

| Property tax | 30,807 | 8% | 6% | 7% | (35%) | (11%) |

| Non-Property Taxes | 30,402 | 12% | (1%) | 2% | (29%) | (21%) |

| Personal Income Tax* | 12,762 | 21% | (5%) | (1%) | (49%) | (39%) |

| Business Income Tax | 5,728 | 0% | (5%) | (1%) | (15%) | (4%) |

| Sales Tax | 7,075 | 15% | 11% | 12% | 0% | 3% |

| Real Estate Transaction Taxes | 1,722 | (29%) | (33%) | (31%) | (44%) | (39%) |

| All Other | 2,045 | 21% | 23% | 18% | 30% | 12% |

| NYC DOF Audits | 1,069 | 111% | 41% | 53% | (62%) | (32%) |

SOURCE: Office of the New York City Comptroller, Mayor’s Office of Management and Budget

* Includes Pass-Through Entity Tax (PTET)

Preliminary data are available for April 2023 tax collections, which are shown in Table 11.

Table 11. Tax Revenue Collections FY 2023 To-Date

| FY through March 2023 ($ in millions) | April 2023 (Preliminary) ($ in millions) | FY through April 2023 (Preliminary) ($ in millions) | FY 2022 Through April ($ in millions) | Difference ($ in millions) | Growth | |

| Total | $61,209 | $4,770 | $65,980 | $62,394 | $3,585 | 6% |

| Property Tax | 30,807 | 731 | 31,538 | 29,560 | 1,978 | 7% |

| Non-Property Taxes | 30,402 | 4,040 | 34,442 | 32,834 | 1,607 | 5% |

| Personal Income Tax* |

12,762 | 2,128 | 14,890 | 14,569 | 322 | 2% |

| Business Income Tax |

5,728 | 928 | 6,656 | 6,601 | 55 | 1% |

| Sales Tax | 7,075 | 704 | 7,779 | 6,836 | 944 | 14% |

| Real Estate Transaction Taxes | 1,722 | 138 | 1,861 | 2,645 | (785) | (30%) |

| All Other | 2,045 | 70 | 2,116 | 1,608 | 508 | 32% |

| NYC DOF Audits | 1,069 | 71 | 1,140 | 576 | 564 | 98% |

SOURCE: New York State Department of Taxation and Finance, Mayor’s Office of Management and Budget, Office of the New York City Comptroller

* Includes Pass-Through Entity Tax (PTET)

Table 12 shows the risks (subtractions) and offsets (additions) that relate our revenue forecast to the Mayor’s April Executive Plan. Table 13 compares growth rates for the taxes and Table 14 compares the levels of forecast tax revenue.

Table 12. Tax Revenues Risks and Offsets

| ($ in millions) | FY 2023 | FY 2024 | FY 2025 | FY 2026 | FY 2027 |

| Property Tax | $90 | ($24) | $513 | $663 | $1,384 |

| PIT/PTET | 590 | 410 | 124 | 99 | (245) |

| Business Taxes | 297 | (359) | (451) | (188) | (49) |

| Sales Tax | 71 | 235 | 151 | 60 | (9) |

| Real Estate-Related | 43 | (45) | 228 | 188 | 3 |

| Other | (1) | (8) | 40 | 67 | 70 |

| Audits | 100 | 179 | 179 | 179 | 179 |

| Total | $1,191 | $388 | $784 | $1,068 | $1,333 |

SOURCE: Office of the New York City Comptroller

Table 13. Comparison of Tax Revenue Projections: Growth Rates

| FY 2023 | FY 2024 | FY 2025 | FY 2026 | FY 2027 | FYs 2023 – 2027 Average Annual Growth | |

|---|---|---|---|---|---|---|

| Property | ||||||

| Comptroller | 7.0% | 2.3% | 1.5% | 1.3% | 4.0% | 2.3% |

| Mayor | 6.7% | 2.6% | (0.1%) | 0.8% | 1.9% | 1.3% |

| PIT/PTET | ||||||

| Comptroller | (1.0%) | (5.3%) | 3.8% | 3.5% | 4.1% | 1.5% |

| Mayor | (4.5%) | (4.4%) | 5.8% | 3.7% | 6.2% | 2.7% |

| Business | ||||||

| Comptroller | (1.1%) | (9.5%) | (0.9%) | 3.3% | 3.2% | (1.1%) |

| Mayor | (4.7%) | (1.5%) | 0.3% | (0.2%) | 1.3% | 0.0% |

| Sales | ||||||

| Comptroller | 11.6% | 5.0% | 4.6% | 4.7% | 3.5% | 4.4% |

| Mayor | 10.7% | 3.3% | 5.6% | 5.7% | 4.1% | 4.7% |

| Real Estate-Related | ||||||

| Comptroller | (31.4%) | (3.2%) | 21.0% | 3.1% | (0.5%) | 4.7% |

| Mayor | (32.7%) | 0.7% | 8.2% | 5.1% | 6.9% | 5.2% |

| All Other | ||||||

| Comptroller | 17.8% | 6.2% | 4.8% | 3.5% | 2.8% | 4.3% |

| Mayor | 17.8% | 6.5% | 3.2% | 2.7% | 2.8% | 3.8% |

| Audits | ||||||

| Comptroller | 53.1% | (30.8%) | 0.0% | 0.0% | 0.0% | (8.8%) |

| Mayor | 41.3% | (39.9%) | 0.0% | 0.0% | 0.0% | (12.0%) |

| Total Tax | ||||||

| Comptroller | 3.9% | (1.0%) | 2.9% | 2.6% | 3.6% | 2.0% |

| Mayor | 2.1% | 0.1% | 2.4% | 2.2% | 3.3% | 2.0% |

SOURCE: Office of the New York City Comptroller, Mayor’s Office of Management and Budget

Table 14. Comparison of Tax Revenue Projections: Levels

| ($ in millions) | FY 2023 | FY 2024 | FY 2025 | FY 2026 | FY 2027 | |

| Property Tax | Comptroller | $31,660 | $32,382 | $32,879 | $33,296 | $34,622 |

| Mayor | 31,570 | 32,405 | 32,366 | 32,633 | 33,238 | |

| PIT/PTET | Comptroller | 16,531 | 15,653 | 16,249 | 16,821 | 17,511 |

| Mayor | 15,941 | 15,243 | 16,125 | 16,722 | 17,756 | |

| Business Taxes | Comptroller | 8,137 | 7,361 | 7,294 | 7,538 | 7,777 |

| Mayor | 7,840 | 7,720 | 7,745 | 7,726 | 7,826 | |

| Sales Taxes | Comptroller | 9,533 | 10,007 | 10,471 | 10,965 | 11,343 |

| Mayor | 9,462 | 9,772 | 10,320 | 10,905 | 11,352 | |

| Real Estate-Related | Comptroller | 2,223 | 2,151 | 2,603 | 2,684 | 2,670 |

| Mayor | 2,180 | 2,196 | 2,375 | 2,496 | 2,667 | |

| Other | Comptroller | 2,894 | 3,074 | 3,222 | 3,336 | 3,431 |

| Mayor | 2,895 | 3,082 | 3,182 | 3,269 | 3,361 | |

| Audits | Comptroller | 1,300 | 900 | 900 | 900 | 900 |

| Mayor | 1,200 | 721 | 721 | 721 | 721 | |

| Total | Comptroller | $72,278 | $71,528 | $73,618 | $75,540 | $78,255 |

| Mayor | $71,088 | $71,139 | $72,834 | $74,472 | $76,921 |

SOURCE: Office of the New York City Comptroller, Mayor’s Office of Management and Budget

Property Tax

The Comptroller projects that property tax revenue for FY 2023 will total $31.7 billion, an increase of $67.7 million since our March forecast, primarily due to positive adjustments in the allowance for abatements and restoration of some exempted properties into the tax roll.

The Comptroller projects FY 2024 property tax revenue of $32.4 billion, an increase of 2.3 percent from the current fiscal year as assessments continue to recover from the reductions in the FY 2022 assessment roll. Revenue growth is projected to slow, growing at an average annual rate of only 2.2 percent through 2027, when property tax collections are expected to reach $34.6 billion.

The Comptroller’s property tax forecast exceeds OMB’s by $90.1 million in 2023, ($23.5) million in 2024, $513.1 million in 2025, $662.5 million in 2026 and $1.4 billion in 2027. For 2023 and 2024, the difference between the Comptroller’s and OMB’s revenue forecasts are due to the forecast of the reserve components of the property tax: cancellations, refunds, delinquencies, etc. The differences in 2025 and beyond are primarily the result of the Comptroller’s higher levy growth forecast compared to OMB’s: 2.2 percent versus 1.0 percent from 2024 to 2027.

Personal Income Tax

The Comptroller forecasts that the combined sum of collections for personal income tax (PIT) and the closely related pass-through entity tax (PTET) will be $16.5 billion in FY 2023, a decline of about 1.0 percent from FY 2022. This forecast is $1.1 billion higher than in March, reflecting non-withheld collections in the intervening months that have greatly exceeded expectations. Our new forecast is also $590 million above OMB’s most recent forecast despite OMB’s upward revision of $657 million in the April Plan.

The introduction of a pass-through entity tax (PTET) for NYC tax has disrupted the usual PIT collection patterns in FY 2023 and made it more difficult both for forecasters to anticipate collections and for the State income tax collectors to properly allocate income tax payments to the City. PTET allows partnerships and S-corporations, which ordinarily pass-through all their income pre-tax to partners and shareholders, to first pay NYC (and NYS) PTET as an entity. When subsequently filing, owners claim tax credits for these taxes already paid on their individual income tax returns. Although designed to be revenue neutral, the timing of payments and credits for the PTET’s first tax year (2022) are not in sync. Extra revenue arrived earlier in large end-of-year payments in 2022 and additional smaller but substantial payments were made through March 2023. The offsetting credits for these payments show up mostly in April as diminished final return payments, smaller estimated payments made with extensions, and larger refunds.

In January, OMB estimated that total PIT/PTET collections in the month of April would total $1.0 billion. In their April Plan, they revised this expectation up to $1.5 billion, with much of the change coming from a lowering of their refund estimate for the month. By the end of April, actual collections for the month were $2.1 billion. The biggest surprises relative to the OMB January Plan expectations were: (i) April estimated payments—over 90 percent of which were extension payments—coming in nearly $300 million above anticipated; (ii) return payments, which were up more than $165 million over forecast; (iii) refunds, almost $200 million lower than expected; and (iv) Over $400 million more in City/State offset payments, which are adjustments based on tax returns that correct for prior misallocation of income tax receipts between the State and the City.