Letter Report on the Review of the New York City Housing Authority’s Calculation of Rent Increases for Public Housing Tenants at the Red Hook East and Red Hook West Developments

Dear Ms. Bova-Hiatt:

This Final Letter Report conveys the findings of the review of the New York City Housing Authority’s (NYCHA) calculation of rent increases for public housing tenants at the Red Hook East and Red Hook West developments.

The objective of this review was to determine whether NYCHA accurately calculated rent increases for tenants residing in the Red Hook East and Red Hook West developments. This review was initiated because of complaints received from tenants who reside at the developments claiming that the rent increases were not properly calculated. As of October 11, 2022, 2,692 of the 2,891 apartments were occupied, of which 853 (32%) experienced a rent increase when compared to the October 2021 rent amounts.

Background

NYCHA is the largest public housing authority in North America. Its mission is to provide decent, affordable public housing to low- and moderate-income New Yorkers. As of March 2022, NYCHA managed 162,143 apartments and served 339,900 residents in its public housing developments; 2,891 of these apartments, with 5,670 residents, are located at the Red Hook East and Red Hook West developments.

After the initial lease is signed, NYCHA residents are required by the United States Department of Housing and Urban Development (HUD) to recertify their incomes at least once every 12 months. Annual recertification occurs within one of four review quarters based on a lease’s effective date. The recertification and rent calculation processes are not centralized; they are handled by management offices within the various developments. This review only assessed the rent calculations made for Red Hook East and Red Hook West, in recertifications conducted between October 2021 and October 2022.

The general process NYCHA officials provided to the auditors is as follows: NYCHA starts by sending a notification letter to residents due for recertification one month prior to the due date. Each household member is required to submit a Public Housing Affidavit of Income (AOI) and provide supporting documentation of the reported income through the Siebel System (Siebel). Siebel is NYCHA’s management system where information and documentation provided by residents and third parties are maintained and used to support rent calculations. If residents submit a hardcopy AOI, NYCHA’s General Service Department Imaging Unit scans the information into Siebel for the development’s management office staff to review. Siebel is also used to generate the Public Housing Lease Addendum and Rent Notices (Rent Notices) after the completion of the recertification process.

NYCHA reviews and verifies household compositions, incomes, assets, and expenses listed, based on information in the AOI and any additional documentation provided by residents. According to NYCHA’s Management Manual (Management Manual), which details the policy and procedures for reviewing and verifying tenants’ household composition and income for annual recertification, as well as the process of setting rent, staff are directed to set a household’s monthly rent based on adjusted net income (total gross income minus total deductions). Staff from the management offices verify the household’s total gross income by first generating HUD’s Enterprise Income Verification (EIV) report and then confirming the income listed on the EIV with supporting documentation provided by the residents and/or obtained from third parties.[1] Each household member’s verified income is then manually entered into Siebel. If there is a discrepancy in income between the documentation provided by the residents and third parties, the higher amount is used.

When calculating deductions, Siebel automatically includes dependent deductions for qualified children based on their birth year. For deductions requiring additional documentation and verification, such as full-time students who are 18 or older, NYCHA’s staff first review the supporting documentation provided by residents and then manually confirm the eligibility of each deduction in Siebel.

After all verifications are processed, Siebel is used to calculate the monthly rent based on the information inputted. Monthly rent is generally set at either 30% of the household’s adjusted gross income (after subtracting allowable deductions) or the flat rent (the maximum amount charged per household based on the number of bedrooms), whichever is lower. Some residents may have additional charges (such as fees for washing machines or air conditioners) or credits (for example, a utility allowance) added or subtracted from the rent calculation.

Once the monthly rent is calculated, Siebel generates the Rent Notice which shows the Projected Annual Income with breakdowns of the total income received by each household member and the allowance and deduction given, and the new monthly rent for the following year and its effective date. Residents can file a grievance if they do not agree with NYCHA’s calculations or file an interim recertification if the household income has changed before the next recertification is due. The notice contains language informing residents of their right to grieve the new rent.

Findings

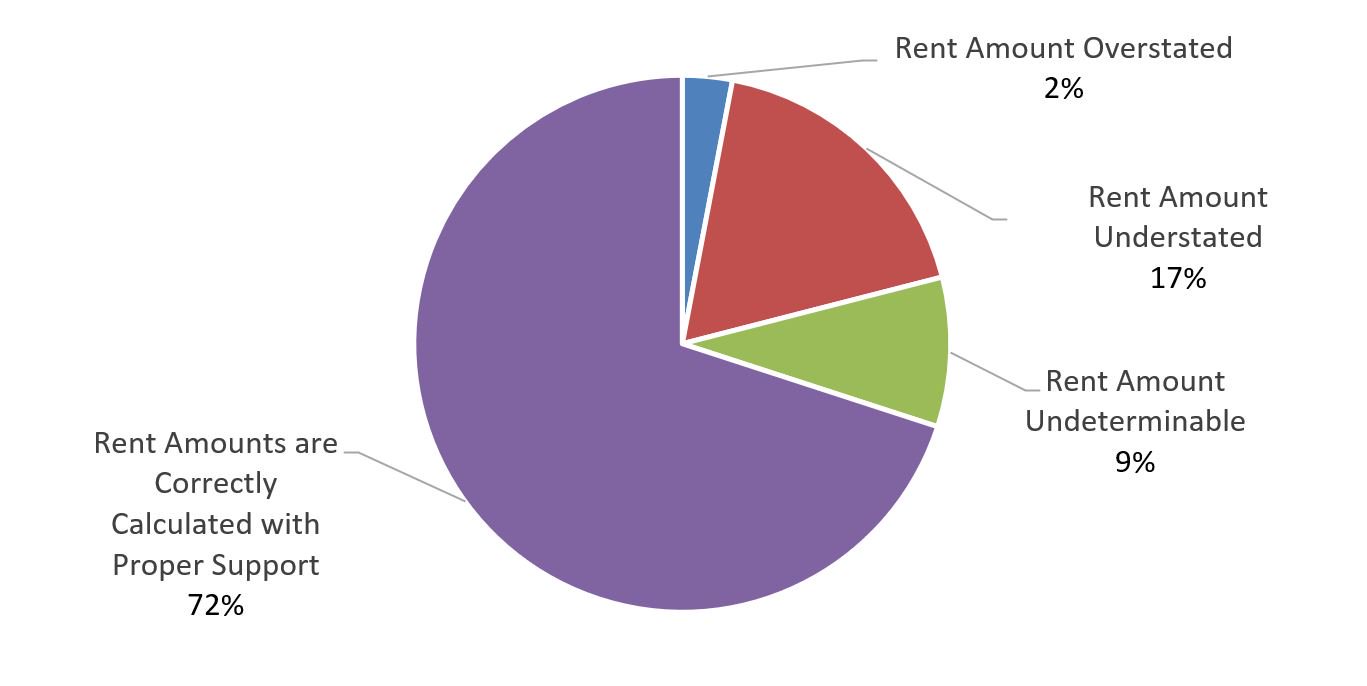

The review found that NYCHA did not consistently calculate rent increases with accuracy. Of 102 apartments sampled (100 apartments with rent increase and two apartments without rent increase), NYCHA overcharged three households by a total of $439 in monthly rent and undercharged 17 households by a total of $1,395 in monthly rent.[2] The auditors were also unable to verify rent calculations for nine apartments due to a lack of supporting documentation. In addition, the Rent Notice does not always display the correct amount for Public Assistance Income. While this did not appear to cause inaccuracies in rent calculations, incorrect information in the notice has the potential to cause confusion for NYCHA staff and tenants.

NYCHA Miscalculated One in Five Rent Increases

As of October 11, 2022, Red Hook East and Red Hook West had 2,692 leased apartments, 853 of which (32%) experienced a rent increase. Of those, 462 apartments received monthly rent increases greater than $26.[3]

Of the 100 samples selected out of the above 462 apartments, NYCHA did not calculate the monthly rent correctly for 19 of these apartments (19%), as shown in Chart I.

Chart I: 100 Sampled Apartments with Rent Increase

The auditors also found that rent was overstated for one of two apartments that did not have rent increases. In total, the auditors found that rent was overstated in three (3%) of the sampled apartments (two with rent increases and one without rent increase) and understated in 17 (17%) during the recertification process. These miscalculations occurred due to data input errors in Siebel.

Specifically, rents for these apartments were overstated by a total of $439 per month, an overstatement ranging from 8% to 32% or from $125 to $184 for the individual apartment. On the other hand, NYCHA understated rents for 17 apartments by a total of $1,395 per month, an understatement ranging from 1% to 57%, as follows:

- Three apartments were understated more than $100 per month;

- Four apartments were understated between $50 to $100 per month; and

- 10 apartments were understated less than $50 per month.

This occurred because NYCHA understated the household total gross income for 12 apartments, leading to a total $1,305 rent understatement. NYCHA also overstated total household deductions for five apartments, leading to a $90 rent understatement.

In response to this finding, NYCHA stated that it is important to properly calculate the rent owed to ensure each resident’s rent is affordable and NYCHA receives the accurate amount. NYCHA also stated that per HUD’s guidelines, overstatement or understatement of rent that is less than $60 per month is “de minimis” and, were the Comptroller to use this $60 threshold, NYCHA only substantially overstated rents for two apartments and substantially understated rents for seven apartments.

In addition, NYCHA did not generate the EIV report for one apartment or obtain third-party verifications for the residents’ incomes in another eight apartments as required by its Management Manual. As a result, the auditors were unable to determine whether there was unreported income that might be identified in the EIV report and whether income listed in the EIV reports can be verified by independent sources.

Incorrect Public Assistance Income Presented on Rent Notices

It appears that Rent Notices provided to tenants do not always display the correct amount of Public Assistance Income. Auditors found four instances in which Public Assistance Income shown on Rent Notices did not match the amounts used to calculate the upcoming rents. As a result, if the residents add each household member’s income as presented on the Rent Notice, the sum does not equal the total Projected Annual Income used to calculate the monthly rent amount. Although the Projected Annual Income and the rent calculation were not affected in these four cases, an incorrect Public Assistance Income amount displayed on a Rent Notice can be confusing for both NYCHA staff and residents as it complicates and adds ambiguity to the rent calculation process.

Based on these findings, NYCHA should:

- Review the rent calculation for the apartments that were either overstated or understated and determine if corrective action should be taken.

- Provide periodic training to its staff to ensure adherence to the Management Manual, so that staff are able to (1) accurately verify and input household incomes and deductions for Siebel to calculate the monthly rent amount; and (2) generate the EIV report and confirm the tenants’ incomes through independent sources.

- Test rent calculations across the system after every recertification.

- Conduct a system review of Siebel to ensure that it properly generates the correct amount on Rent Notices for Public Assistance Income for each qualified household member.

In its response, NYCHA agreed with the four recommendations and provided its corrective actions to address these recommendations.

Scope and Methodology

The scope of this review covered all the Red Hook East and Red Hook West apartment units with an active lease as of October 2022.

To achieve the objective, the auditors reviewed the Management Manual for the annual recertification process for determining rent and interviewed NYCHA officials to obtain an understanding of the use of Siebel, the reviewing procedures for the annual recertification, and how NYCHA calculates residents’ incomes and deductions.

To determine the number of apartments that had a rent increase, the auditors obtained the October 2021 and October 2022 rent rolls from NYCHA and compared the rent amounts listed.

To determine whether NYCHA properly determined the rent amounts, the auditors selected 100 apartments with rent increases between October 2021 and October 2022 and two apartments that appeared to be associated with the same tenant as samples.[4] The auditors then performed direct testing on these selected samples by reviewing the supporting documentation maintained in Siebel or the hardcopies held in the management office at the development, then recalculated the monthly rent amounts. The auditors also interviewed NYCHA’s Property Managers and Housing Assistants at the Red Hook East and Red Hook West developments to understand how they reviewed the supporting documentation and determined the monthly rent for their tenants.

The matters covered in this Final Letter Report were discussed with NYCHA officials during and at the conclusion of this review. A draft letter report was sent to NYCHA on May 4, 2023, with a request for written comments, and discussed with NYCHA at an exit conference held on May 12, 2023. NYCHA’s comments at the exit conference and additional documentation submitted were considered and the report was amended where relevant. A written response from NYCHA was received on May 25, 2023.

The full text of NYCHA’s response is included as an addendum to this letter report.

Yours sincerely,

Maura Hayes-Chaffe

c: Brad Greenberg, Chief Compliance Officer, NYCHA

Marjorie Landa, Director, Mayor’s Office of Risk Management and Compliance

Douglas Giuliano, Deputy Director, Audit Management, Mayor’s Office of Risk Management and Compliance

Endnotes

[1] Per Management Manual Section VII(B)(1), EIV is a supplemental verification tool for people who are currently employed or receive benefits such as unemployment. The EIV report provides employment and income information reported by the HHS National Directory of New Hires and Social Security Administration (SSA) for each tenant and authorized household member that passes the SSA identity verification. When completing an Annual Recertification or Interim Recertification, the housing assistant must generate the EIV Income Report for the tenant and all authorized household members listed on the report but cannot solely use EIV to project a household’s earned income.

[2] The auditors selected a sample of 100 apartments with rent increases between October 2021 and October 2022 and two apartments that appeared to be associated with the same tenant. These two apartments did not have a rent increase between 2021 and 2022.

[3] Of the 2,692 leased apartments, 443 had a rent decrease and for 1,377 apartments rent remained the same. Nineteen apartments were vacant in October 2021, but occupied as of October 11, 2022.

[4] The auditors determined 853 apartments had a rent increase between October 2021 and October 2022. Based on the amount of the rent increase, the auditors judgmentally excluded apartments with a rent increase of less than $26. The auditors then selected 64 apartments with rent increases between $26 and $500 and all 36 apartments with rent increases over $500 from the remaining 462 apartments.

Addendum

LISA BOVA-HIATT

INTERIM CHIEF EXECUTIVE OFFICER

May 25, 2023

BY ELECTRONIC MAIL

Maura Hayes-Chaffe, Deputy Comptroller for Audit NYC Office of the Comptroller

One Centre Street, Room 1100 New York, NY 10007

Email: mhayes1@comptroller.nyc.gov

Dear Ms. Hayes-Chaffe:

This letter is in response to your May 4, 2023 letter, which provided the Draft Letter Report on the New York City Housing Authority’s (NYCHA’s) Calculation of Rent Increases for Public Housing Tenants at the Red Hook East and Red Hook West developments – #FN23-066S.

NYCHA is committed to providing safe, high quality and affordable housing to our residents. Calculating and collecting rent is an important NYCHA function that helps fund day-to-day operations at our properties. While rent calculations can be complicated, it is important that NYCHA properly calculate the rent owed to ensure each resident’s rent is affordable and NYCHA receives the accurate amount.

NYCHA believes it is important to ensure the Comptroller’s findings are produced in a straightforward manner with important context based on the U.S. Department of Housing and Urban Development (HUD) guidelines on how an error should be assessed:

- The purpose of the Comptroller’s audit was to determine whether NYCHA properly increased the rent based on income at Red Hook Houses for a subset of households that saw an increase in their rent during a set period of

- The Comptroller found that 462 households of the 2,692 occupied apartments at Red Hook Houses experienced a rent increase greater than $26, based on a change in income between October 2021 and October

- To accomplish the intended purpose, the Comptroller pulled a sample of 100 of those 462 apartments and performed a rent calculation exercise for those

- In the end, the Comptroller found that for 3 of the 100 sampled apartments (3%) NYCHA had overstated the monthly rent when the increase was calculated, meaning NYCHA had assessed too large of a rent increase and rent should be reduced. In 1 of those 3 cases, rent was overstated by just $0.94. In another case, rent was overstated by $125 and in the third case rent was overstated by $130. The Comptroller also found that another apartment outside the sample had rent overstated by $184.

- The Comptroller also found that for 18 of the 100 sampled apartments (18%) NYCHA had understated the monthly rent when the rent was calculated. In other words, in these cases, NYCHA did not increase the rent enough based on the household’s income, though NYCHA correctly increased the monthly rent in general.

NYCHA also provided the Comptroller with the threshold used by HUD to determine which errors when calculating income are considered a “substantial discrepancy” using HUD’s Enterprise Income Verification system as opposed to which errors are considered “de minimis.” Under HUD’s rules at the time these calculations took place, an income discrepancy amounting to less than $200 per month would have been considered by HUD to be “de minimis” while if the income discrepancy was greater than $200 per month, the error would have been considered substantial. Though the rent calculation can be more complicated and is not solely based on income in all cases, rent for NYCHA households is generally calculated at 30% of a resident’s income. Thus, $60 is a potentially useful threshold to consider when evaluating whether the errors made by the NYCHA that were identified by the Comptroller in the rent calculation should be considered substantial or de minimis. If the Comptroller were to use this $60 threshold:

- 2 of the 100 sampled apartments (2%) would have been found to have substantially overstated the monthly rent when the increase was calculated while 1 of the 100 sampled apartments had a de minimis error.

- 7 of the 100 sampled apartments (7%) would have been found to have substantially understated the monthly rent when the increase was calculated while 11 of the 100 sampled apartments had a de minimis error.

To be clear, NYCHA takes any individual error seriously and will return to each of these findings to ensure rent is calculated correctly for these households. However, we think it is important to present the data in a straightforward manner with proper context based on HUD’s guidelines. That way, the Comptroller’s findings can be well understood when NYCHA takes the required actions to correct the errors that were found.

Please find NYCHA’s response below which provides our corrective actions to address each of the four (4) recommendations presented in the Letter Report.

Audit Recommendation No. 1

Review the rent calculation for the apartments that were either overstated or understated and determine if corrective action should be taken.

NYCHA Response:

Red Hook Houses property staff will work with each household identified in the report to ensure the monthly rent charged accurately reflects the household’s income. The development staff is currently reviewing each overstated and understated case to recalculate, and retroactively credit as needed. If corrective action has not already happened, these tenants will receive a new lease addendum and rent change notice stating their corrected rent and retroactive credit amount. If the rent was understated, NYCHA will not retroactively charge the tenants.

Audit Recommendation No. 2

Provide periodic training to its staff to ensure adherence to the Management Manual, so that staff are able to (1) accurately verify and input household incomes and deductions for Siebel to calculate the monthly rent amount; and (2) generate the EIV report and confirm the tenant’s incomes through independent sources.

NYCHA Response:

NYCHA’s Management Services Department (MSD) will continue to support Property Management by providing guidance and updates to Public Housing policy and process. MSD will refresh guidance last issued on June 13, 2022.

In addition, Property Managers enroll Housing Assistants that require additional training through NYCHA’s Learning and Development Department.

Audit Recommendation No. 3

Test rent calculations across the system after every recertification.

NYCHA Response:

Consistent with HUD regulation 24 C.F.R. §S985.2, which sets forth the definition of “PHA’s quality control sample” and explains how to determine the number that must be reviewed, NYCHA’s Management Services Department’s Quality Assurance Unit reviews completed annual and interim recertifications based on random sampling to ensure consistency in verification methods, income determination, and rent calculation. When issues are identified, the QA unit will contact Property Management to discuss what corrective action should be taken.

Audit Recommendation No. 4

Conduct a system review of Siebel to ensure that it properly generates the correct amount on Rent Notices for Public Housing Assistance Income for each qualified household member.

NYCHA Response:

As noted by the NYC Comptroller’s audit team, the Projected Annual Income and the rent calculation were not affected by this finding. The Management Services Department (MSD) is working with IT to identify and implement an enhancement to revise the rent notices and place controls that guide staff towards inputting correct gross public assistance incomes. This enhancement has an anticipated implementation date of 1st Quarter of 2024.

We look forward to our continued collaboration with HUD, the City of New York, and residents as well as employees to improve customer service and ensure progress toward safe, clean, and connected communities for now and for the future.

Should you have any questions, please call Terrence H. Clarke, Acting Audit Director, at 212 -306- 8484, or email Terrence.Clarke@nycha.nyc.gov.

Sincerely,

Lisa Bova-Hiatt

Interim Chief Executive Officer

cc: Marjorie Landa, Director, Mayor’s Office of Risk Management and Compliance

Doug Giuliano, Deputy Director, Audit Management, Mayor’s Office of Risk Management and Compliance Eva Trimble, Chief Operating Officer Andrew Kaplan, Chief of Staff Vilma Huertas, Special Advisor to the Chief Executive Officer David Rohde, Interim Executive Vice President for Legal Affairs and General Counsel Brad Greenburg, Chief Compliance Officer

Daniel Greene, Executive Vice President for Property Management Operations Sylvia Aude, Senior Vice President for PHO, Tenancy Administration Terrence H Clarke, Acting Director, Internal Audit and Assessment Anil Agrawal, Assistant Director of External Audits, Internal Audit and Assessment File