Review of the Department of Sanitation’s Commercial Waste Zone Request for Proposals and Carter Selection Process

Introduction

Background

The New York City Department of Sanitation (DSNY) collects waste from residents, while a network of more than 90 private carting companies collect waste from commercial businesses.[1] Each carter must be licensed by the New York City Business Integrity Commission (BIC).[2] Collectively, the City’s commercial businesses generate more than 3 million tons of waste each year.

According to DSNY, the private carting industry has historically operated in a disorganized, inefficient, hazardous, and overly competitive manner. Each night, private carter garbage trucks travel across the City collecting waste from businesses along long routes with numerous overlaps.[3] In some parts of the City, over 50 carters serve a single neighborhood, and an individual commercial block could see dozens of different private carter garbage trucks on a given night. This results in millions of excess truck miles driven each year, negatively impacting the City’s air quality and public health. Additionally, the industry lacks strong customer service standards and pricing transparency.

DSNY officials further explained that the competitive nature of the private carting industry creates conditions that encourage dangerous driving and inadequate attention to public safety. In order to remain competitive, carter truck drivers often cut corners and engage in behavior that endangers both workers and members of the public, such as running red lights, driving the wrong way on one-way streets, and speeding to finish routes before dawn. As reported by the Department of Citywide Administrative Services (DCAS) in a 2021 press release, between January 2010 and May 2019, private carter garbage trucks were involved in at least 43 fatalities and 107 injuries in the City.[4]

Establishment of the Commercial Waste Zone (CWZ) Program

To address these issues with the private carting industry, the City passed Local Law 199 of 2019 (LL199), which established the CWZ program in November of that year. The law required DSNY to:

- Divide the City into at least 20 Commercial Waste Zones.[5]

- Select and enter into agreements with up to three private carters that are licensed by BIC for each zone.[6]

- Refrain from entering into any agreement that would result in the private carter providing services in more than 15 Commercial Waste Zones.

LL199 also listed 13 factors that DSNY was required to consider during its proposal evaluation process:

- The rates that the carter would charge to businesses for its services.

- The nature and frequency of the carter’s commercial waste removal services to be provided, and the carter’s plan to ensure the ability and capacity to provide services within the zone.

- The carter’s customer service plan, detailing information including, but not limited to, customer service support tools, customer service standards, a mechanism for receiving and addressing customer complaints, and addressing the language access needs of businesses in the zone.

- The carter’s waste reduction plan, describing practices to support waste reduction, reuse, and recycling among commercial establishments within the zone.

- The carter’s waste management plan, describing practices for disposal of commercial waste collected.

- The carter’s plan (if any) to reduce air pollution and greenhouse gas emissions from commercial waste vehicles, including any plans to provide commercial waste collection, removal, and disposal services with a fleet composed of at least 50% zero emissions vehicles by 2030.

- The carter’s plan (if any) to reduce air pollution and greenhouse gas emissions through infrastructure investments, adoption of technologies, or other sustainable solutions.

- The carter’s health and safety plan, detailing compliance with applicable federal, state, and local laws and specific practices to further the goals of promoting health and safety.

- The carter’s history of compliance with existing federal, state, and local laws, including, but not limited to, laws relating to waste collection, removal, and disposal, environmental protection, consumer protection, health and safety, labor, and employment.

- The carter’s customer communication plan, describing the efforts the carter will undertake during the transition to the CWZ system and other communication efforts that will support and supplement DSNY’s public outreach and education efforts.

- The carter’s subcontracting plan, if applicable, describing how subcontracting will enhance public safety, minimize harmful environmental impacts, and improve customer service.

- The carter’s history of operating in the City and within the geographic area of each zone that the carter includes in the submitted proposal.

- The carter’s financial statements, including available capital, access to credit, and physical assets, including number of available commercial waste vehicles.

The purpose of these changes was to reduce truck traffic, enhance road and worker safety, and reform the commercial waste hauling industry. LL199 did not set any specific weight to the requirements pertaining to these factors; instead, it authorized DSNY to establish guidelines and gave it discretion to make decisions needed to implement the CWZ program.

CWZ Program Planning and Preparation

The CWZ program is the result of years of planning, analysis, and stakeholder engagement by DSNY.

- In August 2016, a Private Carting Study commissioned by DSNY and BIC was issued. The study found that establishing commercial waste collection zones could reduce commercial waste truck traffic by 49% to 68% and reduce greenhouse gas emissions by 42% to 64%.

- In June 2017, DSNY contracted with the design, engineering, and management consulting company Arcadis of New York, Inc. (Arcadis) to serve as a CWZ implementation consultant. Arcadis’ contracted responsibilities included developing a plan to establish and implement the CWZ program, assisting DSNY with stakeholder and public engagement, performing the environmental reviews or other regulatory processes necessary to establish the system, drafting the solicitations for carting companies to bid on waste zones, evaluating carter responses, and assisting in contract negotiations with carters.

- In November 2018, DSNY released the CWZ Implementation Plan, laying out a blueprint for the implementation of commercial waste collection zones across the city. The plan built on the 2016 Private Carting Study and outlined the City’s recommended framework to move forward with the reforms.

- In February 2020, DSNY established 20 zones for the CWZ program and created the Bureau of Commercial Waste to implement and oversee it. DSNY then issued the CWZ Request for Proposals (RFP) in two parts.

- Part 1 was issued in November 2020 with a response due date of February 2021. Part 1 requested information about each carter’s qualifications to participate in the CWZ program, as well as financial history and compliance with applicable laws.

- Part 2 was issued in November 2021 with an initial response due date of March 2022, but this was extended to July 2022 because of the high volume of questions from prospective carters and the clarifications needed for certain aspects or requirements. Part 2 requested information about the carters’ capacity and services, and required CWZ plans, including health and safety and customer service.

Throughout the RFP process, DSNY provided guidance to carters regarding the CWZ program and RFP process. DSNY held two pre-proposal conferences between December 2021 and January 2022 to provide a CWZ overview, an RFP overview, a CWZ RFP proposal package walkthrough, and respond to questions from carters. DSNY also required carters to certify that they met minimum qualification requirements, such as evidence that the carters had active or pending BIC licenses and that they attended at least one of DSNY’s two pre-proposal conferences.[7] Additionally, DSNY issued several addenda to the RFP to help clarify questions from carters regarding the CWZ program and the RFP.

According to DSNY, only carters found “responsive” to Part 1 of the RFP were eligible to submit proposals for Part 2.[8] Of the 54 carters that submitted a proposal to RFP Part 1, 50 were found eligible to submit a proposal to RFP Part 2. Of this group, 34 submitted a subsequent proposal to RFP Part 2. The first zones were initially anticipated to be fully implemented by spring 2023, according to RFP Part 2. However, as of January 2025, only one zone had been implemented.

Please see Table 1 below for a summary of the CWZ RFP and carter selection timeline.

Table 1: Summary of CWZ RFP and Carter Selection Timeline

| Month/Year | Event Description |

|---|---|

| November 2019 | Local Law 199 established. |

| November 2020 | DSNY issued CWZ RFP Part 1.

54 carters submitted a response to RFP Part 1; 50 were deemed eligible to submit a response to Part 2. |

| November 2021 | DSNY issued CWZ RFP Part 2.

34 of the 50 eligible carters submitted a response. |

| December 2021 – January 2022 | DSNY held two pre-proposal conferences to provide a CWZ overview, an RFP overview, and an RFP proposal package walkthrough, and to respond to questions from carters. |

| January 2022 – June 2022 | DSNY issued seven addenda to the CWZ RFP Part 2. |

| September 2022 – February 2023 | DSNY requested and received Best and Final Offers (BAFO) from carters.[9] |

| February 2023 – August 2023 | DSNY reviewed, evaluated, and scored the 34 carter responses to the CWZ RFP Part 2. |

| October 2023 – January 2024 | DSNY conducted responsibility determinations for the 18 prospective awarded carters. |

| January 2024 | DSNY announced the 18 final awardees. |

| September 3, 2024 | DSNY started the rollout and implementation of the first zone: the Queens Central zone. |

| January 2, 2025 | DSNY announced the full implementation of the Queens Central zone. |

| April 23, 2025 | DSNY announced that the full implementation of both zones in the Bronx is scheduled to occur in November 2025, and full implementation of all zones by the end of 2027. |

DSNY’s Carter Evaluation and Selection Processes

DSNY created three scoring categories for the proposals: (1) Pricing, (2) Technical Proposals, and (3) Capacity and Operations.[10] (The three categories will be discussed in more detail later in the report.) DSNY stated that submitted proposals for RFP Parts 1 and 2 were reviewed to determine whether they were complete and addressed the requirements of both the statute and the RFP. All 34 proposals received in response to RFP Part 2 were reviewed to confirm their sufficiency and compliance, before being presented to the Evaluation Committee.[11]

Arcadis performed preliminary reviews of proposals received and provided its assessment to DSNY, which included determining proposal completeness and responsiveness, and providing recommendations from the review of submitted proposals. In addition, Arcadis was responsible for developing a tool to score proposals based on pricing, one of three categories that were scored.

DSNY informed auditors that in August 2023, officials noticed that the pricing tool it developed with Arcadis to score the Pricing category had a miscalculation in the formula. The error impacted how pricing scores were weighted, leading to adjustments in scoring and rankings. The error was caught by DSNY prior to final award decisions and was resolved before the end of the same month. According to DSNY, only one carter was impacted at the award level, which led to the carter dropping out of the running for the proposed Midtown South zone. At the time, the carter was one of the top three prospective carters for the zone.

Overall, 18 carters were awarded contracts and were authorized to participate in the CWZ program. In January 2024, DSNY announced the selection of three carters for each of the 20 zones.

The Queens Central zone was selected as the pilot. Queens Central comprises the neighborhoods Corona, Elmhurst, East Elmhurst, Forest Hills, Glendale, Jackson Heights, Maspeth, Middle Village, Rego Park, and Ridgewood. Implementation began in September 2024 and completed in January 2025.

According to DSNY, Queens Central was selected as a pilot zone because of its wide variety of business types; DSNY felt that the rollout of the pilot would inform the timeline and methodology of subsequent zones. In April 2025, DSNY announced that both zones in the Bronx would begin rolling out in October 2025, with full implementation scheduled to occur in November 2025. It also announced that the remaining 17 zones would be implemented by the end of 2027.

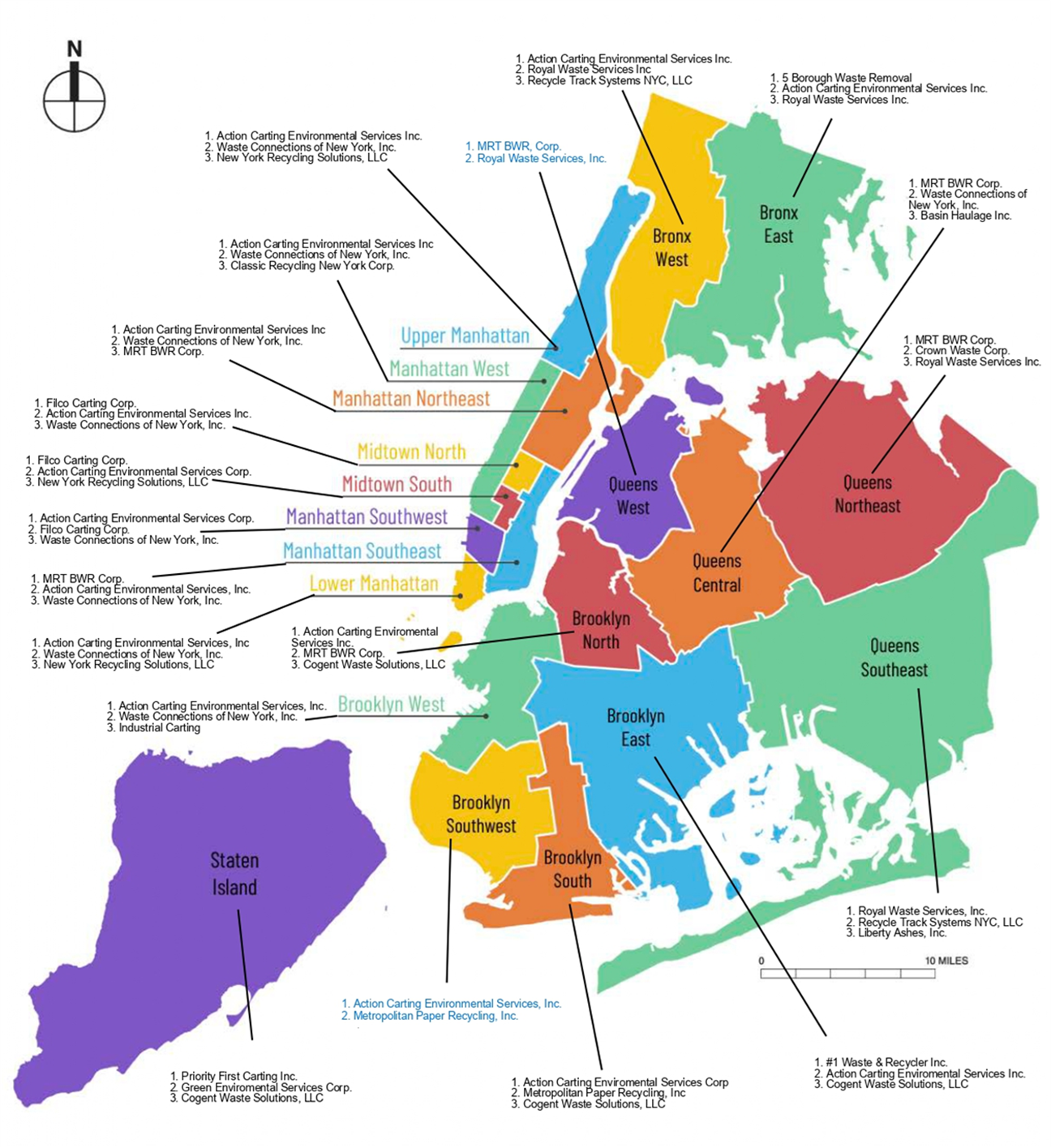

See Appendix I for a map of the 20 zones and the carters assigned to each zone.

Concerns About the CWZ Program

Advocates and elected officials have raised concerns about the design of the RFP process, delays in DSNY’s implementation of the CWZ program, and the chosen carters’ records of safety, labor, and environmental violations.

Regarding the design of the RFP process, the primary issue advocates raised was that the factors for evaluating carter proposals were broken up and lumped into categories, instead of being independently evaluated and weighed. Advocates said that this could possibly lead to DSNY overlooking certain factors or not taking different factors into consideration—such as required plans detailing how carters would reduce the number of miles traveled. Historically, the high number of miles driven by carters has led to driver fatigue, more gas emissions affecting climate change, and a possible increase in accidents.

There were other concerns about the lack of transparency regarding plans submitted by carters that were awarded zones. Moreover, in 2022, DSNY announced an increase in the percentage of weight given to the Pricing category, from 35% to 40%. This led some advocates to express concern that DSNY was overemphasizing pricing (i.e., how much carters charge businesses) during the RFP process, to the detriment of environmental and safety issues.

Additional issues were raised regarding delays in the implementation of the CWZ program. By September 2024, DSNY had only rolled out one of the 20 zones, and at the time did not have any timeframe for when the other 19 zones would be implemented. This led to concerns over the impact of extended delays on increased traffic, pollution, and safety.

According to DSNY, the primary cause of the delays was the COVID-19 pandemic. RFP Part 1 was issued at the height of the pandemic in November 2020, when the carting industry experienced a significant decrease in operations—an almost 50% reduction—due to the shuttering of businesses at the time. RFP Part 2 was issued in November 2021 to give time for the carting industry to recover and to allow DSNY to answer carters’ questions about the RFP process.

Finally, there were concerns that some of the awarded carters had histories of safety violations, which were brought to DSNY and the City Council on June 3, 2024.

This review was undertaken to address some of these concerns.

Objectives

The objectives of this review were to determine whether the DSNY Commercial Waste Zone RFP and selection process of carters complied with the requirements established in LL199, and to examine the safety and violation histories of selected carters.[12]

Discussion of Review Results with DSNY

The matters covered in this report were discussed with DSNY officials during and at the conclusion of this audit. On June 4, 2025, we submitted a Draft Report to DSNY with a request for written comments. We received a written response from DSNY on June 18, 2025.

DSNY’s response has been fully considered and, where relevant, changes and comments have been added to the report.

In its response, DSNY agreed with two of the suggested improvements, partially agreed with one, and disagreed with one.

The full text of DSNY’s response is included as an addendum to this report.

Key Takeaways

The review found that DSNY’s RFP and carter selection processes were designed to meet the requirements of LL199. DSNY incorporated the required evaluation factors into its RFP process and ensured that none of the zones had more than three assigned carters and that none of the carters were awarded more than 15 zones.

The review also found that DSNY established guidelines pertaining to pricing, capacity, labor, safety, and the environment, in accordance with LL199 requirements, and that the agency required carters to submit related information to be considered in the grading of proposals. Auditors examined RFP scorecards and related documents and found that (1) scoring calculations were accurate, (2) evaluators provided reasonable justifications for scores, and (3) there were no significant differences among evaluators in the scores given to a particular proposal.

Regarding the reduction of harmful emissions from waste hauling vehicles—one of the intended purposes of LL199—the RFP required each carter to submit an Air Pollution Reduction Plan (reduction plan) and report on its compliance with requirements set forth in Local Law 145 of 2013 (Vehicle Emission Law).[13] The auditors’ review of the proposals found that all of the carters that submitted proposals stated their fleets met those requirements. The reduction plan was to also detail each carter’s strategies to ensure that at least 50% of its fleet consisted of zero emissions vehicles. However, the 50% requirement does not go into effect until 2030, and no interim percentage goals have been established.

Additionally, despite the implementation of these measures within the RFP process, the review identified several concerns relating to carters’ violation histories and obscure pricing practices. These issues are as follows:

- The traffic and safety violation history of the carters selected by DSNY for the CWZ program did not compare favorably with the records of the carters that were not selected. An analysis of the 10 carters that amassed the most violations during the period reviewed by DSNY revealed that eight of them were selected for the CWZ program.

- One of the awarded carters—Cogent Waste Solutions—had the highest-ever recorded payout of $500,000 in fines for violations issued by BIC in January 2023. These violations included accusations of overcharging customers in close to 5,000 instances from March 2020 through December 2022.

- Violation histories of carters proposed as subcontractors show that 12 of the 15 were issued almost 1,500 safety violations from February 2018 through July 2022—three of the carters (including one that was approved as a primary carter for the CWZ program) accounted for more than 1,000 of these violations.

- Lack of transparency regarding how prices charged to customers were derived. There were significant differences within certain zones in the maximum fixed monthly charges that businesses could pay, but no information in the carters’ proposals explaining the reasons for the differences. In the Staten Island zone, the maximum price listed by one carter was more than double the price listed by another carter within that zone.

The auditors conducted additional observations of the RFP process and found the following issues:

- Of the 18 selected CWZ carters, four of them—Action Carting, Waste Connections, MRT BWR, and Cogent—were selected to cover more than 70% of the available zone assignments.[14] These carters have all previously provided carting services in the City and several have served the same areas that they will now be serving under the CWZ program.

- Zone awards were not necessarily given to the highest ranked carters. Of the 20 zones, the highest ranked carters were selected for only three zones. DSNY stated that zone assignments were adjusted if a highly ranked carter had already reached the maximum number of zones DSNY determined it had the capacity to serve, or if another carter had garages or facilities in closer proximity to the zone.

- The size of a carter’s operations appeared to carry considerable weight in the selection process. Of the 15 carters with the largest fleets, 11 were selected for the program.

- Of the 13 factors that DSNY was required to consider in evaluating proposals, the heaviest weight was given to pricing (evaluation factor #1), which accounted for a maximum of 40 points (out of 100). As a result, the remaining 12 factors cumulatively accounted for only 60 points (out of 100). Although the review did not find that awards were predominantly given to carters who scored well in pricing, it nonetheless raises questions concerning the relative importance given to other factors that aligned with core goals of the program, such as reducing emissions and improving safety.

These findings are discussed in detail in the following sections.

Some Authorized CWZ Carters Have Significant Violation Histories

Carters with Highest Number of Traffic and Safety Violations Approved to Operate in the Largest Number of Zones

A review of the traffic and safety violations of the 34 carters that submitted proposals to RFP Part 2 revealed that 10 of the 15 carters with the most safety violations were selected to participate in the CWZ program. Five of the approved carters were listed among the six carters that had been issued the most violations during the scope period; these five carters were approved to operate in 35 of the 60 CWZ zone assignments.

To ascertain the carters’ safety records, DSNY reviewed the complaints and traffic and safety violations issued by the Business Integrity Commission (BIC) and NYPD for the period of February 2018 to July 2022. Auditors examined the violation information found in DSNY’s scorecard notes for the 34 carters reviewed by DSNY to determine whether there were any notable differences in the violation histories of those selected and those not selected. Auditors also obtained the safety records submitted by the carters, which generally consisted of traffic violations (including speed camera and red-light tickets), parking violations, accident reports, and inspection records. The review found that 31 (91%) of the 34 carters had violations related to safety.

Action Carting Environmental Services Inc. (Action Carting) had the highest number of safety violations with 1,924; 5 Borough Waste Removal Inc. had the lowest with two. Three carters had zero safety violations (Rubicon Global, LLC; Kings County Carting Corp.; and 1 Take All Corp), but none were approved for the CWZ program. The auditors note that these three carters were listed among those with the smallest numbers of employees and trucks in their fleets.

The auditors focused on the violations that relate to safety, including:

- Repeated instances of unsafe vehicle operation, such as illegal backing, U-turns, traffic signal violations, speeding, driving against traffic, obstruction of pedestrian and cyclist paths, and unauthorized riding on the vehicle’s exterior.

- Noncompliance with environmental, health, and transportation regulations, particularly those concerning the safe handling and disposal of hazardous waste.

- Improper handling of trade waste.

- Improper handling and/or maintenance of safety inspection records.

According to the information contained in scorecard notes, a total of 5,492 violations in the above categories were issued to the 34 carters. The breakdown per carter is shown in Table 2 below, with approved carters highlighted.

Table 2: Breakdown of Safety Violations per Carter (February 2018 to July 2022)

| Carter | # of Safety Violations | # of Employees | Fleet Size (# of Trucks) | Safety Violations per Employee | Safety Violations per Truck | # of Assigned Zones |

|---|---|---|---|---|---|---|

| Action Carting Environmental Services Inc. | 1,924 | 455 | 150 | 4.23 | 12.83 | 14 |

| Waste Connections Of New York, Inc. | 494 | 214 | 82 | 2.31 | 6.02 | 12 |

| Century Waste Services L.L.C. | 420 | 84 | 43 | 5 | 9.77 | N/A |

| Metropolitan Paper Recycling, Inc. | 404 | 85 | 29 | 4.75 | 13.93 | 2 |

| Liberty Ashes, Inc. | 317 | 47 | 19 | 6.74 | 16.68 | 1 |

| MRT BWR Corp. | 252 | 199 | 61 | 1.27 | 4.13 | 6 |

| Bestway Carting Inc. | 183 | 19 | 17 | 9.63 | 10.76 | N/A |

| New York Recycling Solutions LLC | 171 | 504 | 207 | 0.34 | 0.83 | 2 |

| Basin Haulage Inc. | 170 | 32 | 19 | 5.31 | 8.95 | 1 |

| Royal Waste Services Inc. | 139 | 363 | 120 | 0.38 | 1.16 | 5 |

| Green Environmental Services Corp | 125 | 44 | 16 | 2.84 | 7.81 | 1 |

| Falso Carting Co., Inc. | 104 | 31 | 8 | 3.35 | 13 | N/A |

| M & M Sanitation Corp. | 85 | 31 | 19 | 2.74 | 4.47 | N/A |

| D. Daniels Contracting Ltd. | 81 | 21 | 9 | 3.86 | 9 | N/A |

| Filco Carting Corp. | 76 | 104 | 35 | 0.73 | 2.17 | 3 |

| # 1 Waste & Recycler Inc. | 75 | 7 | 2 | 10.71 | 37.50 | 1 |

| Approved Storage And Waste Hauling Inc | 64 | 24 | 50 | 2.67 | 1.28 | N/A |

| American Recycling Management, LLC | 53 | 14 | 4 | 3.79 | 13.25 | N/A |

| D & D Carting Co., Inc. | 50 | 15 | 12 | 3.33 | 4.17 | N/A |

| Priority First Carting Inc. | 48 | 9 | 6 | 5.33 | 8 | 1 |

| Classic Recycling New York Corp. | 48 | 45 | 25 | 1.07 | 1.92 | 1 |

| Enviro Sanitation LLC | 47 | 43 | 32 | 1.09 | 1.47 | N/A |

| Cogent Waste Solutions, LLC | 32 | 141 | 87 | 0.23 | 0.37 | 4 |

| Cutting Room Recycling Corp. / Industrial Carting | 26 | 16 | 8 | 1.63 | 3.25 | 1 |

| Flash Recycling Corporation | 24 | 10 | 4 | 2.40 | 6 | N/A |

| Mybem Corp. | 24 | 21 | 10 | 1.14 | 2.40 | N/A |

| Liverpool Carting Co., Inc. | 18 | 12 | 4 | 1.50 | 4.50 | N/A |

| Recycle Track Systems NYC, LLC | 16 | 103 | 0 | 0.16 | N/A | 3 |

| Crown Waste Corp | 13 | 27 | 10 | 0.48 | 1.30 | 1 |

| Tully Environmental Inc. | 7 | 44 | 9 | 0.16 | 0.78 | N/A |

| 5 Borough Waste Removal | 2 | 11 | 4 | 0.18 | 0.50 | 1 |

| Rubicon Global, LLC | 0 | 0 | 0 | N/A | N/A | N/A |

| 1 Take All Corp. | 0 | 2 | 3 | 0 | 0 | N/A |

| Kings County Carting Corp. | 0 | 9 | 3 | 0 | 0 | N/A |

| Total | 5,492 | 60 |

As shown in the table, half (17) of the carters had more than 60 safety violations during the four-year period; 11 of them were approved by DSNY for the CWZ program. Three carters with zero violations were not approved. The two carters with the highest number of violations were also approved to operate in the most zones—Action Carting had 1,924 violations and was approved to operate in 14 zones; Waste Connections of New York, Inc. (Waste Connections) had 494 violations and was approved to operate in 12 zones. Action Carting’s violations history is particularly egregious, outstripping Waste Connections by nearly four times, and outstripping many others exponentially.

Overall, the 18 carters selected to participate in the CWZ program were issued an average of 241 violations each during the four-year period. Even if the worst violator, Action Carting, is excluded, the average number of violations for the remaining carters is 142. This number is significantly higher than the 73 violations on average that were issued to the 16 carters that were not approved to operate as part of the CWZ program.

When looking at the number of violations issued in relation to fleet size, the auditors found that the number of violations issued per truck varied among carters regardless of whether they were approved for the program. In fact, of the 10 carters with the highest number of violations per truck, five were approved for the CWZ program, which included the three worst violators (in terms of violations per truck)—#1 Waste & Recycler Inc.; Liberty Ashes, Inc.; and Metropolitan Paper Recycling, Inc. The carter that was approved for the most zones, Action Carting (with 14 zones), was ranked the sixth highest in terms of violations per truck.

In conclusion, the auditors found no evidence that the carters’ violation histories were a significant variable in determining their suitability for the program. The evaluation materials contained no indications that a high number of violations (relative to other prospective carters) negatively impacted a carter’s likelihood of being selected, despite “improving safety” being a key goal of the program. Instead, the results indicate that DSNY gave more weight to technical and operational factors (e.g., capacity, waste management plans) than safety when it selected carters.

DSNY Awarded Contract to Carter with Highest Payout Ever Recorded by Business Integrity Commission

Among the approved carters was Cogent Waste Solutions LLC (Cogent)—which holds the record for the highest-ever recorded payout for BIC-issued violations. Despite this, Cogent was awarded four zones (Brooklyn North, Brooklyn East, Brooklyn South, and Staten Island). DSNY also awarded two zones to a carter in which Cogent owned a 50% stake, New York Recycling. Since then, Cogent has assumed full ownership of New York Recycling.

According to DSNY’s Vendor Responsibility Determination for Cogent, in December 2023, BIC issued a notice of violation with 4,944 counts against Cogent, with a maximum penalty of $10,000 for each count, amounting to nearly $50 million in total fines.[15]

Cogent was charged with the following violations:

- falsifying business records;

- charging customers a rate greater than the maximum permissible rate;

- failing to disclose an employee to BIC within 10 business days of their hire;

- failing to maintain a complete and accurate customer register;

- filing a false and incomplete customer register; and

- making false statements to BIC.

As stated above, DSNY officials indicated that they reviewed violations issued by BIC as part of its RFP evaluation process, and “violation history” is one of the factors that comprise the Capacity and Operations category. An examination of the rating awarded to Cogent found that it received an average zone score (each zone was scored separately) of 22.2 out of a maximum of 25 for Capacity and Operations (this category makes up 25% of a carter’s score). The overall average score awarded to Cogent was 67.1 (out of a maximum score of 100).

The violations noted above appear to indicate a lack of business integrity on the part of Cogent. Nevertheless, DSNY officials stated that they discussed the issue with the City’s Law Department. DSNY officials stated that they then determined that these violations did not provide a sufficient basis to find Cogent non-responsible, and thereby disqualify them from the RFP process. According to DSNY, while violation histories were considered, disqualification from participating in the RFP process only occurred if a carter were found non-responsible in the vendor responsibility determination, or if the carter did not have an active or pending BIC license. DSNY noted that Cogent had an active license during the entire RFP process.

Despite its lengthy violation history, Cogent received an average score of 29.5 points (out of 35) in the Technical Proposals category, due to what DSNY considered its detailed and implemented plans, extensive facilities, robust subcontractor network, and large company size and customer base. Cogent currently has its own waste processing facility, recycling facility, and waste transfer stations, along with 12 truck parking lots across Brooklyn, Staten Island, and New Jersey. Additionally, it stated that it can scale up to meet the needs of its four awarded zones. Cogent also has a surplus of trucks on standby to meet the needs of an increased customer count.

As per DSNY’s agreement with each awarded carter, DSNY has the authority to require the carter to enter into a monitorship agreement with an independent monitor at any time. DSNY exercised this authority and assigned a monitor to Cogent and to New York Recycling Solutions LLC.

The monitor has the authority to investigate Cogent’s compliance with applicable federal, state, and local laws, rules, and regulations, including those related to safety. According to DSNY, the monitor’s responsibilities will begin at least four months before Cogent’s first zone implementation. The monitor will submit confidential reports to DSNY every 60 days for the first 180 days of the monitorship, and every 90 days thereafter.

Almost 1,500 Violations Issued to Subcontracted Carters from 2018 through 2022

According to LL199 and RFP Part 2, each awarded carter may subcontract with up to two carters for each awarded zone to perform commercial waste collection services. Primary awardees were required to submit the subcontractors it intended to use to DSNY for approval, which stated that subcontractors were to be held to the same standards as the primary carters, as outlined in the RFP. For example, primary awardees were required to submit their subcontractors’ financial statements, experience serving the zone, and compliance histories.

DSNY reviewed the information received on the subcontractors, which was validated through collaboration with Arcadis, BIC, and NYPD. Documentation included trade waste licenses, financial statements, and violation information, along with traffic and safety violations.

Auditors requested and received the Evaluation Committee’s scorecards and scorecard notes which documented the review of information submitted for subcontractors, including the number of trucks, employees, compliance history, and violations. Based on the auditors’ review of this information, seven of the 18 awarded carters proposed the use of 15 subcontractors in total.[16]

The auditors reviewed the safety violation histories from February 2018 to July 2022 for the 15 proposed subcontractors and found that 12 (80%) had safety violations during that period. Of these, Century Waste Services L.L.C. received the highest number of safety violations with 420, and Green Bay Sanitation Corp. received the lowest number of safety violations with seven.

According to the information contained in the RFP and scorecard notes, a total of 1,490 violations were issued to the 15 subcontractors. The breakdown per subcontractor is shown in Table 3 below.

Table 3: Breakdown of Safety Violations per Proposed Subcontractor (February 2018 to July 2022)

| Prime Carter | Subcontractor | # of Safety Violations | # of Employees | Fleet Size (# of Trucks) | Safety Violations per Employee | Safety Violations per Truck | # of Zones in which Subcontractor Operates |

|---|---|---|---|---|---|---|---|

| Cutting Room Recycling Corp./Industrial Carting | Century Waste Services L.L.C. | 420 | 84 | 41 | 5 | 10.24 | 1 |

| New York Recycling Solutions LLC | Metropolitan Paper Recycling, Inc. | 404 | 85 | 29 | 4.75 | 13.93 | 1 |

| Recycle Track Systems NYC, LLC | Winters Bros. Waste Systems Of NYC, LLC[17] | 202 | 0 | 0 | NA | NA | 1 |

| Green Environmental Services Corp | Gaeta Interior Demolition, Inc. | 125 | 44 | 16 | 2.84 | 7.81 | 1 |

| Royal Waste Services Inc. | Avid Waste Systems, Inc. | 103 | Not Provided | Not Provided | Unable to Determine | Unable to Determine | 1 |

| Royal Waste Services Inc. | Midland Carting, Inc. | 75 | Not Provided | Not Provided | Unable to Determine | Unable to Determine | 1 |

| Recycle Track Systems NYC, LLC | Regency Recycling Corp. | 49 | 25 | 10 | 1.96 | 4.90 | 1 |

| Recycle Track Systems NYC, LLC | City Waste Services Of New York, Inc. | 34 | 59 | 27 | 0.58 | 1.26 | 3 |

| Royal Waste Services Inc. | Cogent Waste Solutions LLC | 32 | 141 | 87 | 0.23 | 0.37 | 1 |

| Action Carting Environmental Services Inc. | JEG, Inc. | 23 | 19 | 8 | 1.21 | 2.88 | 14 |

| Royal Waste Services Inc. | Daniello Carting Company LLC | 16 | Not Provided | Not Provided | Unable to Determine | Unable to Determine | 1 |

| Royal Waste Services Inc. | Green Bay Sanitation Corp. | 7 | Not Provided | Not Provided | Unable to Determine | Unable to Determine | 1 |

| Royal Waste Services Inc. | C.J.S. Sanitation Corp. | 0 | Not Provided | Not Provided | Unable to Determine | Unable to Determine | 2 |

| Cogent Waste Solutions LLC & Cutting Room Recycling Corp/ Industrial Carting) | Hodge, Inc. | 0 | 8 | N/A | N/A | N/A | 4 |

| Cogent Waste Solutions LLC | Peat, Inc. | 0 | 8 | N/A | N/A | N/A | 1 |

| Total | 1,490 |

As shown in the table, three subcontractors (Century Waste Services L.L.C, Metropolitan Paper Recycling, Inc., and Winters Bros. Waste Systems Of NYC, LLC) accounted for nearly 70% of all safety violations (1,026 of 1,490) during the period. Five subcontractors had more than 100 safety violations. Overall, the 12 subcontractors with violations on record were issued an average of 124 safety violations.

Moreover, the auditors found that 11 of the proposed subcontractors had submitted proposals for the CWZ program, of which two were also assigned to zones as an awarded carter—Cogent is a proposed subcontractor in the Queens West zone for Royal Waste, and Metropolitan Paper Recycling is a proposed subcontractor in the Lower Manhattan zone for New York Recycling Solutions. Additionally, although Green Environmental Services Corp listed Gaeta Interior Demolition, Inc. as its proposed subcontractor, the proposal documentation shows that both companies have the same owner and functionally operate as one. According to Green’s proposal, Gaeta does not own any trucks and all trucks operated by Gaeta are owned by Green.

The auditors were unable to determine the number of violations per employee or truck for five of the six listed subcontractors for Royal Waste, because it did not provide employee/truck information for any of its six subcontractors on an individual basis; it only provided the overall total for all subcontractors. However, the auditors used Cogent’s response to RFP Part 2 to retrieve this information and calculated the violations per employee and truck for Cogent. After removing Cogent from the overall total provided by Royal Waste, the remaining five subcontractors had 106 employees and 47 trucks.

Regarding Hodge, Inc. and Peat, Inc., the auditors found that Hodge, Inc. uses a van for pickup instead of a commercial waste truck, and Peat, Inc. uses pedal-assist electric bicycles for waste collection as a micro-hauler; therefore, the fleet size column did not apply to those two subcontractors. The auditors note that neither of the two subcontractors had safety violations.

DSNY officials indicated that they intend to monitor the carters (both prime and subcontractors) in these zones to enforce compliance with applicable safety requirements. The agency stated that it currently employs several inspectors in the Queens Central zone (the only zone implemented thus far). As of March 14, 2025, DSNY has issued approximately 193 violations since the zone’s implementation.

Several Carters Selected for CWZ Program Had Labor Violations

DSNY also reviewed labor violations issued from February 2018 through July 2022 by the U.S. Department of Labor, the National Labor Relations Board, the New York State Department of Labor, the New York State Public Employment Relations Board, and the New York City Department of Consumer and Worker Protection. The auditors reviewed labor violation information within the RFP Part 2 for the awarded carters and found that five had received 14 labor violations in total, as shown below:

- Action Carting received six labor violations relating to unfair labor practices.

- Waste Connections received four labor violations relating to anti-discrimination laws.

- Recycle Track Systems NYC, LLC (RTS) received two labor violations relating to anti-discrimination laws.

- Filco Carting Corp. received a labor violation relating to unfair labor practices.

- Basin Haulage Inc. received a labor violation relating to anti-discrimination laws.

Additionally, the auditors reviewed the City Comptroller’s Employer Violations Dashboard, which reflects labor violations from 2020–2023, and found that three of the awarded carters (including one listed above—Waste Connections) received three labor violations in total, as shown below:

- Waste Connections received a labor violation relating to unfair labor practices.

- Royal Waste Services received a labor violation relating to workplace safety.

- Cogent received a labor violation relating to wage theft.[18]

Despite these violations, DSNY determined that the carters were capable of fulfilling the overall requirements of the CWZ program. The violations were considered in the scoring of the carters’ proposals under the Capacity and Operations category, which comprised 25% of the overall score. The other factors included in the Capacity and Operations category were the carter’s experience, financial and business information, and capacity and services.

For the zones in which these carters were approved to operate, auditors reviewed the scores given for these carters. A listing of the average scores is shown in Table 4 below.

Table 4: Listing of Evaluation Scores for Carters with Labor Violations

| Carter | # of Assigned Zones | Labor Violations | Average Score for Capacity and Operations |

|---|---|---|---|

| Waste Connections of New York Inc. | 12 | 5 | 23.2 |

| Action Carting Environmental Services, Corp. | 14 | 6 | 22.1 |

| Recycle Track Systems, LLC | 3 | 2 | 18.6 |

| Filco Carting Corp. | 3 | 1 | 22.5 |

| Basin Haulage, Inc. | 1 | 1 | 18.0 |

| Royal Waste Services, Inc. | 5 | 1 | 21.3 |

| Cogent | 4 | 1 | 22.2 |

As shown in the table, the average scores given to these carters’ proposals in the Capacity and Operations category ranged from 18 (Basin Haulage) to 23.2 (Waste Connections). However, two of the carters with high average scores for Capacity and Operations also had the most labor violations, which suggests that labor violations were not a significant determining factor in the scoring and awarding of carters. Action Carting had six labor violations with an average score for Capacity and Operations of 22.1, and Waste Connections of New York Inc. had five labor violations with an average score of 23.2. As mentioned previously, DSNY considered the ability to meet the technical and operational requirements (e.g., capacity, waste management plans) to be more important when selecting carters.

Several Carters Approved for CWZ Program Involved in Civil Litigation

The auditors reviewed information on civil litigation against the 18 awarded carters from the New York State WebCivil Supreme court case database and found that 12 carters faced a total of 200 civil complaints from 2018 to 2022.[19] Specifically:

- 159 complaints concerned accident/injury involving a vehicle operated by carters.

- 23 complaints contained claims of a carter/carter employee’s negligence causing injury.

- 15 complaints were listed as either “Tort-Other”, “OM-Other” or “Comm-Other” (which appear to relate to allegations of workplace discrimination harassment claims and failure to pay overtime wages).

- Three cases involved contract disputes.

Please see Table 5 below for a breakdown of the civil litigation identified from 2018–2022.

Table 5: Listing of Awarded Carters Facing Civil Litigation from 2018–2022

| Carter | Case Type | Total | |||||

|---|---|---|---|---|---|---|---|

| Motor Vehicle | Negligence | Contract | Tort-Other | OM-Other | Comm-Other | ||

| Royal Waste Services, Inc. | 56 | 7 | 0 | 1 | 0 | 1 | 65 |

| Action Carting Environmental Services, Inc. | 50 | 3 | 0 | 3 | 0 | 0 | 56 |

| Metropolitan Paper Recycling, Inc. | 13 | 3 | 2 | 2 | 2 | 0 | 22 |

| Waste Connections of New York, Inc. | 9 | 4 | 0 | 2 | 1 | 0 | 16 |

| Liberty Ashes, Inc. | 9 | 2 | 0 | 1 | 0 | 0 | 12 |

| Filco Carting Corp. | 6 | 4 | 0 | 1 | 0 | 0 | 11 |

| Crown Waste Corp. | 5 | 0 | 0 | 0 | 0 | 0 | 5 |

| Cogent Waste Solutions, LLC | 4 | 0 | 1 | 0 | 0 | 0 | 5 |

| # 1 Waste & Recycler Inc. | 3 | 0 | 0 | 0 | 0 | 0 | 3 |

| Basin Haulage Inc. | 2 | 0 | 0 | 1 | 0 | 0 | 3 |

| Classic Recycling New York Corp. | 1 | 0 | 0 | 0 | 0 | 0 | 1 |

| Priority First Carting Inc. | 1 | 0 | 0 | 0 | 0 | 0 | 1 |

| Total | 159 | 23 | 3 | 11 | 3 | 1 | 200 |

As shown in the table, Royal Waste and Action Carting accounted for 121 (60%) of all 200 cases (65 and 56 respectively) and most cases (106 of 159) related to motor vehicles. Only six of the carters had cases involving negligence.

Under the Capacity and Operations category, violations that may result in litigation may be considered in the scoring of carters’ proposals. Of the 12 carters involved in litigation, all of them had safety violations during the period reviewed (2018 through 2022) and six had labor violations during the period.

Maximum Prices That Can Be Charged by Carters Varied Significantly within Zones

An examination of the maximum pricing schedules for curbside pickup services for the various zones revealed significant differences within certain zones.[20] For example, in five of the 20 zones, the maximum five-day monthly price that one carter could charge was at least 50% more than the maximum price that another carter could charge within the same zone.[21]

Businesses pay for trash by volume/weight and also pay a fixed monthly rate based upon the number of pickups per week.[22]

For example, the maximum monthly price that a business in the Bronx West zone may have to pay if it chooses to have five pickups per week provided by Recycle Track Systems LLC (RTS), assuming each pickup averages 100 lbs., is illustrated in the following scenario:

| Frequency Rate | RTS’ Maximum Monthly Rate for Five Day Pickup Per Week Frequency in Bronx West | $216.67 |

| Monthly Quantity | (100 lbs. per pickup X 5 day per week pickup frequency) X 4 weeks per month | 2,000 lbs. |

| Max Per 100 lb. Rate | RTS’ Max Per lb. rate in Bronx West | $15 |

| Maximum Monthly Charge | Pricing Formula Per DSNY’s Maximum Price Calculator:

Price = Frequency Rate + (Monthly Quantity * (Per 100 lb. Rate / 100)) |

$216.67 + (2,000 * ($15/100)) = $516.67 |

In this scenario, the most the business would pay is $516.67 per month. This example shows that a business is charged both by weight and by the frequency of pickups.

The auditors reviewed the maximum price per 100 lbs. for the awarded carters in each zone and found that the average maximum price paid varied among zones, ranging from $11.40 per 100 lbs. in Brooklyn South to $18.30 in Upper Manhattan. Of the prices charged by the nine carters approved to operate in two or more zones, six of them had the same max price in each zone. Of those that varied their prices, Recycle Track Systems had the widest range, with a max price of $15 per 100 lbs. for the Bronx West zone and a max price of $22 per 100 lbs. in the Upper Manhattan zone—a difference of 47%.

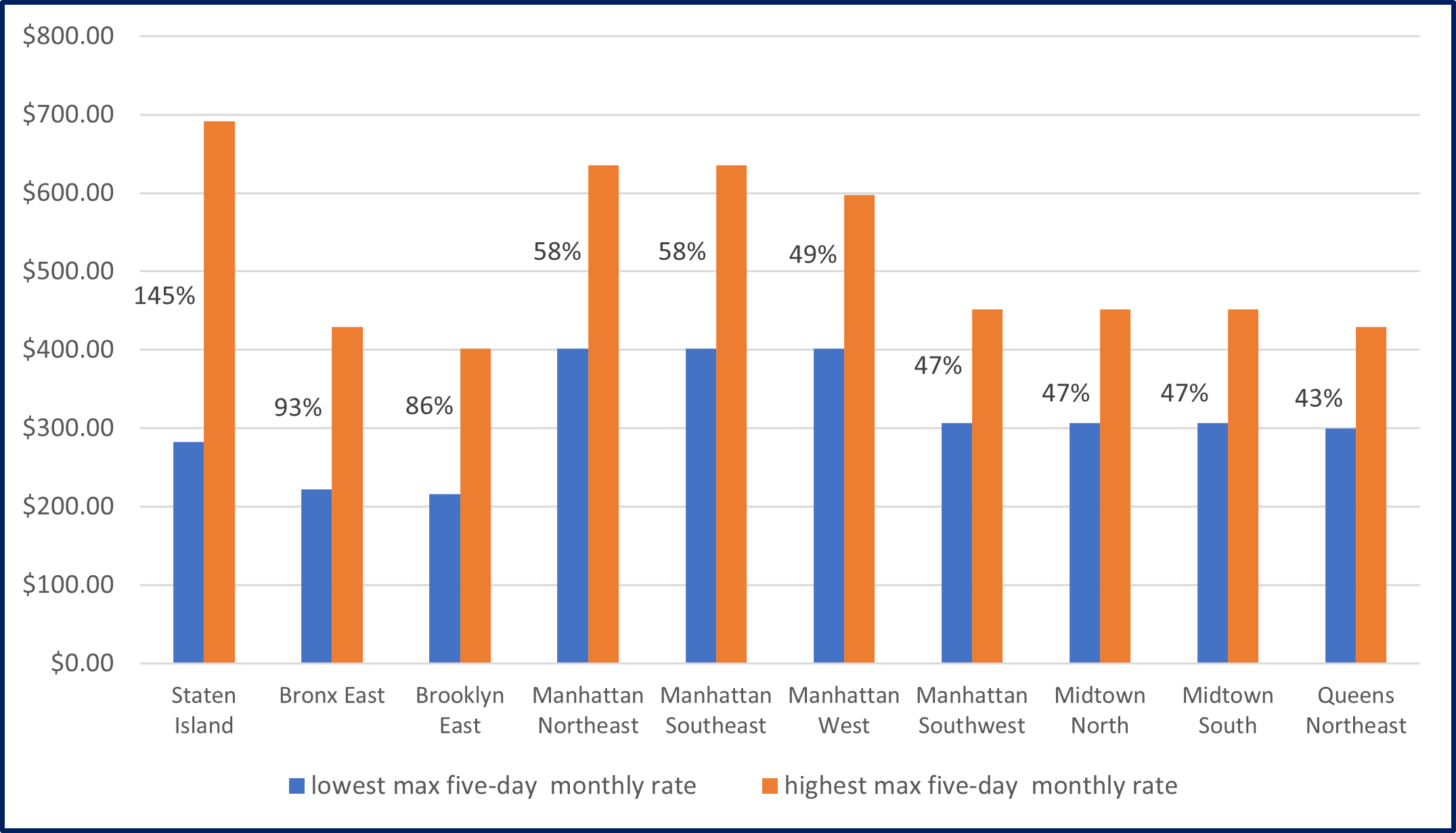

The auditors found that the largest differences in pricing occurred with maximum fixed monthly rates. For example, in one of the 20 zones, the highest max fixed five-day monthly rate was more than double the lowest max monthly rate (based on an average pickup weighing 100 lbs.) and nearly double the lowest rate in two other zones. These three zones are included among the 10 zones with the largest price variations, as shown in Table 6 below. (The maximum fixed rate schedule for curbside service for the awarded carters, per zone, is found in Appendix IV.)

The auditors were unable to identify specific factors that account for these differences. As detailed in the previously referenced 2016 private carting study, there is a lack of transparency within the industry regarding how prices are established, and the proposals reviewed by the auditors did not provide sufficient information to draw conclusions. Both the lack of transparency and the significant differences in pricing conflict with one of LL199’s intended purposes—to provide fair and transparent pricing with low prices for businesses.

Table 6: Zones with the Largest Differences in Five-Day Max Monthly Rates Charged to Businesses

| Zone | Lowest Max Five-Day Fixed Monthly Rate | Highest Max Five-Day Fixed Monthly Rate | Five-Day Max Fixed Monthly Rate Difference | % Increase | ||

|---|---|---|---|---|---|---|

| Staten Island | $282.20 | Priority First Carting | $691.20 | Green Environmental Services Corp. | $409.00 | 145% |

| Bronx East | $221.80 | 5 Borough Waste Removal |

$428.90 |

Action Carting Environmental Services, Inc. |

$207.10 |

93% |

| Brooklyn East | $216.00 | # 1 Waste & Recycler Inc. | $401.20 | Action Carting Environmental Services, Inc. | $185.20 | 86% |

| Manhattan Northeast | $401.20 | Action Carting Environmental Services | $635.60 | MRT BWR, Corp. | $234.40 | 58% |

| Manhattan Southeast | $401.20 | Action Carting Environmental Services | $635.60 | MRT BWR, Corp. | $234.40 | 58% |

| Manhattan West | $401.20 | Action Carting Environmental Services | $597.60 | Classic Recycling New York Corp. | $196.40 | 49% |

| Manhattan Southwest | $306.60 | Filco Carting Corp. | $451.45 | Waste Connections of New York, Inc. | $144.85 | 47% |

| Midtown North | $306.60 | Filco Carting Corp. | $451.45 | Waste Connections of New York, Inc. | $144.85 | 47% |

| Midtown South | $306.60 | Filco Carting Corp. | $451.45 | Waste Connections of New York, Inc. | $144.85 | 47% |

| Queens Northeast | $300.00 | Crown Waste Corp. | $428.90 | Royal Waste Services, Inc. | $128.90 | 43% |

The differences are more clearly demonstrated in Chart 1 below.

Chart 1: Highest Percentage Differences in Five-Day Max Monthly Rates

As shown in the table and chart above, the widest differences were found in the Staten Island and Bronx East zones, where carters had max monthly prices that were 145% and 93% higher than the max monthly prices of other carters operating in their respective zones.

Of the nine carters that operated in multiple zones, five varied their monthly fixed rate prices between zones. The carter with the largest variation was MRT BWR, which had a five-day fixed monthly rate that was more than three times as high in the Manhattan Northeast and Manhattan Southeast zones ($353) than the rate in the Brooklyn North, Queens Central, Queens Northeast and Queens West zones ($110).

Businesses may negotiate rates below these maximums, and actual rates charged will depend on the actual services provided.

Analysis of RFP Process and Award Results

Pricing Was the Most Heavily Weighted Factor in Selection of Carters

LL199 required DSNY to consider 13 factors—including capacity, labor, safety, and the environment—when evaluating carters’ proposals for participation in the CWZ program. The review found that pricing accounted for 40% of the overall score, with the other 12 factors cumulatively accounting for the remaining 60%.

LL199 did not set any specific requirements pertaining to these factors; instead, it authorized DSNY to establish its own guidelines. The review found that DSNY incorporated these factors in the RFP process across three broad categories: (1) Pricing, (2) Technical Proposals, and (3) Capacity and Operations. Table 7 below provides a general description of what areas were considered under each category and the alignment with the RFP factors required by LL199.

Table 7: RFP Scoring Categories and Required Information

| Category | % of Carter Score | General Description of the Category |

|---|---|---|

| Pricing | 40% | In accordance with LL199 RFP Factor #1, the Pricing category included carters’ information on their:

DSNY utilized a pricing tool developed by its contracted vendor Arcadis to calculate scores using data-driven methods based upon the received information. |

| Technical Proposal | 35% | The Technical Proposal category included the carters’ detailed plans for:

|

| Capacity and Operations | 25% | The Capacity and Operations category included the following information:

|

According to DSNY, all elements contained within the three categories were considered holistically when selecting carters; therefore, the agency could not single out one aspect when considering carters for zone award selection.

Nevertheless, as shown in the table, pricing was the most heavily weighted factor, accounting for 40% (40 points out of 100) of a carter’s overall score. Initially, when the RFP was first issued, the Pricing category accounted for 35% of the score. When RFP Addendum #4 was issued in May 2022, the weight for pricing increased to 40% and the weight for the Capacity and Operations category correspondingly decreased from 30% to 25%. According to DSNY officials, the Pricing category was increased to place greater emphasis on affordability. DSNY explained that the shift toward prioritizing pricing was a direct response to lessons learned from the Los Angeles commercial waste franchise program, where price increases led to public backlash and delayed implementation.[23]

The other 12 factors collectively account for the remaining 60% of the overall score. DSNY stated that these other factors were not assigned specific weights within the broader categories. Still, by dividing the number of factors under each category by the total weight assigned to that category, the review calculated that the eight factors considered under Technical Proposal each average out to 4.375 points (35 ÷ 8) of the carter’s score, and the four factors considered under Capacity and Operations each average out to 6.25 points (25 ÷ 4) of the carter’s score. Each carter received a separate score for every zone for which they applied.

Two of the factors set forth in LL199 pertain to carters’ violation histories and safety protocols. The compliance history is addressed under the Capacity and Operations category, and health and safety plans are addressed under the Technical Proposals category. Under Capacity and Operations, a carter’s history of compliance with existing federal, state and local laws is reviewed, including but not limited to, laws relating to waste removal and disposal, labor, and health and safety.

Due to the relatively low weight that violation histories were given in evaluating proposals, carters with fewer violations did not have an advantage over those with more violations. (This is discussed in more detail in the following section of this report.)

Although pricing was the most heavily weighted factor, the auditors found that the carters that scored highest for pricing in particular zones were generally not approved for those zones; of the 20 zones, the carters with the highest score for pricing within a zone were approved to operate in that particular zone in only five instances. (Conversely, the carters with highest scores given for Capacity and Operations and Technical Proposals within a zone were approved to operate in that zone in 14 instances [Capacity and Operations] and 15 instances [Technical Proposals].) Among the approved carters, scores for pricing in the respective zones varied significantly, ranging from a low of 7.4 points (out of 40) for a carter in one zone, to a high of 38.7 points for a carter in another.

Four Carters Filled More Than 70% of Zone Assignments

The review found that only a few carters received a significant portion of zone assignments. Of the carters selected to operate in the program, four effectively filled more than 70% of all available zone assignments. Based on the information in their proposals, these four carters have extensive experience conducting waste disposal in the City and historically have provided service in many of the areas that they will now be serving under the CWZ program.

As stated previously, DSNY received proposals from 34 entities requesting to be named authorized carters in the CWZ program. Included among that group was New York Recycling Solutions LLC (New York Recycling), which identified itself as a joint venture of two other carters applying for the CWZ program: Cogent and Royal Waste. According to the RFP requirements, entities are prohibited from submitting multiple bids for the same zone, and the auditors confirmed that DSNY ensured that none of the three above-named entities bid on any overlapping zones in any combination.[24]

The zone assignments at the initial announcement in January 2024 are shown in Table 8 below.

Table 8: Listing of the Awarded Zone Assignments as of January 2024

| Approved Carter | # of Approved Zones as of Jan. 2024 | % of Total Zone Assignments | # of Employees | Fleet Size (# of Trucks) |

|---|---|---|---|---|

| Action Carting Environmental Services Inc. | 14 | 23% | 455 | 150 |

| Waste Connections Of New York, Inc. | 12 | 20% | 214 | 82 |

| Cogent Waste Solutions LLC (New York Recycling Solutions LLC)* | 6** | 10% | 141 | 87 |

| MRT BWR Corp. | 6 | 10% | 199 | 61 |

| Royal Waste Services Inc. | 5 | 8% | 363 | 120 |

| Filco Carting Corp. | 3 | 5% | 104 | 35 |

| Recycle Track Systems NYC, LLC | 3 | 5% | 103 | 0 |

| Metropolitan Paper Recycling, Inc. | 2 | 3% | 85 | 29 |

| # 1 Waste & Recycler Inc. | 1 | 2% | 7 | 2 |

| 5 Borough Waste Removal Inc | 1 | 2% | 11 | 4 |

| Basin Haulage Inc. | 1 | 2% | 32 | 19 |

| Classic Recycling New York Corp. | 1 | 2% | 45 | 25 |

| Crown Waste Corp. | 1 | 2% | 27 | 10 |

| Cutting Room Recycling Corp. / Industrial Carting | 1 | 2% | 16 | 8 |

| Green Environmental Services Corp. | 1 | 2% | 44 | 16 |

| Liberty Ashes, Inc. | 1 | 2% | 47 | 19 |

| Priority First Carting Inc. | 1 | 2% | 9 | 6 |

| Total | 60 | 100% |

As shown in the table, five carters—Action Carting, Waste Connections, Cogent (including New York Recycling), MRT BWR, and Royal Waste—were approved for 43 (72%) of the 60 total zone assignments, as of January 2024. (Of the remaining 12 carters, nine were approved for one zone.)

After the award determinations, Royal Waste lost its stake in New York Recycling after being acquired by Waste Connections in September 2024. According to DSNY, New York Recycling is now 100% owned by Cogent and its principals. Moreover, because of the acquisition, Waste Connections (initially awarded 12 zones) would now be authorized to operate in 17 zones (Royal Waste was awarded five zones). This change would violate LL199, which limits the number of zones per carter to 15. To address this violation, DSNY removed Waste Connections from serving Brooklyn Southwest and Queens West and is in the process of assigning a third carter to those zones.[25] The current assignments after Waste Connections’ acquisition of Royal Waste are shown in Table 9 below.

Table 9: Listing of the Awarded Zone Assignments as of September 2024

| Approved Carter | # of Approved Zones as of Sep. 2024 | % of Total Zone Assignments | # of Employees | Fleet Size (# of Trucks) |

|---|---|---|---|---|

| Waste Connections Of New York, Inc. (incl. Royal Waste)* | 15 | 26% | 577 | 202 |

| Action Carting Environmental Services Inc. | 14 | 24% | 455 | 150 |

| MRT BWR Corp. | 6 | 10% | 199 | 61 |

| Cogent Waste Solutions LLC (incl. New York Recycling) | 6 | 10% | 141 | 87 |

| Filco Carting Corp. | 3 | 5% | 104 | 35 |

| Recycle Track Systems NYC, LLC | 3 | 5% | 103 | 0 |

| Metropolitan Paper Recycling, Inc. | 2 | 3% | 85 | 29 |

| Liberty Ashes, Inc. | 1 | 2% | 47 | 19 |

| Classic Recycling New York Corp. | 1 | 2% | 45 | 25 |

| Green Environmental Services Corp. | 1 | 2% | 44 | 16 |

| Basin Haulage Inc. | 1 | 2% | 32 | 19 |

| Crown Waste Corp. | 1 | 2% | 27 | 10 |

| Cutting Room Recycling Corp. / Industrial Carting | 1 | 2% | 16 | 8 |

| 5 Borough Waste Removal Inc. | 1 | 2% | 11 | 4 |

| Priority First Carting Inc. | 1 | 2% | 9 | 6 |

| # 1 Waste & Recycler Inc. | 1 | 2% | 7 | 2 |

| Total | 58* | 100% |

As shown in the table, Waste Connections and Action Carting still account for 29 (48%) of the available 60 zone assignments. Together with MRT BWR Corp. and Cogent, these four carters fill 41 (71%) of the available zone assignments. A review of the proposals submitted by these carters revealed that they have been providing carting service in the City—and in several of the zones for which they have been approved—prior to the program’s implementation.

The carters assigned multiple zones were generally larger firms in terms of employee headcount and fleet size. DSNY indicated that the larger firms generally had the infrastructure needed to meet the various goals of the program. Of the 10 carters with the largest fleets, seven of them (including the top five) were awarded zones. (The number of people employed and fleet sizes for each of the 34 carters that submitted proposals are found in Appendix II.)

An examination of the scores given for Capacity and Operations revealed that the higher scores were awarded to proposals submitted by the larger carters, suggesting that the weighting process may have disadvantaged smaller operators. Each carter received a separate score for every zone for which they applied. A review of the top three scores for Capacity and Operations for each of the 20 zones (60 scores in total) revealed that 65% were awarded to carters who were in the top ten in employee headcount, and 63% were awarded to carters in the top ten in fleet size. An examination of the scores given for Technical Proposals yielded similar results. A review of the top three scores for each of the zones found that 67% were awarded to carters in the top ten in employee headcount, and 63% were awarded to carters among the top ten in fleet size.

As shown in the table, one of the carters approved to operate in the CWZ program, Recycle Track Systems (RTS), does not have a fleet of trucks. Rather, RTS owns trash and recycling containers that it supplies to businesses, and subcontracts with local carters for trash pickup, receiving a percentage of the monthly recurring pickup fee from these subcontractors. RTS also supplies tablets that run RTS software to its subcontractors.

There is no requirement that a carter must own a fleet of trucks; according to RFP Part 2, a carter may own or lease its own equipment or utilize the equipment of a subcontractor. Officials stated that operational capacity (which includes the carter’s experience, capacity and services, financial and business information, and compliance history) is the basis used for determining whether a carter meets the minimum qualification requirement, rather than actual ownership of trucks.

Following the RFP evaluation process, RTS was authorized to operate in the following zones, and proposed to work with the subcontractors identified below:

- In the Bronx West zone, RTS proposed to subcontract with City Waste Services of NY Inc. (City Waste) for commercial waste pickup.

- In the Queens Southeast zone, RTS proposed to subcontract with City Waste and Regency Recycling Corp. for commercial waste pickup.

- In the Upper Manhattan zone, RTS proposed to subcontract with City Waste and Winter Bros. Waste Systems of NYC, LLC, for commercial waste pickup.

Zone Assignments Not Necessarily Awarded to the Highest Ranked Carters

According to DSNY, its Evaluation Committee found it necessary to adjust zone assignments for various reasons. For example, a carter in the top three scorers of the zone reached the maximum number of zones it had the capacity to serve. In another, a carter had garages or facilities in closer proximity to the zone than the initially assigned carter.

A review of the scores revealed that the top three highest scoring carters were approved to operate in only three zones (Brooklyn South, Manhattan Southeast, and Manhattan Southwest). In nine zones, carters that ranked fifth or sixth in overall score were approved to operate. (Please see Appendix III for a breakdown of the ranks received by the carters in each of the three scoring categories for the 20 zones.)

In determining the zones that a carter could serve, DSNY considered the maximum number of zones that the carter could serve and the proximity of the carter’s facilities and garages to the zone. To do this, DSNY used its Maximum Zones Tool, which analyzes the carter’s truck fleet, workforce size, and operational efficiency based on industry standard ratios. The calculator also factored the carters’ capacity for operations scaling, including expansion of its truck fleet. If the preliminary results suggested that a carter qualified to operate in more zones than it was able to serve, DSNY took the proximity of the carter’s facilities to the zones under consideration before deciding which zones the carter would be assigned. According to DSNY, in some cases, a carter was approved to serve a zone over a higher-ranked carter if the former’s facilities were closer to the zone in question.

For example, a review of the scoring documentation for New York Recycling revealed that the carter was one of the three highest scoring carters for only one zone (Manhattan West). However, New York Recycling was bypassed in that zone by the fourth-highest ranked carter (Classic Recycling New York Corp.), because New York Recycling was selected to serve the Lower Manhattan zone instead, despite receiving the fifth-highest score. That move was made because one of the other carters that scored higher (Crown Waste Corp.) had already reached their maximum zone capacity. Additionally, it was determined that Filco would be better suited for serving Midtown North, which had a higher number of container-based customers. For Midtown South, New York Recycling was selected because the highest ranked carter for that zone—MRT BWR Corp.—had a large existing customer base in a different zone.

In another example, DSNY authorized Cogent to provide service in four zones: Brooklyn North, Brooklyn South, Brooklyn East, and Staten Island. For three of these zones—Brooklyn North, Brooklyn East, Staten Island—the carter’s score was not in the top three. In both Brooklyn East and Staten Island, Cogent was ranked fourth but was selected because a higher ranked carter (MRT BWR Corp. in Brooklyn East and Action Carting in Staten Island) had already reached the maximum number of zones it could serve. In Brooklyn North, Cogent was ranked sixth but was selected by DSNY because two higher ranked carters (5 Borough Waste Removal and # 1 Waste & Recycler Inc.) had already reached the maximum number of zones they could serve. For another higher ranked carter (Waste Connections of New York, Inc.), the agency determined that Cogent was better suited to serve the zone due to the proximity of Cogent’s garages and facilities to the zone.

RFP Complied with Local Law 199 and Sought to Meet its Intended Purposes

According to the introduction to LL199, the intended purposes of the law were to:

- Establish new safety standards (improve training and safety standards to make industry safer for workers and the public);

- Reduce vehicle miles traveled (VMT);

- Reduce harmful emissions from waste hauling vehicles;

- Improve industry labor standards and uphold worker rights;

- Improve service for businesses (strengthen customer service standards and establish accountability); and

- Provide fair, transparent pricing with low prices for businesses

A review of the RFP found that it included elements intended to meet these purposes. (A full comparison of LL199’s intended purposes, with the requirements of the RFP, are found in Appendix V.) For example, regarding safety, DSNY required that carter trucks be equipped with a GPS telematics system to allow the agency to monitor and track critical safety information, such as hard stops, sudden accelerations, and speeding. (According to DSNY, its Bureau of Commercial Waste is responsible for monitoring this data.) Furthermore, DSNY required carters to submit safety records (e.g., inspection records), ensure that all vehicles have backup cameras by January 2026, and meet training requirements established by DSNY.

With regard to reducing VMT, DSNY required that the telematics system also allows the agency to monitor VMT in real time. For example, DSNY’s CWZ rules require dedicated routing per zone to ensure clear enforcement, route optimization, and performance tracking. According to DSNY, carter trucks are not permitted to operate across multiple zones in a single route unless explicitly authorized by DSNY. The telematics system allows DSNY to monitor each carter’s compliance with the requirement that they collect waste only within their authorized zone(s). Regarding the number of carters allowed to operate in a zone, the auditors found that the maximum number of carters (including the awarded carters and their proposed subcontractors) that could be operating in any given zone is nine, which is still significantly less than the 50+ carters that reportedly operated in certain areas prior to the CWZ program.[26]

DSNY required that proposals include a customer service plan, a plan describing practices to support waste reduction, a waste management plan, and a plan to reduce air pollution and greenhouse gas emissions from commercial waste vehicles. Regarding air pollution reduction, carters must have a plan to ensure that at least half of their fleet is composed of zero emission vehicles by 2030. In addition, DSNY required carters to submit the percentage of their fleets that meet EPA requirements for truck engines. The review of the proposals for each of the selected carters found that all 18 reported that 100% of their fleets complied with EPA requirements.

With regard to fair and transparent pricing, DSNY’s website has a Maximum Price Calculator, which allows businesses to view the maximum rate each carter is allowed to charge within their respective zone.[27] Businesses can use the information to negotiate lower prices with carters. Moreover, DSNY’s CWZ rules specify that customer service agreements between carter and business must include a clear description of applicable fees. However, as noted earlier, the auditors found significant differences in the maximum prices that could be charged by carters within certain zones, with no information in the RFP submissions explaining the reasons for these differences.

The auditors reviewed DSNY’s evaluation of the 34 proposals and found sufficient evidence supporting DSNY’s determinations that they were complete and met the requirements of the RFP.

According to DSNY, the information submitted by carters was reviewed in depth during the evaluation process. Regarding the financial documentation submitted by carters, DSNY worked with contracted vendor Arcadis to review and verify carters’ financial data. The verification process primarily relied on audited financial statements or tax returns submitted by the carters to ensure the authenticity of the information. Additionally, DSNY reviewed other requirements such as customer service plans, which included customer complaint procedures and language access plans. The Evaluation Committee used scorecards and notes to document the review of the detailed plans.

Suggested Improvements

Based on this review, the auditors suggest that DSNY:

- Track various indicators (e.g., vehicle miles traveled, safety violations, complaints received, vehicle inspections) to ascertain the extent to which the intended purposes of LL199 are being realized. These should be incorporated into the Mayor’s Management Report and published quarterly to ensure transparency.

DSNY Response:DSNY partially agreed with this suggestion. DSNY agreed that tracking the various indicators is critical to monitoring the success of the CWZ program. However, it stated that “LL 199 already imposes nearly identical tracking and reporting requirements on DSNY. Specifically, Section 16-1011 of the New York City Administrative Code requires the Department to issue an annual report to Council and the Mayor and post such report on DSNY’s website. […] Therefore, incorporating these indicators into the Mayor’s Management Report as suggested by the Comptroller would be unnecessarily duplicative.”

Auditor Comment: The tracking requirements referred to above are annual. The auditors recommended—and continue to recommend—that DSNY track and publish these indicators on a quarterly basis to more promptly identify trends that should be addressed.

- Investigate the reasons for the wide price differences charged by carters within certain zones and determine whether such differences hinder the ability of businesses to obtain carting services at a reasonable rate.

DSNY Response: DSNY disagreed with this suggestion, stating that “LL 199 does not require all awardees to offer the same prices for commercial waste collection services. Instead, as part of the Commercial Waste Zone RFP process carters were required to submit their best offer for the price they would charge customers if selected.” DSNY further stated that “[t]he prices awardees submitted varied depending on market conditions specific to each awardee, such as their location, disposal facilities used, services provided, capacity, and many other factors. As a result, no two awardees will offer the same exact price. Instead, price is one of the many factors awardees can compete with for customers as part of the Commercial Waste Zone program.”

Auditor Comment: The stated goals of LL199 included access to reasonable rates and transparency in pricing. The unexplained differences in pricing undermine transparency and raise related questions about the reasonableness of rates. DSNY should implement the recommendation.

- Closely monitor the performances of Cogent and New York Recycling to ensure compliance with the CWZ agreement.

DSNY Response: DSNY agreed with this suggestion.

- Ensure that the monitor assigned to Cogent and New York Recycling submits required reports to DSNY updating the agency of its investigations.

DSNY Response: DSNY agreed with this suggestion.

Appendix I

Map of the 20 Commercial Waste Zones and Awarded Carters*

*Waste Connections was the third awarded carter for Brooklyn Southwest and Queens West in January 2024; however, the carter was removed from serving those zones because it acquired Royal Waste in September 2024.

Appendix II

List of Carters that Submitted Proposals to RFP Part 2 for the CWZ Program (Approved Carters Are in Bold)

| # | Carter Name | # of Employees | Fleet Size (# of Trucks) | # of Assigned Zones |

|---|---|---|---|---|

| 1 | # 1 Waste & Recycler Inc. | 7 | 2 | 1 |

| 2 | 1 Take All Corp | 2 | 3 | |

| 3 | 5 Borough Waste Removal Inc | 11 | 4 | 1 |

| 4 | Action Carting Environmental Services Inc. | 455 | 150 | 14 |

| 5 | American Recycling Management, LLC | 14 | 4 | |

| 6 | Approved Storage And Waste Hauling Inc | 24 | 50 | |

| 7 | Basin Haulage Inc. | 32 | 19 | 1 |

| 8 | Bestway Carting Inc. | 19 | 17 | |

| 9 | Century Waste Services L.L.C. | 84 | 43 | |

| 10 | Classic Recycling New York Corp. | 45 | 25 | 1 |

| 11 | Cogent Waste Solutions LLC* | 141 | 87 | 4 |

| 12 | Crown Waste Corp | 27 | 10 | 1 |

| 13 | Cutting Room Recycling Corp. / Industrial Carting | 16 | 8 | 1 |

| 14 | D & D Carting Co., Inc. | 15 | 12 | |

| 15 | D. Daniels Contracting Ltd. | 21 | 9 | |

| 16 | Enviro Sanitation LLC | 43 | 32 | |

| 17 | Falso Carting Co., Inc. | 31 | 8 | |

| 18 | Filco Carting Corp. | 104 | 35 | 3 |

| 19 | Flash Recycling Corporation | 10 | 4 | |

| 20 | Green Environmental Services Corp | 44 | 16 | 1 |

| 21 | Kings County Carting Corp. | 9 | 3 | |

| 22 | Liberty Ashes, Inc. | 47 | 19 | 1 |

| 23 | Liverpool Carting Co. Inc. | 12 | 4 | |

| 24 | M & M Sanitation Corp. | 31 | 19 | |

| 25 | Metropolitan Paper Recycling, Inc. | 85 | 29 | 2 |

| 26 | MRT BWR Corp | 199 | 61 | 6 |

| 27 | Mybem Corp. | 21 | 10 | |

| 28 | New York Recycling Solutions LLC* | 504 | 207 | 2 |

| 29 | Priority First Carting Inc. | 9 | 6 | 1 |

| 30 | Recycle Track Systems NYC, LLC | 103 | 0 | 3 |

| 31 | Royal Waste Services Inc.* | 363 | 120 | 5 |

| 32 | Rubicon Global, LLC | 0 | 0 | |

| 33 | Tully Environmental Inc. | 44 | 9 | |

| 34 | Waste Connections of New York, Inc.** | 214 | 82 | 12 |

| Total | 60** |

* New York Recycling was submitted as a joint venture between Cogent Waste Solutions LLC and Royal Waste Services Inc. The number of employees and fleet size for New York Recycling is arrived at by adding the figures for Cogent and Royal Waste.

** After the zone assignments were initially awarded: (1) Cogent bought out Royal Waste and assumed full ownership of New York Recycling; and (2) Waste Connections of New York, Inc. acquired Royal Waste. Following Waste Connections’ acquisition, the number of zones that would be under Waste Connections’ assignment would be 17, exceeding the LL199-mandated limit of 15. Consequently, DSNY removed Waste Connections as one of the three approved carters in the Brooklyn Southwest and Queens West zones. As of April 2025, the third carter for these zones had not yet been named.

Appendix III

List of the 20 Zones and Rank Breakdown of Each Carter per Zone

Key:

<tbody?

| One of the awarded carters for the zone.[28] | |

| Awarded the zone after an adjustment by DSNY’s Evaluation Committee. | |

| Removed from the zone after an adjustment by DSNY’s Evaluation Committee. | |

| Deemed ineligible to service the zone due to reaching their maximum zone capacity per Maximum Zones Tool. | |

Bronx (2 Zones)

| # | Zone | Carter Name | Scoring Categories | |||

|---|---|---|---|---|---|---|

| Capacity & Operations | Technical Proposals | Pricing | Overall Ranking | |||

| 1 | Bronx East | 5 Borough Waste Removal | 7 | 7 | 1 | 1 |

| Action Carting Environmental Services Inc. | 1 | 1 | 2 | 2 | ||

| Mr. T Carting Corp. | 2 | 2 | 4 | 3 | ||

| Royal Waste Services Inc. | 3 | 3 | 6 | 4 | ||

| Recycle Track Systems NYC, LLC | 4 | 4 | 5 | 5 | ||

| Falso Carting Co., Inc. | 5 | 5 | 3 | 6 | ||

| Approved Storage And Waste Hauling Inc | 6 | 6 | 7 | 7 | ||

| 2 | Bronx West | 5 Borough Waste Removal | 8 | 8 | 1 | 1 |

| Action Carting Environmental Services Inc. | 2 | 1 | 2 | 2 | ||