News

December 2014 Monthly Public Finance Wrap-Up

To Our Investor Community:

New York City continued to be one of the largest municipal bond issuers in the country, according to statistics published in The Bond Buyer on January 8th. While the State of California was the top issuer in these rankings with New York City TFA and GO at #4 and #8, respectively, combined TFA and GO issuance topped California’s.

Over the last 12 months, New York City has issued $11.5 billion of bonds through its major credits. Issuance included new money to fund long-term capital needs and refundings of higher interest rate debt to provide budget savings benefitting City taxpayers and water and sewer ratepayers. We continue to receive support from a deep pool of investors, including individuals (acting directly and through separately managed accounts) and diverse institutional investors ranging from money managers and bond funds to property and casualty insurers and strategic investors.

The Comptroller’s Office released reports in December providing analysis on the City’s cash position as well as the state of the City’s economy and finances. The Public Finance Bureau continued development and outreach work on our proposed Green Bonds Program for New York City. There were no bond sales in December; the calendar picks up again in January with a Transitional Finance Authority (TFA) Building Aid Revenue Bond issue pricing the week of January 12th.

2014 – Public Finance Year in Review

New York City and its related issuers completed nine new-money transactions totaling $5.7 billion in calendar year 2014, funding capital projects with useful lives of five years or more. Of the $5.7 billion new money issued, approximately 21 percent or $1.2 billion was issued as variable rate debt. The majority of the variable rate debt was sold as traditional Variable Rate Demand Bonds, which are repriced daily or weekly and backed by bank credit or liquidity facilities. City issuers also sold index-based Floating Rate Notes in both the public markets and direct placements with banks.

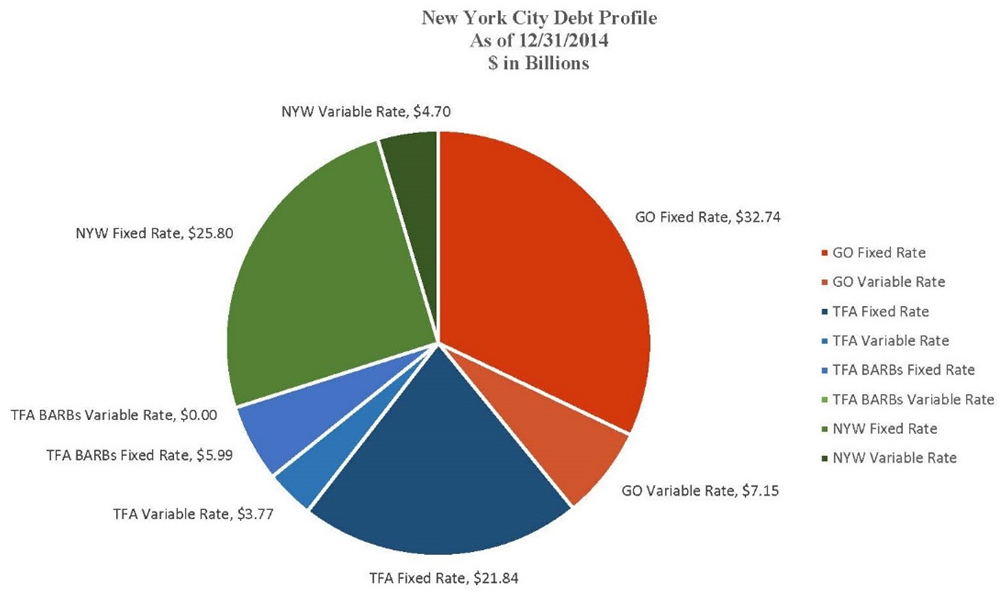

Variable rate debt has played an important role in the City’s debt profile for many years. Approximately 15 percent of the total General Obligation, TFA and New York Water debt outstanding is in a variable rate mode. The chart to the right shows the mix of fixed and floating rate debt for these credits.

Variable rate debt has played an important role in the City’s debt profile for many years. Approximately 15 percent of the total General Obligation, TFA and New York Water debt outstanding is in a variable rate mode. The chart to the right shows the mix of fixed and floating rate debt for these credits.

Taking advantage of low interest rates, the City also sold $5.8 billion bonds to refinance higher coupon bonds and reduce interest expense. The refundings resulted in over $1.2 billion of debt expense savings over the life of the bonds. These refunding bonds were sold under the City’s General Obligation, Municipal Water Finance Authority and Sales Tax Asset Receivable Corporation (STAR) credits. STAR accounted for over $2 billion of the $5.8 billion sold as well as over $649 million in savings. As always, we will continue to monitor refunding opportunities throughout calendar 2015.

NYC Green Bond Program

Since the Comptroller’s Office released its Green Bond Program for New York City in September 2014, the Bureau of Public Finance along with its partners in debt issuance at the Mayor’s Office of Management and Budget have met with key investors in the Green Bond space. Investor feedback has been highly positive for the underlying principles and parameters of the proposal. Investors also told us that the market would welcome and benefit from New York City entering with a sustained, high-quality Green Bond program. We are excited about the opportunity Green Bonds provide for New York City to reach new investors and shine a spotlight on environmentally-beneficial work in the City’s capital program, and will continue to work towards our goal of implementing this program.

New York City Cash Position

On December 24, the Comptroller’s Office Bureau of Financial Analysis released its Quarterly Cash Report for the first quarter of fiscal year 2015. This report provides a retrospective look at the major cash events during the July to September 2014 period. High cash balances in New York City’s Central Treasury reflect the City’s strong economic position. The opening balance on July 1 was $9.858 billion, the highest opening balance on record. During the quarter, expenditures exceeded receipts by $846 million. During the same period in FY 2014, expenditures were greater than revenues by $2.170 billion. By the end of the quarter, the City’s unrestricted cash balance declined slightly to $9.011 billion compared to $5.773 billion at the same time last year. At $9.442 billion, the FY 2015 first quarter average cash balance was the highest first quarter average in 10 years. You may download the entire report on our website.

The State of the City’s Economy and Finances Report

On December 15, the Comptroller released his City Charter-mandated State of the City’s Economy and Finances report. The report shows that growth in New York City’s economy in FY 2014 helped the City’s financial position. The rate of growth in the City’s economy outpaced the national rate over the first three quarters of the year. New York City’s real gross city product (GCP ) grew at an average annualized rate of three percent over the first three quarters of the year, almost one percentage point more than the U.S. during the same period. One concern about the city’s economic performance is that most of the new jobs created have been in relatively low wage industries. Since the beginning of 2011, nearly 40 percent of the job creation has occurred in the low-wage sectors of home health care, retail trade, and food service, although at the start of the period only about 16 percent of all jobs in the city were in those sectors. You may download the entire report on our website.

Transitional Finance Authority Building Aid Revenue Bond Rating Upgrade

On December 11th, Standard & Poor’s upgraded the New York City Transitional Finance Authority’s Building Aid Revenue Bonds (BARBs) from AA- to AA, based on the upgrade earlier this year of New York State’s credit. The BARBs are paid from annual appropriations of State building aid for school capital projects. With this upgrade Standard & Poor’s joins Moody’s Investor Services and Fitch, which made similar ratings upgrades earlier this year when they too upgraded the State. Moody’s and Fitch each rate BARBs at Aa2 and AA. You may download the entire S& P report on our website.

Looking Ahead

The New York City Transitional Finance Authority will issue Building Aid Revenue Bonds during the month of January. This $750 million tax-exempt, fixed rate issue will be priced the week of January 12th. You may link to the transaction announcement and preliminary Offering Circular here.

Information on how to buy New York City bonds is also available on the Comptroller’s website. You can subscribe on our website to receive sale announcements and other City publications and reports. The New York State Comptroller also maintains a website with a preliminary forward calendar for major State and City issuers.

As always, we appreciate your interest in New York City bonds. Please contact us if you have any questions or suggestions as to how we can improve our investor communications.

Happy New Year!

Carol S. Kostik

Deputy Comptroller for Public Finance