News

December 2015 Monthly Public Finance Wrap-Up

To Our Investor Community:

The final month of 2015 was quiet for the bond market with no sales during the month of December but active at the Comptroller’s Office as Comptroller Stringer released his charter-mandated analysis on the condition of the City’s economy and finances and evaluated the Mayor’s most recent financial plan.

2015 – Public Finance Year in Review

Over the last 12 months, New York City has issued $9.6 billion of bonds through its General Obligation, Transitional Finance Authority and Municipal Water Finance Authority. Issuance included $5.9 billion of new money to fund long-term capital assets with useful lives of five years or more. These issuers also sold $3.7 billion of refunding bonds that refinanced higher interest rate debt and provided over $700 million in budget savings benefitting City taxpayers and water and sewer ratepayers over the life of the bonds. We continued to receive support from a deep pool of investors, including individuals (acting directly and through separately managed accounts) and diverse institutional investors ranging from money managers and bond funds to property and casualty insurers and strategic investors.

Over the last 12 months, New York City has issued $9.6 billion of bonds through its General Obligation, Transitional Finance Authority and Municipal Water Finance Authority. Issuance included $5.9 billion of new money to fund long-term capital assets with useful lives of five years or more. These issuers also sold $3.7 billion of refunding bonds that refinanced higher interest rate debt and provided over $700 million in budget savings benefitting City taxpayers and water and sewer ratepayers over the life of the bonds. We continued to receive support from a deep pool of investors, including individuals (acting directly and through separately managed accounts) and diverse institutional investors ranging from money managers and bond funds to property and casualty insurers and strategic investors.

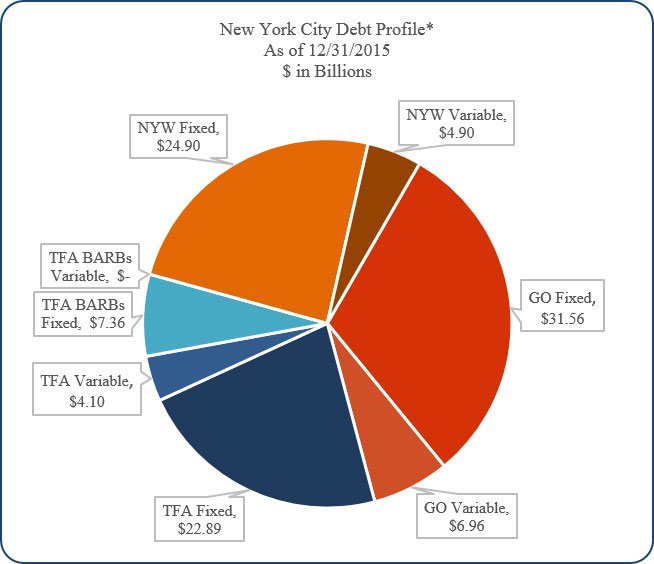

The accompanying table provides an overview of NYC’s debt profile for these three credits. As you will notice, variable rate debt continues to play an important role making up approximately 15.5 percent of the total General Obligation, TFA and New York Water debt outstanding.

The State of the City’s Economy and Finances Report

On December 11, the Comptroller released his City Charter-mandated State of the City’s Economy and Finances report. The report highlights that in Fiscal Year 2015, New York City took in more money than it spent, the first time that has happened in seven years. However, the same report found that the City’s budget cushion remains between $1.2 to $6.1 billion below optimal levels, based on analysis by the Comptroller’s Bureau of Budget and Fiscal Studies.

The City’s economy, as measured by the change in the Gross City Product (GCP), is expected to end 2015 with a 3.4 percent increase over the prior year. This is the sixth consecutive year of steady growth during which the City’s economy has averaged annual growth of 2.8 percent, comfortably outpacing the 2.1 percent average national growth rate over this period.

The City’s labor market also continued to strengthen in 2015, with the private sector adding 76,000 jobs through the first 10 months of the year. While the strong jobs gain is encouraging news, the composition of the jobs is a cause of concern. In the first 10 months of 2015, more than 41 percent of the jobs created were in retail trade, home health care and food services, where workers earn on average about half the average wage of all private sector workers. You may download the entire report on our website.

Looking Ahead

There are no New York City bond sales currently scheduled for January. Information on how to buy New York City bonds is available on the Comptroller’s website. There, you can subscribe to receive sale announcements and other City publications and reports. The New York State Comptroller also maintains a website with a preliminary forward calendar for major State and City issuers.

As always, we appreciate your interest in New York City bonds. Please contact us if you have any questions or suggestions as to how we can improve our investor communications.

Happy New Year!

Carol S. Kostik

Deputy Comptroller for Public Finance