News

Monthly Public Finance Wrap-Up: April 2018

$1.2 Billion NYC General Obligation Bond Sale

New York City sold approximately $1.2 billion of tax-exempt and taxable new money and conversion bonds via negotiated and competitive sales on April 11. The preceding two-day order period for individual investors received a strong response and positioned the City well for institutional orders. International buyers from Europe and Asia expressed interest in both the tax-exempt and taxable bonds during the institutional order period, which the City had not seen in some time. Due to strong demand, the City was able to reduce yields by up to six basis points. Citigroup served as book-running senior manager for the tax-exempt bonds. J.P. Morgan won both competitive bond tranches over six other bidders, for a total of $250 million of bonds. Read the full press release.

$459 Million New York Water Bond Sale

The New York City Municipal Water Finance Authority sold approximately $459 million of refunding revenue bonds via negotiated sale on April 4. Individuals and professionally-managed individual accounts placed over $85 million in orders for the bonds during their one-day individual priority order period. A strong institutional period the next day resulted in favorable pricing for the Water Authority and the transaction resulted in over $152 million of savings for ratepayers over the life of the bonds. Siebert Cisneros Shank & Co. served as book-running senior manager for the bonds. Learn more about the impact of investing in New York Water bonds.

NYC Bond Fact – 1846!

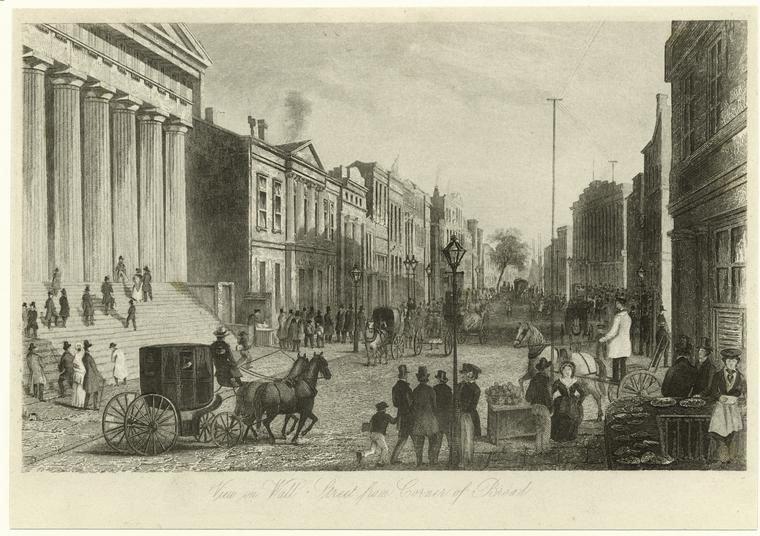

Wall Street, 1846 (John A. Rolph, 1799-1862 (Artist), from the New York Public Library’s Digital Collections)

Wall Street, 1846 (John A. Rolph, 1799-1862 (Artist), from the New York Public Library’s Digital Collections)

Municipal debt limits were introduced in New York at the 1846 State Constitutional Convention. The amendment that passed was less restrictive than the one initially proposed. The ratified amendment ultimately read:

It shall be the duty of the Legislature to provide for the organization of cities and incorporated villages, and to restrict their power of taxation, assessment, borrowing money, contracting debts, and loaning their credit, so as to prevent abuses in assessments, and in contracting debt by such municipal corporations.

Before 1846, the New York State Constitution included no restrictions on municipal debt, though New York City had issued its first municipal bond over 30 years earlier.

(Source: Robert W. Cockren, Maria L. Vecchiotti, and Donna M. Zerbo, Local Finance: A Brief Constitutional History, 8 Fordham Urb. L.J. 135 (1980). Available here.)

Today, the City’s allowable indebtedness is still governed by the New York State Constitution and is limited to no more than 10% of the average full value of taxable real estate in the City for the most recent five years. The City’s Official Statements provide a more detailed description of the constitutional debt limit.

Looking Ahead

The New York City Transitional Finance Authority plans to offer approximately $1.3 billion of Future Tax Secured tax-exempt and taxable bonds the week of May 14. Additional details will be announced when they become available.

As always, we appreciate your interest in New York City bonds.

Carol S. Kostik

Deputy Comptroller for Public Finance

Flushing Town Hall is the home to Flushing Council on Culture and the Arts, a nonprofit organization that promotes intercultural understanding through the arts.