News

Monthly Public Finance Wrap-Up: August 2017

$1.5 Billion Transitional Finance Authority Bond Sale

The New York City Transitional Finance Authority (“TFA”) sold $1.5 billion of subordinate bonds via competitive sale on August 8. Proceeds from the sale will fund capital improvement projects throughout New York City. TFA sold six sub-series of bonds, ranging in size from $124 million to $412 million, with maturities between 2019 and 2045. This was the largest competitive bond sale in NYC history and was met with strong demand, with 7-8 bidders for each of the six tranches offered. Read the full summary

Federal Infrastructure Proposals

After the August recess concludes and before working on an infrastructure package, Congress is expected to take up a tax bill. This could push federal infrastructure legislation back to the end of 2017 or early 2018. We will continue to monitor federal proposals and discussions.

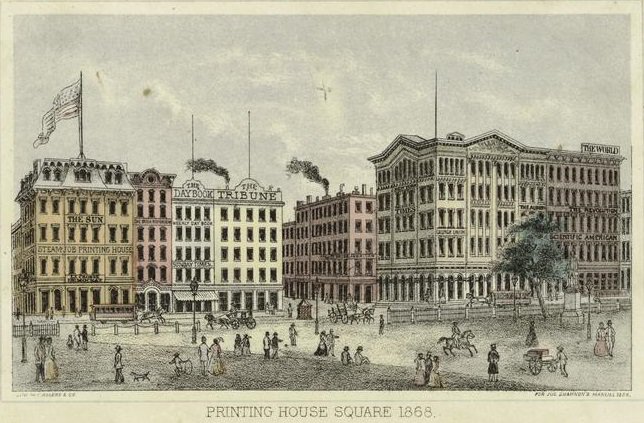

New York City Bond Fact – From 1868 to 2024

New York City’s oldest outstanding bond has a 7% coupon and was issued in 1868. It will mature on March 1, 2024 – 156 years after it was issued. Today, the bonds we sell with maturities of 10 years or longer are always callable, and have a maturity no longer than the life of the asset being financed, so you won’t see this kind of bond again!

An 1868 lithograph by W.C. Rogers & Co. depicting Printing House Square, across the street from the site of the NYC Comptroller’s current office. (From the New York Public Library’s Digital Collections).

Looking Ahead

New York City plans to sell approximately $1.3 billion of tax-exempt and taxable new money General Obligation bonds, with an order period for individual investors on September 12th and 13th and final pricing on the 14th. Read the full announcement. We also expect a New York Water deal to price in September – details to come. You can sign up on our website to receive deal announcements.

As always, we appreciate your interest in New York City bonds.

Carol S. Kostik

Deputy Comptroller for Public Finance