News

Monthly Public Finance Wrap-Up: August 2018

$870 Million NYC General Obligation Bond Sale

New York City sold approximately $830 million of tax-exempt and taxable refunding bonds and $40 million of conversion bonds via negotiated and competitive sale on August 8. During a two-day order period for individual investors, the City received $551 million of retail orders. On the day of pricing, the City received $190 million in orders from institutional investors. During the institutional repricing, yields were increased by two basis points for maturities in 2019 through 2022, and by one basis point in 2023. RBC Capital Markets served as book-running senior manager for the tax-exempt bonds, and also won the competitive bid for the taxable series among eleven bidders with a true interest cost of 3.390%. This was the first GO refunding after the tax law change eliminating tax-exempt advance refundings, and as such it had an amortization that was short with large maturity sizes. Read the full press release.

$264 Million New York Water Bond Sale

The New York City Municipal Water Finance Authority sold approximately $264 million of refunding revenue bonds via negotiated sale on August 15. The refunding bonds were offered in two maturities, 2023 and 2024, and received strong demand from investors since the Water Authority does not often offer bonds on the shorter end of the yield curve. Individual investors and professionally-managed accounts placed $394 million in orders for the bonds and institutional investors submitted $432 million in orders. Due to strong demand, the Water Authority was able to reduce yields by up to four basis points. RBC Capital Markets served as senior book-running manager, with Barclays and Blaylock Van, LLC serving as joint lead managers.

NYC Bond Fact – A Billion Gallons

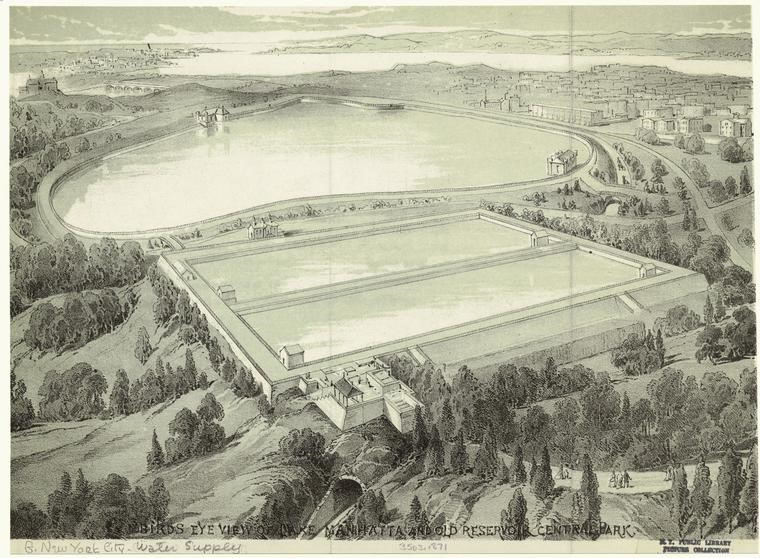

Each day, New York City’s Water System, operated by the City’s Department of Environmental Protection, provides approximately one billion gallons of drinking water to the 8.6 million residents of the City. For an order of magnitude, this is about the same amount of water the Onassis Reservoir in Central Park can hold. While the Reservoir was originally built in 1862 to be part of the City’s water delivery system, it was later decommissioned in 1993, and today is overseen by the City’s Department of Parks and Recreation.

Bird’s Eye View of Lake Manahatta and Old Reservoir, Central Park, 1871 (from the New York Public Library’s Digital Collections)

Looking Ahead

The New York City Municipal Water Finance Authority plans to offer tax-exempt variable rate revenue bonds the week of September 10. Sign up to receive notices of upcoming sales here.

As always, we appreciate your interest in New York City bonds.

Tim Martin

Assistant Comptroller for Public Finance