News

Monthly Public Finance Wrap-Up: May 2018

$1.3 Billion TFA Bond Sale

The New York City Transitional Finance Authority sold $1.1 billion of tax-exempt and taxable new money Future Tax Secured bonds via competitive sales on May 15. The transaction was broken up into five tranches, ranging in size from $113 million to $399 million each. In a moving market, the TFA received seven to nine bids for each block of bonds. Several bids were very close and in one case the difference between the winning and second-place bid was one ten thousandth of a percent. Five different institutions won the five competitive bids, with Goldman Sachs & Co., Bank of America Merrill Lynch, J.P. Morgan Securities, Morgan Stanley & Co., and UBS Financial Services Inc. each winning a tranche. The TFA also sold $100 million of adjustable rate bonds via negotiated sale and $75 million of tax-exempt index rate bonds via direct placement in connection with the sale. Read the full press release.

NYC Bond Fact – I’ve Got the Horse Right Here

The Belmont Stakes horserace, first run in 1867, is named after August Belmont, a New York banker and socialite. Why? And what does this have to do with municipal bonds?

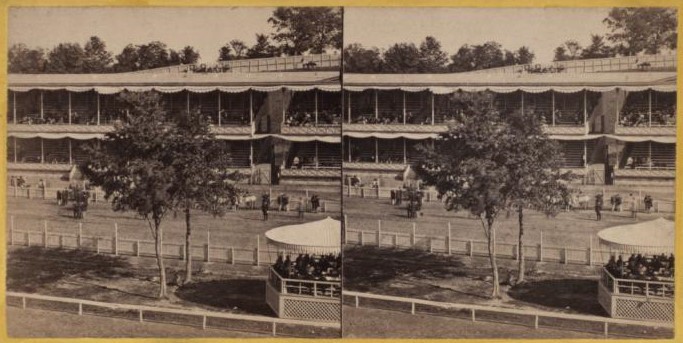

Stereograph of Jerome Park’s Grandstand, soon after the track’s opening (from The New York Public Library)

Leonard Jerome, a speculator and racetrack owner in what is now the Bronx, wanted to entice August Belmont and other wealthy New Yorkers to visit his track, which he did by naming races for them. But he needed a road from the then-edge of New York City to the site. The racetrack was near the villages of West Farms and Morrisania. Neither of the villages had money to build the connecting road, so they issued bonds backed by Jerome to pay for it.

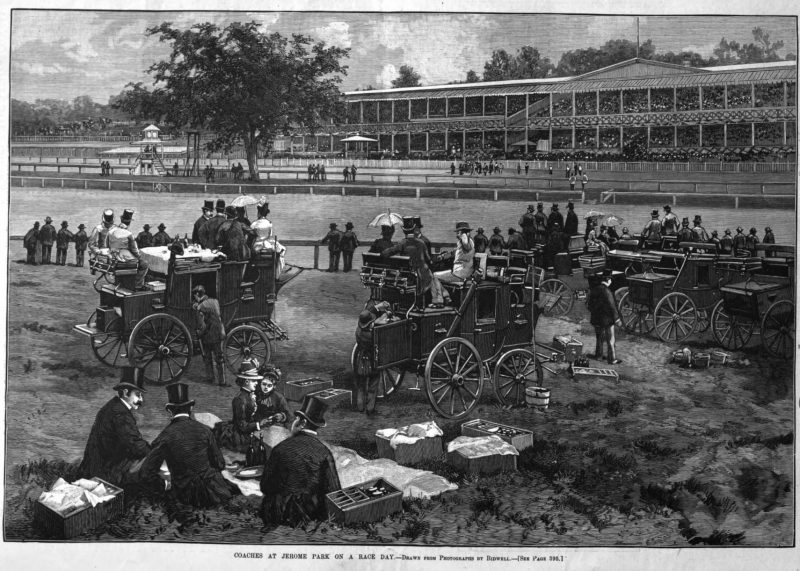

New York City was expanding rapidly at the time, so the bonds were issued in 1868 with extremely long maturities with the hope that New York City would annex the villages and take over payments. That is exactly what happened and the City continues servicing these still-outstanding bonds. The final maturity is 2147. The road that the bonds financed did receive some attention. An 1886 article in Harper’s Weekly describes the journey from New York City to the track: “The pleasant drive through Central Park and along the beautiful road out to the race-course is no unimportant part of the enjoyment, and the pleasure of going to see good racing gives a zest to the pleasure of a coaching trip that makes the horse-lover’s joy complete.”

Coaches at Jerome Park on race day (from Harper’s Weekly June 19, 1886, The Library of Congress)

Visiting the racetrack site today, visitors will find a different view. In 1894, the track was closed to be converted into the Jerome Park Reservoir, though the original basin was built only half as large as planned. Lehman College now stands where the track once did.

This year’s Belmont Stakes will be held at Belmont Park on June 9 in Elmont, New York – where it’s been run since 1905 – just outside the New York City limits.

Looking Ahead

The New York City Municipal Water Finance Authority plans to offer fixed rate tax-exempt refunding bonds via negotiated sale the week of June 11. The City also expects to offer fixed rate tax-exempt refunding bonds through the Dormitory Authority of the State of New York’s Municipal Health Facilities Improvement Program via negotiated sale the week of June 25. Additional details will be announced when they become available.

As always, we appreciate your interest in New York City bonds.

Carol S. Kostik

Deputy Comptroller for Public Finance