News

Public Finance Wrap-Up: August 2019

NYC Releases Debt Policy

New York City released a written debt policy on August 5 for both its General Obligation bonds and the NYC Transitional Finance Authority’s bonds. The document lays out the fiscally prudent policies and practices the Comptroller’s Office and the Office of Management and Budget have been following for years, giving assurance to investors, rating agencies, and the larger municipal bond community that the practices will continue.

The David N. Dinkins Manhattan Municipal Building

(“Manhattan Sunset” by Ajay Suresh / CC BY 2.0)

Quarterly Update Shows NYC Economic Growth Outpacing the U.S.

Comptroller Stringer released New York City’s quarterly economic update on August 8. The report includes downloadable historical data on metrics such as hiring and unemployment, hourly wages, and real estate prices. Q2 2019 highlights include:

- Gross City Product grew by 3.4%

- The private sector added 26,200 jobs

- Personal Income Tax collections rose 25% year-over-year

TFA and NYC Complete Successful Bond Sales

The New York City Transitional Finance Authority sold $1.35 billion of Future Tax Secured Subordinate bonds via competitive bid on August 6. The combination of tax-exempt and taxable bonds were sold in five parts, with maturity dates ranging from 2021 to 2045.

The next day, August 7, New York City sold $197 million of General Obligation stepped-coupon bonds, which have an interest rate step up date in 2024. If the bonds are not remarketed, converted, or redeemed by then, the interest rate increases from 5% to 9%.

NYC Bond History – Water, Water Everywhere and Lots and Lots to Drink

An 1846 lithograph shows the incredible length of the Croton Aqueduct, running along the Hudson River. The thicker, straighter line at the top of the image is the New York and Albany Railroad. (“Hydrographic map of the counties of New-York, Westchester and Putnam: and also showing the line of the Croton aqueduct”, Lithograph by N. Currier, 1846, from the New York Public Library)

An 1846 lithograph shows the incredible length of the Croton Aqueduct, running along the Hudson River. The thicker, straighter line at the top of the image is the New York and Albany Railroad. (“Hydrographic map of the counties of New-York, Westchester and Putnam: and also showing the line of the Croton aqueduct”, Lithograph by N. Currier, 1846, from the New York Public Library)

Construction of the original Croton Aqueduct caused a rapid increase in New York City’s debt in the middle of the 19th century, which had been relatively small up to that point.

In 1830, the City’s outstanding debt was about $500,000 – less than $3 per capita – and was roughly equivalent to 0.5% of the City’s total assessed value. New York City needed a better water system to improve public health and support its rapidly increasing population. Voters approved the ambitious aqueduct construction project in 1835, with 74% voting in favor.

The authorization for the bonds did not include many details about interest payments and redemption, so additional bonds were sold during construction to pay for interest in the early years, reflecting the concept of capitalized interest today.

By 1850, less than a decade after the aqueduct’s completion, the City’s debt had increased to about $30 per capita – 6% of the City’s assessed value – largely as a result of the water project. The aqueduct dramatically improved the quality of water available to City residents and by 1851 water charges covered a majority of interest costs. (The Finances of New York City (1898), by Edward Dana Durand, pp. 51-54)

Today, visitors can trek along sections of the aqueduct, which is a National Historic Landmark, and take free guided tours of its surviving infrastructure.

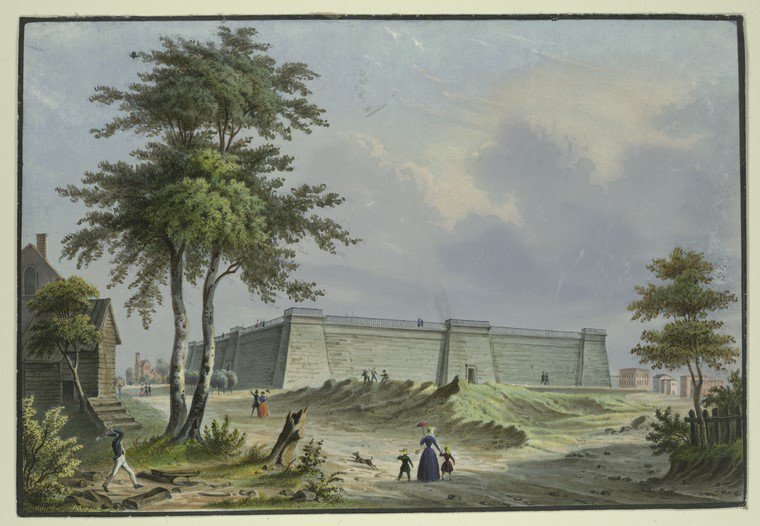

The Croton Aqueduct fed water to the Croton Distributing Reservoir in New York City. The reservoir sat on what is now Fifth Avenue and 42nd Street, today the site of the New York Public Library and Bryant Park. (“Croton Water Reservoir, New York City”, by Augustus Fay, 1850, from the New York Public Library)

Looking Ahead

New York City expects to sell $1.55 billion of General Obligation bonds the week of September 30, through a combination of negotiated and competitive sales.

As always, we appreciate your interest in New York City bonds.

Marj Henning

Deputy Comptroller for Public Finance

“Croton Walk, south of Kingsbridge Road, Bronx” by Jim Henderson / public domain