News

Public Finance Wrap-Up: December 2019

Water Finance Authority Offers Shorter Maturities

The New York City Municipal Water Finance Authority (NYW) sold $638 million of bonds on December 4, offering maturities ranging from 2020 to 2049. NYW rarely offers shorter maturities and demand was strong from individual investors. During the individual priority period, many early maturities sold out and some bonds were subscribed for nearly four times over.

TFA Bond Sale Closes Out 2019

The New York City Transitional Finance Authority (TFA) sold $1.18 billion of taxable and tax-exempt bonds on December 12. Individual investors placed $350 million of orders over the two-day priority order period. Read the press release. The bond sale was the last for TFA in 2019, with the next sale scheduled for January 7.

NYC Bond History – Civil War Recruitment Bounties

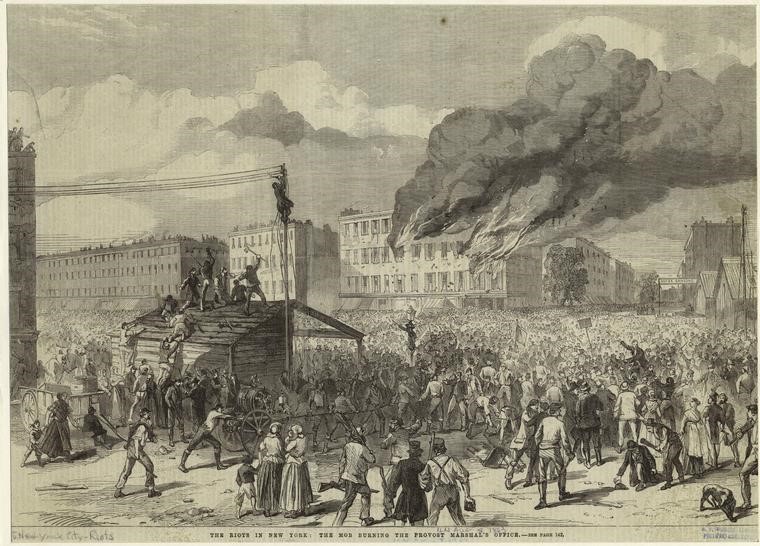

New York City’s payment of recruitment bounties during the Civil War was particularly high compared to other states and localities. Having witnessed the draft riots of 1863, the City paid large sums to volunteers in an attempt to avoid a repeat.

The Riots in New York, The Mob Burning the Provost Marshal’s Office (1863, from the New York Public Library)

A county board of supervisors, a duplicative and overlapping entity created for greater state control of New York City, issued debt to repair property damaged in the draft riots. The county supervisors then began paying $300 to volunteers, funded by bonds, with some soldiers receiving payment from the City as well. A quarter of all New York City soldiers received a recruitment bounty from either the City or county over the course of the Civil War.

New York City and New York County debt related to the Civil War peaked at about $14.5 million and bonds were sold with 6% coupons in order to keep them at par, rather than selling at a discount. The bonds had maturities of up to 30 years and were payable from tax revenues in a level debt structure of equal annual installments. (The Finances of New York City (1898), by Edward Dana Durand, p.102-104)

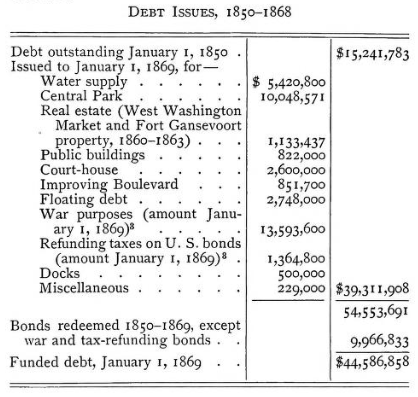

Table of New York City debt issuance from 1850-1868, showing $13.5 million of bonds for “War purposes”

Table of New York City debt issuance from 1850-1868, showing $13.5 million of bonds for “War purposes”

(The Finances of New York City (1898), by Edward Dana Durand, p.105)

Looking Ahead

- The New York City Transitional Finance Authority plans to sell $109 million of tax-exempt New York City Recovery bonds via competitive bid on January 7. Proceeds from the sale will be used to pay outstanding variable rate bonds that are being converted to fixed rate.

Best wishes for a happy and healthy new year.

Marj Henning

Deputy Comptroller for Public Finance