News

Public Finance Wrap-Up: February 2019

NYW Completes Successful Competitive Sale

The New York City Municipal Water Finance Authority (NYW) sold $415 million of tax-exempt Second General Resolution Revenue Bonds via competitive bid on February 27. The bonds were divided into two tranches, with Morgan Stanley and Bank of America Merrill Lynch each winning a bid. NYW expects to offer $450 million of tax-exempt bonds via negotiated sale the week of April 8.

NYC Economic Update Details Solid Job Growth

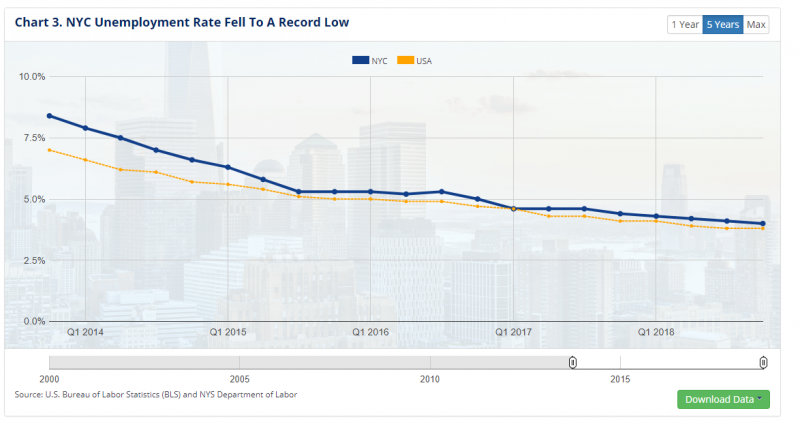

The Comptroller’s Quarterly Economic Update showed continued growth in New York City in the fourth quarter of 2018, with job growth at its fastest pace in four years. The report, which was released on February 19, notes that a majority of job growth was in low-wage industries. The report tracks New York City’s economic health and analyzes the City’s economy in a national context. It includes a trove of downloadable data for anyone analyzing historic economic trends.

NYC Bond Fact – Bonds Expected to Fund Almost All of the City’s Capital Projects

This month, New York City’s Office of Management and Budget released the City’s Preliminary Ten-Year Capital Strategy for Fiscal Years 2020-2029. Bonds issued by the City, the Transitional Finance Authority, and the Municipal Water Finance Authority are projected to fund 94% of the $104.1 billion of capital projects outlined in the plan. Federal, state, and other non-City sources fund the remaining 6%. Over the ten-year period, debt service as a percentage of tax revenue is projected to range from 11.7% to 13.6%, which is below the generally accepted level of 15% that demonstrates sound debt management.

Looking Ahead

- The City of New York plans to offer $986 million of fixed rate General Obligation Bonds next week via negotiated and competitive sales.

- The New York City Transitional Finance Authority plans to offer $1.1 billion of fixed rate Future Tax Secured Subordinate Revenue Bonds the week of March 25.

- The New York City Municipal Water Finance Authority plans to offer $450 million of fixed rate Second General Resolution Revenue Bonds the week of April 8.

As always, we appreciate your interest in New York City bonds.

Marj Henning

Deputy Comptroller for Public Finance