News

Public Finance Wrap-Up: July 2019

General Obligation Bond Sale Accelerates

New York City sold just over $1.5 billion of tax-exempt and taxable fixed rate bonds on July 23. Following solid retail investor response, we moved final pricing forward one day. Institutional investors submitted over $1 billion of orders to round out the deal. Yields on the bonds ranged from 1.12% for bonds maturing in 2021 to 2.48% for bonds maturing in 2045. Ramirez & Co. served as book-running lead manager with The Williams Capital Group serving as joint lead manager. Two tranches of taxable bonds were offered by competitive bid, with one bid won by BofA Merrill Lynch and the other by Morgan Stanley. Read the full press release here.

NYC Bond History

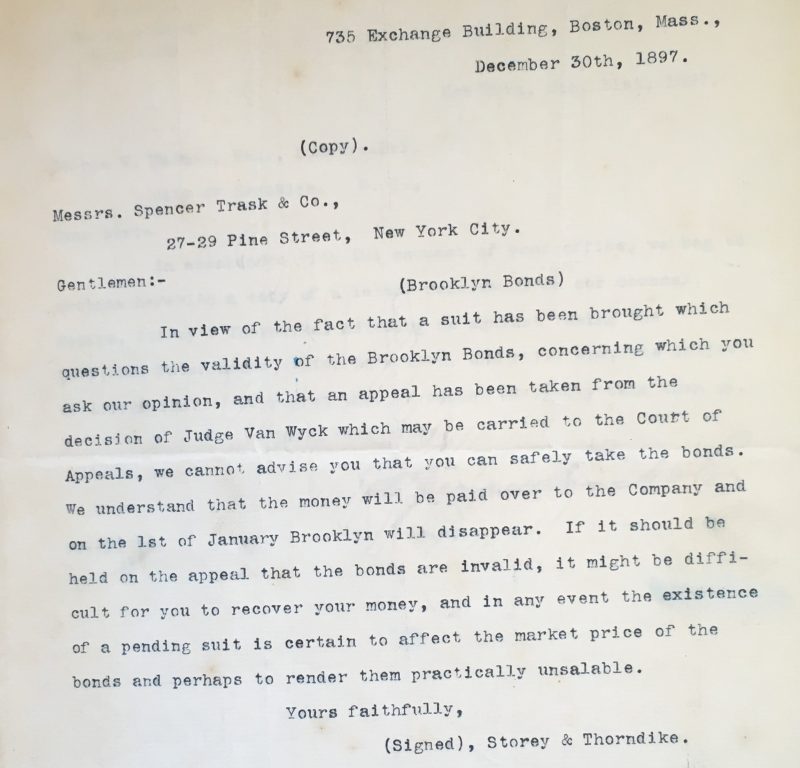

Bond counsel provides an opinion on the validity of municipal bonds when the bonds are issued. The letter above, written in 1897 on the eve of Brooklyn’s incorporation into New York City, advises potential investors against buying Brooklyn Bonds. It notes that a pending court case could invalidate the bonds or affect their price.

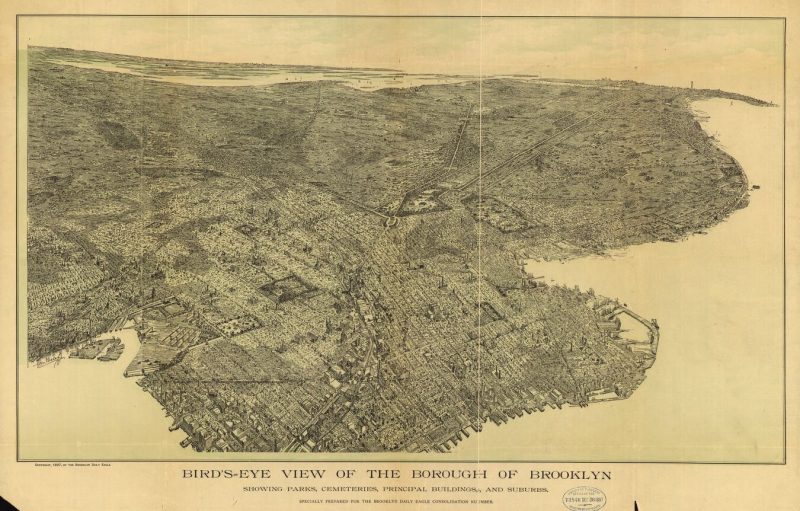

A drawing of 1897 Brooklyn published in the Brooklyn Daily Eagle.

(Image from the Library of Congress Geography and Map Division)

Looking Ahead

- The City plans to convert its $225 million Fiscal 2014 Series D-3 General Obligation Bonds from a daily variable rate to a fixed rate step coupon, with pricing scheduled for August 7th.

- The New York City Transitional Finance Authority is offering $1.35 billion of fixed rate Future Tax Secured Subordinate Revenue bonds today, via competitive sales.

- The City of New York plans to offer $1.55 billion of fixed and variable rate General Obligation bonds the week of September 9, via negotiated and competitive sales.

As always, we appreciate your interest in New York City bonds.

Marj Henning

Deputy Comptroller for Public Finance

(Photo by Marjorie Zien, CC BY-SA 4.0)