News

Public Finance Wrap-Up: June 2019

NYW Completes Successful Refunding

The New York City Municipal Water Finance Authority (NYW) sold about $460 million of fixed rate Second General Resolution Revenue bonds for refunding purposes on June 25 in a negotiated sale. The transaction generated nearly $173 million in net present value savings for ratepayers – over 31% savings over the refunded bonds.

FY 2020 Adopted Budget Released

The Fiscal Year 2020 Adopted Budget was released on June 19. The Adopted Budget calls for approximately $8.9 billion of new money bonds in Fiscal Year 2020 across the City’s General Obligation, Transitional Finance Authority, and Municipal Water Finance Authority credits. The City’s fiscal year begins on July 1.

NYC Bond History

Historical NYC bond sale ledgers dating from 1864 to 1941 are held at the Comptroller’s Office.

Historical NYC bond sale ledgers dating from 1864 to 1941 are held at the Comptroller’s Office.

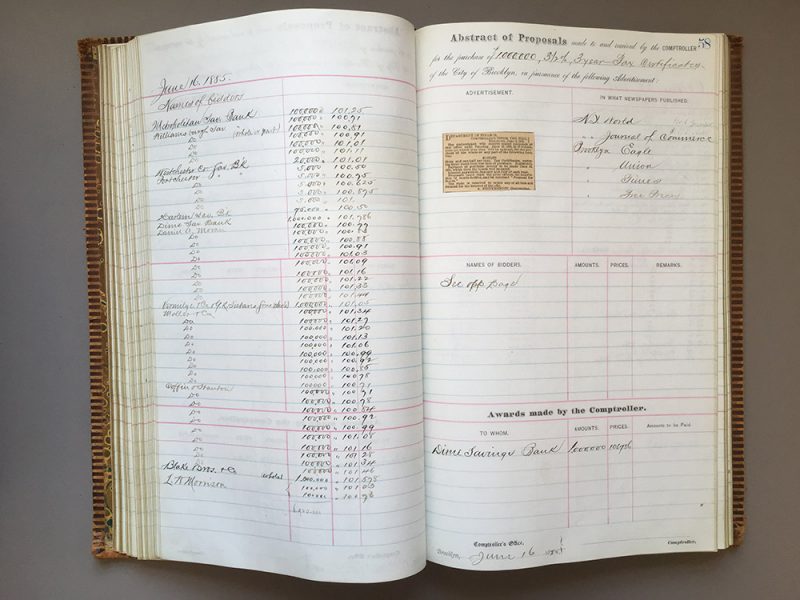

Last month’s bond fact recalled an 1885 Harper’s Magazine description of bond trading at the New York Stock Exchange. The Comptroller’s Office actually retains ledgers dating back to 1864 with details of the City’s bond sales. Newspaper clippings advertising the bond sales are pasted alongside records of bidders and awardees.

A page from an 1885 bond sale for the then-separate City of Brooklyn. The Dime Savings Bank was awarded the entirety of the $1 million bonds for sale.

A page from an 1885 bond sale for the then-separate City of Brooklyn. The Dime Savings Bank was awarded the entirety of the $1 million bonds for sale.

Looking Ahead

- The New York City Municipal Water Finance Authority plans to offer $400 million of tax-exempt fixed rate Second General Resolution Revenue Bonds via negotiated sale. Individual investors will have priority to place orders on July 9, with final pricing on July 10.

- The City of New York plans to offer $1.4 billion of General Obligation new money bonds the week of July 22 via negotiated and competitive sales.

- The New York City Transitional Finance Authority plans to offer $1.45 billion of Future Tax Secured Subordinate Revenue Bonds the week of August 5 via negotiated and competitive sales.

As always, we appreciate your interest in New York City bonds.

Marj Henning

Deputy Comptroller for Public Finance