News

Public Finance Wrap-Up: May 2019

RFPs for Advisory Services Released

The City of New York, New York City Transitional Finance Authority, New York City Municipal Water Finance Authority, and other City-related issuers are requesting proposals from firms interested in providing financial advisory/pricing advisory and/or swap advisory services.

To receive either or both RFPs send an email with “Request FA/PA RFP” and/or “Request Swap Advisor RFP” in the subject line to: rfppfi@comptroller.nyc.gov AND contracts@omb.nyc.gov.

Comptroller Stringer Releases Comments on FY 2020 Executive Budget

On May 23rd, Comptroller Stringer released his Comments on New York City’s Fiscal Year 2020 Executive Budget. The report notes that the short-term economic outlook has improved and that the City’s economic growth is expected to outpace that of the nation. Adjusted for prepayments and reserves, the FY 2020 Executive Budget is less than one percent larger than the FY 2019 modified budget. The Ten-Year Capital Strategy increased projected borrowing from the Preliminary Ten-Year Capital Strategy published in February, though debt service is estimated to reach only 13.1% of tax revenues by 2023, keeping it below the 15% benchmark for prudent debt management.

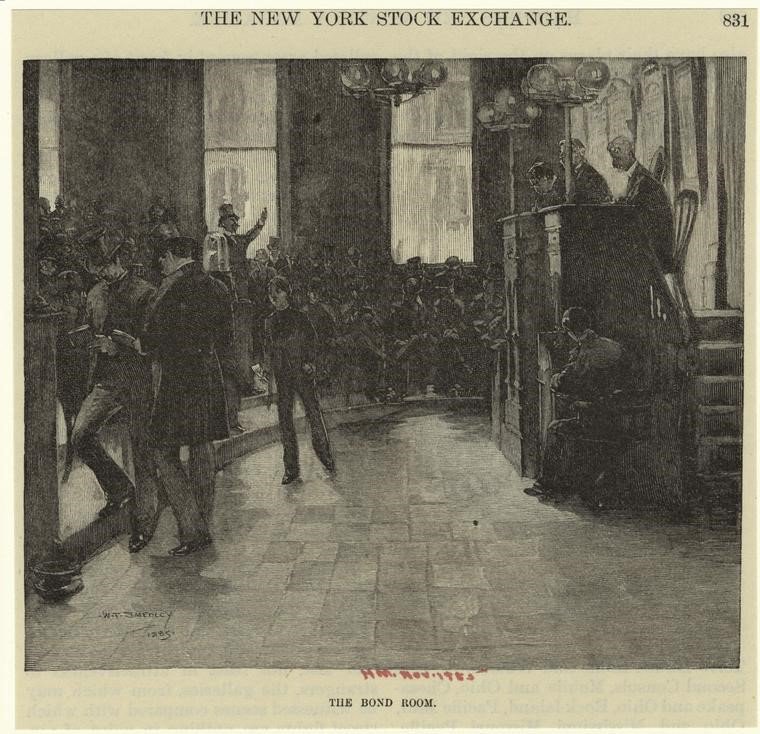

NYC Bond Fact – Comparative Order Reigns

An article in the June-November 1885 issue of Harper’s Magazine describes the inner workings of the New York Stock Exchange. After describing the hubbub of stock trading, the authors writes, “In the Bond Room comparative order reigns.” Municipal bonds and railroad bonds were “called twice a day in the Bond Room–at 11 A.M. and 1.45 P.M.” Buy-and-hold investors played a role in the market in 1885 as well and the author writes that high-quality bonds “that pass into the hands of permanent investors are infrequent subjects of traffic in the Exchange.”

Looking Ahead

The New York City Municipal Water Finance Authority plans to offer $450 million of fixed rate Second General Resolution Revenue Bonds for refunding purposes via negotiated sale the week of June 24.

As always, we appreciate your interest in New York City bonds.

Marj Henning

Deputy Comptroller for Public Finance