News

Public Finance Wrap-Up: November 2018

Investor Relations Website Receives Update

New York City’s investor relations website has been updated to make it easier to access relevant information and streamline its visual presentation. Let us know what you think.

November 2018 Financial Plan

The Mayor’s Office of Management and Budget (OMB) released a Financial Plan update on November 8. Recent financial developments and other data from this update are reflected in the Official Statement published November 30 in connection with the General Obligation bond sale described below.

City Publishes Popular Annual Financial Report

New York City released its user-friendly Popular Annual Financial Report (PAFR) for the fiscal year ending June 30, 2018. The PAFR presents financial information about the City in a concise and simplified format.

$1.2 Billion General Obligation Bond Sale

New York City sold approximately $855 million of tax-exempt General Obligation bonds via negotiated sale and $350 million of taxable General Obligation bonds via competitive sale on November 29. During a two-day order period for retail investors, the City received $327 million of orders for the tax-exempt bonds. On the day of pricing, the City received more than $1.2 billion in orders from institutional investors, allowing the City to reduce yields on the tax-exempt bonds by up to 3 basis points. Bank of America Merrill Lynch served as book-running senior manager for the transaction, with Blaylock Van serving as joint lead manager. Citigroup Global Markets won the competitive bid for approximately $223.3 million of the taxable bonds and Bank of America Merrill Lynch won the competitive bid for the remaining $126.7 million of taxable bonds. Read Full Press Release.

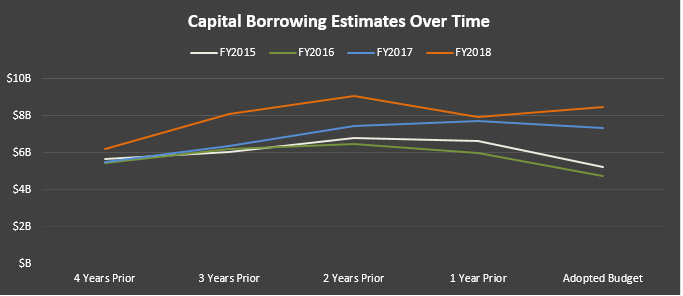

NYC Bond Fact – Planning Ahead

New York City’s Financial Plan helps give a sense of the City’s projected capital borrowing needs. These future estimates are updated with each Fiscal Year’s Financial Plan. The chart below shows how the City’s recent Capital Plan estimates have changed from several years out, through to budget adoption.

Source: Financial Plans for Fiscal Years 2011-2018

Looking Ahead

The New York City Housing Development Corporation plans to offer fixed rate tax-exempt new money and refunding bonds via negotiated sale the week of December 2nd. Sign up to receive notices of upcoming sales here.

As always, we appreciate your interest in New York City bonds.

Marj Henning

Deputy Comptroller for Public Finance