News

Public Finance Wrap-Up: November 2019

Popular Annual Financial Report Summarizes Spending

Comptroller Stringer released New York City’s Popular Annual Financial Report (PAFR) on November 21. The PAFR is a transparency tool that serves as a user-friendly companion to the City’s Comprehensive Annual Financial Report. The PAFR received the Government Finance Officers Association’s Award for Outstanding Achievement for the fourth consecutive year, which recognizes creativity, presentation, understandability, and reader appeal.

Quarterly Update Shows NYC Economic Growth Still Outpacing the U.S.

Comptroller Stringer released New York City’s quarterly economic update on November 13. The City’s economic growth moderated in Q3. The report includes downloadable historical data on metrics such as hiring and unemployment, hourly wages, and real estate prices. Q3 2019 highlights include:

- Gross City Product grew by 2.4%

- Private sector jobs remained relatively flat

- Private sector average hourly earnings rose 3.4% year-over-year

NYC Bond History – Lack of Tax Fines Strains City Finances

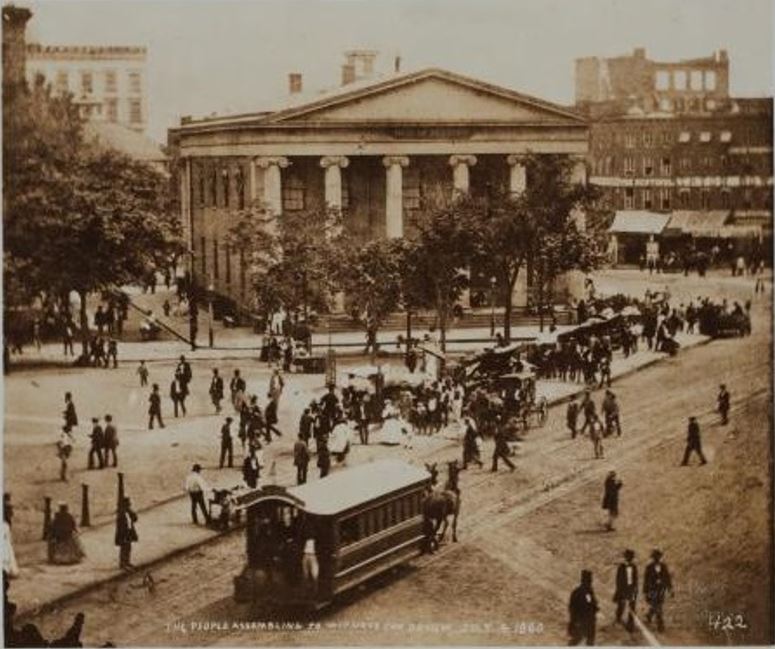

Financial strain leading up to 1860 required New York City to issue $2,748,000 of bonds to fund its budget deficit that year. Borrowing for operating expenses might be the definition of poor fiscal management, but City leaders had few other choices at the time.

Large amounts of owed taxes sat uncollected, because there were no laws allowing for a penalty on unpaid taxes. Any delinquent taxes remained pegged at their original amount, instead of accruing interest. As a result, outstanding special assessment taxes in particular strained the City’s finances. A law passed in 1861 corrected this problem by adding penalties for unpaid taxes. (The Finances of New York City (1898), by Edward Dana Durand, p.102)

(Manhattan: City Hall Park – Old Hall of Records, 1860, from the New York Public Library

(Manhattan: City Hall Park – Old Hall of Records, 1860, from the New York Public Library

Looking Ahead

- The New York City Municipal Water Finance Authority plans to sell $537 million of tax-exempt Second General Resolution Revenue bonds via negotiated sale on December 4, with a priority order period for individual investors on December 3. Read the press release.

- The New York City Transitional Finance Authority plans to sell $1.18 billion of tax-exempt and taxable Future Tax Secured Subordinate bonds on December 12, with a priority order period for individual investors on December 10 and 11. Read the press release.

As always, we appreciate your interest in New York City bonds.

Marj Henning

Deputy Comptroller for Public Finance