News

Quarterly Public Finance Wrap-Up: October-December 2022

Looking Back: 2022 Highlights

- Comptroller Brad Lander began his term as New York City’s 45th comptroller.

- The City of New York issued its first-ever Social bonds to fund affordable housing projects.

- Despite a volatile market and a sharp rise in interest rates, the City and the New York City Transitional Finance Authority achieved more than $450 million in debt service savings across four refundings.

Data, Data, Data

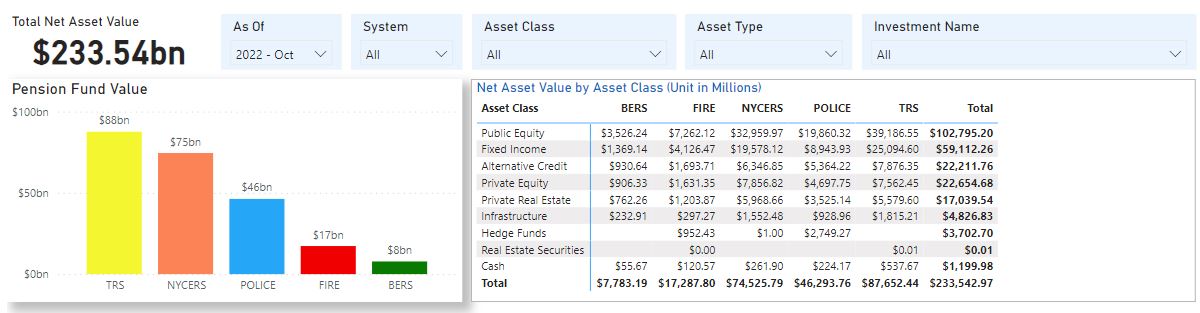

Comptroller Introduces New Transparency Dashboard to View Pension Fund Assets and Performance

The Comptroller’s Office unveiled a new interactive website that allows pension beneficiaries and the public to view asset allocation and performance for the City’s five public pension funds, which guarantee retirement security for city workers. Together, the New York City Employees’ Retirement System, Teachers’ Retirement System, Police Pension Fund, Fire Department Pension Fund, and Board of Education Retirement System have approximately $234 billion in assets under management across all asset classes as of October 31, 2022. View the asset allocation dashboard and the asset performance dashboard.

Annual Comprehensive Financial Report Now Includes Downloadable Data

In October, the Comptroller’s Office published the City’s Annual Comprehensive Financial Report for Fiscal Year 2022. The report includes audited financial statements, outlines important economic and financial data about the City, and highlights the work of the Comptroller’s Office. For the first time, the financial and statistical tables in the annual report are available for download. Read the press release and download the data. The complementary Popular Annual Comprehensive Financial Report distills important information about local government and its finances for use by City residents.

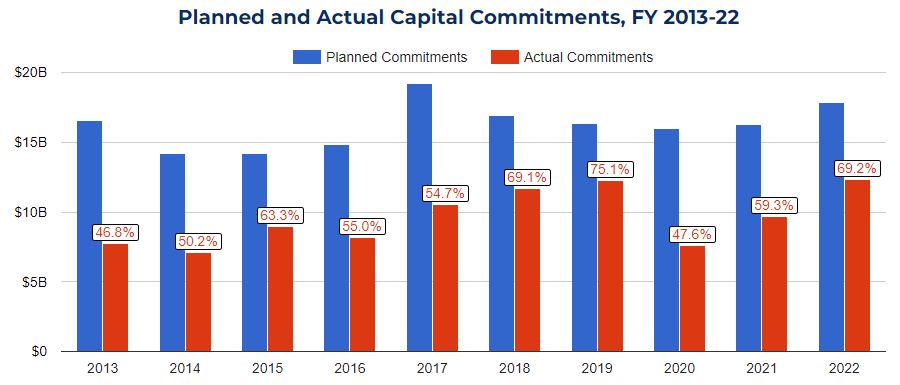

New York by the Numbers – Capital Financial Planning

The Comptroller’s Office continues to track economic indicators in its monthly New York by the Numbers newsletter. The most recent report, released on December 13, dives into the capital financing process, which readers of this email may find particularly interesting.

Capital Debt and Obligations Report Released

In December, the Comptroller’s Office released its Annual Report on Capital Debt and Obligations for fiscal year 2023, which assesses the current state of the City of New York’s debt burden compared to its tax base, the statutory debt limit, and other cities across the nation. The City’s debt, excluding that of the New York City Municipal Water Finance Authority, grew from $39.55 billion in FY 2000 to $95.27 billion in FY 2022, an increase of 141%. Over the same period, New York City personal income grew by 136% and local tax revenues grew by 205%.

By several measures, the City’s debt burden relative to its tax base has improved over the past two decades. Debt service as a percentage of local tax revenues dropped from 17.2% in FY 2002 to 9.7% in FY 2022. Over that period, debt outstanding as a percent of the City’s total personal income decreased from 15.2% to 13.2% and debt outstanding as a percent of taxable assessed property values decreased from 41.7% to 36.6%. Included for the first time in the report, debt as a percentage of property market values was 3.4% in FY 2021, using a sales-based valuation of real estate. Read the full report.

NYC Issues First Social Bonds

The City of New York issued its first ESG-labeled bonds in October, in connection with its regular capital financing program. Social bonds totaling $400 million accompanied a $950 million tax-exempt offering. The taxable general obligation social bonds attracted at least 10 investors specifically for their social designation, representing $380 million in orders. During the order period for the taxable social bonds, the City received indications of interest totaling $1.88 billion, representing 4.7x the bonds offered.

The proceeds of the sale of the taxable social bonds are dedicated solely to reimburse City spending on affordable housing projects, supporting the creation of over 3,000 homes under the New York City Department of Housing Preservation and Development’s (HPD) Extremely Low- and Low-Income Affordability (ELLA) program, Supportive Housing Loan Program (SHLP), and Senior Affordable Rental Apartments (SARA). Read the press release.

Renderings of two of the projects being financed by the City’s first-ever social bonds. The 139 affordable units at 88 Throop Ave in Brooklyn (left) and the 107 affordable units at 1510 Broadway in Brooklyn (right) are some of the over 3,000 homes financed through the City’s first-ever social bond offering.

Looking Ahead

Sign up to receive emails about upcoming NYC bond sales and the City’s financial position by visiting the Comptroller’s website and clicking on “Join Mailing List” at the top of the page.

Happy new year 2023 | Photo credit: alexmstudio | Shutterstock

Best wishes for 2023!