Annual Summary Contracts Report for the City of New York

Fiscal Year 2023

A Message from the New York City Comptroller

Dear New Yorkers,

I’m pleased to share the Annual Summary Contracts Report, covering Fiscal Year (FY23).

Contracting is how the City meets many of our goals and provides services to New Yorkers. City agencies contract with vendors to provide meals to home-bound seniors, childcare and afterschool programs for kids, construction projects to build new schools, upgrade our parks, repair our roads. And much more.

In FY 23, the City entered into 12,820 new procurement and revenue contracts, valued at $38.22 billion – more than budgets of 30 states. This report provides a transparent and detailed snapshot of that contracting activity. We provide information here on the contracts entered into by the City in FY23, including what agencies have been purchasing, what procurement methods they are utilizing, the 10 largest contracts, real property transactions, contact modifications, purchase orders, and more.

The report also includes a look at several key trends in City procurement. For years, the City’s onerous procurement process has created considerable registration delays that hinder the ability of its vendors, especially human service providers, nonprofits, and M/WBEs, to get paid on time. Unfortunately, this year’s data shows that problem continues to grow.

To respond to the growing need for shelter and services for people seeking asylum, the total value of the City’s emergency procurement contracts has grown. For a deeper dive into emergency procurement, please refer to our recent report “Rethinking Emergency Procurements; A Roadmap to Efficiency and Accountability.”

Next month, we will release our annual report on M/WBE procurement, highlighting trends in the City’s efforts to make sure we are contracting fairly and inclusively.

Finally, if you’re interested in learning more about City procurement, we’ve got a great resource for you: last fall, we released a new Contract Primer on NYC Contracting. The Primer contains useful descriptions of many of the contract categories, solicitation methods, and contracting processes that are discussed in this Report.

In the meantime, I hope you will find the information in this Annual Report to be both interesting and useful!

Brad

I. Executive Summary

The City’s procurement system encompasses tens of thousands of transactions each year. The supplies, services, and construction purchased by the City and the revenue agreements it enters into enable agencies and elected officials to serve the public, address critical challenges, and encourage growth.

In accordance with section 6-116.2 of the New York City Administrative Code (Administrative Code), the Comptroller’s Office is required to publish an annual summary report of contracts and agreements assumed by New York City during the previous FY.[1] This “Annual Summary Contracts Report” (or Report) aims to provide better transparency into the City’s contracts that were registered in FY23, and how these agreements are entered into.

The content in this Report that is specifically mandated by the Administrative Code includes detail for:[2]

- All franchises, concessions, or goods and services contracts valued at more than $10K (or more than $15K for construction contracts);

- The types and dollar amounts of each contract from the previous FY;

- The agency, affiliated agency, elected official, or City Council that entered into each contract, franchise, or concession;

- The vendors associated with each contract, franchise, or concession entered into with the City; and

- How the City selected the contractor, franchisee, or concessionaire.

While not related to City contracting actions, this Report also contains data required by Sections 6-109 and 6-130 of the Administrative Code, relating to the Comptroller’s enforcement of certain living and prevailing wage requirements.[3]

Role of the Comptroller’s Office

Under the New York City Charter (“Charter”), the Comptroller’s Office is responsible for reviewing and approving city contracts and agreements before they are legally effective, unless this authority has been delegated to City agencies or is otherwise not legally required.[4] During a review period lasting no more than 30 calendar days by law, the Comptroller’s Office ensures that appropriate funds exist for the City to make payments to vendors, confirms that the contracting agency followed proper procurement rules, and that there was no corruption in the decision‐making process. The Comptroller’s Office also ensures that contracting agencies have vetted vendors looking to do business with the City and verified that they are operating in good standing, and therefore eligible to be awarded City contracts.

Operating within guidelines set forth by the Charter and Administrative Code, the Comptroller’s Office achieves the functions outlined above by:[5]

- Encumbering funds to contracts for use in payments for goods and services;

- Maintaining a registry of City contracts and agreements;

- Presenting objections if the Comptroller’s review process yields sufficient concern that there was corruption in the awarding of a new contract, or that an agency failed to sufficiently review an awarded vendor; and

- Tracking expenditures and revenues associated with registered contracts and agreements.

The Comptroller’s registration authority is separate and distinct from decisions relating to the necessity of new procurements or revenue opportunities, which vendors are selected for City contracts, how contracted goods or services will be provided, and (besides checking for cases of corruption or debarment) whether specific vendors are fit to contract with the City.[6] Each of these processes may be managed by different partners across the City, and can take a considerable amount of time to advance. Accordingly, the Comptroller remains committed to working with the Mayor’s Administration to streamline outdated and lengthy processes in City contracting so that:

- Needed goods, services, and construction can be brought to bear more quickly;

- Vendors doing business with the City, including non-profits and M/WBEs, can get paid more quickly for the goods, services, and construction that they are providing; and

- The City can save time and money by realizing greater efficiencies in the contracting process.

Additional Reporting Sections

This Report expands on procurement data mandated by the Administrative Code in order to provide more context around City contracting activities. Additional sections of this Report present information on the following topics:

- Real property transactions

- Contract modifications (including construction change orders)

- Task Orders registered under agency master agreements

- Purchase Orders

- An explanation of emergency procurements

- Contract registrations with applied industry classifications

- Contract registrations by agency type

- Retroactive registration data (i.e. contracts registered after their start dates)

Source Data

In order to accomplish these aims, this Report draws extensively from data stored in the City’s Financial Management System (FMS), a computerized database jointly administered by the Mayor and the Comptroller and maintained by Financial Information Services Agency (FISA). [7] Each agency, affiliated agency, elected official, and the City Council, is required to enter information in FMS for every franchise and concession, as well as for every contract for goods or services worth more than $10K (or $15K if the contract is related to construction, repair, rehabilitation, or alteration).

Information in Section IX of this Report relating to the Comptroller’s enforcement of certain living and prevailing wage requirements was provided by the Comptroller’s Bureau of Labor Law, rather than FMS.

The City tracks data in FMS using a variety of identifiers that reflect vital contract information. Two of the most prominent identifiers for the purposes of this Report are “Contract Type” and “Award Method.” [8] To better track expenses and revenues, agencies are required to specifically identify the type of contract submitted for registration by selecting from a list of predetermined contract type codes in FMS. Award Method categories indicate how the City selects vendors for a particular contract. This Report also references “Industry classifications” which are not entered by agencies into FMS but are instead derived from various FMS data points to reveal procurement trends by sector. Data used for this Report is available to readers in Section XI – Appendices.

Topline Citywide Numbers for FY23

$38.2B

In Registered Contract Value

12,600+

Procurement Actions

A total of 12,820 new procurement and revenue contracts were registered in FY23 for a total value of $38.22 billion.[9] The contracts in this Report reflect binding agreements between the City and another entity, or sometimes between two City agencies, which contain the terms and conditions to be performed by both parties as well as the terms of payment (as applicable). This Report broadly organizes contracts into procurements (where the City is contracting for goods, services, or construction) and revenues (where the City is a recipient of funds from another entity).[10] The 12,820 figure does not include registered Real Property Transactions, which are captured in Section III of this Report. Though they are constituted as newly registered agreements in FY23, Real Property Transactions are not covered by the reporting requirements outlined for this report under the Administrative Code.

Table 1 below illustrates that the vast majority of registered contract volume, by both the number of actions and total value, is driven by procurement actions. Registrations for procurement contracts in FY23 reflect City investments in economic development projects, new construction, and further expansion of the City’s homeless shelter capacity.

Table 1: FY23 New Contract Registrations

| Category | # of Actions | Value of Actions |

| Total Registered Contract Actions | 12,820 | $38,218,189,832 |

| Total Procurement Actions | 12,637 | $38,003,141,457 |

| Total Revenue Actions[11] | 183 | $215,048,375 |

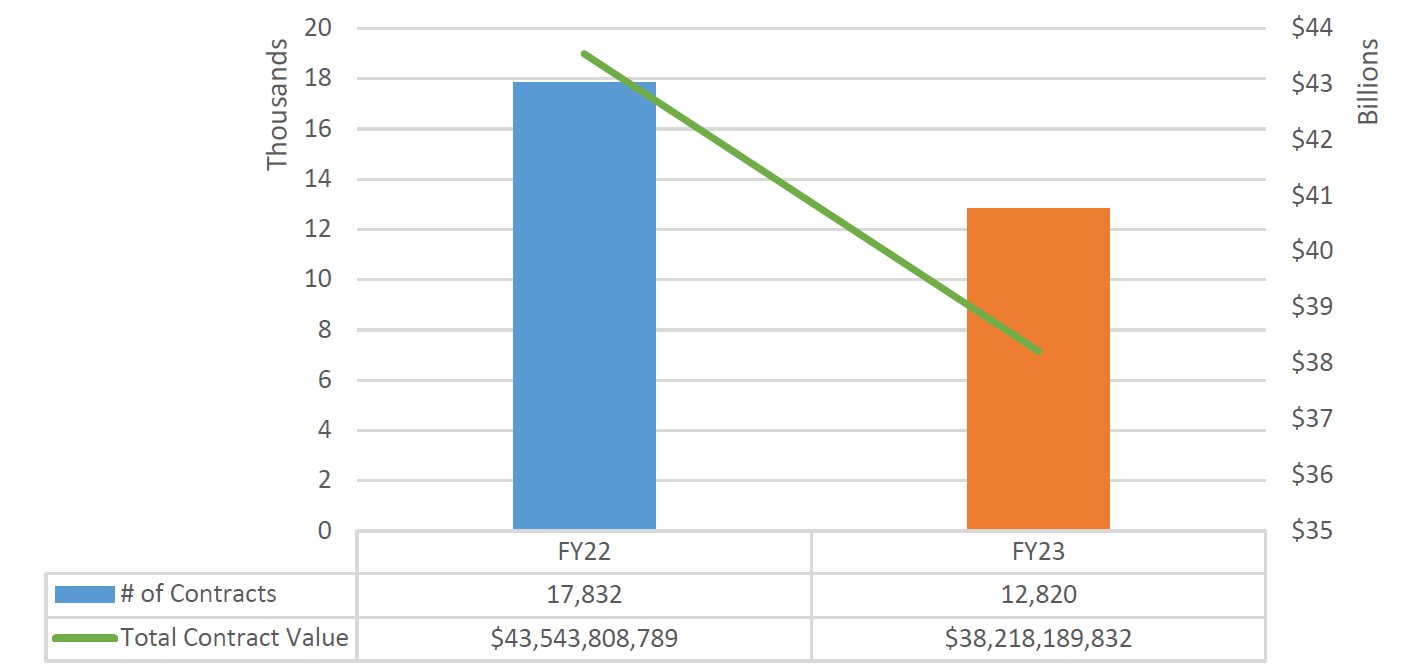

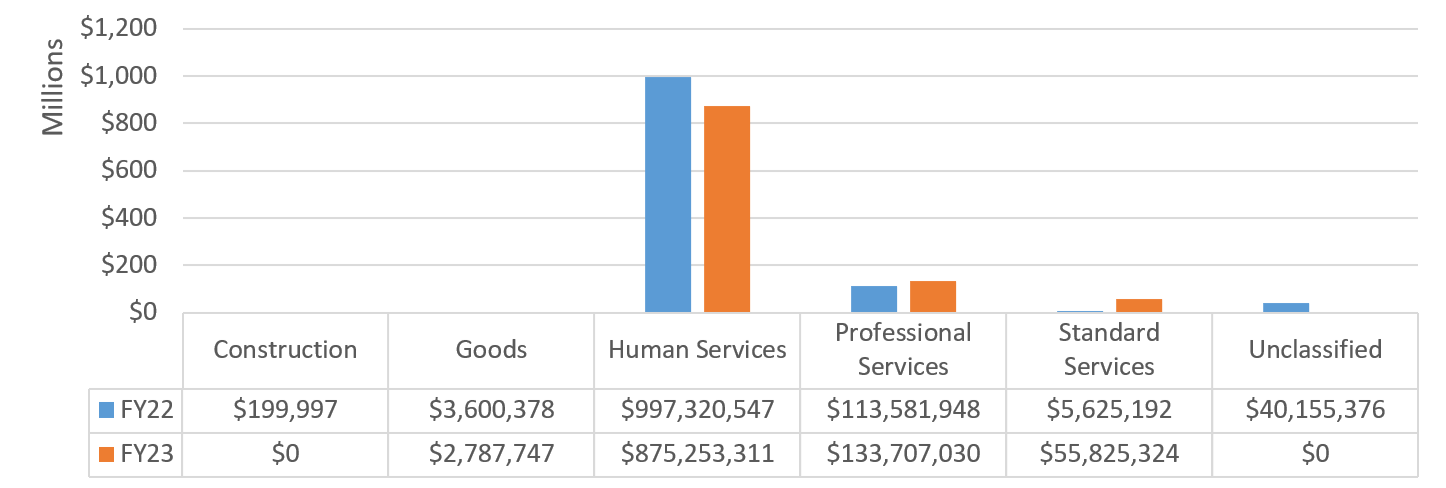

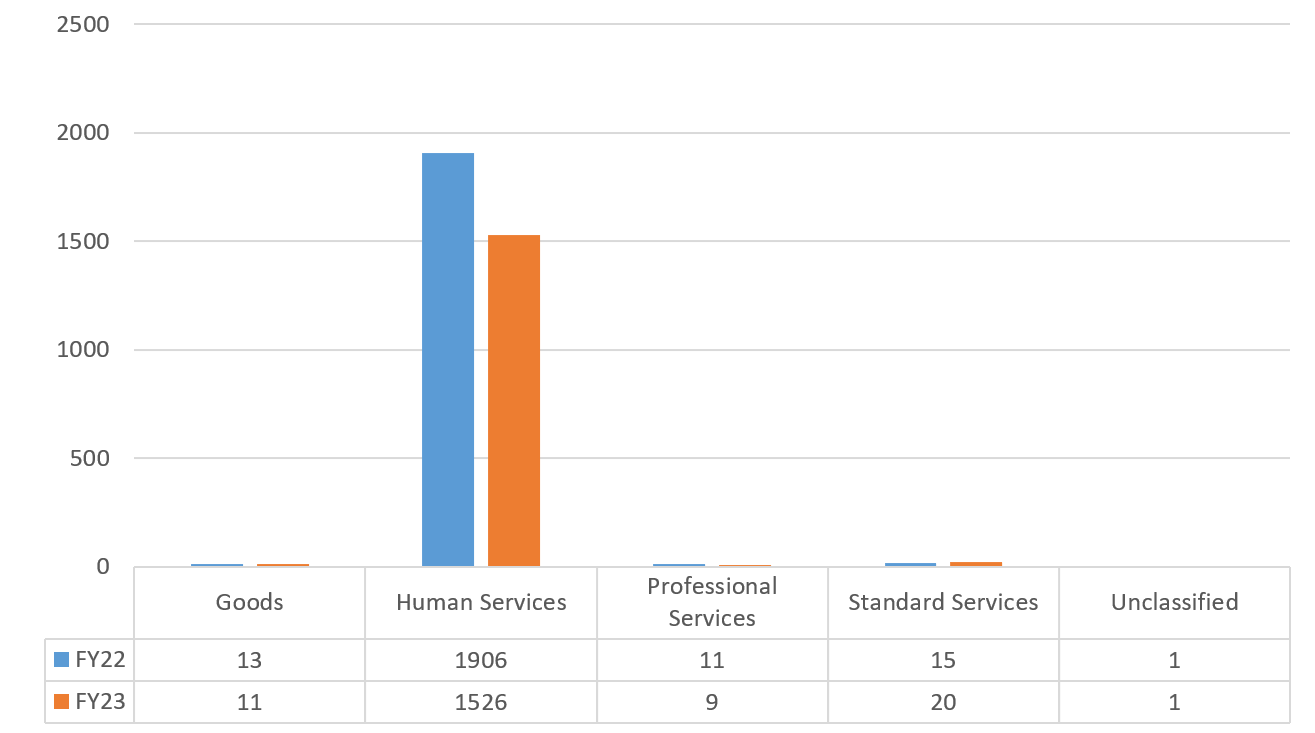

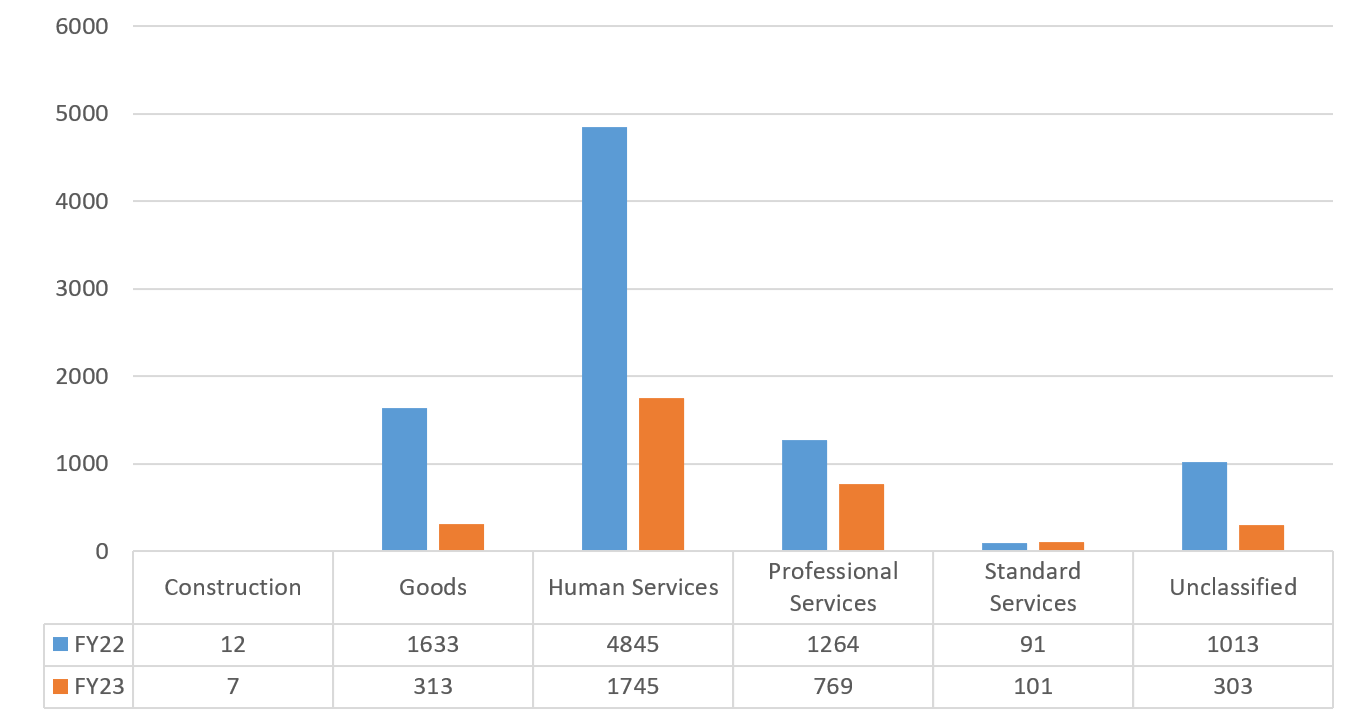

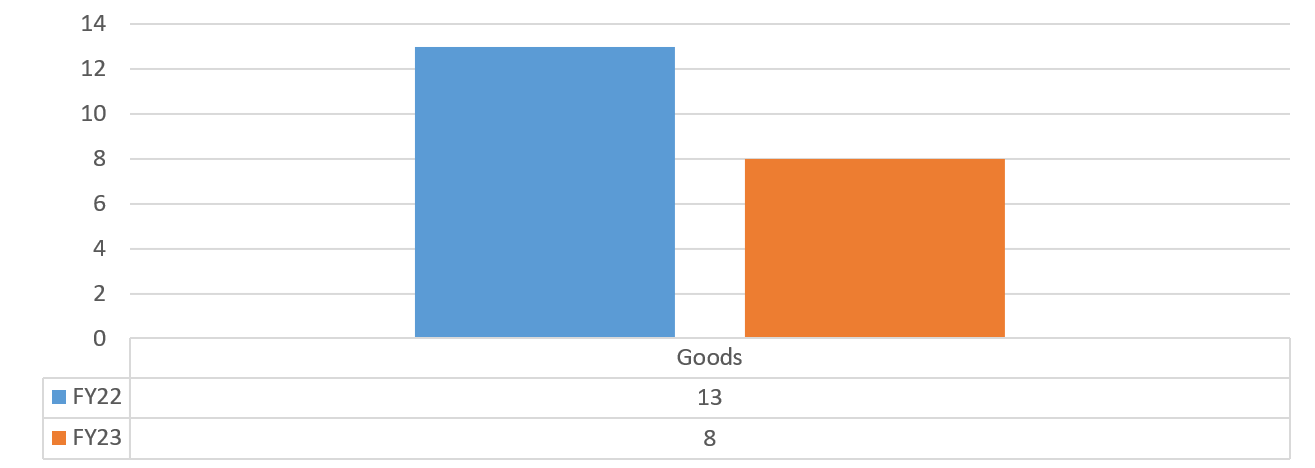

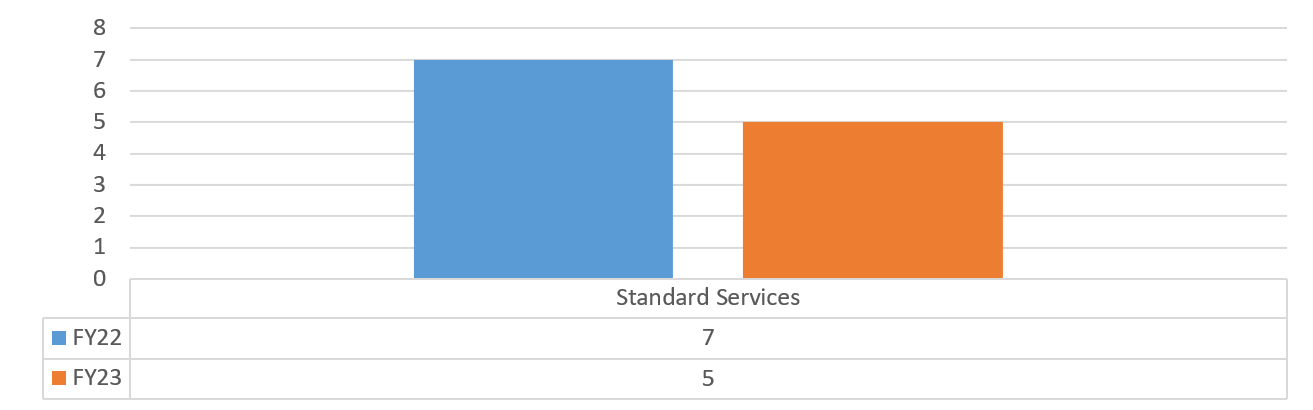

As Chart 1 below shows, the total volume and value of new registered contracts was lower in FY23 than the prior fiscal year. However, this does not necessarily indicate a decline in the City’s procurement activity. Our analysis in Section IV of this Report shows that the number of registered modifications to existing contracts and the number of purchase orders processed both increased in FY23.

Chart 1: New Registered Contract Volume and Value, FY22-FY23

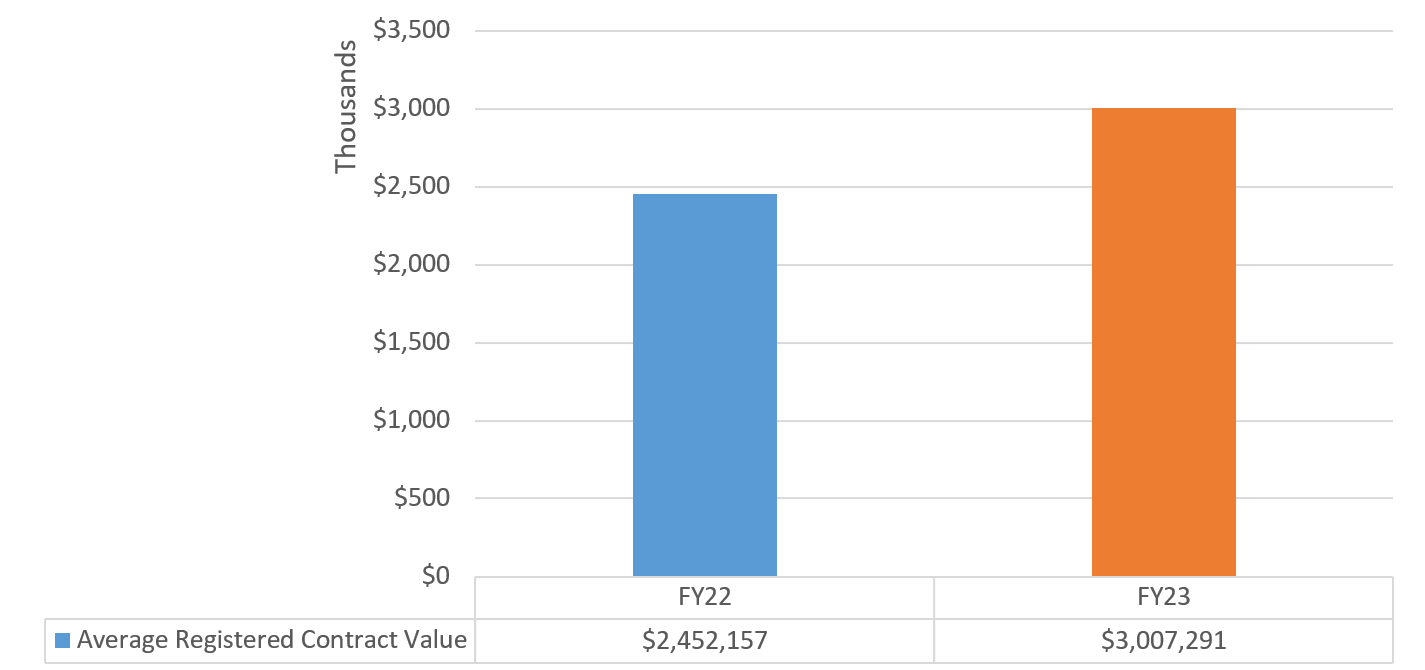

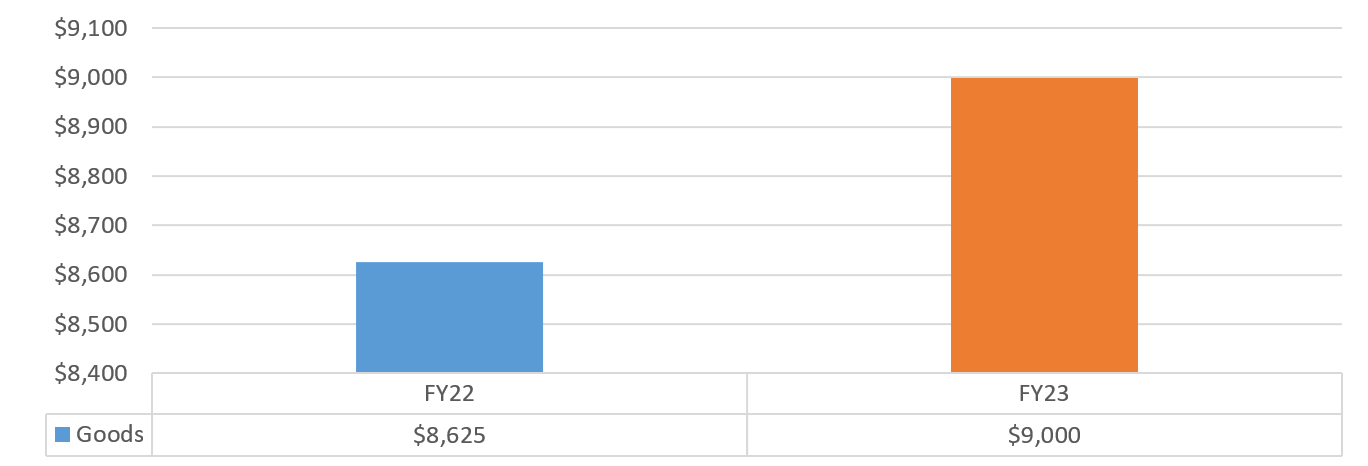

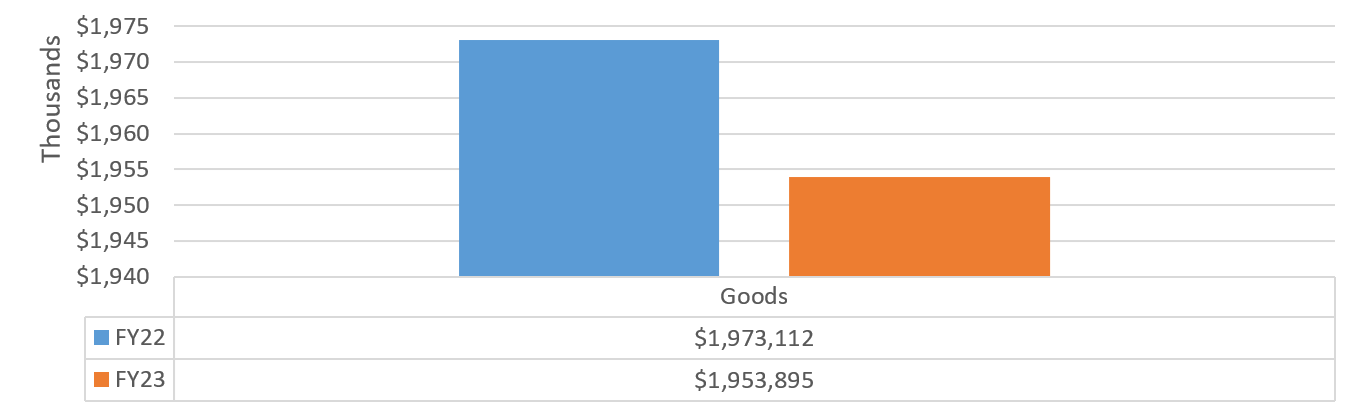

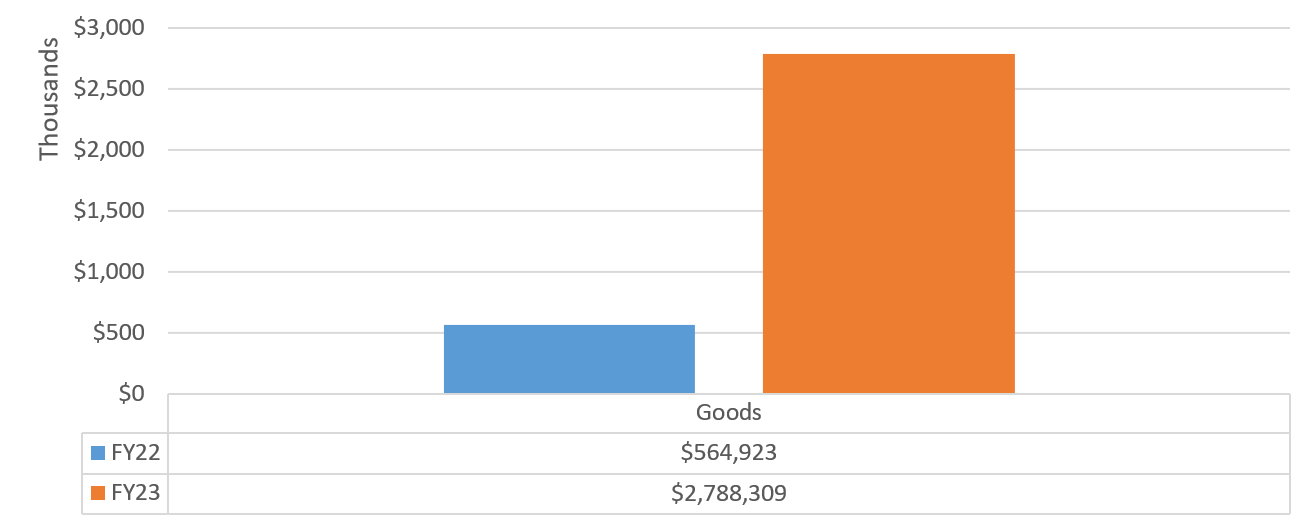

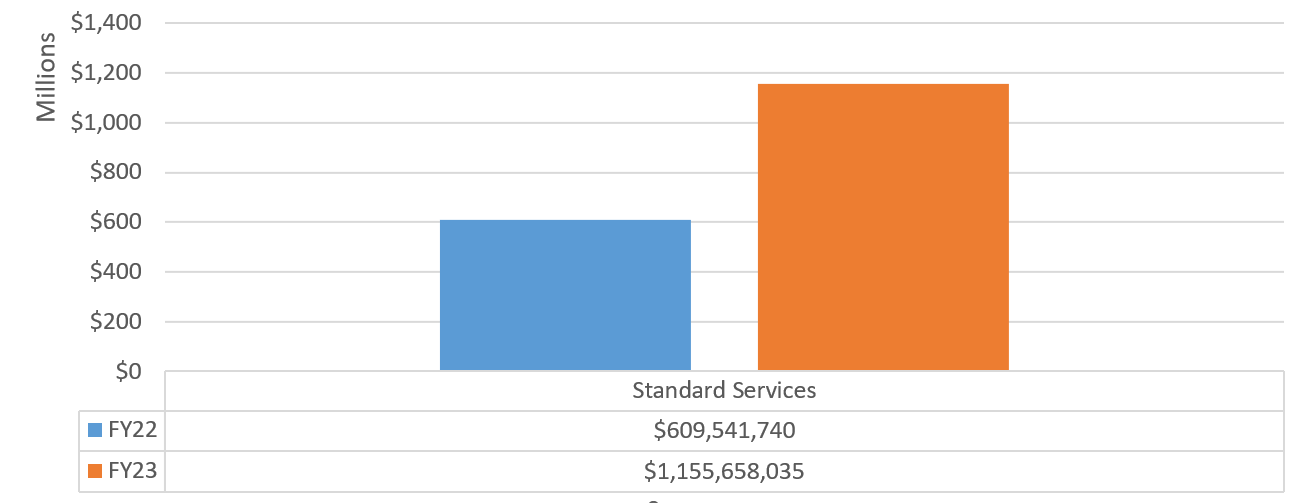

Our analysis also found that the average contract value was more than $500 thousand higher in FY23 than in FY22. Chart 2 shows the average value of a contract in FY22 vs FY23.

Chart 2: Average Procurement Contract Value FY22-FY23

FY23 Procurement Contracts at a Glance

Table 2 illustrates that just ten agencies account for almost 80% of the City’s FY23 procurement value. The Department of Homeless Services (DHS) makes up the largest share (18.66%) of the City’s procurement value. This is because DHS, whose agency mission is to provide temporary shelter for those in need, is leading the City’s contracting for emergency shelter services for newly arrived asylum seekers.

Table 2: Top Ten Agencies Based on FY23 Procurement Value from New Contracts

| Agency | # of contracts | % Share of Contracts | Total Registered Contract Value | % Share of Registered Contract Value |

| DSS/DHS | 232 | 1.81% | $7,131,954,726 | 18.66% |

| DDC | 216 | 1.68% | $5,278,552,895 | 13.81% |

| ACS | 439 | 3.43% | $3,655,741,724 | 9.57% |

| DOE | 3,238 | 25.26% | $2,930,954,971 | 7.67% |

| DCAS | 621 | 4.85% | $2,483,908,056 | 6.50% |

| EDC | 3 | 0.02% | $2,280,321,234 | 5.97% |

| DEP | 285 | 2.22% | $1,868,415,606 | 4.89% |

| MAYOR | 259 | 2.02% | $1,624,177,541 | 4.25% |

| OTI | 233 | 1.82% | $1,375,363,275 | 3.60% |

| DOHMH | 1,311 | 10.23% | $1,354,291,758 | 3.54% |

| Grand Total | 6,840 | 53.35% | $29,983,681,783 | 78.45% |

The ten contracts with the largest registered procurement values account for $8.76 billion, which is almost a quarter (23%) of the City’s overall procurement value in FY23. These contacts are displayed below in Table 3. Note that this table includes information on contract end-dates to draw attention to the fact that several of these top-ten procurements are for goods, services, or construction that will be provided over the course of many years.

Table 3: Top Ten FY23 Registered Procurement Contracts by Value

| Contract # | Agency | Vendor Legal Name | Contract Purpose | Contract Registered Amount | Contract Start Date | Contract End Date |

| 20238807786 | DDC | Tutor Perini Corporation | Design Build Program – NYC Borough Based Jail System, Brooklyn. | $2,958,933,292 | 6/30/2023 | 9/3/2029 |

| 20238804191 | EDC | New York City Economic Development Corporation[12] | Provision of Citywide Economic Development Services. | $1,836,434,092 | 7/1/2022 | 6/30/2023 |

| 20228808498 | MAYOR | Dormitory Authority State Of NY | Development of phase 2 of the Staten Island Master Plan and the renovation of

the New York County State Supreme Court Building. |

$606,911,727 | 7/1/2022 | 6/30/2032 |

| 20238806917 | SBS | Brooklyn Navy Yard Development Corporation | Provision of industrial, commercial, waterfront, maritime, and other economic Development services at the Brooklyn Navy Yard. | $529,981,983 | 7/1/2022 | 6/30/2025 |

| 20231408687 | TRANSIT | Metropolitan Transportation Authority | Bus purchases and track, switch, third rail, and substation replacements. | $498,114,315 | 9/28/2022 | 6/30/2026 |

| 20238802667 | DSS/DHS | Help Social Service Corporation | Shelter facility for homeless families with children. | $489,190,529 | 6/1/2022 | 6/30/2055 |

| 20238808538 | DSS/DHS | Help Social Service Corporation | Shelter facility for homeless single adults. | $467,858,423 | 6/1/2023 | 6/30/2056 |

| 20238804237 | DSS/DHS | Project Renewal Inc | Shelter facility for homeless single adults. | $467,334,567 | 7/1/2022 | 6/30/2056 |

| 20238800486 | DCAS | JP Morgan Chase Bank Na | Procurement card services for agency purchases. | $464,000,000 | 4/1/2023 | 10/12/2027 |

| 20238804188 | EDC | New York City Economic Development Corporation | Provision of City-Wide economic development services related to maritime, rail, aviation, and market transportation. | $443,342,250 | 7/1/2022 | 6/30/2023 |

Retroactive Contract Registration Trends

For years, the City’s onerous and slow procurement process has created considerable registration delays that hinder the ability of its vendors, especially human service providers, nonprofits, and M/WBEs, to get paid on time. These vendors often wait six months, a year, or even more to get paid for services they have provided on behalf of the City. This causes a tremendous strain on many of these organizations, as they are forced to borrow to cover cash flow or triage their own expenses, and makes it extremely difficult to pay, sustain, and grown their businesses.

The current Mayoral and Comptroller Administrations created the Joint Task Force to Get Non-Profits Paid and the Capital Reform Task Force in 2022 to develop critical reforms needed to address components of contracting systems. Some progress was made initially, including the “Clear the Backlog” initiative in the summer of 2022, an Allowance Amendment Initiative to enable the City to make certain changes to existing contracts without requiring lengthy contract amendments, and an initiative with the City Council to make discretionary award contracts multi-year instead of one year at a time.

Unfortunately, progress has stalled on those efforts. A key reform, “ContractStat,” a performance management and transparent reporting system to hold agencies accountable and collectively engage in a process of continuous improvement, was supposed to have been launched by June 2023 but still has not been delivered. Timeframes and key performance indicators for the procurement and contract process have not been established as promised. The only existing timeline, set by the City Charter, is for the Comptroller’s office, which is obligated to register or return each and every contract within 30 days of receiving it – an obligation the office has met consistently.

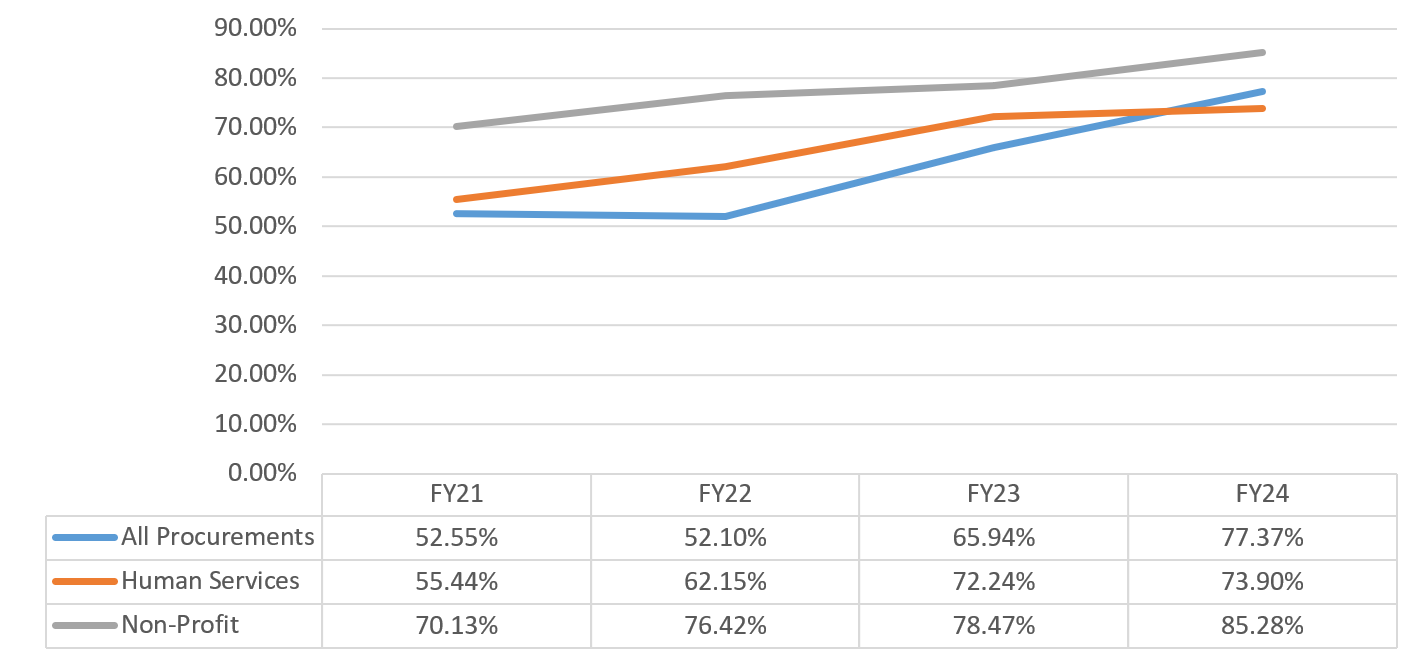

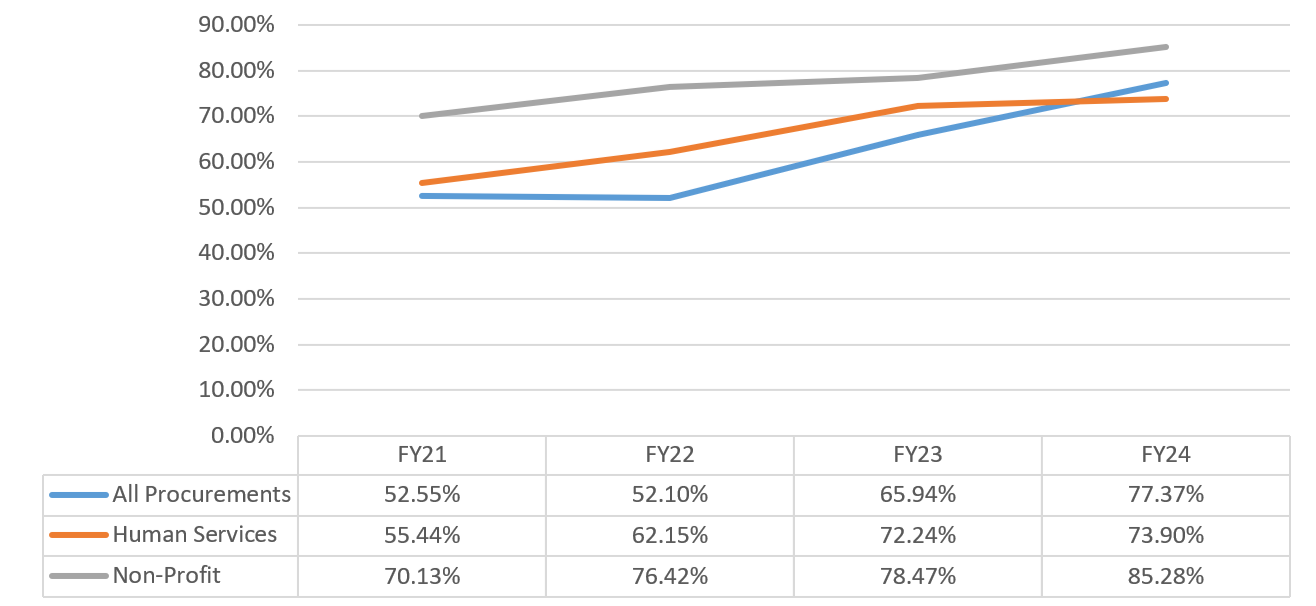

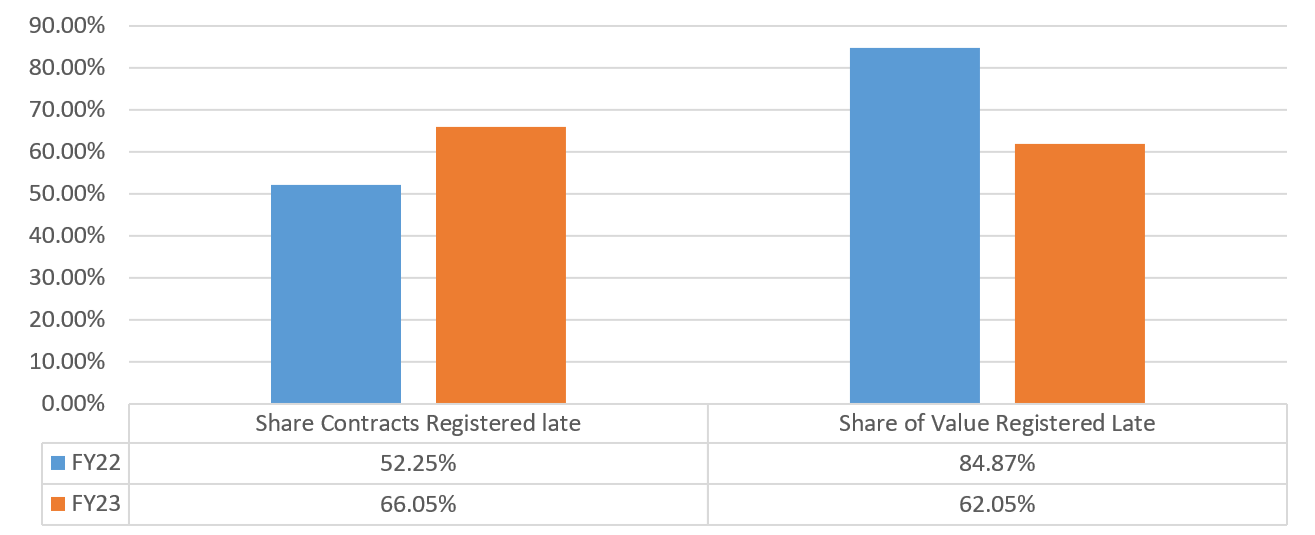

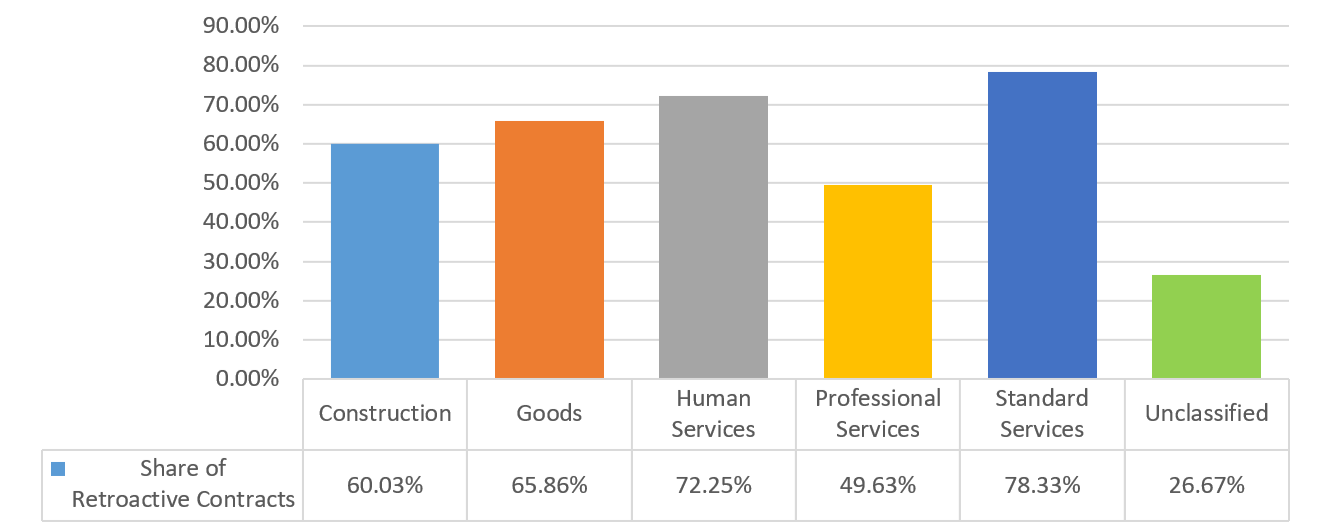

Citywide retroactivity rates (the percentage of contracts that are registered after the start date) are getting worse. The percentage of late-registered contracts by volume has grown each year since FY22 (Chart 3). The problem is especially severe for human service providers and non-profit vendors where over 72% of their total contract value was registered late in FY23. These trends only got worse as we entered FY24, where more than 95% of total contract value for human service and non-profit vendors were registered late in the first half of FY24 (Chart 4). The analysis in Section VIII of this Report reveals that some of these contracts are registered extremely late. For FY23, more than 27% of contracts with non-profit vendors (1,218 contracts) were registered six months to one year late, and more than 31% (1,388 contracts) were registered more than a year late.

Chart 3: Percent of Late-Registered Contracts by Volume – FY21-24

Chart 4: Percent of Late-Registered Contracts by Value – FY21-24

Late registration is a problem for M/WBEs as well. The largest share of M/WBE procurement contracts were registered via the M/WBE Noncompetitive Small Purchase (NCSP) method, which was designed to reduce delays in the contracting process by allowing agencies to contract with City-certified M/WBE vendors for up to $1.5 million without competition. However, the large majority of contracts registered via the M/WBE NCSP method were registered late.

Retroactive contract registration trends are covered in Section VIII of this report.

FY23 Revenue Contracts at a Glance

In addition to procurement agreements, City agencies also contract with private entities for the right to use NYC-owned property in exchange for payment, services, or both. The City derives millions of dollars in revenue from such contracts each year. Over 180 revenue actions were registered in FY23 for a total value of $215.05 million, but the majority of this value can be attributed to Corpus Funded contracts. Corpus Funded contracts are related to the City’s pension management expenses, and while they are currently recorded as revenue transactions, they do not actually generate revenue for the City’s general fund.

Excluding Corpus Funded contracts, the City registered 164 new revenue contracts in FY23 for a total value of $51.60 million. Table 4 contains the top ten revenue contracts that were registered in FY23, by value (excluding Corpus Funded actions).

Table 4: Top Ten FY23 Registered Revenue Contracts by Value (Excluding Corpus Funded)

| Contract # | Agency | Vendor Legal Name | Contract Purpose | Contract Registered Amount | Contract Start Date | Contract End Date |

| 20238200421 | DPR | Samuel Field YM & YWHA INC | Operation and maintenance of indoor tennis – alley pond park. | $8,414,234 | 10/10/2042 | 10/10/2042 |

| 20238201216 | DPR | Legends Boathouse LLC | Operation and maintenance of a restaurant – Central Park. | $7,500,000 | 4/16/2033 | 4/16/2033 |

| 20238200226 | DPR | The Bonnefont LLC | Restaurant operations at Fort Tryon park. | $5,326,423 | 8/31/2042 | 8/31/2042 |

| 20238200107 | DOT | CHPE LLC | Use and operation of spaces in Astoria under the jurisdiction of DOT and DPR. | $4,809,318 | 6/30/2033 | 6/30/2033 |

| 20238802204 | DSNY | Simsmetal East LLC | Acceptance, processing, and marketing of recovered metal. | $3,000,000 | 8/31/2027 | 8/31/2027 |

| 20238201533 | DPR | Busters Marine Bronx Marina | Full-service marina operations at locust point. | $2,884,029 | 6/4/2043 | 6/4/2043 |

| 20238200091 | DPR | F Ottomanelli LIC LLC | Café operations -hunter’s point south park. | $1,971,062 | 7/5/2031 | 7/5/2031 |

| 20238806592 | NYPD | Propertyroom. Com INC | Internet-based auctioning of unclaimed/forfeited property. | $1,875,000 | 3/7/2028 | 3/7/2028 |

| 20238200106 | DOT | CHPE LLC | Use and operations of spaces in Randall’s Island Park. | $1,759,677 | 6/30/2033 | 6/30/2033 |

| 20238200346 | DPR | The Getaway 151 LLC | Snack bar operations at riverside park. | $1,686,362 | 10/9/2042 | 10/9/2042 |

How to Navigate This Report

Section II – New Contract Action Trends: Section II will present data trends for the following contract categories:

- Competitive Contracts

- Limited or Non-Competitive Contracts

- Transactions Not Subject to PPB Rules

- Supplemental Contracts

- Revenue Contracts

Section III – Real Property Transactions: While not covered under the Administrative Code’s scope for this Report, the City also enters into contracts relating to Real Property Transactions each year. Section III will review data trends for these contracts, which mostly consist of lease agreements.

Section IV – Contract Modifications and Administration: While not explicitly called for inclusion in this Report by the Administrative Code, Section IV delves into trends relating to actions undertaken against existing contracts in FY23. Broadly speaking, these actions fall into one of the following categories:

- Actions taken by the City to encumber funds, or to otherwise modify some aspect of an active contract;

- Processing Task Orders (TOs) against existing Master Award contracts; or

- Executing purchase orders for goods, services, or construction (generally under small purchase limits).

Section V – Emergency Procurements: Section V provides additional data regarding the sourcing of required goods or services to meet emergency needs, as authorized by Section 315 of the NYC Charter, and Section 3-06 of the Procurement Policy Board (PPB) Rules.

Section VI – Procurement Actions by Industry: Section VI presents FY23 contract data through the lens of industry classifications, which are used by the City to support analysis of procurement trends.

Section VII – Procurements by Agency Type: Section VII provides information regarding the volume, value, and industry classifications of procurement contracts registered to each agency in FY23.[13]

Section VIII – Retroactive Contract Registrations: Section VIII examines retroactive contract trends, where contracts are legally implemented after the first day of their term.

Section IX – Bureau of Labor Law – Living and Prevailing Wage Cases: Section IX summarizes the Comptroller’s enforcement of certain living and prevailing wage standards, as required under Sections 6-109, 6-130, and 6-145 of the Administrative Code.

Section X – Glossary of Terms: The glossary defines relevant City procurement and contract registration terminology.

Section XI – Appendices: This Section contains complete supporting data sets for the interposed tables as well as other data points required by the Administrative Code that are not specifically referenced in this report.

Resources to Supplement This Report

While not used to generate data for this Report, readers may find the following resources useful for learning more about city contracting and financial trends.

Contract Primer

In the Fall of 2023, this Office released a new Contract Primer to provide the public with a straightforward guide to the basics of the City’s contracting workflows and essential solicitation methods. Readers can reference information on key entities in NYC contracting, learn about the NYC contracting cycle, and access links to helpful public-facing resources. Critically, the Primer also defines contract categories, solicitation methods, and additional contracting processes that are discussed in this Report.

Helpful Links:

Checkbook NYC

In July of 2010 the Comptroller’s Office launched Checkbook NYC, an online transparency tool that for the first time placed the City’s day-to-day spending in the public domain. Using an intuitive dashboard approach that combines a series of graphs and user-friendly tables, Checkbook NYC provides up-to-date information about the City’s financial condition.

Checkbook NYC has been ranked the top transparency tool in the nation for tracking government spending by the United States Public Interest Research Group and was named New York City 2013 “Best External Application” by Government Technology Magazine.

Checkbook NYC also contains a majority of the City’s contract data. This tool enables users to examine data on its “Contracts” tab by fiscal year (or other date ranges), procurement category, contract types, and more.

Helpful Links:

- Click this link to access Checkbook NYC

- Click this link to view videos on how to navigate Checkbook NYC’s search functions

PASSPort Public

Procurement and Sourcing Solutions Portal (PASSPort) is the City of New York’s end-to-end digital procurement platform that manages every stage of the procurement process from vendor enrollment, to the solicitation of goods and services, to contract registration and management. PASSPort Public refreshes data periodically from PASSPort such that the public can derive insight into the City’s procurement system.[14]

Helpful Links:

Agency Procurement Plans (M/WBE, LL63, and Human Services)

Under Local Law 1 of 2013, SBS and the Mayor’s Office of Contract Services (MOCS) are required to publish an annual plan and schedule listing the anticipated contracting opportunities for the coming fiscal year. These plans include the following information for each solicitation: the specific type and scale of the services to be procured, the term of the proposed contract, the method of solicitation the agency intends to utilize, and the anticipated fiscal year quarter of the planned solicitation.

Similarly, under Local Law 63 of 2011, MOCS is required to publish a plan and schedule detailing the anticipated contract actions (for certain categories of procurement) of each City agency for the upcoming fiscal year. This requirement applies to contracts valued at more than $200K providing standard or professional services, including against agency task orders.

Lastly, MOCS also publishes plans reflecting proposed procurements relating to human service programs. This information is collected from, and organized by, city agencies.

Helpful Links:

- Click this link to view M/WBE Procurement plans by agency

- Click this link to view LL63 plans by agency

- Click this link to view Human Service procurement plans by agency

City Record Online

The City Record Online (CROL) is a searchable database of notices published in the City Record newspaper which includes but is not limited to: public hearings and meetings, public auctions and sales, solicitations and awards and official rules proposed and adopted by city agencies.[15]

Helpful Links:

II. New Contract Actions Trends

Overview

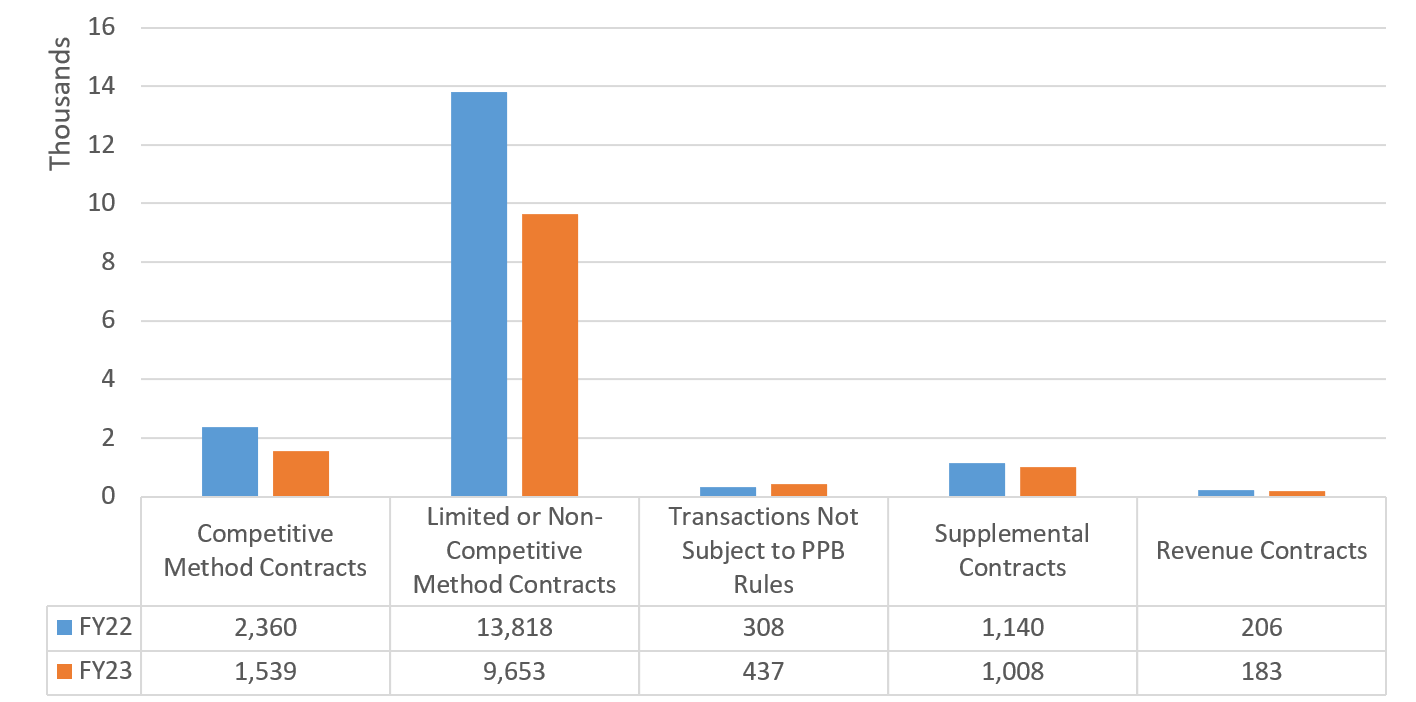

Table 5 provides a breakdown of new procurement and revenue agreements by contract group.[16] Subsequent tables provide details about the distribution of subgroups, by volume and value. As with previous years, competitively sourced contracts in Group 1 comprise the largest share of contract value. Limited or Non-Competitive method contracts comprised more than three quarters of the total contract volume in FY23.

Table 5: FY23 New Procurement and Revenue Contracts by Category

| Contract Category | # of Contracts | % Share of Contracts | Total Registered Contract Value | % Share of Contract Value |

| Group 1: Competitive Method Contracts | 1,539 | 12.00% | $16,967,698,060 | 44.40% |

| Group 2: Limited or Non-Competitive Method Contracts | 9,653 | 75.30% | $14,853,044,164 | 38.86% |

| Group 3: Not Subject to PPB Rules | 437 | 3.41% | $496,908,520 | 1.30% |

| Group 4: Supplemental Contracts | 1,008 | 7.86% | $5,685,490,713 | 14.88% |

| Group 5: Revenue Contracts | 183 | 1.43% | $215,048,375 | 0.56% |

| Grand Total | 12,820 | 100.00% | $38,218,189,832 | 100.00% |

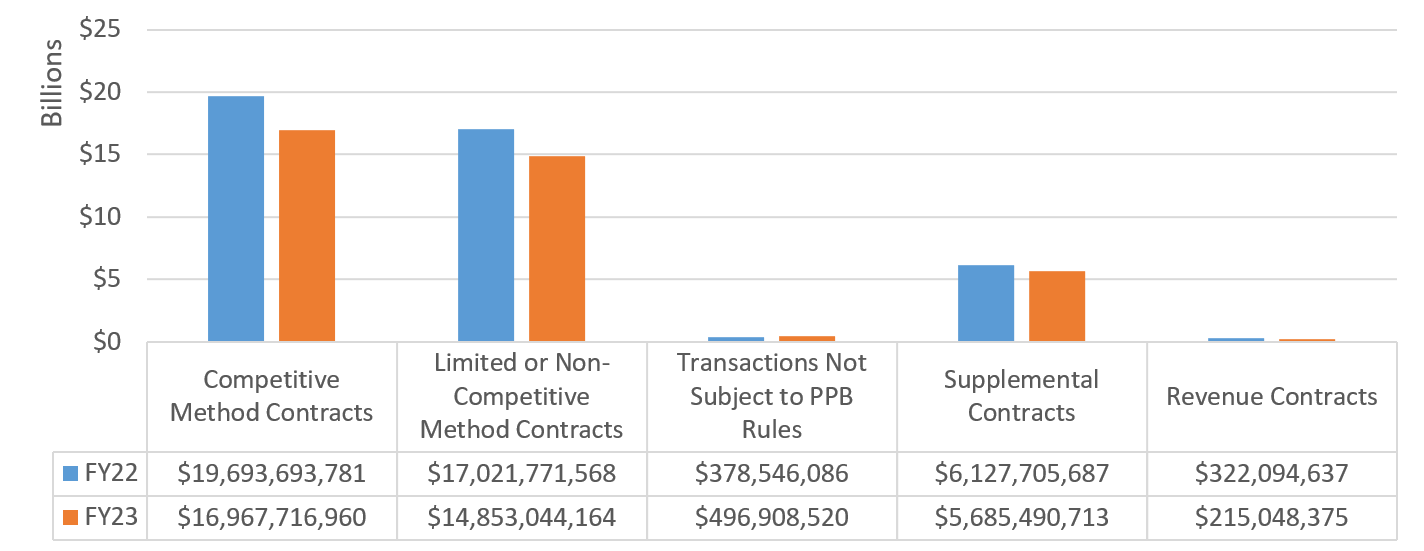

Charts 5 and 6 provide a year-over-year comparison of contract volume and value by the groupings listed in the table above. While both graphics reflect the decline in contract volume and value mentioned in the Executive Summary, they also show consistent year over year trends across the contract groups.

Chart 5: FY22-23 Volume of New Contracts by Contract Group

Chart 6: FY22-23 Value of New Contracts by Contract Group

Group 1: Competitive Method Contracts

Competitive Method contracts are designed to help the City obtain the highest value based on price or quality. There were fewer Competitive Sealed Proposal (CSP) procurements in FY23 relative to the previous year. This may be because of an FY22 spike in procurements for DOE early childhood contracts that were procured via the CSP method. Table 6 provides a breakdown of competitive method subgroups by volume and value.[17]

Table 6: Competitive Methods Contracts by Subgroup

| Subgroup | # of Contracts | % Share of Contracts | Total Registered Contract Value | % Share of Contract Value |

| Competitive Sealed Bid Contracts | 650 | 42.24% | $5,264,380,505 | 31.03% |

| Competitive Sealed Proposal Contracts | 825 | 53.61% | $11,536,808,078 | 67.99% |

| Accelerated Procurement Contracts | 64 | 4.16% | $166,528,377 | 0.98% |

| Grand Total | 1,539 | 100.00% | $16,967,716,960 | 100.00% |

Group 2: Limited or Non-Competitive Methods

Limited or Non-Competitive procurement methods were responsible for the largest share of new procurement contracts (9,652 actions or 75.30%). Nonetheless, the volume of Group 2 contracts declined overall in FY23, largely due to lower number of small purchase registrations. Table 7 provides a breakdown of subgroups under Group 2 by volume and value.

Table 7: Limited/Non-Competitive Methods Contracts by Subgroup

| Subgroup | # of Contracts | % Share of Contracts | Total Registered Contract Value | % Share of Contract Value |

| Buy-Against Procurement Contracts | 3 | 0.03% | $9,550,554 | 0.06% |

| Demonstration Project Contracts | 8 | 0.08% | $11,420,493 | 0.08% |

| Determined by Government Mandate Contracts | 125 | 1.29% | $538,597,224 | 3.63% |

| Discretionary (Line Item) Contracts | 2,626 | 27.20% | $345,515,131 | 2.33% |

| Emergency Procurement Contracts | 193 | 2.00% | $1,102,869,886 | 7.43% |

| Government-to-Government Contracts | 35 | 0.36% | $1,918,846,108 | 12.92% |

| Innovative Procurement Contracts | 107 | 1.11% | $3,480,627,013 | 23.43% |

| Intergovernmental Procurement Contracts | 391 | 4.05% | $1,437,356,926 | 9.68% |

| Micropurchase Contracts | 1,129 | 11.70% | $12,178,901 | 0.08% |

| Negotiated Acquisition Contracts | 700 | 7.25% | $2,025,596,205 | 13.64% |

| Small Purchase Contracts – General | 3,134 | 32.47% | $101,100,092 | 0.68% |

| Small Purchase Contracts – M/WBE | 1,064 | 11.02% | $197,138,236 | 1.33% |

| Sole Source Contracts | 138 | 1.43% | $3,672,247,394 | 24.72% |

| Grand Total | 9,653 | 100.00% | $14,853,044,164 | 100.00% |

Buy-Against Contracts

Buy-Against procurements are used by City agencies to preserve the continuity of goods or service provision after a vendor defaults on their contract, or following the termination of a vendor’s contract because of a material breach to the agreement.[18] Table 9 displays information on the three Buy-Against Contracts that were registered in FY23.

Table 8: FY23 Registered Buy-Against Contracts

| Contract Number | Agency | Vendor Legal Name | Contract Purpose | Contract Registered Amount | Contract End Date |

| 20238807603 | DCAS | NORTH SHORE CHEVROLET LLC | Purchase of three Chevrolet Suburbans. | $183,387 | 8/31/2023 |

| 20231408207 | DSS/DHS | GURTEJ DHALL | Assuming the provision of services under the DHS Meal Program (Bronx). | $3,580,038 | 6/30/2023 |

| 20231408206 | DSS/DHS | RC STILLWELL LLC | Assuming the provision of services under the DHS Meal Program (Manhattan). | $5,787,128 | 6/30/2023 |

Group 3: Transactions Not Subject to PPB Rules

The contracts in Group 3 reflect transactions that are either not mentioned in the PPB rules or are otherwise explicitly excluded in Section 1-02(f). Group 3 makes up a relatively small share of the City’s contracting footprint, with just 437 registered parent contracts in FY23 totaling $496.91 million. Table 9 provides a breakdown Group 3’s subgroups by volume and value.

Table 9: Transactions Not Subject to PPB rules by Subgroup

| Subgroup | # of Contracts |

% Share of Contracts |

Total Registered Contract Value |

% Share of Contract Value |

| Force Account Contracts | 13 | 2.97% | $18,668,733 | 3.76% |

| Grant Agreements | 14 | 3.20% | $11,132,240 | 2.24% |

| Miscellaneous Contracts | 193 | 44.16% | $106,228,471 | 21.38% |

| Professional Membership Negotiation Contracts | 21 | 4.81% | $629,853 | 0.13% |

| Regulated by Government Commission | 41 | 9.38% | $332,241,388 | 66.86% |

| Subscription Contracts | 155 | 35.47% | $28,007,836 | 5.64% |

| Grand Total | 437 | 100.00% | $496,908,520 | 100.00% |

Group 4: Supplemental Contracts

The contracts in Group 4 reflect new agreements whose terms were set forth by a preceding contract. They accounted for 1,008 registrations in FY23 totaling $5.68 billion in value. This reflects almost 15% of the total procurement value registered in FY23. Table 10 provides a breakdown of Group 4’s subgroups by volume and value.

Table 10: Supplemental Contracts by Subgroup

| Subgroup | # of Contracts | % Share of Contracts | Total Registered Contract Value | % Share of Contract Value |

| Assignments | 91 | 9.03% | $728,908,357 | 12.82% |

| Renewals | 917 | 90.97% | $4,956,582,356 | 87.18% |

| Grand Total | 1,008 | 100.00% | $5,685,490,713 | 100.00% |

Group 5: Revenue Contracts

There were 183 registered Revenue contracts in FY23 totaling over $215 million in value. Group 5 also includes Corpus Funded agreements, which relate to the City’s asset management activities. Corpus Funded contracts are currently recorded in FMS as revenue transactions, but they do not actually generate revenues for the City’s general fund. Table 11 provides a breakdown Group 5’s subgroups by volume and value.

Table 11: Revenue Contracts by Subgroup

| Subgroup | # of Contracts | % Share of Contracts | Total Registered Contract Value | % Share of Contract Value |

| Concession Agreements | 74 | 40.44% | $34,008,018 | 15.81% |

| Revocable Consents | 84 | 45.90% | $10,519,044 | 4.89% |

| Corpus Funded Agreements | 19 | 10.38% | $163,446,314 | 76.00% |

| Other Revenue | 6 | 3.28% | $7,075,000 | 3.29% |

| Grand Total | 183 | 100.00% | $215,048,375 | 100.00% |

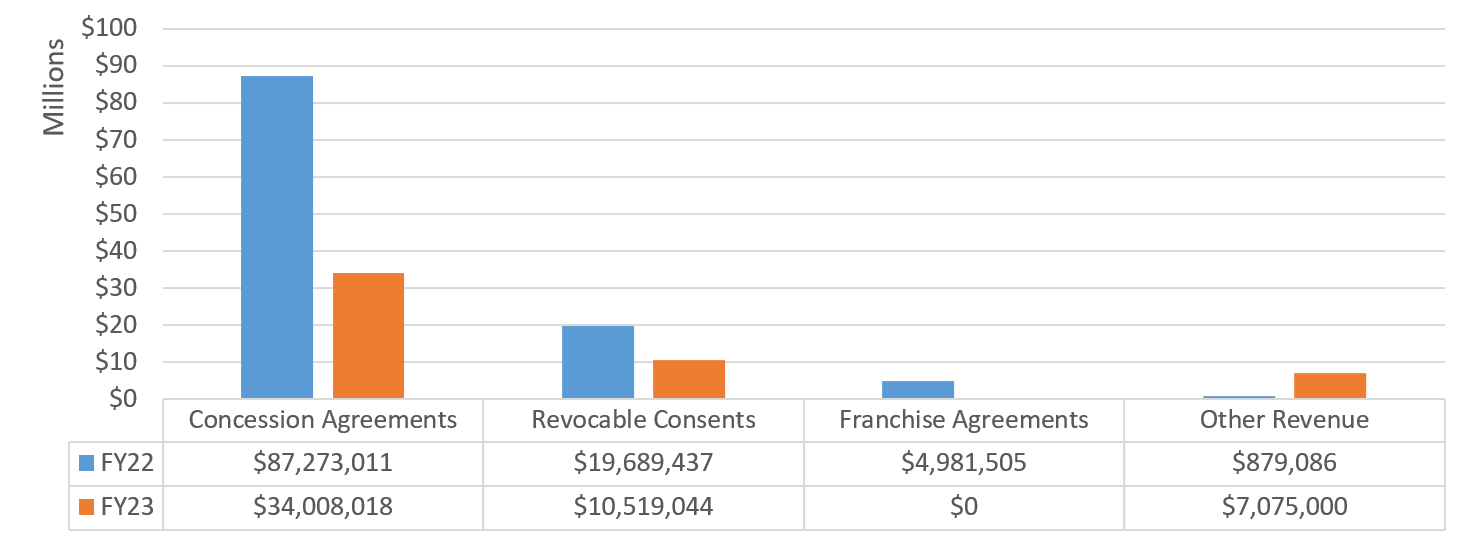

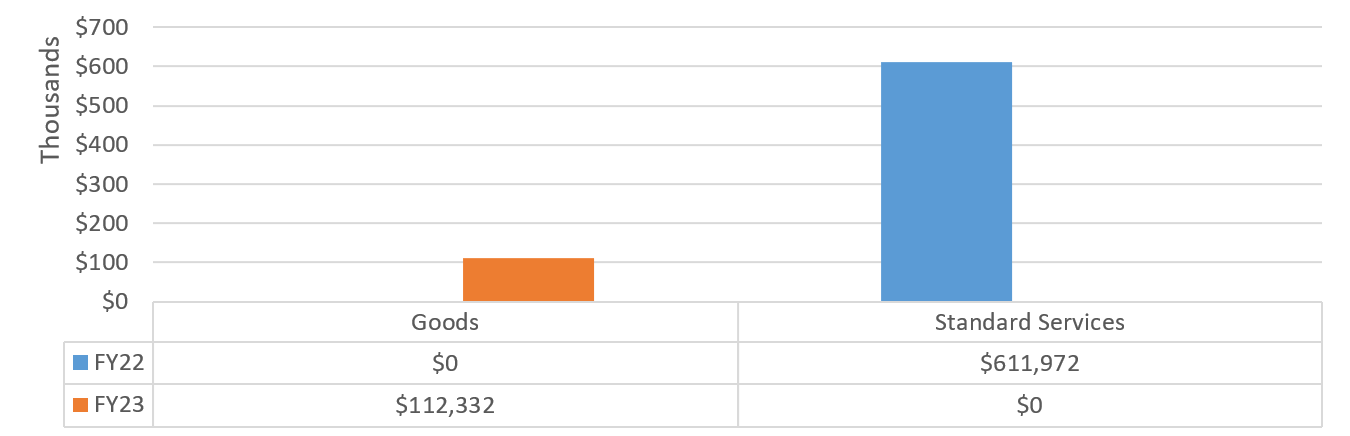

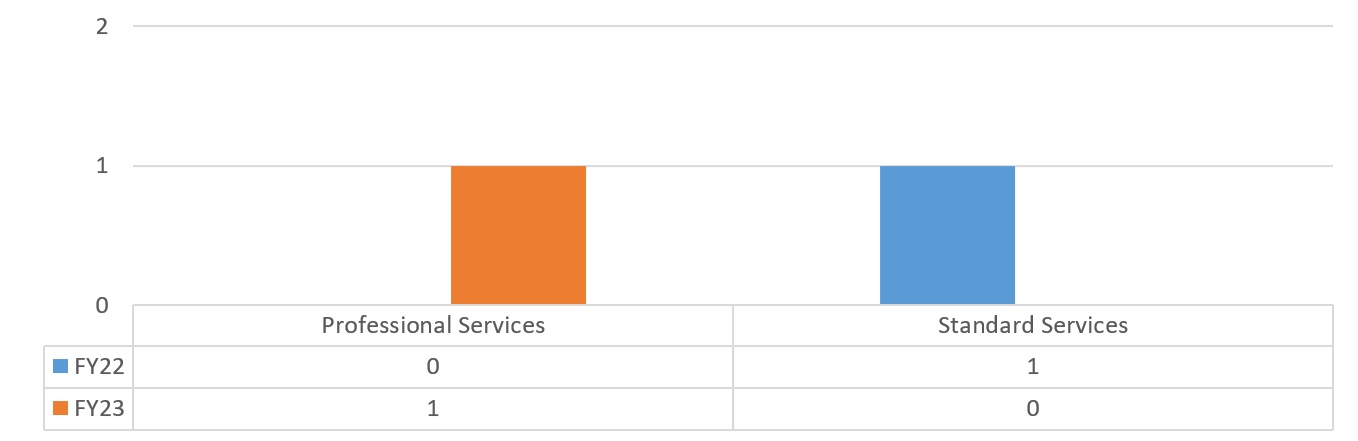

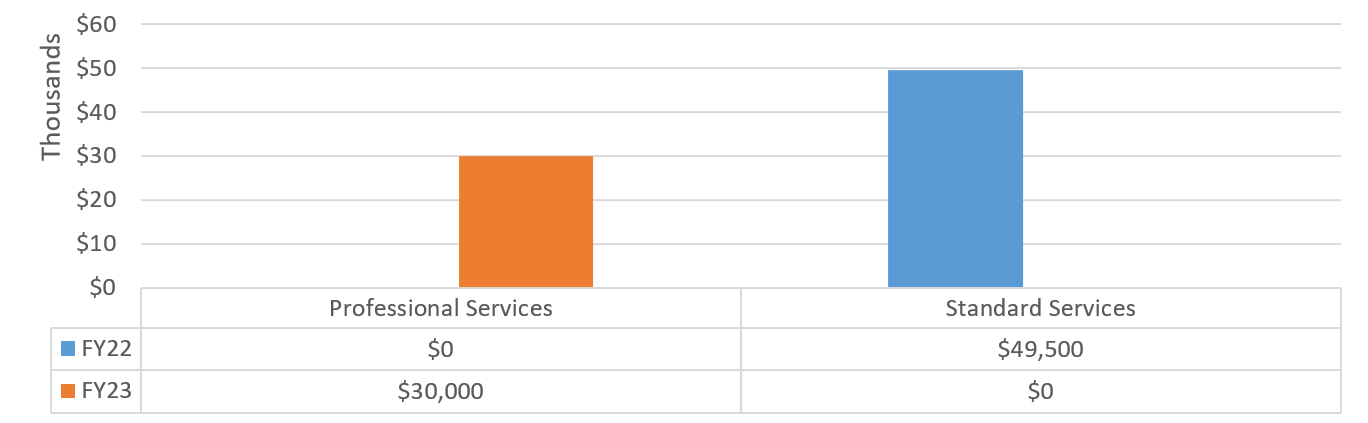

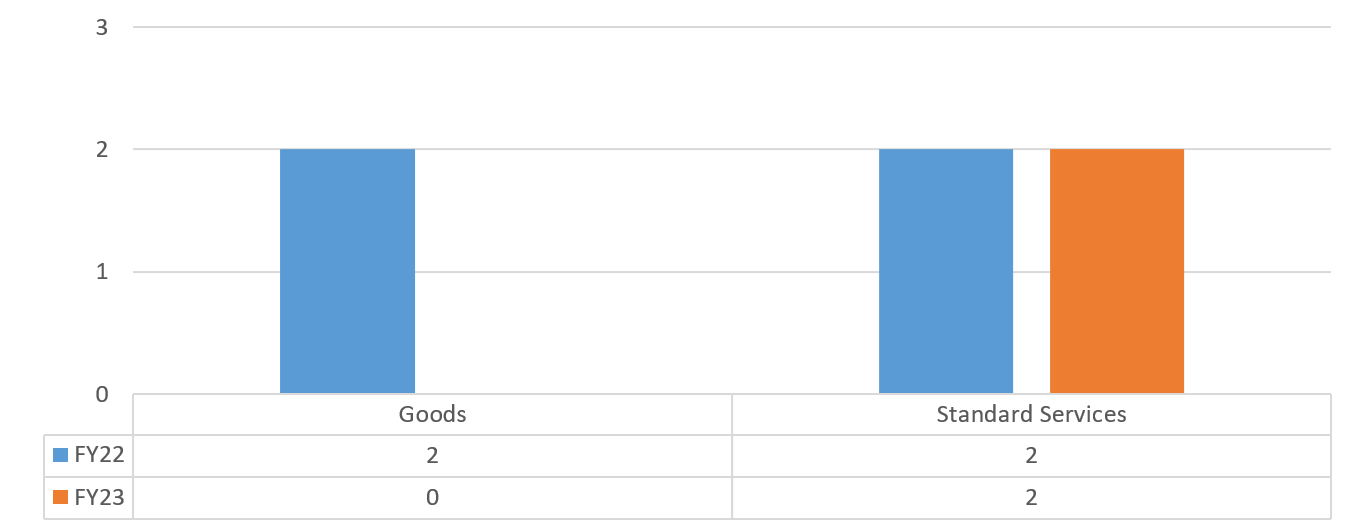

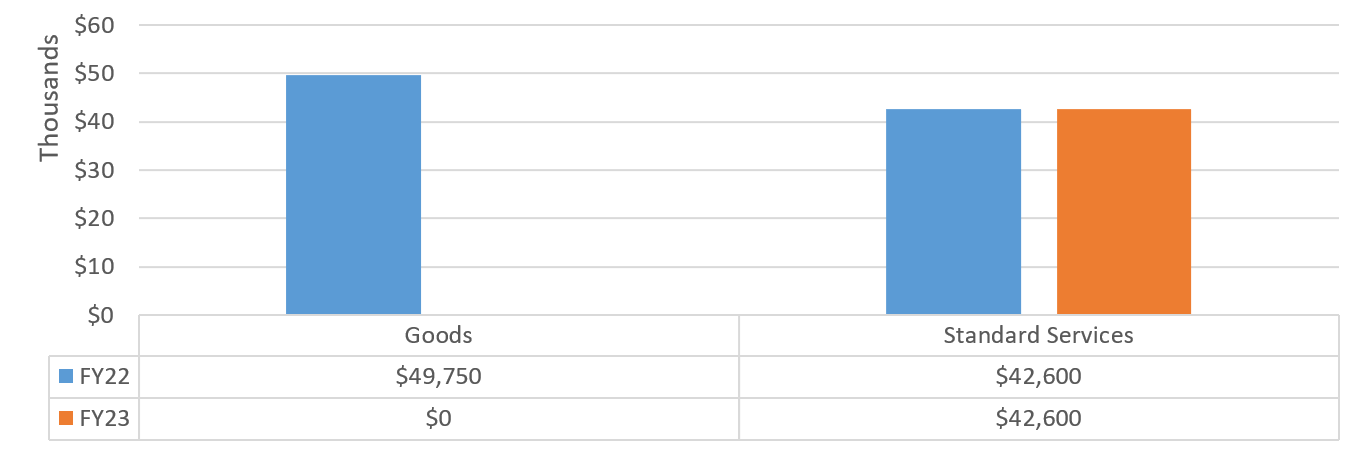

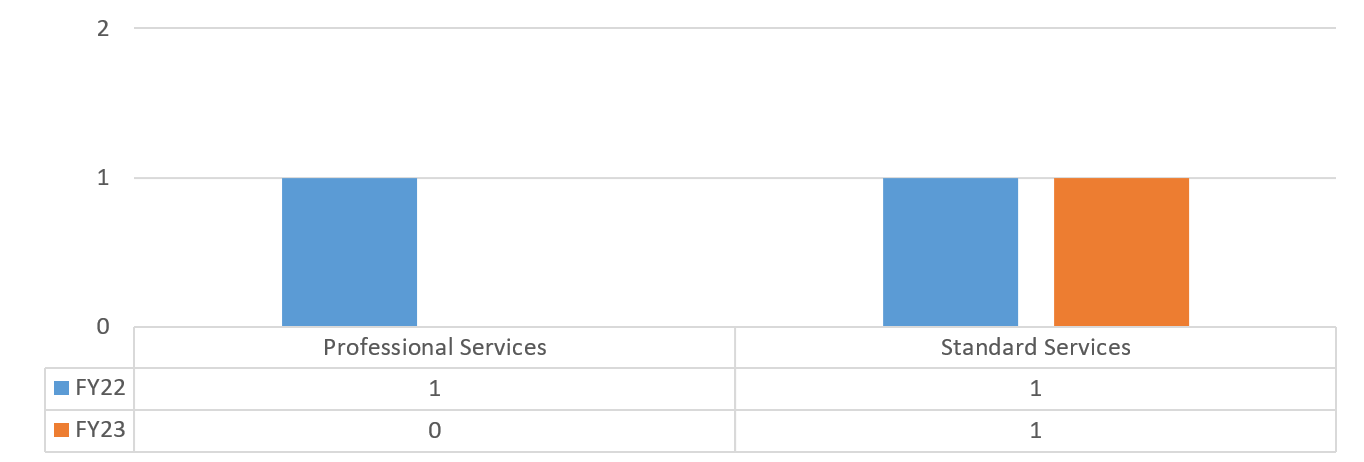

Chart 7 presents a year-over-year comparison of registered revenue contracts by category. There were no new registered Franchise Agreements in FY23.

Chart 7: FY22-FY23 Revenue Totals[19]

III. Real Property Transactions Trends

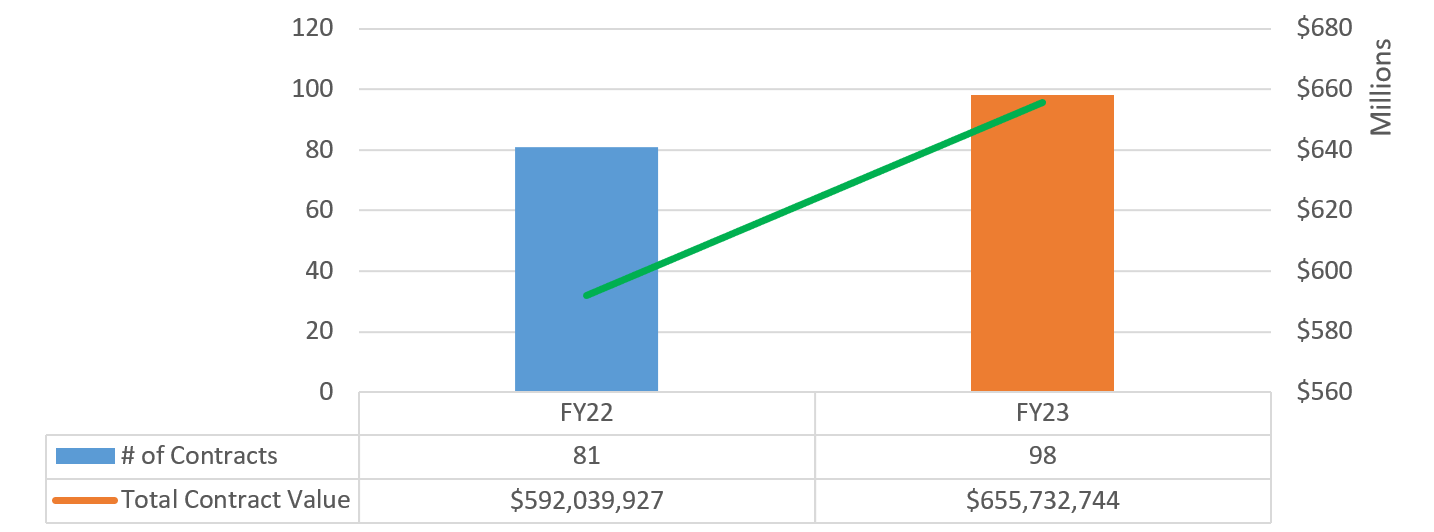

Section III presents data trends relating to Real Property Transactions, which are non-revenue contracts that are also not defined as procurements in either Chapter 13 of the City Charter or in the PPB rules. There were 98 Real Property contracts registered in FY23 for a total value of $655,732,744. Table 12 provides a breakdown by award method.

Table 12: FY23 Registered Real Property Contracts by Award Method

| Award Method | # of Contracts | % Share of Contracts | Total Contract Value | % Share of Contract Value |

| Lessee Negotiation | 76 | 77.55% | $634,468,819 | 96.76% |

| Watershed Land Negotiation | 22 | 22.45% | $21,263,925 | 3.24% |

| Grand Total | 98 | 100.00% | $655,732,744 | 100.00% |

Chart 8 displays Real Property contract volume and value trends across FY22 and FY23. There were modest increases in the number and value of these contracts in FY23.

Chart 8: FY22-23 Registered Real Property Contracts by Volume and Value

Real Property Transactions by Agency

23 City agencies administered real property transactions in FY23. While the City Council made up the largest share of these contracts by volume, DCAS accounted for over a quarter of city’s registered contract value in this category. Table 13 provides a breakdown of transactions by Agency.

Table 13: FY23 New Real Property Transactions by Agency

| Agency | # of Contracts | % Share of Contracts | Total Contract Value | % Share of Contract Value |

| ACS | 1 | 1.02% | $3,305,237 | 0.50% |

| BKCB16 | 1 | 1.02% | $24,005 | 0.00% |

| BKLYN CB #1 | 1 | 1.02% | $33,190 | 0.01% |

| CC | 34 | 34.69% | $2,698,691 | 0.41% |

| CUCF | 3 | 3.06% | $1,327,168 | 0.20% |

| DAKINGS | 1 | 1.02% | $761,639 | 0.12% |

| DCAS | 7 | 7.14% | $167,762,711 | 25.58% |

| DEP | 24 | 24.49% | $57,661,148 | 8.79% |

| DFTA | 1 | 1.02% | $10,975,590 | 1.67% |

| DOF | 2 | 2.04% | $22,453,299 | 3.42% |

| DOHMH | 1 | 1.02% | $659,354 | 0.10% |

| DOP | 4 | 4.08% | $638,751 | 0.10% |

| DOT | 1 | 1.02% | $149,027,404 | 22.73% |

| DSNY | 3 | 3.06% | $143,098,440 | 21.82% |

| FDNY | 2 | 2.04% | $20,259,358 | 3.09% |

| HPD | 1 | 1.02% | $4,316,580 | 0.66% |

| HRA | 2 | 2.04% | $56,611,157 | 8.63% |

| LAW | 2 | 2.04% | $6,596,509 | 1.01% |

| MAN CB #12 | 1 | 1.02% | $1,126,715 | 0.17% |

| MAYOR | 2 | 2.04% | $1,283,371 | 0.20% |

| NCYEM | 1 | 1.02% | $1,187,414 | 0.18% |

| NYPD | 2 | 2.04% | $1,017,625 | 0.16% |

| OTI | 1 | 1.02% | $2,907,388 | 0.44% |

| Grand Total | 98 | 100.00% | $655,732,744 | 100.00% |

IV. Contract Modifications and Administration Trends

Section IV presents data trends relating to modification and contract administration trends.

Modifications

Agencies are authorized to change certain aspects of existing registered agreements, such as:[20]

- Updating contract amounts to reflect additional authorized or omitted work.

- Extending the duration of a contract for good and sufficient cause (generally not for longer than an additional year).

- Administrative reasons, such as encumbering funds to expense contracts or revising commodity and accounting lines.

Any change that requires a material alteration to the scope of work outlined in an initial contract’s terms cannot be resolved by a modification. The agency must instead procure a new contract in such cases.

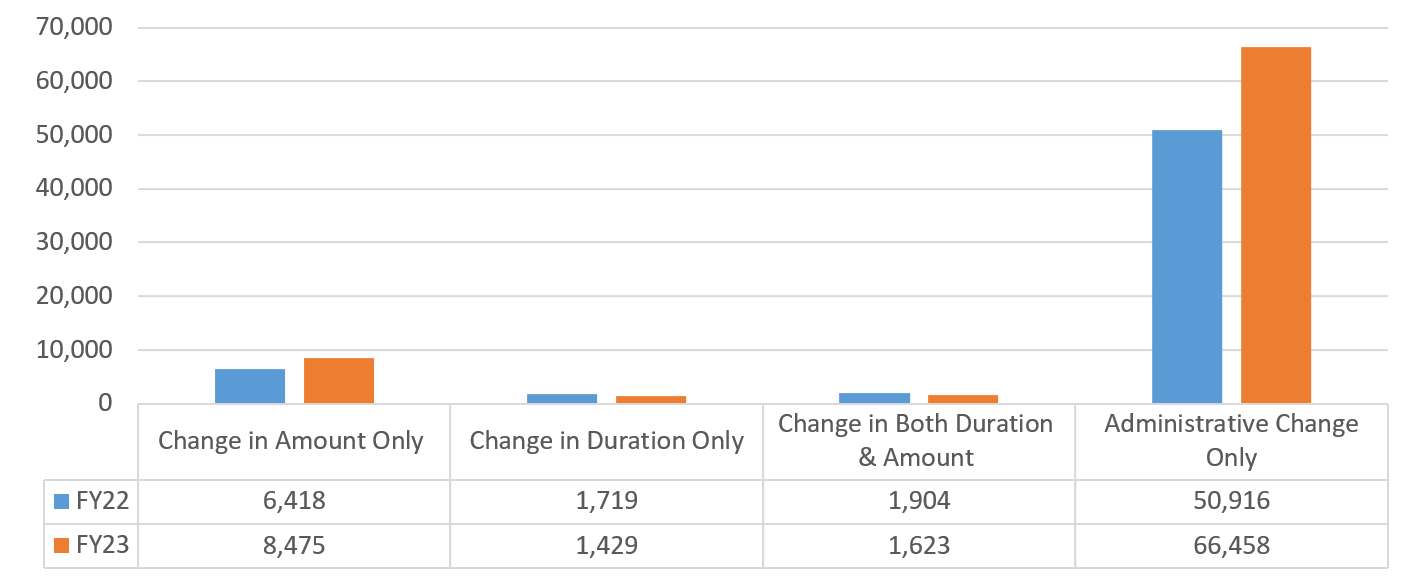

Table 14 below presents the share of modifications registered by the type of modification.

Table 14: FY23 Analysis of Registered Modifications By Category

| Modification Category | Total # of Registered Modifications | % Share of Registered Modifications |

| Change-in-Amount Only | 8,475 | 10.87% |

| Change in Duration Only | 1,429 | 1.83% |

| Change in Both Duration & Amount | 1,623 | 2.08% |

| Administrative Change Only | 66,458 | 85.22% |

| Grand Total | 77,985 | 100.00% |

Chart 9 shows year-over-year registered modification trends by category. Notably, the number of Change-in-Amount modifications increased by over two thousand actions in FY23. The total value of FY23 change-in-amount modifications was $9.59 billion, which exceeded last year’s total by $1.17 billion. This increase was largely driven by DCAS, which registered 800 more change-in-amount modifications in FY23 over the prior year, most of which were related to its COMPASS Programs. Similarly, the DOE registered over 700 more change-in-amount modifications in FY23, many of which were related to early childhood programs.

Chart 9: FY22-23 Registered Modifications by Category

FY23 BCA-Registered Contract Modifications by Agency

While agencies have been delegated to self-register some contract modifications, many must be submitted to this Office’s Bureau of Contract Administration (BCA) for review and registration. Over 75% of the modifications that BCA registered in FY23 were administered by just ten agencies. DYCD modified the most BCA-registered contracts with 2,541 actions. Table 15 below displays the top ten agencies by volume of BCA registered actions.

Table 15: Top Ten Agencies with BCA-Registered Modifications in FY23

| Agency | # of BCA-Registered Modifications | % Share of BCA-Registered Modifications |

| DYCD | 2,541 | 23.12% |

| DDC | 1,781 | 16.21% |

| DEP | 735 | 6.69% |

| DPR | 645 | 5.87% |

| DOHMH | 570 | 5.19% |

| DOE | 507 | 4.61% |

| DCAS | 454 | 4.13% |

| DOT | 445 | 4.05% |

| ACS | 395 | 3.59% |

| HRA | 374 | 3.40% |

| Grand Total | 8,447 | 76.86% |

When isolating change-in-amount modifications, DYCD was the source of the most BCA-registered modifications with 2,532. Most of DYCD’s modifications were registered against contracts having to do with the COMPASS program. See Table 16 below for a breakdown by top ten agencies.

Table 16: Top Ten Agencies with BCA-Registered Change-In-Amount Modifications

| Agency | # of Modifications | % Share of Modifications |

| DYCD | 2,532 | 32.41% |

| DDC | 1,033 | 13.22% |

| DOE | 491 | 6.28% |

| DPR | 411 | 5.26% |

| DOHMH | 393 | 5.03% |

| ACS | 371 | 4.75% |

| DEP | 313 | 4.01% |

| DFTA | 284 | 3.63% |

| HRA | 233 | 2.98% |

| NYCHA | 225 | 2.88% |

| Grand Total | 6,286 | 80.46% |

Construction Change Orders

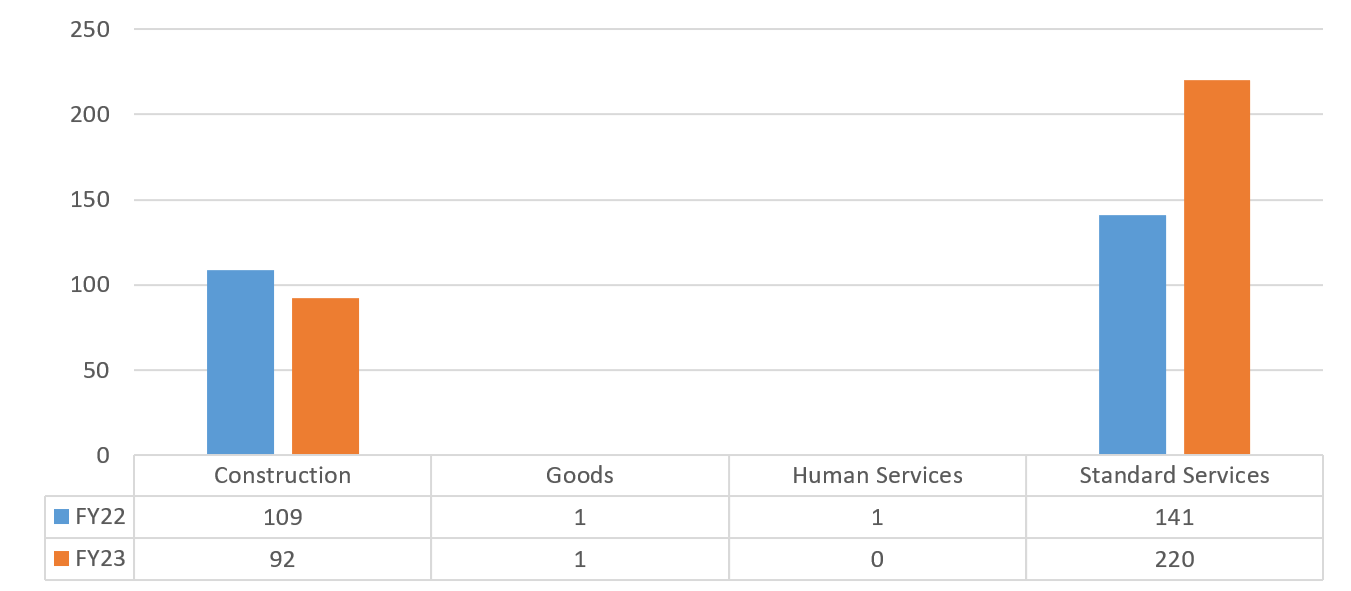

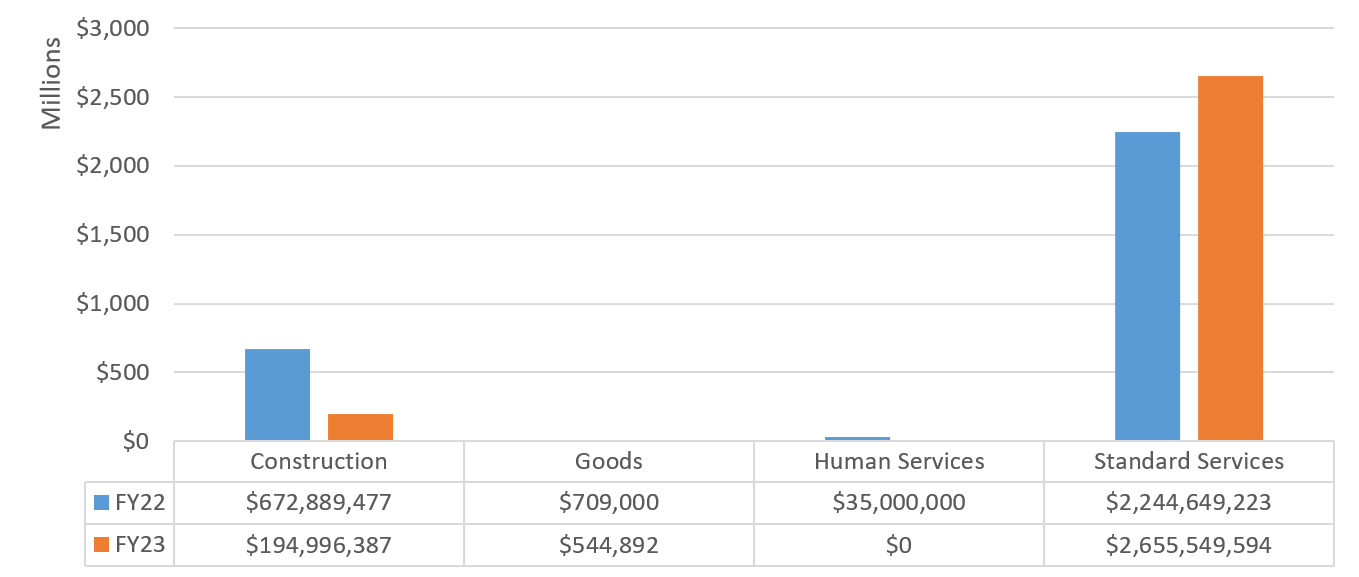

Construction change orders (CCO) reflect a subset of the modification data discussed above, although the data below includes additional CCOs that were not registered by the Comptroller’s Office.[21] CCOs are typically used to authorize non-material additional labor and/or equipment needed to complete a construction project. As shown in Chart 10, CCOs increased in both volume and value in FY23.

Chart 10: FY22-FY23 CCOs by Volume and Value

Table 17 reflects the top-five agencies using CCOs by volume. These five agencies comprised over 79.40% of the CCO volume in FY23.

Table 17: Top Five Agencies with FY23 Registered CCOs, by Volume

| Agency | # of Registered CCOs | % Share of FY23 Registered CCOs |

| DDC | 1,012 | 31.01% |

| HPD | 500 | 15.32% |

| DEP | 439 | 13.45% |

| DPR | 431 | 13.21% |

| DOT | 209 | 6.41% |

| Grant Total | 2,591 | 79.40% |

Similarly, Table 18 shows only change-in-amount CCOs.

Table 18: Change-in-Amount CCOs for the Top Five Agencies With FY23 CCOs, by Volume

| Agency | # of Registered CCOs | Average Original Contract Value | Average Revised Contract Value |

| DDC | 654 | $39,962,352 | $42,712,535 |

| DPR | 319 | $5,156,019 | $6,214,363 |

| DEP | 209 | $113,486,240 | $127,074,447 |

| NYCHA | 119 | $4,276,911 | $6,044,538 |

| EDC | 107 | $6,823,382 | $14,870,321 |

Task Orders

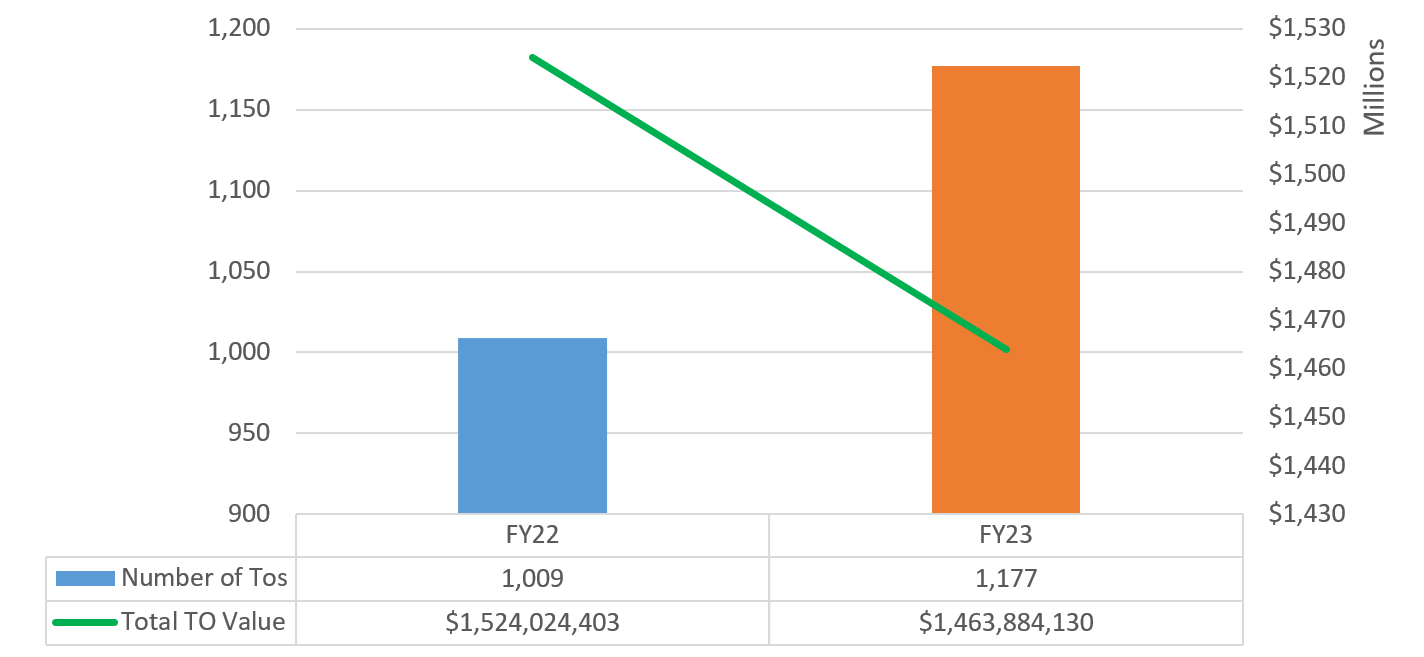

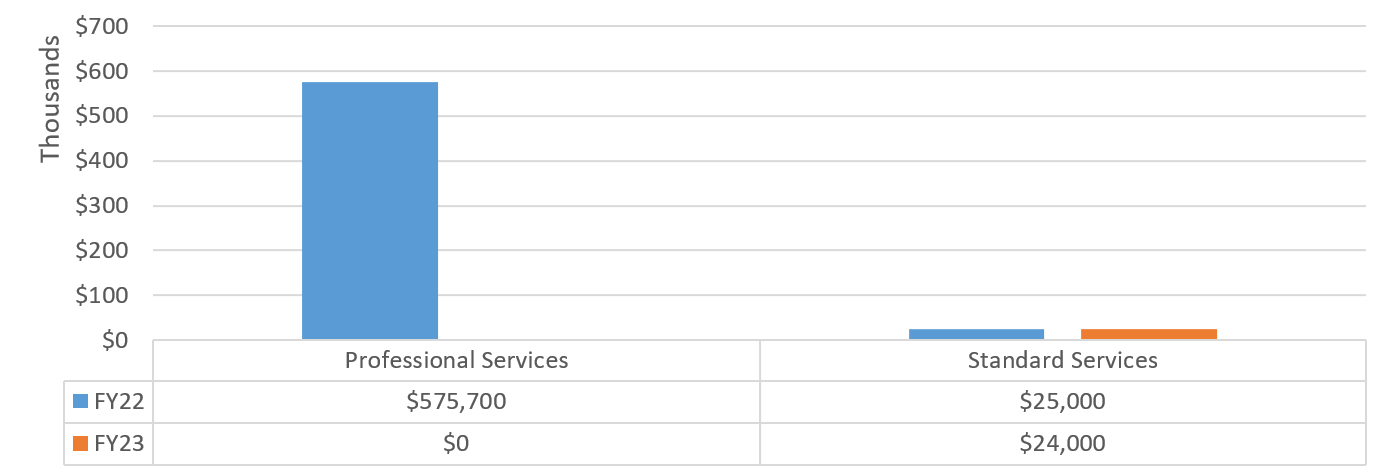

Agencies registered 1,177 TOs in FY23, against 315 Multiple Master Agreements for a total value of $1,463,884,130. 156 of these TOs were registered to EDC under a single SBS agreement.[22] Although the volume of registered TOs increased in FY23, their total value declined relative to FY22. Chart 11 below displays the volume and value of registered TOs in FY22 and FY23.

Chart 11: Registered Task Orders FY22-FY23

The top five agencies based on the volume of registered TOs account for over 77% of all TOs registered in FY23, and 76% of the total registered TO value. Table 19 displays the five agencies that registered the most TOs in FY23.

Table 19: Top Five Agencies by Volume of Registered TOs in FY23

| Row Labels | # of TOs | Total Registered Value |

| EDC | 310 | $570,769,639 |

| NYCHA | 286 | $181,386,580 |

| DDC | 159 | $183,786,815 |

| DPR | 107 | $88,488,216 |

| DCAS | 52 | $95,543,665 |

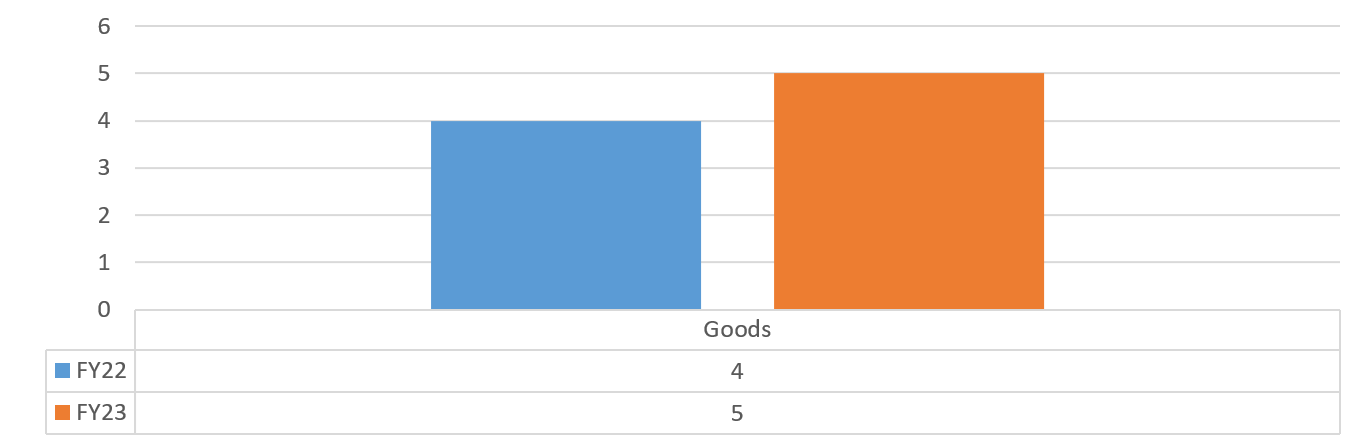

Purchase Orders

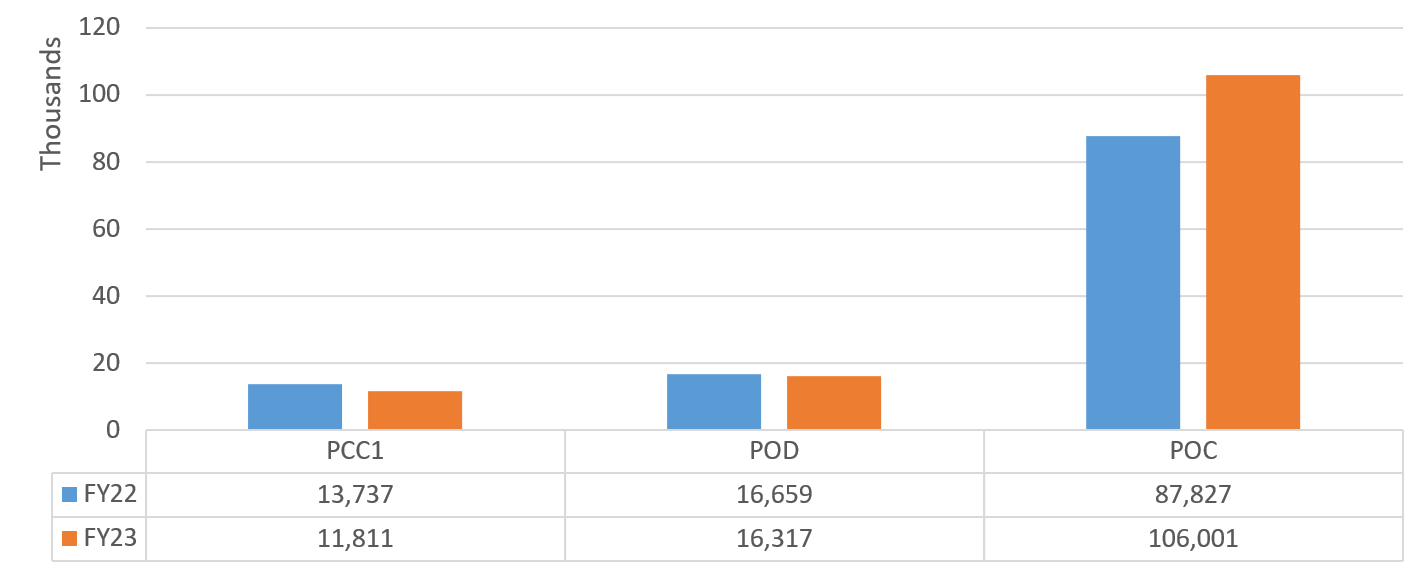

134,129 POs were recorded in FY23 for a total value exceeding $411 million.[23] Both figures represent an increase over FY22 levels. Table 20 reflects the number and value of POs issued in FY23 by category.

Table 20: PO Records by Category FY23

| PO Type | Total # of POs | Actual Amount | Obligation Amount Adjusted for Outyear | Available To Obligate |

| PCC1 | 11,811 | $21,158,952 | $21,158,637 | $315 |

| POD | 16,317 | $88,191,170 | $87,653,396 | $537,774 |

| POC | 106,001 | $302,421,813 | $302,241,353 | $180,434 |

| Grand Total | 134,129 | $411,771,936 | $411,053,386 | $718,523 |

Chart 12 compares the volume of POs issued in FY22 and FY23 by Category. Nearly 20 thousand additional POs were issued in FY23 relative to FY22 levels.

Chart 12: FY22-FY23 Volume of POs by Category

The top-five agencies using POs in FY23, by volume, accounted for over 89% of the total share of POs processed by the City. Table 23 displays the volume and value of POs across each of these agencies. DOE continued to issue the most POs in FY23, issuing nearly 20 thousand more POs than they did in the prior fiscal year.

Table 21: Top Five Agencies by Volume of Recorded POs in FY23

| Agency | # of Recorded POs | Total Value PO Actual Amount | % share of all POs |

| DOE | 102,274 | $269,396,923 | 76.25% |

| HPD | 11,780 | $ 18,263,136 | 8.78% |

| NYPD | 2,627 | $14,707,961 | 1.96% |

| DEP | 1,784 | $18,309,945 | 1.33% |

| DPR | 1,537 | $9,410,949 | 1.15% |

| Grand Total | 120,002 | $330,088,914 | 89.47% |

V. Emergency Procurement Trends

Section V presents data trends relating to procurement methods used by the City to respond quickly in the event of emergencies.[24]

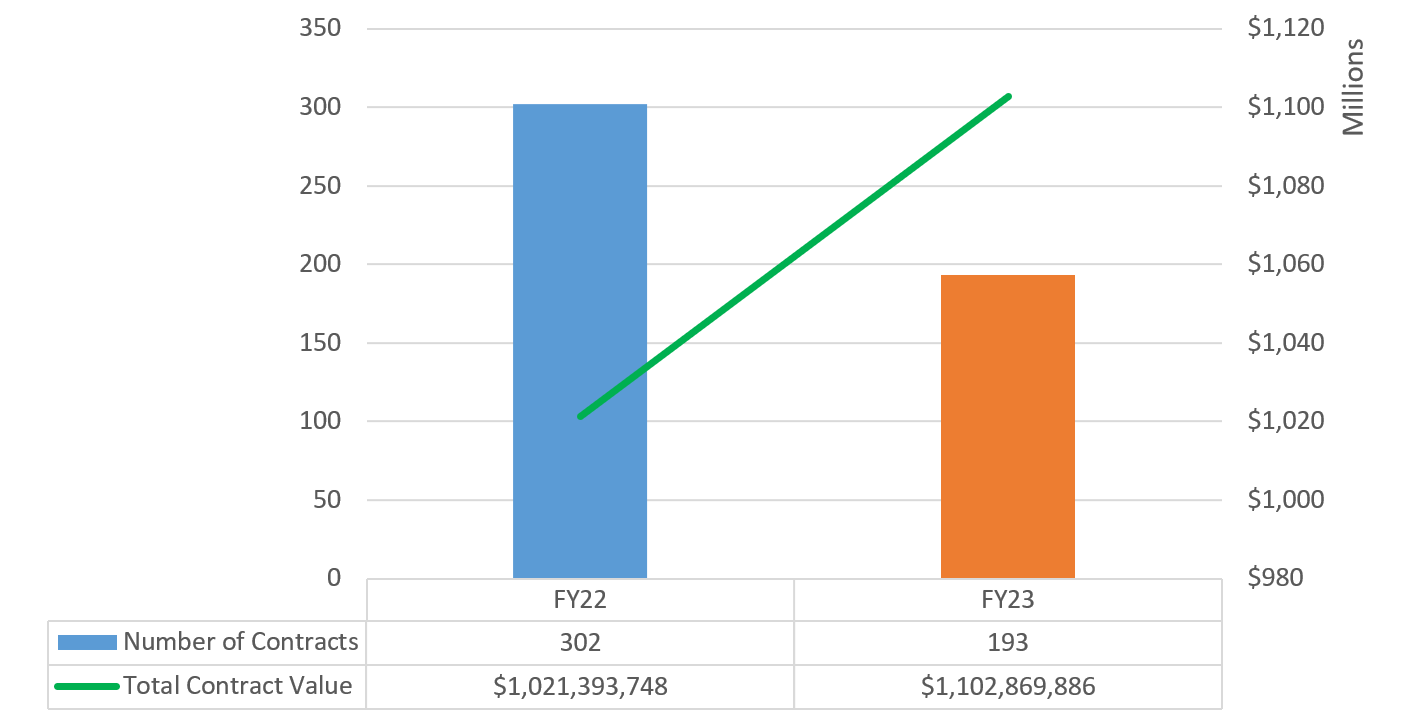

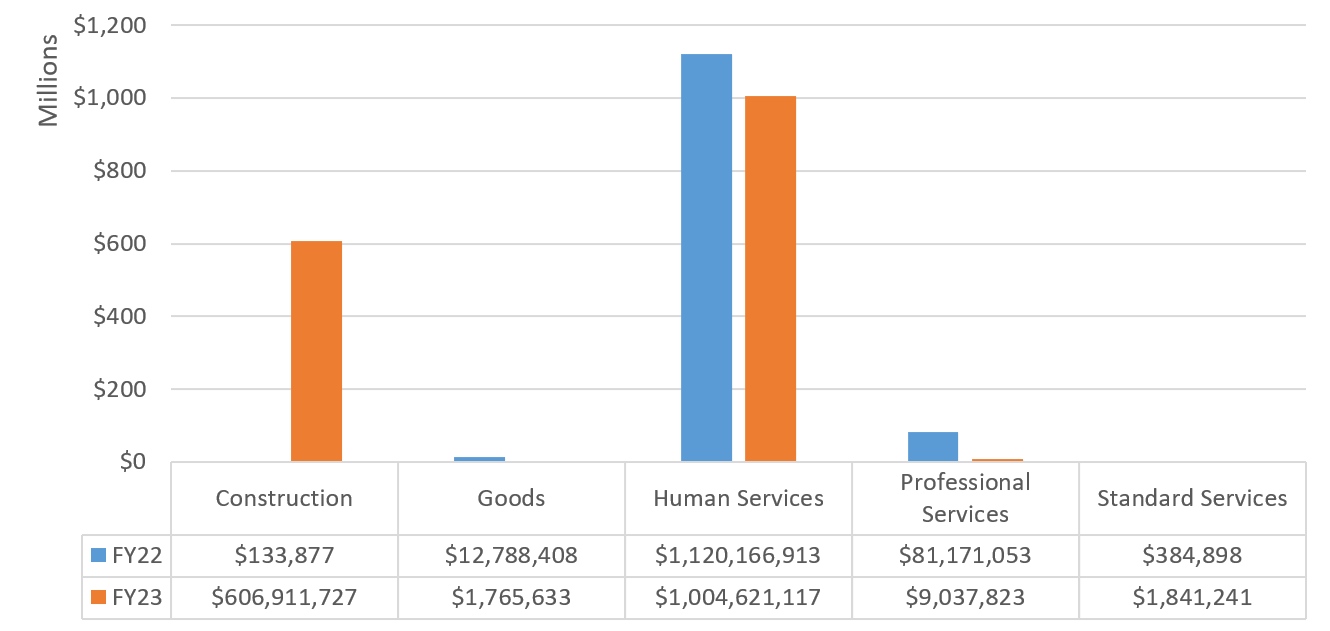

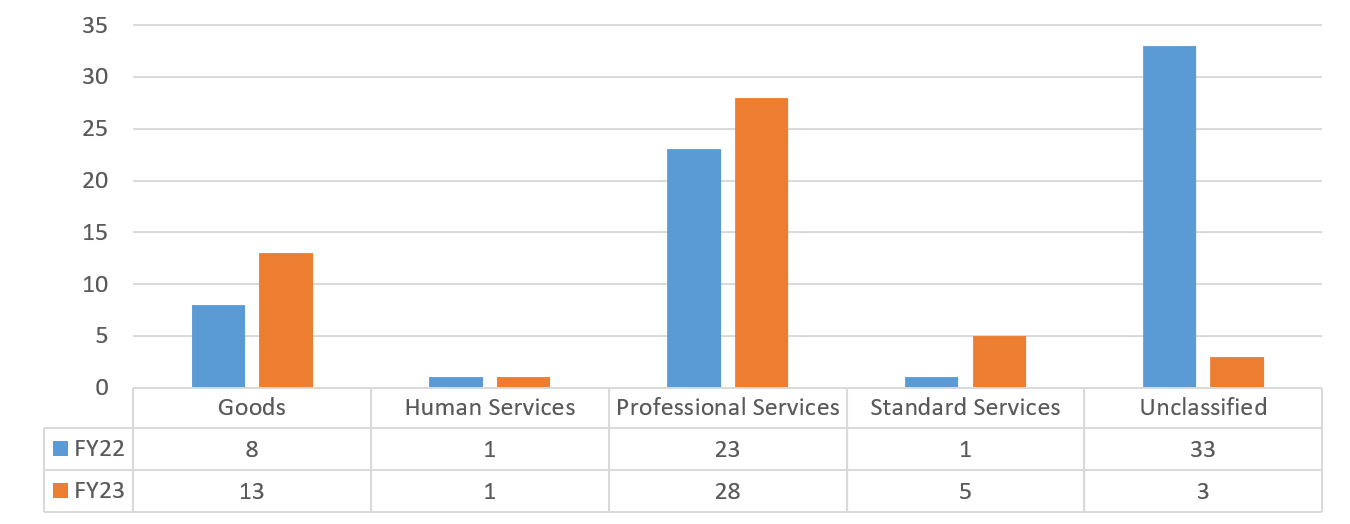

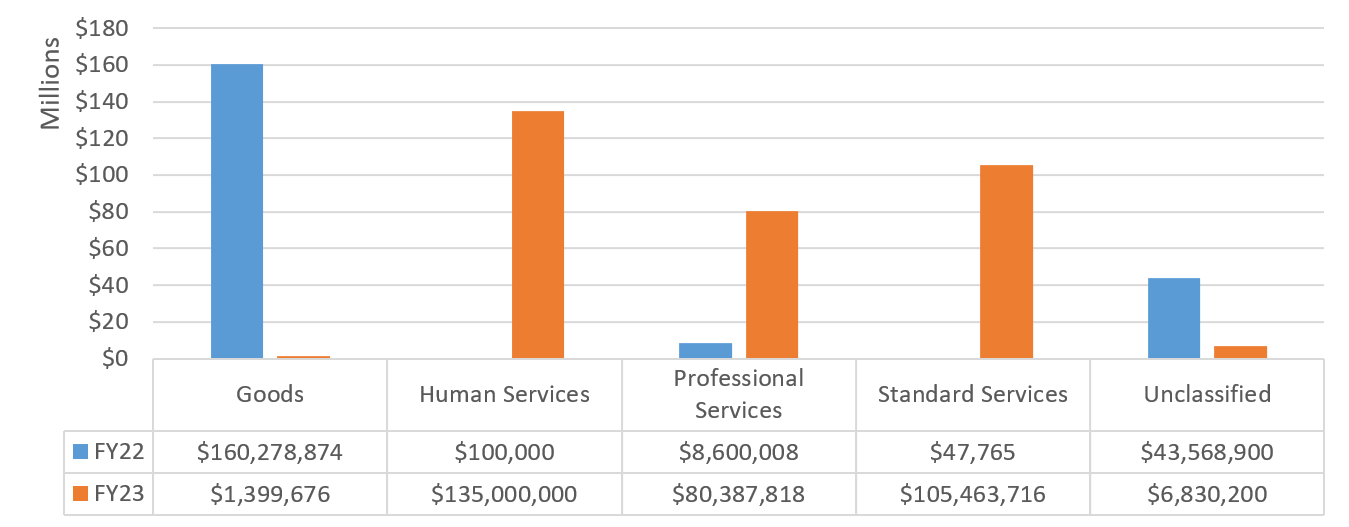

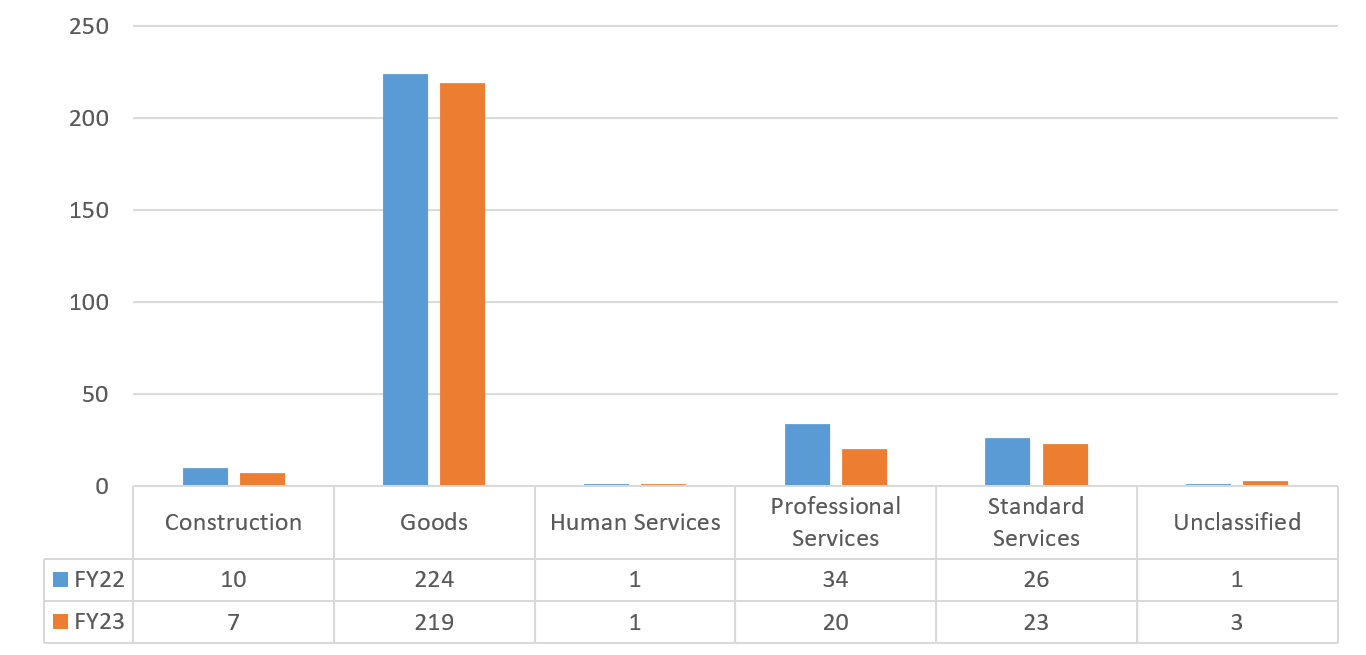

Emergency Procurement Method Actions

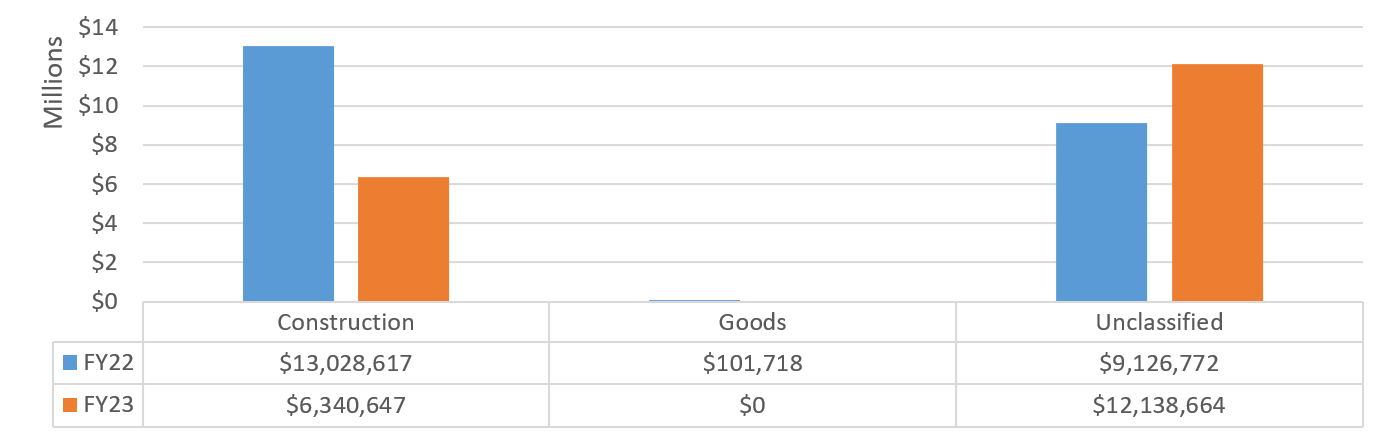

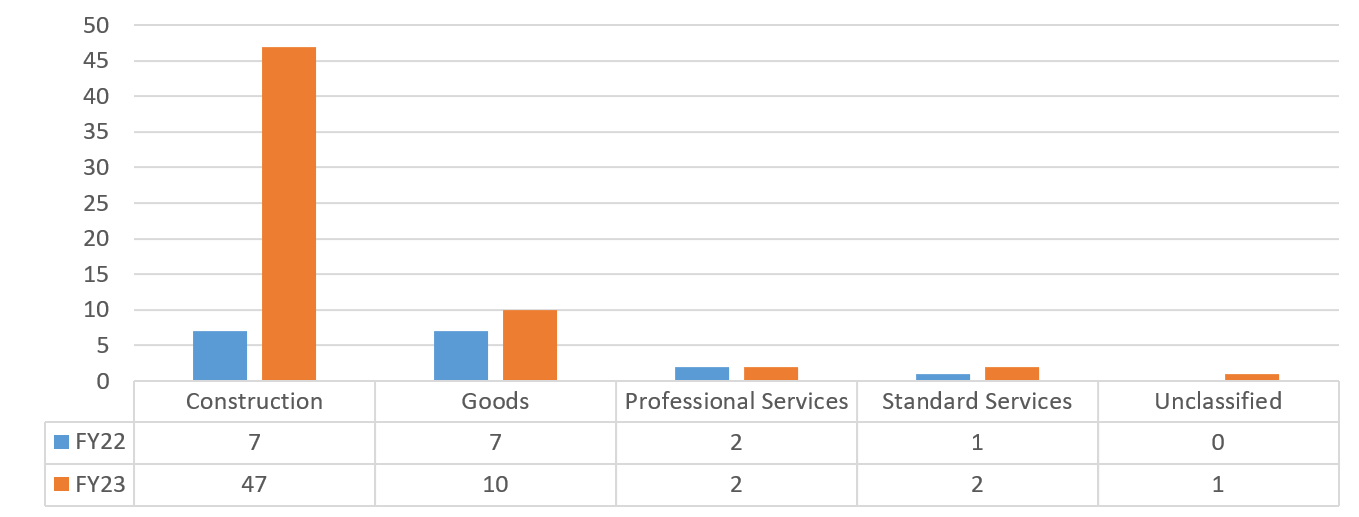

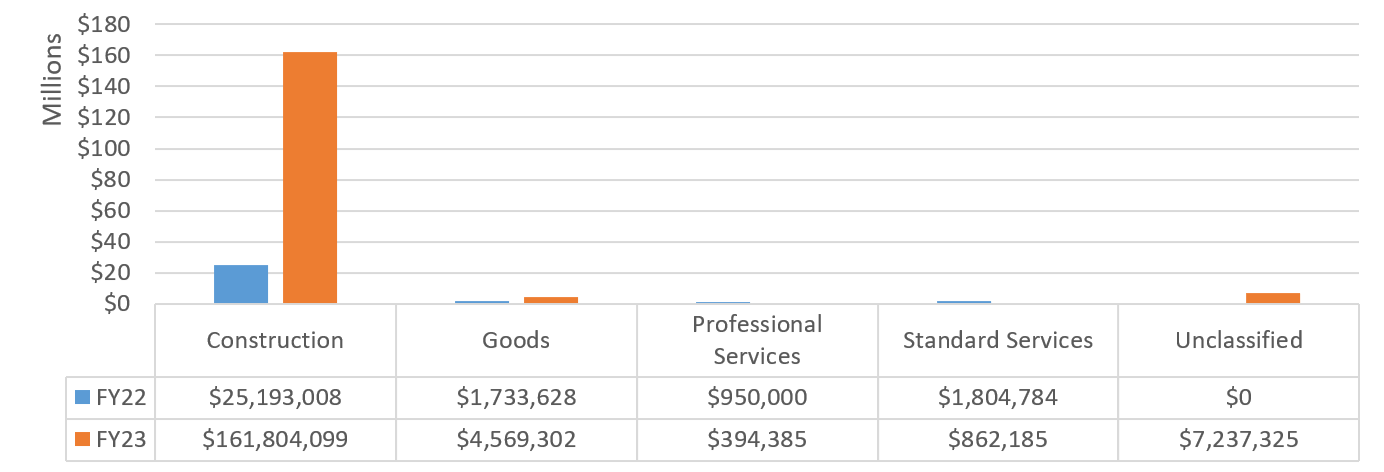

The City processed 193 contracts via the Emergency Procurement method in FY23 for a total value of $1,102,869,886. Although there was a decline in the # of emergency contracts in FY23 relative to FY22, the value of emergency procurements in FY23 increased by over $81 million. This is likely related to higher-value contracts associated with the influx of asylum seekers. Chart 13 displays the number and value of Emergency contracts filed in FMS across FY22 and FY23 respectively.

Chart 13: FY22-23 Emergency Contracts by Volume and Value

Table 22 displays the top five agencies by volume of new emergency contracts. Together, these agencies account for nearly 90% of all emergency procurements in FY23. HPD continues to be the largest driver of these contracts since it is tasked with hiring contractors to conduct emergency building demolitions.

Table 22: FY23 Emergency Procurements Volume by Top Five Agencies

| Agency | # of Contracts | % Share of Contracts |

| HPD | 77 | 39.90% |

| DHS | 49 | 25.39% |

| DOHMH | 36 | 18.65% |

| DOE | 7 | 3.63% |

| DEP | 4 | 2.07% |

| Grand Total | 173 | 89.64% |

Table 23 similarly lists the top five agencies by value of new emergency contracts. Once again, the top five agencies account for about 90% of the total emergency contract value in FY23. DSS/DHS shelter services contracts made up the highest share of contract value. This is because DSS/DHS, whose agency mission is to provide temporary shelter for those in need, is leading the City’s contracting for emergency shelter services for newly arrived asylum seekers

Table 23: FY23 Emergency Procurements Value by Top Five Agencies

| Agency | Total Contract Value | % Share of Emergency Contract Value |

| DSS/DHS | $601,381,111 | 54.53% |

| DOE | $195,762,781 | 17.75% |

| NYCEM | $135,717,111 | 12.31% |

| HPD | $34,498,186 | 3.13% |

| SBS | $30,000,000 | 2.72% |

| Grand Total | $997,359,189 | 90.43% |

Table 24 provides a breakdown of modifications to emergency contracts that were filed in FY23. As was the case with new emergency contracts, there were fewer emergency modifications in FY23 relative to the prior fiscal year.

Table 24: FY23 Emergency Contract Modifications, by Category

| Type of Modification | Number of Emergency Modifications |

| Change To Amount Only | 30 |

| Change To Duration Only | 24 |

| Change to Both Amount and Duration | 66 |

| Administrative Change Only | 708 |

| Grand Total | 828 |

Asylum-Related Emergency Contracts Processed in FY23

New York City has welcomed tens of thousands of asylum seekers since spring of 2022, entering into contracts across many agencies to provide shelter, meals, medical care, and legal assistance to new arrivals. Five agencies filed emergency contracts related to supports for asylum seekers in FY23, for a total value of $805.88 million. Table 25 below provides a breakdown by agency.

Table 25: FY23 Emergency Asylum-Related Contracts by Agency

| Agency | # of Contracts | Contract Value |

| DSS/DHS | 49 | $601,381,111 |

| DSS | 2 | $14,947,988 |

| OTI | 2 | $54,272,865 |

| NYCEM | 1 | $135,000,000 |

| DDC | 1 | $278,078 |

| Grand Total | 55 | $805,880,042 |

The Comptroller’s office was tracking 194 unique contract actions (including non-emergency contracts) related to these services as of July 31, 2023. A list of these contracts and related information is being periodically refreshed on the Comptroller’s Office website.

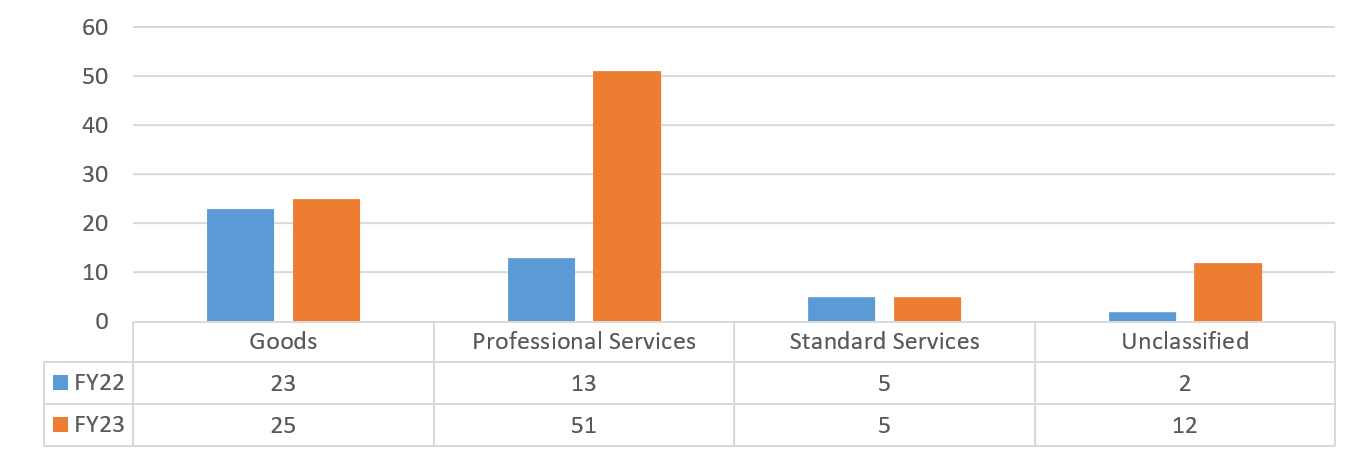

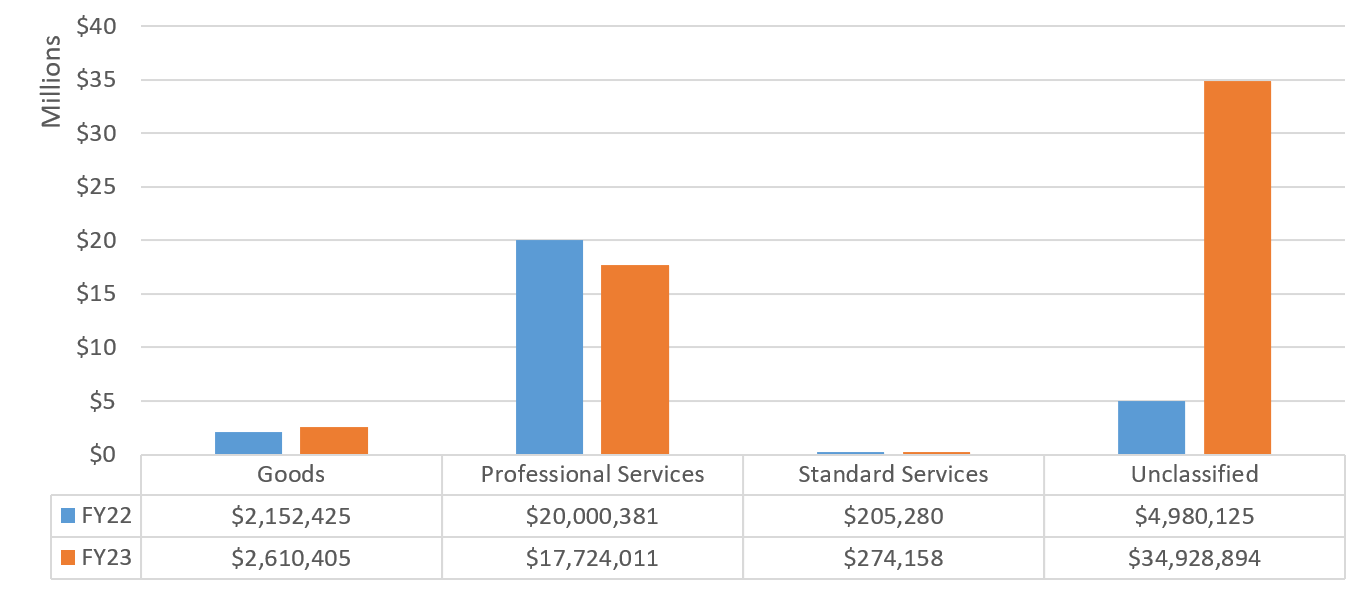

VI. Procurement Actions by Industry

PPB Rules and other applicable procurement rules define several industries that are frequently used by the City to support the analysis of procurement trends. Industry classifications provide another perspective to understand where the City is investing its resources. Section VI of this Report examines FY23 procurements across the following industries:

- Construction Services

- Goods

- Human Services

- Professional Services

- Standard Services

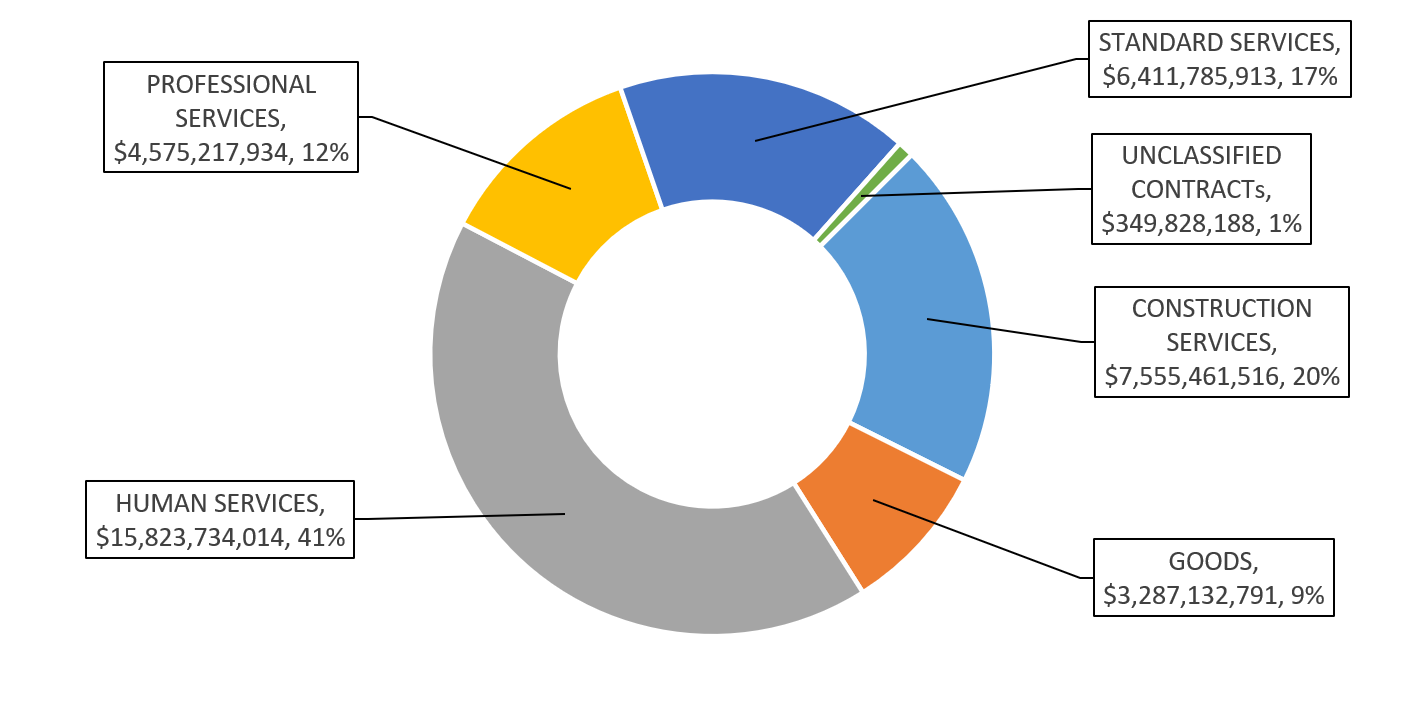

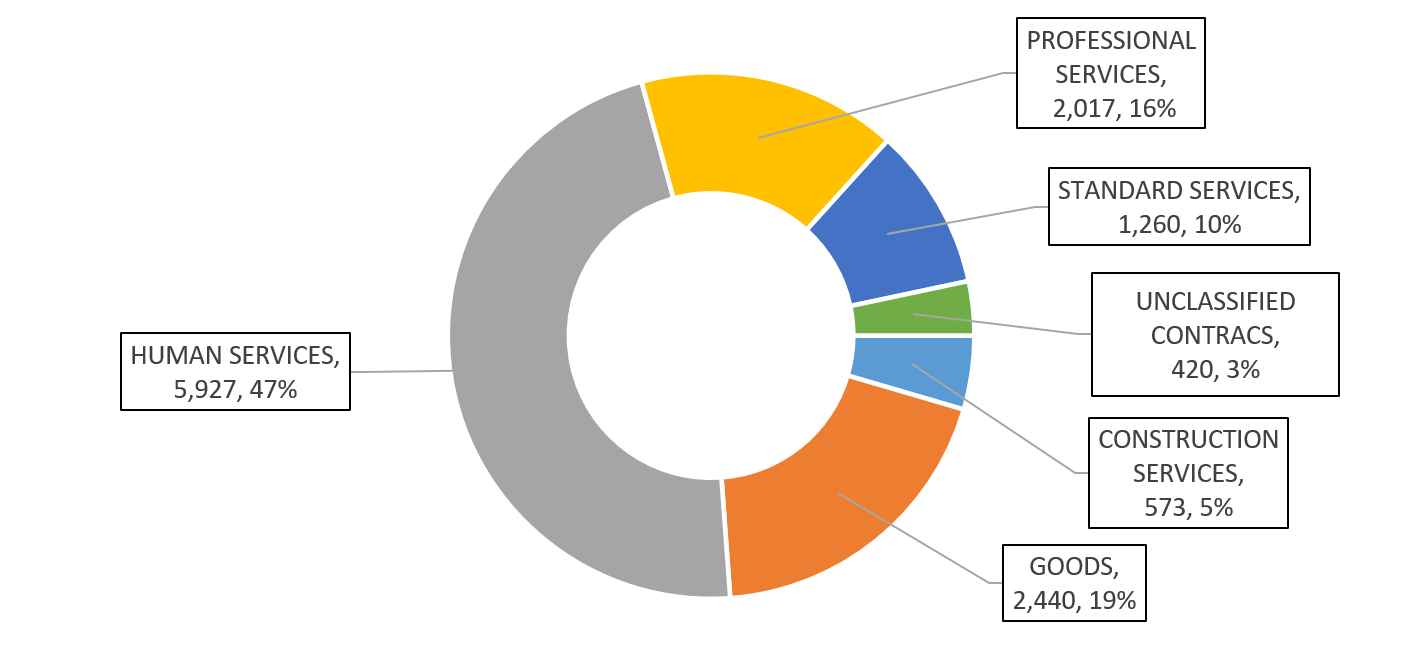

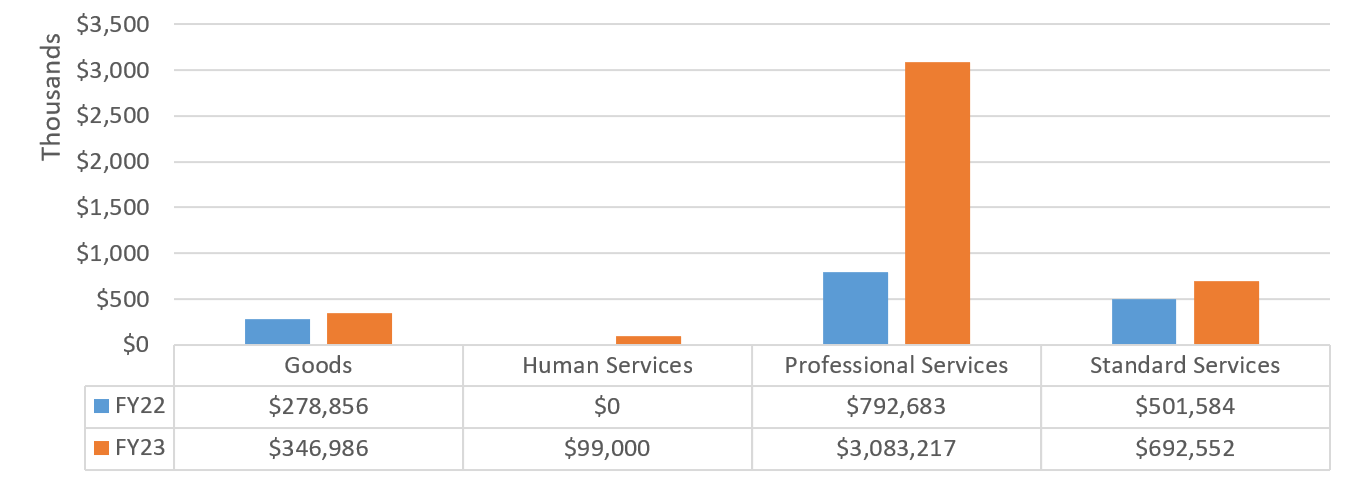

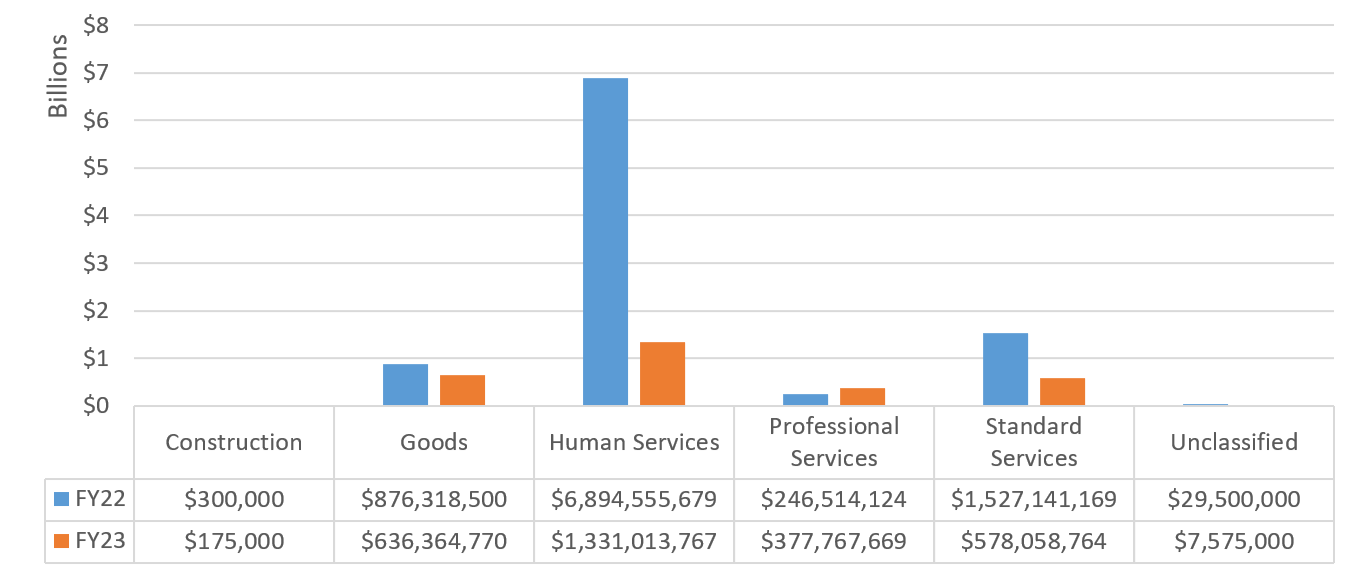

Industry classifications were assigned using rules employed by Checkbook NYC based on contract characteristics such as award category, contract type, and expense category. 12,217 procurement contracts were mapped to one of the above industries classifications using Checkbook NYC’s rules for a total value of $37.65 billion. Additionally, 420 procurement contracts, with a total registered value of $349.82 million, could not be classified into an industry group. Chart 14 below provides a comparison of registered contract value by industry.

Chart 14: Share of Registered New Procurement Contract Value by Industry

Relatedly, Chart 15 lays out the volume of new procurement contracts by industry. The Construction and Standard Service industries make up a greater share of registered procurement value than they do of the city’s procurement volume, indicating that their contracts tend to be larger in value relative to the contracts in other industries.

Chart 15: Share of Registered New Procurement Contract Volume by Industry

Construction Services

PPB Rules define the Construction Service industry as dealing in the planning, design, or construction of real property or other public improvements.[25] In addition to engineering and construction work, this industry also includes contracts for painting, carpentry, plumbing and electrical installation, asbestos and lead abatement, carpet installation and removal, and demolition.

The Comptroller’s Office has been working alongside City Hall as a part of the Capital Process Task Force to undertake a comprehensive review of the City’s capital process and advocate for recommendations to streamline the city’s procurement of construction (and other capitally funded) services. The recommendations of this Task Force aim to reduce timelines for capital project completion, achieve taxpayer savings, enhance vendor participation and inclusion in the construction industry, and increase the City’s capacity to address emerging needs. Additionally, the Comptroller’s Office is working with several City construction agencies to allow for broader usage of the expanded work allowance (EWA), which is a funded, pre-registered allowance in a construction contract that leads to shorter CCO processing times and the ability to make faster payments to contractors.

The 573 new procurement contracts registered in FY23 under the Construction Services industry account for only 5% of procurement contracts by volume, but the $7.55 billion associated with these contracts makes up nearly 20% of FY23’s registered procurement value in FY23. Table 26 lists the top ten construction service industry contracts registered in FY23.

Table 26: FY23 Top Ten Construction Service Industry Procurement Contracts, by Value

| Contract # | Agency | Vendor Legal Name | Award Method Description | Contract Purpose | Contract Registered Amount | Contract End Date |

| 20238807786 | DDC | Tutor Perini Corporation | Innovative Procurement | Design Build Program – NYC Borough Based Jail System, Brooklyn. | $2,958,933,292 | 9/3/2029 |

| 20228808498 | MAYOR | Dormitory Authority State Of NY | Government To Government | Development of phase 2 of the Staten Island Master Plan and the renovation of the New York County State Supreme Court Building. | $606,911,727 | 6/30/2032 |

| 20238803094 | DDC | John P Picone Inc. | Competitive Sealed Bidding | Installation of Brooklyn Bridge costal resiliency structures. | $349,000,000 | 9/29/2026 |

| 20238805276 | DEP | Gowanus Canal Constructors | Competitive Sealed Bidding | Construction of combined sewage overflow facilities for the Gowanus Canal. | $329,311,000 | 2/15/2027 |

| 20238803080 | DOT | Skanska Koch Inc | Competitive Sealed Bidding | Reconstruction of Williamsburg Bridge and miscellaneous rehabilitation. | $167,590,554 | 6/21/2025 |

| 20238803058 | DDC | Lendlease Us Construction LMB Inc. | Innovative Procurement | Design-Build project for the development of the Shirley Chisholm Recreation Center in Brooklyn | $130,986,000 | 12/21/2025 |

| 20238802753 | DEP | Jett Industries Inc. | Competitive Sealed Bidding | Reconstruction of Primary Tanks at the Wards Island waste water treatment plant. | $123,296,000 | 1/4/2027 |

| 20238806570 | DDC | Scalamandre-Tully JV | Innovative Procurement | Design-Build project for the Harper St. administrative building in Queens. | $120,648,807 | 9/23/2026 |

| 20238805489 | DDC | Gilbane Building Company | Innovative Procurement | Design-Build project for the Boyland Community Multi-Service Center in Brooklyn. | $119,000,000 | 8/13/2026 |

| 20238806874 | DDC | Inter Laperuta JV | Competitive Sealed Bidding | For the construction of storm sewers and appurtenances in Idlewild Park. | $78,566,121 | 4/16/2026 |

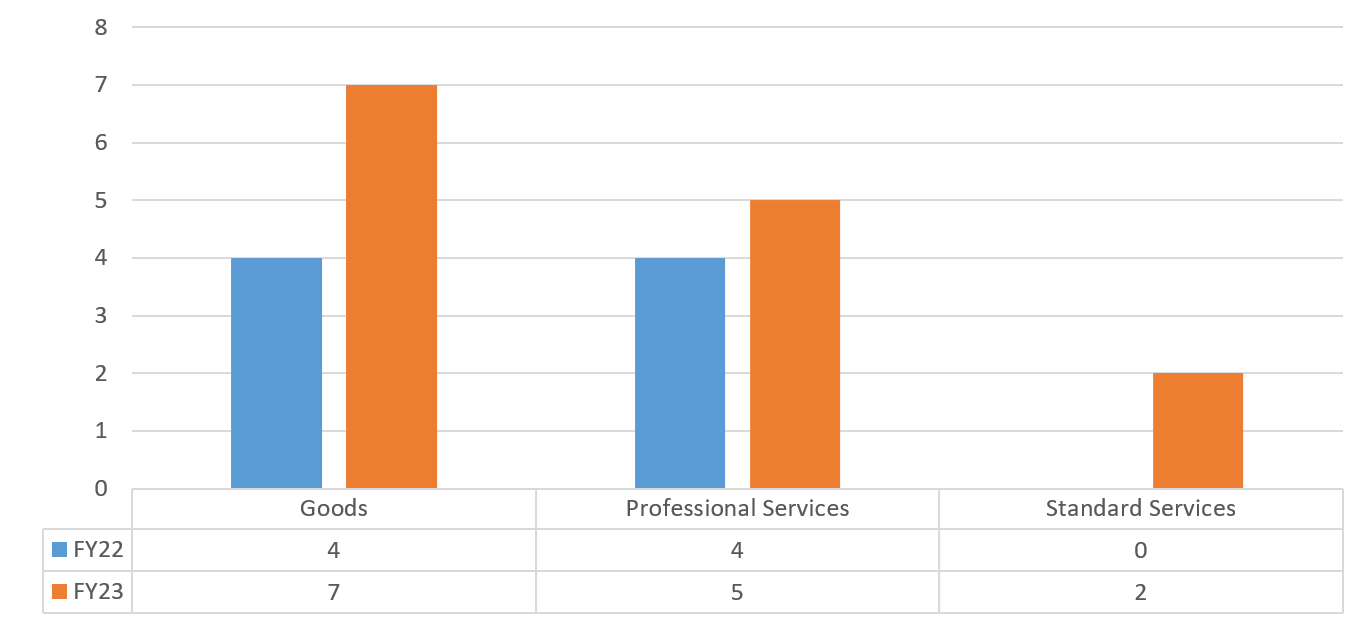

Goods

The Goods industry is made up of contracts for physical items and personal property, including but not limited to equipment, materials, printing, and insurance.[26] Procurements related to consumables such as food and fuel may also fall into the goods industry. Under the Charter, DCAS is responsible for procuring all goods, supplies, materials, equipment, and other personal property on behalf of city agencies, unless such authority has been otherwise delegated.[27] On occasion, DCAS delegates the procurement of a specific good to a particular agency when it’s in the City’s best interests, subject to the approval of the DCAS Commissioner and the Comptroller.[28] For example, DCAS authorized agencies to make goods purchases using the M/WBE Noncompetitive Small Purchase method up to $1.5 million to allow agencies to encourage greater M/WBE participation on contracts.

In FY23, 2,440 contracts were registered within the Goods industry for a total value of $3.28 billion. This accounts for 8.65% of the total registered procurement value in FY23. Table 27 provides a list of the top ten goods contacts, by value.

Table 27: FY23 Top Ten Goods Industry Procurement Contracts, by Value

| Contract # | Agency | Vendor Legal Name | Award Method Description | Contract Purpose | Contract Registered Amount | Contract End Date |

| 20238800486 | DCAS | JP Morgan Chase Bank NA | Intergovernmental Procurement | Procurement card services for agency purchases. | $464,000,000 | 10/12/2027 |

| 20238806149 | DCAS | Gabrielli Truck Sales Ltd. | Competitive Sealed Bidding | Procurement of a rear-loading collection truck with a snow hitch for DSNY. | $222,533,811 | 3/14/2028 |

| 20238802966 | DCAS | Global Environmental Products Inc. | Competitive Sealed Bidding | Procurement of four wheel street sweepers for New York City. | $156,083,177 | 9/30/2027 |

| 20238806111 | DCAS | Gabrielli Truck Sales Ltd. | Competitive Sealed Bidding | Procurement of a dual compartment rear loading truck. | $148,764,066 | 3/14/2028 |

| 20245000061 | DCAS | Consolidated Edison Company Of New York Inc. | Public Utility | Purchase of natural gas on behalf of various city agencies | $133,593,168 | 6/30/2024 |

| 20239377085 | DOE | Houghton Mifflin Harcourt Publishing Company | Dept Of Ed Listing Application | Purchase of textbooks & ancillary materials. | $123,232,632 | 10/31/2029 |

| 20245000062 | DCAS | The Brooklyn Union Gas Company | Public Utility | Purchase of natural gas on behalf of various city agencies. | $87,334,411 | 6/30/2024 |

| 20239376547 | DOE | B & H Foto & Electronics Corp | Competitive Sealed Bidding | Procurement of audio-visual equipment and computer peripherals. | $74,220,798 | 7/31/2027 |

| 20245000063 | DCAS | Consolidated Edison Company Of New York Inc. | Public Utility | Purchase of steam for use at various agency buildings. | $70,966,939 | 6/30/2024 |

| 20238807668 | DCAS | Kuehne Chemical Company, Inc. | Accelerated Procurement | To procure sodium hypochlorite for various wastewater resources. | $66,168,500 | 4/30/2026 |

Human Services

The Human Services Industry encompasses services that are provided directly to clients in various at-need groups. Examples of Human Services include but are not limited to: day care, foster care, mental health treatment, operation of senior centers, home care, employment training, homeless assistance, preventive services, health maintenance organizations, and youth services.[29] Vendors in this category are primarily nonprofit organizations although services like home and early childcare services are also offered by for-profit businesses.

The Comptroller’s Office is participating in a Joint Task Force to Get Non-Profits Paid on Time, which has developed five recommendations to reform the City’s procurement process and ensure that nonprofits are paid on time, in full, and with certainty so they can keep doing their jobs of meeting the needs of New Yorkers.

Human Service Industry contracts made up the largest share by both volume of contracts and contract value in FY23. The 5,927 Human Service contracts accounted for nearly 47% of registered procurements and amounted to $15.82 billion in total value. Table 28 provides a list of the top Ten Human Service Industry Contacts, by value, all associated with shelter services under DSS/DHS.

Table 28: FY23 Top Ten Human Services Industry Procurement Contracts, by Value

| Contract # | Agency | Vendor Legal Name | Award Method Description | Contract Purpose | Contract Registered Amount | Contract End Date |

| 20238802667 | DSS/DHS | HELP Social Service Corporation | RFP From a PQVL | Shelter facility for homeless families with children. | $489,190,529 | 6/30/2055 |

| 20238808538 | DSS/DHS | HELP Social Service Corporation | RFP From a PQVL | Shelter facility for homeless single adults. | $467,858,423 | 6/30/2056 |

| 2023880437 | DSS/DHS | Project Renewal Inc | RFP From a PQVL | Shelter facility for homeless single adults. | $467,334,567 | 6/30/2056 |

| 20238803025 | DSS/DHS | Urban Resource Institute | RFP From a PQVL | Shelter facility for homeless families with children. | $375,607,033 | 6/30/2053 |

| 20231406241 | DSS/DHS | Bowery Residents’ Committee, Inc. | RFP From a PQVL | Shelter facility for homeless families with children. | $364,416,055 | 6/30/2054 |

| 20238804003 | DSS/DHS | WESTHAB, Inc. | RFP From a PQVL | Shelter facility for homeless families with children. | $328,950,889 | 6/30/2055 |

| 20238804160 | DSS/DHS | Care For The Homeless | RFP From a PQVL | Shelter facility for homeless single adults. | $317,499,022 | 6/30/2054 |

| 20238804456 | DSS/DHS | Women In Need, Inc. | RFP From a PQVL | Shelter facility for homeless families with children. | $316,387,674 | 6/30/2055 |

| 20238808453 | DSS/DHS | WESTHAB, Inc. | RFP From a PQVL | Shelter facility for homeless single adults. | $290,246,446 | 6/30/2055 |

| 20238805437 | DSS/DHS | HANYC Foundation Inc | Emergency | To secure hotel sites for asylum seekers | $237,250,000 | 8/31/2023 |

Professional Services

The Professional Services industry includes contracts for the provision of various kinds of expert advice and consulting, including legal services, medical services and information technology and construction-related consulting.[30]

2,017 contacts associated with the Professional Services industry were registered in FY23, accounting for 15.96% of all registered procurements. Their $4.57 billion makes up 12.05% of the total FY23 procurement value.

Table 29 provides a list of the top ten Professional Service Industry Contacts, by value.

Table 29: FY23 Top Ten Professional Services Industry Procurement Contracts, by Value

| Contract # | Agency | Vendor Legal Name | Award Method Description | Contract Purpose | Contract Registered Amount | Contract End Date |

| 20238803029 | OTI | Motorola Solutions, Inc | Sole Source | Purchase of Motorola radios and maintenance of citywide public safety communication networks. | $323,739,667 | 2/28/2028 |

| 20238804607 | OTI | Verizon Business Network Services LLC | Renewal Of Contract | Provision of citywide telecommunications services. | $284,754,473 | 12/31/2026 |

| 20238800311 | DOHMH | Opad Media Solutions LLC | Intergovernmental Procurement | Strategic media planning, buying, and placement across various media platforms. | $243,545,240 | 9/26/2024 |

| 20238807641 | OTI | AT&T Corp | Renewal Of Contract | Provision of citywide telecommunications services. | $191,387,262 | 5/19/2027 |

| 20238802315 | DOF | First Data Merchant Services LLC | Request For Proposal (RFP) | Provision of automated clearing house, electronic check processing, and e-check account validation services. | $122,573,761 | 3/31/2027 |

| 20238802258 | DEP | McMillen JA Engineering PLLC/Brown and Caldwell Associates | Request For Proposal (RFP) | Preliminary Design Services for the Newtown Creek combined sewage overflow tunnel. | $106,661,931 | 7/30/2034 |

| 20239378810 | DOE | Willis Towers Watson Northeast Inc | Emergency | Insurance carrier and third-party administrative services. | $101,991,311 | 6/30/2021 |

| 20239377235 | DOE | Edgewood Partners Insurance Center | Emergency | Brokerage, insurance coverage and administration. | $87,400,638 | 6/30/2023 |

| 20238803744 | OEM | Citizens Committee For New York City Inc | Negotiated Acquisition | Provision of grant management and financial services for the NYC Strengthening Communities program. | $75,000,000 | 11/30/2027 |

| 20238803252 | OTI | Spruce Technology Inc | Request For Proposal (RFP) | Provision of citywide system integration services including analysis, design, architecture, development, testing, implementation, etc. | $50,000,000 | 12/31/2025 |

Standard Services

The Standard Services industry is composed of services other than Professional Services and Human/Client Services such as custodial services, security guard services, stenography services and office machine repair.[31] There were 1,260 contracts registered in the Standard Service Industry in FY23, comprising 9.97% of all procurement contracts. These contracts were for $6.41 billion in value, accounting for 16.87% of all FY23 registered procurement value. Table 30 provides a list of the top ten Standard Service Industry Contacts, by value.

Table 30: FY23 Top Ten Standard Services Industry Procurement Contracts, by Value

| Contract # | Agency | Vendor Legal Name | Award Method Description | Contract Purpose | Contract Registered Amount | Contract End Date |

| 20238804191 | EDC | New York City Economic Development Corporation | Sole Source | Citywide Economic Development Services. | $1,836,434,092.00 | 6/30/2023 |

| 20238806917 | SBS | Brooklyn Navy Yard Development Corporation | Sole Source | Provision of industrial, commercial, waterfront, maritime, and other economic Development services at the Brooklyn Navy Yard. | $529,981,983.00 | 6/30/2025 |

| 20231408687 | TRANSIT | Metropolitan Transportation Authority | Government To Government | Bus purchases and track, switch, third rail, and substation replacements. | $498,114,315.00 | 6/30/2026 |

| 20238804188 | EDC | New York City Economic Development Corporation | Sole Source | Provision of City-Wide economic development services related to maritime, rail, aviation, and market transportation. | $443,342,250.00 | 6/30/2023 |

| 20231420236 | TRANSIT | Metropolitan Transportation Authority | Government To Government | Elevator and escalator replacement. | $235,569,750.00 | 6/30/2023 |

| 20231409993 | TRANSIT | Metropolitan Transportation Authority | Government To Government | Bridge reconstruction & substation replacement | $205,826,035.00 | 6/30/2023 |

| 20231415707 | TRANSIT | Metropolitan Transportation Authority | Government To Government | Escalator Replacements. | $200,489,900.00 | 6/30/2023 |

| 20238802986 | DEP | Clean & Green Recycling Corp | Negotiated Acquisition and DOE Negotiated Services | Processing of biosolids from various waste water treatment and water resource recovery facilities. | $121,069,669.77 | 6/30/2032 |

| 20238802367 | SBS | NYC & Company, Inc. New York Convention & Visitors | Sole Source | Citywide economic development marketing and tourism. | $94,647,392.00 | 6/30/2026 |

| 20238805244 | FDNY | Digitech Computer LLC | Request For Proposal (RFP) | Provision of invoicing, dunning, and litigation services to support the FDNY ambulance transport invoicing unit. | $66,769,150.00 | 1/31/2030 |

VII. Procurements by Agency Type

City agencies, affiliated agencies, elected officials, and the City Council all take part in the contracting process. Procurements via new contracts and TOs were registered to 65 separate entities in FY23.[32] Section VII of this report examines contracting trends by industry and contract group for each procuring entity. It also compares new procurement contracts registered to agencies operating under the Mayor’s Office (Mayoral Agencies), independent City agencies (Non-Mayoral Agencies), and a collection of state agencies, authorities, boards, libraries, and other corporations that perform public functions in NYC (Other Agencies).[33]

With 63.07% of all new procurement contracts, City – Mayoral Agencies were the biggest driver of new contract registrations by volume in FY23. They also accounted for 79.07% of FY23 procurement contract value. Table 31 displays new procurements, by volume and value, across agency type.

Table 31: FY23 New Procurement Contracts and Task Orders by Agency Type

| Agency Type | # of Contracts | % of Contracts | Total Registered Contract Value | % Share Of Registered Contract Value |

| City – Mayoral Agency | 8,346 | 63.07% | $30,645,371,859 | 79.07% |

| City – Non-Mayoral | 600 | 4.53% | $138,883,923 | 0.36% |

| Other Agency | 4,287 | 32.40% | $7,971,060,793 | 20.57% |

| Grand Total | 13,233 | 100.00% | $38,755,316,576.10 | 100.00% |

City Mayoral Agencies

Every Mayoral Administration directly oversees and appoints department heads for a number of City agencies. Table 32 displays information on new procurement contracts registered to each Mayoral Agency.

Table 32: FY23 New Procurement Contracts by Mayoral Agency

| Agency | # of Contracts | % Share of Contracts | Total Contract Value | % Share of Contract Value |

| ACS | 439 | 5.26% | $3,655,718,153.56 | 11.93% |

| BIC | 2 | 0.02% | $113,129.00 | 0.00% |

| CCHR | 5 | 0.06% | $1,817,740.50 | 0.01% |

| CCRB | 14 | 0.17% | $498,620.03 | 0.00% |

| DCAS | 621 | 7.44% | $2,483,908,055.53 | 8.11% |

| DCLA | 16 | 0.19% | $8,290,877.68 | 0.03% |

| DCP | 16 | 0.19% | $13,066,034.55 | 0.04% |

| DCWP | 17 | 0.20% | $11,604,047.44 | 0.04% |

| DDC | 216 | 2.59% | $5,278,552,894.76 | 17.22% |

| DEP | 285 | 3.41% | $1,868,415,605.70 | 6.10% |

| DFTA | 634 | 7.60% | $266,228,489.87 | 0.87% |

| DOB | 30 | 0.36% | $13,530,588.32 | 0.04% |

| DOC | 110 | 1.32% | $103,279,039.16 | 0.34% |

| DOF | 72 | 0.86% | $269,083,774.27 | 0.88% |

| DOHMH | 1311 | 15.71% | $1,354,291,758.09 | 4.42% |

| DOI | 11 | 0.13% | $878,925.10 | 0.00% |

| DOP | 58 | 0.69% | $27,696,859.40 | 0.09% |

| DORIS | 4 | 0.05% | $396,698.87 | 0.00% |

| DOT | 229 | 2.74% | $1,025,142,731.60 | 3.35% |

| DPR | 409 | 4.90% | $728,027,130.16 | 2.38% |

| DSNY | 115 | 1.38% | $230,660,657.59 | 0.75% |

| DSS/DHS | 232 | 2.78% | $7,131,954,725.58 | 23.27% |

| DSS/HRA | 485 | 5.81% | $1,067,573,413.21 | 3.48% |

| DYCD | 1567 | 18.78% | $437,014,436.87 | 1.43% |

| FDNY | 107 | 1.28% | $154,701,894.40 | 0.50% |

| HPD | 273 | 3.27% | $132,645,284.66 | 0.43% |

| LAW | 72 | 0.86% | $88,126,099.19 | 0.29% |

| LPC | 2 | 0.02% | $67,230.00 | 0.00% |

| MAYOR | 259 | 3.10% | $1,624,177,540.65 | 5.30% |

| NYCEM | 50 | 0.60% | $329,081,409.94 | 1.07% |

| NYPD | 273 | 3.27% | $161,759,741.55 | 0.53% |

| OTI | 233 | 2.79% | $1,375,363,275.01 | 4.49% |

| SBS | 169 | 2.02% | $697,306,155.57 | 2.28% |

| TLC | 10 | 0.12% | $104,398,841.52 | 0.34% |

| Grand Total | 8,346 | 100.00% | $30,645,371,859.33 | 100.00% |

Administration for Children’s Services (ACS)

The Administration for Children’s Services (ACS) protects and promotes the safety and well-being of New York City’s children, young people, families, and communities by providing child welfare, juvenile justice, foster care, early care, and education services.

Table 33 – ACS: FY22-FY23 Registrations by Contract Category

| FY22 | FY23 | |||

|---|---|---|---|---|

| Contract Category | # of Contracts | Total Contract Value | # of Contracts | Total Contract Value |

| Competitive Method Contracts | 12 | $37,907,774 | 62 | $2,400,819,648 |

| Limited or Non-Competitive Method Contracts | 282 | $459,400,680 | 227 | $334,167,308 |

| Transactions Not Subject to PPB Rules | 16 | $941,200 | 3 | $461,000 |

| Supplemental Contracts | 40 | $314,583,237 | 147 | $920,270,198 |

| Grand Total | 350 | $812,832,891 | 439 | $3,655,718,154 |

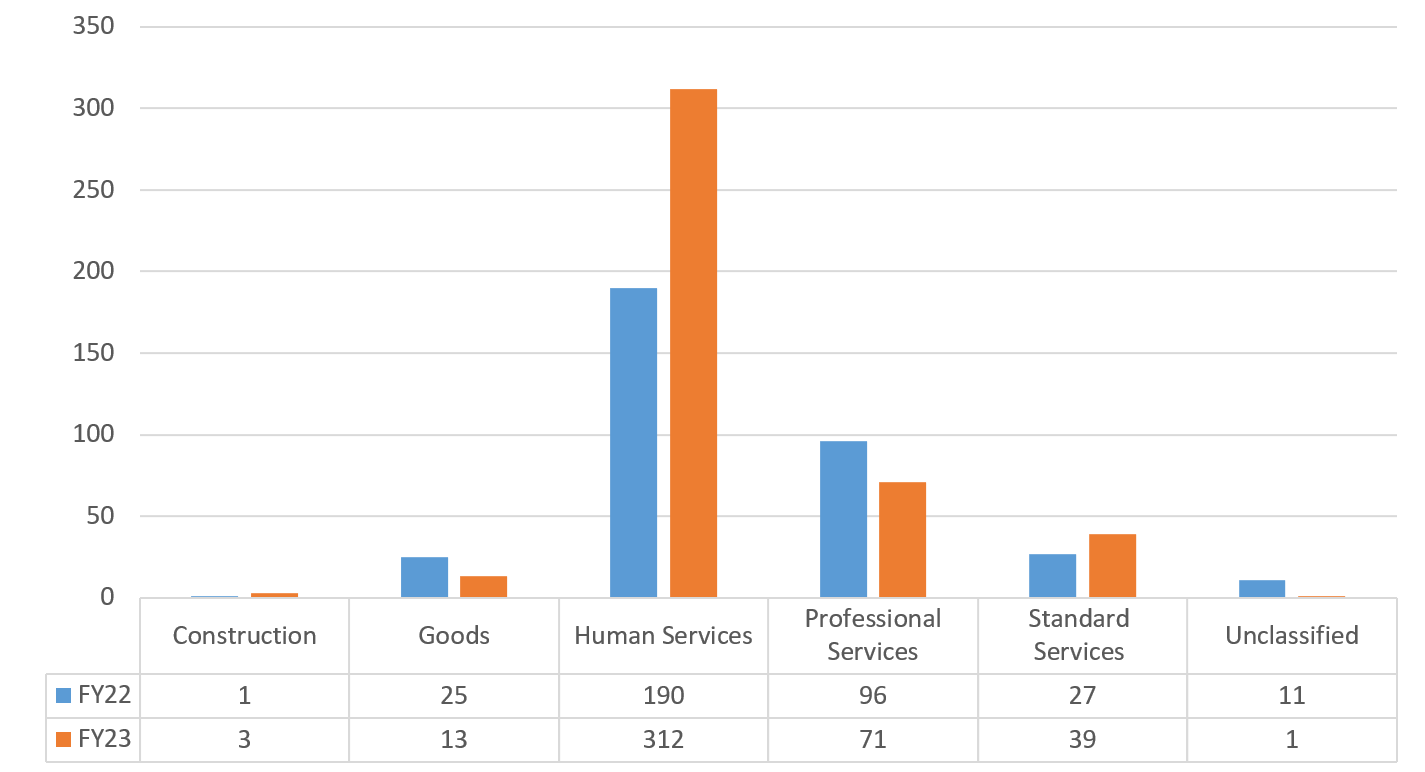

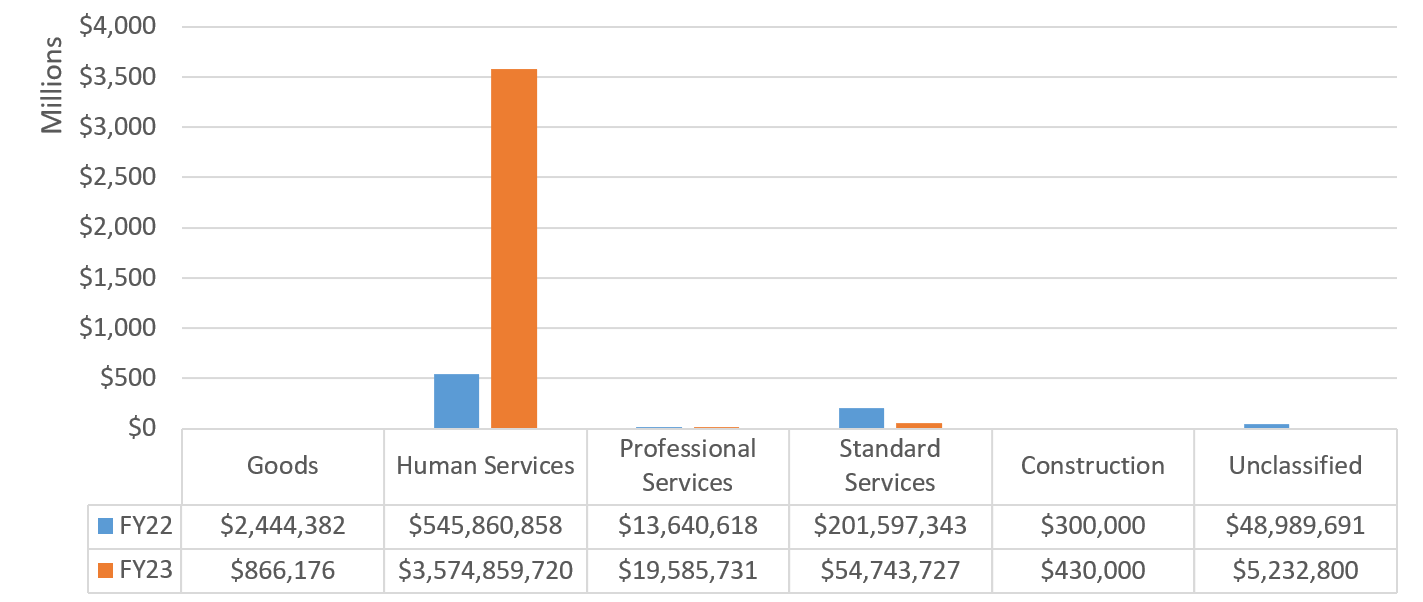

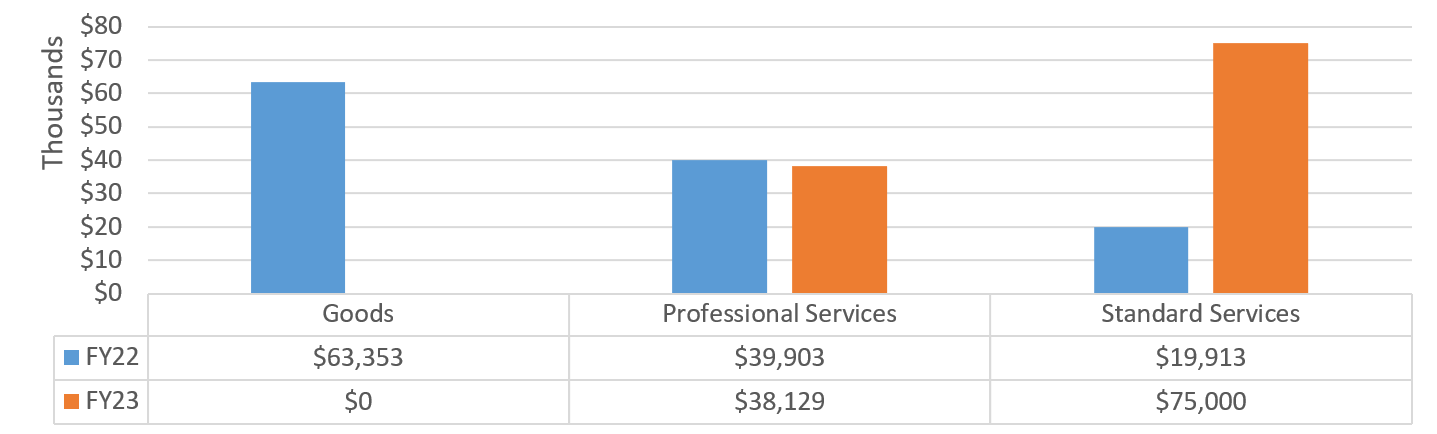

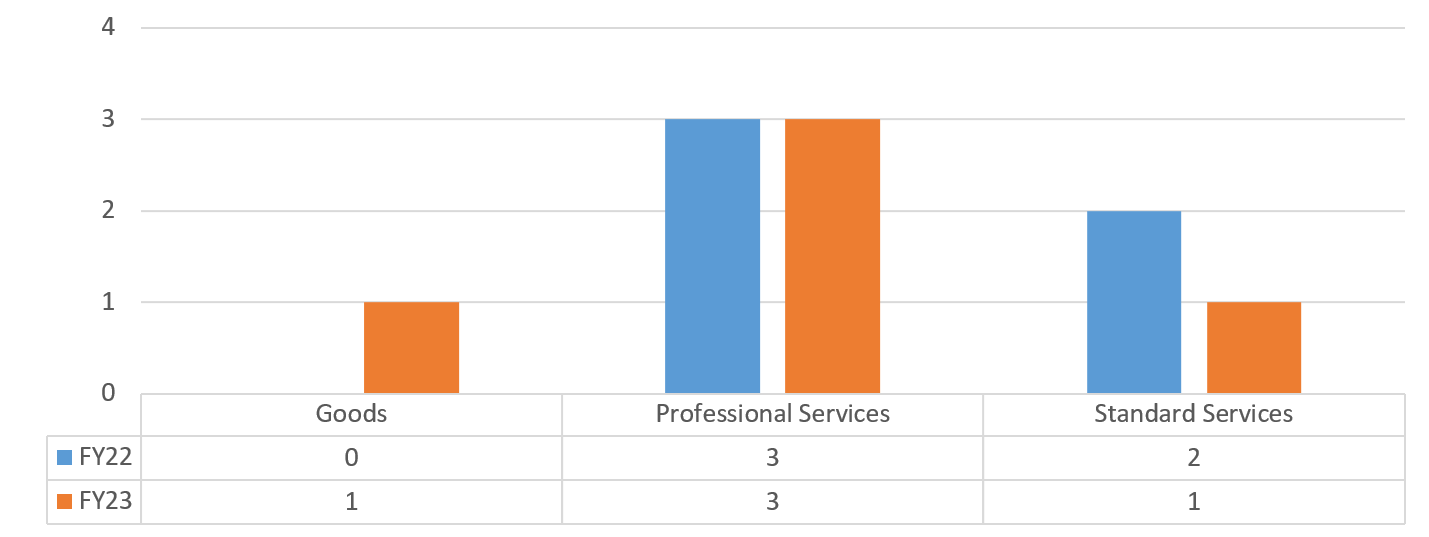

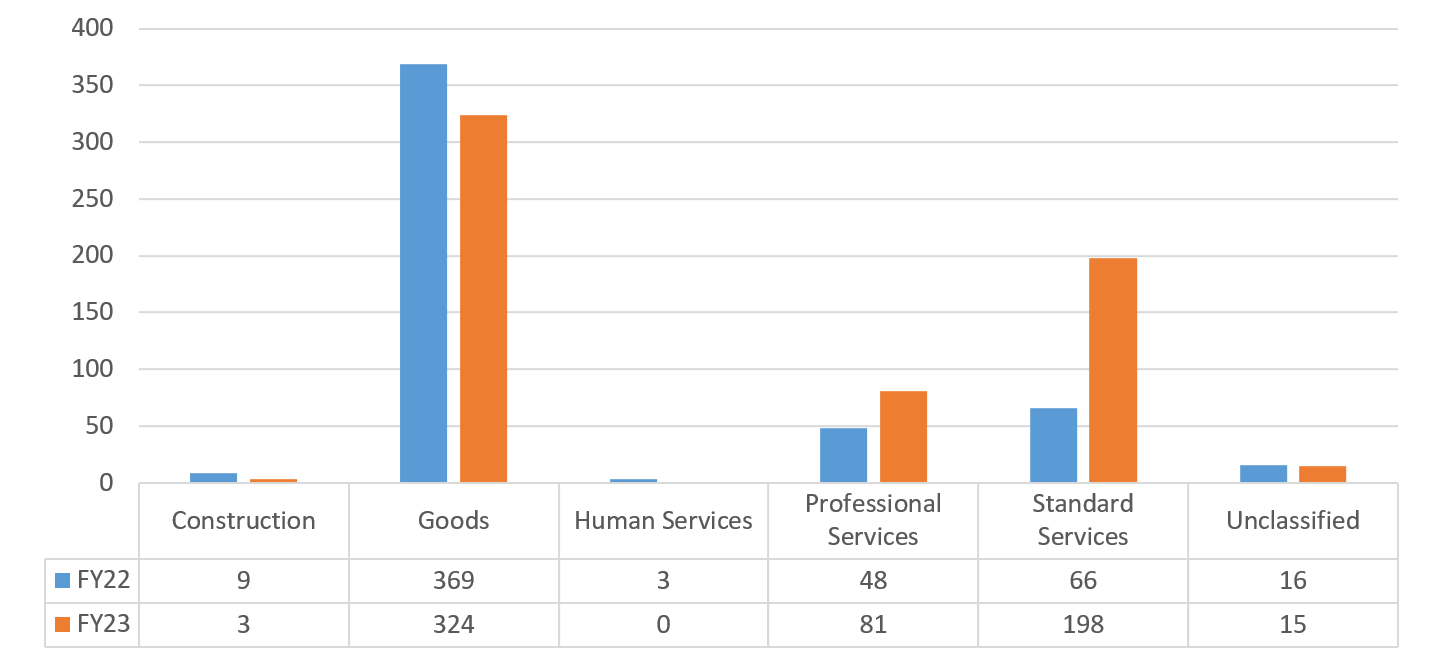

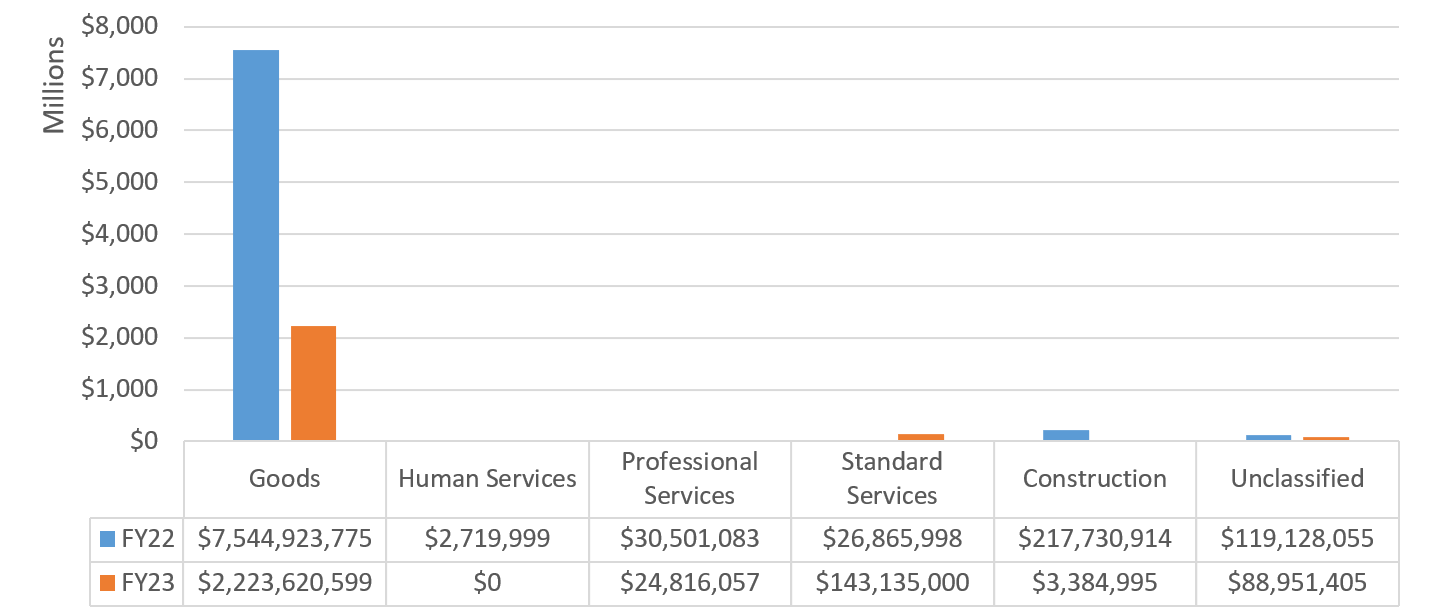

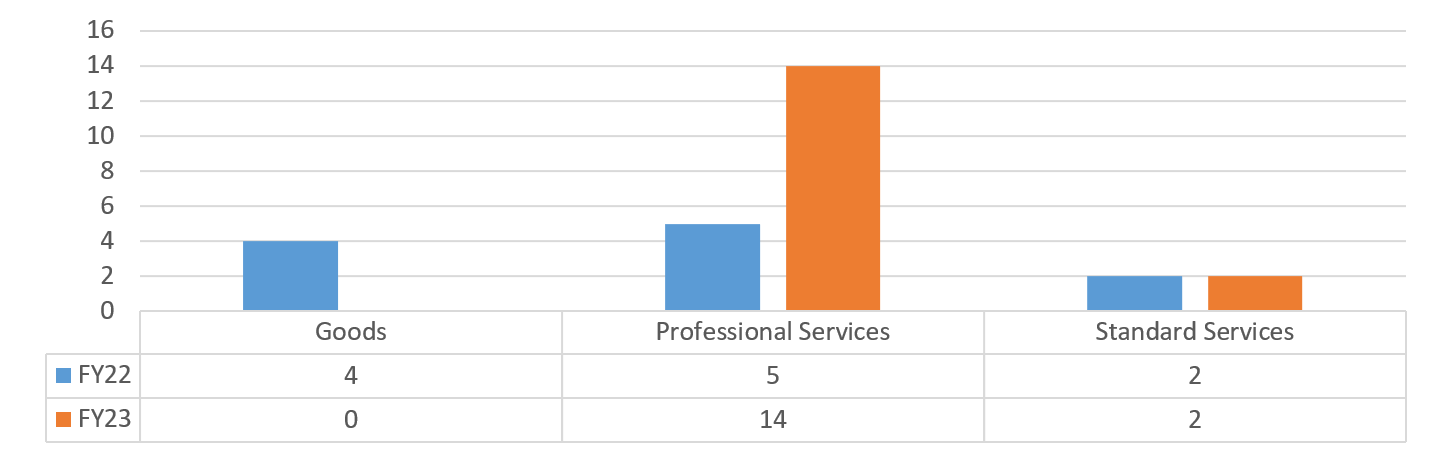

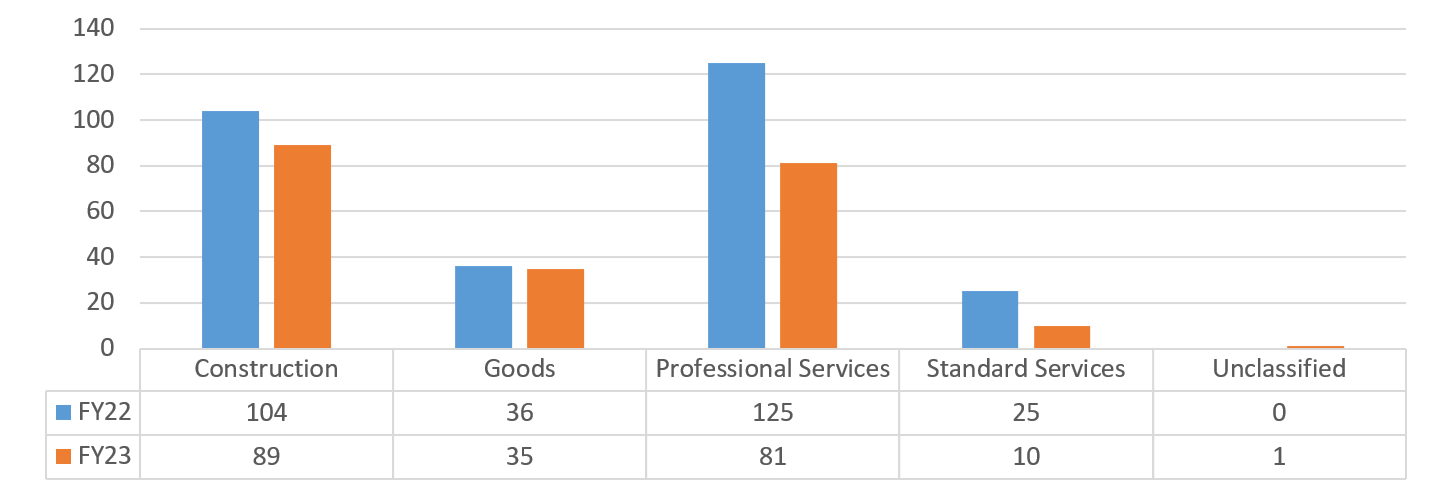

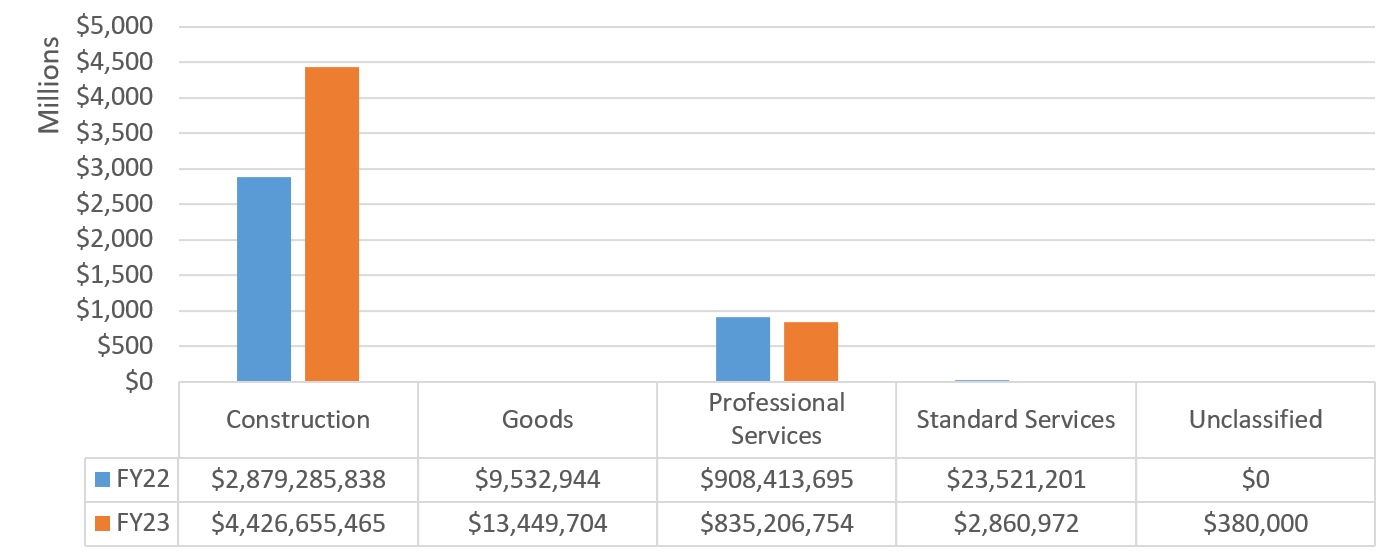

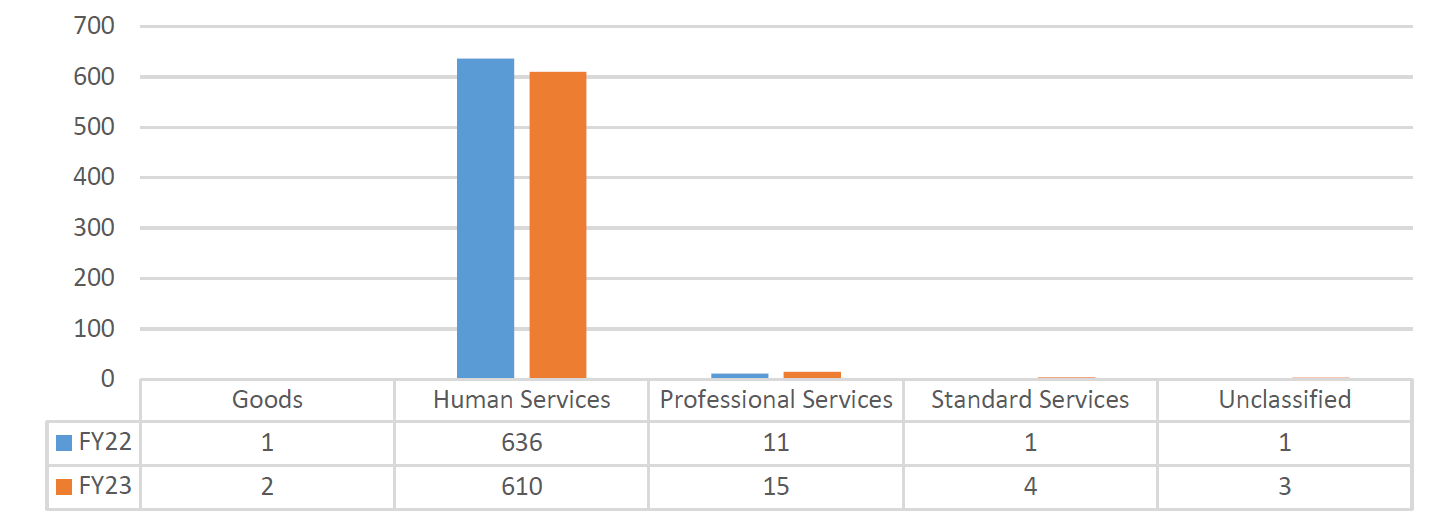

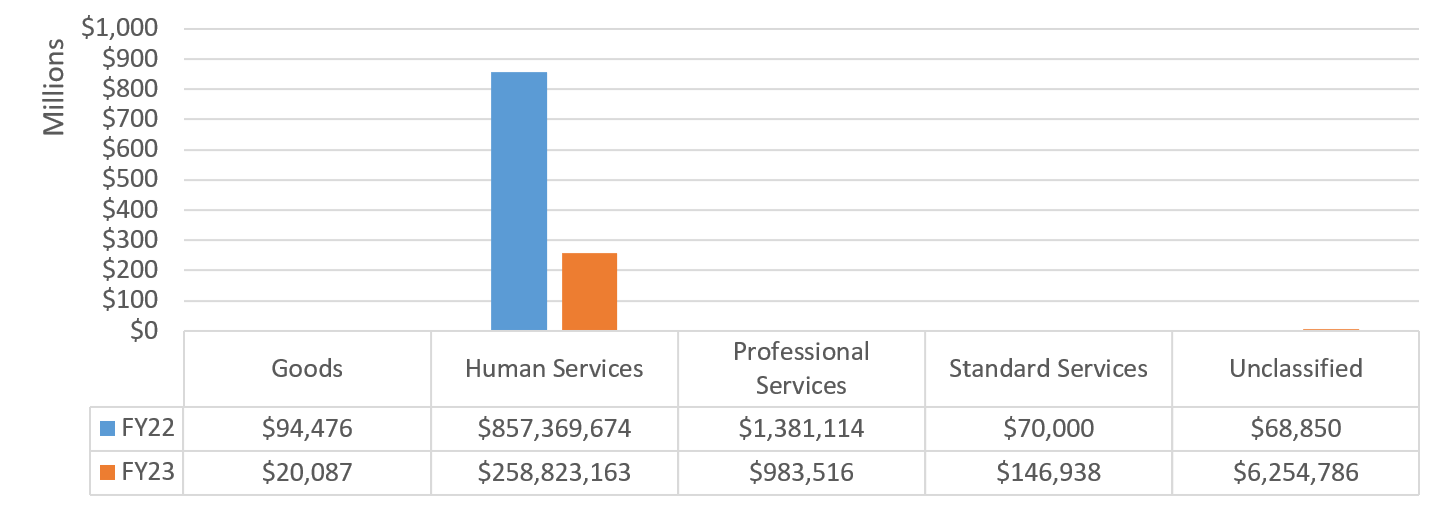

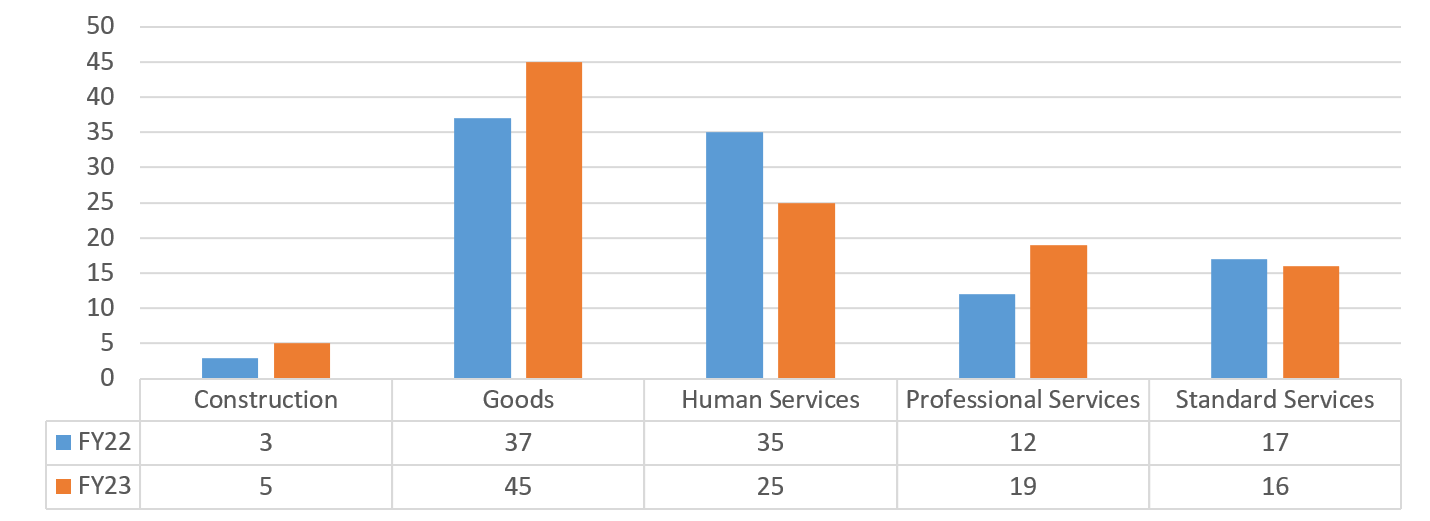

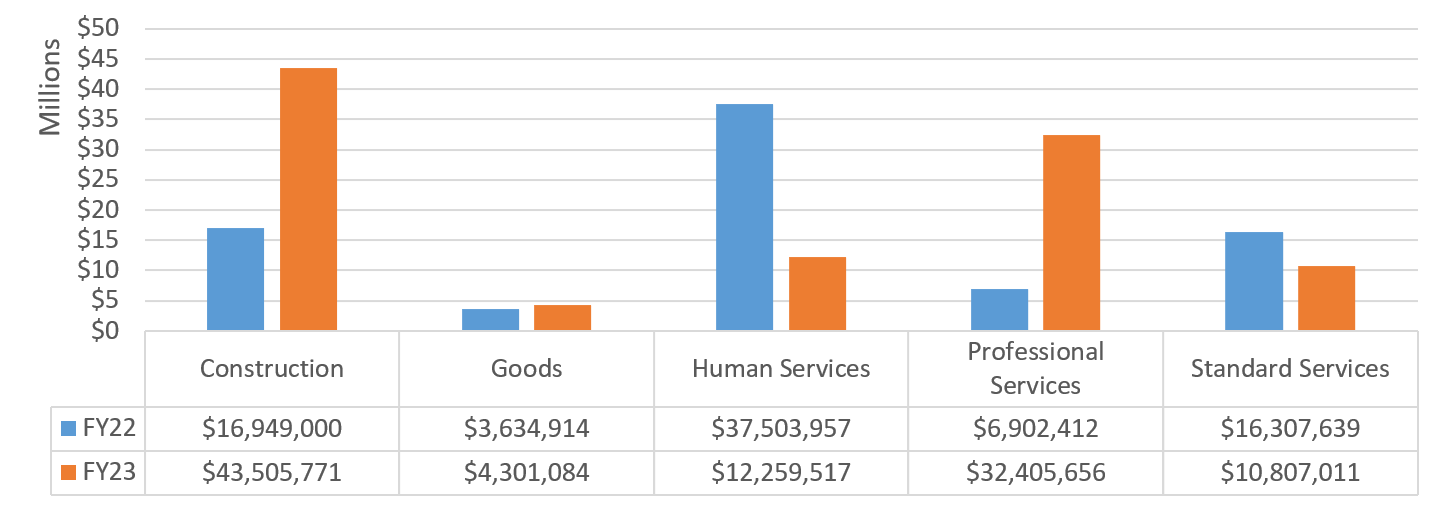

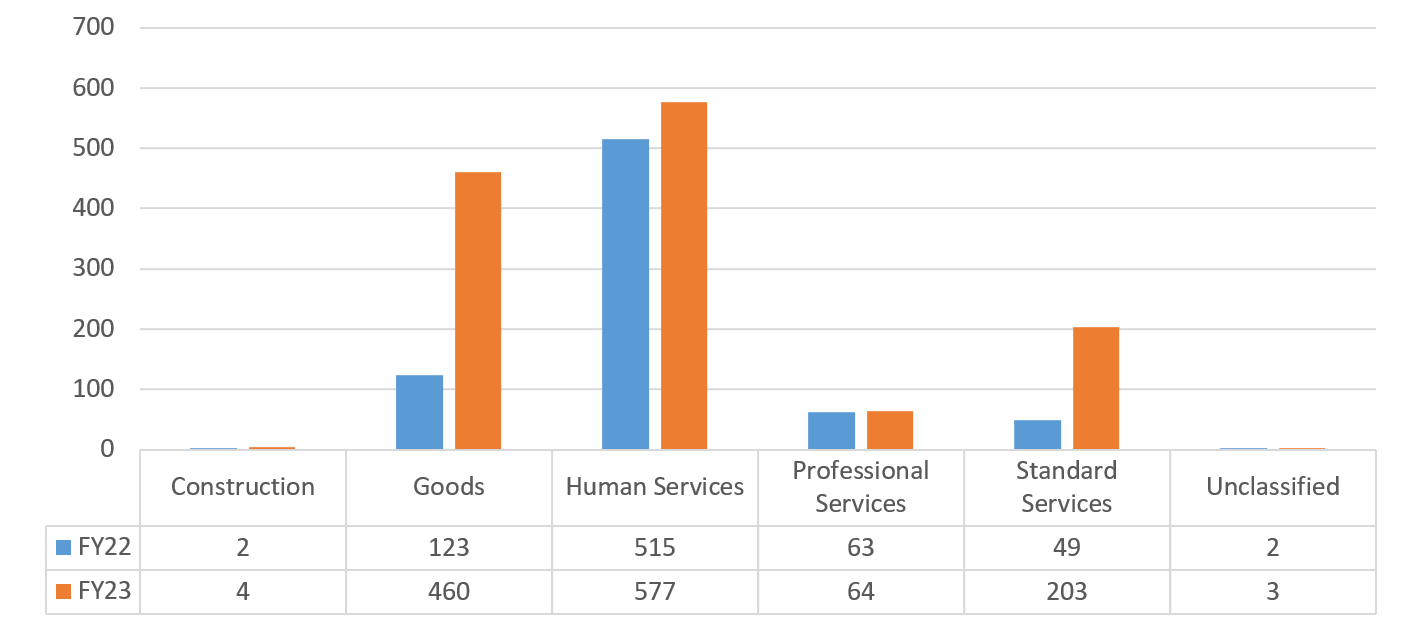

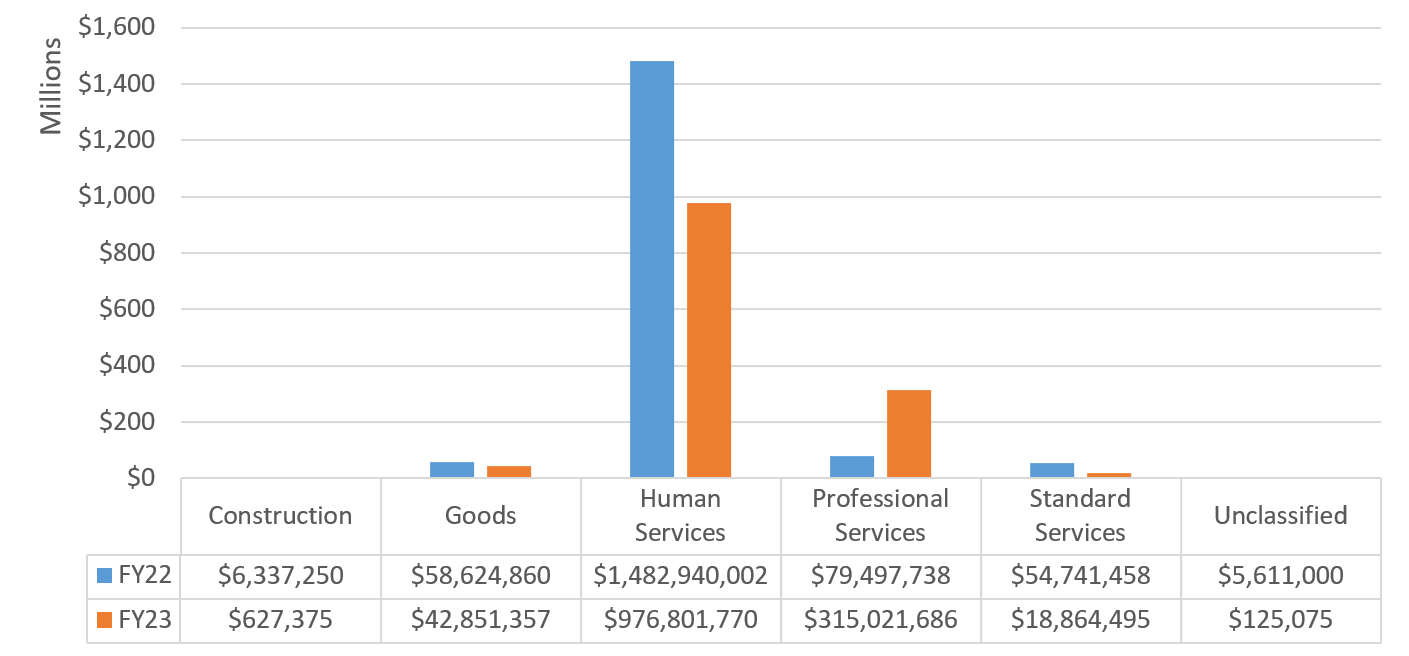

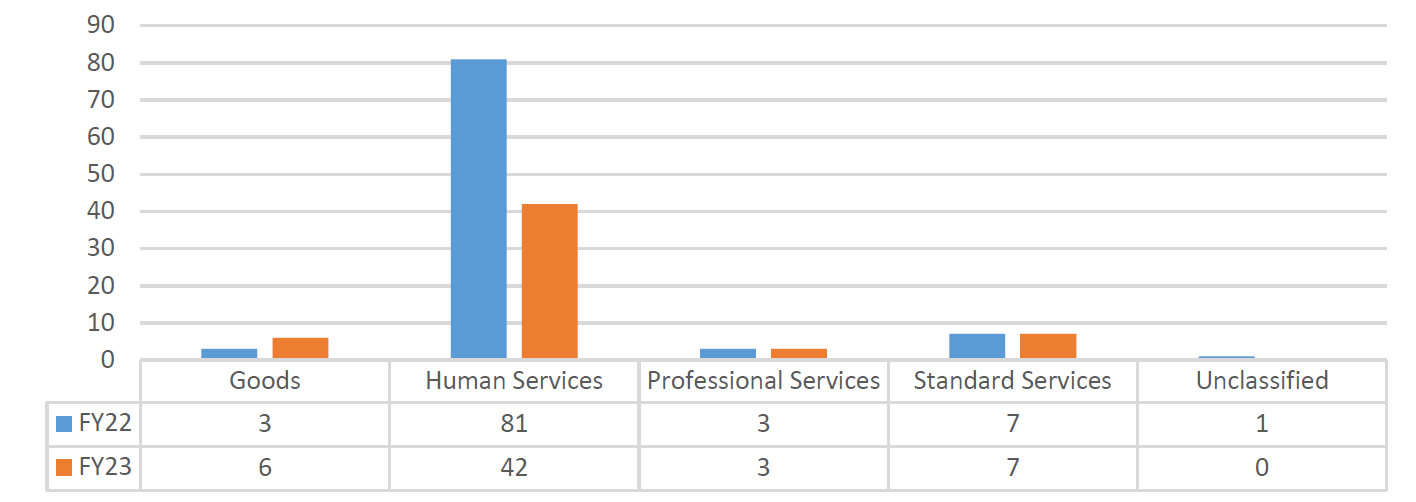

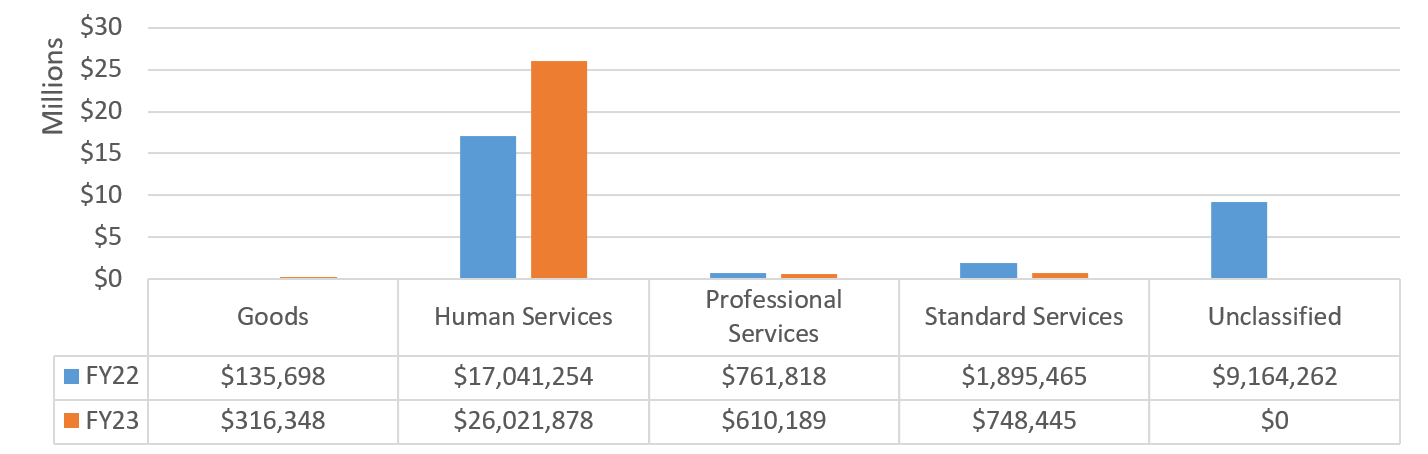

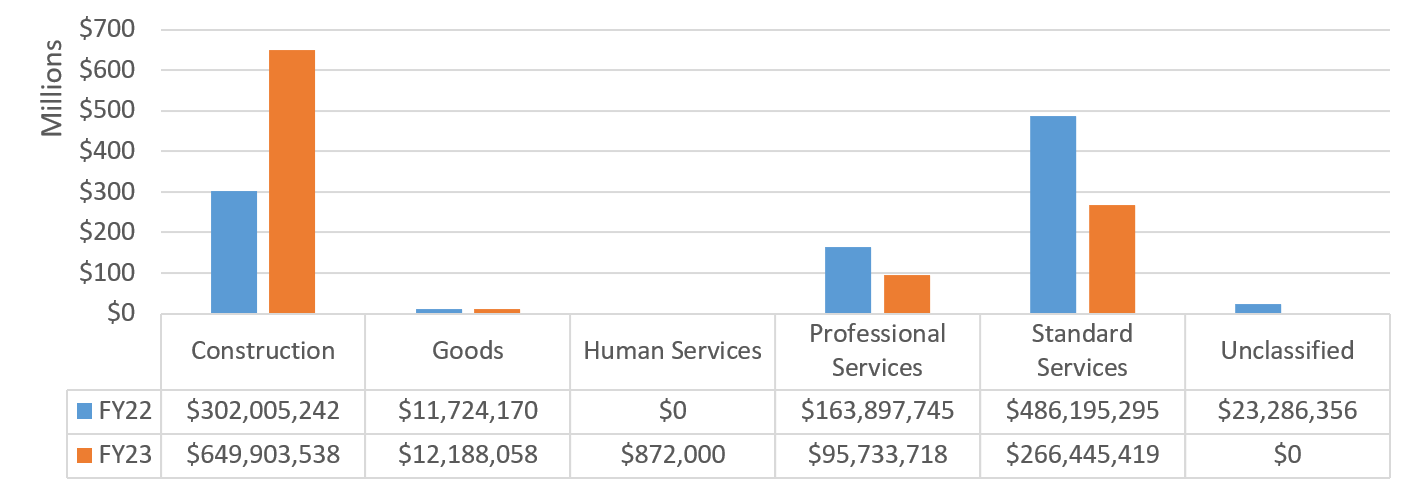

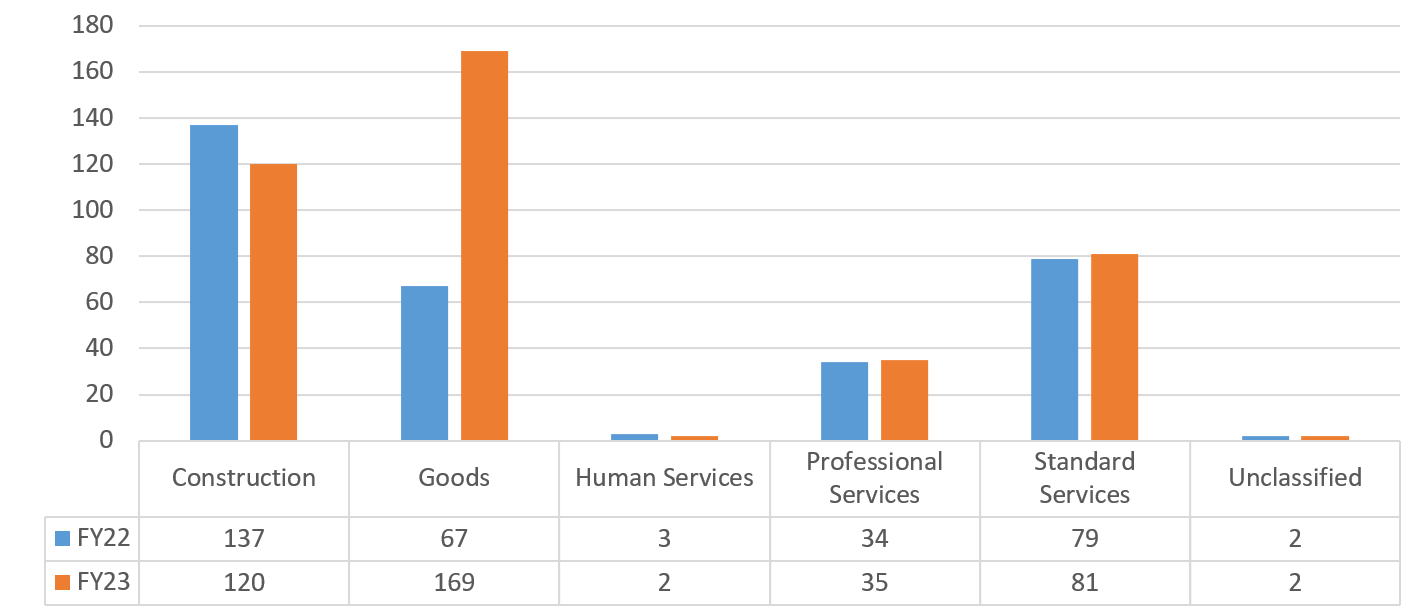

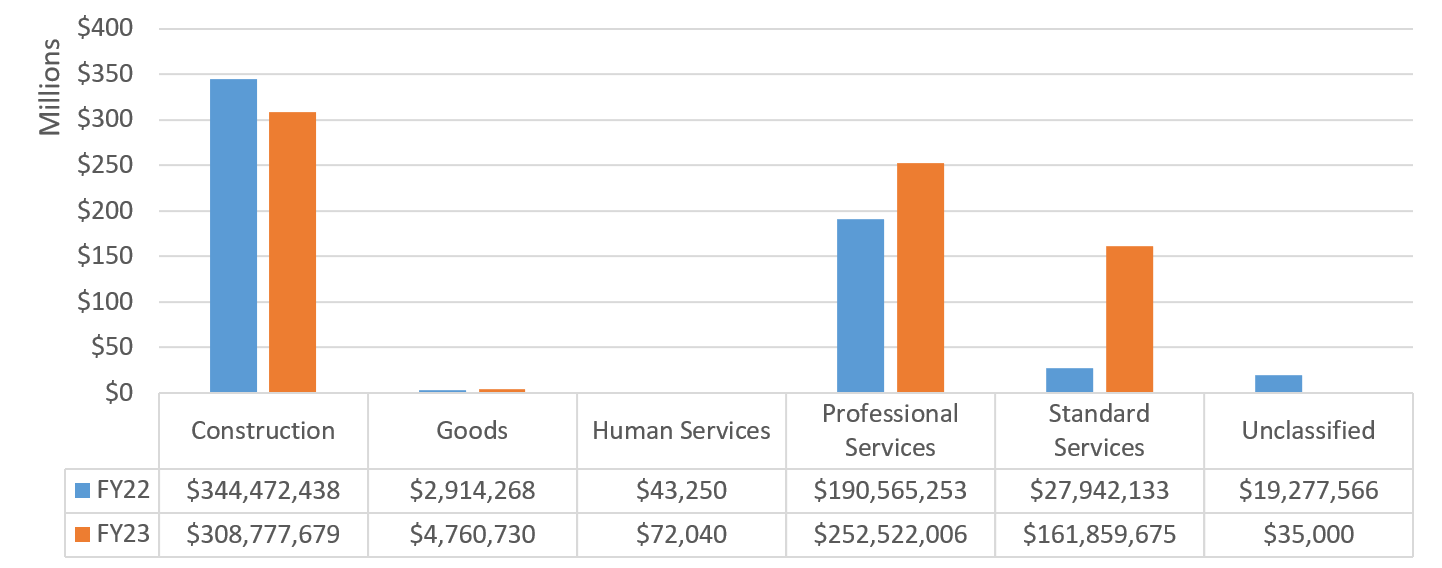

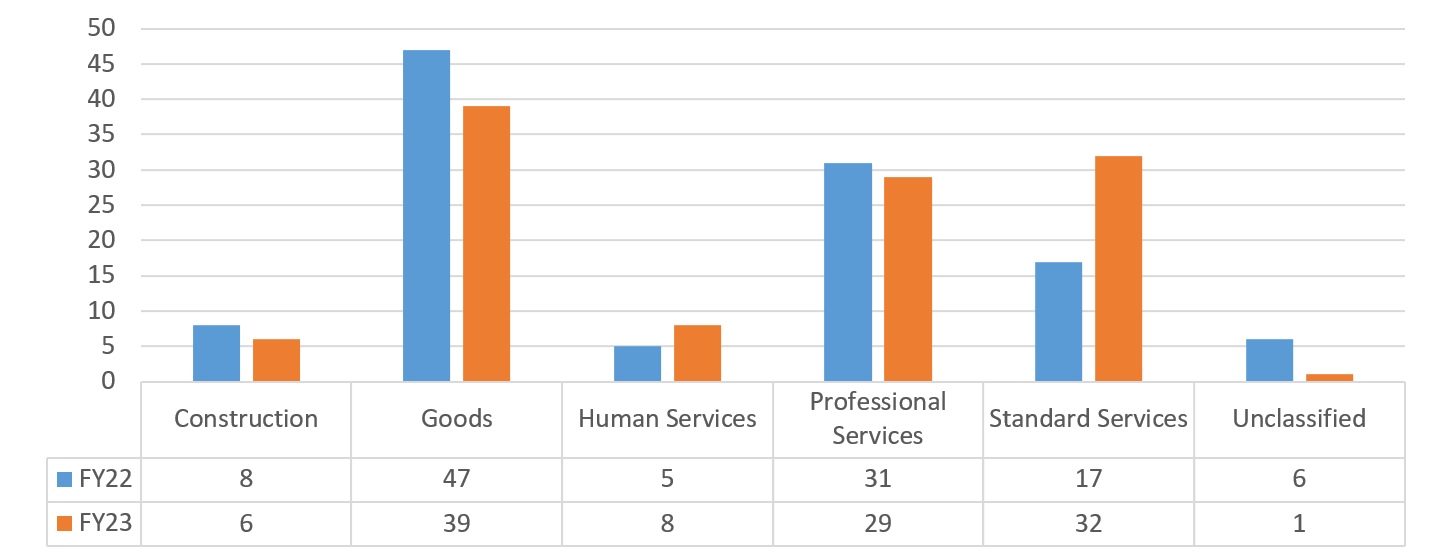

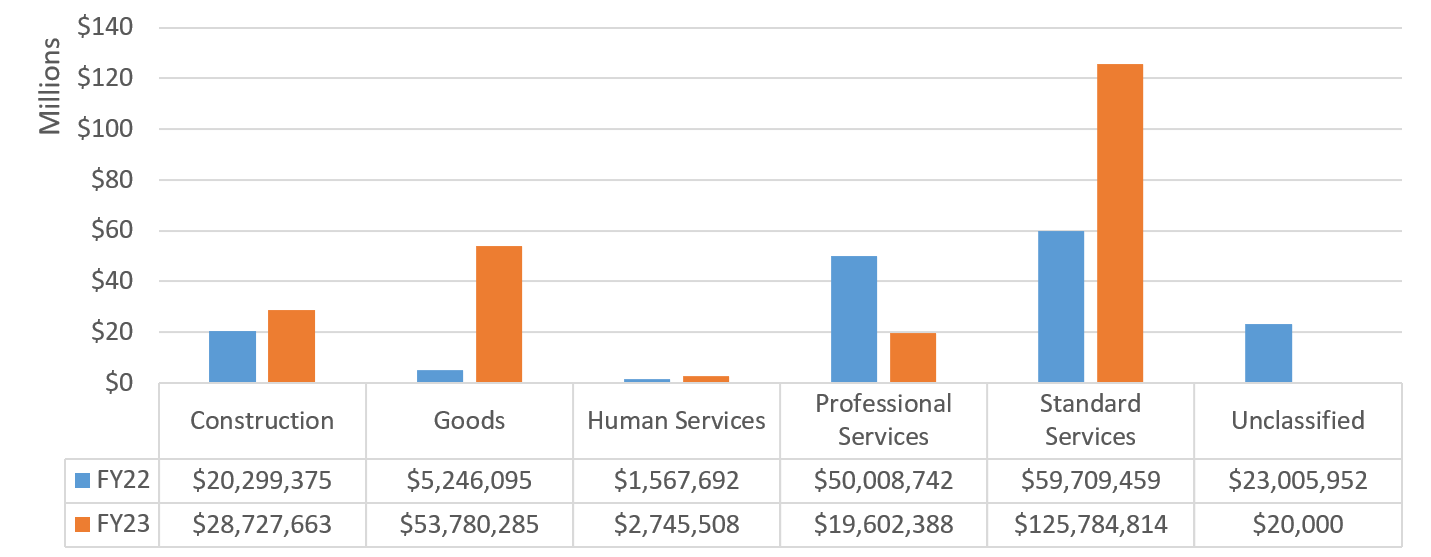

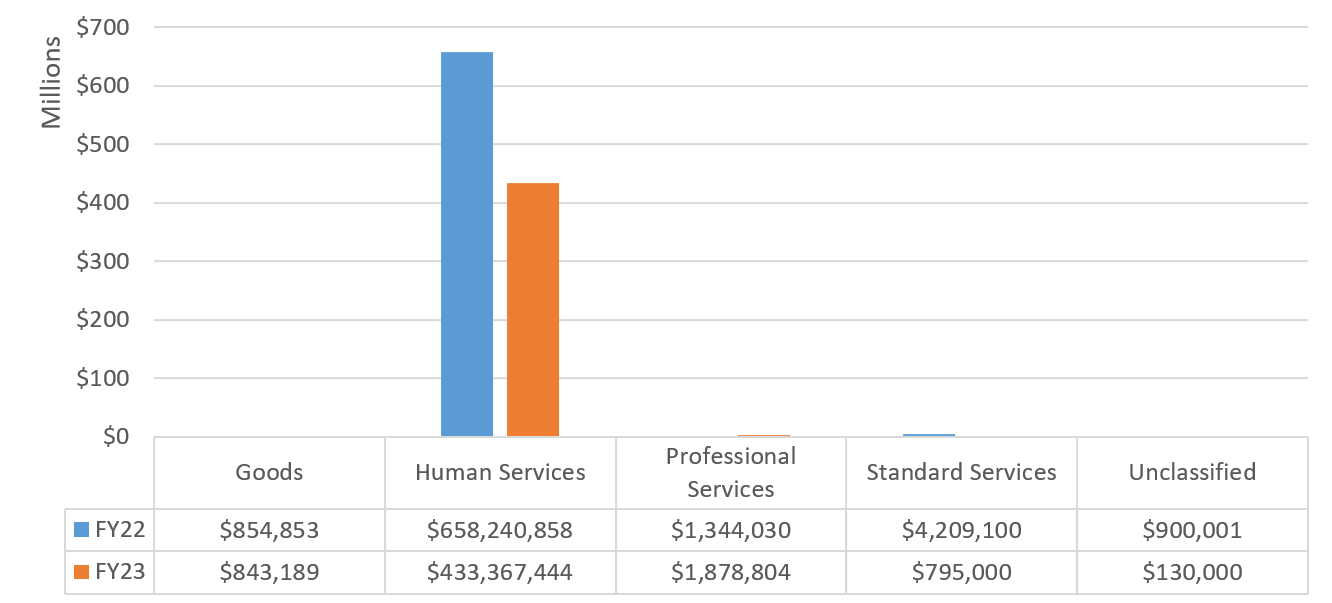

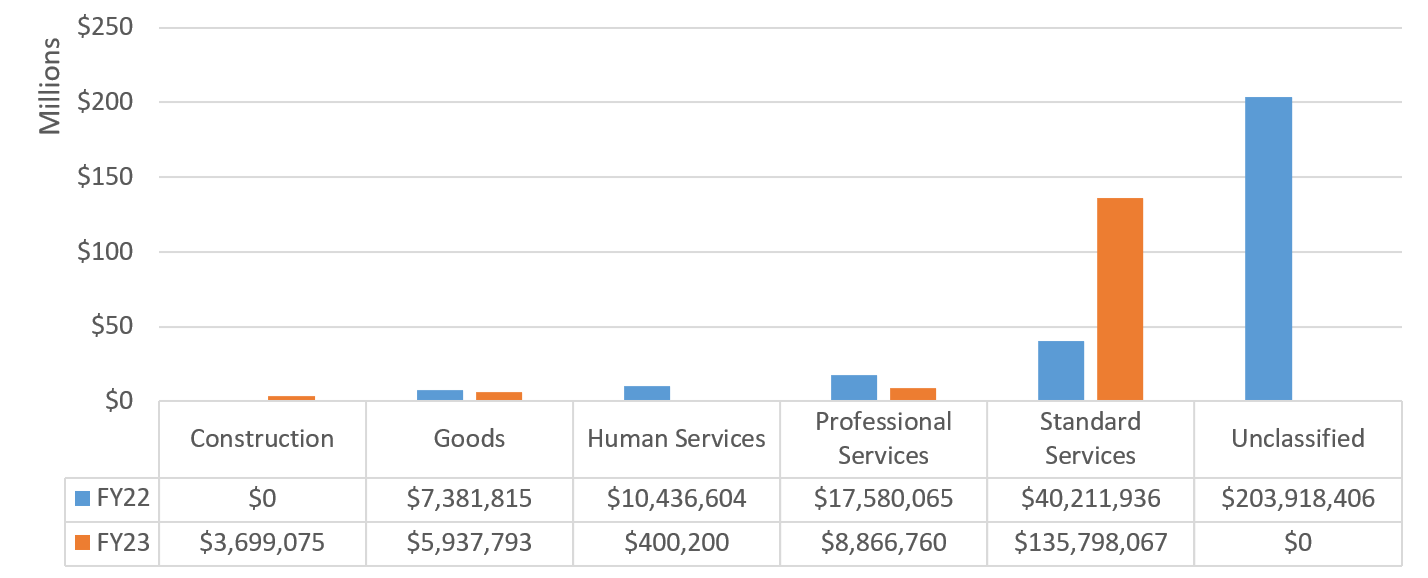

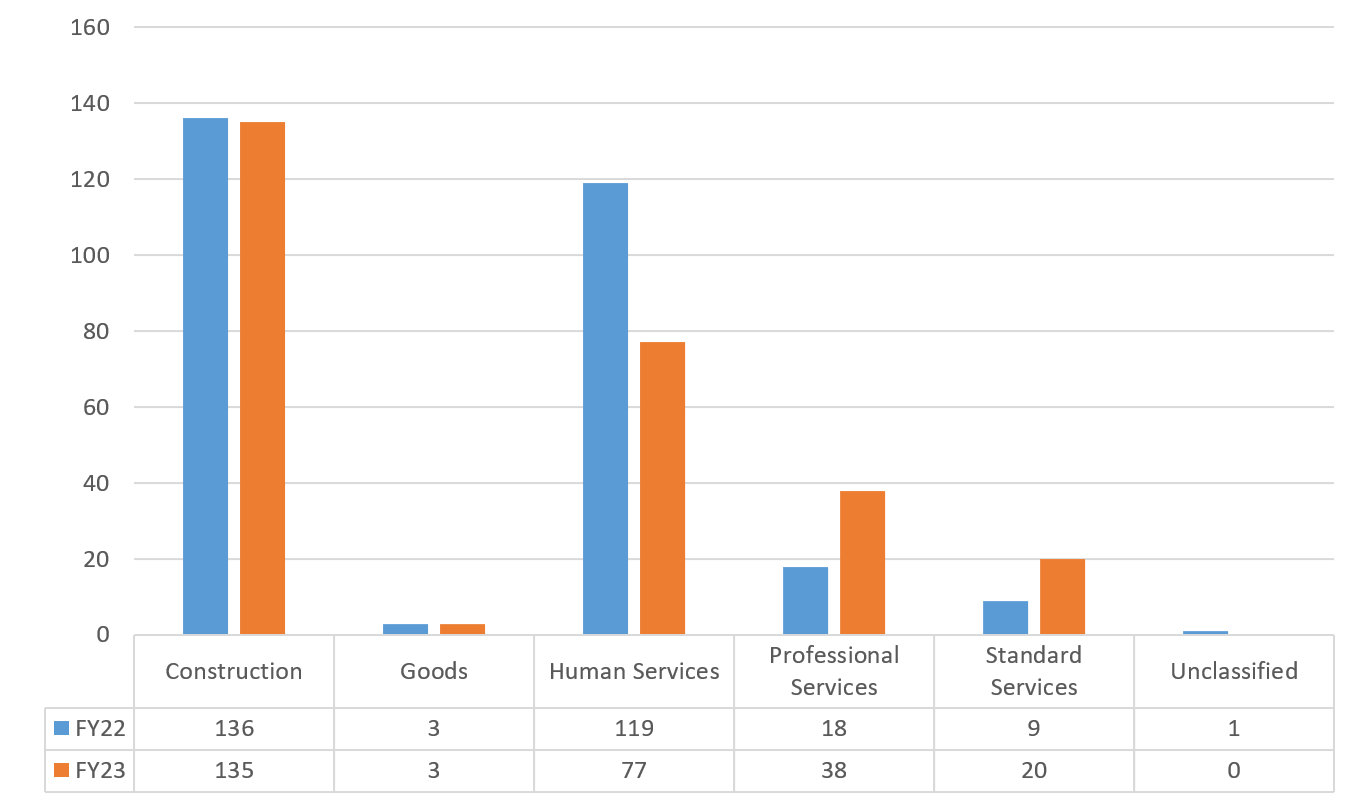

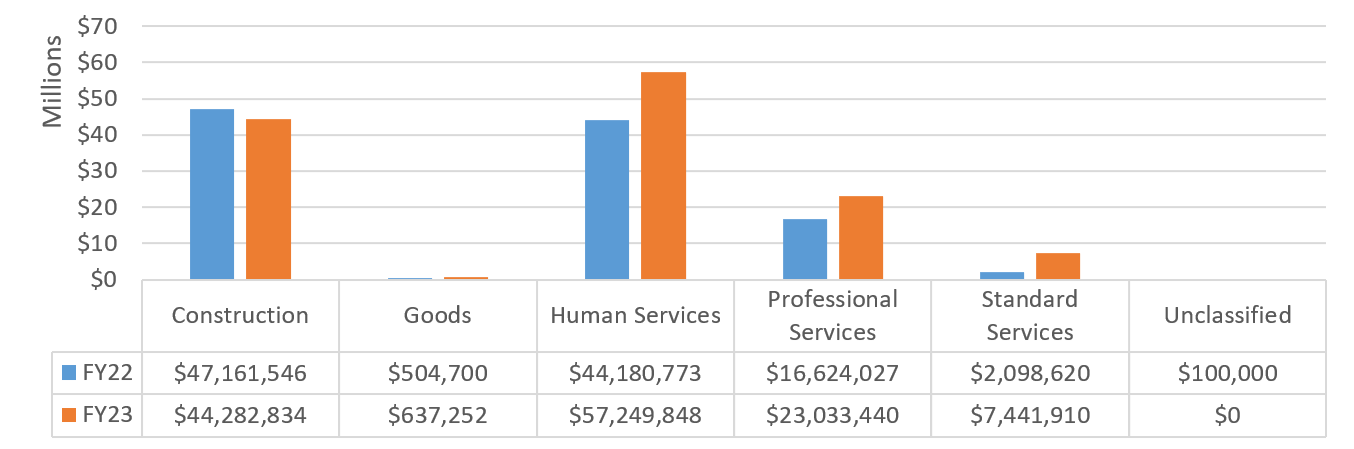

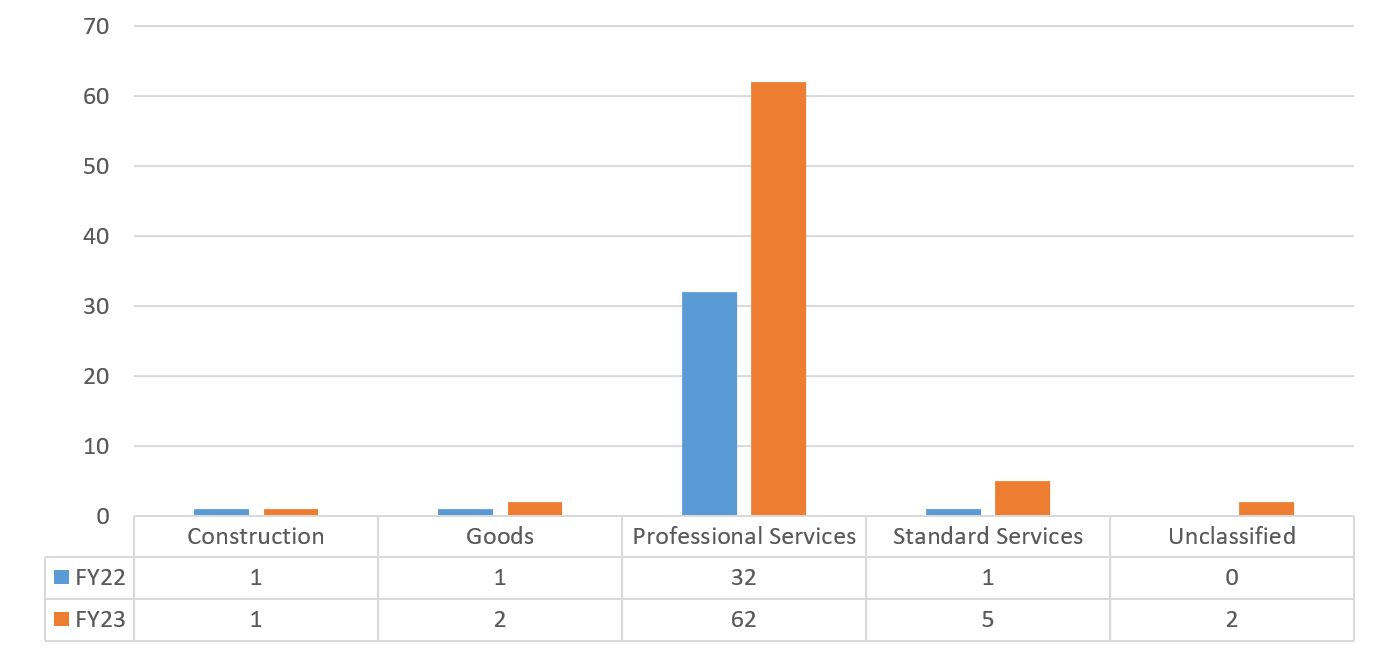

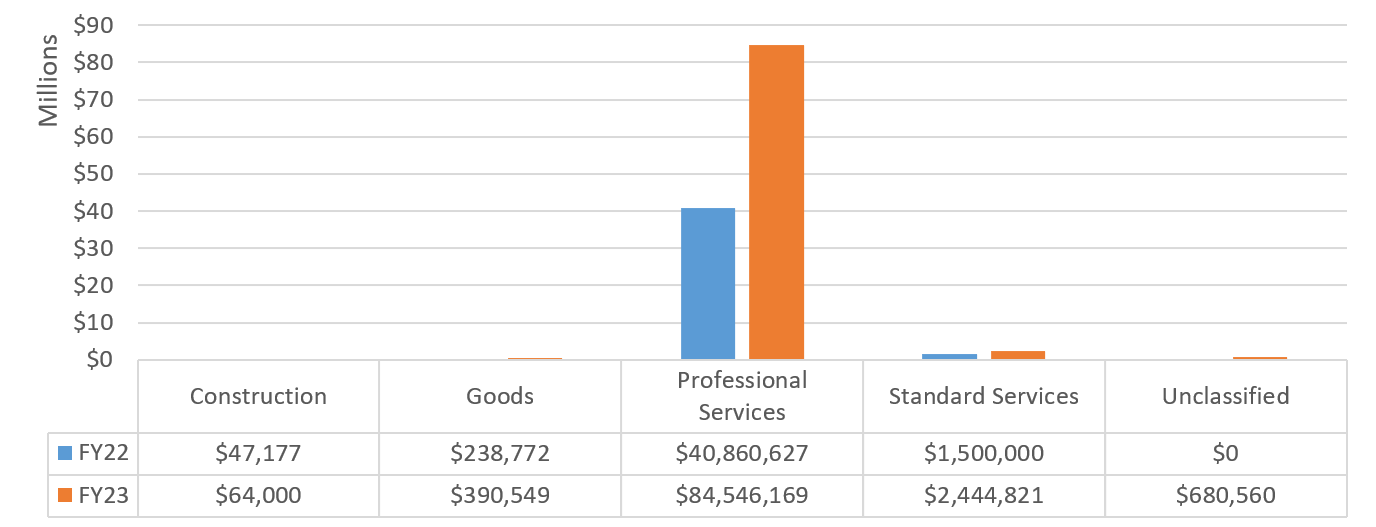

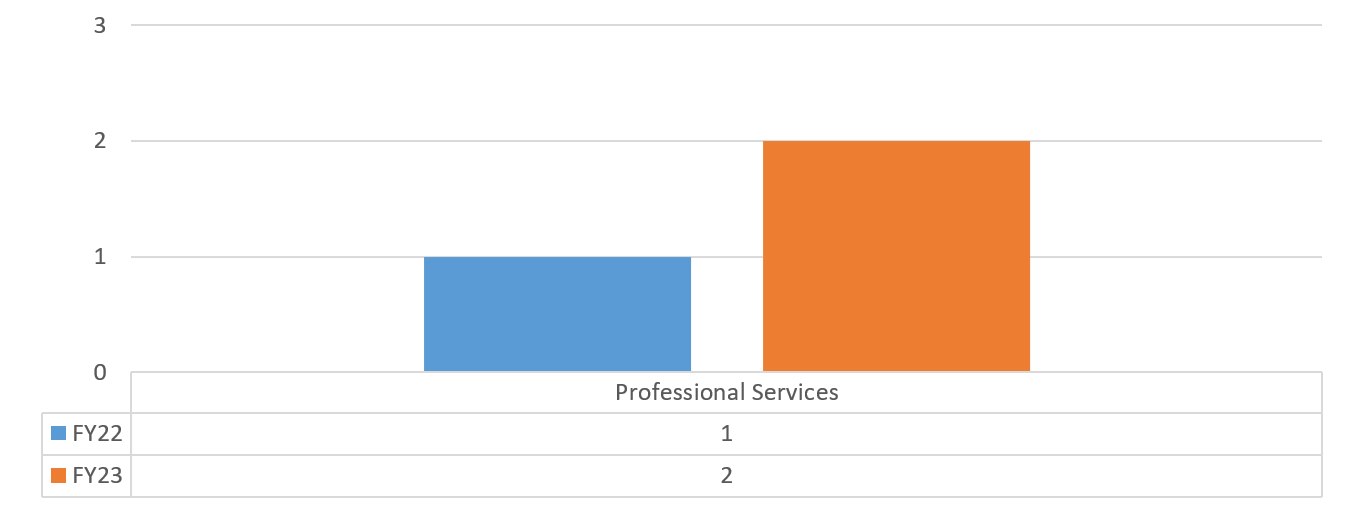

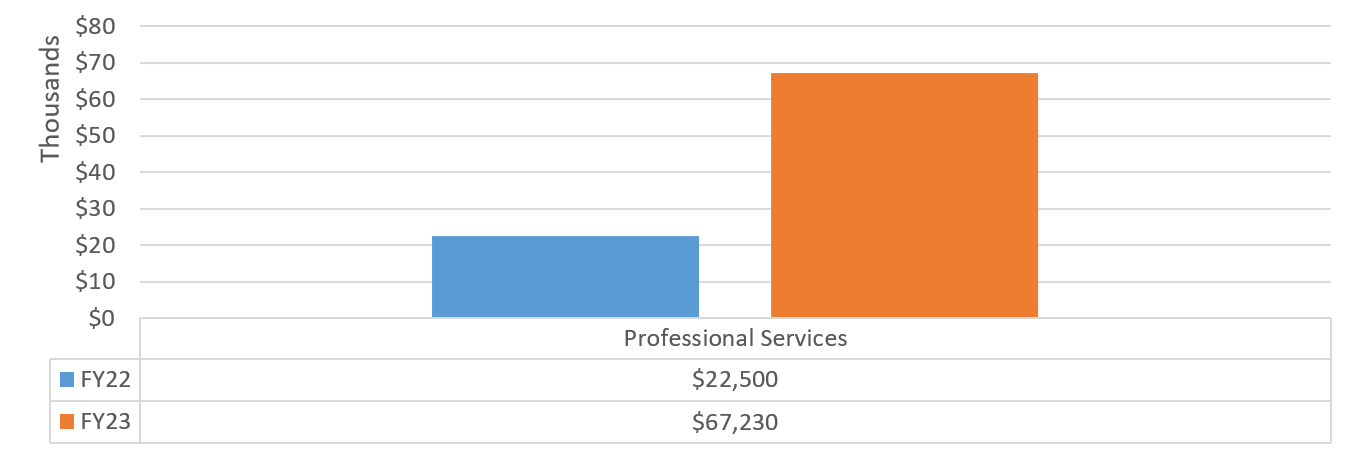

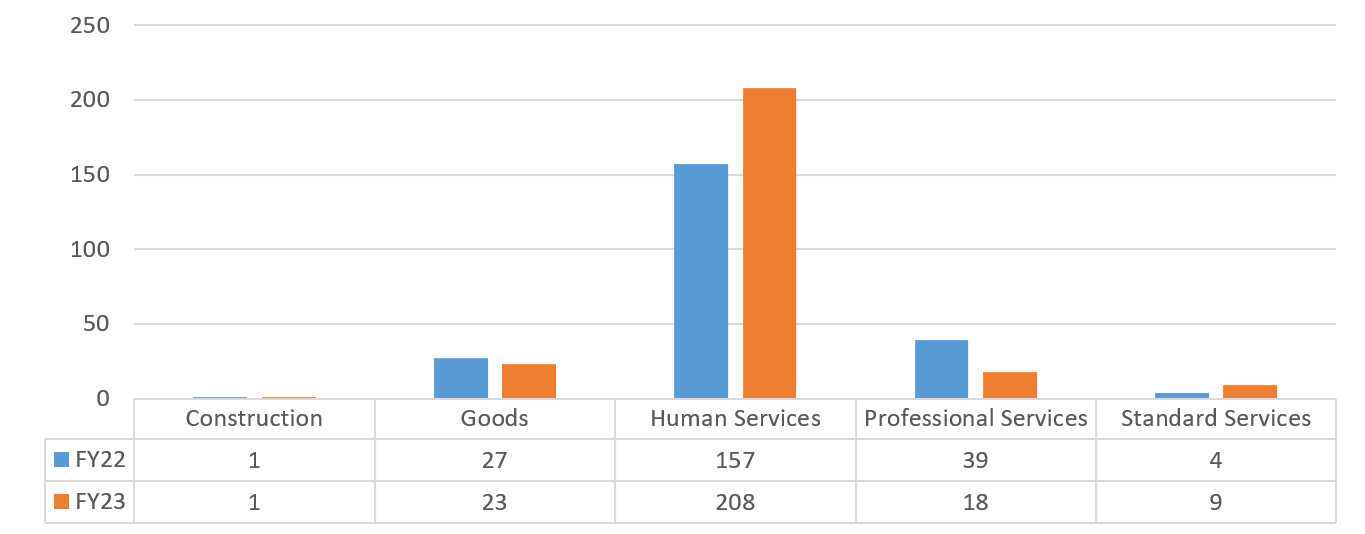

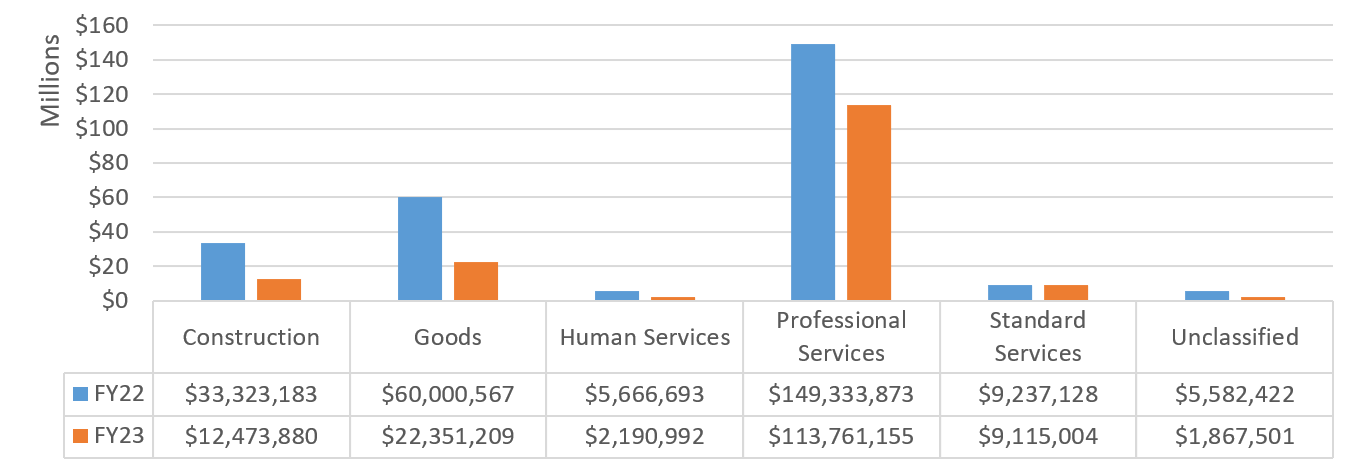

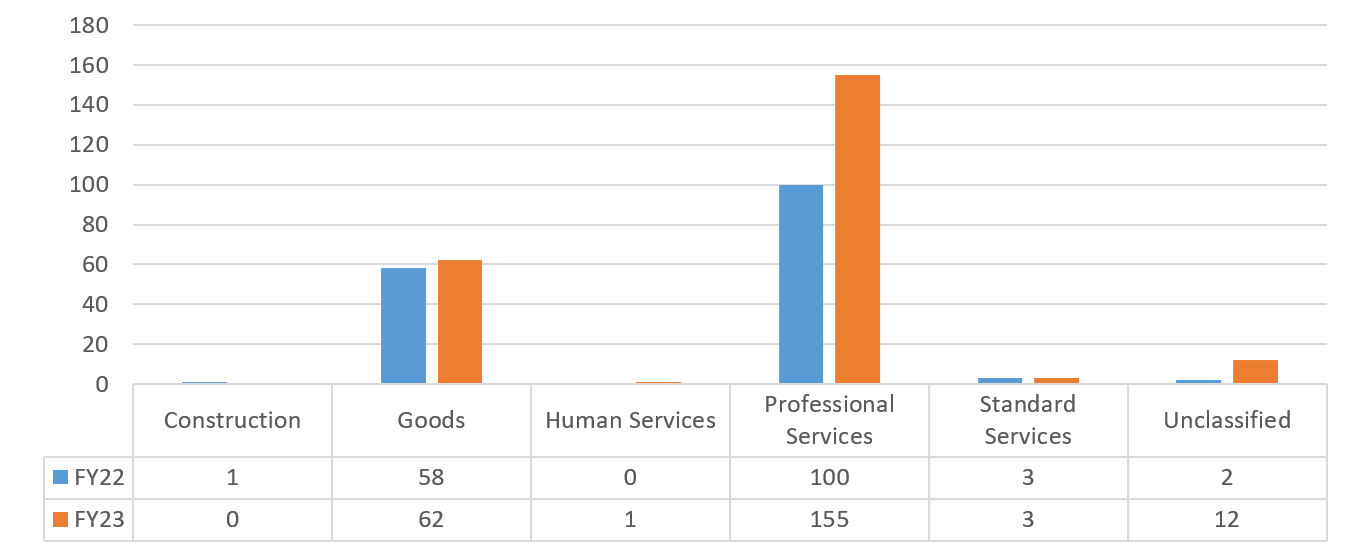

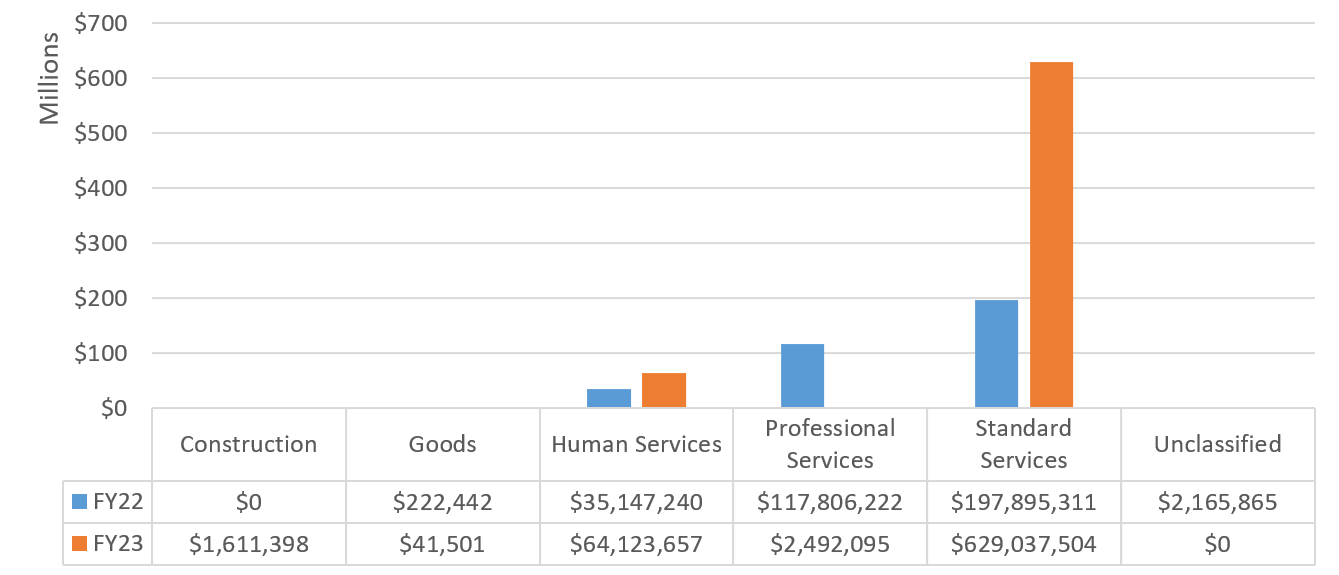

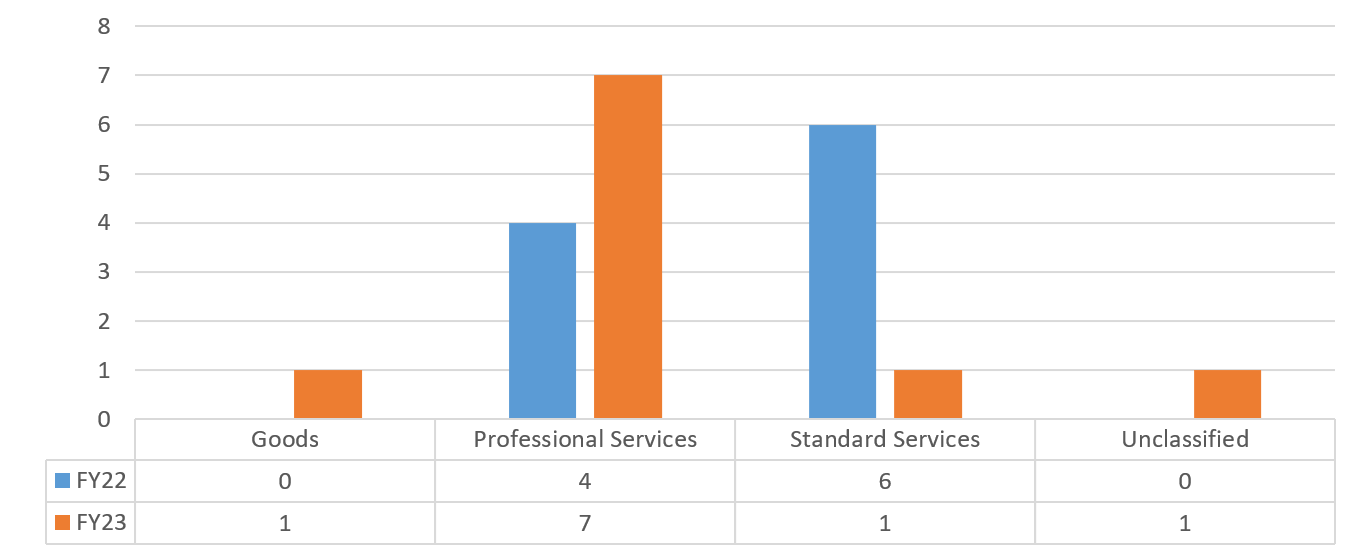

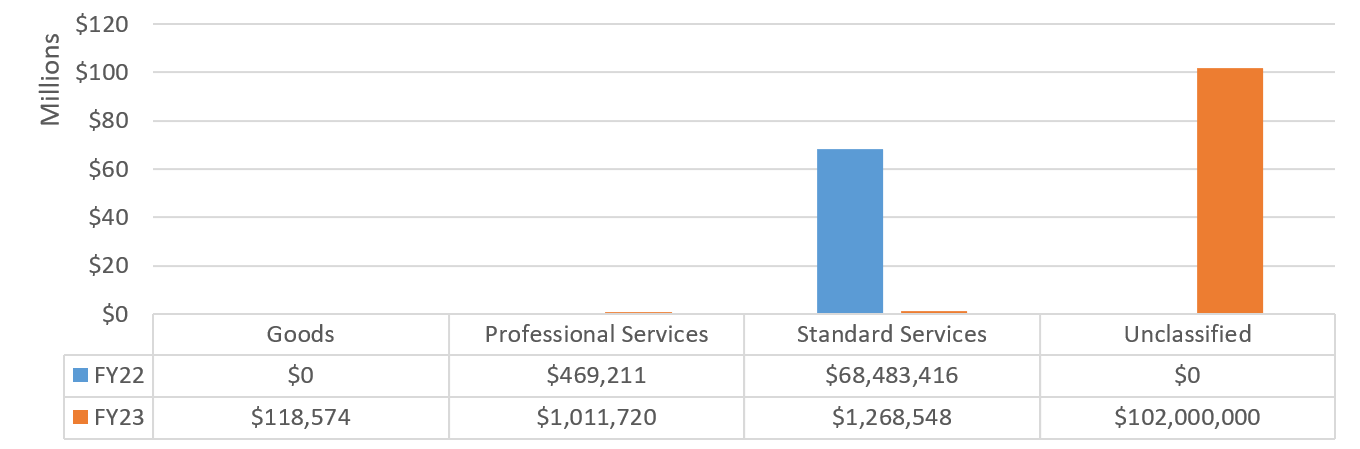

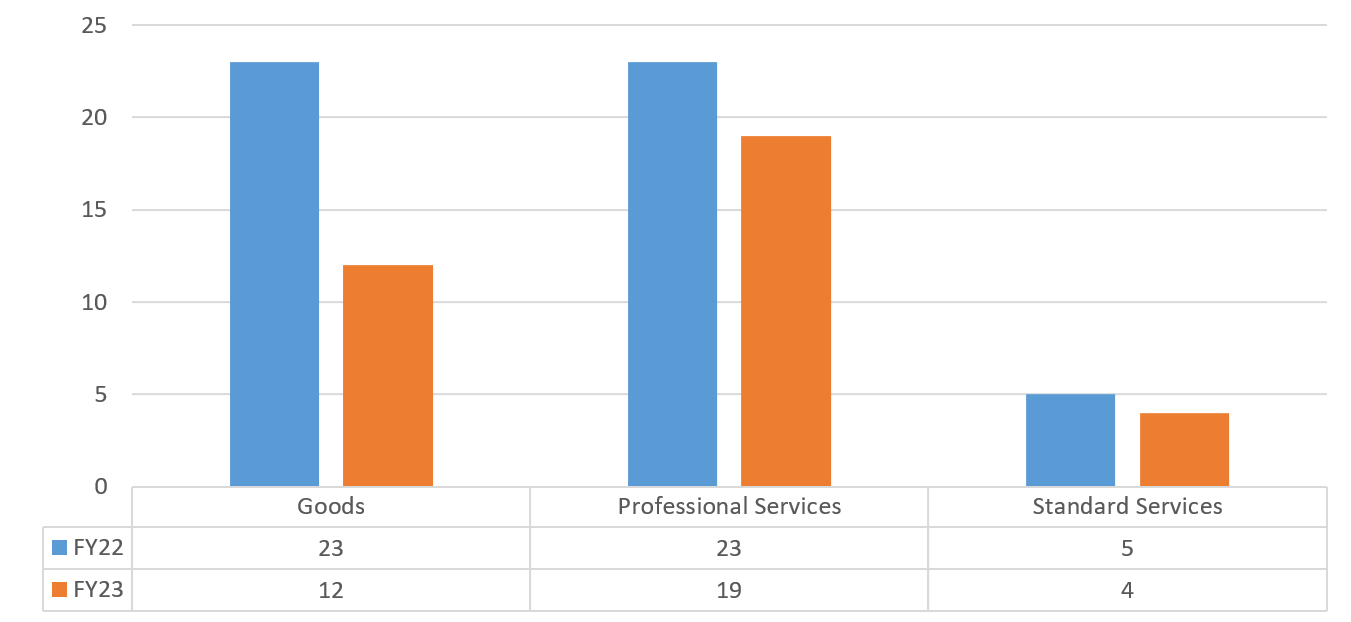

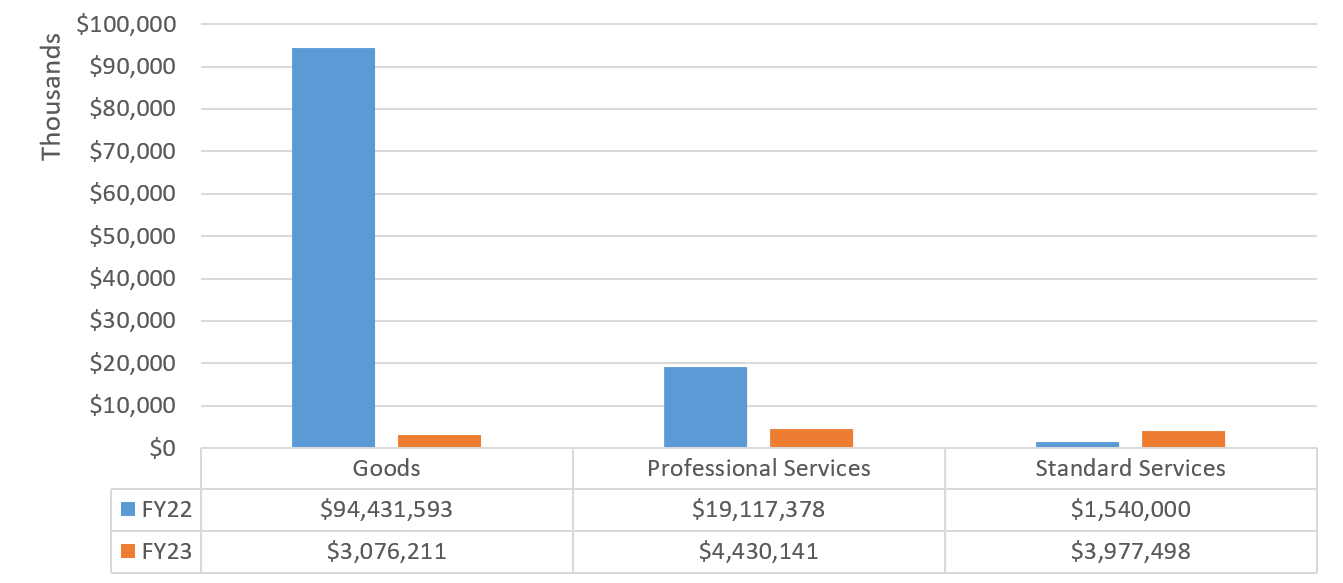

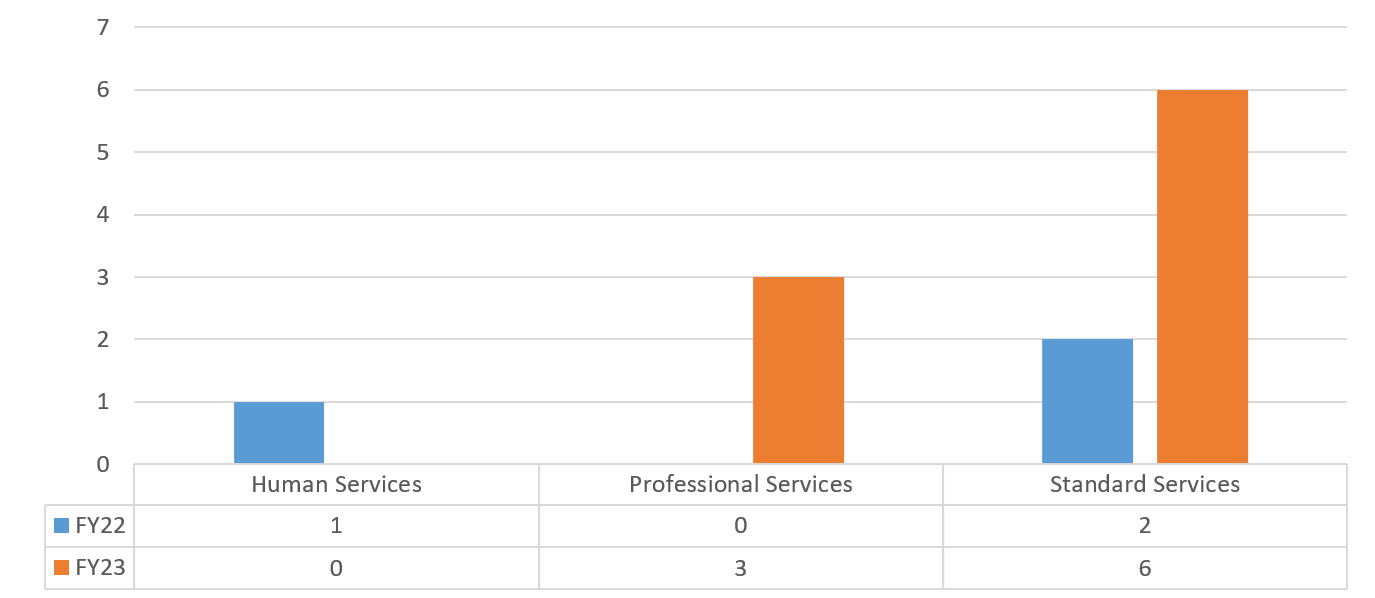

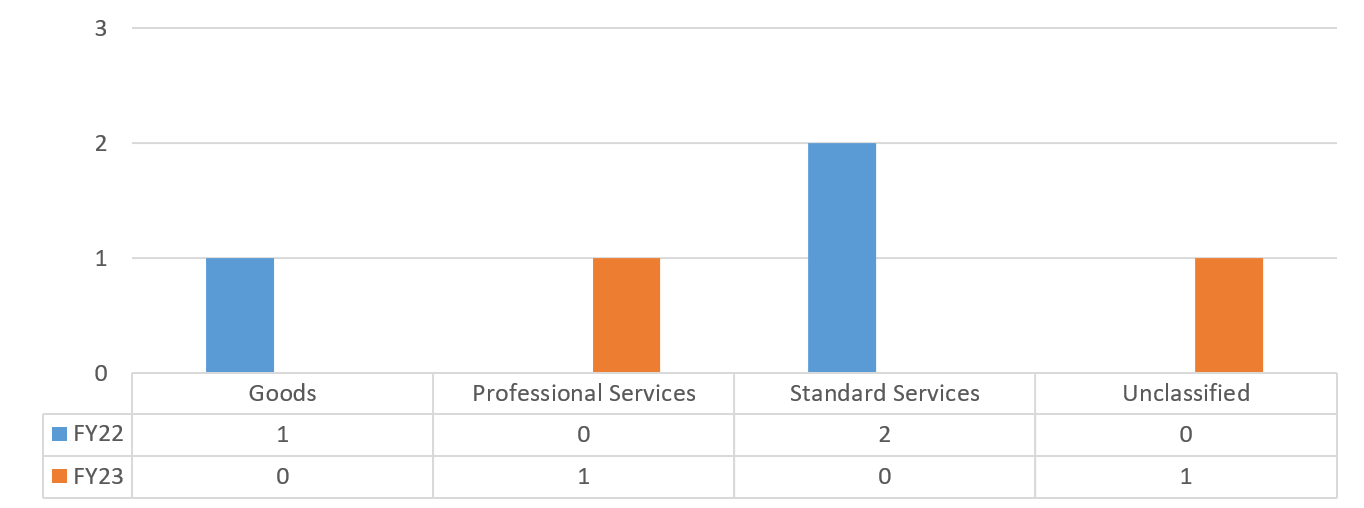

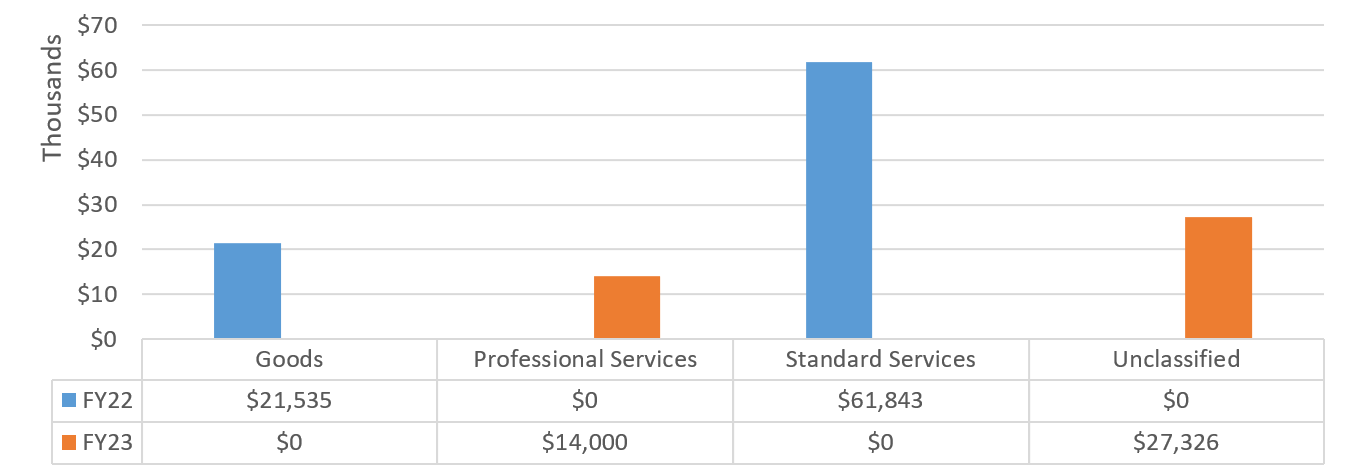

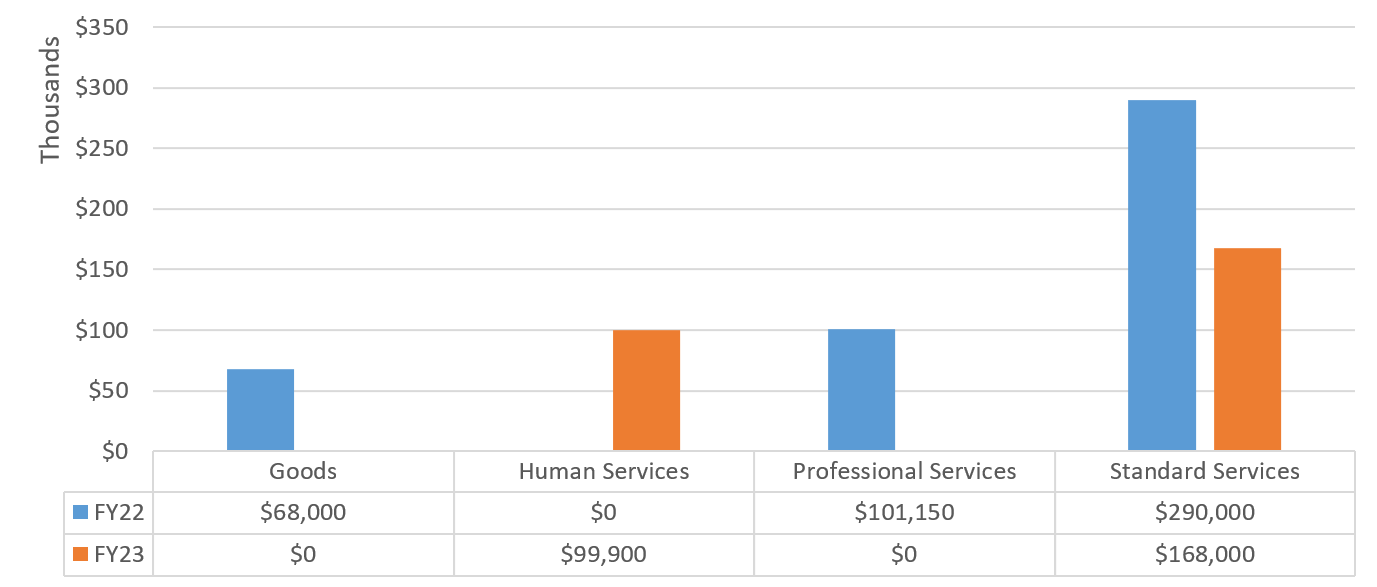

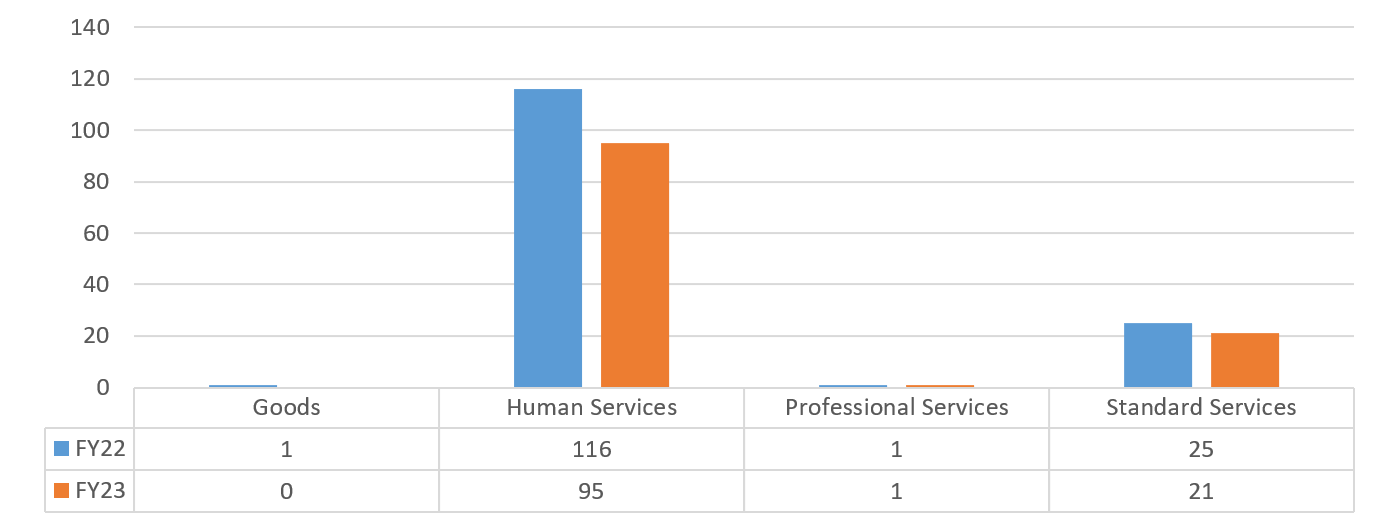

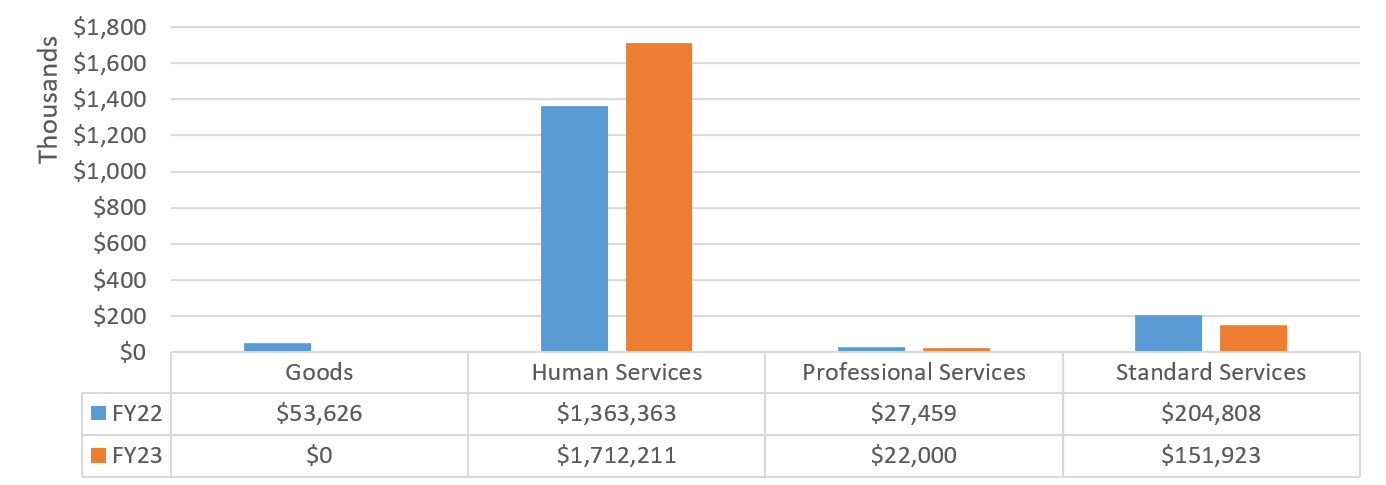

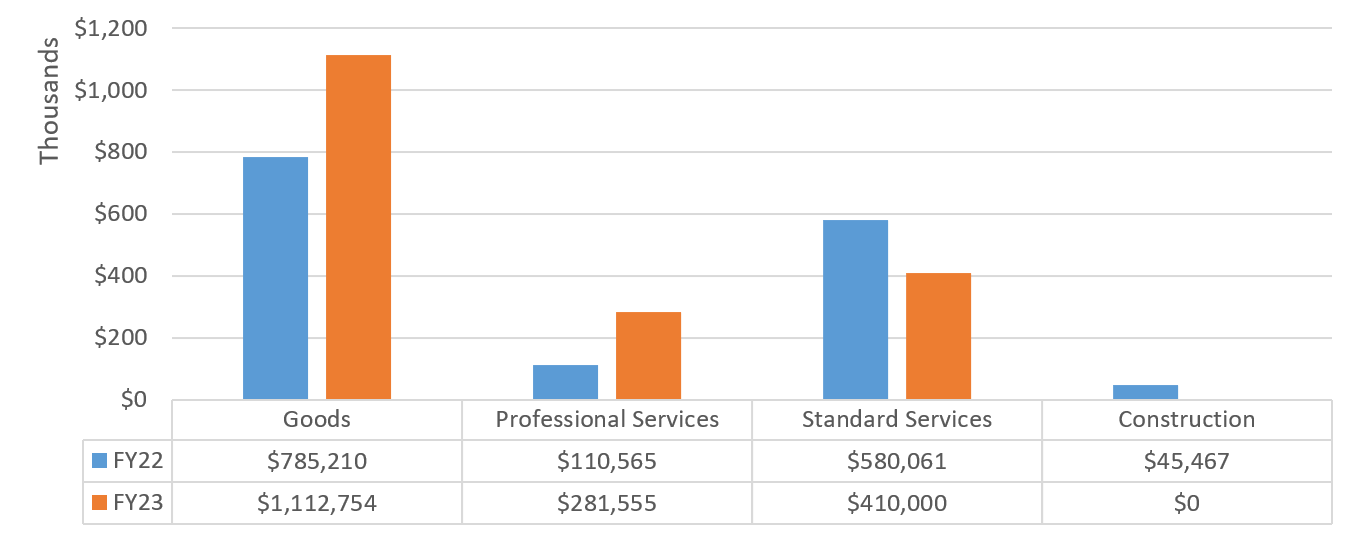

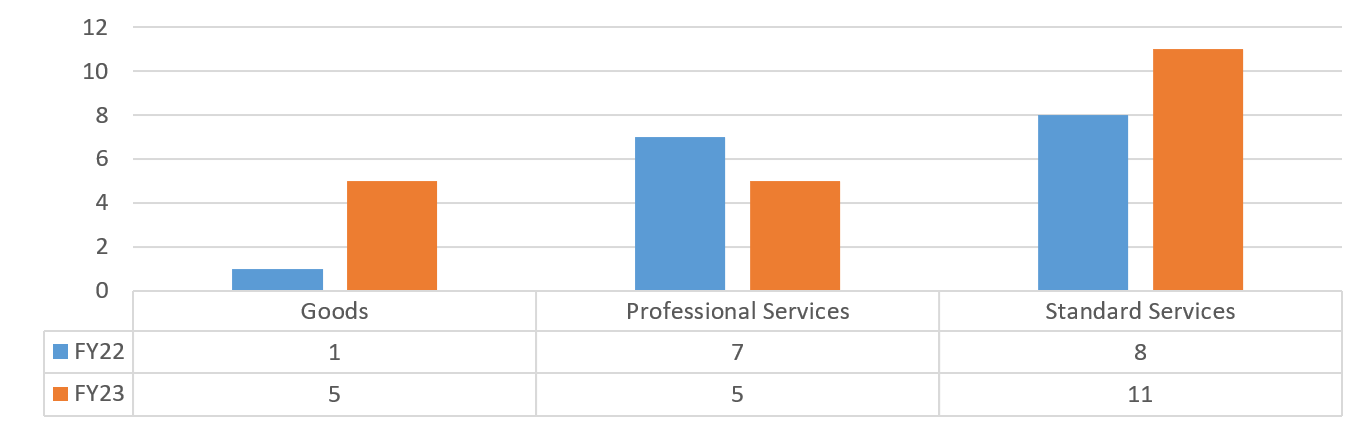

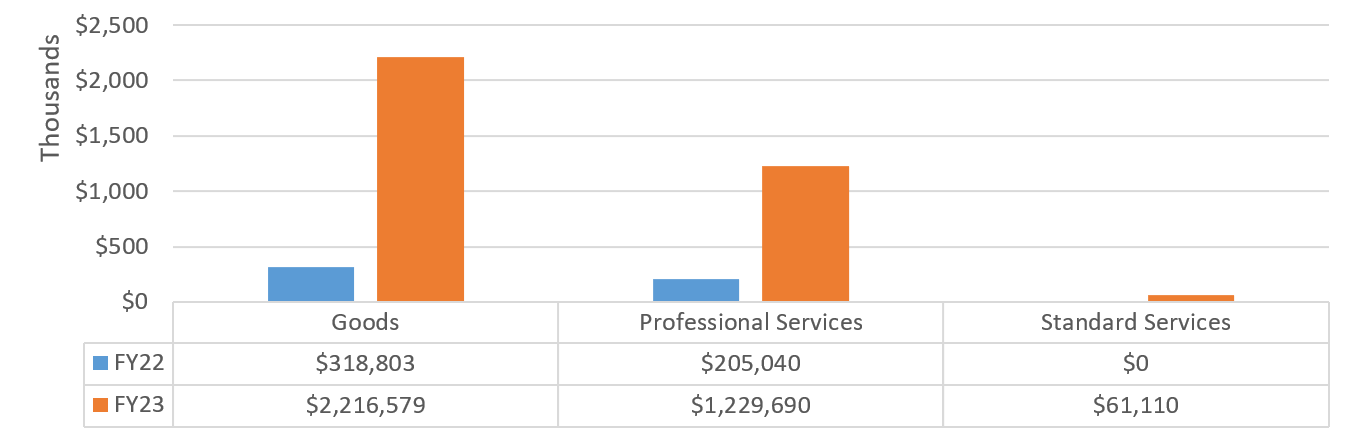

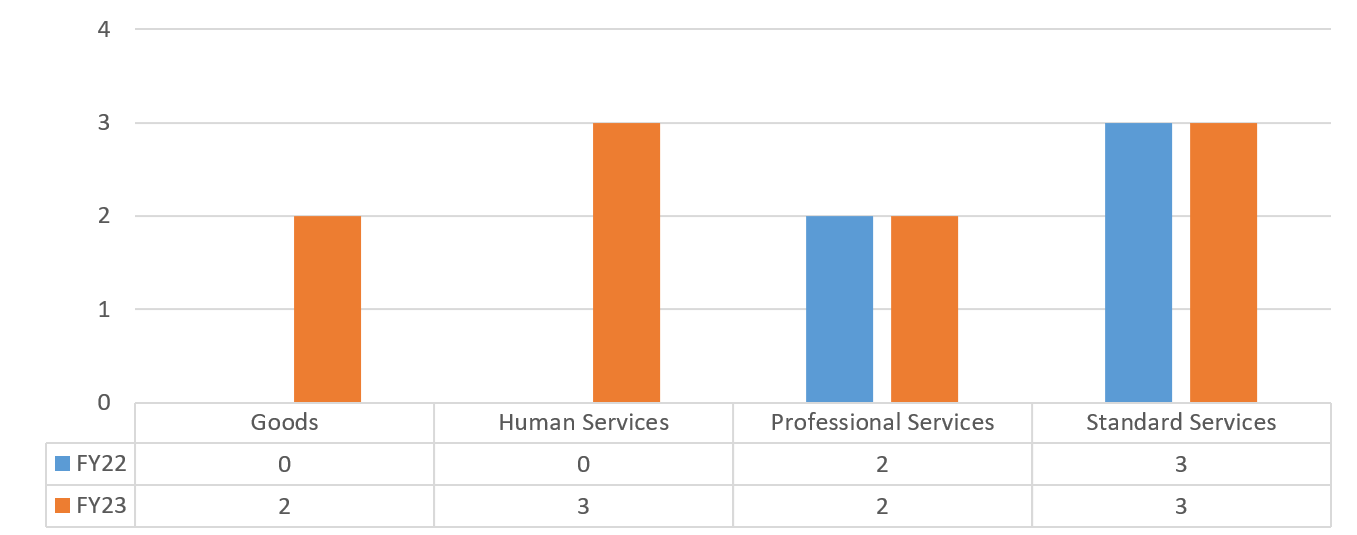

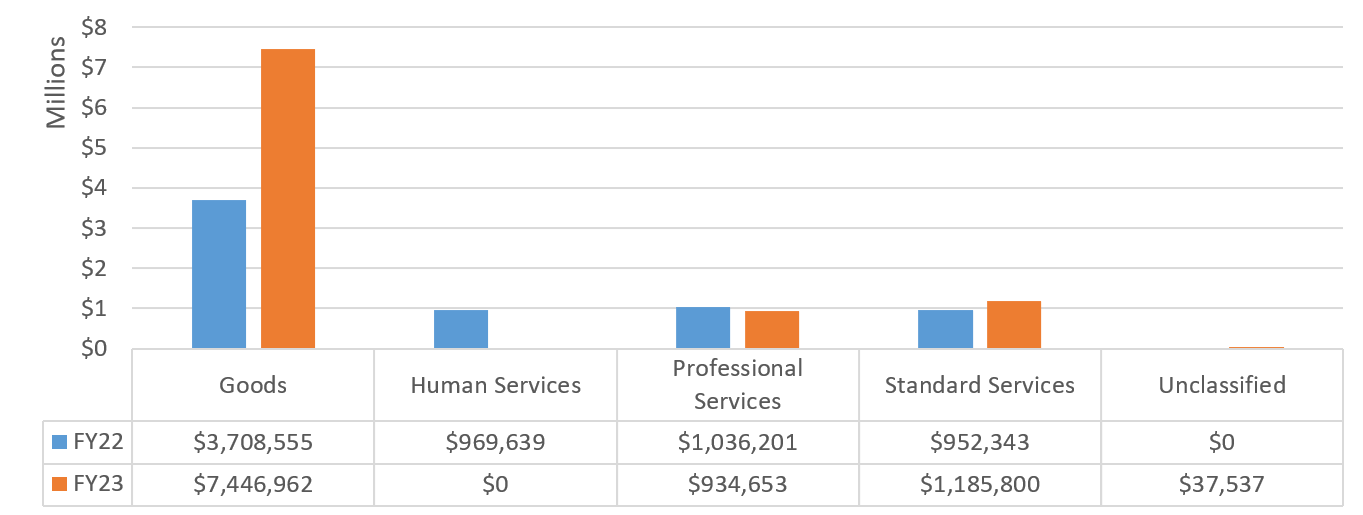

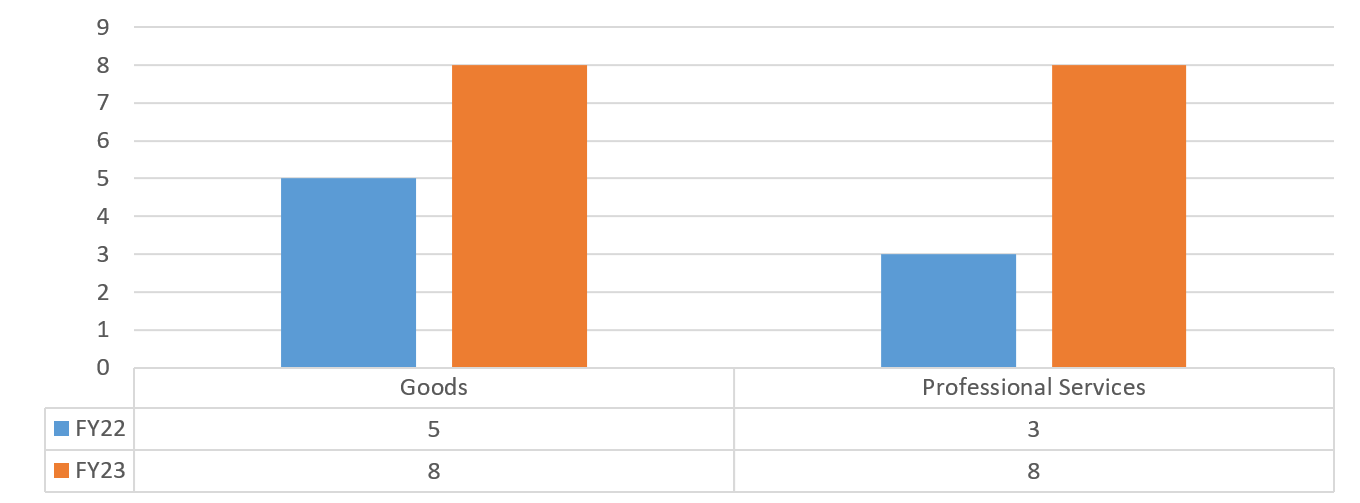

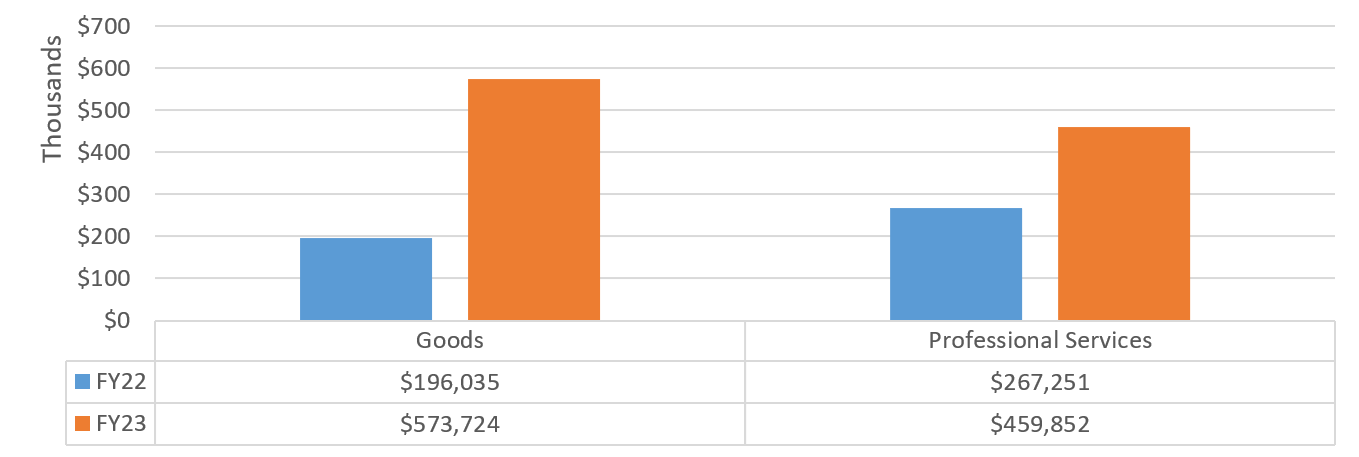

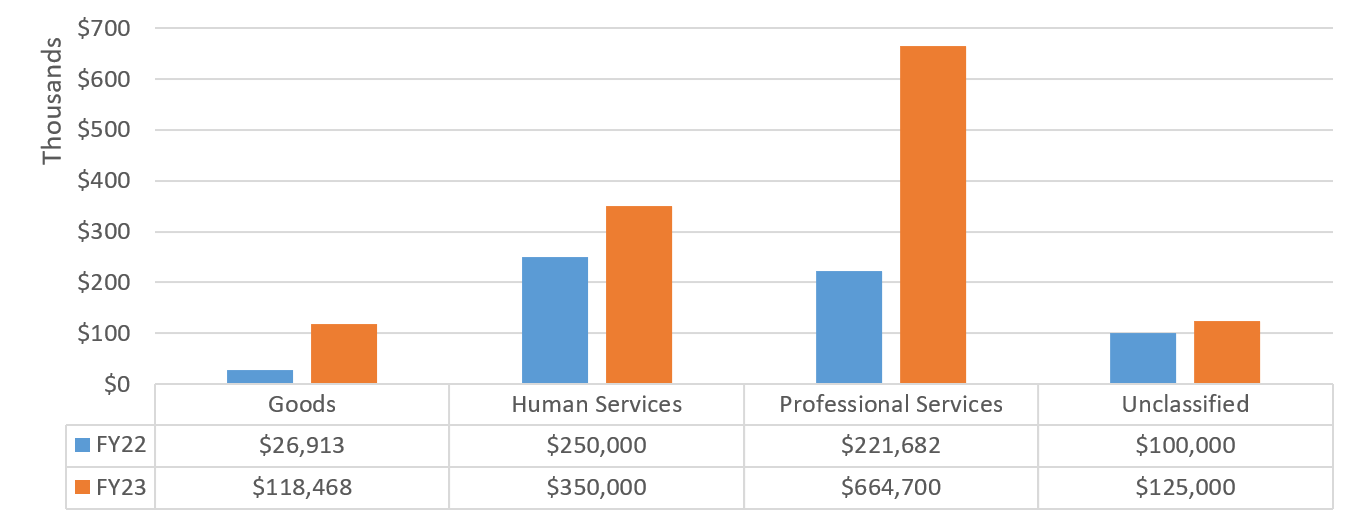

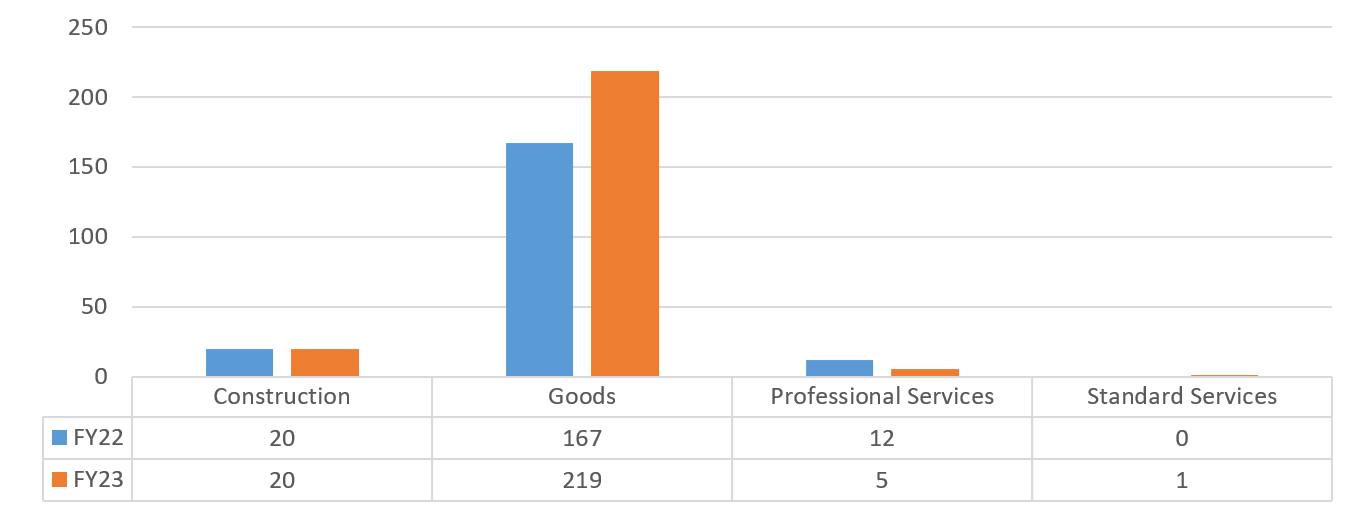

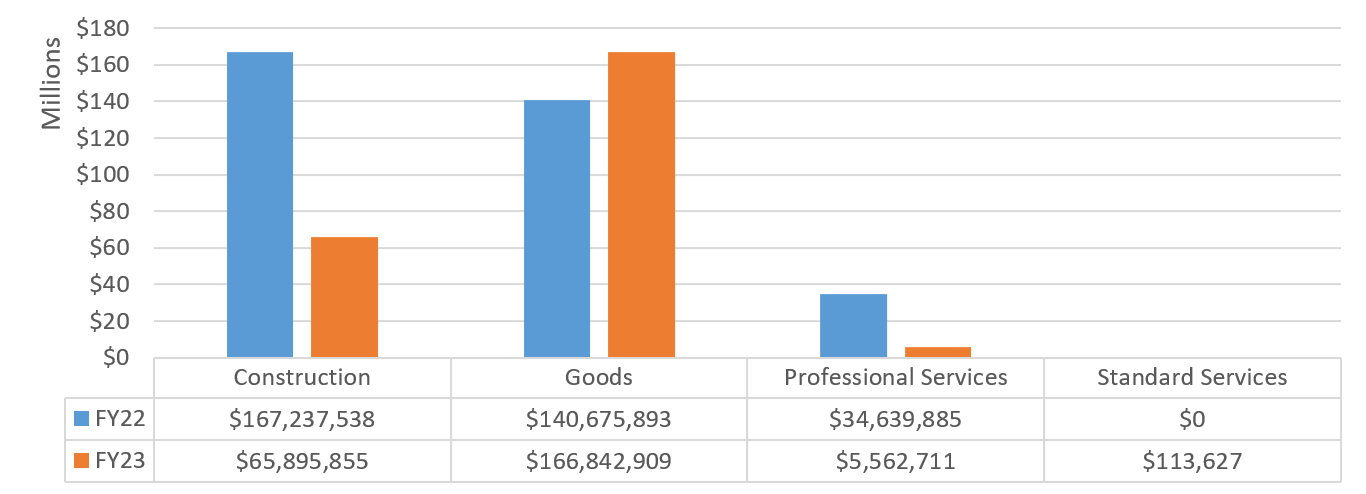

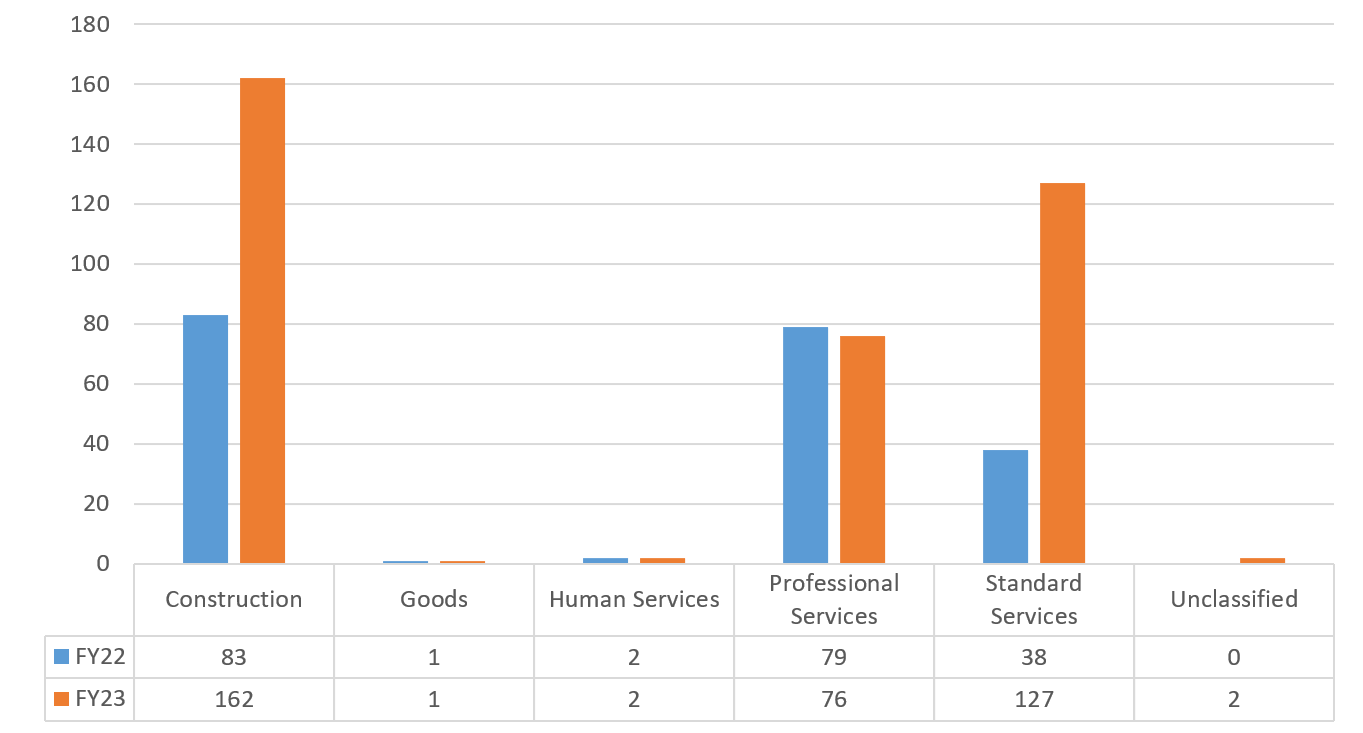

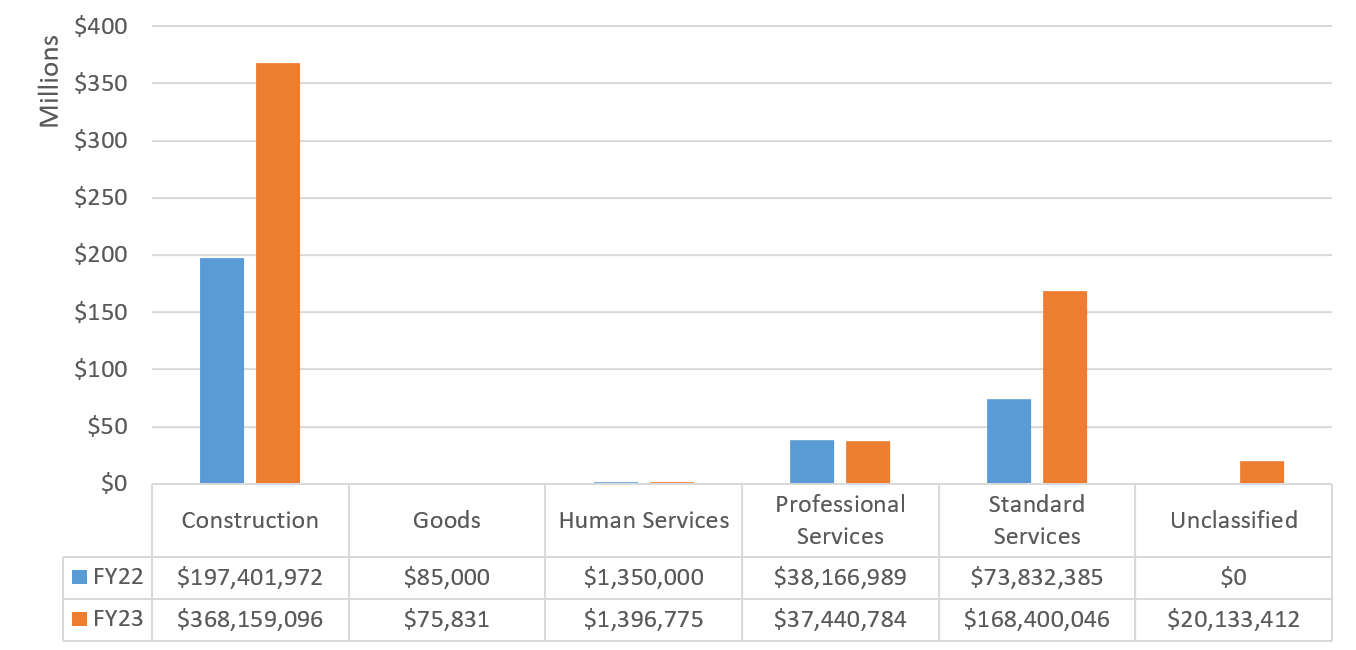

Chart 16 – ACS: FY22-FY23 Volume of Contracts by Industry

Chart 17 – ACS: FY22-FY23 Value of Contracts by Industry

Business Integrity Commission (BIC)

The Business Integrity Commission (BIC) is a law enforcement and regulatory agency charged with oversight of the private carting industry throughout the five boroughs, the city’s public wholesale markets and the shipboard gaming industry. BIC investigates applicants, issue licenses and registrations, conduct criminal and regulatory investigations, enforce applicable laws, and promulgates rules and regulations that govern the conduct of the businesses it oversees.

Table 34 – BIC: FY22-FY23 Registrations by Contract Category

| FY22 | FY23 | |||

|---|---|---|---|---|

| Contract Category | # of Contracts | Total Contract Value | # of Contracts | Total Contract Value |

| Limited or Non-Competitive Method Contracts | 5 | $123,168 | 2 | $113,129 |

| Grand Total | 5 | $123,168 | 2 | $113,129 |

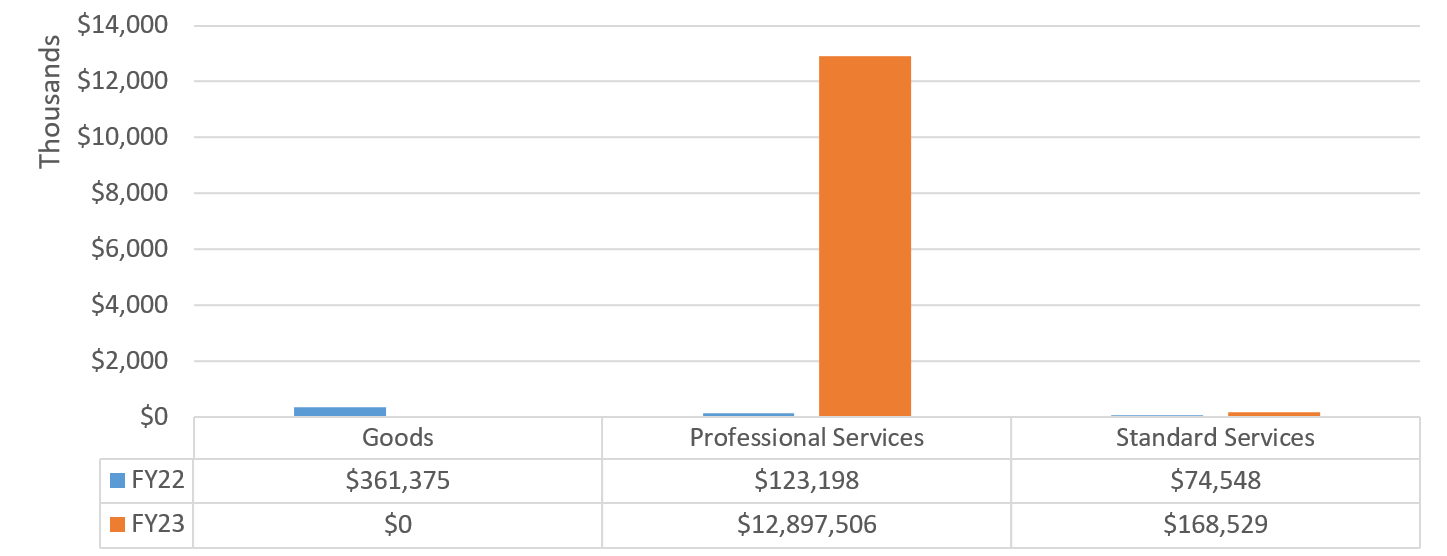

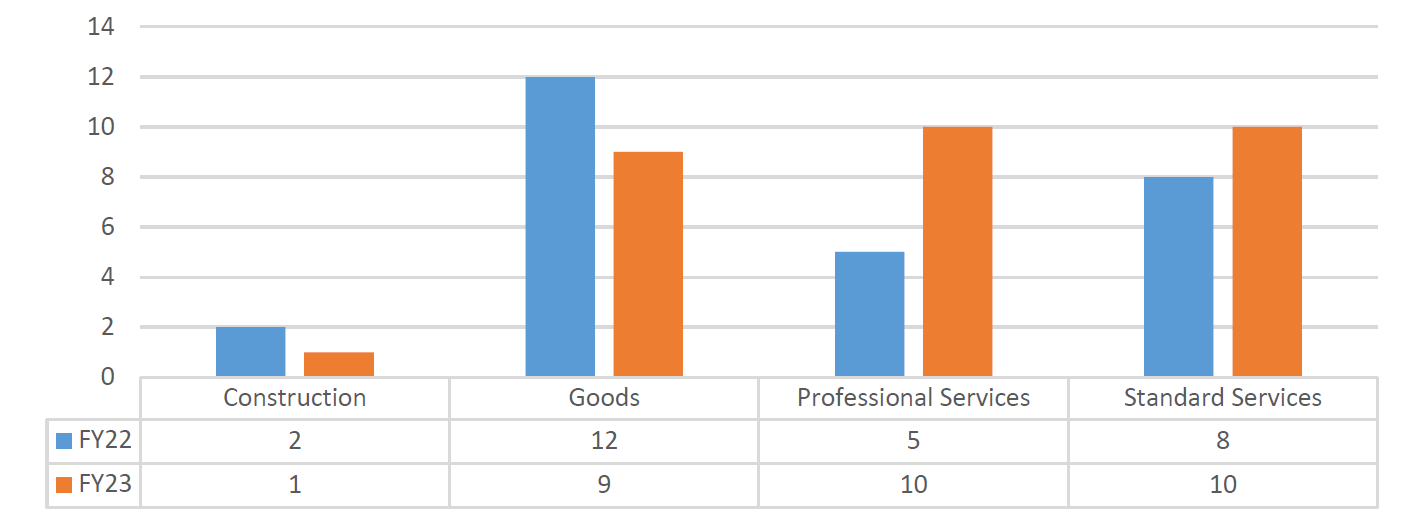

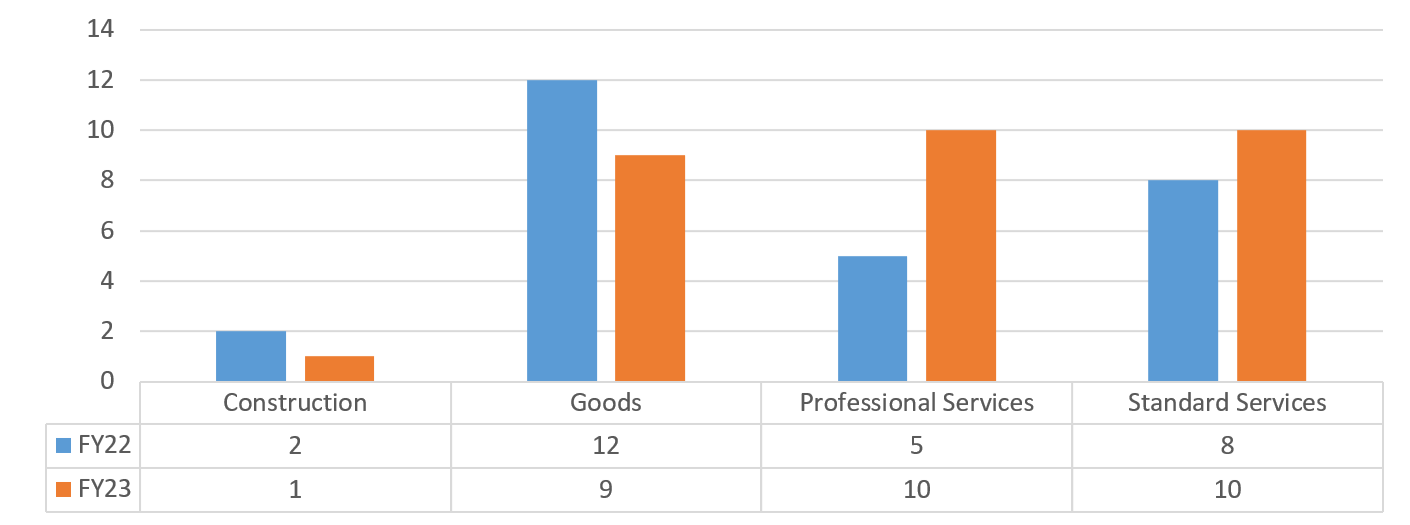

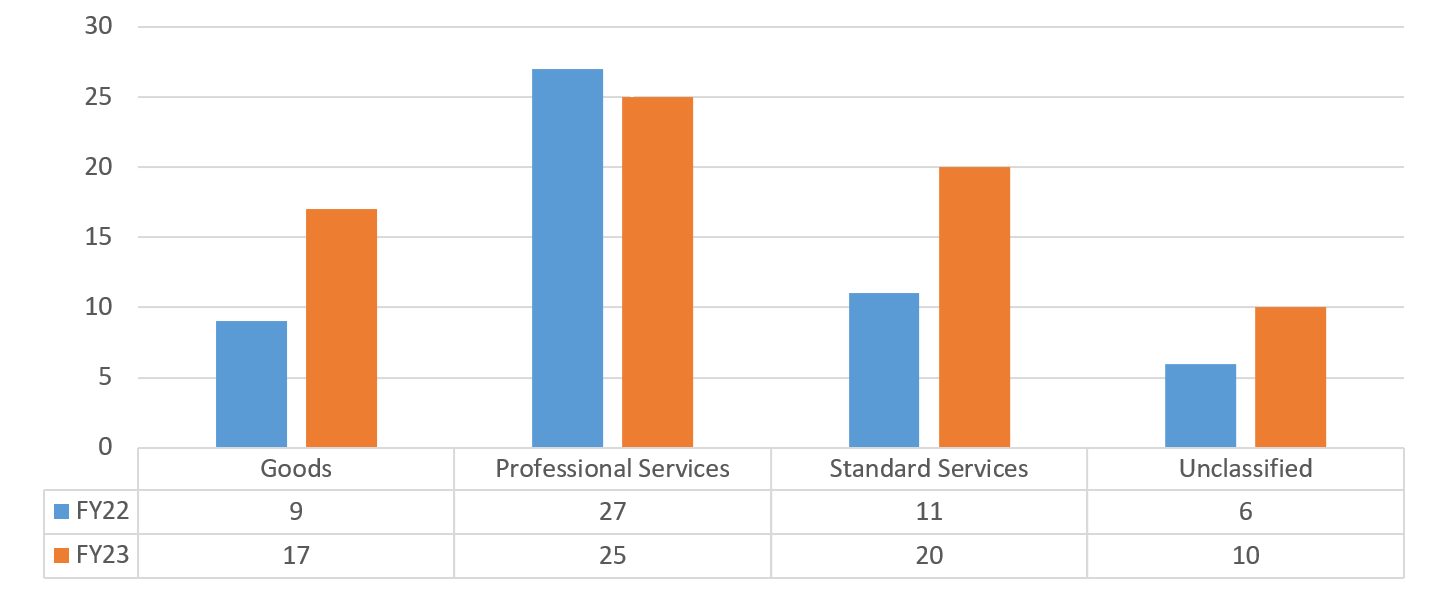

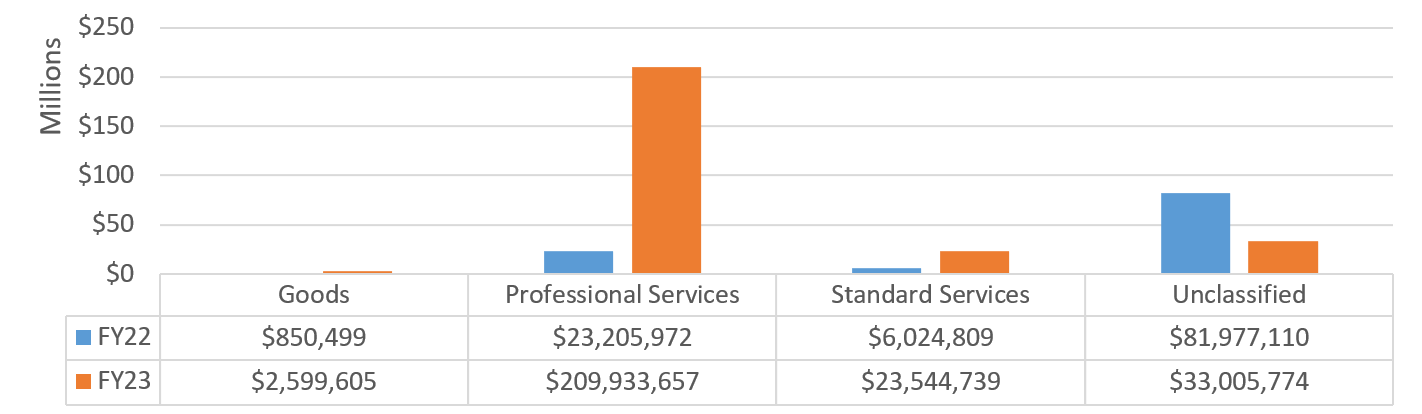

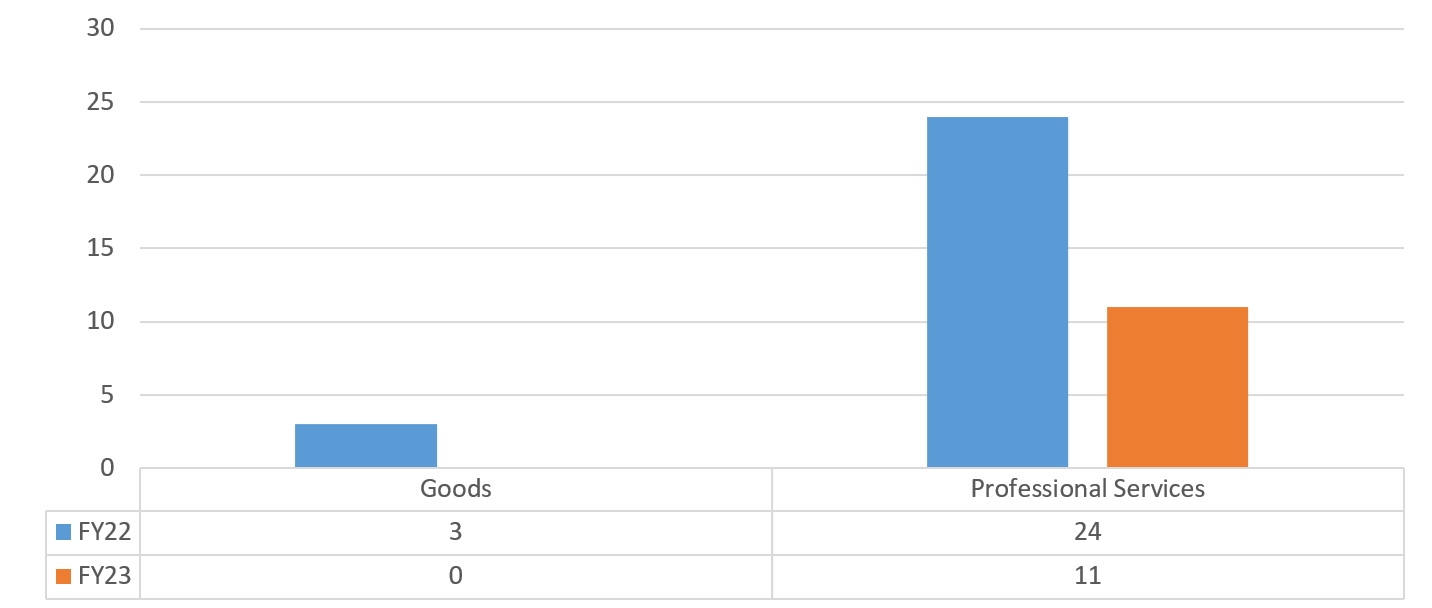

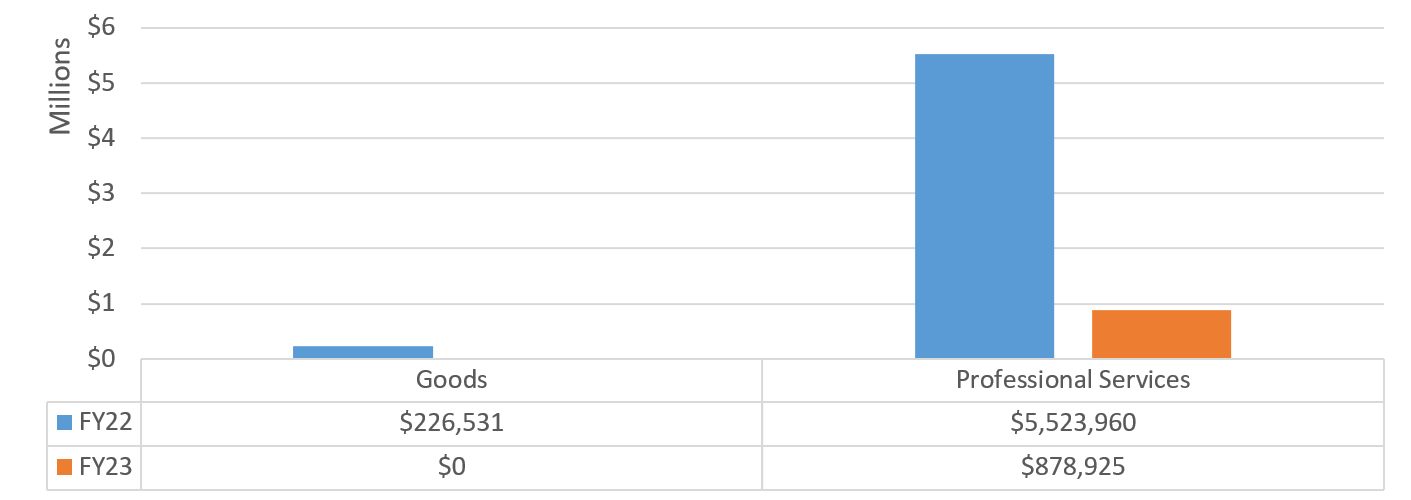

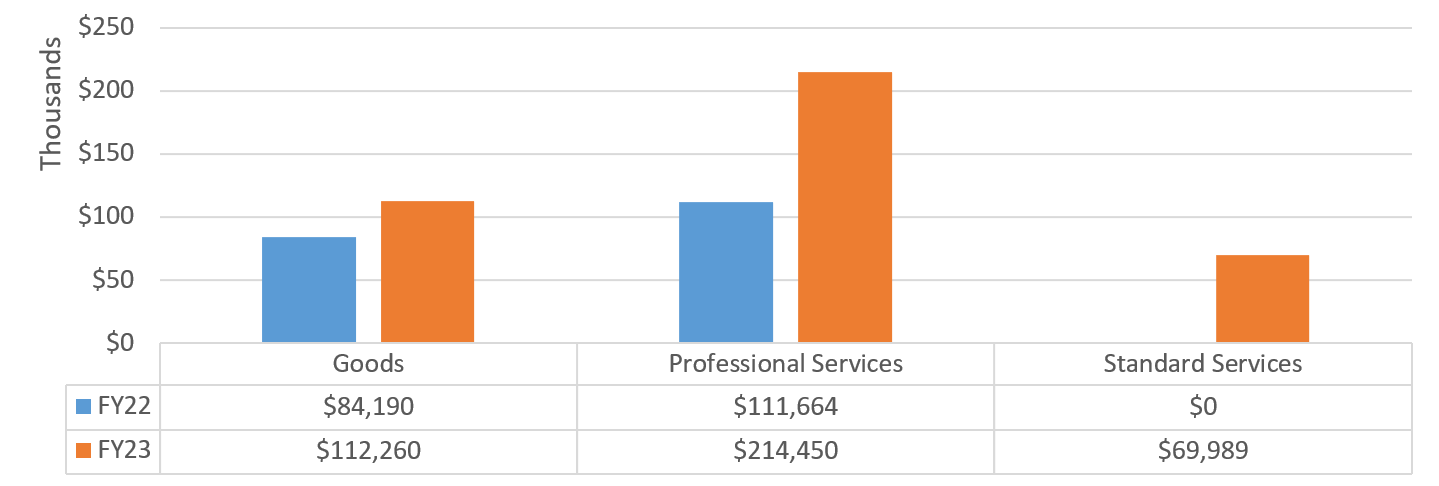

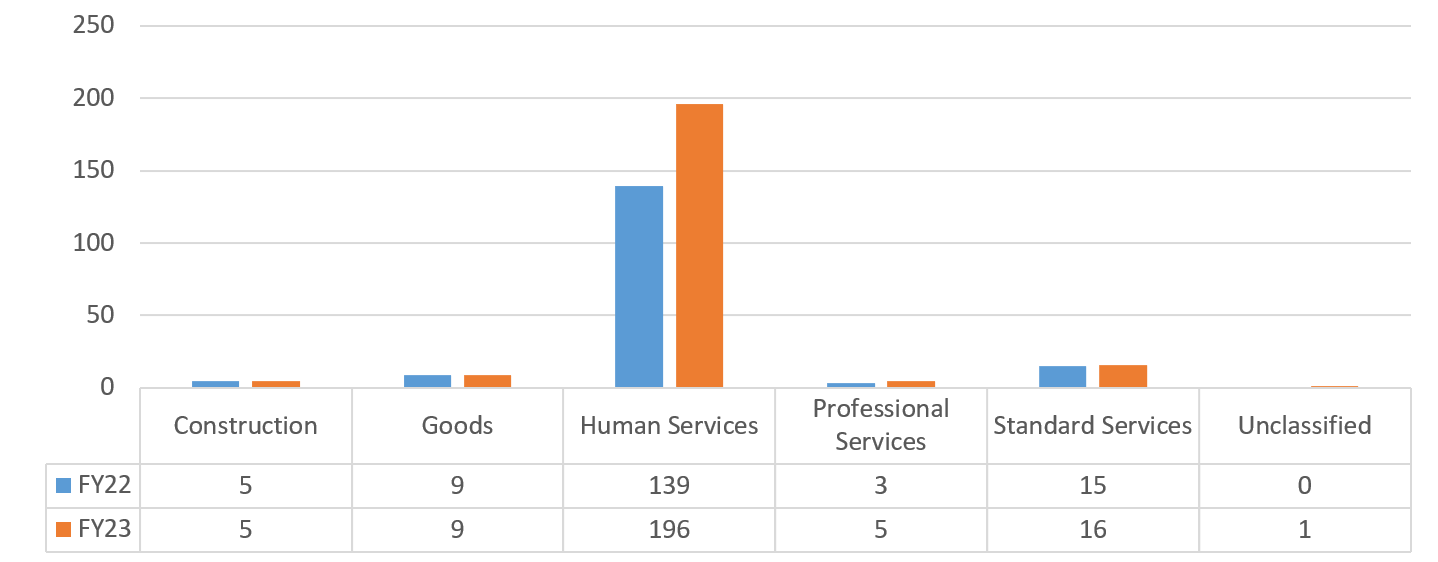

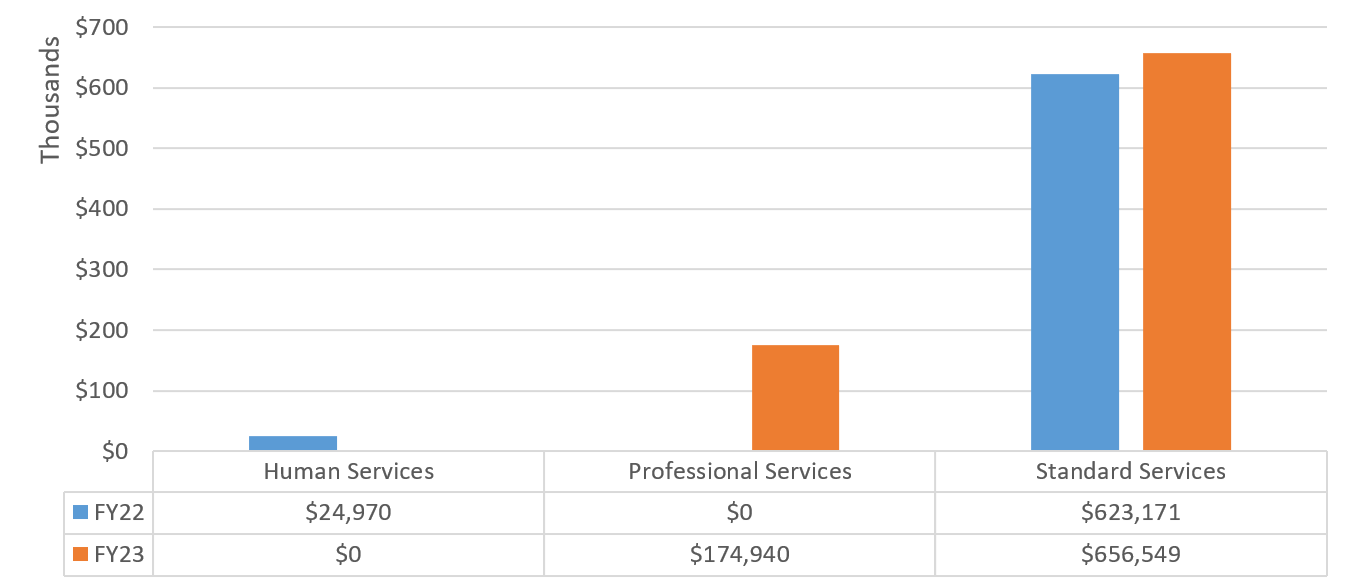

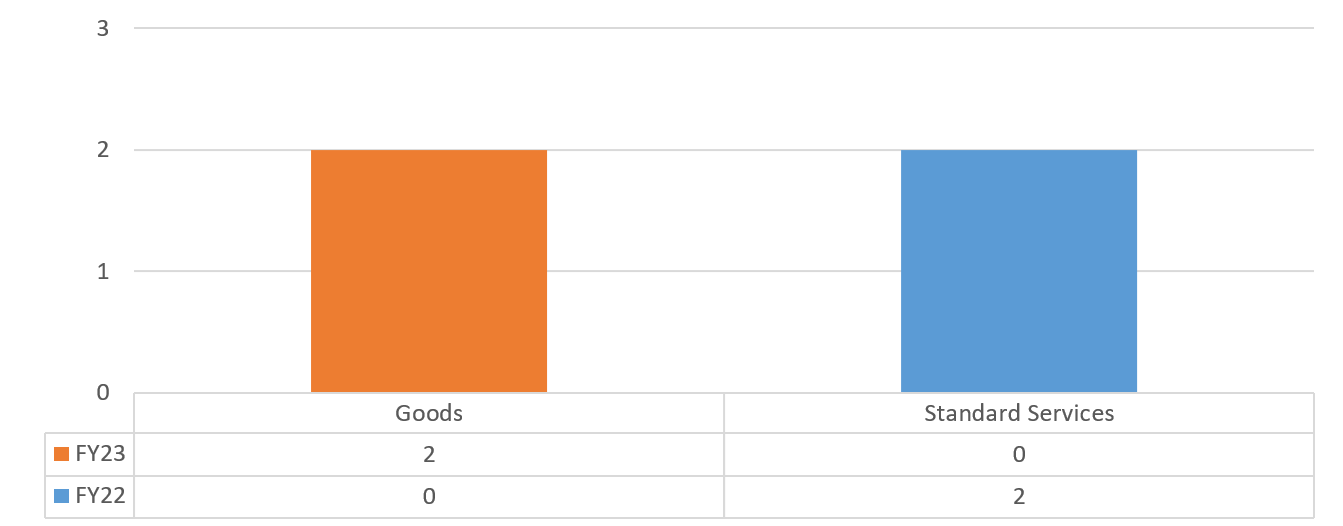

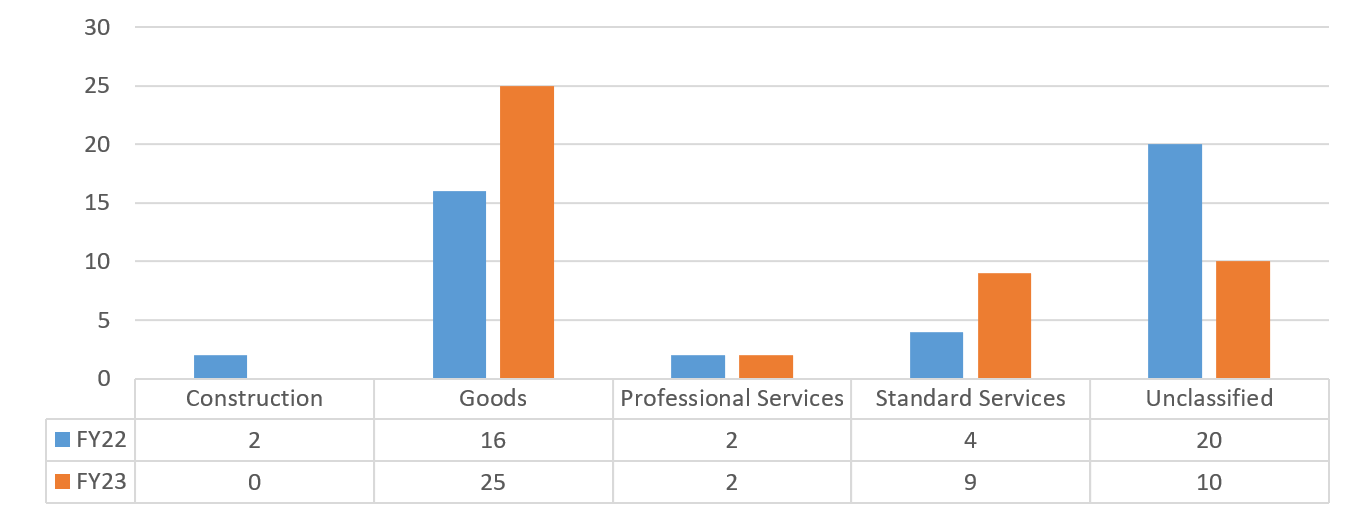

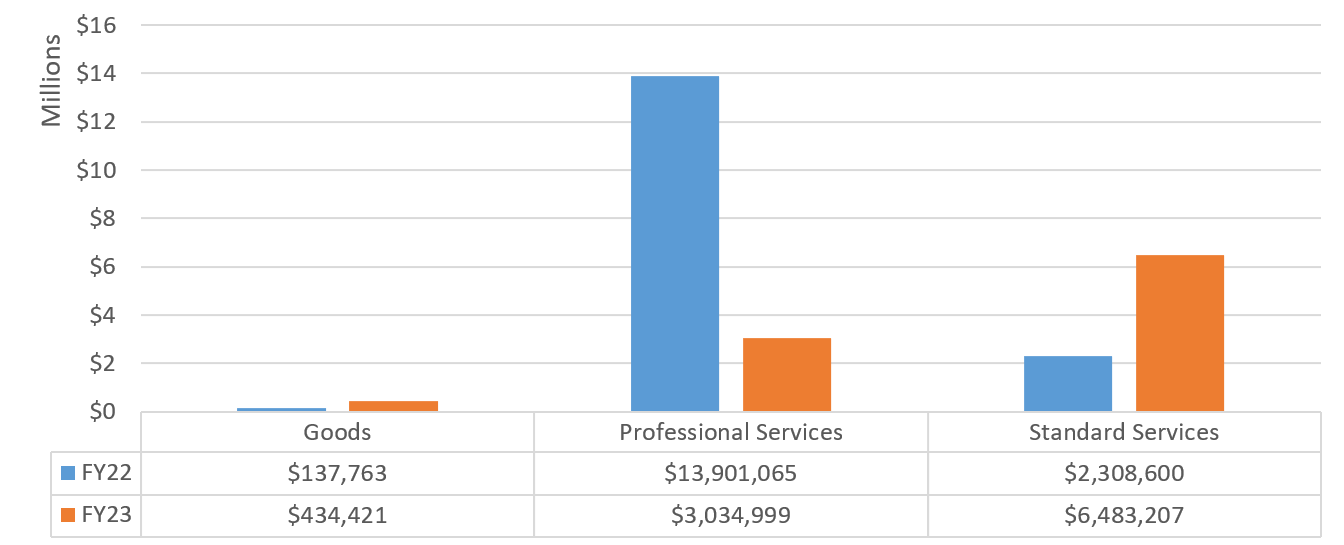

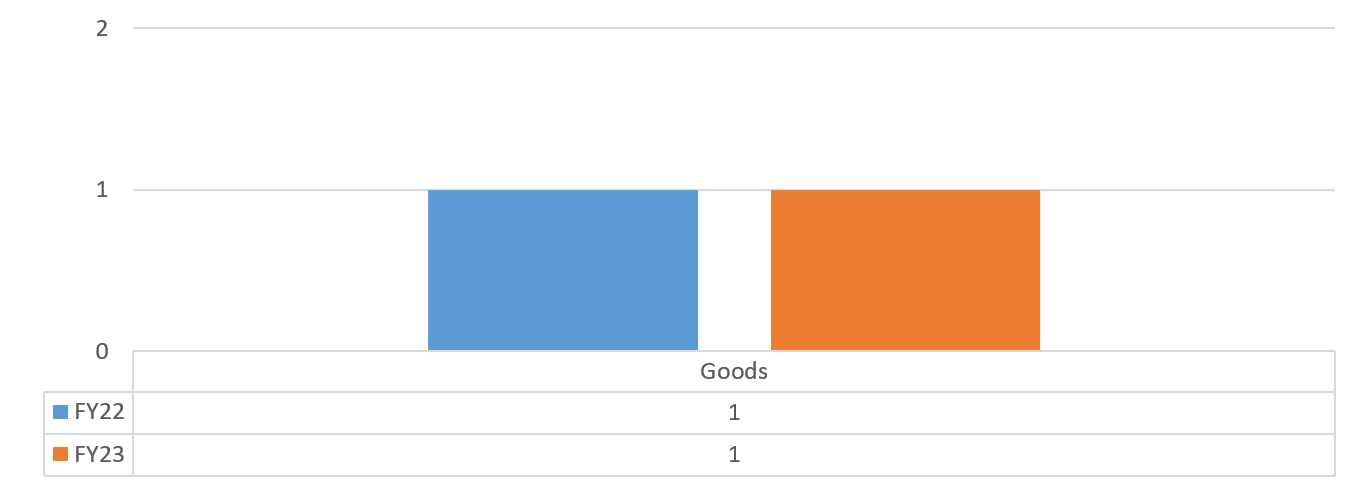

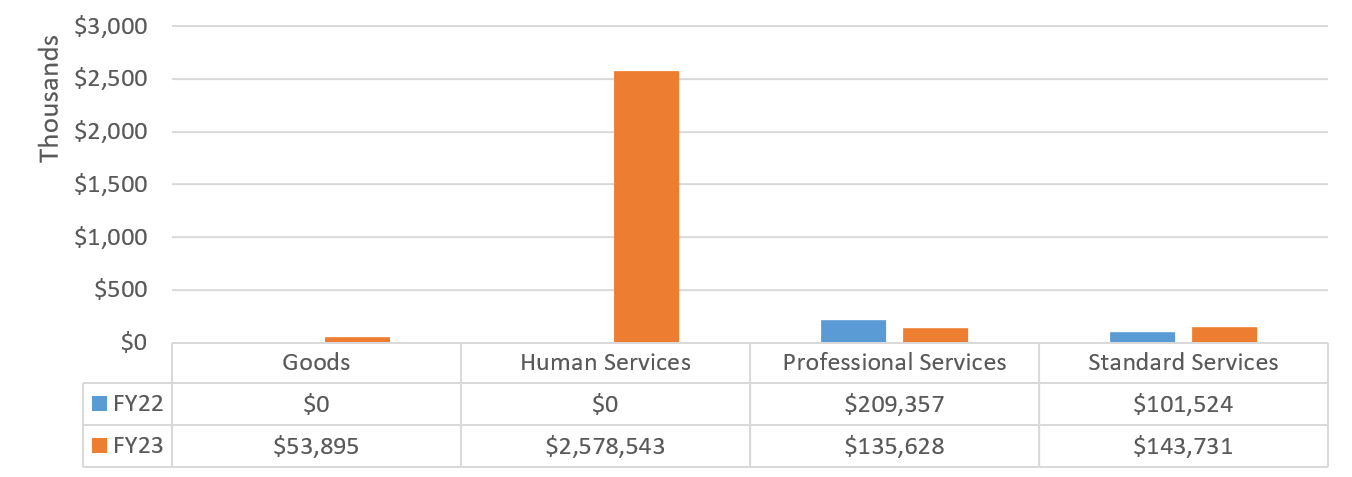

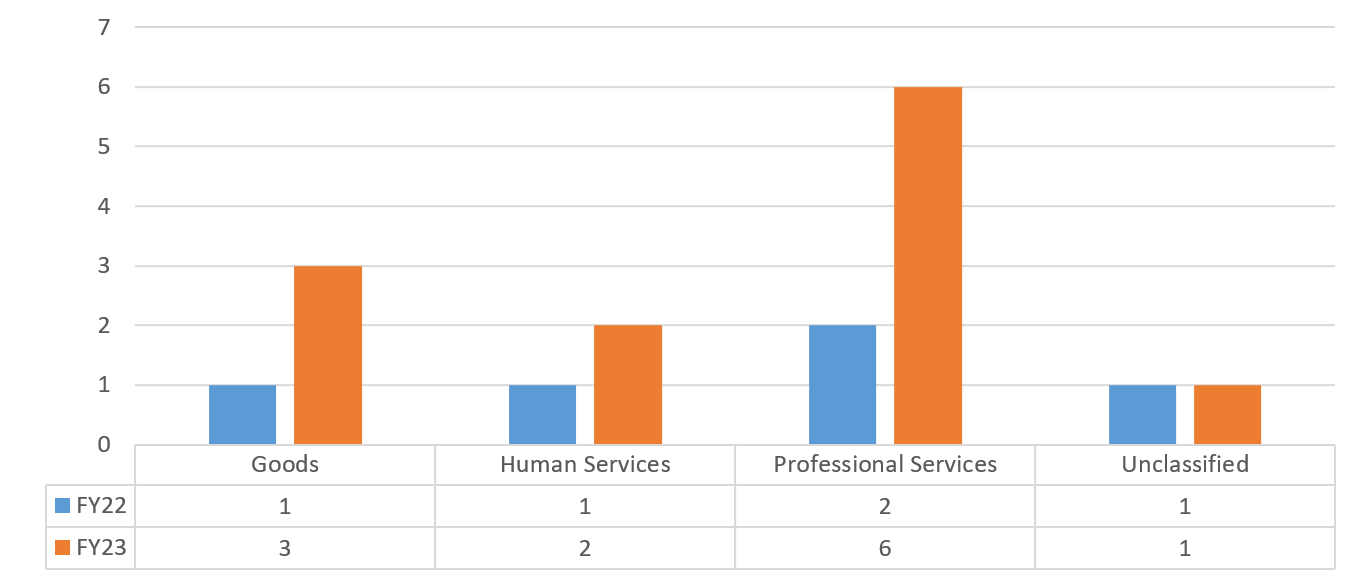

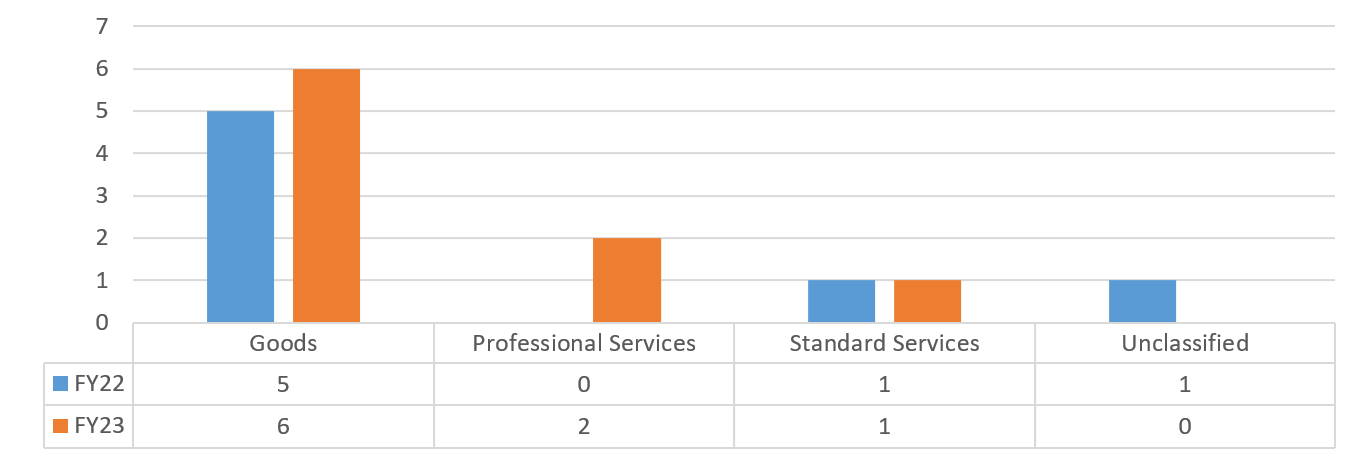

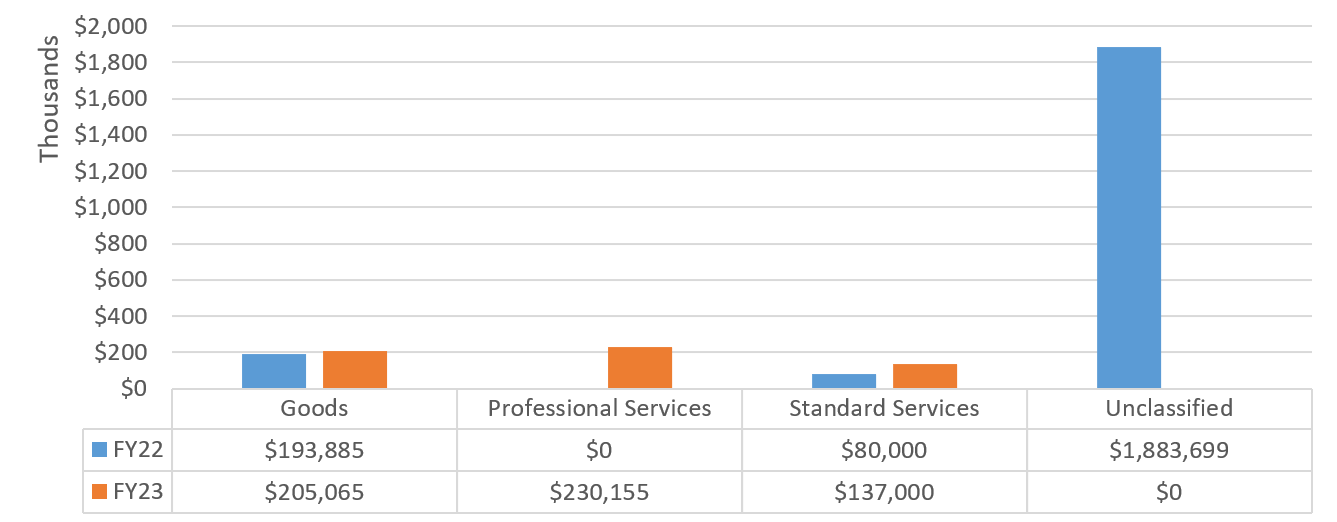

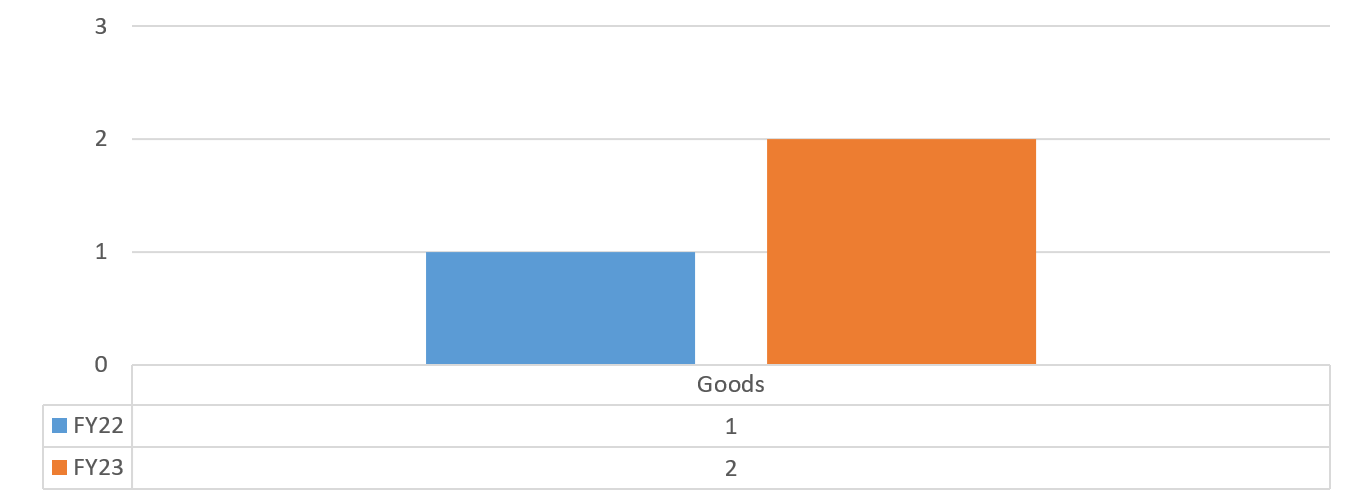

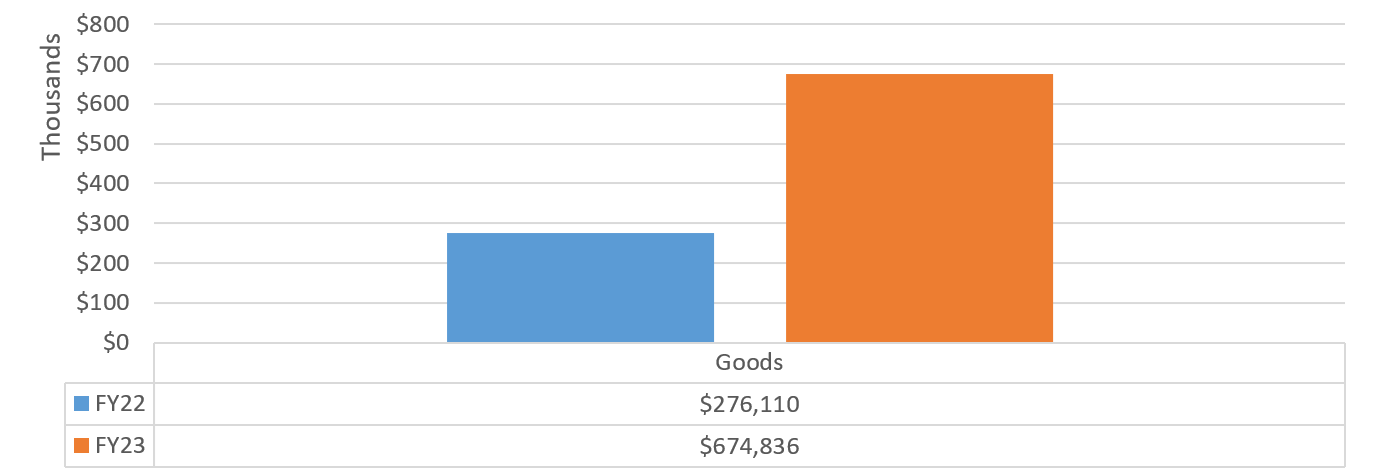

Chart 18 – BIC: FY22-FY23 Volume of Contracts by Industry

Chart 19 – BIC: FY22-FY23 Value of Contracts by Industry

Commission on Human rights (CCHR)

The City Commission on Human Rights (CCHR) is responsible for enforcing the City’s Human Rights Law, which prohibits discrimination in employment, housing, and public accommodations among other areas. CCHR is also dedicated to educating the public about their rights and promoting positive community relations.

Table 35 – CCHR: FY22-FY23 Registrations by Contract Category

| FY22 | FY23 | |||

|---|---|---|---|---|

| Contract Category | # of Contracts | Total Contract Value | # of Contracts | Total Contract Value |

| Limited or Non-Competitive Method Contracts | 5 | $270,000 | 3 | $223,848 |

| Transactions Not Subject to PPB Rules | 0 | $0 | 1 | $25,755 |

| Supplemental Contracts | 0 | $0 | 1 | $1,568,138 |

| Grand Total | 5 | $270,000 | 5 | $1,817,741 |

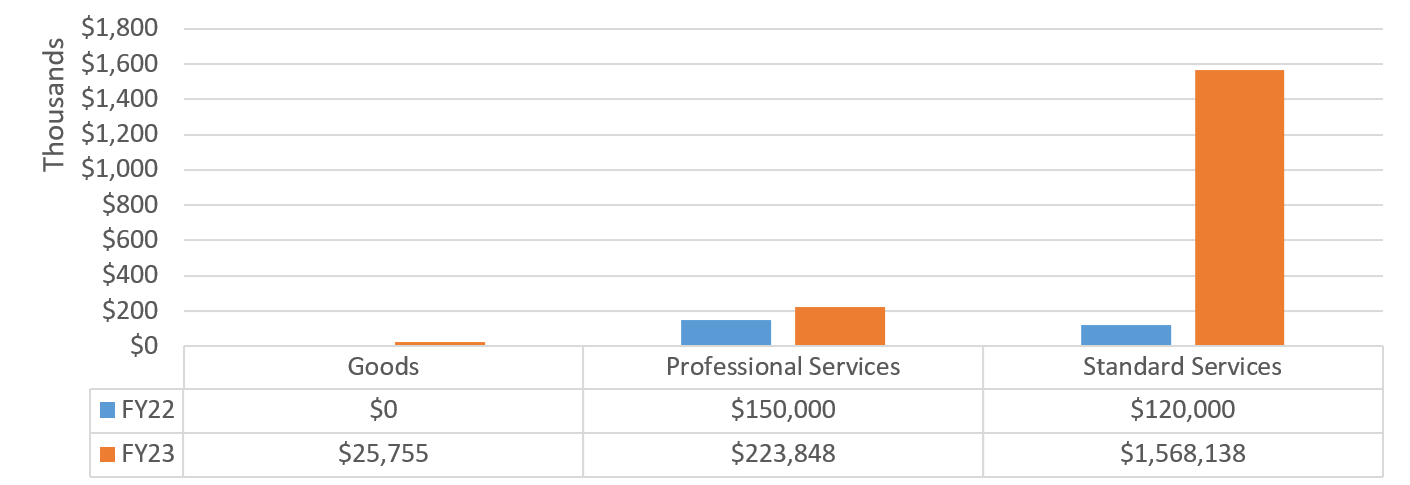

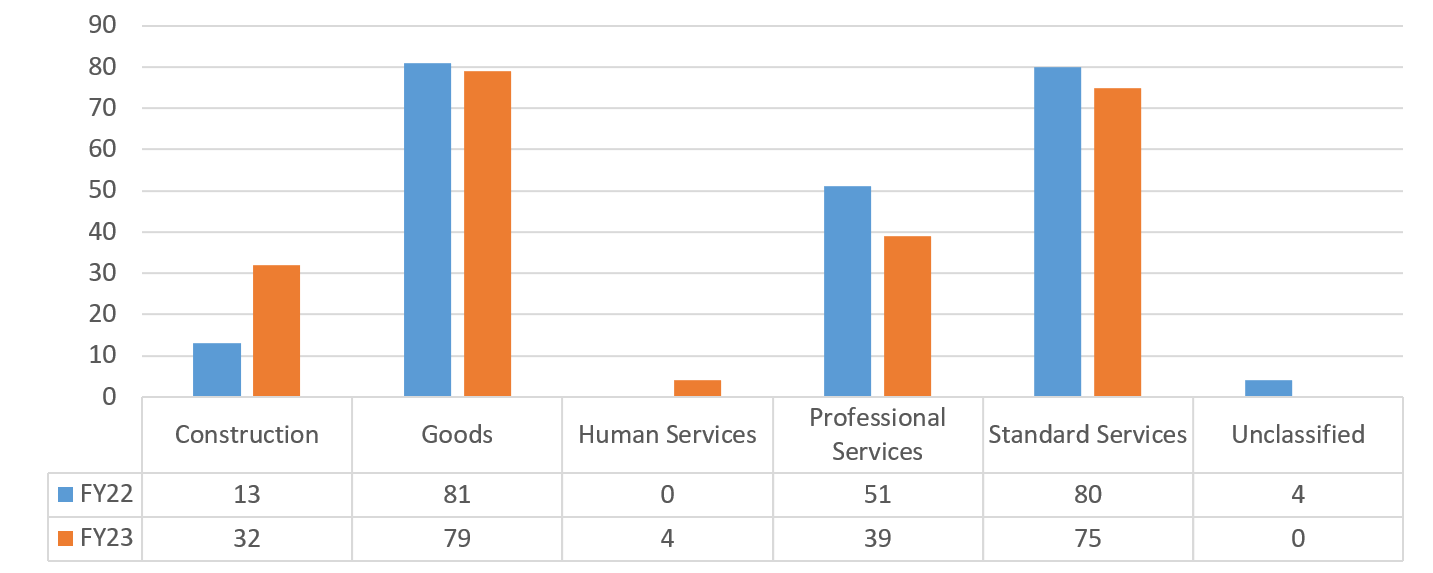

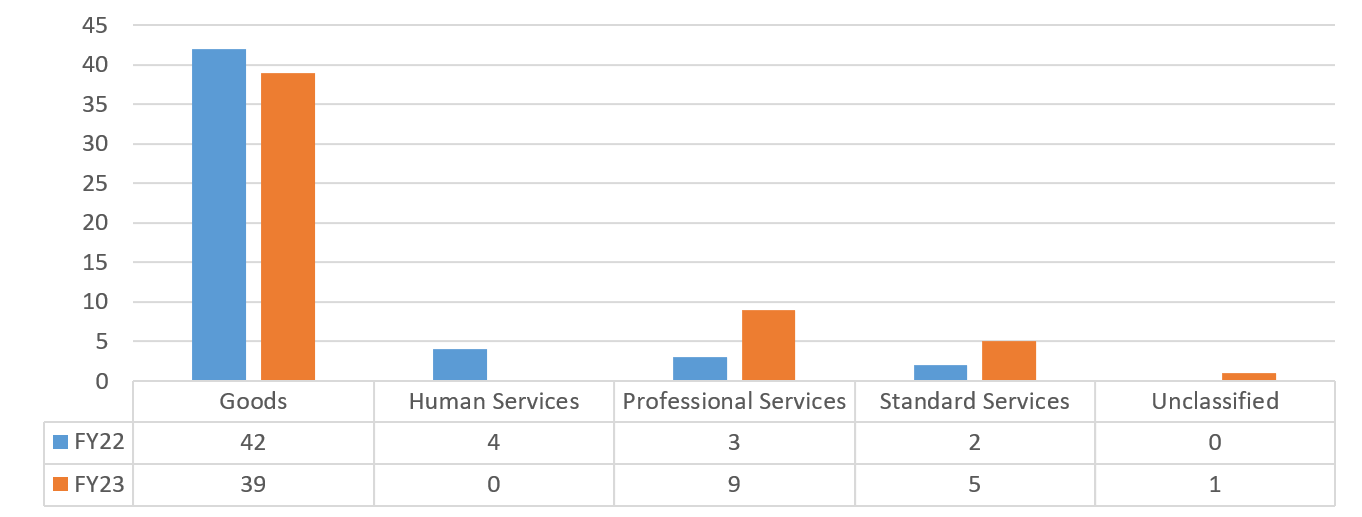

Chart 20 – CCHR: FY22-FY23 Value of Contracts by Industry

Chart 21 – CCHR: FY22-FY23 Volume of Contracts by Industry

Civilian Complaint Review Board (CCRB)

The Civilian Complaint Review Board (CCRB) is charged with investigating and mediating complaints filed by members of the public against New York City police officers involving the use of force, abuse of authority, discourtesy, or offensive language. CCRB consists of 13 members appointed by the Mayor, the City Council, and the Police Commissioner. It is the largest police oversight agency in the United States.

Table 36 – CCRB: FY22-23 Registrations by Contract Category

| FY22 | FY23 | |||

|---|---|---|---|---|

| Contract Category | # of Contracts | Total Contract Value | # of Contracts | Total Contract Value |

| Limited or Non-Competitive Method Contracts | 21 | $493,705 | 14 | $498,620 |

| Transactions Not Subject to PPB Rules | 1 | $87,500 | 0 | $0 |

| Grand Total | 22 | $581,205 | 14 | $498,620 |

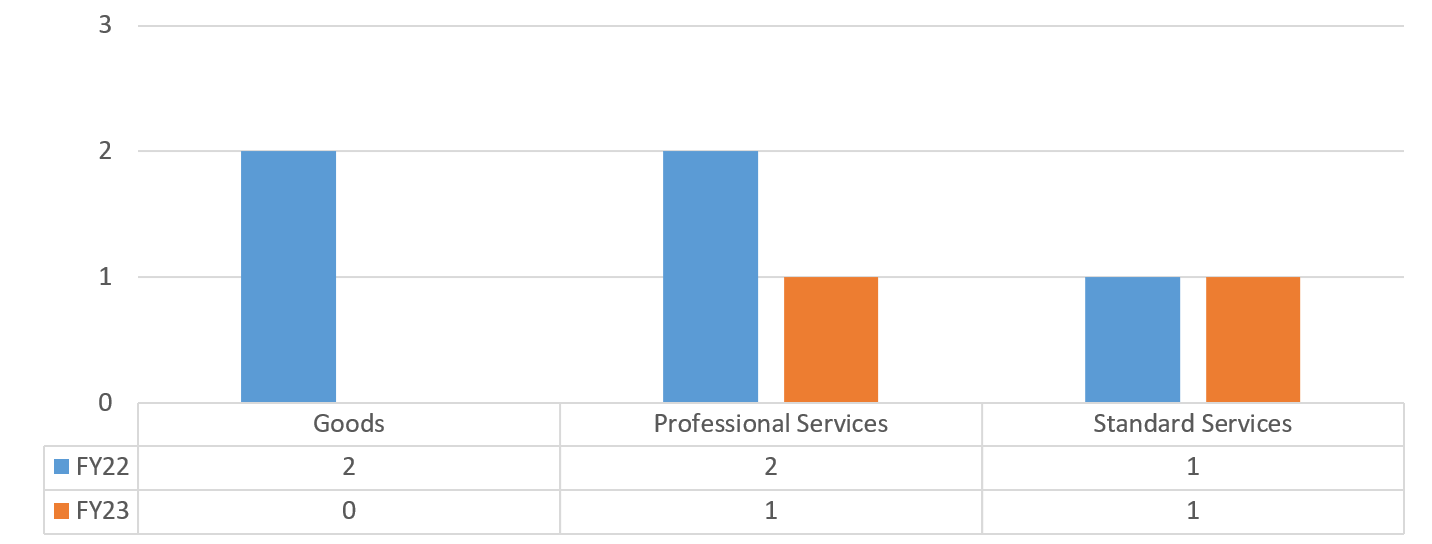

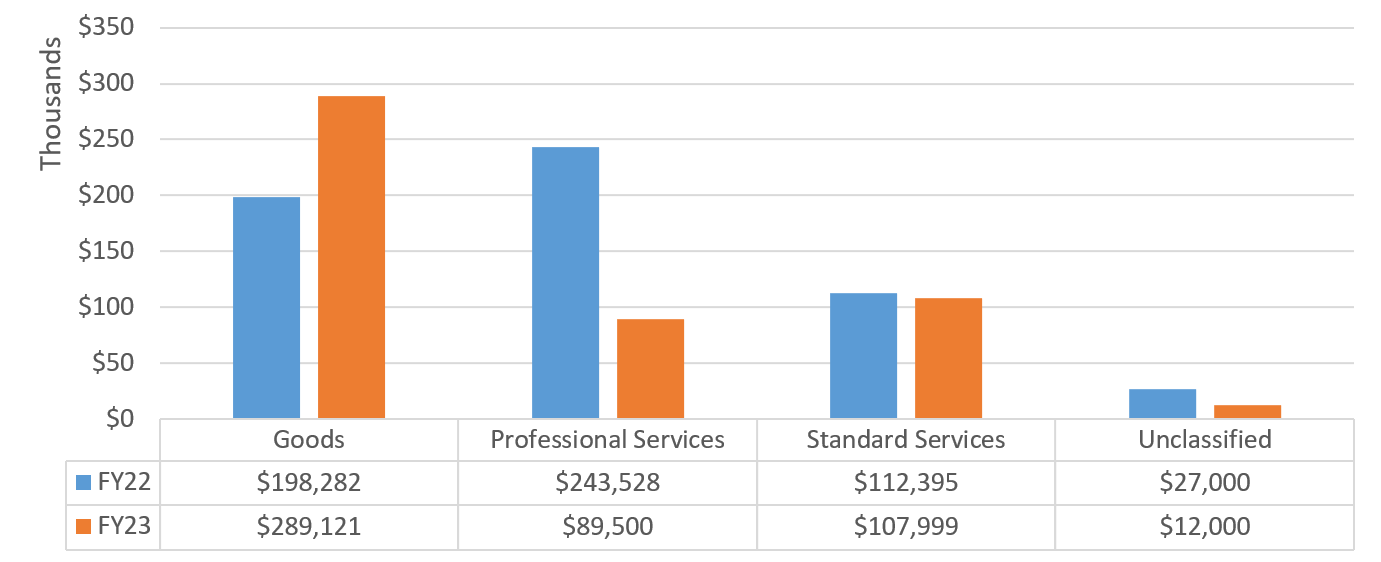

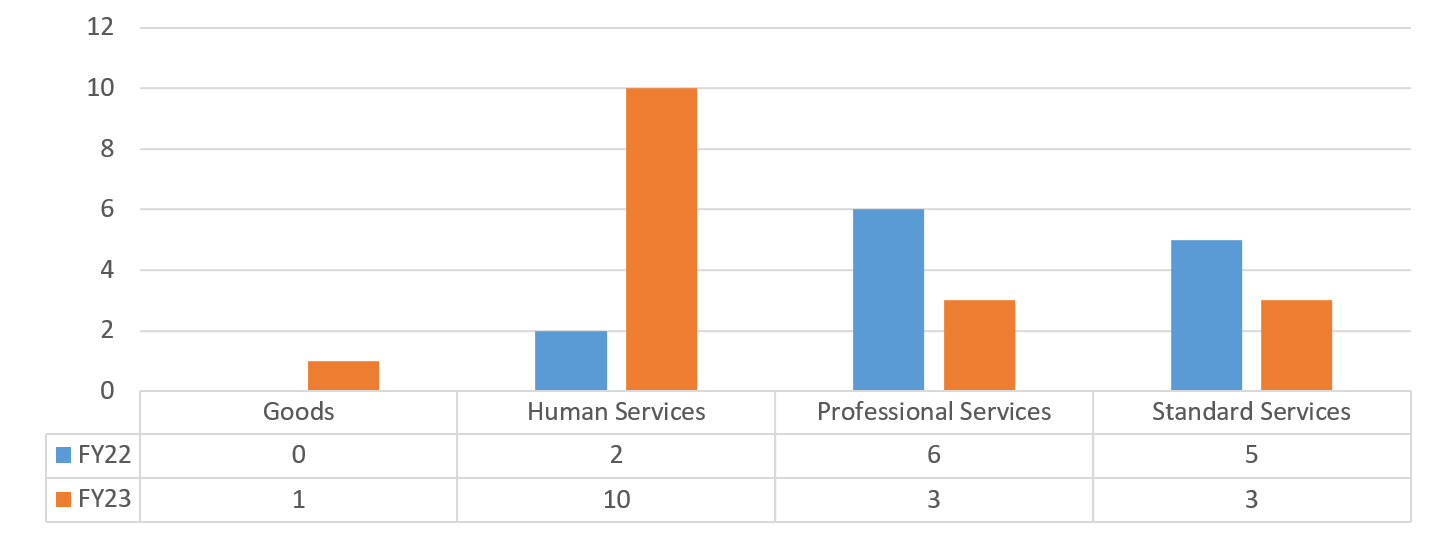

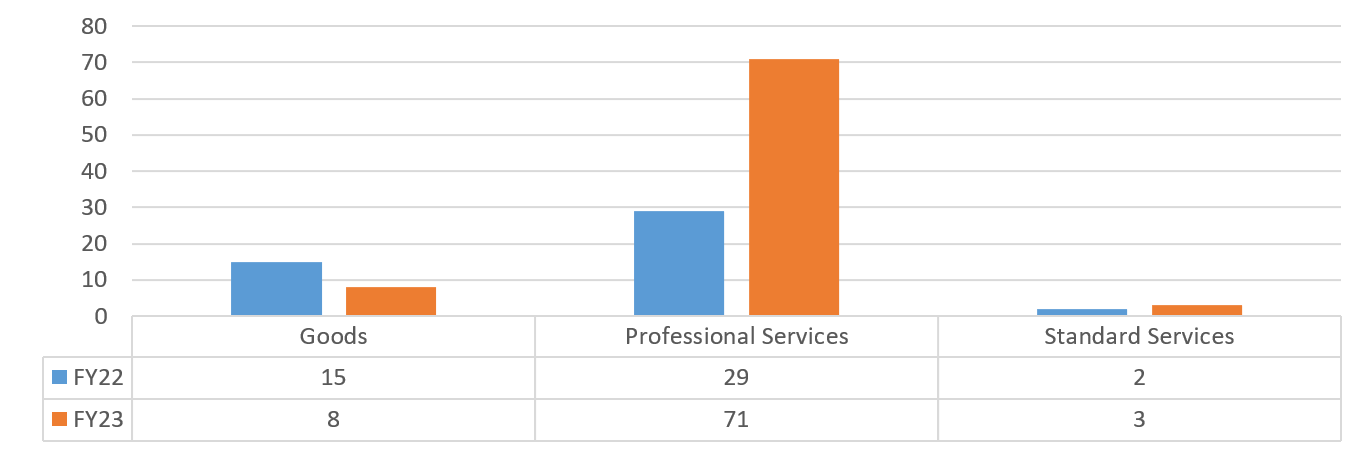

Chart 22 – CCRB: FY22-FY23 Volume of Contracts by Industry

Chart 23 – CCRB: FY22-FY23 Value of Contracts by Industry

Department of Citywide Administrative Services (DCAS)

The Department of Citywide Administrative Services (DCAS) is responsible for supporting City agencies in hiring and training City employees, leasing and managing facilities, workforce recruitment, inspection and distribution of supplies and equipment, and implementation of energy conservation programs throughout City-owned facilities. Additionally, the DCAS Division of Municipal Supply Service operates as a centralized procurement office for New York City’s agencies for goods and services. Its mission is to provide high-quality, cost-effective goods and services that support the long-term strategic and environmental goals of the City.

Table 37 – DCAS: FY22-FY23 Registrations by Contract Category

| FY22 | FY23 | |||

|---|---|---|---|---|

| Contract Category | # of Contracts | Total Contract Value | # of Contracts | Total Contract Value |

| Competitive Method Contracts | 220 | $1,203,843,582 | 179 | $1,188,084,468 |

| Limited or Non-Competitive Method Contracts | 186 | $6,252,381,303 | 183 | $618,503,809 |

| Transactions Not Subject to PPB Rules | 55 | $273,795,150 | 196 | $374,518,687 |

| Supplemental Contracts | 50 | $211,849,789 | 63 | $302,801,091 |

| Grand Total | 511 | $7,941,869,824 | 621 | $2,483,908,056 |

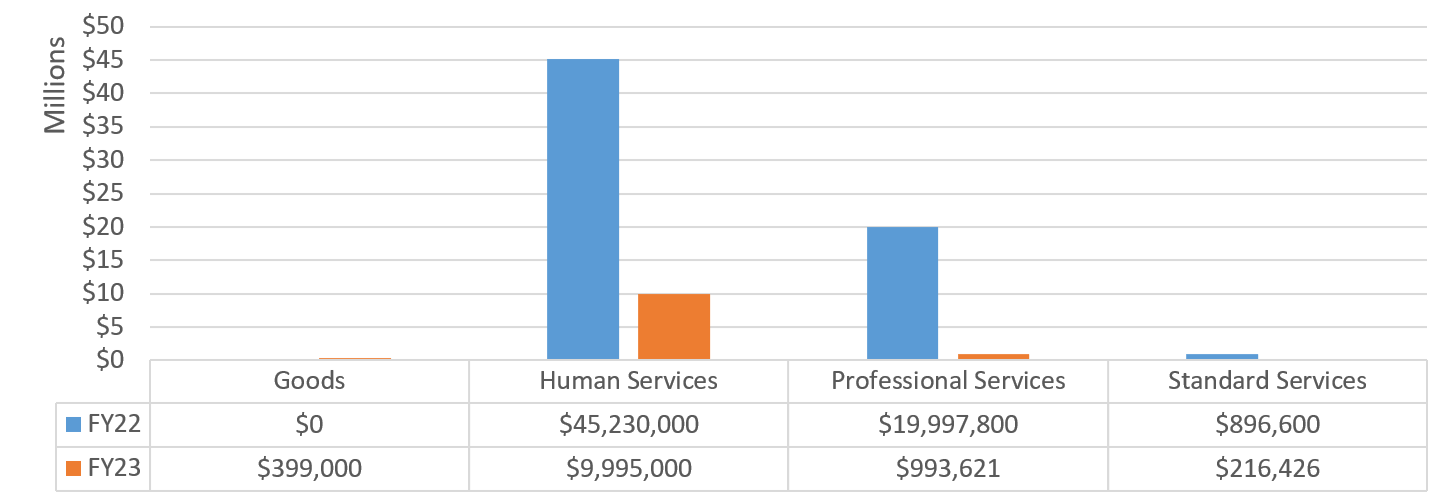

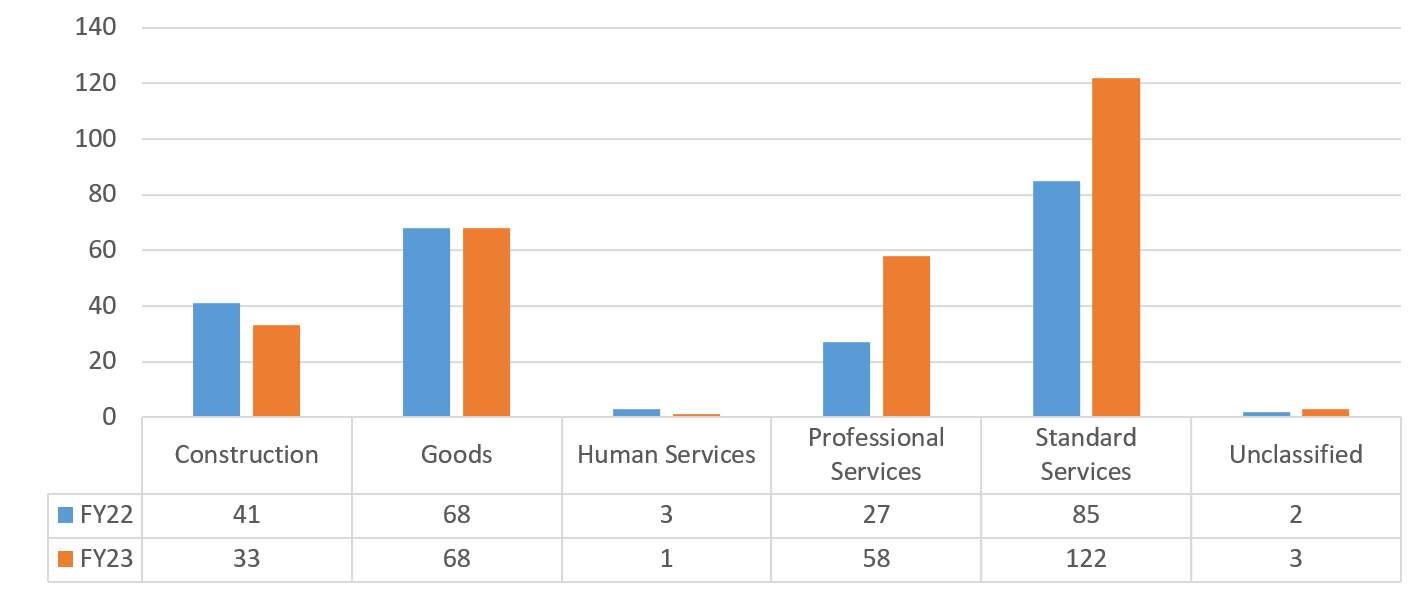

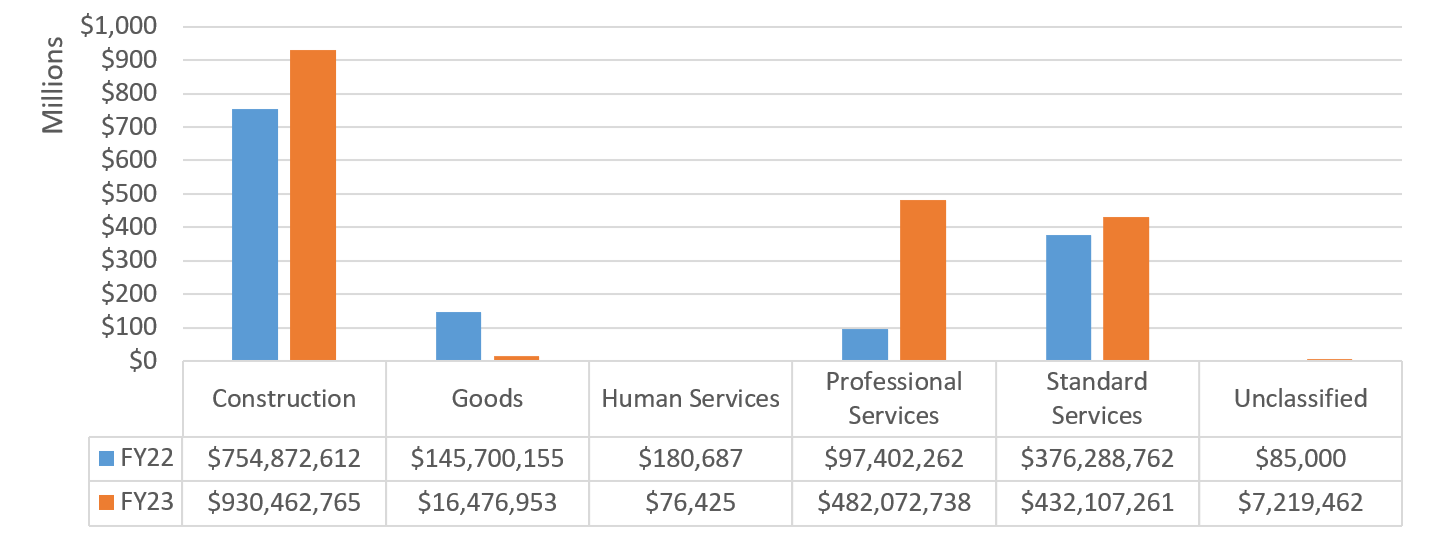

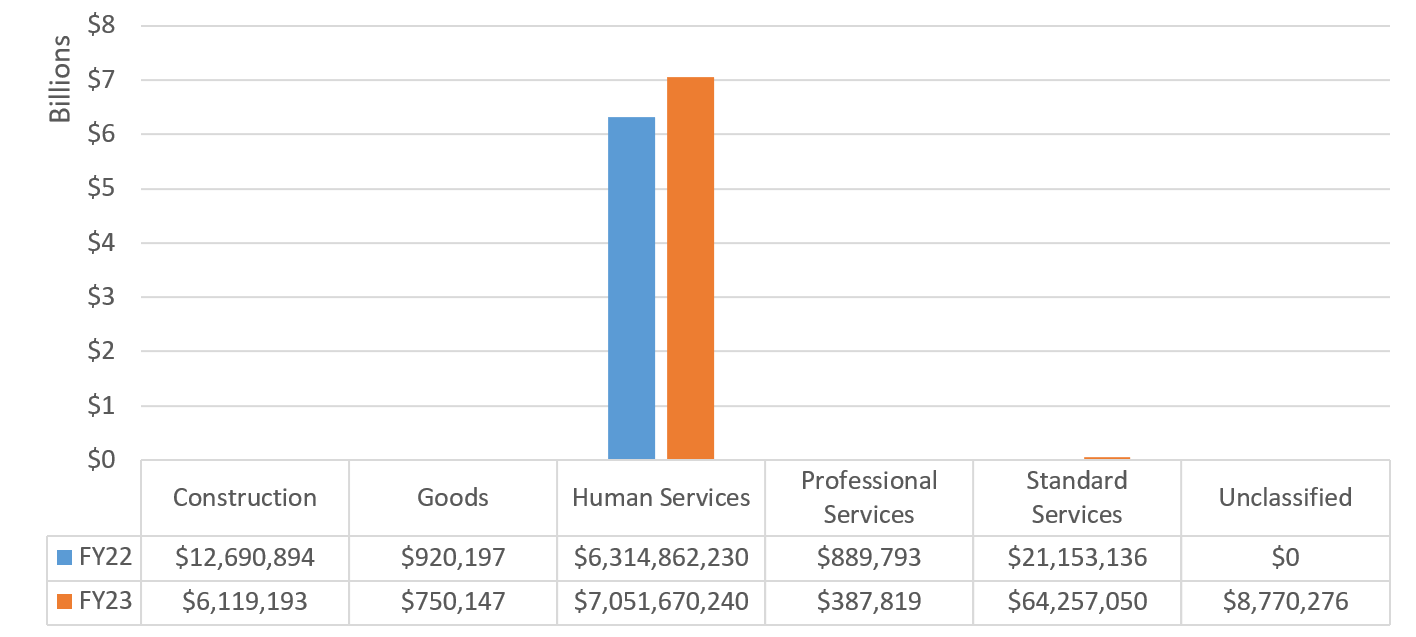

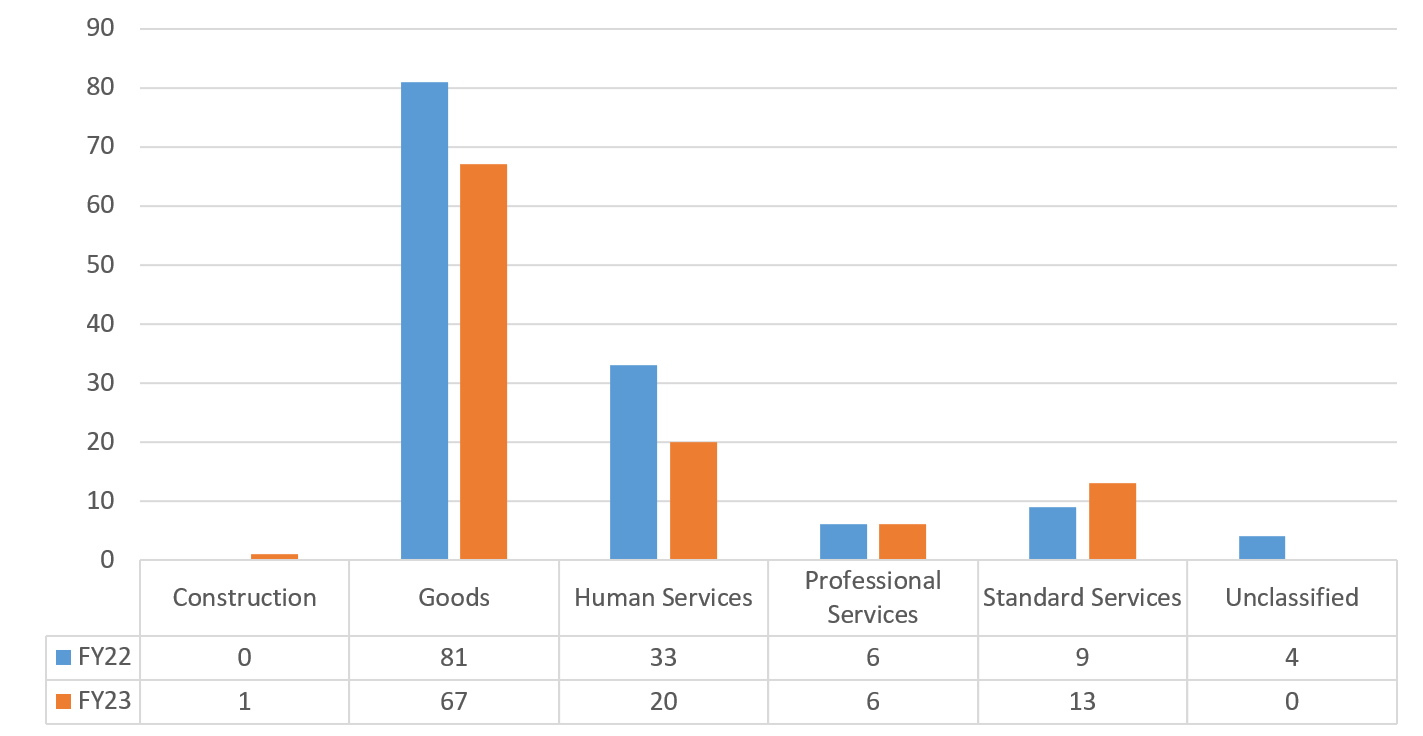

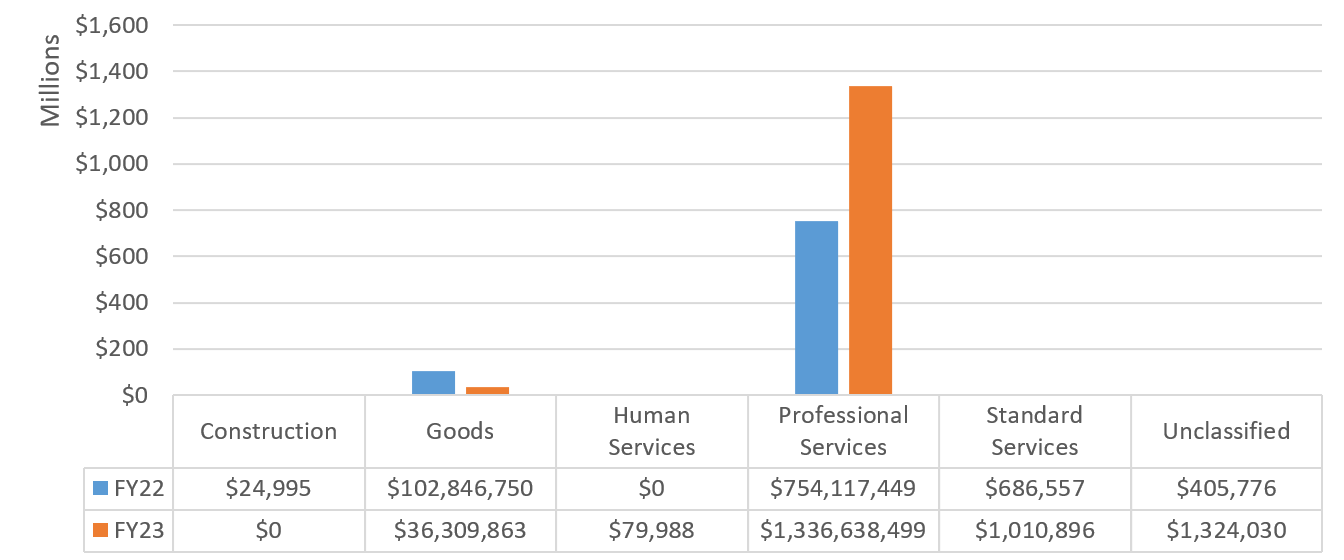

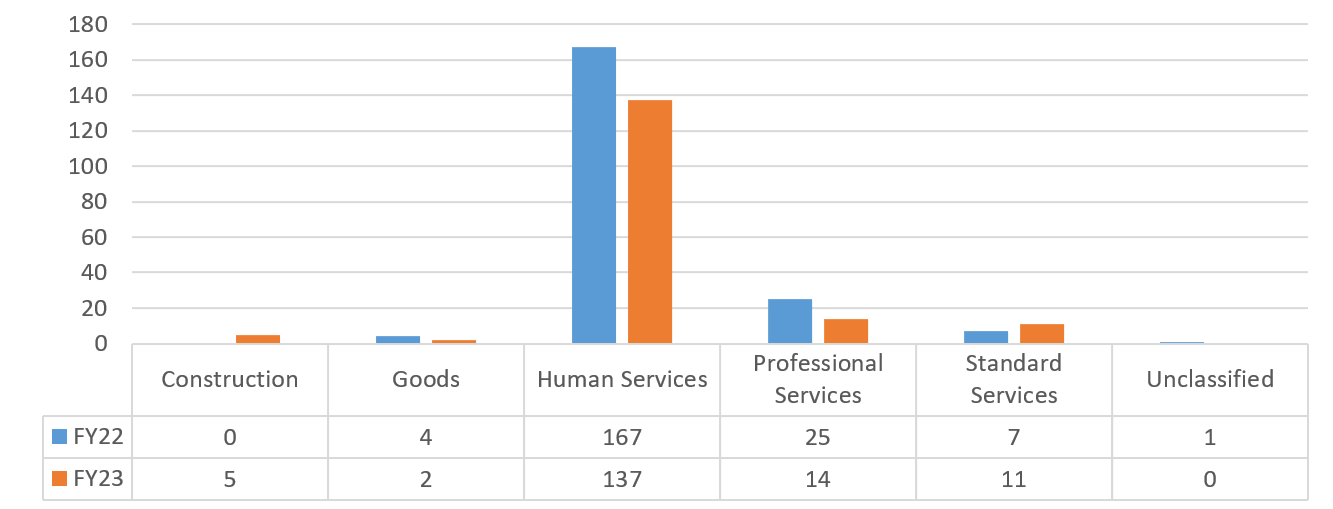

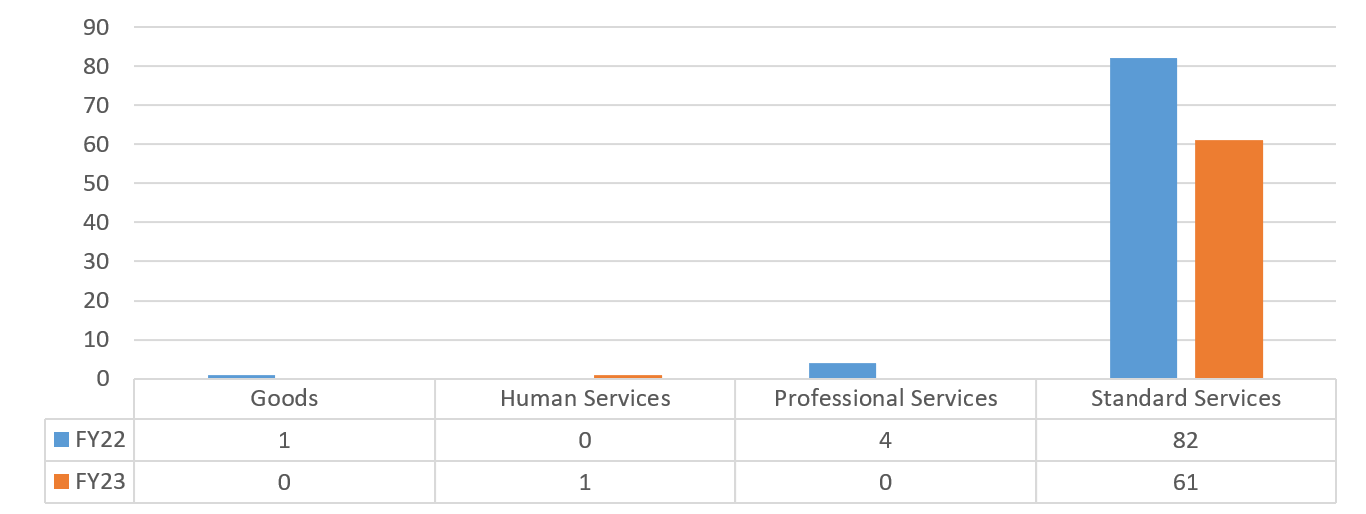

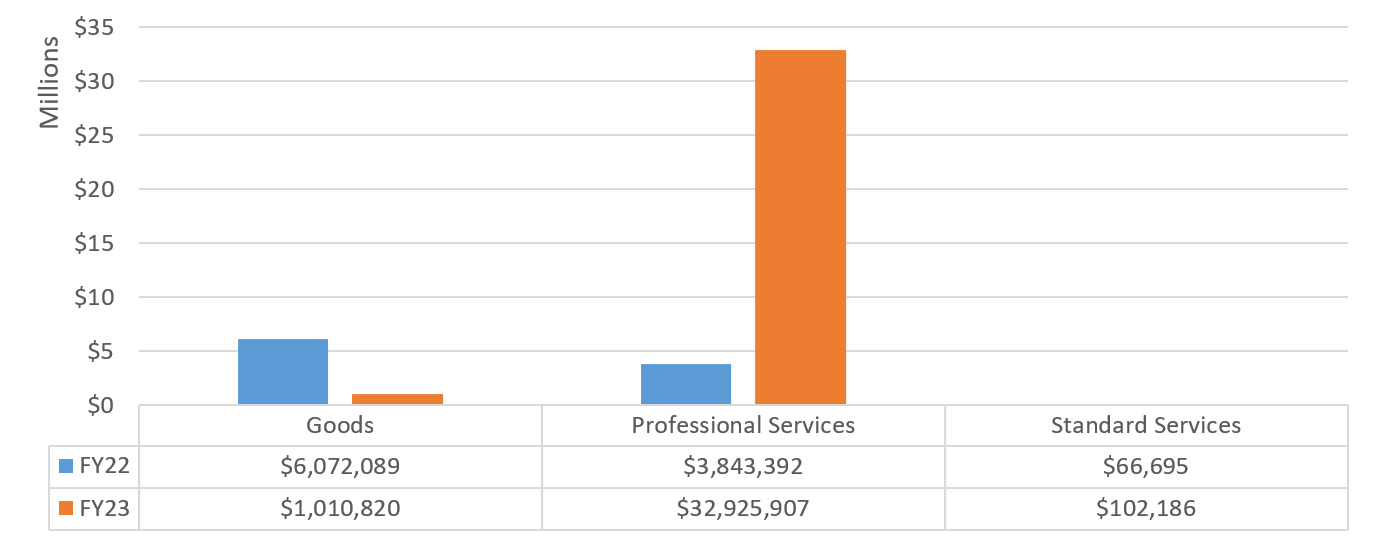

Chart 24 – DCAS: FY22-FY23 Volume of Contracts by Industry

Chart 25 – DCAS: FY22-FY23 Value of Contracts by Industry

Department of Cultural Affairs (DCLA)

The New York City Department of Cultural Affairs is dedicated to supporting and strengthening New York City’s vibrant cultural life. DCLA provides public funding for nonprofit cultural organizations throughout the five boroughs and provides advocacy around matters relating to the City’s cultural institutions. The agency represents and serves nonprofit cultural organizations involved in the visual, literary and performing arts; public-oriented science and humanities institutions including zoos, botanical gardens and historic and preservation societies; and creative artists in all disciplines who live and work within the City’s five boroughs. DCLA also provides donated materials for arts programs offered by the public schools, cultural, social service groups, and commissions works of public art at City funded construction projects throughout the City.

Table 38 – DCLA: FY22-FY23 Registrations by Contract Category

| FY22 | FY23 | |||

|---|---|---|---|---|

| Contract Category | # of Contracts | Total Contract Value | # of Contracts | Total Contract Value |

| Limited or Non-Competitive Method Contracts | 9 | $1,632,274 | 15 | $3,989,068 |

| Transactions Not Subject to PPB Rules | 9 | $1,551,400 | 0 | $0 |

| Supplemental Contracts | 0 | $0 | 1 | $4,301,809 |

| Grand Total | 18 | $3,183,674 | 16 | $8,290,878 |

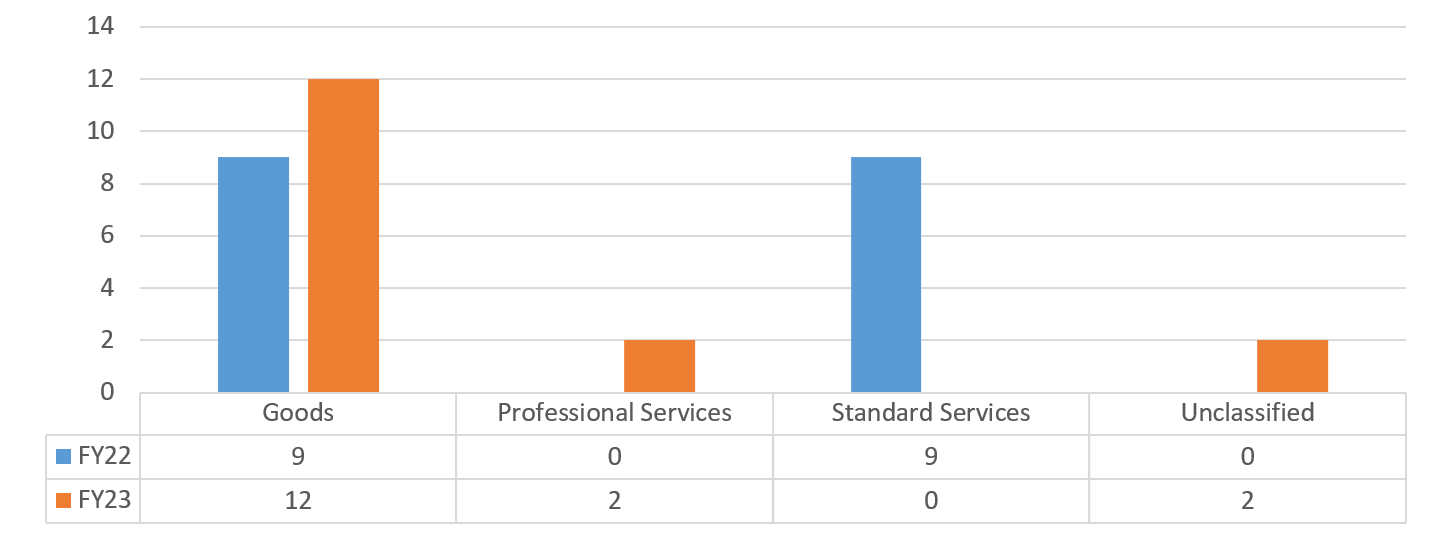

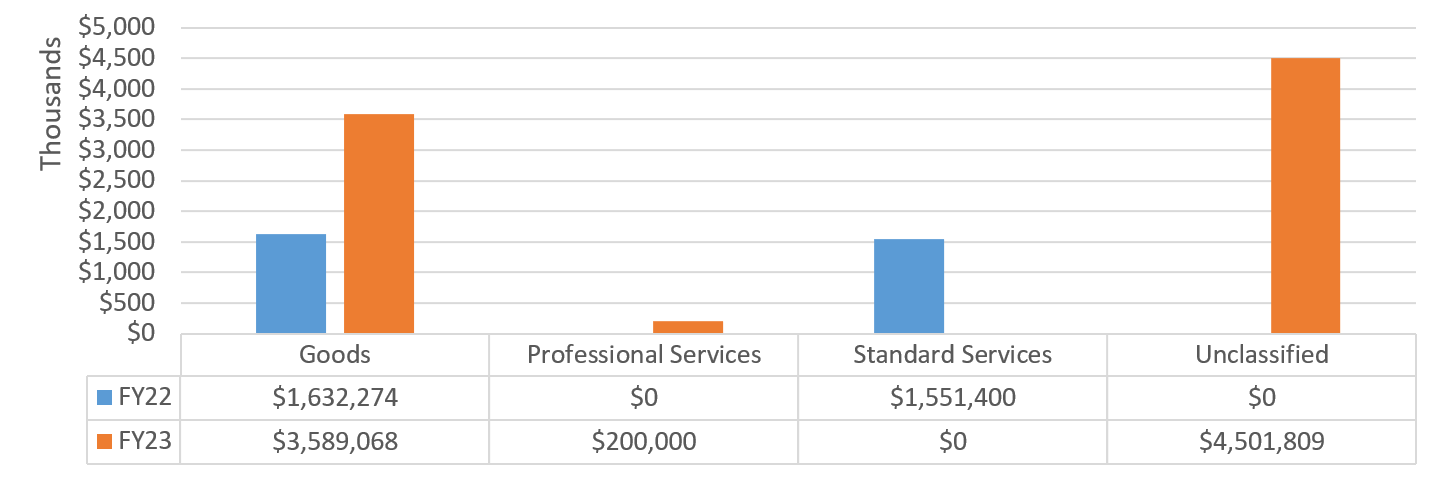

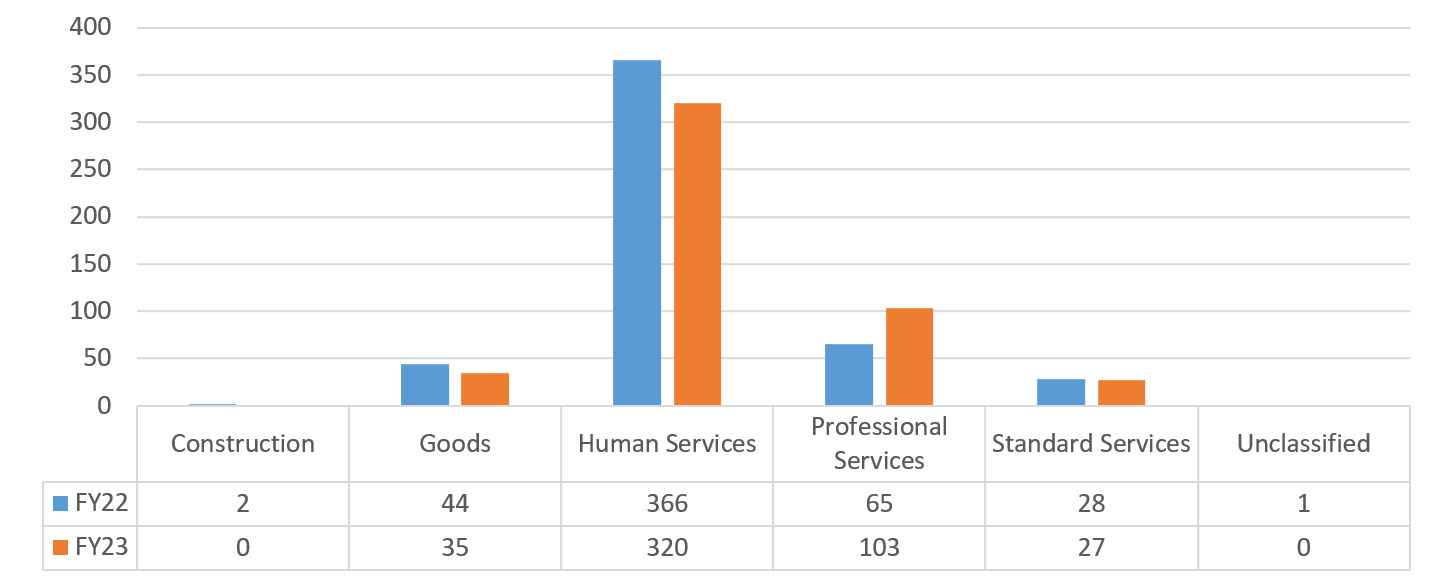

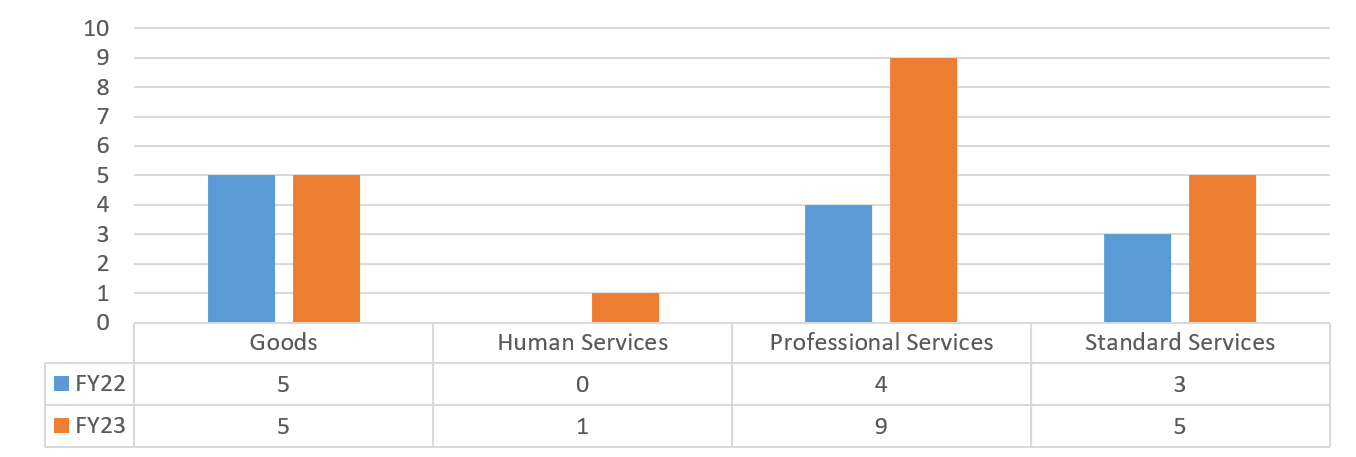

Chart 26 – DCLA: FY22-FY23 Volume of Contracts by Industry

Chart 27 – DCLA: FY22-FY23 Value of Contracts by Industry

Department of City Planning (DCP)

The Department of City Planning (DCP) promotes housing production and affordability, fosters economic development by coordinating investments in infrastructure and services, and supports resilient and sustainable communities across the five boroughs for a more equitable New York City. In addition, DCP also provides public access to planning resources including land use, housing, and population data through its online Community Portal.

Table 39 – DCP: FY22-FY23 Registrations by Contract Category

| FY22 | FY23 | |||

|---|---|---|---|---|

| Contract Category | # of Contracts | Total Contract Value | # of Contracts | Total Contract Value |

| Competitive Method Contracts | 0 | $0 | 8 | $12,762,501 |

| Limited or Non-Competitive Method Contracts | 11 | $559,122 | 8 | $303,533 |

| Grand Total | 11 | $559,122 | 16 | $13,066,035 |

Chart 28 – DCP: FY22-FY23 Volume of Contracts by Industry

Chart 29 – DCP: FY22-FY23 Value of Contracts by Industry

Department of Consumer and Worker Protection (DCWP)