Executive Summary

Each year, the City of New York purchases billions of dollars of goods and services, ranging from schools supplies to massive infrastructure projects. The City has both an opportunity and an obligation to ensure that the businesses who are awarded those contracts – which last year totaled $43 billion – reflect the diversity of New Yorkers. Despite decades of laws and programs designed to increase the number of Minority/Women-Owned Business Enterprises (M/WBEs) contracting with the City, the share of City dollars going to diverse businesses remains woefully small. [1]

New Yorkers see the work of M/WBEs contracted by the City in the programs, parks, and playgrounds they enjoy. The work of M/WBEs includes offering health and safety assistance, facilitating infrastructure improvements, and renovating schools, fire houses, and senior centers. M/WBEs have stepped up to help in the City’s efforts to address the ongoing impact of COVID-19 crisis and to provide shelter and services for asylum seekers.

- Last year, the Department of Design and Construction (DDC) relied on the work of Safeco Construction Corp., a Hispanic American male-owned Minority Business Enterprise (MBE), to provide needed repairs to pedestrian ramps, restoring accessibility in public spaces throughout the city.

- This year, the Taxi and Limousine Commission (TLC) worked with Navigator Technologies LLC, an Asian American male-owned MBE, to manage the design and build of its online licensing portal.

- The Department of Health and Mental Hygiene (DOHMH) partnered with Relationship & Psychology Consulting LLC, a Black women-owned MBE, to provide motivational interviewing and Mental Health training for DOE school officials.

Unfortunately, despite many efforts in recent decades, the City of New York has historically procured goods and services overwhelmingly from businesses owned by Non-Certified firms, including white men. The City’s procurement process and systems have historically fostered an inequitable landscape that require M/WBEs to jump higher over bureaucratic hurdles only to earn lesser returns.

In his 2023 State of the City address, Mayor Eric Adams announced plans to double the rate of the City’s current M/WBE contracts, with ambitious goals through FY26 and FY30.[2] He subsequently appointed the first ever citywide Chief Business Diversity Officer of Mayor’s Office of Minority and Women-Owned Business Enterprises to help fulfill these goals.

This Annual Report on M/WBE Procurement presents data on the City’s Fiscal Year 2022 procurement that will be necessary for focusing and evaluating those efforts. By shining a spotlight on M/WBE contracting, the report aims to identify progress, confront shortcomings honestly, and make recommendations for much-needed improvement to help enable the City deliver on its commitment for M/WBE businesses to receive their fair share of City contracting.

Key Findings

- M/WBEs continue to win only a small share of the value of City contracts. M/WBEs accounted for only 2% of the value of all new City contracts and Purchase Orders (POs) registered in FY22, and just 15.9% of the narrower universe of City contracts and POs subject to M/WBE participation goals under Local Law 174 (LL 174).[3] Similarly, M/WBEs received only 12.29% of the City’s total spending on prime contracts subject to LL 174 in FY22.

- Disparities among M/WBEs remain stark. Black (male- and women-owned) M/WBEs, Hispanic American (male- and women-owned) M/WBEs, Asian American women-owned MBEs, and Native American M/WBEs (male- and women-owned) each represent less than 2% of the value of all FY22 registered contracts subject to LL 174 participation goals. Over 70% of the value of M/WBE contracts in FY22 was awarded to firms owned by white women and Asian American men.

- M/WBEs win contracts that are much smaller on average. Many City agencies have succeeded in increasing the number of contracts they award to M/WBEs, often utilizing discretionary procurement methods intended to increase M/WBE access. Unfortunately, the LL 174 eligible contracts that M/WBEs win tend to be far smaller. The average value of a new contract registered in FY22 to a non-certified firm was $5.01 million, nearly eight times larger than the average value of a new contract registered to a M/WBE, which was just $679 thousand.

- Few City-certified M/WBEs actually do business with the City. In FY22, fewer than 18% of City-certified M/WBEs had a contract, purchase order, or approved subcontract registered by the City.[4]

- Subcontracting and M/WBE compliance processes are paper-based, opaque and ineffective. The current M/WBE compliance mechanisms are also too reliant on self-reporting by contracting agencies and prime vendors, in outdated or underutilized systems, which limits accountability as well as the City’s ability to meet the requirements of the M/WBE program.

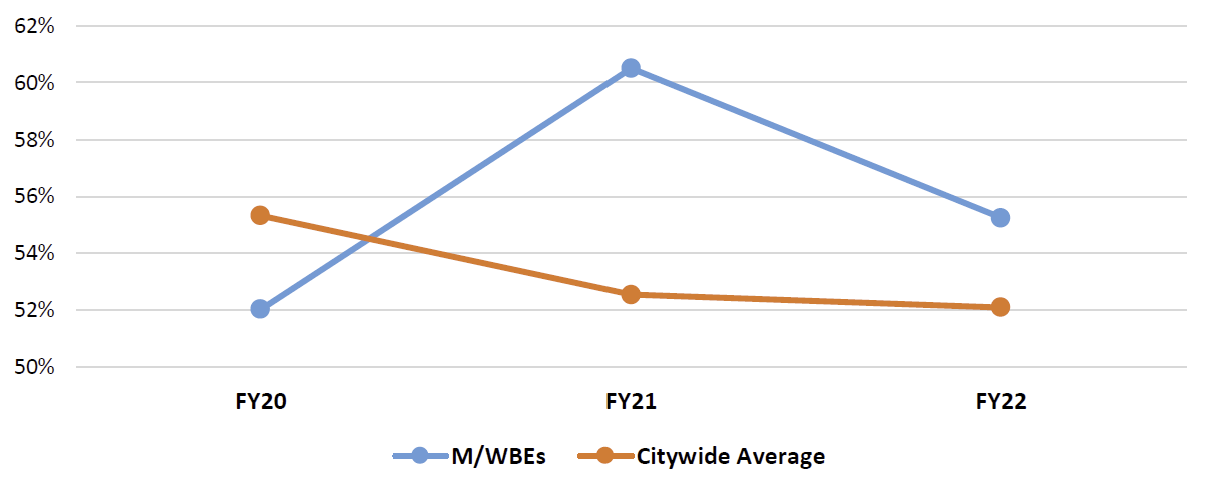

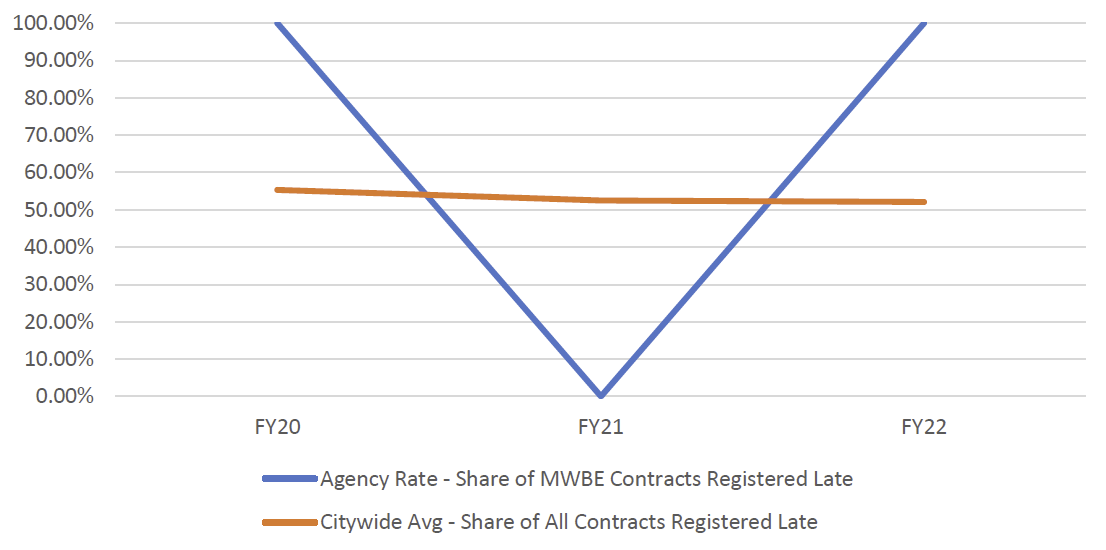

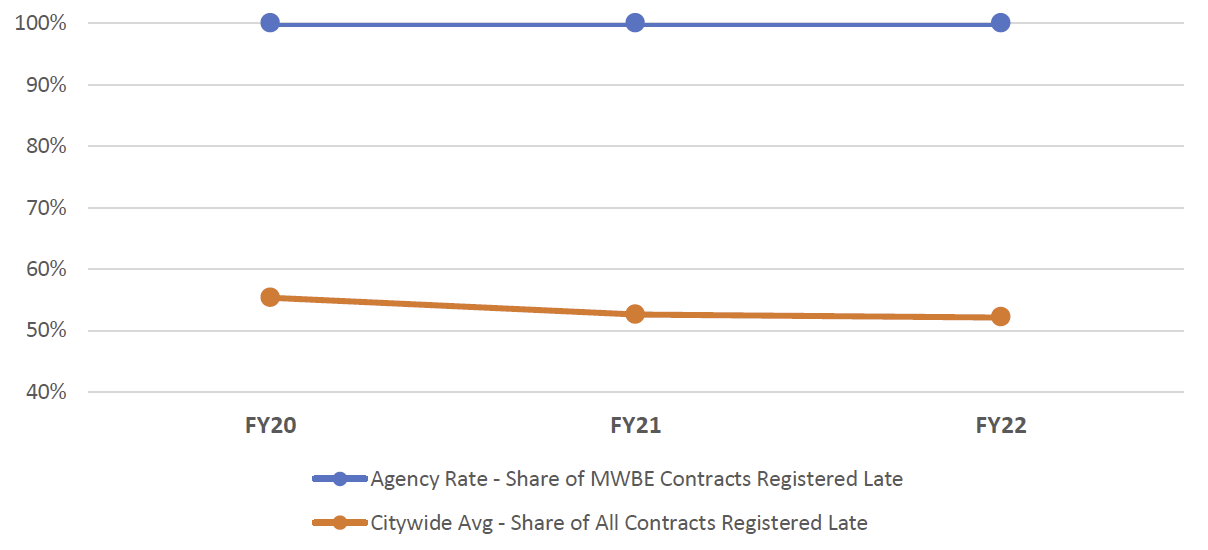

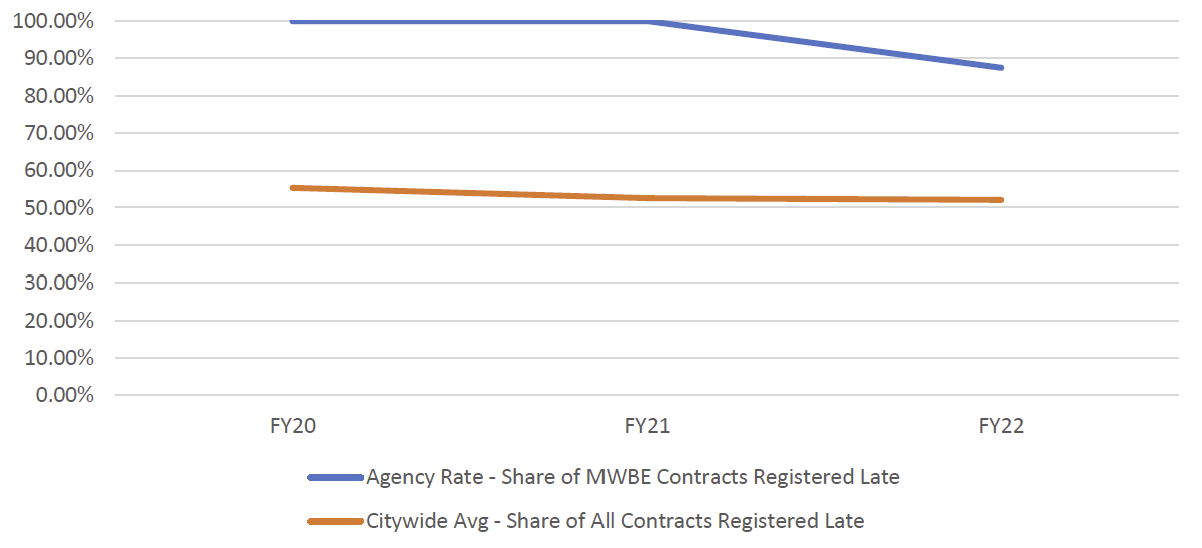

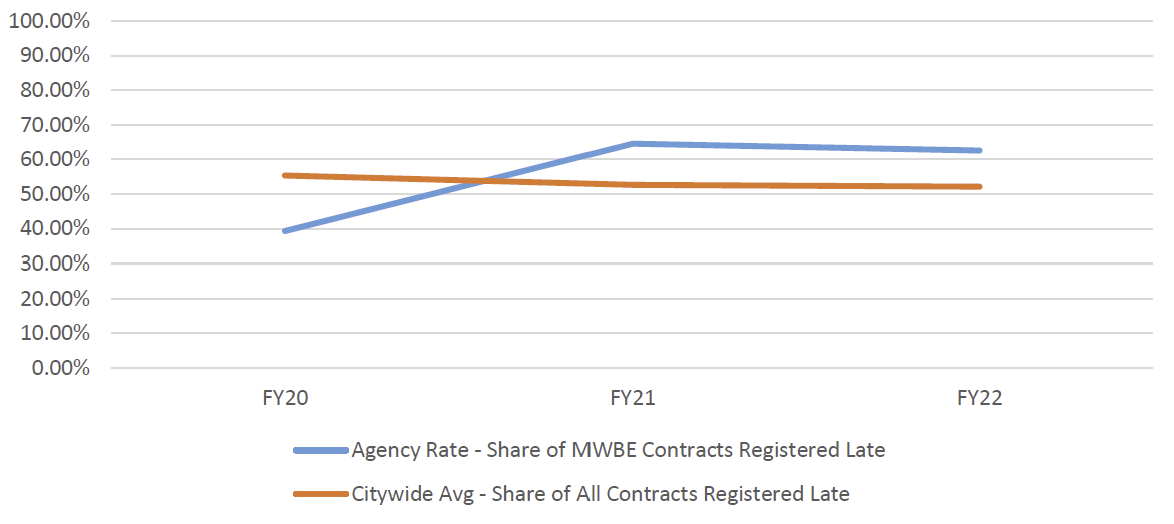

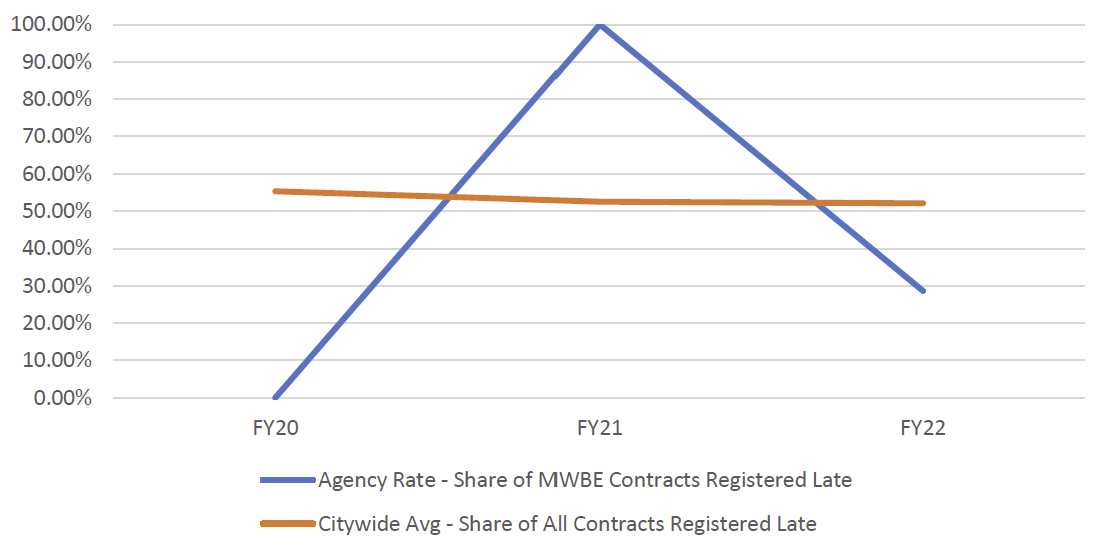

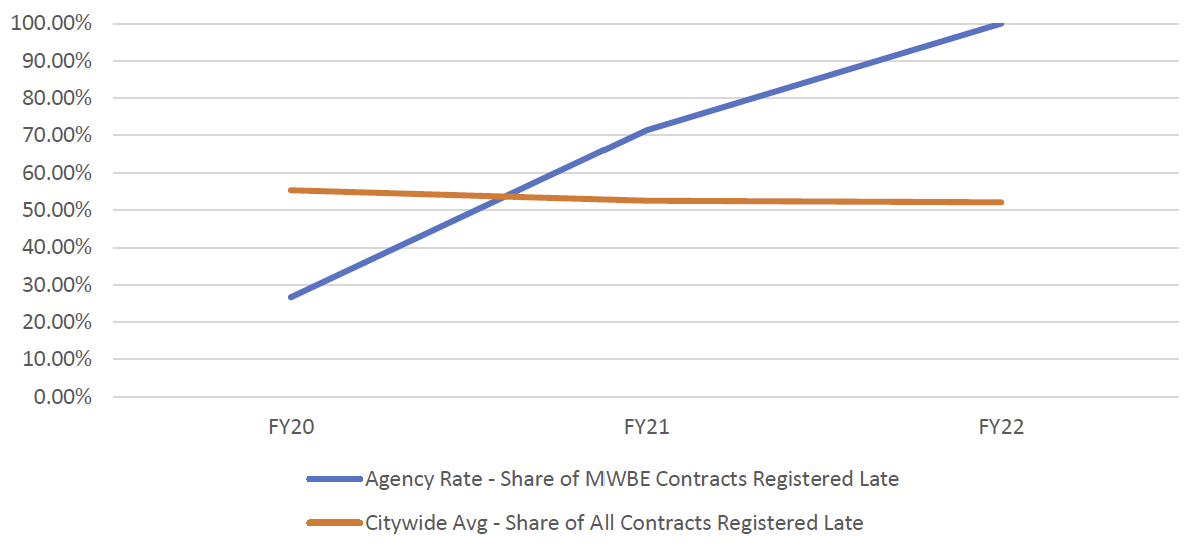

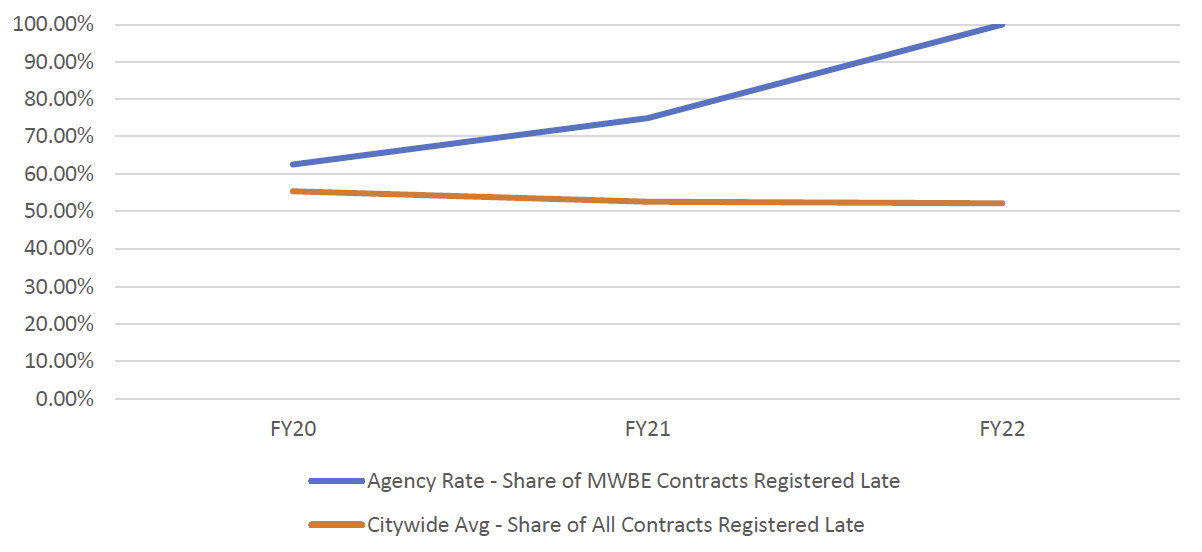

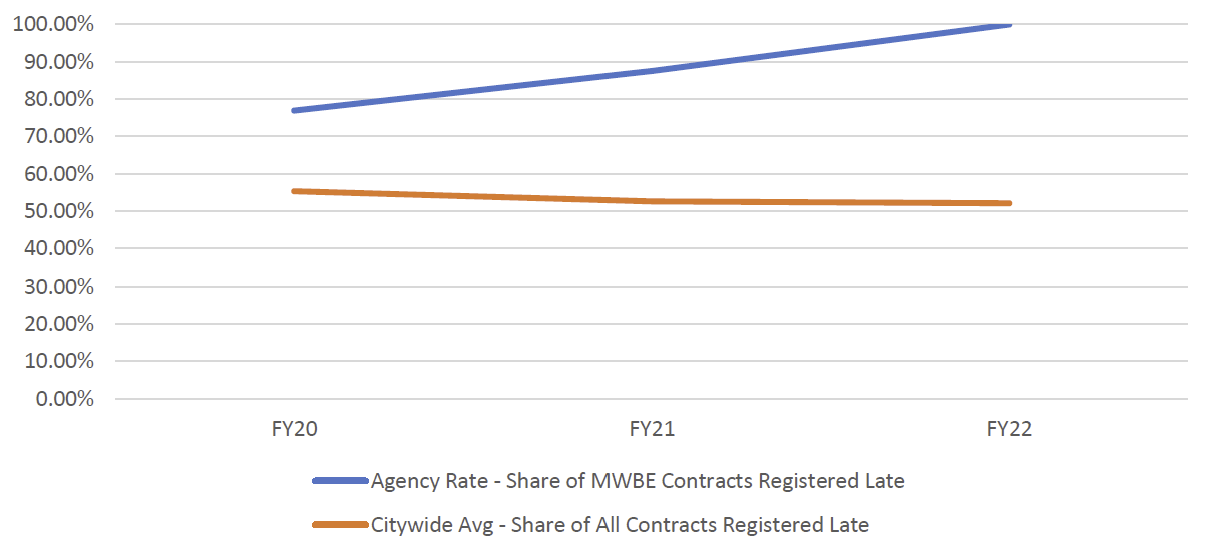

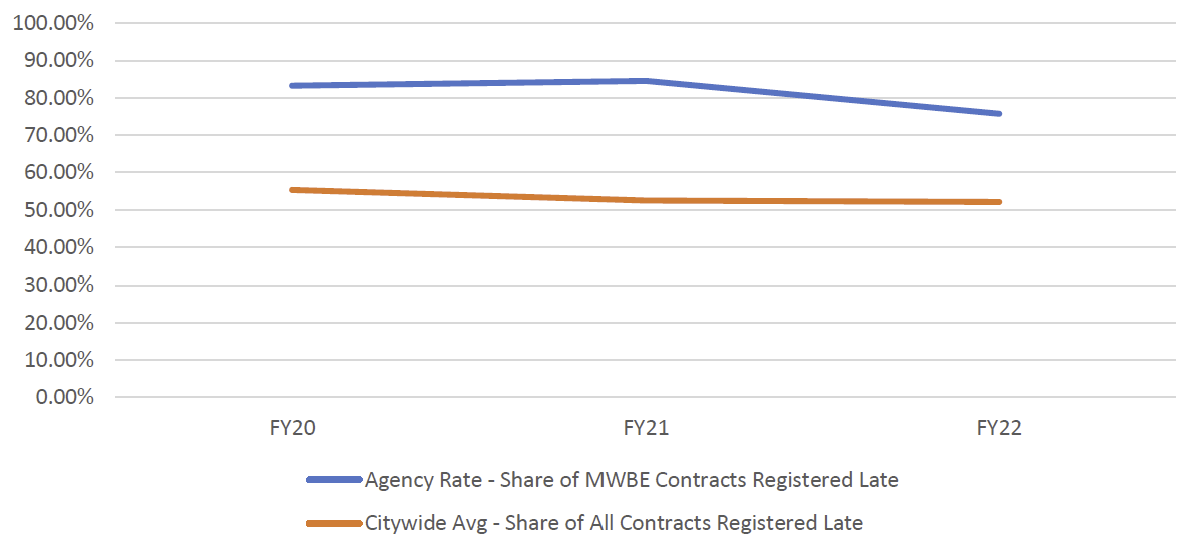

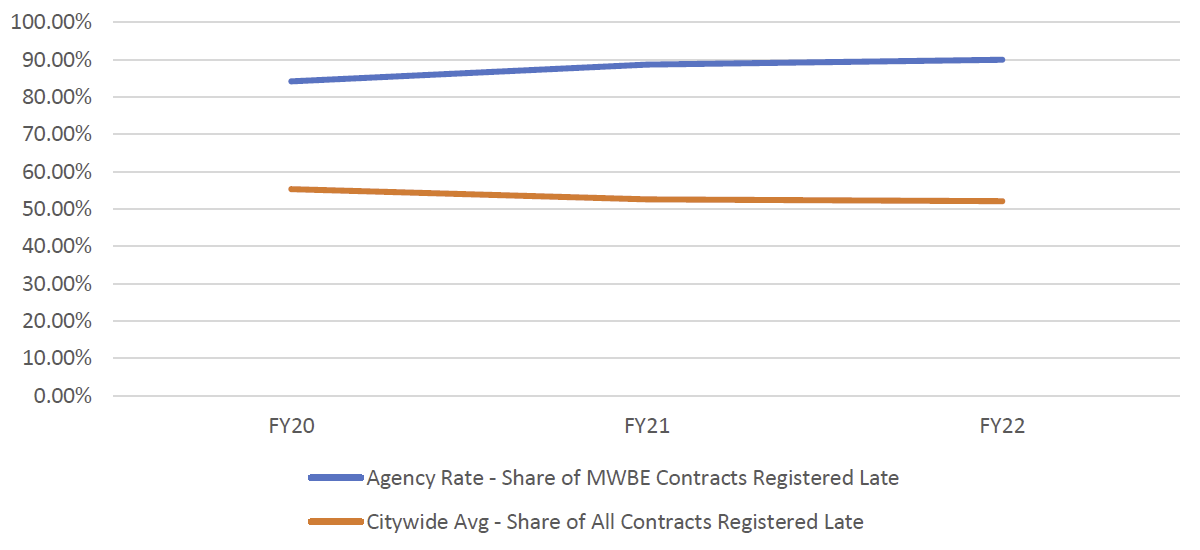

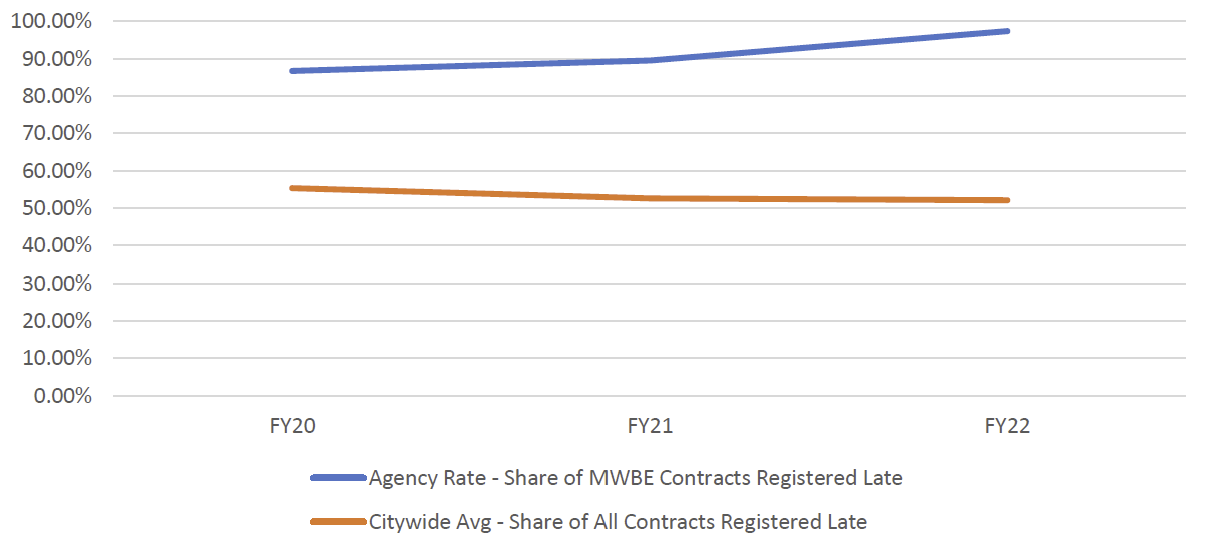

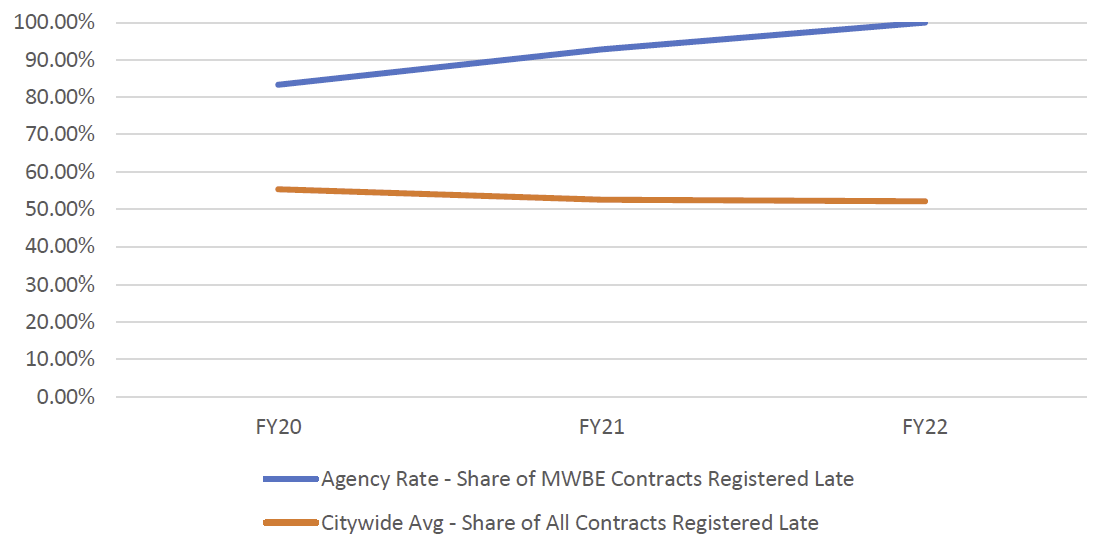

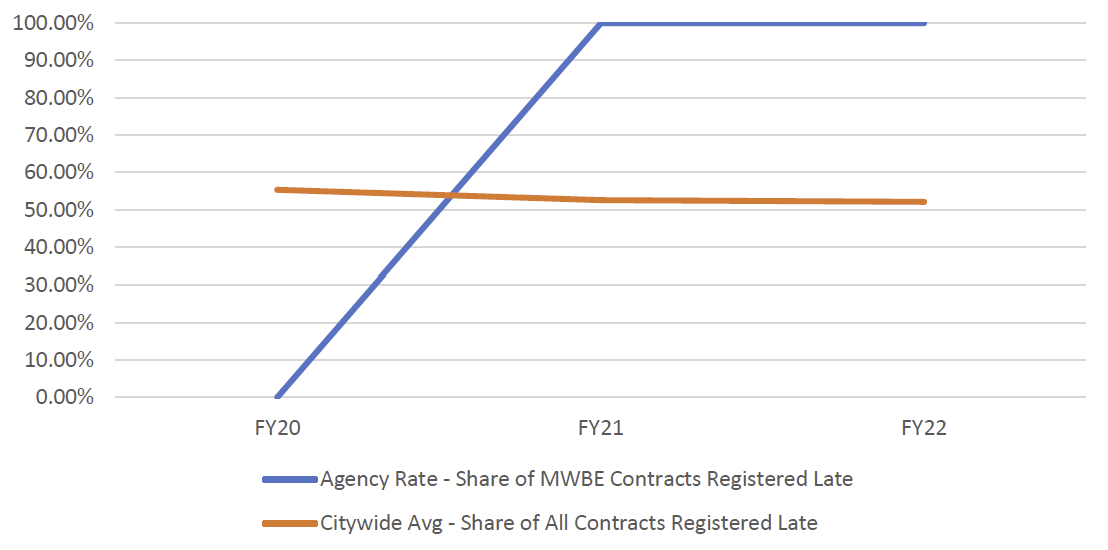

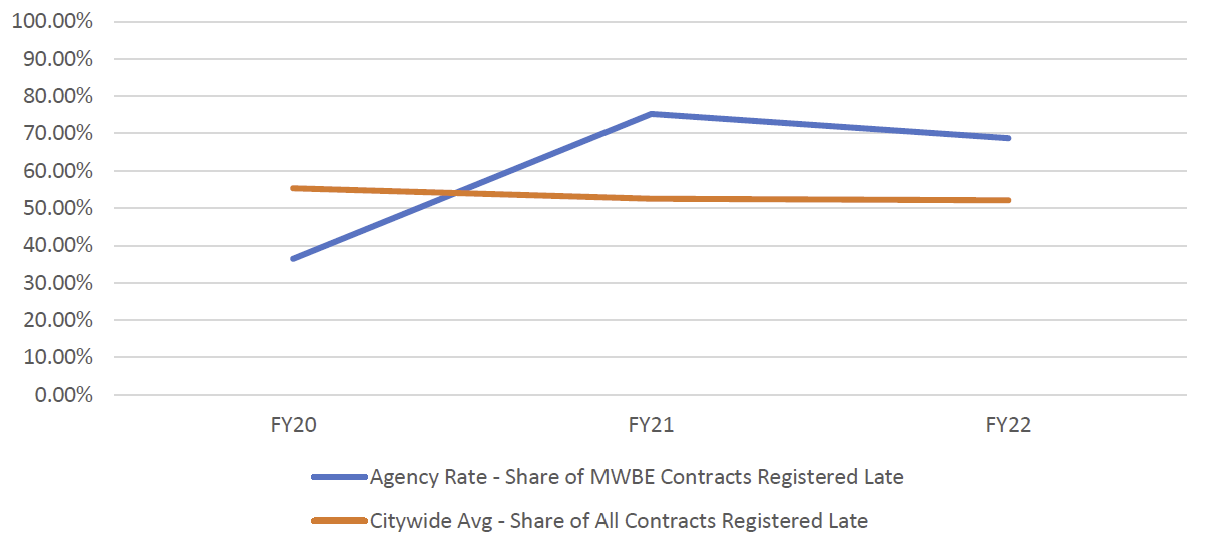

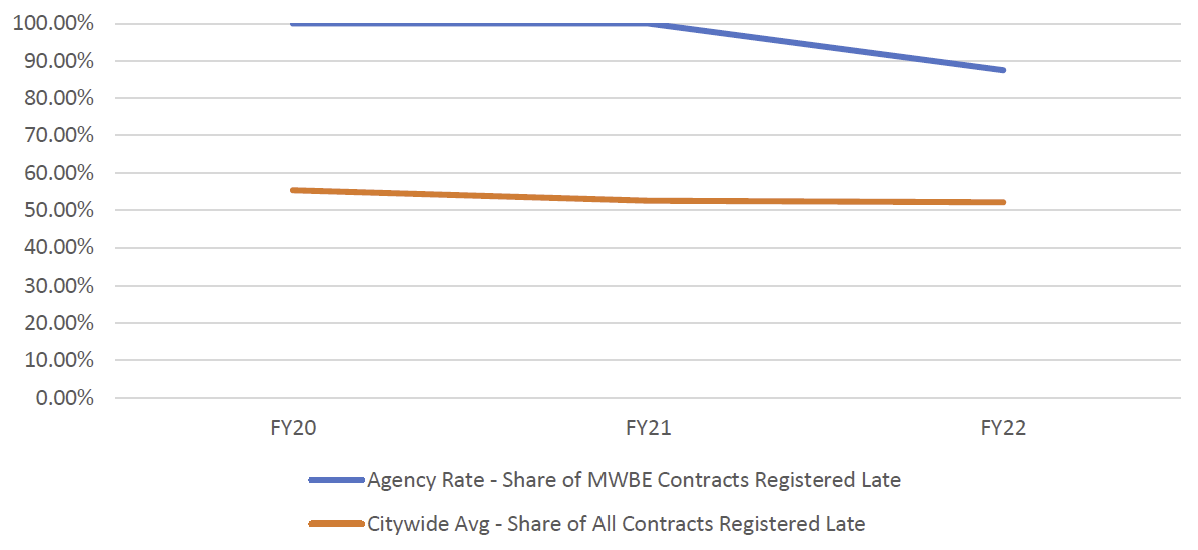

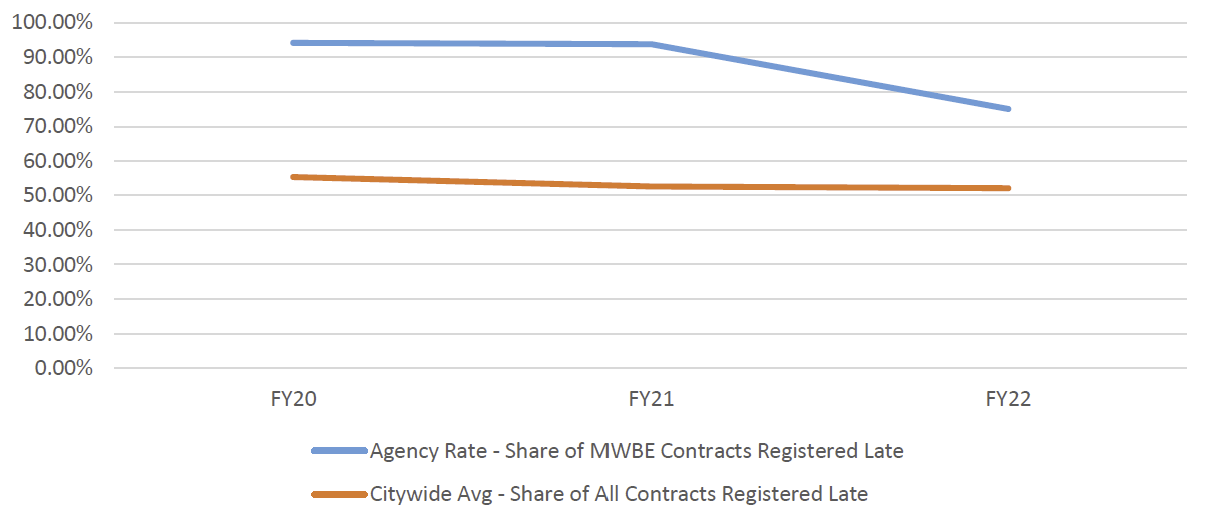

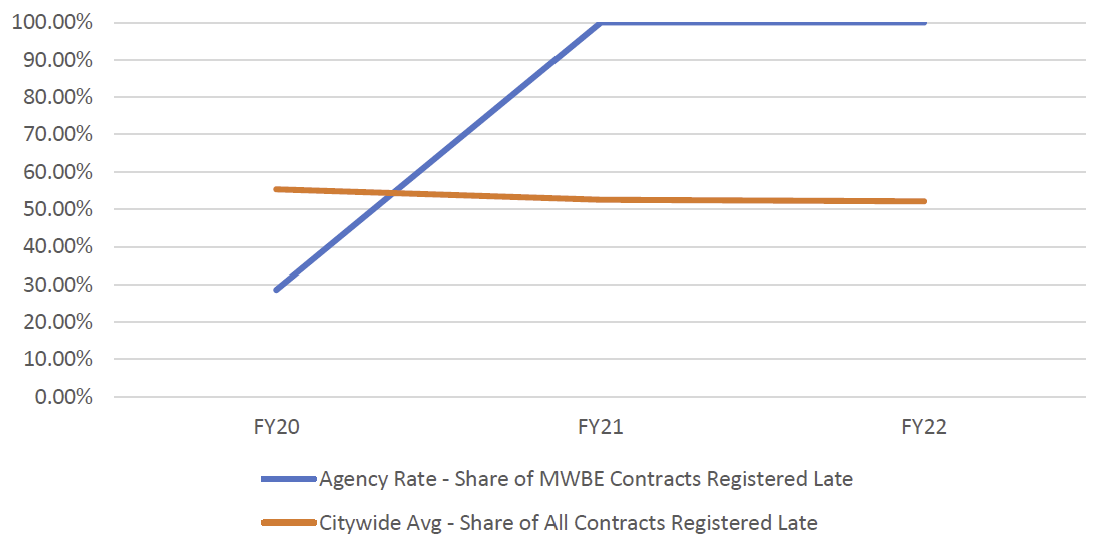

- When M/WBEs do receive contract awards, they are not paid on time. Approximately 55% of M/WBE contracts registered in FY22 were retroactive, even worse than the citywide rate of approximately 52%. This is a particular challenge for smaller firms, without sufficient working capital to endure long wait times for payment.

Recommendations

Recommendation #1: Ensure that M/WBEs Have Access to Higher Value Contracts through Competitive Procurements. Wider adoption of M/WBE Prequalified Lists (PQLs) and the utilization of “Best Value” preferences is needed to direct higher-dollar-value contracting opportunities to eligible M/WBEs, particularly targeted to underutilized M/WBE Categories.

Recommendation #2: Bolster Agencies’ Use of Existing Discretionary Procurement Methods. Raising the threshold for the M/WBE Noncompetitive Small Purchase (NCSP) method and improving the use of discretionary micropurchases and small purchases will allow City agencies to drive contract awards to M/WBEs with limited targeted competition.

Recommendation #3: Reform the subcontracting process and incorporate it into PASSPort. Such reforms must ensure that prime vendors and contracting agencies are being held accountable for M/WBE participation goals on eligible prime contracts. Digitizing the subcontracting process and integrating it into PASSPort will bring greater accountability to meeting M/WBE goals for subcontractors.

Recommendation #4 Provide stronger tools to City agencies. The City must strengthen existing systems to make M/WBE data more accessible, improve the quality of data maintained by the systems so that agencies can find the right M/WBEs, and ensure there is sufficient capacity of ready, willing and able M/WBEs to compete for goods and services that the City procures.

Recommendation #5: Improve the timeliness of City contract registration. The City must remain committed to prioritizing needed reforms proposed by the Capital Process Task Force and Joint Task Force to Get Nonprofits Paid On Time to deliver faster and more cost-effective goods and services to New Yorkers in a way that increases investments to M/WBEs and reduces barriers to the participation and inclusion of these businesses in City contracting.

Agency and Sector Highlights

In addition to providing analysis of the overall state of city procurement with M/WBEs, this report provides a snapshot for each agency and compares M/WBE participation by industry. In Fiscal Year 2022:

- The Department of Small Business Services (90.1%), Department of Cultural Affairs (85.2%), and Department of Buildings (79.6%) had the highest share of contract value subject to LL 174 registered to M/WBEs.

- The Department of Finance (7.4%), Department of Environmental Protection (7.9%), and Department of Transportation (10.6%) had the lowest share of contract value subject to LL 174 registered to M/WBEs.

- The Department of Education is a non-mayoral agency and during FY22 was not subject to LL 174 participation goals. However, this Report includes data analyses for the DOE because it has the largest procurement portfolio in the City. If the same LL 174 participation goals were applied to the DOE, it would have the lowest share of contract value subject to LL 174 registered to M/WBEs (5.6%).

- The Department of Small Business Services, Department of Correction, and the Office of the Comptroller were the three most improved agencies from FY20 to FY22 in percentage of contract value subject to LL 174 registered to M/WBEs.

- The Office of Technology and Innovation (99 procurements), Department of Health and Mental Hygiene (73), and Department of Transportation (63) made the most frequent use of the M/WBE Noncompetitive Small Purchase method.

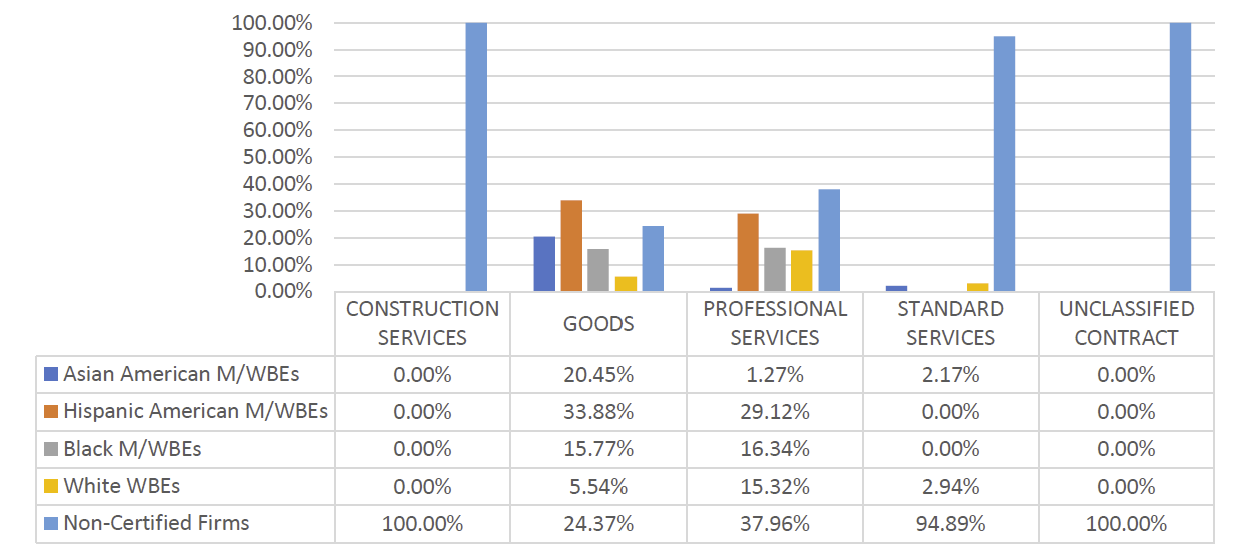

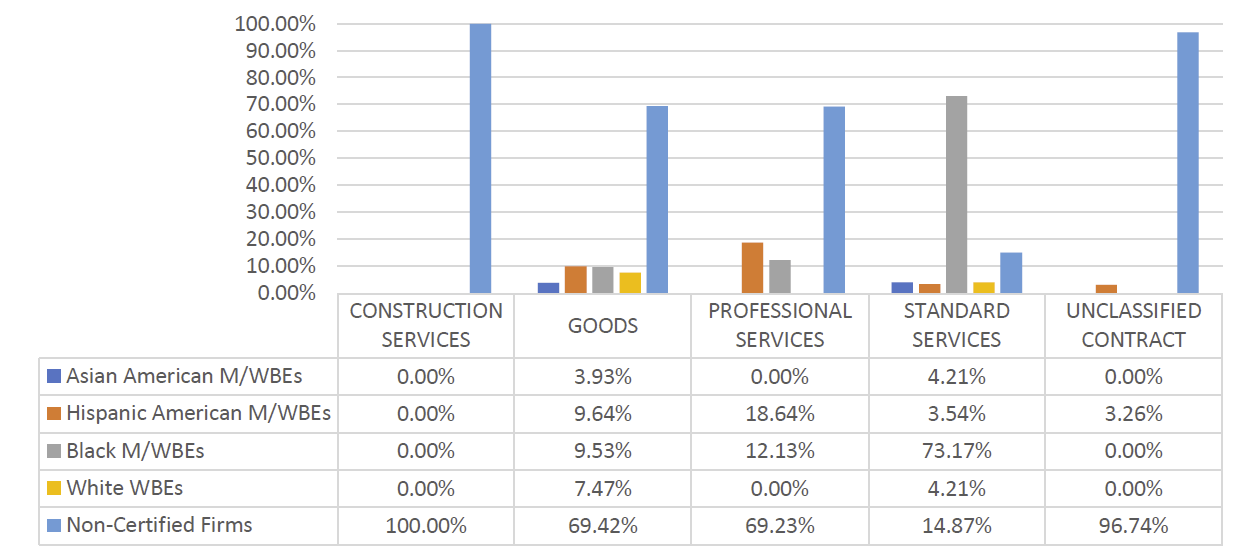

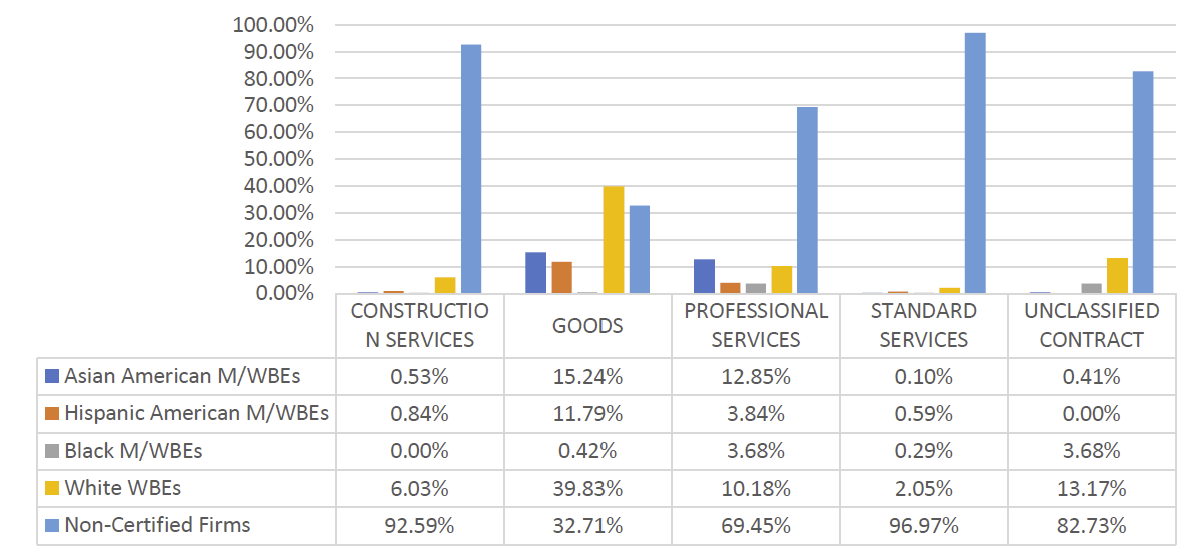

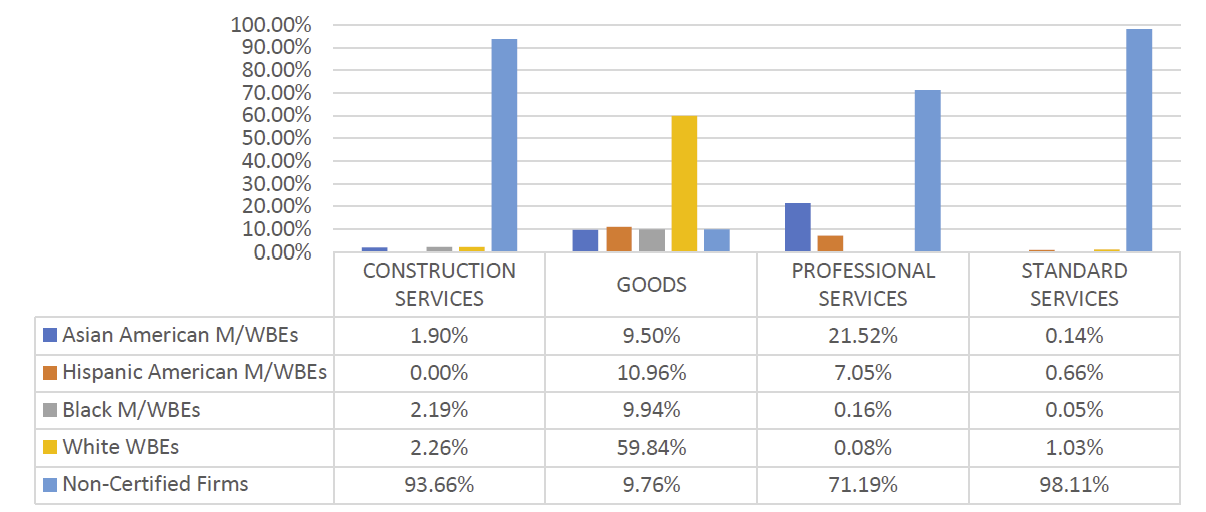

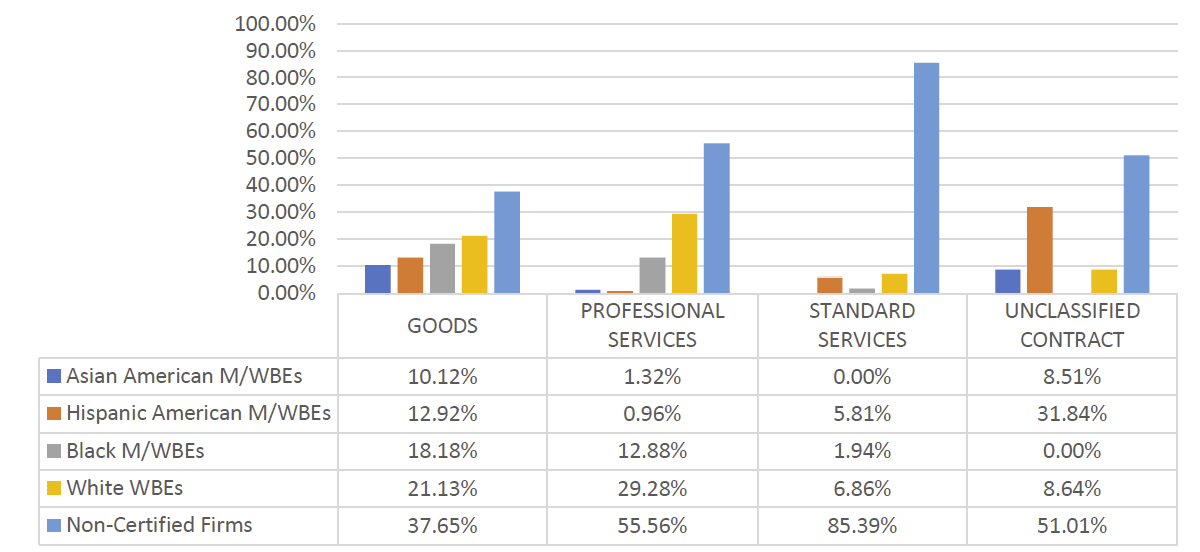

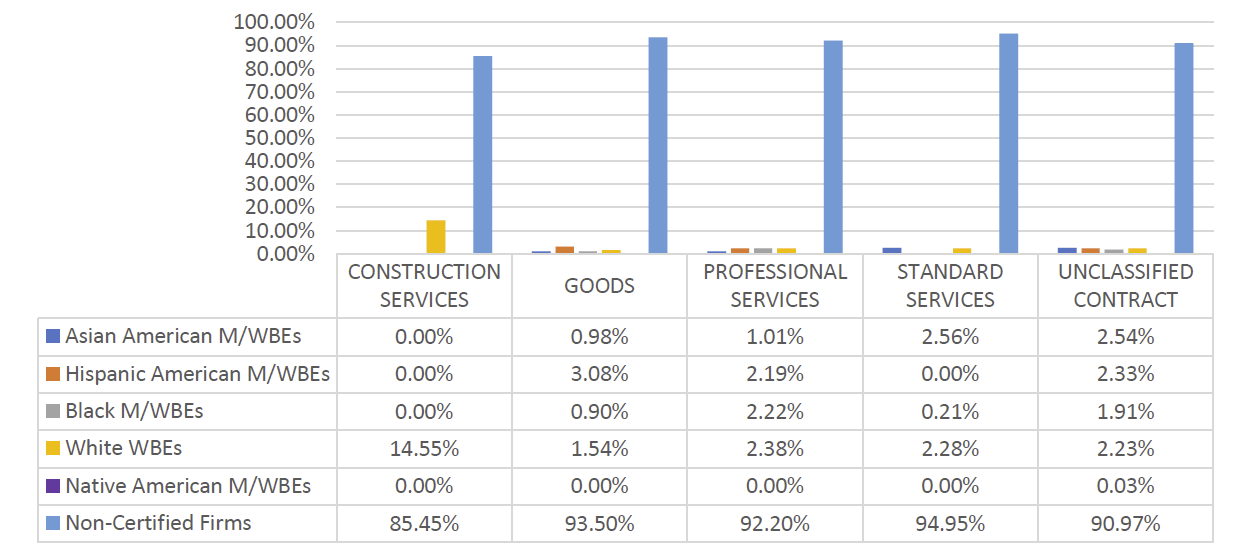

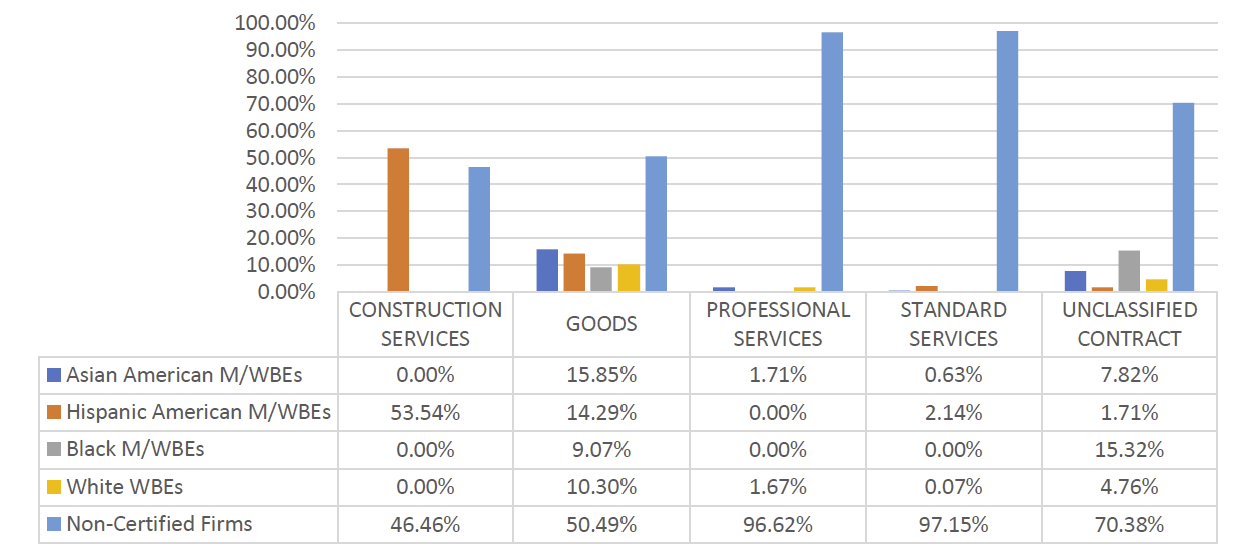

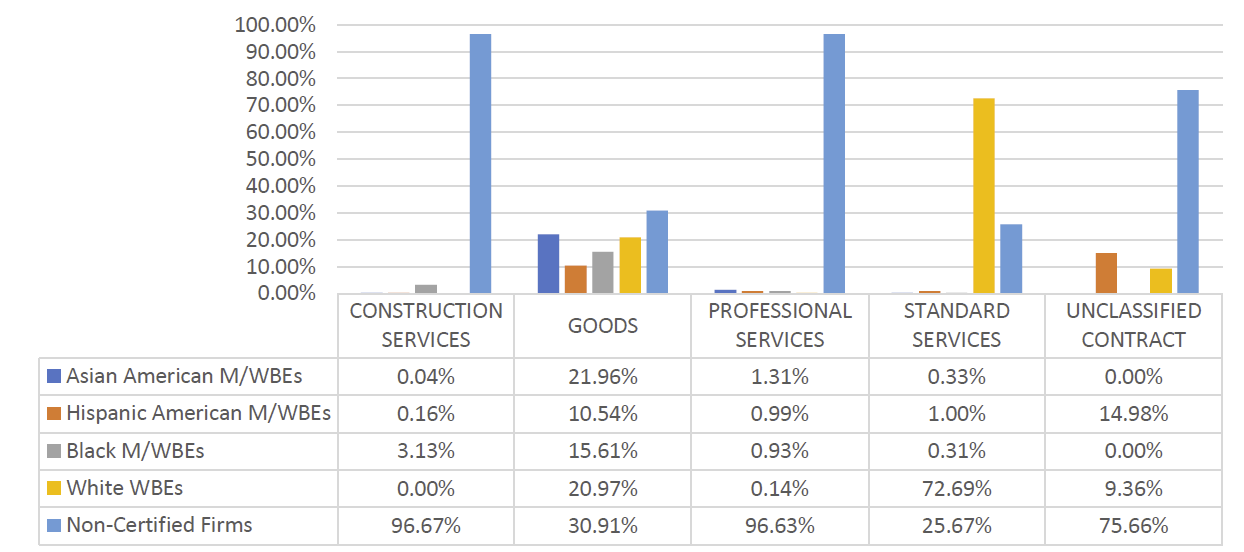

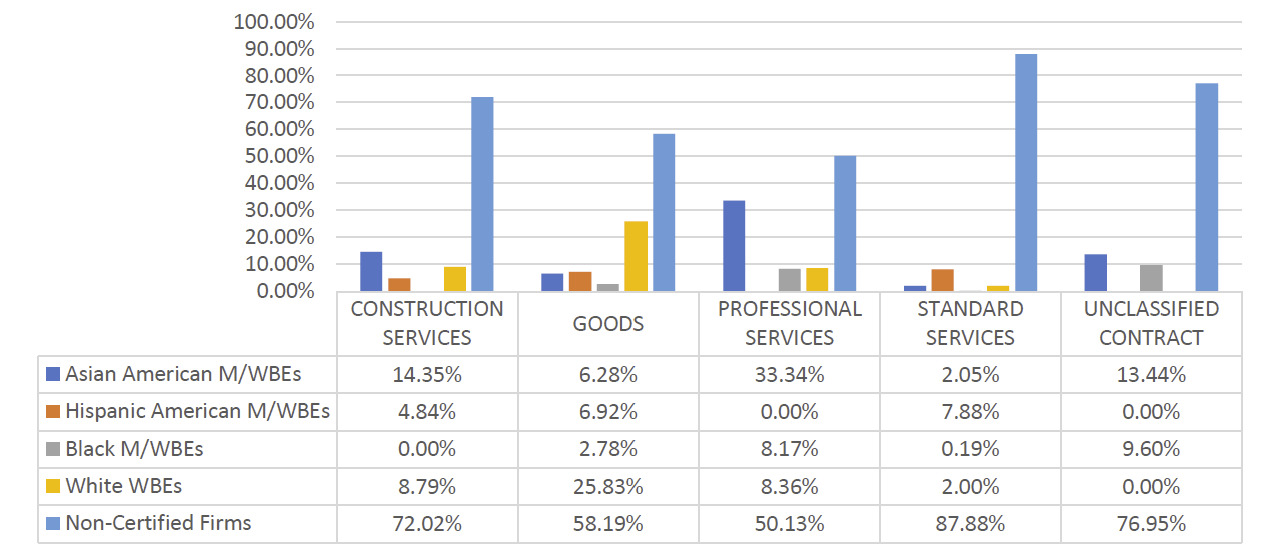

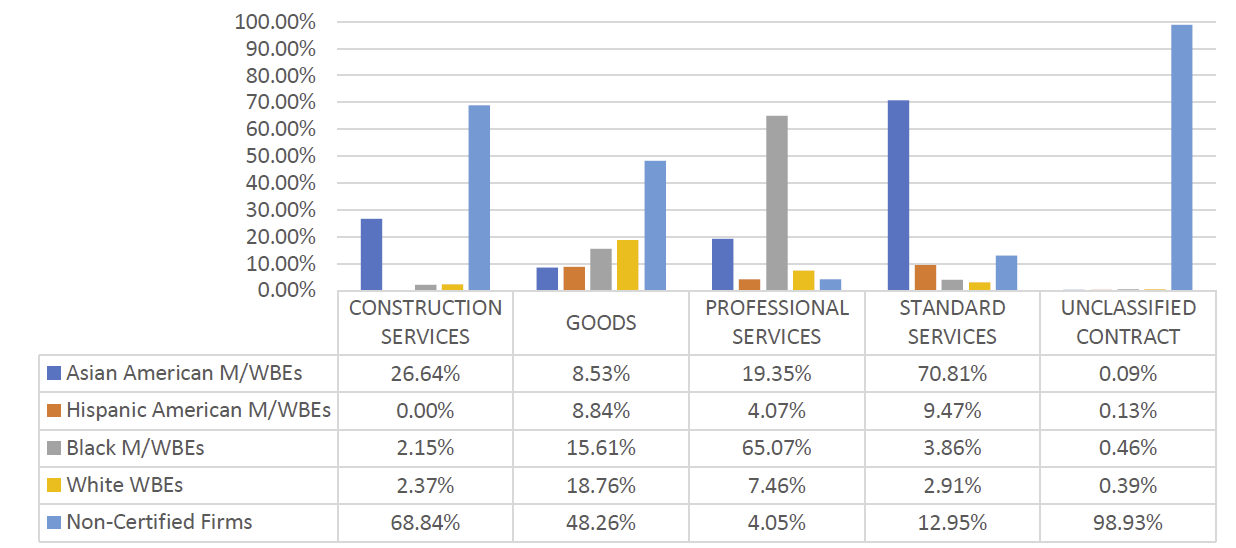

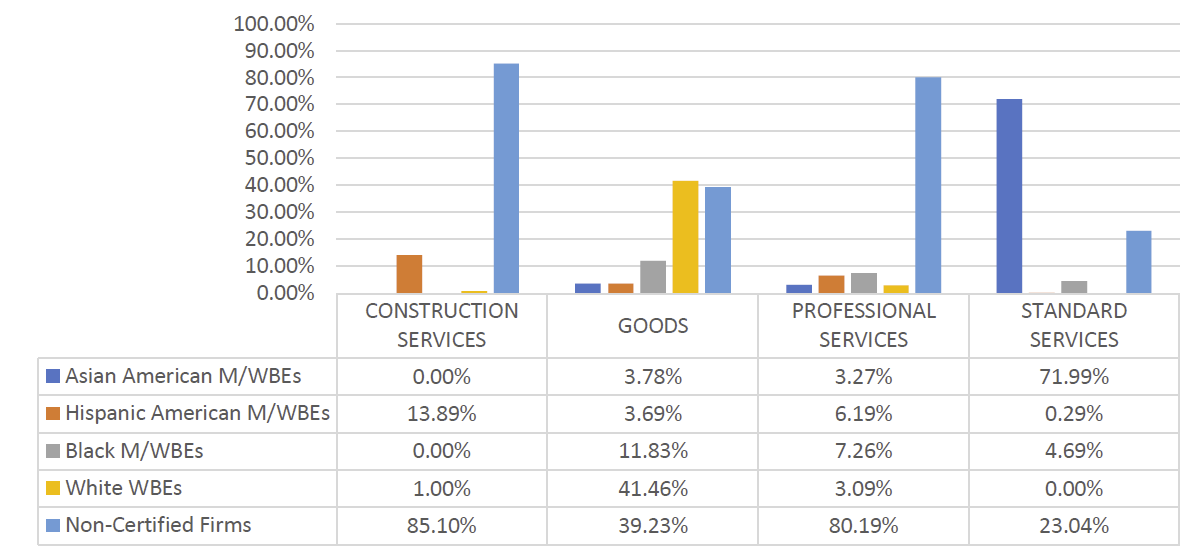

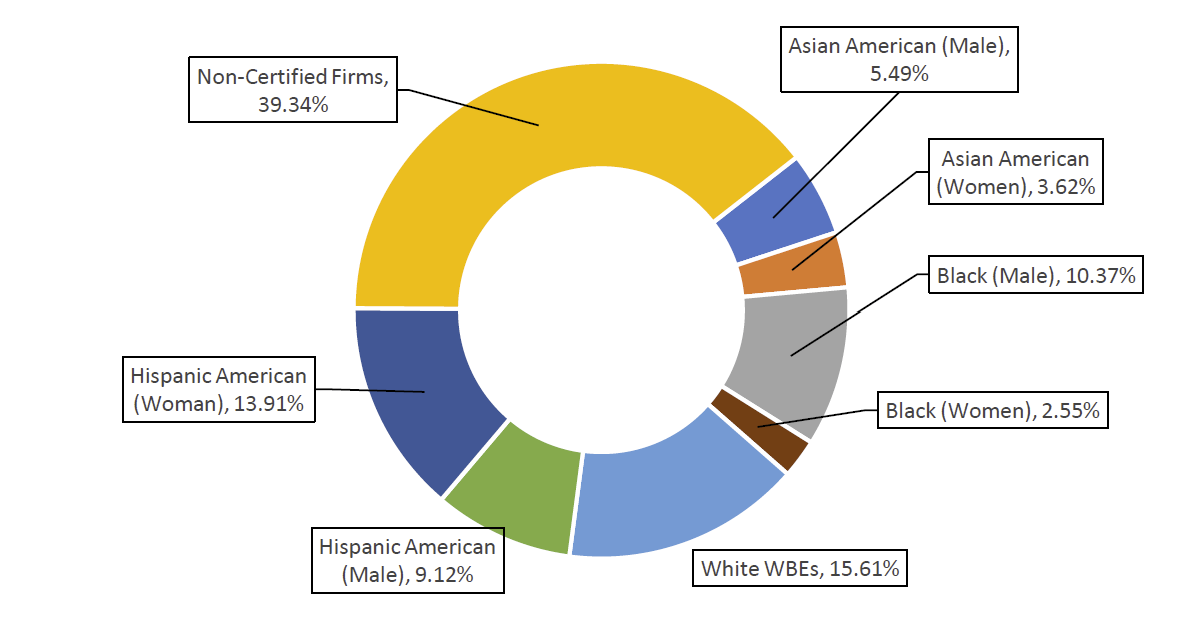

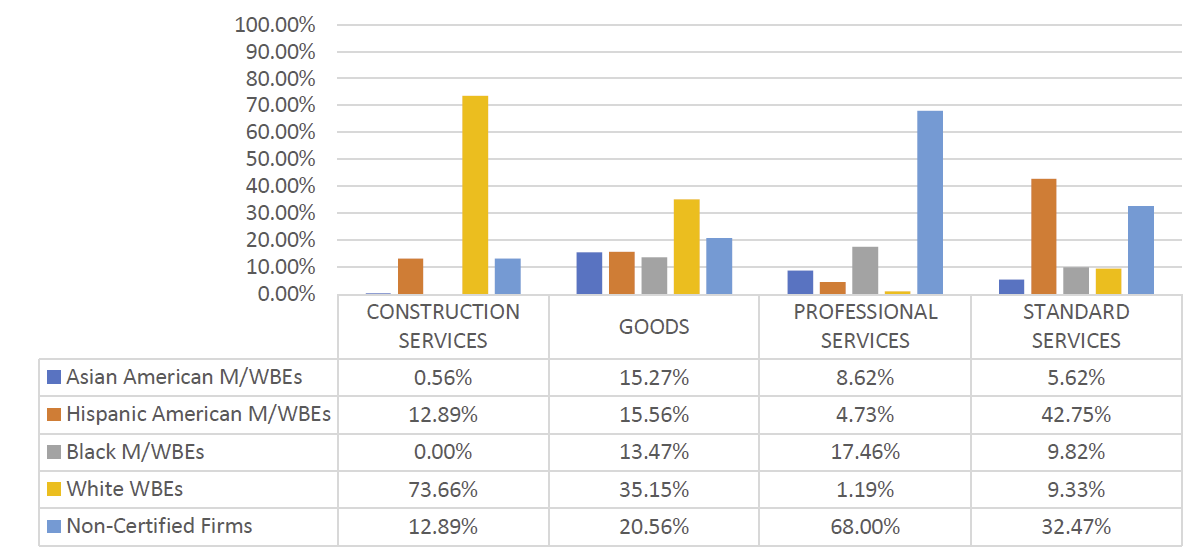

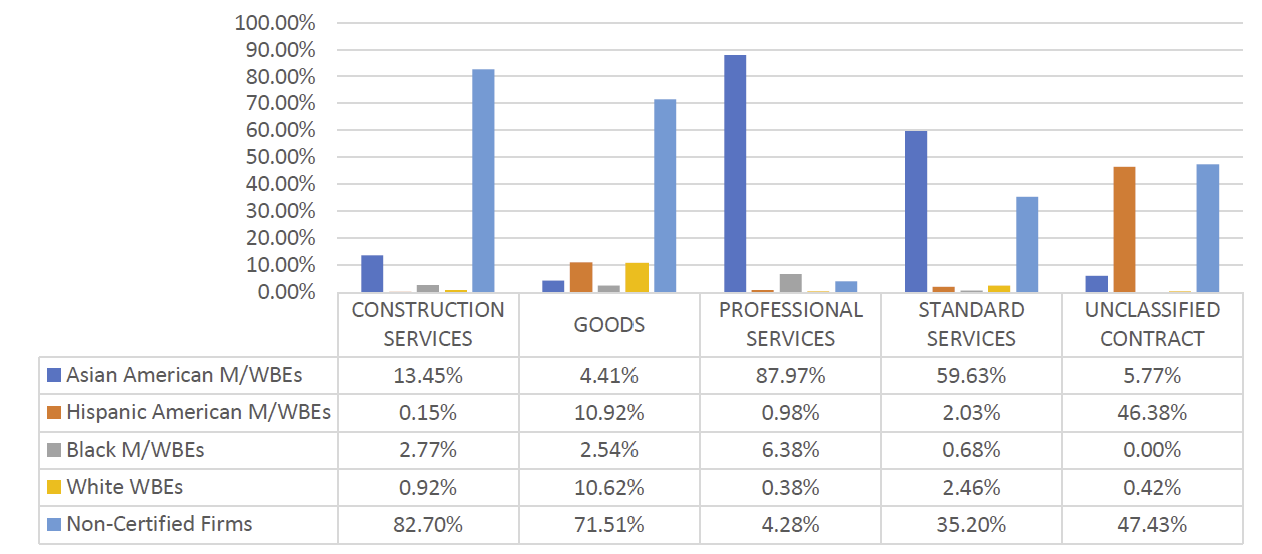

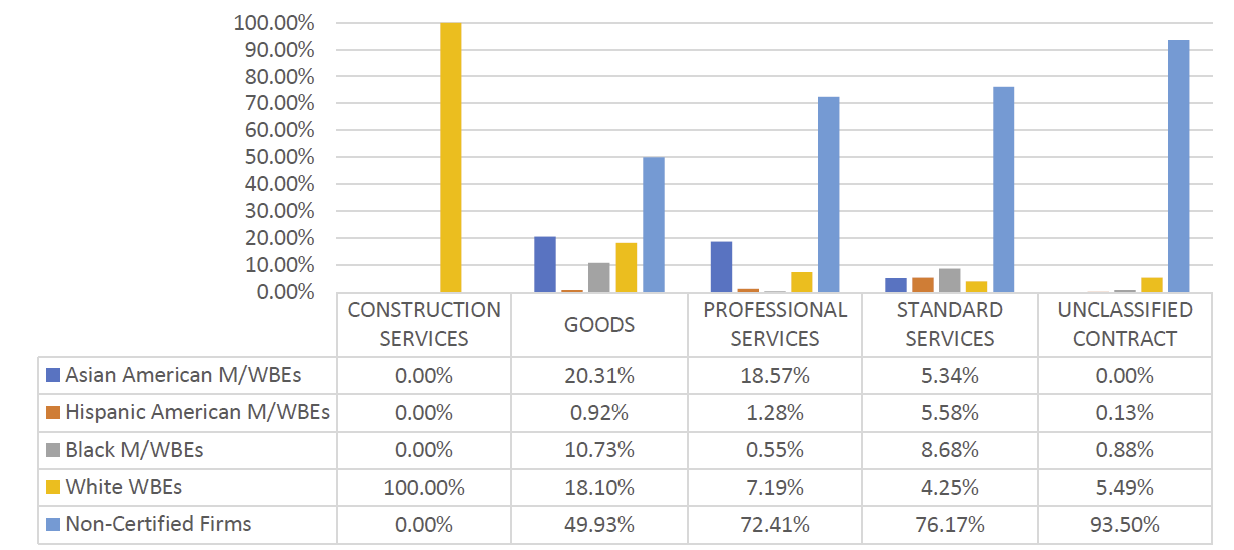

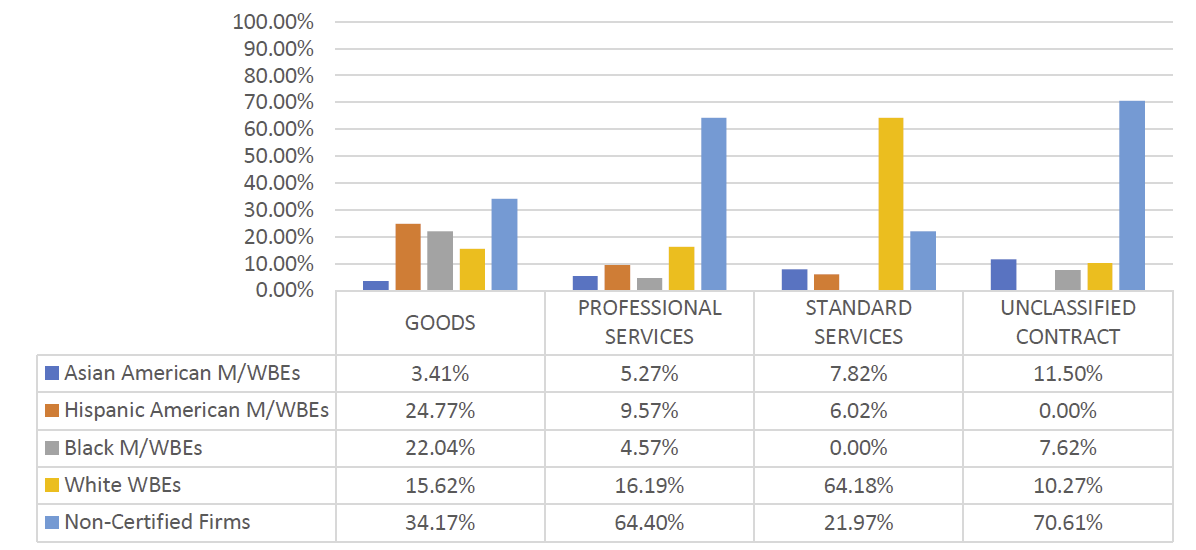

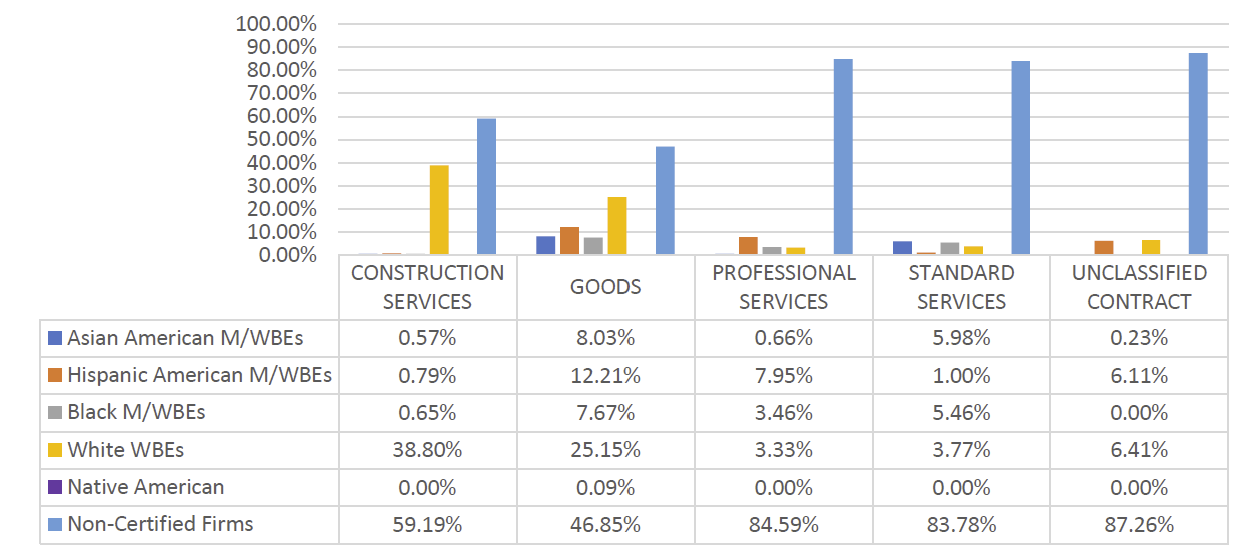

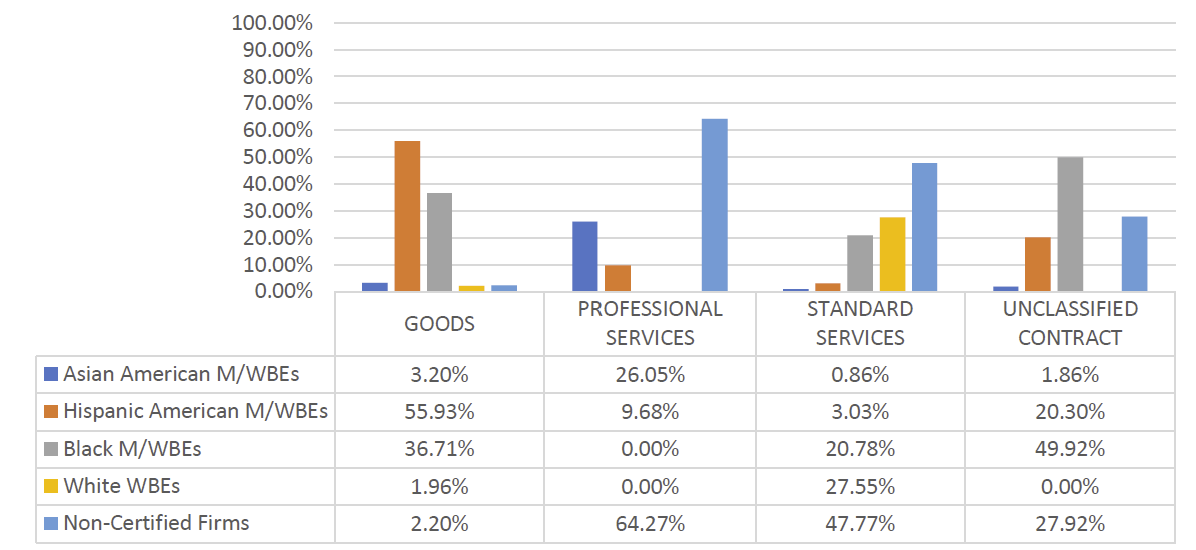

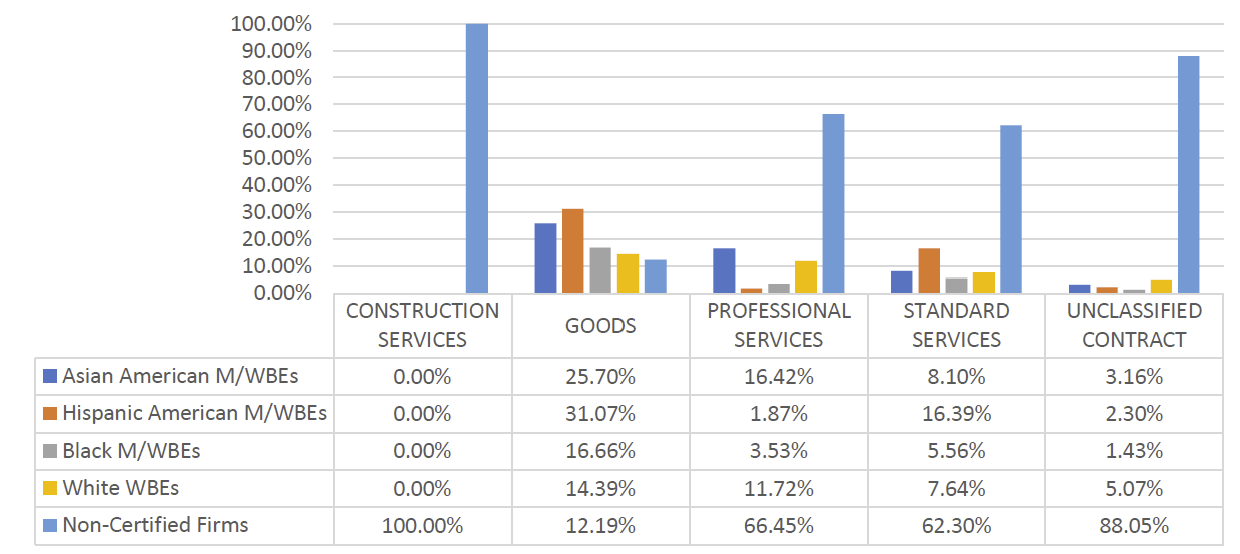

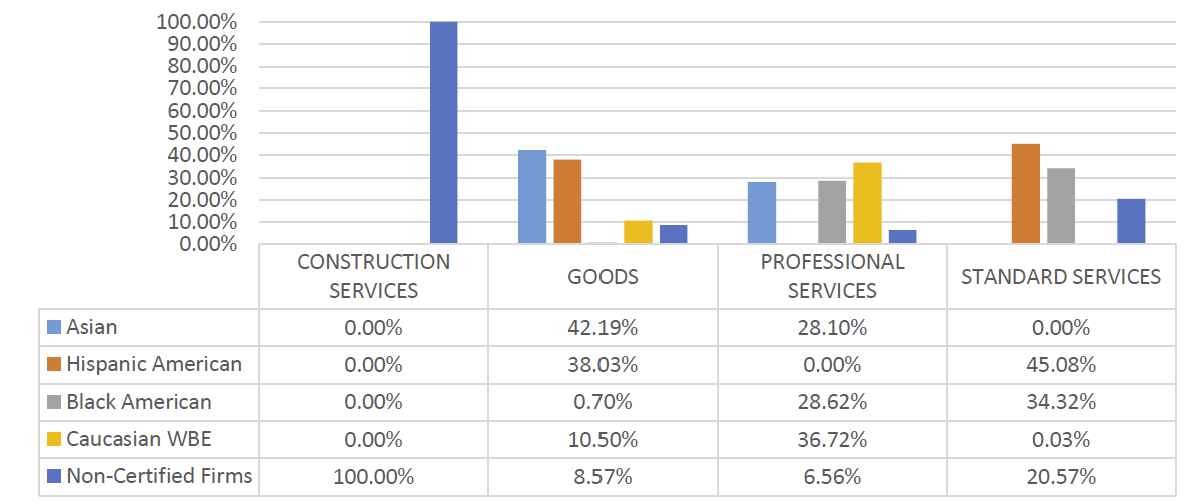

- Construction and Standard Services procurements lagged behind those for Goods and Professional Services in resulting prime contracts to M/WBEs.

Our Approach

This Annual Report provides a comprehensive review of FY22 contract registration data of New York City agencies and affiliated agencies to highlight the frequency in which M/WBEs are awarded contracts based on procurement method, dollar value, and industry to identify procedural roadblocks and other inequities that impact the way M/WBEs contract with the City.

In order to provide as accurate an assessment as possible, this year’s report makes several changes from prior years. This report includes data on both FY22 contract registrations (legally binding agreements between agencies and vendors that were registered during FY22) and POs, and FY22 spending on contracts (regardless of what year they were registered). In addition, the report presents data from multiple perspectives, including certification disparities, average contract value, procurement methods, and contract retroactivity. Unlike prior years, we do not combine these into a single letter grade, but instead present the full data for each agency.

In preparing this report, the Comptroller’s Office gathered stakeholder feedback from small and large M/WBEs across several sectors and from contracting agencies with practical experience to highlight the factors that present obstacles to M/WBEs from successfully working with the City.

Data

This Report largely measures M/WBE utilization in alignment with the expectations and M/WBE participation goals set in LL 174 and Section 6-129 of the New York City Administrative Code (“Administrative Code”) for eligible contracts.

LL 174 excludes large areas of City contacting including: Human Service contracts and other not-for-profit contracts (as they do not have owners or shareholders), Emergency Procurements, Intra-governmental contracts, contracts subject to federal or state funding requirements that preclude the City from imposing City-certified M/WBE participation goals or impose their own, and contracts issued by some non-mayoral agencies (including at the time of this report the Department of Education, the Economic Development Corporation, and the New York City Housing Authority).[5] This Report only includes information on M/WBEs certified by New York City and does not include information about contracts registered to businesses who may be New York State certified M/WBEs. This Report also does not include data related to Renewals. A full list of excluded considerations is included in Appendix C of this Report.

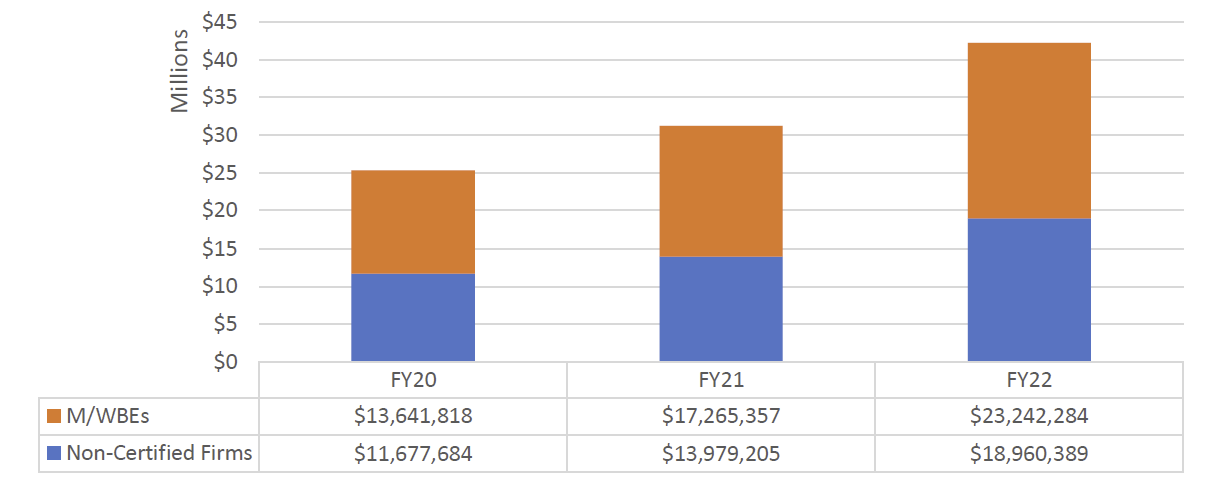

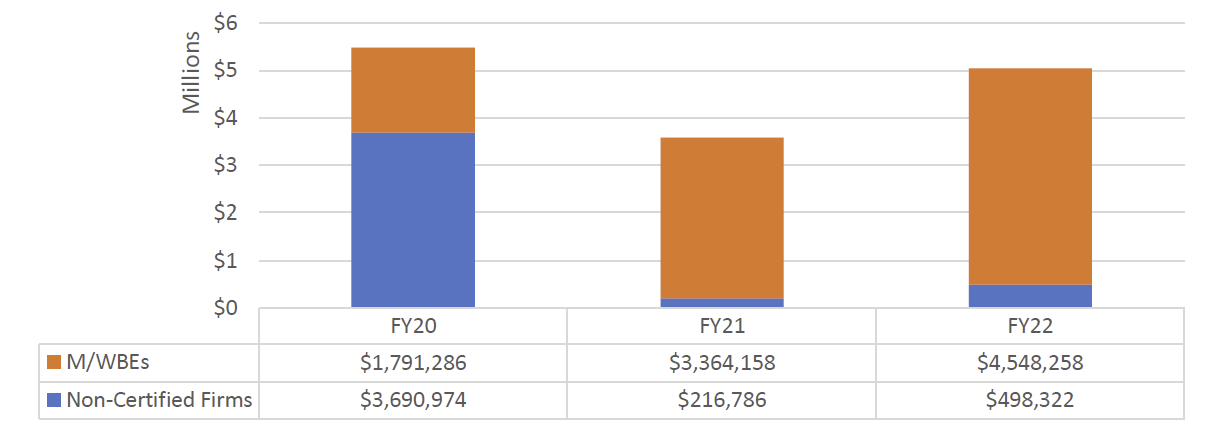

As a result of these exclusions, less than 14% of total City procurement for FY22 was subject to the M/WBE participation goals of LL 174.[6] The total for new contracts and purchase orders registered by the City during FY22 was $44,560,595,459 (of which 5.2% went to M/WBEs), while procurement subject to LL 174 was $6,149,586,703 (of which 15.91% went to M/WBEs).

In an effort to provide a broader view, therefore, in some circumstances data is included for contracting agencies and procurement actions not covered by Local Law 174. The report will specify when and where analyses pertain to contracts subject to participation goals or instead to citywide data sets.

Additional context and information about the City’s participation goals program and relevant guiding legislation can be found in Appendix A.

Findings

Finding #1: M/WBEs continue to win only a small share of the value of City contracts.

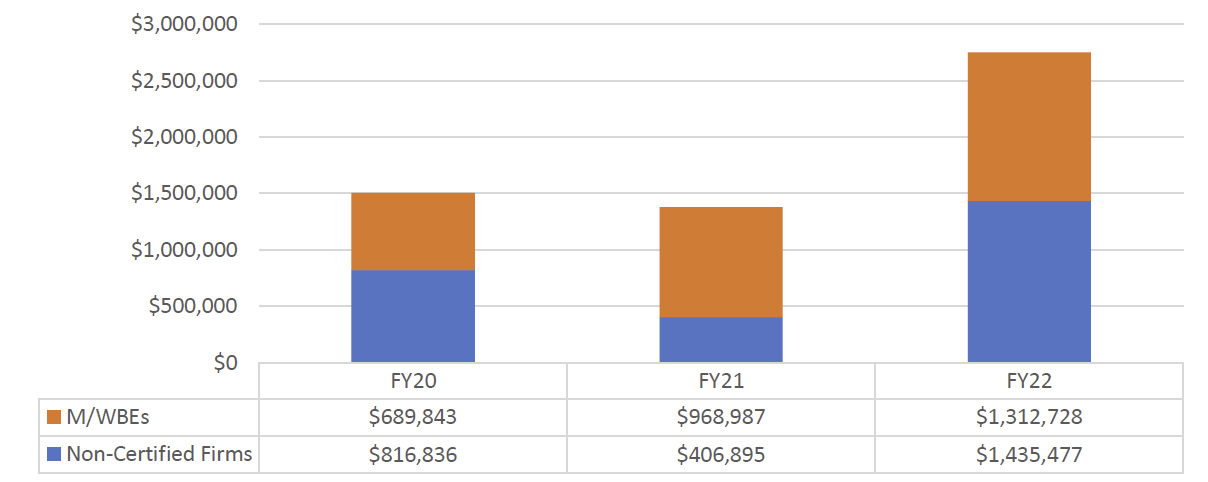

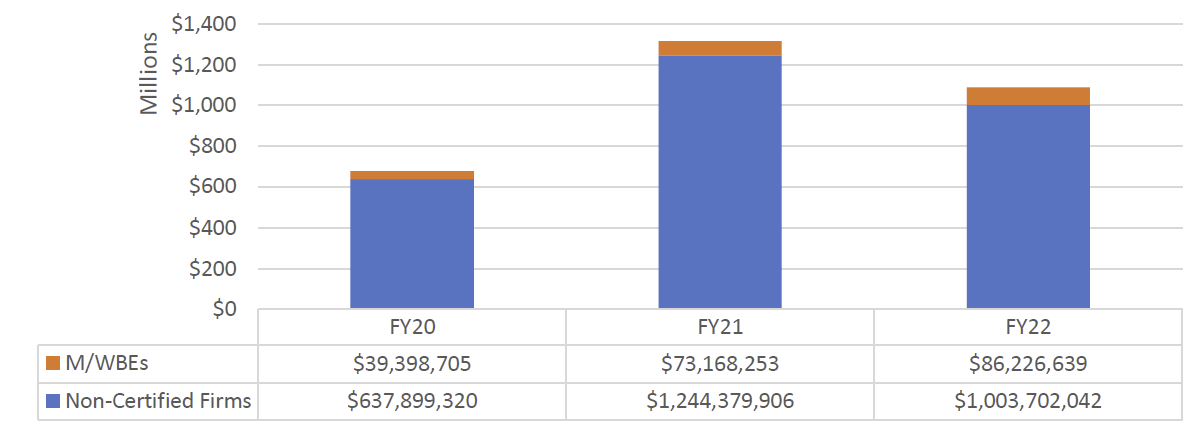

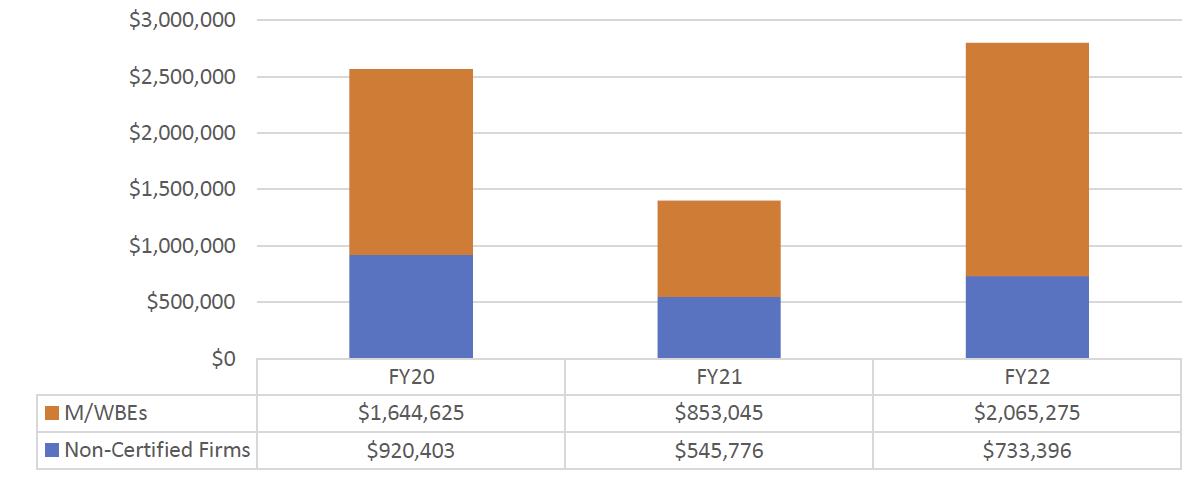

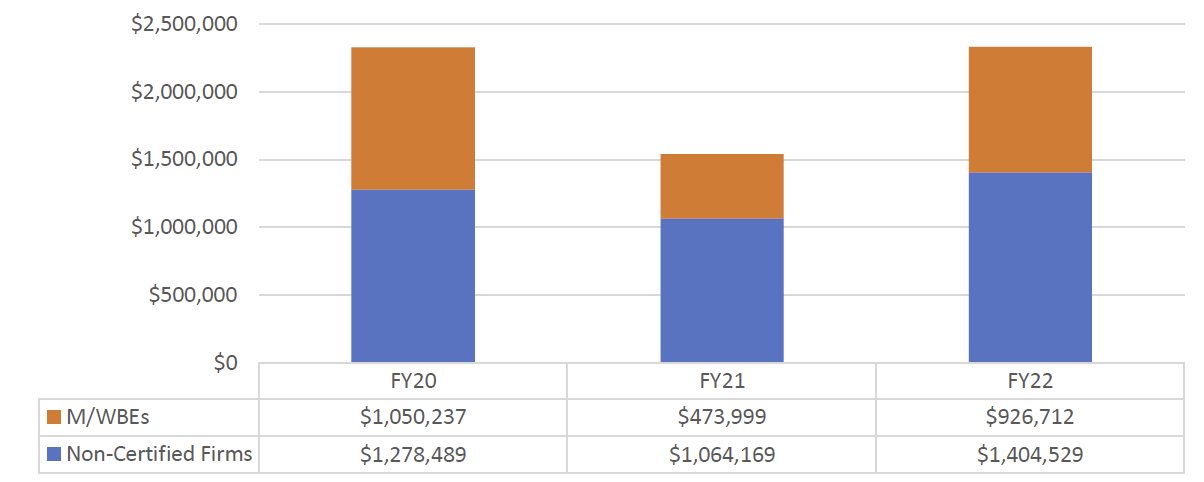

In FY22, the City registered 136,269 new contracts and POs valued at over $44 billion. This includes many areas of contracting that are not subject to LL 174 participation goals including human services contracts (which account for almost 43% of the registered contract value citywide). It also does not include Emergency contracts or contracts for non-mayoral agencies. Across all City contracts and POs, 24,033 were registered to M/WBEs, representing 5% of the value and 17% of the volume. This relative share of registered contracts remains generally stagnant with the share from prior fiscal years.

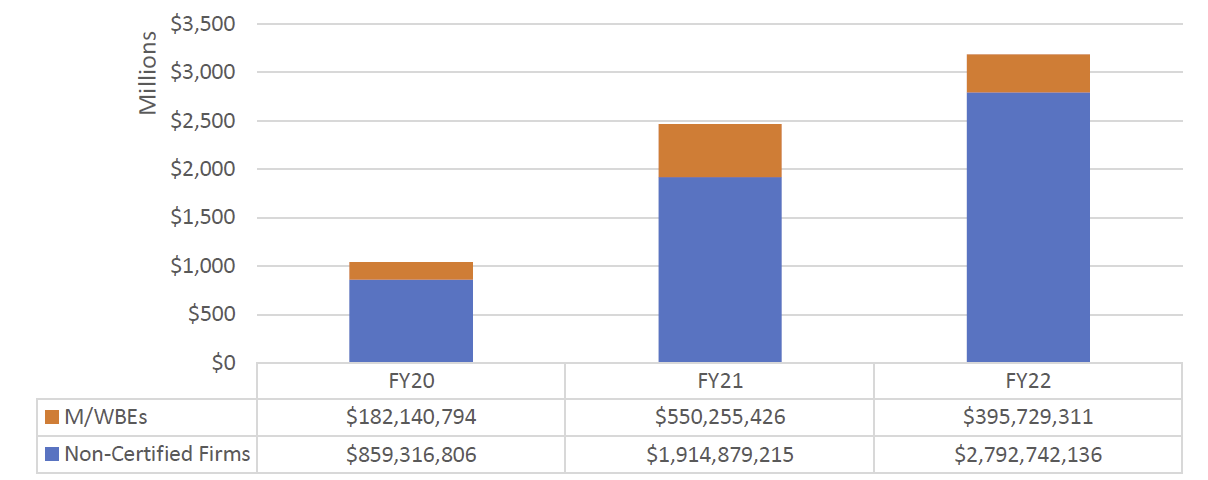

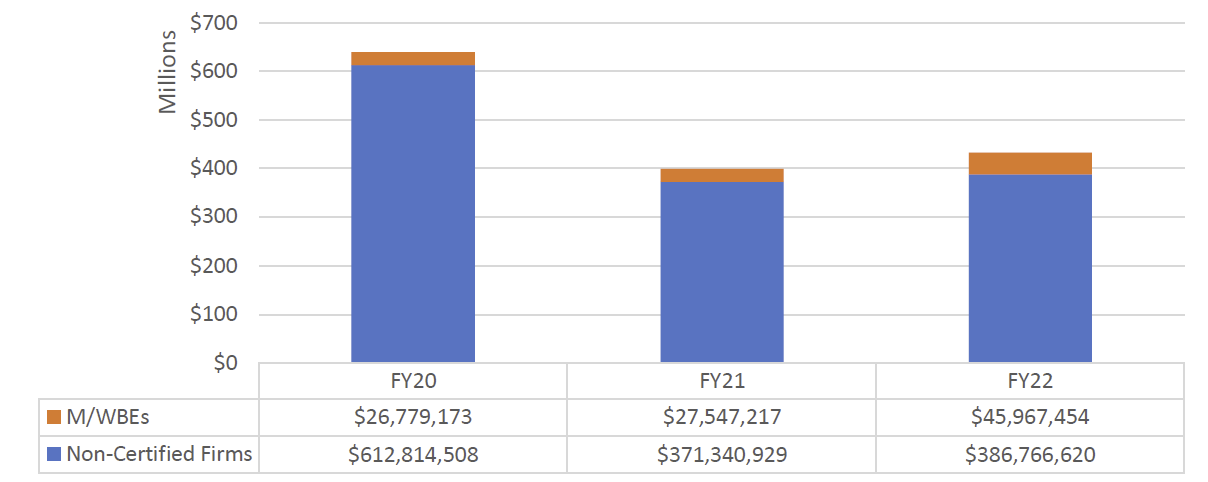

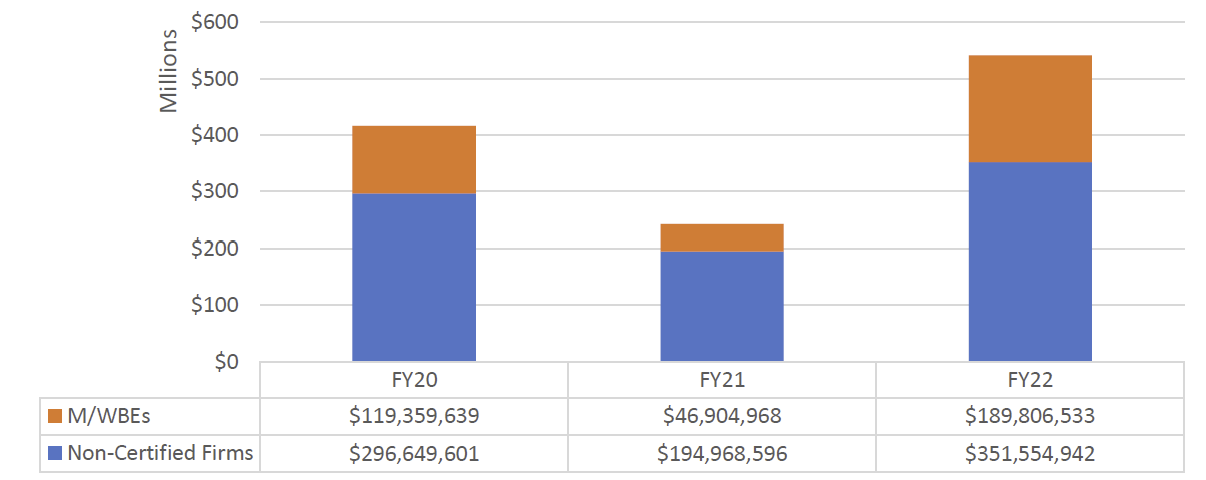

Table 1: All Registered New Contracts and POs Citywide, FY20-22

| Certification Type | # of Contracts | % Share of Number of Contracts | Total Registered Contract Value | % Share of Contract Value |

| FY20 | 116,926 | N/A | $23,501,616,476 | N/A |

| Non-Certified | 97,016 | 82.97% | $21,764,326,473 | 92.61% |

| M/WBEs | 19,910 | 17.03% | $1,737,290,004 | 7.39% |

| FY21 | 95,378 | N/A | $31,663,781,674 | N/A |

| Non-Certified | 74,104 | 77.70% | $30,199,840,438 | 95.38% |

| M/WBEs | 21,274 | 22.30% | $1,463,941,236 | 4.62% |

| FY22 | 136,269 | N/A | $44,560,595,459 | N/A |

| Non-Certified | 112,236 | 82.36% | $42,242,006,814 | 94.80% |

| M/WBEs | 24,033 | 17.64% | $2,318,588,645 | 5.20% |

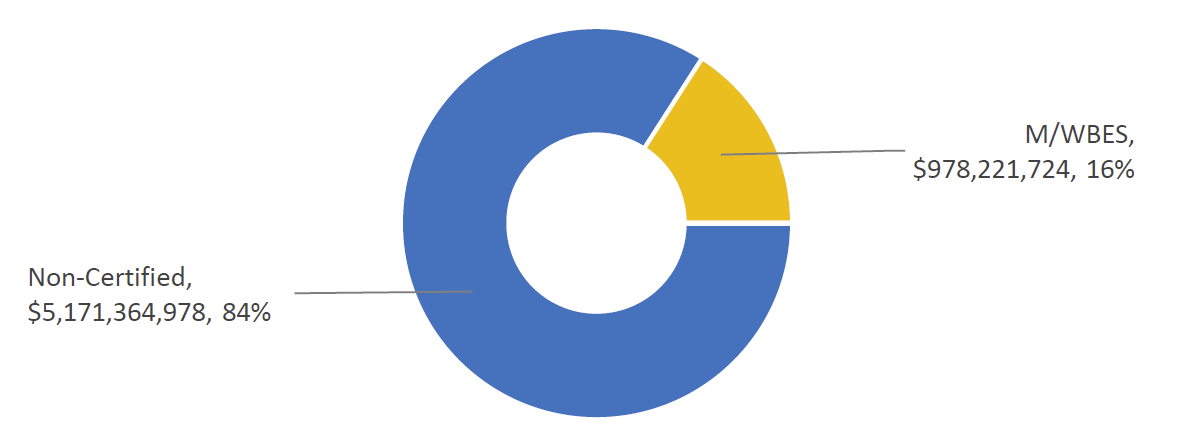

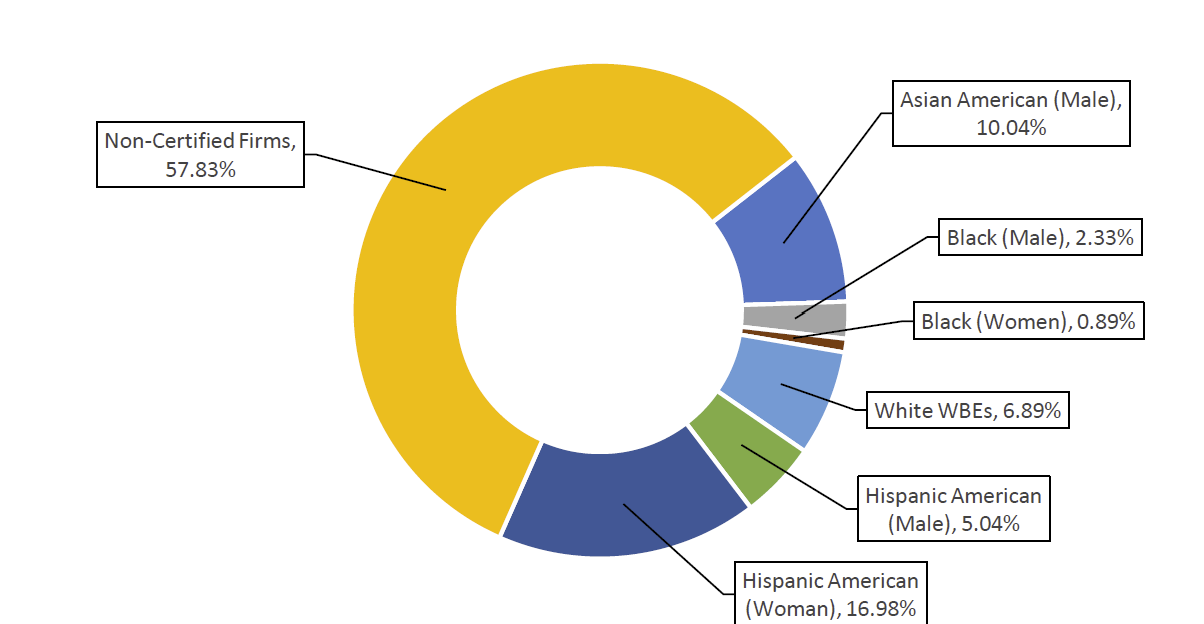

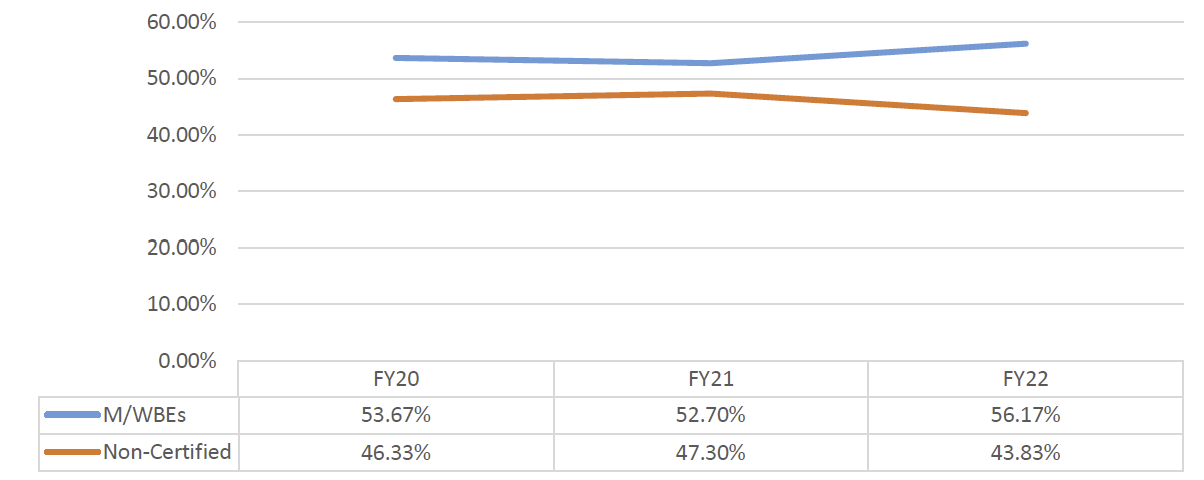

The numbers are somewhat better for new contract registrations and POs subject to LL 174 M/WBE participation goals. Per Table 2, M/WBEs accounted for 57.83% of new contracts and POs subject to LL 174 participation goals by count, and 15.91% of the associated value. The 15.91% share reflects a marginal decrease from prior fiscal years.

This small share is especially disappointing, given the actual diversity and demographics of the City. For reference throughout this report: According to the U.S. Census, in 2022, New York City was 31.9% non-Hispanic white, 28.9% Hispanic or Latino, 23.4% Black, 14.3% Asian or Pacific Islander, 0.5% Native American, and 7.1% two or more races. And 52% women, and 48% men.[7]

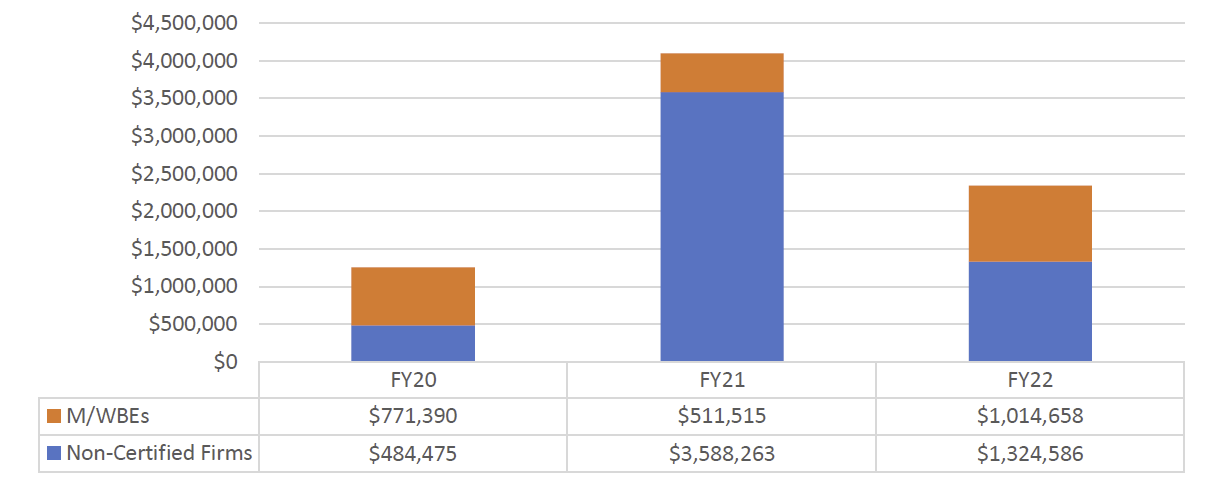

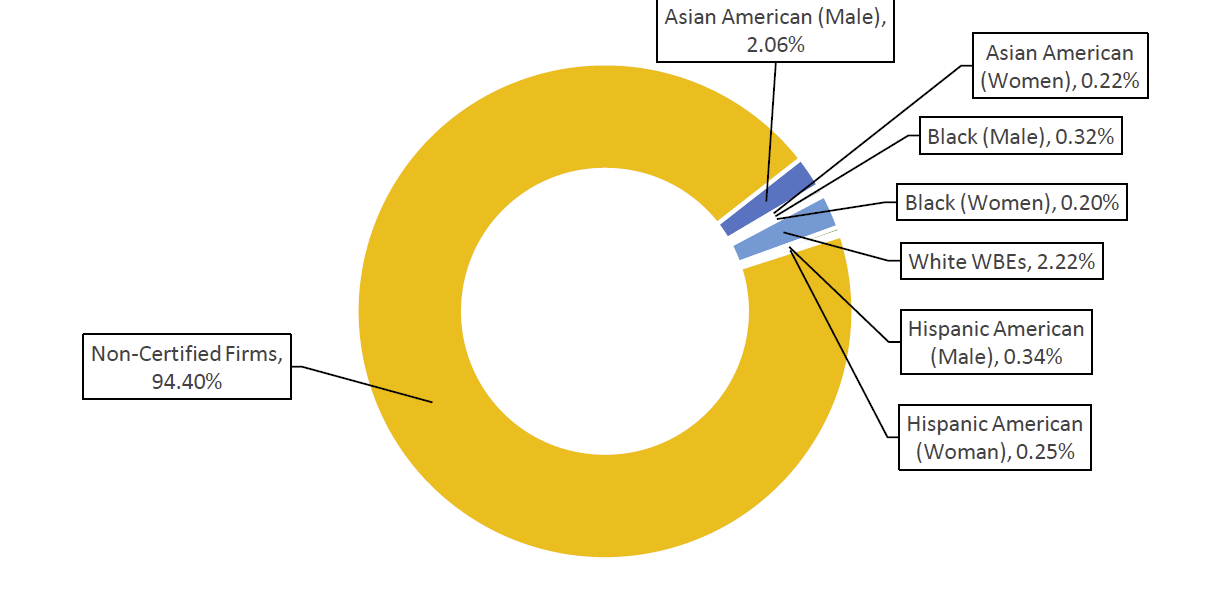

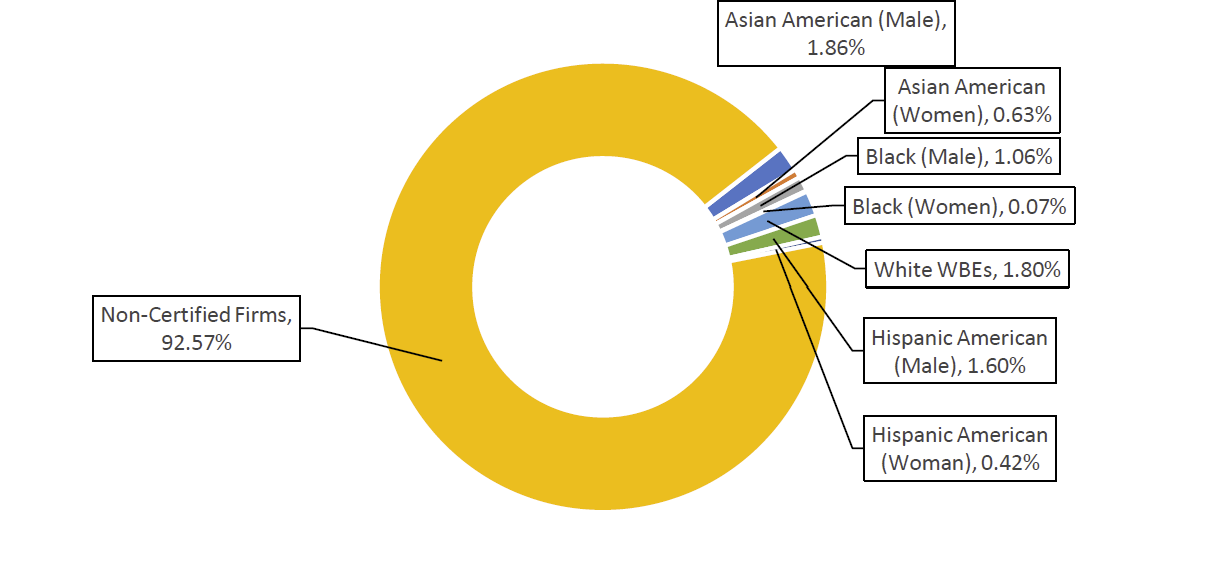

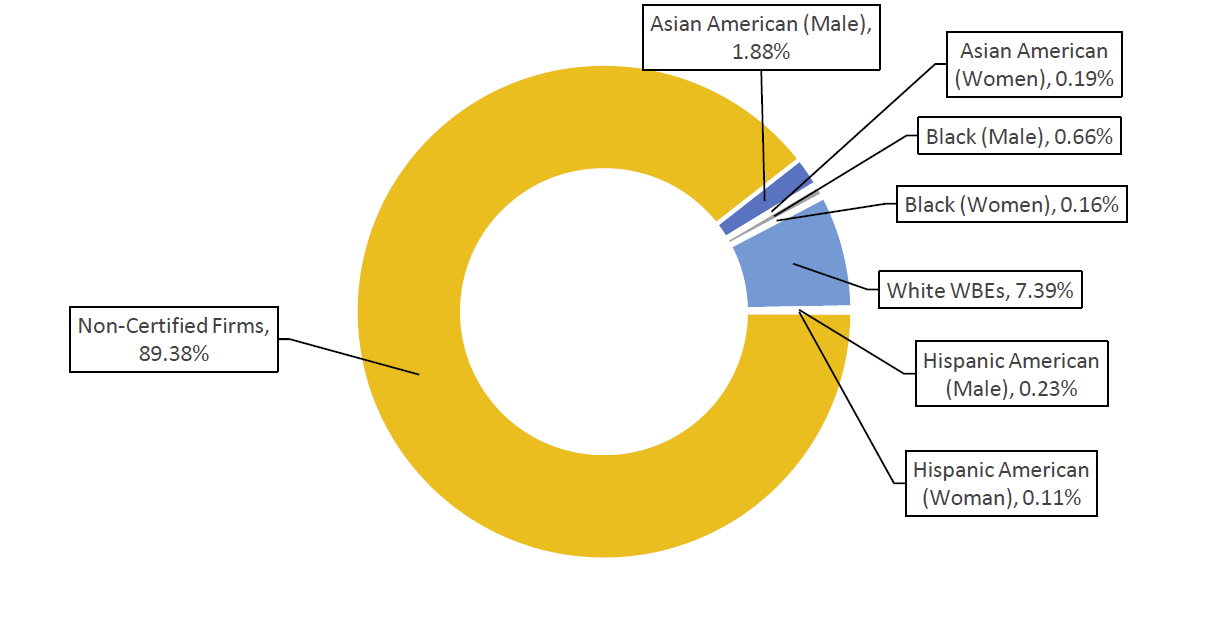

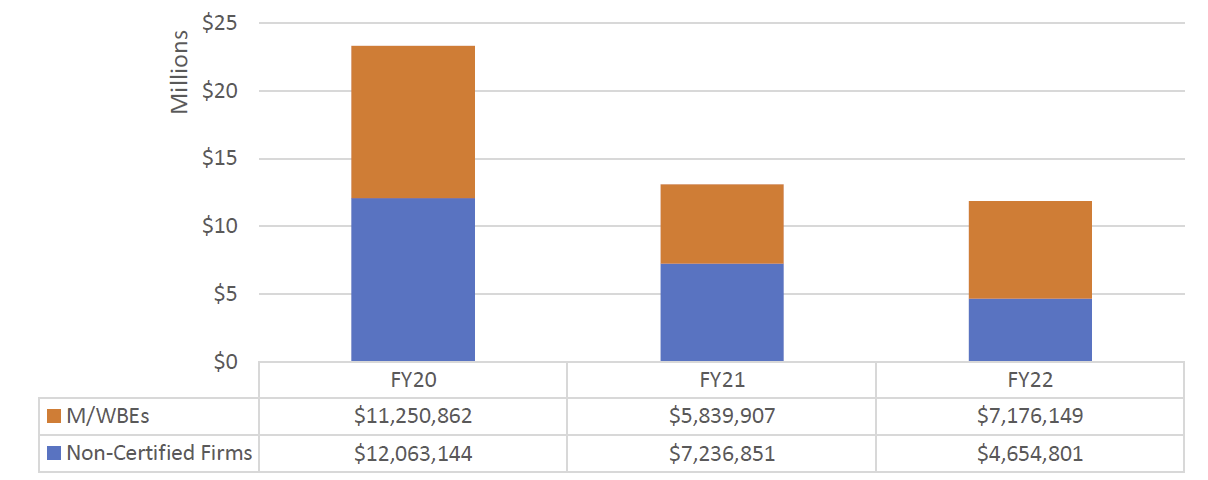

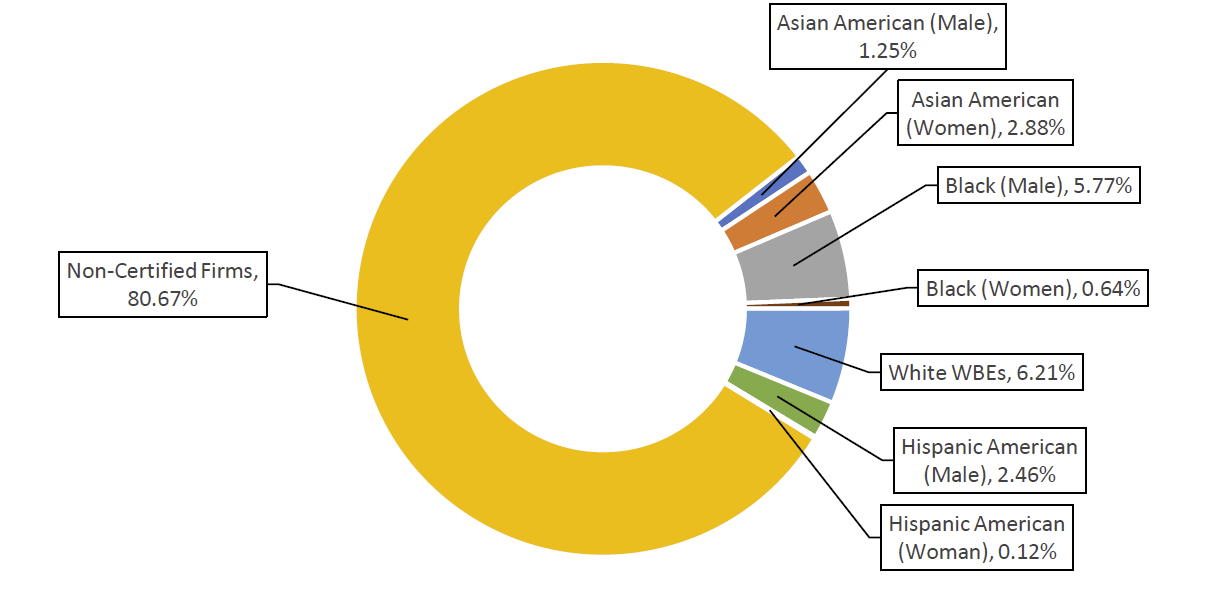

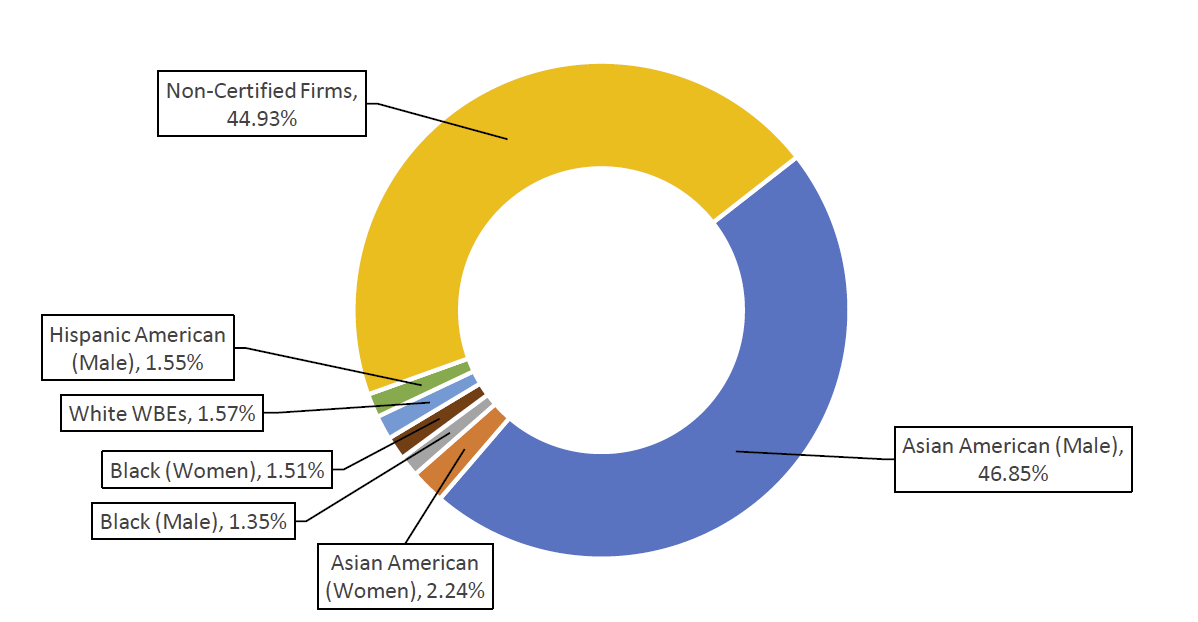

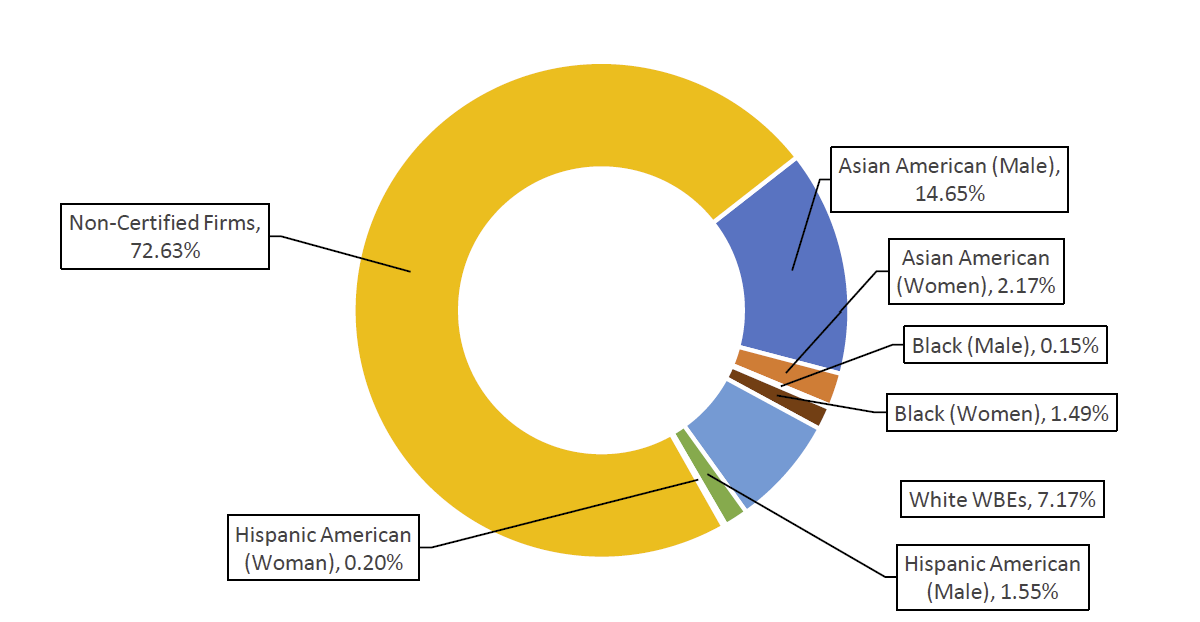

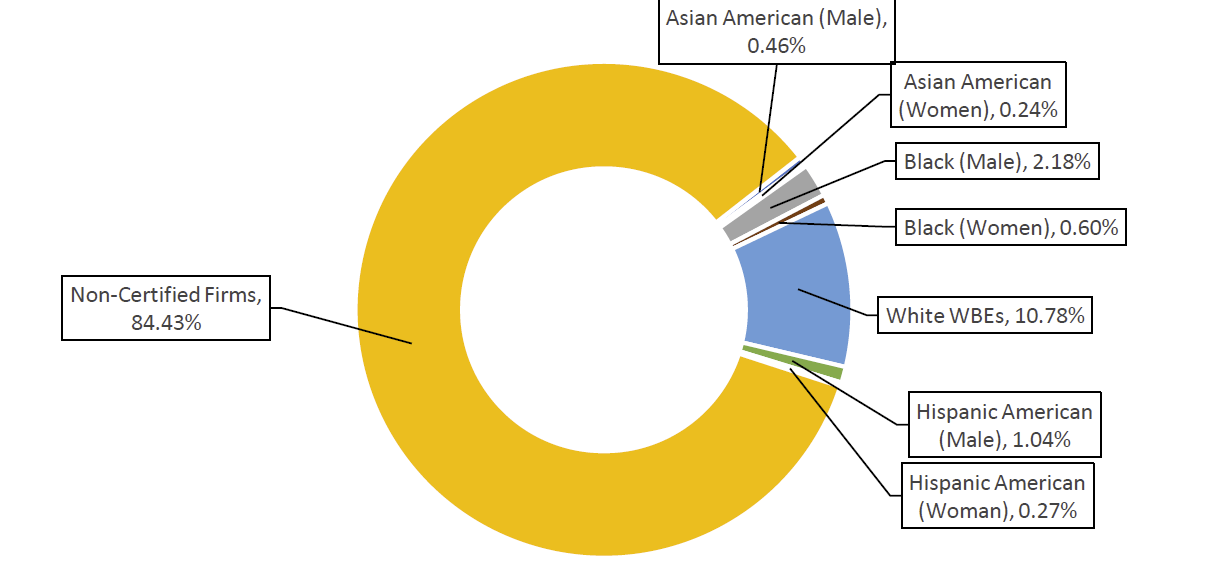

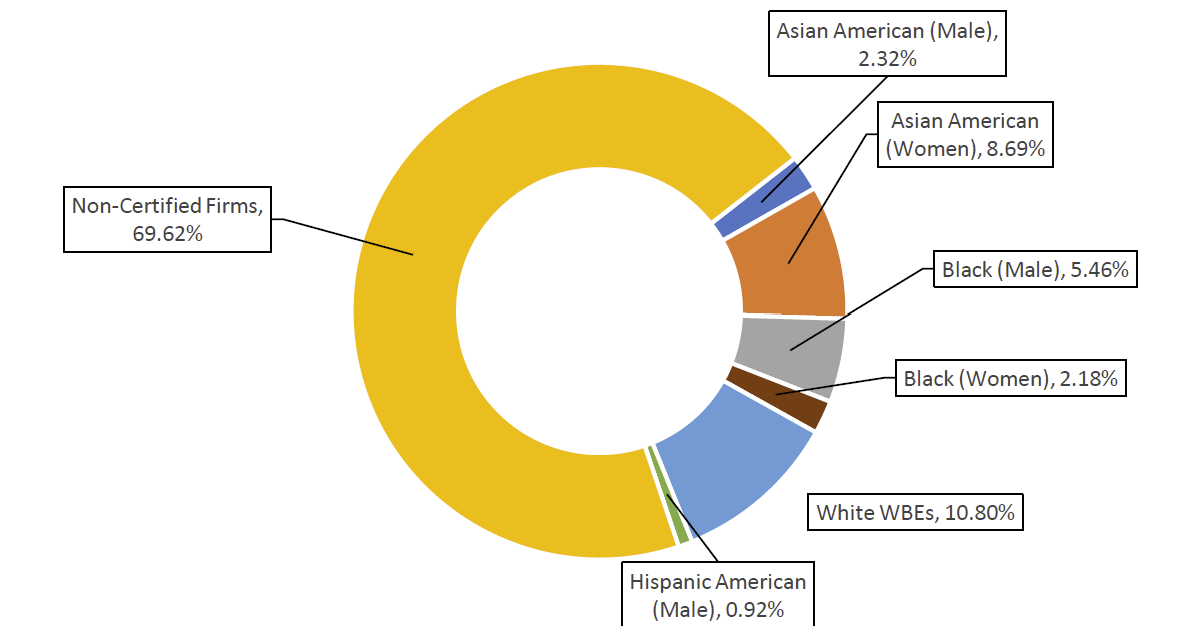

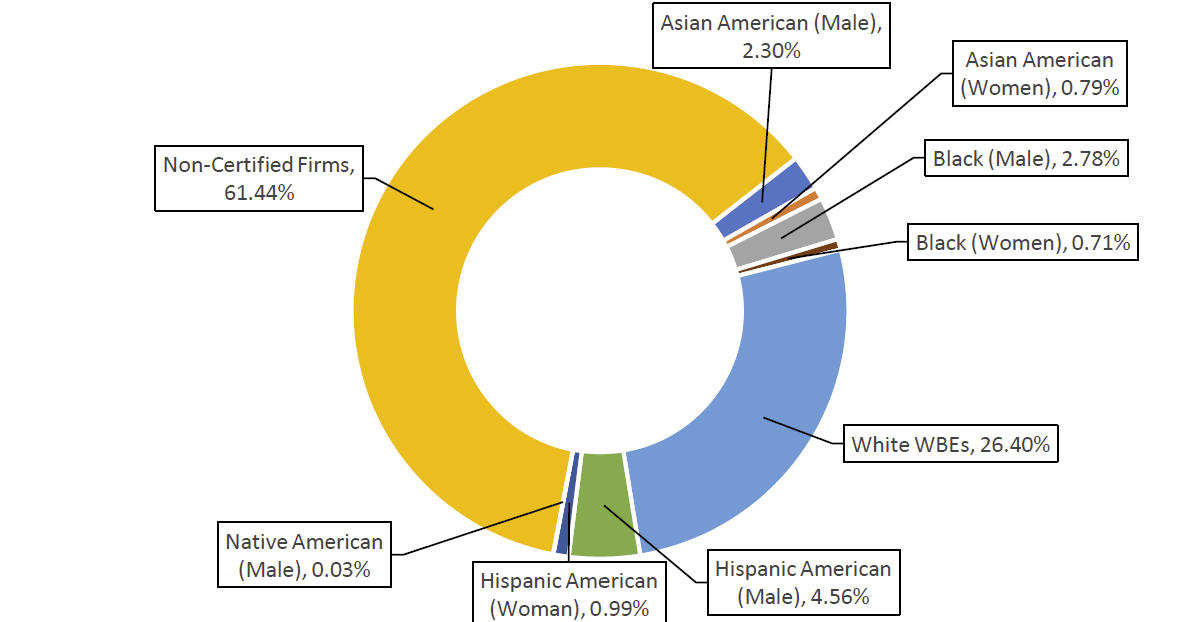

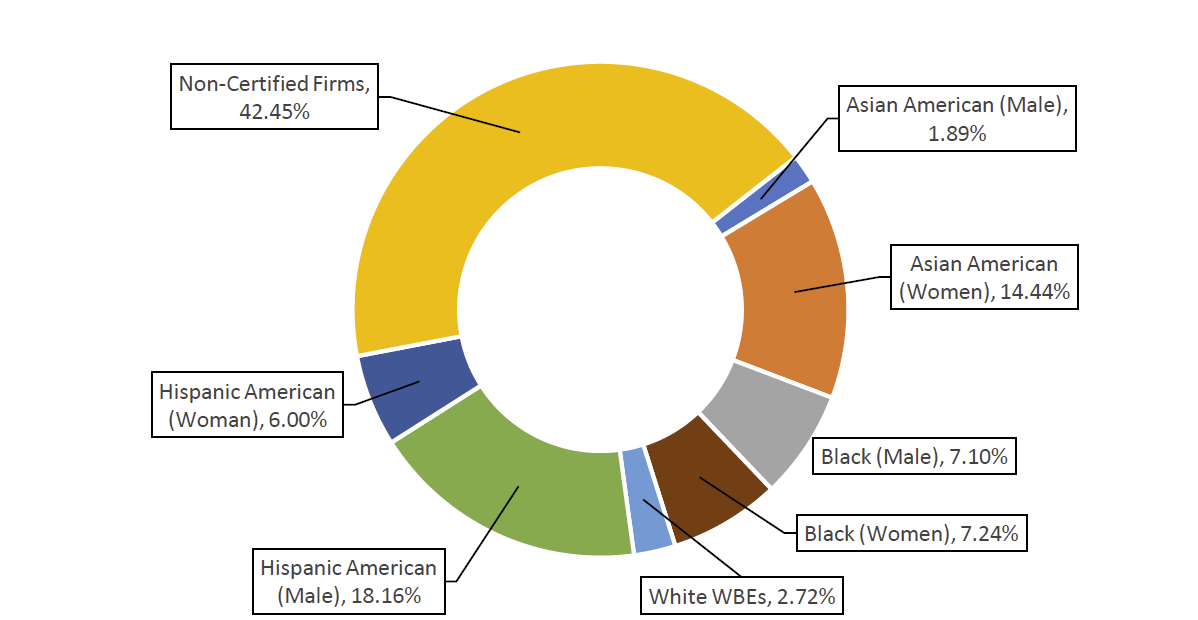

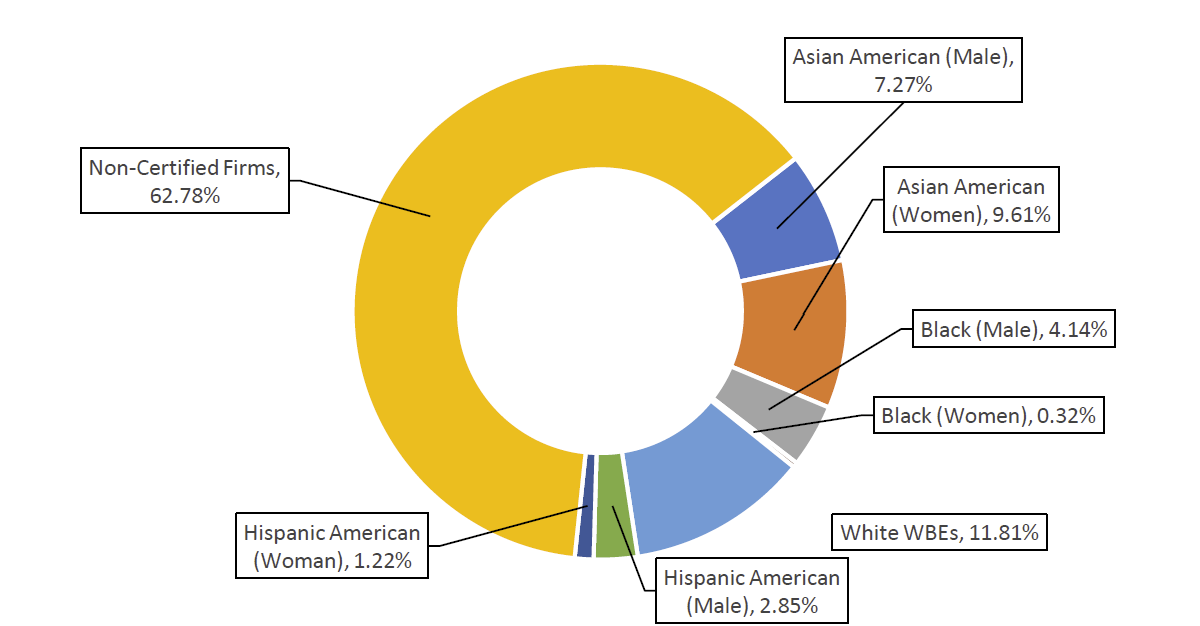

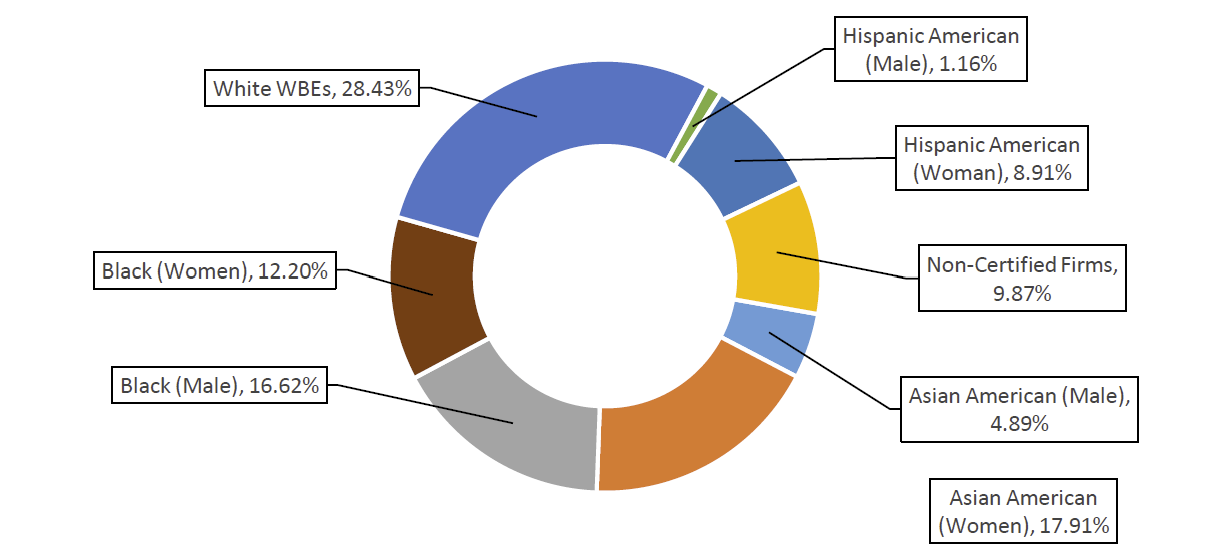

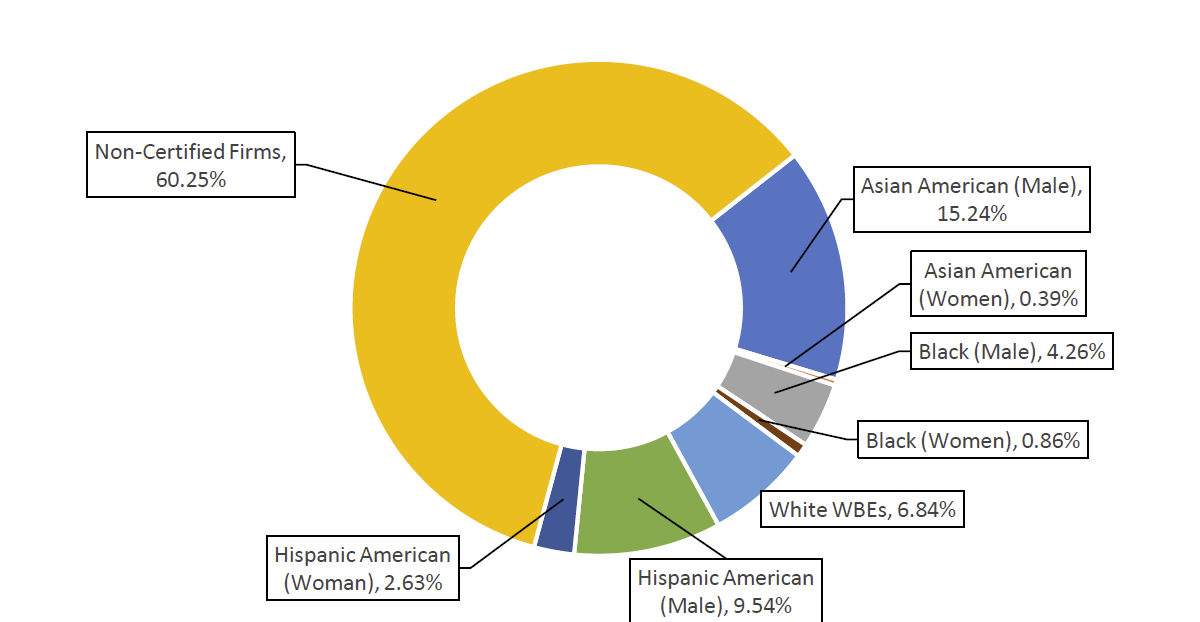

Chart 1: FY22 Share of Contract and PO Value Subject to LL 174 Participation Goals

Table 2: New Contracts and POs – Subject to LL 174 Participation Goals, FY20-22[8]

| Certification Type | # of Contracts | % Share of Contracts | Total Registered Contract Value | % Share of Contract Value |

| FY20 | 26,994 | N/A | $3,849,452,447 | N/A |

| Non-Certified | 12,770 | 47.31% | $3,219,884,594 | 83.65% |

| M/WBEs | 14,224 | 52.69% | $629,567,853 | 16.35% |

| FY21 | 26,426 | N/A | $5,259,835,911 | N/A |

| Non-Certified | 10,162 | 38.45% | $4,394,002,487 | 83.54% |

| M/WBEs | 16,264 | 61.55% | $865,833,423 | 16.46% |

| FY22 | 29,486 | N/A | $6,149,586,703 | N/A |

| Non-Certified | 12,435 | 42.17% | $5,171,364,978 | 84.09% |

| M/WBEs | 17,051 | 57.83% | $978,221,724 | 15.91% |

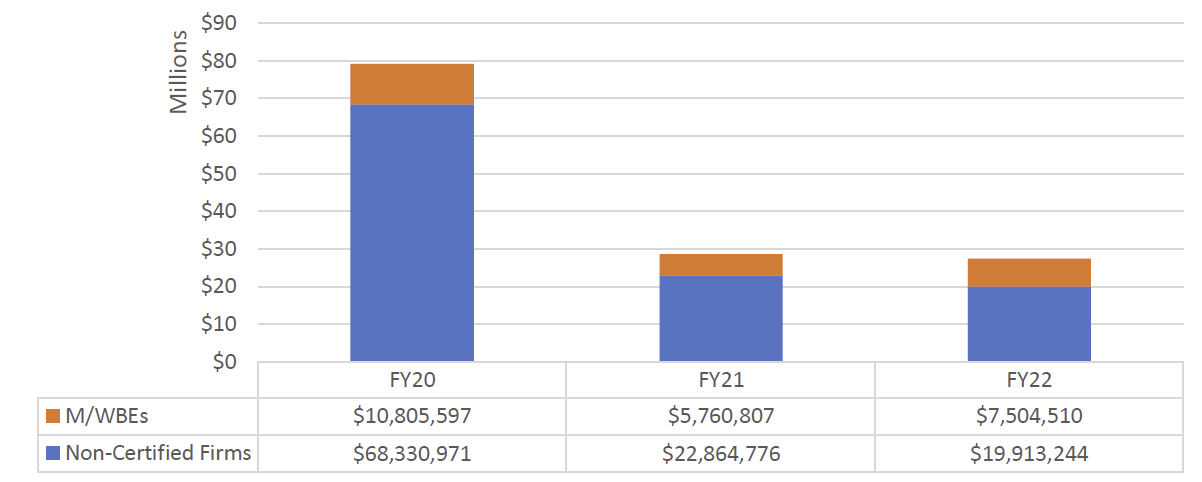

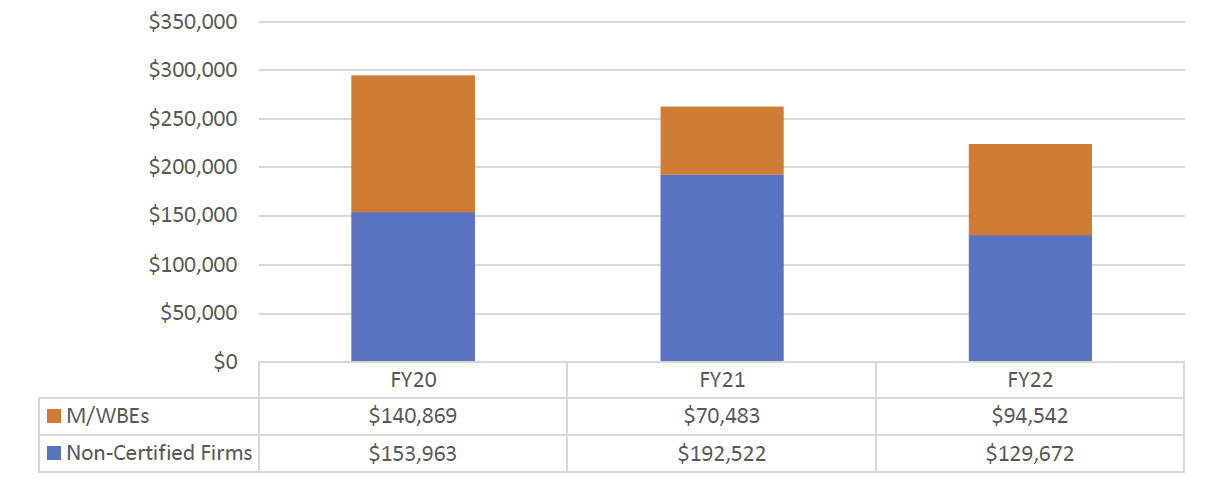

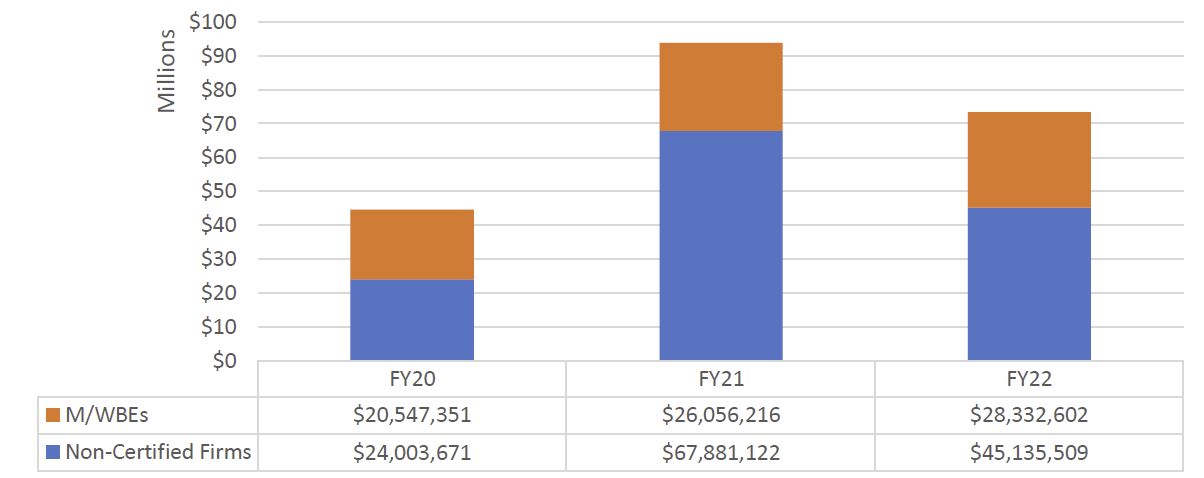

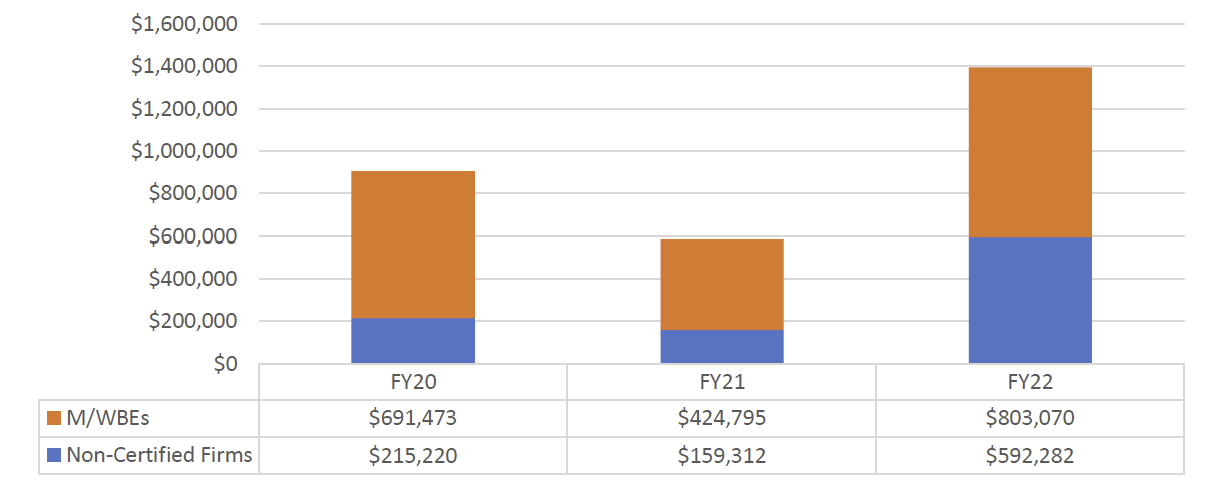

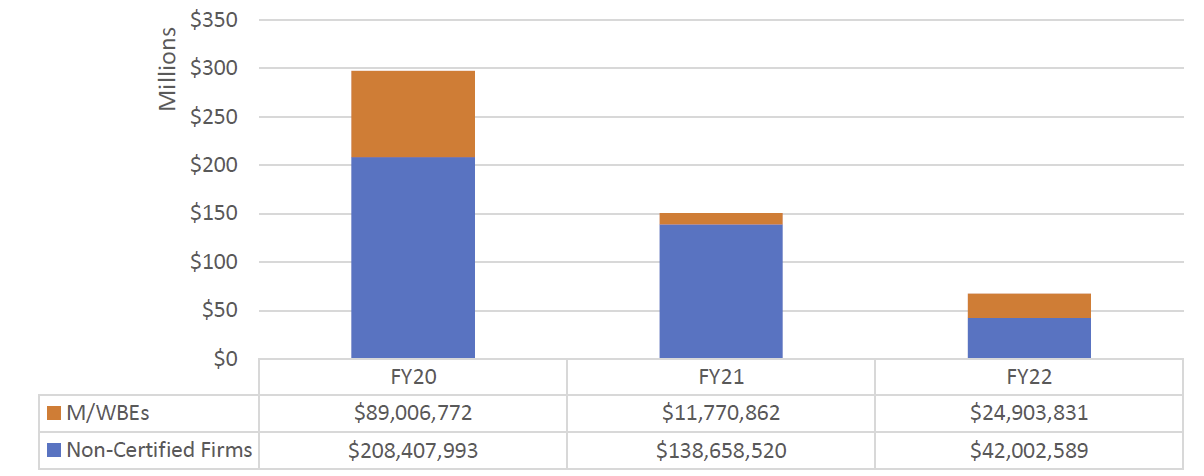

The City spent a total of $6.72 billion in FY22 (prime contracts registered in FY22 and prior fiscal years subject to LL 174 participation goals), 12.29% of which ($826.33 million) was spent with M/WBE prime vendors, a modest increase in share compared to prior fiscal years.

Table 3: Prime Spend Subject to LL 174 Participation Goals, FY20-22

| Fiscal Year | M/WBE Spending | Non-Certified Spending | Total Spending | M/WBE Share |

| FY20 | $797,963,627 | $6,067,576,798 | $6,865,540,425 | 11.62% |

| FY21 | $774,832,134 | $6,024,249,948 | $6,799,082,082 | 11.40% |

| FY22 | $826,330,701 | $5,896,850,869 | $6,723,181,569 | 12.29% |

| Total | $2,399,126,462 | 17,988,677,615 | $20,387,804,077 | 11.77% |

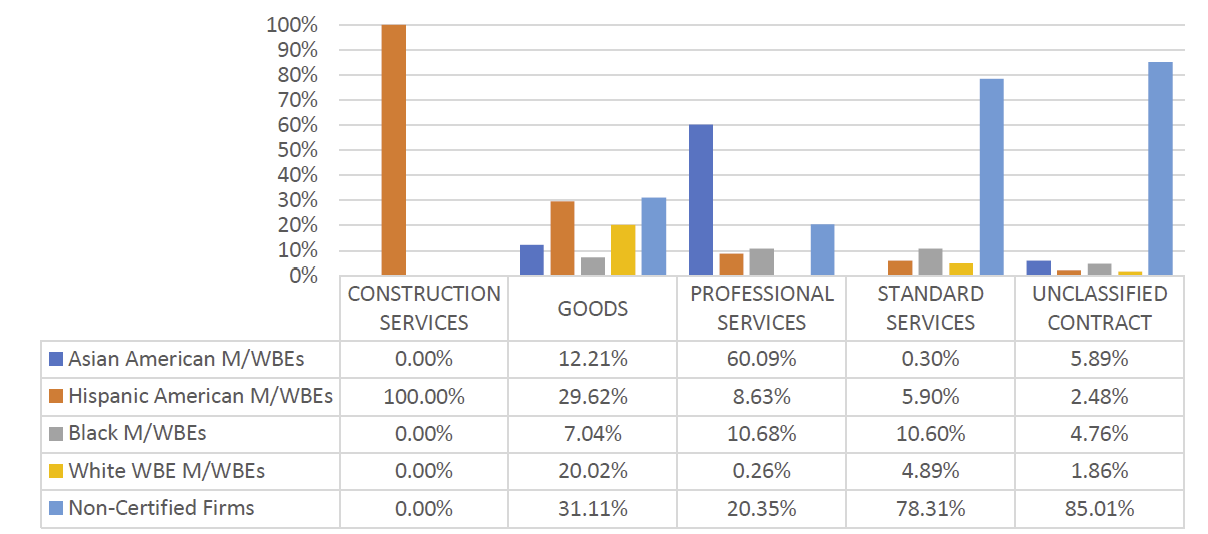

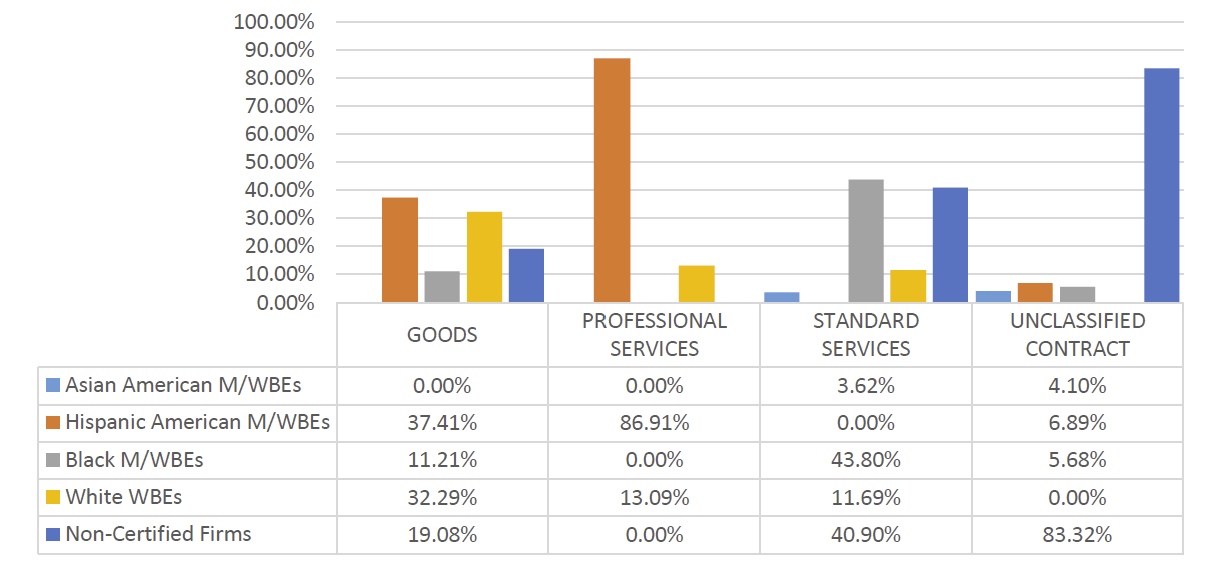

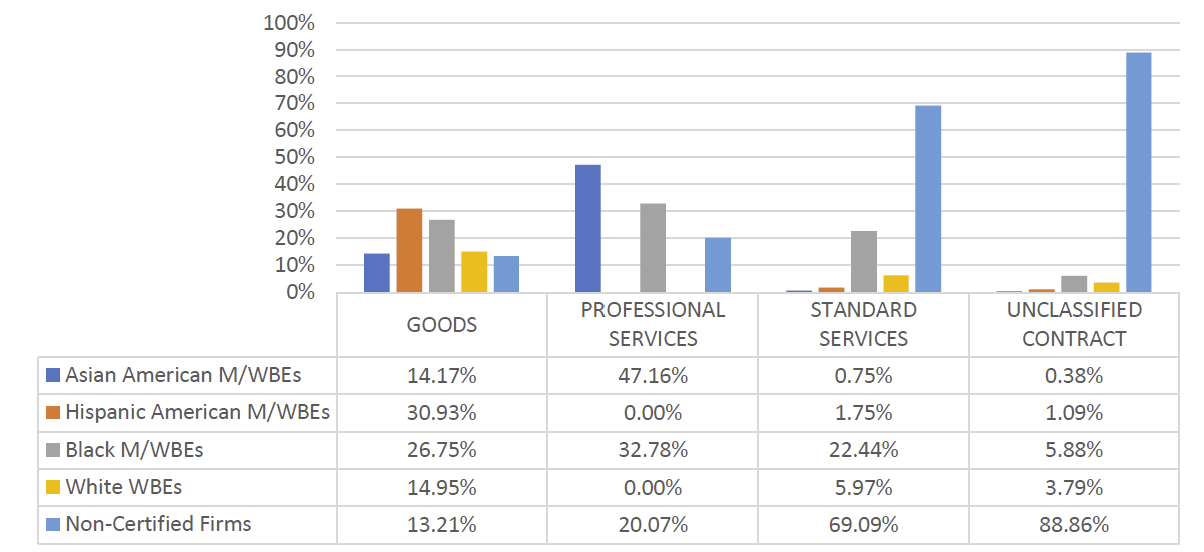

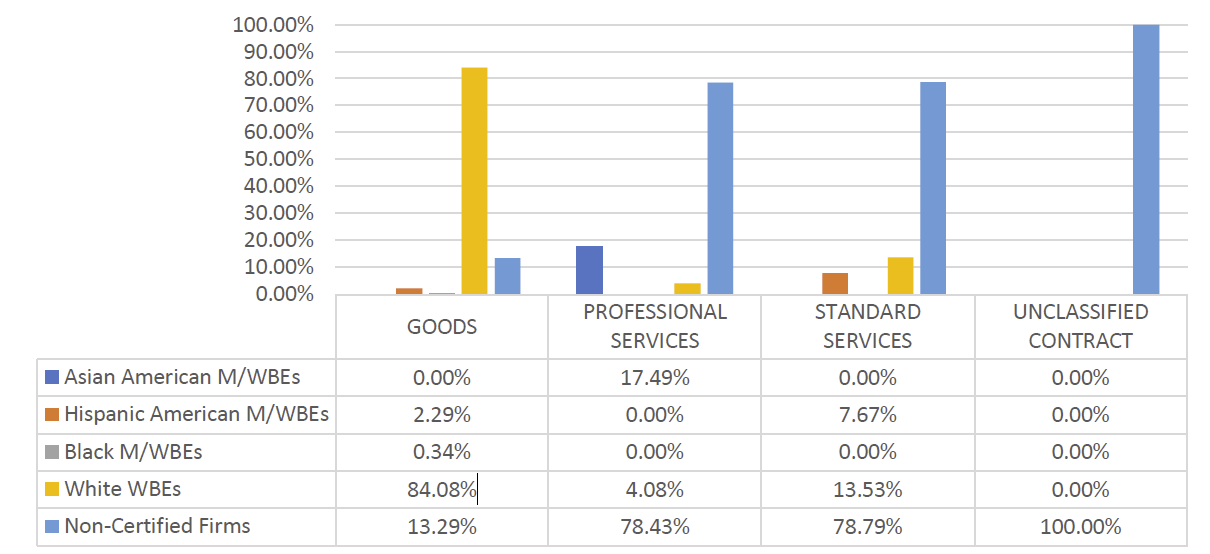

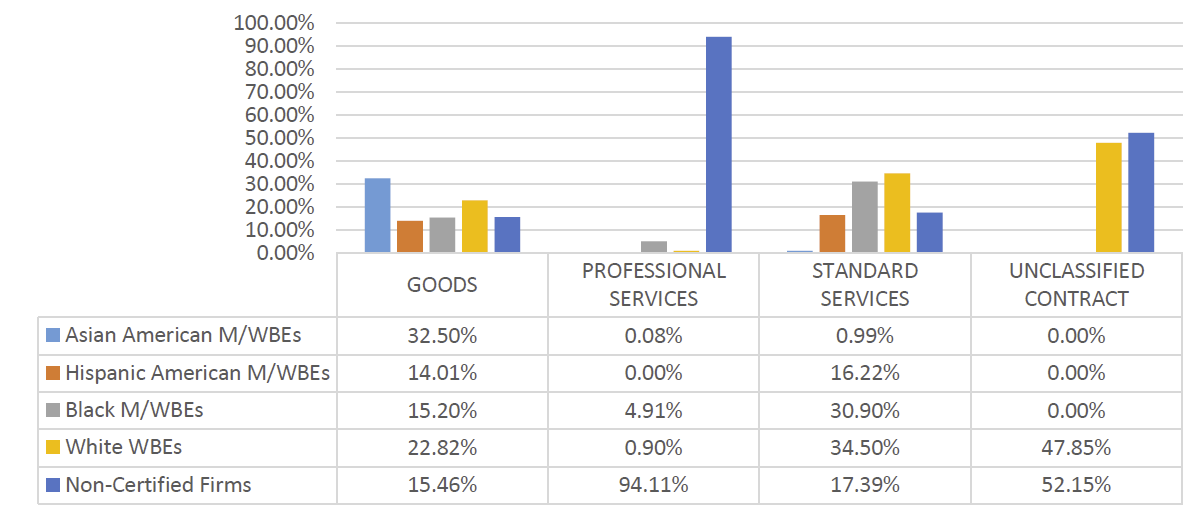

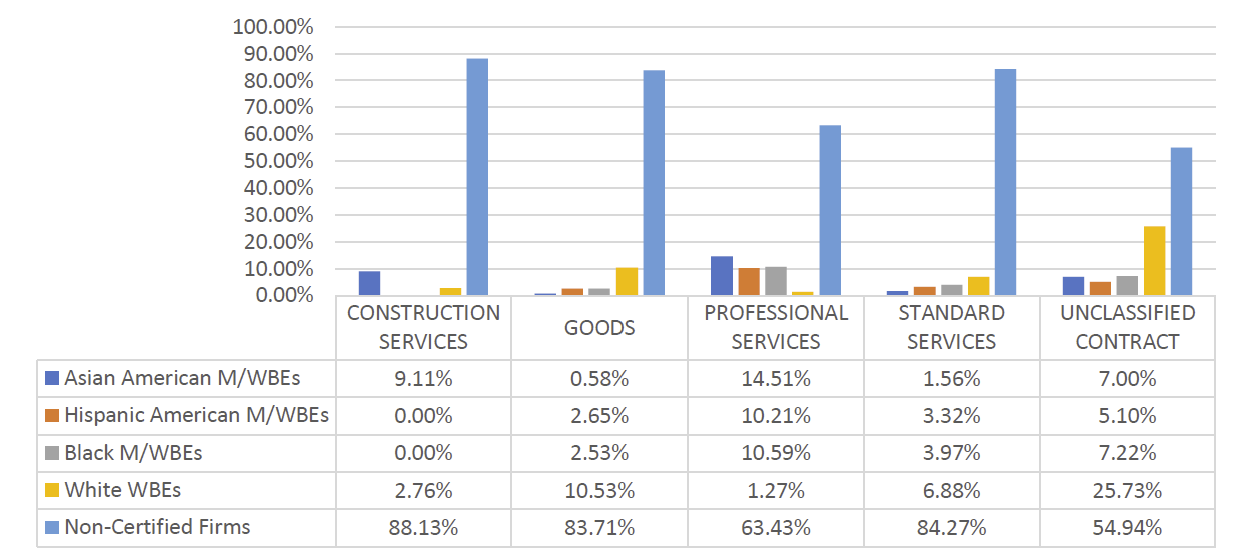

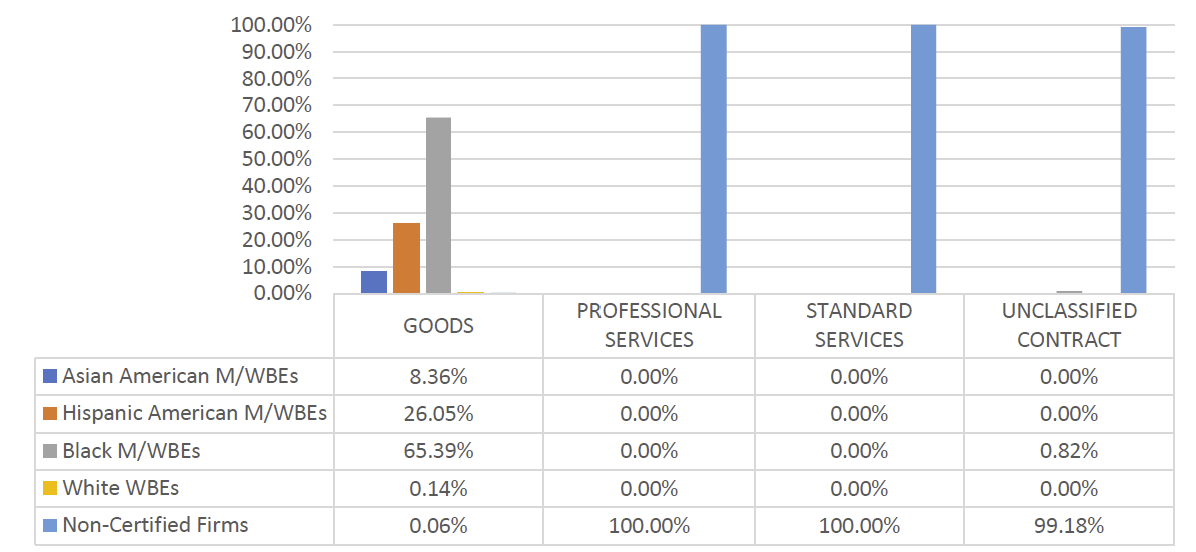

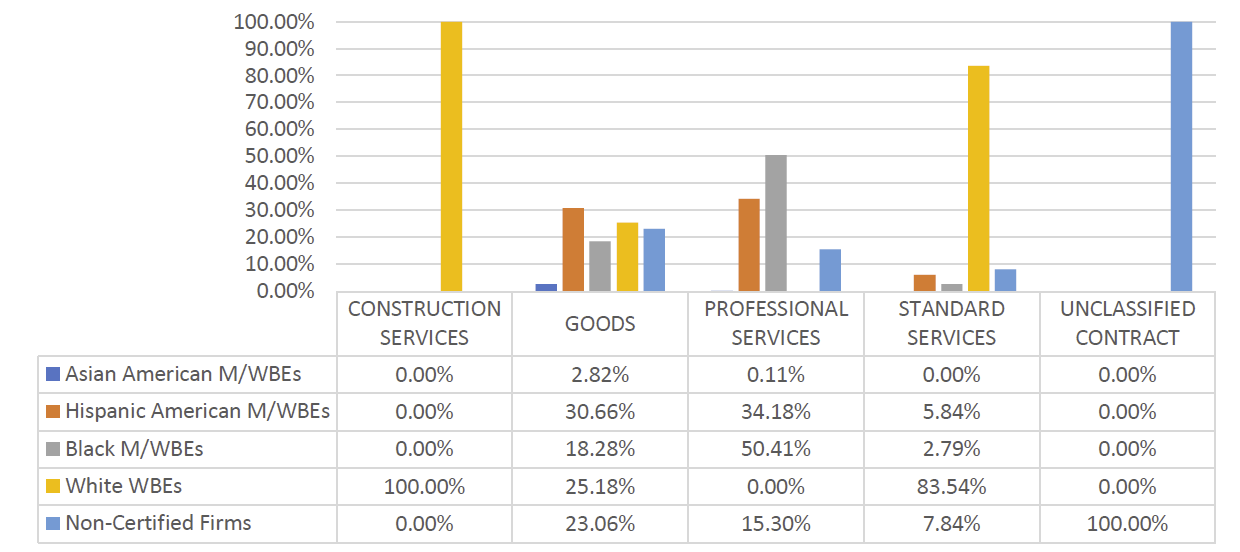

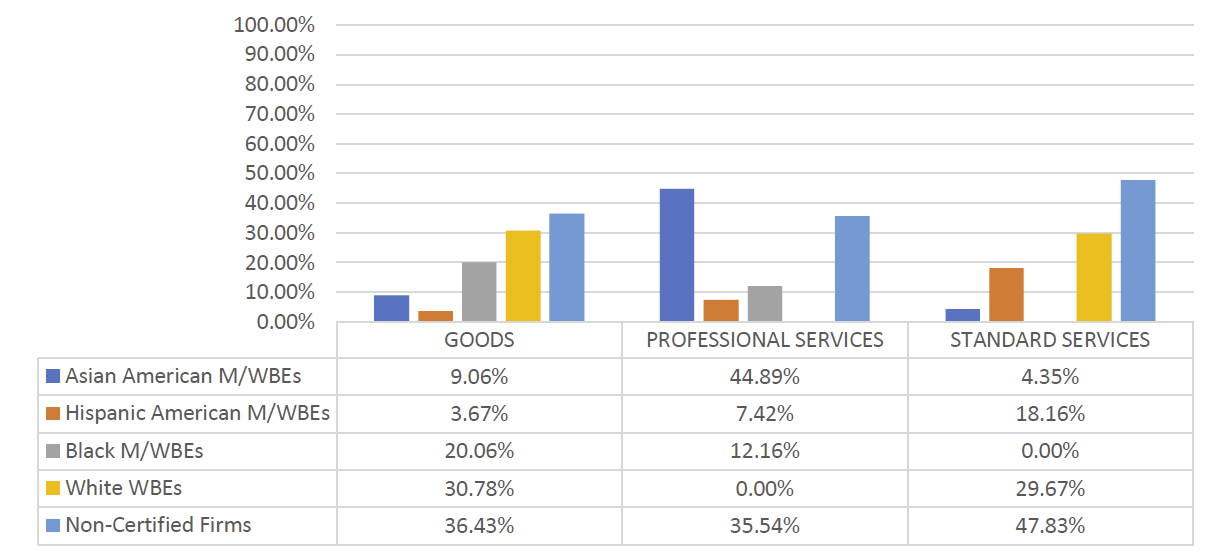

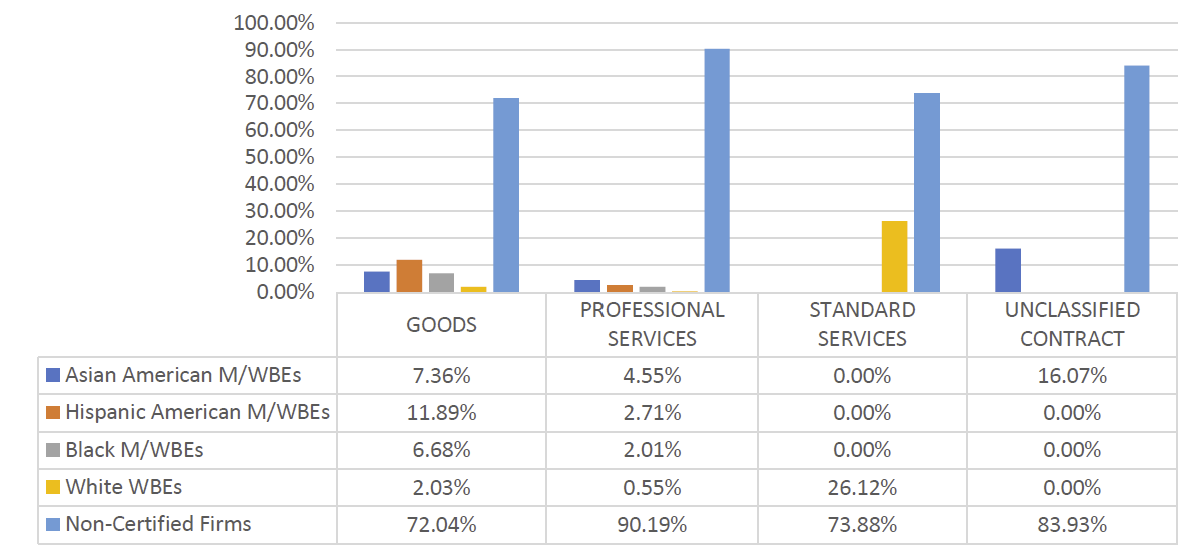

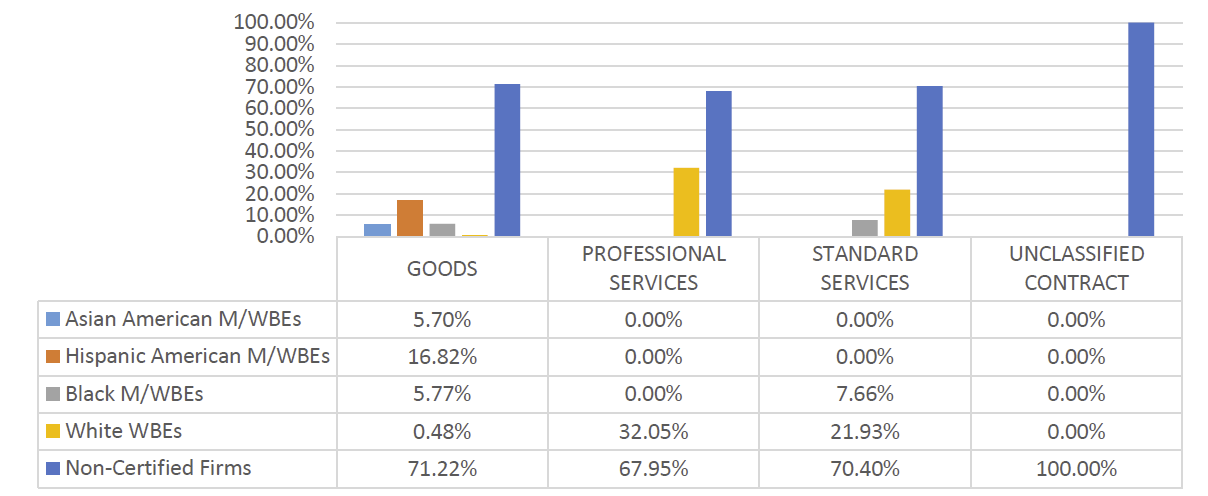

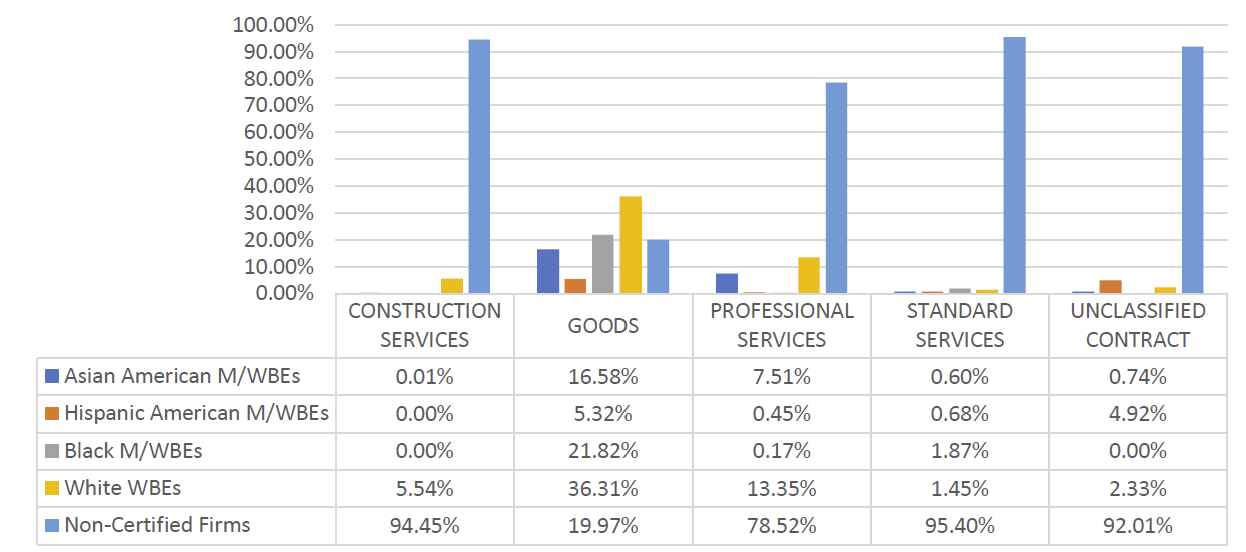

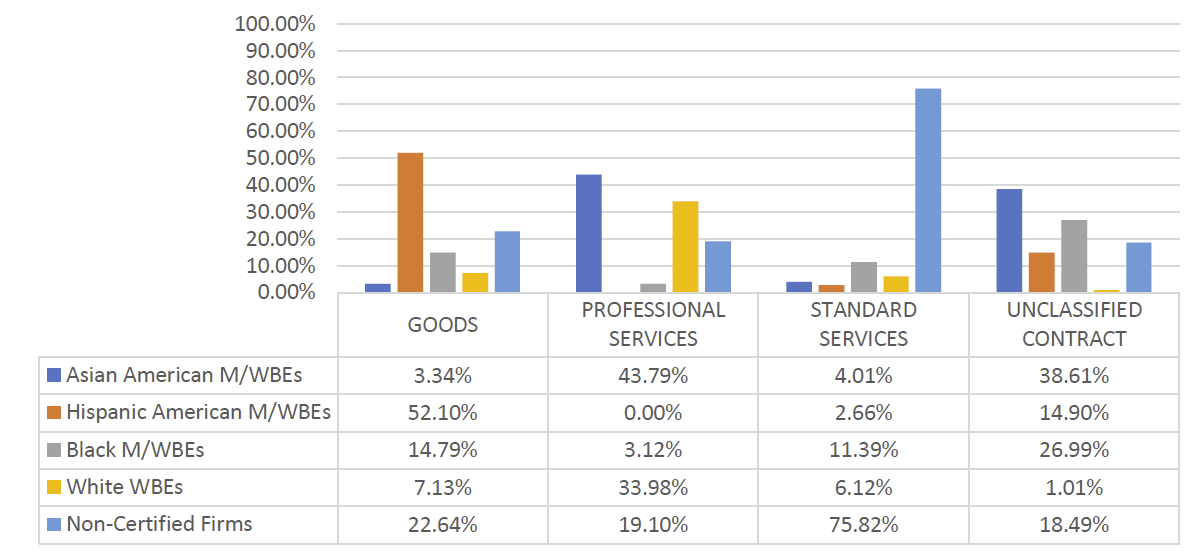

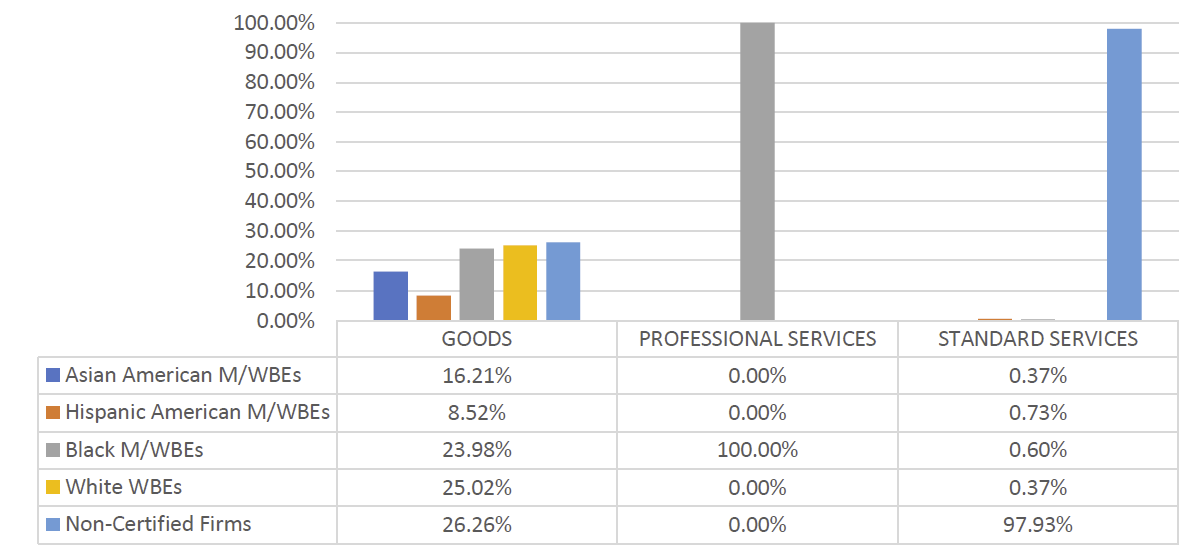

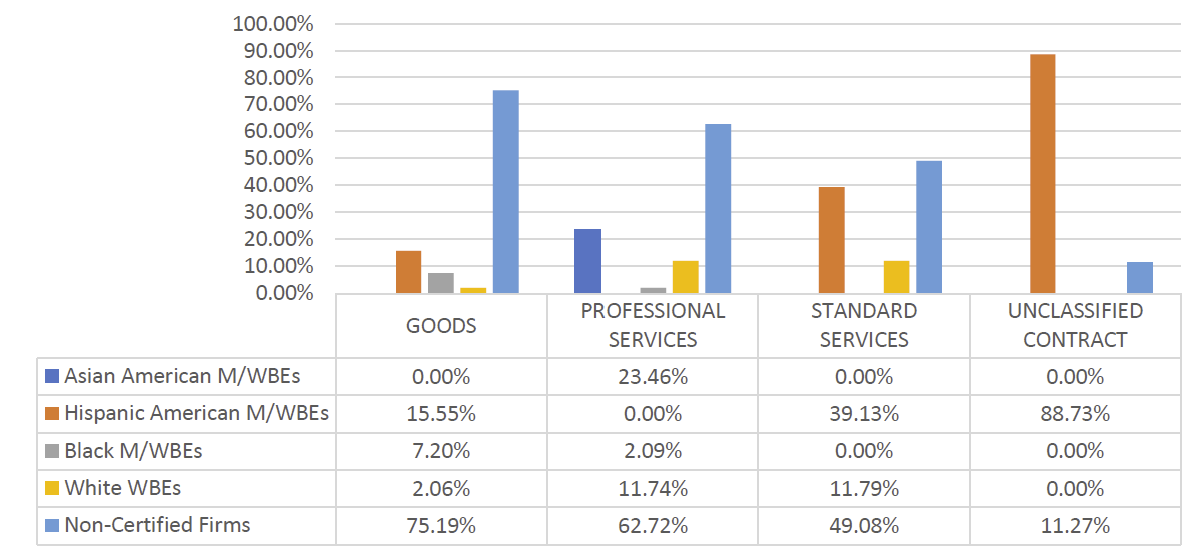

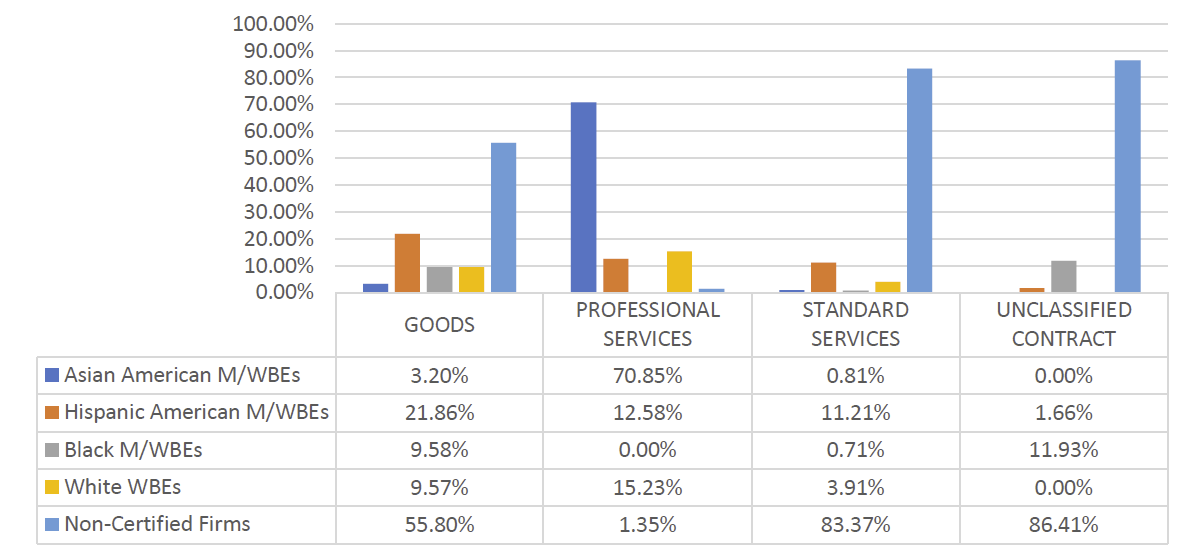

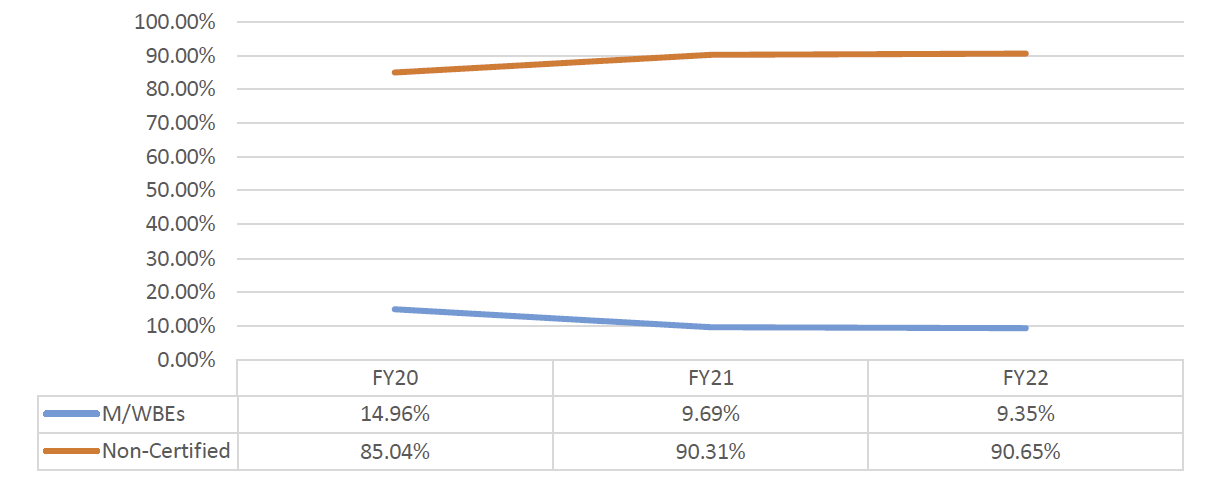

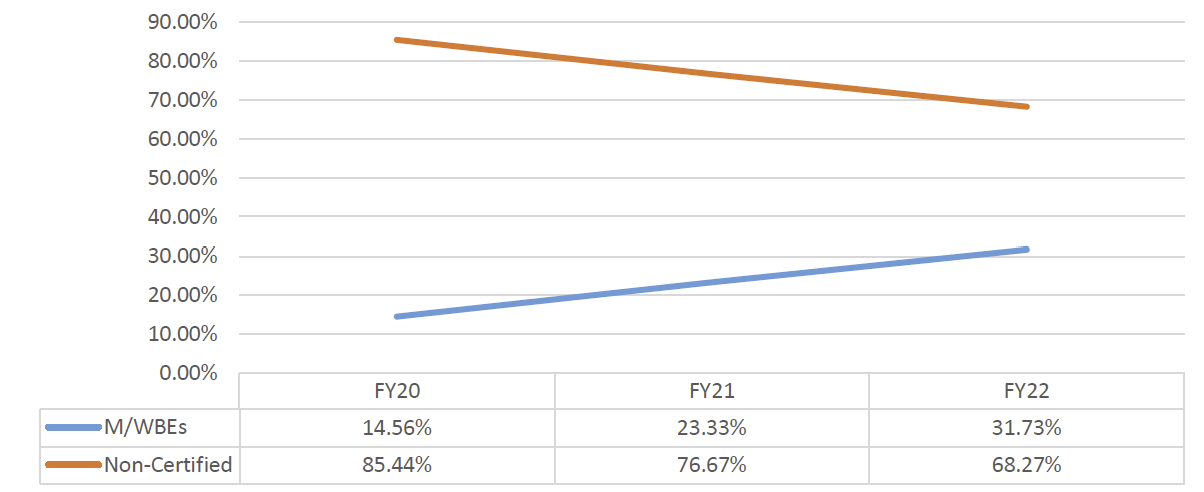

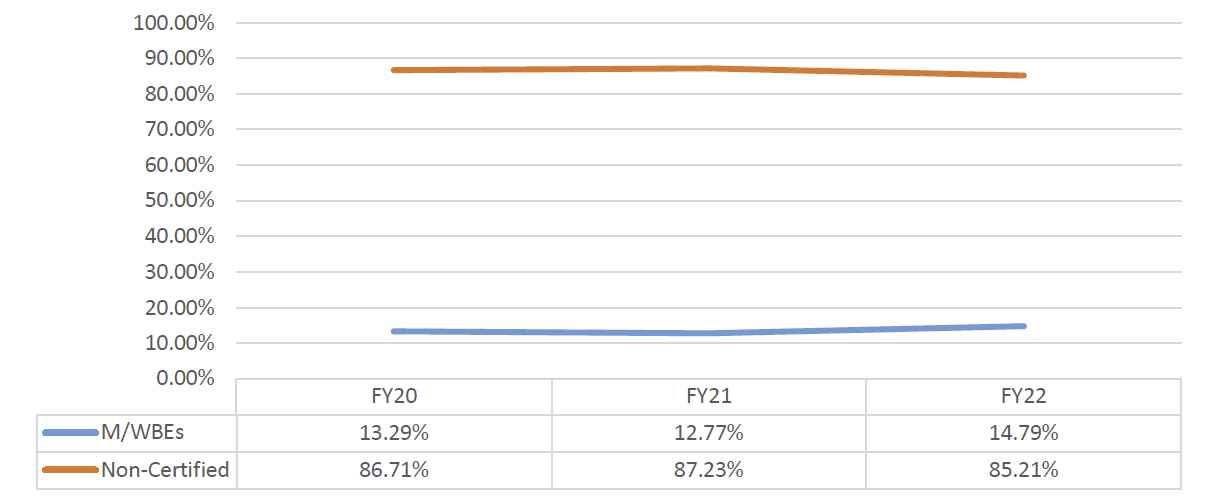

M/WBE utilization varies depending on the industry. The Construction and Standard Services industries see some of the lowest spending and registration values to M/WBEs. Only 9% of Construction and 15% of Standard Services prime contract registration value subject to LL 174 participation goals were registered to M/WBEs. Similarly, only 11% of prime Construction spending and less than 15% of prime Standard Services Spending went to M/WBEs. Additional details analyzing M/WBE utilization at the industry level can be found in the “M/WBE Utilization by Industry” section of this Report.

Table 4: FY22 Value of M/WBE Prime Contract Registrations and POs, Subject to LL 174 Participation Goals, by Industry

| M/WBEs | Non-Certified | ||||

| Industry | Total Contract and PO Value | % Share of Contract and PO Value | Total Contract and PO Value | % Share of Contract and PO Value | |

|---|---|---|---|---|---|

| Construction | $379,322,280 | 9.35% | $3,679,602,595 | 90.65% | |

| Goods <$1 million | $91,147,171 | 56.17% | $71,120,120 | 43.83% | |

| Professional Services | $410,033,659 | 31.73% | $882,092,100 | 68.27% | |

| Standardized Services | $81,961,129 | 14.79% | $472,293,049 | 85.21% | |

| Grand Total | $962,464,239 | 15.86% | $5,105,107,864 | 84.14% | |

Table 5: FY22 Total Prime Vendor Spend Subject to LL 174 Participation Goals, by Industry

| M/WBE Category | Construction – % of Total Spending | Professional Services % of Total Spending | Standardized Services – % of Total Spending | Goods – % of Total Spending |

| All M/WBE | 11.05% | 15.11% | 14.55% | 15.42% |

| Non-Certified | 88.95% | 84.89% | 85.45% | 84.58% |

| Total | 100.00% | 100.00% | 100.00% | 100.00% |

It is important to note that these trends look different for subcontracted spending across industries. M/WBEs receive higher shares of subcontracted spending than non-certified firms in Construction, Professional Services, and Standardized Services. M/WBEs only receive a very small share of Goods subcontracted spending, as there is little subcontracting in this industry generally.

Table 6: FY22 Total Sub Vendor Spend Subject to LL 174 Participation Goals, by Industry

| M/WBE Category | Construction – % of Total Spending | Professional Services % of Total Spending | Standardized Services – % of Total Spending | Goods – % of Total Spending |

| All M/WBE | 53.59% | 66.95% | 58.57% | 4.44% |

| Non-Certified | 46.41% | 33.05% | 41.43% | 95.56% |

| Total | 100.00% | 100.00% | 100.00% | 100.00% |

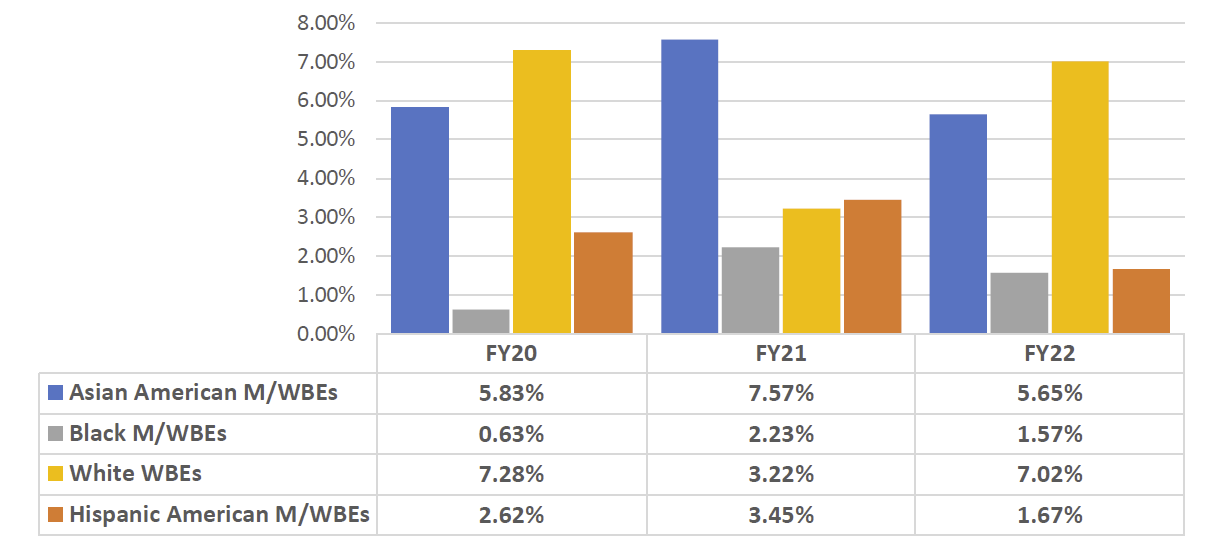

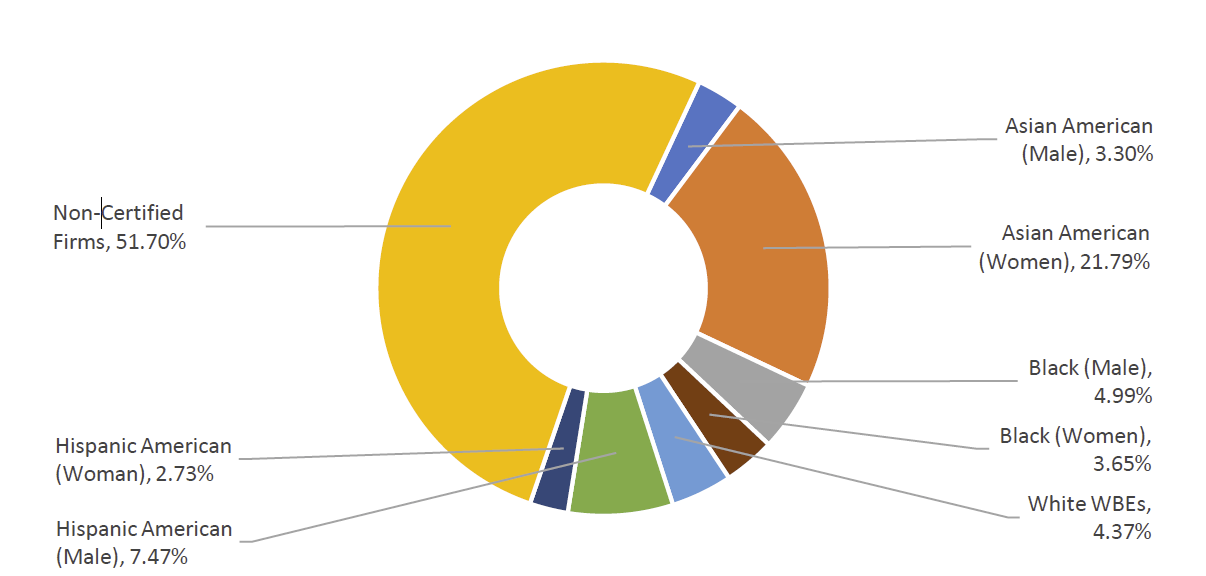

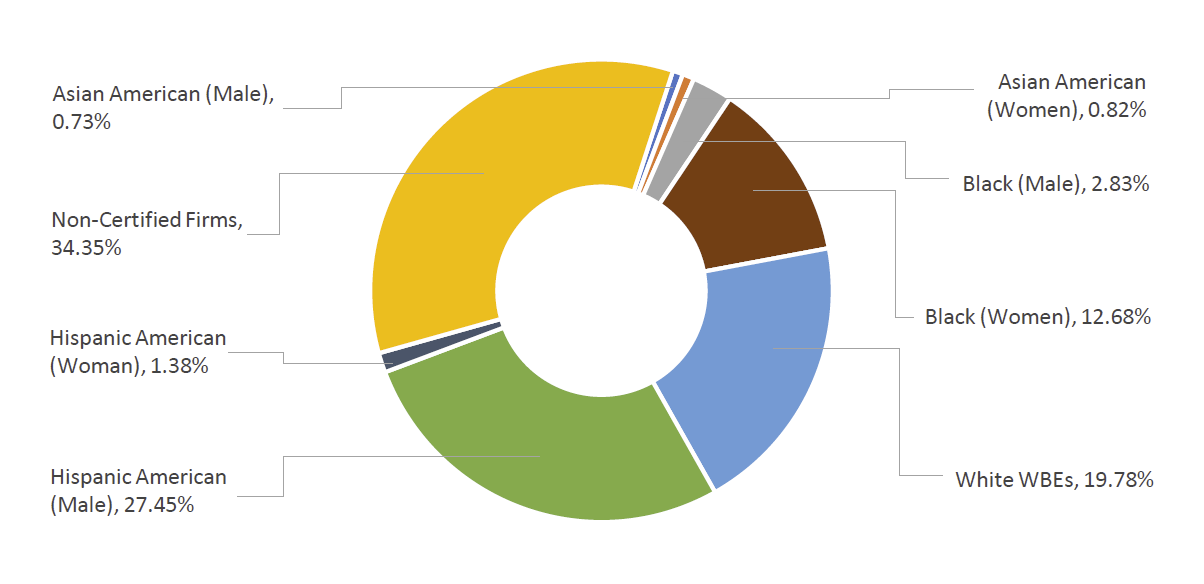

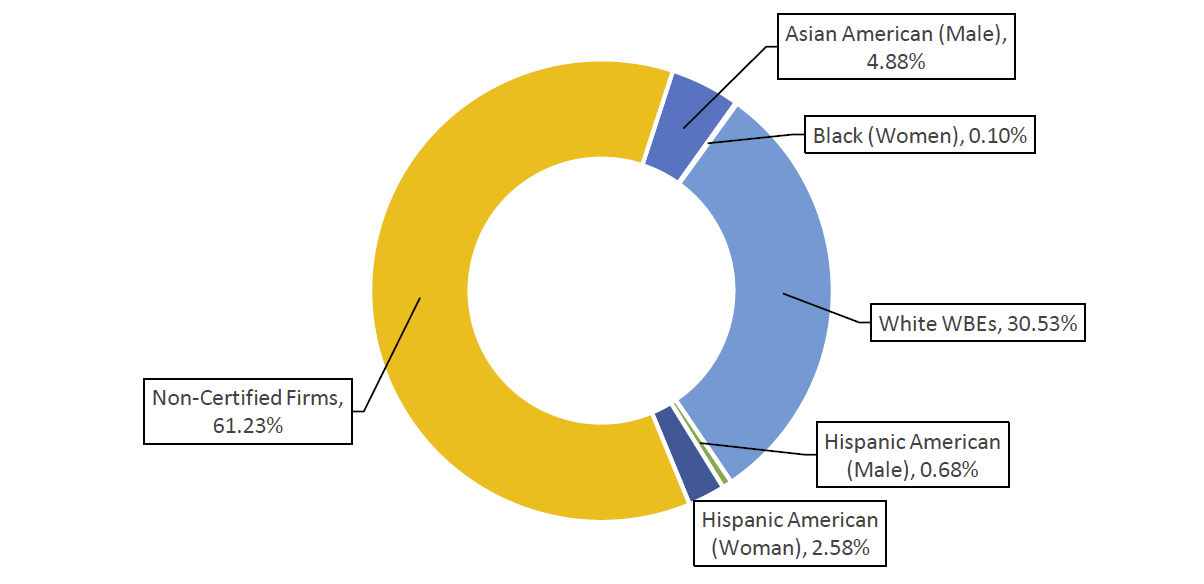

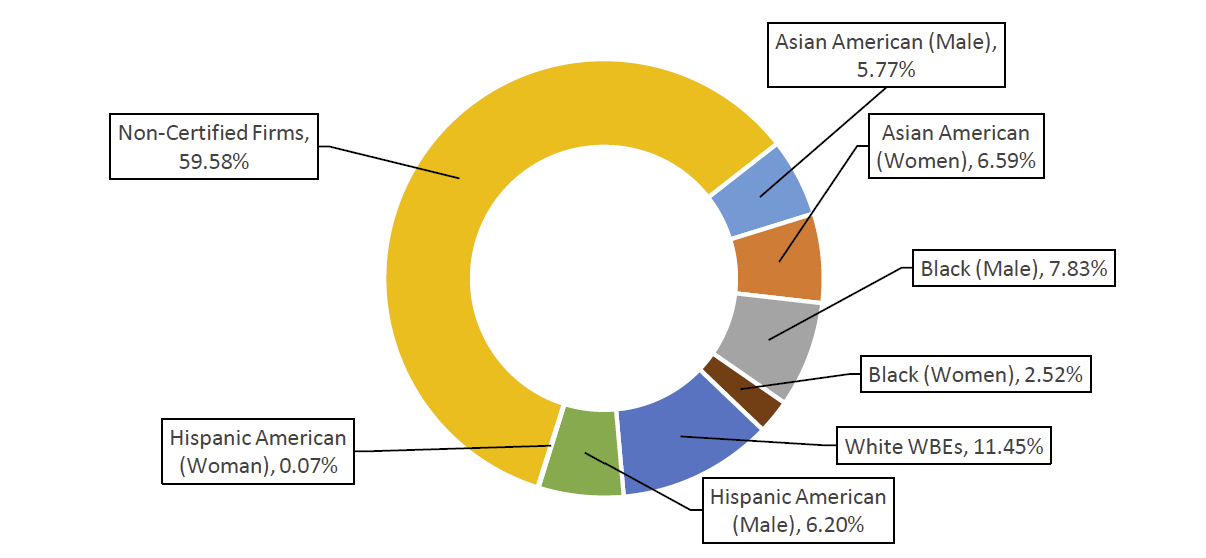

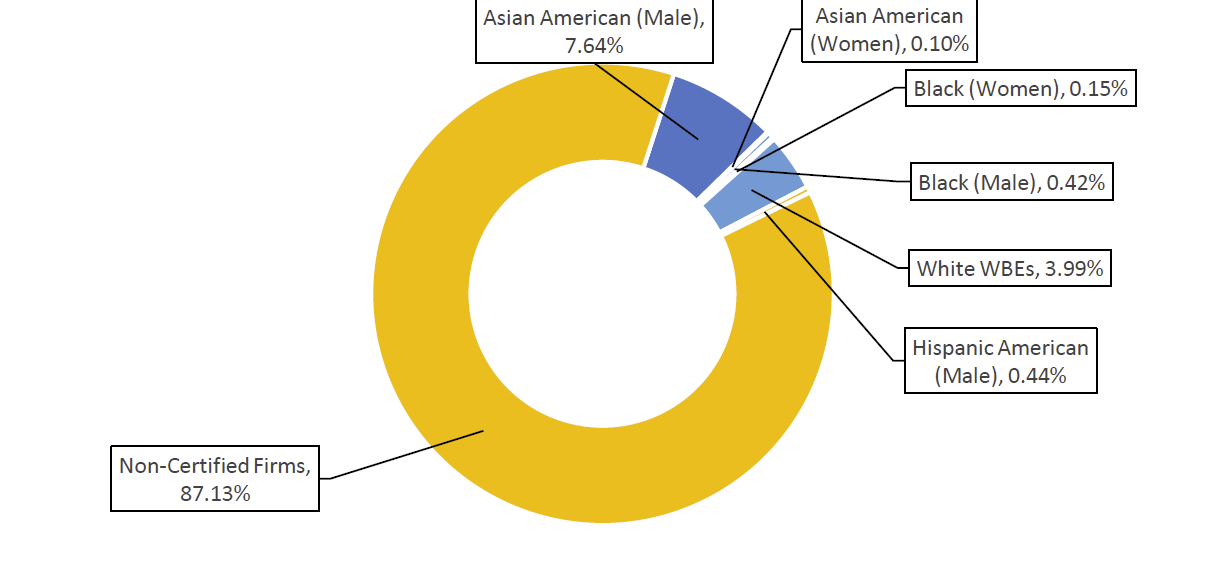

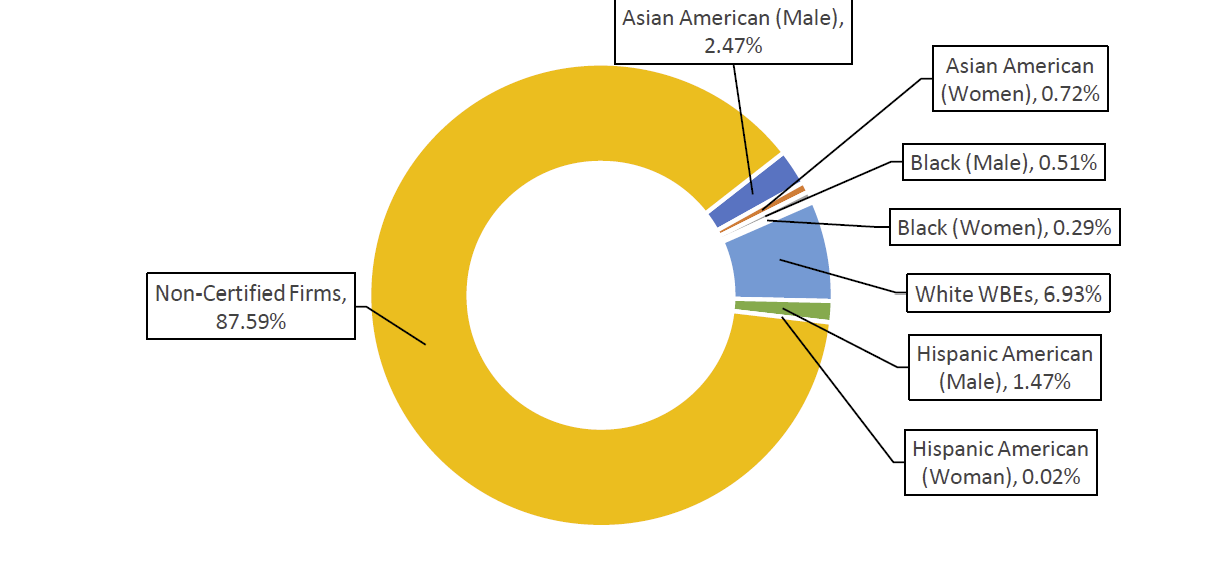

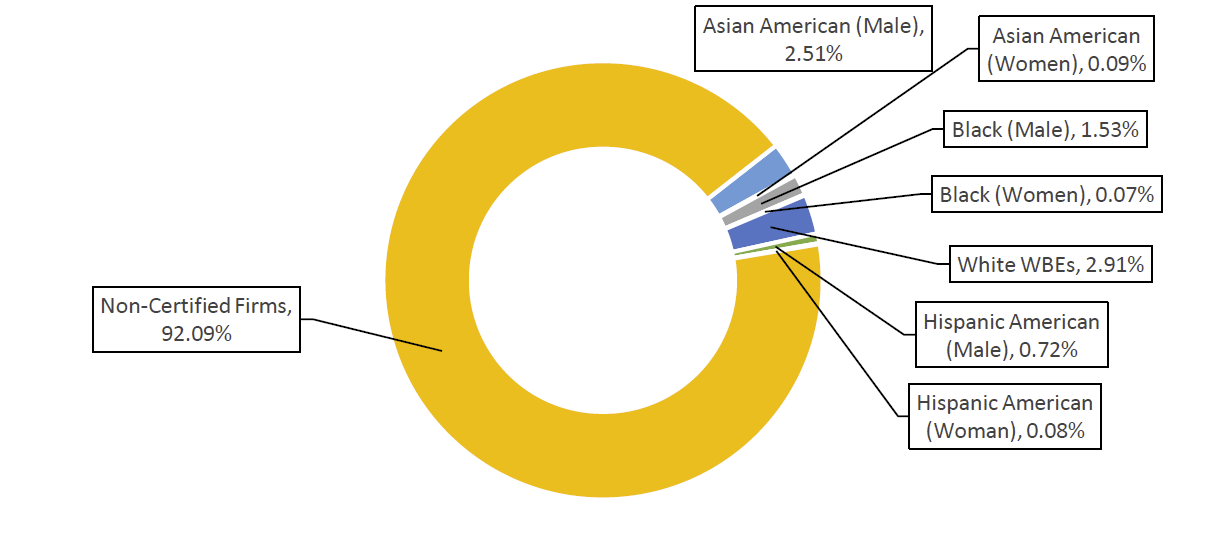

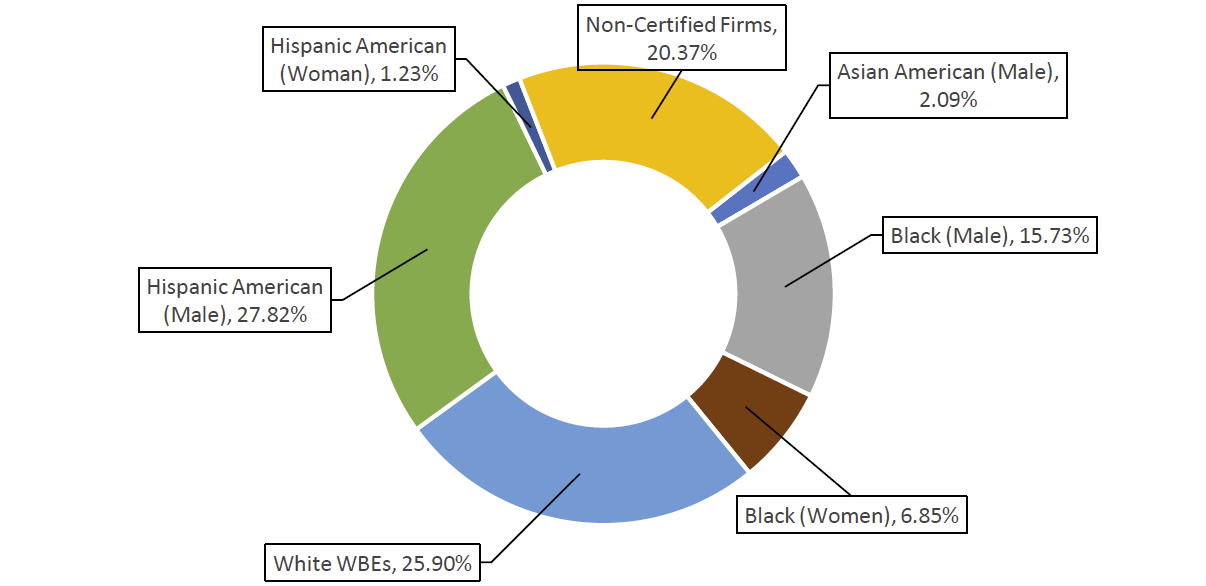

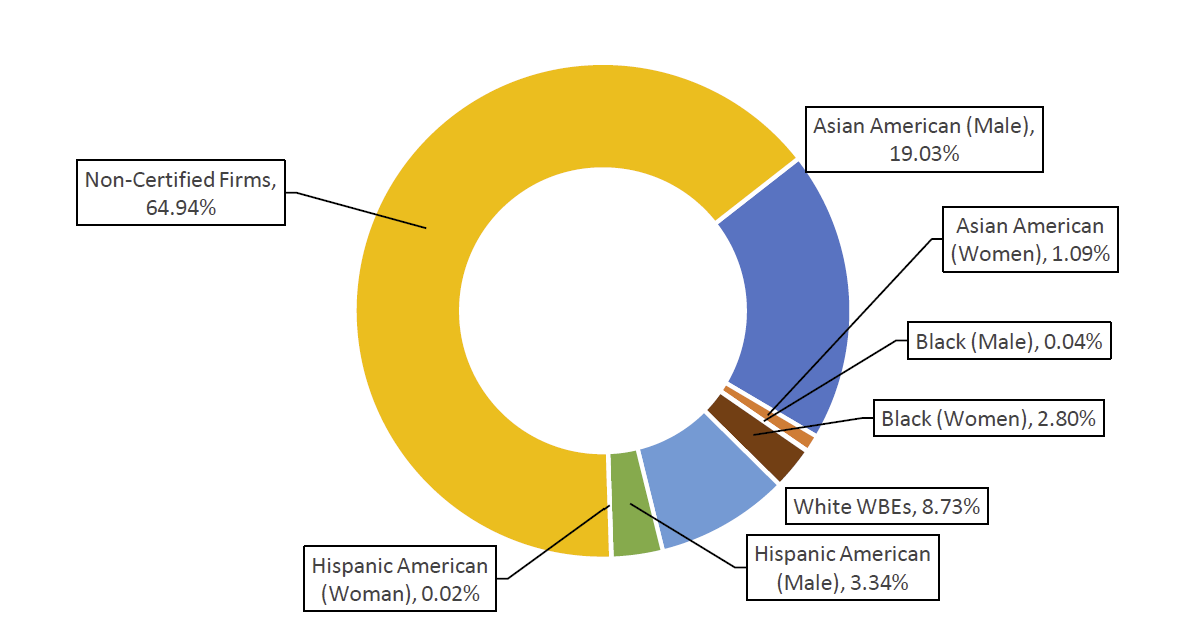

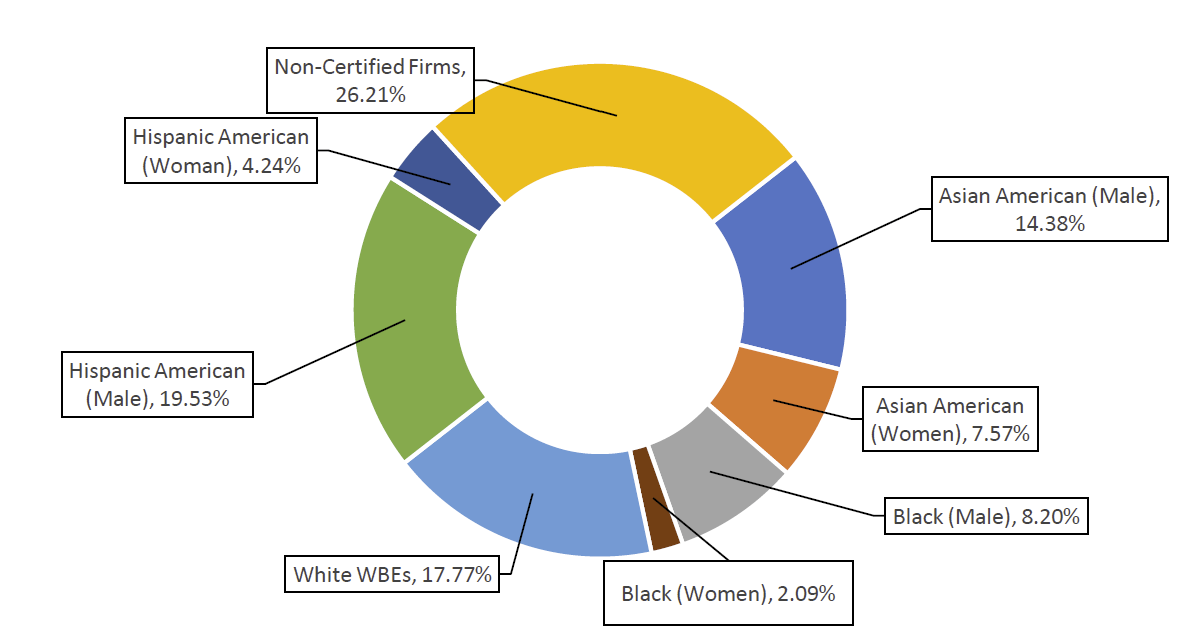

Finding #2: Disparities among different categories of M/WBEs remain stark

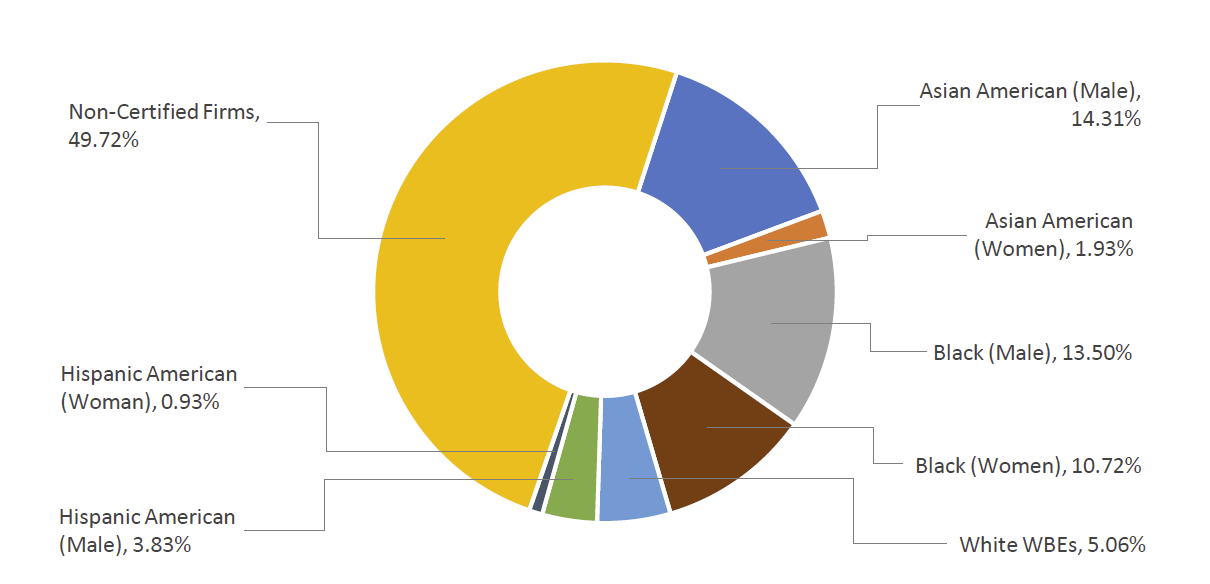

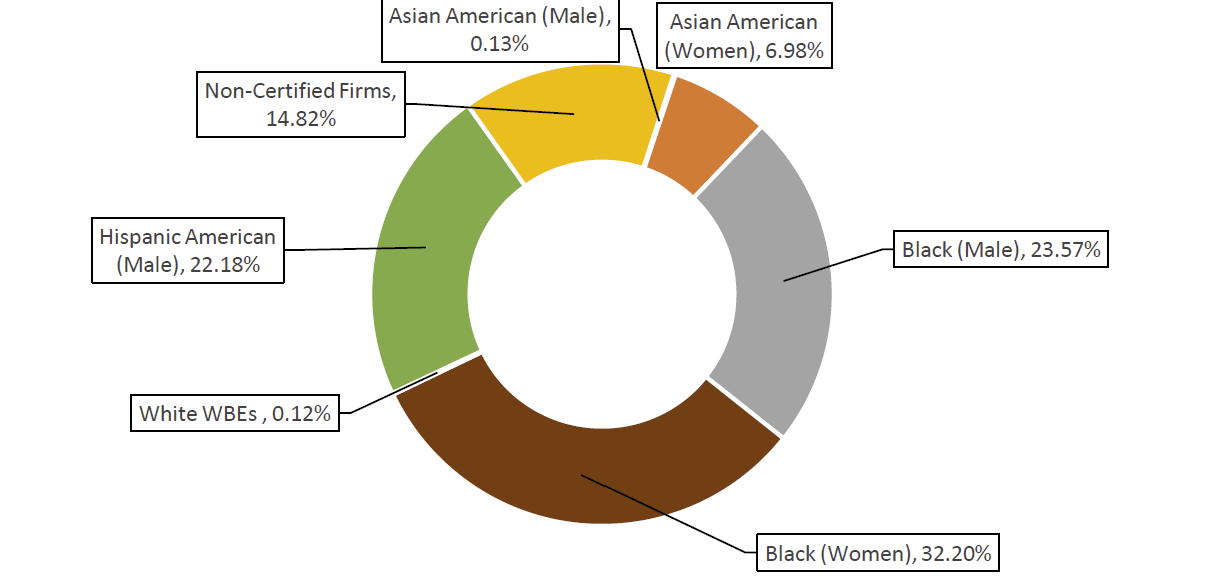

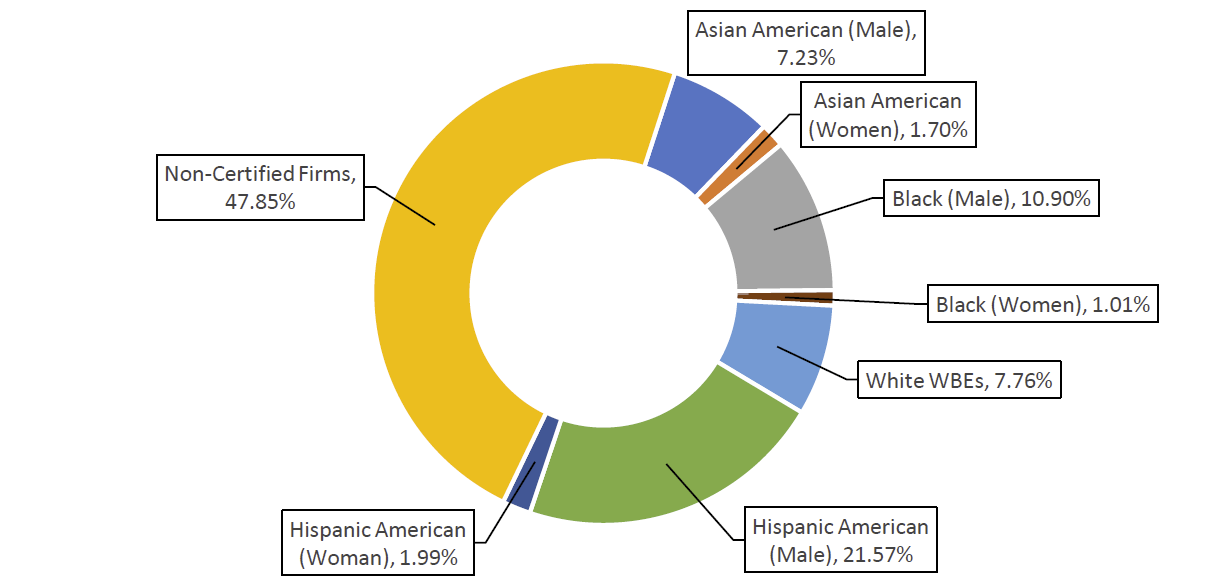

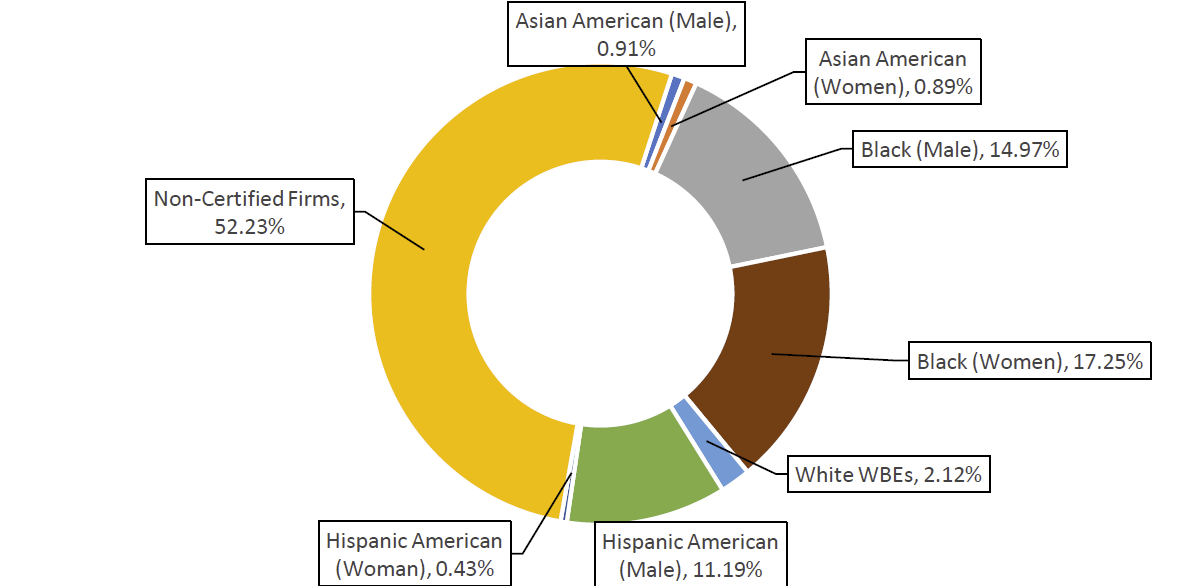

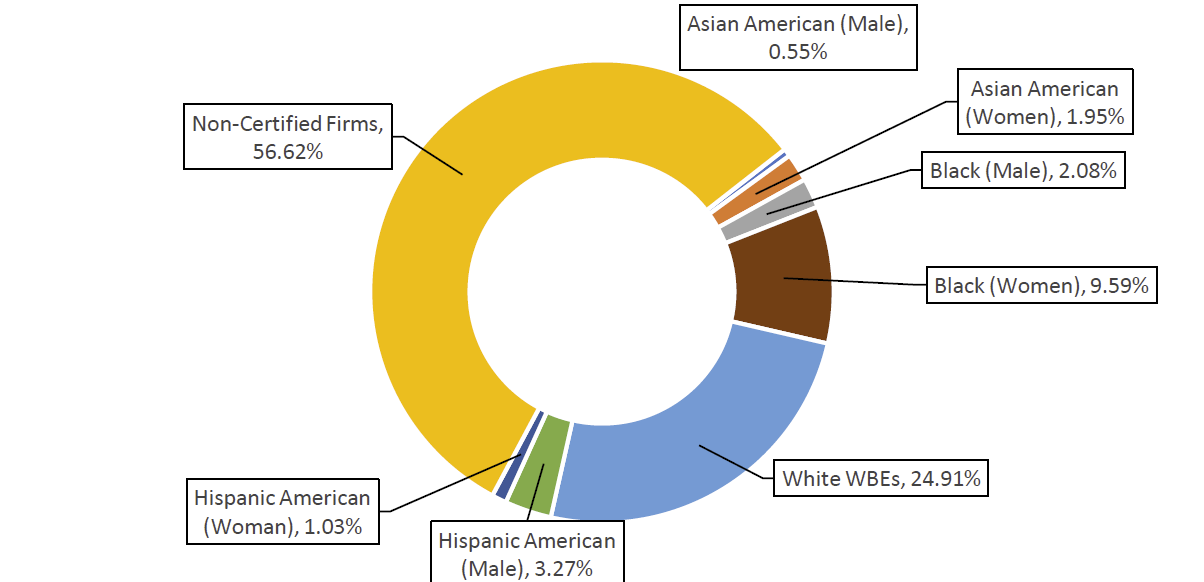

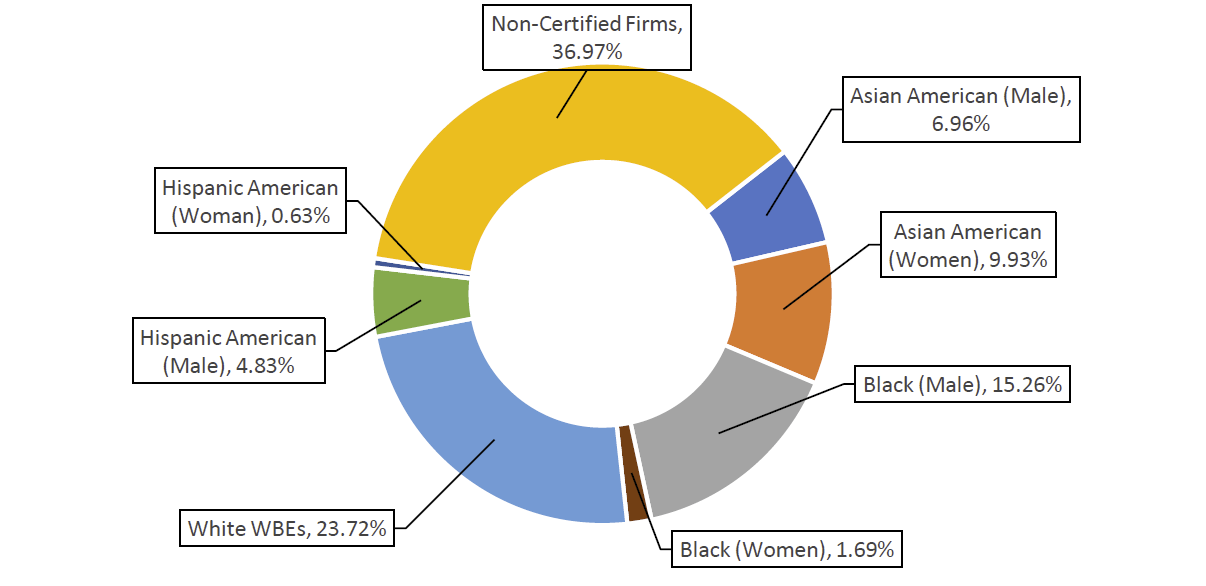

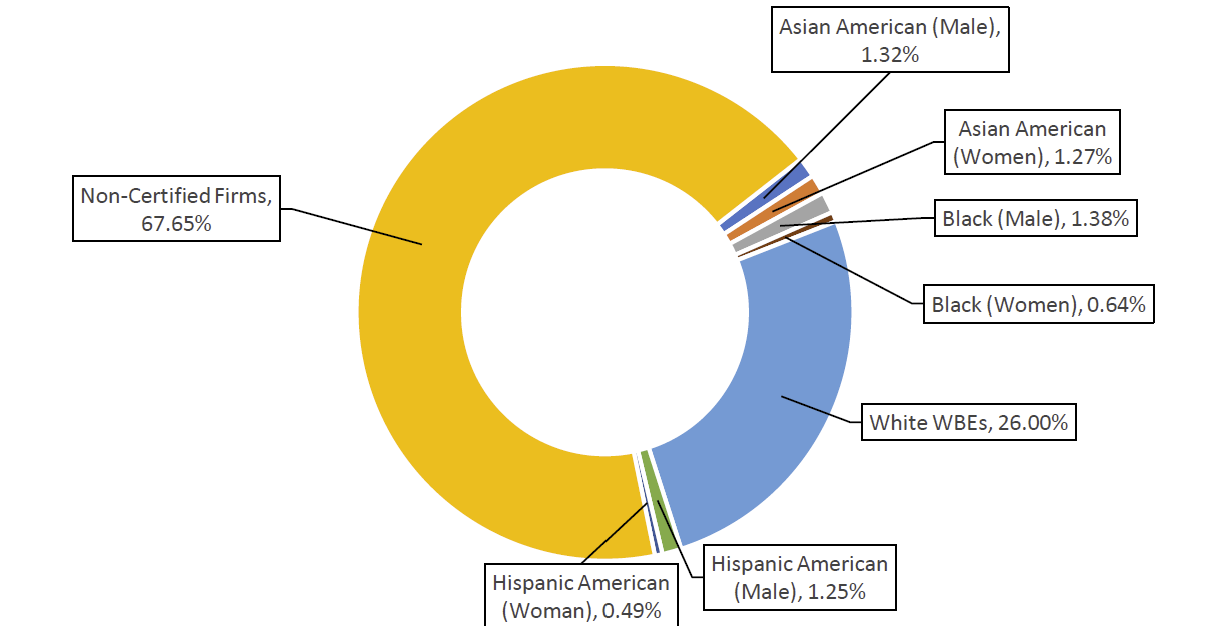

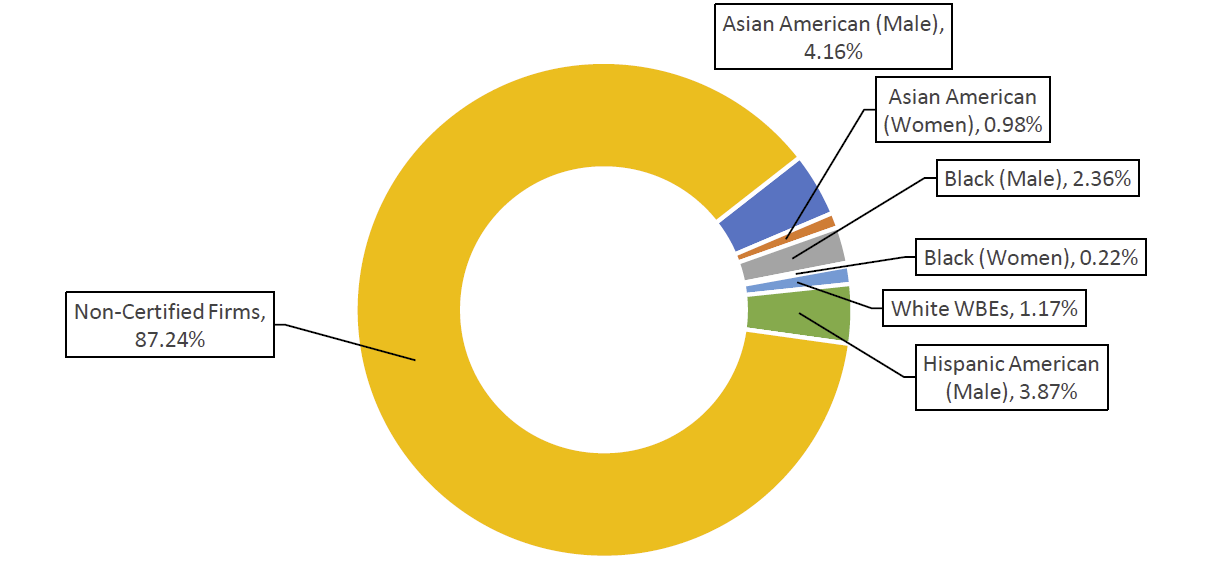

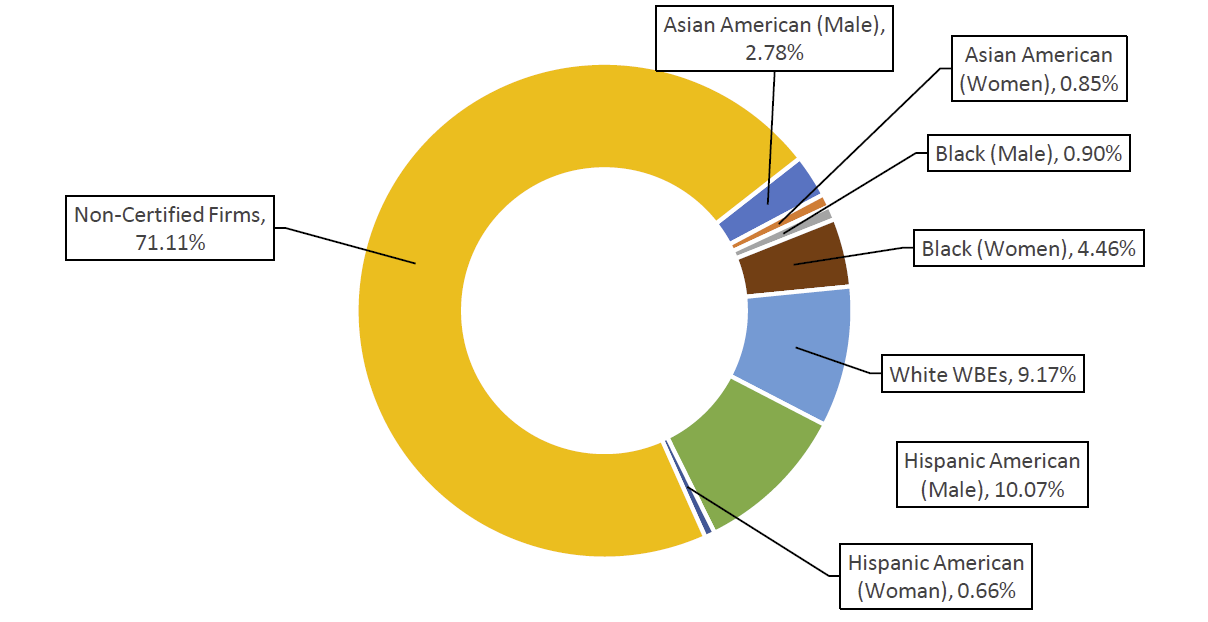

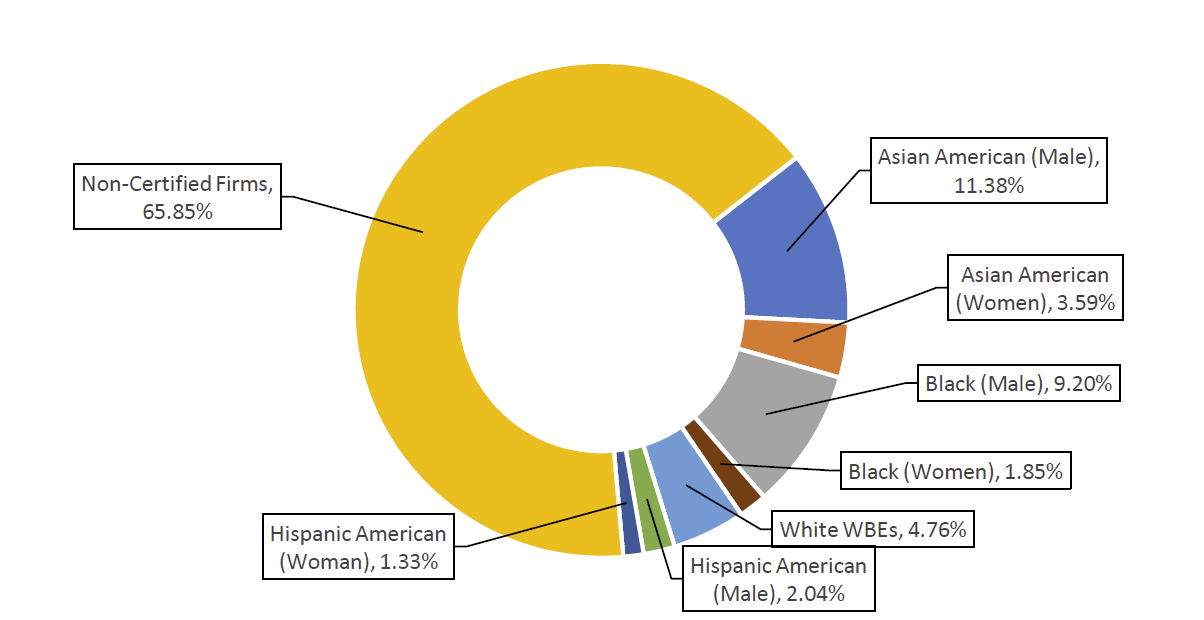

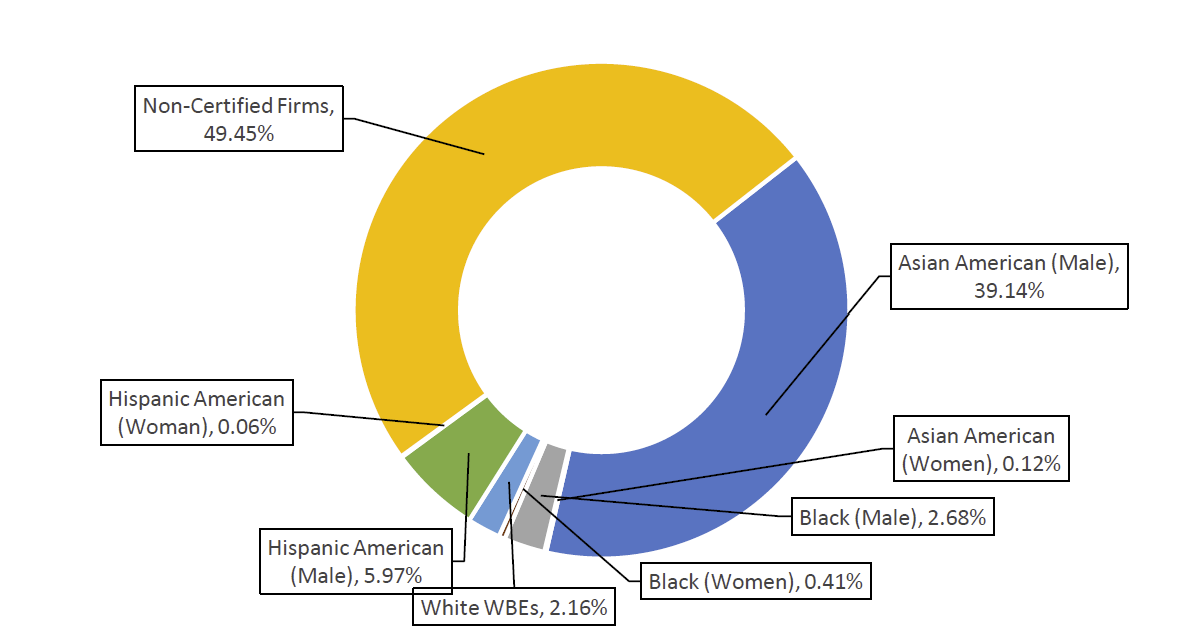

The City is falling even farther short when it comes to contracting with Black, Hispanic American, and Native American-owned businesses and businesses owned by Asian American women (collectively “underutilized M/WBE categories”), each of which represent less than 2% of the value of all FY22 registered contracts subject to LL 174 participation goals.

Viewed as a share of the value of all M/WBE contracts, Black M/WBEs represent less than 10%, and Hispanic American M/WBEs only 11%. To date, the City has not awarded a prime contract to a Native American M/WBE.[9] Over 70% of the value of M/WBE contracts subject to LL 174 participation goals were registered to businesses owned by white women or Asian American males.

Table 7: FY22 Registrations for Contracts and POs Subject to LL 174 Participation Goals, by M/WBE Category

| M/WBE Category | # of Contracts and POs | % Share of LL Contracts and POs | Total Contract and PO Value | % Share of LL Contract and PO Value | % Share of All M/WBE LL Contract and PO Value |

| Asian American M/WBEs | 10,600 | 35.95% | $347,237,468 | 5.65% | 35.50% |

| Black M/WBEs | 1,156 | 3.92% | $96,853,512 | 1.57% | 9.90% |

| White WBEs | 3,905 | 13.24% | $431,400,898 | 7.02% | 44.10% |

| Hispanic American M/WBEs | 1,389 | 4.71% | $102,709,871 | 1.67% | 10.50% |

| Native American M/WBEs | 1 | 0.00% | $19,976 | 0.00% | 0.00% |

| Grand Total | 17,051 | 57.83% | $978,221,724 | 15.91% | 100.00% |

Table 8: FY22 Registered Contracts Subject to LL 174 Participation Goals, by M/WBE Category and Gender

| M/WBE Category | # of Contracts or POs | % Share of Contracts and POs | Total Contract and PO Value | % Share of Contract and PO Value | % Share of All M/WBE Value |

| Asian American male-owned MBEs | 9,734 | 33.01% | $290,201,026 | 4.72% | 29.67% |

| Asian American women-owned MBEs | 866 | 2.94% | $57,036,441 | 0.93% | 5.83% |

| Black male-owned MBEs | 826 | 2.80% | $61,811,290 | 1.01% | 6.32% |

| Black women-owned MBEs | 330 | 1.12% | $35,042,222 | 0.57% | 3.58% |

| Hispanic American male-owned MBEs | 1,152 | 3.91% | $93,966,605 | 1.53% | 9.61% |

| Hispanic American women-owned MBEs | 237 | 0.80% | $8,743,266 | 0.14% | 0.89% |

| Native American male-owned MBEs | 1 | <.01% | $19,976 | <.01% | <.01% |

| White WBEs | 3,905 | 13.24% | $431,400,898 | 7.02% | 44.10% |

| M/WBE ALL (Not Included in Grand Total) | 17,051 | 57.83% | $978,221,724 | 15.91% | 100.00% |

| Non-Certified | 12,435 | 42.17% | $5,171,364,978 | 84.09% | N/A |

| Grand Total | 29,486 | 100.00% | $6,149,586,703 | 100.00% | N/A |

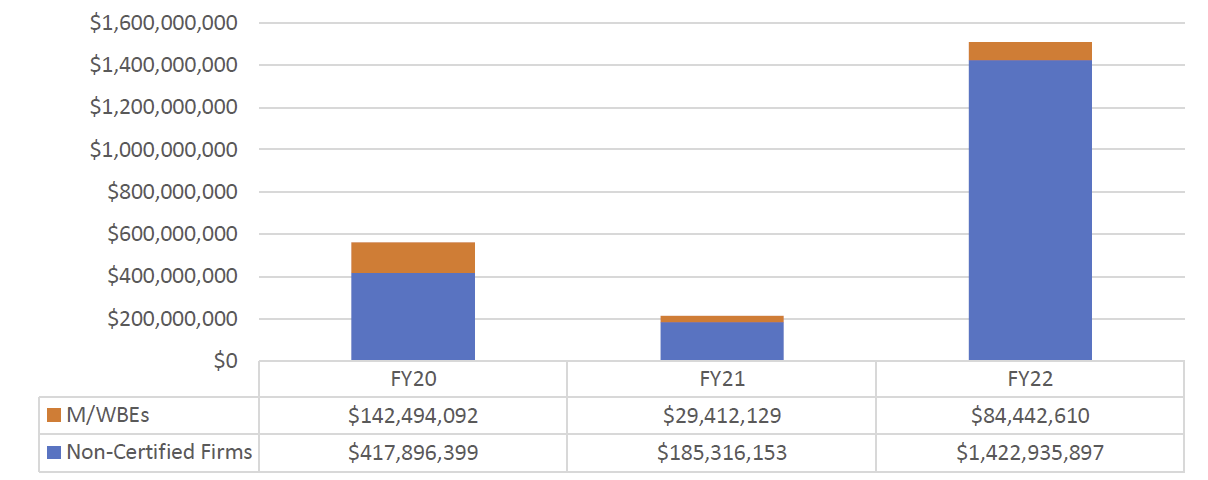

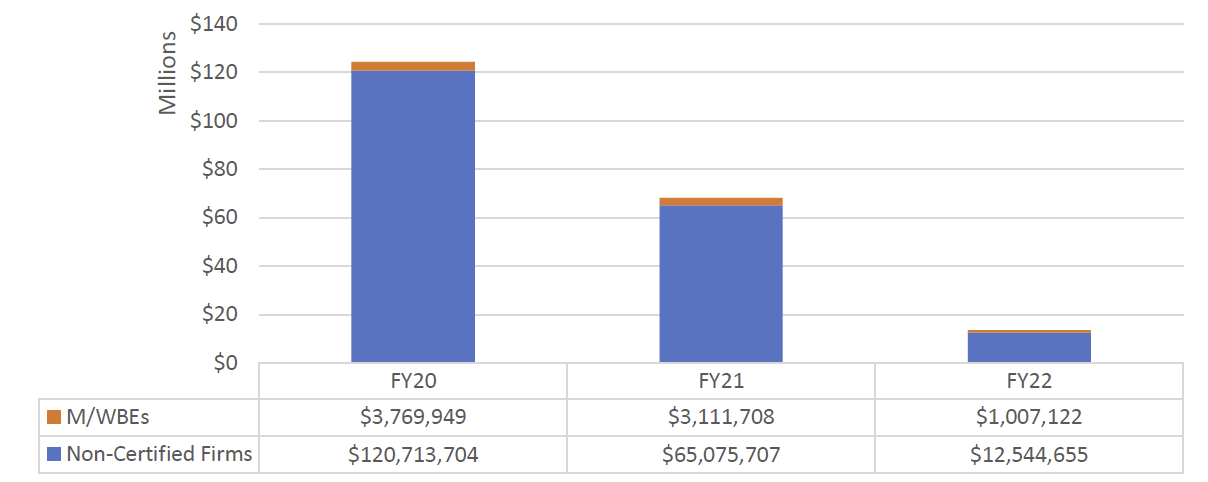

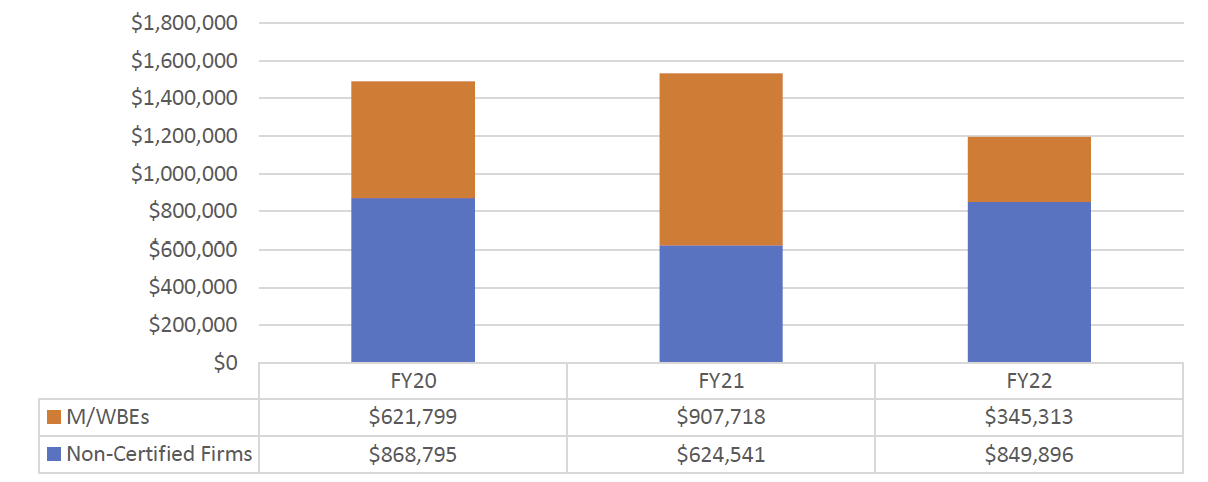

Chart 2: Value of Contracts and POs Subject to LL 174 Participation Goals, By Race, FY20-22[10]

Table 9: FY22 M/WBE Contracts and POs Subject to LL 174 Participation Goals, as a Share of Total M/WBE Contracts, by M/WBE Category

| M/WBE Category | Number of Contracts and POs | % of M/WBE Contracts | Total $ Value | % Share of M/WBE value | % Share of All Value subject to LL 174 goals |

| Asian American M/WBEs | 10,600 | 62.17% | $347,237,467 | 35.50% | 5.65% |

| Black M/WBEs | 1,156 | 6.78% | $96,853,511 | 9.90% | 1.57% |

| Hispanic American M/WBEs | 1,389 | 8.15% | $102,709,871 | 10.50% | 1.67% |

| Native American M/WBEs | 1 | 0.01% | $19,976 | 0.00% | 0.00% |

| White WBEs | 3,905 | 22.90% | $431,400,897 | 44.10% | 7.02% |

| Grand Total | 17,051 | 100.00% | $978,221,724 | 100.00% | 15.91% |

These trends are true in analyzing both contract registrations and spend data – though, Black M/WBEs received an even smaller portion of prime spending in comparison to other M/WBE categories.

Table 10: FY22 Prime Spending Subject to LL 174 Participation Goals, by Race

| Category – By Race | Total Spend | % Share of Total City Spending | % Share of Spending Out of Total M/WBE Spending |

| Asian American M/WBEs | $386,755,404 | 5.75% | 46.80% |

| Black M/WBEs | $47,578,167 | 0.71% | 5.76% |

| Hispanic American M/WBE | $120,227,530 | 1.79% | 14.55% |

| White WBEs | $271,769,600 | 4.04% | 32.89% |

| Non-Certified | $5,896,850,869 | 87.71% | N/A |

| Total | $6,723,181,569 | 12.29% | 100% |

Women-Owned Firms Lag Behind

Overall, the City’s utilization of MBEs owned by women is significantly less than the low utilization of MBEs owned by males. The data shows that the disparity is even more stark across businesses owned by women across difference races. The total number of LL 174-eligible contracts registered to businesses owned by white women (3,905) was more than double the total count of contracts registered to all other women-owned MBEs combined (1,433). Furthermore, contracts registered to businesses owned by white women represented a larger value (7.02%) than the value of all contracts registered to all women-owned MBEs combined (1.64%).

This is driven in part by the fact that there are more certified businesses owned by white women in the Department of Small Business Services (SBS) Online Directory of NYC Certified Vendors (“the SBS Directory”) than there are certified women-owned MBEs for all minority categories combined (Black women-owned MBEs, Hispanic American women-owned MBEs, Asian American women-owned MBEs, and Native American women-owned MBEs). In order for agencies and vendors to contract with underutilized M/WBE categories, SBS must target its certification efforts particularly with women-owned MBEs.

Within each racial category, male certified firms consistently represent larger shares of the counts of registered contracts and POs. Male-owned MBEs account for more than double (11,713) the total number of contracts and POs registered to women-owned M/WBEs (5,338, including white WBEs).

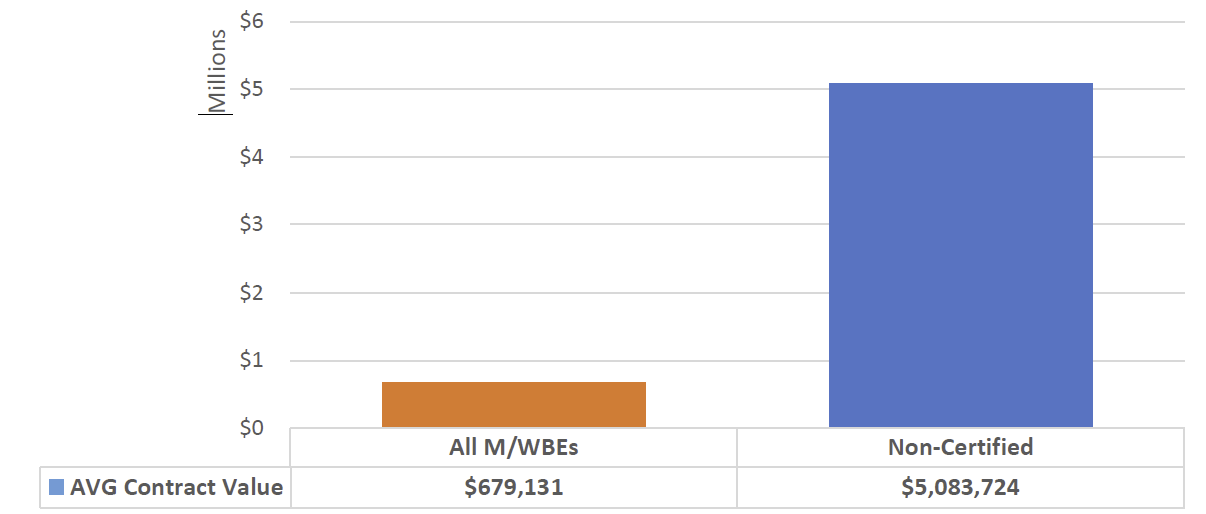

Finding #3: M/WBEs Win Contracts That Are Much Smaller on Average

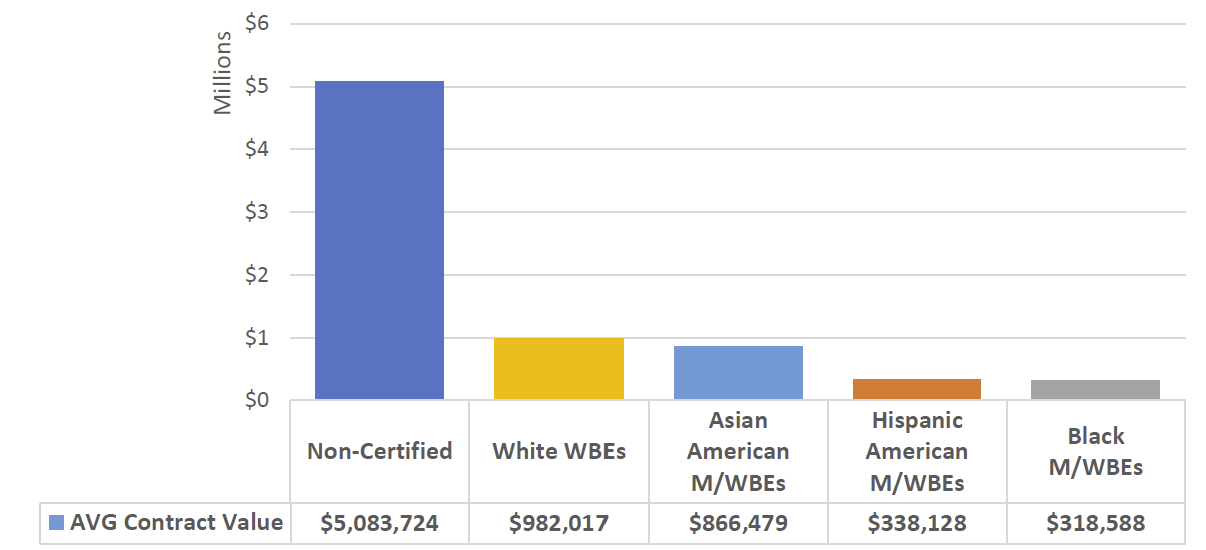

Our analysis identifies a key factor contributing to the unsatisfactory utilization rate: the average dollar value of registered M/WBE contracts is significantly lower than the average dollar value of contracts registered to non-certified firms. As a result, M/WBEs are jumping higher hurdles for lower returns.

In analyzing FY22 registrations subject to LL 174 participation goals, the average dollar value of a contract registered to a M/WBE ($679,131) was less than 14% of the average dollar value of a contract registered to a Non-Certified firm ($5.08 million).

Chart 3: Average Value of Registered Contracts Subject to LL 174 Participation Goals

Award Method Analyses

A tension exists in the City’s M/WBE procurement: Award methods with agency discretion – such as Micropurchase, Small Purchase, and M/WBE NCSP– are more likely to result in a prime contract with an M/WBE; however, these discretionary methods generally result in lower-dollar-value contracts. However, even within competitive methods – both Competitive Sealed Bid (CSB) and Competitive Sealed Proposal (CSP) – the average contract value for M/WBEs is far lower than for non-certified firms.

Table 11: FY22 Registered Contracts by Award Method, Citywide[11]

| Award Method | M/WBE | Non-Certified | ||

| Award Method Category | # of contracts | % Share of contracts | # of contracts | % Share of Contracts |

|---|---|---|---|---|

| Methods Without Discretion | ||||

| CSB | 143 | 25.72% | 413 | 74.28% |

| CSP | 136 | 8.01% | 1562 | 91.99% |

| Accelerated Procurements | 11 | 10.38% | 95 | 89.62% |

| Total | 290 | 12.29% | 2070 | 87.71% |

| Methods With Discretion[12] | ||||

| Demonstration Projects | 0 | 0.00% | 24 | 100.00% |

| Innovative Procurement Contracts | 3 | 2.91% | 100 | 97.09% |

| Micropurchase Contracts | 21,395 | 17.87% | 98,314 | 82.13% |

| Negotiated Acquisition Contracts | 21 | 2.04% | 1007 | 97.96% |

| Small Purchase Contracts – General | 1,122 | 14.01% | 6,887 | 85.99% |

| M/WBE – NCSP[13] | 944 | 100% | 0 | 0% |

| Total | 23,485 | 18.97% | 100329 | 81.03% |

Table 12: FY22 Average Value of Registered Contracts by Award Method, Citywide

| Award Method | M/WBE – AVG Contract Value | Non-Certified – AVG Contact Value |

| Methods Without Discretion | ||

|---|---|---|

| CSB | $2,998,811 | $11,786,323 |

| CSP | $5,773,720 | $8,582,401 |

| Accelerated Procurements | $143,196 | $2,153,685 |

| Methods With Discretion[14] | ||

| Demonstration Projects | N/A | $1,959,954 |

| Innovative Procurement Contracts | $42,195,277[15] | $4,443,022 |

| Micropurchase Contracts | $3,424 | $2,679 |

| Negotiated Acquisition Contracts | $9,700,570[16] | $2,961,258 |

| Small Purchase Contracts – General | $36,699 | $27,165 |

| M/WBE NCSP method | $134,907 | N/A |

Disaggregated By Race

Underutilized M/WBE Categories also earn less lucrative contracts than businesses owned by white women and Asian American males.

Chart 4: FY22 Average Value of Registered Contracts Subject to LL 174 Participation Goals, by M/WBE Category

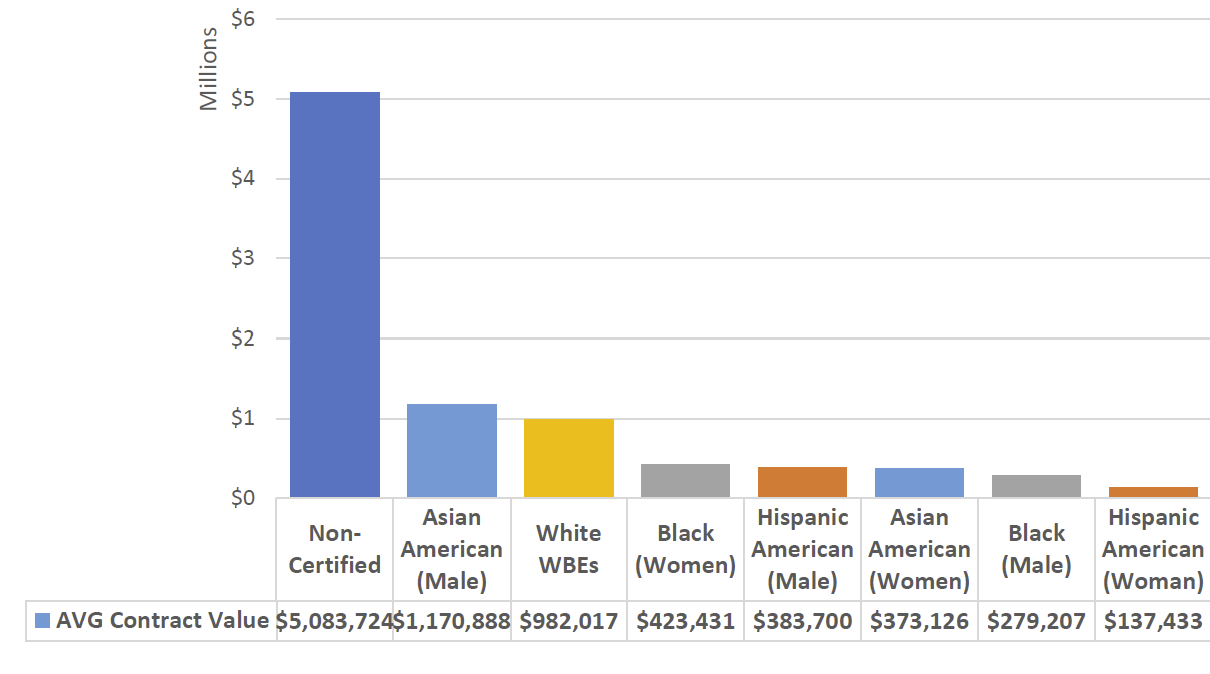

Disaggregated By Gender

The value of contracts and POs subject to LL 174 participation goals registered to male-owned MBEs (7.25%) is more than four times the value of contracts registered to women-owned MBEs (1.64%). Hispanic American women-owned MBEs represented the smallest relative share, whose contract value represents only 0.14% of all registrations (and <1% of M/WBE registrations).

With the exception of Black M/WBEs, the average value of women-owned MBE contract registrations is consistently lower than the value of male-owned MBE contract registrations. The starkest contrast exists for Hispanic American women-owned MBEs – the average contract registered to a Hispanic American women-owned MBE ($137,433) is only worth roughly 2.70% of the average value of a contract registered to a Non-Certified firm (~$5.1 million). This analysis also highlights a significant gender disparity across Asian American M/WBEs – the average dollar value of a contract registered to an Asian American male-owned MBE contract is about $1.17 million, whereas the average dollar value for contract registered to an Asian American women-owned MBE is only about $373,000.

Chart 5: FY22 Average Value of Registered Contracts Subject to LL 174 Participation Goals, by Race and Gender

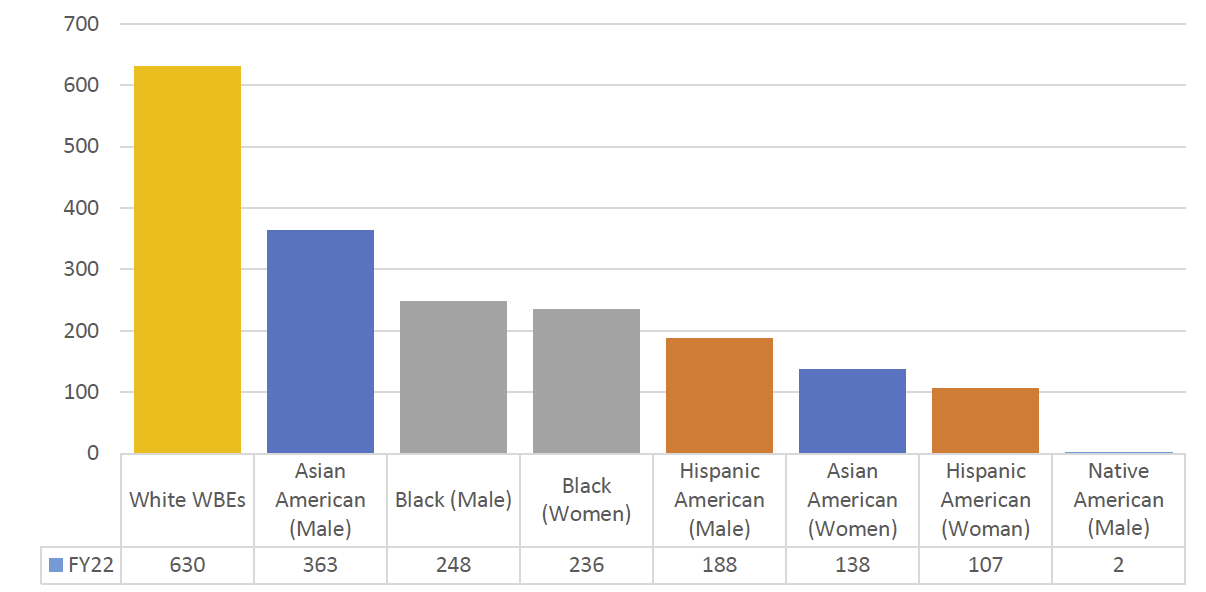

Finding #4: Only a Small Percentage of City-Certified M/WBEs Actually Do Business with the City

The City’s most recent disparity study was published in 2018 to analyze the availability and representation of M/WBEs in City contracting (from the years 2006-2015). This disparity study established the foundation for the goal-setting process and has informed the City’s metrics for certification (additional information can be found in Appendix A of this report). The City has dedicated significant resources in the past few years to increase the number of certified M/WBEs in the SBS Directory.

As of June 30, 2022, there were 10,768 City-certified M/WBEs in the SBS Directory.[17] However, only 1,912 (17.76%) of these certified M/WBEs entered a new contract, subcontract, or PO with the City in FY22.[18] There have been increases since FY20 for several underutilized M/WBE Categories: Asian American women-owned MBEs (138, increased from 98 in FY20); Black women-owned MBEs (236, increased from 163 in FY20); Black male-owned MBEs (248, increased from 192 in FY20); and Hispanic American women-owned MBEs (107, increased from 87 in FY20).

It goes without saying that the City’s economy today is significantly different than in 2015, and so the City is long overdue for a study that reflects its current state. In its Local Law 63 Plan, SBS planned to release an RFP for a “Citywide Disparity Study- Analysis of Citywide M/WBE Goals” with an anticipated contract start date of January 2023.[19] As of the date of this Report, there is no record of the contract in PASSPort Public nor has it been submitted for Comptroller’s Office registration review. It is imperative that the City takes immediate steps to advance the procurement of the disparity study to better reflect the state of the current economy and the availability of M/WBEs. Furthermore, this study should also explore whether the current categories of “minority groups” is sufficiently representative and reflective of the constituents and business owners in New York City.[20]

Table 13: Unique M/WBEs with New Prime Contracts, Purchase Orders, or Subcontracts, FY20-22

| M/WBE Category | FY20 | FY21 | FY22 |

| Asian American male-owned MBEs | 387 | 313 | 363 |

| Asian American women-owned MBEs | 93 | 101 | 138 |

| Black male-owned MBEs | 192 | 205 | 248 |

| Black women-owned MBEs | 163 | 174 | 236 |

| Hispanic American male-owned MBEs | 205 | 198 | 188 |

| Hispanic American women-owned MBEs | 87 | 75 | 107 |

| Native American male-owned MBEs | 0 | 1 | 2 |

| White WBEs | 652 | 580 | 630 |

| All Male-Owned MBEs (Not Reflected in “Total”) | 784 | 717 | 801 |

| All Women-Owned MBEs (Not Reflected in “Total”) | 343 | 350 | 481 |

| Total | 1,779 | 1,647 | 1,912 |

Chart 6: FY22 Unique M/WBEs with New Prime Contracts, Purchase Orders, or Subcontracts

Finding #5: Subcontracting and M/WBE Compliance Processes Are Paper-Based, Opaque and Ineffective

Subcontracting is an alternative way for M/WBEs to get involved in City contracting. Many prime vendors are required to subcontract work components to fulfill the M/WBE participation goals that may be established on the contract. By connecting with a prime vendor, an M/WBE can create meaningful subcontract opportunities today that can lead to direct contracts with the City tomorrow.

Unfortunately, the City’s subcontracting ecosystem is largely paper-based, with most required steps still occurring outside of electronic systems. This outdated and opaque process creates barriers for M/WBEs that rely on subcontracting as a pathway to partner with prime vendors and to cultivate direct opportunities with contracting agencies. The lack of a dynamic, end-to-end workflow system for subcontracting intensifies the challenges for M/WBEs and leads to difficulties in holding contracting agencies and prime vendors accountable for abiding by the City’s rules and procedures around subcontracting.

City procurement rules specify that each subcontractor must be approved by the contracting agency before starting work.[21] This approval is often obtained through a process that is managed by the prime vendor, who works with potential subcontractors and contracting agencies to submit documents for review and, upon contract registration, enter subcontractor information into the Payee Information Portal (PIP).

To account for the reality that City contracts are often registered retroactively (after the contract work has already started), the City has created a preliminary approval process that allows prime vendors to front-load subcontractor approvals. The preliminary approval process obligates prime vendors to complete and submit a paper Subcontractor Approval Form (SAF) to the contracting agency for an offline review, outside of a centralized system. The agency’s review of the paper SAF is often protracted, and sometimes does not happen at all. Across the three fiscal years since FY20, 17 agencies recorded no approved subcontractors in PIP, and an additional 10 agencies approved fewer than 10 subcontractors. Because of its self-reporting nature, an agency’s lack of approved subcontractors in PIP may be due to its failures to ensure compliance with the City’s subcontracting rules and procedures and/or to set inefficient M/WBE participation goals on the prime contract.

The lack of transparency associated with this offline process causes confusion and uncertainty that leads to projects starting behind schedule from the beginning. This is damaging to M/WBE subcontractors, to the City, and to the communities that are counting on a City project to be completed on time and on budget.

The preliminary approval may come with conditions that a subcontractor file vendor and principal questionnaires in the City’s PASSPort procurement database, and provide other supporting documentation, including but not limited to a SBS Division of Labor Services (DLS) employment report, professional licenses, Project Labor Agreement (PLA) letters of assent, apprenticeship agreements and references. Once the prime contract is registered, the prime vendor can formally submit all subcontractors for approval through PIP, which in this instance serves as a database for prime vendors with contracts valued at $250,000 or more to manage subcontractor approvals and record subcontractor payments. Unfortunately, PIP does not manage the submission and review of supporting documents that may be required for a subcontractor to get approved, further clouding an already disjointed process.

Once a subcontractor approval is reflected in PIP, prime vendors are then required to report on all payments made to subcontractors within 30 days of paying the subcontractor for the work performed. Subcontractor payment data is self-reported by the prime vendor, so validation may be difficult. Contracting agencies can request documentation or use other means to verify subcontractor participation and payment such as payment voucher forms, cancelled checks, periodic audits of prime vendors, job site inspections and performance evaluations. Because many of the validation activities also occur offline and aren’t directly tied to contract management activities in a system, contracting agencies, prime vendors, and subcontractors can face difficulty interacting with each other in a meaningful, transparent fashion.

The City isn’t fully maximizing M/WBE subcontractors by continuing to deploy paper-based processes along with a system (PIP) that is disconnected from other contract management, vendor disclosure, and payment activities that occur in other City systems. The current landscape fails to provide prime vendors or subcontractors with an ability to monitor the status of agency reviews or a central platform to submit required documents to get a subcontractor approved or to prove that a subcontractor was paid.

“My visibility in PIP is limited – I can’t always see if my prime contractors are in compliance with M/WBE goals or not.”

The tools for monitoring compliance with M/WBE participation goals are decentralized and too reliant on self-reporting

The City does not have centralized tools to properly measure compliance with meeting M/WBE participation goals on contracts, many of which are met through subcontracting. The current M/WBE compliance mechanisms are also too reliant on self-reporting by contracting agencies and prime vendors in outdated or underutilized systems, which limits accountability as well as the City’s ability to meet the requirements of the M/WBE program.

For contracts subject to M/WBE participation goals under Local Law 174, agencies are required by MOCS policy to enter M/WBE participation goal requirements into the City’s Financial Management System (FMS) along with prime contractor and contract information, the total value of anticipated subcontracts, and industry classifications among other details. This data entry exercise is the sole responsibility of the agency and occurs separate and apart from the traditional activities that happen in PASSPort and FMS in connection with processing and registering a contract. As a result, the City depends on contracting agencies to enter M/WBE participation goals in FMS, which may not always occur, and to monitor compliance using FMS and agency-specific tracking mechanisms.

Prime vendors with contracts that are subject to M/WBE participation goals must also submit a subcontractor utilization plan (also referred to as a list of subcontractors) to the contracting agency within 30 days of a notice to proceed, and every 12 months throughout the duration of the contract.[22] This plan must list all the vendors that the prime vendor intends to award subcontracts to within the next 12 months, and ultimately shows how a prime vendor will meet its M/WBE obligations over the course of the contract. This submission process (when it does happen) occurs on paper and outside of City systems, which can lead to agencies failing to hold prime vendors accountable from the outset of a project can result in M/WBE participation goals being missed or not fully maximized.

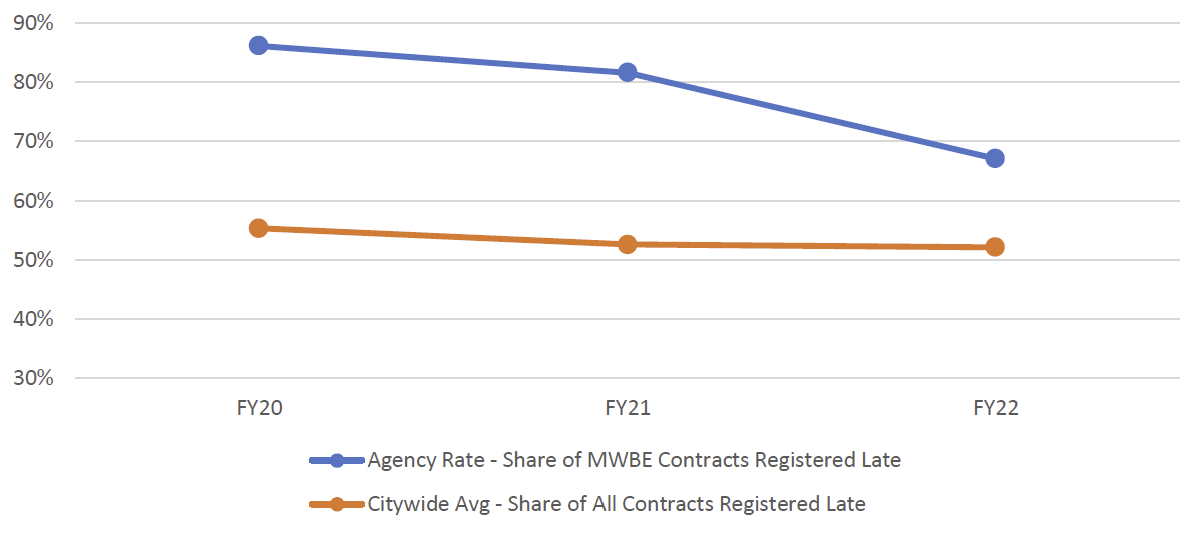

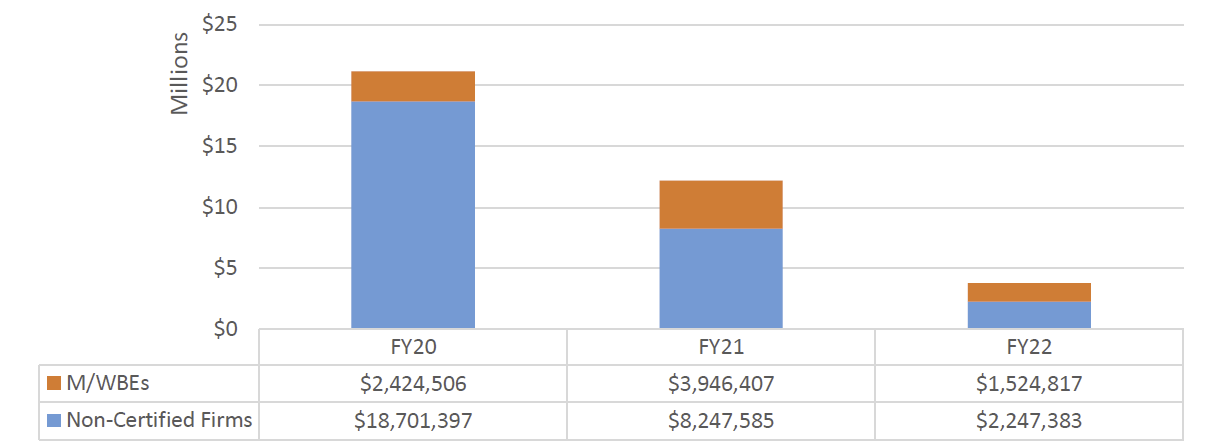

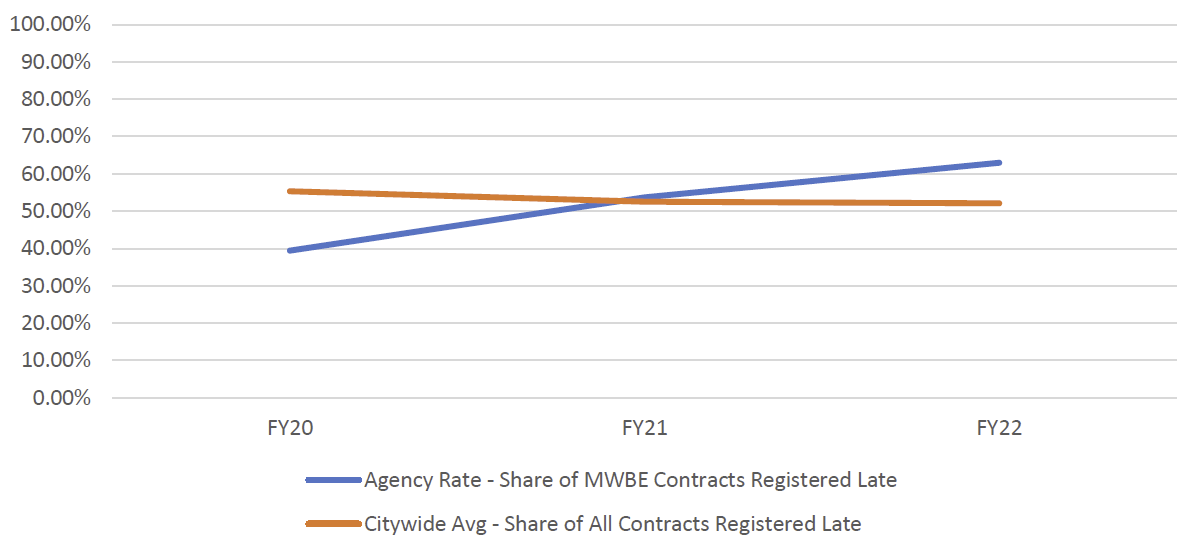

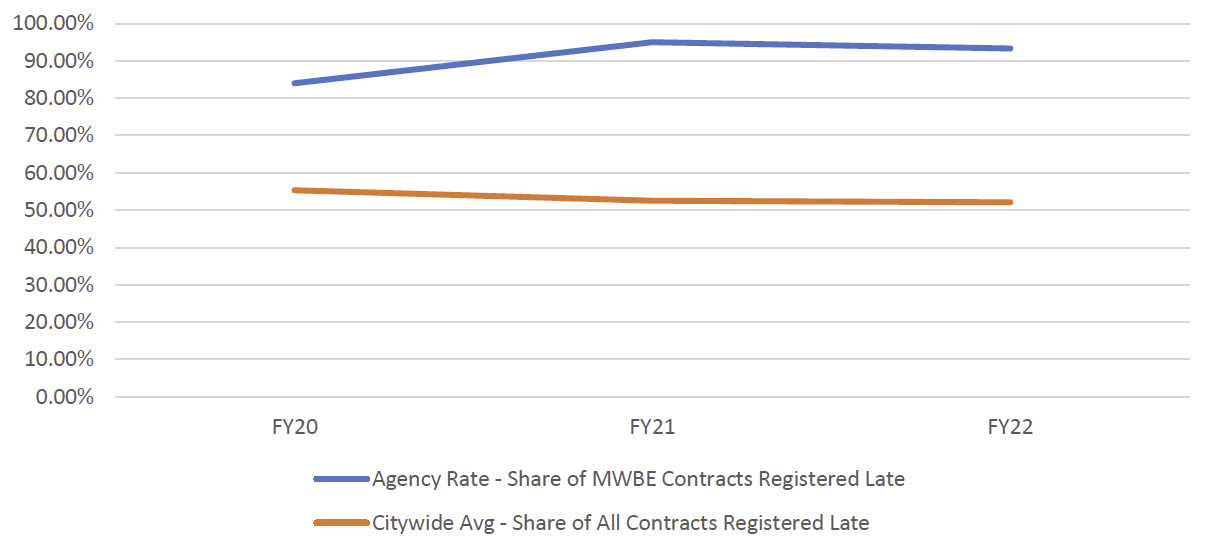

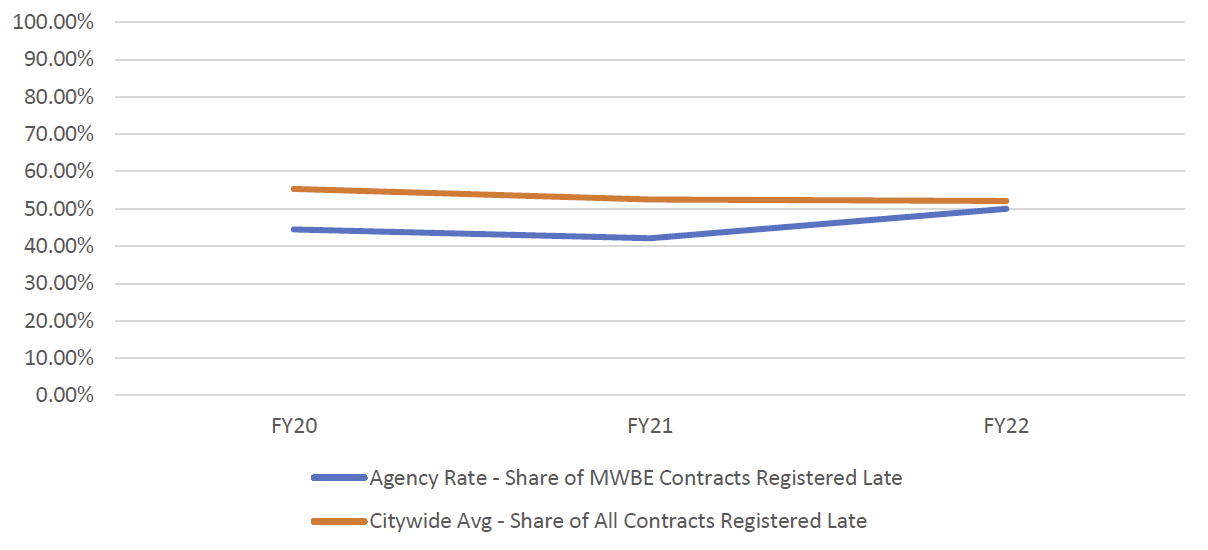

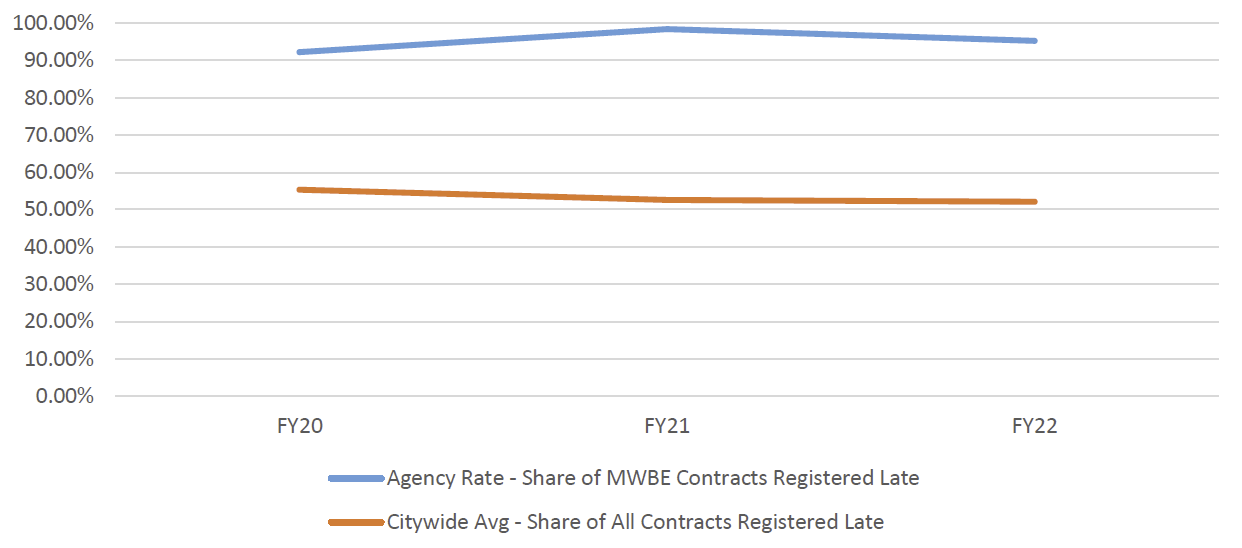

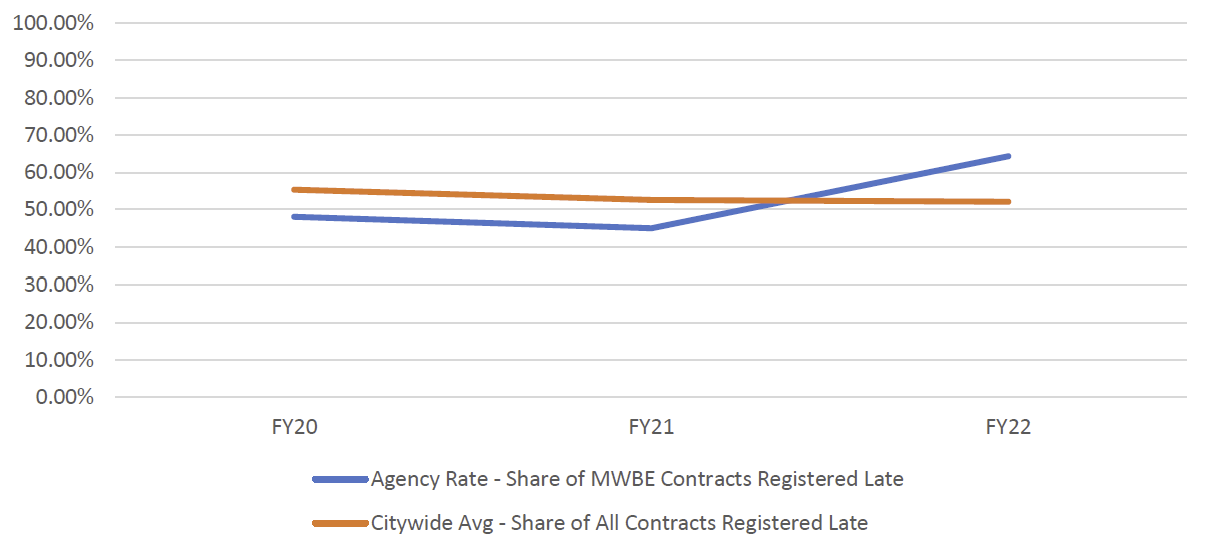

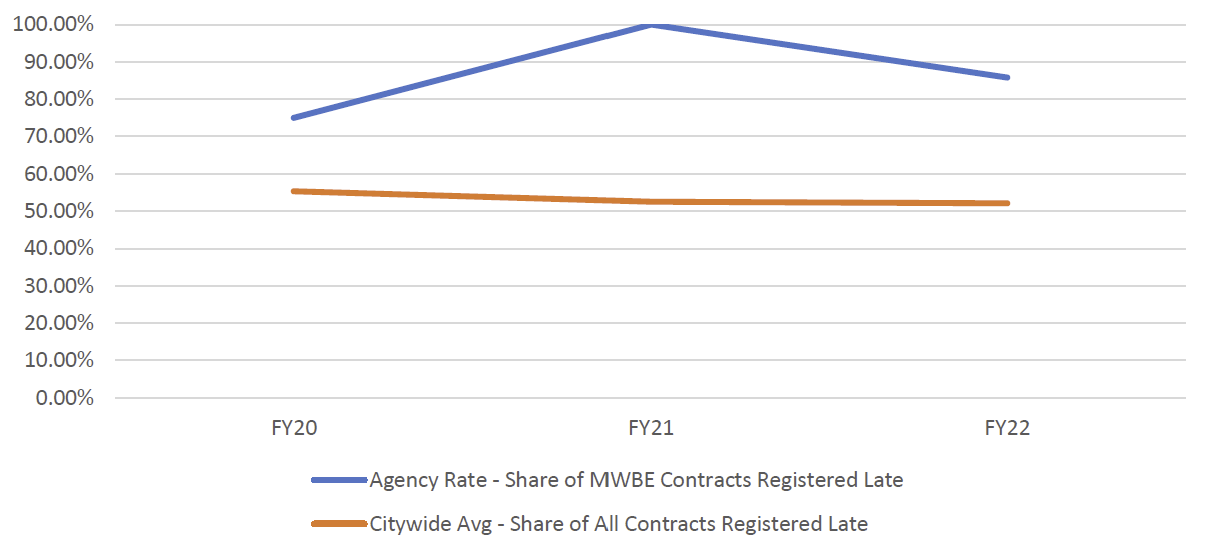

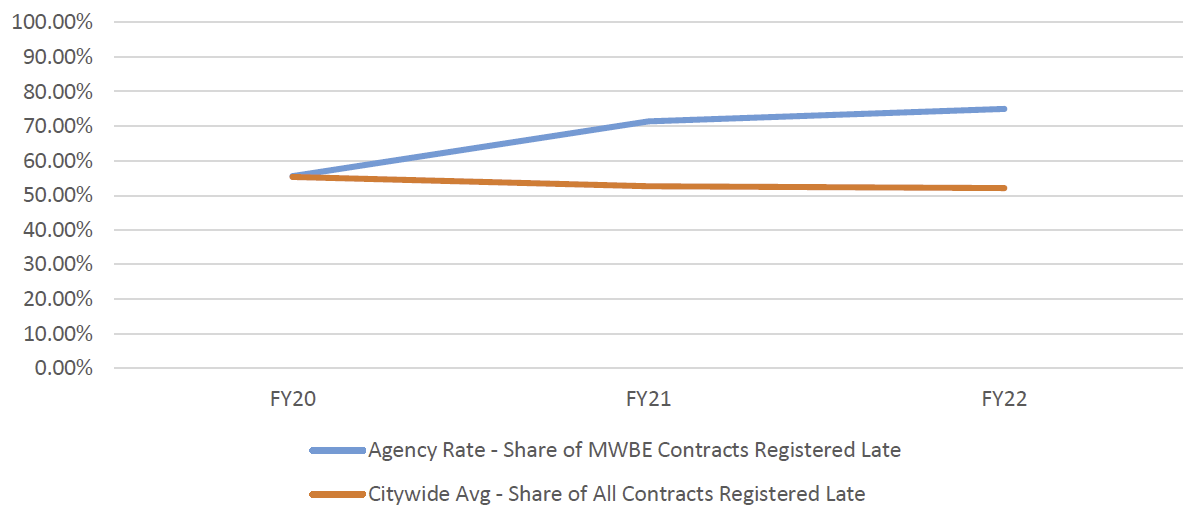

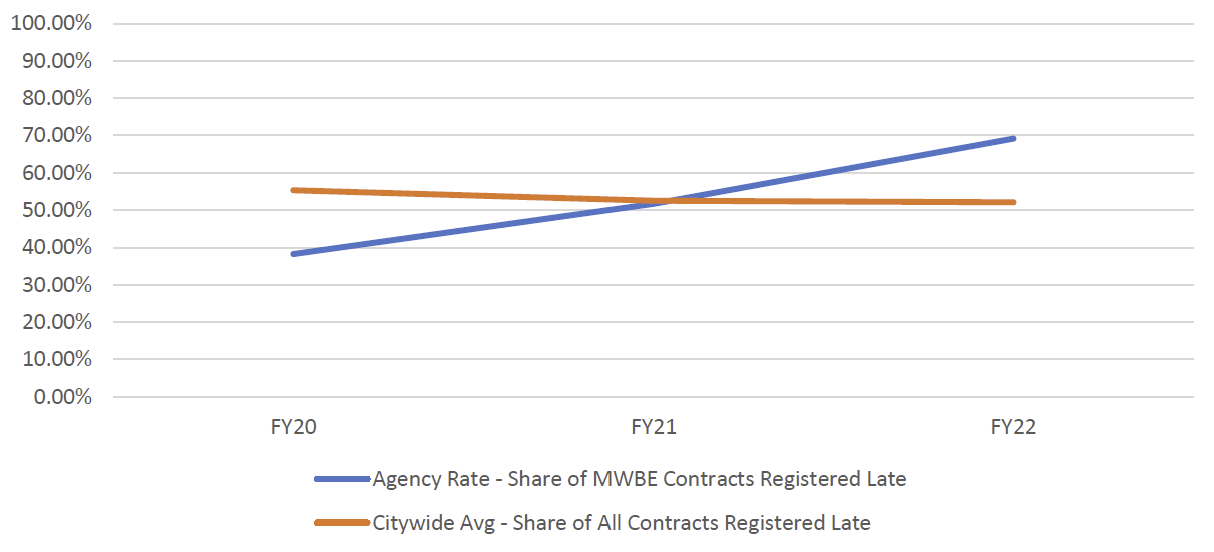

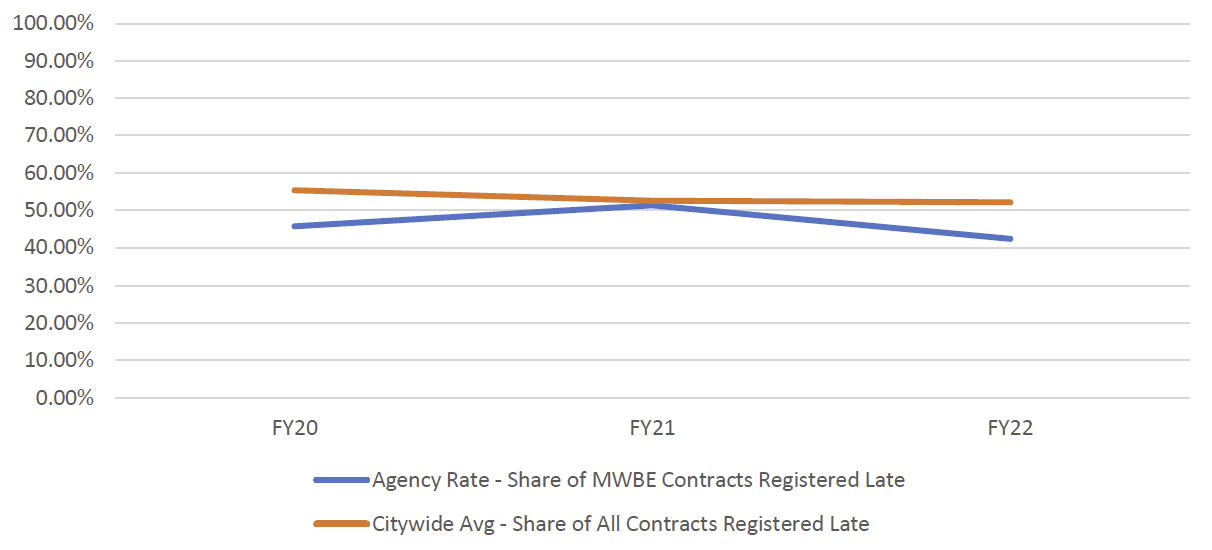

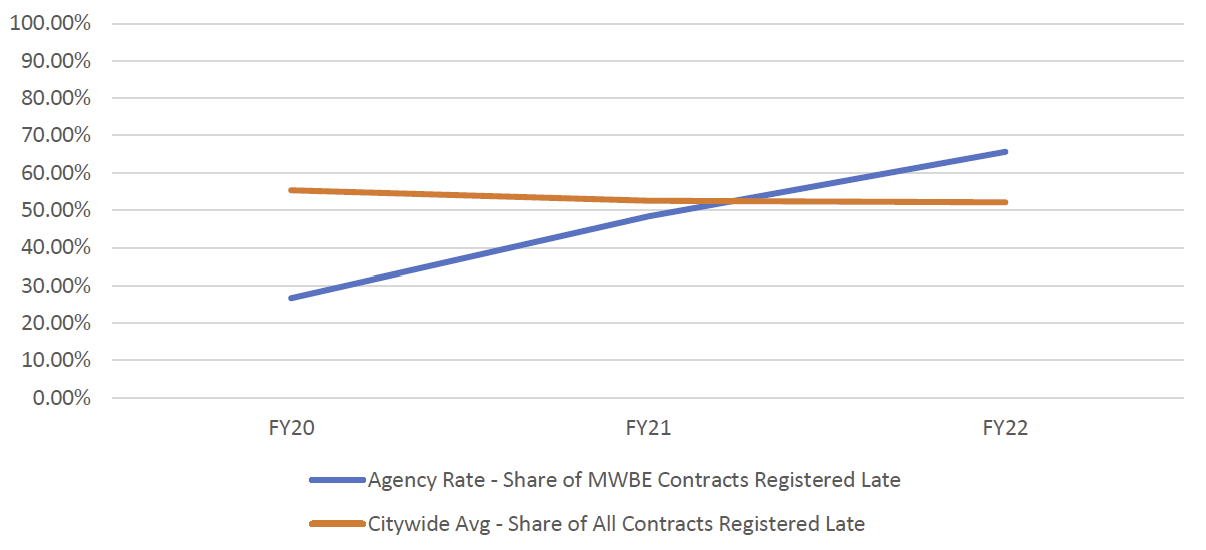

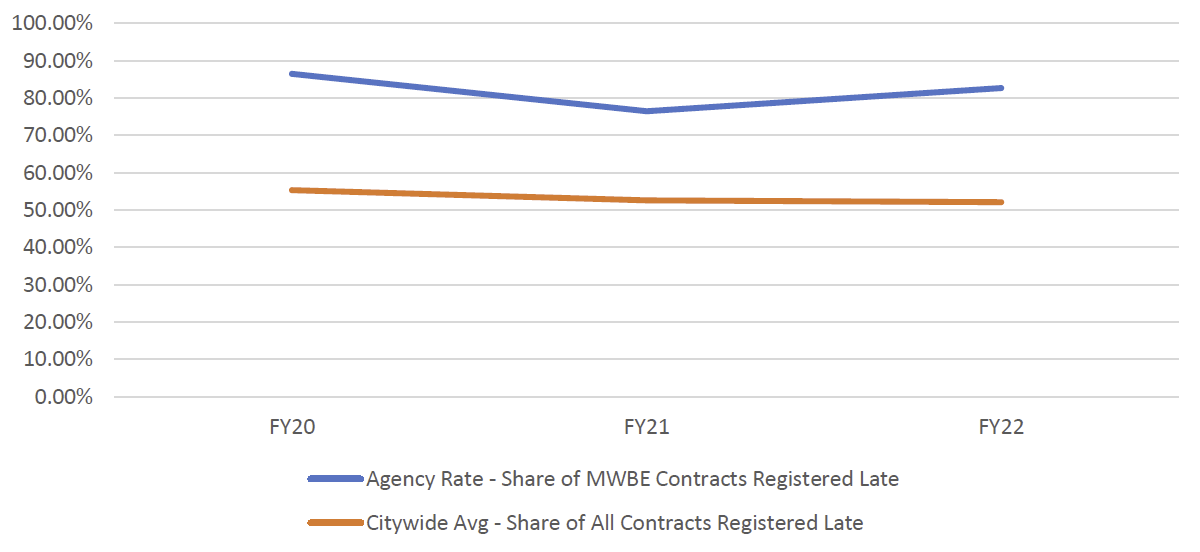

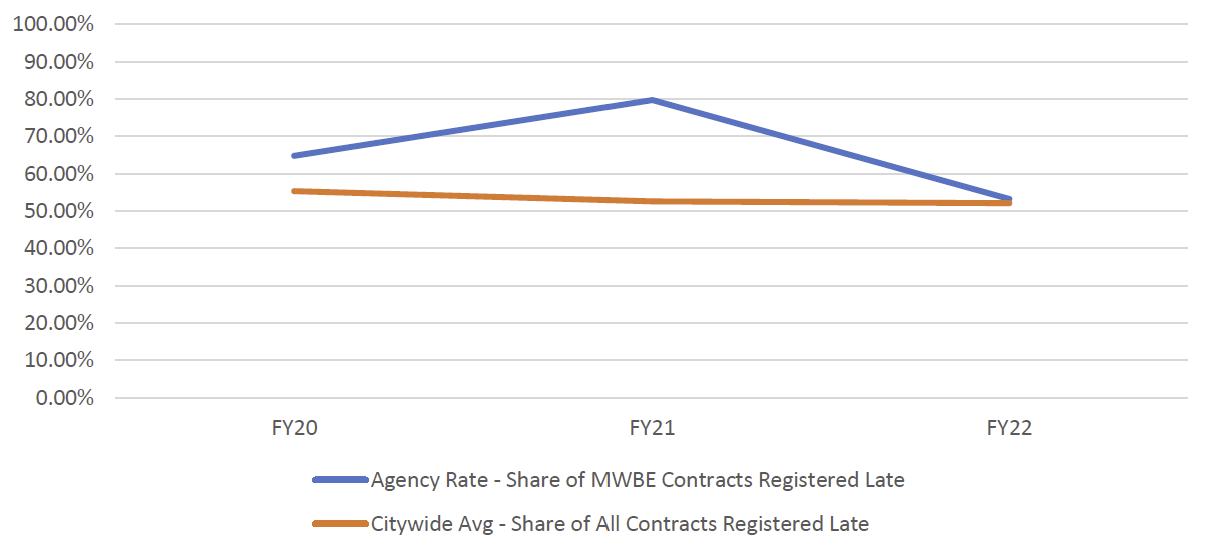

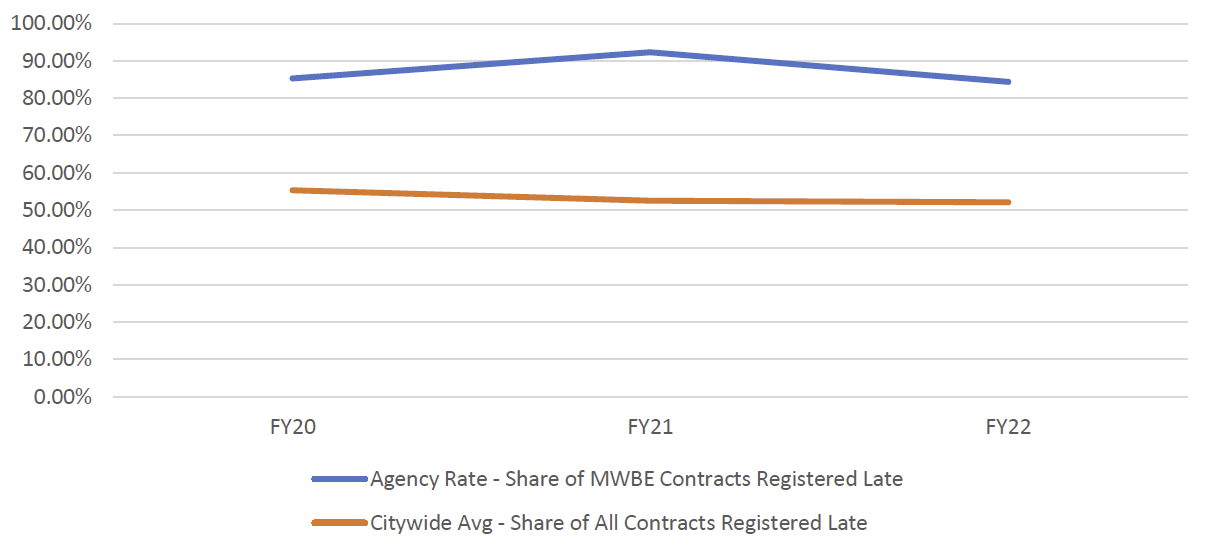

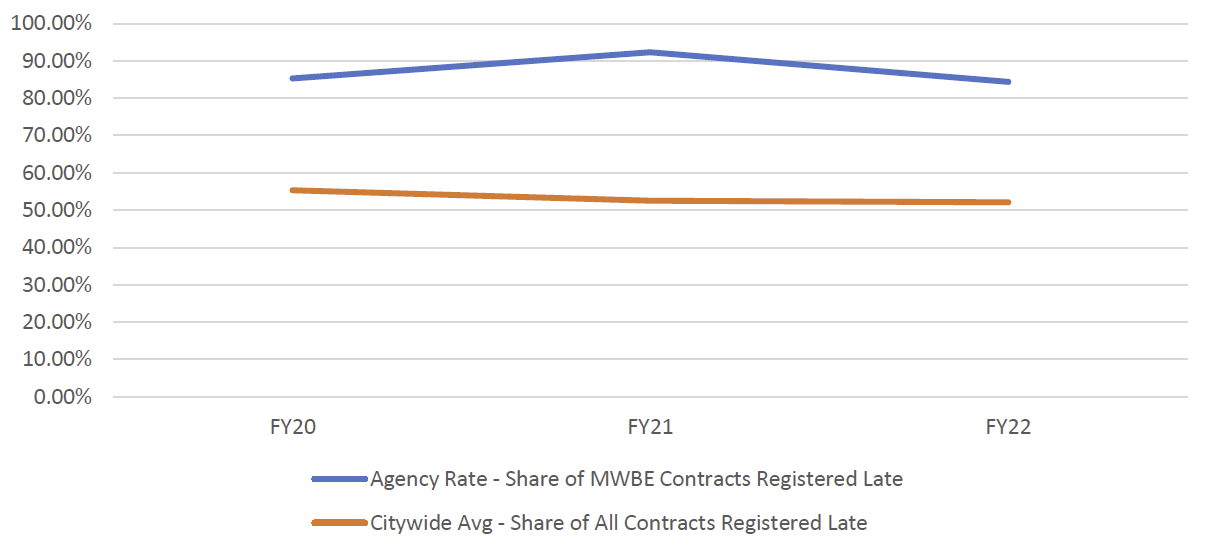

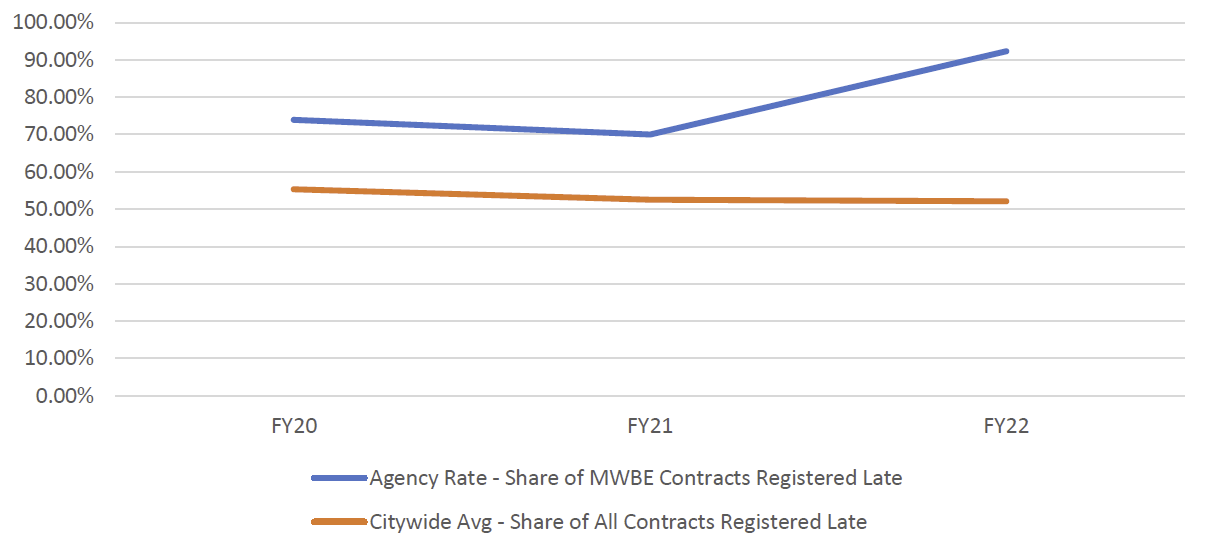

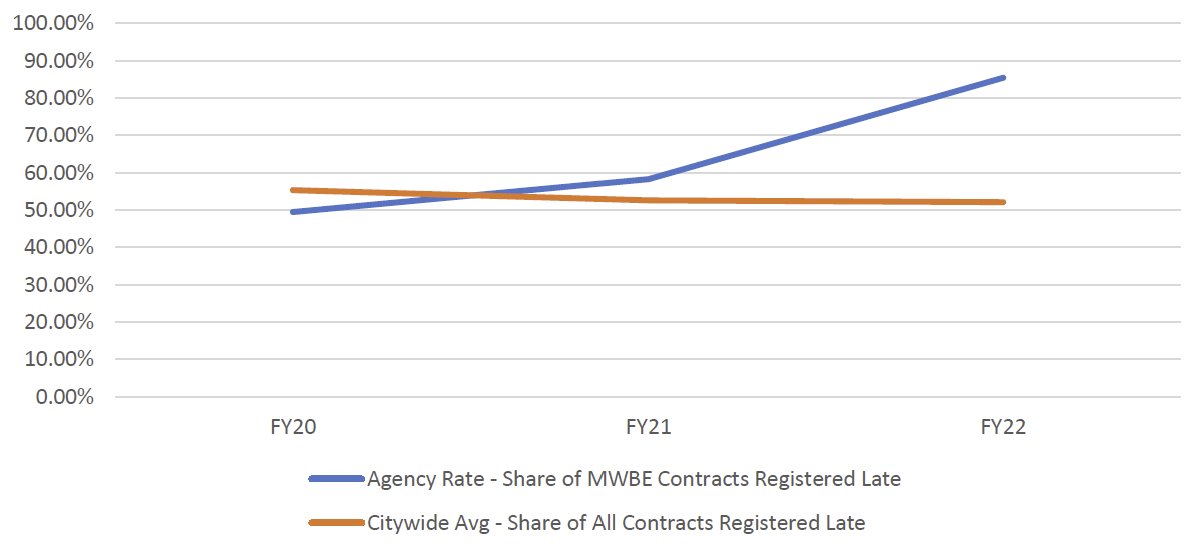

Finding #6: When M/WBEs do receive contract awards, they are not paid on time

The City’s lengthy contracting processes too often compromise the stability of its contractors. In FY22, over 55% of new contracts with M/WBEs were registered retroactively, after the beginning of their contract term, compared with the 52% citywide average. This forces M/WBEs to advance funds out of limited working capital, to seek to borrow in order to start the project, or to delay work. In some circumstances, it means M/WBEs are providing City services without any guarantee of pay. This is especially challenging given that average M/WBE contract sizes are smaller, and that many M/WBEs are small businesses that lack sufficient working capital and may have a more challenging time borrowing from traditional lending institutions.

Table 14: FY22 New M/WBE Contract Registrations by Retroactive Category, Citywide

| Retroactive Category | # of Contracts | % Share of Contracts | Total Contract Value | % Share of Contract Value |

| On Time or Early | 1,193 | 44.75% | $621,227,332 | 27.68% |

| Late – Within 30 days | 606 | 22.73% | $392,544,775 | 17.49% |

| Later – Between 31-180 days | 673 | 25.24% | $1,027,777,171 | 45.79% |

| Very Late – Between 181-365 Days | 130 | 4.88% | $135,353,991 | 6.03% |

| Latest – More than 1-year | 64 | 2.40% | $67,759,384 | 3.02% |

| Grand Total | 2,666 | 100.00% | $2,244,662,655 | 100.00% |

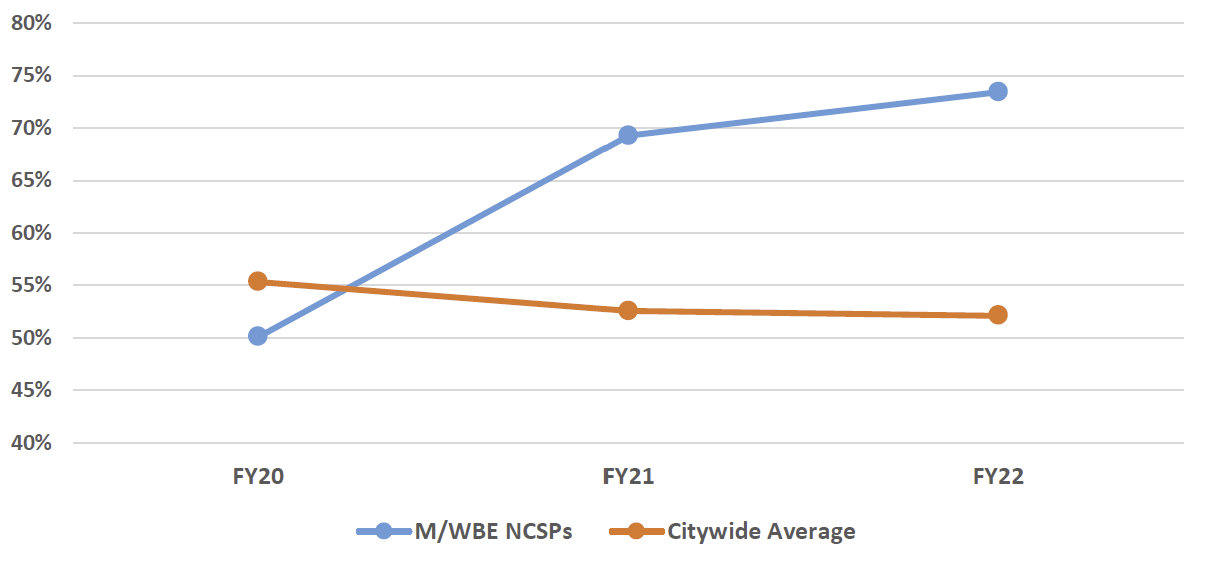

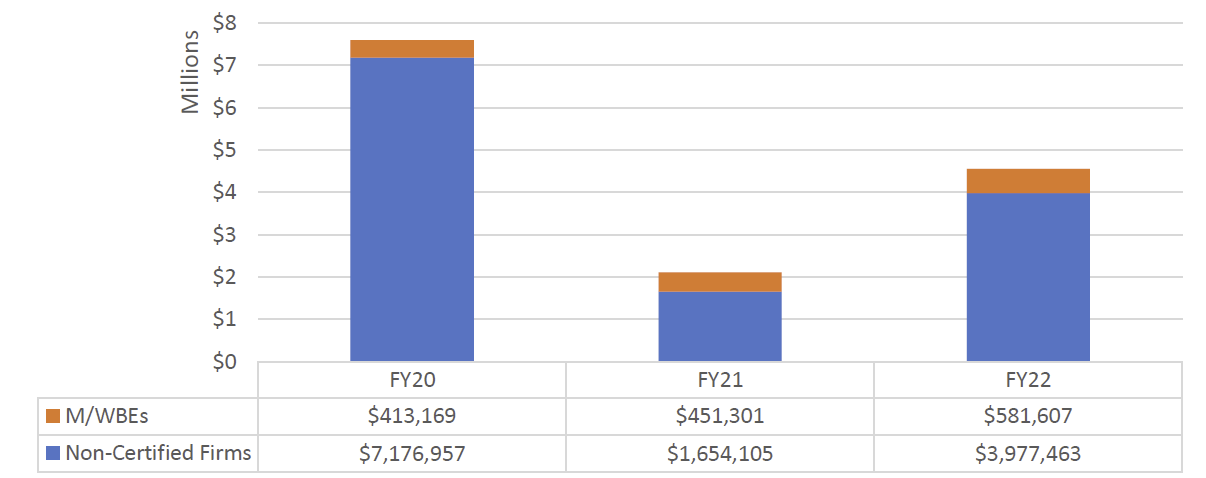

Chart 7: Citywide Share of Late Registrations by Count, FY20-22

Retroactive registration is even higher, on average, for procurements using the M/WBE NCSP method, despite the fact that the Comptroller’s office has delegated authority to allow agencies, with appropriate oversight measures, to self-register contracts procured pursuant to the M/WBE NCSP method. In doing so, vendors awarded contracts using this method do not wait up to 30-calendar days for their contract to be registered, which then provides a vehicle by which they are able to be paid. Yet, despite the time savings this provides, agencies are still self-registering contracts after their start date at a greater rate than for M/WBE contracts that are registered by the Comptroller.

Table 15: FY22 M/WBE NCSP Registrations by Retroactive Category, Citywide

| Retroactive Category | # of Contracts | % Share of Contracts | Total Contract Value | % Share of Contract Value |

| On Time or Early | 251 | 26.59% | $31,218,862 | 24.51% |

| Late – Within 30 days | 335 | 35.49% | $38,222,414 | 30.01% |

| Later – Between 31-180 days | 303 | 32.10% | $48,317,876 | 37.94% |

| Very Late – Between 181-365 Days | 50 | 5.30% | $8,923,518 | 7.01% |

| Latest – More than 1-year | 5 | 0.53% | $669,623 | 0.53% |

| Grand Total | 944 | 100.00% | $127,352,292 | 100.00% |

Chart 8: Citywide Share of Late M/WBE NCSP Registrations by Count, FY20-22

Recommendations

Recommendation #1: Ensure that M/WBEs Have Access to Higher Value Contracts through Competitive Procurements

1.1 Establish more M/WBE Prequalified Lists (PQL)

CSB and CSP are appropriately the primary vehicles by which the City awards higher-dollar value contracts. Procurement Policy Board rules authorize agencies to limit competition pools for procurements pursuant to RFBs and RFPs to vendors on pre-qualified lists. Pursuant to State legislative authority, PQLs may also be established exclusively for M/WBEs. Agencies may also establish PQLs that, as a condition of prequalification, require that a significant portion of any awarded contract funds be spent with M/WBEs (either as prime vendors or through subcontracting).

The Comptroller’s Office supports the recommendation of the Capital Process Reform Task Force to increase the use of M/WBE exclusive prequalified lists.[23] Some agencies have successfully utilized both types of PQLs, but wider adoption of PQLs is needed to direct higher-dollar-value contracting opportunities to eligible M/WBEs, particularly targeted the for underutilized M/WBE Categories. In addition to the utilization advantages, PQLs intend to fast track the award of contracts, which offers an opportunity for agencies to procure critical goods and services more quickly, and to improve timeliness of registrations.

City systems such as PASSPort and FMS already include identifiers for procurements pursuant to PQLs, but additional enhancements would better highlight the use of PQLs that are specifically targeted to direct opportunities to M/WBEs at either the prime or subcontracting levels.

1.2 Utilize “Best Value” Preferences

The PPB Rules also already provide authorization for contracting agencies to provide M/WBE bidders and proposers with “best value” price or point preferences in all new procurements (see Appendix A of this Report for more information). The City is obligated to monitor agency compliance with the M/WBE Program generally, but “best value” remains underutilized and unenforced by oversight agencies.[24]

To tackle this problem, the City must make necessary changes in PASSPort to require oversight review of all CSBs and CSPs to determine whether the contracting agency properly considered M/WBE price or point preferences in their solicitation documents. Such enforcement can be amplified by reducing or rescinding delegated procurement and/or contracting authority of contracting agencies that are missing the mark on best value, as is permitted under LL 174.

Additionally, there is no designated identifier in either PASSPort or FMS to accurately reflect procurements that utilize the “best value” preference. The lack of transparency further masks the ability to track whether City agencies are effectively exercising their discretion to offer point preferences to M/WBEs. PASSPort and FMS enhancements should create award methods that identify the use of Best Value in RFBs and RFPs. As a joint administrator of FMS, the Comptroller’s Office is committed to working with the Mayoral Administration and FISA to effectuate any changes that will bring additional transparency to this process, including the use of “best value.”

Recommendation #2: Bolster Agencies’ Use of Existing Discretionary Procurement Methods

The PPB Rules authorize agencies to choose from multiple procurement methods that allow contracting agencies latitude to make direct contract awards to M/WBEs without formal competition under appropriate conditions. These methods are often also quicker and have limited and condensed procedural steps, which make them nimbler than some of the methods discussed elsewhere in this Report.

The dollar value of awards made through discretionary methods is generally lower than through other methods. As a result, expanding the use of these methods will not address the fact that M/WBE contracts are significantly lower in value on average. These methods do, nonetheless, give many M/WBEs real opportunities to provide goods and services to meet the needs of City agencies. These smaller awards are a meaningful entry point for smaller M/WBEs who are looking to start contracting with the City and over time can help contribute to a larger pool of M/WBEs that are ready and able to take on larger contracts.

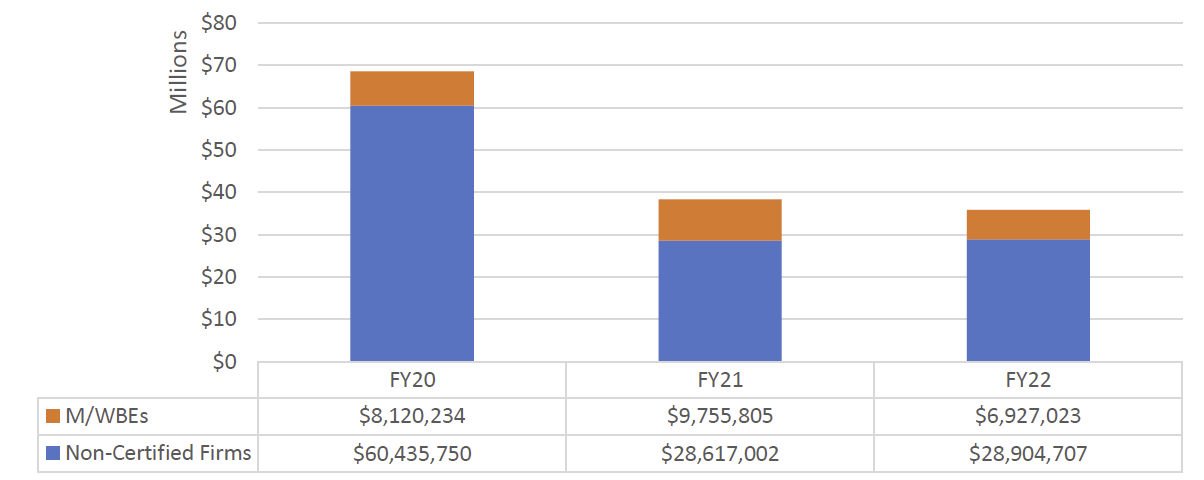

2.1 Achieve broader and higher dollar use of the M/WBE NCSP Method

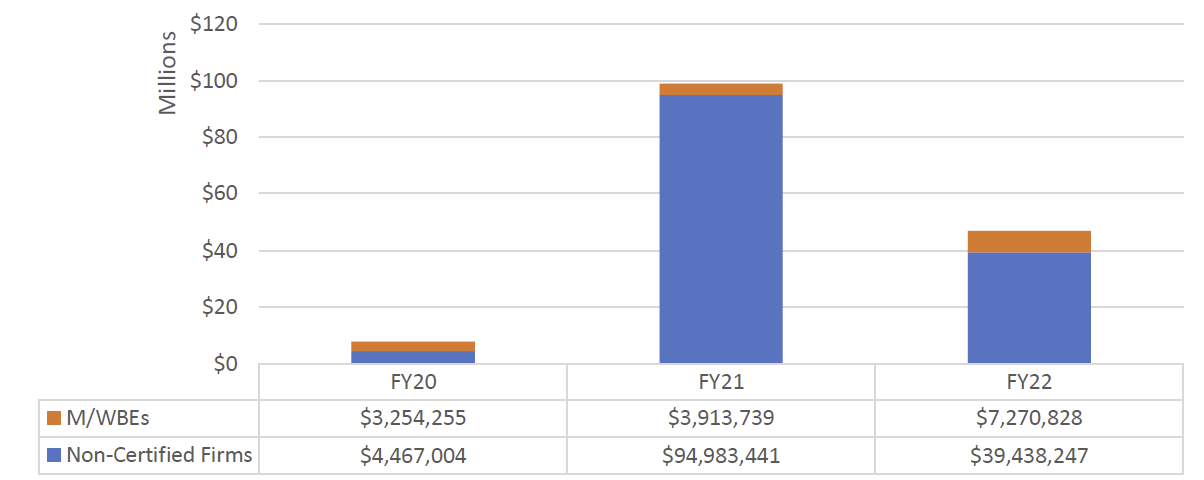

The M/WBE Noncompetitive Small Purchase (NCSP) method allows City agencies to make direct contract awards to M/WBEs with limited targeted competition. In general, contracting agencies leverage this method by soliciting at least three quotes from certified M/WBEs and then awarding the contract to a responsible vendor that offers a fair and reasonable price. With a threshold higher than those for micro- and small purchases, the method is one of the City’s most effective tools in driving prime contract awards to M/WBEs.

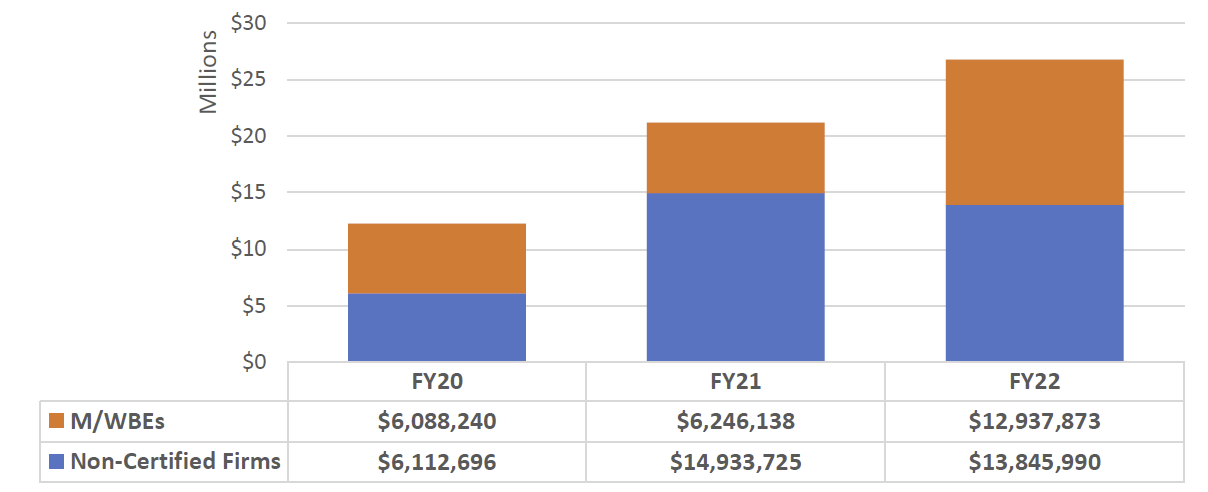

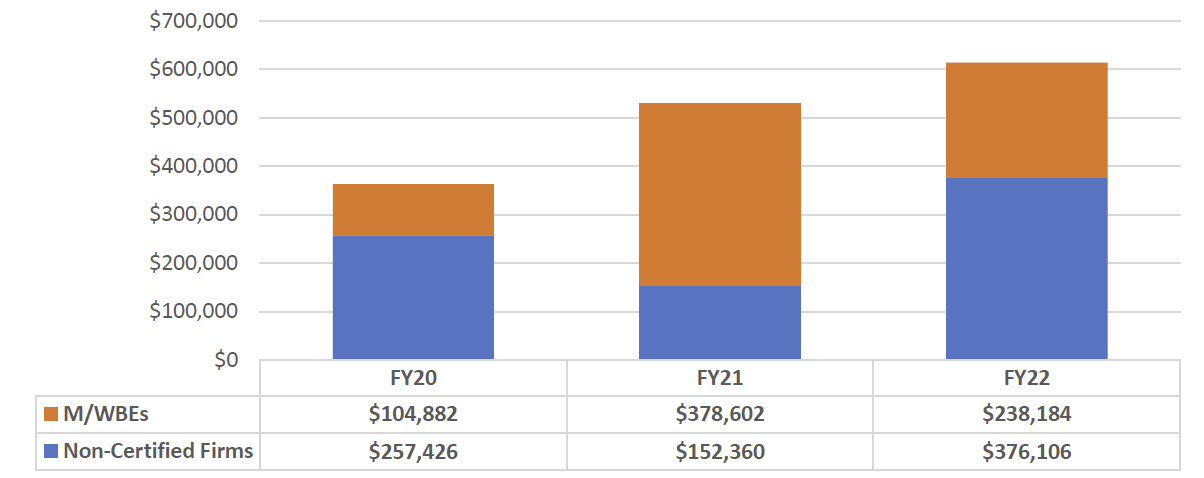

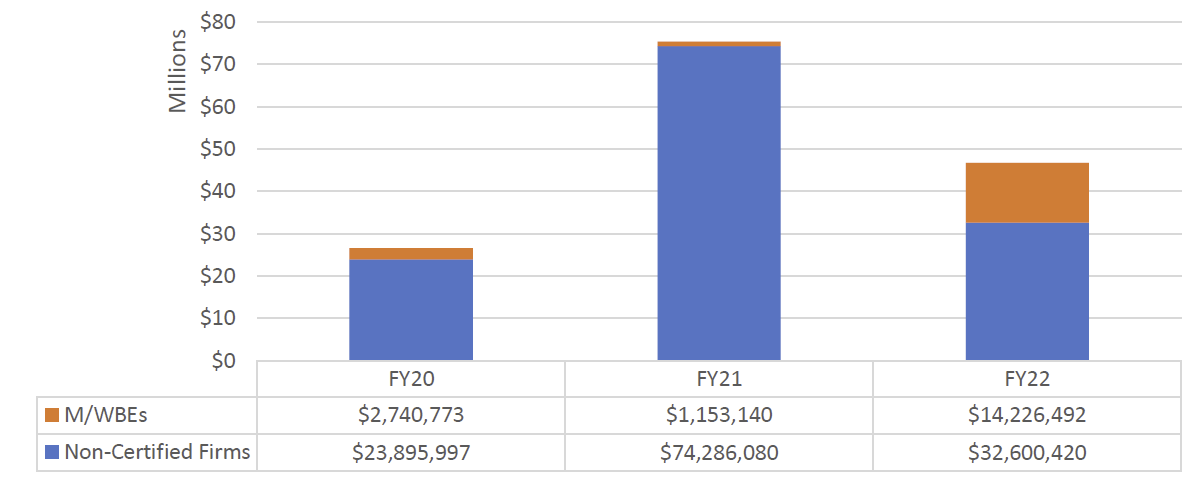

When first authorized by the State Legislature in 2017, the M/WBE NCSP method threshold was only up to $150,000 and limited to goods and services. In 2019, the M/WBE NCSP method was expanded up to $500,000 and to include construction. Procurement for FY22 reflected this $500,000 threshold.

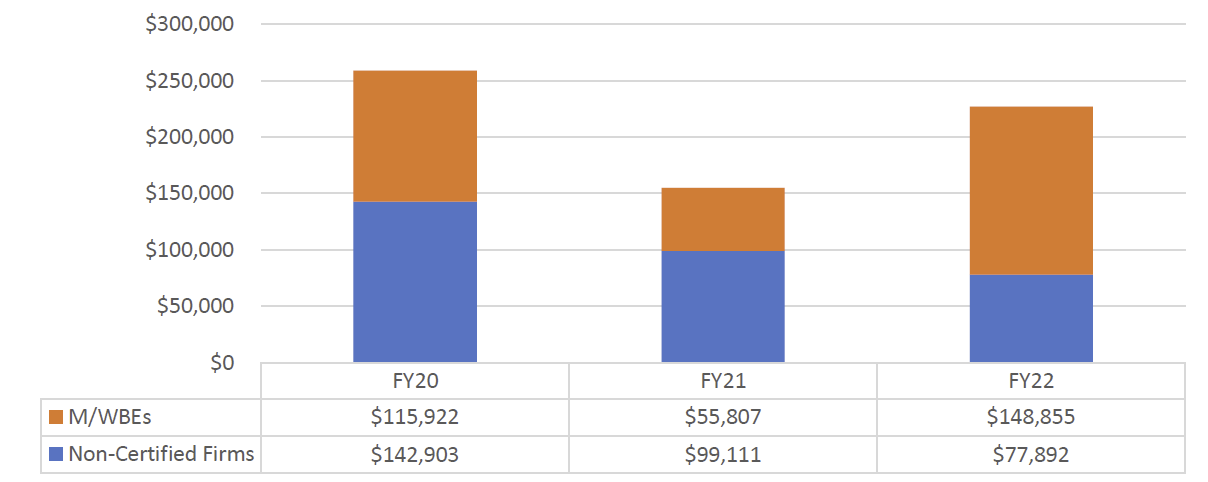

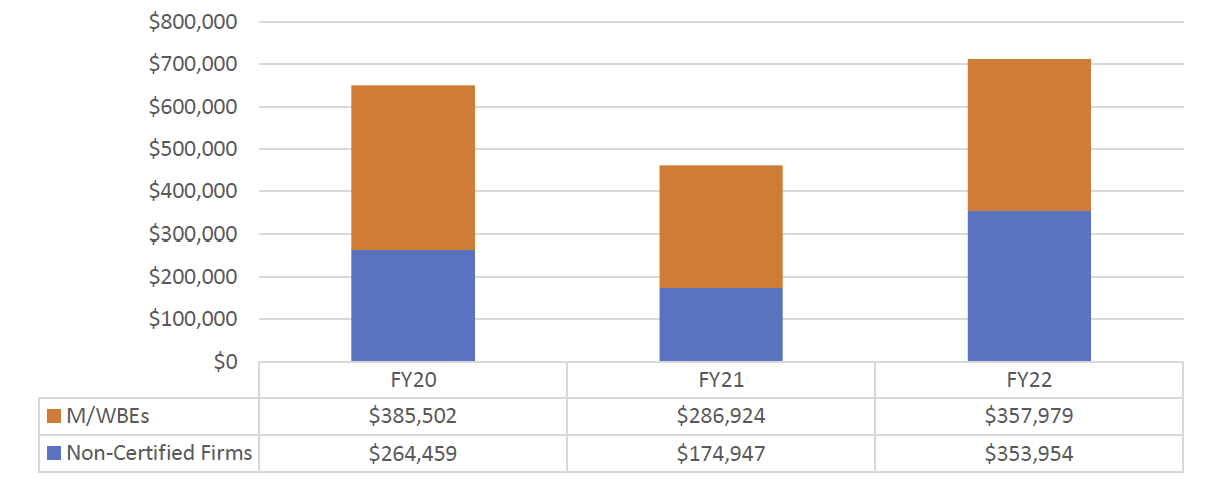

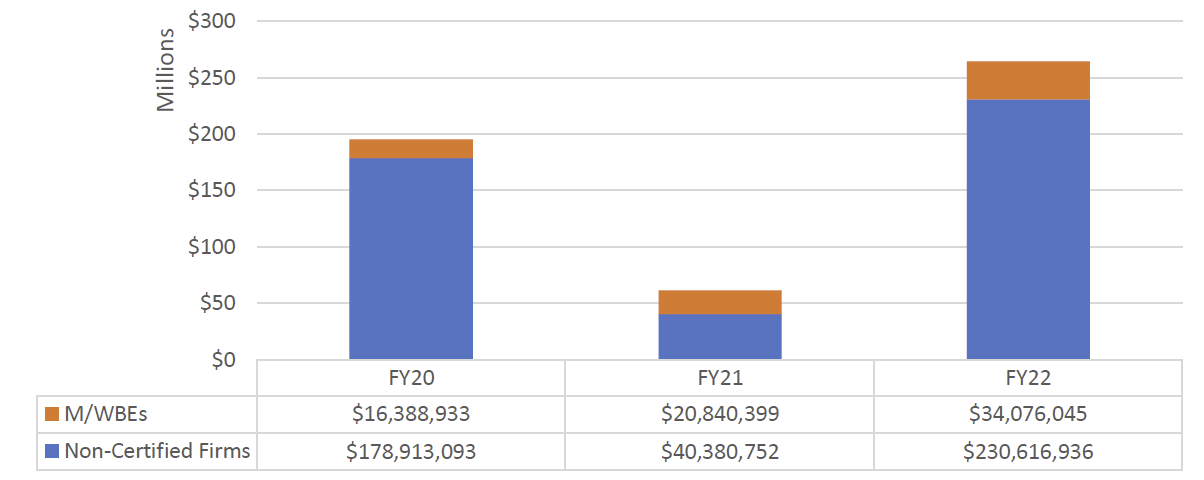

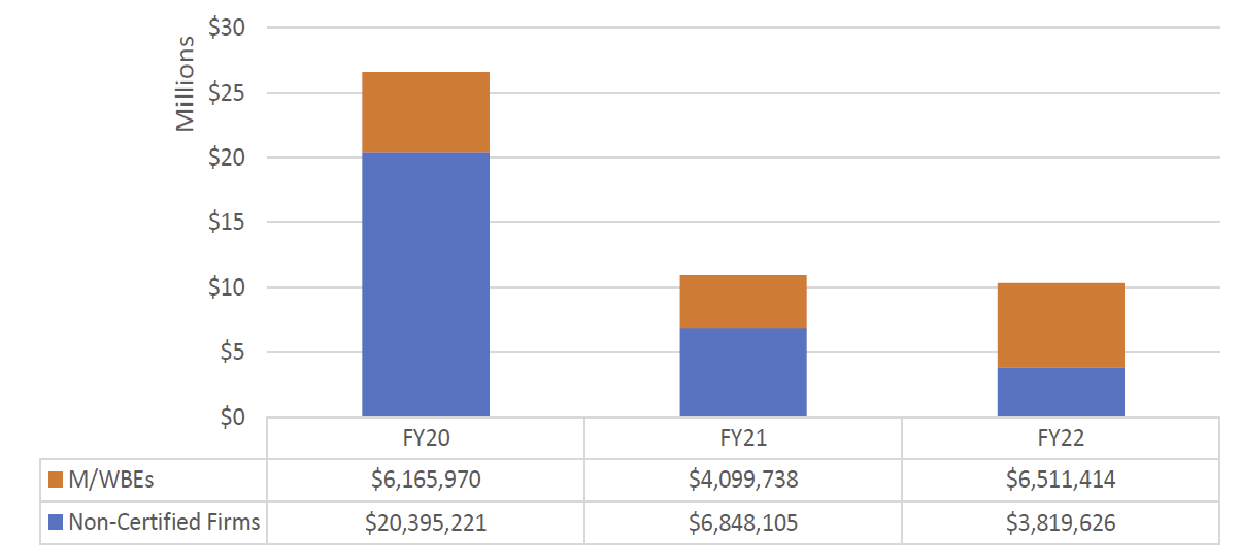

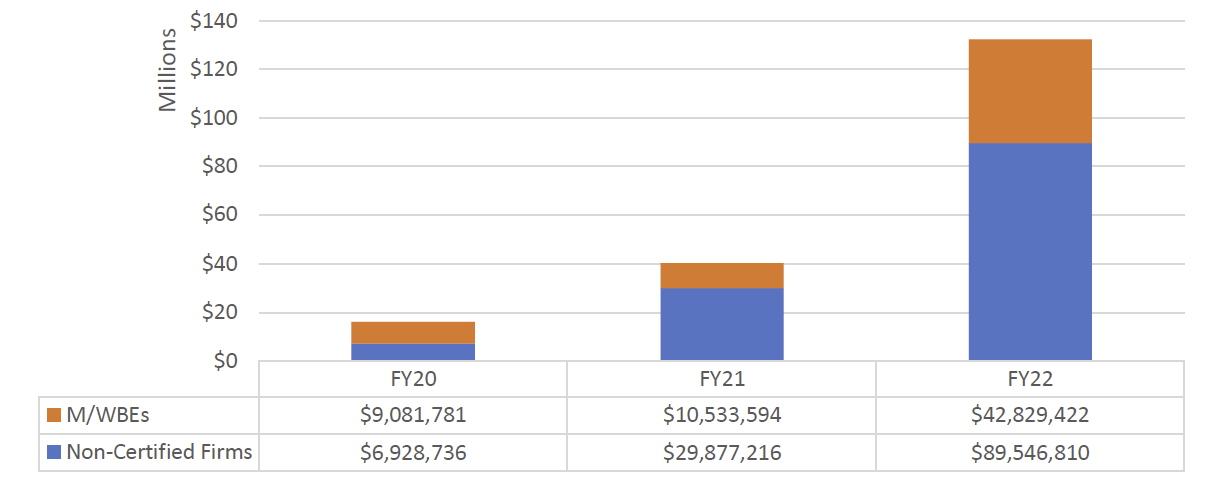

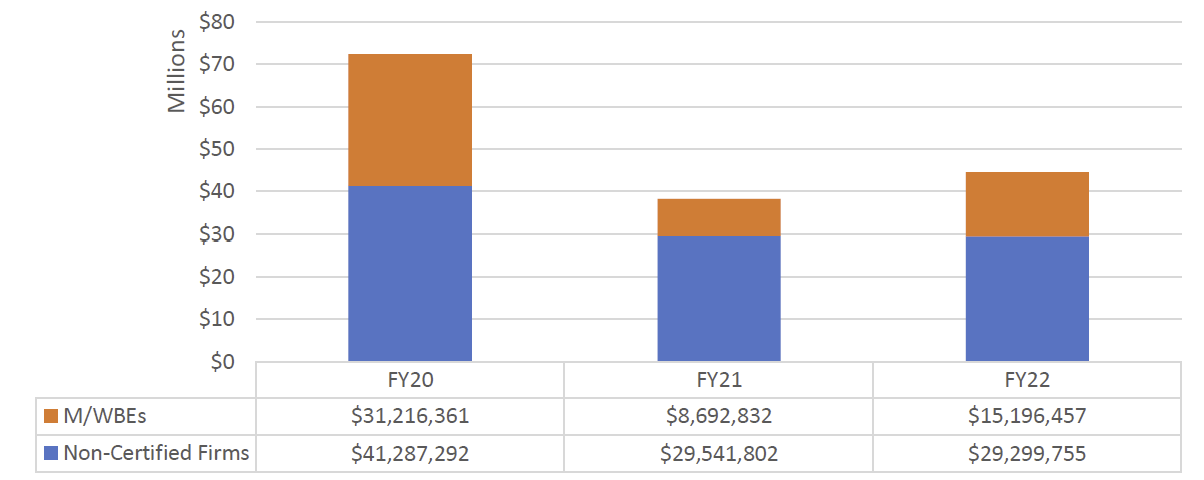

Since it was introduced in FY20, the M/WBE NCSP method has made up a significant share of new M/WBE contract registrations (35.41% in FY22). In FY22 city agencies registered 944 contracts via the M/WBE NCSP method, valued at over $127 million.[25] These numbers represent contract values as of the time of initial registration.[26]

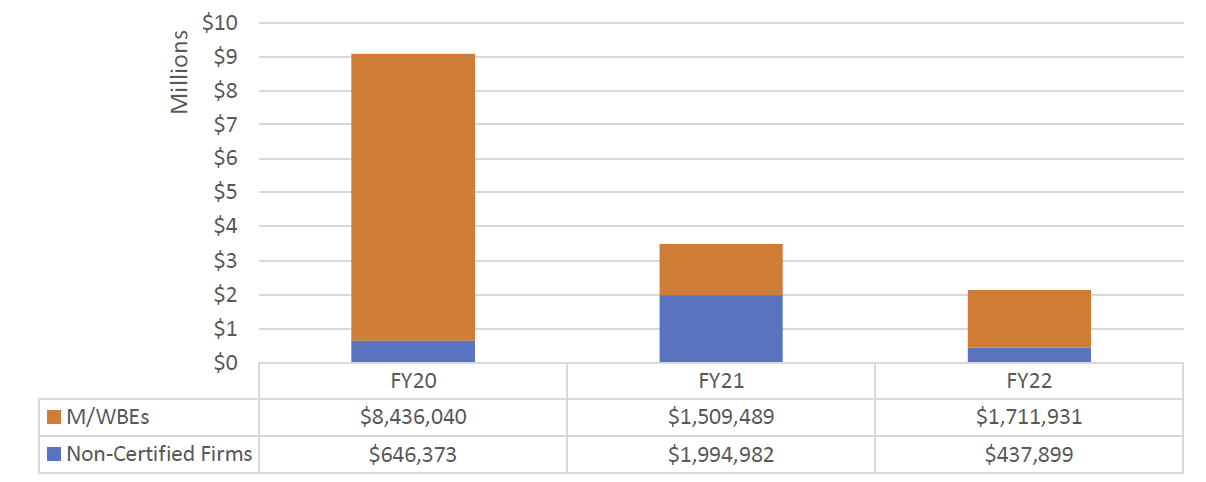

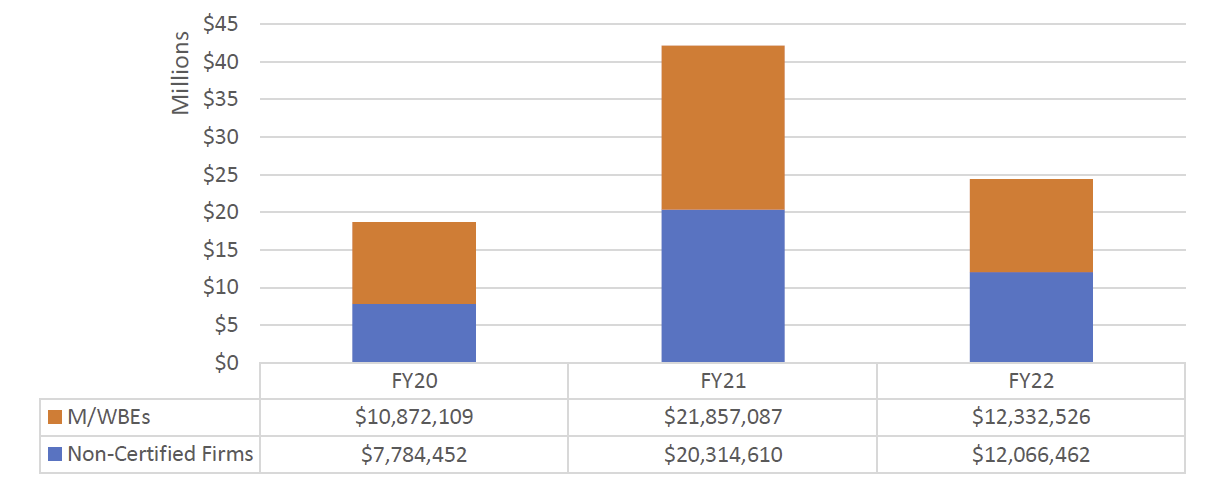

Table 16: Contracts Registered Using the M/WBE NCSP Method, Citywide, FY20-22

| Fiscal Year | # of M/WBE NCSP Contracts | % Share of All M/WBE Contract Registrations | Total Value of M/WBE NCSPs | AVG Contract Value of M/WBE NCSP |

| FY20 | 1,190 | 52.12% | $94,340,220 | $79,277 |

| FY21 | 833 | 39.69% | $87,566,148 | $105,121 |

| FY22 | 944 | 35.41% | $127,352,292 | $134,907 |

| Grand Total | 2,967 | N/A | $309,258,661 | $104,233 |

However, the FY22 registration data illustrates that many agencies focused their use of the M/WBE NCSP method at values far below the $500,000 threshold. In FY22, 83.58% of contracts registered using the M/WBE NCSP method were below $250,000, half the maximum value permitted by the Rule.[27] Almost three quarters of the contracts registered using this method did not exceed $150,000, the initial cap set back in 2017.

Table 17: FY22 Contracts Registered Using the M/WBE NCSP Method, Citywide[28]

| Contract Value | Black | Asian American | Hispanic American | White WBE | Total | Percent |

| Less than $150K | 180 | 177 | 205 | 145 | 707 | 74.89% |

| $150K – $250K | 20 | 29 | 15 | 18 | 82 | 8.69% |

| $250K – $450K | 19 | 36 | 18 | 20 | 93 | 9.85% |

| $450K – $500K | 14 | 19 | 6 | 23 | 62 | 6.57% |

| Grand Total | 233 | 261 | 244 | 206 | 944 | 100.00% |

The share of M/WBE NCSP registrations by count are relatively evenly distributed across race. Still, businesses owned by Asian American males and white women had a higher average dollar value than contracts registered to M/WBEs in other categories.

Table 18: FY22 Contracts Registered Using the M/WBE NCSP Method, Citywide, by M/WBE Category[29]

| M/WBE Category | # of Contracts | Percent of All M/WBE NCSP | NCSP Share of Total M/WBE Category Registrations | AVG M/WBE NCSP Value |

| Asian American male-owned MBEs | 114 | 12.08% | 4.54% | $175,610 |

| Asian American women-owned MBEs | 147 | 15.57% | 5.85% | $138,574 |

| Black Male-owned MBEs | 167 | 17.69% | 6.65% | $122,383 |

| Black women-owned MBEs | 66 | 6.99% | 2.63% | $145,420 |

| Hispanic American male-owned MBEs | 201 | 21.29% | 8.00% | $89,915 |

| Hispanic American women-owned MBEs | 43 | 4.56% | 1.71% | $160,785 |

| Native American M/WBEs | 0 | 0% | 0% | 0% |

| White WBEs | 206 | 21.82% | 8.20% | $155,047 |

| Grand Total | 944 | 100.00% | 37.56% | $134,907 |

The Comptroller’s Office recently delegated authority to City agencies and DOE to permit them to self-register contracts procured pursuant to the M/WBE NCSP method, while maintaining appropriate oversight measures. This delegation provides a tool that contributes to eliminating the retroactive registration of M/WBE contracts so that they are timely paid.

Mayor Adams and his Administration took an important step to build upon this in signing Executive Order 26 (EO 26) in February 2023 to focus on increasing participation in underutilized M/WBE Categories.[30] EO 26 formalizes a Recovery for All policy put in place by the DeBlasio Administration in July 2021 (the beginning of the fiscal year covered in this Report). Given the disparate findings in this Report, the City must also take affirmative steps to establish responsible measures to hold agencies accountable for eliminating bias and the underutilization of certain M/WBE groups by enforcing EO 26.

To that end, as a condition for delegating registration authority directly to agencies, the Comptroller’s Office mandated additional reporting and oversight requirements to make more transparent the City’s use of the M/WBE NCSP method with the expectation that tracking and reporting on utilization will highlight areas that require intentional focus. Commencing this calendar year, the City is required to publish reports on key performance indicators including the total unique M/WBE vendors that have been awarded contracts through the M/WBE NCSP method and a disaggregation of awarded M/WBE data by racial and gender categories. The first of these public reports is due by the City on August 15, 2023.

The delegation also mandates that the City review anticipated agency contract management actions at or below the new $1 million threshold to ensure that contracting agencies are maximizing use of this method.

2.2 Raise the M/WBE NCSP method threshold to $1.5 million

On October 6, 2022, New York State enacted new legislation increasing the dollar threshold for eligible procurements from M/WBEs from $500,000 to $1 million. In line with prior legislative approvals, this provides the City with the legal authority to codify changes in the PPB Rules to reflect the increased dollar threshold. Recognizing this historic opportunity, Comptroller Lander urged the PPB to convene to immediately commence the procedural process to enact the amendment. In December 2022, the PPB convened for the first time in three years and unanimously approved amending the PPB Rules to raise the threshold to not only align with the current State legislative authority up to $1 million, but also offers the flexibility to swiftly implement increases moving forward.

In January 2023, the NYC Capital Process Reform Task Force released its final set of immediate recommendations, seeking further State Legislative authority to increase the M/WBE NCSP method threshold to up to $1.5 million, consistent with the threshold for other public entities such as the Metropolitan Transportation Authority (MTA). Governor Hochul included legislation to increase the threshold to $1.5 million in her FY24 Executive Budget. The Comptroller’s Office urges the State Legislature to support this change.

“I am so excited for this increased threshold for the M/WBE noncompetitive small purchase award method. This will really give my business (and others like mine) a chance to actually grow, not to just stay alive.”

2.3 Ensure that discretionary micropurchases and small purchases are more fairly distributed to M/WBEs

Micropurchase procurements are those that do not exceed $20,000 for most goods and services, or up to $35,000 for construction. These purchases allow for the most discretion of any procurement method. The Rules require that agencies making micropurchases ensure that the purchases are distributed appropriately, including to M/WBEs. Yet the data shows that even when given wide discretionary latitude, the City is still not sufficiently contracting with M/WBEs.

Given the lower dollar value, Micropurchases are entered into either as registered contracts or POs. A total of 1,353 new contracts were registered in FY22 using the Micropurchase method for a total value of $13.67 million, and the City also issued 118,356 purchase orders at or below the Micropurchase threshold, for an average value of under $3,000, and a total value of $322.94 million.

M/WBEs accounted for 17.9% of the volume of these Micropurchases, and 27.82% of their total value.

Table 19: FY22 Micropurchases, Citywide

| Certification Type | Number of Contracts and POs | % Share of Contracts and POs | Total Contract and PO Value | AVG Value |

| Non-Certified | 98,314 | 82.13% | $263,358,009 | $2,679 |

| M/WBE | 21,395 | 17.87% | $73,261,077 | $3,424 |

The Small Purchase method also enables agencies to procure goods, services, and construction without formal competition or public advertisement, at a greater threshold. Given that the method affords agencies a quicker mechanism to procure goods and services, small purchases account for a large share of registered procurement actions in FY22. There are mechanisms built into this method that aim to facilitate M/WBE participation. Despite this, agencies are still not effectively utilizing M/WBEs using this method. In FY22, the 8,009 Small Purchase contracts and POs account for a total value of $227.83 million. M/WBEs accounted for 14% of the volume of these small purchases, and only 21.8% of their total value. Additional details on this method can be found in Appendix A of this report. When the threshold of the procurement overlaps with the M/WBE NCSP method, agencies should be directed to use the M/WBE NCSP method, given that it limits the competition to certified M/WBEs.

Table 20: FY22 Small Purchases, Citywide

| Certification Type | Number of Contracts and POs | % Share of Contracts and POs | Total Contract and PO Value | AVG Value |

| Non-Certified | 6,887 | 85.99% | $187,087,775 | $27,165 |

| M/WBE | 1,122 | 14.01% | $40,743,526 | $36,699 |

Recommendation #3: Reform the subcontracting process and incorporate it into PASSPort

Reforming the subcontracting process is critical for enhancing M/WBE participation and ensuring transparency. Such reforms must ensure that prime vendors and contracting agencies are being held accountable for M/WBE participation goals on eligible prime contracts.

The City should, therefore, eliminate the paper-based subcontractor submission and review process and incorporate the Payee Information Portal (PIP) subcontractor process into PASSPort with end-to-end functionality. These technology enhancements will create a one-stop-shop for contracting agencies, prime vendors, and subcontractors to manage all the activities related to their City contract. An online platform with workflow functionality that allows for document submission, review and approval steps, and information sharing would streamline subcontractor approvals and reduce barriers for M/WBEs. It would also allow the City to collect more reliable, trustworthy, and transparent data to monitor compliance with M/WBE participation goals and target outreach in particular sectors and industries where there may be subcontracting gaps or bottlenecks.

While this will be no small task, in recent years the City has successfully moved its vendor management activities (previously handled offline, on paper and in VENDEX) and its procurement and contract management process (also handled offline, on paper and in Automated Procurement Tracking system, or APT) into PASSPort. This brought many inefficient, paper-based processes into an electronic platform that cut down processing times, leveraged information sharing amongst vendors and contracting agencies, and brought transparency to those same stakeholders along with other interested parties with the recent PASSPort Public innovations.

Recommendation #4 Provide stronger tools to City agencies

New York City is full of capable, ready, and willing M/WBEs; however, finding them can present a challenge for contracting agencies. Recent investments in PASSPort, the SBS Directory, and Checkbook, have offered needed access to data and facilitated greater transparency. However, without targeted enhancements, these systems will continue to fall short of providing the level of access and information needed to narrow the wide disparities identified in this report. Information and resources remain in difficult-to-navigate silos that prevent agencies from achieving greater M/WBE utilization. The City must strengthen existing systems to make data more accessible across City tools and improve the quality of data maintained by the systems.

4.1 Update the training and guidance that agencies receive to reflect changes in procurement methods, markets, City goals, and best practices

In their work to increase M/WBE utilization, procurement officers are required to consider unique factors that vary by procurement, including its size and nature, the availability of certified M/WBEs with the capacity to perform the specific types and scale of work involved, appropriate or required licensing, vendors’ existing active contracts (private and public), past work experience and performance, and the value and scope of the vendor’s contracting portfolio. Agencies must also identify areas of work that may be subcontracted, and in doing so are directed to consider both subcontracting areas identified on past similar contracts and the current market and industry analyses that could result in new subcontracting opportunities.

The current resources available to agency procurement officers are complicated and outdated. Agencies are directed to use an offline Excel template worksheet to set goals for each eligible procurement. This worksheet does help standardize some consideration factors across agencies, but it is cumbersome to use and requires extensive training and resources for agencies to understand how to complete it.

The City has not issued revised goal-setting training or resources on BuyWise, the online platform that supports City procurement professionals, in at least five years. The current resources available to agencies include: a 2015 Best Practices Memo; a 69-page 2017 M/WBE Goal Setting Process Training Materials; and a 2018 Revised M/WBE Goal-Setting Policy Memo.

It is unrealistic to expect agency officials to navigate each of these documents to set a single goal, a process required for each of the 1,360 new contracts and 517 task orders registered in FY22 subject to LL 174. This outdated guidance also fails to provide agencies with training on current market trends and analyses necessary to develop informed metrics. Agencies should have access to expert insight into evolving industries, including sectors that may have opened more opportunities for subcontracting than previously existed.

Furthermore, these tools are completed individually and used offline, without support or oversight from the NYC Mayor’s Office of Contract Services (MOCS) or the NYC Office of Minority and Women Business Enterprises (OM/WBE). This provides the City and the public with little insight into what goals are set for each procurement, and how this may vary across agencies or industries. Modernized resources and tools will help Agencies set and achieve more realistic and ambitious M/WBE utilization goals.

4.2 Make data relevant to M/WBE procurement more easily accessible across City data tools and contracting systems

New York City agencies and vendors leverage many systems, platforms, and resources that support its contracting functions. Appendix A of this Report includes context and details about the many key technology resources that are particularly relevant when discussing contracting with M/WBEs. The City must prioritize a series of targeted integrations and enhancements of these systems to remedy the pervasive and incidental administrative hurdles preventing agencies from developing a broad, diverse pool of M/WBE partners.

These enhancements will allow for better information sharing to support agencies and M/WBEs alike. Among its many features, Checkbook NYC allows users to view the contracting and spend history of virtually all City agencies. Users can search for data on contracts with prime vendors and subcontractors, and focus searches for M/WBEs. This information should be leveraged as both a helpful transparency tool and to foster connections between agencies and M/WBEs doing business with the City. For M/WBEs not yet doing business with the City, Checkbook also provides search functionalities that offer information that can be used for direct networking and outreach.

The City should streamline this process by integrating Checkbook functionality into other City systems like the SBS Directory. M/WBE Vendor Profiles in the SBS Directory should be enhanced to include a Checkbook NYC link that would provide real-time registration and spend data that more accurately reflects an M/WBE’s capacity to undertake City contracts. This up-to-date information will bolster the market research and vendor outreach required of agencies when targeting vendors when using discretionary award methods. It will also support agencies in establishing appropriate participation goals required of prime vendors.

SBS has already begun important work to strengthen the connection between the SBS Directory and FMS. FMS will soon include additional essential details, including real time certification dates, which will be critical to ensure that agencies are able to identify M/WBEs as they become certified, and also to better ensure compliance if a certification status changes.

PASSPort Public would also benefit from several enhancements, including the development of functionality to allow users more useful options to accurately search for solicitations and contracts. For example, users have the ability to search open solicitations by filtering for the “RFI (M/WBE)” procurement method, seemingly to identify currently issued M/WBE NCSP method solicitations. However, search results do not accurately display the solicitations issued through this method, making it unhelpful for M/WBEs looking to identify potential opportunities that are meant to specifically target their participation.

PASSPort Public should also be expanded to provide information regarding subcontracting opportunities. The NYC Economic Development Corporation (NYCEDC) offers many resources to interested M/WBE subcontractors than can act as a model for other mayoral agencies, and perhaps for PASSPort, to follow.[31] NYCEDC allows M/WBEs to join Interested Subcontractor Lists, review Plan Holders Lists, and see what prime contractors have recently been awarded contracts. M/WBE subcontractors would benefit from this level of insight for other contracting agencies throughout the City.

4.3 Validate commodity codes so agencies can find the right M/WBEs

A commodity code is a standardized number for a product or service that a vendor might offer to the City and is used by agencies to find and target eligible M/WBEs. PASSPort allows vendors to enroll in commodities to connect them directly to applicable City contracting opportunities. Prior to issuing a solicitation or request for bids, proposals or quotes, City agencies generate a vendor competition pool by selecting the appropriate commodity codes associated with the goods or services that are being procured. During Comptroller’s Office focus groups, agency contracting staff shared that these commodity codes are often too general and may cast too wide of a net, making it difficult for agencies to find M/WBEs that actually aligned with the specific goods or services that are being procured. Conversely, there are times when commodity codes are too narrow, thereby leaving able M/WBEs out of the procurement competition pool.

In fulfillment of their responsibilities outlined in LL 174, SBS, OM/WBE, and MOCS must work closely with City contracting practitioners to strengthen the integrity and accuracy of commodity codes. It is imperative that M/WBEs are appropriately and timely classified in order to ensure compliance with procurement rules. At the time of certification and regularly thereafter, the City must proactively engage with M/WBEs to review selected commodity code and confirm alignment with the goods and services that they are able to provide. Given the large number of certified entities, engagement should be prioritized first to support underrepresented M/WBEs: Black M/WBEs, Hispanic American M/WBEs, Native American M/WBEs and Asian American women-owned MBEs.

Recommendation #5: Improve the timeliness of City contract registration

The City’s lengthy contracting processes are compromising the stability of its contractors. Over half of new contracts registered to M/WBEs were registered after the beginning of their contract term. This forces M/WBEs to advance funding, borrow to cover those advances, adjust, or delay work, and in some cases provide City services without any guarantee of pay.

Through the Capital Process Reform Task Force and the Joint Task Force to Get Nonprofits Paid on Time, the Comptroller’s Office and the Adams Administration have begun collaborative efforts to advance substantial reforms to the procurement system.

The New York City Capital Process Task Force was convened by then First Deputy Mayor Lorraine Grillo in April 2022 to undertake a comprehensive review of the City’s capital process and advocate for recommendations to reform capital delivery. The Task Force issued 39 recommendations to reduce timelines for capital project completion, achieve taxpayer savings, enhance vendor participation and inclusion in the construction industry, and increase the City’s capacity to address emerging needs

Nine of the recommendations involve changes in State legislation. Governor Hochul included three of them in her FY2024 Executive Budget – including expanded use of alternative delivery methods and raising the threshold for the M/WBE NCSP method from $1 million to $1.5 million. The Mayor and Comptroller are advocating for the inclusion of the remaining items with the State Legislature.

The remaining 30 recommendations call for action at the City level, including doubling the number of projects that use the Capital Project Scope Development fund, creating a template and establishing standard response times for the Certificate to Proceed process, and expanding the “Expanded Work Allowance” program for unforeseen field conditions from DDC to all other agencies. As part of this work, the Comptroller’s Office recently revised Comptroller’s Directive 10 to update interpretations of capital eligibility in limited scenarios where warranted.

The Joint Task Force to Get Non-Profits Paid on Time developed a series of recommendations to reform the City’s procurement process and ensure that nonprofits are paid on time, in full, and with certainty so they can keep doing their jobs of meeting the needs of New Yorkers. Many of these reforms will also benefit M/WBEs. The Task Force recommended that the City create new processes and routines to hold City stakeholders accountable for timely procurement and contracting procedures and make information about the process transparent to nonprofit providers and the public; and establish new processes to streamline and modernize the procurement and contracting process to reduce inefficiencies. Following the initial work of the Task Force, the City engaged McKinsey & Company to conduct a full-scale review and identify concrete process improvements. The First Deputy Mayor, Mayor’s Office of Contracts Services, Comptroller’s Office, and other agency stakeholders continue to meet on a regular basis to drive implementation of those reforms.

Together, these reforms will address outdated and lengthy procurement processes and aim to deliver faster, more cost-effective, high-quality goods and services to New Yorkers. The City must remain committed to prioritizing these needed reforms in a way that increases investments to M/WBEs and reduces barriers to the participation and inclusion of these businesses in City contracting.

M/WBE Utilization by Agency

This Section includes individual analyses for City agencies with LL 174-eligible contract registrations and spend. Though not subject to LL 174 participation goals, this Section also includes the same analyses for the Department of Education (DOE), given the size and value of its contracting portfolio. Similarly, for transparency and accountability this Section also includes analyses for the Comptroller’s Office.

These analyses provide a detailed understanding into the contract registration data, spend data and other procurement trends of each individual agency.[32] It is important to note that each agency procures different goods and services, has different operating budgets, and different priorities – so a one for one comparison may not always be appropriate. The Annual Summary Contracts Report includes more helpful information about contracting across agencies.

However, it can be helpful and informative to note patterns and trends across agencies, including the count and value of contracting opportunities across similar industries. Agencies are encouraged to review data pertaining to sister agencies that procure similar goods and services for best practices or to identify areas where they can share context or resources to improve their utilization. These analyses are intended to be reviewed in combination with the findings throughout the rest of the Report, including in the next Section by industry.

These analyses do not capture agency utilization information about businesses certified by other municipalities, including those who may be NY State certified M/WBEs or federal Disadvantage Business Enterprises (DBE)[33]. Some City agencies such as DOT Department of Transportation (DOT), Department of Parks and Recreation (DPR), and Department of Design and Construction (DDC) procure large contracts funded by federal transportation funds that are subject to DBE goals, and therefore must satisfy DBE participation requirements. Compliance with these non-City requirements is not reflected in this Report.

Ranked Measures:

These ranked measures are intended to provide additional context for the individual agency data. Rankings were made in consideration of a few measures that were conducive to cross-agency comparison:

- The relative share of LL 174-eligible contract and purchase order value that was registered to M/WBEs

- The number of contracts registered using the M/WBE NCSP method for each agency

- The average value of contracts registered using the M/WBE NCSP method for each agency

These considerations were made to ensure that smaller agencies would not be disadvantaged against agencies with larger budgets and procurement portfolios, since the first measure examines relative value shares, and citywide average M/WBE NCSP dollar value never rose above $135 thousand.

Rankings: Share of LL 174-Eligible Contract and PO Value Registered to M/WBEs

The following agencies registered the highest share of the value of LL 174-eligible contracts and POs to M/WBEs in FY22. The agencies in this list have varied sizes of procurement portfolios, funding sources, and account for purchases of goods and services in all industries.

Table 21: Top Five Agencies – FY22

| Agency | % Share of LL 174 Contracts registered to M/WBEs |

| Small Business Services (SBS) | 90.13% |

| Department of Cultural Affairs (DCLA) | 85.18% |

| Department of Buildings (DOB) | 79.63% |

| Department of Youth and Community Development (DYCD) | 73.79% |

| Business Integrity Commission (BIC) | 65.65% |

The agencies in Table 22 registered the lowest share of LL 174-eligible contract and PO value to M/WBEs. Many of the agencies in this list have some of the largest procurement portfolios in the City. Some of these low utilization rates may reflect additional constraints referenced earlier in the report, such as federal or state funding requirements.

Table 22: Bottom Five Agencies – FY22

| Agency | % Share of LL 174 Contracts registered to M/WBEs |

| Department of Education (DOE) | 5.60% |

| Department of Finance (DOF) | 7.43% |

| Department of Environmental Protection (DEP) | 7.91% |

| Department of Transportation (DOT) | 10.62% |

| Department of Design and Construction (DDC) | 12.41% |

The following agencies showed the largest improvement in utilization relative to FY20 levels. The agencies in this list have varied sizes of procurement portfolios, and account for purchases of goods and services in all industries.

Table 23: Five Most Improved Agencies – FY20-22

| Agency | FY20 | FY22 | Difference |

| Small Business Services (SBS) | 32.67% | 90.13% | 57.45% |

| Department of Corrections (DOC) | 23.21% | 63.03% | 39.81% |

| Comptroller (COMP) | 11.40% | 37.01% | 25.61% |

| Business Integrity Commission (BIC) | 44.79% | 65.65% | 20.86% |

| NYC Office of Emergency Management (NYCEM) | 10.29% | 30.38% | 20.09% |

Agency Rankings: Utilization of M/WBE NCSP Method by Count

The following LL 174-rated agencies utilized the M/WBE NCSP method most frequently in FY22. These agencies typically have larger procurement portfolios.

Table 24: Top Five Agencies – FY22

| Agency | # of Contracts Registered using M/WBE NCSP method |

| Office of Technology and Innovation (OTI) | 99 |

| Department of Health and Mental Hygiene (DOHMH) | 73 |

| Department of Transportation (DOT) | 63 |

| Fire Department (FDNY) | 57 |

| Department of Citywide Administrative Services (DCAS) | 54 |

The agencies in Table 25 utilized the M/WBE NCSP method least frequently in FY22. Generally speaking, these are all agencies with relatively small procurement portfolios.

Table 25: Bottom Five Agencies – FY22

| Agency | # of Contracts Registered using M/WBE NCSP method |

| Landmarks Preservation Commission (LPC) | 1 |

| Department of City Planning (DCP) | 1 |

| Department of Probation (DOP) | 2 |

| Civilian Complaint Review Board (CCRB) | 3 |

| Department of Investigation (DOI) | 3 |

The agencies in Table 26 showed the biggest increases in the count of contracts registered using the M/WBE NCSP method since FY20. Generally speaking, these agencies all have large procurement portfolios. Notably, DOI appears in Table 25 (bottom five agencies for M/WBE NCSP method utilization) as well as the most improved rankings. Given the overall decline in M/WBE NCSP method utilization by count since FY20, an increase of 3 registrations was enough for an agency to reach the top five.

Table 26: Five Most Improved Agencies – FY20-22

| Agency | FY20 | FY22 | Difference |

| Office of Technology and Innovation (OTI) | 77 | 99 | 22 |

| Department of Parks and Recreation (DPR) | 29 | 50 | 21 |

| Small Business Services (SBS) | 11 | 24 | 13 |

| Department of Design and Construction (DDC) | 19 | 27 | 8 |

| Department of Investigation (DOI) | 0 | 3 | 3 |

Agency Rankings: Utilization of M/WBE NCSP Method by Average Contract Value

As previously mentioned, the average value of a contract registered using the M/WBE NCSP method in FY22 was $134,907. The agencies in Table 27 utilized the M/WBE NCSP method to register contracts with the highest average contract value in FY22. Most of these agencies generally tend to procure high-dollar-value contracts.

Table 27: Top Five Agencies – FY22

| Agency | AVG Value of contracts registered using the M/WBE NCSP method |

| Small Business Services (SBS) | $207,713 |

| Department of Homeless Services (DHS) | $206,250 |

| Department of Design and Construction (DDC) | $197,322 |

| Administration for Children’s Services (ACS) | $184,271 |

| Department of Cultural Affairs (DCLA) | $180,029 |

Table 28 displays agencies that utilized the M/WBE NCSP method with the lowest average contract value in FY22. Most of these agencies generally tend to have small procurement portfolios.

Table 28: Bottom Five Agencies – FY22

| Agency | AVG Value of contracts registered using the M/WBE NCSP method |

| Landmarks Preservation Commission (LPC) | $22,500 |

| Department of City Planning (DCP) | $23,167 |

| Department of Probation (DOP) | $51,968 |

| Civilian Complaint Review Board (CCRB) | $55,840 |

| Department of Investigation (DOI) | $58,731 |

Table 29 ranks the top five agencies showing the largest increase in average value of contracts registered utilizing the M/WBE NCSP method since FY20. Most of these agencies generally tend to have relatively large procurement portfolios.

Table 29: Five Most Improved Agencies – FY20-22

| Agency | FY20 | FY22 | Difference |

| Department of Design and Construction (DDC) | $68,655 | $197,322 | $128,667 |