A Message from the New York City Comptroller

Dear New Yorkers,

I’m pleased to share the Annual Summary Contracts Report for the City of New York, covering Fiscal Year 2025 (FY25). I know you’ve been on the edge of your seat waiting for it!

Each year, this report provides the public with an overview of what New York City purchased in the prior fiscal year, who we purchased it from, and how these purchases (we call them “procurements”) were made. Taken together, these procurements reflect investments in critical infrastructure, social services, economic development projects, and a very wide array of goods and services that enable City agencies to accomplish their missions on behalf of New Yorkers.

For the first time since FY22, the number and value of contracts entered into by the City grew from the prior year (12,955 new contracts were registered in FY25 for a total value of $42.45 billion, across both the operating and capital budgets). Nearly a quarter of this value comes from three large capital contracts associated with the City’s Borough-Based Jail project, which is a critical part of the initiative to close and replace the jails on Rikers Island. In addition to big-ticket purchases, the City made tens of thousands of additional low-dollar purchases via purchase orders relative to prior-year levels.

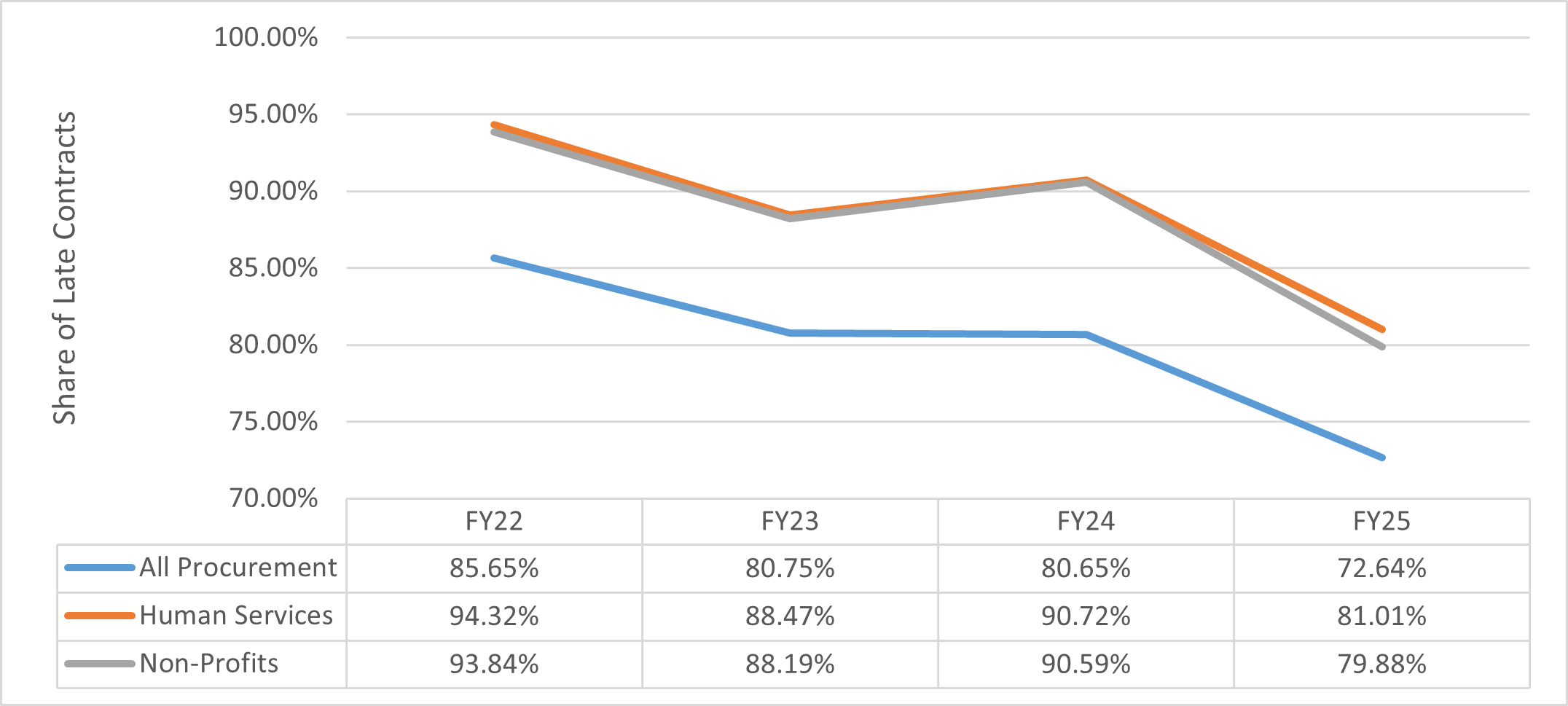

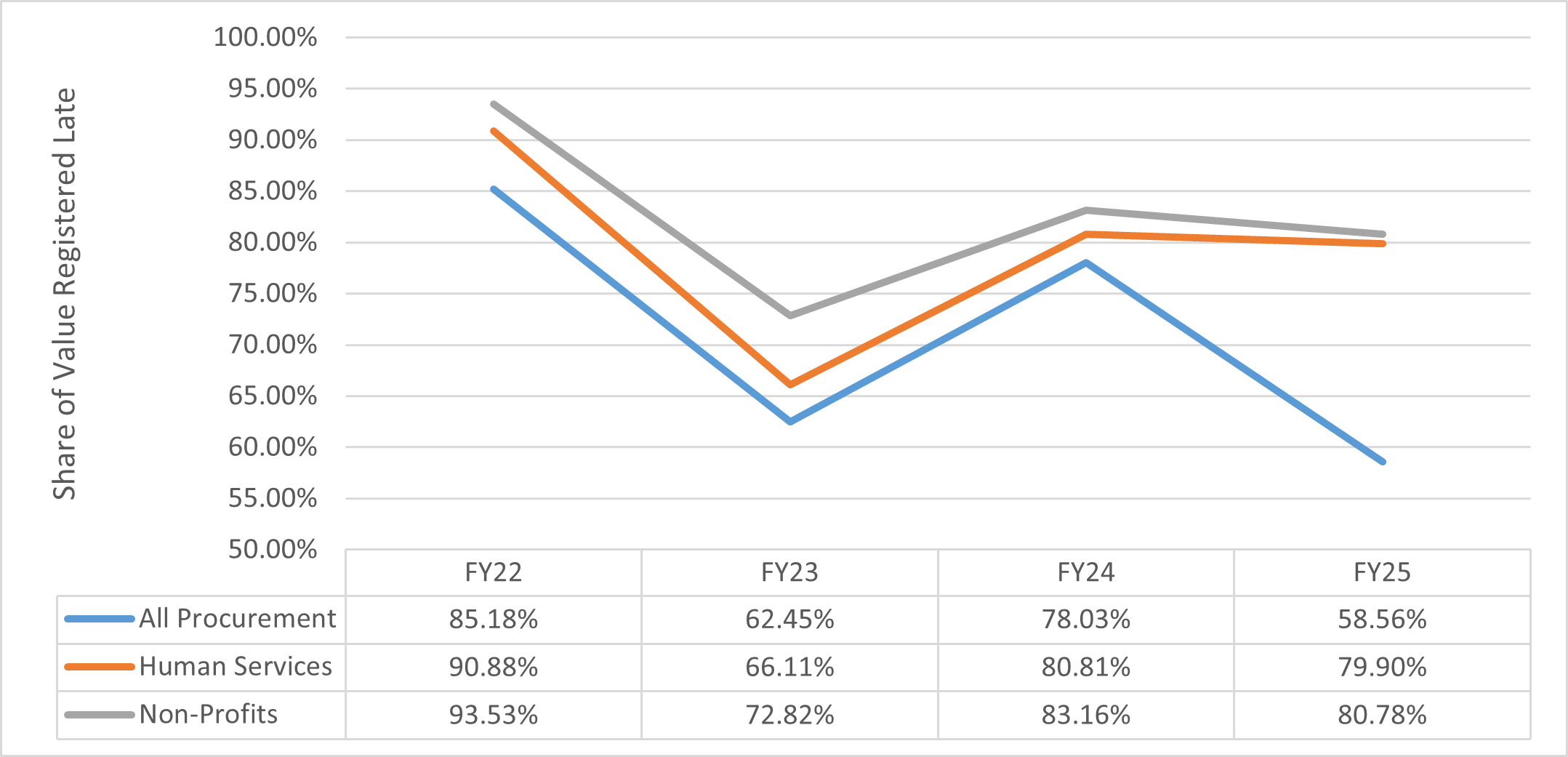

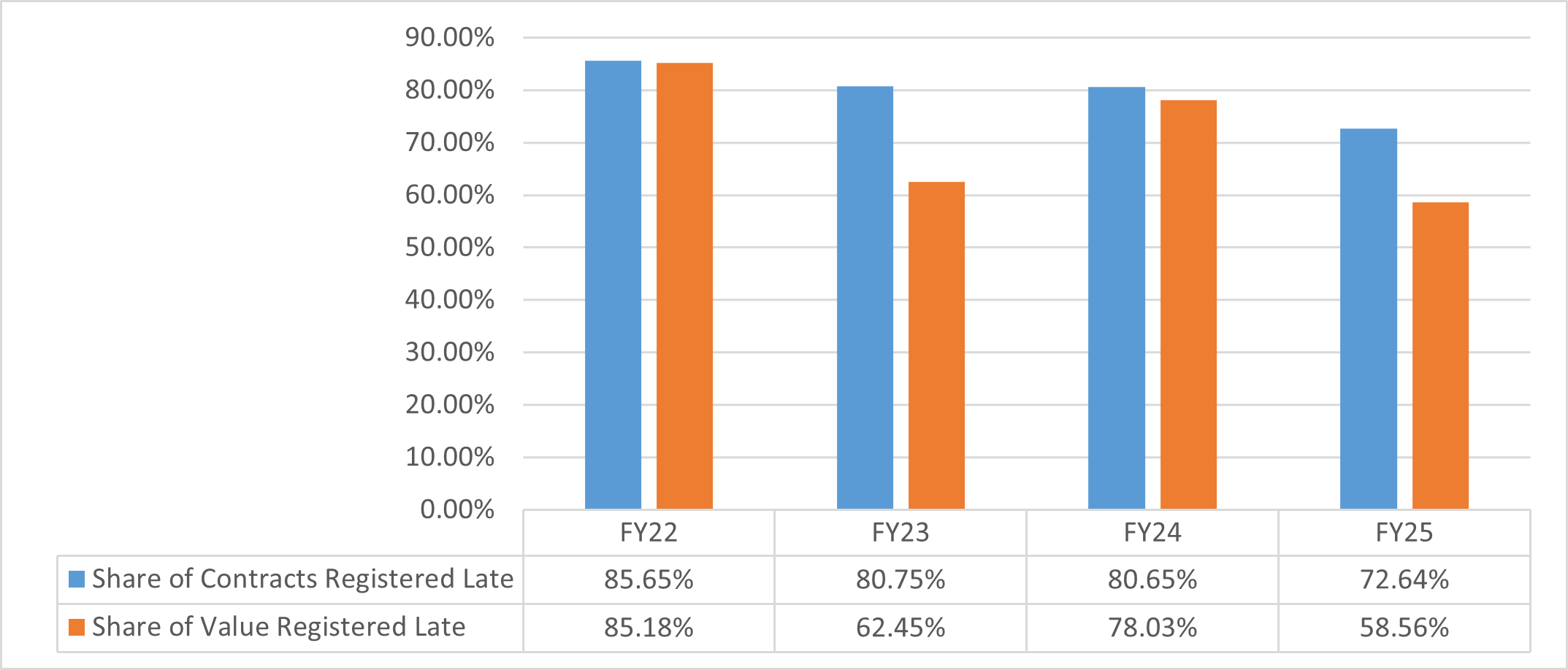

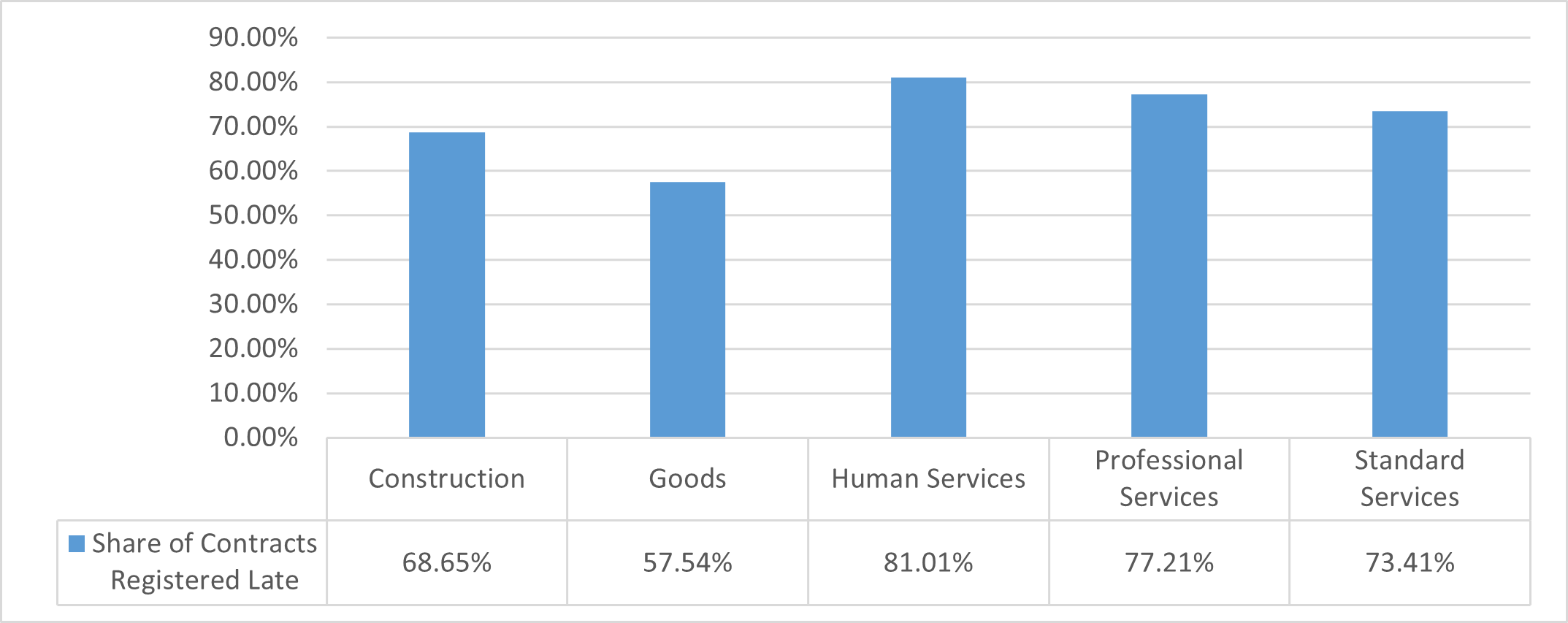

This annual report also provides updates on the City’s contract registration delays, which continue to persist at worrying levels. These delays often place enormous financial strains on businesses and non-profit organizations that are doing work that New Yorkers rely on every day. Many organizations are forced to borrow to cover cash flow and triage their own expenses, making it difficult to pay their workers, sustain operations, and grow their footprint. Procurement delays are also causing the City to compromise on standards designed to improve fairness and competition in the contracting space.

We’re proud to provide this important information to the public – and to provide a great deal of additional information about City contracts at checkbooknyc.com.

I hope that you’ll find this report to be informative and useful!

Brad

I. Executive Summary

The City’s procurement system encompasses tens of thousands of transactions each year. The supplies, services, and construction purchased by the City and the revenue agreements it enters into enable agencies and elected officials to serve the public, address critical challenges, and encourage growth.

In accordance with section 6-116.2 of the New York City Administrative Code (Administrative Code), the Comptroller’s Office is required to publish an annual summary report of contracts and agreements assumed by New York City during the previous FY.[1] This “Annual Summary Contracts Report” (or Report) aims to provide better transparency into the City’s contracts that were registered in FY25, and how these agreements are entered into.

The content in this Report that is specifically mandated by the Administrative Code includes detail for:[2]

- All franchises, concessions, or goods and services contracts valued at more than $10K (or more than $15K for construction contracts);

- The types and dollar amounts of each contract from the previous FY;

- The agency, affiliated agency, elected official, or City Council that entered into each contract, franchise, or concession;

- The vendors associated with each contract, franchise, or concession entered into with the City; and

- How the City selected the contractor, franchisee, or concessionaire.

While not related to City contracting actions, this Report also contains data required by Sections 6-109 and 6-130 of the Administrative Code, relating to the Comptroller’s enforcement of certain living and prevailing wage requirements.[3]

Role of the Comptroller’s Office

Under the New York City Charter (“Charter”), the Comptroller’s Office is responsible for reviewing and approving city contracts and agreements before they are legally effective, unless this authority has been delegated to City agencies or is otherwise not legally required.[4] During a review period lasting no more than 30 calendar days by law, the Comptroller’s Office ensures that appropriate funds exist for the City to make payments to vendors, confirms that the contracting agency followed proper procurement rules, and that there was no corruption in the decision‐making process. The Comptroller’s Office also ensures that contracting agencies have vetted vendors looking to do business with the City and verified that they are operating in good standing, and therefore eligible to be awarded City contracts.

Operating within guidelines set forth by the Charter and Administrative Code, the Comptroller’s Office achieves the functions outlined above by:[5]

- Encumbering funds to contracts for use in payments for goods and services;

- Maintaining a registry of City contracts and agreements;

- Presenting objections if the Comptroller’s review process yields sufficient concern that there was corruption in the awarding of a new contract, or that an agency failed to sufficiently review an awarded vendor; and

- Tracking expenditures and revenues associated with registered contracts and agreements.

The Comptroller’s registration authority is separate and distinct from decisions relating to the necessity of new procurements or revenue opportunities, which vendors are selected for City contracts, how contracted goods or services will be provided, and (besides checking for cases of corruption or debarment) whether specific vendors are fit to contract with the City.[6] Each of these processes may be managed by different partners across the City, and can take a considerable amount of time to advance. Accordingly, the Comptroller remains committed to working with the Mayor’s Administration to streamline outdated and lengthy processes in City contracting so that:

- Needed goods, services, and construction can be brought to bear more quickly;

- Vendors doing business with the City, including non-profits and M/WBEs, can get paid more quickly for the goods, services, and construction that they are providing; and

- The City can save time and money by realizing greater efficiencies in the contracting process.

Additional Reporting Sections

This Report expands on procurement data mandated by the Administrative Code in order to provide more context around City contracting activities. Additional sections of this Report present information on the following topics:

- Real property transactions

- Contract modifications (including construction change orders)

- Task Orders registered under agency master agreements

- Purchase Orders

- Emergency procurements

- Contract registrations with applied industry classifications

- Contract registrations by agency type

- Retroactive registration data (i.e. contracts registered after their start dates)

Source Data

In order to accomplish these aims, this Report draws extensively from data stored in the City’s Financial Management System (FMS), a computerized database jointly administered by the Mayor and the Comptroller and maintained by Financial Information Services Agency (FISA).[7] Each agency, affiliated agency, elected official, and the City Council, is required to enter information in FMS for every franchise and concession, as well as for every contract for goods or services worth more than $10K (or $15K if the contract is related to construction, repair, rehabilitation, or alteration).

Information in Section IX of this Report relating to the Comptroller’s enforcement of certain living and prevailing wage requirements was provided by the Comptroller’s Bureau of Labor Law, rather than FMS.

The City tracks data in FMS using a variety of identifiers that reflect vital contract information. Two of the most prominent identifiers for the purposes of this Report are “Contract Type” and “Award Method.” [8] To better track expenses and revenues, agencies are required to specifically identify the type of contract submitted for registration by selecting from a list of predetermined contract type codes in FMS. Award Method categories indicate how the City selects vendors for a particular contract. This Report also references “Industry classifications” which are not entered by agencies into FMS but are instead derived from various FMS data points to reveal procurement trends by sector. Data used for this Report is available to readers in Section XI – Appendices.

Topline Citywide Numbers for FY25

A total of 12,955 new procurement and revenue contracts were registered in FY25 for a total value of $42.45 billion. The contracts in this Report reflect binding agreements between the City and another entity, or sometimes between two City agencies, which contain the terms and conditions to be performed by both parties as well as the terms of payment (as applicable). This Report broadly organizes contracts into procurements (where the City is contracting for goods, services, or construction) and revenues (where the City is a recipient of funds from another entity). The 12,955 figure does not include registered Real Property Transactions, which are captured in Section III of this Report. Though they are constituted as newly registered agreements, Real Property Transactions are not covered by the reporting requirements outlined for this report under the Administrative Code. Task orders are also not included in the 12,955 figure and more information on task orders can be found in section IV.

Table 1 below illustrates that the vast majority of registered contract volume, by both the number of actions and total value, is driven by procurement actions. Registrations for procurement contracts in reflect City investments in economic development projects, new construction, and further expansion of the City’s homeless shelter capacity

Table 1: FY25 New Contract Registrations

| Category | # of Actions | Value of Actions |

|---|---|---|

| Total Registered Contract Actions | 12,955 | $42,446,174,150 |

| Total Procurement Actions | 12,500 | $42,298,970,761 |

| Total Revenue Actions | 455 | $147,203,389 |

As Chart 1 below shows, the total volume and value of new registered contracts was higher in FY25 than the prior fiscal year. FY25 was the highest number of contract registrations and total value of registrations since FY22.

Chart 1: New Registered Contract Volume and Value, FY22-FY25

Our analysis also found that the average contract value was $750k more in FY25 than it was in FY24[9]. Chart 2 shows the average value of a contract in FY22, FY23, FY24, and FY25.

Chart 2: Average Procurement Contract Value FY22-FY25

FY25 Procurement Contracts at a Glance

Table 2 illustrates that just ten agencies account for 86.61% of the City’s FY25 procurement value. The Department of Design and Construction (DDC) makes up the largest share (32.11%) of the City’s procurement value. This is because DDC is the contracting agency associated with various billion-dollar borough-based jail contracts.

Table 2: Top Ten Agencies Based on FY25 Procurement Value from New Contracts

| Agency | # of Contracts | % Share of Contracts | Total Registered Contract Value | % Share of Registered Contract Value |

|---|---|---|---|---|

| DDC | 292 | 2.25% | $13,631,293,454 | 32.11% |

| DHS/DSS | 159 | 1.23% | $5,328,248,337 | 12.55% |

| DEP | 257 | 1.98% | $3,656,541,088 | 8.61% |

| DSS/HRA | 382 | 2.95% | $3,512,829,553 | 8.28% |

| DOHMH | 884 | 6.82% | $2,406,280,162 | 5.67% |

| DYCD | 1,521 | 11.74% | $2,125,715,425 | 5.01% |

| DCAS | 454 | 3.50% | $1,878,594,308 | 4.43% |

| DOE | 3,990 | 30.80% | $1,865,015,776 | 4.39% |

| EDC[10] | 3 | 0.02% | $1,318,701,511 | 3.11% |

| NYCHA[11] | 162 | 1.25% | $1,039,128,072 | 2.45% |

| Grand Total | 8,104 | 62.55% | $36,762,347,686 | 86.61% |

The ten contracts with the largest registered procurement values account for $16.5 billion, which is almost 40% (38.87%) of the City’s overall procurement value in FY25. These contracts are displayed below in Table 3. Note that this table includes information on contract end-dates to draw attention to the fact that several of these top ten procurements are for goods, services, or construction that will be provided over the course of many years. Note: the three highest value contracts are all part of the City’s Borough Based Jail (BBJ) program.[12]

Table 3: Top Ten FY25 Registered Procurement Contracts by Value

| Contract # | Agency | Vendor legal name | Contract Purpose | Contract Registered Amount | Contract Start Date | Contract End Date |

|---|---|---|---|---|---|---|

| 20248809672 | DDC | Leon D. DeMatteis Construction Corp | Construction of New Queens Detention Facility | $3,984,819,968 | 8/15/2024 | 12/29/2031 |

| 20258806440 | DDC | Tutor Perini O&G Joint Venture | Construction of New Manhattan Detention Facility | $3,764,251,136 | 5/15/2025 | 8/12/2032 |

| 20248809339 | DDC | Transformative Reform Group LLC | Construction of New Bronx Detention Facility | $2,971,891,712 | 8/15/2024 | 11/1/2031 |

| 20258805355 | DEP | Frontier-Kemper Constructors INC | KENS-EAST-1: TUNNEL, SHAFTS & KENSICO ROCK EXCAVATION | $1,093,255,040 | 12/2/2024 | 10/7/2030 |

| 20258803455 | SBS | New York City Economic Development Corporation | This service consists of providing Certain City-Wide economic development services | $977,673,920 | 7/1/2024 | 6/30/2025 |

| 20258806286 | DHS/DSS | HANYC Foundation INC | Hotel management services for DHS emergency programs | $929,104,960 | 1/1/2025 | 6/30/2026 |

| 20258801735 | DEP | Skanska ECCO III HVR JV | The addition of Hillview reservoir chemical facilities | $847,720,000 | 6/30/2024 | 3/10/2030 |

| 20258802303 | DHS/DSS | Westhab INC | Shelter facilities for homeless | $708,807,488 | 4/1/2024 | 6/30/2057 |

| 20258807437 | DSS/HRA | Institute for Community Living INC | Affordable housing for DSS referred households | $659,967,680.00 | 4/1/2025 | 3/31/2065 |

| 20251403077 | DOHMH | Public Health Solutions | Master contractor for disease control | $563,178,624 | 7/1/2021 | 9/1/2029 |

FY25 Revenue Contracts at a Glance

In addition to procurement agreements, City agencies also contract with private entities for the right to use NYC-owned property in exchange for payment, services, or both. The City derives millions of dollars in revenue from such contracts each year. Over 450 revenue actions were registered in FY25 for a total value of $147.2 million. 80% of this value comes from concessions.

There was a significant decline in the volume and value of Corpus Funded “revenue” contracts in FY25. Corpus Contracts are related to the City’s pension management expenses, and while they have historically been recorded as revenue transactions, they do not actually generate revenue for the City’s general fund. In early FY25, the Comptroller’s office and FISA-OPA agreed to reforms to better capture costs associated with the management of the City’s five pension funds. As a result, the majority of the Corpus Funded contracts registered in FY25 are no longer being recorded as revenue contracts.

Table 4: Top Ten FY25 Registered Revenue Contracts by Value (Excluding Corpus Funded)

| Contract # | Agency | Vendor legal name | Contract Purpose | Contract Registered Amount | Contract Start Date | Contract End Date |

|---|---|---|---|---|---|---|

| 20268000000 | DPR | American Golf Corporation | Two 18-Hole golf courses at Pelham Bay & Split Rock | $20,500,000 | 7/4/2025 | 1/14/2044 |

| 20258201021 | DPR | Sportime Clubs LLC | Operation and maintenance of Driving Range on Randalls Island | $17,553,124 | 10/17/2024 | 10/16/2042 |

| 20258201262 | SBS | Downtown Skyport LLC | Operation of the downtown Manhattan heliport at Pier 6 | $14,894,887 | 3/30/2025 | 3/30/2030 |

| 20258202086 | DPR | American Gold Corporation | 18-hole golf course and Dyker Beach | $13,000,000 | 5/10/2030 | 1/14/2044 |

| 20258200286 | DPR | Global Bikerent Inc. | Bicycle rental locations throughout Manhattan | $11,280,615 | 7/17/2024 | 10/22/2029 |

| 20258202372 | DOT | Silvercup Studios NY LLC | Continuing to conduct parking and storage businesses | $10,180,698 | 5/9/2025 | 5/8/2045 |

| 20258201666 | DPR | SSC & R LLC | Food service facility at South Shore golf course | $4,275,610 | 4/1/2025 | 1/15/2044 |

| 20258200376 | DPR | Staten Island FC Sports Complex | Construction of a sports and recreation facility at Willobrook Park | $4,172,285 | 11/1/2024 | 10/31/2044 |

| 20258202373 | DOT | Silvercup Studios NY LLC | Conduct business accessory parking and storage activities | $3,054,204 | 5/9/2025 | 5/8/2045 |

| 20258802781 | DCAS | Liquidity Services Operations LLC | Furnishing, operating, and maintaining an online surplus auction | $3,000,000 | 7/1/2024 | 6/30/2027 |

How to Navigate This Report

Section II – New Contract Action Trends: Section II will present data trends for the following contract categories:

- Competitive Contracts

- Limited or Non-Competitive Contracts

- Transactions Not Subject to PPB Rules

- Supplemental Contracts

- Revenue Contracts

Section III – Real Property Transactions: While not covered under the Administrative Code’s scope for this Report, the City also enters into contracts relating to Real Property Transactions each year. Section III will review data trends for these contracts, which mostly consist of lease agreements.

Section IV – Contract Modifications and Administration: While not explicitly called for inclusion in this Report by the Administrative Code, Section IV delves into trends relating to actions undertaken against existing contracts in FY25. Broadly speaking, these actions fall into one of the following categories:

- Actions taken by the City to encumber funds, or to otherwise modify some aspect of an active contract;

- Processing Task Orders (TOs) against existing Master Award contracts; or

- Executing purchase orders for goods, services, or construction (generally under small purchase limits).

Section V – Emergency Procurements: Section V provides additional data regarding the sourcing of required goods or services to meet emergency needs, as authorized by Section 315 of the NYC Charter, and Section 3-06 of the Procurement Policy Board (PPB) Rules.

Section VI – Procurement Actions by Industry: Section VI presents FY25 contract data through the lens of industry classifications, which are used by the City to support analysis of procurement trends.

Section VII – Procurements by Agency Type: Section VII provides information regarding the volume, value, and industry classifications of procurement contracts registered to each agency in FY25.[13]

Section VIII – Retroactive Contract Registrations: Section VIII examines retroactive contract trends, where contracts are legally implemented after the first day of their term.

Section IX – Bureau of Labor Law – Living and Prevailing Wage Cases: Section IX summarizes the Comptroller’s enforcement of certain living and prevailing wage standards, as required under Sections 6-109, 6-130, and 6-145 of the Administrative Code.

Section X – Glossary of Terms: The glossary defines relevant City procurement and contract registration terminology.

Section XI – Appendices: This Section contains complete supporting data sets for the interposed tables as well as other data points required by the Administrative Code that are not specifically referenced in this report.

Resources to Supplement This Report

While not used to generate data for this Report, readers may find the following resources useful for learning more about city contracting and financial trends.

Contract Primer

In the Fall of 2023, this Office released a new Contract Primer to provide the public with a straightforward guide to the basics of the City’s contracting workflows and essential solicitation methods. Readers can reference information on key entities in NYC contracting, learn about the NYC contracting cycle, and access links to helpful public-facing resources. Critically, the Primer also defines contract categories, solicitation methods, and additional contracting processes that are discussed in this Report.

Helpful Links:

Checkbook NYC

In July of 2010 the Comptroller’s Office launched Checkbook NYC, an online transparency tool that for the first time placed the City’s day-to-day spending in the public domain. Using an intuitive dashboard approach that combines a series of graphs and user-friendly tables, Checkbook NYC provides up-to-date information about the City’s financial condition.

Checkbook NYC has been ranked the top transparency tool in the nation for tracking government spending by the United States Public Interest Research Group and was named New York City 2013 “Best External Application” by Government Technology Magazine.

Checkbook NYC also contains a majority of the City’s contract data. This tool enables users to examine data on its “Contracts” tab by fiscal year (or other date ranges), procurement category, contract types, and more.

Helpful Links:

- Click this link to access Checkbook NYC

- Click this link to view videos on how to navigate Checkbook NYC’s search functions

PASSPort Public

Procurement and Sourcing Solutions Portal (PASSPort) is the City of New York’s end-to-end digital procurement platform that manages every stage of the procurement process from vendor enrollment, to the solicitation of goods and services, to contract registration and management. PASSPort Public refreshes data periodically from PASSPort such that the public can derive insight into the City’s procurement system.[14]

Helpful Links:

Agency Procurement Plans (M/WBE, LL63, and Human Services)

Under Local Law 1 of 2013, SBS and the Mayor’s Office of Contract Services (MOCS) are required to publish an annual plan and schedule listing the anticipated contracting opportunities for the coming fiscal year. These plans include the following information for each solicitation: the specific type and scale of the services to be procured, the term of the proposed contract, the method of solicitation the agency intends to utilize, and the anticipated fiscal year quarter of the planned solicitation.

Similarly, under Local Law 63 of 2011, MOCS is required to publish a plan and schedule detailing the anticipated contract actions (for certain categories of procurement) of each City agency for the upcoming fiscal year. This requirement applies to contracts valued at more than $200K providing standard or professional services, including against agency task orders.

Lastly, MOCS also publishes plans reflecting proposed procurements relating to human service programs. This information is collected from, and organized by, city agencies.

Helpful Links:

- Click this link to view M/WBE Procurement plans by agency

- Click this link to view LL63 plans by agency

- Click this link to view Human Service procurement plans by agency

City Record Online

The City Record Online (CROL) is a searchable database of notices published in the City Record newspaper which includes but is not limited to: public hearings and meetings, public auctions and sales, solicitations and awards and official rules proposed and adopted by city agencies.[15]

Helpful Links:

NYC Open Data

Open Data is free public data published by New York City agencies and other partners. There are a variety of datasets all searchable by keyword or update frequency. All of the datasets are exportable via a CSV or Excel file. New datasets are constantly added and updated.

Helpful Links:

II. New Contract Actions Trends

Overview

Table 5 provides a breakdown of new procurement and revenue agreements by contract group.[16] Subsequent tables provide details about the distribution of subgroups, by volume and value. As with previous years, competitively sourced contracts in Group 1 comprise the largest share of contract value. Limited or Non-Competitive method contracts comprised more than three quarters of the total contract volume in FY25.

Table 5: FY25 New Procurement and Revenue Contracts by Category

| Contract Category | # of Contracts | % Share of Contracts | Total Registered Contract Value | % Share of Contract Value |

|---|---|---|---|---|

| Group 1: Competitive Method Contracts | 1,085 | 8.38% | $13,829,267,909 | 32.58% |

| Group 2: Limited or Non-Competitive Method Contracts | 9,784 | 75.52% | $21,588,123,459 | 50.86% |

| Group 3: Not Subject to PPB Rules | 304 | 2.35% | $859,951,062 | 2.03% |

| Group 4: Supplemental Contracts | 1,327 | 10.24% | $6,021,628,331 | 14.19% |

| Group 5: Revenue Contracts | 455 | 3.51% | $147,203,389 | 0.35% |

| Grand Total | 12,955 | 100.00% | $42,446,174,150 | 100.00% |

Charts 3 and 4 provide a year-over-year comparison of contract volume and value by the groupings listed in the table above. Both graphics show consistent year-over-year trends across the contract groups.

Chart 3: FY22-25 Volume of New Contracts by Contract Group

Chart 4: FY22-25 Value of New Contracts by Contract Group

Group 1: Competitive Method Contracts

Competitive Method contracts are designed to help the City obtain the highest value based on price or quality. There were less Competitive Sealed Proposal (CSP) procurements in FY25 relative to the previous year. Accelerated procurements, which are used by the City to expedite commodity purchases, decreased this year. Table 6 provides a breakdown of competitive method subgroups by volume and value.

Table 6: Competitive Methods Contracts by Subgroup

| Subgroup | # of Contracts | % Share of Contracts | Total Registered Contract Value | % Share of Contract Value |

|---|---|---|---|---|

| Competitive Sealed Bid Contracts | 451 | 41.57% | $5,652,126,579 | 40.87% |

| Competitive Sealed Proposal Contracts | 576 | 53.09% | $8,044,928,284 | 58.17% |

| Accelerated Procurement Contracts | 58 | 5.35% | $132,213,046 | 0.96% |

| Grand Total | 1,085 | 100.00% | $13,829,267,909 | 100.00% |

Group 2: Limited or Non-Competitive Methods

Limited or Non-Competitive procurement methods were responsible for the largest share of new procurement contracts (9,784 actions or 75.52%). This is an increase compared to FY24. The value of Innovative Procurement Contracts contributed most to the drastic increase in value. Table 7 provides a breakdown of subgroups under Group 2 by volume and value.

Table 7: Limited/Non-Competitive Methods Contracts by Subgroup

| Subgroup | # of Contracts | % Share of Contracts |

Total Registered Contract Value |

% Share of Contract Value |

|---|---|---|---|---|

| Demonstration Project Contracts | 4 | 0.04% | $2,931,253 | 0.01% |

| Determined by Government Mandate Contracts | 138 | 1.41% | $871,314,665 | 4.04% |

| Discretionary (Line Item) Contracts | 1,561 | 15.95% | $735,384,414 | 3.41% |

| Emergency Procurement Contracts | 106 | 1.08% | $1,326,037,939 | 6.14% |

| Government-to-Government Contracts | 31 | 0.32% | $891,413,172 | 4.13% |

| Innovative Procurement Contracts[17] | 19 | 0.19% | $10,976,912,119 | 50.85% |

| Intergovernmental Procurement Contracts | 280 | 2.86% | $623,037,419 | 2.89% |

| Micropurchase Contracts | 1,572 | 16.07% | $15,172,408 | 0.07% |

| Negotiated Acquisition Contracts | 962 | 9.83% | $4,058,851,691 | 18.80% |

| Small Purchase Contracts – General | 3,841 | 39.26% | $111,618,847 | 0.52% |

| Small Purchase Contracts – M/WBE | 1,144 | 11.69% | $376,298,765 | 1.74% |

| Sole Source Contracts | 126 | 1.29% | $1,599,150,768 | 7.41% |

| Grand Total | 9,784 | 100.00% | $21,588,123,459 | 100.00% |

Buy-Against Contracts

Buy-Against procurements are used by City agencies to preserve the continuity of goods or services after a vendor has defaulted on their contract or after an agency has terminated a vendor’s contract because of a material breach to the agreement.[18] There were no Buy-Against contracts registered in FY25.

Discretionary Contracts

Discretionary procurements reflect agreements between City agencies and nonprofit organizations, or public service providers, that have been selected by City elected officials other than the Mayor and the Comptroller, or allocated through line-item appropriations in the city budget.[19] While the vast majority of elected official selections are made through the City Council, the list of elected officials that are able to enter into discretionary contracts also includes the five Borough Presidents. The City has long struggled to register its discretionary contracts on a timely basis, which creates enormous strain on the non-profit recipients that otherwise rely on this funding to provide critical services to New Yorkers. As of July 2025, there were over 2,000 discretionary contracts with start dates during the prior fiscal year that were still pending in the City’s procurement pipeline.[20]

Negotiated Acquisition Contracts

Under section 3-04 of the PPB rules, agencies can move to limit competition via a negotiated acquisition (NA) procurement when the ACCO determines, with CCPO approval, that:

- There is a time-sensitive situation where a vendor must be retained quickly to meet the terms of a court order or consent decree, to avoid loss of available funding, or to ensure continuity of services.

- There are a limited number of vendors available and able to perform required work.

- There is a need to procure legal services or consulting services in support of current or anticipated litigation, investigative or confidential services.

- There are previously unforeseen or unforeseeable construction-related service needs, typically after construction has begun, that cannot be addressed by a change order or other contract modification.

Negotiated acquisition extensions (NAE) are typically used when agencies have exhausted all contractual renewals, as well as contract extensions permitted by other sections of the PPB Rules, because goods or services were needed for a longer time than originally anticipated, or because the agency has not been able to procure a replacement contract in a timely manner.

DYCD has registered the vast majority of NAs and NAEs since FY22, including 575 contracts across these two procurement methods in FY25 alone. These procurements have largely been used to support the Comprehensive After School System (COMPASS) NYC program, which provides academic, recreation, enrichment, and cultural activities for children enrolled in grades K-12.

The Comptroller’s office released a report in July 2025 detailing the City’s overuse of the NAE method in particular, and the harm done to human service providers as a result.[21]

Group 3: Transactions Not Subject to PPB Rules

The contracts in Group 3 reflect transactions that are either not mentioned in the PPB rules or are otherwise explicitly excluded in Section 1-02(f). Group 3 makes up a relatively small share of the City’s contracting footprint, with just 304 registered parent contracts in FY25 totaling $859 million. FY25 did see a large increase in value compared to the last 3 fiscal years. Table 8 provides a breakdown Group 3’s subgroups by volume and value.

Table 8: Transactions Not Subject to PPB rules by Subgroup

Group 4: Supplemental Contracts

The contracts in Group 4 reflect new agreements whose terms were set forth by a preceding contract. They accounted for 1,327 registrations in FY25 totaling $6 billion in value, an increase in volume and a decrease in value from the prior fiscal year. The higher volume of renewal contracts in FY25 was largely driven by human service contracts that were expiring at the end of FY25. Table 9 provides a breakdown of Group 4’s subgroups by volume and value.

Table 9: Supplemental Contracts by Subgroup

| Subgroup | # of Contracts | % Share of Contracts | Total Registered Contract Value | % Share of Contract Value |

|---|---|---|---|---|

| Assignments | 71 | 5.35% | $948,936,251 | 15.76% |

| Renewals | 1,256 | 94.65% | $5,072,692,080 | 84.24% |

| Grand Total | 1,327 | 100.00% | $6,021,628,331 | 100.00% |

Group 5: Revenue Contracts

There were 455 registered Revenue contracts in FY25 totaling $147.2 million in value. DOT outdoor ding permits account for a large increase in the volume of revenue contracts from FY24 to FY25. Table 10 provides a breakdown of Group 5’s subgroups by volume and value.

Table 10: Revenue Contracts by Subgroup

| Subgroup | # of Contracts | % Share of Contracts | Total Registered Contract Value | % Share of Contract Value |

|---|---|---|---|---|

| Franchise Agreements | 2 | 0.44% | $2,550,000 | 1.73% |

| Concession Agreements | 149 | 32.74% | $118,045,644 | 80.19% |

| Revocable Consents | 291 | 63.96% | $11,697,743 | 7.95% |

| Corpus Funded agreements | 2 | 0.44% | $10,179,000 | 6.91% |

| Other Revenue | 11 | 2.42% | $4,731,002 | 3.21% |

| Grand Total | 455 | 100.00% | $147,203,389 | 100.00% |

Chart 5 presents a year-over-year comparison of registered revenue contracts by category, with corpus funded contracts excluded. Revenue contracts in all subcategories exceeded the prior fiscal year’s value.

Chart 5: FY22-FY25 Revenue Totals[22]

III. Real Property Transactions Trends

Section III presents data trends relating to Real Property Transactions, which are non-revenue contracts that are also not defined as procurements in either Chapter 13 of the City Charter or in the PPB rules. The City registered 64 Real Property contracts in FY25 for a total value of $2.01 billion. Table 11 provides a breakdown by award method.

Table 11: FY25 Registered Real Property Contracts by Award Method

| Award Method | # of Contracts | % Share of Contracts | Total Contract Value | % Share of Contract Value |

|---|---|---|---|---|

| Lessee Negotiation | 55 | 85.94% | $2,013,396,727 | 99.84% |

| Real Estate Sales and Purchases | 1 | 1.56% | $105,170 | 0.01% |

| Watershed Land Negotiation | 8 | 12.50% | $3,047,200 | 0.15% |

| Grand Total | 64 | 100.00% | $2,016,549,097 | 100.00% |

Table displays Real Property contract volume and value trends across the four prior fiscal years. The City registered fewer real property contracts in FY25, but the total value well exceeds any prior year of the Adams Administration. A $1.29 billion twenty-two-year lease that the City entered into for ACS office space in downtown Manhattan accounts for over two thirds of this total value.

Chart 6: FY22-25 Registered Real Property Contracts by Volume and Value

Real Property Transactions by Agency

25 City agencies administered real property transactions in FY25. While the City Council made up the largest share of these contracts by volume, DCAS accounted for almost 80% of City’s registered contract value in this category. This value can be attributed in part to additional leases that the City entered to for HRA, NYPD, and BOE, as well as other spaces for use in support of homeless services. Table 12 provides a breakdown of transactions by Agency.

Table 12: FY25 New Real Property Transactions by Agency

| Agency | # of Contracts | % Share of Contracts | Total Value of all Contracts | % Share of Value |

|---|---|---|---|---|

| CC or Council | 17 | 26.56% | $2,463,650 | 0.12% |

| COMP | 1 | 1.56% | $50,000 | 0.00% |

| CUCF | 3 | 4.69% | $824,015 | 0.04% |

| DCAS | 9 | 14.06% | $1,600,988,523 | 79.39% |

| DCLA | 1 | 1.56% | $3,679,147 | 0.18% |

| DCWP | 1 | 1.56% | $1,046,051 | 0.05% |

| DEP | 9 | 14.06% | $3,152,370 | 0.16% |

| DFTA | 2 | 3.13% | $358,058 | 0.02% |

| DOF | 1 | 1.56% | $15,511,503 | 0.77% |

| DOP | 2 | 3.13% | $434,832 | 0.02% |

| DOT | 2 | 3.13% | $20,591,287 | 1.02% |

| DPR | 1 | 1.56% | $136,130 | 0.01% |

| DSS/HRA | 1 | 1.56% | $78,224,640 | 3.88% |

| DYCD | 1 | 1.56% | $1,396,125 | 0.07% |

| FDNY | 1 | 1.56% | $7,364,710 | 0.37% |

| LAW | 1 | 1.56% | $73,296 | 0.00% |

| MBP | 1 | 1.56% | $452,300 | 0.02% |

| NULL | 1 | 1.56% | $405,979 | 0.02% |

| NYCEM | 1 | 1.56% | $451,617 | 0.02% |

| NYPD | 2 | 3.13% | $13,676,910 | 0.68% |

| OTI | 2 | 3.13% | $585,104 | 0.03% |

| DOI | 1 | 1.56% | $263,188,418 | 13.05% |

| SI CB #2 | 1 | 1.56% | $918,200 | 0.05% |

| BX CB #10 | 1 | 1.56% | $304,698 | 0.02% |

| BX CB #3 | 1 | 1.56% | $271,534 | 0.01% |

| Grand Total | 64 | 100.00% | $2,016,549,097 | 100.00% |

IV. Contract Modifications and Administration Trends

Section IV presents data trends relating to modification and contract administration trends.

Modifications

Agencies are authorized to change certain aspects of existing registered agreements, such as:[23]

- Updating contract amounts to reflect additional authorized or omitted work.

- Extending the duration of a contract for good and sufficient cause (generally not for longer than an additional year).

- Administrative reasons, such as encumbering funds to expense contracts or revising commodity and accounting lines.

Any change that requires a material alteration to the scope of work outlined in an initial contract’s terms cannot be resolved by a modification. The agency must instead procure a new contract in such cases.

Table 13 below presents the share of modifications registered by the type of modification.

Table 13: FY25 Analysis of Registered Modifications by Category

| Modification Category | Total # of Registered Modifications | % Share of Registered Modifications |

|---|---|---|

| Change-in-Amount Only | 4,119 | 6.28% |

| Change in Duration Only | 1,427 | 2.18% |

| Change in Both Duration & Amount | 1,480 | 2.26% |

| Encumbrance Increases | 42,218 | 64.40% |

| Encumbrance Decreases | 12,938 | 19.74% |

| Administrative Changes Only | 3,374 | 5.15% |

| Grand Total | 65,556 | 100.00% |

Chart 7 shows year-over-year registered modification trends by category. Notably, FY25 saw some increased modification activity in some categories relative to FY24, but overall activity remained below FY23 levels. DYCD, typically a big driver of registered modifications for its afterschool programs, processed far fewer of these actions in FY25.

Chart 7: FY22-25 Registered Modifications by Category

FY25 BCA-Registered Contract Modifications by Agency

While agencies have been delegated to self-register some contract modifications, many must be submitted to this Office’s Bureau of Contract Administration (BCA) for review and registration. Over 75% of the modifications that BCA registered in FY25 were administered by just ten agencies. DDC submitted the most BCA-registered modifications, many of which decreased contract values for projects relating to commissioning services and storm sewer construction. Table 14 below displays the top ten agencies by volume of BCA registered actions.

Table 14: Top Ten Agencies with BCA-Registered Modifications in FY25

| Agency | # of BCA-Registered Modifications | % Share of BCA-Registered Modifications |

|---|---|---|

| DDC | 1,818 | 23.43% |

| DEP | 669 | 8.62% |

| DPR | 579 | 7.46% |

| DOE | 528 | 6.81% |

| DYCD | 472 | 6.08% |

| DOT | 460 | 5.93% |

| EDC | 386 | 4.97% |

| HPD | 375 | 4.83% |

| DCAS | 353 | 4.55% |

| DSNY | 248 | 3.20% |

| Grand Total | 5,888 | 75.89% |

Even when isolating change-in-amount modifications, DDC was the source of the most BCA registered modifications with 1,053. See Table 15 below for a breakdown by top ten agencies.

Table 15: Top Ten Agencies with BCA-Registered Change-In-Amount Modifications in FY25

| Agency | # of BCA-Registered Modifications | % Share of BCA-Registered Modifications |

|---|---|---|

| DDC | 1,053 | 22.19% |

| DOE | 497 | 10.47% |

| DYCD | 469 | 9.88% |

| DPR | 426 | 8.98% |

| EDC | 382 | 8.05% |

| HPD | 327 | 6.89% |

| DEP | 284 | 5.98% |

| DOT | 151 | 3.18% |

| DHS | 120 | 2.53% |

| DSS | 109 | 2.30% |

| Grand Total | 3,818 | 80.45% |

Construction Change Orders

Construction change orders (CCO) reflect a subset of the modification data discussed above, although the data below includes additional CCOs that were not registered by the Comptroller’s Office.[24] CCOs are typically used to authorize non-material additional labor and/or equipment needed to complete a construction project. Chart 8 illustrates that CCOs saw an increase in both volume and value in FY25 compared to FY24.

Chart 8: FY22-FY25 CCOs by Volume and Value

Table 16 reflects the top-five agencies using CCOs by volume. These five agencies comprised over 81% of the CCO volume in FY25. While DDC and DEP registered fewer CCOs in FY25 than the prior fiscal year, HPD, DPR, and DOT all registered more of them.

Table 16: Top Five Agencies with FY25 Registered CCOs, by Volume

| Agency | # of Registered CCOs | % Share of FY25 Registered CCOs |

|---|---|---|

| DDC | 1,083 | 31.34% |

| HPD | 676 | 19.56% |

| DPR | 442 | 12.79% |

| DEP | 335 | 9.69% |

| DOT | 278 | 8.04% |

| Grant Total | 2,814 | 81.42% |

Similarly, Table 17 filters the data above to only display change-in-amount CCOs.

Table 17: Change-in-Amount CCOs for the Top Five Agencies With FY25 CCOs, by Volume

| Agency | # of Registered CCOs | Average Original Contract Value | Average Revised Contract Value |

|---|---|---|---|

| DDC | 682 | $70,055,509 | $75,588,111 |

| DPR | 328 | $8,309,923 | $10,663,474 |

| DEP | 185 | $122,065,810 | $127,036,070 |

| HPD | 134 | $5,949,181 | $8,301,284 |

| DOT | 97 | $111,990,457 | $139,860,906 |

Task Orders

Agencies registered 1,005 TOs in FY25, against 331 Multiple Master Agreements for a total value of $1.6 billion. About 41% (417) of these TOs were registered to EDC and NYCHA. Although the volume of registered TOs decreased in FY25, their total value increased relative to FY24. Chart 9 below displays the volume and value of registered TOs from FY22-FY25.

Chart 9: Registered Task Orders FY22-FY25

The top five agencies based on the volume of registered TOs account for over 78% of all TOs registered in FY25, and 70% of the total registered TO value. Table 18 displays the five agencies that registered the most TOs in FY25.

Table 18: Top Five Agencies by Volume of Registered TOs in FY25

| Agency | # of TOs | Total Registered Value |

|---|---|---|

| EDC | 242 | $461,017,768 |

| DDC | 205 | $301,438,127 |

| NYCHA | 175 | $244,783,522 |

| DPR | 117 | $84,960,221 |

| DOT | 41 | $22,839,672 |

Delivery Orders

Delivery Orders (DO1s) are created when an agency purchases a good or service contracted under a parent master agreement (MA1).[25] While MA1 contract values reflect an estimate of how much the City expects to spend, the sum of DO1s issued under an associated MA1 reflects how much an agency is actually paying under a contract. Only DCAS, OTI, and the DOE are able to enter into MA1 parent contracts, but other agencies can make purchases under them using DO1s. The Comptroller’s office does not review or register DO1 records. Almost 400 thousand DO1s were processed in FY25 against 1,933 unique MA1s for a total value of $5.3 billion. Table 19 reflects the top five agencies in terms of value of delivery orders placed and Table 20 reflects the top five agencies that placed the most delivery orders.

Table 19: Top Five Agencies by Value of DO1s in FY25

| Agency | # of DO1s | # of Unique MA1 Contracts against which DO1s were issued | Total Value |

|---|---|---|---|

| DOE | 366,781 | 1,227 | $3,900,922,509 |

| DCAS | 4,973 | 497 | $600,484,500 |

| OTI | 349 | 25 | $379,167,770 |

| NYPD | 2,042 | 38 | $135,867,793 |

| FDNY | 439 | 38 | $46,867,351 |

Table 20: Top Five Agencies by Volume of DO1s in FY25

| Agency | # of DO1s | # of Unique MA1 Contracts against which DO1s were issued | Total Value |

|---|---|---|---|

| DOE | 366,781 | 1,227 | $3,900,922,509 |

| DCAS | 4,973 | 497 | $600,484,500 |

| ACS | 2,616 | 81 | $12,091,435 |

| DSNY | 2,332 | 32 | $13,769,110 |

| NYPD | 2,042 | 38 | $135,867,793 |

DOE holds the most MA1 contracts of any authorized agency by a wide margin, so it follows that they have the most volume and value of DO1 records.

Chart 10 displays the changes in DO1 volume and value over the prior three fiscal years. Even as the overall volume and value of Citywide procurements has declined over this period, DO1 value has remained relatively steady.

Chart 10: DO1 Volume and Value FY22-25

Table 21 reflects the five active MA1 contracts with the most DO1 records in FY25. Spending under three out of the top five master agreements has exceeded the estimated value of the MA1 contract. Notably, the total value of DO1s can far exceed, or amount to just a fraction of, the estimated value of its parent MA1 contract. Based on an analysis of expired MA1 contracts registered between FY16-23, just under 30% had been utilized by a third of the estimated contract value or less and slightly over 30% had more than 100% utilization.

Table 21: Top Five Master Agreements with the Most Spending in FY25

| Contract # | Agency | Vendor Name | Contract Purpose | Total Spending in FY25 | % of Term Completed as of 6/30/2024 | Utilization of contract as of 6/30/2024F[26] |

|---|---|---|---|---|---|---|

| 20191200181 | OTI | Shi International Corp | Citywide IT purchasing contract | $256,301,359 | 97.63% | 389.86% |

| 20191200196 | OTI | CDW Government LLC | Citywide IT purchasing contract | $205,440,849 | 93.21% | 296.00% |

| 20219178455 | DOE | NYC School Bus Umbrella Services Inc | To provide school busing services | $190,000,000 | 81.85% | 81.65% |

| 20249470535 | DOE | Edgewood Partners Insurance Center | To provide pupil transportation insurance | $139,999,998 | 66.76% | 94.17% |

| 20238804225 | DCAS | Garner Environmental Services, Inc. | Emergency preparedness & response goods & related services | $117,984,645 | 75.07% | 2067.97% |

Purchase Orders

Over 189 thousand POs were recorded in FY25 for a total value of $520 million.[27] Both figures represent an increase over FY24 levels. Table 22 reflects the number and value of POs issued in FY25 by category.

Table 22: PO Records by Category FY25

| PO Type | Total # of POs | Actual Amount | Obligation Amount Adjusted for Outyear | Available To Obligate |

|---|---|---|---|---|

| PCC1 | 17,326 | $25,178,991 | $25,178,981 | $10 |

| POD | 15,262 | $82,984,851 | $82,821,877 | $162,975 |

| POC | 157,270 | $411,558,449 | $411,542,330 | $16,119 |

| Grand Total | 189,858 | $519,722,291 | $519,543,187 | $179,104 |

Chart 11 compares the volume of POs issued from FY22-FY25 by category. The City issued more POs in FY25 relative to prior years. As Table 24 illustrates, DOE lead this increase, processing around 10 thousand more POs in FY25 than they did the prior year.

Chart 11: FY22-FY25 Volume of POs by Category.

The top-five agencies using POs in FY25, by volume, accounted for over 80% of the total share of POs processed by the City. Table 23 displays the volume and value of POs across each of these agencies. DOE continued to issue the most POs in FY25, issuing more than forty thousand more POs than they did in the prior fiscal year.

Table 23: Top Five Agencies by Volume of Recorded POs in FY25

| PO Type | Total # of POs | % Share of All POs | Total PO Value |

|---|---|---|---|

| DOE | 153,769 | 80.99% | $383,044,016 |

| HPD | 17,340 | 9.13% | $23,758,080 |

| NYPD | 2,765 | 1.46% | $15,689,788 |

| DEP | 1,760 | 0.93% | $19,403,763 |

| CITY COUNCIL | 1,505 | 0.79% | $3,907,005 |

| Grand Total | 153,769 | 80.99% | $383,044,016 |

V. Emergency Procurement Trends

Section V presents data trends relating to procurement methods used by the City to respond quickly in the event of emergencies.[28]

Emergency Procurement Method Actions

The City processed 106 contracts via the Emergency Procurement method in FY25 for a total value of $1.32 billion. The volume of new emergency contracts declined by 34% relative to FY24, accounting for the lowest number of such registrations since the start of the Adams administration. Emergency Contract value also declined by 46% relative to the prior year. Chart 12 displays the number and value of Emergency contracts filed in FMS across FY22, FY23, FY24, and FY25 respectively.

Chart 12: FY22-25 Emergency Contracts by Volume and Value

Table 24 displays the top five agencies by volume of new emergency contracts. Together, these agencies account for more than 90% of all emergency procurements in FY25. HPD continues to be the largest driver of these contracts since it is tasked with hiring contractors to conduct emergency building demolitions.

Table 24: FY25 Emergency Procurements Volume by Top Five Agencies

| Agency | Number of Emergency Contracts | % Share of Emergency Contracts |

|---|---|---|

| HPD | 57 | 53.78% |

| DHS/DSS | 33 | 31.13% |

| DEP | 3 | 2.83% |

| DSS/HRA | 3 | 2.83% |

| NYCEM | 2 | 1.89% |

| Grand Total | 98 | 92.45% |

Table 25 similarly lists the top five agencies by value of new emergency contracts. These agencies accounted for over 99% of the emergency contract value registered by the City in FY25. DSS/HRA and DSS/DHS shelter services contracts made up the highest share of contract value. This is because DSS, whose mission is to provide temporary shelter for those in need, is leading the City’s contracting for emergency shelter services.

Table 25: FY25 Emergency Procurements Value by Top Five Agencies

| Agency | Value of Emergency Contracts | % Share of emergency contracts |

|---|---|---|

| DSS/HRA | $748,155,936 | 56.42% |

| DSS/DHS | $492,280,925 | 37.12% |

| HPD | $52,016,402 | 3.92% |

| DEP | $16,909,900 | 1.28% |

| ACS | $7,398,376 | 0.56% |

| Grand Total | $1,316,761 | 99.30% |

Table 26 provides a breakdown of modifications to emergency contracts that were filed in FY25. There were more emergency contract modifications in FY25 relative to any other period of the Adams Administration, although a smaller share increased the contract durations than in prior years.

Table 26: FY25 Emergency Contract Modifications, by Category

| Type of Modification | Number of Emergency Modifications |

|---|---|

| Change To Amount Only | 28 |

| Change To Duration Only | 9 |

| Change to Both Amount and Duration | 16 |

| Administrative Change Only | 257 |

| Encumbrance Increase | 634 |

| Encumbrance Decrease | 381 |

| Grand Total | 1,325 |

VI. Procurement Actions by Industry

PPB Rules and other applicable procurement rules define several industries that are frequently used by the City to support the analysis of procurement trends. Industry classifications provide another perspective to understand where the City is investing its resources. Section VI of this Report examines FY25 procurements across the following industries:

- Construction Services

- Goods

- Human Services

- Professional Services

- Standard Services

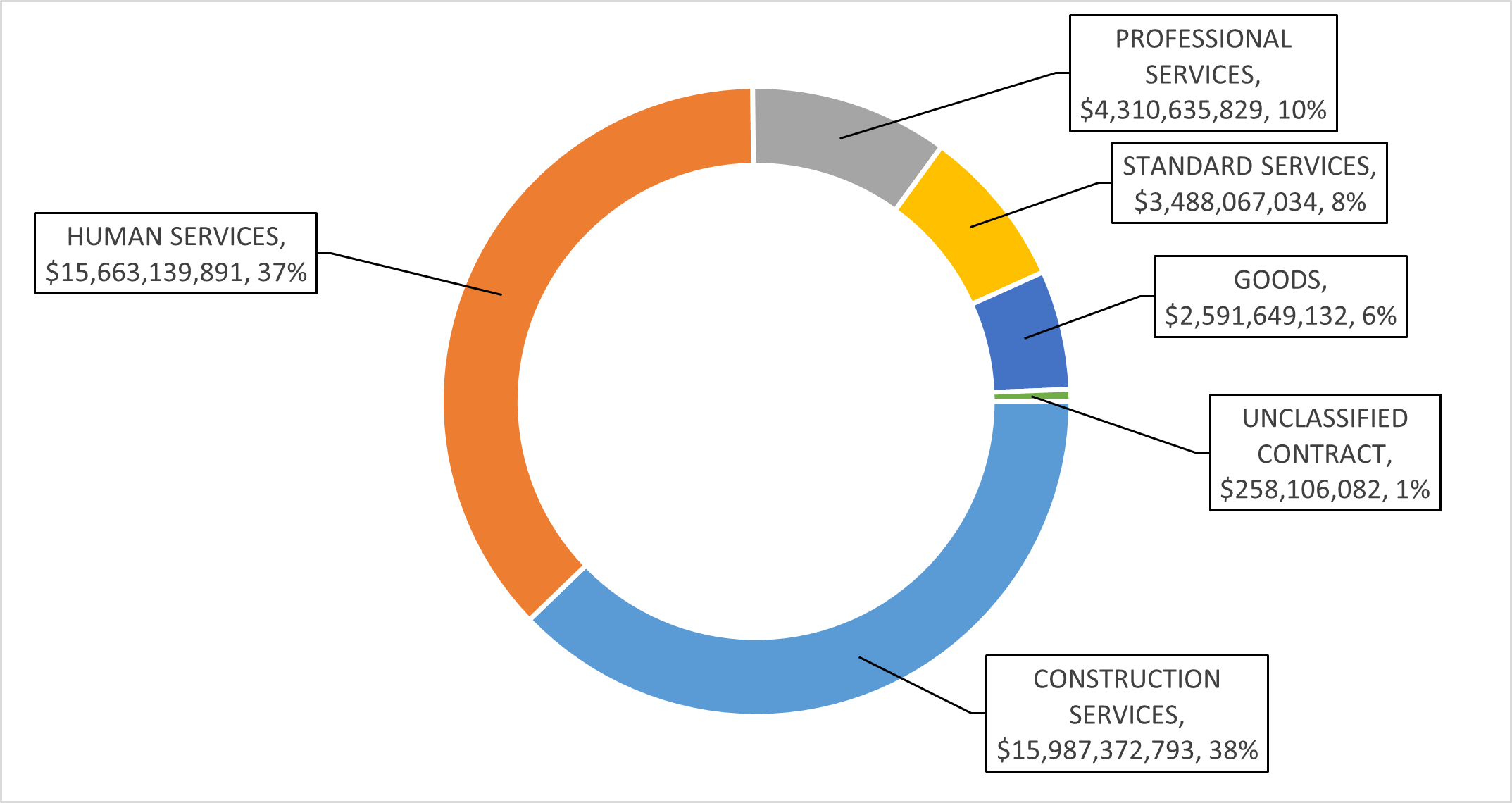

Industry classifications were assigned using rules employed by Checkbook NYC based on contract characteristics such as award category, contract type, and expense category. 12,500 procurement contracts were mapped to one of the above industries classifications using Checkbook NYC’s rules for a total value of $42.3 billion. Additionally, 844 procurement contracts, with a total registered value of $258.10 million, could not be classified into an industry group. Chart 13 below provides a comparison of registered contract value by industry.

Chart 13: Share of Registered New Procurement Contract Value by Industry

Relatedly, Chart 14 lays out the volume of new procurement contracts by industry. The Construction industry makes up a greater share of registered procurement value than they do of the city’s procurement volume, indicating that their contracts tend to be larger in value relative to the contracts in other industries.

Chart 14: Share of Registered New Procurement Contract Volume by Industry

Construction Services

PPB Rules define the Construction Service industry as dealing in the planning, design, or construction of real property or other public improvements.[29] In addition to engineering and construction work, this industry also includes contracts for painting, carpentry, plumbing and electrical installation, asbestos and lead abatement, carpet installation and removal, and demolition.

The Comptroller’s Office has been working alongside City Hall as a part of the Capital Process Task Force to undertake a comprehensive review of the City’s capital process and advocate for recommendations to streamline the city’s procurement of construction (and other capitally funded) services. The recommendations of this Task Force aim to reduce timelines for capital project completion, achieve taxpayer savings, enhance vendor participation and inclusion in the construction industry, and increase the City’s capacity to address emerging needs. Additionally, the Comptroller’s Office is working with several City construction agencies to allow for broader usage of the expanded work allowance (EWA), which is a funded, pre-registered allowance in a construction contract that leads to shorter CCO processing times and the ability to make faster payments to contractors.

The 530 new procurement contracts registered in FY25 under the Construction Services industry account for less than 5% of procurement contracts by volume, but the $15.98 billion associated with these contracts makes up nearly 38% of FY25’s registered procurement value. Table 27 lists the top ten construction service industry contracts registered in FY25. Note: the three highest value contracts are all part of the City’s Borough Based Jail (BBJ) program.[30]

Table 27: FY25 Top Ten Construction Service Industry Procurement Contracts, by Value

| Contract # | Agency | Vendor Legal Name | Award Method Description | Contract Purpose | Contract Registered Amount | Contract End Date |

|---|---|---|---|---|---|---|

| 20248809672 | DDC | Leon D. Dematteis Construction Corp | Innovative Procurement | Construction of new Queens detention facility | $3,984,819,968 | 12/29/2031 |

| 20258806440 | DDC | Tutor Perini O&G Joint Venture | Innovative Procurement | Construction of new Manhattan detention facility | $3,764,251,136 | 8/12/2032 |

| 20248809339 | DDC | Transformative Reform Group | Innovative Procurement | Construction of new Bronx detention facility | $2,971,891,712 | 11/1/2031 |

| 20258805355 | DEP | Frontier-Kemper Constructors Inc | Competitive Sealed Bidding | Construction of tunnels, shafts, and rock excavation | $1,093,255,040 | 10/7/2030 |

| 20258801735 | DEP | Skanska ECCO III HVR JV | Competitive Sealed Bidding | Construction of new reservoir chemical facilities and related infrastructure | $847,720,000 | 3/10/2030 |

| 20258804797 | DEP | John P Picone Inc | Competitive Sealed Bidding | Upgrades to pumping stations on Mersereau, Mayflower, and Richmond avenues | $170,647,376 | 6/18/2027 |

| 20258806982 | DDC | Triton Elite Joint Venture | Innovative Procurement | Design and build for Roy Wilkins Recreation Center | $120,490,000 | 11/14/2029 |

| 20258805166 | DDC | Restani Construction Corp | Innovative Procurement | Designing and building citywide raised crosswalks | $95,392,640 | 11/29/2028 |

| 20258804590 | DDC | CAC Industries Inc | Competitive Sealed Bidding | Replacement of water main distribution and appurtenances | $85,830,968 | 1/26/2029 |

| 20258807173 | DOT | CAC Industries Inc | Competitive Sealed Bidding | Flood mitigation improvements for Battery Park underpass | $77,306,400 | 7/18/2025 |

Goods

The Goods industry is made up of contracts for physical items and personal property, including but not limited to equipment, materials, printing, and insurance.[31] Procurements related to consumables such as food and fuel may also fall into the goods industry. Under the Charter, DCAS is responsible for procuring all goods, supplies, materials, equipment, and other personal property on behalf of city agencies, unless such authority has been otherwise delegated.[32] On occasion, DCAS delegates the procurement of a specific good to a particular agency when it’s in the City’s best interests, subject to the approval of the DCAS Commissioner and the Comptroller.[33] For example, DCAS authorized agencies to make goods purchases using the M/WBE Small Purchase method up to $1.5 million to allow agencies to encourage greater M/WBE participation on contracts.

In FY25, 2,664 contracts were registered within the Goods industry for a total value of $2.59 billion. This accounts for 6.13% of the total registered procurement value in FY25. Table 28provides a list of the top ten goods contacts, by value.

Table 28: FY25 Top Ten Goods Industry Procurement Contracts, by Value

| Contract # | Agency | Vendor Legal Name | Award Method Description | Contract Purpose | Contract Registered Amount | Contract End Date |

|---|---|---|---|---|---|---|

| 20255000030 | DCAS | Consolidated Edison Company Of New York Inc | Public Utility | Con Ed Gas | $141,494,000 | 6/30/2025 |

| 20259575420 | DOE | Staples Contract & Commercial LLC | Competitive Sealed Bidding | Purchase of office supplies | $140,731,760 | 9/30/2029 |

| 20265000061 | DCAS | Consolidated Edison Company Of New York Inc | Public Utility | Cond Ed Gas | $139,908,000 | 6/30/2026 |

| 20265000063 | DCAS | The Brooklyn Union Gas Company | Public Utility | National Grid west | $116,407,000 | 6/30/2026 |

| 20255000031 | DCAS | The Brooklyn Union Gas Company | Public Utility | National Grid west | $106,090,000 | 6/30/2025 |

| 20265000062 | DCAS | Consolidated Edison Company Of New York Inc | Public Utility | Con Ed steam | $98,798,000 | 6/30/2026 |

| 20248807720 | DCAS | Genuine Parts Company | Negotiated Acquisition | Purchase goods and services from Genuine Parts Company | $96,000,000 | 5/31/2026 |

| 20255000075 | DCAS | Consolidated Edison Company Of New York Inc | Public Utility | Con Ed steam | $81,142,000 | 6/30/2025 |

| 20258800953 | DCAS | Gabrielli Truck Sales Ltd | Competitive Sealed Bidding | Purchase heavy duty salt spreader truck chassis | $77,058,368 | 8/14/2029 |

| 20259574956 | DOE | Sid Tool Co Inc | Intergovernmental Procurement | Purchase industrial and commercial supplies and equipment | $72,566,816 | 3/21/2028 |

Human Services

The Human Services Industry encompasses services that are provided directly to clients in various at-need groups. Examples of Human Services include but are not limited to: day care, foster care, mental health treatment, operation of senior centers, home care, employment training, homeless assistance, preventive services, health maintenance organizations, and youth services.[34] Vendors in this category are primarily nonprofit organizations although services like home and early childcare services are also offered by for-profit businesses.

Human Service Industry contracts made up the largest share by volume of contracts and second largest in contract value in FY25. The 5,164 Human Service contracts accounted for over 41% of registered procurements and amounted to $15.66 billion in total value. Table 29 provides a list of the top Ten Human Service Industry Contacts, by value, mostly associated with shelter services under DSS/DHS.

Table 29: FY25 Top Ten Human Services Industry Procurement Contracts, by Value

| Contract # | Agency | Vendor Legal Name | Award Method Description | Contract Purpose | Contract Registered Amount | Contract End Date |

|---|---|---|---|---|---|---|

| 20258806286 | DHS | HANYC Foundation Inc | Negotiated Acquisition | Hotel Management services For DHS Emergency Programs 10,651 Unit | $929,104,960 | 6/30/2026 |

| 20258802303 | DHS | Westhab, Inc. | RFP From A PQVL | Shelter Facilities Homeless Families with Children – 175 unit | $708,807,488 | 6/30/2057 |

| 20258807437 | DSS | Institute For Community Living, Inc. | RFP From A PQVL | Affordable Housing DSS Referred Households | $659,967,680 | 3/31/2065 |

| 20251403077 | DOHMH | Public Health Solutions | Assignment | Master Contractor For Disease Control | $563,178,624 | 8/31/2029 |

| 20258807145 | DHS | Vocational Instruction Project Community Services Inc | RFP From A PQVL | Vocational Instruction Services Single Adults -200 Beds | $512,994,976 | 6/30/2057 |

| 20251401351 | DSS | Vocational Instruction Project Community Services Inc | Emergency | Affordable Housing Program- DSS Referred Households -66 Units | $265,238,128 | 6/30/2064 |

| 20251401382 | DSS | Vocational Instruction Project Community Services Inc | Emergency | Provision of Affordable Housing -59 Units | $251,285,072 | 6/30/2064 |

| 20258806214 | DSS | Services For the Underserved Inc | RFP From A PQVL | Affordable Housing DSS Referred Households 80 Unit | $233,984,672 | 1/31/2062 |

| 20251406992 | DSS | The DOE Fund Inc | Emergency | Master Lease Housing Unit – 63 Units | $231,632,736 | 6/30/2064 |

| 20258800561 | DHS | Samaritan Daytop Village Inc | Negotiated Acquisition | Commercial Hotel Services + Allowance – 449 Units | $157,772,800 | 6/30/2026 |

Professional Services

The Professional Services industry includes contracts for the provision of various kinds of expert advice and consulting, including legal services, medical services and information technology and construction-related consulting.[35]

2,007 contacts associated with the Professional Services industry were registered in FY25, accounting for 16.06% of all registered procurements. Their $4.31 billion makes up 10.19% of the total FY25 procurement value.

Table 30: FY25 Top Ten Professional Services Industry Procurement Contracts, by Value[36]

| Contract # | Agency | Vendor Legal Name | Award Method Description | Contract Purpose | Contract Registered Amount | Contract End Date |

|---|---|---|---|---|---|---|

| 20256200556 | DEP | New York Power Authority | Government To Government | Implementation Of Energy Efficiency Improvement Projects For | $500,000,000 | 12/31/2028 |

| 20258804731 | DDC | Liro Program And Construction Management PE PC | Request For Proposal | Construction management/Build Services For Rodmans Neck Firearms and Tactics Facility | $273,211,520 | 1/29/2030 |

| 20258800614 | DOHMH | HLN Consulting LLC | Intergovernmental Procurement | Enhancements to the Citywide Immunization Registry (Cir) | $66,000,000 | 6/30/2030 |

| 20258802351 | NYCEM | Hagerty Consulting Inc. Hagerty Consulting | Renewal Of Contract | Surge Staffing Renewal | $65,000,000 | 9/30/2026 |

| 20258804917 | DEP | Watershed Agrig. Council | Determined By Gov’t Mandate | The implementation and replacement of agricultural best management practices for participating farms and forests | $53,900,000 | 3/30/2030 |

| 20258807176 | DDC | Ks Engineers P C | Request For Proposal | Resident engineering inspections with various city infrastructure | $50,000,000 | 3/31/2029 |

| 20258807179 | DDC | Tectonic Engineering Consultants Geologists & Land Surveyors | Request For Proposal | Resident engineering inspections with various city infrastructure | $50,000,000 | 3/31/2029 |

| 20258807180 | DDC | Liro Engineers Inc | Request For Proposal | Resident engineering inspections with various city infrastructure | $50,000,000 | 3/31/2029 |

| 20258807181 | DDC | HNTB New York Engineering and Architecture P C | Request For Proposal | Resident engineering inspections with various city infrastructure | $50,000,000 | 3/31/2029 |

| 20258807187 | DDC | Nv5 New York-Engineers Architects Landscape Architects And | Request For Proposal | Resident engineering inspections with various city infrastructure | $50,000,000 | 3/31/2029 |

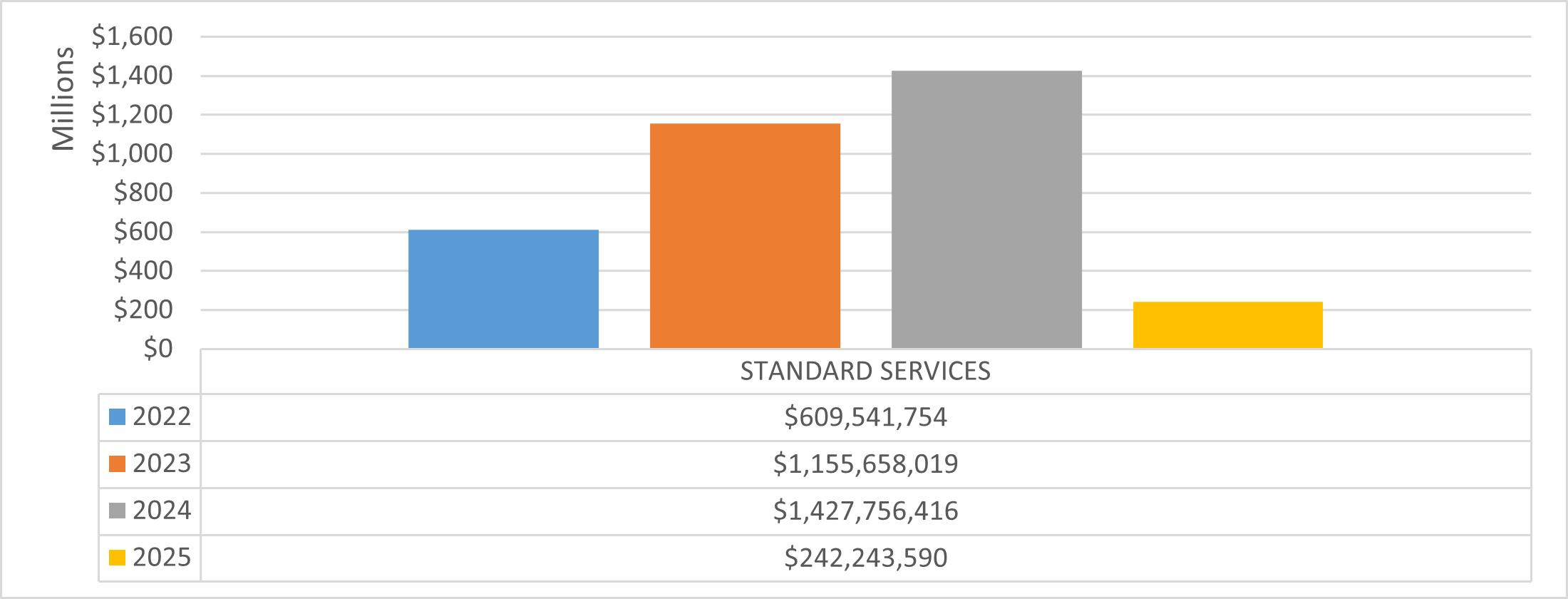

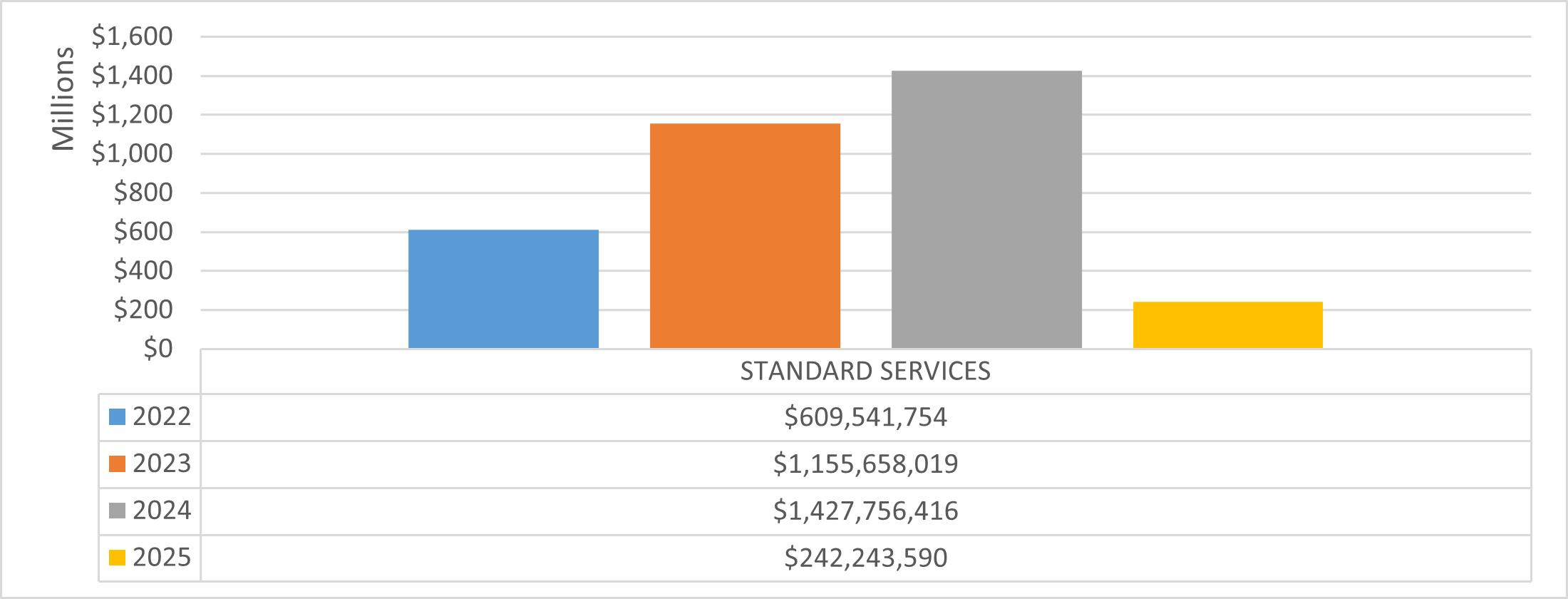

Standard Services

The Standard Services industry is composed of services other than Professional Services and Human/Client Services such as custodial services, security guard services, stenography services and office machine repair.[37] There were 1,291 contracts registered in the Standard Service Industry in FY25, comprising 10.33% of all procurement contracts. These contracts came to $3.49 billion in value, accounting for 8.25% of all FY25 registered procurement value. Table 31 provides a list of the top ten Standard Service Industry Contacts, by value.

Table 31 FY25 Top Ten Standard Services Industry Procurement Contracts, by Value

| Contract # | Agency | Vendor Legal Name | Award Method Description | Contract Purpose | Contract Registered Amount | Contract End Date |

|---|---|---|---|---|---|---|

| 20258803455 | SBS | New York City Economic Development Corporation | Sole Source | This service consists of providing Certain City-Wide economic development services | $977,673,920 | 6/30/2026 |

| 20258803498 | SBS | New York City Economic Development Corporation | Sole Source | This service consists of providing Certain City-Wide economic development services | $340,275,808 | 6/30/2026 |

| 20251403271 | TRANSIT | Metropolitan Transportation Authority | Government To Government | Subway track replacements and renewals city wide | $211,957,248 | 6/30/2025 |

| 20258804159 | DEP | Watershed Agrig. Council | Determined By Gov’t Mandate | The continued implementation of the Watershed Agricultural Program | $167,000,000 | 3/30/2035 |

| 20259574776 | DOE | NTT Data Americas Inc | Renewal Of Contract | Infrastructure Build-Out Services | $142,623,392 | 3/31/2025 |

| 20268800772 | DEP | Chemtall Inc. | Competitive Sealed Bidding | Supplying Cationic Dewatering Polymer | $96,217,744 | 6/29/2030 |

| 20258805427 | DHS | New York State Industries For The Disabled Inc | Determined By Gov’t Mandate | DHS janitorial cleaning and maintenance | $72,200,744 | 6/30/2027 |

| 20258806537 | NYCEM | Strategic Security Corp | Renewal Of Contract | Base Camp Provider Renewal #1 | $54,000,000 | 3/31/2026 |

| 20251409887 | HPD | New York City Housing Authority | Request For Proposal | Comprehensive modernization of Gowanus Houses in Brooklyn | $41,038,804 | 2/15/2028 |

| 20251414896 | TRANSIT | Metropolitan Transportation Authority | Government To Government | Mainline track replacements city wide | $30,286,342 | 9/30/2025 |

VII. Procurements by Agency Type

City agencies, affiliated agencies, elected officials, and the City Council all take part in the contracting process. Procurements via new contracts and TOs were registered to 68 separate entities in FY25. Section VII of this report examines contracting trends by industry and contract group for each procuring entity. It also compares new procurement contracts registered to agencies operating under the Mayor’s Office (Mayoral Agencies), independent City agencies (Non-Mayoral Agencies), and a collection of state agencies, authorities, boards, libraries, and other corporations that perform public functions in NYC (Other Agencies). With 59.34% of all new procurement contracts, City – Mayoral Agencies were the biggest driver of new contract registrations by volume in FY25. They also accounted for 87.10% of FY25 procurement contract value. Table 32 displays new procurements, by volume and value, across agency type.

Table 32: FY25 New Procurement Contracts and Task Orders by Agency Type

| Agency Type | # of Contracts | % of Contracts | Total Registered Contract Value | % Share Of Registered Contract Value |

|---|---|---|---|---|

| City – Mayoral Agency | 8,371 | 61.98% | $38,406,609,667 | 87.50% |

| City – Non-Mayoral | 673 | 4.98% | $671,255,636 | 1.53% |

| Other Agency | 4,461 | 33.03% | $4,817,783,702 | 10.98% |

| Grand Total | 13,505 | 100.00% | $43,895,649,005 | 100.00% |

City Mayoral Agencies

Every Mayoral Administration directly oversees and appoints department heads for a number of City agencies. Table 33 displays information on new procurement contracts registered to each Mayoral Agency.

Table 33: FY25 New Procurement Contracts by Mayoral Agency

| Agency | # of Contracts | % Share of Contracts | Total Registered Contract Value | % Share of Registered Contract Value |

|---|---|---|---|---|

| ACS | 168 | 2.27% | $228,427,915 | 0.62% |

| CCHR | 2 | 0.03% | $184,071 | 0.00% |

| CCRB | 4 | 0.05% | $269,367 | 0.00% |

| DCAS | 450 | 6.07% | $1,874,594,308 | 5.09% |

| DCLA | 10 | 0.13% | $5,103,483 | 0.01% |

| DCP | 17 | 0.23% | $2,747,428 | 0.01% |

| DCWP | 14 | 0.19% | $39,838,359 | 0.11% |

| DDC | 292 | 3.94% | $13,631,293,454 | 37.00% |

| DEP | 256 | 3.45% | $3,656,010,088 | 9.92% |

| DFTA | 355 | 4.79% | $768,824,789 | 2.09% |

| DHS/DSS | 159 | 2.14% | $5,328,248,337 | 14.46% |

| DOB | 19 | 0.26% | $41,658,526 | 0.11% |

| DOC | 81 | 1.09% | $29,618,193 | 0.08% |

| DOF | 50 | 0.67% | $45,533,377 | 0.12% |

| DOHMH | 883 | 11.91% | $2,406,280,162 | 6.53% |

| DOI | 21 | 0.28% | $17,022,265 | 0.05% |

| DOP | 53 | 0.71% | $30,939,395 | 0.08% |

| DORIS | 1 | 0.01% | $347,190 | 0.00% |

| DOT | 185 | 2.49% | $442,742,449 | 1.20% |

| DPR | 1,152 | 15.53% | $703,963,081 | 1.91% |

| DSNY | 81 | 1.09% | $182,364,164 | 0.49% |

| DSS/HRA | 382 | 5.15% | $3,512,829,553 | 9.53% |

| DVS | 6 | 0.08% | $677,330 | 0.00% |

| DYCD | 1,521 | 20.51% | $2,125,715,425 | 5.77% |

| FDNY | 124 | 1.67% | $147,006,429 | 0.40% |

| HPD | 204 | 2.75% | $210,781,775 | 0.57% |

| LAW | 77 | 1.04% | $62,899,384 | 0.17% |

| LPC | 1 | 0.01% | $22,500 | 0.00% |

| MAYOR | 60 | 0.81% | $10,563,248 | 0.03% |

| NYCEM | 72 | 0.97% | $212,398,403 | 0.58% |

| NYPD | 244 | 3.29% | $160,136,000 | 0.43% |

| OATH | 12 | 0.16% | $6,164,001 | 0.02% |

| OCJ | 78 | 1.05% | $658,256,168 | 1.79% |

| OTI | 198 | 2.67% | $167,218,273 | 0.45% |

| SBS | 176 | 2.37% | $130,310,954 | 0.35% |

| TLC | 9 | 0.12% | $1,687,027 | 0.00% |

| Grand Total | 7,417 | 100.00% | $36,842,676,870 | 100.00% |

Administration for Children’s Services (ACS)

The Administration for Children’s Services (ACS) protects and promotes the safety and well-being of New York City’s children, young people, families, and communities by providing child welfare, juvenile justice, foster care, early care, and education services.

Table 34 – ACS: FY23-FY25 Registrations by Contract Category

| FY23 | FY24 | FY25 | ||||

|---|---|---|---|---|---|---|

| Contract Category | # of Contracts | Total Contract Value | # of Contracts | Total Contract Value | # of Contracts | Total Contract Value |

| Competitive Method Contracts | 62 | $2,400,819,624 | 48 | $376,571,251 | 16 | $40,441,151 |

| Limited or Non-Competitive Method Contracts | 227 | $334,167,307 | 150 | $146,733,176 | 120 | $59,867,382 |

| Supplemental Contracts | 147 | $920,270,198 | 34 | $214,577,615 | 32 | $128,119,382 |

| Transactions Not Subject to PPB Rules | 3 | $461,000 | 1 | $300,000 | 0 | $0 |

| Grand Total | 439 | $3,655,718,130 | 233 | $738,182,042 | 168 | $228,427,915 |

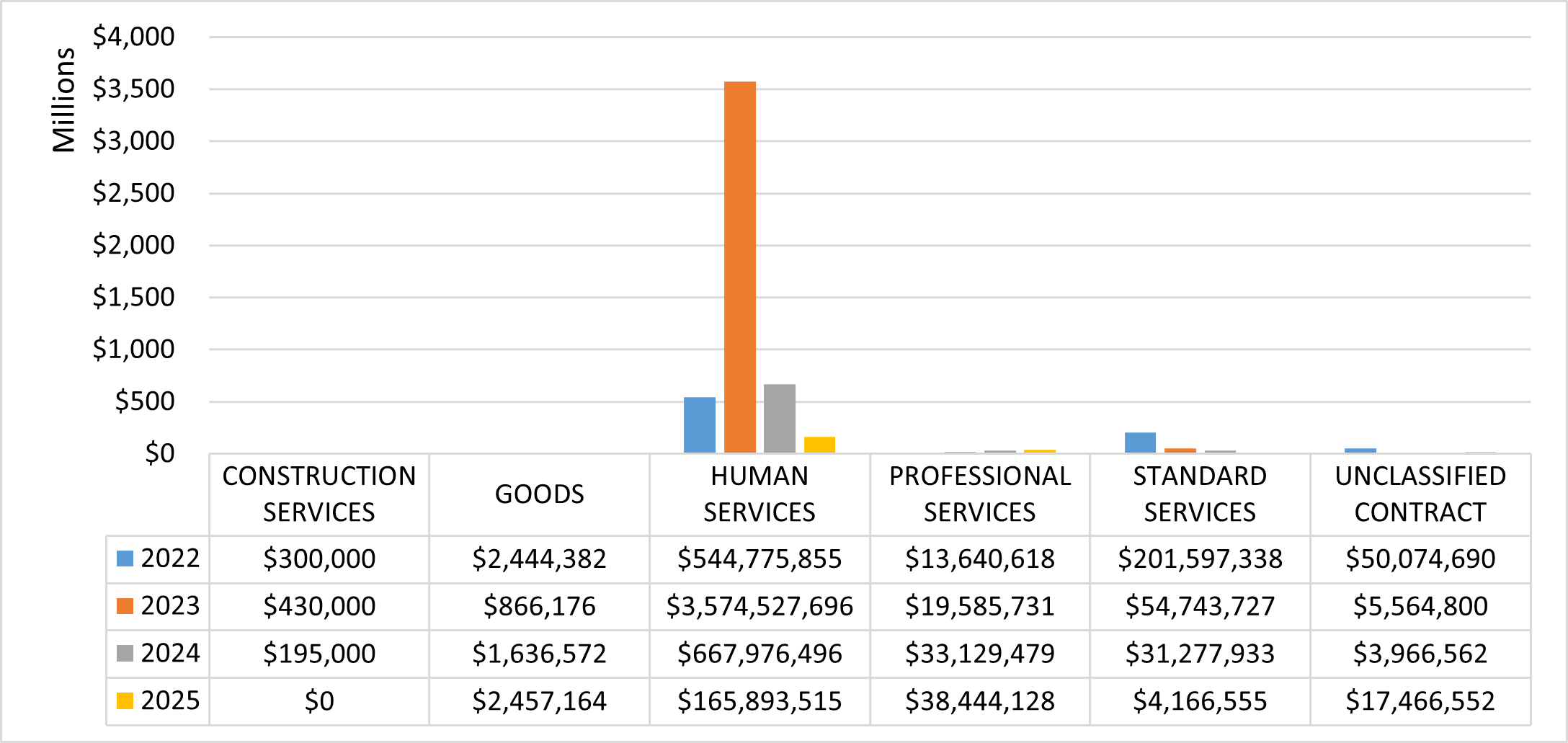

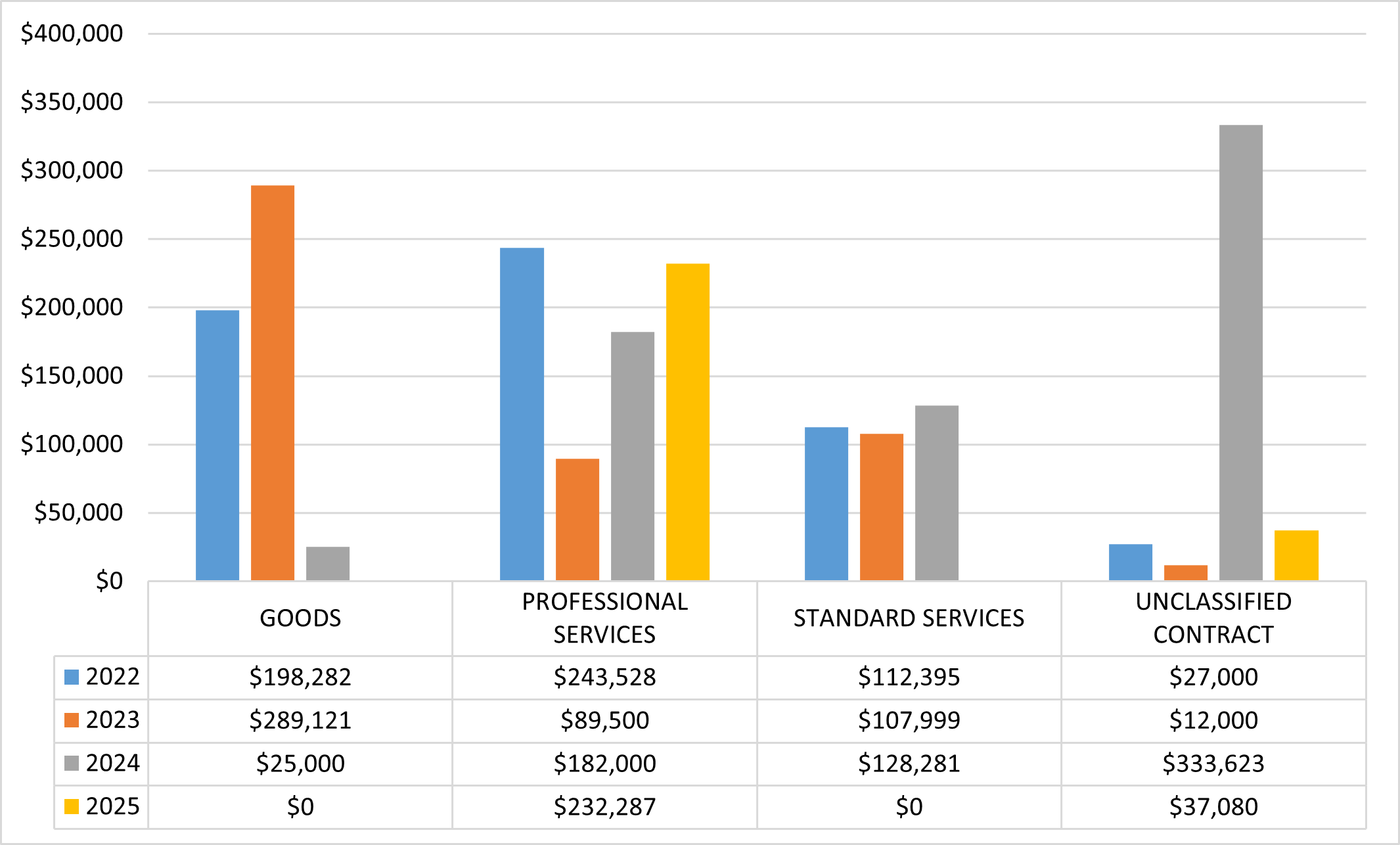

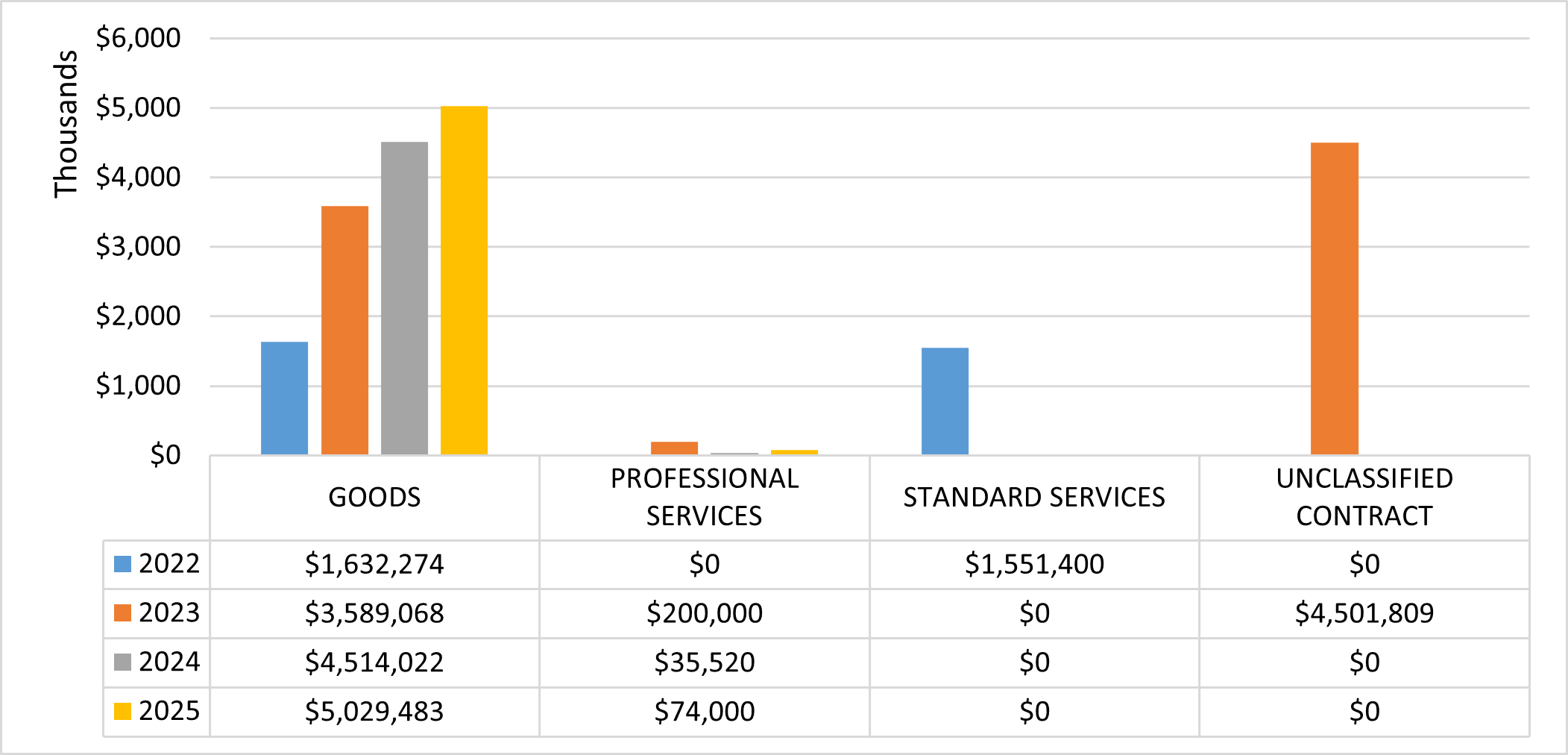

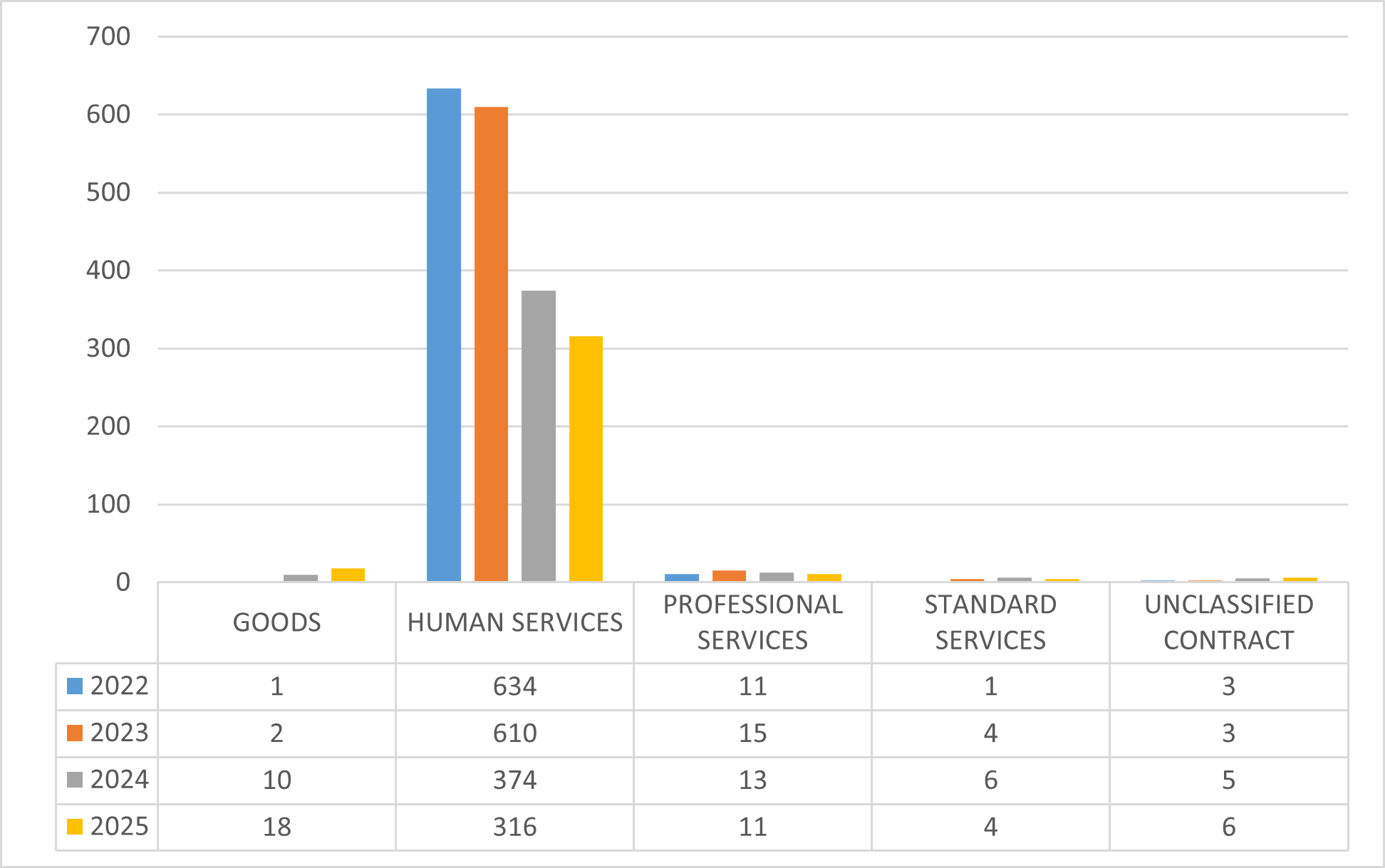

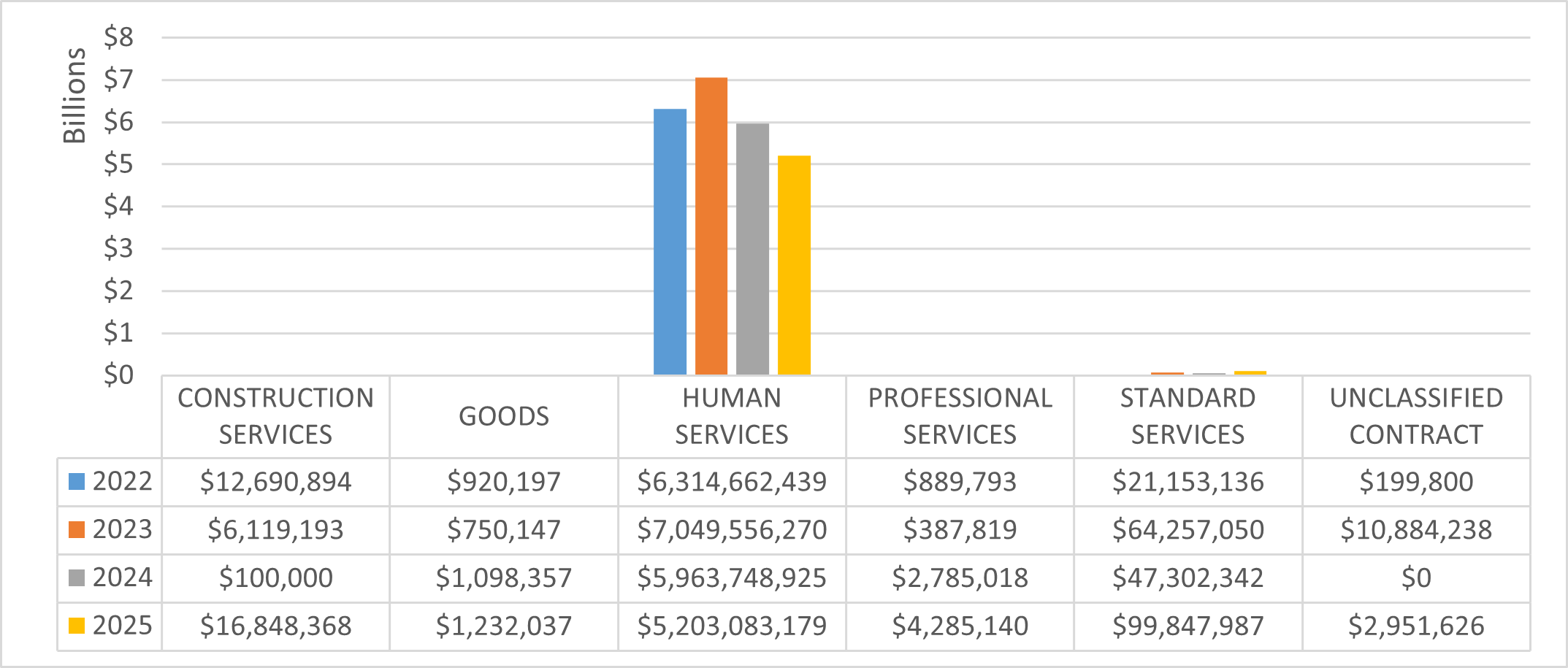

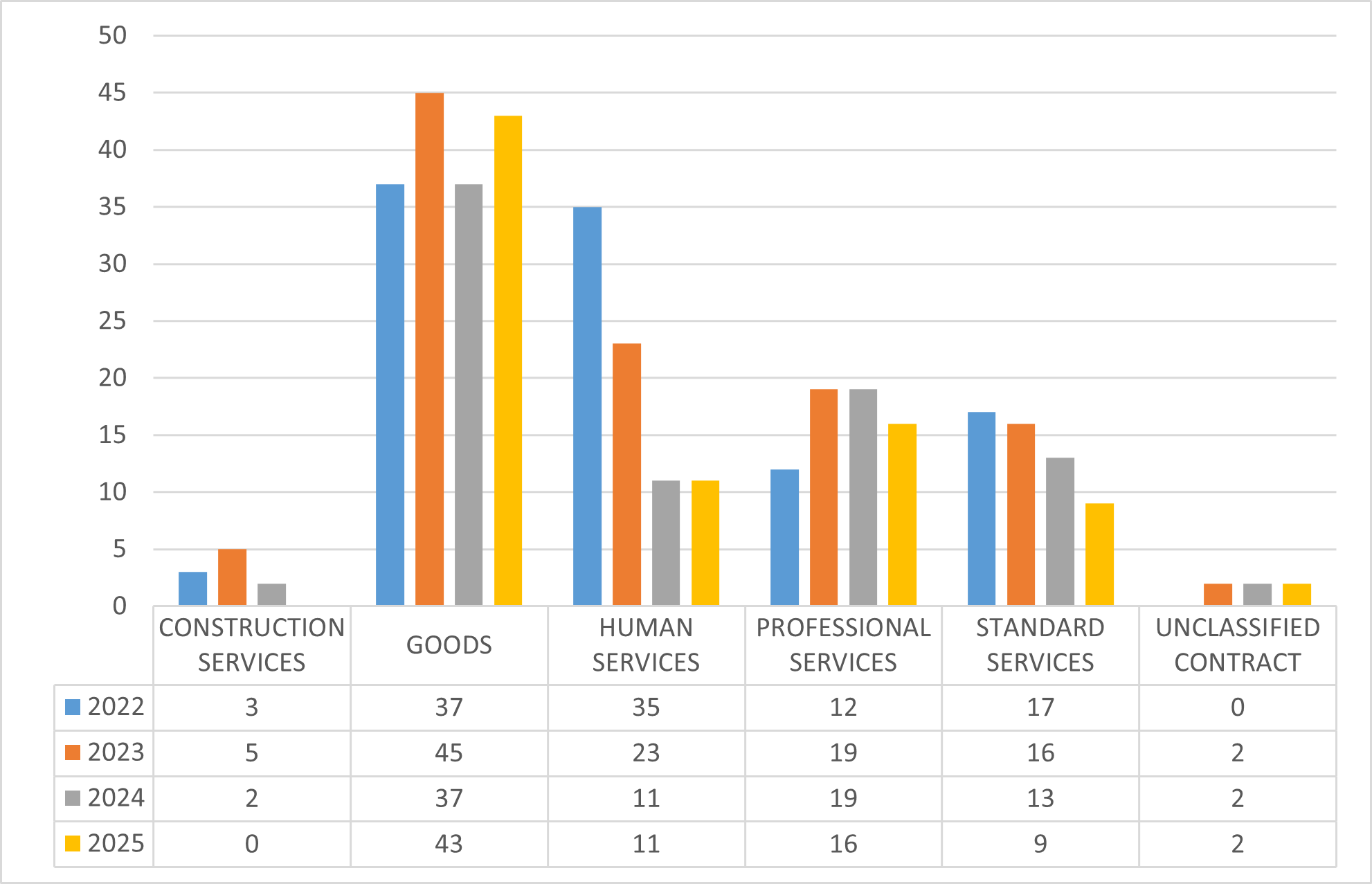

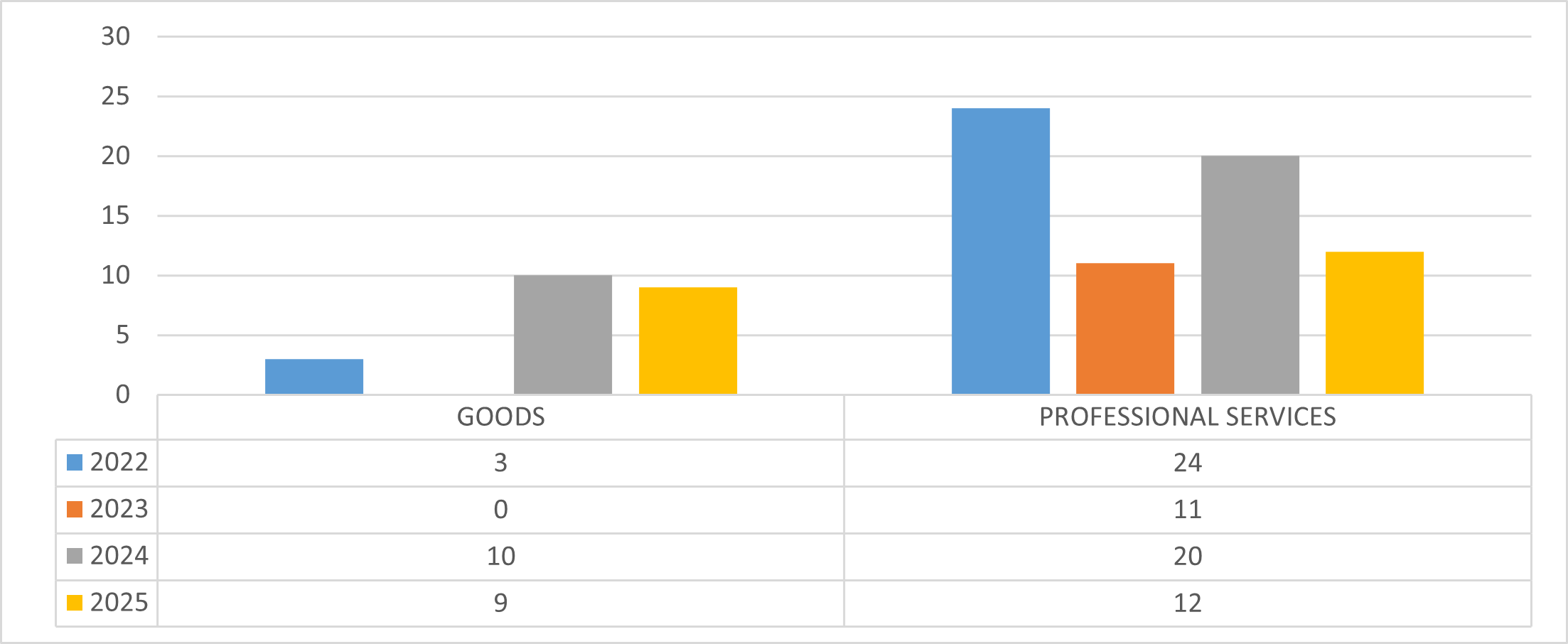

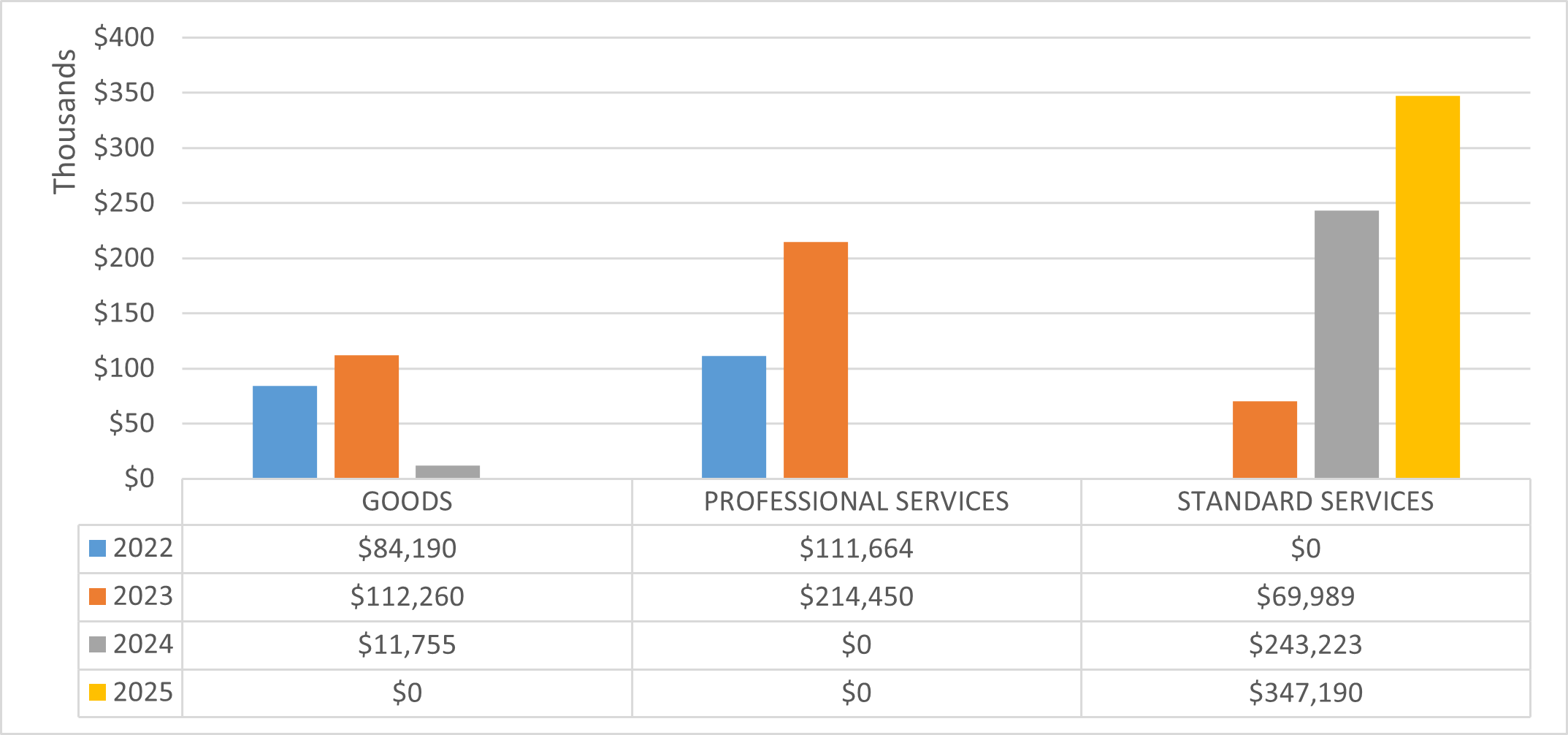

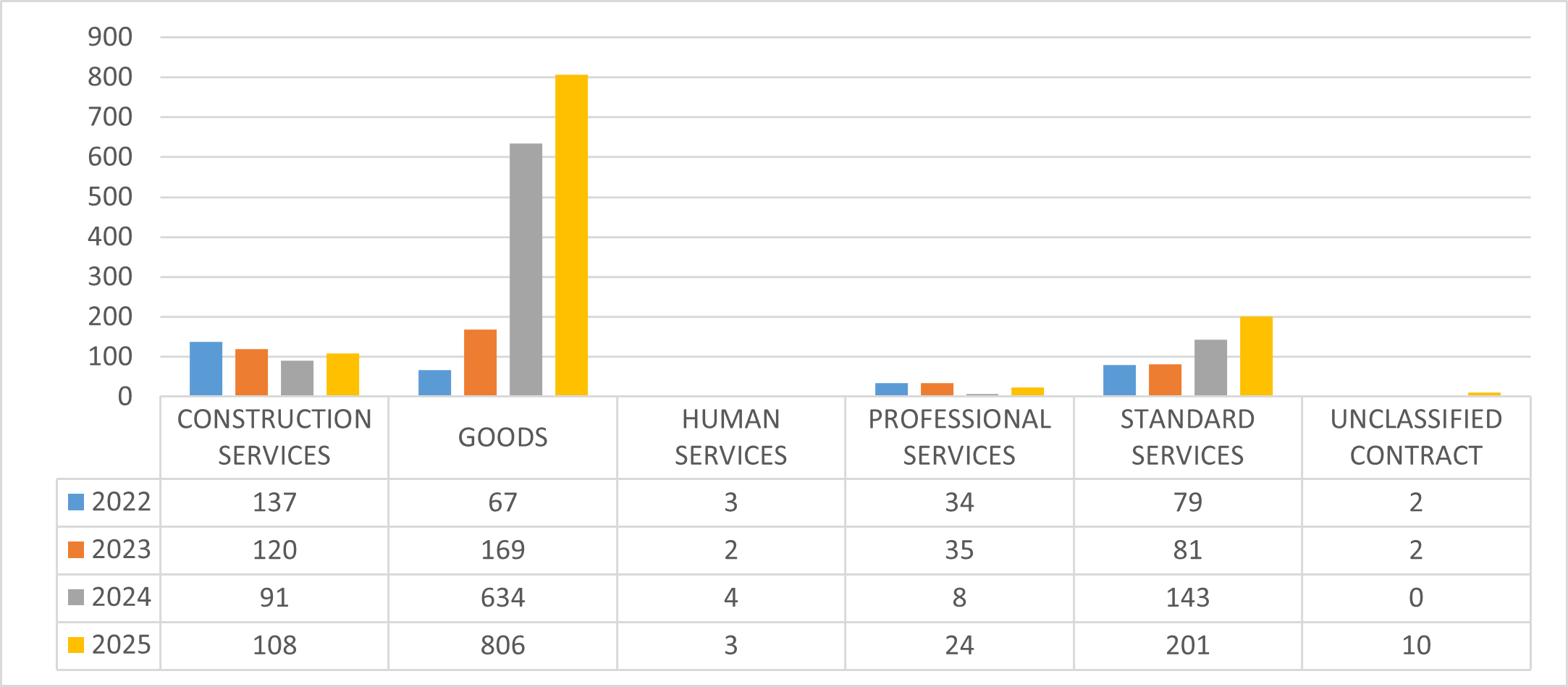

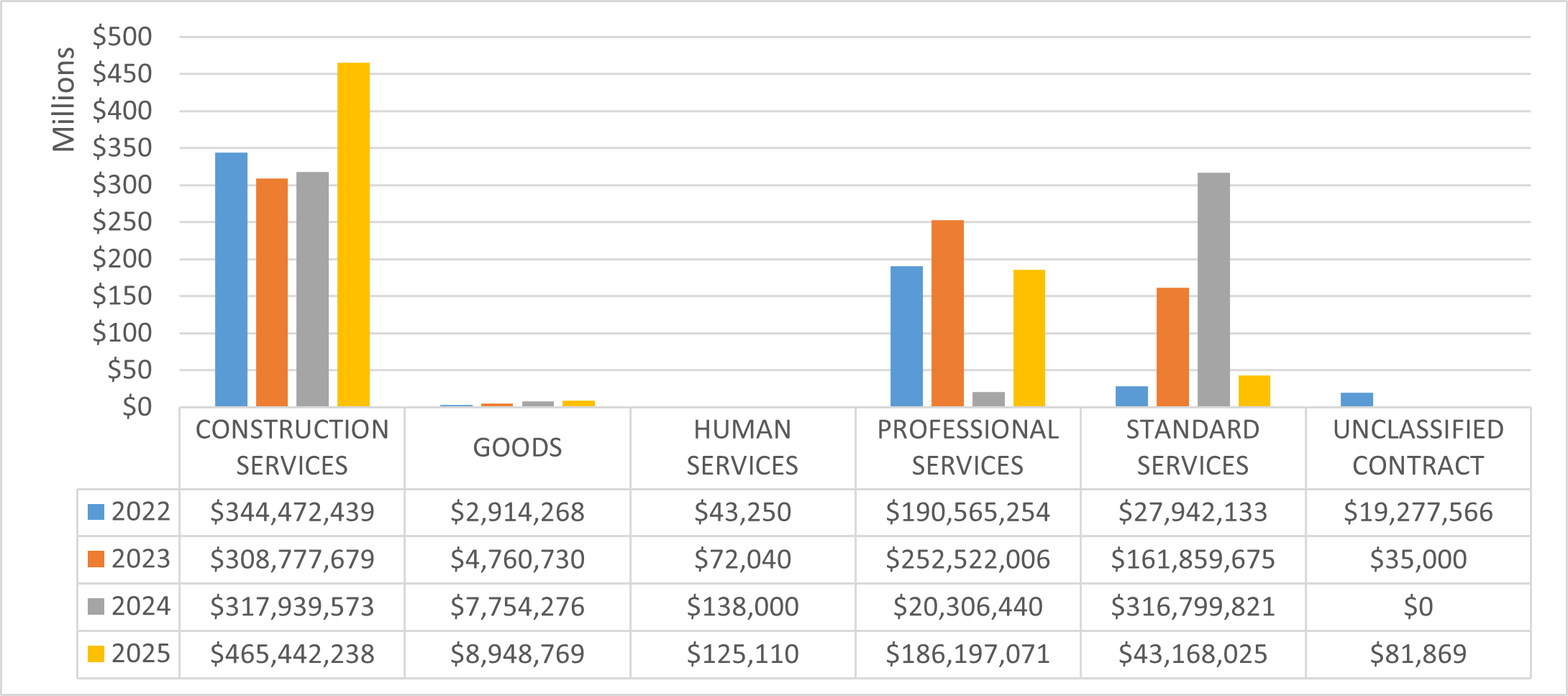

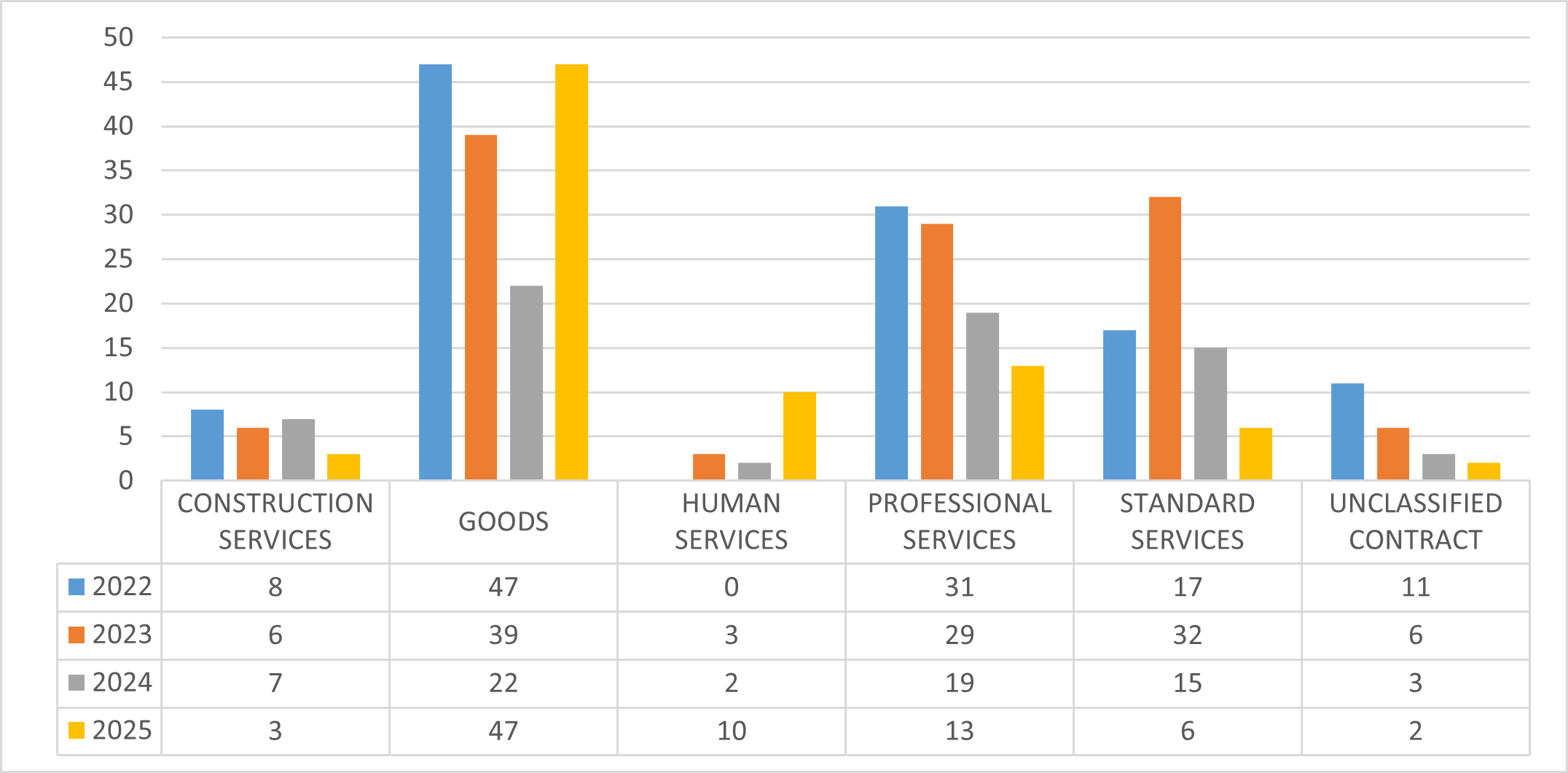

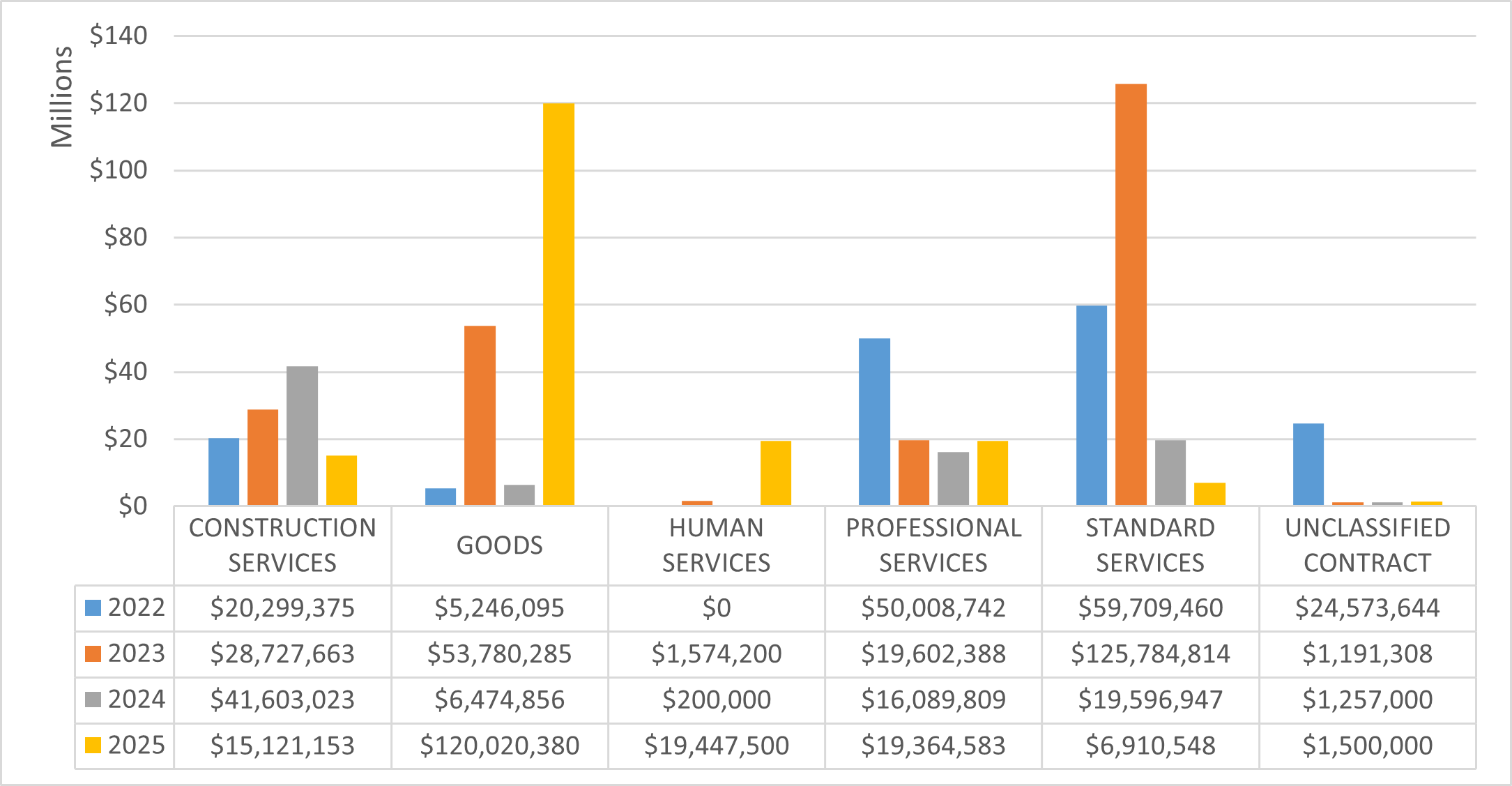

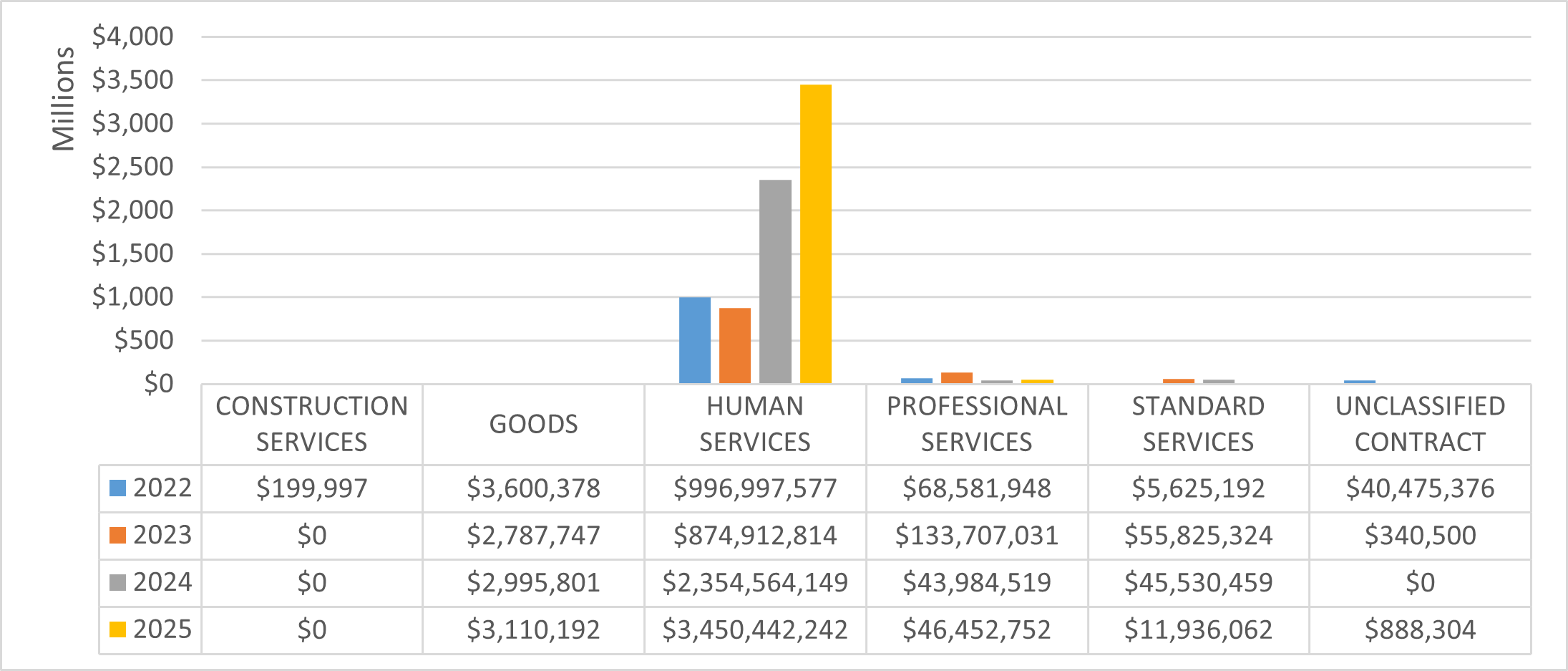

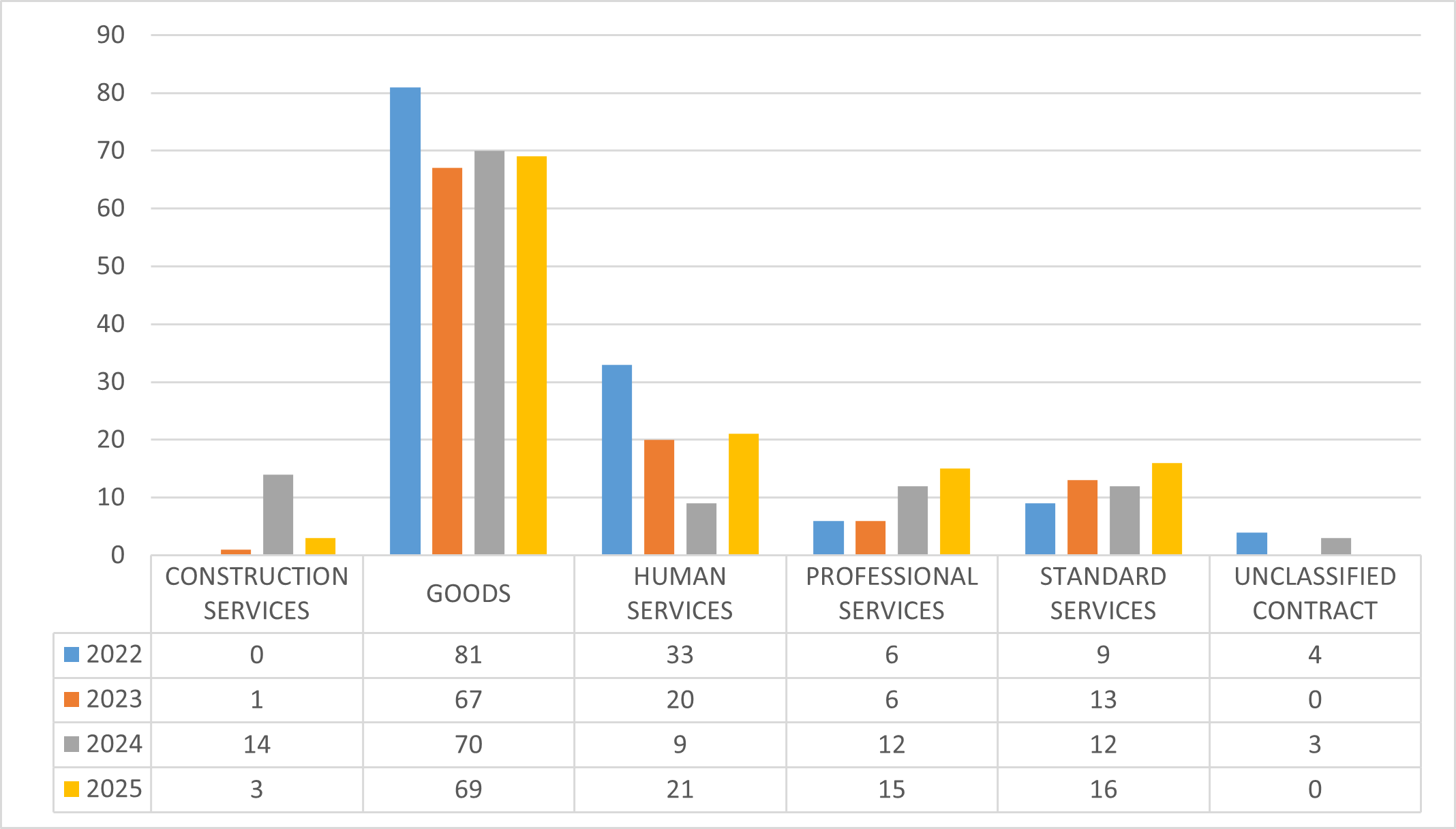

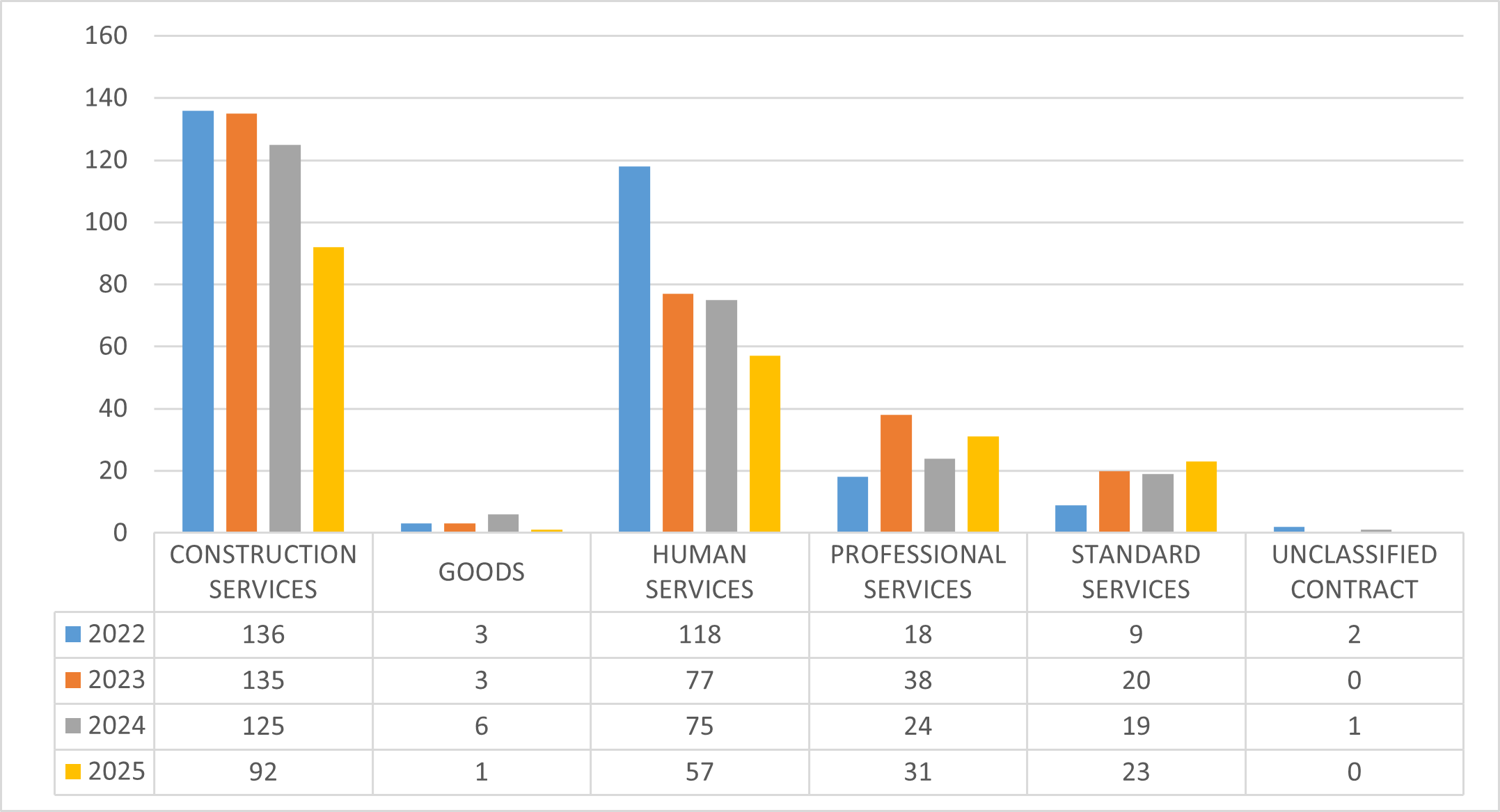

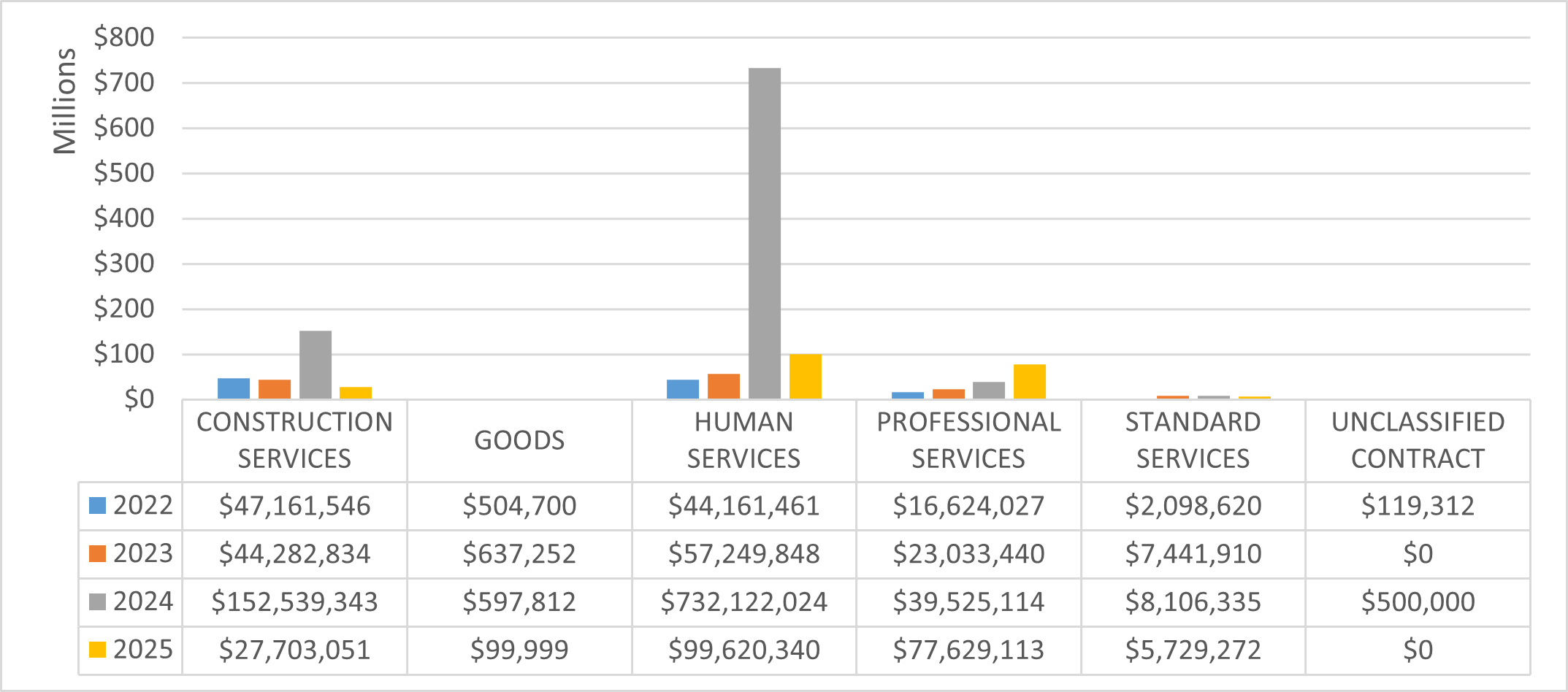

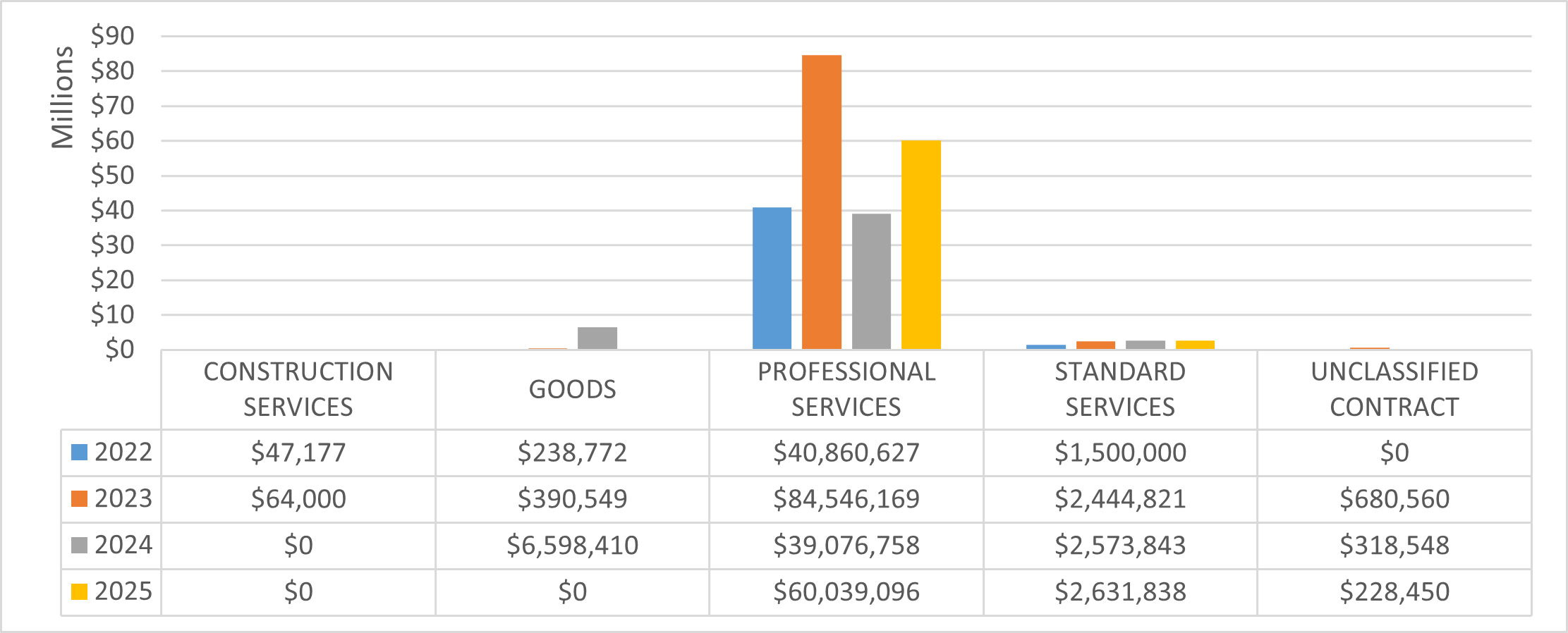

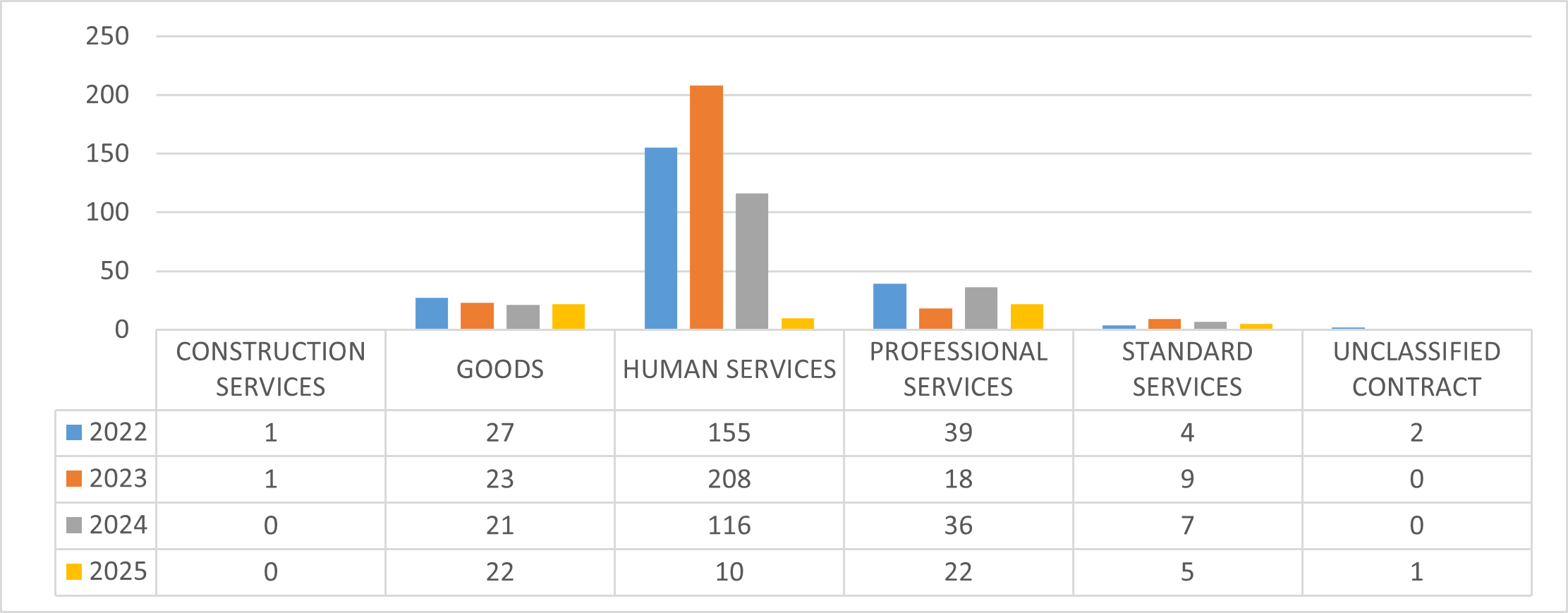

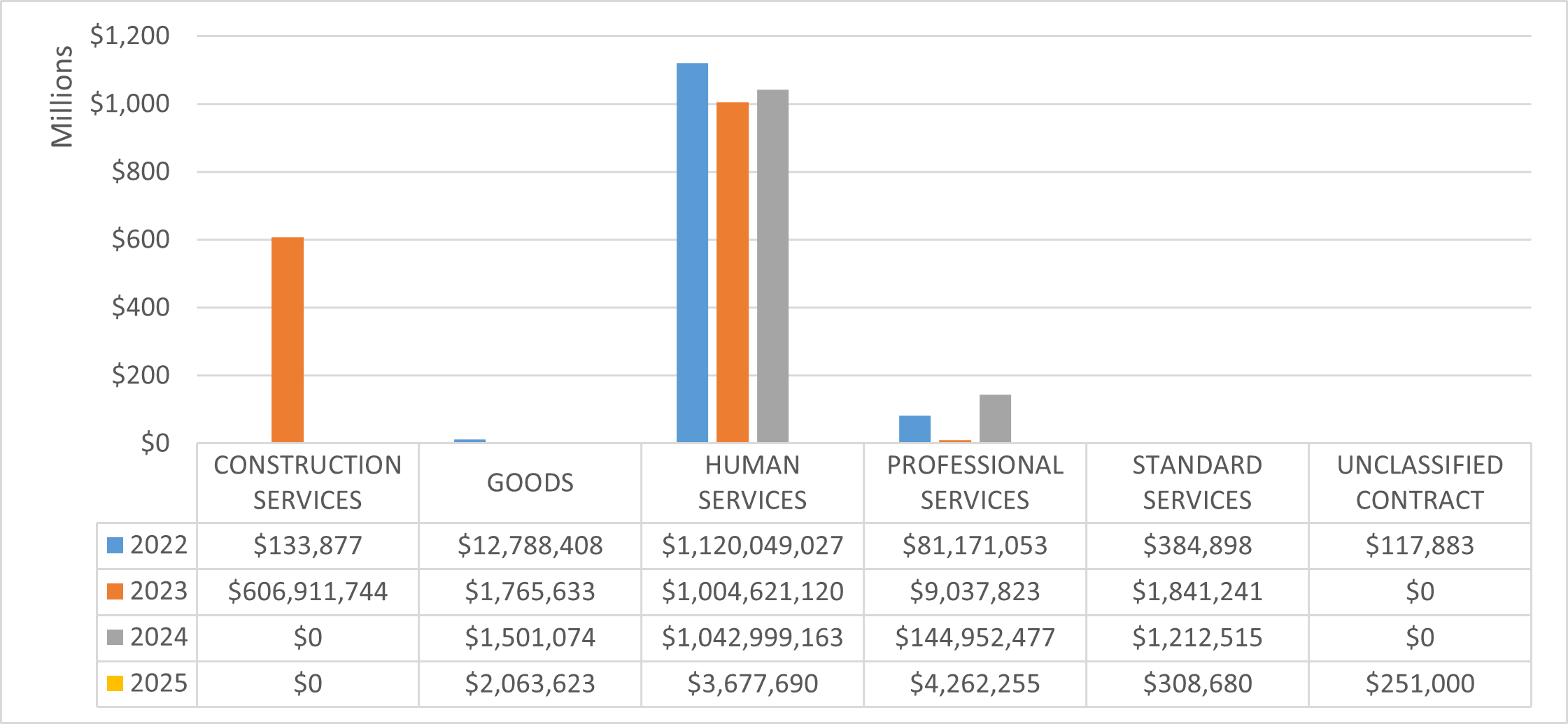

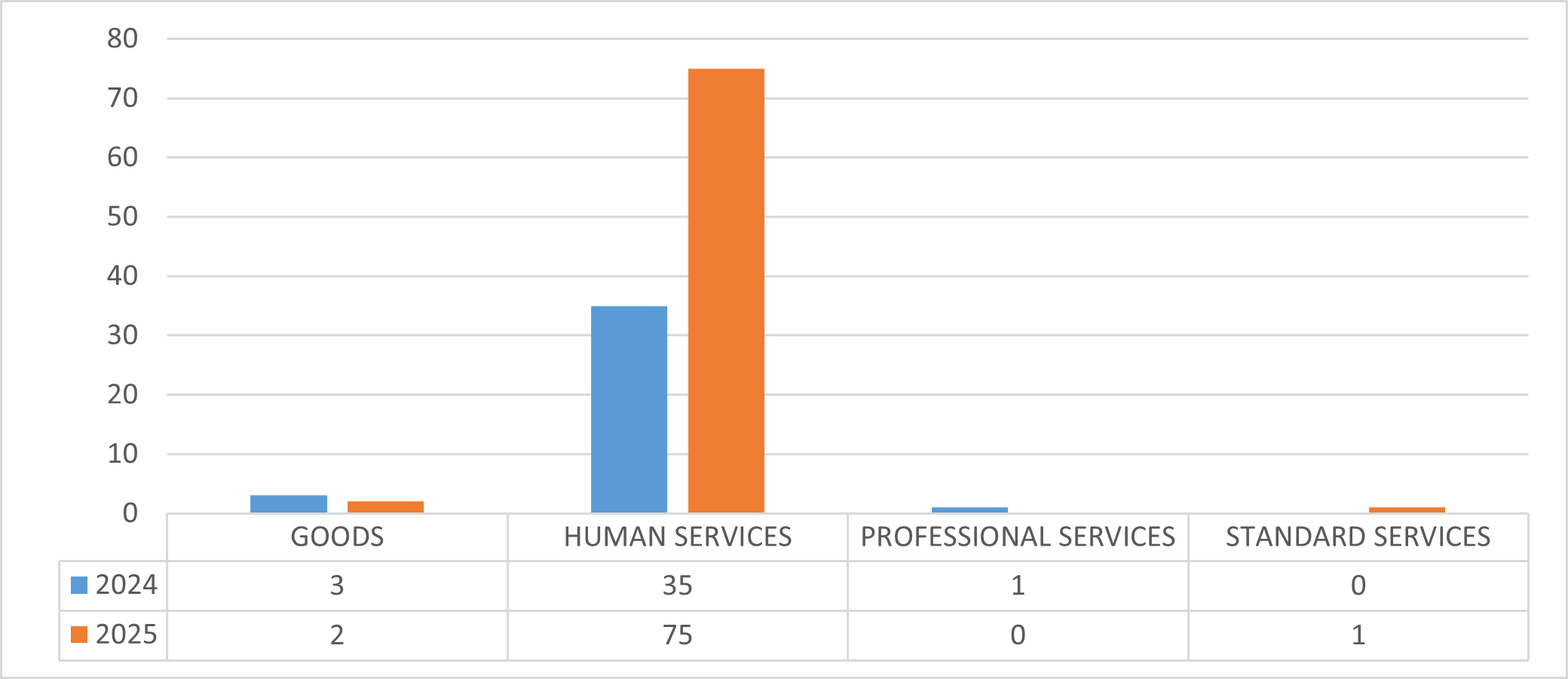

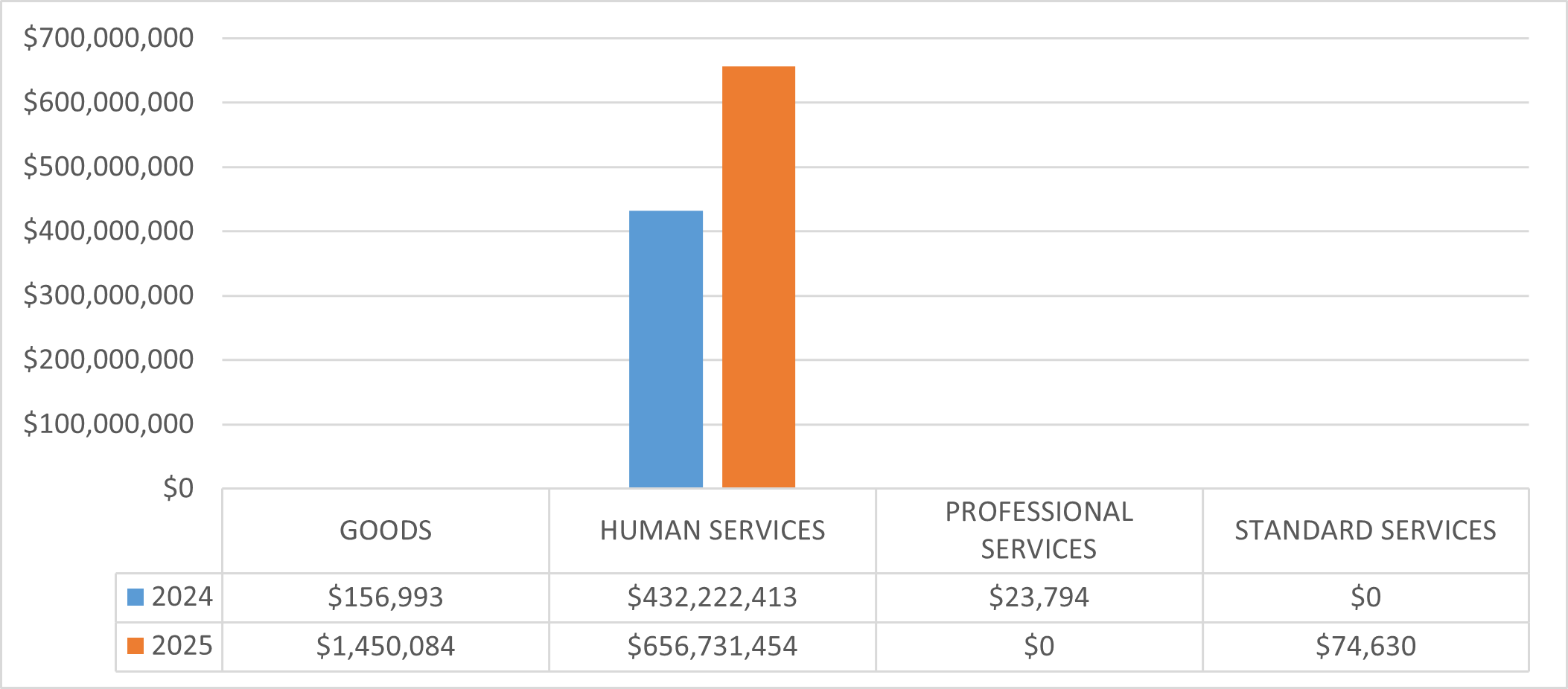

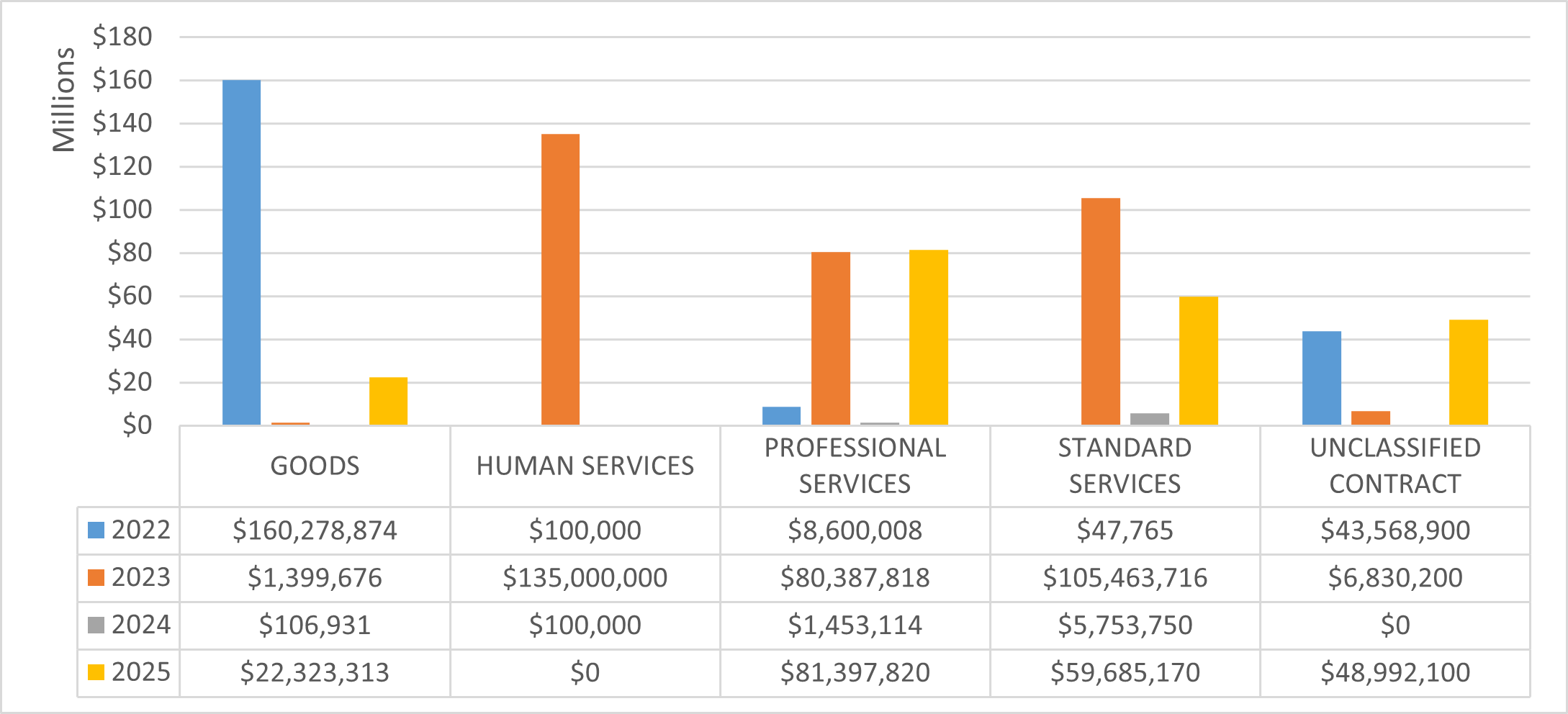

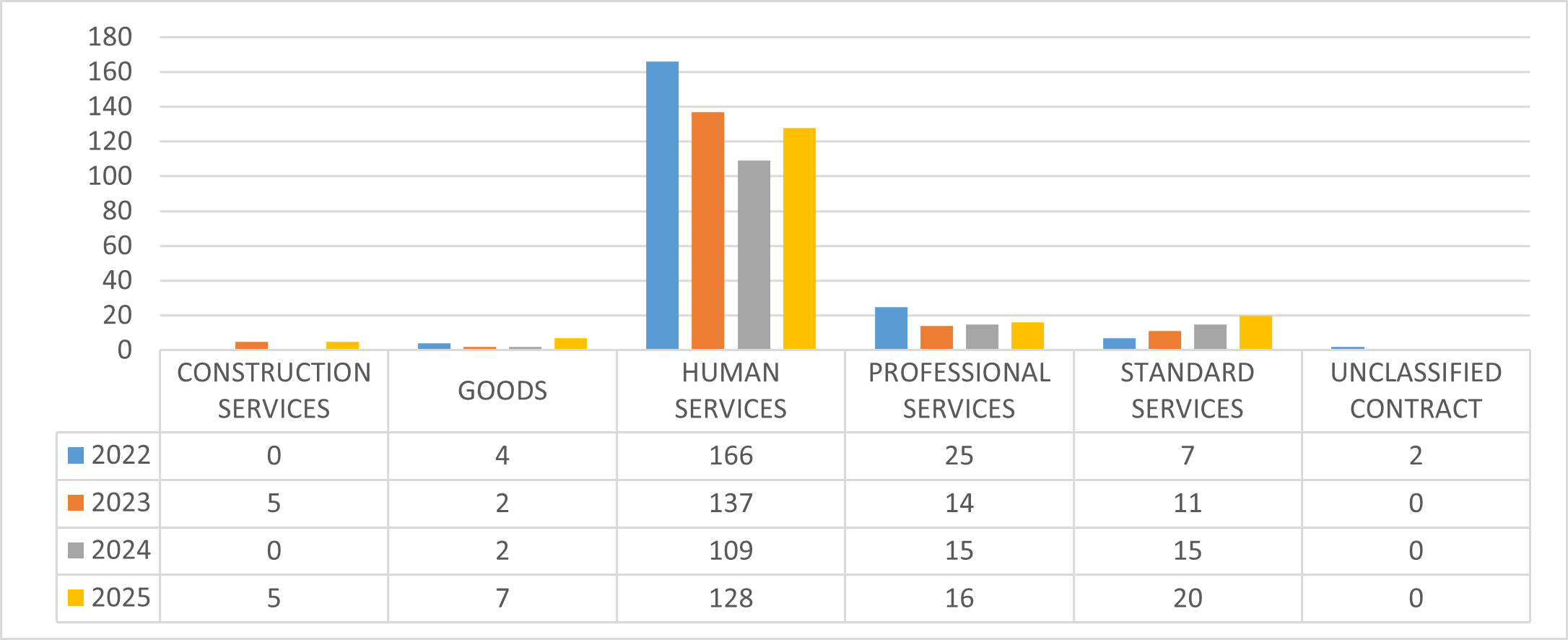

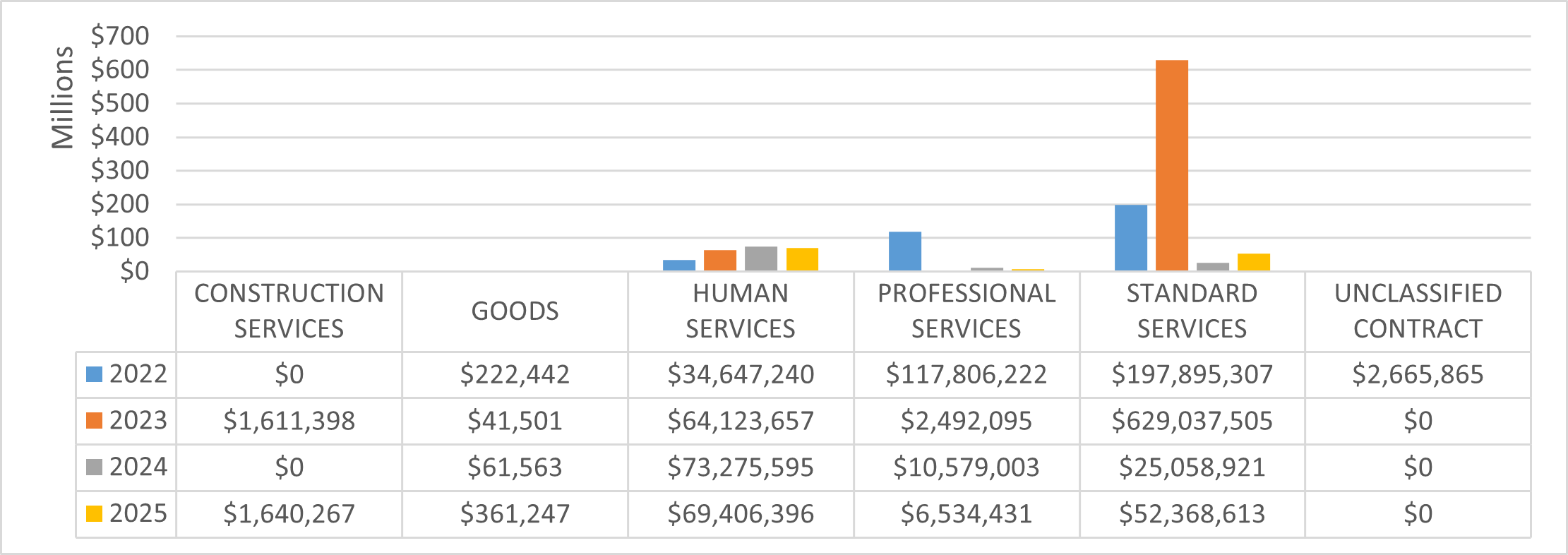

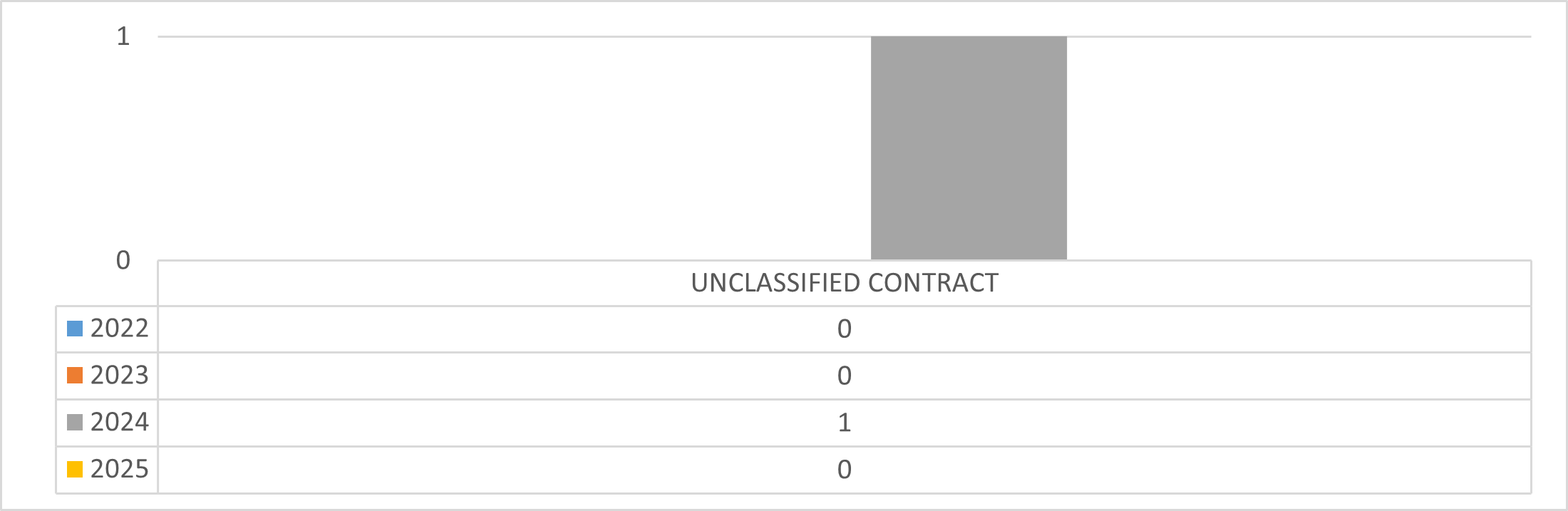

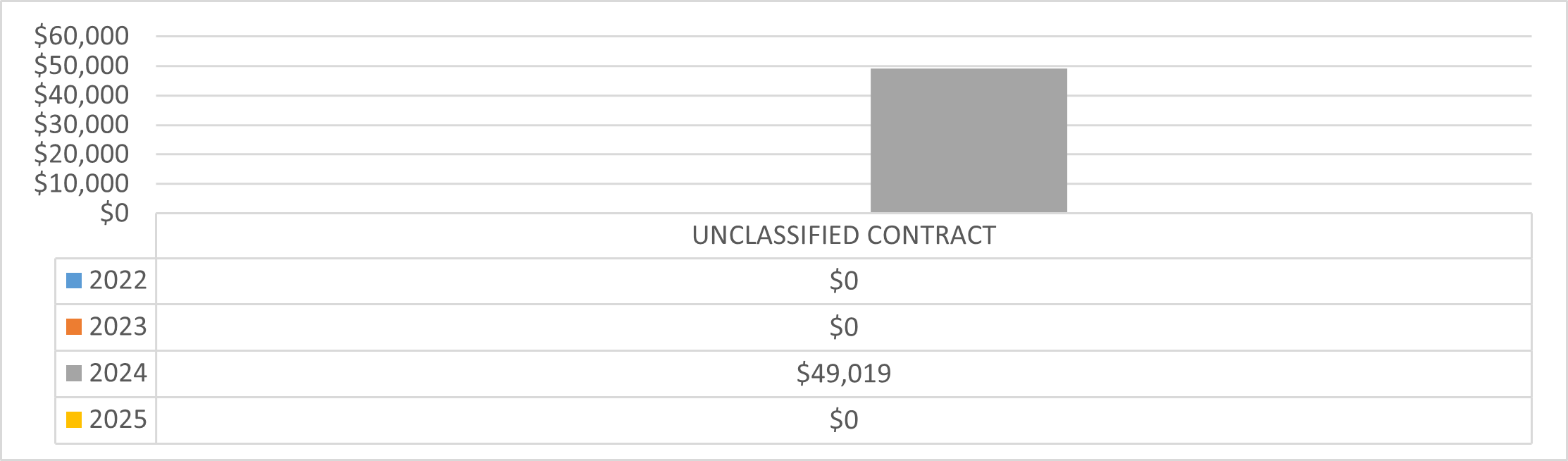

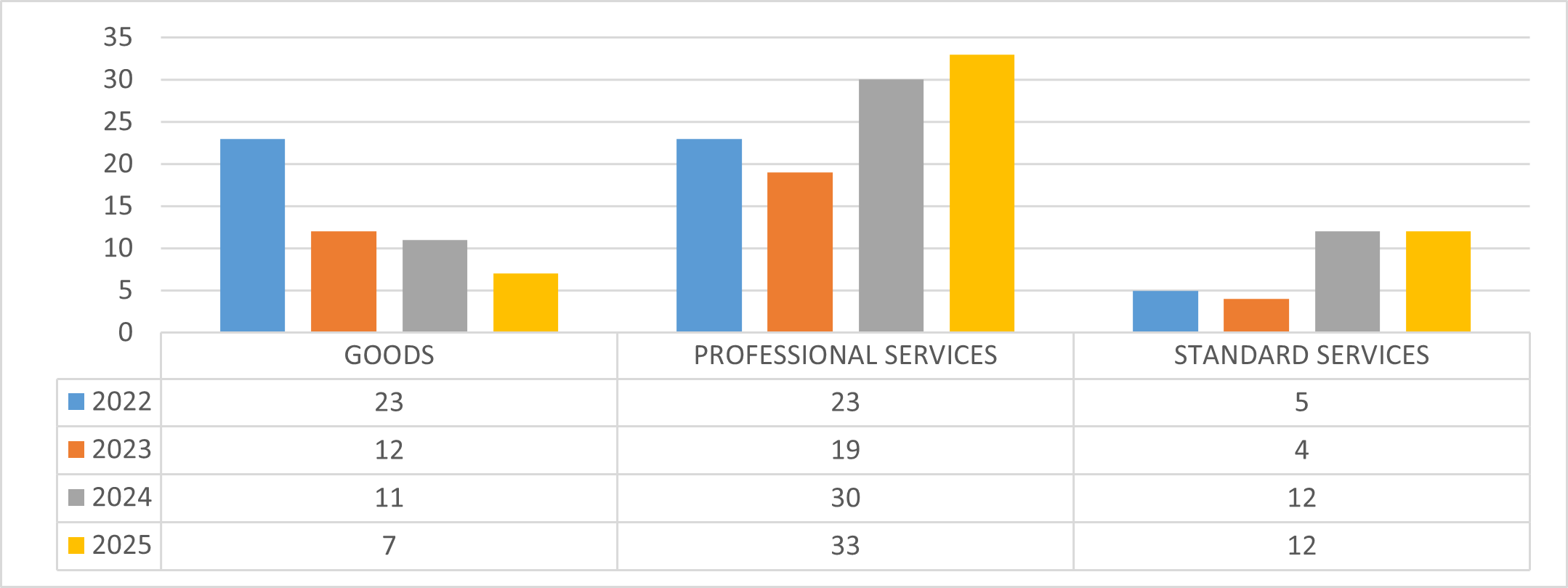

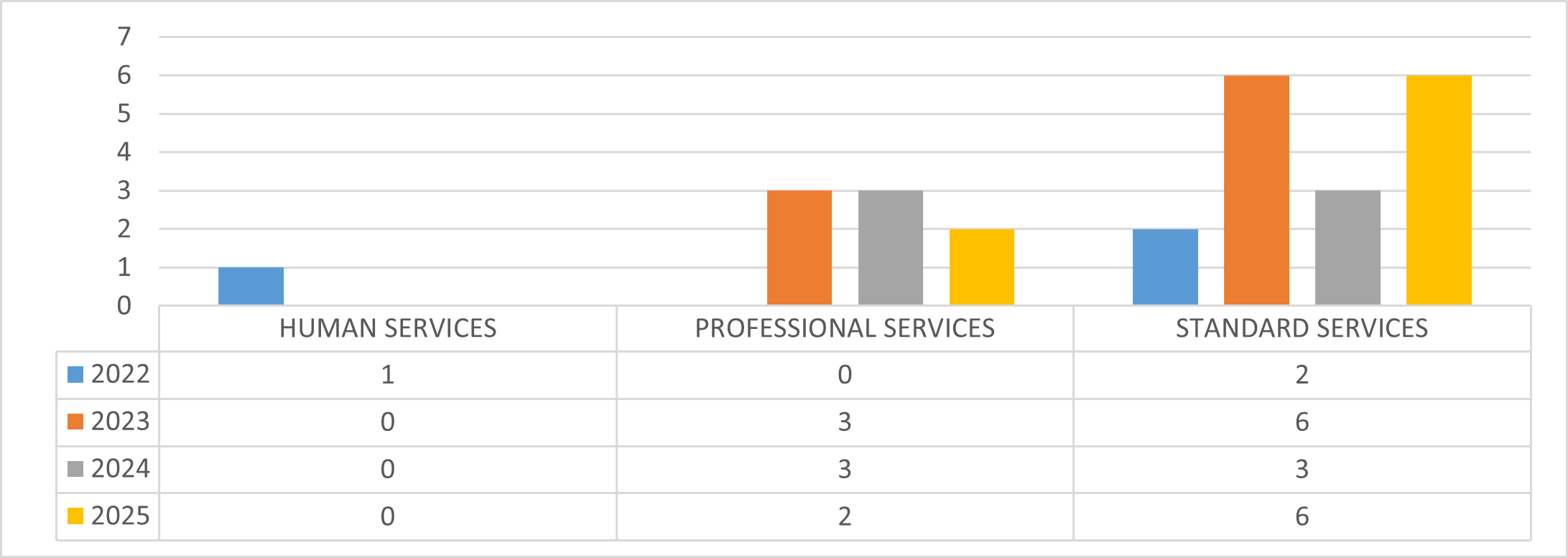

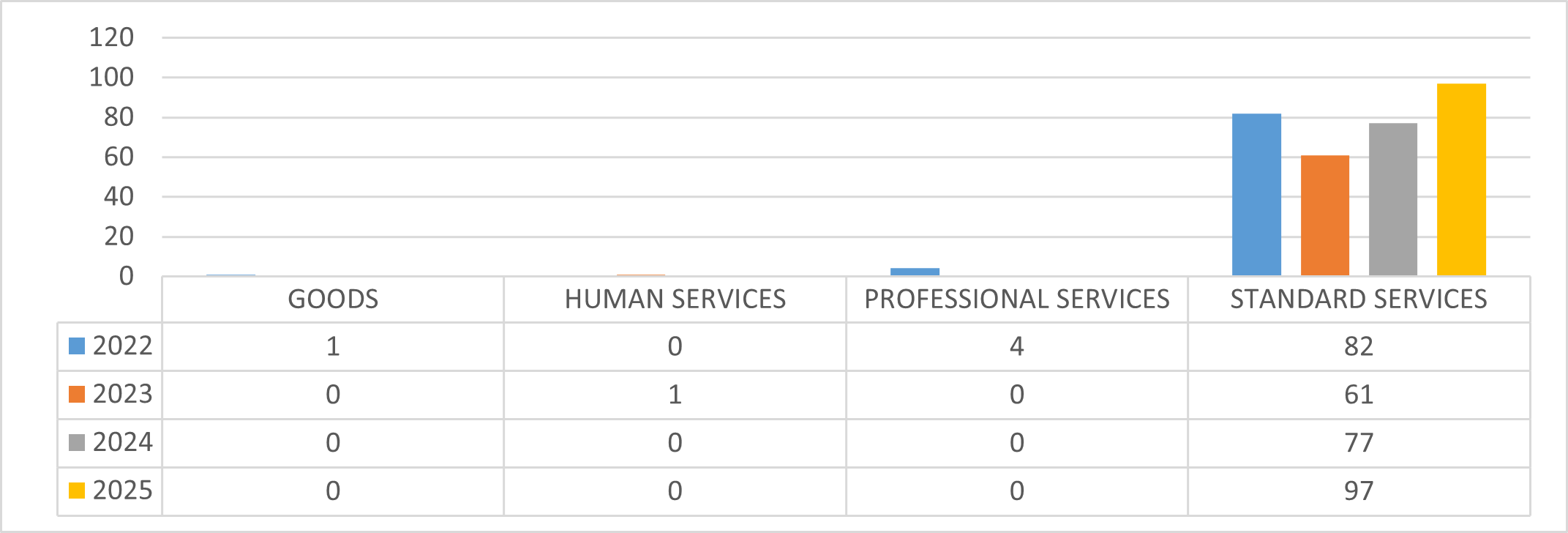

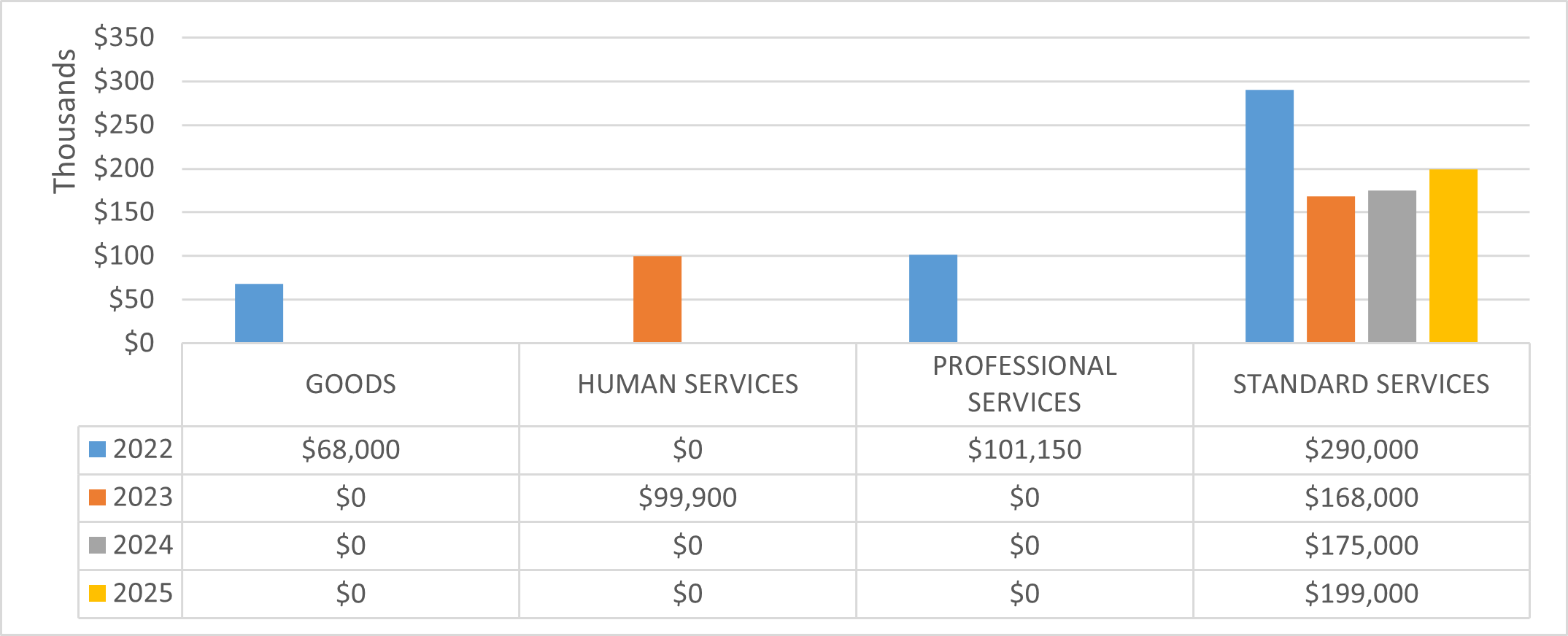

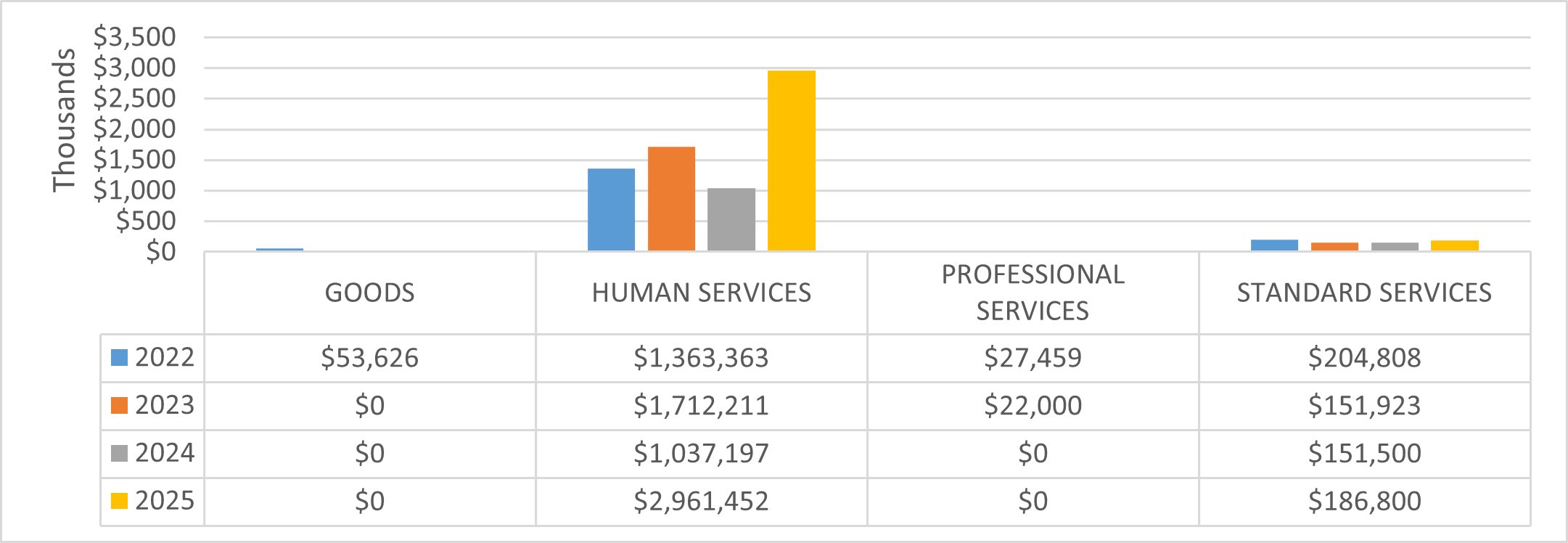

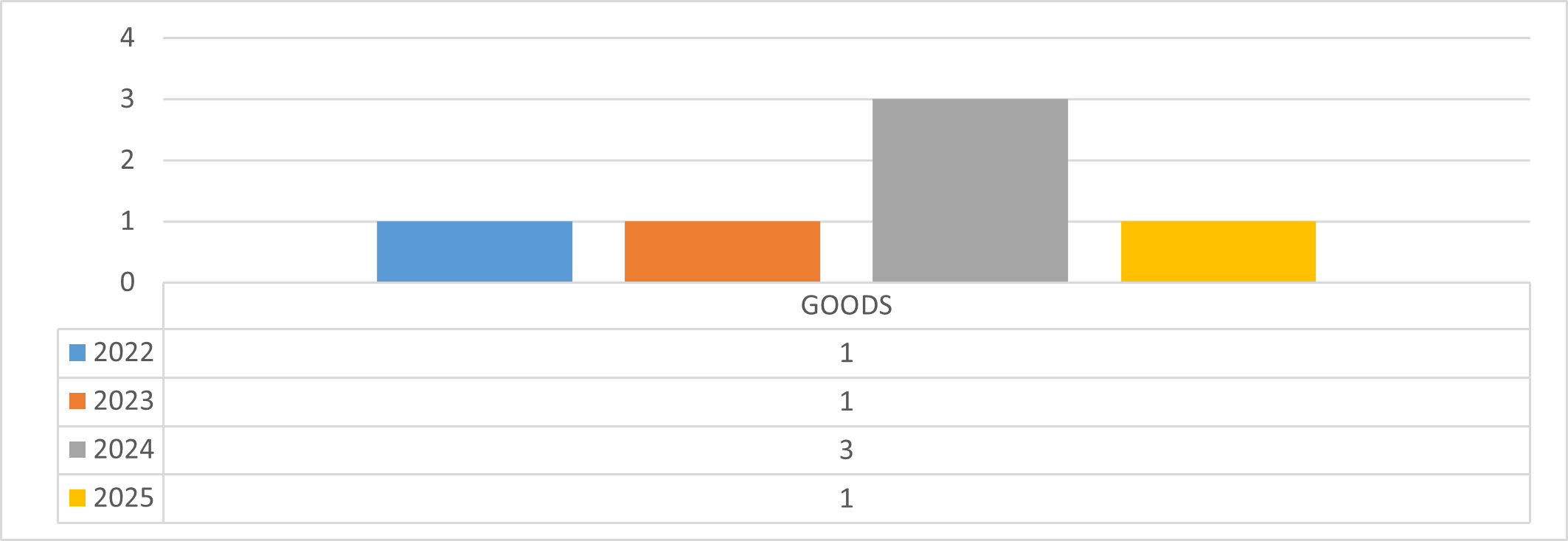

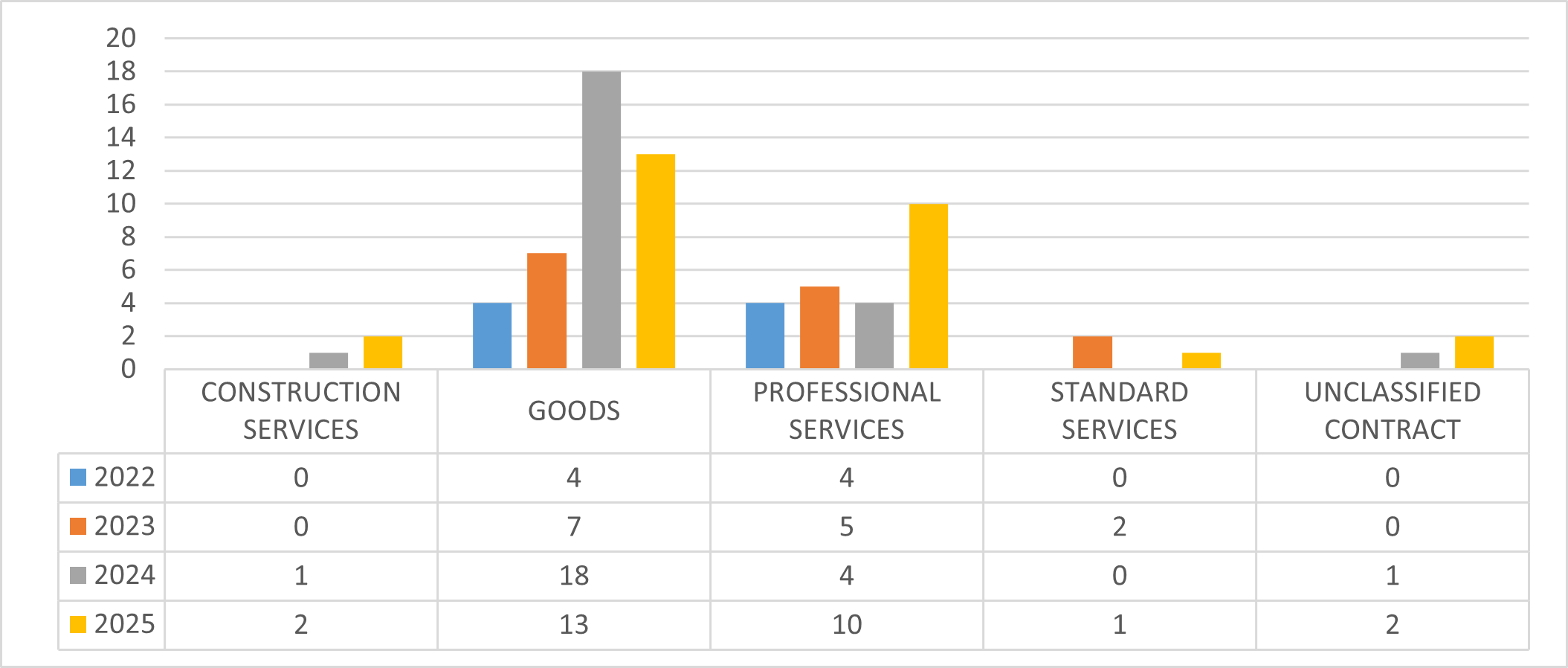

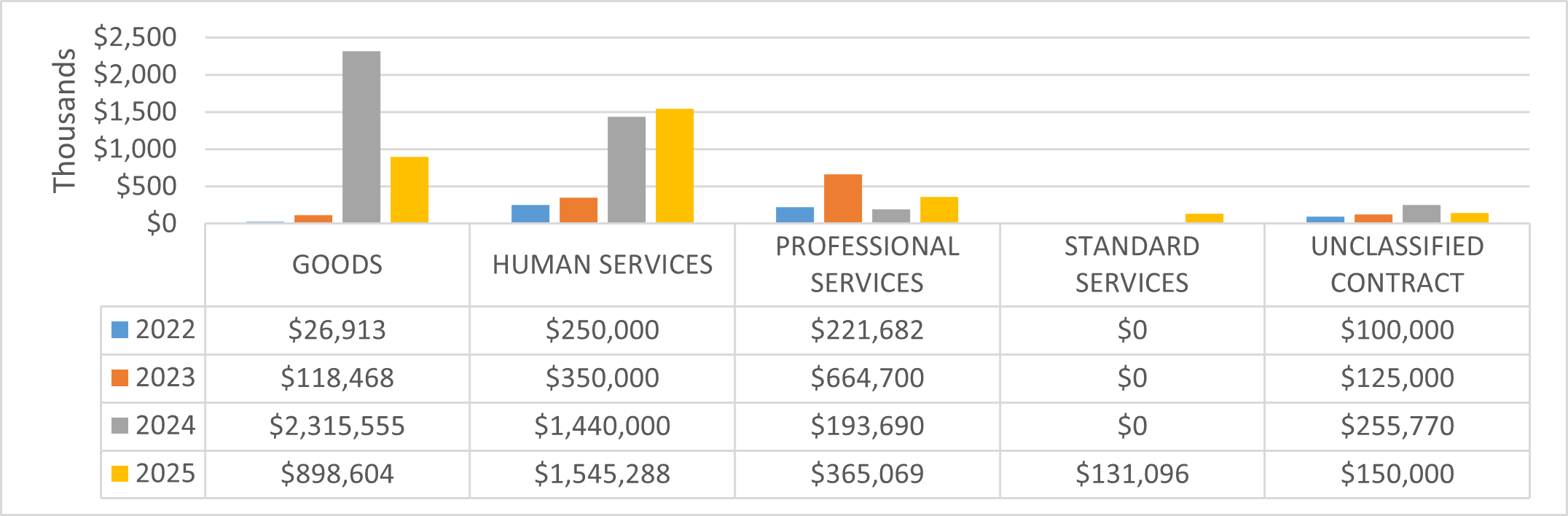

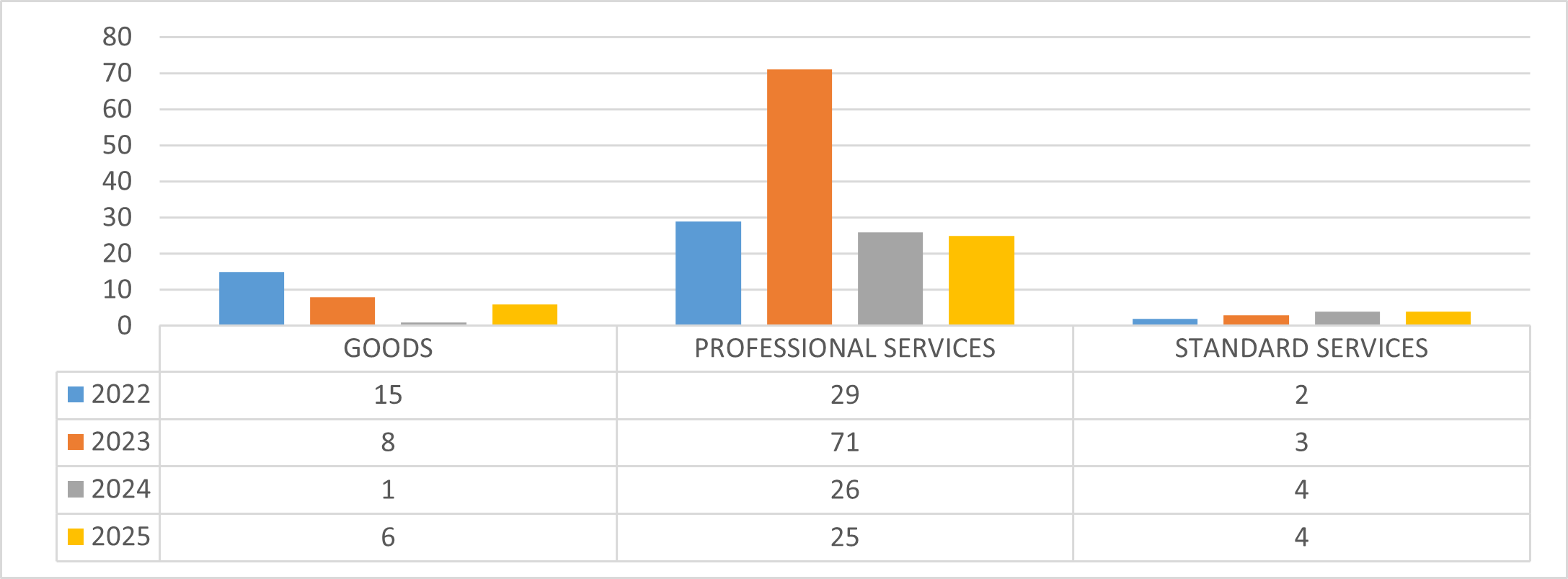

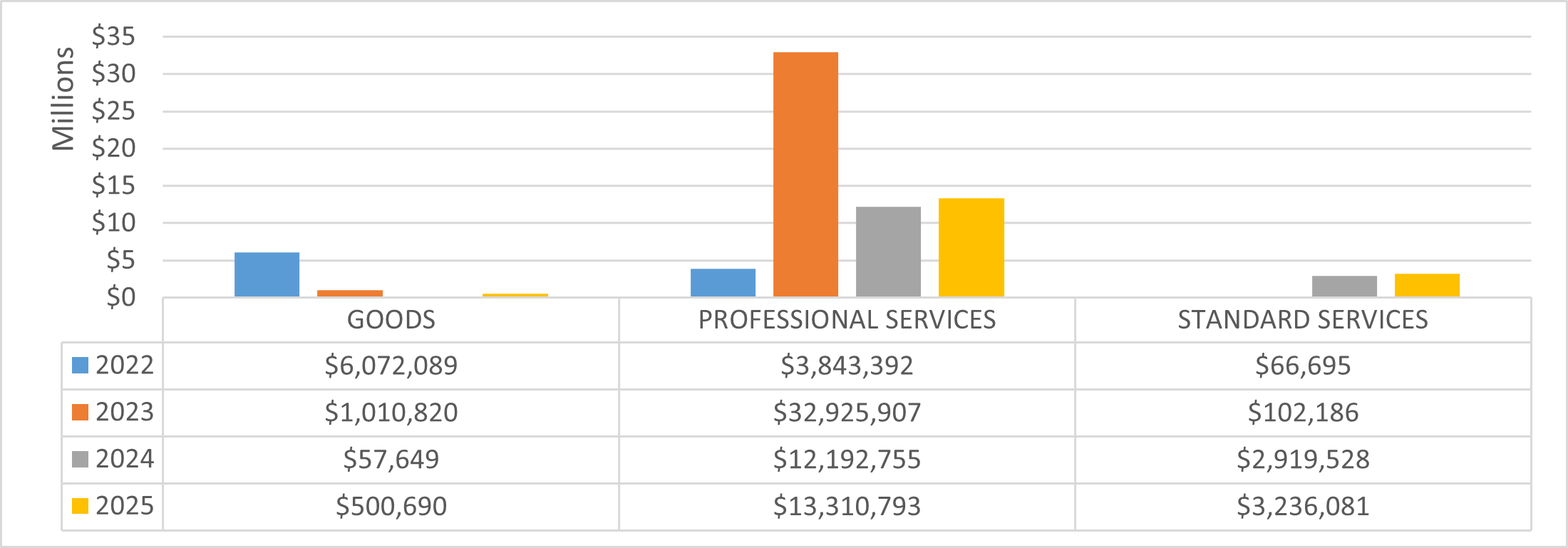

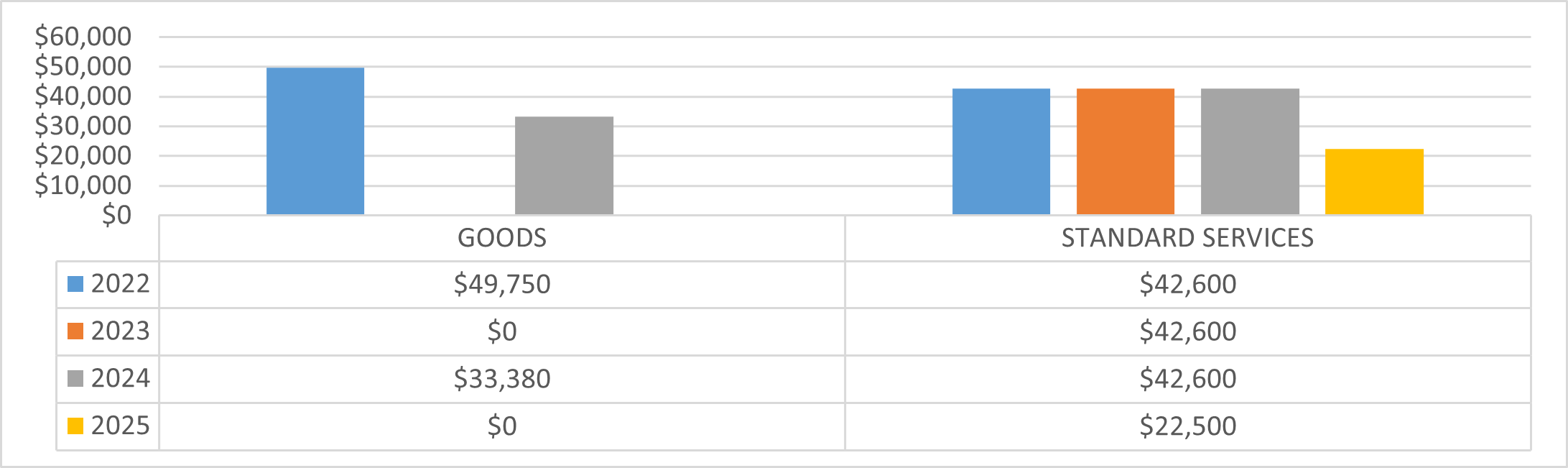

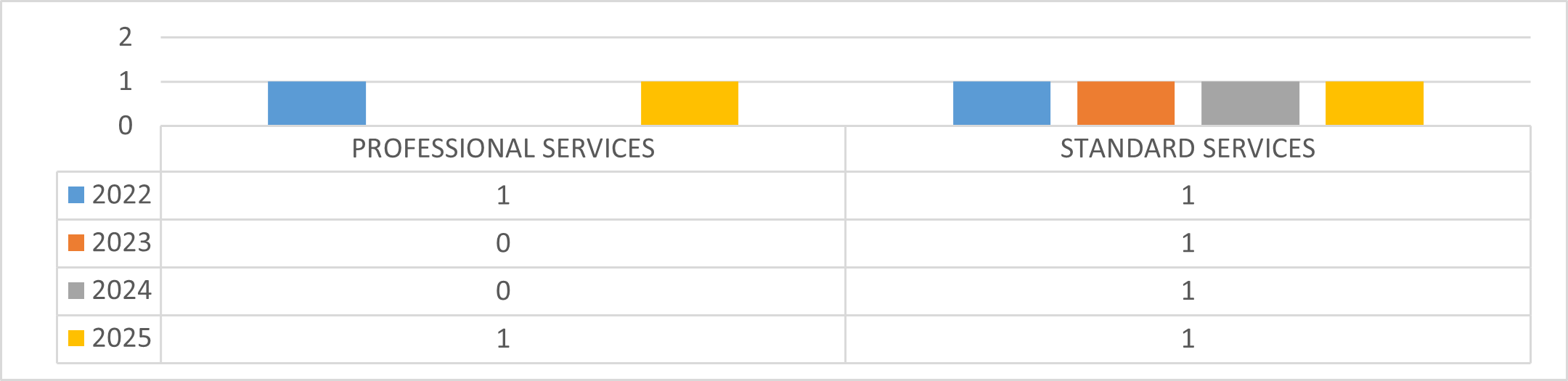

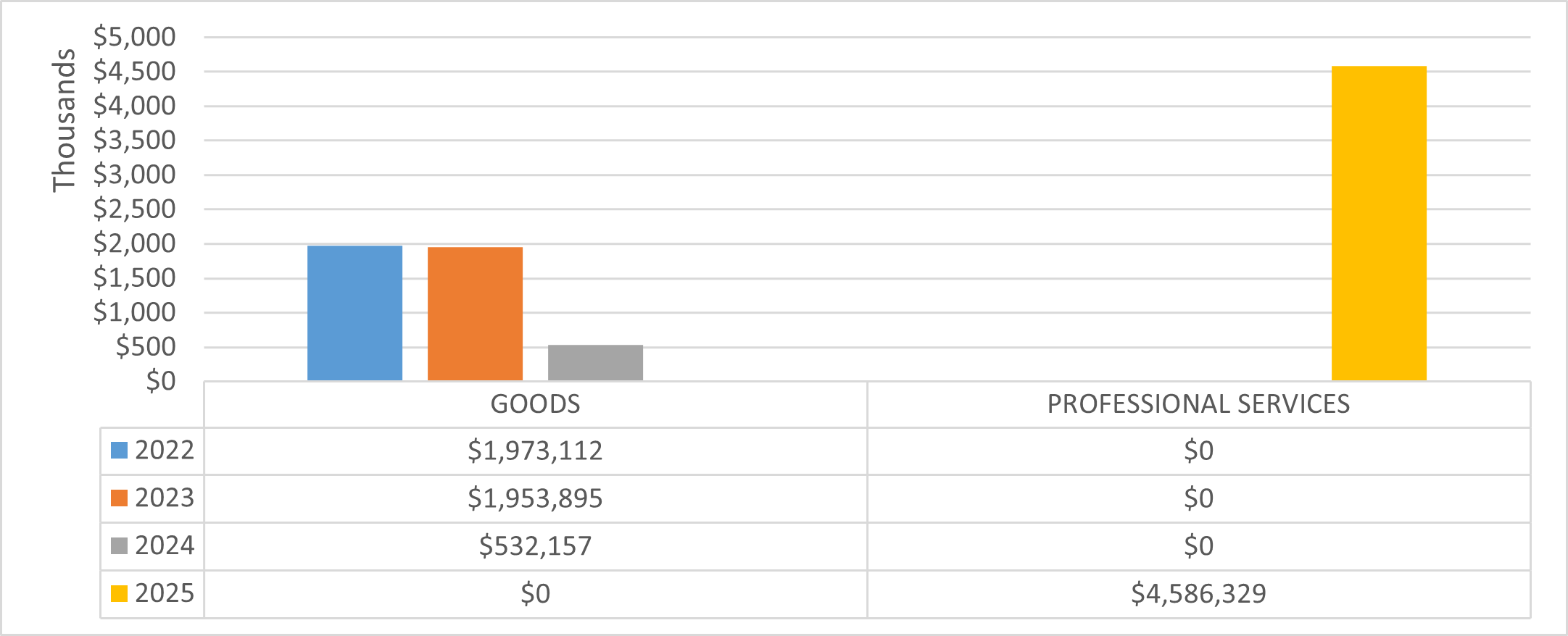

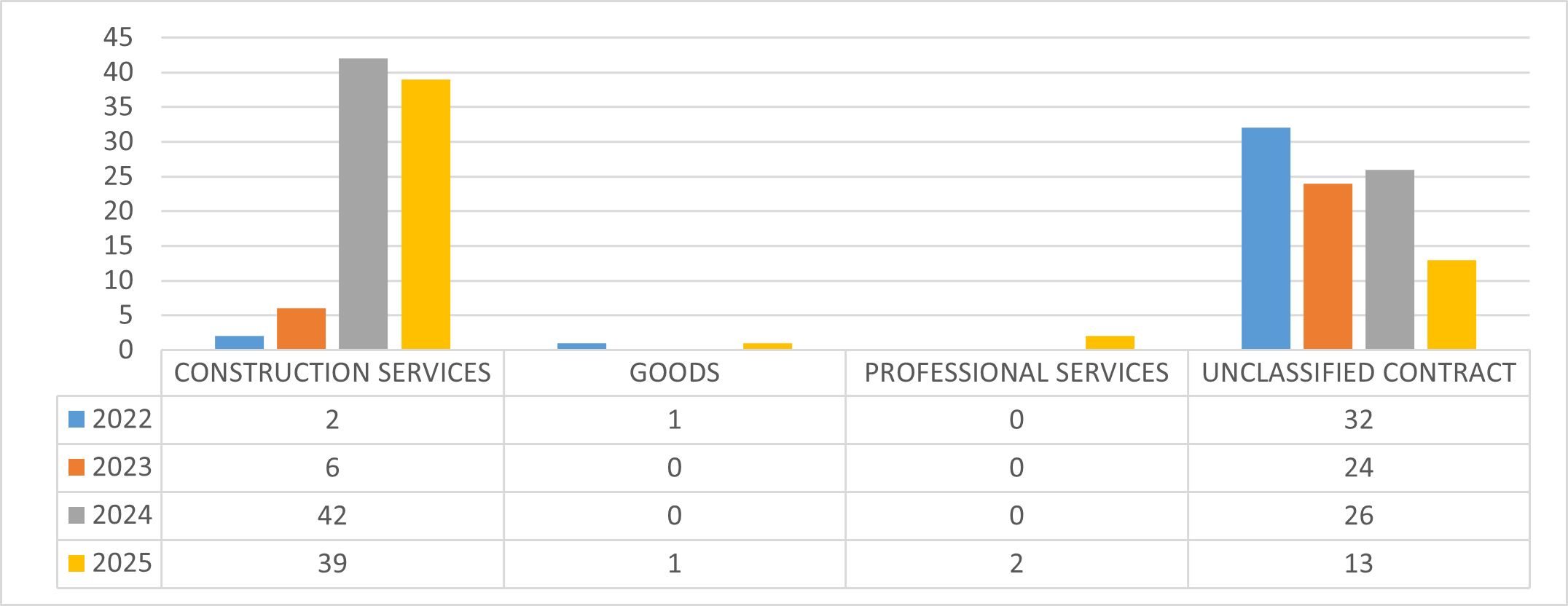

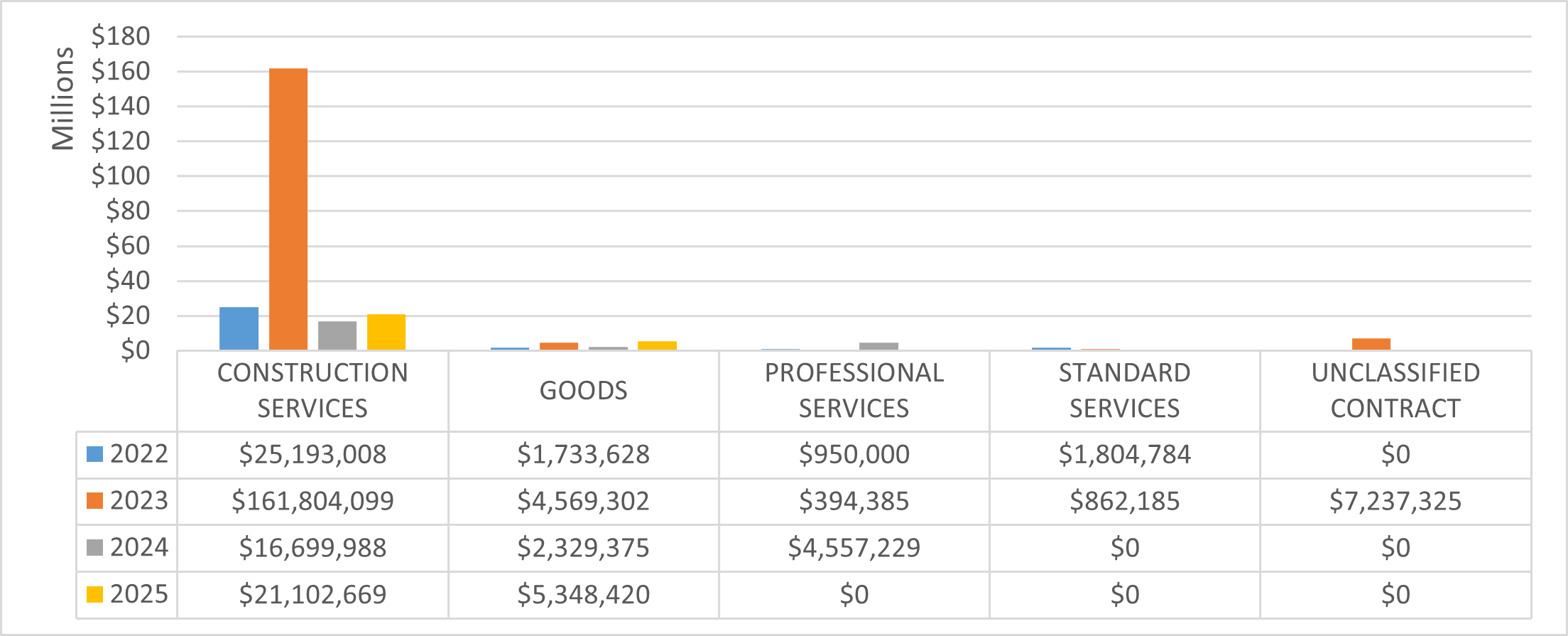

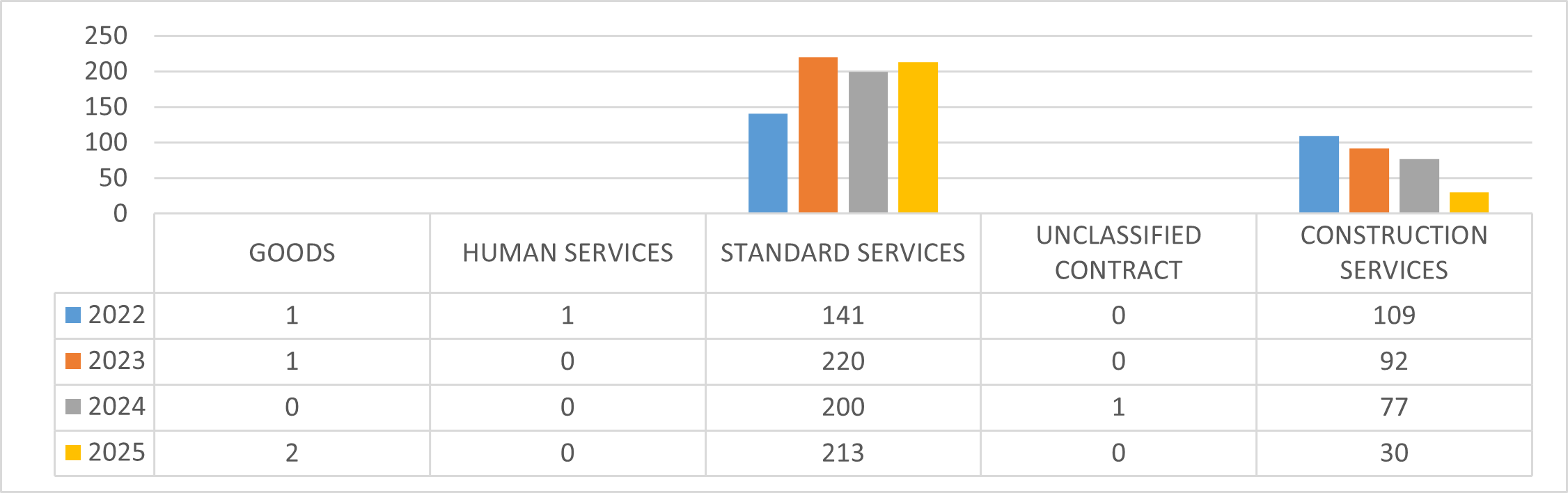

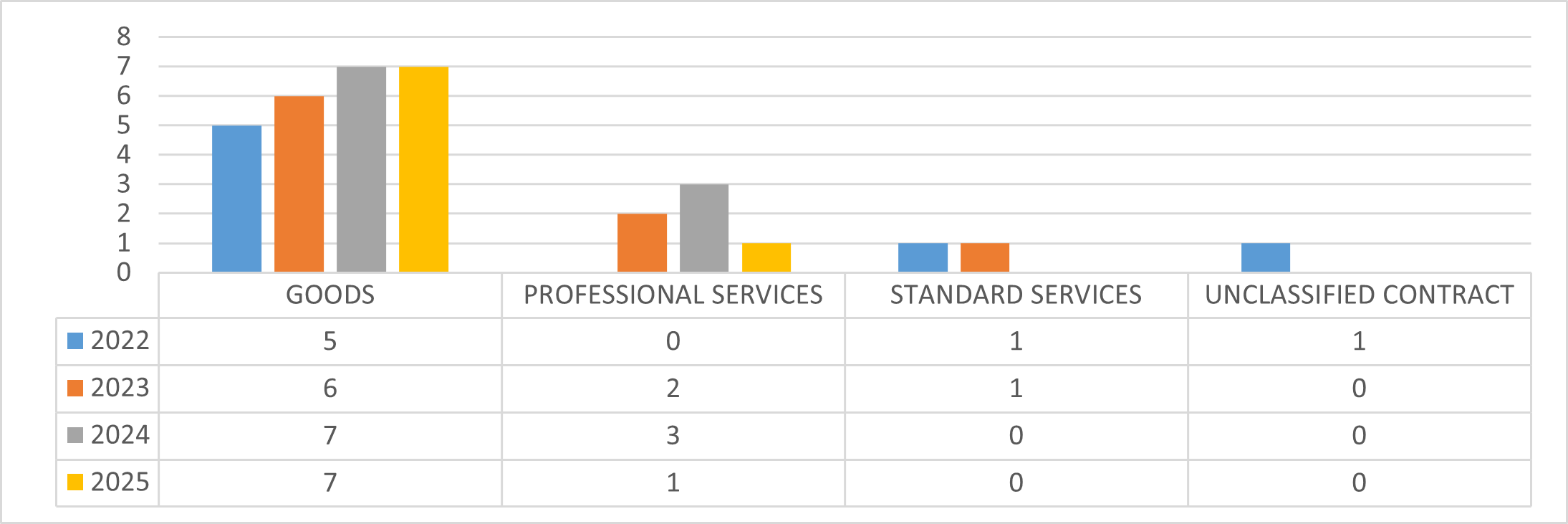

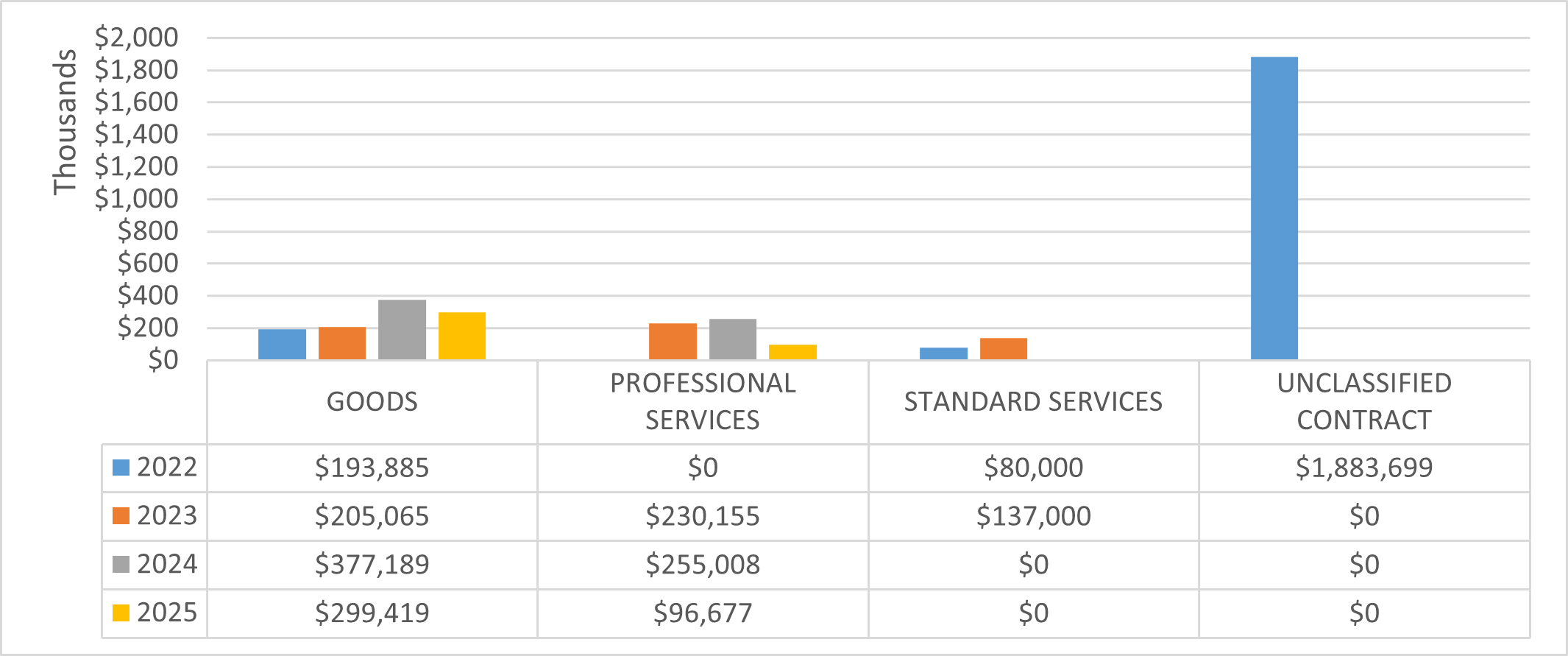

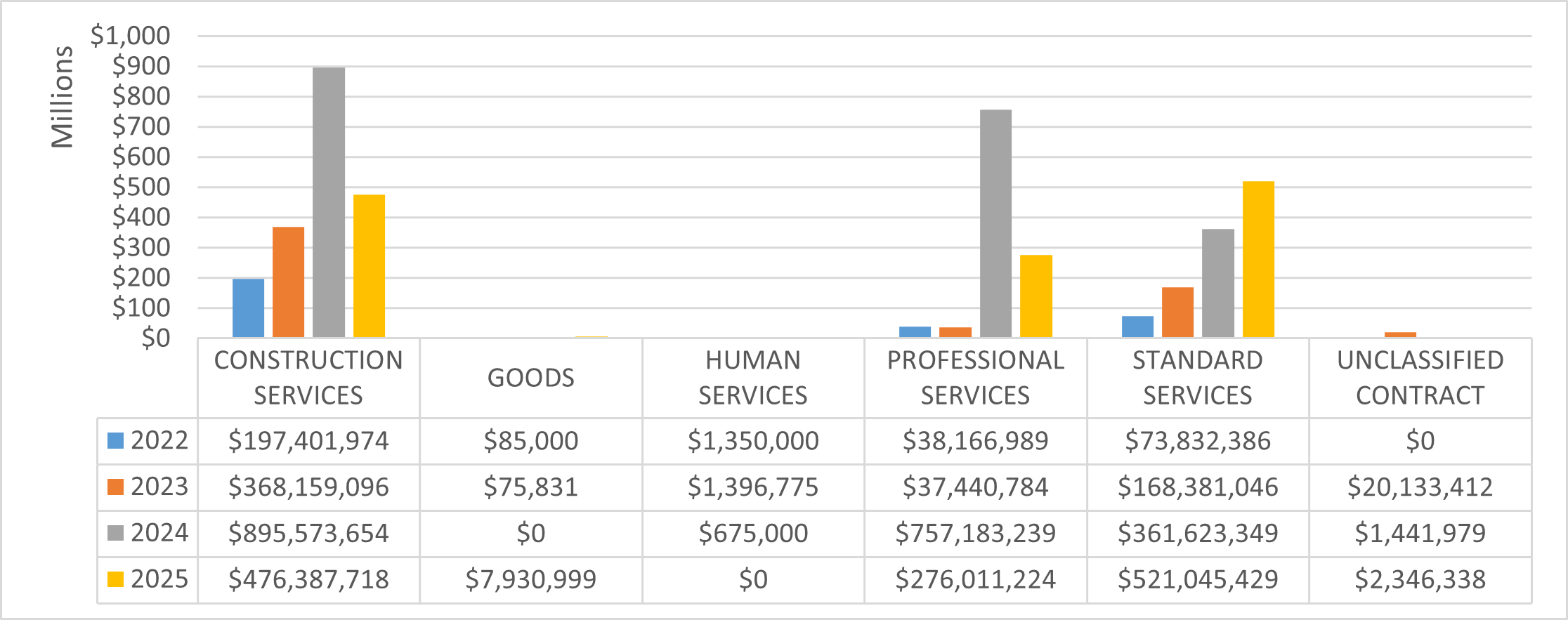

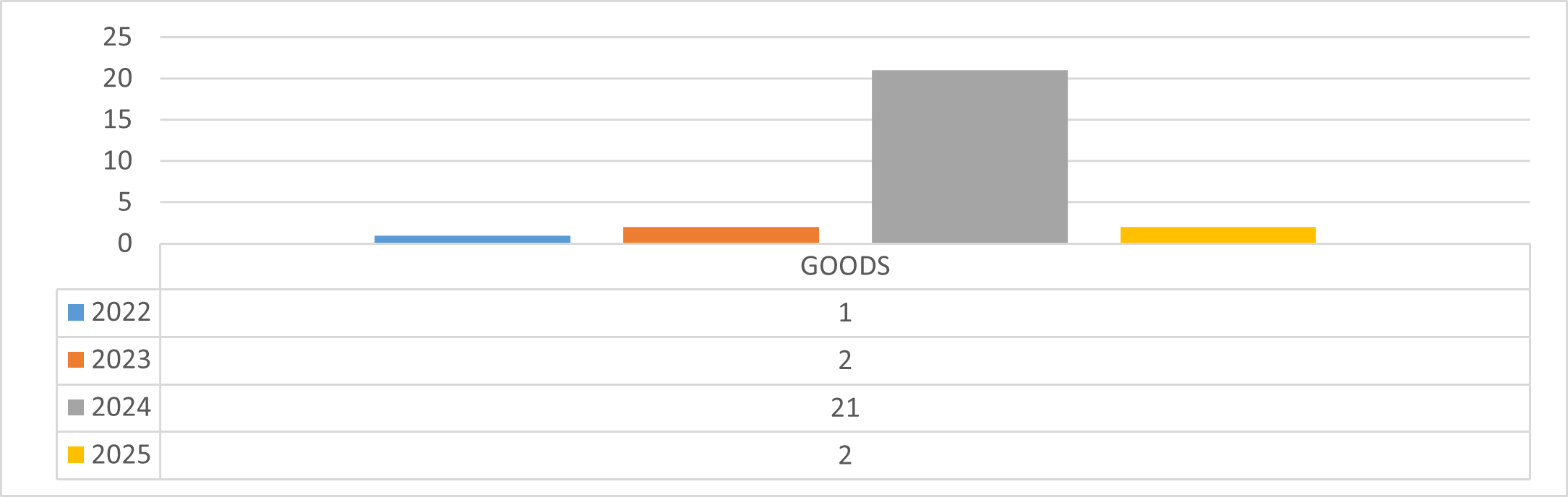

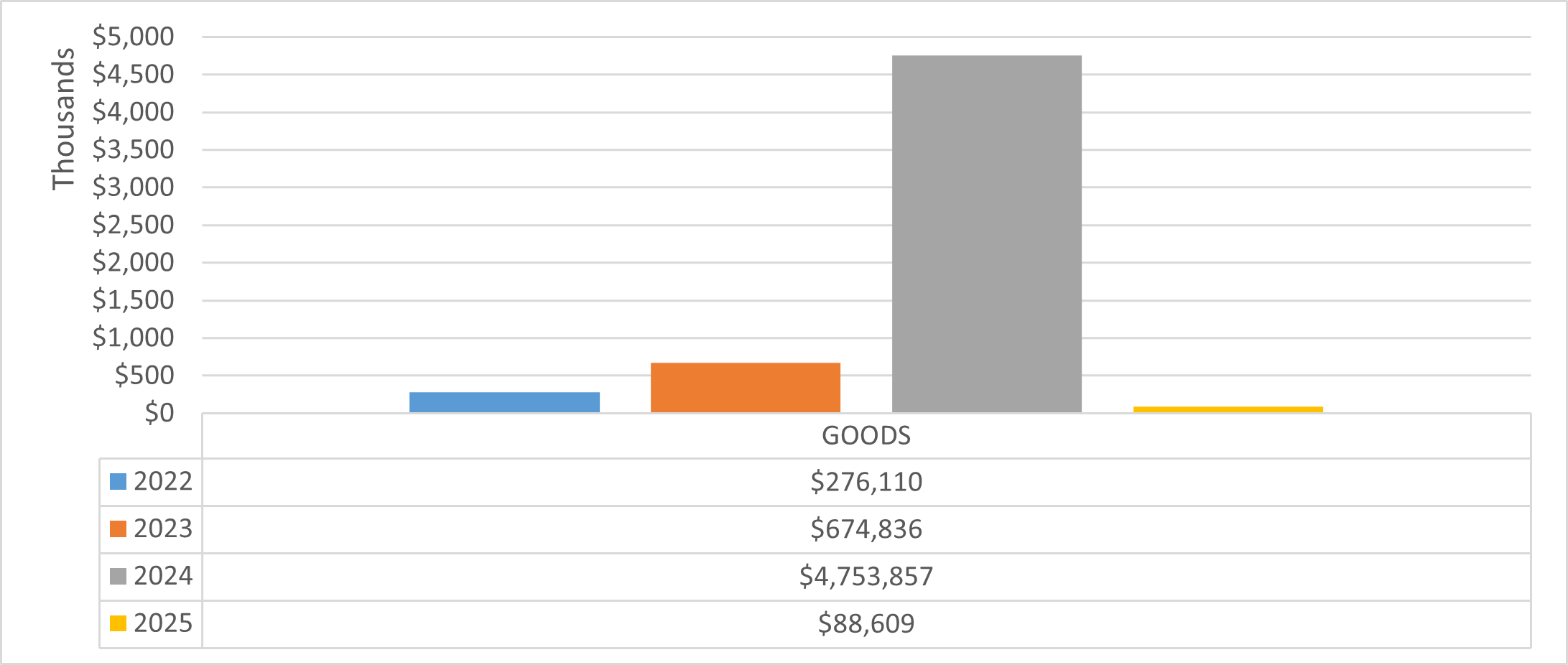

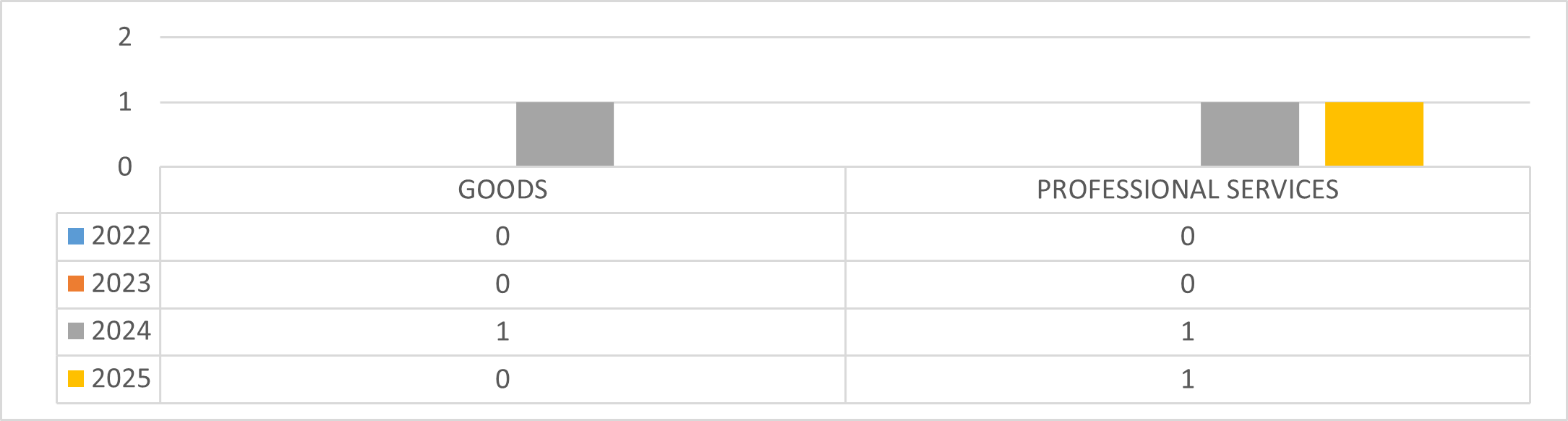

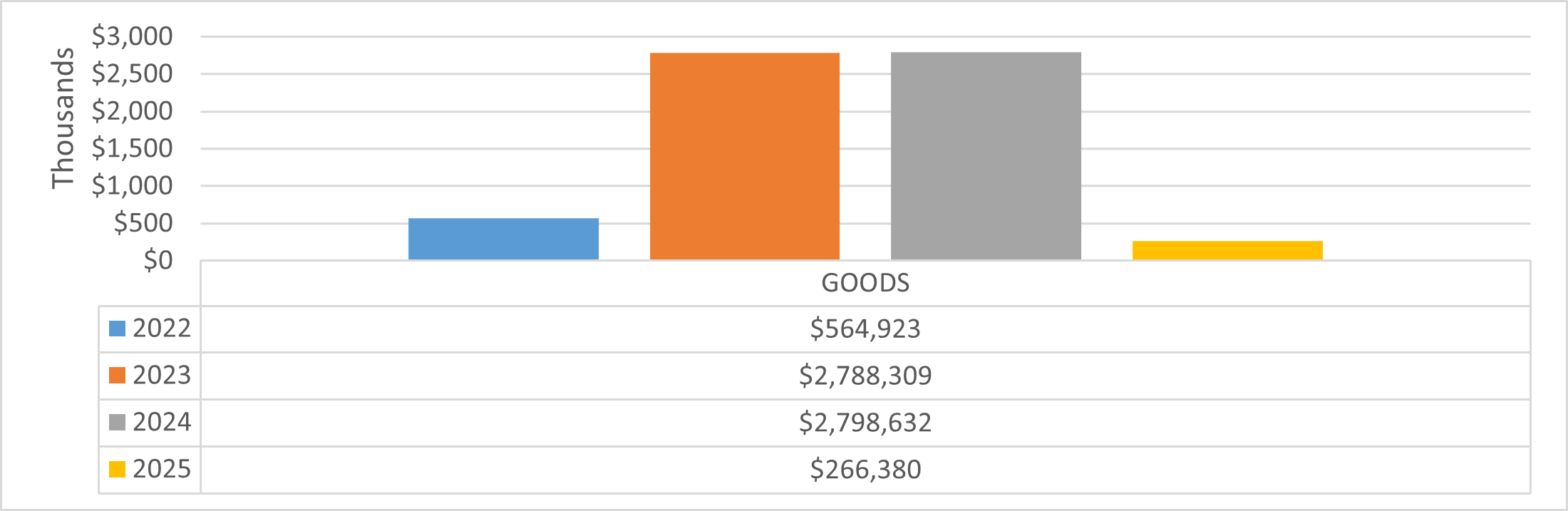

Chart 15 – ACS: FY22-FY25 Volume of Contracts by Industry

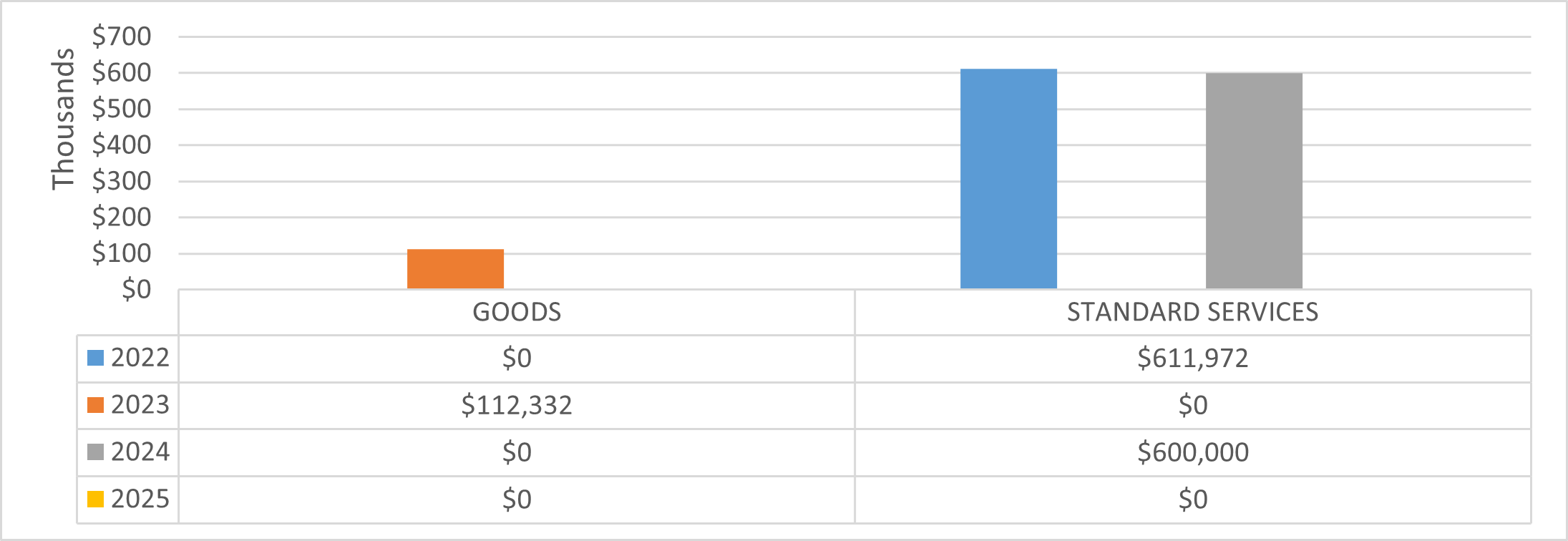

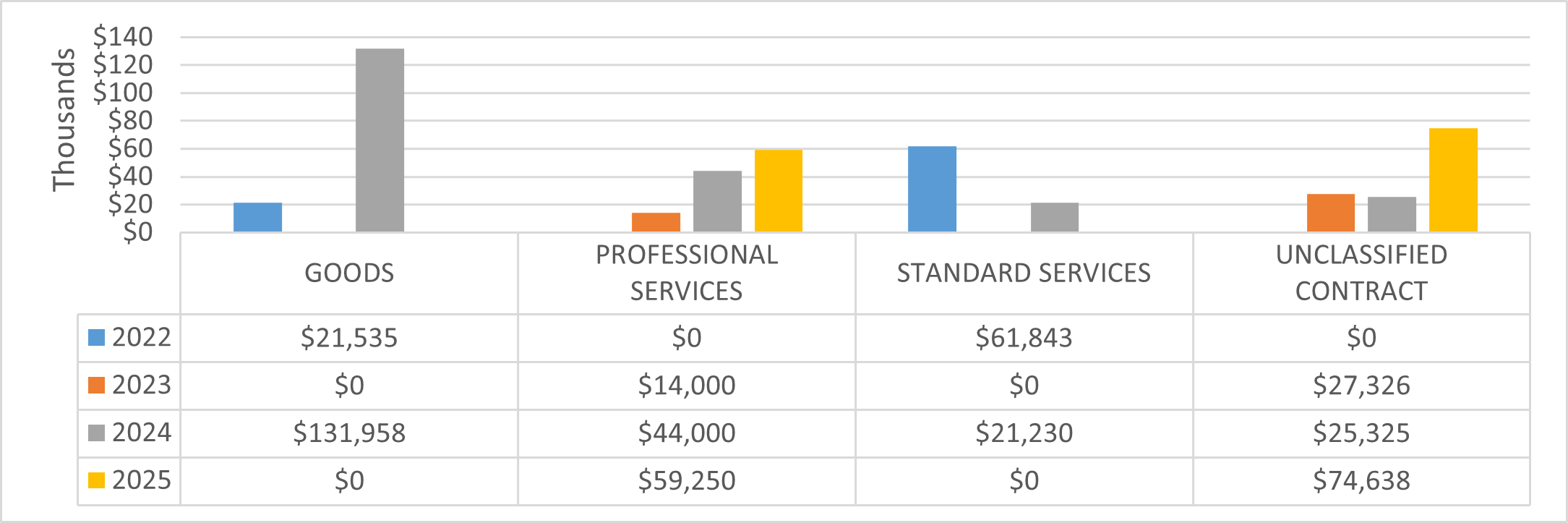

Chart 16 – ACS: FY22-FY25 Value of Contracts by Industry

Business Integrity Commission (BIC)

The Business Integrity Commission (BIC) is a law enforcement and regulatory agency charged with oversight of the private carting industry throughout the five boroughs, the city’s public wholesale markets and the shipboard gaming industry. BIC investigates applicants, issue licenses and registrations, conduct criminal and regulatory investigations, enforce applicable laws, and promulgates rules and regulations that govern the conduct of the businesses it oversees.

Table 35 – BIC: FY23-FY25 Registrations by Contract Category

| FY23 | FY24 | FY25 | ||||

|---|---|---|---|---|---|---|

| Contract Category | # of Contracts | Total Contract Value | # of Contracts | Total Contract Value | # of Contracts | Total Contract Value |

| Limited or Non-Competitive Method Contracts | 2 | $113,129 | 1 | $34,731 | 3 | $147,860 |

| Grand Total | 2 | $113,129 | 1 | $34,731 | 3 | $147,860 |

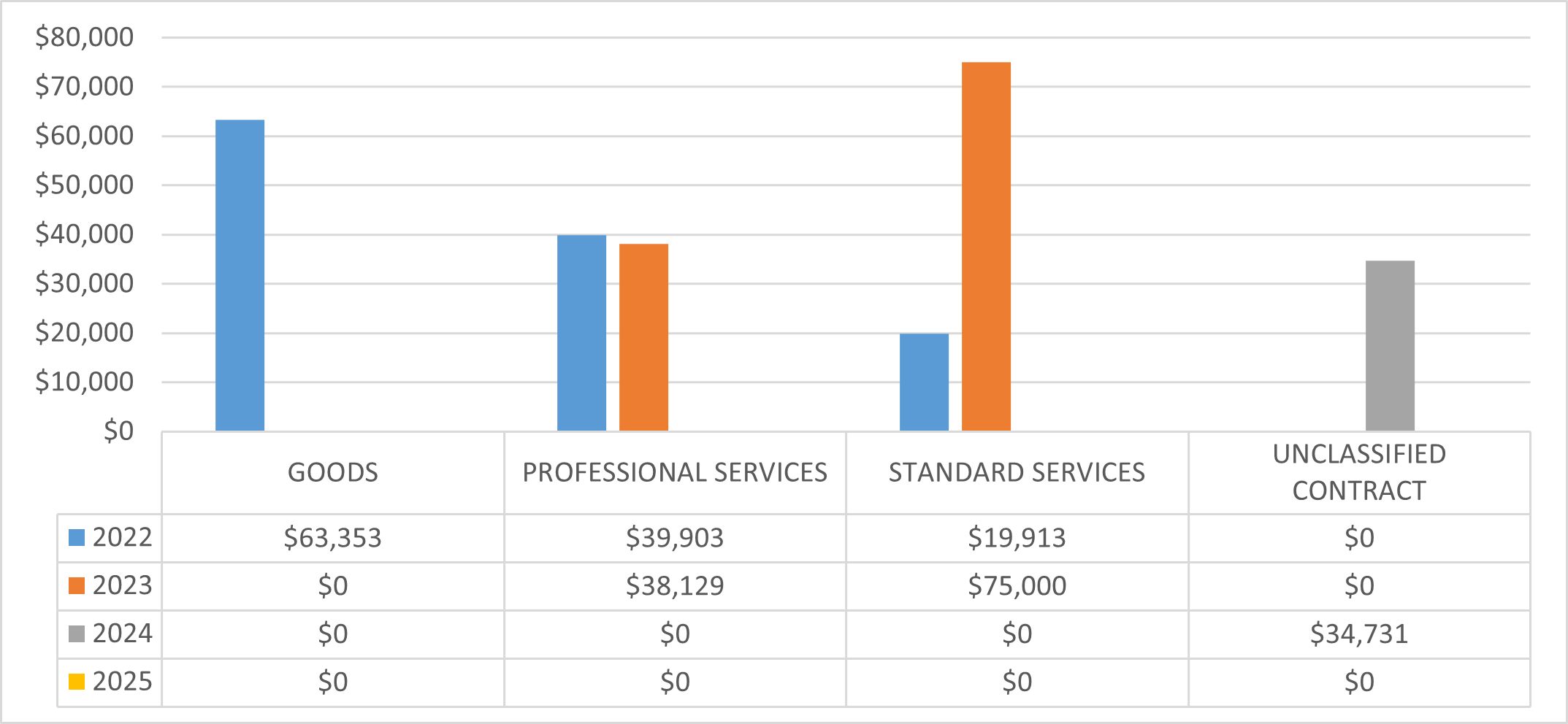

Chart 17– BIC: FY22-FY25 Volume of Contracts by Industry

Chart 18 – BIC: FY22-FY25 Value of Contracts by Industry

Commission on Human rights (CCHR)

The City Commission on Human Rights (CCHR) is responsible for enforcing the City’s Human Rights Law, which prohibits discrimination in employment, housing, and public accommodations among other areas. CCHR is also dedicated to educating the public about their rights and promoting positive community relations.

Table 36 – CCHR: FY23-FY25 Registrations by Contract Category

| FY23 | FY24 | FY25 | ||||

|---|---|---|---|---|---|---|

| Contract Category | # of Contracts | Total Contract Value | # of Contracts | Total Contract Value | # of Contracts | Total Contract Value |

| Limited or Non-Competitive Method Contracts | 3 | $223,848 | 1 | $41,750 | 2 | $184,071 |

| Supplemental Contracts | 1 | $1,568,138 | 1 | $105,086 | 0 | $0 |

| Transactions Not Subject to PPB Rules | 1 | $25,755 | 1 | $28,355 | 0 | $0 |

| Grand Total | 5 | $1,817,741 | 3 | $175,191 | 2 | $184,071 |

Chart 19 – CCHR: FY22-FY25 Volume of Contracts by Industry

Chart 20 – CCHR: FY22-FY25 Value of Contracts by Industry

Civilian Complaint Review Board (CCRB)

The Civilian Complaint Review Board (CCRB) is charged with investigating and mediating complaints filed by members of the public against New York City police officers involving the use of force, abuse of authority, discourtesy, or offensive language. CCRB consists of 13 members appointed by the Mayor, the City Council, and the Police Commissioner. It is the largest police oversight agency in the United States.

Table 37 – CCRB: FY23-FY25 Registrations by Contract Category

| FY23 | FY24 | FY25 | ||||

|---|---|---|---|---|---|---|

| Contract Category | # of Contracts | Total Contract Value | # of Contracts | Total Contract Value | # of Contracts | Total Contract Value |

| Limited or Non-Competitive Method Contracts | 14 | $498,620 | 12 | $558,905 | 4 | $269,367 |

| Transactions Not Subject to PPB Rules | 0 | $0 | 2 | $110,000 | 0 | $0 |

| Grand Total | 14 | $498,620 | 14 | $668,905 | 4 | $269,367 |

Chart 21 – CCRB: FY22-FY25 Volume of Contracts by Industry

Chart 22– CCRB: FY22-FY25 Value of Contracts by Industry

Department of Citywide Administrative Services (DCAS)

The Department of Citywide Administrative Services (DCAS) is responsible for supporting City agencies in hiring and training City employees, leasing and managing facilities, workforce recruitment, inspection and distribution of supplies and equipment, and implementation of energy conservation programs throughout City-owned facilities. Additionally, the DCAS Division of Municipal Supply Service operates as a centralized procurement office for New York City’s agencies for goods and services. Its mission is to provide high-quality, cost-effective goods and services that support the long-term strategic and environmental goals of the City.

Table 38 – DCAS: FY23-FY25 Registrations by Contract Category

| FY23 | FY24 | FY25 | ||||

|---|---|---|---|---|---|---|

| Contract Category | # of Contracts | Total Contract Value | # of Contracts | Total Contract Value | # of Contracts | Total Contract Value |

| Competitive Method Contracts | 179 | $1,188,084,568 | 241 | $834,488,117 | 133 | $672,429,436 |

| Limited or Non-Competitive Method Contracts | 183 | $618,503,810 | 173 | $104,187,496 | 217 | $211,343,306 |

| Supplemental Contracts | 63 | $302,801,094 | 22 | $76,971,564 | 28 | $245,229,935 |

| Transactions Not Subject to PPB Rules | 196 | $374,518,681 | 50 | $19,465,808 | 72 | $745,591,631 |

| Grand Total | 621 | $2,483,908,152 | 486 | $1,035,112,986 | 450 | $1,874,594,308 |

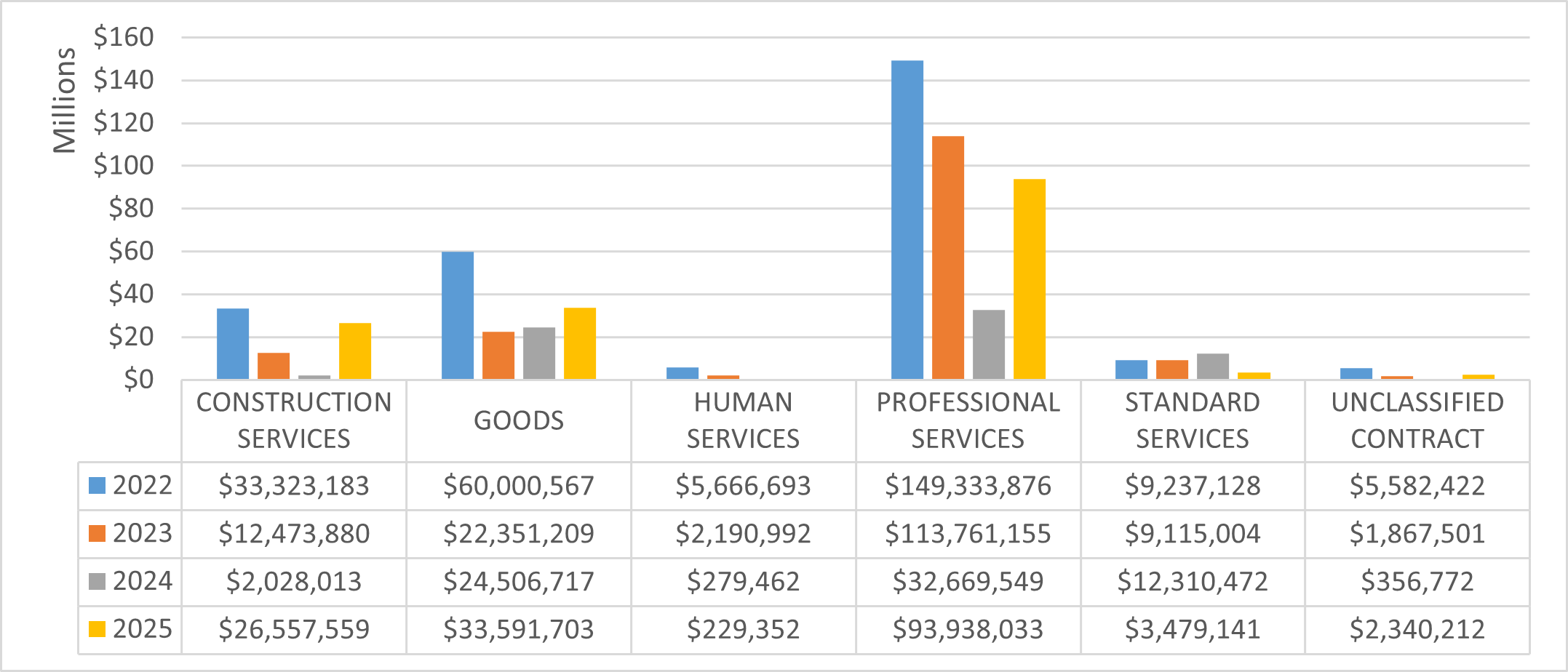

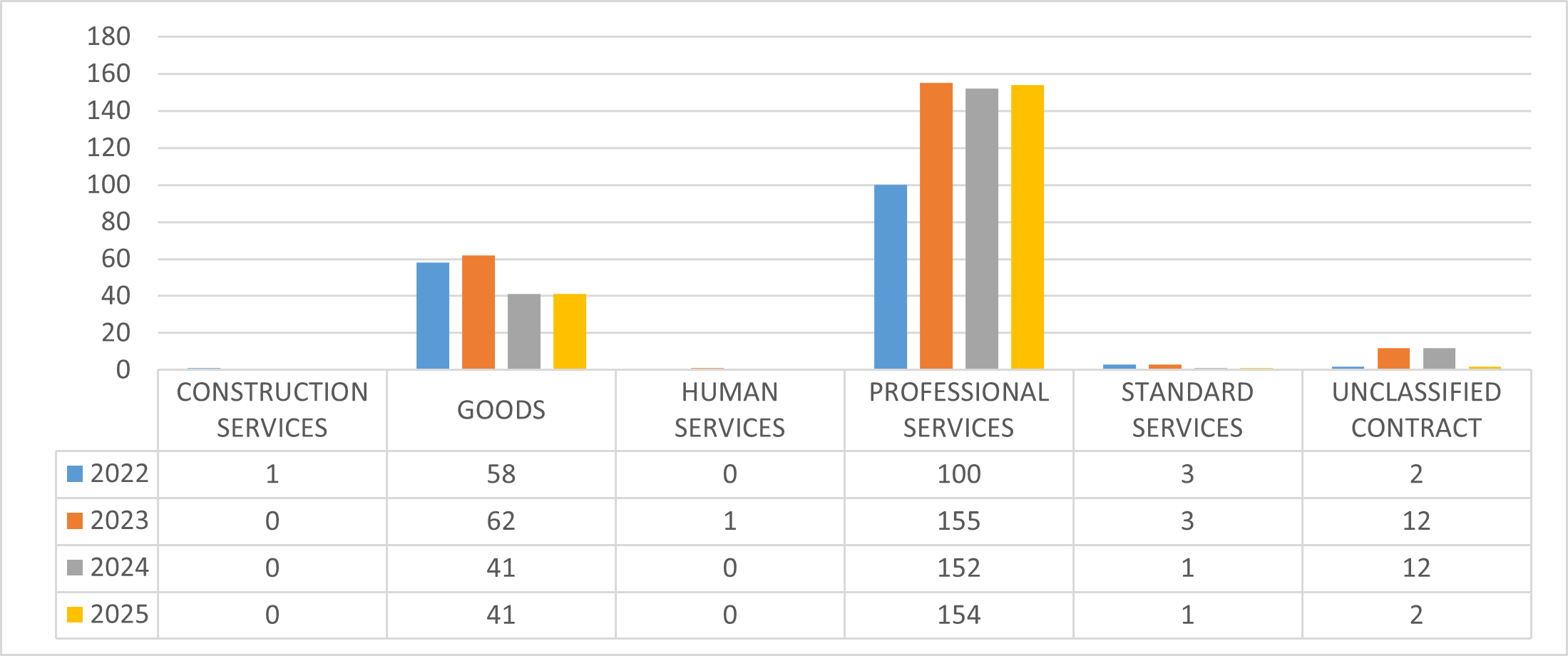

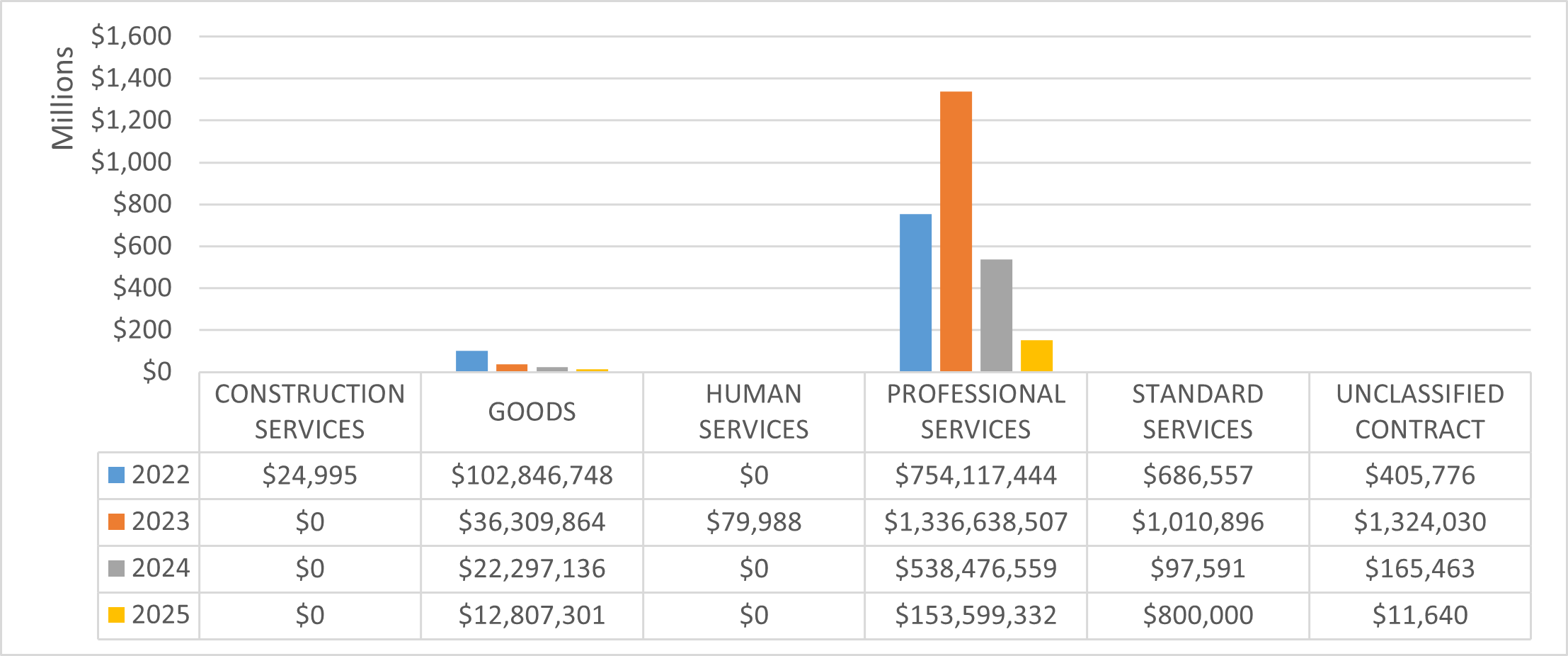

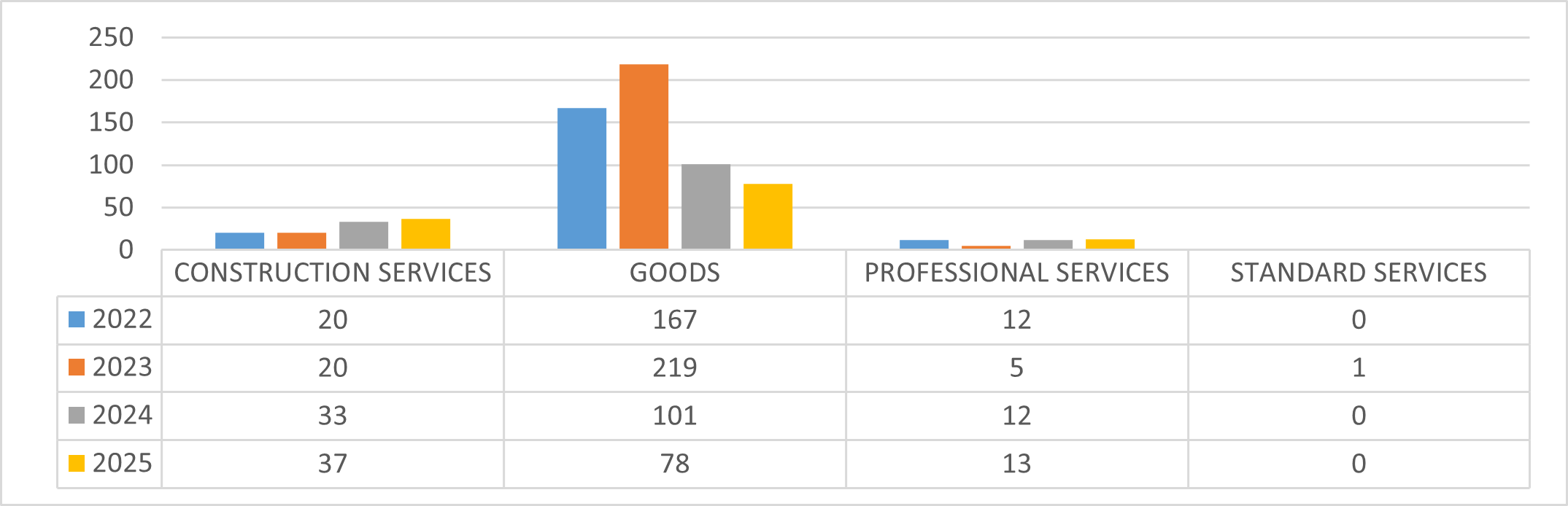

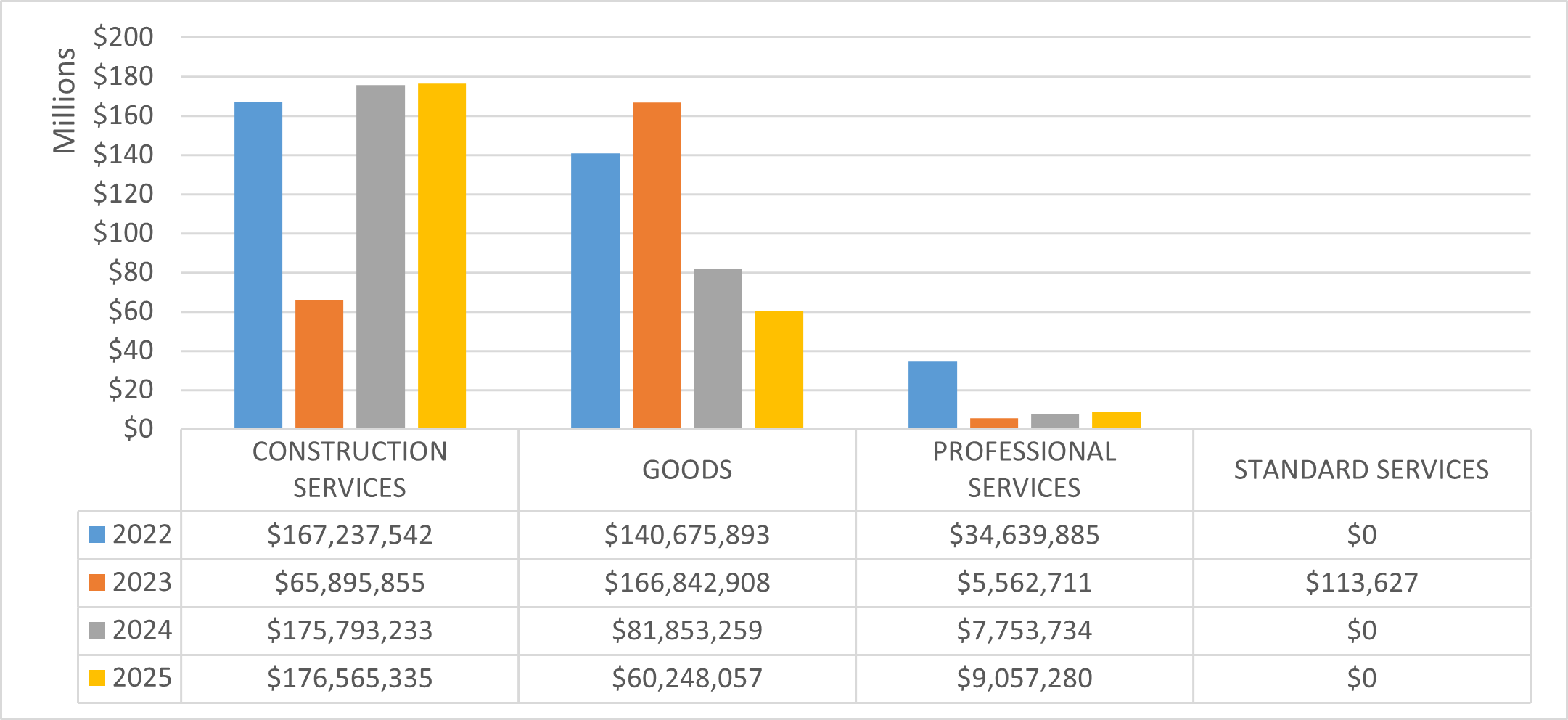

Chart 23– DCAS: FY22-FY25 Volume of Contracts by Industry

Chart 24 – DCAS: FY22-FY25 Value of Contracts by Industry

Department of Cultural Affairs (DCLA)

The New York City Department of Cultural Affairs is dedicated to supporting and strengthening New York City’s vibrant cultural life. DCLA provides public funding for nonprofit cultural organizations throughout the five boroughs and provides advocacy around matters relating to the City’s cultural institutions. The agency represents and serves nonprofit cultural organizations involved in the visual, literary and performing arts; public-oriented science and humanities institutions including zoos, botanical gardens and historic and preservation societies; and creative artists in all disciplines who live and work within the City’s five boroughs. DCLA also provides donated materials for arts programs offered by the public schools, cultural, social service groups, and commissions works of public art at City funded construction projects throughout the City.

Table 39 – DCLA: FY23-FY25 Registrations by Contract Category

| FY23 | FY24 | FY25 | ||||

|---|---|---|---|---|---|---|

| Contract Category | # of Contracts | Total Contract Value | # of Contracts | Total Contract Value | # of Contracts | Total Contract Value |

| Limited or Non-Competitive Method Contracts | 15 | $3,989,068 | 10 | $4,549,542 | 10 | $5,103,483 |

| Supplemental Contracts | 1 | $4,301,809 | 0 | $0 | 0 | $0 |

| Grand Total | 16 | $8,290,877 | 10 | $4,549,542 | 10 | $5,103,483 |

Chart 25 – DCLA: FY22-FY25 Volume of Contracts by Industry

Chart 26 – DCLA: FY22-FY25 Value of Contracts by Industry

Department of City Planning (DCP)