Please be advised that a new section 220-j in Article 8 of the NYS Labor Law will require contractors and subcontractors to submit electronic certified payroll reports for public work contracts.

In accordance with this new section, the City is developing a publicly accessible online database of electronic certified payroll reports. All certified payroll reports for contracts bid for on or after December 31, 2025, will be required to be submitted electronically through this system.

For more information, please see: https://www.nyc.gov/site/communityhiring/resources/online-database-for-certified-payroll.page.

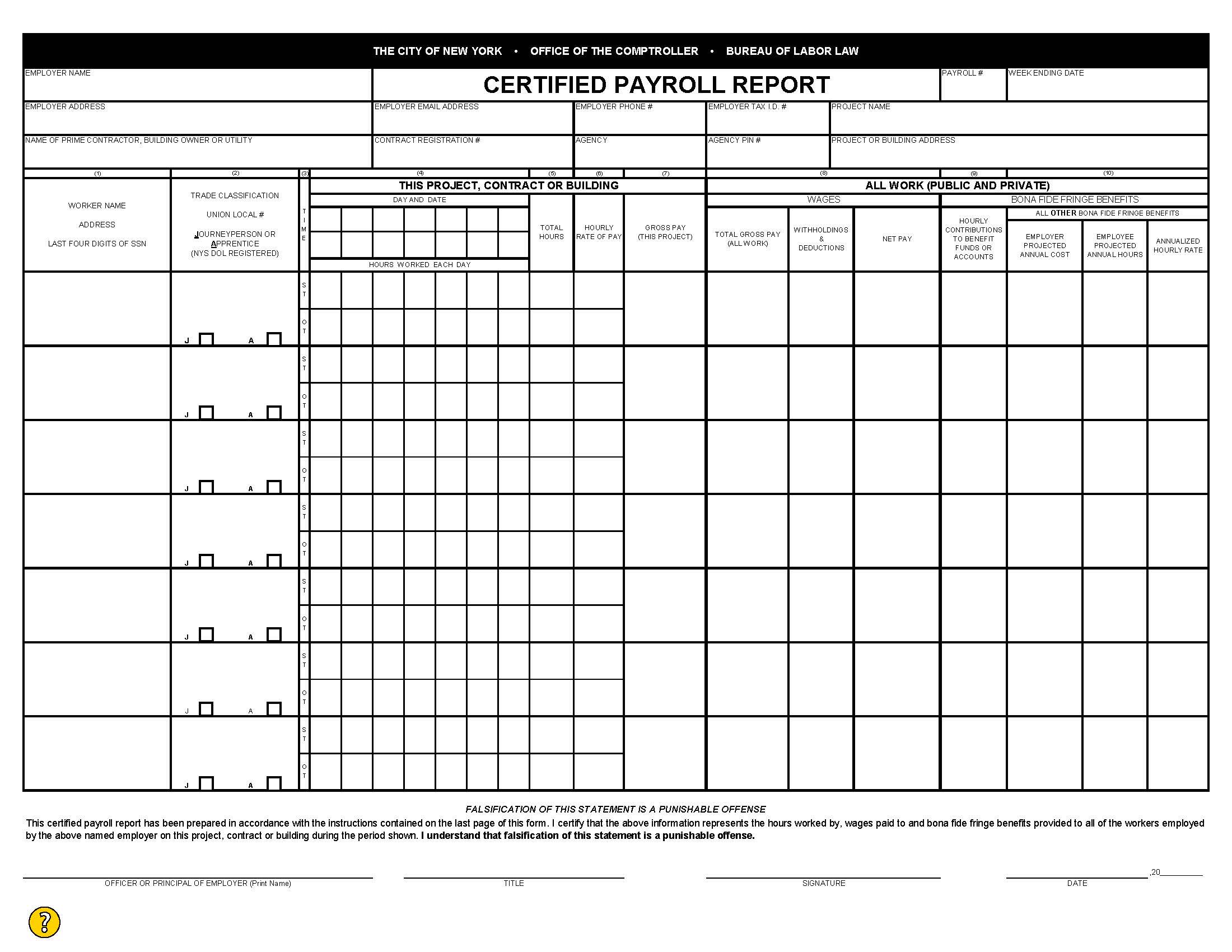

Certified Payroll Reports

All employers covered by prevailing wage, living wage, and minimum average hourly wage requirements must maintain certified payroll reports specifying, among other things, the hours worked, the trade classification, and the wages and benefits received by each covered employee.

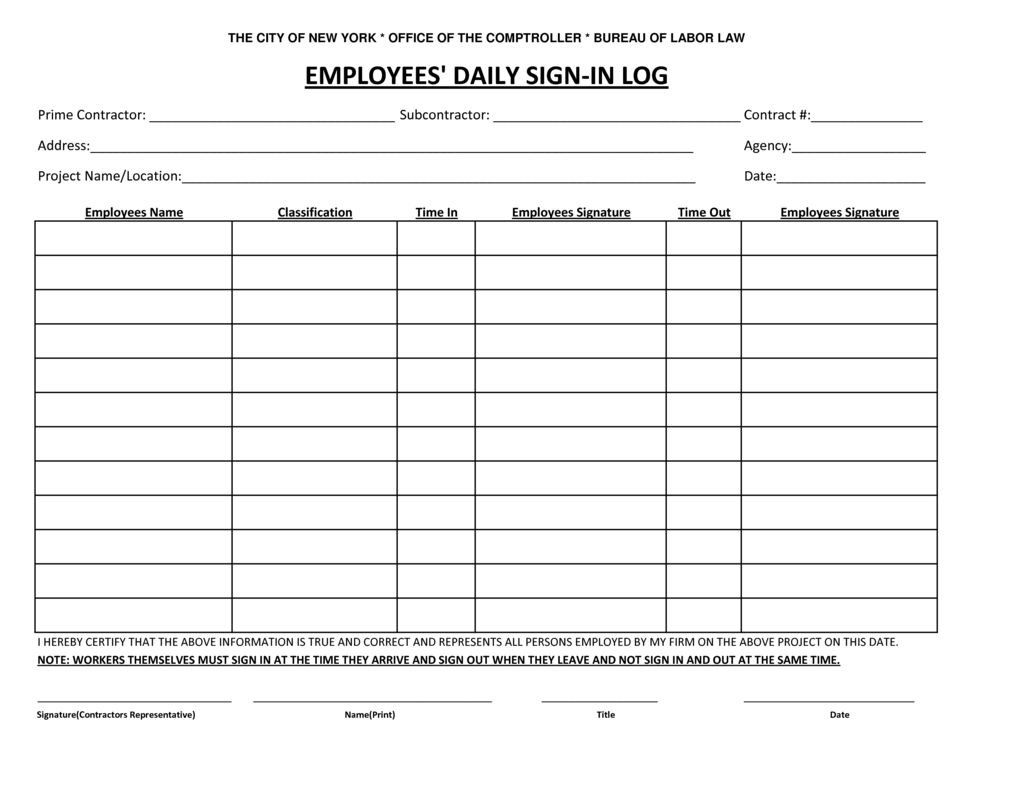

Sign-in Sheets

All employers covered by prevailing wage, living wage, and minimum average hourly wage requirements must also have their covered employees sign in and out of the job site on sign-in sheets which specify the name, trade classification and time in and out for each employee.

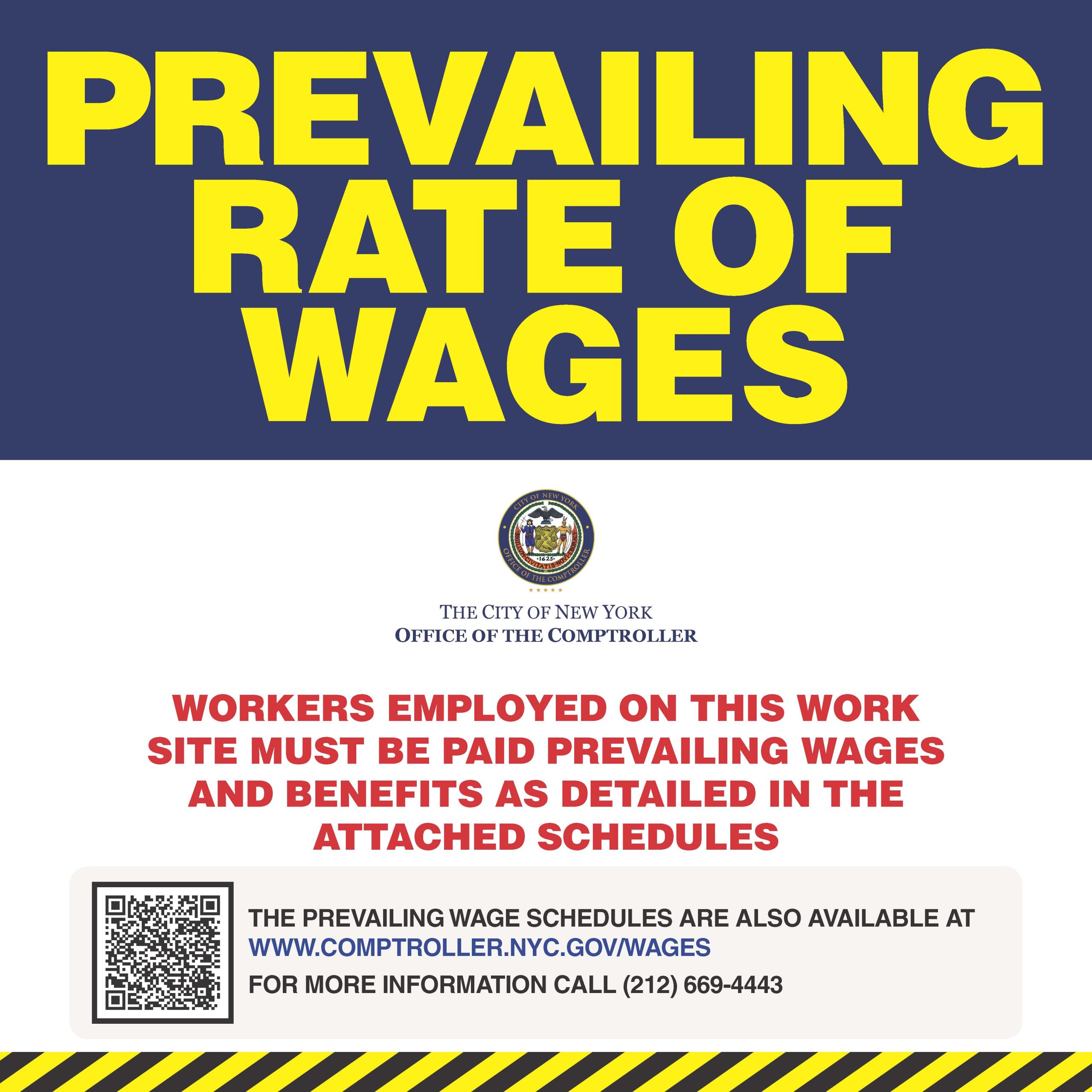

Construction Poster

Contractors and subcontractors on public work projects (construction-like work) must post the Construction Poster in a prominent and accessible place at each work site. The Construction Poster is two feet in height and two feet in width, with the heading “Prevailing Rate of Wages” in lettering no smaller than two inches in height and two inches in width. The Construction Poster must attach prevailing wage schedules for all applicable trade classifications and must be constructed of materials capable of withstanding adverse weather conditions.

Worker Notice – Prevailing Wage/Living Wage

All employers covered by prevailing wage and living wage requirements must post the Prevailing Wage/Living Wage Worker Notice along with wage schedules for all applicable trade classifications in a conspicuous manner at each covered job site. In addition, contractors and subcontractors on public work projects must distribute the Prevailing Wage/Living Wage Worker Notice, along with prevailing wage schedules for all applicable trade classifications to all covered employees at the beginning of the performance of each public work contract, and with each covered employee’s first paycheck after July first of each year.

Worker Notice – Minimum Average Hourly Wage

All employers covered by minimum average hourly wage requirements must post the Minimum Average Hourly Wage Worker Notice Poster in a conspicuous manner at each covered job site.

Pay Stubs/Wage Statements

Contractors and subcontractors on public work projects (construction-like work) must specify the applicable trade classifications and prevailing wage and benefit rates for their covered employees on their pay stubs/wage statements. If the required information will not fit, an accompanying sheet or attachment with the applicable trade classifications and prevailing wage and benefit rates will suffice.

Benefit Plan Notices/Pay Stubs/Certified Payroll Reports

Contractors and subcontractors on public work projects (construction-like work) that provide fringe benefits to their employees (as opposed to wage supplements) must provide written notices with benefit plan information to those employees at the time of hiring, and seven days before any change in benefits. The notices must identify the type of benefits (such as pension or healthcare) provided, the hourly rate claimed for each benefit, the benefit plan provider and how to obtain a copy of its agreement. Employees must acknowledge receipt of this notice in writing, in their primary language, which the employer must keep for six years. Every weekly pay stub must identify the type of benefits provided and the hourly rate claimed for each benefit. Employers may instead provide the same written benefit plan notice with every weekly pay stub. Employers are also required to submit the benefit plan notice with every certified payroll report.