News

Monthly Public Finance Wrap-Up: June 2018

$374 Million NYW Bond Sale

The New York City Municipal Water Finance Authority sold $374 million of tax-exempt refunding Second General Resolution Revenue bonds via negotiated sale on June 12. By refinancing higher-rate bonds, the transaction will save water and sewer ratepayers more than $101 million over the life of the bonds. Raymond James served as the book-running senior manager on the transaction, which also held an order period for individual investors on June 11. Individual investors and professionally-managed individual accounts placed over $372 million in orders for the bonds. On June 12th, institutional investors placed over $606 million in orders for the bonds. The strong demand from both individual investors and institutions enabled the Authority to reduce yields on the bonds by one to seven basis points on various maturities.

NYC DASNY Bond Sale

On June 27, New York City sold $340 million of refunding bonds through the Dormitory Authority of the State of New York’s Municipal Health Facilities Improvement Program. Raymond James served as book-running manager on the deal, with Citigroup and Loop Capital Markets serving as co-senior managers. The sale garnered $782 million in orders, which allowed for yield reductions of one to six basis points. Due to strong demand from individual investors, over 80% of the bonds were placed during the retail order period. The bonds will be used to refund outstanding bonds with higher interest rates, generating savings of $92 million.

NYC Bond Fact – The GWB

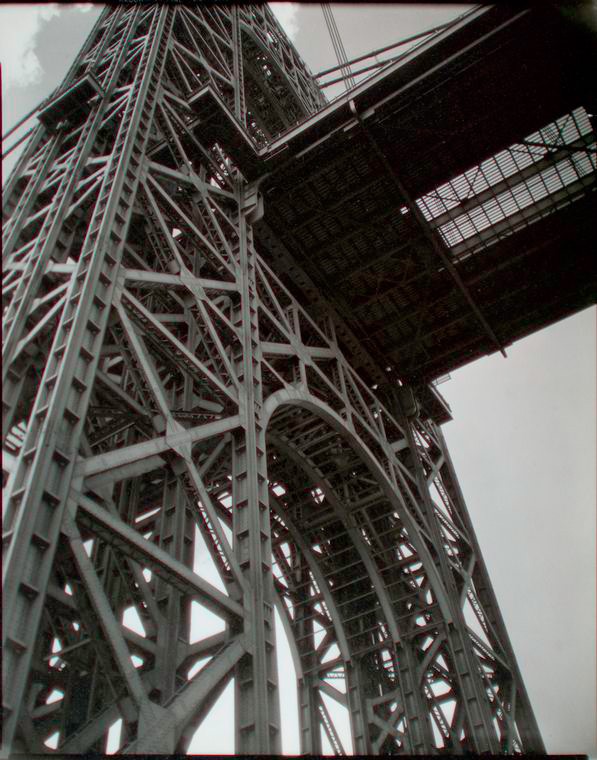

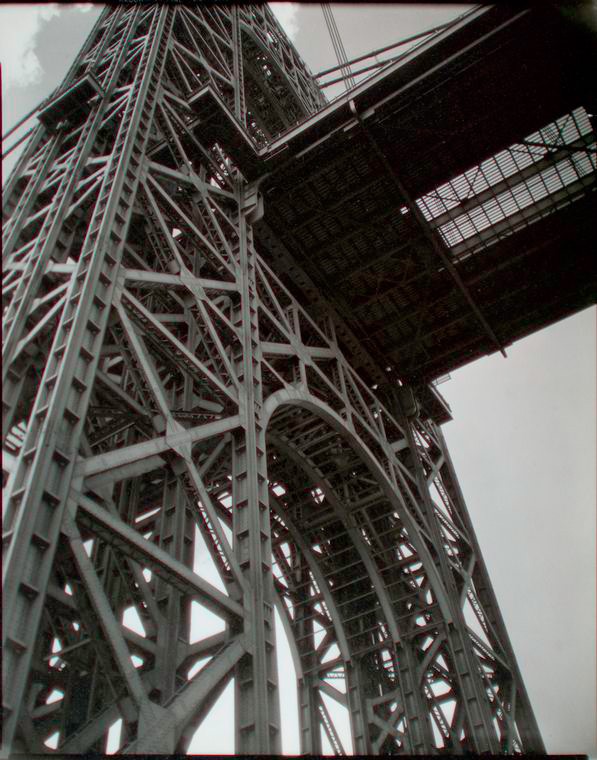

The George Washington Bridge in 1936, five years after its opening. (By Berenice Abbott, from the New York Public Library’s Digital Collections).

The George Washington Bridge that connects New York to New Jersey opened in 1931, four years after construction began, and was the longest suspension bridge in the world until it was surpassed by the Golden Gate Bridge in 1937. Bridges that connect New York City’s five boroughs to each other and to other parts of New York and New Jersey are not all owned or operated by the City. The GWB, one of the City’s most beautiful bridges, is owned and operated by the Port Authority of New York and New Jersey. It was paid for with two bond issues by the then-named Port of New York Authority. The first, $20 million in December 1926, was led by senior manager National City Company. Those bonds had a four percent coupon and were sold at a discount, making the true interest cost 4.242%. The second bond issue, $30 million in 1929, also offered 4 percent coupon bonds at a discount. In today’s dollars, that $50 million of debt is equivalent to $736 million. The bridge was expanded several times to allow for more traffic, including the addition of a second deck, and today is one of the busiest in the world, averaging over 290,000 vehicles per day.

Looking Ahead

New York City issuers will bring a full calendar of offerings in July. The New York City Transitional Finance Authority plans to offer $1 billion of fixed rate tax-exempt new money and refunding Building Aid Revenue Bonds the week of July 16 via negotiated sale, with a small taxable portion of the issue being sold via competitive bid. The New York City Municipal Water Finance Authority also expects to offer $355 million of fixed rate tax-exempt bonds through the Environmental Facilities Corporation via negotiated sale the week of July 16. The week of July 23, the New York City Transitional Finance Authority plans to offer $1.1 billion of fixed rate tax-exempt and taxable Future Tax Secured bonds via negotiated and competitive sales. Additional details will be announced when available. Sign up to receive notices of upcoming sales here.

As always, we appreciate your interest in New York City bonds.

Carol S. Kostik

Deputy Comptroller for Public Finance