Prevailing Wage

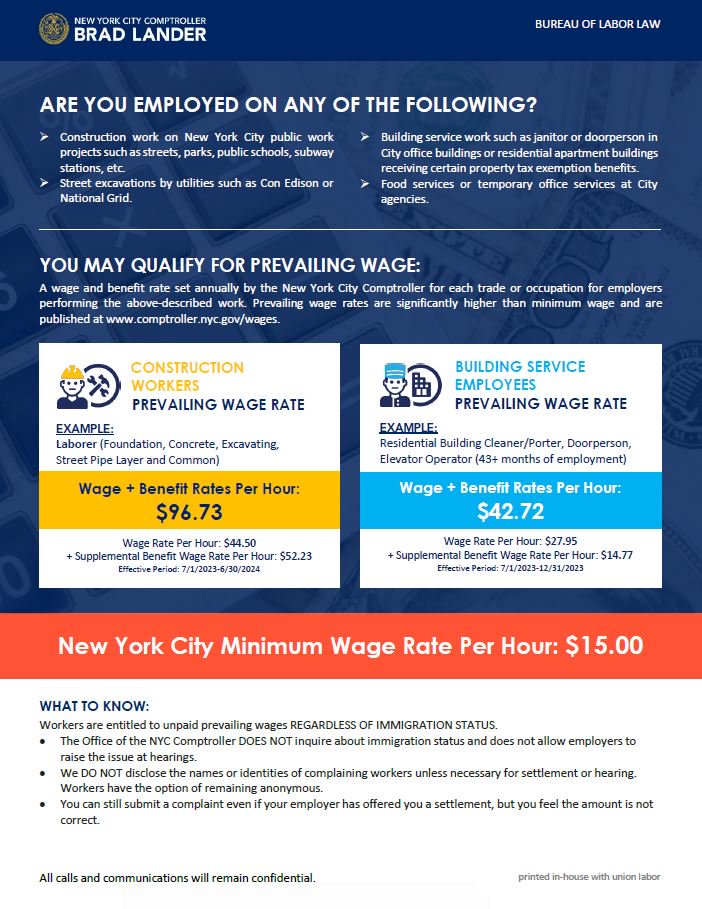

Prevailing wage is the wage and benefit rate set annually by the New York City Comptroller for each trade or occupation for employers performing public works projects and building service work on New York City government-funded work sites.

Prevailing wage rates for construction work on New York City public works projects are required by New York State Labor Law Article Eight. These rates are contained in the Construction Worker and Construction Apprentice Schedules.

Prevailing wage rates for building service work are required by New York State Labor Law Article Nine for contracts with New York City government agencies, by New York State Real Property Tax Law Section 421-a for certain buildings receiving tax exemption benefits and by NYC Administrative Code Section 6-130 for certain buildings receiving financial assistance from, or leasing space to, New York City government. These rates are contained in the Building Service Employee Schedule.

Prevailing wage rates for food services or temporary office services for contracts with New York City government agencies are required by NYC Administrative Code 6-109. These rates are contained in the NYC Service Contractors Schedule.

Construction Work

NYC Public Works Projects

If you are employed by a contractor or subcontractor performing construction work on a New York City public works project such as a public school, City street, City park or subway station, you may be entitled to prevailing wages under New York State Labor Law Article Eight.

Building Service Work

NYC Government Agency Contracts

If you are employed by a contractor or subcontractor performing building service work for City agencies, such as cleaning, security, landscaping or moving office furniture and equipment, you may be entitled to prevailing wages under New York State Labor Law Article Nine.

421-a Property Tax Exemption Benefit Recipients

If you perform building service work such as cleaning or security at a building with 30 or more residential units that was built after 2007 and whose owner receives tax exemption benefits, you may be entitled to prevailing wages under Real Property Tax Law Section 421-a.

Click below to see a list of addresses for buildings with 421-a tax exemption benefits that may be covered by prevailing wage requirements.

Covered Buildings Under RPTL 421-a

467-a Property Tax Abatements for Cooperative and Condominium Buildings

467-a Property Tax Abatements for Cooperative and Condominium Buildings

If you perform building service work such as cleaning or security at a residential cooperative or condominium building whose owners receive tax abatements, you may be entitled to prevailing wages under Real Property Tax Law Section 467-a.

Click below to see a list of addresses for residential cooperative or condominium buildings with 467-a tax abatements that may be covered by prevailing wage requirements.

Covered Buildings Under RPTL 467-a

NYC Government Financial Assistance Recipients

If you perform building service work such as cleaning or security at a building whose owner receives financial assistance from the City of New York, you may be entitled to prevailing wages under NYC Administrative Code Section 6-130.

Click below to go to the Mayor’s Office of Operations website to search for buildings that receive financial assistance from the City of New York and may be covered by prevailing wage requirements under 6-130.

Landlords Leasing Space to City Agencies

If you perform building service work such as cleaning or security at a building whose owner leases space to a City agency, you may be entitled to prevailing wages under NYC Administrative Code Section 6-130.

Click below to see a list of addresses for buildings that lease space to City agencies that may be covered by prevailing wage requirements.

Food Services or Temporary Office Services for NYC Government Agency Contracts

If you are employed by a contractor or subcontractor performing food services or temporary office services for City agencies you may be entitled to prevailing wages under NYC Administrative Code Section 6-109.

Living Wage

Living wage is the minimum wage and benefit rate set by law for employers that enter into certain service contracts with New York City government agencies, or receive certain types of financial assistance from New York City government.

Living wage rates for homecare services, day care services, head start services or services to persons with cerebral palsy for contracts with New York City government agencies are required by NYC Administrative Code Section 6-109. These rates are contained in the NYC Service Contractors Schedule.

Living wage rates for employers that receive financial assistance from New York City government are required by NYC Administrative Code Section 6-134. These rates are contained in the NYC Financial Assistance Recipients Schedule.

Currently, the New York State minimum wage rate for New York City is $15.00 per hour, which is higher than both living wage rates.

Human Services

Homecare, Day Care, Head Start and Cerebral Palsy Services for NYC Government Agency Contracts

If you are employed by a contractor or subcontractor performing homecare services, day care services, head start services, or services to persons with cerebral palsy for City agencies you may be entitled to living wages under NYC Administrative Code Section 6-109. Currently, the New York State minimum wage rate for New York City is $15.00 per hour, which is higher than the living wage. To file a claim for underpayment of minimum wage, contact the New York State Department of Labor at 1-888-4-NYSDOL (1-888-469-7365).

Minimum Average Hourly Wage

Minimum Average Hourly Wage applies only to construction work on residential buildings with 300 or more rental units that will receive tax exemption benefits under Real Property Tax Law Section 421-a. The Minimum Average Hourly Wage is not a prevailing wage or a minimum hourly wage that must be paid to each construction worker on a project; it is the average of the total compensation (including benefits) provided to all construction workers on a project divided by the total hours they all worked. The Minimum Average Hourly Wage is: For building construction commenced by April 9, 2020: $60 per hour in Manhattan south of 96th Street, and $45 per hour in Brooklyn and Queens within one mile of the East River waterfront. For building construction commenced on or after April 10, 2020: $63.00 per hour in Manhattan south of 96th Street, and $47.25 per hour in Brooklyn and Queens within one mile of the East River waterfront.

Construction Work

Residential Buildings with 300 or More Rental Units

If you are employed by a contractor or subcontractor performing construction work on a residential building with 300 or more rental units that will receive tax exemption benefits in Manhattan south of 96 Street or in Brooklyn or Queens within one mile of the East River waterfront, you may be covered by minimum average hourly wage requirements under Real Property Tax Law Section 421-a. Some construction workers may legally earn less than the minimum average hourly wage. No one will know if there has been an underpayment to any construction worker until the Comptroller’s Bureau of Labor Law has had the opportunity to review all payroll records after the entire project has been completed.

Click below to see a list of addresses for buildings that have applied for 421-a tax exemption benefits that may be covered by minimum average hourly wage requirements.

Know Your Rights

Workers employed on certain New York City government-funded worksites are entitled to unpaid prevailing wages regardless of immigration status. The Office of the NYC Comptroller does not inquire about immigration status and does not allow employers to raise the issue at hearings.