New York by the Numbers

Weekly Economic and Fiscal Outlook

By NYC Comptroller Scott M. Stringer

Preston Niblack, Deputy Comptroller

Andrew McWilliam, Director of Economic Research

No. 42 – April 12th, 2021

Photo Credit: haveseen/Shuttterstock.comA Message from the Comptroller

Dear New Yorkers,

With spring in the air, and vaccines in arms, New Yorkers are out and about at the highest levels since September. Look for continued improvements on all fronts.

In the Spotlight this week, the newly approved New York State budget provides billions of dollars in short-term relief for renters, small businesses, arts and culture, undocumented adults, and child care; and it provides much needed, and overdue, long-term aid to New York City schools.

Until next week — mask up, and when your turn comes, get vaccinated!

Sincerely,

Scott M. Stringer

The Economy

National Indicators

- The Federal government made approximately 8.9 million doses of COVID-19 vaccines available for distribution to states for the week of April 12th, down from over 12 million last week (Chart 1).

- This week’s national allocation represents a 32% decline from the week before due primarily to manufacturing problems with the Johnson & Johnson single-dose vaccine.

- Because Moderna and Pfizer vaccines require two doses, but J&J only one, the total number of people that can be fully vaccinated (the number of J&J doses + half the number of Pfizer and Moderna doses) will fall dramatically this week due to decreased availability of the J&J vaccine.

Chart 1

SOURCE: Centers for Disease Control and Prevention.

- February unemployment rates remain elevated from a year ago in almost every Metropolitan area in the country, with unemployment in the New York/New Jersey metropolitan area among the highest among major U.S. metropolitan areas at 9.8%, just below the 9.9% of Los Angeles.

Chart 2

SOURCE: U.S. Bureau of Labor Statistics

- Initial U.S. unemployment claims rose slightly to a seasonally adjusted 744,000 for the week of April 3rd, from a revised 728,000 last week (Chart 3). Weekly claims peaked at almost 7 million in March of last year.

Chart 3

SOURCE: U.S. Dept. of Labor

- Continuing unemployment insurance claims, including PEUC and PUA, together covered 17,286,418 unemployed Americans as of the week ending March 20th, from a revised 17,100,528 the week prior (Chart 4).

- Recipients of Pandemic Emergency Unemployment Compensation (PEUC) rose to 5,633,595 for the week of March 20th, up slightly from a revised 5,516,487 the week prior.

- Continuing claims for Pandemic Unemployment Assistance (PUA) rose to 7,553,628 up from a revised 7,350,339 the week prior.

Chart 4

SOURCE: U.S. Dept. of Labor, PEUC provides extended benefits to unemployed workers whose 26 weeks of regular unemployment benefits have run out. PUA covers workers who are typically not eligible for state unemployment benefits, including the self-employed and those with poorly documented income, or who are unable to work due to COVID-19. Both were enacted as part of the CARES Act and extended by the American Rescue Plan Act.

New York City

COVID

- First doses administered in New York City continue to trend down toward a seven-day average of 30,000 after peaking at 50,000 in early March.

- Second doses administered declined to a seven-day average below 30,000, down from 40,000 daily in early April.

- Administered doses of Johnson & Johnson’s single-dose vaccine approached 10,000 daily after a slow start, but deliveries are expected to slow due to manufacturing issues.

Chart 5

SOURCE: NYC DOHMH

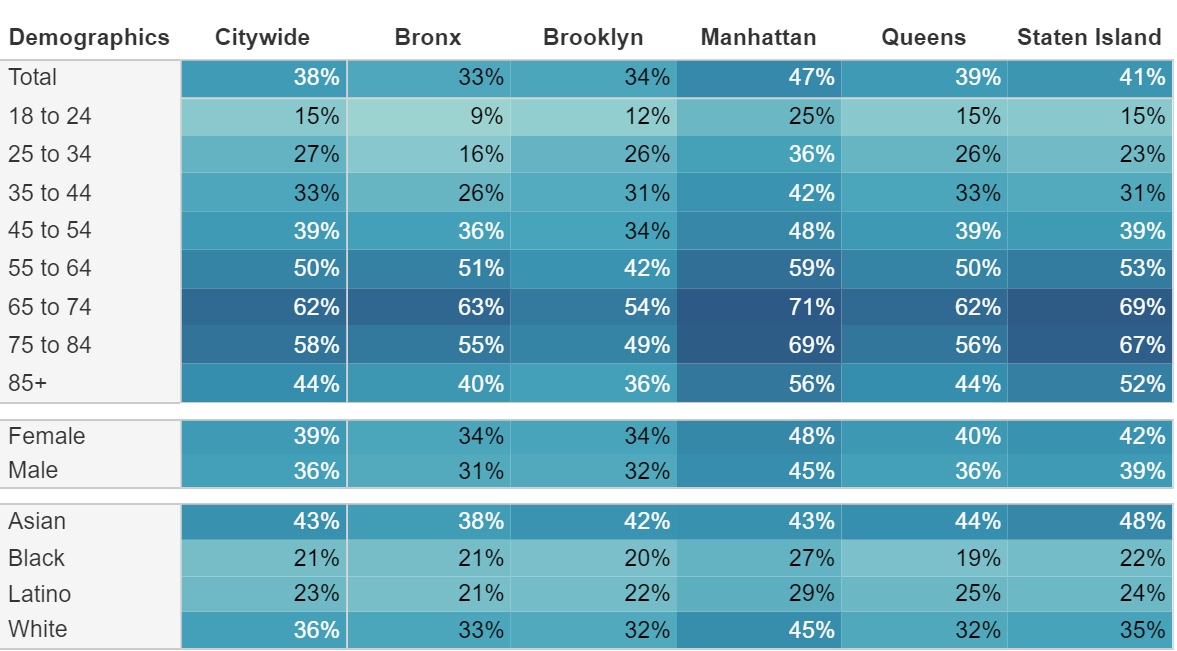

- As of April 8th, New York City had fully vaccinated 24% of the population, with 38% receiving at least one dose, including a majority of New York City seniors (Table 1).

- Among seniors, vaccination rates are lowest for those 85 and older; the oldest seniors are most vulnerable to COVID, but mobility, awareness and sign-up issues may be impeding vaccination. Only 36% of seniors 85 and older have received at least one vaccine dose in Brooklyn, and only 40% in the Bronx.

- Among racial and ethnic groups, Black New York City residents have been vaccinated at the lowest rates, with only 19% of Black Queens residents, and only 20% of Black Brooklyn residents having received at least one dose.

Table 1: New York City Vaccination Rates by Borough, Age, and Race (% of Adults Having Received at Least 1 Dose)

SOURCE: NYC DOHMH, as of 4/8/2021

- The share of NYC COVID cases from the b.1.1.7/U.K. variant rose to 29.5% for the week March 22nd to 28th, up from 26.2% the week prior (Chart 6), but this does not yet suggest that cases from this more transmissible U.K. variant are exploding.

Chart 6

SOURCE: GISAID via NYC DOHMH, weekly estimates are based on small sample sizes that may not be representative

NOTE: “Variants of Concern” are associated with greater disease severity, reduced vaccine effectiveness, and greater transmissibility. There is limited evidence linking “Variants of Interest” to increased transmissibility.

The Economy

Note: Data on New York City unemployment claims is unavailable this week.

- Pandemic related job losses in New York City disproportionally impacted young workers, with employment of workers 24 and under declining by 20% in the 2nd quarter of 2020 from pre-pandemic levels, compared to a 10% decline in employment overall (Table 2).

- Unless reversed, these jobs losses will continue to weigh heavily on the City’s apartment rental market since persons in this age group are more than three times as likely to rent as they are to live in owner occupied homes. This will also impact young adults’ means to pursue higher education.

Table 2: Change in Employment, by Age Group

| Age Group | Q2 2019 | Q2 2020 | Year-over-Year % Change |

| 24 and under | 418,439 | 335,007 | -20% |

| 25-34 | 1,222,029 | 1,082,888 | -11% |

| 35-44 | 1,039,789 | 955,649 | -8% |

| 45-54 | 917,755 | 832,339 | -9% |

| 55-64 | 732,300 | 675,129 | -8% |

| Over 64 | 263,471 | 246,411 | -6% |

| TOTAL | 4,593,783 | 4,127,423 | -10% |

SOURCE: US Census Bureau, Quarterly Workforce Indicators, Q2 2020 is the most recent available

- Prior to the pandemic, the growth in the average wages of young New York City workers was modest compared to many other cities (Chart 7) due to faster job expansion in lower-wage service sectors of the New York City economy – the very sectors of the economy hit hardest by the pandemic.

- Average New York City wages of workers age 34 and under grew only 16% from 2008 to 2019, but grew 93% in San Francisco.

Chart 7

SOURCE: US Census Bureau, Quarterly Workforce Indicators

- With vaccination progress and warmer weather, New Yorkers are spending more time in parks, shopping, eating out, on public transit, and less time stuck at home. As of April 2nd, time spent at retail and recreation is down 30% from pre-pandemic levels, but was down over 50% in early February (Chart 8).

- Time spent at home remains 12% above pre-pandemic levels, but was up by 19% in early February, and as much as 35% in the height of the pandemic last April.

Chart 8

SOURCE: GPS mobility data indexed to 1/3/2020 to 2/6/2020, from Google COVID-19 Community Mobility Reports.

MTA Subway and Bus Ridership

- Average weekday MTA subway ridership continues to trend upward, albeit at a slow pace (Chart 9). Over Monday, April 5th through Wednesday, April 7th, ridership averaged about 1.92 million, the highest average since the beginning of the pandemic.

- As of Wednesday, April 7, 2021, subway ridership was 66% below the equivalent, pre-pandemic day according to the MTA, and bus ridership was down 53%.

Chart 9

SOURCE: Metropolitan Transportation Authority, Day-by-Day Ridership Numbers.

NOTE: Excludes federal holidays. Figures for the week ending April 9 include data through Wednesday, April 7th.

MTA Bridge and Tunnel Crossings

- After a decline in the late fall and winter, average traffic volume on MTA bridges and tunnels has steadily risen since the beginning of March (Chart 10).

- As of April 7, 2021, an average of 823,216 vehicles per day had crossed MTA bridges and tunnels over the last seven days. Volume was down about 12% compared to pre-pandemic levels.

Chart 10

SOURCE: Metropolitan Transportation Authority, Day-by-Day Ridership Numbers.

City Finances

COVID-19 Spending

- The City’s January 2021 Financial Plan includes $3.58 billion in COVID related spending in FY 2021 (Table 3).

- Through April 7th, the City has committed to $3.59 billion in COVID related spending in FY 2021, exceeding the budget amount. Of this $2.97 billion has been expensed.

- In total, the City has incurred or committed to $6.15 billion in COVID related spending in FY 2020 and FY 2021.

Table 3: FY 2021 COVID-19 Expenditures

| Budget | Committed | Expensed | |

| Medical, Surgical and Lab Supplies | $788 M | $493 M | $401 M |

| NYC Health+Hospitals | 813 M | 952 M | 952 M |

| Dept. of Emergency Management | 264 M | 203 M | 154 M |

| Uniformed Agencies Overtime | 24 M | 1 M | 1 M |

| Dept. of Design and Construction | 89 M | 48 M | 26 M |

| Dept. of Small Business Services | 81 M | 33 M | 33 M |

| Dept. of Education | 78 M | 300 M | 250 M |

| Dept. of Homeless Services | 329 M | 443 M | 340 M |

| Food/Forage | 527 M | 471 M | 430 M |

| Other | 591 M | 641 M | 380 M |

| Total | $3.584 B | $3.587 B | $2.968 B |

SOURCE: Office of the NYC Comptroller from FMS.

COVID-19 Contracts

- Through April 7th, City has registered $5.67 billion in contracts to procure goods and services in response to the COVID pandemic (Table 4).

- About 62% of the contracts, $3.51 billion, are for vaccination, hotel and food related contracts and the procurement of personal protective equipment (PPE).

- Other significant contracts include $509 million for medical staffing for COVID-19, $379 million for medical, surgical and lab supplies excluding PPE and ventilators, $296 million for vaccination-related activities, $149 million for ventilators and $100 million for testing centers.

Table 4: Registered COVID-19 Contracts through 4-7-2021

| Maximum Contract Amount | |

| Personal Protective Equipment | $733 M |

| Ventilators | 149 M |

| Medical Staffing for COVID-19 | 509 M |

| Hotels | 893 M |

| Food Related Contracts | 1.181 B |

| IT Related Contracts | 164 M |

| Temporary Staff Contracts | 24 M |

| Testing Centers | 100 M |

| Other Medical, Surgical and Lab Supplies | 379 M |

| Vaccination Related Contracts | 701 M |

| Contact Tracing Related Contracts | 63 M |

| Other | 773 M |

| Total | $5.671 B |

SOURCE: Office of the NYC Comptroller analysis of NYC FMS data.

NOTE: Includes only contracts with COVID budget codes.

Cash Position

- The City’s central treasury balance (funds available for expenditure) stood at $12.0 billion as of Wednesday, April 7th. At the same time last year, the City had $9.2 billion (Chart 11).

- The rise in cash balances stems from a $4.1 billion decline in fiscal year-to-date cash expenditures, including a $1.8 billion decline in capital spending.

- The Comptroller’s Office’s review of the City’s cash position during the second quarter of FY 2021 and projections for cash balances through June 30th, 2021, are available here.

Chart 11

SOURCE: Office of the NYC Comptroller

Spotlight of the Week

Enacted State Budget Approves Billions for New York City Schools and COVID-19 Relief

Last week, the New York State Legislature approved a $212 billion budget for state fiscal year 2022, which began on April 1. By allocating more than $20 billion in federal pandemic relief and increasing taxes by $4 billion on high earners and corporations, the budget will boost funding for education and health care, while also offering relief to struggling businesses and individuals.

Under an historic agreement to fully fund Foundation Aid over three years, State formula-based school aids to New York City will rise from $10.5 billion this year to $11.9 billion in FY 2022. In the wake of a court-ordered mandate to provide a “sound, basic education” to New York City students, New York State implemented Foundation Aid to direct funding to higher need and lower wealth school districts. Foundation Aid was first allocated in FY 2008 but was soon interrupted by the Great Recession and has never been fully funded. Under the state budget agreement, Foundation Aid for New York City will increase to $8.6 billion in FY 2022 and will eventually rise to $9.2 billion, based on current formulas (Chart S.1). In addition, the New York City Department of Education (DOE) will receive $7 billion — including $2.15 billion from the December federal stimulus bill and $4.8 billion from the American Rescue Plan Act (ARPA) — 58% of the State’s total allocation. Half of the ARPA funds are to be spread evenly over the next four school years, subject to a plan for their use.

Chart S.1

*Projected

SOURCE: Office of the New York City Comptroller, Comprehensive Annual Financial Reports; and Enacted FY 2022 State Budget School Aid Runs.

NOTE: In FY 2021, the State used $1.1 billion in federal CARES Act funding, including $721 million for New York City, to supplant state funds.

New York City residents and businesses will also benefit from new COVID-19 relief funds, largely funded by federal resources. The State Budget includes $1 billion for small businesses and nonprofits; $2.4 billion in rent relief; $2.4 billion for child care; $2.1 billion for undocumented residents who have been unable to access unemployment benefits; and $600 million for homeowner relief.

Among many other provisions, the State also approved $200 million in capital funds for the New York City Housing Authority, $100 million for an Adaptive Reuse Affordable Housing Program in New York City, which would support conversion of certain hotel and commercial office properties into affordable housing, and a 3-year property tax relief credit for homeowners earning less than $250,000.

The state budget also gives the City the option to participate in an early retirement incentive program. The incentive would apply to certain civilian employees, teachers and other DOE staff. The City’s Actuary estimates that 75,610 employees would potentially meet eligibility requirements. The City must demonstrate that the program would provide budgetary savings.

Contributors

Central Treasury Cash Balances Past 12 Months vs. Prior Year

COVID-19 Vaccines Allocated for U.S. Distribution

Metro Area Unemployment (Feb. 2020 and Feb. 2021, Not Seasonally Adjusted)

Initial U.S. Unemployment Insurance Claims(Seasonally Adjusted)

Continuing Unemployment Insurance ClaimsNot Seasonally Adjusted

7-Day Average Number of Vaccine Doses Administered in NYC

COVID Variants in NYC

Average Monthly Wage, Age 34 and Under (Index 2008 = 100)

Change in Time Spent by Location

MTA Average Weekday Ridership

MTA Bridge and Tunnel Crossings (7-Day Trailing Average)

Actual and Projected New York City Foundation Aid

Archives

- No. 110 – February 2026

- No. 108 – December 2025

- No. 107 – November 2025

- No. 106 – October 2025

- No. 105 – September 2025

- No. 104 – August 2025

- No. 103 – July 2025

- No. 102 – June 2025

- No. 101 – May 2025

- No. 100 – April 2025

- No. 99 – March 2025

- No. 98 - February 11, 2025

- No. 97 - January 15, 2025

- No. 96 – December 10, 2024

- No. 95 - November 13, 2024

- No. 94 – October 16, 2024

- No. 93 – September 10, 2024

- No. 92 – August 13, 2024

- No. 91 – July 9, 2024

- No. 90 – June 11, 2024

- No. 89 – May 14, 2024

- No. 88 – April 9th, 2024

- No. 87 – March 12th, 2024

- No. 86 – February 13th, 2024

- No. 85 – January 17th, 2024

- No. 84 – December 12th, 2023

- No. 83 – November 14th, 2023

- No. 82 – October 12th, 2023

- No. 81 – September 12th, 2023

- No. 80 – August 8th, 2023

- No. 79 – July 11th, 2023

- No. 78 – June 13th, 2023

- No. 77 – May 9th, 2023

- No. 76 – April 11th, 2023

- No. 75 – March 21st, 2023

- No. 74 – February 14th, 2023

- No. 73 – January 10th, 2023

- No. 72 – December 13th, 2022

- No. 71 – November 15th, 2022

- No. 70 – October 11th, 2022

- No. 69 – September 12th, 2022

- No. 68 – August 8th, 2022

- No. 67 – July 11th, 2022

- No. 66 – June 6th, 2022

- No. 65 – May 2nd, 2022

- No. 64 – April 4th, 2022

- No. 63 – March 7th, 2022

- No. 62 – February 7th, 2022

- No. 61 – January 10th, 2022

- No. 60 – December 6th, 2021

- No. 59 – November 1st, 2021

- No. 58 – October 4th, 2021

- No. 57 – September 13th, 2021

- No. 56 – August 2nd, 2021

- No. 55 - July 26th, 2021

- No. 54 July 19th, 2021

- No. 53 July 12th, 2021

- No. 52 – June 28th, 2021

- No. 51 – June 21st, 2021

- No. 50 – June 14th, 2021

- No. 49 – June 7th, 2021

- No. 48 – May 24th, 2021

- No. 47 – May 17th, 2021

- No. 46 – May 10th, 2021

- No. 45 – May 3rd, 2021

- No. 44 – April 26th, 2021

- No. 43 – April 19th, 2021

- No. 42 – April 12th, 2021

- No. 41 – April 5th, 2021

- No. 40 – March 29th, 2021

- No. 39 – March 22nd, 2021

- No. 38 – March 15th, 2021

- No. 37 – March 8th, 2021

- No. 36 – March 1st, 2021

- No. 35 – February 22nd, 2021

- No. 34 – February 8th, 2021

- No. 33 – February 1st, 2021

- No. 32 – January 25th, 2021

- No. 31 – January 19th, 2021

- No. 30 – January 11th, 2021

- No. 29 – December 21, 2020

- No. 28 – December 14, 2020

- No. 27 – December 7, 2020

- No. 26 – November 23, 2020

- No. 25 – November 16, 2020

- No. 24 – November 9, 2020

- No. 23 – November 2, 2020

- No. 22 – October 26, 2020

- No. 21 – October 19, 2020

- No. 20 – October 13, 2020

- No. 19 – October 5, 2020

- No. 18 – September 28, 2020

- No. 17 – September 21, 2020

- No. 16 – September 14, 2020

- No. 15 – August 24, 2020

- No. 14 – August 17, 2020

- No. 13 – August 10, 2020

- No. 12 – August 3, 2020

- No. 11 – July 27, 2020